23 minute read

News

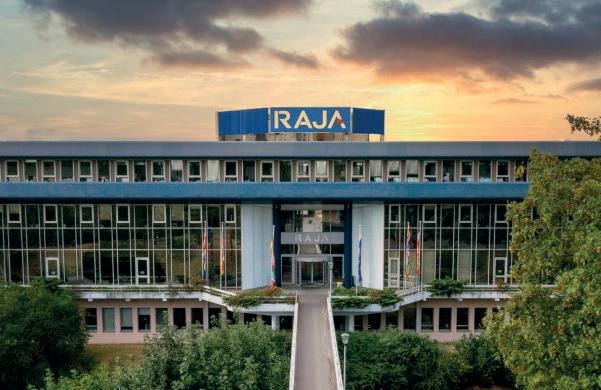

Analysis: RAJA ramps up OP

RAJA’s B2B direct office products business has taken a giant leap forward after it made a move for Office Depot Europe and its Viking brand

RAJA Group has cemented its position as a major player in the European office supplies market after agreeing to acquire the remaining businesses of Office Depot Europe (ODE) from private equity firm Aurelius. The transaction – for which financial details have not been revealed – is expected to close at the end of October.

Competition approvals have already been given, OPI understands, and there are just a few remaining formalities to finalise. RAJA will then own the Viking brand in seven European markets – the UK, Ireland, DACH (Germany, Austria, Switzerland), the Netherlands and Belgium – plus the remaining ODE contract customers in DACH.

Altogether, the deal will add almost €500 million ($590 million) to RAJA’s top line, most of that derived from Viking. Almost 1,500 employees are set to make the switch, while RAJA will also take on two distribution centres, one in Großostheim (Germany), the other in Leicester (UK).

A GOOD FIT

The move comes about two years after the France-based packaging specialist bought Staples Solutions’ operations in France, Italy and Spain, which led to the creation of RAJA Office. With the addition of ODE, RAJA Office will have annual sales of around €800 million and a presence in ten countries.

Group-wise, RAJA will service more than 2.2 million clients in Europe, with revenues jumping to over €1.6 billion a year.

In geographical and business model terms, the acquisition dovetails nicely with the acquired Staples Solutions assets, which currently trade under their former, pre-Staples, brand names: Bernard and JPG in France, Mondoffice in Italy and Kalamazoo in Spain.

Therefore, it is now clearer why Aurelius entered into separate agreements for ODE in Italy (with Bruneau) and Spain (Bruneau and Lyreco) and for the UK contract business (OT Group) – it is unlikely these units were of great interest to RAJA.

OPI had the opportunity to speak with RAJA CEO Danièle Kapel-Marcovici shortly after the acquisition announcement. She was reluctant to give too much away ahead of the deal closing, and will most likely provide an in-depth strategy update at a press conference in Paris in October.

However, she referred to comments she had made in a press release, in which she spoke about driving profitable growth at Viking and achieving synergies in areas such as purchasing, marketing and sales.

DEVELOPING POTENTIAL

“We have already identified several areas of potential at Viking, and I’m sure we will discover others,” Kapel-Marcovici said. “There is a need to invest in this business, and we will do exactly that.”

She hinted at several things which appear to have been taken from the playbook RAJA adopted following the Staples Solutions acquisition: greater autonomy for local management, improving the quality of sales media (internet and catalogues) and expanding product ranges.

The latter is not about Viking selling more packaging products, but evolving its offering to better cater to new ways of working: categories such as furniture, workplace collaboration and well-being. A greater emphasis on sustainable products is also something the RAJA CEO is keen on developing.

The acquisition will no doubt be good news for RAJA Office’s supplier partners. The group has a history of sourcing locally wherever possible and the vast majority of items in the new RAJA-branded office products range come from vendors that manufacture in Europe.

There is no reason to believe it will shift from that philosophy with Viking on board. Indeed, it will likely be looking to leverage those supplier relationships following the significant increase in purchasing power.

