Connecting the business products world June 2023

Solutions BIG INTERVIEW l Amazon Business expands l Gentile to leave ISG l Data-driven cleaning l Cybercrime dangers l Safety beyond compliance l State of the OP Industry report 2022-23 l Ireland: land of opportunity INSIDE THIS ISSUE FACILITIES / SAFETY / PPE Special Issue

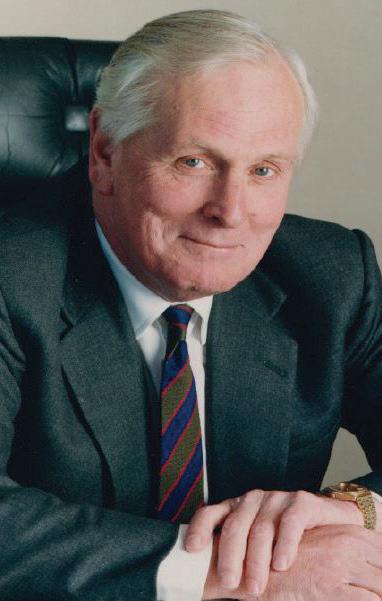

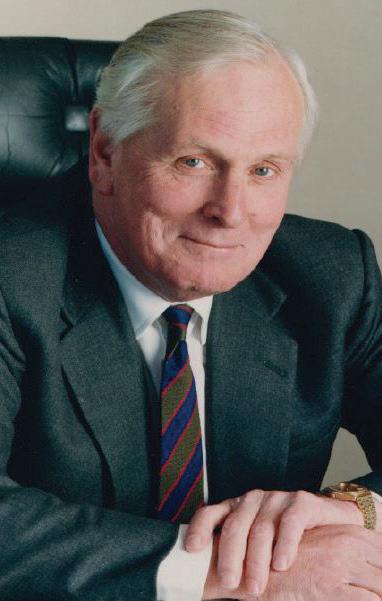

Angie Bukta, Canadian Workplace

Big Interview: A united (Canadian) front

When three Canadian dealer groups came together towards the end of 2022, it was the cumulative effect of many challenges at Basics Office Products, CIS Office Plus and Guild Stationers. Following years of duplicated efforts – and costs – the final straw was the loss of the single biggest dealership across all groups to big box operator Staples last June.

Angie Bukta, previously President of CIS, picked up the reins to lead what’s now known as Canadian Workplace Solutions. Her focus, she says, is to create a harmonised network for dealers, stability in an everchanging market and a solid platform for growth.

FOCUS: DON’T BE HELD TO RANSOM

Every organisation is a potential target for a ransomware attack. Over the past nine years, I have worked with businesses of all sizes and across various industries, from sole traders to FTSE 100 companies.

Cybercrime impacts any organisation that critically relies on electronic communications to conduct operations. If this sounds like your firm, from a criminal’s perspective, there’s a high likelihood you may contemplate paying a ransom to recover your data in order to save your business. Offences have become more targeted towards specific sectors, unlike the original attacks that were sent to almost random targets.

6 Obituary

Remembering Jimmy Godwin, Mark Pelletier and Tony Brown

20 Big Interview

Canadian Workplace Solutions is beginning to reap the benefits of group collaboration

28 Focus

Cybercrime is omnipresent, as a recent attack on Essendant has shown. But there are ways to prepare for and deal with such an event

42 Spotlight

What are the core issues the European reseller channel is facing following a highly challenging 2022?

46 Research

The State of the OP Industry 2022-23 report

26 Opinion

Reckitt’s Jonathan Weiss points to great hygiene as a vital component of a healthy business

32 Interview

Raising the bar in workplace safety

36 Category Update

The facilities, safety and PPE segments continue to present opportunities in a stabilising market

REGULARS

5 Comment

8 News

16

48 5 minutes with...

Carissa Ryan

50 Final Word

Ashley Burke

June 2023 3

CONTENTS

Green Thinking News

18 OPI Small Talk

FACILITIES / SAFETY / PPE Special Issue FACILITIES / SAFETY / PPE Special Issue BREAKROOM SPECIAL Special Issue BREAKROOM SPECIAL Special Issue Special Issue BREAKROOM SPECIAL FACILITIES / SAFETY / PPE Special Issue

The OPI team

EDITORIAL

Editor

Heike Dieckmann

+44 1462 422 143 heike.dieckmann@opi.net

Deputy Editor

Michelle Sturman

michelle.sturman@opi.net

News Editor

Andy Braithwaite +33 4 32 62 71 07 andy.braithwaite@opi.net

Freelance Contributor David Holes david.holes@opi.net

SALES & MARKETING

Chief Commercial Officer

Chris Exner +44 7973 186801 chris.exner@opi.net

Head of Media Sales

Chris Turness +44 7872 684746 chris.turness@opi.net

Digital Marketing Manager

Aurora Enghis aurora.enghis@opi.net

EVENTS

Events Manager

Lisa Haywood events@opi.net

Event Programmer

Sophie Carus sophie.carus@opi.net

PRODUCTION & FINANCE

Head of Creative

Joel Mitchell joel.mitchell@opi.net

Finance & Operations

Kelly Hilleard kelly.hilleard@opi.net

PUBLISHERS

CEO

Steve Hilleard

+44 7799 891000 steve.hilleard@opi.net

Director

Janet Bell

+44 7771 658130 janet.bell@opi.net

Executive Assistant

Debbie Garrand

+44 20 3290 1511 debbie.garrand@opi.net

Follow us online

Twitter: @opinews Linkedin: opi.net/linkedin

Facebook: facebook.com/opimagazine

Podcasts: opi.net/podcast App: opi.net/app

Making progress – one step at a time

Watching the comings and goings of industry people has always intrigued me – a sure sign maybe that I, myself, have been around for a long time. Putting this issue together, especially the ‘On the move’ (pages 8 & 9) and – very sadly – Obituary sections (pages 6 & 7), it was a reminder that our sector is quite old and, at the top end, quite male.

With the retirements of some of these individuals – Sylvamo ’s Greg Gibson, AFFLINK ’s Dennis Riffer or Georgia-Pacific ’s Scott Light –goes so much knowledge and experience And here I also add those not with us anymore – Jimmy Godwin, Tony Brown and Mark Pelletier. Are we well and truly prepared for replacing those industry giants?

I’m not for a second saying that their successors are not worthy of their roles. Not remotely. What I am asking is: do we have enough young people coming through the ranks, perhaps another generation down, with the potential of going all the way to the top?

Who are the, say, ‘ top 40 under 40’ in our space? Who is excelling and has what it takes to become the next – and now I’m really going back – Irwin Helford, Tom Stemberg, Eric Bigeard or Jack Miller?

This is precisely what OPI is hoping to discover for a forthcoming issue and research has begun to find and highlight the cohort of potential future leaders. As always, nobody is more qualified to be judge and jury than our readers, so any help and feedback is most appreciated (write to me at heike.dieckmann@opi.net).

Having a broad outlook is becoming ever more important in all that we do at OPI. Being conscious of age diversity, as I’ve just alluded to. Or variety and expanse in terms of product categories sold.

In this issue, for instance, we spotlight the facilities, safety and PPE segments which have become so important to resellers, in the process bringing in ‘ adjacent’ vendors, forging new cooperative relationships and simply adding a further string to their bow. Follow the little sticker for relevant sections.

Gender representation is another topic we feel very strongly about and I’m so pleased we’re making progress here – see Small Talk (page 18), the Big Interview (page 20), 5 minutes with... (page 48) and the Final Word (page 50). I echo Big Interviewee Angie Bukta’s words: ‘‘One step at a time.’’

no responsibility for comments made by contributing authors or interviewees that may offend.

June 2023 5

No

stored in an electronic retrieval system

International

verified, it is possible that

errors or

Office

errors or omissions.

COMMENT

The carrier sheet is printed on Satimat Silk paper, which is produced on pulpmanufactured wood obtained from recognised responsible forests and at an FSC® certified mill. It is polywrapped in recyclable plastic that will biodegrade within six months.

part of this magazine may be reproduced, copied,

or transmitted save with written permission or in accordance with provision of the copyright designs and patents act of 1988. Stringent efforts have been made by Office Products

to ensure accuracy. However, due principally to the fact that data cannot always be

some

omissions may occur.

