THE HIGHS, THE LOWS, THE GRIT AND THE GLORY

365 DAYS IN THE ROA

Annual Report 2019/20

365 DAYS IN THE ROA

Annual Report 2019/20

The Coronavirus pandemic and associated quarantine provisions led to the postponement of the ROA Annual General Meeting originally scheduled to take place on 30th June 2020.

Recent Government legislation, the Corporate Insolvency and Governance Bill Act 2020, gives organisations the temporary right to undertake an Annual General Meeting in a virtual manner, making use of online meeting and voting systems.

Notice is therefore given that the 76th Annual General Meeting of the Racehorse Owners Association Limited (the company) will be held on Thursday 3rd September at 12.00 for the following purposes:

To receive, by way of Ordinary Resolution, the nominations of the Board for President (Charlie Parker) and Vice- President (Chris Wright) for the coming Year.

To receive, by way of Ordinary Resolution, the results of the Election to fill vacancies on the Board.

To confirm and adopt, by way of Ordinary Resolution, the Report and Financial Statements for the year ended 31st March 2020.

To appoint, by way of Ordinary Resolution, RSM UK Audit LLP as auditors in accordance with Section 485 of the Companies Act 2006 [as amended].

To authorise, by way of Ordinary Resolution, the ROA Board to fix the remuneration of the Auditors.

To represent and protect the interests of owners through rigorous advocacy of racing and its benefits.

To promote ownership for the good of the sport we love, across the racehorse owning world.

To attract people of all ages and backgrounds to the owner community by making ownership more rewarding and the racing experience more elevated and exciting.

And to ensure that the sport is a stimulating, sustainable part of the UK’s social fabric – driving up standards, improving welfare, participating in charitable activities and developing its funding.

My last communication to you, the members, is one of mixed emotions. It is tinged with sadness that my time at the head of this great racing institution has come to an end. It is filled with joy that truly believe this organisation is making a difference for owners and to racing, daily. And it is filled with hope that, with the challenges we face as a country, our sport and bodies like the ROA, can work together for the future of Racing.

COVID-19 and the suspension of racing has brought significant issues for owners and participants across the sport. These are challenges that I believe the sport can overcome, as it always has in the past. When became President, my aim was to strengthen the operational foundations of the ROA and allow it to grow in the future. Today, believe this organisation has never been better placed to fight for owners and tackle the big questions as a balanced, independent voice in the industry.

Since my election in 2015 we have undergone a transformational change operationally, grown our membership to an all time high of 8,200 and are represented on the Board of the BHA and the Horse Welfare Board. We have brought owners closer to racing, we have made an owners racecourse experience better in many places and we have put horses first with continued extraordinary welfare work in collaboration with the industry. Most of all, we have grown an organisation that works hard for its owners and can continue to do so throughout and beyond this crisis. This has been achieved through graft and an attention

to detail, both organisationally and within our membership, focussing in on a number of initiatives that have fundamentally changed ownership and laid the foundations for a brighter future. For me, putting in place a strong ownership strategy to grow racing’s ownership, its financial lifeblood, has been vital for the ROA and for racing.

The industry ownership strategy, funded by the HBLB, has seen the implementation of a more objective and robust independent racecourse Industry Ownership Quality Mark which runs in parallel to the ROA Gold Standard Award; monthly Industry Ownership Racedays; ownership-focused training to the industry; Racecourse workshops highlighting the expectation of owners on a raceday; ROA Raceday Liaison to support owners and the racecourse on a raceday; and developed a leasing proposition with the TBA.

Prize-money – I am proud to have vehemently defended the importance of prize-money for our owners. Our sport is bigger than prize-money, yet as the main source of redistribution of income in our sport we cannot let it be eroded or unbalanced. The Appearance Money Scheme, developed with the BHA and racecourses has improved returns at the middle and lower tiers of racing and ensured that owners see some reward for their passion.

