54 minute read

News

from OPI APP March/April 2021 A

by OPI

Analysis: More reseller consolidation in Europe

It has been a busy first couple of months of 2021 on the ‘old continent’ in terms of reseller M&A activity

At the end of January, two leading players in the Swiss office products market – Office World Holding (OWH) and OFFIX Holding – announced the establishment of a joint venture to be known as Office World Group (OWG). OWH is the majority shareholder in the new entity, which has almost 600 employees and sales of around CHF400 million ($440 million).

OWH, based in Bolligen, near Bern, operates 19 locations in Switzerland, generated revenues of around CHF170 million in 2019 and employs a total of 359 staff. It includes the Office World retail chain, B2B reseller iba and managed print business Tramondi.

STRONGER TOGETHER

OWH is part of the Austrian MTH Retail Group, which achieved consolidated group sales of around €730 million ($870 million) in 2019. MTH acquired Office World/iba from Swiss group Migros in 2017.

OFFIX, meanwhile, has been an umbrella organisation of Aarburg-based cooperative PEG since 2015 following its phased acquisition of technology distributor Ecomedia. The company is one of the leading stationery and office products players in Switzerland, with sales of around CHF240 million and 235 employees. It includes the Papedis and Ecomedia wholesaling businesses, retail services firm Oridis, B2B reseller Office Leader and managed print company DocuServ.

The rationale behind the transaction lies in the challenges facing the business supplies sector, including the effects of digitisation on filing and archiving product needs, the hybrid workplace trend and the rapid shift towards online sales channels.

There is certainly an opportunity for independent dealers in the new entity to increase their online presence. Another “crucial factor” is the scale the combination will bring in terms of purchasing terms. While each business will still be run separately, overall responsibility for OWG lies with MTH Retail CEO Matthias Baumann, himself a former CEO of Office World (see page 12).

DISRUPTION CONTINUES

Elsewhere, the dismantling of the European Office Depot and Staples networks continues. In early February, Office Depot France (OD France) filed for voluntary administration after its owner – private equity firm Aurelius – chose not to provide funds (estimated at around €10 million) or provide guarantees that would have helped the reseller obtain a €30 million government loan.

Faced with an impending cash crisis, OD France CEO Guillaume de Feydeau and his advisors chose to file for administration. This created the breathing room to be able to come up with a viable, long-term solution for the company.

Aurelius confirmed this would happen via a sale of assets and interested parties had until 19 March (shortly after this issue of OPI went to press) to submit bids.

OD France operates a multichannel model, with 60 stores plus contract and direct units, and employs some 1,750 people. Its sales in 2020 were around €280 million, down by about 20% versus 2019, with the contract arm, in particular, hit by COVID-related lockdowns.

The question now is whether anyone will come in for the company as a whole, or if it will be acquired in parts. That should be known fairly rapidly, with the court-appointed administrators expected to announce their preferred option(s) in the weeks following the 19 March deadline.

Over at Office Depot’s European rival Staples Solutions, its Global Accounts Team (GAT) was sold to multichannel operator PBS Holding, effective 19 February.

GAT comprises around 24 staff members under the leadership of Ian Kirton and was based at the company’s shared services centre in Gdansk, Poland. The entire group has now transferred to PBS, along with several key local account managers.

Staples Solutions said the transaction formed part of its localisation strategy, with GAT actually being the last centralised business at the company. As regards PBS, it now has 85 contracts with large enterprise customers and a foothold in a European contract channel where it sees plenty of market opportunities.

M&A activity in Europe is unlikely to stop there, with expectations of further transactions in countries such as the UK and Italy, for example.

Analysis: ODP hones strategy despite Staples shadow

ODP is ploughing ahead with its strategic transformation, but will it be able to fend off the advances of Sycamore Partners-owned Staples?

In the January/February 2021 issue of OPI (page 6), we expected further developments in Staples’ latest attempt to acquire Office Depot – now known as The ODP Corporation (ODP) – and so it has proved. At the end of February, it was confirmed that the US Federal Trade Commission (FTC) was investigating the proposed transaction and had sent ODP a Civil Investigatory Demand (CID).

Explaining the situation during the company’s 24 February earnings conference call, ODP’s Chief Legal and Administrative Officer David Bleisch stated: “The CID makes clear the FTC is not only reviewing the proposal’s potential impact on competition with respect to the B2B businesses, regardless of any proposed divestiture, but is also conducting a thorough and broad review extending into every aspect of our businesses across every distribution channel.”

That, and the information that Staples did “not want to engage in substantive discussions until the regulatory process is completed”, suggested a prolonged pause in proceedings. After all, an FTC investigation of this nature can take up to six months. However, there was optimism that a deal for a retail/e-commerce tie-up would be agreed.

In a client note, UBS analyst Michael Lasser said ODP’s share price of around $41 (on 25 February) “likely reflects the possibility that a deal can be worked out”. He also pointed to the importance of ODP’s willingness to engage with Staples, including its suggestion of forming a joint venture.

NEW DEVELOPMENTS

The tale took another twist on 10 March when, instead of grasping ODP’s olive branch, Staples sent a revised proposal to the ODP board in the form of a letter of intent (LOI).

In this document, it laid out plans to acquire the following ODP assets: the retail stores and consumer-facing e-commerce businesses; Canadian subsidiary Grand & Toy; the network of acquired ‘Federation’ dealers; all US company-owned distribution centres; and ODP’s global headquarters in Boca Raton, Florida. In other words, the whole of ODP minus its B2B contract division and IT services unit CompuCom (the latter of which ODP is trying to sell anyway).

Unlike its earlier $40 a share proposal, Staples did not specify a purchase price for the assets it wants to acquire. It said this would be negotiated once the FTC and the Canadian Competition Bureau (CCB) had made their positions clear.

The LOI also contained provisions for the leaseback of the ODP head office and its distribution centres, and for ODP to opt out of selling the Boca Raton premises and the Federation business if the parties could not agree on a mutually acceptable price for these assets.

According to Staples, this “simplified proposed transaction” would reduce antitrust risk, remove uncertainty surrounding Staples’ intended tender offer to acquire all ODP’s common shares and provide clarity on the future of ODP’s B2B contract unit.

At least two of those reasons are questionable. Firstly, while not including ODP’s contract operations in the LOI might make things easier with the FTC, the inclusion of Grand & Toy in Canada is bound to face close scrutiny from the CCB.