Products International cannot accept responsibility for such

Office Products International accepts

Office Products International Ltd (OPI) Focus7 House, Fairclough Hall, Halls Green, Hertfordshire SG4 7DP, UK Tel: +44 20 7841 2950 Connecting the business products world

OPI is printed in the UK by Do we have enough young people coming through [...] with the potential of going all the way to the top? www.carbonbalancedpaper.com CBP0009242909111341 HEIKE DIECKMANN, EDITOR

OBITUARY

office supplies dealers in the country, with more than 250 employees.

Jimmy held the position of CEO until 2018, when he stepped back from active involvement, although he continued to serve as a Senior Advisor until recently. He received numerous awards over the years for his professional accomplishments, including the Lifetime Achievement Award from the Business Solutions Association.

FSIoffice is now led by Jimmy and Diane’s three children, Kim, Donna and Jay, with granddaughter Beth also being on the executive team.

Paying tribute to her father, CEO Kim Leazer said: “He will be remembered in the business community as a generous and highly ethical leader who was guided by his faith in God. He lived an incredible life and built a tremendous legacy in his family, business, and as a sower of the seeds of the gospel of Jesus Christ.”

Jimmy Godwin: a life well lived

Jimmy Godwin, the founder and former CEO of Forms and Supply (now FSIoffice) passed away on 31 March at the age of 87.

After working in the office supplies industry for several years – starting during his time at King’s College in Charlotte, North Carolina – Jimmy ventured out on his own in 1962. It’s when he founded Forms and Supply with his wife Diane, whom he had married two years earlier. Since then, FSIoffice has served businesses across the south-east of the US, growing into one of the largest independent

Mark Pelletier passes away

OPI was also shocked and saddened to learn of the passing of industry veteran Mark Pelletier. Surrounded by his family, Mark, who was 65, died on 24 April.

It was only recently Mark had posted on LinkedIn, saying how excited he was about reaching his two-year anniversary at S.P. Richards (SPR) and that he still had “lots of unfinished business”.

He was Director of Sales for the IDC in the jan/san category at the wholesaler, having previously spent more than 21 years at Essendant/United Stationers in a number of senior sales and marketing roles.

SPR’s SVP of Sales, Jan/San and New Business Development, Nick Lomax – who

A Celebration of Life service for Jimmy took place on 15 April. During this moving and uplifting service, attended by over 250 guests – many from the business supplies industry – current and past pastors as well as several family members spoke about Jimmy’s unwavering faith and his dedication to his family, his company and the wider community.

OPI extends its heartfelt best wishes to the Godwin family and all FSIoffice employees.

Mark reported to – said: “Anyone who crossed paths with this man was better for it. I know I was. I am honoured to have been his friend and teammate. His faith was strong, his kindness was available to all. Most of all, he was a loving husband, father and grandpa. An example for us all. Rest easy my friend.”

SPR EVP Jack Reagan, meanwhile, called Mark a “kind and talented man”, adding: “He had the unique ability to stay calm, but was always looking out for all – customers, teammates, friends and, of course, family. SPR is very saddened to lose a friend.”

OPI sends its heartfelt condolences to Mark’s wife Lorrie and their three children Brayden, Ashley and Lauren, eight grandchildren, his siblings and all the extended family.

6 www.opi.net

Mark Pelletier

Jimmy Godwin

Industry salutes Bisley legend

It was with great sorrow that Bisley announced the passing of its owner and Chairman Anthony ‘Tony’ Brown, aged 86, on 4 April.

Tony began working at Bisley in 1960 and acquired the company from his father in 1970. At the time, the business had 45 staff members and annual sales of £370,000 ($400,000). Today, it generates revenue of around £70 million and exports its products to more than 75 countries.

Hugely passionate about manufacturing, Tony was awarded an OBE in 1993, as well as a lifetime achievement award from the Furniture Makers’ Company in 2016 for his outstanding contribution to the British manufacturing industry.

Tony was incredibly proud of Bisley’s successful international expansion. For this, the vendor has received numerous accolades. These include two Queen’s Awards for Export Achievement, several Design Guild Mark awards for its products, and being a recipient of the Manufacturing

Guild Mark from The Furniture Makers’ Company since 2015.

Outside of Bisley, Tony was a staple of the community, particularly in his support of his local rugby team, the Dragons. He became a major shareholder and, today, the main function room at the club’s ground – located in the Bisley Stand – is named after him.

Last year, Tony’s care for his staff was evident with the establishment of the Employee Ownership Trust, gifting 51% of Bisley to its employees to ensure its long-term future.

“We are all hugely saddened by Tony’s passing,” said Bisley CEO Richard Costin. “Speaking personally, it has been an honour to work with Tony and be entrusted with Bisley’s legacy. We look forward to commemorating his wonderful life of public service, and sharing his great many achievements and our fond memories in the coming weeks and months.

“We pass on our condolences to Mr Brown’s friends and family. We will miss him greatly.”

OPI joins Costin in offering its deepest sympathies to Tony’s family and friends.

OBITUARY June 2023 7

Tony Brown

Amazon Business looking to expand

Amazon Business is set to enter new markets, both in Europe and beyond, according to Alexandre Gagnon, VP of Worldwide. Speaking at the Amazon Business Exchange event in London at the end of April, he said the e-tailer’s B2B arm was planning to develop in Europe and internationally – although he didn’t specify which countries.

Amazon Business – started in the US in 2015 – came to Europe in 2016

ON THE MOVE

Promotions and departures at EVO

when it launched in Germany. The UK followed a year later, with France, Spain and Italy added in 2018. The unit also operates in Canada, India and Japan, meaning Amazon’s nine largest markets are already covered.

Given that Amazon Business is likely to open in countries where Amazon already has some scale, future possibilities include Australia, the UAE, Mexico, Brazil and Turkey.

There have been several departures and senior promotions at the UK’s EVO Group recently. Leaving the business were Business Development Director Debbie Nice and Group Marketing Director Cheryl Lamont. Nice will continue to be involved with the BOSS Business Supplies Charity. Meanwhile, at Complete – part of EVO’s Banner business – Adam Noble has departed. Former Complete Regional Director John Barker is now Managing Director of this unit.

EVO has also created several new roles following a strategic review of its buying function. Stuart Bleese has been named Product Management Director, Gilly Blackburn is now Procurement Framework Director, while Nigel Hindmarch is Purchasing Director at Complete. All three report to EVO Buying Director Simon McLoughlin.

Brother UK makes senior appointments

Brother UK has announced two promotions to its senior leadership team following the retirement of Sales and Marketing Director Andy Forsyth.

Greig Millar has been promoted from General Manager for Sales to Chief Revenue Officer while Terry Caulfield – previously Brother’s General Manager Products and Solutions – has been named Chief Commercial Officer.

Given its proximity to Germany and the online purchasing maturity of its consumers, the Netherlands could also be on the list.

As Amazon CEO Andy Jassy revealed recently, Amazon Business is trending at an annualised revenue rate of around $35 billion and has more than six million active customers. While the US is by far its largest market, sales in Europe grew at an annual compound rate of 25% between 2020 and 2022 as it benefitted from the shift to online purchasing during COVID.

Gagnon says Amazon Business is focusing on logistics to make it easier for firms in Europe to buy items such as office chairs, desks, paper and printer ink in bulk, with a view to winning contracts to supply them.

Amazon Business Director Todd Heimes explained this further in a blog post: “If you want to buy 500 black chairs, we will take that quote, send it out to sellers we know sell chairs, and give them the opportunity to bid on that order. It’s called a ‘request for a quote’, and it’s our offering to address our customers’ forecasted and large purchase needs.”

Management changes at Sylvamo

Sylvamo’s long-serving North America General Manager Greg Gibson is to move to the new role of SVP of Commercial Excellence from 1 July, a post he will hold until his retirement at the end of March 2024. Succeeding him will be Rodrigo Davoli, currently General Manager of Latin America.

Promotions at Lyreco

Lyreco veteran Juraj Nemjo has been named Zone Managing Director, having been promoted from his most recent Group Marketing Director position.

