O O

ISSUE 12 - JUNE 2024 SUBSCRIBE FOR FREE workplace360.co.uk

business supplies and beyond

business supplies and beyond

FIND YOUR NICHE

Diversification – it’s talked and written about incessantly, but is it really happening at ground level? Mostly, I’m sure it is, although comments made by US industry veteran Mike Maggio struck a chord. He pointed out there are still dealers not yet selling furniture, breakroom and jan/san! You can delve into his insights in View from across the pond on page 44.

This got me thinking about the real challenges of entering a new category and achieving genuine success. What USP can you offer customers if everyone else is also jumping on the bandwagon? After talking with many dealers over the years, I’ve come to this conclusion: progressive businesses can indeed be ‘Jacks of all trades’ – with one caveat: cover all bases, but have at least one niche where you truly excel – an area where no other company can compete.

Fortunately, within broad categories, there are always niches for dealers to explore. This issue is packed with ideas to help you find yours. For instance, Maggio also mentions

There was a great atmosphere at the Business Design Centre for the 12th outing of the London Stationery Show in mid-May. Find out more in Postitive vibes on page 36

business supplies and beyond

business supplies and beyond

Workplace360 c/o OPI, Focus House, Fairclough Hall, Halls Green, Hertfordshire SG4 7DP Tel: 020 7841 2950

Follow us online:

Website: workplace360.co.uk

Linkedin: workplace360.co.uk/linkedin

The carrier sheet is printed on Satimat Silk paper, which is produced on pulpmanufactured wood obtained from recognised responsible forests and at an FSC® certified mill. It is polywrapped in recyclable plastic that will biodegrade within six months.

EDITORIAL

Workplace360 Editor

Michelle Sturman 020 7841 2950

News Editor

Andy Braithwaite +33 4 32 62 71 07

Assistant Editor Kate Davies 020 7841 2950

OPI Editor Heike Dieckmann

What USP can you offer to customers if everyone else is also jumping on the bandwagon?

medical supplies and missed opportunities in technology. He astutely observes that while offices have become high-tech environments, dealers have largely overlooked this category.