RAJA has breathed new life into the Staples Solutions brands since the end of 2019, despite the challenges of the COVID pandemic. It has also given them a fresh sense of identity, framed within the values and culture of the RAJA family.

It will be looking to achieve exactly the same with Viking over the coming months. Some difficult decisions will have to be taken – that’s a given with any acquisition of this nature and size. But we can hopefully look forward to a reinvigoration of the iconic Viking brand in Europe, which for many years led the way in terms of innovation and customer service.

NEWS Analysis: ODP ploughs ahead with spin-off plans

Analysts and journalists hoping for something meaningful from The ODP Corporation (ODP) relating to its proposed retail transaction with Staples were left disappointed after the reseller’s second quarter earnings announcement in August.

Since Staples (via its owner Sycamore Partners) made a $1 billion offer on 4 June to acquire ODP’s retail and consumer-facing e-commerce operations (officedepot.com), there has been radio silence on the matter from all parties.

During the Q2 earnings conference call, ODP Chief Legal and Administrative Officer David Bleisch did speak for a few minutes about the Staples proposal, but we learned very little.

He said the ODP board is continuing to review the offer and that it has been in contact with representatives of Sycamore. However, he didn’t give any indication as to what stage negotiations were at nor when we might be provided with further details.

AMICABLE NEGOTIATIONS?

At least it infers talks are progressing on an amicable basis. Staples had previously said that if negotiations were not successful, it would proceed with a tender offer to acquire the whole of ODP. There has been no suggestion it is preparing to take this course of action.

Indeed, it would be a major surprise if it did – Staples wants to buy and ODP wants to sell, so one assumes they are still working through the details and an agreement on the final price.

“I think ODP is just marching down its own path to spin off the retail side and then determine if Staples is the best fit or not,” Edgewater Research Partner Eamon Kelly told OPI. “I would still expect something to get done between the two.”

In the meantime, ODP’s Retail division keeps posting strong sales and profit numbers. In its most recent quarterly results, revenue was flat at $914 million despite having 169 fewer stores open versus last year. That suggests a same-store increase in the double digits.

Removing less profitable locations, plus initiatives such as a new in-store labour model, helped the unit’s operating profit more than double in Q2 to $44 million, while operating margin climbed by 290 basis points to 4.8%. In the first six months of 2021, Retail made $145 million, a sum which might give ODP some leverage in any negotiations.