Indeed, in its 15 March response to Staples, ODP noted: “Grand & Toy customers and suppliers have raised serious concerns with the proposed transaction and no significant change to the competitive landscape appears to have occurred since the prior review of the proposed transaction in 2016 which would meaningfully mitigate those concerns.”

Secondly, the future of ODP’s contract unit would be far from certain. If the proposed transaction was consummated according to the LOI, ODP would just be left with B2B contracts and (it appears) its recent BuyerQuest acquisition (see right, ‘ODP pursues marketplace strategy’). It would even be renting its distribution network from its nearest direct competitor. It’s hard to see this as a long-term, viable business model for ODP.

REJECTION

It was therefore not a surprise the ODP board unanimously rejected Staples’ 10 March proposal. Instead, it urged its rival to engage in talks about a merger of the retail operations and direct web businesses as per its January response.

However, Staples shows every sign that it wants any potential discussions to focus on all parts of the LOI and not just retail and consumer-facing e-commerce.

If the reseller is trying to disrupt ODP’s ‘Maximize B2B’ strategy, it seems to be doing a good job so far. ODP’s plan is built on its North American supply chain and it’s difficult to imagine it moving ahead on a network that was owned by Staples.

The situation is certainly an unwanted distraction for ODP CEO Gerry Smith and his team as they try to build out a digital B2B platform. In addition, the prospect of a drawn-out regulatory process could increase the possibility of ODP losing key talent, something that has happened in the past.

As this issue went to press, there was no sign of any flexibility from Staples, and it was still due to launch its tender offer for the whole of ODP. Undoubtedly, there will be another instalment of this unfolding saga in the next issue of OPI! Against the backdrop of the overtures from Staples Inc, ODP has made some key moves that confirm its strategic direction towards becoming a stronger player in the $8 trillion US B2B commerce market.

In mid-February, it announced the hire of Prentis Wilson – the man who launched Amazon Business in 2015 and turned it into a $10 billion business in just three years. Wilson has been recruited as President, New Technology Prentis Wilson, an Business, with a goal eye-catching hire for ODP to “further drive the company’s digital transformation, leading a new technology business focused on transforming B2B sourcing, purchasing, and supply chain for suppliers and buyers”.

Wilson joins another former Amazonian, Terry Leeper, at ODP. The former Head of Product and Technology at Amazon Business was named ODP’s Chief Technology Officer last July. Both appointments show the reseller’s ability to attract star performers and, arguably, validate its technology aspirations.

Shortly after the announcement of Wilson’s appointment, ODP confirmed it had acquired highly respected P2P (procure-to-pay) software company BuyerQuest – with regulatory documents later showing a purchase price of around $62 million. BuyerQuest is a provider of cloud-based P2P software, private marketplaces and B2B marketplace hubs.

ODP also announced a strategic partnership with Microsoft, essentially involving two projects. Firstly, ODP is to migrate its legacy IT systems onto Microsoft’s Azure cloud platform; secondly, BuyerQuest will be the P2P element of businesses that use the Microsoft Dynamics 365 Business Central ERP system – this will be a boost to ODP’s new digital procurement platform.

“Our digital transformation focuses on providing our customers a complete B2B commerce platform designed to meet the needs of both buyers and suppliers,” said ODP CEO Gerry Smith during the company’s Q4 2020 earnings call in February. Details are still sketchy, but the strategy is set to revolve around P2P, e-commerce and supply chain capabilities. Smith called the marketplace “a curated platform defined by contractual agreements […] connecting B2B buyers and sellers”.

ODP has said it will reveal more at its 2021 Investor Day. That event was due to take place in March, but was postponed due to the ongoing Staples situation. It is now unlikely to happen until talks with Staples have been concluded, especially given the uncertainty over ODP’s supply chain assets – a cornerstone of its marketplace strategy.

ISG confirms Industry Week ’21

Independent Suppliers Group (ISG) has announced the dates and location of its highly anticipated Industry Week ’21 later this year. The event will take place from 7-12 November 2021 at the Orlando World Center Marriott in Orlando, Florida.

The dealer organisation is promising the largest business products industry event of the year by bringing together its members, suppliers and partners for a week-long agenda.

Industry Week ’21 will include, among other things, a general session, educational seminars, member-to-member peer networking, a NEXT young leaders peer exchange, one-on-one member/supplier meetings, as well as an exhibitor tradeshow.

“I believe this groundbreaking event will allow ISG members and vendors to collaborate at an even higher level,” said ISG Chairman Jordan Kudler. “Members are anxious to spend some quality time together and engage in some good old-fashioned networking. While video conferencing served as an adequate bridge for communicating, there is nothing like some live face-to-face time.”

Given the cancellation of Industry Week 2020 and a rescheduled gathering in March 2021, ISG developed a series of virtual events to connect with its members but, as Kudler said, it will be a welcome breath of fresh air for many to be able to meet in person once again. OPI is pleased to announce that Partnership, the strategic meeting event for vendors and resellers/distributors, will now take place from 19-21 September 2021. While the OPI team was still comfortable with the previously scheduled dates at the end of June, it believes the extra three months will make Partnership even more secure.

It is hoped that the COVID-19 vaccine rollout across Europe will soon start to accelerate, making it more likely that some semblance of normality will return over the next few months. “I am pleased to report that we are almost fully booked and have a very exciting list of vendors and resellers lined up,” said OPI Commercial Director Chris Exner.

“Delegates will spend valuable time with the 50 most prominent companies in Europe, have at least 12 formal one-hour meetings and network with over100 influential executives over two days. It is a perfect opportunity to build and deepen strategic relationships with key European players and grow your business profitably.”

The venue for Partnership has not changed, meaning it will take place once again at the Hotel Okura in Amsterdam, Netherlands (for more information, please contact the OPI team on events@opi.net).

US dealer joins Office Depot fold

Well-known US independent office products dealer Twist Office Partners has been acquired by The ODP Corporation as part of its Federation strategy.

Unlike previous Office Depot Federation acquisitions, Twist is no longer running under its own name. Instead, its customers – since 1 February – are being serviced through the operations of three other Federation dealers: Garvey’s in Illinois and Indiana, Business Essentials in Minnesota, and Complete Office in Wisconsin. Office Depot has now acquired almost 20 dealers as part of its Federation programme.

Amazon Business hits $25 billion

For the first time in two and a half years, Amazon Business has officially updated its global revenue number. In September 2018, Amazon Business was tracking at more than $10 billion in annualised sales. In March 2021, the e-commerce giant revealed that this figure has more than doubled to $25 billion.