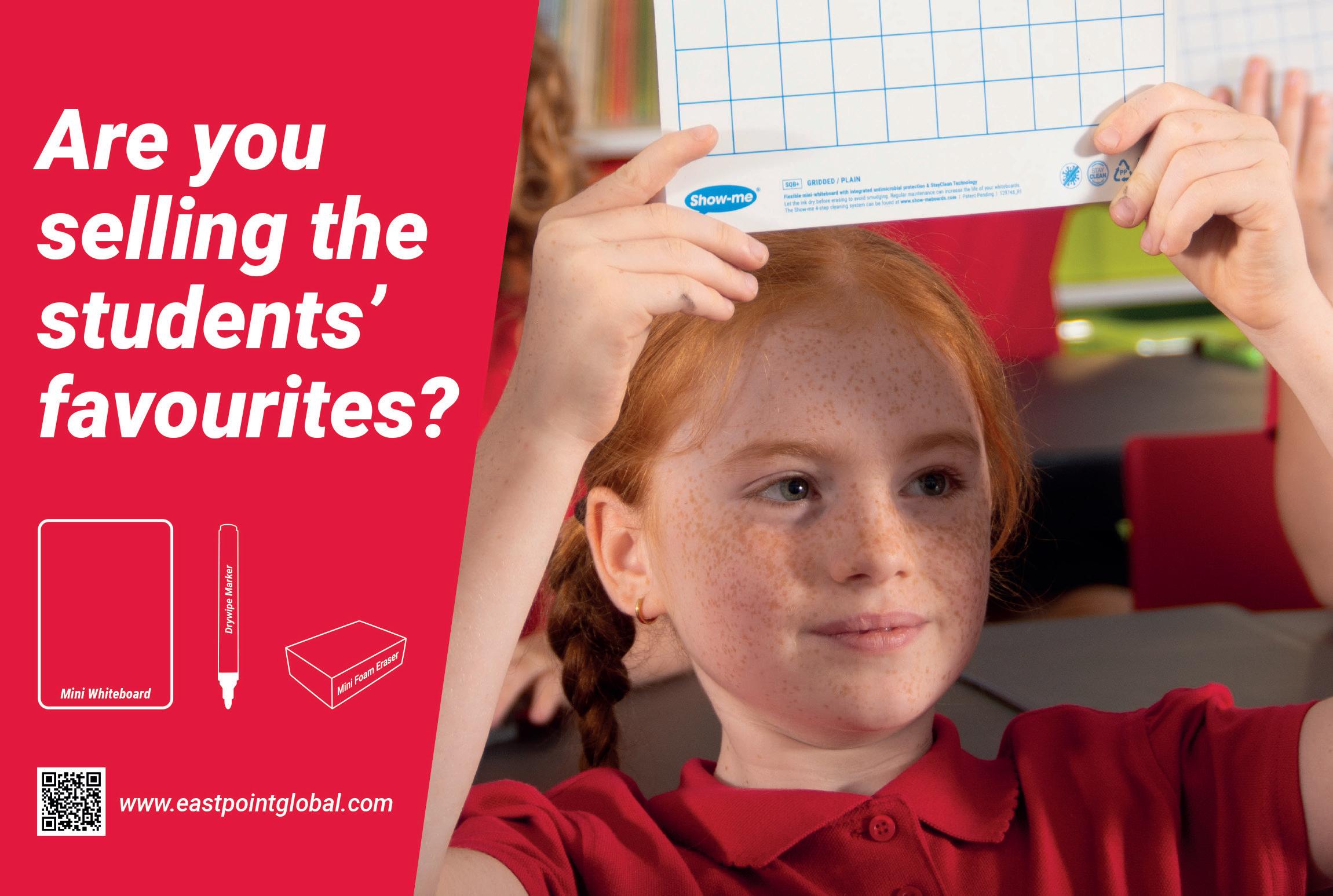

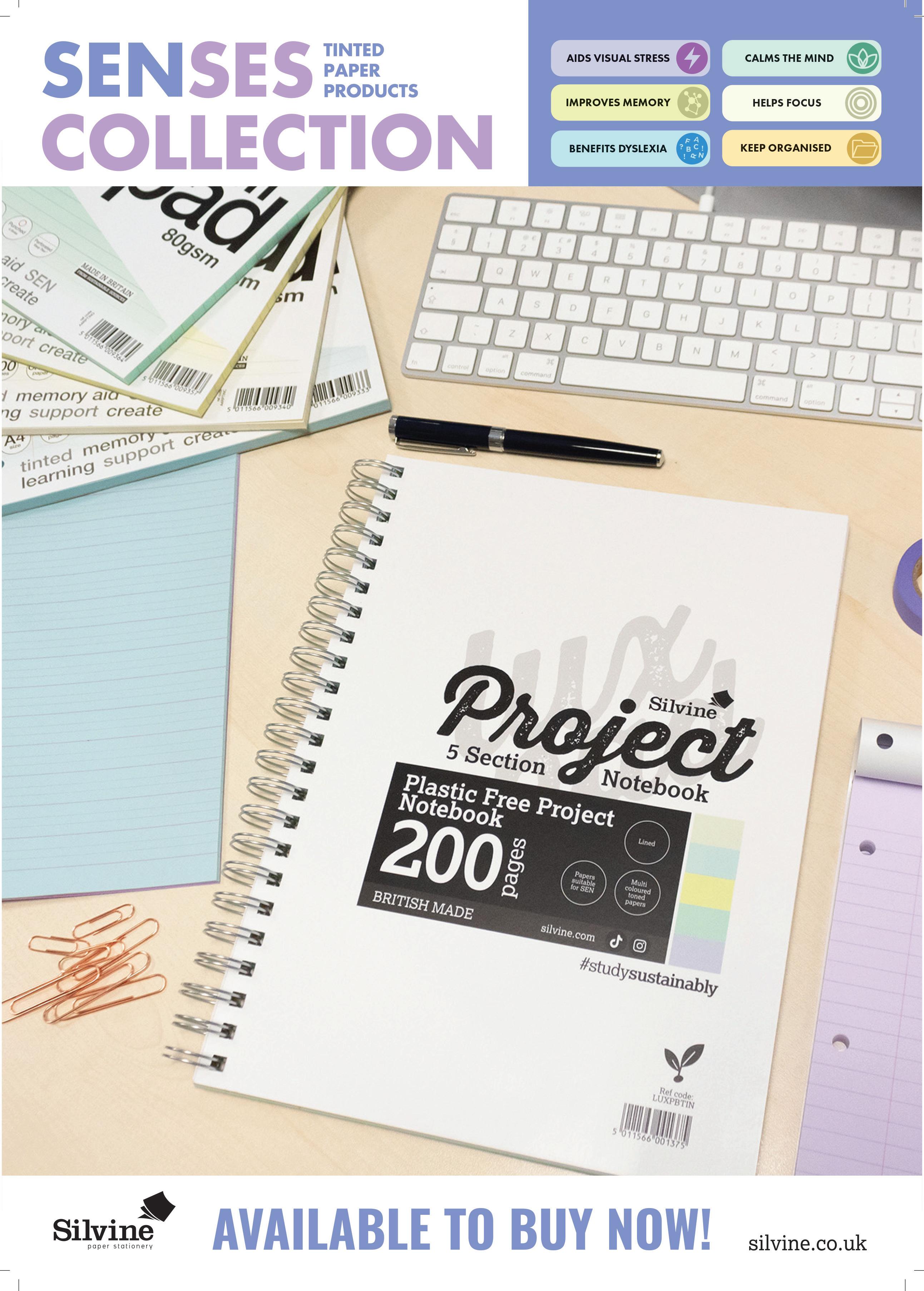

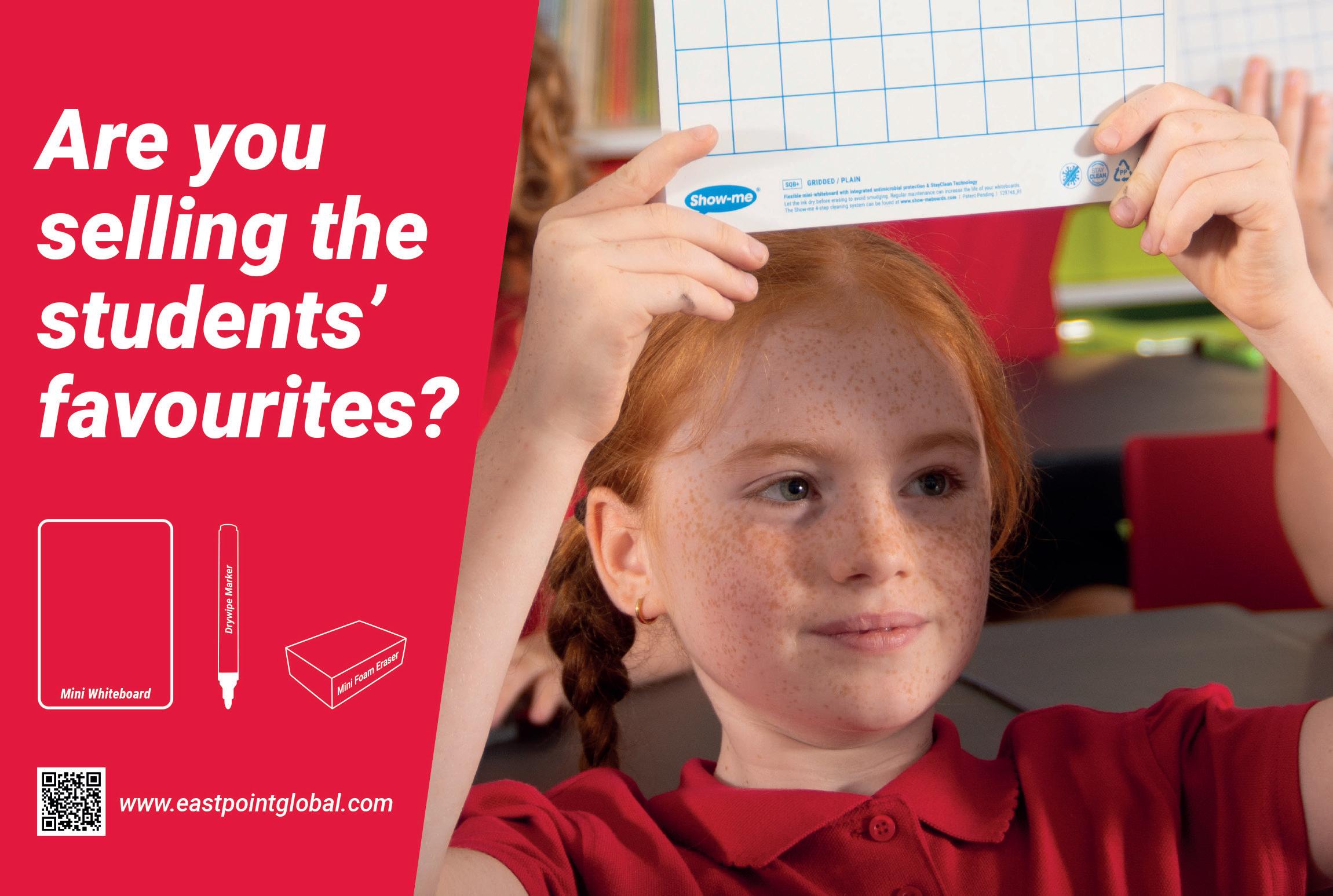

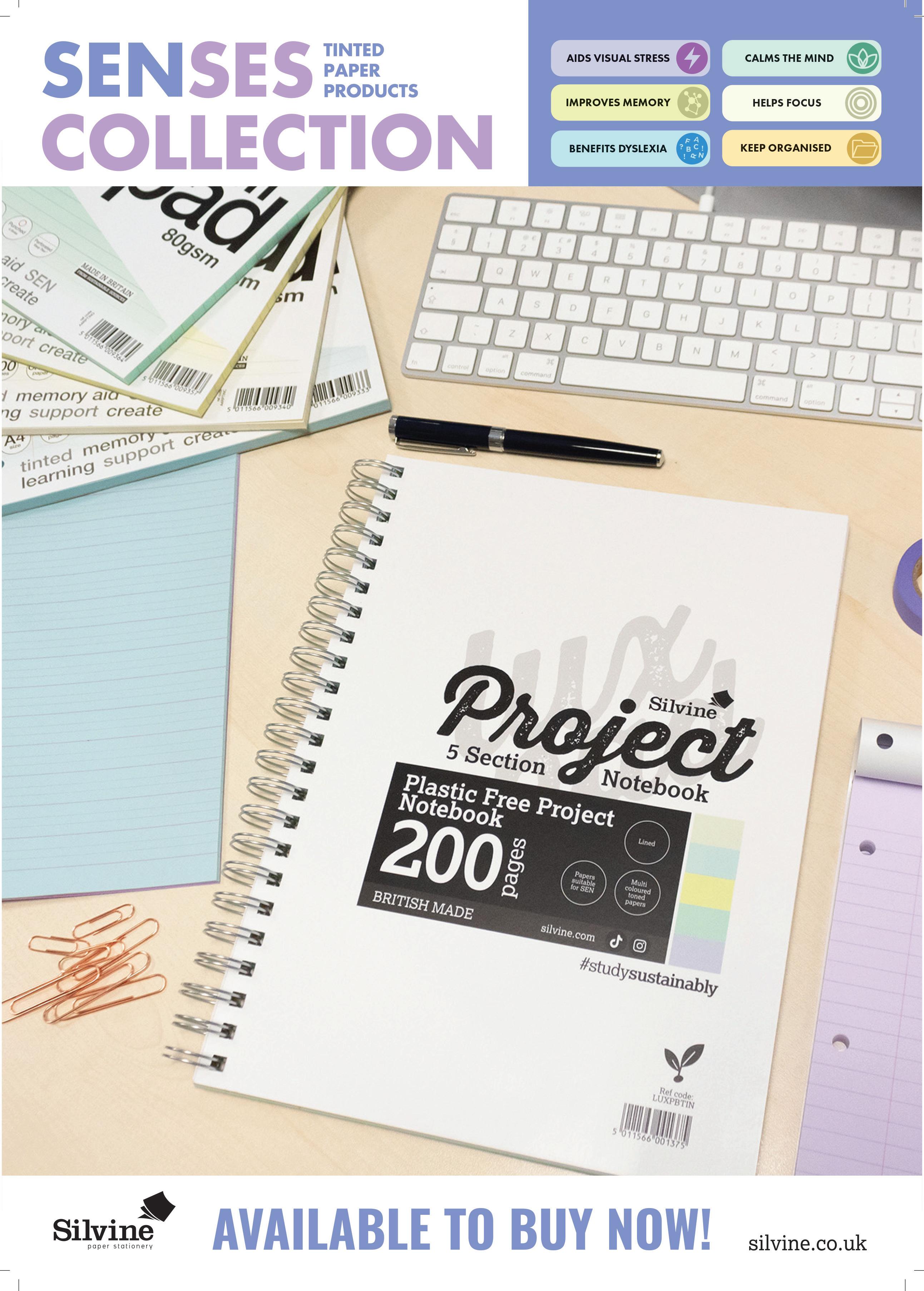

In the education space, schools and colleges are investing in sixth-form areas, labs and sensory spaces – all of which need to be kitted out. Dive into these trends in Tech and tradition on page 38.

In the safety and workwear arena, consider sustainable clothing, smart PPE and garments and equipment designed specifically for women. Discover more in Safe as houses on page 30.

And let’s not forget workplace wellbeing. Turning up the heat on page 46 is all about the impact of menopause in the workplace. It’s a great way to incorporate plenty of products such as desk fans, air con units and water coolers into a wellness plan for customers to help menopausal employees. Feminine hygiene products also play a key role – which, incidentally, is mentioned by evo CEO Andrew Gale as one of the operator’s start-up categories last year in evo by the numbers on page 26.

