“Financial advisors, for people who don’t like financial advisors”

“Financial advisors, for people who don’t like financial advisors”

Featherstone is a small but leading investment management and financial advice firm included in Spear’s Magazine’s list of ‘Top 10 UK Wealth Managers’.

Our clients enjoy the qualities of a smaller, friendlier firm while benefiting from our team’s experience working for Goldman Sachs, Odey, JP Morgan, UBS and Deloitte.

We are part of a group founded in 1999 to manage the investments of a single family. Our clients can now invest alongside and in the same way as the original family.

We differentiate ourselves by investing alongside our clients and providing them with access to investment funds which are often inaccessible to private clients and the mass market.

Our founders, families and friends are among our largest (and smallest) investors.

Peter has previously been Deputy Chairman of HSBC Investment Bank and Head of Europe for the Canadian Imperial Bank of Commerce World Markets.

SOPHIE BURKE-MURPHY INVESTMENT DIRECTOR

SOPHIE BURKE-MURPHY INVESTMENT DIRECTOR

Sophie joined Featherstone after ten years working for Ruffer, where she managed portfolios for private clients. Prior to that she spent five years at Swiss fund manager Global Asset Management (GAM). Sophie is a Chartered Alternative Investment Analyst and also a Chartered Member of the Chartered Institute for Securities & Investment (MSCI).

ALEX MAYAlex has looked after private clients at UBS and Close Brothers. He holds the Investment Management Certificate, Financial Planning Diplomas from the CII and CISI, and is a Chartered Member of the Chartered Institute for Securities & Investment (MCSI).

ANDREW COX CFO

ANDREW COX CFO

Andrew previously worked at Goldman Sachs in the derivative markets. He’s a graduate of the University of Exeter and the London School of Economics, and he holds the CISI Certificate in Investment Management.

Tom started his career on the graduate programme at Aberdeen Asset Management, going on to work as an investment consultant for institutional clients. He has a Bachelor’s degree in Accounting and Finance.

BAKER CHARTERED FINANCIAL PLANNER

BAKER CHARTERED FINANCIAL PLANNER

Larysa is involved with all aspects of the financial planning process and provides front office technical support. Larysa has worked for Barclays and AXA Wealth, is a Chartered Member of the Personal Finance Society (PFS) and holds the CII Advanced Diploma in Financial Planning and the CISI Investment Operations Certificate.

OLIVIA BUCHANAN INVESTMENT ASSISTANTOlivia is studying the Chartered Institute for Securities and Investment (CISI) exams and helps to look after our clients. Liv trained as a chef at a Michelin star restaurant and in 2021 was voted Thames Valley ‘Apprentice of the Year’.

LARYSA

LARYSA

•

•

•

•

• We diversify our portfolios across many of the world’s leading fund managers.

• Our clients gain access to smaller, harderto-discover and (often) better-performing investments than private clients typically have exposure to.

• Decreasing risk when necessary and embracing appropriate risk when opportune. We provide ongoing financial advice to make our clients as tax efficient as possible.

“Our clients enjoy the many qualities of a smaller, more friendly firm, while benefiting from our team’s experience working with large firms.”

We invest alongside our clients. Admittedly, it is hard to find an advisor who does not make this claim orally (but it is rare to see it written down).

The genesis of our group in 1999 was to run an optimal investment strategy for a single family, we simply offer our clients the opportunity to invest alongside them.

The key benefit of being a family office investor is that our clients’ interests are completely aligned with ours.

The most insightful fund managers are often unavailable to private clients for various reasons:

They are too small for larger investment firms.

They do not deal directly with private clients. They have high minimum investment requirements. They are closed to new investors. They are low profile and hard to discover.

Our group is an industry leader in creating multi-manager funds, selecting the best specialist practitioners globally.

These funds are often more niche, higher quality and lower profile than many private investors have exposure to.

Our portfolios are deliberately agnostic of the static asset allocation benchmarks commonly used within the industry, as we firmly believe that our freedom to take a flexible approach and our active fund selection is a key driver of returns

There is a misconception that bigger investment firms are better... fuelled, of course, by the marketing machines of these large companies. We will keep the size of the firm small enough to continually benefit our clients.

The truth is that the best funds are often off the menu for larger firms which are restricted by their size to mass-market and often mediocre investments. Smaller ’boutique’ firms can invest in niche, better quality and (potentially) better performing investments.