It was also confirmed there are currently more than five million registered Amazon Business accounts worldwide and that the platform offers “hundreds of millions” of products. Just over 50% of revenue comes from third-party sellers.

Amazon Business – which now operates in nine markets – also provided details on the customers it serves in various countries:

UK: More than 50% of FTSE 100 companies, all of the 15 largest universities, 13 of the 15 biggest cities and six of the largest 15 hospitals across the country.

US: 45 states, 90 of the 100 largest cities and counties, more than 75,000 non-profit organisations and 92 of the country’s 100 largest hospital systems. More than 80 of the Fortune 100 companies, including Citigroup, Intel, Cisco and ExxonMobil.

Germany: 25 of the DAX 30, 54 of the MDAX 60 and 39 of the SDAX 70 listed companies, plus 74 of the top 100 German SMBs. In the public sector, 96 of the 100 largest German cities, 13 of its 15 biggest universities and 10 of the 15 largest hospitals.

France: 90% of CAC 40-listed companies, more than 3,000 schools and universities, and 300 medical institutions (including 130 hospitals, 70 clinics and 80 state-run retirement homes).

Italy: 53 of the 100 companies listed on Italy’s FTSE MIB exchange and 20 of the country’s leading universities.

Spain: 54% of companies on the IBEX 35 index and around 1,650 Spanish schools and universities.

GP MAKES AFH APPOINTMENTS

Georgia-Pacific (GP) has promoted Kim Price (pictured) to the role of VP of Market Sales for its Consumer Products group. In her new position, she will oversee the away-from-home (AFH) sales teams for the GP PRO B2B division. Price has been with GP for 15 years.

In addition, GP said Erin Beckman has been promoted to VP of AFH National Sales.

LYRECO NAMES CLIENT RELATIONS DIRECTOR

David Lameirinhas has made the switch from Lyreco Group management to lead its client relations department in the company’s largest subsidiary, France. He joined the reseller in September 2019 as Global Customer Care Director, and will now devise a strategic roadmap to ensure an optimal customer experience across the various touchpoints at the 200-strong call centre in France.

EXECUTIVE CHANGE AT ANTALIS UK

Antalis UK has named Simon Fisher (pictured) as new Commercial Director for its print, publishing, office and visual communications units following the retirement of Bruce Munro.

Munro is retiring from the distributor after 29 years, although he will be staying on until October to support the transition. Fisher himself is a company veteran, having been with the firm – and paper merchant James McNaughton, which Antalis acquired in 2010 – for 18 years, most recently serving as National Sales Director.

MARCO CEO TO RETIRE

Jeff Gau (pictured), CEO of leading print and IT services dealer Marco, is stepping down from his current role and will become Chairman as of 1 April. Marco President Doug Albregts – a respected print industry executive and former CEO of Sharp USA – will step up to the role of CEO. He joined the company as President in 2019.

COLOP MAKES LEADERSHIP ANNOUNCEMENT

The son of COLOP’s founder Karl Skopek has been appointed as a Managing Director at the Austria-based vendor. Christoph Skopek (pictured) will jointly carry out the overall management duties of the company with longstanding CEO Ernst Faber.

Christoph Skopek has been with the family business since 2003 in various roles of responsibility. Since 2018, he has overseen key areas such as IT, e-business, and software and app development.

NESPRESSO NAMES B2B DIRECTOR

Nespresso has named Beth Langley as Out-of-Home Director for its UK and Republic of Ireland division. She joins Nespresso Professional from UCC Coffee, where she spent the past eight and a half years and gained an in-depth knowledge of the coffee business.

NEW CEO AT MAC PAPERS AND PACKAGING

US distributor Mac Papers and Packaging has named Charles Paquin (pictured) as its new CEO, succeeding the retiring Rick Mitchell. Paquin was most recently CEO of ModSpace, a provider of modular space and portable storage solutions with 80 branch locations throughout the US and Canada. He left the company in 2018 after leading its sale to competitor WillScot.

BUSINESS SOLUTIONS APPOINTMENT AT WINC

Australian reseller Winc has hired Simon Lane (pictured) as General Manager of its Solutions organisation. He took over from Drew Fairnham, who has left the company to join former Winc CEO Darren Fullerton at drinks giant Frucor Suntory.

Winc’s Solutions contract business includes technology, furniture, print and marketing, MPS, health, hygiene and safety. Lane said one of his first priorities is to grow Winc’s share of customer wallet. UK dealer group Office Friendly has announced that its popular Managing Director Julie Hawley will be leaving the organisation. Hawley is stepping down from her role at the end of April to become Executive Director of Finance at leading UK group purchasing organisation YPO.

Hawley joined Office Friendly in 2006 from wholesaler Kingfield Heath, where she had been Financial Controller. After becoming Finance Director at the dealer group in 2012, she was promoted to the role of Managing Director in 2016.

Since then, she has been credited with overseeing many successful initiatives at the Sheffield-based dealer group, something which earned her the Professional of the Year prize at the 2019 European Office Products Awards.

“I have spent 15 great years at Office Friendly and this has not been an easy decision to make; however, I leave the business in rude health,” she commented. “I am first and foremost from a finance background and this opportunity was too good to turn down.”

Chairman Gordon Profit will lead the Office Friendly team on an interim basis until a permanent successor to Hawley has been appointed.

Julie Hawley

Matthias Baumann, CEO, MTH Retail Group

Matthias Baumann has returned to OPI’s radar with a bang. The former Managing Director of Swiss retailer Office World and Young Professional of the Year winner at the 2004 European

Office Products

Award was Matthias appointed as CEO Baumann of Austria-based MTH Retail Group in September 2020.

The company was already the owner of OWiba (comprising Office World and iba) and is now behind the creation of Office World Group (see Analysis, page 6).

After leaving Office World in 2008, Baumann spent three years as CEO of Swiss furniture company Interio followed by five years as Managing Director as Managing Director Switzerland for online pharmaceutical group Zur Rose. In 2015, he returned to the furniture industry as CEO of another Swiss company, Möbel Pfister, overseeing its digital transformation. While there, he had the opportunity to join the MTH Retail Group board of directors, and this eventually led to him being offered the CEO role.

MTH Retail has historically operated in the DACH (Germany, Austria and Switzerland) region – both in the B2B and B2C space – but Baumann has not ruled out making acquisitions outside these markets.

PICTURE OF THE MONTH

This month’s photo may not seem unusual, just a bunch of guys standing in an office – but we are not living in ordinary times.

