6 minute read

Spotlight

by OPI

DEVELOPING

a multi-local approach

Former Fiducial Office Solutions Managing Director Laurent Bertrand is now leading France’s largest independent dealer, Lacoste Dactyl Bureau & École. In a currently rare outing, OPI’s Andy Braithwaite recently caught up with Bertrand at the firm’s head office near Avignon

Laurent Bertrand was not away from the French office products industry for long following his departure from Fiducial Office Solutions in mid-2018 after 15 years with the company. Nine months after leaving the Lyon-based reseller, he was named Managing Director of the country’s largest dealer, Lacoste-Dactyl Buro (LDB), as it was then known.

LDB came into existence at the end of 2018 when two regional French dealers – Lacoste, based in the south, and Dactyl Buro, located in the centre of the country – merged in a leveraged buyout. This transaction created France’s first ‘multi-local’ independent reseller, with the potential to expand its reach nationwide. In 2019, the company generated annual revenues of about €100 million ($120 million), employed 520 staff and had 40 locations (offices, warehouses and stores) dotted around the country.

When Bertrand joined LDB, he was tasked with integrating the two companies, moving them onto a common IT platform, developing a single e-commerce solution, and optimising the distribution network for its office products and educational supplies offerings. He was right in the middle of this project when COVID-19 hit in March 2020.

“It was a real nightmare,” he says. “We had to switch almost overnight to coordinating everything in a virtual working environment.

Having said that, the fact that the level of business declined dramatically did provide a window of opportunity to make good progress with various aspects of the integration, especially as regards the supply chain.

“When I look back now, it’s difficult to say whether COVID made things more challenging or, strangely enough, actually helped us,” he notes. “But when orders began picking up again in June [2020], we were up to speed both in terms of logistics and the IT systems.”

REBRANDING

In January 2021, the two companies legally merged and the business rebranded to Lacoste Dactyl Bureau & École (LDBE). There was a subtle change in the spelling of ‘Bureau’ (from Buro) to the standard French form of the word ‘office’, while ‘École’ was added to highlight its expertise in the school supplies market.

“It was important to show our true activity and to illustrate through our logo and trademark that we are a French player,” Bertrand explains.

The approach to merging the legacy Lacoste and Dactyl Buro businesses has been a pragmatic and realistic one. It has not been a question of taking a hammer to either and trying to drive home a single corporate culture or imposing one set of values over another.

Quite the opposite. Bertrand recognises there are separate ‘north’ and ‘south’ cultures, but he is happy to keep it this way. “You have to accept the differences and try and build on the strengths of each to develop the whole,” he states. “Company culture isn’t something that is decided; it’s the result of something; in our case, the realisation of our project and what we want to achieve.”

In terms of the two main locations – Le Thor, near Avignon (Lacoste) and Bourges (Dactyl Buro) – there are distinct roles for each. The Le Thor site is now set up to handle all distribution for the 12,000 school SKUs, while the 10,000-strong office supplies range is shipped from Bourges.

“If we had tried to put both sets of products in the same warehouse, firstly they would not have fitted and, secondly, we would not be able to accommodate the growth plans we have,” explains Bertrand.

GROWTH OPPORTUNITIES

One of the planned synergies from the merger is to develop the school and public sector markets in the north of the country. For example, while Lacoste has a thriving business in the education channel – with annual sales of around €20 million – Dactyl Buro had virtually nothing in this segment. The target is to grow this to €20 million over the next 3-4 years. The early signs are encouraging; this year, school supplies sales in the north of France should be between €3-€4 million.

Other areas Bertrand has identified for organic growth include developing the product assortment to gain a greater share of customer wallet. Packaging, health and hygiene, breakroom and furniture are some of the categories he is targeting. There are also geographical expansion opportunities, particularly in the north-west and south-east of France.

While LDBE does not have a large retail presence with just 11 outlets, growing this part of the business is also on Bertrand’s to-do list. He isn’t giving much away about his retail expansion plans, but is hoping LDBE will become an attractive choice for entrepreneurs from other banners who are looking for something different or are considering selling their businesses.

There has been a lot of talk in the office products world recently about the changing role of the salesperson, even questioning whether resellers actually need an outside sales team.

For Bertrand, sales is a “human story”, and the rep remains a core part of the customer service proposition. That, of course, is dependent on whether the customer values this human interaction. Bertrand appreciates that some buyers are self-sufficient and use online-only channels, but he firmly believes there are still many companies – especially among LDBE’s core base of SMBs located in the French provinces – that “want to do business via a human being”.

“People value our approach of giving advice, helping to find the right products, and saving them time and money,” he notes. “And this is not just with older generations. I’ve been out on customer

visits and there are office assistants in their twenties who want to deal with a real person. The French market is not all about catering to those working in a big office tower in La Défense [main business district in Paris].”

With the LDBE entity now established, is Bertrand looking at making any acquisitions, especially considering the reseller’s private equity backing? “There are always external growth possibilities,” he says, hinting that something might occur in the near future.

One thing is certain: LDBE isn’t in the running to acquire Office Depot France, but there are plenty of other fish in the sea in what is still a relatively fragmented French market.

LOCAL HEROES

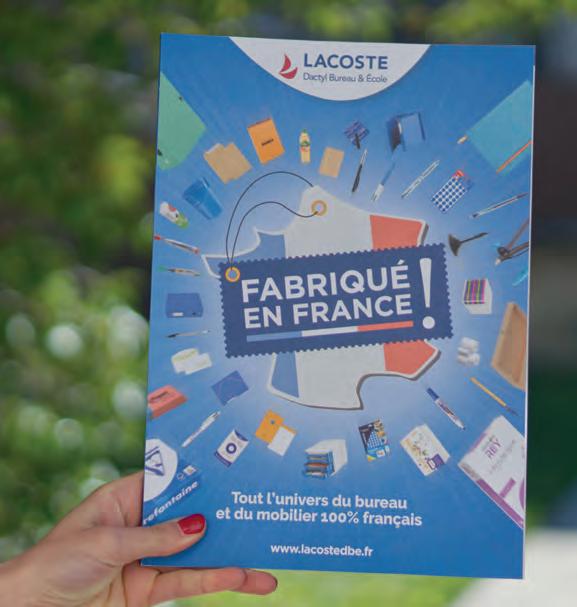

In March 2021, Lacoste Dactyl Bureau & École (LDBE) introduced its first-ever catalogue devoted entirely to products made in France. Managing Director Laurent Bertrand recognises that, as a result of COVID-19, customers have become more aware of the origin of the products they purchase.

“While this might sometimes present buyers with a dilemma – between price and where an item is made – we believe local purchasing is a trend that is here to stay,” he says.

Certainly, France is well placed when it comes to business products manufacturers. With companies including Pilot Corporation, BIC, Hamelin, Exacompta Clairefontaine, CEP, Tarifold, Pentel, Viquel, Proven and Jex which all have production sites in the country, LDBE has been able to fill a 135-page catalogue with more than 1,800 ‘Made in France’ items.

Pages describing the manufacturers highlight areas such as the number of workers employed in France, the locations of production sites and company histories.

“We can all play a role in safeguarding French manufacturing jobs,” notes Bertrand. “The companies selected for our catalogue represent more than 10,000 employees. Not only that, but reduced shipping distances also have an important impact on reducing carbon footprints – and this is something purchasers are increasingly taking into account.”