Connecting the business products world

The OPI Top 100 list has seen constant evolution over many years. Some periods were fairly static, others showed considerable upheaval in terms of people turnover. 2024 fits the latter with a 20% churn.

Retirements, replacements, company acquisitions as well as collapses all have their part to play in this churn. One channel that is clearly in a state of flux is the wholesale/distribution space.

In the UK, this has manifested itself in the demise of one operator – OT Group and, by association, Spicers – while Westcoast was acquired and is now part of ALSO Group. The two wholesalers in the US, meanwhile, have new heads with Andrew Wallach and David Boone. US-based Global Industrial and Australia’s Dynamic Supplies, finally, are new entries.

INTERVIEW: NAVIGATING CHANGE

I’ve been active in the buying group space for the past 15 years [...]. This participation has been incredibly valuable to me and the amount I’ve learnt from other dealers is immeasurable. I’ve built strong relationships nationwide and now I know exactly who to call across regions. These connections wouldn’t exist without my involvement [...].

My advice to anybody in this business as we move away from traditional office products is to connect with fellow dealers, congregate and share best practices because this category is diminishing rapidly.

18 Interview

Ian Wist highlights the importance of strong leadership in a tough business environment

24 Feature

The past 12 months have been challenging, reflected in a sizeable turnover rate in our perennial Top 100 list

34 Category Update

Long-term opportunities remain in the mailroom and packaging sector

38 Category Update

As traditional routes to market recede, operators in the stamping category continue to innovate to stay relevant

42 Review: Industry Week ’24

Collaborating, learning and networking: the fourth Industry Week in Orlando, Florida, was a resounding success

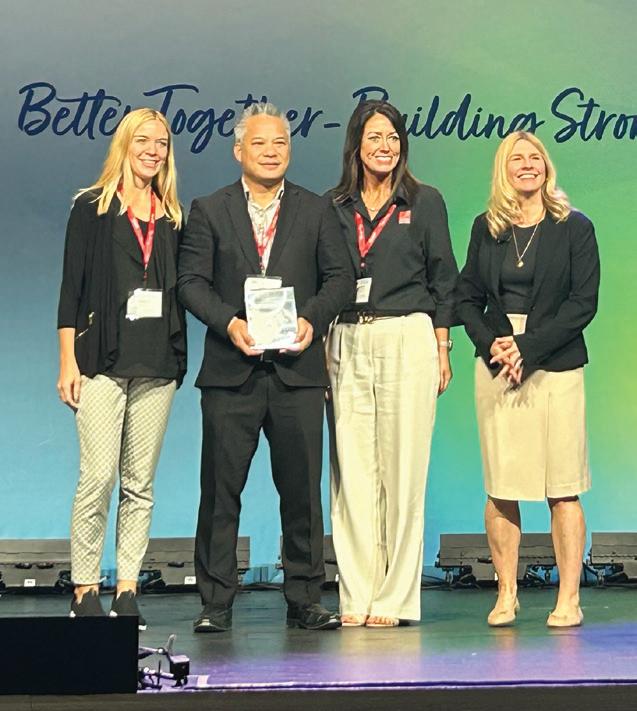

44 Review: NAOPA

All the winners from the 2024 North American Office Products Awards – and why they triumphed

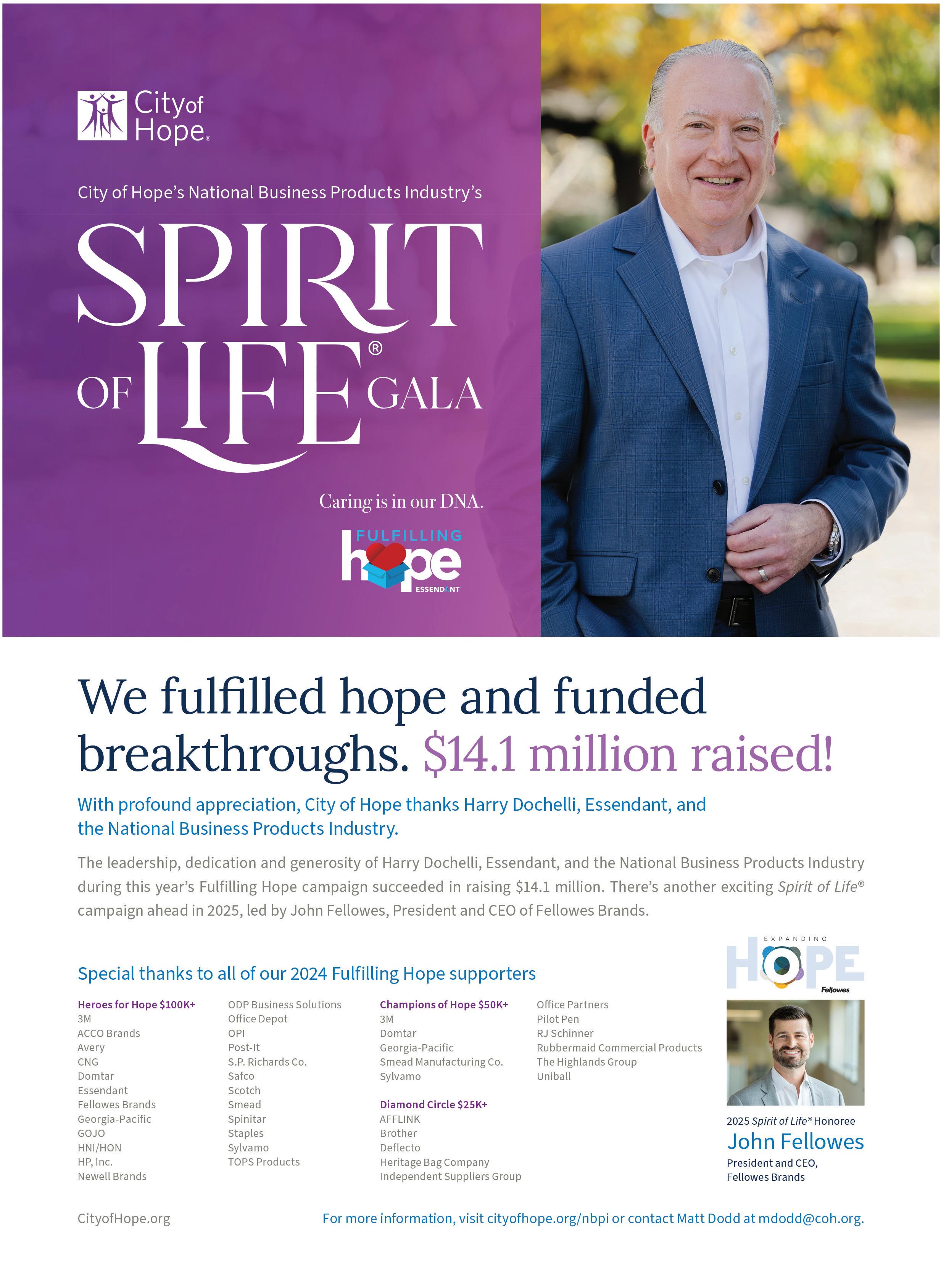

49 Review: City of Hope Gala Dinner

The Fulfilling Hope fundraising campaign concludes at the Spirit of Life event in Chicago

50 Preview: Climb of Life 2024

Members of the UK business supplies industry get ready to scale the Lake District’s mountains to raise vital funds for the Institute of Cancer Research

Editor

Heike Dieckmann

+44 1462 422 143 heike.dieckmann@opi.net

News Editor

Andy Braithwaite

+33 4 32 62 71 07 andy.braithwaite@opi.net

Assistant Editor

Kate Davies kate.davies@opi.net

Workplace360 Editor

Michelle Sturman

michelle.sturman@workplace360.co.uk

Freelance Contributor

David Holes david.holes@opi.net

Chief Commercial Officer

Jade Wilson +44 7369 232590 jade.wilson@opi.net

Head of Media Sales

Chris Turness +44 7872 684746 chris.turness@opi.net

Commercial Development Manager

Chris Armstrong chris.armstrong@opi.net

Digital Marketing Manager

Aurora Enghis aurora.enghis@opi.net

Events Manager

Lisa Haywood events@opi.net

Head of Creative

Joel Mitchell

joel.mitchell@opi.net

Finance & Operations

Kelly Hilleard kelly.hilleard@opi.net

CEO Steve Hilleard +44 7799 891000 steve.hilleard@opi.net

Director Janet Bell

+44 7771 658130 janet.bell@opi.net

Executive Assistant

Debbie Garrand

+44 20 3290 1511 debbie.garrand@opi.net

Follow us online

Twitter: @opinews Linkedin: opi.net/linkedin Facebook: facebook.com/opimagazine Podcasts: opi.net/podcast App: opi.net/app

Highlighting achievements, of individuals as well as companies, is part of the remit of an industry publication I believe – although we are also duty-bound to point out some inconvenient truths at times, I would argue. We’ve certainly done the former in this issue with our Top 100 list (page 24)

Continuously updated on opi.net, we take the opportunity once every 12 months to ‘formalise’ – subjectively no doubt – this who’s who in the business supplies sector to establish what’s happened in any given year, hence the references to ‘churn’ , ‘20% turnover’, etc Several of the new entries are profiled in more detail in these pages, which we hope will give readers some valuable information.