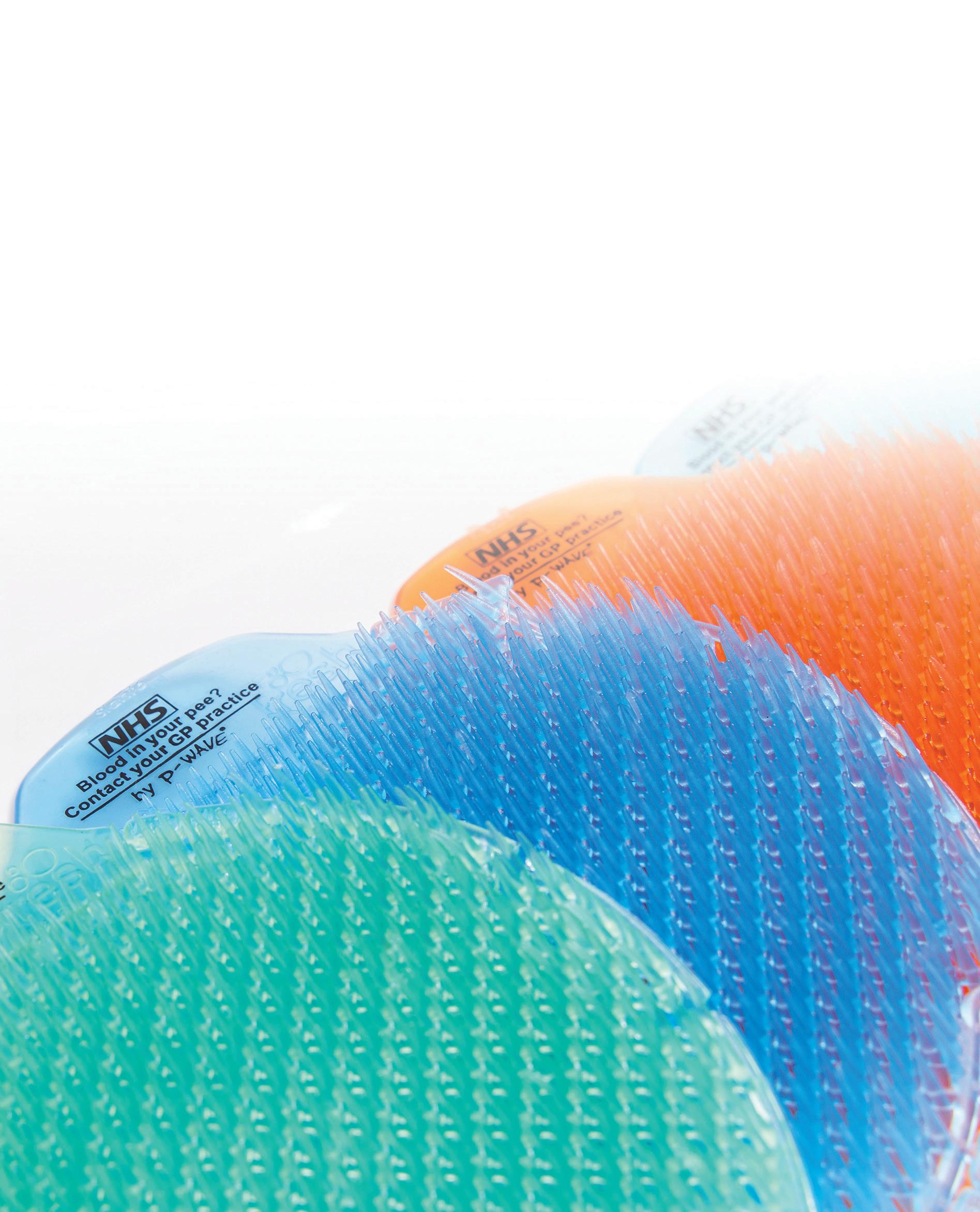

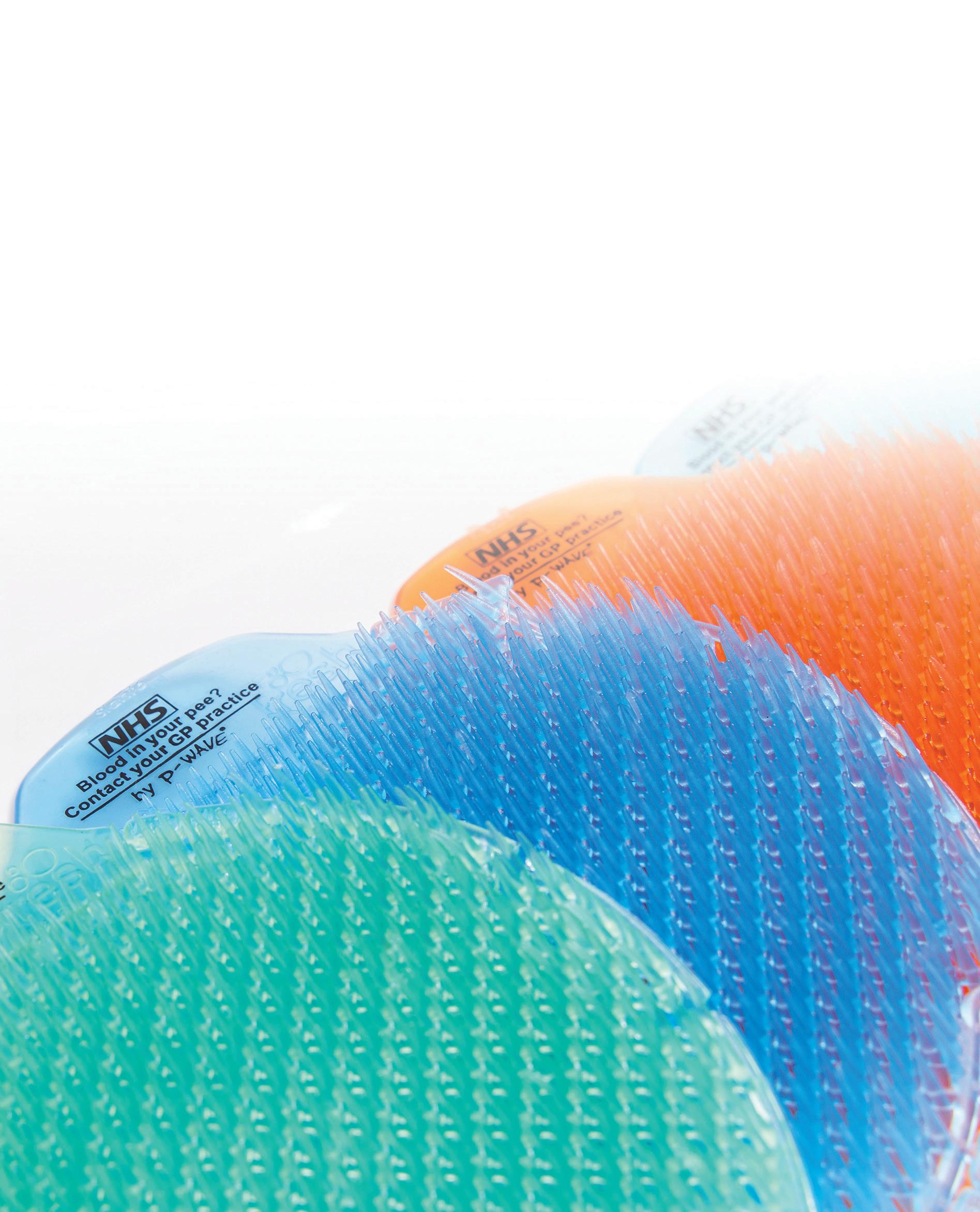

Men’s health is on our radar too. P-Wave, a brand known for urinal products and air fresheners, has partnered with NHS England to raise awareness of urological cancers, promoting early detection through messages on urinal screens. Read more in Making waves on page 34.

Michelle Sturman, Editor

SALES & MARKETING

Head of Media Sales

Chris Turness 07872 684746

Chief Commercial Officer Jade Wilson 07369 232590

Commercial Development Manager Chris Armstrong

Digital

PRODUCTION & FINANCE

Head of Creative

Joel Mitchell

Finance & Operations

Kelly Hilleard

EVENTS

Events Manager

Lisa Haywood

PUBLISHERS

CEO

Steve Hilleard 07799 891000

Director Janet Bell 07771 658130

Executive Assistant Debbie Garrand

EDITOR’S NOTE

Marketing Manager Aurora Enghis

O O

No part of this magazine may be reproduced, copied, stored in an electronic retrieval system or transmitted save with written permission or in accordance with provision of the copyright designs and patents act of 1988. Stringent efforts have been made by Office Products International to ensure accuracy. However, due principally to the fact that data cannot always be verified, it is possible that some errors or omissions may occur. Office Products International cannot accept responsibility for such errors or omissions. Office Products International accepts no responsibility for comments made by contributing authors or interviewees that may offend. Workplace360

the UK by An

is printed in

OPI publication EMAIL US... To email any of the Workplace360 team, use the following: first name.surname@ workplace360.co.uk

3 WORKPLACE360 - JUNE 2024

looks at how cities around the world – including London – are adapting to the

ECI Software Solutions provides an update on its FusionPlus Eco Aware label initiative

look at evo’s latest financial results

Flashy Cactus Director

Jason Kinsey explains the company’s unique approach to sourcing specials

Urinal screens from P-Wave are helping the NHS in the fight against

industry doyen Mike Maggio offers UK dealers some sage advice

Exposed! Kristian Danielson from BIC

03 Editor’s note 06 News 10 Dealer spotlight Rewriting the rule book, ACS Group holds true to its core values of culture, customers and community 14 Research WORKTECH Academy

new

of working and living 24

ways

Sustainability

26 Talking point A

28 Interview

34 Advertorial

cancer 44 Interview

50

CONTENTS

US

JUNE 2024 16 46 Vicky Dymoke and Laura Wingate explain why dealing with the impact of menopause in the workplace is so important Despite budget constraints, there are still plenty of sales opportunities in the education sector 38 30 Sustainability and digital innovations are two areas currently driving the workwear and safety category Now under new management, the London Stationery Show offered a buzzy vibe 36 4 WORKPLACE360 - JUNE 2024

In conversation with... Nemo Office Club Managing Director Tim Beaumont

UK government names framework suppliers

Eight resellers, including four small businesses, have been awarded places on the UK government’s new Office Solutions framework. The Office Solutions contract (RM2699) was put out to tender last year. At the time, it was valued at £400 million over three years.

Originally to be split into three lots, the new framework – which replaces the previous Office

Supplies RM6059 agreement that expired at the beginning of April – has been awarded according to two multi-supplier lots. Lot 1 covers office stationery and EOS, including jan/san, foodservice, furniture and PPE; while Lot 2 comprises ink and toner products.

A total of eight suppliers were selected across the two lots as follows:

Lot 1:

l ACS

l Banner

l Bates

l Hyper Talent Solutions

l Lyreco

l OT Group

l Wildhearts

Lot 2:

l ACS

l Banner

l Bates

l Hyper Talent Solutions

l Lyreco

l OT Group

l XMA

The Crown Commercial Service – the entity that handles public procurement in the UK – said the inclusion of four SMEs on the agreement supports the government’s goal for £1 in every £3 to be spent with these types of businesses. The framework runs until the end of April 2027, but there is the possibility of a 12-month extension.

GOJO pulling out of Europe

GOJO Industries is closing down its operations in Europe. The maker of Purell hand sanitiser has decided to withdraw from the wider European market, including the UK and Ireland.

According to the most recent financial documents filed with Companies House (the 2022 accounts are four months overdue), GOJO Industries Europe (GIE) reported an operating loss in 2021 of £5.7 million. This came after revenue had dropped by almost 50% that year to £57 million following a stellar 2020 when COVID led to a surge in demand.

GOJO provided the following media statement to Workplace360: “Our GIE business has struggled financially for over a decade, requiring significant, ongoing support from the US throughout that time. As a result, a strategic review of GIE was initiated using outside experts to find a sustainable, long-term solution. Many options to turn around the business or to sell it were explored, but regrettably, no viable option could be found.

“Winding down our European operations was only done after making very extensive efforts to achieve financial viability in the region. For European business customers, part of the wind-down process includes continuing to produce products in France in the immediate term and making existing inventory available. GOJO Industries is also exploring other ways to minimise disruption.”

UK acquisition for Trodat

Trodat UK has announced the acquisition of independent rubber stamp manufacturer ASAP Stamps. ASAP – which describes itself as the “UK’s largest independent rubber stamp manufacturer” – has been supplying stationers and printers for 40 years.

The successful sale of the Sheffield-based company also marks the retirement of Managing Director Nigel Eyre. Trodat said: “ASAP’s proven track record for delivering excellent products and services, combined with its expertise in the office products industry, has made it a perfect partner.” Trodat

UK Managing Director Stuart Login called the acquisition a “significant milestone” for both companies.

NEWS

6 WORKPLACE360 - JUNE 2024

Fujifilm launches A3 line-up in UK

Fujifilm Business Innovation has announced the UK launch of its Apeos A3 multifunction printers (MFPs). Fujifilm is a leading brand in Asia-Pacific but has had little representation in the office MFP channel in other regions since the end of its joint venture with Xerox in 2021. Now, it is bringing Apeos products to the UK.

Fujifilm has partnered with business solutions provider Aurora for the initial launch of the Apeos series in the UK, with further expansion planned through a partner channel business model. Westcoast will handle the distribution of supplies.

Taku Ueno, SVP, Device Technology Division at Fujifilm Europe, said the company has enjoyed “huge success” in Europe since its entry into the toner production printer business in 2021. He called the launch of the firm’s office printers the “natural next step”.