David Harman, meanwhile, has been appointed Group Merchandising Director, a change from his previous Group Product & Services Director role.

Georgia-Pacific’s Light to retire

Georgia-Pacific (GP) exec Scott Light has announced he is retiring after 25 years with the company. He currently leads GP’s Packaging & Cellulose segment, a position he has occupied since 2017.

8 www.opi.net NEWS

Scott Light

Greg Gibson

Alexandre Gagnon at ABX 2023

Juraj Nemjo

Gagnon added: “Because businesses buy in larger quantities, the fulfilment economics are more advantageous.” This is important for Amazon as the online giant looks to improve the profitability of its distribution operations.

It could also represent an interesting dynamic as Amazon potentially eyes evolving its model beyond a supplier of ad hoc tail-spend products towards more contractual relationships with customers. It already has a number of framework agreements with public sector group purchasing organisations as well as close relationships with leading multinational private sector groups.

Another angle in the messaging is that, as Amazon grows its footprint with corporate and large public sector clients, this is also beneficial for small businesses. “Our purpose is to give access for diverse, small and local sellers to be able to interact with a large organisation,” said Aster Angagaw, VP & Head of Commercial, Public and Strategic Sector at Amazon Business.

Hilleard to be next Society of Old Friends President

OPI CEO Steve Hilleard has been confirmed as the next President of UK business products industry networking group, the Society of Old Friends.

Hilleard – who is currently Honorary Treasurer of the organisation that was established 114 years ago – will serve as President from April 2024 to March 2026. He will succeed current President, John Logan of Floortex.

“It will be an absolute privilege and honour to lead this esteemed group and I’m looking forward to hosting some great functions and events during my time in office,” said Hilleard.

IOPFDA rebrands

The Independent Office Products and Furniture Dealers Association (IOPFDA) has a new identity. The US trade organisation – acquired by ISSA in 2020 and currently with about 550 members – is now known as the Workplace Solutions Association (WSA).

“With the evolution of the industry, it became clear that we needed a new name and focus to better serve our members,” said Executive Director Mike Tucker.

Ex-Staples exec out of retirement

US OP veteran Joe McDonald has joined sustainable products manufacturer Emerald Brand. The former Staples and Grainger senior executive has taken on the role of EVP of Sales at Emerald.

AFFLINK CEO to retire

Dennis Riffer, CEO of packaging, foodservice and jan/san sales and marketing organisation AFFLINK has confirmed he will retire this year, having served 20 years at the group.

Schultz joins RJ Schinner

Steve Schultz has joined North American redistribution business RJ Schinner as President. Schultz’s career of more than 30 years has included senior roles at Essendant, GOJO and S.P. Richards.

ALSO CEO to step down

IT distributor ALSO CEO Gustavo Möller-Hergt – in charge for the past 12 years – will step down from the role at the end of April 2024. He will be available to continue as Chairman.

Leadership change at ODP dealer

ODP Federation dealer Office Essentials has named long-time exec Kate Dougherty as President, following the retirement of former owner Jim Porter.

New BDM at Office Friendly

Office Friendly has appointed Stacey Atkinson to the role of New Business Development Manager. She joined the dealer group after spending more than 19 years at wholesaler VOW.

RS Group appoints new CEO

Simon Pryce is the new CEO at industrial distributor RS Group, following the departure of Lindsley Ruth, who left suddenly last December.

SPR

confirms senior promotions

S.P. Richards (SPR) has promoted

Susan Lada to the role of VP of Merchandising while Adam Fox has been named VP of Marketing. Former VP of Marketing Paul Gatens, who enjoyed a career spanning 23 years at SPR, has left the company.

NEWS June 2023 9

Joe McDonald

Dennis Riffer

Steve Schultz

Gustavo Möller-Hergt

Steve Hilleard

Kate Dougherty

Stacey Atkinson

Simon Pryce

Susan Lada

Mike Gentile to leave ISG

Mike Gentile has announced his intention to step down as President and CEO of Independent Suppliers Group (ISG).

Gentile joined the organisation –then called Independent Stationers Group – in 2003 and took over as CEO two years later. Prior to that, he had enjoyed a successful 16-year career at power channel player Boise Cascade.

3M to cut workforce

3M has announced a major restructuring programme that will affect thousands of jobs. The global manufacturing giant is planning a structural reorganisation that “will reduce the size of the corporate centre of the company, simplify the supply chain, streamline 3M’s geographic footprint, reduce layers of management, and further align business go-to-market models to customers”.

Mike Gentile

The ISG CEO will stay on until the end of 2023, and the group’s board has formed a search committee to immediately begin the process of finding a successor. “It has been a distinct honour and great joy leading Independent Suppliers Group over the past 18 years [and] I am excited to announce that I have decided to move on to the next stage of my personal and professional journey,” said Gentile.

“I have been fortunate to have worked for two amazing organisations across most of my industry career. Throughout this time, I have been equally as fortunate to have forged several lifelong friendships with inspiring leaders and talented colleagues. I wish everyone continued success and I remain very optimistic about our industry’s future.”

ISG Chairman Yancey Jones Jr added: “I would like to thank Mike for all he has done to help make ISG the organisation it is today. His commitment to our industry and the IDC is greatly appreciated, and we wish him all the best as he enters this next chapter in life.”

Lyreco makes coffee acquisition

Lyreco has expanded its Nespresso coffee offering in three Scandinavian countries. The reseller has acquired the operations of Premium Coffee, the distributor of Nespresso in away-from-home channels in Denmark, Finland and Sweden, effective 1 April 2023. Financial details of the transaction were not disclosed.

The deal cements Lyreco’s exclusive relationship with Nespresso Professional in the Nordics following a distribution agreement last year in Norway.

These actions, which will impact “all functions, businesses and geographies”, are expected to result in around 6,000 redundancies, which are in addition to the reduction of 2,500 global manufacturing roles announced in January.

Aussie government lifts A4 antidumping duties

The Australian government has exempted A4 copy paper imports from antidumping and countervailing duties. The levies had been in place since 2017 at the behest of Opal (formerly Australian Paper) in an attempt to protect local production. However, following supply issues, Opal announced in February that it would cease production of graphic papers, including cut-sheet office paper.

While there were fears it might take six months or so for the Australian authorities to tackle the issue of the now meaningless duties, it appears the matter has been fast-tracked following the opening of an investigation by the country’s Antidumping Commission in February.

NEWS 10 www.opi.net

French office products retailer up for sale

Negotiations are underway regarding a change in the ownership structure of Top Office. The French OP retailer was founded in 1996 by Patrick Mulliez, a member of the Mulliez retail empire (Auchan, Décathlon, etc), and former Guilbert Managing Director André Guilbert. Today, it is controlled by the Mulliez family association, AFM, and has 33 stores dotted around France (11 of which are franchised), mostly located in out-of-town retail parks.

Citing structural declines and consolidation in the business supplies sector as well as Top Office’s lack of scale to “adapt to new market needs”, a statement referred to a strategic plan that would ensure the longevity and independence of the retailer.

To this effect, talks are taking place between the owners and a consortium consisting of Top Office franchisee Jérôme Lorie (who has four stores in north-east France), senior company execs and multichannel operator ADVEO. The latter will take on the role of franchisor, carrying out all the services required for running a store network.

Canon concludes lawsuit

ADVEO’s renewed interest in the office superstore segment comes two years after its failed bid to acquire approximately 50 Office Depot outlets in France – which were ultimately bought out of administration by a number of Alkor members.

Canon has said that US district court patent lawsuits against Ninestar and a number of resellers have been concluded. In March 2021, Canon filed suits against Ninestar Image Tech, Ninestar Technology and Static Control Components as well as LD Products, The Supplies Guys and Easy Group for alleged infringement of ten of the OEM’s patents.

On 21 April 2023, Canon said each of the respondents has agreed to the entry of consent judgements and permanent injunctions which prohibit further infringement of the asserted patents, while Ninestar is to pay Canon an undisclosed sum.

Another acquisition for Hospeco

North American jan/san supplier Hospeco Brands has created what it calls a “multi-market juggernaut” with its most recent acquisition. The company’s latest deal involves Monarch Brands, a wholesaler and manufacturer of microfibre, commercial laundry linen, institutional textiles and wiping products.