We’re not making a difference. But then again, perhaps we are

Aside from a well-earned pat on the back – on this note, may I also say a massive ‘congratulations’ to all the winners of this year’s North American Office Products Awards (page 44) – hearing success stories further serves as best practice advice. After all, success is typically the result of executing an exceptional strategy, keeping a keen eye on trends and having the ability to adapt. Many of our Top 100 candidates perfectly fit this bill.

One of the new entries, incidentally, is also our Interview candidate: Ian Wist (page 18). Highly experienced but wonderfully humble, Wist doesn’t sugarcoat the challenges – far from it – but refers to the incredible benefits which can be gained from truly immersing yourself in the industry, collaborating and learning from peers. “The amount I’ve learnt from other dealers is immeasurable,ˮ he says

Speaking of ‘humble’, there’s something else I want to draw attention to and that is our industry’s philanthropic engagement. However successful the various players in our sector are, let’s be honest, we’re not saving lives and we’re not making a difference. But then again, perhaps we are – not by selling paper, pencils or toilet rolls, but by wholeheartedly and perennially supporting organisations such as City of Hope in the US (page 49) and the Institute of Cancer Research in the UK (page 50)

Hearing about what these research centres do and how they advance and break through medical barriers is humbling. Being part of a community that helps fund these breakthroughs makes me feel a bit proud too – and appreciative of what you can do if you put your mind to it.

Integra Business Solutions and Office Friendly, two of the UK’s leading dealer groups, have revealed that they are in discussions regarding a potential merger.

The move comes as both organisations aim to leverage synergies and align their growth plans to benefit members’ businesses and the independent dealer channel.

According to a joint statement, the boards of the groups have identified several areas of mutual benefit, including diversification, sustainability and digital solutions.

The merger process has been initiated, with shareholders from both companies having received communication regarding the proposal and respective voting

The 2025 European Office Products Awards (EOPA) will feature two additional categories. The new awards are Best Workplace and Online Reseller of the Year.

The former has been introduced to recognise organisations that are going the extra mile to create a positive workplace experience, while the second will be presented to an exceptional business which primarily operates online.

The deadline for all entries is 13 November 2024, with the shortlist set to be announced at the end of January following a thorough judging process. Submitting entries and nominations is very straightforward – just head to eopa.opi.net or email awards@opi.net.

requirements. The outcome of these votes and the next steps are expected to be communicated at the beginning of October – at the time of OPI going to press.

In the meantime, the two groups have assured all members and partners that there will be no disruption to operations or any changes to existing trading relationships while a decision is being made.

Follow developments related to this story on opi.net and in sister publication Workplace360.

A total of 13 awards will be handed out at the EOPA 2025 presentation dinner taking place at the Hotel Okura in Amsterdam, Netherlands, on 11 March 2025. The dinner is one of the highlights on the European business products industry’s events calendar, and there is an early bird rate for tickets which runs until 13 December.

It was with great sadness that OPI learnt of the recent passing of Bi-silque founder Virgílio Vasconcelos.

Virgílio passed away peacefully on 22 September at the age of 86. Along with his wife Aida, he established Bi-silque in 1979. Initially, the company focused on cork products, but over the years diversified into the wider visual communications and workplace environment categories and became a force in the international business products world.

“His commitment to excellence, dedication to quality and relentless

pursuit of innovation have made Bi-silque a leader in its field,” the company wrote in a statement. “Virgílio built a company which not only achieved commercial success, but also stood for strong values –ethics, community engagement and sustainability – that have made a lasting impact on the business world and beyond.”

For the past several years, Bi-silque has been run by André Vasconcelos, Virgílio and Aida’s son. OPI extends its deepest sympathies to André, Aida and their family and friends.

Lyreco has announced an agreement to acquire Groenendijk Workwear, a Netherlands-based company specialising in work- and footwear. The deal aims to strengthen Lyreco’s expertise in work- and footwear, two of the fastest growing sub-segments within its safety division Lyreco Intersafe. The French reseller had acquired Intersafe in 2018 and it became a Lyreco brand in December 2021.

Serving the Benelux region, Groenendijk has over 25 years of experience in the PPE market and reports annual sales exceeding €60 million ($66 million) – 90% of which are generated in the Netherlands.

The new entity will be integrated into Lyreco Intersafe when the transaction closes. This is expected to be on 1 January 2025, but the deal still requires approval from the Dutch Competition and Consumers Authority.

Until then, founders Nanda and Marien Groenendijk are staying on to ensure a smooth transition. Day-to-day management will continue to be overseen by existing key staff post completion of the acquisition.

“Groenendijk enables us to take a leap forward with our ambitious plan by having a company with knowledge and experience in workwear and with an even wider portfolio of possibilities that we can roll out internationally,” said Joris Wels, CEO of Lyreco Intersafe.

From left: Nanda Groenendijk, Greg Liénard (Lyreco Group CEO), Joris Wels & Marien Groenendijk

On 27 September, the creditors of insolvent European paper and packaging distributor Inapa overwhelmingly approved a number of proposals put forward by the company’s administrator.

Portugal-based Inapa collapsed into administration at the end of July (see Analysis, OPI September 2024, page 8) after it violated German liquidity regulations. A court-appointed administrator then began the process of trying to secure the group’s future.

A proposal to acquire the entire business was rejected because it would have required an injection of capital of €50 million ($56 million) from existing shareholders. The administrator therefore recommended accepting two separate bids for Inapa’s French entities: a €20 million offer from Next Pack (which trades as Fidel Fillaud) to acquire Inapa Packaging SAS, and a €25 million proposal from Japan Pulp and Paper (JPP) for Inapa France (which is subject to a 30-day negotiation period).

While no formal offers have been made for other Inapa entities, JPP has expressed an interest in acquiring assets in Germany and Portugal.

German dealer Kaut-Bullinger has entered into a form of creditor protection as it struggles with declining sales. At the end of September, the Munich District Court approved the procedure, which means the company can continue to operate as normal under its current management team. Under German law, the salaries of Kaut-Bullinger’s staff are guaranteed until the end of November.

Representatives from Stuttgart-based law firm Grub Brugger are assisting with a

restructuring of the 230-year-old reseller. They are optimistic the business still has a long-term future. Meanwhile, Oliver Schartl from Müller-Heydenreich Bierbach & Kollegen in Munich has been appointed as provisional trustee.

“The tough competition in online retail, combined with companies’ reluctance to purchase – which is partly due to working from home – has led to a significant drop in sales,” explained Kaut-Bullinger Managing Director Robert Brech.

He added: “We therefore had to take the difficult step of filing for insolvency proceedings under self-administration. We hope this will enable us to maintain our previously successful position in the market.”

Fellowes Brands is rolling out a major new marketing campaign across Europe. The vendor has introduced a brand character called the WorkLife Coach who will demonstrate how the company’s products help make people’s workspaces more productive and comfortable.

The campaign features videos, print ads, out-of-home advertising and social posts as well as a new content hub on Fellowes’ website. AI voice cloning in several languages has been used on the videos to cater to the vendor’s different markets.

Fellowes has developed associated marketing toolkits for resellers to help them grow sales in the final quarter of the year. It will also be running a series of promotional activities with end users.

Aftermarket consumables specialist Katun is looking to disrupt the OEM copier and printer market. The vendor has announced its first line of multifunctional printers under the Arivia brand. It claims its devices offer “advanced security features, user-friendly design and top-of-the-line performance”.

The initial product launch features 11 A3 devices, consisting of five monochrome and six colour models. These cater to a broad range of environments, from small offices to large workgroups.

Meanwhile, in a separate development, US distributor Image Star unveiled a laser A4 line-up under the Capsul name, aimed at the SOHO segment.

Describing Capsul as an “IT peripherals brand”, Image Star said it was “poised to disrupt SOHO print with aggressively low prices and higher reseller margins”.

PBS Holding has acquired ADVEO Benelux, with the deal taking effect retroactively from 1 August 2024. PBS said the move strengthens the Austria-based group’s presence in the Benelux region, further expanding its operations that now span ten European countries.

Despite the change in ownership, day-to-day management will remain consistent, with the current management team, led by General Manager Erwin Snoeker, continuing to oversee operations.

The deal marks PBS’ second major purchase in 2024, following the integration of OCL Trade into its Italian subsidiary Desktoo in May.

As a result of the acquisition, PBS Benelux, as the business is now called, has become a member of Interaction, the European purchasing group that manages the Q-Connect brand.

The company voluntary arrangement (CVA) signalling the end of UK multichannel operator OT Group was approved by creditors on 10 September.