Equine Welfare – for so many owners, the love of the sport comes from a passion for the horse. As the ROA has looked to engage on the big issues facing racing, welfare has become a primary concern I was determined to address. We have to ensure, to guarantee ownership in the future

and younger generations engage with our sport, that we ensure the welfare of the animals that make our sport. am so proud of what has happened with our membership of the Horse Welfare Board and other initiatives ensuring that the ROA remains central to the development of the sport’s equine welfare policies. As a modern, representative body the ROA has a strong future, it has expanded its horizons to ensure that it properly addresses the issues that matter to owners and affect the future of our sport.

am incredibly proud of what has been achieved during my time and alongside such fantastic board members. I would also like to thank the extraordinary team and leadership at the ROA for all their support and ability to execute ambitious, challenging projects for our members and our sport.

That work will continue with an updated team after my tenure. Alongside the new President, Charlie Parker, owner and trainer Gay Kelleway will join the Board adding additional breadth to the Board’s wide horseracing experience. would like to thank Sally Bethell and Paul Duffy, who retire from the Board alongside myself, for their service and invaluable contributions to the work of the ROA.

look forward to supporting the ROA in the years ahead and I am confident the team will tackle the pressing issues facing our sport head on with the zeal they always have done. There is great work underway and long may that continue, for owners and for racing.

This year has seen the ROA move from strength to strength, delivering against its strategic objectives, delivering against member’s expectations and delivering for racing as a whole. For us, it has been a year of ever closer collaboration with racing’s stakeholders to get the best result for racing. This extraordinary work, modernising our organisation, collaborating across racing and ensuring we truly represent the interests of owners and of racing, stands us in good stead to tackle the significant challenges our industry faces now and in the future.

Last year we set out several strategic objectives and am delighted we have delivered against many of them. These objectives, ranging from welfare to working to improve funding, to better engagement with Government, have defined our year and built out our organisation to ensure owners are properly represented.

We have never been more in touch with our members, making sure we understand your concerns and that racing hears the voice of the owner. More engagement, through regular communications on the work of the ROA, monthly racecourse events with up to 100 owners in attendance, owner feedback meetings and ownership surveys, has transformed our organisation into one that really listens and accurately represents owners. am incredibly proud of the way the team at the ROA has handled that transformation and moving forward we will continue to grow the owner share of voice, in line with your contribution to the sport.

With fixtures and funding and prize-money, for example, we have fought vociferously to make sure owners are effectively rewarded for their commitment to this sport. This work is vital and as you will be aware, already this year our determination continues with another push to ensure we effectively hold racecourses to account for their contributions and look to put in place a long-term, fair revenue sharing agreement.

As an organisation we have pushed what it means to be an owner and what owners now and in the future demand from racing, whether that is the raceday experience or a new, wide-ranging commitment to equine welfare with the Equine Welfare Board. The ROA have put themselves at the forefront of both with our role in the Horse Welfare Board and continuing to work with racecourses directly on their raceday experience through the ROA Gold Standard. We are working hard to create an experience for owners, today and tomorrow.

Our drive to become more representative, closer to our members and more visible has seen us move out of London from the BHA offices, to Reading. I have never felt comfortable with the centre of racing being stuck in London, so far from the action. Outside London we are going to bring the ROA

closer to its members, attending more meetings, hosting more owner events and generally working with and getting closer to the sport. Across all these initiatives, I have been clear that our aim as an organisation is to be more open, collaborative and representative: a modern organisation fit for the future.

That future is an uncertain one with the impact of COVID. As an organisation, we have continued to deliver throughout this crisis, and I am incredibly thankful to the team and the Board for their dedication and hard work. They have put owners at the forefront of the recovery and made sure your voices are heard on issues across the piece. Owners’ contribution to racing during the suspension will not and cannot be forgotten.

Going forward, have never more firmly believed in the value of openness, collaboration and the need for our sport to fight for its future together. There is an incredible amount still to do and many of you will be aware that the ROA, alongside other industry bodies, is already fighting hard to secure real structural change that safeguards the future of our sport and owners’ role in it. We are focussed on change that really makes a difference.

