FOCUS

GROUP DISCUSSIONS

94 A state of the tourism industry discussion

106

PANEL:MATTHEW COWMAN, JEFFREY KIRK, VANESSA KING, JEROEN HOOGENDIJK, CLARENCE FAULKNER, ROBERT BRIANT, GEORGE WESTON, ELIZABETH KILLEEN

a sovereign

a sovereign

What’s

going on in the luxury travel space

As I pen these remarks, the current debate raging in London is over the just published, January edition of the IMF World Economic Outlook Update, which forecast that the UK will be the only major developed economy to slip into recession in 2023. This, coming after headlines the previous day that the UK Army was no longer considered a tier one fighting force. One commentator reflected that, this is what happens when the country has seen four Chancellors of the Exchequer in a month and with the sitting government double digits behind Labour in the polls, ahead of advancing general elections. This is all about confidence. Or in this case, the lack of confidence and what it means for any country. In the case of our beloved BVI, our confidence about the future has been shaken and our ability to successfully navigate the same in the near term. Confidence is a commodity. One that is critical to the success of any modern economy. Since 2017, our confidence in the BVI has been serially shaken at a very foundational level. First came the double whammy of two category five hurricanes, followed by a global pandemic two years later. Fast on its devastating heels, a year later, the appointment of a Commission of Inquiry into Governance in the Territory; the principal recommendation of which, was the partial suspension of the constitution. Essentially, the suspension of the hard fought for democracy in these British Virgin Islands. A recommendation accepted by the UK’s FCDO, two short months after Putin’s attempt to snuff out Ukraine’s democracy. To cap it all off, this announcement was made by the Governor, coupled with his release of the COI Report, one day after the arrest of the then Premier in Miami, at the end of last April. Clearly, a sustained broadside that would rattle the confidence of all, but the Angels guarding St. Peter’s gate.

It goes without saying, that just as confidence is contagious, the absence of confidence is equally so. It is critical that as a territory we move collectively, to do all we can to shore up longterm confidence in our economy, given the beating it has taken over the last several years. Not just from the pandemic, but also from ill conceived governmental action and policies. The time is opportune for the territory to implement a robust growth agenda. One that invests in the economic muscle of the BVI.

Such an agenda would entail the territory threading a series of needles over the next several years, in a very disciplined manner. Some concurrently, while others with a bit longer window on alternate paths, all coalescing within a 3-5 year period. In our estimation, the primary needles are; The general elections, immediately up ahead - electing an able and experienced team to the 5th HOA, negotiating a fit for purpose relationship with the UK, inclusive of an architecture that fosters economic growth - in the ever changing global economic environment, diversification of the economy, a mission focused national infrastructure agenda, a human resources agenda directed at talent for a competitive services-based economy and a framework for effectively engaging in a global economy, given the emerging Cold War like blocks.

As we contemplated the direction for this edition, we focused on the critical role of confidence in repositioning the BVI, given the uncertain global economic outlook. We opted for a Special Section (p.54) informed by focus group discussions and augmented with articles and interviews with leading private sector influencers in tourism and financial services. Persons uniquely positioned to share with our readership, their insight into the economic and business outlook for the territory in 2023, and beyond. We did so with an eye on the fact that 2023 will see general elections in the territory, setting political leadership for the next four years.

What follows, is our near 40K words, deep dive into the ongoing discussion of what we as a territory must do to halt our race to the bottom. Regain our footing we must, and return to our former posture of - punching above our weight in our economic space. We believe that the BVI has substantial upside potential for a bright economic future and quality of life. We intend the following three focus groups to help to inform the discussion.

1. BVI FINANCIAL SERVICES FOCUS GROUP DISCUSSION (p.82). An informative dive into the current state of doing business in the BVI and the global challenges and trends that are impacting the jurisdiction, in a sustained period of global uncertainty, economically and geopolitically.

2. BVI TOURISM FOCUS GROUP: A STATE OF THE INDUSTRY DISCUSSION (p.94) An immersive dive into the current state of tourism, informed by the back drop of a destination emerging from the hurricanes of 2017, pandemic overhang, a competitive global tourism space and the ghostly figure of recession in our key markets. A worthy read for anyone, given tourism’s directional pull on the local economy.