In August, it was confirmed OT Group would be broken up, with Spicers shutting down and reseller businesses Office Depot and Officeteam.co.uk folding into Paragon, a sister company of main shareholder Grenadier Holdings (see Focus, OPI September 2024, page 30)

Grenadier has said it intends to pay OT Group’s creditors “100% of agreed balances”. Documents filed with Companies House show the amount owed totalled more than £31 million ($40 million), although £22 million of that was to Grenadier itself and related entities.

Nevertheless, it still leaves around £9 million outstanding, with some familiar names in the UK business supplies industry being owed sums which – in some cases – run into hundreds of thousands of pounds.

Senior changes at Essendant

US distributor Essendant has named Patrick Allard as President of its Fulfillment Services division. He will lead the company’s 3PL efforts, including the recently announced Connected Commerce services business. Meanwhile, the head of Essendant’s Wholesale Commercial organisation Renee Starr is to leave the company in mid-October. She will take on a senior role at PPE and safety supplier Hospeco Brands. Essendant is expected to make an interim appointment while it searches for Starr’s permanent successor.

Ex-Depot exec joins Codex Codex has appointed Niall Murphy as Key Account Manager. He joins the Irish reseller from Office Depot, where he spent 17 years. Murphy will manage key accounts within the Health Service Executive and is tasked with driving growth in the province of Munster.

IT distribution giant TD SYNNEX has appointed Reyna Thompson as President of North America from 1 December. She is currently leading the North America Advanced Solutions business unit. Thompson will succeed Peter Larocque who is transitioning to an advisory role after 40 years with the firm.

OP channel hire at Highlands Highlands has appointed Kaitlyn McCrerey as Strategic Account Manager in the office channel. McCrerey joins the sales and marketing agency from The ODP Corporation, where she was most recently Senior Associate Product Manager.

Dismore makes AMD swich

HP Inc’s head of its Northwest Europe (NWE) region, Stephanie Dismore, left the firm in September. After more than 25 years with the tech giant, Dismore took on the role of President EMEA at computer processor producer AMD. Koen Van Beneden, Managing Director of HP’s Benelux cluster, has taken on the NWE Managing Director role on an interim basis.

ECI Software Solutions has confirmed Ray Wizbowski joined the company as Chief Marketing Officer in August. He has more than 20 years of marketing experience spanning multiple industries as well as both SMB and enterprise customers. Most recently, Wizbowski was CMO at Diligent, a Software-as-a-Service company specialising in governance, risk and compliance.

MD change at Sigel

Sigel company veteran Daniel Petrasch has been named as the vendor’s new Managing Director, effective 1 October. Having been with the business for 34 years, Petrasch succeeded Götz Stamm who stepped down after more than four years in the role.

Australian reseller COS has announced two acquisitions recently. Firstly, the family-owned business said it had bought Tosco Business and Education, the largest independent dealer in the northern Queensland region.

Established in 1958 as Typewriter and Office Supplies Company, Cairns-based Tosco had been owned by Stephen and Judy Gardiner since the early 2000s. The Gardiners retired following the closing of the transaction on 1 October.

Shortly after, COS confirmed the acquisition of Kookaburra Educational Resources, also effective 1 October. Founded by a teacher in 1989, Kookaburra is one of Australia’s largest B2B educational suppliers. These latest deals for COS come as rival Officeworks continues to expand in the B2B segment, with the education market a key focus area.

Fujifilm Business Innovation (BI) and sister company Fujifilm North America have announced their expansion into the US office and commercial production space.

The Japan-based OEM has confirmed leading reseller Marco Technologies as its first US channel dealer authorised to sell, market and service Fujifilm’s full portfolio of office and production solutions. Devices now available include Fujifilm’s APEOS series of A3 and A4 office digital multifunction printers and solutions as well as the REVORIA production-oriented series.

Marco said the partnership was an addition to rather than a replacement for its current vendor relationships.

The move into the US comes just a few months after Fujifilm BI expanded into Europe with launches in Italy, the UK and France.

The highest level of education is valued about 7.5 times less than knowing how to code […] Employers sometimes appreciate certain specific skills more than having a particular degree [which] evens the playing field

Valeri Potchekailov, CEO, StoryChief

76%

Amount of large companies in India, Spain, the US and the UK admitting to a severe shortage of AI-skilled personnel

Brother receives Technical Packaging Award in Japan

Print OEM Brother submitted its new lightweight, moulded pulp cushioning material to the Japan Packaging Contest 2024. It reduces the size and weight of packaging, resulting in a 33% drop in CO2 emissions.

The Indian Paper Manufacturers Association’s 2023-24 report shows the packaging paper and paperboard market is growing 8.2% annually. Growth is driven by demand from FMCG, textiles, pharmaceuticals, e-commerce and healthcare, along with India’s 2022 ban on single-use plastics.

59%Percentage of Asia/Pacific enterprises targeted by attacksransomware in 2023

Drexel announces partnership

Philadelphia, US-based Drexel University has entered a three-year contract with WB Mason and Supra Office Solutions, with options for two additional one-year extensions. The partnership aims to develop supplier diversity and support the local economy.

$247.2 billion

Expected global end-user Software-as-a-Service spending by the end of 2024

Office Depot transforms store

Office Depot Korea has converted its Gangnam outlet into a flagship store for the Korea Baseball Organisation (KBO), featuring merchandise from league teams and fan experiences. The transformation follows a recent marketing agreement with the KBO.

Brother is to launch a new remanufacturing line at its Recycling Technology Centre in Wrexham, UK, saying it is the first print OEM to remanufacture its inkjet cartridges. Once fully operational, Brother expects to remanufacture over two million inkjet cartridges annually, creating 20 new jobs at the facility.

Business and home users in 30 European countries can return used ink cartridges free of charge to Brother. In fact, they have been encouraged to do this for the past year so that the OEM can build up a stock of empties. All returned cartridges are inspected, cleaned, reassembled and refilled with Brother original ink.

This new initiative complements Brother’s long-standing toner cartridge remanufacturing service, which has produced over 40 million remanufactured toner cartridges globally since 2004.

German vendor tesa plans to use green hydrogen energy at its Hamburg production facility by partnering with public energy supplier Gasnetz Hamburg to connect the plant to the hydrogen network. By 2027, tesa aims to produce its first adhesive tapes using hydrogen, reducing CO2 emissions by appoximately 6,000 tonnes annually. The company is investing €300 million ($330 million) in this and similar projects over the coming years to support its aim of achieving climate-neutral Scope 1 and 2 production by 2030.

“Decarbonisation can only succeed if we exploit all opportunities to use renewable energies,” stated tesa CEO Dr Norman Goldberg.

For more on tesa’s sustainability strategy, look out for an interview with Executive Board member Andreas Mack in the forthcoming Green Thinking issue of OPI

Sales and marketing agency Highlands has been appointed by Ireland-based company Riley to build its distribution footprint across Europe, bringing the company’s sustainable period products to a broader market.

Riley supplies eco-friendly period products made from 100% certified organic cotton, free from pesticides, chlorine bleach and other harmful chemicals. With demand for accessible and sustainable sanitary products growing, Highlands sees this partnership as an opportunity for distributors within the expanding feminine hygiene market.

European e-procurement platform Unite has earned its first gold award from sustainability business ratings provider EcoVadis.

The recognition places Unite among the top 5% of companies evaluated in July 2024 and within the top 3% in its industry. Additionally, it reflects a significant improvement in Unite’s sustainability performance, with the organisation increasing its score by 21 points compared with 2023.

Fellowes Brands has released the results of its Annual International Day of Clean Air Survey, highlighting employees’ ongoing needs and concerns in the workplace.

Somewhat discouragingly, only 35% of respondents rated their indoor air quality (IAQ) as “very clean”, although this is a slight increase from last year’s 33%. Common issues reported in the US and Canada included inconsistent temperatures (51%), stagnant air (35%) and visible signs of mould, stains or dust (23%).

The survey highlighted the majority of workers, particularly in Italy (72%), the UK (67%) and Germany (67%), believe air purification units in their workplace would improve their confidence in IAQ. In the US, 60% of employees agreed.

Additionally, 67% of hybrid workers in the US indicated that visible improvements in air quality management would make them more motivated to work from the office, suggesting IAQ is becoming an important factor in return-to-office trends.

Sustainable cleaning solutions manufacturer Greenspeed has achieved B Corp certification after B Lab, the non-profit organisation behind the B Corp movement, scored Greenspeed 82.5 points.

Applicants to become a B Corp must achieve a benchmark score of at least 80 (out of 200) points and demonstrate that they adopt both socially and environmentally responsible practices in energy supply, waste and water usage, employee compensation, diversity and company transparency.

Greenspeed is now part of a global community of over 8,500 companies certified as B Corps in 92 countries and 161 sectors.

French office and school supplies group Alkor has presented its first CSR awards to encourage and reward the sustainability efforts of its suppliers.

The inaugeral winners were aftermarket ink and toner specialist Altkin in the Office Equipment category, and BIC in the Education and Creative category. They were selected based on strict criteria, including a minimum EcoVadis score of 50.