After 12 months of Zoom calls, the board of directors and executive team at Australian dealer group Office Choice were finally able to gather for an in-person meeting in March.

Hopefully, many OPI readers will be experiencing the thrill of similar ‘real-life’ get-togethers in the coming weeks or months. ECI Software Solutions has promoted COO Trevor Gruenewald to CEO. He succeeds long-time CEO Ron Books, who has transitioned to the role of Chairman. Meanwhile, former CFO Sarah Hagan has been appointed COO.

Gruenewald and Hagan will be responsible for the day-to-day operations of ECI, while Books will continue to work closely with both the ECI leadership team and its board of directors on driving the strategic mission and vision of the company.

Gruenewald – who has been at the software company since 2009 – will also be in charge of ECI’s overall product Trevor and M&A strategy. He has helped Gruenewald complete and integrate more than 25 acquisitions in the past 11 years. Hagan, meanwhile, will be responsible for overseeing all of ECI’s business units. US business products wholesaler Essendant has said its customers will have “a whole new way to compete” after completing its distribution centre network project with Staples.

Essendant’s Market ADOT (Automated Distribution Order Transfer) initiative means that its resellers have the option of having orders fulfilled through one of 19 Staples distribution centres – effectively adding almost ten million sq ft (one million sq m) of floor space. This is now live, with the last Staples distribution centres having been added in the middle of March.

Market ADOT is a programme that both Essendant and Staples have been working on for some time and which enables their warehouses to ‘talk’ to each other. It has been in pilot phase for the past several months to allow the project team to validate the offering and prove it in real-life market conditions.

Essendant CEO Harry Dochelli commented: “Our goal for Market ADOT was to make the experience seamless for our resellers while maximising the benefits. Achieving this goal took time but I’m proud to say we delivered against it.”

UK groups in ‘buy local’ move

UK dealer groups Nemo and Office Club have teamed up with a marketing agency for the launch of a website called Office Circle. The aim of the initiative is to “create a national network of office supplies dealers offering local delivery from one central website”.

Managing Director Tim Beaumont commented: “The new venture with Office Circle is ready to provide a custom, local service at a national level. It’s a one-stop-shop for B2B supplies and equipment to be delivered straight to offices or homes for people working remotely.”

The Office Circle website features more than 20,000 products that are offered at “competitive prices”. Delivery is free of charge and fulfilment is done by Nemo and Office Club’s network of local dealers.

Essendant announces distribution milestone

Harry Dochelli

Here to HELP

Improvise, adapt and overcome was Jim Hebert’s motto in business. His son Matthew – now running US dealer group Office Partners – couldn’t agree more

Odenville, Alabama-based dealer group Office Partners is a veritable David to Independent Suppliers Group’s (ISG) Goliath. But the two – four prior to the merger of ISG with TriMega Purchasing Association and Pinnacle Associates in 2019 – have happily coexisted for well over 20 years now.

With the exception of TriMega spin-off Pinnacle (in 2008), Office Partners was the last into the fold, having been created by the late Jim Hebert in 1998 (ISG was founded in 1977, TriMega in 1987). It has always been run as a family business and when Jim passed away in 2018, his son Matthew – who had been in the group since 2005, most recently as Director of Marketing and Dealer Development – took on the mantle of President.

Titles mean little to the man in the top job, however, as OPI’s Heike Dieckmann found out when she spoke to Hebert. Now working closely with his mother Diane, wife Bobbi and his brother-in-law Kevin McEntyre, Office Partners remains a lean outfit where, despite fixed roles, everyone constantly wears multiple hats. And while Office Partners itself is a small entity, what it refers to as its family is huge – encompassing all its 125 dealer members. The group’s mission is quite simple: to help that family stay alive and thrive.

OPI: Matthew, we talked to your father Jim a few years ago for the Big Interview, after he had won Industry Achievement at the North American Office Products Awards in 2015 at S.P. Richards’ (SPR) ABC show in Las Vegas. You were on stage with him I remember, presenting Jim with the award. Let’s start with your recollection of Office Partners in its early days.

Matthew Hebert: Well, we started from nothing. When my Dad set up the group, we had 100 vendors willing to provide competitive programmes but without a single dealer signed up. The numbers went up and down a bit over the years as dealerships merged or simply disappeared, but we are now standing at 125 members.

Our dealers are nationwide – from the East Coast of the US all the way to Hawaii. The only state in which we have no presence is Alaska.

OPI: You are not a cooperative, are you, so your dealers do not own the group?

MH: That is correct. When my Dad started Office Partners, he had managed and developed other groups. What was then the National Purchasing Association and National Office Buyers, for example. They were co-ops. He was asked to run the merged entity which became TriMega and turned it down.

So this is how Office Partners started. But he did not want to operate it as a co-op. He always said he did not want dealers to have to worry about the state of another dealer on the other side of the country – if one operator goes under, others would have to pay the debt. My father did not like the idea of them having that responsibility.

We run our group quite efficiently and simply, and what we do now is no different to what my Dad did all those years ago. Office Partners does not go after large rebates the way other groups

Office Partners does not go after large rebates the way other groups do; that is not our aim

do; that is not our aim. Our priorities are different: we want to help dealers with shipping, so we ask vendors for lower or free freight terms. And we ask for lower minimum order values and for better pricing. Those are the three key areas for our group of dealers. Getting better negotiated terms on these key things is going to help our dealer base sell more products, rather than waiting 90 days or a year for any type of rebate.

OPI: Is there such a thing as a typical Office Partners dealer?

MH: There is. Start-ups all the way up to players worth $10 million in revenue comprise many dealers we have. But we have a few considerably larger ones too, including our biggest member Indoff, which is a $160 million operator.

You might remember that MyOfficeProducts was a member when it was in its prime and one of the biggest dealers in the country.

But the sweet spot for us certainly is the small to medium-sized dealer because these independents value the personal touch as much as we do. Most dealers are family-owned businesses. We take calls from them 24/7 and we have an intuitive website so they can find exactly what they need very easily. We keep it simple and help them wherever and whenever we can – that is what we have always been good at.

The same goes for the vendors – we do not beat them up, we work with them.

OPI: Do you have any stockless dealers?

MH: Many dealers now stock a small percentage of what they offer. One of the few exceptions is Indoff which is a non-stocking dealer. This is because it’s a franchise model, with representation nationwide and no distribution facilities.

Our dealer base relies on lower minimums from the manufacturing community as well as national wholesale support.

