Real Estate

THE COASTAL REAL ESTATE RESOURCE Coastal Association of Realtors/OC TODAY-DISPATCH

THE COASTAL REAL ESTATE RESOURCE Coastal Association of Realtors/OC TODAY-DISPATCH

THE COASTAL REAL ESTATE RESOURCE Coastal Association of Realtors - OC Today-Dispatch

Published by OC Today-Dispatch for the Coastal Association of Realtors. Advertising in this publication is limited to members and affiliated members of the Association.

The COASTAL ASSOCIATION OF REALTORS® (CAR) is a trade organization for real estate professionals in Wicomico, Worcester and Somerset Counties on the Eastern Shore of Maryland. Its membership consists of more than 1,000 REALTORs® and affiliate members serving the home-buying and homeselling needs of the public since 1957.

The term REALTOR® is a registered collective membership mark, which may be used only by real estate professionals who are members of the NATIONAL ASSOCIATION OF REALTORS® and subscribe to its strict Code of Ethics.

The COASTAL ASSOCIATION OF REALTORS is located at 314 Franklin Avenue, Suite 106 • Berlin, MD 21811. Phone: 410-641-4409. On the Web: www.coastalrealtor.org

OC TODAY-DISPATCH is the leading newspaper publisher on the Maryland coast, with OC Today-Dispatch publishing weekly on Friday, Bayside Gazette and Ocean City Digest publishing on Thursdays and Real Estate, the Coastal Real Estate Resource publishing key weekends throughout the year. On the Web: www.oceancitytoday.com

Editor......................................................................... Stewart Dobson

Executive Editor................................................................ Steve Green

Account Managers....................... Mary Cooper, Renée Kelly, Terri French

Classifieds/Legals ........................................................ Pamela Green

Art Director....................................................................... Cole Gibson

Senior Page Designer....................................................... Susan Parks

Senior Ad Designer............................................................ Kelly Brown

Publisher..................................................................... Christine Brown

Administrative Asistant.......................................................... Gini Tufts

• Waterfront Updated 3BR, 3 BA Townhome with Boat Dock.

• Beautiful Bayfront views & waterfront deck

• Close to shopping, restaurants, grocery stores, tennis courts & art center.

• Living Room fireplace.

• A must-see for anyone looking to enjoy the rest of the summer in style.

((( This listing is contingent upon sellers finding a replacement property )))

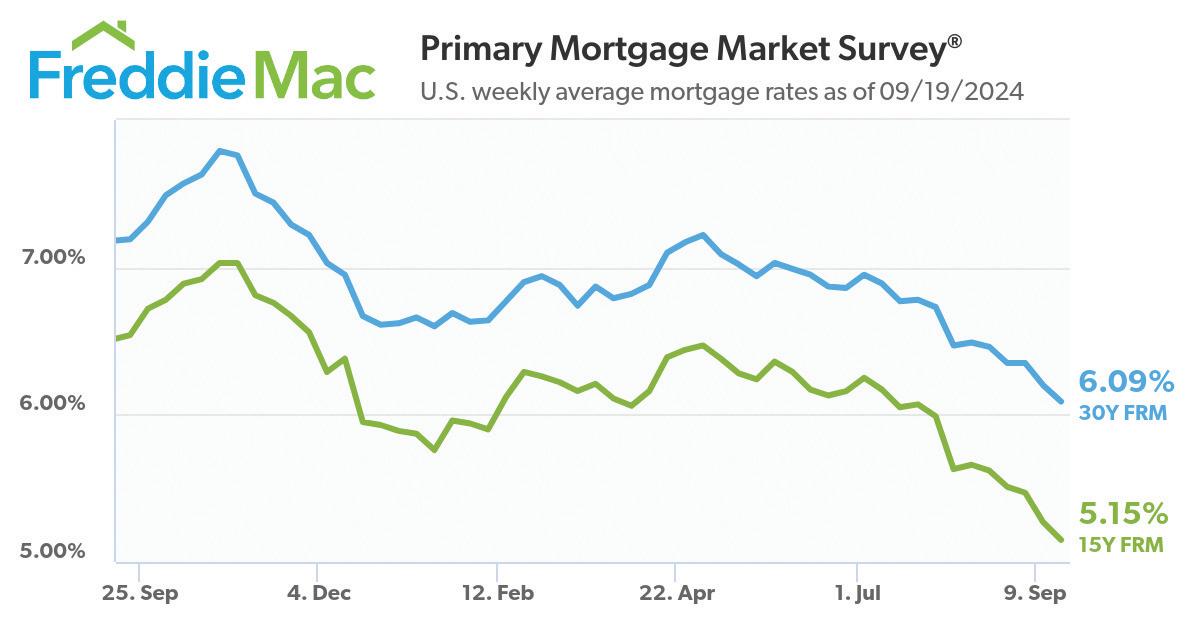

(GLOBE NEWSWIRE) — Freddie Mac released the results of its Primary Mortgage Market Survey (PMMS) on Sept. 12, showing the 30-year fixedrate mortgage (FRM) averaged 6.20 percent.