Essity’s net zero emissions targets have been validated by Science Based Targets initiative (SBTi). The hygiene and health vendor’s long-term target is to achieve net zero emissions across its value chain by 2050. Its near-term Scope 1 and 2 target (energy use within the company and purchased energy) is to reach a 35% reduction by 2030.

Meanwhile, the near-term Scope 3 target (including purchased goods and services, transportation, production waste and end-of-life treatment of sold products) has been updated from 18% to a 35% reduction within the same timeframe. All targets are relative to a 2016 baseline.

Xerox has launched a carbon neutrality service as part of its managed print offering. Developed to the ISO 14068 climate neutrality standard and independently verified, it provides a “comprehensive assessment” of print devices, enabling organisations to better understand the environmental impact across their print infrastructure life cycle – from raw materials and manufacturing to delivery, use, maintenance and end-of-life management.

The service also includes a carbon reduction plan with initiatives such as print management, recycling and remote service. Xerox then handles the implementation and purchasing of “high quality” carbon credits to offset emissions.

The latest back-to-school

Market research firm Circana tracks the office supplies category – excluding janitorial, breakroom and storage – at leading US bricks-and-mortar and online retailers. In August, the company revealed details of its latest forecast for the segment in 2024 and beyond.

The headline figure was a 4.9% revenue decline in 2024, but the expectation is for declines in units and revenue to ease over the next two years. OPI Talk spoke to Ben Arnold, Industry Advisor, Office Supplies at Circana, to find out more – with a focus on this year’s back-to school (BTS) season, which was in full swing at the time of recording the podcast.

We are essentially looking at a normalisation of the market after the volatility of 2020 and 2021, which was followed by price increases on a variety of goods. In 2024, there are certainly some consumer and economic headwinds facing buyers; there is a quest for value, with everybody trying to cut costs from every corner of their budget.

The industry is still down compared with prior years, but the overall message is one of softening declines and a return to a steady market in terms of the categories we cover.

This year’s BTS season began quite softly. I believe this was partly due to the timing of

the 4 July holiday in the US and promotional activity typically occurring in the second week of July shifting to the third.

As a result, early comparisons were down on last year. However, as the BTS period progressed, we started tracking more closely to flat compared to a year ago. Students also returned to school later than they did in 2023, which could account for the slow start.

Private label is an area where consumers can cut costs on their BTS bill or other supplies. Looking at sales on a week-to-week basis, private label accounted for a larger percentage of revenue during BTS versus earlier in the year. This tells us the search for value followed the consumer into the BTS timeframe.

If we’re working in more environments, it’s ultimately a positive development for everybody

Another factor we have seen in our data is that private label has gained more distribution at retailers. Therefore, it’s not just consumers choosing private label brands more than they were, but they have a greater choice when they visit stores too.

This being said, brands still matter very much. My 12-year-old seventh grade

daughter, for instance, recently came home from BTS shopping with a bag full of national brands. When I asked her about some of those, she referred to influencers she had seen on social media.

Private label accounted for a larger percentage of revenue during BTS versus earlier in the year

So, while consumers are trying to find more value, students have reasons for choosing particular products and brands. As such, there appears to be a balance.

What is interesting for brands is how they can harness social media trends and reach younger consumers.

We have seen lower volumes this year, while prices are definitely still elevated compared to 2019. However, I believe the softness we’ve seen has been less about demand – or lack thereof – and more about buyers trying to find value and alleviate the impact of higher average selling prices.

This could translate into looking for larger pack sizes which bring down the cost of an individual unit – that’s one way to save.

In terms of categories, there has been more stability in writing instruments than we were

probably expecting at the start of 2024, which is encouraging. Creator-focused categories have also been stronger this year; one example is painting supplies, which ties in with the wider creator trend we are witnessing in the market.

Year to date [mid-September], 25% of office supplies revenue came from online channels. This represents a two percentage point increase versus a year ago, which may not sound a lot, but actually is.

When we look back over the course of four to five years, there has been a consistent shift to online in the low single digits. The reason we’re not seeing higher rates – say 60% – of sales occurring online is because the in-store shopping experience is still important; it’s an occasion, a reason to go out as a family ahead of the upcoming school year.

Our research shows we’re at about 50% in terms of the in-office rate compared to 2019. As far as I’m concerned, that’s a good thing for the office products industry because many workers are keeping two sets of supplies: one they have at work, generally purchased by the company, and another at home.

If we take the idea that the ‘office’ is wherever work occurs, be this at home, in a coffee shop or in a company cubicle, there are special needs for supplies in a lot of these venues. If we’re working in more environments, it’s ultimately a positive development for everybody in the channel.

Even though I’m located in Washington DC, I’m not sure I have a perspective on how the result of the election in November could impact a return to the office.

The wider issue is how to jumpstart the economy and have a strong, productive workforce with lots of consumers in jobs. This would be a plus for the office supplies industry.

There are promising signs despite the market softness. What our forecast says is that consumers are trying to find room in their budgets for business supplies, but are having some difficulty doing it.

One of my takeaways is there could be additional opportunities for manufacturers and retailers to create more shopping occasions throughout the year. There are now established promotional events in July and October, for instance. Can the office supplies industry do something similar?

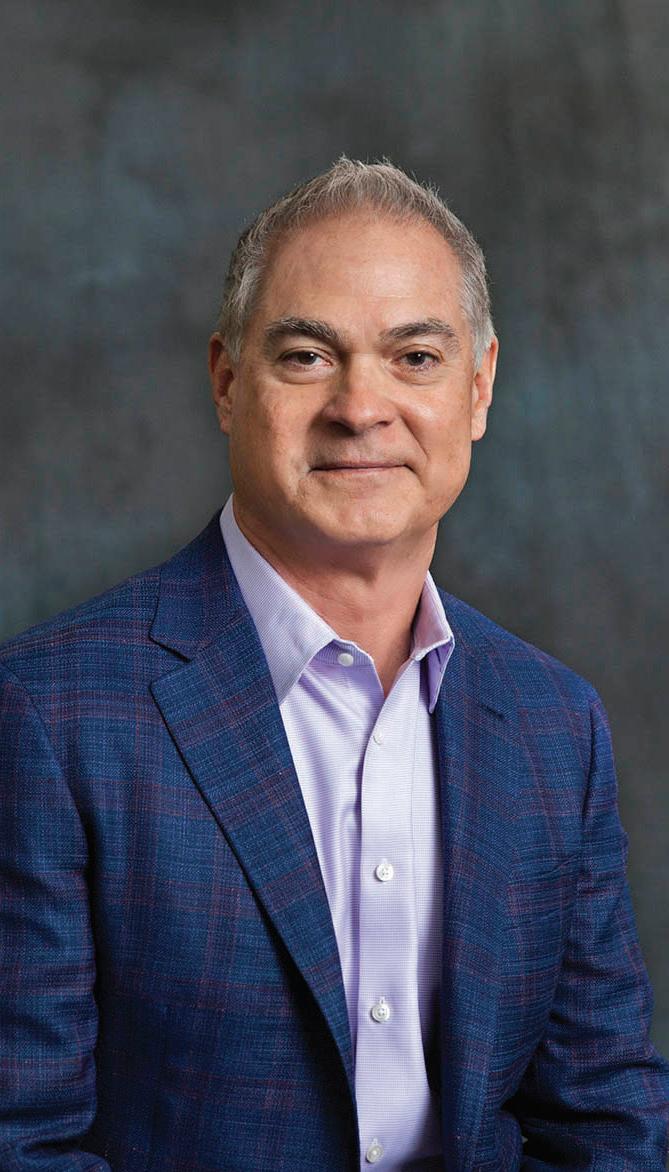

Ian Wist underscores the importance of strong leadership when steering independent dealers through challenges and towards success

Wist Business Supplies has been a staple of the US office supplies industry since its creation in 1955. Having served nearly 38 years in the company, owner and General Manager Ian Wist, grandson of founder Martin Wist, has grown the dealership into the largest privately-owned reseller in the southwest. He has expanded its offerings beyond traditional office supplies, while staying true to the operator’s roots and family values.

Wist’s leadership style is characterised by a willingness to innovate, complete confidence in his team and strong relationships across the industry. All of the above were recognised, for example, when he was named Professional of the Year at the North American Office Products Awards (NAOPA) in 2021.

Speaking to OPI’s Kate Davies, Wist reflects on the leadership qualities he has honed through his extensive involvement in roles within and outside of his own business.

OPI: First, can you chart your career path?

Ian Wist: I’ve spent my entire career at Wist Business Supplies, starting straight out of Arizona State University in 1987. I’ve held almost every role within the company, from sales to leadership, navigating transitions as the business evolved.

I’ve been active in the buying group space for the past 15 years too, particularly at TriMega Purchasing Association which merged with Independent Suppliers Group (ISG) in 2019. This participation has been incredibly valuable to me and the amount I’ve learnt from other dealers is immeasurable. I’ve built strong relationships nationwide and now I know exactly who to call across regions. These connections wouldn’t exist without my involvement with ISG.