There is change too at the ROA with Nicholas Cooper leaving as President and Charlie Parker stepping into the role. Nicholas has always shown the calm and steady leadership required to grow the ROA as an organisation and am forever thankful for his support as President. He has been unwavering in his support of all of us at the ROA and cannot thank him enough for his gentle yet firm guidance over the past four years. I am sure that Charlie’s vigour and passion for racing and his hunger to deliver for owners can continue that forward momentum and he has already imbued the organisation with more drive through this crisis. am excited to be working alongside Charlie to deliver on our long-term plan and tackle the immediate challenges facing owners and racing.

Already we are addressing four key industry wide areas we see as vital to a fair future for this sport and its participants: Fixtures and Funding, Revenue Sharing Agreements, Transparency Commitments and Corporate Governance. As we move through the recovery, these will continue to be our focus for the betterment of our sport.

There are challenges for our organisation. There are challenges for our sport. Both are intrinsically related, and we cannot shirk either of them. The impact of COVID has seen challenges for everyone working in racing and now more than ever we are making sure we represent you and work with others to protect the future of our sport. I am confident, with the performance and positioning of last year, that the ROA has built the right foundations and relationships to continue its upward trajectory and deliver for owners and for racing.

In these challenging times am reminded that there are opportunities for real change and to drive forward our organisation and our sport with an effective long-term vision.

As we look to the future, the ROA is working to reimagine its long-term priorities in the new normal and ensure it addresses the issues that matter most to owners and the future of racing. Next year, we will be driving at a clear set of long term goals, as well as our day-to-day objectives, that we believe support ownership in racing, encourage the growth of our sport and most of all, give our sport a long and healthy future.

Today our sport is in trouble and requires significant modernisation to survive in the future. As owners, we must address the imbalances and inequities across the sport, pushing racing towards a more progressive and fair sport that respects its participants.

Our sport has a future. A future that can inspire generations of people into ownership, into race riding, into the stables, into the world of racing. We have to see how we can change the sport for the better, be more welcoming and rewarding for those that are involved and get involved.

For owners, that still means creating an experience that acknowledges and respects their contribution to the sport. It means delivering raceday experiences that reward and encourage people into the sport and retains the excitement for those already there.

PROTECTING RACING’S FUTURE ELEVATING THE OWNERSHIP EXPERIENCE BUILDING FOUNDATIONS FOR GROWTH COLLABORATING ACROSS THE SPORT AND BEYOND INSPIRING OWNERSHIP

As we know pool betting is a crucial part of the funding model for almost every leading racing nation, with Great Britain being a notable exception.

It is therefore very encouraging to see the Tote now owned and operated by people with a clear plan to ensure this 90-year old institution has a bright future which can be an important part of British racing’s financial structure.

As investors, the ROA has been supporters of the UK Tote Group from the outset, alongside a host of familiar owners and breeders in British racing.

The UK Tote Group completed its acquisition of the Tote in October 2019 and since then there has been some significant progress. First off, it was encouraging to see Chester and Bangor-on-Dee racecourses bring the Tote back on course meaning all British racecourses are once again partnered with the Tote. This was followed in April with the news that the UK Tote and Tote Ireland had formed a strategic alliance in order to help further boost liquidity for UK and Irish racing fans and build on the combined strengths of world class racing across 86 racecourses.

There have been a number of exciting developments introduced at pace by the UK Tote Group. These started with the launch of a new Tote brand and new website –tote.co.uk – which offers betting on all racing from the UK, Ireland, Hong Kong, South Africa, Sweden and several other countries, as well as live streaming of racing and exclusive content and tips from experts.

November saw the very welcome return of the ever-popular Tote Ten to Follow with 63,000 stables entered or the National Hunt game proving it is a fantastic way to ensure existing, and we hope new, racing fans can follow the sport throughout the year.

The Tote has also introduced some important developments to increase the appeal of pool betting. With Tote Guarantee in place since February the Tote ensures it will pay the industry Starting Price (SP) or the pool price if it is bigger on all win bets placed on tote.co.uk. This has been very positively received by customers as it takes away the price uncertainty of pool betting. Irish customers will be able to enjoy Tote Guarantee when the new tote.ie website is launched in August immediately highlighting the benefits of the UK Tote and Tote Ireland’s alliance.