Pennsylvania-based Monarch, which can trace its roots back to 1947, serves a range of markets, such as environmental services, hospitality, institutional, foodservice, industrial and jan/san. It also has a presence in the retail sector – something new for Hospeco – with brands including The Sloppy Chef, Messy Mechanic and Towelzilla.

TOPS buys Redi-Tag assets

TOPS Office Products has made an acquisition in the home, school and office organisation category. The North American vendor – owned by Atlas Holdings – has purchased “select assets” of Redi-Tag from Identity Group. Redi-Tag is a manufacturer of page flags, laser tabs, sticky notes and other back-to-school and office products. Terms of the transaction were not disclosed.

“Redi-Tag has a long history in our channels and will be a great complement to our existing portfolio,” said TOPS CEO Matt Roberts. “We look forward to growing the brand as part of TOPS and continuing to provide the same high product quality that Redi-Tags’ loyal customer base has counted on for the past four decades.”

Identity Group CEO Sam Richardson added: “This strategic divestiture will strengthen Identity Group’s focus and success in the experiential signage industry where we continue to lead the market.”

NEWS 12 www.opi.net

$200-$300 million

Estimated value of IPO for Indian stationery manufacturer Doms, which is majority-owned by Italy-based group FILA

€14,400

Amount paid to each employee of German online reseller Böttcher in relation to the company’s 2022 profit-sharing scheme and fuel/inflation bonuses

Lyreco unveils safety platform

Lyreco UK & Ireland has launched a centralised safety products platform. Called Lyreco Safety, the online resource includes category information and advice as well as guides and resources to help customers implement their PPE and safety gear effectively.

$470 million Total amount of severance payments made by Amazon in Q1 2023

MM to cut paper capacity

European packaging specialist MM is to reduce its office paper production capacity by 200,000 tonnes a year. The Austria-based group will convert a machine at its Kwidzyn site in Poland from copy to kraft paper.

¥5 billion Damages awarded to Japanese reseller

Askul in relation to a fire that destroyed its distribution centre in 2017 (Askul had been seeking ¥10 billion/$75 million)

Hamelin exec breaks world record in cancer fundraiser Hamelin Brands UK Channel Sales Manager Shane Owen claimed the world record for the ‘fastest marathon dressed as a book (male)’ at this year’s London Marathon in April.

Owen crossed the line in 5 hours, 19 minutes and 15 seconds, breaking last year’s record – set by the vendor’s UK Managing Director Philip Beer – by around 15 minutes. He took on the challenge to raise funds for the Institute of Cancer Research. His costume – a book named Eddie – is in memory of colleague Eddie Sampson, who passed

NEWS 14 www.opi.net

IN BRIEF

away from cancer in 2021.

Xerox has donated its Palo Alto Research Center (PARC) in California, US, to non-profit research institute SRI International. The move comes as part of the OEM’s cost-reduction initiatives and will lead to R&D spending being focused on its core business areas.

Andy Jassy, CEO, Amazon

Xerox donates research centre

Change is always around the corner. Sometimes, you proactively invite it in, and sometimes it just comes a-knocking. But when you see it’s coming, you have to embrace it. And the companies that do this well over a long period of time usually succeed

PICTURE OF THE MONTH

Planet Mark advises on greenwashing

Environmental certification organisation Planet Mark has published its thoughts and advice on greenwashing. Below are slightly edited excerpts from the article:

According to a Capgemini Research Institute consumer trends report, sustainability remains an important factor for consumers, with 41% stating they’re willing to pay more for a product they believe to be sustainable.

This can lend itself to companies’ greenwashing. In a 2021 study, the European Commission found 42% of green claims were exaggerated, false or deceptive, which points to greenwashing on an industrial scale.

Unintentional greenwashing can occur when organisations have a limited understanding of sustainability or fail to verify their claims. However, a lack of understanding doesn’t excuse them from the consequences that follow. Greenwashing poses a significant threat to losing stakeholder trust. Getting it wrong on environmental claims also increasingly risks legal action.

On the one hand, people want companies to be vocal about what they’re doing. On the other, they are ready to shout “greenwashing” if firms appear to overstep. This has given way to greenhushing. The challenge facing

organisations today is how to effectively communicate their green credentials in a way that is perceived by consumers to be genuine and authentic. Planet Mark offers five tips to help establish a credible platform to discuss sustainability-related topics:

1. Be transparent and accessible

Make claims clear and easy to understand without leaving anything up to interpretation. When describing your carbon footprint, detail all accounted emissions. Avoid using language that is difficult to define, such as acronyms or words like ‘eco-friendly’, ‘sustainable’ or ‘green’. Buzzwords such as ‘plastic-neutral’ and ‘carbon negative’ can be appealing, but the use of offsets and current lack of standardisation can potentially mislead consumers.

2. Be credible

Keep data available and updated on your website and anywhere else you make sustainability claims. Only use data that can be verified. If possible, verify it with trustworthy third-party auditors or ensure claims are credible and substantial.

3. Be honest and accountable

It’s important to be transparent about progress towards sustainability goals, including what has been achieved and what is still being worked on. In the event of any communication errors, it’s vital to take responsibility, apologise, and explain plans to correct the mistake.

4. Educate yourself and your employees

The more people who are engaged with your sustainability strategy, the stronger it will be. Make sure that everyone in the organisation understands the fabric of the sustainability plan and the importance of accurate and honest environmental claims.

5. Focus on impact

Rather than making grand claims about your company’s environmental and societal impact, focus on tangible actions you are taking to reduce your carbon footprint, conserve natural resources or protect biodiversity.

Bureau Vallée revamps product rating system

French retailer Bureau Vallée is taking a new approach to the environmental rating of its products. Since 2009, all 30,000 SKUs sold by the company have had an A-E rating. Overseen by consulting firm GreenFlex, this system is based on environmental and social criteria.

Now, Bureau Vallée is adopting a life cycle assessment approach in line with legislation introduced by the French Agency for Ecological Transition (ADEME) and the European Union. The reseller has partnered with start-up Waro for this initiative, initially focusing on the furniture and paper-based categories – which, together, account for 40% of Bureau Vallée’s CO2 emissions.

A pilot phase is currently underway with several furniture suppliers before the new rating system is progressively extended across the whole category by 2024. Early indicators are encouraging, with the carbon footprint of products tested about 25% below the ADEME average. Bureau Vallée has set a goal of a 50% reduction in the CO2 emissions of the products it sells by 2030.

16 www.opi.net GREEN THINKING

RCP publishes new sustainability report

Rubbermaid Commercial Products (RCP) has announced the release of a new insights report: Why Product Longevity is a Powerful First Step to Improving Commercial Sustainability. Aimed at supporting businesses in turning ideas into action, the publication provides data-driven recommendations to combat ‘green confusion’ and reassess purchasing decisions that ultimately improve operational and systemic sustainability.

For example, the document reveals that by extending the life cycle of passive products, businesses can significantly reduce their environmental impact by up to 72% and their costs by up to a third. The subsequent reallocation of resources and investment will allow them to invest in innovation, improving their overall sustainability.

“We know that a staggering 95% of decision-makers want to do more on sustainability but face various challenges to implementation,” explained Emilio Capelli, VP Sales & Marketing International for Commercial at Newell Brands.

KCP expands recycling programme

Kimberly-Clark Professional (KCP) has rolled out its RightCycle recycling initiative in two more European countries. The programme, which started in the US in 2011, was the first large-scale recycling effort for non-hazardous lab, cleanroom and industrial PPE waste.

After being introduced in Canada, the UK, Ireland, Germany, France, Belgium, Austria and Spain over the years, the organisation has now added the Netherlands and Switzerland.

In 2021, KCP expanded RightCycle in Europe to include the recycling of plastic dispensers and hand towels. In 2022, it began to accept flex-film plastic packaging from Kimtech and KleenGuard products in the US and Canada. Items are recycled by regional partners that create plastic pellets, which are then used to produce consumer products and other durable goods.

“RCP is dedicated to being part of a concerted sustainability effort across the business world, not just through its products, but also through vital education and tools. The brand has already made progress when it comes to changing attitudes surrounding efficacy and the cost of sustainable products, but there is still work to be done.”