VOW and Commercial agree new trading deal

VOW and leading reseller Commercial have announced that terms have been agreed on a new multi-year trading agreement. The companies said the deal represents a major commitment from both parties and marks the continuation of a trading relationship that has lasted more than 30 years.

VOW Managing Director Adrian Butler commented: “Commercial had several competing options and we are confident they have made the right choice in choosing to partner with VOW again. We do not take the loyalty of our customers for granted and believe we have a compelling proposition to help Commercial grow and develop its business over the next few years.”

Paul Nicholson, Commercial’s Group Sales Director, added: “As we build the foundations for our business to £100 million and beyond, it is critical we have the right partners supporting our growth ambitions. We conducted an extremely thorough review of warehousing and transportation providers across the UK and Ireland. Following this, and with the support of many people across Commercial, we conducted a detailed tender process.

“We are delighted that VOW stepped up to the challenge and is clearly able to provide the technology solutions and overall wrap-around services we require, providing the best value for ourselves and our clients.”

Drakeford steps down

Simon Drakeford is standing down as CEO of EO Group. Drakeford joined the business in 2007, succeeding founder George Karibian as CEO.

During his time at EO Group, Drakeford has been actively involved in helping develop and shape the business products industry, including serving as Chair of the BOSS Federation.

EO Group will now be jointly led by two experienced execs: CFO Nick Wilson and COO Richard Sinclair have been appointed as co-CEOs. Drakeford – still a shareholder in the business – is not stepping away entirely: he will stay on as a senior advisor.

Langstane has confirmed that Mark Campbell will take over as Managing Director in June. The news is not a surprise. In January, current Managing Director Colin Campbell told Workplace360 he would be retiring after an incredible 50 years with the business, 37 of those leading the Scotland-based reseller.

Mark Campbell is the son of Colin’s cousin, Jack, and has already been with the organisation for more than 30 years. In that time, he has held several roles, most recently as the Director of the company’s Office Interiors division.

James Webb has joined the BOSS Business Supplies Charity as a trustee. He has worked in the industry for close to 30 years having joined Fellowes Brands in 1997.

Webb has held a number of UKbased and international roles and is currently VP Central Europe and European Marketing.

NEWS

MOVERS

SHAKERS

&

MD change at Langstane

New trustee for BOSS Charity

7 WORKPLACE360 - JUNE 2024

MOVERS & SHAKERS

Durable promotes Day

James Day has been named as Managing Director of Durable UK. Day has been with the OP vendor for almost six years and was most recently Sales and Marketing Director. He is on the committee of the BOSS Leaders of the Future initiative, was the 2023 winner of the Young Executive of the Year category at the European Office Products Awards and is one of the rising industry stars on OPI’s 40 Under 40 list.

Strategic

appointment at United

United UK has said the recent appointment of Finance Director Steve Johnson will contribute to its ambitious growth plans.

Johnson has extensive finance leadership and M&A experience at both private and private equitybacked firms.

Most recently, he was CFO at vehicle technology business Collision Management Systems, where he played a key role in its strategic repositioning and sale to US market leader Samba Safety.

Expanded role for Weedall

Martin Weedall has taken on extra responsibilities at OT Group’s (OTG) Spicers wholesaling arm. In addition to his role as OTG COO, Weedall is now leading all areas of Spicers that impact dealer customers. These include price, stock, service, operations, transport and customer experience.

Weedall joined OTG in 2022. Prior to that, he spent more than three decades at evo, where he held senior sales and operations positions across the VOW and Banner divisions.

Ambiente axes office supplies

B2B office supplies will no longer be part of the Ambiente trade fair in Frankfurt. Instead, Messe Frankfurt announced that going forward, its commercial office products offering would be focused on the Paperworld Middle East event in Dubai.

“In Germany and Europe, this market has been stagnating for years, driven primarily by digital transformation. In response to new market requirements, manufacturers are increasingly expanding their B2B office product portfolio by adding B2C stationery offers or looking for new distribution channels and sales markets for their office products,” Messe Frankfurt stated.

As a result, suppliers that were previously housed in the Ambiente Working expo in Frankfurt will now be encouraged to exhibit in other halls, such as Creativeworld in Hall 1 and the stationery/back-to-school-themed Hall 4.2. The Future of Work area will remain in Hall 3.1, but this is aimed more at the contract furnishings segment that targets the likes of architects, planners and commercial end users. Ambiente Working will still exist as a concept but will focus on smart office solutions (such as room layout and acoustics) in Hall 3.1.

No reference was made to the Remanexpo aftermarket print supplies event at Ambiente, but Workplace360 understands this will still take place despite poor attendance levels this year.

Acquisition for Westcoast

IT distributor Westcoast has confirmed the acquisition of components wholesaler Spire Technology. Based in the south of England, Spire reported sales of just over £103 million for the 12 months ended 30 April 2023 and traded with a gross profit margin of 6%. Founded in 1990, the company was majority owned by co-founder Victor Unt.

The deal for 100% of Spire’s share capital was completed in April and the business will now form part of the wider £4.7 billion Westcoast Group.

“There are so many benefits to the combination of Spire and Westcoast for both companies, vendors, UK resellers and employees,” said Westcoast Executive Director Alex Tatham.

“It will add significantly to Westcoast’s components portfolio. Spire will become the group’s main components pillar – with full access to all the customers, finance and tools that make Westcoast such a strong distributor in the UK and Europe.”

NEWS

8 WORKPLACE360 - JUNE 2024

Old Friends’ Spring Dinner welcomed The Stig

In April, the prestigious RAF Club in London hosted another memorable gathering of around 100 guests for the 2024 Spring Dinner organised by The Society of Old Friends.

The evening marked not only a celebration of camaraderie but also the inauguration of Workplace360 CEO Steve Hilleard as President of The Society of Old Friends. Meanwhile, Kelly Hilleard, Workplace360’s Operations and Finance Manager, is the organisation’s new Treasurer.

Founded in 1909, the networking group has honoured traditions while embracing modernity. This commitment to evolution was showcased as the President’s toast was written entirely by ChatGPT, highlighting the Society’s adoption of technological advancements and mirroring the dynamic nature of the industry it represents.

The highlight of the evening was welcoming former Formula 1 driver Perry McCarthy. Throughout the evening, he regaled attendees with tales of his battle to break into the world of professional motorsport and his time as the original secret

racing driver – The Stig – on the BBC’s long-running and popular Top Gear series.

McCarthy’s story is truly one-ofa-kind and had guests wide-eyed and eager to listen to the next uproarious adventure.

NEWS 9 WORKPLACE360 - JUNE 2024

Supplying success

From start-up to industry leader, ACS Group rewrites the rulebook, blending innovation with a steadfast commitment to culture, customers and community

In 2008, amid the economic turmoil of the global financial crisis, a bold venture took form: Amalgamated Computer Supplies, now known as ACS Group. Co-founded by CEO Mike Hussain and supported by Commercial Director Harry Stevenson, who had previously worked together at ISA (now evo Group), ACS launched with a clear mission to ‘amalgamate’ diverse skill sets and deliver office essentials to the SME market.

Today, the ACS board comprises Stevenson and Hussain, with Martine Box as Group Sales Director and Sacha Jones as Sales Director. Reflecting on the company’s origins, Stevenson says: “Starting during the recession might seem counterintuitive to many, but for us, it was perfect timing.”

In its formative years, ACS adopted a telesales approach, targeting primarily the SME sector – a focus that has not only persisted but also expanded as the company has grown. From a modest start, ACS has grown to employ 115 staff members, adopting a people-first philosophy integral to its corporate culture

and instrumental to its success. Stevenson expresses pride in the team, stating: “Our people are the core of our business. Their commitment and the robust relationships they forge with customers are the key drivers of our growth.”

ACS is committed to employee wellbeing and professional development, which has promoted high staff retention rates and a motivated workforce and, in return, enhanced customer service and satisfaction.

Each year, the company conducts a Q4 promotion, rewarding team members with a trip of a lifetime prize alongside celebrating outstanding achievements with “old school” awards such as Employee of the Year and Salesperson of the Year, together with more contemporary awards recognising Young Professionals. Stevenson notes: “We consistently go above and beyond to ensure our staff feel valued, and I believe this sets us apart from others.”

A few years following its founding, a significant shift in ACS’s approach came after venturing into the public sector. Says Stevenson: “Securing contracts with

1 NO. OF DOGS IN THE OFFICE

115 NO. OF EMPLOYEES

DEALER SPOTLIGHT - ACS GROUP 10 WORKPLACE360 - JUNE 2024

major entities like the BBC was a turning point for us. It provided the confidence boost we needed, prompting us to invest further in our capabilities and broaden our range of offerings.”

The transition towards the public sector signified more than just a strategic move; it mirrored the company’s burgeoning ambition and operational prowess. Over the following decade, ACS not only expanded its array of services but also strategically diversified its operations.

The introduction of managed print services, IT solutions and interiors was a natural progression aimed at meeting the increasingly complex needs of its clients. “We’ve always viewed our role as more than just suppliers; we see ourselves as partners who amplify our customers’ business efficiency. Expanding our services was a direct response to fulfilling that mission,” Stevenson remarks.

DYNAMIC DEVELOPMENT

The company underwent a rebranding, becoming ACS Group and restructured operationally into distinct ACS divisions: Office, IT, Managed Print, Interiors and Print. Stevenson highlights the significance of this rebranding: “The shift to ACS Group was pivotal. It harmonised our name with the expansive breadth of our services and laid the groundwork for future expansion.”

This internal reorganisation allowed each business unit to focus on deepening its expertise while still benefiting from the synergies within the larger ACS ecosystem. “It’s almost as if we’ve acquired five smaller businesses under the ACS Group umbrella,” Stevenson explains. “Following heavy investments in each area and robust marketing efforts to showcase this expertise, clients now place greater confidence in ACS to provide solutions across these diverse categories. We didn’t have that before.”

Crucially, this strategic reorganisation provides ACS with a cross-selling platform, which will be vital in moving forward with its ambitious plans to double the size of the business from its 2023 sales of £34 million – within a five-year timeframe.

Stevenson views this goal as achievable, especially with recent developments: “We have secured a position on the new Office Solutions Crown Commercial Service framework, significantly broadening our public sector opportunities. This placement not only continues our engagements with the police and the DVSA but also opens doors to influential bodies such as the MOD, central government, HMRC and the Home Office. The potential these partnerships offer makes us very confident about doubling our business.”

To date, all of ACS’s growth has been organic. While this doesn’t preclude the possibility of acquisitions, any such moves would need to align with the company’s strategic vision and integrate smoothly with the existing restructuring efforts.