My advice to anybody in this business as we move away from traditional office products is to connect with fellow dealers, congregate and share best practices because this category is diminishing rapidly.

OPI: How would you summarise Wist Business Supplies?

IW: We’re based in Tempe, Arizona, with another facility in Tucson. While our main market is Arizona, we also serve national accounts such as furniture clients nationwide. We don’t necessarily chase businesses outside the state, but many companies are multi-location so we naturally go beyond Arizona.

This is another benefit of being part of a buying group. Thanks to industry connections, I can serve clients further afield, leveraging relationships with dealers in other regions to meet customer needs anywhere. It could be New York, Chicago or somewhere much smaller – the group is like a family where we all know what the other one needs.

OPI: What is your customer sweet spot?

IW: It revolves around Group Purchasing Organisations where others can piggyback on purchasing contracts. We have a couple that match our geography, including government, education and state municipality. In fact, over 50% of our business is from this area. The other half of our clientele is the private sector, but this is not our niche.

We either expand into new categories and take market share or we don’t exist

Ultimately, we focus on places where there will always be people, like manufacturing sites, for instance. If it’s decentralised, it becomes a tough fit for us. We know our market well; now our challenge is to make our services more convenient than Amazon’s and provide a better proposition than what Staples or Office Depot can offer.

OPI: How have your relationships with manufacturers and wholesalers evolved?

IW: It’s been largely outside our control. We’ve seen some manufacturers disappear, particularly in categories like binders, where we used to have several options. Of course, we still sell them, but technology has surpassed this segment along with many others.

Despite these changes, maintaining close relationships remains essential to be aware of

market trends and then apply the information gleaned to our business model.

OPI: Essendant announced its 3PL initiative a while ago. How has this impacted you?

IW: I haven’t fully utilised it, but I see the value in keeping the wholesalers’ businesses healthy. Clearly, Essendant has the logistical power, so augmenting its business with 3PL hopefully makes it even stronger. At the end of the day, we need strong wholesalers.

Both Essendant and SPR have created virtual warehouses, allowing products to be shipped from countrywide distribution centres. While next-day delivery is less common now, having access to broad inventory across the regions is helpful to fulfil customer orders.

Diversification is also increasingly existential for customer satisfaction. I always tell my team: “There’s no plan B – we either expand into new categories and take market share or we don’t exist.” We’re working hard to get into areas such as breakroom, jan/san and MRO as well as products like snacks and other perishables to help companies incentivise employees back to the office.

OPI: I believe you do very well with water...

IW: We do. What started as a small front-page promotion ten years ago has grown drastically. In 2023, we sold 166 truckloads (40 ft containers) to a small group of clients.

Now available in refillable, recyclable aluminium bottles, water was our third largest

SKU last year. We supply it to various places, from fire departments and heat stations to offices and the homeless, serving a wide range of needs.

OPI: What are the other best-selling SKUs?

IW: We still sell an awful lot of paper, although we haven’t aggressively pursued the low-margin truckload business. We didn’t find a lot of value in it, but it continues to be a big category and is reasonably expensive when you consider the cost of a case of paper.

Furniture, particularly with our partner The HON Company, has become a major category over the past decade.

We’re also expanding into the janitorial space, with strong sales of items such as bin liners, towels and tissues.

OPI: What about tech products and hardware – do they feature heavily?

IW: During COVID, we saw an increase in sales of consumable tech products including cameras, screens and monitor arms, but we’re not venturing into hardware like laptops or routers. We do have some printer sales, but the process is challenging due to the turnaround on promotions from OEMs such as HP.

I often don’t receive information from our wholesale partners in time to share it with my reps and effectively promote these products.

With a better process, dealers could increase printer revenues, but for now, we’re not actively pursuing this category.

OPI: Talking of efficiency and processes, where do you stand on AI and how it can help streamline a business?

IW: While some believe AI will crush smaller businesses, I see it as a leveller that improves efficiency across the board. Although I may not use it to the same extent as multinational companies, it enhances my operations and I’m confident it can benefit everyone in our industry. There’s nothing to fear from embracing this technology.

I consider myself an early adopter of AI technologies and have experimented with these tools to find which work best for me. For example, I’ve used AI to quickly draft job descriptions, saving me a lot of time.

OPI: How is your business differentiating itself from the competition?

IW: Competition has increased, especially with more independent dealers closing or being acquired. Staples, Office Depot and Amazon remain active in my market, with Amazon being particularly concerning due to its market share. We’re focused on navigating these competitors in the office and education sectors while at the same time expanding into jan/san and MRO.

We’re also butting heads with BradyPLUS. However, I’m pursuing the opportunities that arise. When distributors like BradyIFS and Envoy Solutions go through mergers, blending cultures, staff and inventory can cause disruptions, resulting in dissatisfied customers seeking alternatives. This positions Wist well to attract new clients and manufacturers.

By closely engaging with customers to understand their needs, we’re leveraging these types of situations to differentiate ourselves and accelerate growth.

OPI: How would you describe your leadership style?

IW: Finding good people who I can align with as well as trust is crucial. I focus on empowering capable people to take ownership of their areas. I don’t want to chase anyone. Instead, I prefer to give them something to call their own; something that is as important to them as it is to me.

We’ve built a long-standing, tenured team at Wist. When there’s a poor fit, it disrupts the dynamic. My role is to create an environment where our staff feel valued, not only through compensation but through personal and professional fulfilment.

OPI: Has your position as Chairman of former independent dealer group TriMega and your involvement with ISG affected your leadership?

IW: I’ve benefitted not just professionally, but personally. It allowed me to build valuable relationships with industry leaders, including Mike Maggio, Lyle Dabbert, Dave Kenworthy and Yancey Jones Jr.

My interactions with these great entrepreneurs have made me smarter. Their insights have taught me to ask better questions, gain fresh perspectives and refine my business strategies, all in all benefitting my profitability and ability to support staff.

I’m committed to putting the right people in place today, so that Wist can continue to thrive

OPI: You have also been quite involved with City of Hope over the years.

IW: I have. At Wist, we host events to fundraise for this incredible organisation. One of our standout initiatives is a golf tournament held during the Phoenix Open, which draws over 100,000 people each day. This event not only provides a chance for industry engagement, but also raises funds for a cause we’re all passionate about.

Typically, we donate between $50,000 to $70,000 which is a significant contribution for a business of my size.

OPI: On a completely different topic, how big a focus is sustainability for Wist?

IW: We’ve seen the emergence of green committees influencing purchasing decisions, particularly within government sectors. Although their impact can still be limited, it’s a noteworthy shift from the past when there was no voice representing sustainability.

I mentioned our aluminium water bottles that are reusable and keep water cool. Yes, they are more expensive, which creates a push-pull dynamic, but they are 100% recyclable and there are many effective ways to collect them.

OPI: What about the broader business supplies sector – how much traction is the concept gaining in the US?

IW: While the US is not as advanced in all things sustainability as Europe, we are seeing progress, particularly with compostable food service items – these are improving in quality and availability. The movement is certainly gaining momentum, but it’s without a doubt slower than in Europe.

There’s also a generational element within this shift. Change often starts at the grassroots level, driven by individuals eager to find better solutions. For example, my daughter actively looks for sustainable practices to pursue, reflecting a growing awareness among younger generations.

OPI: What are some of the biggest challenges Wist is facing? And how are you preparing to overcome them?

IW: We’re going through a succession shift at Wist, that’s probably the biggest challenge. My brother Robert, who is our President, is nearing retirement. With several long-term employees also retiring, I often think about who will fill which roles and whether we will still be doing things the same way or adapting with new talent and ideas. It’s crucial for our planning and we’ve started to address the succession topic.

Attracting young talent to our industry is essential. As a distributor with a diverse product range, we have expanded beyond traditional office supplies, which requires the recruitment of individuals with wide-ranging skills and an innovative approach. The challenge is to find forward-thinking, customer-centric people who are keen to support local business and their community.

I’m regularly reminded how quickly things change. I watched a movie set in a 1980s office recently and realised how many products I used to sell no longer exist. While it’s nostalgic and perhaps a little sad, it’s a reminder that we need to adapt. I won’t be leading the future, but I’m committed to putting the right people in place today, so that Wist can continue to thrive in the coming decades – just in new ways.

OPI: What is your short- and medium-term outlook for Wist?

IW: We have a solid plan for the next five years, guided by the Wist Advisory Group. While some might say we should be more aggressive with our growth targets, I’m conscious of the ongoing decline in OP and how quickly this could accelerate. Even with people returning to offices, they aren’t using supplies like before because of digitisation and changes in workplace protocols.

It’s tough seeing the decline, but I’m excited about the opportunities, particularly in the jan/san sector. However, I want to be realistic about how quickly we can grow in this category. I wish we were five years further into the transition, but we have a clear path forward, and we’re committed to getting there.