“Mortgage rates have fallen more than half a percent over the last six weeks and are at their lowest level since February 2023,” said Sam Khater, Freddie Mac’s chief economist.

“Rates continue to soften due to incoming economic data that is more se-

date. But despite the improving mortgage rate environment, prospective buyers remain on the sidelines, as they negotiate a combination of high house prices and persistent supply shortages.”

In brief

The 30-year FRM averaged 6.20 percent as of Sept. 12, down from last week when it averaged 6.35 percent. A year ago at this time, the 30-year FRM averaged 7.18 percent.

The 15-year FRM averaged 5.27

percent, down from last week when it averaged 5.47 percent. A year ago at this time, the 15-year FRM averaged 6.51 percent.

The PMMS is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

Freddie Mac promotes liquidity, stability, affordability and equity in the housing market throughout all economic cycles.

The Federal Reserve’s half-point rate cut decision is the beginning of six to eight rounds of further rate cuts well into 2025, National Association of Realtors economist said after the Sept. 18 action by the board.

“The very next cut will occur after the presidential election. The justification is cooling inflation in recent months and lighter job gains,” Yun said.

Mortgage rates have already anticipated the Fed’s likely path. That is why the 30-year rate has fallen by 150 basis points from early in the year to today. Any further decline in mortgage rates will be minimal, Yun said.

The Fed does not directly control mortgage rates, and the federal budget deficit is huge. Future Fed rate cuts are not only anticipated but will not be as impactful because large federal borrowing will leave less capital available for mortgage lending, according to Yun.

Due to the already low mortgage rates compared to spring, the purchasing power for home buyers has been lifted by around $50,000 for those with a $2,000 monthly mortgage payment budget. Consumers who were priced out due to earlier higher mortgage rates could now be back in the market, Yun concluded.

are not only anticipated but will not be as impactful because large federal borrowing will leave less capital available for mortgage lending.”

By Melissa Dittman Tracy REALTOR Magazine

The Federal Reserve did what the real estate market has long been waiting for and lowered its key benchmark rate Sept. 18 — the first time in four years. The Fed dropped its rate by 50 basis points; so, what could this mean for mortgage rates? Maybe not much at first.

The Fed’s rate influences but is not directly tied to mortgages. As the Fed feels more confident in its battle against inflation, many economists believe the rate cut could be the first step in helping to eventually move mortgage rates lower. However, it’s debatable how much.

“The Fed’s half-point rate cut decision is the beginning of six to eight rounds of further rate cuts well into 2025,” says Lawrence Yun, chief economist at the National Association of Realtors. But “mortgage rates have already anticipated the Fed’s likely path.”

The Fed was largely expected to lower rates at its mid-September meeting, so mortgage rates may already have preemptively dropped in recent weeks to account for that expectation. The rate for the 30-year mortgage is down 150 basis points from earlier in the year, Yun says. Last week, the 30-year fixed-rate mortgage averaged 6.2%, down from 7.18% a year earlier, Freddie Mac reports.

“Any further decline in mortgage rates will be minimal,” Yun says. “The Fed does not directly control mortgage rates, and the federal budget deficit is huge. Future Fed rate cuts

Still, some home buyers may be holding out for even lower mortgage rates. That could happen, although economists are not predicting a drastic drop. Many economists have predicted rates to average about 6% by the end of the year.

But every drop could help in releasing pent-up housing demand. Home sales were sluggish this summer, and lower mortgage rates could motivate more prospective buyers to make their move.

The lower mortgage rates compared to the spring have already helped to improve the purchasing power of many home buyers, equating to about $50,000 in savings for those with a $2,000 monthly mortgage payment, Yun says. “Consumers who were priced out due to earlier higher mortgage rates could now be back in the market,” he says.

Any further rate cuts could get even more home buyers off the sidelines, says Chris Heller, co-founder of Agent Advice. “An interest rate cut helps first-time buyers and buyers in the lower income brackets disproportionately more than it does higher-income buyers,” he says. “This is because their home payment and mortgage usually take up a larger portion of their income.”

Lower rates can indirectly benefit sellers, since it increases buyers’ purchasing power and options, Heller adds. “Real estate agents should communicate the urgency for their clients,” he says. “Because of the advantages of owning or selling real estate, it is in the best interests of both the buyer and seller to buy or sell as soon as possible.”

Renters are rethinking what they want and need in a home, looking beyond buildings with traditional rental amenities in favor of those with features and services that better suit their lifestyle and budget.

New research from Zillow Rentals finds listings with a turfed pet area, coworking space or community happy hours are drawing more interest than listings with typical luxury amenities like a fitness center, pool and business center.

“Renters are spending more money and more time in the rental market than ever before, making them more intentional about the spaces they choose,” said Emily Mc-

Donald, Zillow’s rental trends expert.