INNOVATIVE HORIZONS

ACS is proactively positioning itself to achieve its ambitious growth targets by not only customising its offerings but also leveraging advanced technologies like AI. As a forward-thinking company, ACS has fully embraced technology to enhance operational efficiency and workplace productivity. The reseller recognises the distinct advantages of AI and automation and is committed to significant investments in both areas.

Automation will be utilised to streamline repetitive tasks, thereby reducing the need for manual intervention. However, it’s the incorporation of AI that particularly excites the ACS team. Says Stevenson: “We’re planning to use AI to assist in making complex decisions, analysing data and predicting behaviours. This will enable us to tackle challenges and stay ahead of those tech advancements.”

We’ve always viewed our role as more than just suppliers; we see ourselves as partners

Harry Stevenson

DEALER SPOTLIGHT - ACS GROUP 5 NO. OF SUSTAINABILITY GOALS SET EACH YEAR

ACS Group Commercial Director

£34 million FY2023 SALES 11 WORKPLACE360 - JUNE 2024

ACS’s initial foray into leveraging AI includes the introduction of a chatbot designed to enable clients to retrieve invoices, track orders and more, without needing to directly contact customer service. While some relevant expertise was already available in-house, integrating AI technologies has been a significant learning curve for the team.

To address this, ACS has invested in a local education programme, resulting in two new team members specifically skilled in AI. This strategic move enhances the reseller’s current capabilities and also commits it to ongoing training. This ensures the team remains knowledgeable about the latest advancements and stays competitive in a rapidly evolving field. Stevenson adds: “As integral as this is, we are determined not to lose the personal approach that remains fundamental to our success.”

EMPOWERING GOALS

While technology will aid in operational efficiencies, ACS has demonstrated adaptability in navigating the optimal logistical and supply chain strategies to support its growth. Initially partnering with Spicers and later transitioning to VOW as its primary wholesaler, Stevenson notes that while the relationship with VOW has been “instrumental” to ACS’s business over more than a dozen years, the company maintains strong ties with both Spicers and Exertis Supplies.

Although primarily operating as a stockless entity, ACS does retain a substantial warehouse. Stevenson explains that this facility gives them the ability to offer customers an extra layer of service, from holding bespoke stock to offering a full consolidation solution. Despite having a warehouse, ACS differs from many resellers in that it does not own any delivery vehicles. The majority of orders are drop-shipped by wholesalers, while shipments from its warehouse are handled by courier services such as DPD.

Stevenson elaborates on this choice, noting that initiating in-house delivery logistics would go against

the company’s vision and strategy and, more crucially, would contradict its commitment to sustainability.

“Throughout our 16-year journey in business, we’ve consistently acknowledged our environmental responsibilities. However, in recent times, we’ve taken a significant stride by ingraining sustainability into our core business strategy,” he says.

Now firmly entrenched in ACS’s operational ethos, the company has undertaken substantial green initiatives. These include a shift to solar power and a commitment to adopting an all-electric company car policy by the upcoming year. The approach is straightforward and impactful and includes five sustainability goals set annually as well as incorporating updates into review packages for every customer.

Furthermore, ACS has forged a partnership with Nick Hollis, an adventurer, motivational speaker and life coach.

As the ACS Group Ambassador, Hollis will contribute his expertise to assist the company in reaching its net zero target and sustainability objectives, while ACS supports his ambitious 721 Challenge – which involves climbing the seven summits, skiing across the North and South Poles and rowing across the Atlantic Ocean.

ACS’s efforts have not gone unrecognised. The company won Reseller of the Year at the 2024 European Office Products Awards – a testament to its impact and commitment to excellence. “Entering was initially about raising our profile, but winning this award goes beyond just receiving a trophy,” reflects Stevenson, “it’s confirmation that our strategies and dedication to our clients and sustainability are on the right track.”

DEALER SPOTLIGHT - ACS GROUP

12 WORKPLACE360 - JUNE 2024

ACS Group Ambassador Nick Hollis

Skyline shifts

WORKTECH Academy research reveals how global cities are creatively adapting to the evolving demands of the modern workplace and urban living

WORKTECH Academy’s comprehensive Cities on the Frontline of the Future of Work: Trend Report Q1 2024 survey of six urban centres – New York, London, Sydney, Tokyo, Buenos Aires and Madrid – reveals significant trends reshaping the global real estate landscape, driven largely by the adoption of hybrid work models. These evolving work patterns are transforming city economies, altering public transport usage and redefining CBDs.

A notable swing is the ‘flight to quality,’ whereby corporations are shifting towards smaller, more sustainable office spaces with superior facilities. This migration is leaving behind a considerable amount of subprime office stock, leading to a geographic realignment of business districts and rental increases in prime locations.

Furthermore, there is a growing focus on the adaptive reuse of buildings and a concerted push towards sustainability. This is particularly evident in cities such as New York and London, where outdated buildings are undergoing essential upgrades to meet strict environmental standards.

Despite this, the popularity of tall towers and mixeduse developments remains high. A core issue for all the cities is the acute shortage of affordable housing, leading to various solutions being explored, such as converting office spaces into residential units and expanding buy-to-rent schemes.

URBAN TAPESTRY

While these are global real estate market trends, local nuances provide distinct contrasts. For instance, New York is seeing a decline in its coworking sector, whereas London’s flexible workplace market is flourishing.

RESEARCH - FUTURE OF CITIES

14 WORKPLACE360 - JUNE 2024

Tokyo is looking to address its ageing infrastructure and commuting culture, while political and economic instability has stalled progress in Buenos Aires. Sydney is preparing for extreme weather events, while Madrid is balancing its budding digital economy with a traditional preference for in-person communication.

Across all surveyed cities, hybrid working has become a mainstream element of workplace culture, impacting how people work and interact within urban centres. The move towards high-quality, environmentally friendly office spaces is ubiquitous, with an increasing emphasis on creating vibrant, walkable communities. Workplace360 takes a look at what’s happening in our capital city.

LONDON

The London office market is embracing a renewed sense of optimism as a burst in leasing activities, including substantial transactions by corporations such as HSBC, signalled a robust end to 2023. This was not merely a recovery but a vigorous close to the year, driven by both a spike in demand and a significant supply squeeze.

Expected declines in interest rates are anticipated to spur investment levels, while a resilient surge in office jobs fuels expectations of rent increases, especially combined with a scarcity of prime location offerings.

London’s famed bouncebackability from major disruptions such as Brexit and the pandemic is once again evident. A notable resurgence in construction activity is marked by the commencement of 5.1 million sq ft across 43 schemes – the most substantial since 2005, as highlighted in Deloitte’s latest Crane Survey.

A CRITICAL JUNCTURE

Despite these positives, the transition to hybrid working models is now deeply entrenched, conceivably more pronounced in London than in other European cities due to long and costly commutes. It is transforming the office landscape, with the flexible space market not only recovering but also expanding its share.

Interestingly, the main driver is in managed space for larger businesses. Coworking spaces are evolving to increasingly cater to those organisations seeking to manage a workforce effectively, with many corporate occupiers blending traditional leased spaces with highquality flex spaces.

Meanwhile, the demand for environmentally sustainable office spaces is transforming lower-grade assets and shaping the design of new buildings.

These developments are predominantly aimed at attracting small to medium-sized tenants from sectors such as technology. The City of London Corporation is responding by easing regulations to allow the conversion of older, under-utilised buildings into spaces for cultural, educational and hospitality purposes.

London’s famed bouncebackability from major disruptions such as Brexit and the pandemic is once again evident

Geographically, the office market is witnessing significant shifts, which are about not only offering space but also enriching the user experience, emphasising the importance of comprehensive amenities that enhance both work and leisure. Traditional business hubs such as Docklands and Canary Wharf are seeing major firms relocate, with burgeoning interest in the West End, locations west of the City as well as areas such as Waterloo due to their social amenities.

IN A PICKLE

Still, the city faces ongoing obstacles. London’s positive real estate outlook is tempered by the realities of high interest rates and limited space for new developments, compounded by an excess of outdated, less sustainable office structures. Moreover, London is grappling with societal issues such as a stark lack of affordable housing, rising wealth disparities and increased crime rates.

In addition, the pervasive adoption of hybrid working models might dilute the centralisation that is crucial for London’s high productivity in knowledge-intensive sectors, risking the traditional dynamics on which its economic success was founded. This factor could impact sectors that rely on in-person interactions, such as professional services and the creative industries.

While London faces many challenges, its office market is dynamically adapting, underpinned by a shift towards quality and flexibility. The city’s enduring appeal, bolstered by its cultural heritage and diverse sectors, continues to make it an attractive hub for a wide range of industries. This resilience and adaptability underscore its reputation as an ‘unstoppable city’.

To read the Cities on the Frontline of the Future of Work: Trend Report Q1 2024 and watch the accompanying webinars, visit www.worktechacademy.com.

RESEARCH - FUTURE OF CITIES

15 WORKPLACE360 - JUNE 2024

Pushing boundaries

Nemo Office Club Managing Director Tim Beaumont shares insider details on steering the cooperative through significant transformations, including the integration of Office Club and evolving market demands. He also gave Workplace360 CEO Steve Hilleard his candid views on the strategic shifts that are shaping the future of workplace supplies

IN CONVERSATION WITH - TIM BEAUMONT

16 WORKPLACE360 - JUNE 2024

W360: How did you end up in the wonderful world of workplace supplies?

TB: Amazingly, over 43 years of work life, I have had 30 different roles across four industries. Some were more exciting than others. In the late 1990s and early 2000s, I was involved in three tech start-ups with venture capital-backed offerings. I should clarify that I was the business lead rather than a technologist!

Following my last business venture, I worked for three years at SCC, a £3 billion turnover IT services firm, in a senior European marketing role. After some time not working and my wife insisting that I get a new job, I got the opportunity to join Nemo with a mandate to grow the organisation; and nearly 13 years later, I am still here.

W360: You’ve obviously found your home.

TB: I believe so, and given my age, this role might very well be my last stop. The tech stuff was really interesting, but Nemo Office Club is a completely different beast. I effectively work for the members, who are essentially my bosses.

W360: So it’s a cooperative owned by the members?

TB: Nemo has always functioned as a cooperative where each full member holds a share and has a say in how we run things. I’m accountable to a board of executives comprised of members and these positions rotate.

However, the acquisition of Office Club introduced a hybrid model. It brought in many new members who, unlike our full members, don’t hold equity shares or the same level of sway over business decisions. While they may not have the same voting rights as the full members, they still have a significant influence on the way the business is run.

W360: What did the group look like when you joined?