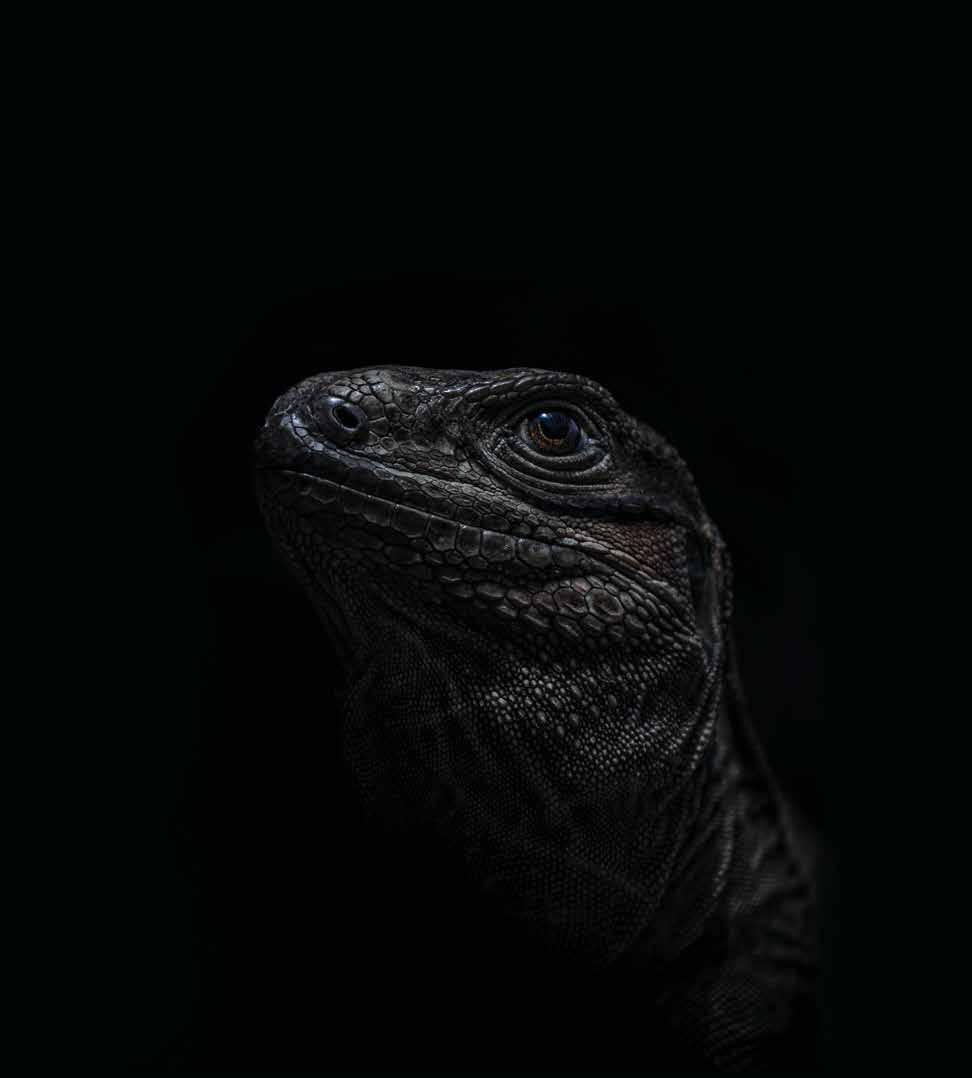

3. BVI TOURISM FOCUS GROUP: WHAT’S GOING ON IN THE LUXURY TRAVEL SPACE (p.106) No economic sector in the territory is in greater need of attention than the Tyrannosaurus-rex in the space: Tourism. A failure to refocus tourism, has the potential to impair the local economy, with real consequences. We followed our mantra of seeking out some of the sharpest minds and freshest thinkers, with in the weeds knowledge of marketing luxury travel. Panelists with a granular understanding of brand BVI and what differentiates it in the luxury travel space. We were not disappointed.