MAKING PROGRESS

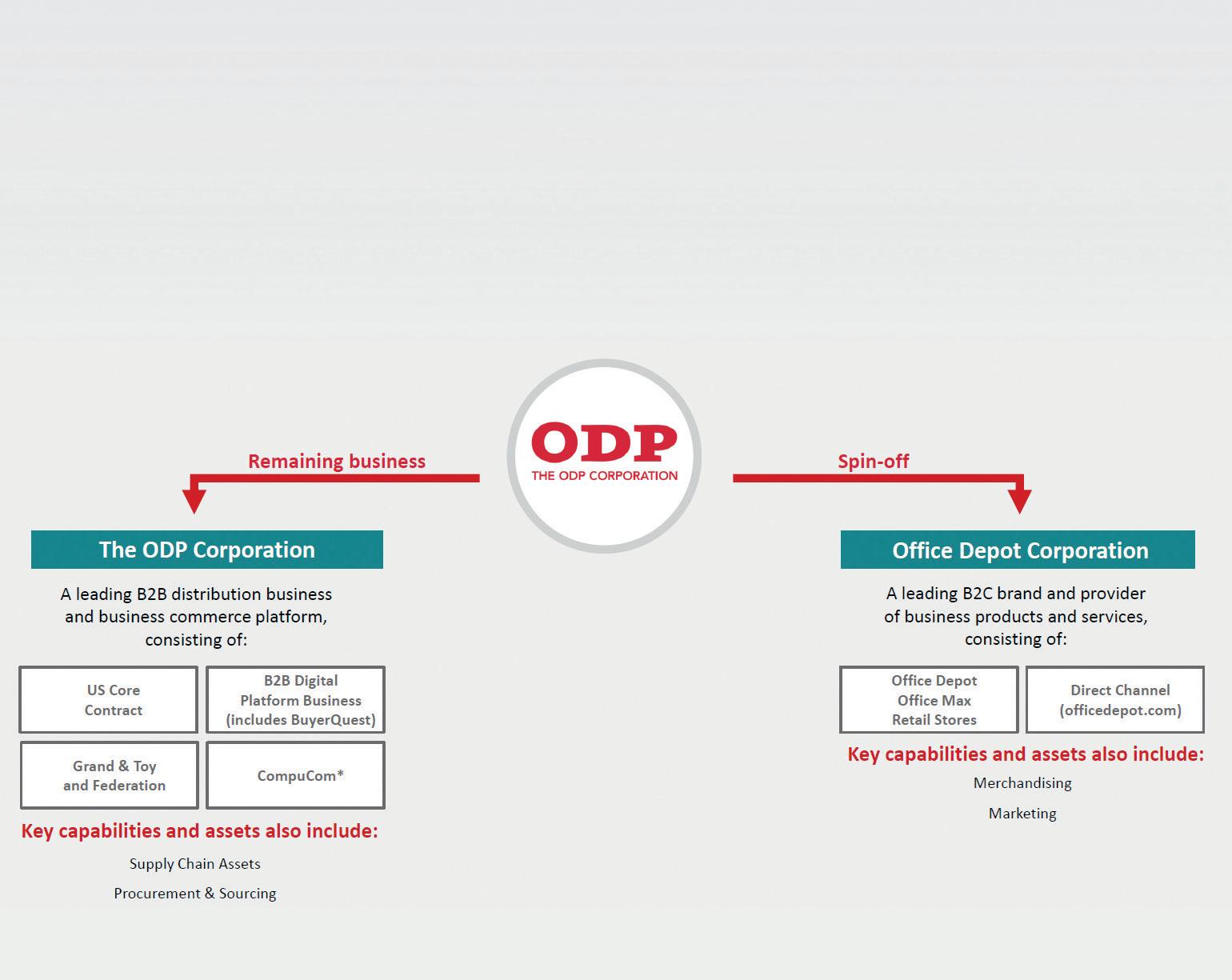

Of course, there is no guarantee that ODP and Staples will reach an agreement. With this in mind, ODP continues to make progress with its plans to split into two separate, publicly-listed companies during the first half of 2022.

The surviving ODP – to be headed by current CEO Gerry Smith – will consist of several operating companies, including the contract sales channel of ODP’s Business Solutions Division (BSD) – which will be renamed ODP Business Solutions – and its new technology platform, Varis. These will be operated separately.

The spun-off entity will be called Office Depot Inc, comprising around 1,100 Office Depot and OfficeMax retail locations and e-commerce site officedepot.com. After the transaction, this business will be led by Kevin Moffitt, currently Chief Retail Officer at ODP.

The smart money, however, is still on a combination of more than 2,000 Office Depot, OfficeMax and Staples locations in the US. We will just have to wait and see if it happens before or after ODP splits into two.

More intriguing is what ODP’s Varis will be all about and what the future holds for its BSD unit. If Varis is an Amazon Business-style marketplace – and all signs are pointing this way – then it might very well be competing with BSD in the public sector and corporate accounts spaces.

Assuming BSD forms part of ODP’s longer-term strategic plans, of course.

It’s been an important time for Australian independent dealer COS. Just over three years after it acquired Lyreco Australia and two after strengthening its position in the education sector by purchasing Vital Office, COS has now snapped up Quick Corporate Australia (QCA), the country’s second-largest independent reseller.

The deal – effective 1 October – involves QCA’s book of business and inventory, with the majority of its staff also making the switch. COS will use its own distribution facilities to service former QCA customers. These include a new, purpose-built office and warehouse in the city of Perth, where QCA is headquartered.