OPI: You mentioned Indoff a couple of times. This is one of the dealers in OP Direct, the direct-buy subgroup you set up for larger independents last year, isn’t it?

MH: Correct. We now have four independents in that group – Hawaii-based HSC Office Products,

OPI: Was there a need for this separate group?

MH: Yes. Necessary and warranted to survive the competitive landscape in the marketplace. The independent dealer channel (IDC) as a whole already had the Direct Purchasing Catalog Group (DPCG), Pinnacle and the Dealer Supplier Collaborative (DSC).

Again, all we aim to do is help dealers. HSC joined Office Partners last year. We wanted to ensure this independent stayed whole and didn’t lose out in the transfer from DPCG to us. When a large dealer contacts Office Partners, we need to be able to offer a strong solution to be competitive. We had not planned OP Direct, but we felt dealers had to have options.

OPI: What has the past, pandemic-dominated year been like for you?

MH: It has been interesting. I have been on the phone constantly trying to find the next PPE item, unique masks, special gloves, and so forth. One dealer wanted a face scanner, so we signed a vendor which does facial recognition products that read your temperature, etc.

Everybody has really pulled together and done what they could. The ink and toner remanufacturers have done a phenomenal job, for instance. Clover, Liberty Laser Solutions, Arlington, NSA – they helped with a lot of PPE product our dealers just could not get elsewhere. The highlight was that they also knew how to ship small quantities which is important to dealers.

OPI: What about the wholesalers? I think there was some early criticism because they could not get enough of the much-needed PPE either.

MH: But nobody could because nobody was ready for what was about to unfold last March. All

Standing (l-r): Bobbi and Matthew Hebert; Kevin McEntyre. Sitting (m): Diane Hebert these items went to the healthcare sector, to the frontline where they were needed the most, which was completely understandable.

Wholesalers, as well as many of our vendors, improvised, adapted and overcame, and helped to develop and get to market the necessary PPE. Now you can get pretty much anything if you are not too fixated on branded product like Clorox or GOJO. These are still limited through our channel.

OPI: Did dealers get burnt by non-branded items and products they did not have any experience with? Or surplus goods that now cannot be shifted?

MH: There were some quality issues, certainly, especially for hand sanitiser. Dealers were ordering pallets of it and now they are stuck with those products that smell like tequila or vodka.

Many of the players in our industry, and Office Partners members like I said, are small to medium-sized operators. As such, they typically have excellent relationships with local companies. Small distilleries, for example, which started making all these hand sanitisers.

It was something that was really supported by the local authorities too. But they smell horrendous and the main vendors like GOJO today have better availability of Purell again. Dealers, meanwhile, cannot get rid of those pallets. I had a lot of samples sent to me and some of them were bad.

OPI: How did dealers respond to the need to deliver to customers’ home addresses? Were they able to do it?

MH: Some did. A lot of them asked the wholesalers to do their shipping for them. Several of the manufacturers also came out with drop-ship programmes. And a few customers would just come and pick orders up from a dealer’s front door – this is obviously particularly relevant in small communities.

OPI: So overall, have your members suffered financially in this past year?

MH: It sounds terrible, under the circumstances, but some dealers had their best year ever. We have not had a single dealer close because of COVID yet.

PPE has certainly allowed them to have their numbers in the same ballpark as 2019. There has been light demand for domestic furniture – chairs, tables and desks for the home office, etc, and obviously for any electronic and technology products associated with that environment.

There has not been a lot of call for office supplies, as you can imagine. Commercial furniture is also down, as is demand for breakroom products. Even when staff must be in their usual place of work – typically not in an office environment – they are not allowed to be in a group setting anywhere.

The one thing I heard in this context is some demand for TV tray-type tables. A large dealer customer I know bought several of these items so staff can eat lunch in their own area.

OPI: PPE will continue in some way, but not on the same level. What are dealers doing to prepare for when the pandemic situation eases again, bit by bit?

MH: They are asking their customers so many questions. What are you going to be doing when any kind of normalcy returns? Will staff return to the office? Will you offer a hybrid working scenario? What equipment do employees need? How can we help facilitate any changes? Can any equipment be retrofitted?

But they are also going to the vendors, saying: “Hey, this is the new norm for my customer; what can I do to prepare for that?” We have been liaising with a lot of vendors asking them to help our members with additional information.

Overall, I believe dealers are really starting to broaden their scope and reach in the marketplace. Jan/san has been an adjacent category for them for years, supported by the wholesalers. But it’s not adjacent anymore and they need to take a much bigger step into it.

OPI: On the jan/san note, you entered a relationship with The United Group (TUG) about four years ago. How is that going?

MH: Yes, we did. TUG is a purchasing organisation with more than 500 independent jan/ san, foodservice, safety, and industrial packaging supplies dealers in the US. Our groups overlap in several ways, so it made perfect sense to work together in some capacity.

TUG has over 200 vendor partners that we do not carry, and we have 120 vendors they don’t have. It’s easier to work together than starting from the beginning.

TUG dealers can buy through our programmes and Office Partners members have the same opportunity with TUG vendors. We collectively have excellent relationships with our vendors. Why try to understand those new categories when one party already has the expertise?

OPI: I guess the strife or success of independents has depended to a large extent on the demographic they are in, the level of restrictions in place and their particular customer base. Those catering for the large, corporate customer, I imagine, wouldn’t have done so well?

MH: They adapted, providing more deliverables to homes and thereby directly competing with the likes of Walmart.com and Amazon, for example.

In most instances, dealers would typically never have had the opportunity to compete in this segment. Because many manufacturers supported drop-ship programmes, they could.

OPI: You referred to furniture a moment ago. Has your GSA furniture contract been a slow burner over the past year?

MH: Very slow. But it does not cost us anything and we still have the contract. There is a bit of transactional business right now, but definitely no large orders.

We are constantly enlisting our vendors to better define and build the government sector – strategically and methodically.

OPI: Are you looking for other relationships that would help your dealers tap into different product categories?

MH: Absolutely. We are always looking at new ideas or areas we can help our dealers get into. I love having dealers call me and tell me about an opportunity they got which we can then investigate.

I have a group comprising both dealers and vendors – kind of an advisory sounding board – that I’m in touch with regularly to ask questions about new ideas.

OPI: Do you work with both wholesalers in equal measure?

MH: We do. Both have a great and vested interest in the dealer community. As a group, we are flexible and adapt to today’s marketplace demands – and our national wholesalers help us tremendously in this regard.

Office Partners’ members are split in terms of which wholesaler is first call and which is the back-up supplier – that seems to work very well.