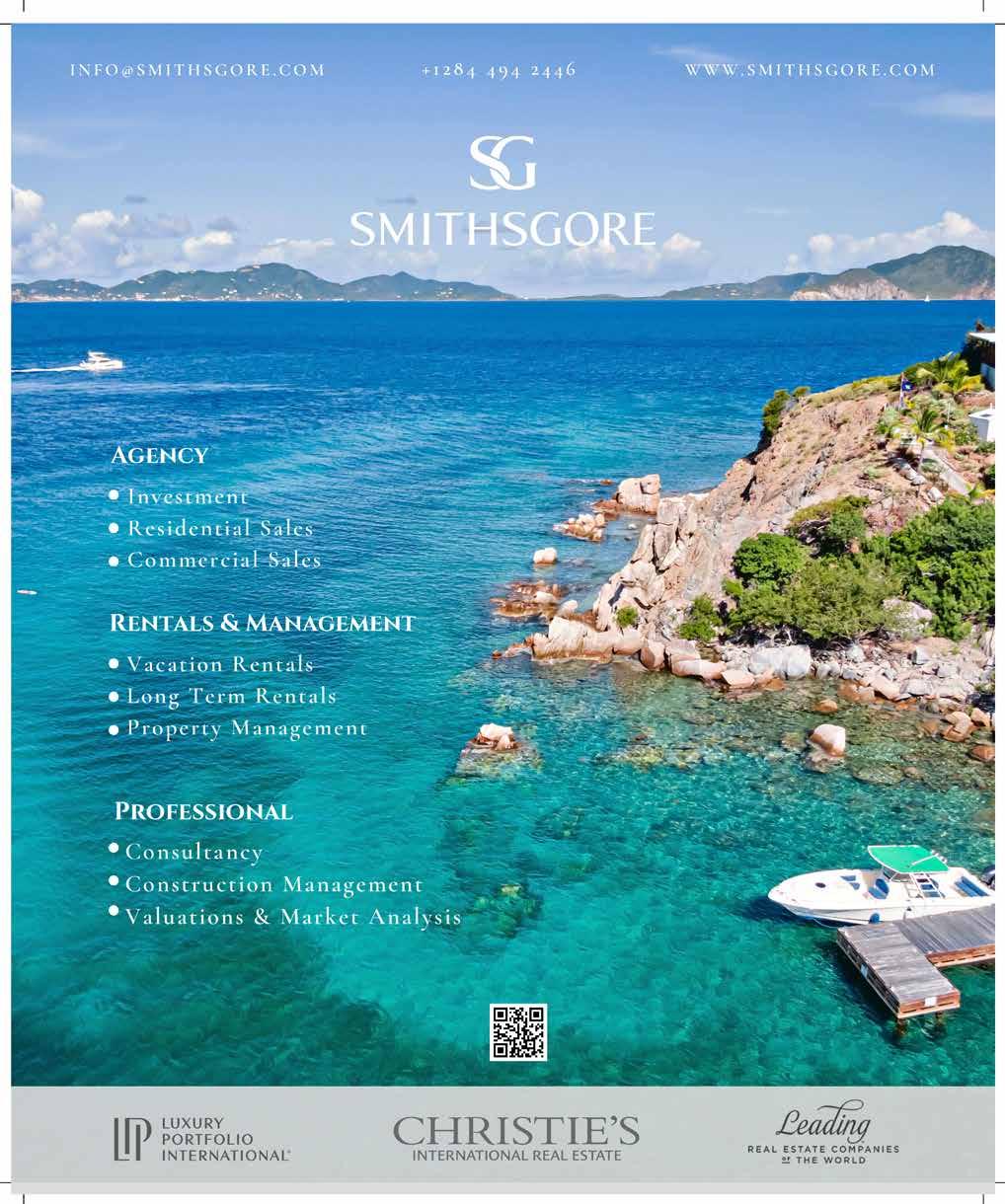

As you journey beyond the focus groups, we stay focused on the confidence theme, with a spread of timely articles and interviews with key leaders in the business and economic space. We kick off with - Filling Big Shoes (p.26) an interview with Kenneth Baker, MD/CEO-FSC, and transitions to a growth agenda - Building for Growth: The Key role of Infrastructure (p.57). Next, we segue to - The BVI in the new World Order (p.73) and realise that if you are not world class, you can’t be on the stage - Choosing challenge and chasing growth (p.65) and we ask - How about a sovereign wealth fund for the Virgin Islands? (p.70). Meanwhile we interrogate Mark Pragnell - Charting uncertain Seas (p.34) about his recent report“Beyond globalisation: The British Virgin Islands’ contribution to global prosperity in an uncertain world.” Never to be missed is The Outlook for Real Estate (p.128) a comprehensive sector roundup. Sales increased by 106.5% between 2018 and 2021 with total real estate sales in 2022 likely to match, or exceed, that of 2021. Total sales in 2022 was boosted by a single sale of $44.34M within Oil Nut Bay.