The addition of QCA takes COS’ 2021 sales run rate to around A$275 million (US$203 million). It strengthens its position in the private sector mid-market and in Western Australia, where QCA achieved around half of its A$19 million in annual revenue.

News of the QCA acquisition came shortly after COS had announced that Amie and Belinda Lyone – daughters of company founder Dominique Lyone – were formally instated as co-CEOs on 1 September 2021.

Between them, the sisters have 34 years of experience at COS, with Belinda focusing on strategy, sourcing and sales and Amie in charge of the team, service levels and logistics. The COS founder revealed, however, that he wasn’t quite ready to hang up his independent dealer boots completely just yet.

He will step up to the new role of Chairman and will direct his energy on his core passions. These include: strategic acquisitions, market research, the Lyone Foundation, mentoring up-and-coming CEOs, and teaching on the Money & You programme and at the Excellerated Business School for Entrepreneurs.

German independent dealer Kaut-Bullinger is to exit the retail channel early next year after confirming it will close its flagship location in the heart of Munich.

The store – located in a busy shopping area in the centre of the city – has been an iconic part of the German stationery trade since 1970, while Kaut-Bullinger’s retail presence in the city dates back to 1805. When the outlet closes next February, it will mark the end of Kaut-Bullinger’s bricks-and-mortar operations.

“The COVID crisis has clearly shown that the stationery retail trade in its current form and size can no longer be the focus of our corporate strategy,” said the reseller’s Group Managing Director Robert Brech.

The dealer will now focus its efforts on conducting business online, which currently accounts for around 50% of its revenue. It said its B2B Office + Solutions division will not be impacted by the retail developments.

From left: Belinda, Dominique and Amie Lyone

ACCO names COO

ACCO Brands has appointed Tom Tedford as its COO and named his successor for the role of President of the company’s North American operations.

As COO, Tedford – who joined ACCO in 2010 – will have full responsibility for the sales, marketing and operations of all the vendor’s businesses Tom Tedford and products worldwide. He started his new job on 1 September, continuing to report to CEO Boris Elisman.

The last time ACCO appointed a COO was back in December 2010, with Elisman himself taking on the role. That move came as part of the vendor’s senior leadership succession planning. Just over two years later, he was appointed as CEO to take over from Bob Keller. With Elisman now the same age as Keller was 11 years ago, Tedford’s appointment could be in the same vein – although the company made no reference to that possibility in its press release.

ACCO selected an external candidate to succeed Tedford as head of its North America division. Roxanne Bernstein started in the post on 7 September, joining from Crystal Farms Dairy. A former Captain in the US Army, Bernstein has held a number of senior sales and marketing roles at Fortune 500 companies such as Kraft Foods, Kellogg’s and Post Consumer Brands.

Kaut-Bullinger to exit retail

The Staples name has disappeared from the Argentinean business products market three-and-a-half years after the business was acquired by a local distribution company.

Staples Argentina was sold to HC Corporation in February 2018 as part of Staples’ strategy to focus on its North American operations. It had begun life in 1997 as Officenet – founded by young entrepreneurs Santiago Bilinkis and Andy Freire – before being acquired by the US giant in 2004. It was rebranded to Staples Argentina in 2011, shortly after Bilinkis had departed.

The reseller has now dropped the Staples name in favour of a new brand: ALOT. It operates under a multichannel strategy after moving into retail a few years ago. ALOT has 18 stores in the Buenos Aires area, as well as a strong delivery business that ships to more than 20,000 SMBs in 800 locations throughout the country as well as government and enterprise customers.

ISG distributes millions to members

US dealer organisation Independent Suppliers Group (ISG) distributed Q2 2021 rebates to its members of more than $6.2 million. This was a jump of almost 40% versus the same quarter last year.