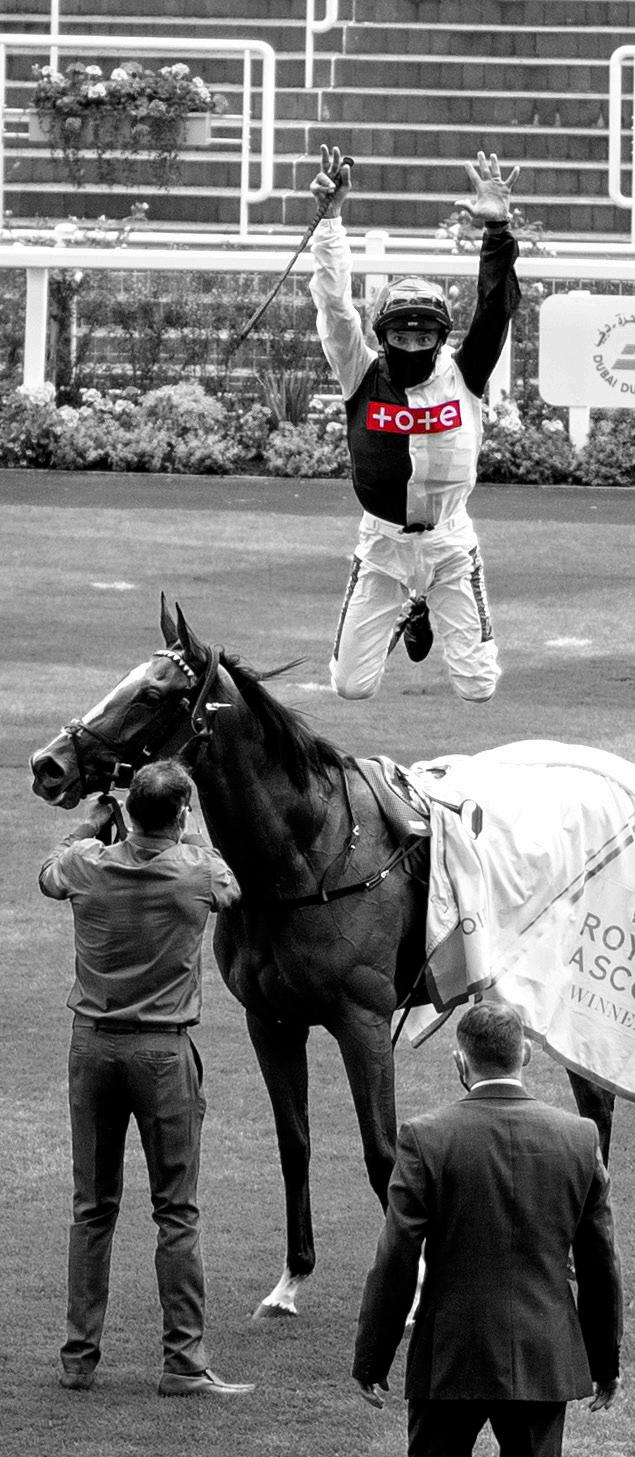

One of the most important developments this year has been the success of Tote Superpools at Royal Ascot. These are the supersized pools generated from international commingling between pool betting operators for major race meetings. This year’s Royal meeting saw 20 nations betting into a single pool which grew nearly 50% to £137 million.

The Tote offered great value beating SP on 19 of the 36 races and matching it on the remaining occasions. This is a truly exciting template for the future.

While the last few months have undoubtedly been hugely challenging for everyone, the Tote has utilised the time to accelerate its partnerships with other leading international pool betting operators. In addition, the Tote was one of the founding members of the World Tote Association in June whose 20 members have a combined turnover of

over €20 billion and intend to be on the forefront of the responsible gambling agenda while ensuring they work together to showcase pool betting on horseracing and the benefits it can bring the sport in all parts of the world.

From the ROA’s perspective, we are delighted the Tote and Britbet are now the supporters of the Owner Sponsorship Scheme which is utilised by the vast majority of our members and an important benefit for the sport.