TB: When I joined, there were 48 full members. That year, although it wasn’t my initiative, we launched the Evolve membership – it was designed to serve as a pathway to full membership, although it hasn’t quite turned out as we envisioned.

Evolve members pay reduced fees and enjoy a subset of the full member benefits. Then, in July 2019, we expanded significantly by acquiring Office Club. We now have 264 members.

W360: How many of the 264 members are part of Office Club?

TB: 140 members are originally from Office Club, with around 80 being retailers. It brought about a massive change to our business model and was not without challenges. But we always believed the fit was right for the two groups, and I am pleased to say that has been the case.

W360: What is your largest member size?

TB: Total revenue, our largest members hit around £60 million, but workplace-related sales are only part of their offering. We have a number with revenues between £5-£8 million, but our sweet spot is dealers between £1-£2 million.

W360: What would you estimate is the combined revenue of the membership your group handles?

TB: This is an elusive figure for all dealer groups, as many of our members also sell a breadth of product we don’t help them with. Our estimate is £350-£400 million end-user sales. Our tracked purchases are over £40 million.

Nemo has always functioned as a cooperative where each full member holds a share and has a say in how we run things

W360: There still are several dealer groups in the UK. Yours is probably unique with the retail element, but what are its other USPs?

TB: Our key differentiator really lies in our focus on membership engagement and frequent support and contact with our members and vendor partners. Recently, we brought Anne Cooper, an industry veteran, on board from Nectere to enhance these efforts. She now manages a significant number of our smaller members, ensuring they receive regular –often weekly – interactions.

While some may point to networking or marketing as a USP – both of which we do really well – I believe that the true uniqueness of Nemo Office Club lies in the active participation of our members in shaping the direction of our business. They are genuinely involved. We have a motto that rings very true: “Together we are stronger”.

IN CONVERSATION WITH - TIM BEAUMONT 17 WORKPLACE360 - JUNE 2024

W360: How would you describe the past few years in terms of performance for your members?

TB: Retail has faced challenges, notably the reduction in footfall in town centres, but they’re very entrepreneurial and we’re now working with a lot of them to integrate more B2B aspects. Some are embracing online and we’re helping them to build a new business from the back of the shop, so to speak.

With many people now hybrid working, some have initiated local marketing efforts such as leaflet drops to attract business customers from their areas. We’ve also worked hard to boost footfall through our Keep It Local campaign. On the B2B front, there are those that are hungry and want to grow and take on new ideas and those that don’t. I think dealers have fared far better than expected.

A senior executive at Spicers predicted five years ago that there would only be 500 dealers by this time, and clearly, that’s not the case. There are still a lot out there and, perhaps surprisingly, new ones starting all the time.

It’s a bit arrogant to expect to go and eat someone else’s lunch without a tremendous amount of focus and effort

W360: Did you lose many through COVID?

TB: A few, but not as many as expected. The government furlough scheme was extremely generous, which helped many businesses stay afloat. Last year, although we lost 20 members, we also signed up 25 new ones, so we ended the year slightly ahead. In Q1 this year, we had already signed up five new members.

W360: Where are you picking those up from?

TB: Well, one has come from the Nectere demise and the others are just part of our persistent new business drive. The wholesalers tell us that they trade with c1,400 companies per month, but just how many of them are traditional dealers, we don’t know. We believe there are probably around 200-300 not in a group, and that is where we focus our efforts.

W360: Given the emphasis on diversification, what has the journey been like for your dealers?

TB: It’s a bit arrogant to expect to go and eat someone else’s lunch without a tremendous amount of focus and effort. Diversification requires commitment and additional resources.

Historically, dealers have relied heavily on the wholesalers, which perhaps has made them less inclined to venture out on their own. So, in my view, it has been much tougher than everybody thought. Plus, I don’t believe the broadline wholesalers have been that successful.

IN CONVERSATION WITH - TIM BEAUMONT 18 WORKPLACE360 - JUNE 2024

When I first came to this industry, wholesalers might have handled 70-80% of a dealer’s business, but this is no longer the case. Now, dealers are diversifying, sourcing product and exploring other suppliers to broaden their product offerings. Workwear – especially personalised workwear – is an area where we’ve seen significant interest and growth among our members.

Furniture is an interesting one. It experienced a lull during COVID but surged afterwards as companies revamped their office spaces, with furniture-led dealers doing really well. Our dealers have also seen new business growth in the medical, first aid and hygiene sectors, as well as some success in areas as diverse as tools and grounds maintenance.

W360: Technology must play a significant role in supporting those dealers who are successfully diversifying. How widespread is e-commerce adoption among your members?

TB: I think most of what we refer to as websites are actually customer portals. Most require a login and the pricing displayed isn’t particularly attractive. If dealers use it to interact with individual customers with their pricing, it’s not a website. Increasingly, I believe dealers need to offer visibility of pricing and an option to purchase for non-account visitors.

We’re offering a sort of hybrid model. However, there is still an insistence among many dealers that they would prefer not to have the orders online and instead talk to customers, with the option to upsell and maintain a personal touch.

For me, an online sale has many benefits, with lower cost of sale and non-negotiable price being two such examples.

W360: Customers probably want both options.

TB: In 1999, I was involved with an ad agency that went into what it called ‘new media’ and we were explaining the capabilities of websites. Fast forward to today and platforms such as Amazon have perfected the art of recommendations, ie ‘customers who bought this item also bought…’.

However, in our industry, I believe we are still a long way behind in terms of introducing recommendations and cross-selling on websites. Similarly, there is scope for increasing search functionality to make it easier for website visitors to self-serve better online.

W360: Maybe that’s where AI will come into play.

TB: I’m sure it will, yes. We’ve got a couple of big online players and it’s still challenging for them to get new customers. The cost of acquisition is becoming increasingly expensive, PPC is tough in an industry like ours and SEO takes a long time. Not every dealer is ready to dive in, so we’re moving incrementally in this direction.

Coming from a technology background, I find AI fascinating. We’ve started integrating AI tools, so our managed service for email marketing and social

media has drastically changed. These tools have transformed these services into highly personalised experiences with unique images and text specific to each dealer’s customer base.

W360: Let’s focus on dealer groups. Does it surprise you there are still five groups, excluding Office Power, Unity and those sorts of entities?

TB: Yes, it is surprising – especially when you look at trends globally, like in the US or Australia. You would think it is inevitable that consolidation will happen here too; having acquired Office Club, we are not averse to the idea of further conversations if it was right for all involved.

Why hasn’t it happened? I think there needs to be an appetite for it. There were challenges when we took on Office Club due to the different company cultures and approaches.

Ironically, the pandemic helped us bridge some of these gaps. We furloughed some staff, which left a core management team of five who met twice daily, and we started to get to know each other better and really bonded as a team and identified the key services and support needed across the diverse range of members. It changed the dynamics and we started to build one culture.

W360: A central issue must be the tangible benefits for the members in any potential consolidation.

TB: Precisely. The most important stakeholder has to be the members. I can see great benefits in the merger of certain groups, with the potential for significant buying power to approach wholesalers and suppliers with strong negotiating leverage. Consolidating two existing groups could pack a real punch in negotiation terms with the supply chain.

As previously mentioned, we are a cooperative owned by our members and at the end of each financial year, surplus funds – which in all of my time here have exceeded membership fees – are returned to the members. It’s why we exist: to make our members more profitable.

I believe in other groups, the surplus is held on to centrally. If we were to do that, our membership would quickly ask what the plans were for that cash.

W360: Having said all that, you’ve all come together recently as part of a BOSS Federation special interest group. What do you hope to achieve?

TB: There are benefits to collaboration. In my view, we need far more dealer involvement in BOSS to make it a more rounded organisation. As dealer group heads, we have all come together and are pretty open about the challenges – which are the same, unsurprisingly.

Although we haven’t established any concrete plans yet, it’s good to talk to everyone because we typically sit in our silos and don’t really get involved with each other because we’re competitors.

BPGI serves a similar purpose to some extent, as Nemo Office Club, Superstat and Integra Business Solutions are all members, so I do engage with them.

IN CONVERSATION WITH - TIM BEAUMONT 19 WORKPLACE360 - JUNE 2024

W360: Is BPGI still a relevant organisation? We don’t hear as much about it as we used to.

TB: It was a much bigger organisation when the US and Canada were involved. It now comprises 12 members with 16 supporting vendors. It has combined sales of €3.5 billion, 2,700 dealers and over 1.5 million end-user customers, so it is still a very significant outfit. We derive a lot of value from it and I get to spend time with those running businesses across Europe. I’m fascinated by the idiosyncrasies and challenges they face, which provide great insights we can use for the UK market. It’s an advantage when planning our marketing and strategies for our members, as we can engage with the research and activities of a much broader section of our industry.

From a manufacturer’s perspective, we all benefit from a joint Europe-wide marketing deal. Best practice sharing and engaging with peers at that level are huge value-adds for me and help reassure the vendors they are getting their products presented to end users in the way they know best generates sales. I think it’s still an exciting organisation.

W360: What are your thoughts on the changes from some vendors, such as moving towards direct-toconsumer models and launching their own websites?

TB: Vendors will always need the independent dealer channel, but they do have frustrations that the messaging they put out doesn’t always get to end users. To be fair, other parts of our channel embrace multichannel strategies and I can understand why vendors seek these opportunities.

However, they need to be careful not to help destroy us when they struggle to control pricing models with the likes of Amazon etc. Traditional OP is in decline and we all need to find new products and customers to survive and thrive. Some vendors only get the wholesalers to stock some of their product range, so presenting the whole list seems a good option.

W360: Are you surprised there hasn’t been more collaboration with cooperatives in other industries, such as cleaning, catering or workwear?

TB: It’s an interesting subject. We’re aligned with Network Group in the IT sector and both are part of Nexus – a coalition encompassing dealer groups from various industries with a similar ethos.

Network Group has evolved from hardware sales to becoming a managed services provider, which slightly broadens the gap between our operations. Despite this, we still collaborate on significant aspects. The services we provide to our members are very similar to theirs, so we could easily combine the two for mutual benefit.

I’ve also explored potential synergies with the building industry groups due to product crossovers we could sell to businesses. The groups in this industry are huge because every transaction goes through them.

W360: You mentioned the Keep It Local campaign earlier. Can you update us on its progress?

TB: It kicked off about three and a half years ago.

Other parts of our channel embrace multichannel strategies and I can understand why vendors seek these opportunities

The campaign originated when the government advocated for £1 in every £3 to be spent with small businesses and we felt sure that was not happening. Our members were certainly not getting their share of the pie, so we took that to heart, reaching out to figures such as Michael Gove and even then-Prime Minister Boris Johnson.