“ There are essentially two types of investment manager – those that gather assets and those that generate alpha (out-perform). Big managers are asset gatherers, while the boutiques generate alpha.”

Jonathan Little (Northill Capital).Our clients enjoy the qualities of a smaller, friendlier firm, while benefiting from our team’s experience working for firms such as Goldman Sachs, JP Morgan, UBS, Odey and Deloitte.

We feel that clients no longer want the bland, overly-formal industry stereotype but prefer a friendlier and more inclusive firm whose interests are aligned with theirs.

Our analysts research, identify, interview and carry out due diligence on many of the best investment managers around the world.

For a fund to be considered it will have to display the following characteristics:

•

Fit one of our investment themes.

Consistent strong performance record.

No undue volatility.

Investment alongside clients.

• Historic superior risk-adjusted return. Compliment other holdings within the portfolio.

We invest with the selected underlying funds using a multi manager portfolio run within the group.

• These underlying funds are often not available to private clients for various reasons.

The unitised fund-of-funds structure makes this a very tax efficient way to invest for private clients.

We carry out ongoing due diligence and, as an institutional investor we have access to regular meetings and dialogue with the fund managers.

• We will ensure that the portfolio holdings remain consistent with our macroeconomic view and current investment themes.

• We closely monitor the risk and diversification of the portfolio and employ external experts such as Natixis to add further levels of insight.

Deciding when to exit the position is just as important as entering, but it is an area where most private clients do very badly. There are various red flags:

• Change of manager.

Fund size too big. Style change.

• High volatility.

Changes in transparency and accessibility. A change in our own asset allocation.

“We feel that many larger firms focus more on their shareholders than on their clients... our interests are completely aligned with our clients.”

The need to build infrastructure in both developed and emerging economies is both an engine of economic activity and a necessity, following years of under investment.

Awareness of technology advances and medical discoveries aided by the availability of cheap genome sequencing is making bespoke preventative medicine a reality to gradually replace treatment-based generic drugs. This is sector may benefit from increased government spending post COVID-19.

Today’s industries require greater use of lightweight materials and compounds. Awareness of natural resources needed for battery technology and storage plus industrial applications such as fibre lasers is essential.

Many of our themes contain a common thread – technology. The impact of online shopping on traditional retail and the shift towards home working and the use of cloud technology have been exacerbated and accelerated by COVID-19.

Including automation, artificial intelligence and machine learning. The scale of demand and development of robotics in global industries and the supply chain has again been highlighted by COVID-19.

Cyber security, including the ring-fencing of personal data and online payment security. In addition, there is a much wider context which includes all manner of areas from food and drinking water testing, to physical protection.

The move to clean energy and clean tech, an awareness of environmental challenges and the pressures of climate change, make this a sustainable theme going forward.

History has demonstrated that the strongest and most consistent returns have come from investing in smaller companies and from gaining exposure to their growth. As investors not constrained by size (not too big), we have a natural preference for smaller companies in our thematic approach but there are also pockets of the world where we find the availability of smaller companies to be particularly attractive.

Biotechnology & Healthcare; Disruptive Influences; Technology; Smart Materials; Smaller Companies

Sustainability; Environment; Disruptive Influences

IP group is a private equity company which partners with leading UK & US universities in order to monetise scientific discovery. They have a portfolio of private, early-stage companies categorised into four main sectors (Biotech, Cleantech, Healthcare and Technology). Notable successes include First Light Fusion (Oxford - Fusion Power), Mission Therapeutics (Cambridge – Cancer Therapeutics based on DNA damage response), Oxford Nanopore (Oxford –DNA Sequencing) RFC Power (Imperial – Battery technology)

We believe we are at the foothills of the investment journey for the green energy theme. This fund aims to invest in companies that are delivering solutions to problems of climate change and ecosystem interference. The TT Research Advisory Board consists of leading environmental policymakers and experts such as Dr Ma Jun, a key green policy adviser in China and Co-Chair of the G20 Green Finance Study Group.

Smaller Companies; Disruptive Influences

LOGISTICS Infrastructure; Digital Disruption

We see some of the best investment opportunities in venture capital due to the lack of access and therefore research by the larger institutional investors. This small venture capital trust (£400m) invests in private companies and helps to take them to IPO. Some of their most successful early-stage investments include Klarna, the world’s most valuable private company and Starling Bank, the digital challenger bank.