The Tote has further innovations planned, including the imminent launch of a Placepot App which will help racing fans put on their favourite bet from their mobile phone.

It is clear there is much more to come from the Tote which is encouraging for all in British racing.

Prize-money continues to be the main priority for the ROA, ensuring that owners are fairly rewarded for their contribution to the sport of racing. The ROA has always sought to protect prize-money levels and in recent years, working with the members of the Horsemen’s Group and industry stakeholders, promoted and developed innovative schemes to boost financial returns across the sport, for all owners.

Last year, prize-money remained relatively stable on the previous year after hard work from the ROA and other stakeholders to promote the value of providing good prize-money amongst racecourses. The majority of Owners have been quite clear that prize-money and its distribution is the main reason they retain their interest in racehorse ownership.

With COVID and the suspension of racing, we expect prize-money to be impacted next year. However, at the ROA and across the sport’s participants, we wish to be clear that we do not accept the fall in prize-money nor the lack of executive contributions by racecourses as a long term option. Such a fall severely threatens our sport and its future.

The ROA is already working to ensure prize-money levels not only return to pre-COVID levels, but that we put in place long-term structures to redress previous commercial imbalances. Going forward we want to see racing’s income permanently, fairly and transparently distributed amongst participants, rewarding owners properly and helping participants and other stakeholders collaborate effectively for the betterment of our sport.

The directors present their annual report and financial statements for the year ended 31 March 2020.

Principal activities

The principal activity of the Association continued to be that of promoting and supporting the interests of racehorse owners in Great Britain funded through membership subscriptions.

During the year the organisation continued the industry ownership strategy project, promoting racehorse ownership with funding from the Horserace Betting Levy Board.

Directors

The directors who held office during the year and up to the date of signature of the financial statements were as follows:

S Astaire

S Bethell (Resigned 11 June 2020)

N G Cooper CBE

Y Dixon

C J Djivanovic

D P Duffy

R T Goff (Appointed 2 July 2019)

R S Hoskins

C M Parker

A M Pickering CBE (Resigned 2 July 2019)

P Pugh (Resigned 2 July 2019)

A D Spence

C Wright CBE

Auditor

RSM UK Audit LLP have indicated their willingness to be reappointed for another term and appropriate arrangements have been put in place for them to be deemed reappointed as auditors in the absence of an Annual General Meeting.

Statement of disclosure to auditor

So far as each person who was a director at the date of approving this report is aware, there is no relevant audit information of which the company’s auditor is unaware. Additionally, each director has taken all the necessary steps that they ought to have taken as a director in order to make themselves aware of all relevant audit information and to establish that the company’s auditor is aware of that information.

This report has been prepared in accordance with the provisions applicable to companies entitled to the small companies exemption.

On behalf of the board

N G Cooper CBE

Director

4th August 2020

Directors’ Responsibilities Statement

The directors are responsible for preparing the Directors’ Report and the financial statements in accordance with applicable law and regulations. Company law requires the directors to prepare financial statements for each financial year.

Under that law the directors have elected to prepare the financial statements in accordance with United Kingdom Generally Accepted Accounting Practice (United Kingdom Accounting Standards and applicable law). Under company law the directors must not approve the financial statements unless they are satisfied that they give a true and fair view of the state of affairs of the company and of the surplus or deficit of the company for that period. In preparing these financial statements, the directors are required to:

● select suitable accounting policies and then apply them consistently;

● make judgements and accounting estimates that are reasonable and prudent;

● prepare the financial statements on the going concern basis unless it is inappropriate to presume that the company will continue in business.

The directors are responsible for keeping adequate accounting records that are sufficient to show and explain the company’s transactions and disclose with reasonable accuracy at any time the financial position of the company and enable them to ensure that the financial statements comply with the Companies Act 2006. They are also responsible for safeguarding the assets of the company and hence for taking reasonable steps for the prevention and detection of fraud and other irregularities.

