1 minute read

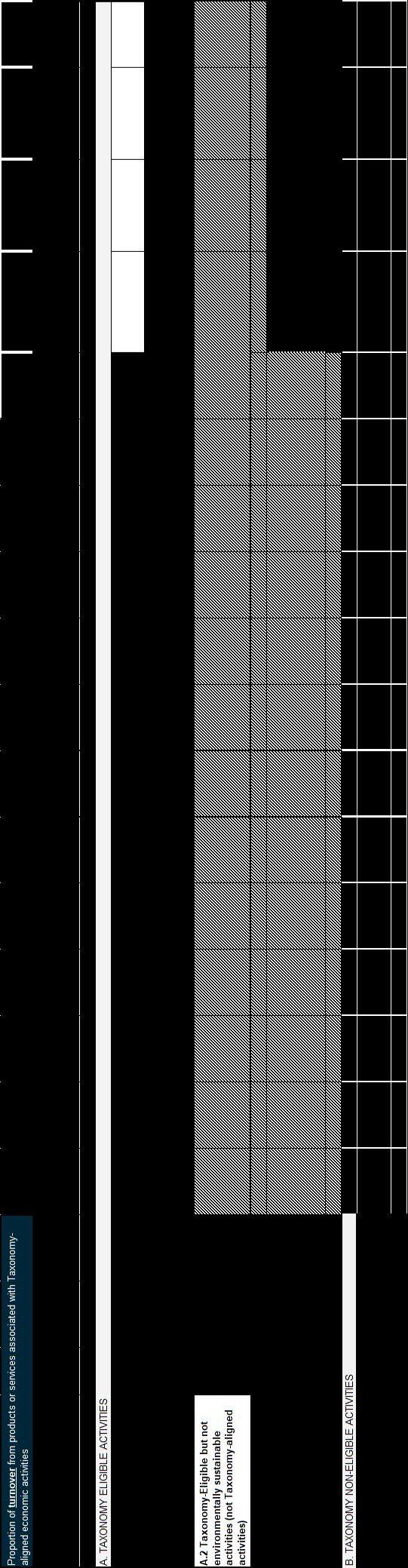

KEY PERFORMANCE INDICATORS TURNOVER

The proportion of taxonomy-eligible economic activities of our total sales has been calculated as the portion of taxonomy-eligible net sales divided by total net sales. The taxonomy-eligible portion (economic activity 7.7) is defined as the portion of owned properties that also have external tenants.

Total net sales is defined in accordance with IAS 1.82(a). and can be found in the Consolidated Statement of Income in the Annual Report as Net sales.

Capital Expenditure

The proportion of taxonomy-eligible economic activities of our total capital expenditure has been calculated as the portion of taxonomy-eligible capital expenditure divided by total capital expenditure. The taxonomy-eligible portion (economic activity 7.7) is defined as the portion of owned properties that also have external tenants.

Total capital expenditure comprises additions to tangible and intangible assets during the financial year, before depreciation and amortisation, revaluations, including impairments, and excluding fair value changes. Goodwill is not included in total capital expenditure. Assets acquired during the year can be found in Note 13 in the Annual Report.

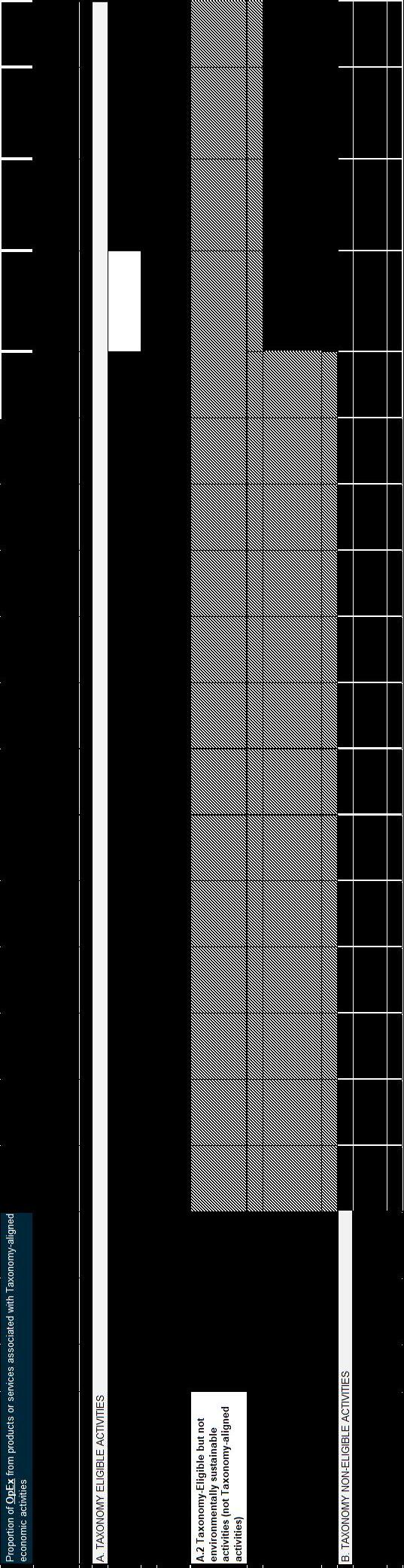

Operating Expenditure

The proportion of taxonomy-eligible economic activities of our total operating expenditure has been calculated as the portion of the taxonomy-eligible operating expenditure divided by total operating expenditure. The taxonomy-eligible portion (economic activity 7.7) is defined as the portion of owned properties that also have external tenants.

Total operating costs refers to direct non-capitalised costs that relate to building renovation measures, shortterm leases, maintenance and repair, and any other direct expenditure relating to the day-to-day servicing of assets of property, plant and equipment by the company or a third party employed for this purpose and that are necessary to ensure the continued and effective functioning of such assets.