Founder of Wist Business Supplies: Martin Wist

OPI: What is in store for the IDC overall?

IW: The next few years will look quite different. Dealers are no longer a homogenous group. While facing similar challenges, many are exploring diverse business models. And as the industry evolves, they will increasingly need to differentiate their offerings.

Each business will be guided by the categories they find opportunities in. This product mix will vary from region to region, but the core business fundamentals will remain the same. I’m also hopeful we will continue to collaborate and support each other.

The OPI App gives you instant access on your mobile or tablet to the latest news and a myriad of other information from the world of business supplies. Useful every day.

Everything to Hand

Access a comprehensive guide to business supplies news, analysis, podcasts, events, videos and research all in one app

Latest news

Stay updated with all the news from the global business supplies industry, ensuring you never miss important developments.

Discover

Latest Events

events,

and webinars directly from the app to stay ahead. Save Your favourites Bookmark articles and news for quick access later, tailoring the app experience to your specific needs.

It would be an exaggeration to say ‘ out with the old, in with the new’ , but there has certainly been some churn again in the OPI Top 100

Last year, we talked about a return to normality in our annual OPI Top 100 list following a period first marked by COVID and then by post-pandemic upheaval. Not so this time. A total of 20 individuals have disappeared, including several long-standing industry stalwarts:

EO Group’s Simon Drakeford, Independent Suppliers Group’s Mike Gentile, Essendant’s Harry Dochelli and The Weeks Lerman Group’s Sid Lerman, to name but a few.

‘Disappeared’ is perhaps the wrong word, but they’ve certainly relinquished their leadership positions, moving to advisory or consultancy roles instead.

In this issue – and after last year’s break to make way for our inaugural ‘40 under 40’ list – we are once again profiling some of the notable new faces of 2024 and those who continue to affect change and take their organisations to new heights.

In terms of where the action has happened over the past year, wholesale is definitely one channel affected. In the UK, this has manifested itself in the demise of one operator – OT Group’s Andrew Jones consequently dropped off our list – to the benefit of evo. Meanwhile, Westcoast was acquired and now falls under the ALSO Group umbrella – and new Top 100 entry Wolfgang Krainz.

The two ‘broadline’ wholesalers in the US, on the other hand, have new heads with Andrew Wallach and David Boone. The latter, as Interim CEO of Essendant, has moved over from a different part of the Sycamore Partners mothership – Staples Canada. Rachel Huckle took his spot and appears well placed to continue one of the relatively few success stories of the retail – although now increasingly multichannel – world.

Another is Officeworks in Australia, often hailed as an enigma in the embattled superstore environment. However, under the leadership of Sarah Hunter, its strategy increasingly focuses on an omnichannel approach and expanding B2B operations.

In addition to featuring replacements of previous Top 100 candidates – be that due to resignation, retirement or something else – we have a few complete newbies in our list, included for their outstanding companies and leaders. Margaret De Francesco at fast-diversifying Australian distributor Dynamic Supplies springs to mind.

We have a few complete newbies in our list, included for their outstanding companies and leaders

From the US, we shine the spotlight on the IDC, with several new entries that embody acquisitive as well as organic growth along with deep industry involvement: step forward Bob Mairena of Office Solutions, Ian Wist of Wist Business Supplies (see Interview, page 18) and Steve Danziger of AAA Business Supplies & Interiors (see Top 100 Resellers on opi.net) These progressive operators – along with many others in the Top 100 – continuously rise to all the challenges they face and find a way to turn them into opportunities. Another shout-out goes to new entry Richard Leeds of Global Industrial. His company, like others such as RJ Schinner, BradyPLUS, OptiGroup and Conrad Electric, has carved out a niche in our diversifying industry.

Although David Boone has the word ‘interim’ in his job title, the company is not looking for another leader after the former Staples Canada CEO succeeded industry veteran Harry Dochelli at the end of April 2024.

With hindsight, the timing of Boone’s departure from Staples Canada – under the same Sycamore Partners ownership as Essendant – was not a coincidence; it allowed him to hit the ground running, armed with a multiyear strategic plan, when he officially took on the top job at the wholesaler.

Actually, ‘wholesaler’ is probably no longer an accurate moniker for Essendant. A few weeks into Boone’s tenure, the company unveiled a third-party logistics (3PL) solution for brands called Connected Commerce. This is seen as an important growth area for the organisation as it looks to tap into its expertise across e-commerce and fulfilment, while leveraging its channel reach and national distribution network in the US.

The Connected Commerce technology has been developed at Essendant’s digital centre near Pasadena in California, a facility that has gone somewhat under the radar over the years. From here, Essendant has also been upping its game on the various direct e-commerce sites it runs, including online

power tools and DIY reseller CPO which was acquired in 2014.

That is not to say Essendant is abandoning its core wholesaling roots – far from it. However, Boone has already implemented some major changes in this area of the business to better align with category and customer purchasing trends.

These have included reorganising the unit into four reseller-centric areas of focus – jan/ san & foodservice, office products & furniture, technology and e-tail/retail.

At the same time, Essendant has established a Center of Excellence to help drive performance across all areas of the company. This is headed by former US Foods exec Dave Rickard, who has taken on the role of Chief Transformation Officer.

‘Transformation’ is certainly a key term in the early days of Boone’s tenure as efforts accelerate to diversify away from the ‘office products wholesaler’ tag.

A new Top 100 entry from down under is Margaret De Francesco. She currently serves as General Manager of Dynamic Supplies Australia, a diversified distributor for resellers in Australia and New Zealand. Appointed to the role in 2019, she leads the sales, marketing and operations functions of the operator.

The primary challenge impacting Dynamic – and its reseller partners – is the declining demand for printed materials. Digital transformation, driven by the shift to electronic communication, online documents and cloud storage, has led to reduced reliance on traditional print products and volumes.

As an organisation that was solely reliant on the distribution of the print category, Dynamic understood the necessity to future-proof the business which required significant category diversification. This is what De Francesco and her team have been doing for the past four years.

The results manifest themselves in its current range. Four years

ago, the portfolio consisted of 12 print brands. Today, it extends to 40 technology brands encompassing computing, networking, audiovisual, digital display, consumer electronics and lifestyle products as well as 34 adjacent office products, stationery and facilities brands.

Key market opportunities currently centre on the replacement cycling of devices. “We experienced a huge surge in demand in the pandemic years and many of those devices are now ripe for renewal,” De Francesco explains. “Furthermore, the march of AI and the advent of AI PCs and associated peripherals will provide significant upside potential,” she adds.

Demonstrating its ongoing commitment to the industry, Dynamic has recently opened its newly built 48,000 sq m (480,000 sq ft) distribution facility in Wacol, Queensland. This state-of-the-art facility underpins the Dynamic Warehousing and Logistics 3PL business which will provide additional opportunities for 3PL distribution and overflow inventory support for vendor partners.

Change appears to be the only constant at German dealer group Büroring. Following the management and membership upheavals of the past few years, the beginning of 2024 saw Frank Eismann named as co-Managing Director alongside Kai-Uwe Heuer, who has been in the role since 2022.

Eismann is a familiar face in the German business product market and has been the driving force behind technology-oriented dealer group WinWin Office Network – which recently announced a strategic partnership with Büroring – for many years.

At its annual meeting held in Koblenz in June, the cooperative announced a major change to its corporate structure. Büroring members voted in favour of a proposal for the organisation to become a public limited company. This corporate form (Aktiengesellschaft in German, usually shortened to AG) is the equivalent of a PLC in the UK.

Eismann, who is in charge of sales and marketing at Büroring while Heuer oversees the finance, IT and logistics functions, also gave a “fiery speech” at the event as he outlined his strategic vision for the group. As well as converting Büroring into an AG –which should be finalised by the end of this

Andrew Gale has been CEO of UK and Ireland multichannel group evo since the end of 2022, but joined the company (then known as Vasanta) as Financial Controller back in 2008. Today, the business – which has annual sales of more than £500 million ($670 million) – comprises the VOW, Banner, Complete, Premier Vanguard and Staples trading divisions.

Organisational, personnel and cultural changes implemented at the beginning of his tenure are now bearing fruit. In 2023, the business delivered the EBITDA target set by its shareholder Endless, and the CEO is looking to improve on that this year.

Therefore, Gale can look back on the past 12 months with a sense of satisfaction, but he is certainly not resting on his laurels. Areas he is targeting for growth include the Complete dealer business acquired out of administration at the beginning of 2023. Understandably, this incurred integration and restructuring costs in its

year – plans include: economic incentives for member companies, closer cooperation with WinWin Office Network, digitalisation of internal and external processes, and the expansion of the brShop24 e-commerce platform.

Eismann’s plans form part of what is being described as the “new” Büroring as the organisation looks to shake off several years of turmoil and instability.

early days under evo ownership, but is on a stronger footing now.

Another opportunity is the Staples B2C division, which grew from a standing start to a top line of £10 million by the end of 2023. A multiyear rights agreement for the name has been agreed with Staples in the US, enabling evo to put more weight behind the brand.