Opinion

We have audited the financial statements of The Racehorse Owners Association Limited (the ‘company’) for the year ended 31 March 2020 which comprise the Statement of comprehensive income, the statement of financial position and notes to the financial statements, including a summary of significant accounting policies. The financial reporting framework that has been applied in their preparation is applicable law and United Kingdom Accounting Standards, including FRS 102 “The Financial Reporting Standard applicable in the UK and Republic of Ireland” (United Kingdom Generally Accepted Accounting Practice).

In our opinion, the financial statements:

● give a true and fair view of the state of the company’s affairs as at 31 March 2020 and of its surplus for the year then ended;

● have been properly prepared in accordance with United Kingdom Generally Accepted Accounting Practice;

● have been prepared in accordance with the requirements of the Companies Act 2006.

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our responsibilities under those standards are further described in the Auditor’s responsibilities for the audit of the financial statements section of our report. We are independent of the company in accordance with the ethical requirements that are relevant to our audit of the financial statements in the UK, including the FRC’s Ethical Standard, and we have fulfilled our other ethical responsibilities in

accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Conclusions relating to going concern

We have nothing to report in respect of the following matters in relation to which the ISAs (UK) require us to report to you where:

● the directors’ use of the going concern basis of accounting in the preparation of the financial statements is not appropriate; or

● the directors have not disclosed in the financial statements any identified material uncertainties that may cast significant doubt about the company’s ability to continue to adopt the going concern basis of accounting for a period of at least twelve months from the date when the financial statements are authorised for issue.

Other information

The other information comprises the information included in the annual report, other than the financial statements and our auditor’s report thereon. The directors are responsible for the other information. Our opinion on the financial statements does not cover the other information and, except to the extent otherwise explicitly stated in our report, we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated. If we identify such material inconsistencies or apparent material misstatements, we are required to determine whether there is a material misstatement in the financial statements or a material misstatement of the other information. If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact.

We have nothing to report in this regard.

Opinions on other matters prescribed by the Companies Act 2006

In our opinion, based on the work undertaken in the course of the audit:

● the information given in the directors’ report for the financial year for which the financial statements are prepared is consistent with the financial statements; and

● the directors’ report has been prepared in accordance with applicable legal requirements.

Matters on which we are required to report by exception

In the light of the knowledge and understanding of the company and its environment obtained in the course of the audit, we have not identified material misstatements in the directors’ report.

We have nothing to report in respect of the following matters in relation to which the Companies Act 2006 requires us to report to you if, in our opinion:

● adequate accounting records have not been kept, or returns adequate for our audit have not been received from branches not visited by us; or

● the financial statements are not in agreement with the accounting records and returns; or

● certain disclosures of directors’ remuneration specified by law are not made; or

● we have not received all the information and explanations we require for our audit; or

● the directors were not entitled to prepare the financial statements in accordance with the small companies regime and take advantage of the small companies’ exemption from the requirement to prepare a strategic report or in preparing the directors’ report.

Responsibilities of directors

As explained more fully in the directors’ responsibilities statement set out on page 2, the directors are responsible for the preparation of the financial statements and for being satisfied that they give a true and fair view, and for such internal control as the directors determine is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, the directors are responsible for assessing the company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless the directors either intend to liquidate the company or to cease operations, or have no realistic alternative but to do so.

Auditor’s responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs (UK) will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

A further description of our responsibilities for the audit of the financial statements is located on the Financial Reporting Council’s website at: http://www.frc.org.uk/ auditorsresponsibilities. This description forms part of our auditor’s report.

Use of our report

This report is made solely to the company’s members, as a body, in accordance with Chapter 3 of Part 16 of the Companies Act 2006. Our audit work has been undertaken so that we might state to the company’s members those matters we are required to state to them in an auditor’s report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the company and the company’s members as a body, for our audit work, for this report, or for the opinions we have formed.