Urban Logistics owns and operates distribution hubs in the UK for online businesses who can share modern distribution network operations, such as order dispatch, delivery and returns processing in order to facilite e-commerce. They have hubs across the UK with high quality tenants achieving a yield of circa 7%

Healthcare; Ageing Population

An investment company with a portfolio invested in care home properties. Strong demand from an ageing population and a shrinking supply of facilities for elderly care within a fragmented market creates a high yield and reliable income stream.

“We are frustrated by a bland and everhomogenising industry which all too often provides poor advice, alienates people with jargon and seems to focus more on shareholders than on clients.”

“Our founders, families and friends are amongst our largest (and smallest) investors.”

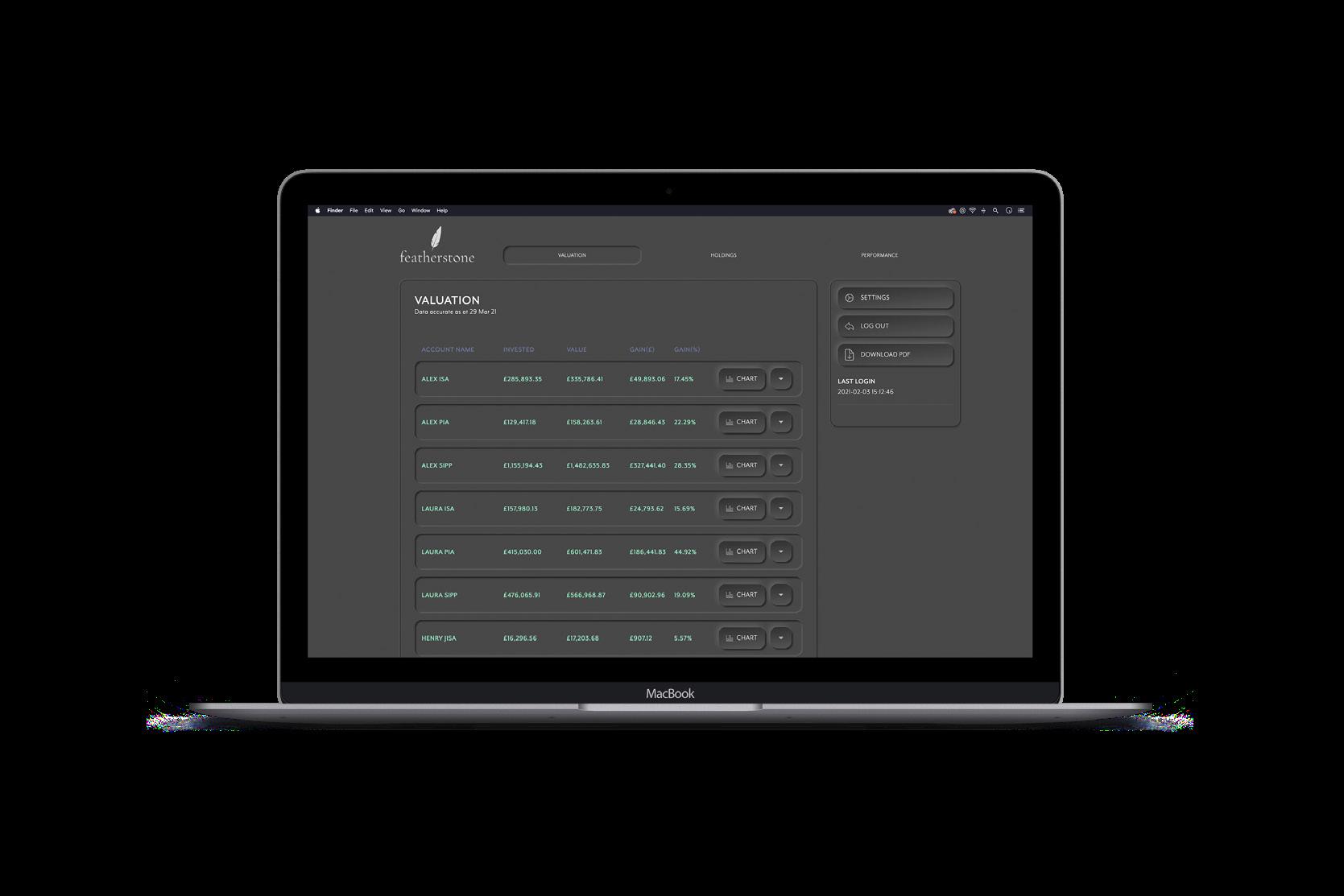

We have created our own, industry-leading portal so that our clients do not need to pay ‘platform fees’ which are typical with other firms.