There has always been much speculation about whether Endless would cut its losses and seek an exit. This was put to bed 12 months ago when the private equity firm recommitted to the business by increasing its revolving credit facility, waiving accrued interest on its legacy instruments and resetting the life of the fund that holds the investment in evo. Gale viewed this as a “major statement of support” from Endless, in terms of both money and time.

M&A is most definitely part of Gale’s plans. In August, evo snapped up the rights to former Spicers’ 5 Star brand after rival OT Group ran into financial troubles. It would not be surprising to see further acquisitions as evo looks to scale in categories outside of traditional office supplies.

In a rapidly evolving retail landscape, Rachel Huckle oversees Staples Canada as its new CEO. Appointed in March of this year and succeeding David Boone who moved over to Essendant as Interim CEO (page 26), new Top 100 entry Huckle is tasked with guiding Staples Canada through the next phase of its journey which is focused on growth, operational efficiency and the integration of digital-first strategies.

She is an accomplished retail executive with more than 20 years of leadership experience across multiple large-scale retail businesses, including pharmacy chain Shoppers Drug Mart and supermarket conglomerate Loblaws.

At Staples Canada, Huckle has already proved her mettle by aiding its transformation into 'The Working and Learning Company'. Prior to her current role, she served as the organisation's Chief Retail Officer from 2019 and was promoted to President/COO in 2022.

In the latter position, she led Staples Canada's strategy of delivering a world-class and seamless omnichannel experience and launching several key initiatives that streamlined supply chain processes, improved customer experience and boosted profitability.

Huckle has consistently demonstrated an ability to adapt to the changing needs of both customers and the broader market, with a reputation for driving sustainable growth and operational excellence.

Her hands-on experience in both bricks-and-mortar and e-commerce operations makes her qualified to bridge the gap between traditional retail models and digital transformation.

A key focus for the Staples Canada team at now is the integration of digital-first strategies while maintaining a best-in-class in-store experience.

“We meet our customers where they are with the products and services they need most – whether that’s in-store, online, through our professional salesforce, or social media channels. Our goal is to make Staples Canada the most agile and responsive B2B and B2C retailer in the market,” says Huckle.

SARAH HUNTER, MANAGING DIRECTOR, OFFICEWORKS

It's been an eventful year for Officeworks, not least because it's the 30th anniversary year of the Australian retailer. Under the leadership of Managing Director Sarah Hunter, the company continues to deliver sustainable long-term growth by capitalising on shifting customer preferences.

Technological advances and digitisation are changing how Australians work, learn, create and connect. With this in mind, Officeworks is leveraging its omnichannel approach, breadth of range and data-driven personalisation to enable a differentiated and constantly evolving experience.

Its strategy is centered around diversification across product categories – private label and branded – customers and channels, accelerating B2B growth, and modifying and simplifying the business. With economic challenges facing Australian individuals and businesses, Officeworks remains focused on its everyday low-price strategy, wide range and delivering the best customer experience.

Hunter has been at the helm of the retailer since 2019. Prior to that, she had worked across several areas of the Coles Group in positions that included Financial Controller, General Manager Workplace Strategy and Demerger Program Director.

Officeworks continues to be a formidable operator in the Australian business landscape. Despite it's ever-growing online presence, it also successfully defends its enviable bricks-and-mortar presence with more than 170 stores across the country.

But it's perhaps the B2B space where the greatest potential lies. During the annual briefing day of parent company Wesfarmers last May, Hunter referred to its ambitious intentions in this area, particularly with corporate and large education customers in mind.

Bob Mairena is a new entry to the Top 100 and an excellent example of the resilience and ongoing success of progressive independent dealers in the US.

In 1984, Bob and Cindy Mairena founded a computer supply company called Data Extras. It later evolved into Office Solutions and is currently the largest remaining independent in Los Angeles, California, and the biggest on the West Coast. Today, Bob Mairena continues to lead Office Solutions as CEO while also managing three other brands under the overall company umbrella: jan/san division Gale Supply; furniture unit bluespace interiors; and Keeney's, an office supplies and interiors company based in Seattle, Washington.

This is an operator which has strategically pivoted to focus on high-opportunity sectors such as education and healthcare, leveraging technology and operational excellence as its competitive edge. Each brand under the Office Solutions parentage offers customers a comprehensive solution, backed by the specific expertise it brings to the table.

Mairena has assembled a seasoned management team and is preparing his daughter Nicole, currently Sales Associate at bluespace interiors, to succeed him when he decides to step down.

While the dealer has been very active in acquiring companies in the past – starting with Office Express in 1997 – the current focus is very much on organic growth. This involves – and necessitates – enhancing marketing efforts, expanding and revitalising the sales team, and concentrating on a number of areas that benefit from a more consultative selling approach.

When former Amazon Global VP Alexandre Gagnon took a leave of absence in April 2024, company veteran Shelley Salomon was initially appointed to the role on an interim basis. This has now been made permanent, with Gagnon expected to move to another division when he eventually returns.

Salomon’s background is in finance, and she joined Amazon from Intel in 2003 as a Senior Finance Manager. Like many other successful Amazonians, she then switched functions on a regular basis over the years, developing solid experience in the e-tailer’s consumer-focused e-commerce stores.

According to Salomon, the switch from consumer to B2B has not been as big a jump as she expected. One area she prefers, she says, is being able to speak face to face

with customers – she has targeted meeting 150 of them in her first year in the job.

Amazon Business has been a wildly successful initiative since it launched in 2015. Now operating in ten countries, its annualised sales at the end of 2023 were a staggering $35 billion. That represented a $10 billion jump in the top line in just two years, with Europe growing – and continuing to grow, according to Salomon – at a compound annual growth rate of 25%.

The B2B division continues to roll out new features to its customer base, which ranges from sole traders to multinational corporations. Initiatives launched in mid-2024 included an App Center for small businesses, curated catalogues, quotes for bulk purchasing and improved budget management tools.

More recently, at its Reshape conference in Dallas, Texas, at the end of September, Amazon Business unveiled integrations with procurement platforms SAP Ariba, Coupa and Oracle NetSuite as well as several eye-catching new features. These included account switching, which enables customers to use the same credentials for their personal and business accounts; and AB Restock, a managed inventory and vending solution.

Italian dealer group In Ufficio is another Top 100 company to have undergone a leadership change in the past few months. For more than 27 years, the business was virtually synonymous with Adriana Alessio, its former Managing Director who stepped down earlier this year and officially retired on 30 September. As well as running In Ufficio, Alessio was a key figure in the wider Italian and European business supplies industry. He was Chair of now-defunct trade association AIFU and a strong proponent of the BPGI purchasing group after bringing the organisation to Italy in the late 1990s.

Taking over the reins at In Ufficio is Luigi Vallero, who officially became Managing Director on 1 June after joining the group at the start of 2024. The arrival of Vallero coincided with the acquisition by In Ufficio of assets of CIAC, a consortium of 15 school-oriented stationery retailers operating under the Cartoshop banner which had run into financial difficulties.

Vallero spent more than 16 years at CIAC as General Coordinator and was instrumental in 14 of its 15 members making the move over to In Ufficio. The enlarged group now comprises 35 members employing a total of 250 sales representatives. Together, these resellers have end-user sales of approximately €220 million ($245 million), making it comfortably the largest dealer group in Italy.

To mark the new phase in its history, dubbed ‘In Ufficio 3.0’, its head office in Milan was recently revamped to provide a more productive working environment. Initial projects have focused on developing a coordinated sales strategy, managing the integration of product ranges, defining the 2024 back-to-school campaign and preparing the 2025 catalogue.

There are also plans to develop a single e-commerce portal, while Vallero has been running focus groups to tap into members’ various areas of expertise for the benefit of the wider group.

US wholesale distributor S.P. Richards (SPR) was acquired by Central National Gottesman (CNG) in early 2023, two and a half years after it had been taken over by a consortium led by independent dealer channel icons Yancey Jones Sr and Mike Maggio.

Founded in 1886, family-owned CNG has primarily been involved in the forestry sector, but entered the distribution business in 1984 when it acquired US firm Lindenmeyr Paper. Since then, it has made regular acquisitions in both the US and Canada.

The group is something of a hidden giant and generally likes to keep its cards close to its chest. CNG has annual revenues of more than $8 billion, approximately 4,000 employees and a presence in almost 30 countries.

Following the SPR acquisition, company veteran and Lindenmeyr Munroe

President Bill Meany was drafted in to head SPR. His initial focus was on stabilising supplier relationships, investing in inventory

and developing adjacent categories. Being President of both SPR and Lindenmeyr Munroe resulted in a brutal schedule for Meany. Therefore, in April 2024, CNG CEO Andrew Wallach – who represents the fifth generation of the founding family – took on the top job at SPR, with Meany assuming an advisory role.