As always, we wrap up with our must read - Investor Conversation with Dr. Juleen Christopher (p.154) looking at her recent acquisition of St. Bernard Hill House, her vision for the estate, her varied interests and a most interesting career.

Enjoy! Please share your feedback at russellharrigan@gmail.com

With matters requiring offshore expertise, you need lawyers who know their stuff and get it right first time. At Collas Crill, we aim to achieve your goals when representing you offshore. When you succeed, we do too. To find out how we can partner with you, visit collascrill.com

Russell Harrigan

MANAGING EDITOR & CHIEF CONTENT OFFICER

Oyster Publications LTD PUBLISHER

Portia Harrigan PROJECT CO-ORDINATOR

Louie Acantilado Oyster Design Team CREATIVE

Russell Harrigan ADVERTISING

Portia Harrigan BUSINESSBVIMAGAZINE.COM

Business BVI is a bi-annual magazine published by Oyster Publications LTD

P.O. Box 3369, Road Town, Tortola, British Virgin Islands

Tel: 284-494-8011 Fax: 284-494-3066 www.oysterbvi.com

Email: info@oysterbvi.com

Please send comments and address changes to this address.

Business BVI and Oyster Publications LTD are divisions of Oyster Global Marketing Group. www.businessbvimagazine.com

All information in this publication has been carefully collected and prepared, but it still remains subject to change and correction. Use this content for general guidance only and seek extra assistance from a professional adviser with regard to any specific matters. Copyright reserved 2023. None of the contents in this publication may be reproduced or copied in any form without permission in writing from the publisher.

These articles do not constitute tax or legal advice, and no action should be taken based on the information in these documents without first consulting suitable tax or legal advisers. No liability for actions taken, or in action, based on the information in these articles, will be accepted.

Introducing some of the talented individuals whose hard work and creativity helped us to produce this edition.

We are very pleased to welcome back Colin O’Neal to the pages of Business BVI after an extended hiatus, contributing a lead article in our Special Section. It is near impossible to be competitive in the global marketplace without fit for purpose infrastructure. Colin makes a passionate, reasoned and compelling case for why we must up our game and focus on upgrading our national infrastructure. Colin is the Chief Executive Officer of JOMA (Properties) Ltd. He is a graduate of Boston University and the University of the West Indies, and the Norman Manley Law School at the University of the West Indies. He is a member of the Urban Land Institute (ULI), BOMA International, the Congress on New Urbanism and other professional bodies related to law and real estate.

CONSTRUCTION IN THE BVI: SECTOR UPDATE AND OUTLOOK FOR 2023 (p.47)

In this annual update, Marvin interprets the picture of the forces that are having an impact on the construction sector either positively or negatively. He explores the global economy, the banks’ role in the construction process, Town and Country Planning, the British Virgin Islands Government, The Recovery and Development Agency (RDA) and opportunities that contractors are utilising to diversify and expand their services. Marvin also speaks to the redevelopment of resorts in the North Sound area, including Biras Creek which has started its rebuild and have passed the halfway mark and targeting Q4 of 2023 to reopen the first phase. Oil Nut Bay continues to outperform most regional residential resorts, with multiple home lots either under construction or several in the design stages.

THE OUTLOOK FOR REAL ESTATE (p.128)

Real estate sales increased by 106.5% between 2018 and 2021 with total real estate sales in 2022 likely to match, or exceed, the total sales of 2021. However, total sales in 2022 were boosted by a single sale of $44.34M within the Oil Nut Bay development. The stamp duty waiver for Belongers continued to be a key driver for local purchases through to December 2021 with the Government introducing a revised policy in 2022 for first time Belonger purchasers. Edward Childs insight is always well informed and driven by research and analysis. Such sound advice is critical to informing a purchaser or a seller final decision be it residential, investment in a vacation villa or the development of a top tier resort, marina or private island.

BVI FAST FACTS (p.146)

We are indebted to Patlian for her yeoman’s role of ensuring that our Fast Fact Guide is well researched, current and informed. We are delighted to have it once again included In this edition after a brief absence in the last issue. This Guide provides invaluable fingertip information which is especially useful to persons doing research about the BVI from a business perspective or for relocation purposes.