OPI: COVID aside, both the wholesalers have been through some fundamental changes in the past couple of years. What is your verdict on their current state of play?

MH: I feel for those guys. How many new programmes and initiatives can you really implement when people are not physically in one place, and when they have also had to do so much pandemic firefighting?

I think we will only truly see what both these operators have up their sleeves and are capable of in terms of helping dealers when some form of normalcy returns. More collaboration and transparency will be needed to achieve a true partnership with the IDC.

Right now, both Essendant and SPR are doing exactly what I am doing: seeing how much Clorox product they can get, and then how they can manage the fulfilment for dealers. They do not have time to figure out what new types of programmes they can come up with or whether and when they are going to host their annual shows again. We are all in the same predicament.

It is not the wholesalers’ fault they cannot get product. They are doing what they can; the problem is the likes of Clorox only designate a certain amount that is allocated for our industry and distributed through our channel.

The wholesalers are never going to lose their dealer business, but the past year has opened some of our members’ eyes to the fact they also have to look elsewhere to pick up items and customers outside of the traditional office products channel. And I’m not just referring to PPE or jan/san items.

OPI: What else?

MH: Furniture. When people were sent home to work and needed home office furniture, our members could not get enough of it from the wholesalers – small desks, different types of tables, outdoor casual furniture you can work from – they just did not have it.

On a different note, I signed up a company called ScentLok – it sells hunting-related gear. My dealers thought I was crazy, but it also sells a product called Ozone which, among other things and for its typical customer, cleans hunting clothes and removes odour from them. It also kills or reduces the spread of viruses and bacteria.

ScentLok makes all these products like cigarette lighters and wall plug-ins that people can use in their cars, in offices, and so on. I get asked about this type of merchandise by our members every day.

Douglas Stewart Company is another company we are dealing with which has helped us find unique school items and PPE that customers are looking for currently.

OPI: And you deal directly with these vendors?

MH: Yes, because my dealers need the products immediately. I can call SPR or Essendant and tell them about these companies, but it takes too long for them to bring these on board – I can just review and refine the programme with them, set up the billing and go.

It is exactly what my Dad had in mind when he set up Office Partners. He wanted the group to be like a small dealer: the customer – dealers in our case – needs something? We can get it. Quickly. You go to a Staples or Depot and it is a different story: this is what we have – take it or leave it.

OPI: What do you think Office Partners excels at?

MH: Let me start by saying that I have never sold an office product in my life. I am all about

marketing – and about keeping it simple. I take our flyers to friends, for example – everybody is a potential office supplies customer in some way – and ask them: how does this look to you? Would you buy from me? Why or why not?

We produce theme-orientated promotional Solutions flyers and a Solutions Book. So, say, a customer wants binders, we have a flyer containing our bestselling binders. Not the least expensive ones necessarily, but those that will make it easy for customers to make an informed buying decision.

Another one is a flyer for people who work in small cubicles or from home. We went directly to our vendors and asked for specific products they recommend, that are in high demand and fulfil all the criteria that workers are concerned about in their working environment.

Obviously, the current in-demand category is PPE, so we have made a PPE flyer. We did not produce it last year because we did not want to put any marketing material out there when we were not sure dealers could actually get any product.

I work very closely with the dealers and manufacturers in finding key areas for marketing pieces. We have our yearly event too which is always very popular for future planning and cooperation. This year’s event will be from 24-26 October in Tampa, Florida. I am very hopeful for this opportunity to have dealers and manufacturers – spanning all categories – collaborate in person again.

OPI: That is just a few weeks before the planned Industry Week. Is that something that interests you?

MH: I have never been asked to be involved. My feeling is that it will still be ISG’s show. And the group will do it extremely well, no doubt. Ours is quite different and very much a one-on-one collaborative effort.

When Avery’s Barry Lane initially worked on Industry Week with the Business Solutions Association (BSA), prior to the collapse of the show, he and the BSA team were doing a great job of getting both wholesalers involved and we were extremely interested in the concept. This is essential in my view – the cohesive partnership with Essendant and SPR. Both combined have a much broader dealer list than any of the groups – ISG, DPCG or Office Partners.

When Barry and BSA were planning Industry Week, with wholesalers and the manufacturing community involved, we were going to participate in the event, along with all entities.

OPI: There has long been the overriding aim to bring the industry together to jointly fight the big enemy of Amazon, but also Staples and Depot. Let’s stick with the big boxes for a moment: do you think it will be third time lucky in terms of Staples/Depot coming together in some capacity?

MH: Good question. Referring to retail and the big boxes, as you say, they are nowhere near as grand as they used to be 15-20 years ago. They might pull it off, but what then, what would they do? The big stores do not work like they used to, but there are a lot of long-term retail leases from what I have been researching.

Because of the presence of Walmart.com, Amazon, Boxed and others, I believe the government may very well view the merger differently than before. No matter what the decision is, independent dealers will have to become more flexible and improvise, adapt and overcome market conditions, mergers and acquisitions to move forward.

OPI: As regards Amazon: some of your dealers I presume are on its marketplace?

MH: Some sell on it, yes, and it works for them. Others have dropped out because it is just too expensive. To me, it is almost like working with GSA contracts – you are either in or you are out. You are probably never going to make a lot of money out of it, but there’s no point fighting it.

My father had the same issues, but with different operators. Initially, it was Walmart, then Staples and Depot with their stores. Small independent dealers are protected to some extent, because they are typically supported by their local communities. And many people still advocate and like that personal attention and care you get with these companies.

OPI: But that advantage surely is at risk of disappearing or at least diminishing with new generations of buyers.

MH: Absolutely. The problem is twofold. First, younger generations are buying differently, as you rightly mention, so small businesses are losing out unless they can cater to all audiences well. Secondly, our industry is getting older and without a big push of the younger generation coming in, a lot of family-run operations will simply disappear.

There are plenty of dealer principals in their 60s and 70s – the age my Dad would have been now. Many don’t have a succession plan, so they will be thinking of selling and consolidating their businesses at some stage. Of course, some of this will happen within the independent channel, but as we know very well, not all of it. And there will be new platforms and marketplaces – Amazon-style perhaps – where years of customer contacts and data will be deployed and perhaps lost to independents.

All that said, I prefer to stay positive. The products we all sell will never truly go away. So, envelopes are in decline – ok, but online parcel sales are booming and so are the materials and products that facilitate that. There are plenty of opportunities.