Claire Sutherland (Senior Statutory Auditor)

For and on behalf of RSM UK Audit LLP, Statutory Auditor, Chartered Accountants, Abbotsgate House, Hollow Road, Bury St Edmunds, Suffolk, IP32 7FA

for the year ended 31 March 2020

Operating (deficit)/surplus

Interest receivable and similar income

(Deficit)/surplus before taxation

Tax on (deficit)/surplus

(Deficit)/surplus for the financial year

Fixed assets

Intagible assets

Tangible assets Investments

Current assets Debtors Investments Cash at bank and in hand

Creditors: amounts falling due within one year

Net current assets

Total assets less current liabilites Reserves

These financial statements have been prepared in accordance with the provisions applicable to companies subject to the small companies’ regime.

The financial statements were approved by the board of directors and authorised for issue on 4 August 2020 and are signed on its behalf by:

Company information

The Racehorse Owners Association Limited is a private company limited by guarantee and is registered and incorporated in England and Wales. The registered office is 12 Forbury Road, Reading, Berkshire, RG1 1SB.

Accounting convention

These financial statements have been prepared in accordance with FRS 102 “The Financial Reporting Standard applicable in the UK and Republic of Ireland” (“FRS 102”) and the requirements of the Companies Act 2006 as applicable to companies subject to the small companies regime. The disclosure requirements of section 1A of FRS 102 have been applied other than where additional disclosure is required to show a true and fair view.

The financial statements are prepared in sterling, which is the functional currency of the company. Monetary amounts in these financial statements are rounded to the nearest £.

The financial statements have been prepared under the historical cost convention. The principal accounting policies adopted are set out below.

Going concern

The Coronavirus pandemic led the directors to consider and review the company’s status as a going concern, including its financial security, the adequacy of its reserves and the robustness of future financial projections up to September 2021. The ROA has made more conservative budget projections for the coming year and has undertaken a re-appraisal of expenditure across a number of areas. The financial impact of the pandemic has had only a limited impact on the financial position of the company, there is a reasonable level of confidence attached to the current budgeted income and expenditure projections that do not threaten the solvency of the ROA or its status as a going concern. Indeed current cash resources provide the company with sufficient financial strength to withstand a significant downturn in the coming twelve months and there is presently no indication of such a downturn as income is in line with expectations and expenditure remains carefully controlled.

Grants

Grants relating to revenue are recognised in income on a systematic basis over the period to which the entity recognises the related costs for which the grant is intended to compensate.

Members’ subscriptions

Members’ subscriptions are accounted for on an accruals basis, in compliance with Section 23 of FRS 102. When the company receives subscription income from a member in advance, a liability is recognised of an equal amount. Over the period to which the subscription relates the liability is proportionately reduced and recognised as revenue.

Intangible fixed assets other than goodwill

Intangible assets, including website development costs, are recognised at cost and are subsequently measured at cost less accumulated amortisation and accumulated impairment losses.

Amortisation is recognised so as to write off the cost or valuation of assets less their residual values over their useful lives on the following bases:

Software 20% per annum on cost

Tangible fixed assets

Tangible fixed assets are initially measured at cost and subsequently measured at cost, net of depreciation and any impairment losses.

Depreciation is recognised so as to write off the cost of assets less their residual values over their useful lives on the following bases:

Leasehold improvements 10 years straight line

Other plant and machinary 20% straight line

Fixed asset investments

Interests in associates are initially measured at cost and subsequently measured at cost less any accumulated impairment losses.

Trade investments are initially measured at fair value, which is normally the transaction price. Such assets are subsequently carried at fair value and the changes in fair value are recognised in profit or loss, except that investments in equity instruments that are not publicly traded and whose fair values cannot be measured reliably are measured at cost less impairment.

Cash and cash equivalents

Cash and cash equivalents are basic financial instruments and include cash in hand, deposits held at call with banks and other short-term liquid investments with original maturities of three months or less.

Financial instruments

The company has elected to apply the provisions of Section 11 ‘Basic Financial Instruments’ and Section 12 ‘Other Financial Instruments Issues’ of FRS 102 to all of its financial instruments.

Financial instruments are recognised when the company becomes party to the contractual provisions of the instrument.

Financial assets and liabilities are offset, with the net amounts presented in the financial statements, when there is a legally enforceable right to set off the recognised amounts and there is an intention to settle on a net basis or to realise the asset and settle the liability simultaneously.