Antalis highlights packaging sustainability scorecard

Antalis Packaging’s UK business recently launched its Green Star System and Green Card to help customers more easily identify sustainable packaging. It follows on from the success of Green Star for Antalis’ paper and visual communication products.

Green Star for packaging is a certification system grounded in a strict set of criteria, including recycled and bio-sourced materials and technical recyclability. Antalis Packaging’s aim is that, by 2025, 100% of its own brand Master’in products and 50% of suppliers’ packaging items have an environmental rating.

Meanwhile, Green Card is an information concept which provides customers with in-depth environmental product information. “Designed and validated by certified environmental experts, these two initiatives provide comprehensive information on environmental products and encourage Antalis’ customers to select the best eco-friendly packaging solutions,” the company stated.

GREEN THINKING NEWS June 2023 17

Data-driven CLEANING

CLEANING POST-COVID

Nancy Farrell: The world has changed so much over the past few years. Coming out of the pandemic, hygiene is still paramount; a lot of tasks related to disinfection and high-touchpoint cleaning – although not as prevalent as during the height of COVID –haven’t gone away.

For example, 73% of people want to use paper hand towels to avoid touching different surfaces in public. They also still have high expectations for places like washrooms and restrooms in terms of hygiene and feeling safe in those spaces.

HYBRID WORKING IMPACT

NF: Hybrid working has definitely caused a change in the cleaning market. We all know that in an office setting, no two days are the same, but this is now much more pronounced due to fluctuating visitor patterns. Cleaning teams have a hard task knowing when people might be in the office, even if companies have set days of the week for staff to come in.

volume of what cleaning teams have needed to do has increased.

Yet, we want to create a great experience for people who are returning to the office and other public spaces, so they feel a sense of having a safe environment they will want to keep coming back to.

MOVING TO A DATA-DRIVEN MODEL

NF: I believe data-driven solutions, such as Tork Vision Cleaning, represent a paradigm shift for an industry that has been relatively slow in the adoption of digitalisation. While we have seen developments in automation, such as cleaning robots, we are now talking about using software as a digital tool to fundamentally change the way of working.

Cleaning has traditionally worked in a pattern of cleaners coming in and following a set schedule of tasks they might have written down on a clipboard. Data-driven cleaning is all about eliminating guesswork by taking real-time data collected throughout a facility.

Tork Vision Cleaning does this in a couple of ways: one is connected dispensers that measure product levels; the other is through people counters which monitor visitor traffic in a building. When you pair these together, you can start to inform and empower teams to clean in the right way.

On the flip side, just because there are fewer people in the office doesn’t necessarily mean there’s less to do. One thing we have seen over the past few years is that the sheer

Therefore, instead of having a static way of working based on assumptions, cleaners go directly to the locations they know need the most attention. It could be because a certain number of visitors have passed through so it’s a high touchpoint area or due to dispensers being almost empty.

18 www.opi.net SMALL TALK

In a recent podcast, Nancy Farrell of Tork, an Essity brand, talked about the latest trends in the commercial jan/san space, with a particular focus on data-driven cleaning

Just because there are fewer people in the office doesn’t necessarily mean there’s less to do

FACILITIES SAFETY Special FACILITIES / SAFETY / PPE Special Issue BREAKROOM SPECIA Special BREAKROOM SPECIAL Special Issue Special BREAKROOM SPECIA

Nancy Farrell is Senior Product Manager for Tork Services and Solutions at Essity in North America. More information about data-driven cleaning and Tork Vision is available at torkusa.com

Feedback suggests that, once customers have used data-driven cleaning, they can’t imagine how they could ever go back because it’s like having an extra set of eyes. It helps cleaning teams and facility managers optimise their resources, tackle labour shortages in today’s marketplace, create efficiencies and –ultimately – deliver the best quality.

Not only does data-driven cleaning use real-time information, but it also leverages historical data. A lot of our clients will use real-time information to act in the moment –this helps avoid complaints and drives better quality throughout the day.

Then, at the end of a week, month or quarter, they’ll look back at the different analytics and reports that are included in our system. This enables them to continually develop and improve the cleaning KPI set.

Over time, as you collect more data, you can start to do more with it. For example, during the pandemic, when visitor patterns were fluctuating so much, businesses were able to close off sections of offices or floors. Imagine how that impacts the bottom line in terms of electricity usage, climate control, etc.

The biggest barrier, as is so often the case, is the onboarding phase – learning how to use the system and changing the way of working. We have a programme where customers work with a dedicated team so we can understand what a client’s particular challenges and KPIs are, and what they’re looking to solve in the longer term. This is something that will be different for each client.

Gradually, it’s about helping them to make corrective actions so they can really understand how to use the technology to drive value. The software is not a ‘one-and-done’ solution; it’s something which should and can evolve to meet greater needs – as long as you’re using it correctly.

The onboarding phase can take anything from a few weeks to several months, depending on a number of factors, including the digital maturity of the company, the cleaning teams themselves, and the size and complexity of the facility.

BETTER DATA = LESS WASTE

NF: An obvious benefit of real-time data is the ability to reduce waste. For example, traditionally, cleaners on a scheduled round may change a toilet paper roll even though there is product left. This is because they don’t know if they will make it back to that restroom in time before the dispenser is empty and they want to avoid a potential complaint. It’s a normal reaction, but chances are the remaining product will get thrown away.

Data has also been used to support capital expenditure projects. If customers want to refurbish an area, they can actually choose how to spend their investment based on the most trafficked places and other data insights.

What we can now do is accurately indicate when a dispenser needs refilling or replacing. As such, cleaners can go to the restroom the moment action is needed. Consequently, less waste is generated.

June 2023 19 SMALL TALK

Nancy Farrell

Once customers have used data-driven cleaning, they can’t imagine how they could ever go back because it’s like having an extra set of eyes

A united (CANADIAN) FRONT

In a vast landscape with plenty of secondary and tertiary markets, Canadian Workplace Solutions is beginning to reap the benefits of collaboration

When three Canadian dealer groups came together towards the end of 2022, it was the cumulative effect of a multitude of challenges at Basics Office Products, CIS Office Plus and Guild Stationers. Following years of duplicated efforts – and costs – the final straw was the loss of the single biggest dealership across all groups to big box operator Staples last June.

Angie Bukta, previously President of CIS, picked up the reins to lead what’s now known as Canadian Workplace Solutions (CWS). Her focus, she tells OPI’s Heike Dieckmann, is to create a harmonised network for dealers, stability in an ever-changing market and a solid platform for growth. All the while building on a strong ethos of Canadian collaboration.

OPI: I believe you’re somewhat of a ‘lifer’ at CIS, one of the groups that now fall under the CWS umbrella. Can you give a quick recap of your career?

Angie Bukta: Sure. I joined CIS in 1995 as Marketing Administrator. It was completely standalone at the time, having been founded in 1978. I learned a lot from the get-go, but after about six months I went to my boss and said that I was looking for more to do. Everything kind of fell into place when one of my colleagues went on maternity leave and I took on her role of Marketing Coordinator for a while.

Since then, I’ve kept moving through the organisation which has allowed me to learn the different components and really understand all aspects of a dealer group.

OPI: Making it all the way to President of three different organisations. What actually is your educational background?

AB: I studied Business Administration and Management. I went back to university a few years ago to do an MBA on the same topic which I completed in 2019. It took three years because I was working full time and studying in the evenings and at weekends.

OPI: Sounds like a full-on, tough time.

AB: It was hard, definitely, but I really wanted to do it and thought it could help me in my career. I had all the hands-on experience through working at CIS, but I wanted to add to my knowledge and learn even more.

OPI: Did it help you secure the role of President which you now hold?

AB: Nobody mandated that I needed to do the MBA to progress further and I’m not sure how much it influenced the board’s decision to appoint me. But it can only have helped.

OPI: When you started back in 1995, it was a period of growing globalisation when two US giants entered the country – Staples

20 www.opi.net BIG INTERVIEW

by buying Business Depot and OfficeMax acquiring Grand & Toy. And, of course, it was one of Lyreco’s first big international markets outside France. An unsettling time for independent dealers, I would think.