As expected, we did not get a response; but we used the dedicated website to encourage dealers and other businesses to contact their local MP for answers and to advocate their support for keeping it local – it definitely created noise, with great feedback from some MPs.

But Keep It Local has become so much more than that for our members – their proximity to their customer base and the fact that every pound spent locally generates wealth and circular economic benefits means this has really become the cornerstone of our marketing. We even use the umbrella brand to generate sales for our members in services such as EV charging, providing new prospects for their everyday consumables business.

Keep It Local aligns clearly with sustainability goals for businesses by promoting local trade and bringing many social and environmental benefits. We provide our members with the marketing tools to become the Keep It Local ambassador in their area, encouraging other companies in the community to get involved. These include a fully branded Keep It Local gazebo sponsored by key suppliers that members take to community and business events to promote their services and really shout the message.

W360: Let’s move on to the current state of the industry. I want to touch on Nectere first. What are your views on what unfolded there?

TB: The end part was terrible. I mean, no communication from the people who invested in the business. Who made that decision?

And then the way the staff were treated… Over 40 employees left to seek redundancy assistance from the government. From all the stories I hear, it was executed very poorly and some people should be ashamed of their behaviour.

W360: With the recent turbulence in the wholesale sector, what’s your view on this channel?

TB: Since I’ve been at Nemo, we’ve maintained a stance of being wholesaler-neutral, aiming to forge strong ties with all the major players – VOW, Spicers and Exertis Supplies – to ensure our members have

IN CONVERSATION WITH - TIM BEAUMONT 20 WORKPLACE360 - JUNE 2024

the best possible opportunities with the wholesaler that is right for them at the time. I firmly believe that competition is good for business and if we could have all three major wholesalers succeeding, that would keep each of them striving to outperform the others. That can only be good for our members and all independent dealers.

In recent years, VOW has been in a comfortably dominant position and should receive some credit for adjusting to survive where others have faltered. But in the long term, a lack of competition can lead to complacency and we do not want to see that. Our members need strong and reliable support from their main wholesaler.

Exertis Supplies shows great ambition with the recent move to an expanded warehouse but seems to have discovered that such a large-scale action rarely goes without its issues. While knocked back a couple of steps, I am confident it will more than bounce back and be a good option for dealers.

I would love to see Exertis expand its offering and become even more diverse, but it has a very defined model, which works well for it, and we maintain a very strong relationship.

As the first group to agree on a deal with the new-look Spicers, we also have a significant relationship with it. I remain hopeful it can overcome its challenges and become a serious player in the market once again.

I am pleased to see the wholesalers turning their focus back to what they do best – providing an excellent distribution service and letting the likes of Nemo Office Club provide the marketing support.

I must say, however, I was a little taken aback by the comments made by Andrew Gale in your recent interview [read In conversation with, March 2024, page 18]. I don’t think dealers are happy with evo’s acquisition of Complete. If you’re a dealer in a town where Complete made one of its acquisitions, by the law of the jungle, if it had gone bust, you would have gained some of that business.

The idea that that company was picked up by one of your own suppliers is a difficult pill to swallow. It is important that independent dealers feel that the industry is on their side and fighting for them.

W360: I don’t have insight into evo’s strategy, but I doubt they are actively looking to acquire resellers.

TB: One of the biggest challenges we face is dealing with members who come to us saying that they have come across VOW customers’ websites where they can buy tail products cheaper than their own cost price. There are already VOW-owned resellers out there. I have never come across an industry with such little pricing discipline and vastly fluctuating costs on individual items.

W360: With a decline in purchases from traditional wholesalers for most dealers, what kinds of relationships have you and your members formed with wholesalers in adjacent categories?

TB: We are working with our members to diversify their offerings and learn how to sell products that fall outside of their natural comfort zone.

We currently have 110 vendor partnerships that dealers can tap into, with these direct sales showing

IN CONVERSATION WITH - TIM BEAUMONT 21 WORKPLACE360 - JUNE 2024

a 30-40% year-on-year increase. We have started working with a tools supplier (hardware, hand tools, power tools, etc), for example, and this has highlighted the challenges of entering new categories and obtaining the required data and pricing structure to introduce the range into a dealer’s offering. But it needs to happen to grow business away from traditional OP.

We also work with our supplier partners to get the message across about their full range, which often extends into categories beyond the top-selling lines featured by the wholesalers. Without a direct account with the likes of ACCO Brands, Beeswift or JGBM, to name just three, dealers can only access a fraction of the products available to sell.

We’re also increasingly focusing on services that generate ongoing revenue and customer loyalty, aiming to establish more sustainable income streams for our members such as print supply, charge point EV installations, drone hire and even cleaning contracts.

It’s not all doom and gloom. There is a future; and for those that diversify and win more customers, it should be rosy

W360: Shifting to a couple of macro issues: how do your members approach sustainable purchasing in light of growing environmental concerns?

TB: We are very clear about helping our members achieve their sustainability goals where we can. We are not currently in the position where we offer a complete programme, but we have a ‘CSR Demystified’ scheme which takes the fear out of delving into the subject.

We assist members in creating and marketing their own CSR strategy. Our catalogue has evolved to clearly identify greener products and our purchasing team is collaborating with suppliers that can deliver an environmental benefit to our members and their customers. Working closely with the Durrell Wildlife Conservation Trust, we have our own brand copier paper that provides financial and awareness support for the organisation. It also helps members to integrate sustainability into their own strategy and take their first steps on the journey.

We have members much further down the road with carbon offsetting goals in place and sustainability accreditations and use these at the forefront of their offerings. These dealers are always willing to share their experiences and explain how to do the right thing.

W360: Addressing the perception of our industry as ‘male, pale and stale’, how can we better attract young talent starting their careers?

TB: Our organisation is pretty balanced, although I see attracting and retaining young talent as core and key. Outside of work, I actively engage in mentoring young professionals. I’m committed to it, but feel something has changed with young people in their attitude to work, work-life balance and company loyalty. The transient nature of their stay in our industry – often around two to three years, especially in roles such as marketing –presents a real challenge.

W360: To wrap up, what’s your perspective on where we’ll be five years from now?

TB: I’ve been very fortunate in my career to have had loads of exciting, challenging assignments. I may not be around at the helm of Nemo Office Club in five years, but I think the industry will adapt to the circumstances – although I don’t see any radical shifts in the model any time soon. No disrupter is about to launch, so I think we will continue as we are.

The independent dealer has incredible survival and entrepreneurial skills and I believe together, we will overcome the decline in traditional product sales and continue into the future.

Proactive members are still making money, although not like the good old days. They are very tenacious and adaptable, so I think the best will thrive. I am confident that Nemo Office Club will still be around, either on its own or as part of a supergroup.

We will find other products and services to sell, and I hope that new, young blood will come into our industry. It’s not all doom and gloom. There is a future; and for those that diversify and win more customers, it should be rosy.

IN CONVERSATION WITH - TIM BEAUMONT

22 WORKPLACE360 - JUNE 2024

Join us in the magnificent dining hall at King’s College, Cambridge, for a delightful evening filled with entertainment, delicious cuisine and exceptional networking opportunities SAVE THE DATE 26 March 2025 The BOSS Business Supplies Charity Centenary Celebration & Patrons’ Dinner A special celebration for a very special occasion

Workplace360 asked ECI for an update on its Eco Aware standards

An infusion of data

ECI Software Solutions’ FusionPlus software is considered critical infrastructure for many industries. It enables suppliers to empower dealers to sell more of their products by converting raw product data into enriched, fully attributed, e-commerce-ready content. This refined content is compatible with 95% of existing software platforms used by dealers.

FusionPlus continues to invest in and grow its offering by adding more supplier catalogues. As part of this effort, we’re working to provide dealers with more products that meet the new ‘Eco Aware’ standards. This initiative aims to equip the dealer community with a broader range of products with a degree of inherent sustainability, ensuring they can confidently purchase products and offer solutions that embody a commitment to environmental responsibility.

The FusionPlus database now includes over 44,000 products carrying the green Eco Aware designation. Our ongoing mission is to continue encouraging manufacturers to provide as much eco-friendly data as possible so it can be used to create a set of standard filters applicable to each product type.

GREEN BUYS

From a product point of view, vendors typically update their product data weekly, monthly, quarterly or on an ad-hoc basis as new information becomes available, ensuring that FusionPlus is up to date. However,

James Stacey is FusionPlus Solution Consultant at ECI Software Solutions

James Stacey is FusionPlus Solution Consultant at ECI Software Solutions

assessing whether a new product meets the Eco Aware criteria can pose challenges. Some products may not be immediately recognisable as eco-friendly or might not naturally fit into the ‘green’ category, making it difficult to ascertain their environmental credentials.

Our ongoing mission is to continue encouraging manufacturers to provide as much eco-friendly data as possible

As customers increasingly look to tip the balance of their product purchases towards environmentally friendly offerings, it’s even more important to incorporate sustainability data wherever possible. Many are now making purchasing decisions based on the environmental impact of products, so providing comprehensive information can significantly influence their buying choices.

I am a member of the BOSS Environmental Forum, which provides businesses with trusted and accurate information. We evaluate eco-friendliness on a productby-product basis. Any product deemed to be ecofriendly will qualify for an Eco Aware label, which helps many customers decide which items will count towards their internal sustainability goals.

QUALITY QUEST

The Forum works closely with suppliers to establish consistent criteria for the Eco Aware designation. However, to reach the level of effectiveness we aspire to, the amount of information we receive about the environmental attributes of a product needs to improve.

SUSTAINABILITY - ECO AWARE

24 WORKPLACE360 - JUNE 2024

It’s important to recognise the great deal of progress already made. Currently, there are 35 criteria used to assess whether to grant a product Eco Aware status; and as our initiative gains traction, we expect this number to increase. While only a few of these criteria may apply to every product, it’s crucial to consider the diverse range of items we evaluate – everything from printer ink to mower attachments.

To enhance the meaningfulness of the Eco Aware label, considerably more detailed information is required. The data we currently receive is good, yet it remains insufficient for comprehensive assessments.

For example, to determine whether a product has eco-friendly attributes, we typically ask if it contains plastic and, if so, whether it is recyclable, already recycled or refillable. These aren’t especially difficult questions, but we often encounter gaps in the responses.

To enhance the meaningfulness of the Eco Aware label, considerably more detailed information is required

FusionPlus incorporates products ranging from paper clips to forklift trucks, each embodying a very different set of eco-friendly attributes that are searchable. When a website doesn’t facilitate easy searches for specific criteria, it can hinder end users from finding exactly what they need.