Basic financial assets

Basic financial assets, which include trade and other debtors and loans due from associate companies, are initially measured at transaction price including transaction costs and are subsequently carried at amortised cost using the effective interest method.

Other financial assets

Other financial assets, including trade investments, are initially measured at fair value, which is normally the transaction price. Such assets are subsequently carried at fair value and the changes in fair value are recognised in surplus or deficit, except that investments in equity instruments that are not publicly traded and whose fair values cannot be measured reliably are measured at cost less impairment.

Basic financial liabilities

Basic financial liabilities, including trade and other creditors, are initially recognised at transaction price and are subsequently carried at amortised cost.

Taxation

The company is exempt from corporation tax, other than on its investment income, it being a company not carrying on a business for the purposes of making a profit.

Employee benefits

The costs of short-term employee benefits are recognised as a liability and an expense.

Retirement benefits

For defined contribution schemes the amount charged to profit or loss is the contributions payable in the year and contributions actually paid are shown as either accruals or prepayments.

Leases

All other leases are operating leases and the annual rentals are charged to profit or loss on a straight line basis over the lease term. Rent free periods or other incentives received for entering into an operating lease are accounted for as a reduction to the expense and are recognised on a straight line basis over the lease term.

2. Employees

The average monthly number of persons (including directors) employed by the company during the year was 10 (2019–8). 3. Taxation

31 March 2020 Depreciations and impairment At April

On 8 June 2004 the company became a member of Owner Breeder Media Group Limited (formerly Thoroughbred Owner & Breeder Limited), a company registered in England and Wales, limited by guarantee, and not having share capital. The liability of its members is limited to £1 each and nothing was paid for the investment. As such there is no asset in the accounts. At the balance sheet date there were two members of this company. The company produces a magazine for members.

On 16 June 2006 the company became a member of Horsemen Limited, a company registered in England and Wales, limited by guarantee, and not having share capital. The liability of its members is limited to £1 each and nothing was paid for the investment. As such there is no asset in the accounts. At the balance sheet date there were five members of this company. The company represents the collective interests of owners, trainers, breeders, jockeys and stable staff

On 31 July 2007 the company became a member of British Horseracing Authority Limited, a company registered in England and Wales, limited by guarantee, and not having share capital. The liability of its members is limited to £1 each and nothing was paid for the investment. As such there is no asset in the accounts. At the balance sheet date there were four members of this company. The company is the regulatory and governing body of horseracing in Great Britain. British Horseracing Authority Limited have two wholly owned subsidiaries, Great British Racing Limited and British Horseracing Database Limited. Both companies are registered in England and Wales. The principal activity of Great British Racing Limited is the commercialisation of the contents of the Racing Administration database through access and user licence agreements with third parties, whilst British Horseracing Database Limited’s principal activity is the maintenance and licences of the database.

On 10 June 2019 the company became a member of Alizeti Capital Limited, a company registered in England & Wales with a share capital of £98,648,000. The company is therefore a minority shareholder. Alizeti Capital Limited changed its name in August 2019 to UK Tote Group

Creditors: amounts falling due within one year

Members’ liability

Each member’s liability is limited to a maximum contribution of £3 in the event of the winding up of the company. The number of members as at 31 March 2020 was 7,772 (2019: 7,976). 11. Operating lease commitments

At the reporting end date the company had outstanding commitments for future minimum lease payments under non-cancellable operating leases, which fall due as follows:

NICHOLAS COOPER CBE

Co-opted 2014

STEVEN ASTAIRE

Elected 2016

SALLY BETHELL

Elected 2013 and 2017

YVETTE DIXON

Elected 2016

Elected: 2018

PAUL DUFFY

Elected 2011

SAM HOSKINS

Elected 2017

TOM GOFF

Elected 2019

CHARLIE PARKER

Elected 2015

ALAN SPENCE

Elected 2017

CHRIS WRIGHT CBE

Co-opted 2016

KEN MCGARRITY

ROA Scotland Representative