3 minute read

Global Production Outlook

Traversing Through Trials

Mike Jackson

Advertisement

Executive Director, Strategy and Research 248.430.5954 │ mjackson@oesa.org

Despite strong regional and global light vehicle demand, sweeping supply chain disruptions of all kinds continue to plague the industry, dragging automotive production levels lower for longer. The latest global production outlook from IHS Markit for October reflects a more pronounced near-term impact in 2021 and 2022 due to the severity of problems and the realization that resolution to current supply chain constraints will be further delayed. Output in 2021 no longer reflects any meaningful volume recovery, with global vehicle production stuck below 75 million units for a second consecutive year, before approaching 83 million units in 2022.

Of course semiconductor supply constraints account for a disproportionate impact, yet this is one of many distortions in global supply chains that has triggered sharply higher prices across a basket of automotive inputs. Moreover, severe labor shortages and mounting logistics bottlenecks have further added to intense volatility and extreme pricing pressure. To this end, research from Wells Fargo lead automotive analyst, Colin Langan, points to a 40% increase from a year ago, for the weighted EV Battery Raw Material Index price per cell. Though this research reflects pricing moderation going forward, this represents a substantial cost headwind that underscores the need for regional raw material supplies.

Though headlines continue to trumpet additional investments in battery electric vehicles (BEVs) and their corresponding battery plants, these vehicle program opportunities face mounting near-term pressures. Sharply higher input costs and intense competition mean automakers and suppliers need to increase their outlays while vehicle pricing power within the marketplace will come under intense pressure. Industry stakeholders need to be engaged within the BEV sector, yet success is far from guaranteed. A flood of investment in new vehicle entrants and industry capacity is being allocated to BEVs at a rate which is arguably outpacing near-term demand. Government regulations on emissions and fuel economy, coupled with consumer incentives, have been important catalysts, driving substantial BEV investments. Government investments in energy and infrastructure are also gaining momentum and accelerating activity, creating incentives for stakeholders to reassess and expand the scope of future initiatives. Transformational change in the mobility sector is ushering in a range of new business models. To this end, Wall Street continues to reward suppliers and OEMs that are well positioned to monetize the ongoing shift toward electrification via sharply higher valuations.

It is critical for automakers and suppliers to participate within this growth sector, yet to apply careful due diligence and recognize additional challenges. The current challenge of sharply higher costs coupled with intense EV market competition will certainly lead to even longer payback periods than first calculated for some programs.

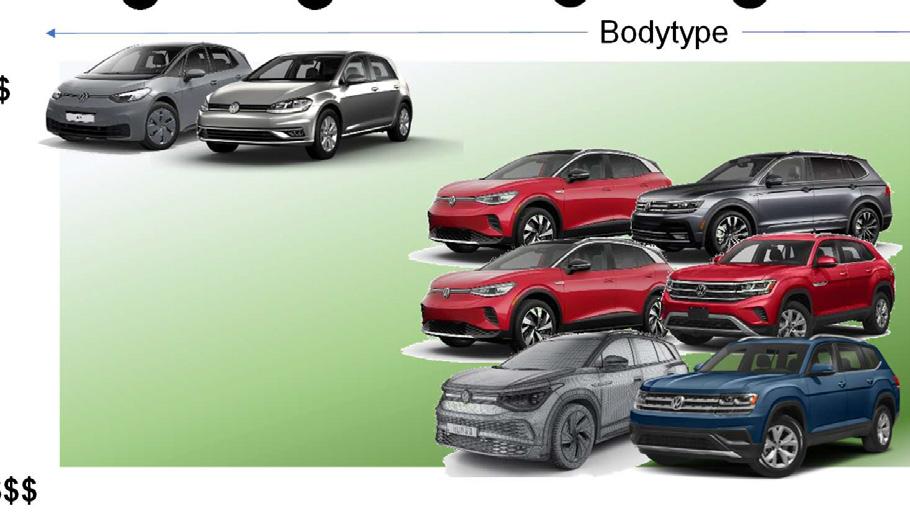

Competition is nothing new, yet strong levels of pre-pandemic demand and output helped mask underperforming programs. The industry will contribute to a surge of all-new BEV nameplates which will surely result in winners and losers. Moreover, recognize that the majority of pending BEV product plans will focus on higher margin SUVs and pickup trucks. Elements of market saturation within the compact and midsize SUV categories as well as the full-size pickup category represent a changing risk dynamic in the market going forward. Recognize the potential for product overlap and subsequent

cannibalization resulting from similarly-sized SUVs and divergent price points. Despite industry pressures, suppliers need to plan and execute on developing their defined areas of competency to capitalize on a sustained period of historic production and demand levels. Suppliers need to plan proactively to as global output is forecast to approach 100 million units for four consecutive years starting in 2024 before surpassing the mark in 2027.

Product Planning –Beware of EV vs ICE Overlap

Small

$

Bodytype

EV vs ICE

Dimension Margin

Large

$$$

Contact Mike Jackson to learn more about automotive supplier sentiments, economic and industry trends, as well as the Chief Financial and Chief Purchasing Officers Councils.