FUNNEL VISION

Ideally, dealers want a way to filter products based on very specific eco-friendly or Eco Aware criteria. It means we need to decide and define a consistent set of standards applicable across a wide range of products. To achieve this, FusionPlus is working with the BOSS Environmental Forum to establish these essential guidelines.

Such an endeavour requires careful consideration as dealers do not wish to include a sprawling list of random or irrelevant ecofilters on their webstores – it’s just not practical. Therefore, obtaining accurate information from manufacturers is imperative to meet customer demands effectively.

It is only by having the correct, comprehensive and most current product details that FusionPlus can provide useful filters that buyers can apply. This enables them to make well-informed choices about their purchases – considering not just a product’s functionality and applicability, but also its environmental credentials.

subscribe TODAY We don’t judge you for not wanting to share your copy of Workplace360. Get your colleagues to subscribe so they can have their own Workplace360 magazine – it’s FREE Visit workplace360.co.uk for more details and to subscribe for free 25 WORKPLACE360 - JUNE 2024

Since the second part of our interview with evo CEO Andrew Gale was published (read On stable ground, Workplace360 April/May 2024, page 20), the group and several of its individual subsidiaries have filed their 2023 accounts with Companies House. A chance, therefore, for us to circle back to Gale and get his take on evo’s progress – from a financial perspective – during his first full year as CEO.

Gale prefers to look forward rather than back, but – as he stated in evo’s strategic report – the 2023 accounts are “an important set of results for the group” and they clearly demonstrate the business is heading in the right direction.

Starting with the overall group results – which include the VOW, Banner, Complete, Premier Vanguard and Staples trading divisions – 2023 revenue was £505.1 million, up from £442 million in 2022. The increase was mainly driven by the addition of Complete, although higher demand and price increases at Banner and Premier Vanguard also had a positive impact on the top line.

As Gale notes, a key metric for a private equityowned business is EBITDA, and this is used as the main profit measure at evo. In 2023, the reported EBITDA was up by 50% to £15.1 million. This included a £3.5 million loss at Complete and results-driven bonus payments that were not made in 2022. Excluding these factors, underlying EBITDA was just over £20 million compared with £10.1 million in 2022.

An important factor behind the vastly improved bottom line was evo dealing with the impact of high cost inflation. “I understood our suppliers needed to pass through higher costs to us, but we, therefore, needed to pass those costs onto our customers,” says Gale. “However, for some of our channels, such as Banner,

evo by numbers

Workplace360 takes a look at the 2023 financials from evo and some of its key priorities for this year

that is harder to do than in others. We fell behind in 2022, but were able to catch up last year.”

He adds: “The job now is to keep up with inflation as we move forward.”

FILLING THE GAPS

The largest individual business in the evo portfolio remains VOW, with sales of £226 million and a much improved EBITDA of £10.4 million (£5.1 million in 2022), with better margins and lower operating costs driving the improvement. Stock fill rates were also up, growing from 92.9% in 2022 to 95.7% last year, very close to where Gale thinks the level should be. As he notes: “A 99% fill rate tells me we’re investing too much cash in inventory; if we’re sub 93%, the phones start ringing.”

The job now is to keep up with inflation as we move forward

Gale has learnt plenty from what and how Complete was buying and saw gaps in the VOW model which needed filling. Initiatives have included the introduction of a new 7,000-8,000-SKU workwear range in 2024 and the creation of a VOW Specials department that, in the first quarter of 2024, already surpassed VOW’s total specials sales for the whole of last year.

Banner is second in revenue terms and also had a good year in 2023. Sales were £179.1 million, a yearon-year increase of almost 5%, while EBITDA (before exceptional items) rose by 50% to £6.8 million.

In addition to the pricing measures already referenced, Banner took action to drive down its cost base during the year. Staff numbers were reduced by 15%, with the number of employees in 2023 standing at 404 versus 473 in the previous year.

Banner’s management report referred to “critically [reviewing] our resources in legacy areas”. Explaining

26

TALKING POINT - EVO RESULTS

WORKPLACE360 - JUNE 2024

this, Gale says he is willing to invest in categories across the sales channels that have positive growth prospects.

Today, these include areas such as facilities supplies, furniture, workwear, paper and feminine hygiene – the latter a start-up category in 2023 which is predicted to grow materially this year. On the flip side, segments that are expected to decline may require the headcount investment to be “revisited”. For the CEO, this ties in with a change of mindset (at group level) over the past couple of years regarding category diversification and resetting the business.

“Broadly speaking, it’s about providing anything an employer is prepared to pay for,” he states. “Whether it’s PPE, a lever arch file or a box of chocolates, we’ll do it –as long as a product fits our distribution model.”

Readers may be surprised to learn that, currently, only around 20% of evo’s sales are what would be classified as ‘traditional stationery’.

A GOOD BALANCE

The beginning of 2023, of course, saw the acquisition of Complete. While its numbers have not officially been filed yet, Gale told Workplace360 that approximately 80% of Complete’s revenue was retained. The purchase price was recovered through trade debtors and the sale of the opening stock. The cost to evo has been the – not unexpected – trading loss and exceptional items in the early months following the buying of the reseller.

Today, the business is on a stronger footing. A lot of integration and property rationalisation work has taken place over the past 12 months and is now almost finished. The company was on budget in March, and Gale expects it to be EBITDA positive this year.

It’s about providing anything an employer is prepared to pay for

“We made the right decision [acquiring Complete], but a lot of blood, sweat and tears have gone into rebuilding it,” he notes. “Taking a business out of administration and fixing it is never easy, especially when [competitors] are vying for its people and contracts.”

Gale believes Complete brings a better balance to evo’s direct operations. The same can be said of the Staples online business, which is set to be one focus area for the group this year. A longer-term licensing deal for the name has been struck with Staples in the US and evo will now look at tailoring the product offering more towards consumers, which make up about two-thirds of the Staples UK customer base.

Something else to look out for over the coming months is further acquisitions. Gale confirms there are several deals in the pipeline, and he is hopeful of getting them finalised before the year is out.

In the meantime, evo began 2024 with its best-ever month as a company, and now it’s very much a question of Gale and his team looking forward with a growing sense of confidence.

TALKING POINT - EVO RESULTS

evo CEO Andrew Gale

27 WORKPLACE360 - JUNE 2024

Workplace360 spoke to Jason Kinsey, founder and Director of Flashy Cactus about its fresh approach to sourcing product specials

A touch of flash

Workplace360: Before we talk about the business, can you tell me more about your career background?

Jason Kinsey: I grew up in Zimbabwe and in 2006, left the country and moved to Yorkshire, where I went straight into a sales executive role with an IT reseller. Afterwards, I joined ISA – now evo Group – as Specials Manager, followed by a two-year stint as a Product Manager at VOW. Jump forward around 15 years when I founded Flashy Cactus in 2021 and the rest is history.

W360: In a nutshell, explain what Flashy Cactus does.

JK: We offer the only specialist sourcing service for the business supplies trade. Dealers can – and do – speak to us about their weird and wonderful requests, usually involving products that are not available from their current suppliers. The team then takes the information, finds what they’re after and delivers most orders directly to the end user.

A valuable part of what we do is getting to know what our customers want and their key drivers. I am fortunate to have the ongoing support of Andrew Tsierkezou, co-founder of Bluesky T, who acts as a Flashy Cactus brand consultant and works directly with dealers to build lasting partnerships.

I’m very proud that we can almost always provide a clear and concise quote within 24 hours of the original request, along with estimated delivery times. Basically, Flashy Cactus is a sourcing specialist on steroids.

W360: That’s one way of defining your USP.

JK: Yes, it’s certainly unique. We’re also the only sourcing procurement business of its kind because we simply source specials, meaning the team is never distracted.

W360: What is your absolute priority when serving your customers?

JK: We must be a one-stop shop for dealers to find all the workplace products their customers are buying. This way, dealers can save time by not having to hunt around shopping online. We’re here to help dealers give their own clients exactly what they need to run a business. Additionally, instead of upfront costs, we offer a credit account with 30-day, end-of-month terms, so dealers can manage their costs more effectively.

W360: Moving on to challenges, have you or your customers faced any drawbacks?

JK: It goes without saying that the industry is constantly

evolving, and everyone has had to adapt. Wholesalers have had their problems and macroeconomic challenges have led to volatile dealer confidence. That said, the wholesale channel remains crucial to our industry and should be supported.

Dealers are crying out for access to more products, but managing more items comes with its own obstacles. That’s partly where we come in because they don’t need to work with hundreds more suppliers to sell thousands of additional products. Instead, they can leave it to us.

While I’m less familiar with manufacturers, I’m aware of the difficulties small businesses have encountered when trying to deal with them in the past. Ten years ago, everything had to go through wholesalers, but not anymore. Over the past three years, I’ve seen manufacturers becoming open to building relationships; we now have lots of direct accounts and are opening up new ones all the time.

W360: In difficult times, businesses can turn to price-centric selling, but you warn against it.

JK: The temptation to rely solely on price as a selling point can lead to negative consequences, from commoditisation and removing distinguishing features to undermining product value and brand image. We’ve seen our bigger customers rise to the challenge, selling on quality of service instead of product cost.

W360: And finally, do you offer any extra resources for dealers?

JK: Alongside our sourcing service, we offer free marketing assets and advice that can be downloaded at flashycactus.com.

INTERVIEW - JASON KINSEY

28 WORKPLACE360 - JUNE 2024

Safe as houses

The performance of the safety and workwear category has been mixed over the past year, but product development has many vendors enthusiastic about the future. By

Kate Davies

Players in the safety and workwear category have been treading water post-COVID. Following a surge in orders of safety equipment and PPE during the pandemic, the market experienced an influx of surplus stock between 2022 and 2023. Fast forward to 2024 and the increased focus on digital solutions and sustainability marks a step towards market growth for those open to modernisation.

One reseller that has made considerable progress in its goal to become a frontrunner in the safety category is Lyreco. The group’s Safety Business Director for the UK & Ireland, Helen Moran, says the brand evolution from Lyreco Safety to Lyreco Intersafe in April this year was a significant milestone for the UK and Ireland arm of the business.

She explains: “It isn’t merely a change in name. By merging Lyreco’s service excellence and sustainability

initiatives with Intersafe’s 90 years of safety expertise, we’re better equipped to cater to our customer requirements both locally and throughout Europe. Focusing on the UK and Ireland, we’ve solidified our position as a reputable contender in a mature market.”

Durable UK has also strengthened its place in the category, with its access control and signage product lines seeing steady growth over the past 12 months. Marketing Manager Aksela Kolodziejczyk feels positive that Durable UK’s offering reflects current trends, which she sees continuing for the next year.