In addition to the Q2 rebates, ISG also issued a ‘patronage dividend’ to its shareholders of record, with the total amount exceeding Jordan $1.18 million. Kudler

ISG Chairman Jordan Kudler said: “These strong rebate and dividend distribution amounts exemplify the benefits of participating in the direct buy programmes that ISG provides to its dealers.

“Earlier this year, I had called for unity among our members. Standing behind our supplier partners, buying direct and selling brands delivers results – and distributing $7.38 million to our membership is proof positive.”

Heiko Drews

Steve Smith

Andrea Eli

Christie Pruett

Stewart Brown

Peter Howard European business supplies reseller Schäfer Shop has hired Heiko Drews as Head of International Procurement. He joins the Germany-based group from Hermes-OTTO International, where he spent several years in sourcing roles in both Turkey and Hong Kong.

VOW Wholesale has appointed Steve Smith as its new Operations Director. Smith is no stranger to the wholesaler, having managed EVO Group’s (then known as Vasanta) Normanton and Ireland distribution centres from 2009-2015. He succeeds Martin Weedall, who recently took on the same role at sister company Banner.

Andrea Eli has taken on the role of Channel Sales Director at VOW. Eli knows the UK independent channel well, having owned Bradford-based dealer Ventura Office Supplies for 12 years before the business was sold to VOW’s parent, EVO Group, in 2018. She takes over from Kathy Briggs, who has joined EO Group as Head of Category.

S.P. Richards (SPR) has promoted Christie Pruett to SVP of IT and CIO. She has been with SPR since 2007 and succeeds Brian McGill, who retired after more than 34 years with the wholesaler.

Stewart Brown, long-serving Purchasing Manager at Scottish independent dealer Langstane Press, retired at the end of August after 37 years at the company. His duties will be handled jointly by Marketing Manager Gwyneth Hume and Sales Director Graham Taylor.

UK print consumables distributor Data Direct has appointed Peter Howard to the role of Business Development Manager. An experienced channel executive, Howard previously spent 15 years at Konica Minolta.

Pentel UK has named Paul Smith as Territory Manager for the south and west of England and Wales. He has extensive experience in the writing instruments industry, having previously spent 16 years with Staedtler. He takes over from Richard Smith, who left following a long career with the manufacturer.

New financing for WB Mason

Top US dealer WB Mason has agreed new $325 million senior secured credit facilities. They include a $275 million asset-based revolving credit agreement and a $50 million FILO (first in, last out) facility. The funds will be used to repay existing debt and support future growth.

Tech Data and SYNNEX complete merger

The combination of Tech Data and SYNNEX has been finalised, with the new entity now known as TD SYNNEX. The $7.2 billion transaction has created the world’s largest IT distribution firm, with annual sales of around $57 billion.

Lacoste expands reach

French independent dealer Lacoste Dactyl Bureau & École (LDBE) has acquired former Calipage member PF Bureautique, located in Toulon. LDBE will now use this deal as a springboard to grow its presence in the south-east of the country.

Jan/san merger in the US

US jan/san distribution group Envoy Solutions – which includes North American Corporation, WAXIE Sanitary Supply and Southeastern Paper Group – has acquired Daycon Products.

Daycon is a 79-year-old distributor of facility supplies and training services located in the state of Maryland. With Daycon, Envoy will employ 2,000 staff, operate a network of 40 distribution centres and service 43,000 customers across the US.

HNI to open Mexican factory

In response to growing demand for office seating, HNI has said it is to open a new office furniture manufacturing plant in Saltillo, Mexico.

The 160,000 sq ft (16,000 sq m) facility is expected to employ an additional 250 workers and will begin production in the first quarter of 2022.

Mitsubishi Pencil sets up European subsidiary

Wayfair releases B2B numbers

Maxime Brasseur

Paul Smith Uni and uni-ball brand owner Mitsubishi Pencil Company is investing in the European market with the establishment of a regional headquarters. Mitsubishi Pencil Europe will be based in Boulogne-Billancourt on the outskirts of Paris.