AB: It was definitely a time of great change. When I joined, there had been a bit of turmoil at CIS because the group had decided to open a warehouse in Toronto where the head office was and that didn’t quite go to plan. Overall, there were plenty more dealers in the country – much like everywhere else in the world. CIS alone had about 50 dealer members back then.

OPI: Let’s talk about the new combined group – Canadian Workplace Solutions. First of all, what prompted this particular choice of name?

AB: It was pretty straightforward. We needed to make sure our identity was clear and also reflect what our purpose was. We wanted to emphasise we are Canadian so this had to be in the name. But we also had to acknowledge how the workplace was changing and that what our dealers offer extends way beyond products now. Canadian Workplace Solutions was the obvious and easy choice.

OPI: What’s the footprint of the group now?

AB: We have a total of 41 shareholders and one of these is buying group Guild Stationers which, in itself, has 56 members. Guild has been a shareholder in Basics for many years.

You may recall that CIS also became a shareholder in Basics in 2009. So for the past 14 years, we’ve been working as three different groups, with separate banners but somehow with some common ownership. It was about joint purchasing power – we had our own marketing strategies, how we went market, etc.

OPI: Did you previously discuss a merger?

AB: Over the past 14 years, the talk in the industry has always been ‘will they or won’t they’ merge. Everybody knew we needed to

BIG INTERVIEW Angie Bukta June 2023 21

Over the past 14 years, the talk in the industry has always been ‘will they or won’t they’ merge

get there at some point, but there were some barriers which had to be overcome first.

CIS and Basics have come together in what I would describe as a merger of equals. Guild is still a separate entity, but after much discussion we agreed it was better for it to remain a shareholder because it has 50+ dealers in secondary and tertiary markets. It makes sense for Guild to continue to manage its own dealers. But all members get the benefit of being organised under one umbrella.

OPI: What’s the ownership structure?

AB: We are a dealer-owned cooperative. Dealers buy shares based on their volume through the group. So I, in effect, have 41 bosses – of varying sizes.

OPI: As regards the merger of equals: Basics used to be much bigger in terms of combined dealer revenues, but lost a really large member when Staples Canada bought Denis Office Supplies and sister company Supreme Basics last year. What kind of a gap did it leave?

AB: A big one. It was approximately 30% of Basics’ business.

OPI: Would it be fair to say the loss of this combined dealership contributed to the three groups coming together?

AB: Absolutely. It was the catalyst to make it all happen. As I said, we always knew we’d get there at some stage, but Denis/Supreme’s exit certainly made the process a lot faster. We urgently needed to figure out how to get over the barriers that had previously stopped us from taking the final step.

OPI: What exactly were those barriers?

AB: One key obstacle was dealers in competing areas and with individual go-to-market strategies. But the competitive landscape has changed over the years and so has our approach to collaboration.

In late 2021, board members from both Basics and CIS met with David Guernsey who shared his experience with Independent Suppliers Group and said we must choose to work together as one group – and the sooner we get our heads around that the better.

OPI: Is there a big rebrand on the cards under the CWS banner? Like Novexco did with its Hamster brand?

AB: No, the name of the organisation has changed to CWS, but dealers are still running under the previous banners – Office Plus for CIS and Basics markets under Basics. We decided against a complete rebrand because in their communities dealers are known by their own names; we’re not concerned right now about how they go to market.

Dealers can tell their story and the fact they belong to a buying group with those two banners – it affords them purchasing power and all that kind of stuff. But locally, a dealer would still be known as Corbett rather than Corbett Office Plus.

I wouldn’t say we’re never going to do it, but right now there are other things to focus on that are more urgent.

OPI: Such as?

AB: A big task is to operate as one company across one group, ie get rid of as many areas of duplication as possible. It takes time and the

BIG INTERVIEW Angie Bukta 22 www.opi.net

The team at Canadian Workplace Solutions

word ‘legacy’ comes up quite a bit in terms of marketing and overall processes.

We have 23 staff in total now – down from 35 when we first got together – and everybody works for CWS, not Basics or CIS. Everyone is working for all 41 shareholders in the group.

OPI: What’s the spread of your dealers across Canada?

AB: CIS and Basics combined had a wide coverage across Canada. One point of interest here is that CIS didn’t have anybody in Quebec, so we didn’t do French marketing, whereas Basics’ former member Denis/ Supreme we’ve just talked about came from Quebec. It resulted in a more bilingual aspect to the group. Now we have the resources to work in both languages as needed.

Pre-merger, CIS had a large contingency in the west – everything west of Manitoba this means – while Basics’ concentration was in Ontario and Eastern Canada. The one exception was Denis/Supreme in Quebec which currently leaves us with a hole in this province that we need to fill. We still have one dealer there, but it’s a big province – the largest in Canada – and we’re looking for more coverage.

OPI: What’s the makeup of your board?

AB: We have a large board, with four members coming from Basics, four from CIS plus one Guild representative. We recently had a meeting during which four positions were up for re-election as we felt strongly that the board should be chosen by our shareholders, not appointed by the group.

OPI: How does CWS work in terms of dividends, rebates and things like that?

AB: Our main focus is on net dealer benefit. Buying shares is a dealer’s contribution to the group; what we’re then looking to do is to give back as much as possible – that’s our remit.

We’re not ‘not for profit’, but we try to operate in this way. We want to create impact for dealers fast and if there’s extra money, let’s give it back to them so they can use it within their business.

OPI: What does a typical dealer look like?

AB: All our members are predominantly B2B, with a broad-brush retail presence of about 10%. But even the retail part is mostly B2B –some customers simply choose to pick up their order in-store rather than having it delivered.

Where things are changing quite a bit is in the online component. Spurred on by the pandemic, many dealers took the opportunity to focus on their website capabilities to meet

the needs of all customers, whether or not they had an account or needed it delivered to their homes. This is where the B2B and B2C lines are becoming a little blurred.

OPI: Are dealers’ end customers mostly local businesses?

AB: They are but it’s important to note that ‘local’ can be quite far-reaching in a country as vast and sparsely populated as Canada. Many of our dealers are in secondary and tertiary markets – local for them can be hundreds of kilometres away.

OPI: Do your members – and you as a group – get involved in large national accounts business?

AB: We’ll never walk away from the opportunity, but it can be a struggle to make this a reality as other players are better set up for it. However, there is a network of dealers

BIG INTERVIEW Angie Bukta June 2023 23

Many of our dealers are in secondary and tertiary markets –local for them can be hundreds of kilometres away

that are succeeding when one has a chance to quote on a national contract and wins it.

OPI: Other than purchasing power – which you already had to some extent – what are the benefits of the merger for dealers?

AB: The vision of CWS remains the same as the one its previous components had: to provide programmes and services to help dealers grow their businesses. But as a combined entity, we can do this much more efficiently and, having taken considerable duplicate costs out, we can deliver a long-lasting, profitable, inclusive and vibrant independent dealer channel.

Painful as it was to address this, reducing our staff, as I mentioned earlier, was part of that duplication. As was having two locations. In April, we all moved to Basics’ offices in Cambridge – that’s about an hour outside of Toronto. We weren’t actually far from each other, so it made perfect sense.

Those two aspects combined were a very large chunk of our overall expenditure. Another part is marketing – creating catalogues, flyers and so. Here too, we’re generating big savings.

We have a product information management (PIM) tool that dealers have been using for years. But we’ve further invested in this PIM solution recently, the idea being to eventually help dealers use data in a more self-sufficient and meaningful way so they can take some costs out of their own systems as well.

Right now, we provide detailed information to dealers but then they have to assess that data themselves. The aim is to create a connection between their and our system so they can see live updates. It’s taking connectivity to the next level – giving them the information they need so they can make the right decisions for their business. But faster. In real time.

OPI: Let’s talk about the broader landscape – and the competition. What and who are your dealers up against?

AB: Staples Canada is definitely the name that comes up the most. Of course, dealers also run into Grand & Toy and various Hamster dealers, but Staples is the biggest threat.

OPI: Is that Staples retail as opposed to Staples Professional?

AB: Both. It’s also closely linked to online – it’s just so easy for people to price check and make their buying decision based on price.