My Dad was a US Marine and the one thing he always told me was to improvise, adapt and overcome, just like the Marines must. That advice will always stay with me, so let us figure out what the next solution is – for whatever problem. And I would be delighted if I was able to pass on any of these solutions to our dealer members. This is what we do: we are here to help.

Has the COVID-19 pandemic breathed a new lease of life into the office products retailing segment? OPI’s Andy Braithwaite takes a look…

There is little doubt that the bricks-and-mortar retail channel has been under huge pressure over the past few years, and still is. The term ‘retail apocalypse’ has become part of everyday language. Global research firm Coresight has predicted 10,000 store closures will happen in 2021 in the US alone.

But it is not all doom and gloom. Despite, or perhaps because of, the COVID-19 pandemic, some areas of retail have actually been performing well – or have at least demonstrated resiliency – over the past 12 months. You could certainly include the office supplies retail segment in that, with sellers recognised as essential businesses by many governments and therefore allowed to keep their outlets open while others around them were forced to close for often extended periods.

For years now, the ‘jewel in the crown’ of speciality OP retailing has been Australia’s Officeworks. Sure, it has not faced some of the competitive pressures seen elsewhere – particularly online. But it has nevertheless fully embraced evolving customer shopping habits and the need to drive efficiencies in its operating model, while keeping stores central to its proposition.

Once again, its most recent results bear testament to the success of its strategy. In the six months to 31 December 2020, the company’s revenue was up 23.7% year on year to A$1.52

billion (US$1.18 billion). EBITDA grew by almost 14% to A$156 million, while pre-tax profit increased 22% to A$100 million.

Those results included strong sales growth both in stores and online. E-commerce – including click and collect – represented 37% of total revenue, up from 29.7% in the previous H1 period. In stores, the technology sections have been completely revamped, while more space has been devoted to categories such as gaming and work-from-home (WFH). Officeworks also introduced a new art brand called Born as it caters to the growing popularity of at-home activities.

DEPOT RETAIL: BEST PERFORMING DIVISION

In the US, The ODP Corporation’s (ODP) North American Retail (NAR) unit – comprising the Office Depot and OfficeMax brands – was the group’s best-performing division in 2020. It even achieved comparable same-store sales growth in the fourth quarter.

Again, a key to this was NAR’s growing digital presence and omnichannel offering – with buy online, pick up in store (BOPIS) sales increasing by 50% year on year. For the year as a whole, BOPIS revenue was $358 million, up by 75% versus 2019.

NAR was also boosted by demand for essential items such as furniture, technology equipment, cleaning supplies, PPE and WFH/learn-from-home products. The growth in these categories, taken together, was $361 million in 2020, helping to offset declines in paper-based OP.

Although there are still uncertainties about how purchasing habits might evolve post-COVID, there are signs that speciality retail has found a new lease of life.

As Ethan Chernofsky, VP of Marketing at retail location tracking company Placer.ai explains to OPI: “The wider office supplies sector was struggling significantly to find its place in the face of Amazon’s rising strength, yet the pandemic may have offered potential for a short-term rebound and brighter overall future. "The rise of WFH meant many people had to upgrade their home office capabilities, and few brands were as well positioned to fill that need as Staples and Office Depot. While they likely have to undergo some degree of rightsizing their offline footprint, they are facing a unique opportunity to drive a significant long-term rebound.”

He continues: “The potential sustainability of greater levels of WFH should help these companies over time, but the combined reimagination of many retail and office spaces could aid even more. With concepts like in-mall co-working spaces rising and a greater appreciation for mixed use of retail and office, there are new formats operators could use to get close to professionals. These will increase the perception they are the most convenient and timely solution to help them in their moment of need.

“In addition, taking pages out of Best Buy’s playbook [see also Best Buy box, page 24], such as Geek Squads and appointment shopping, could provide longer-term boosts to help these brands and others cement their role as the primary players in the OP sector.”

MORE CONFIDENCE

Chernofsky also sheds some light on why Staples and ODP are keen on combining their US retail operations. Placer.ai visitor numbers from the end of last year and early 2021 show improving trends at both brands following the COVID-19-related declines seen in November 2020.

“While Staples holds a larger visit share (see chart below), the rate of return may be giving [it] confidence it can, in fact, compete with digital pressures from Amazon and [push back] a wider consensus that the overall sector could be in trouble,” he notes.

The potential merger of the Staples and ODP US stores (more than 2,000 locations in total) is a story which is likely to develop during 2021. The US Federal Trade Commission is currently conducting an investigation into a wider combination of the two companies (retail and B2B), and this could still take a few months. Staples’ US Retail division declined to contribute to this article, but said it can hopefully share further details of its initiatives in a few weeks – so look out for that on all of OPI’s platforms.

In Europe, the OP retail segment also appears to have been holding its own, despite the challenges of COVID lockdowns. Matthias Baumann, CEO of Austria-based group MTH Retail, has provided OPI with some details of the performance of its Swiss chain Office World.

“Our fiscal year started on 1 March 2020 with a stable like-for-like sales level,” he states. “Then we were hit by the first lockdown with more than 40 days of imposed shop closures. After reopening, we again enjoyed a solid top line, with higher sales compared to 2019 for the rest of the year. Top categories were furniture and home office equipment.”

He continues: “In mid-January 2021, the second lockdown was implemented by the Swiss government. As a large part of our assortment was considered essential, we were able to keep stores open, but revenues were impacted up to 50% due to the general restrictions on customer mobility and products we were not allowed to display or sell. Nevertheless, with a strong online sales channel, cost measures and government support – such as a short-term allowance – we managed to secure FY bottom-line results.”

OMNICHANNEL IS CRUCIAL

Baumann points to the importance of a combined digital and physical offering. “Our omnichannel strategy is crucial for the company's future success. We learned from the lockdown impact that our online sales could offset lower revenue from ‘classic’ retail,” he says.

“However, the rebound in sales and demand in our retail stores after lockdown indicates that the customer is still looking to interact in person with the brand. This is proof all channels have their part to play in our overall strategy. Physical locations will remain relevant in the future, but the role of stores will continue to change. "For example, personal service and advice, as well as the integration of digital tools, will become even more important. We believe in our store business and want to meet all customer needs.”