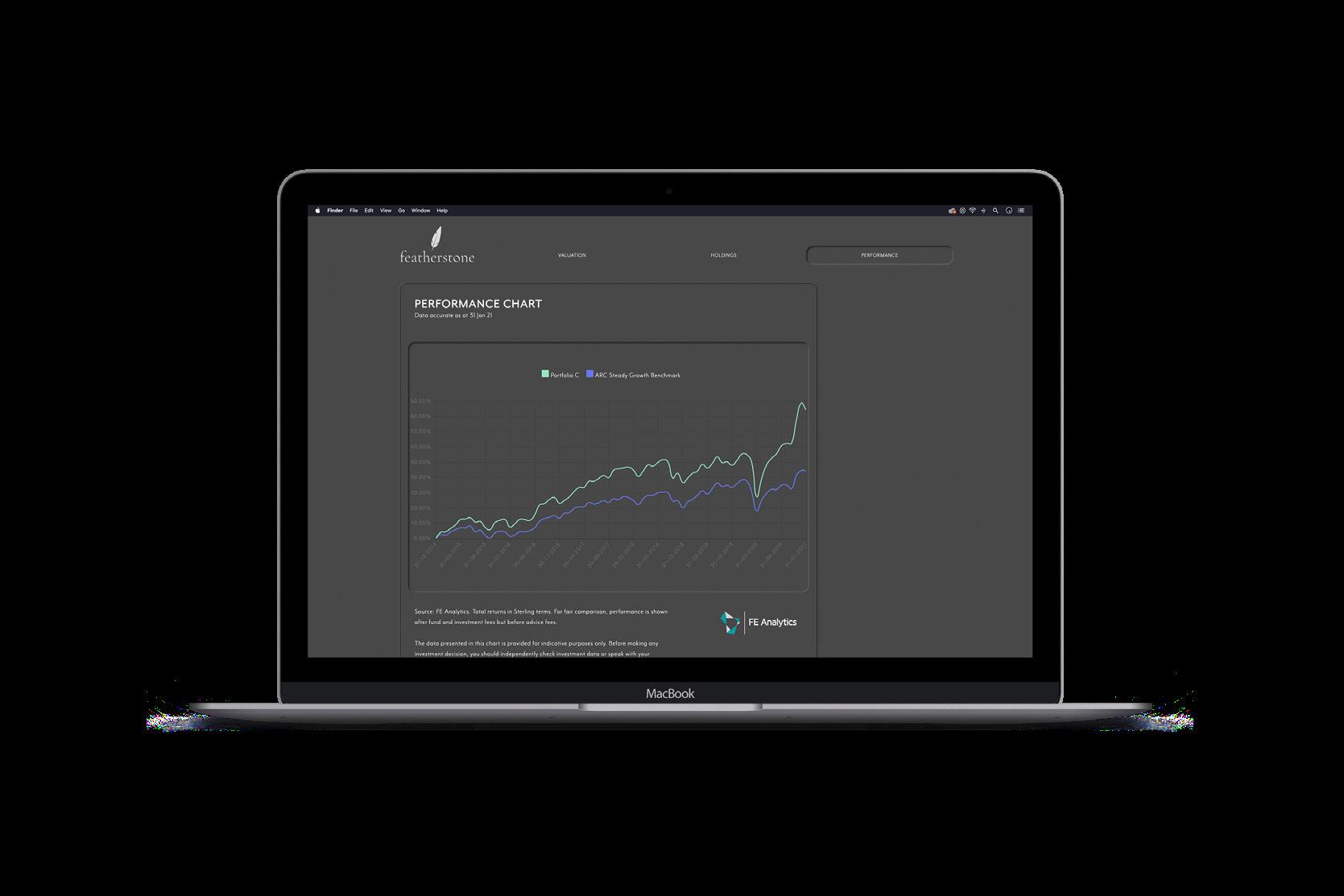

Clients have access to daily updated and interactive valuation, holdings and performance charts and data. This can all be downloaded into a PDF with a single click.

Clients can track the daily performance of their portfolio versus the relevant benchmark using various interactive charts and data points.