OPI: What about Novexco? It’s very much a multichannel operator now, as a result of buying Lyreco and, more recently, S.P. Richards Canada. And, of course, it’s had a wholesale presence for many years

previously as well as a considerable dealer group component. How much of a competitor versus supplier is Novexco?

AB: Novexco is very concentrated in Quebec and the eastern provinces and this is where our dealers will likely encounter their members. But we view our competitors predominantly as Staples – and Grand & Toy.

Novexco is also very focused on national accounts – particularly so since the Lyreco purchase and, as I’ve just mentioned, that’s not our sweet spot.

SPR Canada being bought by Novexco in 2020 was definitely a blow for Basics because the wholesaler had been a shareholder of Basics. When Novexco acquired it, that relationship ended and it left the group. On the plus side, SPR was bought by a Canadian company which is a good thing and helps to fortify our economy.

OPI: Is this Novexco ownership a problem for you now? My understanding is that SPR is the closest Canada has to a true nationwide wholesaler and as such I assume it’s very important to your dealers.

AB: Not really, because it’s operated as a separate component of the business, as Denis Mathieu had reassured us it would be from the get-go. We do see that SPR is 100% supportive of the independent channel and we are a very large customer.

But you’re right, SPR is the only operator with a comprehensive nationwide footprint, with warehouses strategically placed across the country. From that point of view, it’s the main partner for dealers specifically in Western Canada as direct orders from vendors – and we do a lot of direct buying – can take weeks to get to them. Then there’s the minimum freight pre-paid, the actual freight cost, etc. As such, dealers often order from SPR’s warehouses that are local to them.

Guild has a warehouse in Ontario, so there’s a lot of collaboration too, also in the sense that it wholesales our private label products.

OPI: Both Staples and Grand & Toy seem to be increasingly interested in the SME space your dealers typically occupy.

BIG INTERVIEW Angie Bukta 24 www.opi.net

While Amazon is working out its all-out Canadian strategy, dealers need to show what they can offer

Staples buying up dealers like Denis/ Supreme must be a headache for you.

AB: It’s always been a threat and another reason we came together – to provide a network and stability for dealers but also for them to have options – to work with other, like-minded operators or even sell within the group. CWS can help with all of this.

OPI: Are most dealers in Canada organised in buying groups, ie if you want to grow, do you need to grab share from Novexco or is ‘organic’ growth out there?

AB: Between Novexco/Hamster and us – including Guild – we probably have 200 dealers of varying sizes – 100 for CWS, 100 for Novexco. There are hundreds more, although proportionately very small.

And yes, we do want to grow and fortify the group through new shareholders and alliances. But we’re not interested in stealing from each other. We’re looking at new opportunities, for example dealers focusing on categories that have historically been outside their traditional realm of office products.

OPI: How big a deal is Amazon Business?

AB: In the US, Amazon Business is going gangbusters, whereas in Canada, it’s here but it hasn’t quite figured out its game yet.

No doubt at all, Amazon is a force to be reckoned with, with more distribution centres popping up all the time, especially near urban areas. But it’s not the same across the country with same or next-day delivery. As such, the threat is not quite as omnipresent.

And while Amazon is working out its all-out Canadian strategy, dealers need to show what they can offer. There are some things people naturally buy on Amazon, but now is the time for dealers to make their mark, reiterate the notion of buying locally and being the best service provider possible.

The strength of our dealers is their proximity and infrastructure in secondary markets, allowing them to be better equipped to deal with the last-mile demands of customers.

OPI: Are any of your dealers actively involved with Amazon marketplace?

AB: No, not to date. For them, Amazon is a competitor rather than a platform to sell.

OPI: To wrap up: what’s next and imminent for you and CWS?

AB: Short-term, we need to get all our processes aligned. At a grassroots level, CIS and Basics seemed similar, but once you get into the detail you quickly realise how many things we did a little differently. We’re currently at the stage of working through all these things. The goal is to completely move to common marketing sooner rather than later.

We’ve recently had a very successful spring dealer and vendor event. Dealers are eager to adopt and support our newly amalgamated organisation and are extremely motivated to work closely with our vendor partners to grow our market share together.

A high priority is product scope and reach. We hear this from dealers all the time – and this again springs from the dynamics of a country where the stockless concept is pretty much non-existing: I have a warehouse, I sell product and it doesn’t matter what that product is as long as it fits within my infrastructure.

Office supplies and furniture are still big –over 75%, with OP certainly declining fastest – but we’re looking at any and all opportunities. Jan/san is a huge one and an area where we want to become much more consultative and competent. There are a lot of conversations to be had in this context. One step at a time.

OPI: On that note, there’s clearly plenty to do – many thanks for your time Angie.

BIG INTERVIEW Angie Bukta June 2023 25

After the past three years, when we look at businesses across a variety of industries and geographies, they continue to face several challenges – ranging from inflation all the way through to staff shortages.

On this latter point, there are 126,000 vacancies in the UK cleaning sector alone, for instance. Staff shortages can be attributed to multiple reasons, including the tightening of immigration rules post-Brexit or the incorrect labelling of cleaning and hygiene professionals as ‘unskilled’.

With many cleaning professionals being required to do more with less, the importance of productivity and efficiency has never been higher. While not the sole factor, robust protocols can play a crucial part when it comes to building the foundation of a holistically healthy business for office customers.

ADDRESSING ABSENTEEISM

As we continue to emerge from the pandemic, there are rising pressures of absenteeism. According to the Office for National Statistics data, 185.6 million working days were lost in the UK due to sickness or injury last year.

With companies taking responsibility for maintaining high cleaning and disinfection practices, it is hoped these numbers will drop this year, thereby increasing productivity.

A study conducted in the US in 2016, assessing the link between a comprehensive workplace hand hygiene programme, absenteeism and employee perceptions and practices, concluded that providing hand hygiene solutions throughout a building

Jonathan Weiss is Commercial Director Global Business Solutions Europe, Australia and New Zealand at Reckitt. He will be speaking at the next OPI European Forum, held from 22-24 May in Amsterdam, the Netherlands, on the topic of ‘Hygiene as the foundation for a healthier business’ .

BREAKROOM SPECIAL Special Issue

improved employee health outcomes and job satisfaction. At Dettol Pro Solutions, we pride ourselves on our reputation.

Our research (Zappi Survey Partnership Screen 2020) indicates that 72% of people are more likely to be confident in the level of hygiene in an organisation if they use Dettol, which increases to 81% among those who are ‘hygiene driven’ when making decisions to visit a business. These results help us understand how vital consumer trust is, but also the impact effective solutions can have.

BREAKROOM SPECIA Special Issue

CURBING CONTAMINATION

An office environment where many people are sharing a space can be a source of germ transmission. For this reason, a robust hygiene regime is needed which is both backed by comprehensive, science-backed protocols and also engages employees to participate. What’s more, understanding where and when to direct cleaning and disinfection measures is critical.

Special Issue BREAKROOM SPECIA

A key method to minimise time, product and the spread of germs on surfaces is to look towards techniques where surface and hand hygiene interventions are prioritised and most needed. By focusing on what requires the most attention, businesses can be more efficient, simply by encouraging cleaning and disinfection to take place at key moments, rather than just ‘frequently’.

Research has shown that high touchpoints such as door handles are easily contaminated. Using measures such as hand sanitisers, it’s worth bearing in mind that, if a dispenser needs refilling less frequently, it might mean it needs to be placed somewhere more accessible and visible. Or perhaps the messaging encouraging its use should be revisited.

DRIVING COMMERCIAL SUCCESS

Creating a workplace where the well-being of all staff is front of mind is not just the right thing to do, it’s good for business. If this isn’t a priority, the costs associated with sick leave and needing to replace employees can lead to a potential productivity issue.

At Dettol Pro Solutions, we understand that running a holistically successful business involves many factors, but maintaining a rigorous hygiene and cleaning programme should be high up the priority list.

26 www.opi.net

OPINION

Understanding where and when to direct cleaning and disinfection measures is critical

FACILITIES SAFETY / Special Issue FACILITIES / SAFETY / PPE Special Issue

Looking AHEAD

For Essendant, the “security incident” which hit its IT system several months ago is something that, operationally, is now firmly behind it. This is despite “select system gaps” which, at the time of writing, it was continuing to address.