Maintaining relevancy is a crucial point too for Francesco Villa, General Manager at Italian franchise chain Buffetti, where revenues have only been down between 5-10% in the past year. He notes: “We have seen a great increase in online sales, but customers are still looking for personal,

36% 64%

opi.net poll

Is there a future for speciality office supplies retailers?

n Yes n No

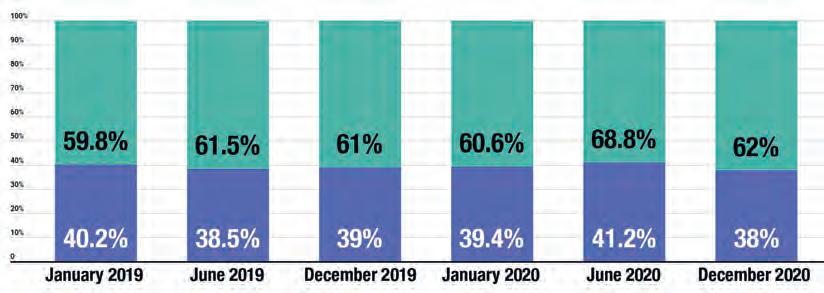

Staples versus Office Depot store visits

n Staples n Office Depot

‘live’ consultants in the shop. We see three pillars to survive and have success: immediate product availability, consulting, and store ambience.”

European omnichannel operator PBS Holding provides wholesaling services to retailers, among other things. In relation to these customers in Germany and Austria, CEO Richard Scharmann says their performance has been steady overall, despite the various lockdowns. However, he adds the caveat that government financial support over the past 12 months or so has had a lot to do with this stability.

“At the end of the day, retailers were not in a very difficult situation and were able to close the year in a fairly normal way,” he says. “In that respect, you could say they are lucky for the time being.”

A WORD OF CAUTION

When government assistance comes to an end, it might change the landscape somewhat, however. “On the positive side, retailers are adding fashion items and changing their assortments,” states Scharmann, “but after COVID, it will be very challenging; certainly more difficult than it is at the moment. As such, I believe we will continue to see a natural decline in the number of shops in the market, at least in Austria and Germany.”

One person hoping that new workplace trends will boost his retail business is Elliot Jacobs, Managing Director of UOE, which comprises retail, post office and co-working locations near London, UK. The company has even opened a standalone co-working space in the town of St Albans as it

BEST BUY: FROM BIG BOX RETAILER TO OMNICHANNEL RETAILER

The results of US consumer electronics operator Best Buy have been impressive over the past 12 months. In its financial year ended 30 January 2021, comparable sales in its US network rose by more than 9% to $43.3 billion. The bottom line grew too. Adjusted operating profit in FY2021 was up by around 20% to $2.54 billion, while adjusted operating margin improved by 90 basis points to 5.9%.

Best Buy’s success goes back to a strategy it formulated in 2019, and which came very much to life in an accelerated way in 2020. Key aspects of that strategy include a couple of concepts it believes to be permanent and structural implications of the COVID-19 pandemic:

Best Buy CEO Corie Barry (centre)

Shopping behaviour will be permanently changed in a way that is even more digital:

Best Buy’s online sales in the US grew by 144% in 2020 and represented 43% of total revenue – compared with 19% in the prior fiscal year and just 5% ten years ago. The company is forecasting the online mix to be 40% in the current fiscal year.

The workforce will need to evolve so it meets the needs of all its customers:

Best Buy is retraining and reskilling its in-store staff to be more flexible and adaptable. This means they will be expected to perform a wider range of duties, such as call centre phone answering, live video chat, kerbside pickup, fulfilment, providing more in-depth product expertise and advice. omnichannel presence to an omnichannel retailer with a large store footprint for support and fulfilment.”

One example of deploying the retail footprint differently is Best Buy’s ship-from-store hub pilot it has been testing for the past few months. In its most recent quarter, it used 340 stores (about 35% of total locations) to handle around 70% of its total ship-from-store product units. Over time, it believes it can achieve similar results by consolidating volume using a smaller group of stores.

As the role of the store shifts, this has led to some “difficult decisions” regarding staffing levels in order to achieve a low cost base. In fiscal 2021, Best Buy let go roughly 21,000

[We are moving] from being a big box retailer with a strong omnichannel presence to an omnichannel retailer with a large store footprint for support and fulfilment

DIGITAL SHIFT

The reality of the digital shift is that footfall in the final quarter of the year fell by 15% while, at the same time, uptake of the company’s mobile app grew by 80%. While this was partly due to COVID restrictions, Best Buy is not expecting store visits to return to prior levels. This means fundamental changes to its retail and labour models.

“Customers expect to be able to seamlessly interact with physical and digital channels and we must be ready to serve these needs at all times in all channels,” said CEO Corie Barry during a recent earnings conference call. She continued: “We are building our experiences around meeting these needs as we move from being a big box retailer with a strong employees (ending the year with 102,000 staff), and has since eliminated a further 5,000 full-time positions as it increases its mix of part-time workers.

While this may not be good news, Barrie affirmed that the stores and staff “will always be central to our strategy”, adding: “We are simply looking at how we can best deploy our team and our physical assets to meet customer expectations and needs.”

The swiftness with which Best Buy has acted during the pandemic, positioning itself for the future of retail within an omnichannel strategy while still growing sales and profits, may well become a case study one day. It took full advantage of the US furlough scheme, and then used this breathing room to greatly accelerate its transformation strategy.

invests in suburban areas where there is a growing demand for work-near-home (WNH).

“My team has been brave and outstanding in its commitment, ensuring all our branches stayed open every day and serving over 25,000 customers a week in a COVID-safe environment,” he states. “There has obviously been a shift in retail purchasing through that time – the first

lockdown saw a big bump in crafting and jigsaw puzzles. We’ve seen an increase in packaging, as you’d expect, and, somewhat surprisingly, greetings cards – I think the power of words on paper means a lot right now.

“We also added a range of sanitisers, masks and other related items which has helped our sales performance. An uptick in home printing has resulted in rising paper and inkjet supplies. That said, the big drops have been in gifts, travel-related products, presentation, printing and binding and related services, as well as in filing and paper storage items.”

On a more positive note, Jacobs points to a heightened desire among consumers to support local businesses. “I think ‘shop local’ has strengthened through the pandemic – and I hope this will remain – as people realise having a vibrant high street, filled with fantastic shops that are operated by local people is what makes the centre of every community. If you’re working from or near home more, supporting your community has never been easier.”

This is the kind of entrepreneurial ethos and enthusiasm that is going to be needed in bucketloads as retail rises to meet the challenges it faces. But there is no reason to believe success cannot be achieved with the correct combination of location, assortment, customer service and experience, digital tools and the right cost base.

Retailers like UOE are capitalising on the work-near-home trend