Although based at CNG’s group headquarters in Purchase, New York, Wallach is very much taking a hands-on approach to running SPR and is spending a lot of time at the distributor’s head office near Atlanta, Georgia.

Essentially, he has been continuing the strategies put in place under Meany’s tenure. However, he did strengthen the leadership team by drafting in Jason Horst as Chief Commercial Officer. Horst has been with CNG for ten years and brings a strong track record of selling into the retail and e-commerce markets. This will be of benefit to SPR as it looks to grow in new customer channels.

Other projects include creating synergies between the CNG and SPR distribution networks and developing further strategic partnerships with vendors. A recent supplier-focused initiative has been the establishment of the SPR Studio. This is a YouTube channel where manufacturers provide product and category insights and give advice to dealers on how they can grow their revenue.

ANDREAS WEISHAAR, INTERIM CEO, TAKKT

Another new entry in this year’s Top 100 is Andreas Weishaar, who took the helm at European and North American reseller Takkt on 1 August, albeit on an interim basis. He succeeded Maria Zesch after she stepped down following three years in the role.

Weishaar is an experienced executive, having begun his career in 1999 at global management consultancy Arthur D Little. Prior to joining Takkt, he worked at agricultural machinery group CNH, including a two-year spell as Chief Separation Officer as the company offloaded its Iveco commercial vehicles business.

Zesch was credited with successfully transforming the company in areas such as structural organisation, digital capabilities, sustainability and culture. However, her efforts did not translate into an improvement in the financial performance of the publicly listed firm.

Indeed, in the first half of this year, all three of Takkt’s divisions reported double-digit declines, pre-tax profit slumped to just above break-even and net financial debt rose by around 50% to €154 million ($172 million). The results have spooked investors and the firm’s share price sank by around 30% in the first nine months of 2024.

Weishaar was drafted in by Takkt’s board to steady the ship in challenging market conditions which have been exacerbated by several internal issues. The latter have included IT migration problems, a lack of sales resources at the FoodService division and the negative impact of a rebranding project at the Industrial & Packaging unit.

His immediate priorities are to get a grip on the internal problems, improve order intake, and optimise processes and systems.

It was all change at the head of UK reseller and technology organisation EO Group earlier this year. In May, after 17 years with the company, Simon Drakeford announced he was stepping down to pursue other business interests. He has not cut ties entirely, however – he remains an important shareholder and will still act as a Senior Advisor to the management team.

Stepping into the hot seat as co-CEOs are two executives who have each been with the group for more than ten years: Nick Wilson and Richard Sinclair. It was a move that had been planned for some time, but was delayed due to factors such as COVID, post-pandemic supply chain issues and the hyperinflationary economic environment.

While the dual CEO arrangement may seem unusual, the reasoning behind it is sound. In addition to the ‘two heads are better than one’ factor, the two execs’ skill sets and experience complement each other nicely. Wilson’s core strengths are in finance, purchasing and supplier management, while Sinclair has a strong technology, sales and marketing background.

They are supported by a high-class team that includes Mark Heath and Danny Berendsen, who head up the Office Power and Euroffice operations respectively.

While EO Group began life as e-commerce reseller Euroffice, Wilson and Sinclair are committed to continuing the transformation into a technology-led organisation. The near-term focus will be on ramping up Office Power. At the same time, Sinclair will be looking closely at business cases for the Control Commerce subsidiary, which is a longer-term project.

That is not to say the direct business isn’t a priority. A key initiative here is expanding Euroffice's product ranges.

NEW Margaret De Francesco General Manager, Dynamic Supplies

Trevor Girnun Managing Director, Waltons

Sarah Hunter Managing Director, Officeworks

NEW John Journee Interim CEO, The Warehouse Group

Adam Joy CEO, Office Brands

Peter Kelly CEO, Winc

Amie & Belinda Lyone Co-CEOs, COS

Craig Noyle & Gary McCluskey Directors, Inovocom

Brad O'Brien CEO, Office Choice

Anne-Marie Sutton CEO, NXP

Paul Yardley Managing Director, GNS Wholesale Stationers

Andrew Beaumont Managing Director, Exertis Supplies

Tim Beaumont Managing Director, Nemo Office Club

Carlos & Rafael Benavides Managing Directors, Comercial del Sur

Laurent Bertrand CEO, Lacoste Dactyl Bureau & École

Anna Bordes Managing Director, ADVEO France

Kenneth Borup CEO, Lomax

Udo Böttcher Managing Director, Böttcher

Robert Brech Managing Director, Kaut-Bullinger

Ralf Bühler CEO, Conrad Electronic

Rui Carvalho CEO, Firmo

Jeanette Caswell Managing Director, Office Friendly

NEW Frank Deshayes Managing Director, Alkor Groupe

Frank Egholm CEO, Office Depot Nordics

NEW Frank Eismann & Kai-Uwe Heuer

Managing Directors, Büroring

Dr Benedikt Erdmann Chairman, Soennecken

Dan Fati CEO, Dacris

László Fehér Managing Director, Corwell

Andrew Gale CEO, evo

Costas Gerardos CEO, Plaisio

Xavier Guichard CEO, Manutan

Per Hansson CEO, AllOffice

Arthur & Simone Hindmarch Managing Directors, Commercial Group

NEW Henrik Hjalmarsson CEO, OptiGroup

Danièle Kapel-Marcovici CEO, RAJA Group

NEW Wolfgang Krainz CEO, ALSO Group

Anders Larsson Managing Director, RKV

Greg Liénard CEO, Lyreco

Pete Malpas President EMEA, RS Group

Aidan McDonough Managing Director, Integra Business Solutions

Patrick Murphy CEO, Codex

Vaida Pacauskienė Managing Director, Officeday

Theo Paphitis CEO, Ryman

Bruno Peyroles CEO, Bureau Vallée

Johann Pintarich CEO, Office World Group

Hervé Poncin CEO, Antalis

Nicolas Potier Managing Director, Bruneau

Elina Rahkonen CEO, Wulff Group

Ferdinando Rese President, Errebian

Andreas Reuter CEO, Schäfer Shop

Richard Scharmann CEO, PBS Holding

Hans Schmid President, Printus

Ingo Schmidt Managing Director, Plate

Jean-Yves Sebaoun Managing Director, Fiducial Office Solutions

Miroslaw Szydlowski Managing Director, PBS Polska

Arnold Theuws Managing Director, Quantore

NEW Luigi Vallero Managing Director, In Ufficio

Jan Van Belleghem Managing Director, Interaction

Frank van Zanten CEO, Bunzl

Thomas Veit Managing Director, soft-carrier

Francesco Villa General Manager, Buffetti Group

Michael Voll CEO, Despec Nordics

NEW Andreas Weishaar Interim CEO, Takkt

Andreas Wielgoss Senior Director eBay Motors, Business & Industrial, eBay Germany

Dr Sebastian Wieser CEO, Unite

NEW Nick Wilson & Richard Sinclair Co-CEOs, EO Group

NEW Albert Zwart Managing Director, Staples Benelux

Jaime Alverde Losada CEO, Office Depot de Mexico

NEW David Boone Interim CEO, Essendant

Angie Bukta President, Canadian Workplace Solutions

David Centrella President, ODP Business Solutions

NEW Steve Danziger CEO, AAA Business Supplies & Interiors

Sean Fleming CEO, Distribution Management

David Guernsey CEO, Guernsey

Matthew Hebert CEO, Office Partners

NEW Rachel Huckle CEO, Staples Canada

Kevin Johnson CEO, Warehouse Direct

Yancey Jones Jr COO, The Supply Room

John Kenworthy CEO, Storey Kenworthy

Mark Leazer Executive Director, AOPD

John Lederer CEO, Staples Inc

NEW Richard Leeds Interim CEO, Global Industrial

DG Macpherson CEO, Grainger

NEW Bob Mairena CEO, Office Solutions

Denis Mathieu CEO, Novexco

Leo Meehan CEO, WB Mason

Mark Miller President, Eakes Office Solutions

Mike Motz CEO, Staples US Retail

NEW Robert Paar & Harris Meth COO & CFO, The Weeks Lerman Group

NEW James Rodgers CEO, Independent Suppliers Group

NEW Shelley Salomon Global VP, Amazon Business

Steve Schultz President, RJ Schinner

Brooks Smith CEO, Innovative Office Solutions

Gerry Smith CEO, The ODP Corporation

Ken Sweder CEO, BradyPLUS

Jason & Robert Tillis CEO & Chairman, Imperial Dade

Alan Tomblin CEO, Network Services

NEW Andrew Wallach President, S.P. Richards

Michael Wilson CEO, AFFLINK

NEW Ian Wist General Manager, Wist Business Supplies

Despite a series of challenges, the mailroom and packaging sector continues to offer opportunities for long-term growth with the right innovative strategies – by Kate Davies

Mailrooms and the packaging sector as a whole have been evolving rapidly as businesses look to streamline operations, minimise costs and develop sustainable practices. The shift has been driven by technological progress and, notably, the growth of e-commerce, according to category leaders.