However, said the US wholesaler, these do not impede its ability to conduct business or serve customers, and most systems for day-to-day operations are fully functional – and have been for some time.

It is common knowledge that Essendant suffered a network outage on 6 March 2023 – with cybercriminal organisation LockBit later claiming responsibility. Overnight, the wholesaler took its systems offline, meaning it was unable to receive products from suppliers, take orders or perform customer deliveries.

A clean-up effort began, involving cross-functional teams at Essendant, who worked around the clock to restore and recover core systems and conduct end-to-end testing. By 17 March, limited pick, pack and ship capabilities were available and, three days later, most systems and operations had been restored.

GOOD COMMUNICATION

The wholesaler declined to comment specifically on the business impact of the system shutdown, but highlighted the “timely and frequent” updates it sent to customers, suppliers and carriers.

“We committed to do this on the first day the incident occurred and it remained an important priority leading up to and throughout the operational recovery,” it said. “We received overwhelmingly positive feedback on our communications process.”

It’s challenging to find Essendant customers who will speak on the record about how they

felt the cyberattack was handled. Independent Suppliers Group (ISG) CEO Mike Gentile certainly believes the wholesaler “did a very good job of communicating” the situation.

“Essendant was careful how it approached it,” he says. “It’s not something you want to overpromise and underdeliver on. I have spoken to many companies that have gone through [something similar] and they all thought Essendant managed it very well.”

WHOLESALE VALUE

There were concerns small resellers may have been impacted more than their larger peers, but Gentile doesn’t see it this way. “It didn’t affect smaller dealers more than it did larger ones that rely on Essendant,” he states.

“What [the cyberattack] did was highlight to many of our members the value of the service they get from a wholesaler. As with many things in life, you never miss something until you no longer have it; dealers realised how dependent they were and what they took for granted.”

For Gentile, having a key part of the supply chain suddenly shut down was another example of the IDC demonstrating its resilience. “When the attack happened, dealers had to pivot – and they did,” he says. “They bought direct and drop-shipped more products from manufacturers, purchased from non-traditional sources, and supported fellow dealers in other markets.”

Now Essendant has recovered its fill rates, the ISG CEO regards the incident as a “blip”, with other issues being more pressing. “People are concerned about the general state of the economy in the US. There is continued inflation, high interest rates, a softness in demand and a very slow acceleration of back-to-office trends. These are all headwinds we have to deal with.”

28 www.opi.net

FOCUS

While temporarily debilitating, the recent cyberattack at Essendant is now viewed as a thing of the past – by Andy Braithwaite

Don’t be held to ransom

such as health and life sciences, professional sports or manufacturing firms.

OPI: Typically, what is the cost of a cyberattack to a victim?

OPI: Could you highlight some current ransomware trends?

Jim Wheeler: Ransomware attacks are carried out by highly organised criminal groups that seek to profit by encrypting a victim’s computer files and demanding payment to decrypt them. This type of cyberattack has been around for many years and has evolved over time to improve the ROI for the attacker.

In recent times, cybercriminals have not only been stealing data and encrypting it, but they are now also using automation to review it and assess its strategic value. By identifying the most sensitive parts and sending the victim snippets as proof, they can include extortion demands which are aligned with the victim’s revenue and profits as well as the ransom.

In some cases, once the data has been stolen, it is sold on dark net auction sites for far less than one might expect. This innovatively, but illegally, allows criminals to generate revenue from one attack in different ways.

JW: Due to their sensitive nature, accurately estimating the cost is a challenge, but in 2022, the average cost of a ransomware attack was assessed as £3.4 million ($4.2 million). This includes the ransom payment, lost productivity, IT infrastructure repair, legal fees and reputational damage.

OPI: What would you describe as an average timeline for restoring systems?

JW: This can vary greatly depending on several factors. These include the severity of the attack, the level of preparation and response from the business, and the complexity of the IT system. It can take anywhere from a few days to several weeks – or even months – to fully restore all systems and functionalities.

It’s important to note that the recovery process is not just about restoring systems to how they were, but also ensuring their security and resilience against future attacks. This will always require additional time and resources to properly assess and fortify the IT infrastructure.

OPI: How should a ransomware attack be communicated externally?

JW: Poorly handled communications can be harmful to a business in the longer term.

OPI: Who is a prime target for these attacks – is there one even?

JW: Every organisation is a potential target for a ransomware attack. Over the past nine years, I have worked with businesses of all sizes and across various industries, from sole traders to FTSE 100 companies.

Cybercrime impacts any organisation that critically relies on electronic communications to conduct operations. If this sounds like your firm, from a criminal’s perspective, there is a high likelihood you may contemplate paying a ransom to recover your data in order to save your business.

Offences have become more targeted towards specific sectors, unlike the original attacks that were sent to almost random targets. Criminals focus on industries where there has been success before, aiming at companies which can meet their demands. Attackers may specialise in different verticals

Jim Wheeler has more than 25 years’ experience in technology, with the past 17 focused on cybersecurity. Since joining the private sector in 2014, he has been advising and supporting businesses and executive boards in their cybersecurity journeys. Wheeler is currently the UK Cyber Lead at Infosys Consulting.

June 2023 29 FOCUS Cybersecurity

Following the ransomware attack that crippled Essendant’s IT system, OPI spoke with cybersecurity expert Jim Wheeler about how to prepare for and deal with such an event

Every organisation is a potential target for a ransomware attack

Attacks are naturally disruptive and damaging to a business’s reputation, but mishandling communications can make things even worse.

If a company is perceived to respond poorly to a ransomware attack, it could give the impression it’s not taking the situation seriously or does not have a sound plan in place for dealing with such incidents. This can erode customer trust, potentially leading to a loss of business and a drop in the organisation’s value.

It could also harm relationships with partners, investors and suppliers, who may lose confidence in the business’s ability to protect sensitive data.

PREVENTION IS BETTER THAN CURE

With nearly every business critically reliant on ‘always-on’ technology which keeps sensitive data confidential, it is crucial to take measures to protect against ransomware attacks before they happen. Below is a list of things a business can do to support its cybersecurity journey:

• Ensure the executive board has been adequately educated on cybersecurity, including the threats and risks, how attacks happen, and what the company intends to do when it’s under attack.

• Cybersecurity should be a regular agenda item for board meetings. The board needs to understand where the business currently stands, what risks it faces and how it plans to develop its security posture.

• A cybersecurity improvement roadmap should be designed and used to ensure progress is being made in a prioritised and cost-effective manner.

• Invest in engaging staff awareness training for every level of the business.

• Draw up a cyber incident response plan and run proportionate exercises to test it.

• Establish an internal and named crisis management team made up of the right roles and provide everyone on this team with the necessary training to deal with an incident.

• Have established relationships with people you may need in a crisis as there is a high likelihood they are already supporting existing clients. Having an agreement in place beforehand can ensure you get the response you expect and need quickly.

• Regularly back up your data in a proportionate way. Don’t assume backups will work on the day, even if you are paying for this service. Always prove they work.

OPI: Do you have any examples of how to best handle a ransomware attack – or not?

JW: I cannot disclose specifics, but I have definitely witnessed companies handle ransomware attacks differently, leading to quite different outcomes.

For example, one business paid the ransom quickly and hoped the situation would end, but it experienced more attacks (in the plural) within three months. The disruption almost cost it its number one client which made up over 75% of annual revenue.

Another, more prepared, client had a well-designed cyber crisis management plan and restored systems using clean backups

within hours. It lost a day’s worth of work for 5-6 people, which did not significantly impact the business.

The difference between having a cyber incident response plan and not having one is considerable. Companies should not only have a plan in place, but also practise responding to cyber crises by running exercises to test plans in a safe environment and identify potential weak points in the strategy.

Cybersecurity is a broad and highly complex subject. Proactive measures can be planned and budgeted for whereas reactive ones often cannot.

FOCUS Cybersecurity 30 www.opi.net

The difference between having a cyber incident response plan and not having one is considerable

WORKPLACE SAFETY: Special Issue BREAKROOM SPECIAL

since 1971. Our grandparents’ generation certainly did not know it in its current format, but that is not to say at all they did not focus on workplace safety.