Under the chairmanship of group President Shigehiko Suhara, the new unit will be headed by Maxime Brasseur, CEO of the company’s French subsidiary. He will be supported by Paul Smith, until recently Director of Sales and Marketing at Mitsubishi Pencil UK, who has been appointed as Director of Sales.

Smith confirmed to OPI that the changes were not a cost-reduction exercise, nor were there any jobs at risk at local subsidiaries. In fact, he said it was more a question of making investments in Europe in order to grow sales and, as such, the company is actually recruiting more staff, both locally and for the European team.

Fifth year for Pink Ream initiative

Sylvamo – the new name for International Paper’s paper business as of 1 October – has entered into its fifth year of supporting the fight against breast cancer with the HP Office Pink Ream campaign in partnership with Think Pink Europe.

Consumers will be able to buy HP Pink Ream throughout October – worldwide Breast Cancer Awareness Month – and November. The monies raised will support a variety of breast cancer projects through Think Pink Europe.

The Pink Ream campaign was launched in Europe in 2017 with distinctively recognisable packaging for reams of HP Office paper.

For each Pink Ream sold, Sylvamo donates €0.10 to European programmes focusing on breast cancer research, awareness and prevention. Since the launch of the initiative, over €450,000 ($530,000) has been raised across the continent.

Online furniture giant Wayfair has revealed that its Professional B2B division is now worth more than $1.5 billion in annual sales, about 10% of the company total. The majority of this revenue comes from the US, where Wayfair Professional counts 84 of the country’s Fortune 100 companies as active customers.

The division is headed by former Google exec Margaret Lawrence. During the company’s most recent earnings conference call, she said Wayfair Professional’s vision was to be “the destination for all things furniture, fixtures and equipment for every business”. She referred to the “enormous future opportunity” in North America and Europe, where the combined addressable B2B market is almost $200 billion – with just 15% of that currently spent online.

The UK trade body BOSS Federation held its annual AGM on 15 September, the first substantial in-person event for the UK industry since COVID-19 hit in early 2020.

The day kicked off with a summary of the past 18 months delivered by Simon Drakeford, the association’s Chairman. Drakeford, CEO of EO Group in his day job, talked delegates through the progress made by BOSS as regards its endeavour to arrest a slow decline in membership and revenues. He pointed to a double-digit rise in income over the past year.

That turnaround was almost certainly due to the impressive and swift reaction to the pandemic by BOSS. It rapidly developed a broad suite of new benefits and resources to help its members navigate the uncertainty, all under the leadership of CEO Amy Hutchinson, who delivered a summary of its activity to the assembled audience of industry leaders.

With substantial cash reserves in hand, it is certain that we’ll see BOSS enhance its portfolio of tools and services in the coming years, further strengthening its relevancy and standing as one of the premier trade associations of business supplies in the world.

Other highlights of the day included a live Zoom interview with the sometimes rebellious Conservative Member of Parliament for Wycombe, Steve Baker. He delivered fascinating insights – concise and direct – into what policy changes can be expected from the UK government as it tackles the aftermath of COVID. There was also a lively panel discussion featuring three BOSS board members – Steve Haworth (EVO Group), Geoffrey Betts (Stewart Superior) and Frances Stephen (Springfield Business Supplies).

The event at the Belton Woods Hotel near Grantham also played host to the annual fundraising day hosted by the BOSS Business Supplies Charity (BBSC). Over 100 delegates enjoyed either a sunny afternoon of golf, or some spa pampering following a rousing and inspirational presentation by entrepreneur Joanne Bonnett.

The day wrapped up with a much-anticipated networking dinner and auction, with BBSC benefitting to the tune of almost £15,000 ($21,000), much to the delight of the retiring Chairman Graeme Chapman OBE.

Stepping up from January 2022 to replace Chapman as the charity’s head is Martin Wilde, whose current role as Vice Chair will be assumed by OPI’s Finance & Operations Manager, Kelly Hilleard.