“They are prioritizing practical amenities while also seeking community-focused perks like coworking spaces and social events. These features offer a balance of convenience and lifestyle enhancement, making renters more willing to invest in homes that cater to both their everyday needs and social lives.”

A new Zillow analysis of nearly 5.6 million rental listings, including apartment buildings and single-family houses, finds certain amenities contribute to more saves and shares per day when a home is listed on Zillow Rentals. These metrics are a sig-

nal of demand, as renters who save a listing or share it with their shopping partner are more serious about a home. The higher the demand, the faster a unit or a house is likely to rent.

It’s no surprise that the most indemand amenities are off-street parking and in-unit laundry. Listings that mention off-street parking get 85% more saves and 103% more shares per day on Zillow Rentals. Inunit laundry helps a listing get 76% more daily saves and 92% more daily shares compared to similar units.

Once those essentials are checked off, renters are looking for new perks. A pet-friendly patch of turf can boost daily saves by 76% and daily shares by 91% on Zillow Rentals. After all, previous Zillow research finds nearly three in five renters have a pet. Air filtration, popularized during the pandemic and increasingly important as more areas feel the impact of wildfire smoke, can help a rental get 72% more saves and 79% more shares per day. Communities that offer happy hours for tenants get 50% more daily saves and 67% more daily shares.

On the flip side, buildings with the usual suite of luxury amenities might have to work harder to compete. Rentals that advertise a fitness center now get 26% fewer saves and 31% fewer shares per day compared to similar listings on Zillow Rentals. Pools contribute to 10% fewer daily saves and 13% fewer daily shares. Rentals with a business center get 24% fewer saves and 27% fewer shares per day on Zillow Rentals. Instead, renters are more interested in coworking spaces, which get 16% more saves and 23% more shares.

“Renters today who are looking at higher-end rentals may expect a suite of amenities,” said McDonald. “Some features, such as a fitness center, don’t stand on their own, but are most often paired with other desirable amenities, such as a playground, or a tennis or sport court. Every renter will have their own priorities so it’s important for a property manager or landlord to list everything a unit has to offer.”

Wow-factor features are still fueling engagement on Zillow Rentals, but today those amenities look different. Bowling alleys can contribute to 30% more saves and 37% more shares per day, and a putting green drives 25% more daily saves and 40% more daily shares. Modern farmhouse features like butcher block countertops and barn doors contribute to more than 55% additional saves (58% and 56% respectively) and about 70% more shares per day (69% and 72% respectively) compared to similar homes on Zillow Rentals.

Well maintained 4 Bedroom, 3 full baths townhouse. 1st floor bedroom w/bathroom. Home to be freshly painted this week. Fenced-in private yard. Community features outdoor pool, clubhouse, fitness center, and more. Close to historic downtown Berlin and short drive to Ocean City & Assateague beaches.

Wow! Almost 3,500 SF with 5+ Bedrooms, 4 full baths, in-law apartment, and parking for multiple vehicles at the end of a cul-de-sac, a stone's throw from the golf course. So much is brand NEW! Vaulted ceilings, a Family Room with skylight, 2 Primary BRs. Walk across the "Bridge" to the game room. Oversized double car garage. A very nice 2 BR apartment on the lower level has a private porch, and separate laundry facilities. 6-foot fenced in backyard.

Location! The spacious rooms include 9' Ceilings, Brushed Nickel fixtures, Granite Countertops, Recessed Lighting, 42" Maple Cabinets, and a large kitchen island. In the Owner's Suite, you will find double walk-in closets, a Venetian Bath and a tile Surround in the shower. Also a Mud Room, Laminate Wood Plank & Ceramic Tile Flooring.

ALMOST COMPLETE! BRAND NEW CONSTRUCTION by GEMCRAFT HOMES!

With stunning curb appeal and thoughtfully designed features and finishes, the Sussex offers versatility to suit any modern lifestyle. The open-concept floor plan seamlessly connects the Living areas, perfect for entertaining! During the warmer months, you may take your living outdoors to the Screened-in Porch. The Owner's Suite has 2 walk-in closets and a luxurious Venetian-Style Bath. Extra space on the 2nd level, with an additional 4th Bedroom, full Bath, and Loft Area. Located on a quiet cul-de-sac street. and services!

$749,999

Location, location, location!! Home is in sought-after Laurel Avenue neighborhood, just off the Ditch, & seconds to the open bay by boat!!! This 4/5 BR property has the perfect blend of rustic/beachy charm with its abundance of natural wood flooring & trim work throughout. The 1st floor has 2 BRs, a den/ 3rd BR, a full BA en suite & a full hall BA. The 2nd floor has the primary BR with an outside deck to enjoy the canal & bay views. Plus, 2nd floor guest BR, extra-large hall BA with tub & shower & loft/office at top of the stairs. Enjoy the water breezes down on the 3-season porch or waterfront deck overlooking your private boat tie up.

$1,149,000