US-based beverages giant Primo Water (formerly Cott) has purchased a minority interest in growing UK water company Sipple Hydration Stations.

Sipple is a provider of water refill points and reusable bottles for workplaces and high-traffic areas, such as train stations, airports and shopping centres.

Primo said the investment would enable it to participate in the growing UK market and offer Sipple’s water stations in other markets where the US company already operates.

Paperworld Middle East points to Africa growth prospects

Research recently commissioned by Paperworld Middle East says that the stationery market in Africa will grow by more than $600 million over the next six years.

The Africa Stationery Market report predicts the continent’s stationery consumption to reach a value of $5.04 billion by 2027, growing at an average annual compound growth rate of 2.4% from its current $4.39 billion valuation. It cites a booming education sector throughout the continent and upscale commercial sector investment as the reasons for the uptick in demand.

According to the research, South Africa – where office inventory is set to reach 14.83 million sq m (150 million sq ft) by the end of this year – Egypt and Nigeria account for the lion’s share of the stationery and office supplies demand.

Education represents 60% of overall sector demand in Africa. And although the COVID-19 pandemic has slowed demand, with schools being forced to close, the sector is expected to rebound by the end of this year.

The report also notes that Africa’s stationery market is largely import driven, with Dubai being the major export hub. That is obviously music to the ears of the Paperworld Middle East organisers, with the show – next scheduled for December 2021 – based in the United Arab Emirates.

Primo Water invests in UK firm

OPI 30TH ANNIVERSARY 30 years of OPI news

OPI has proudly been covering the breaking international stories in our sector for the past 30 years. Here’s a selection of key developments that have helped define and shape the industry since 1991. Enjoy this little trip down memory lane

1990s

1993: Office Depot enters contract stationery channel 1994: Mark Baccash launches the Office 1 franchise operation 1996: Staples attempts to buy Office Depot for the first time. The deal was finally abandoned in June 1997 after it was blocked by the US Federal Trade Commission 1997: David Guernsey creates BPGI 1998: Staples buys the Quill Corporation from company founder Jack Miller, paying $685 million, while Office Depot coughs up $2.7 billion worth of shares to acquire Viking as both big boxes target the direct mail order channel 1998: Esselte acquires Leitz for almost $340 million 1999: Netherlands-based Buhrmann, under the leadership of Janhein Pieterse, acquires Corporate Express in a deal worth $2.3 billion

2000s

2000: Boise Cascade Office Products sells its European business to France-based Guilbert for $320 million 2001: USOP files for Chapter 11 2003: Boise Cascade buys (and rebrands to) OfficeMax 2007: The Vasanta Group (now EVO Group) is created when Electra Partners buys Kingfield Heath and ISA 2008: Staples buys Corporate Express (formerly Buhrmann) for $2.65 billion

Jack Miller

Janhein Pieterse

Mike Maggio (l) & Yancey Jones

2010s

2011: Spain’s Unipapel agrees to buy Spicers’ continental European operations for more than $250 million, while Better Capital purchases Spicers UK & Ireland 2013: Office Depot acquires OfficeMax 2014: 3M abandons its pursuit of Avery after regulators oppose the deal 2015: Amazon Business is launched 2016: Staples again fails to acquire Office Depot due to antitrust issues. Both companies consider the future of their international operations 2017: Staples is bought by private equity firm Sycamore Partners 2018: North American wholesalers S.P. Richards and Essendant are set to merge until Sycamore-backed Staples steps in to acquire Essendant 2019: Independent Suppliers Group, Pinnacle Affiliates and TriMega Purchasing Association merge to form the world’s largest independent dealer group 2019: ADVEO collapses

2020s

2020: Turmoil in the UK as Spicers goes into administration 2020: Yancey Jones and Mike Maggio lead the buyout of S.P. Richards 2021: The final pieces of Staples Solutions and Office Depot Europe are sold off by their private equity owners