INN AT CORNUCOPIA (p.117)

Sharon has become a regular contributor to Business BVI and we are most pleased to have her input. In this edition she was a panelist and as well as a co-moderator for our tourism focus group discussions. And are excited to have the second edition of SHARON’S TAKE coupled with this article on a new twist on hospitality in Virgin Gorda, which opened in March 2022 in Little Trunk Bay. Owners Inge Judd and Rose Giacinto have said time and time again, that they are not hoteliers, but innkeepers and there is indeed a distinct difference. Friends for over forty years and both have been involved in the BVI tourism industry in varied capacities. Sharon is Director of Operations at Virgin Gorda Villa Rentals and Leverick Bay Resort & Marina.

PUTTING ETHICS IN FOCUS THROUGH A REGISTER OF INTEREST (p.33)

We welcome Ann Encontre to the pages of Business BVI with her inaugural article on the most topical of issues, ethics at the national level in the territory. As Director of the Ethics Office at the United Nations High Commissioner for Refugees (UNHCR) in Switzerland, Ann is eminently qualified to speak to the critical role of a culture of ethics in a modern democracy.

OPPORTUNITIES FOR DEMOCRACY AND BUSINESS: THE HOPE OF THE COI (p.77)

We gladly welcome Noni Georges to the pages of Business BVI with this intersection of the recent COI and business. She states that “Governance is governance, but it is also a business. The business of providing the infrastructure, and the legal and regulatory playing field where citizens and businesses can live, work, trade, execute and enforce contracts and prosper. Governance thus provides the undergird of the BVI business platform.” Noni is an attorney at law and environmental policy consultant, and is the Executive Director of the Georges-Rhymer Institute for Public Policy, an independent non-partisan not-for-profit which seeks to improve environmental quality; improve public policy analysis, articulation, and implementation; improve access to justice; and promote a more just and equitable national vision for the Virgin Islands.

OPPORTUNITIES FOR DEMOCRACY: THE HOPE OF THE COI (p.76)

The perspective of our young people on all matters affecting the territory is invaluable. We turned to Joseph ArchibaldBowers for his thoughts about the COI and its implications for the territory. Those recommendations will undoubtedly shape governance in the territory for many years. In this piece, Joseph reminds us that - “Robust democratic governance, with functioning checks and balances, is the best system we have to deliver business freedom and economic prosperity.” He is a writer and an Associate at the Georges-Rhymer Institute for Public Policy assigned to the COI Citizen’s Review Project, which seeks to explore the COI process, report and recommendations and engage, particularly with young people, in a deeper reflection and analysis of the implications for the BVI. He is passionate about financial literacy and civics.

CHOOSING CHALLENGE AND CHASING GROWTH (p.65)

Readers of this edition will repeatably encounter the case being made for a Growth Agenda for the BVI, one that we see as critical to repositioning the territory in an uncertain global economic landscape. No one better exemplifies making such a pivot than Jennifer Potter, a steadfast contributor to Business BVI over many years. Having recently transitioned from the public sector back to the private sector, we asked her to reflect on the same, at a national level vis a vis the global space. “Transitions are naturally reflective, and I’ve thought about purpose and impact. Mine involves problem-solving and strategy. I see the BVI’s place in the world, and our geopolitical relationships, as being ready for a transformation. It is a value I can offer simultaneously to the industry and the Territory” she writes in this must read article. “On a priority list, I would include a pro-business climate, modern infrastructure (physical and digital), skilled workforce, broadband penetration, sustainable development policy frameworks, and access to global markets” she implores us a territory. Jennifer is Head of Operations, Risk and Compliance and has a range of leadership responsibilities at George Henry Partners LP.

THAT AHA MOMENT! ACHIEVING VISION POSSIBLE IN FINANCIAL SERVICES (p.62)

9.

HOW ABOUT A SOVEREIGN WEALTH FUND FOR THE VIRGIN ISLANDS? (p.70)

As a territory we must think in a strategic manner. We asked the most able Kinisha Forbes to explore the idea of a Sovereign Wealth Fund (SWF) for the BVI. She states that “A question sadly, often asked in some form in these Virgin Islands is: “What happened to the billions of dollars that have passed through Government coffers over the last thirty-five years?” She concludes that “Alongside the very obvious physical infrastructural deficits of our Territory, there is another looming deficit present in these Virgin Islands that should not go unattended: the Virgin Islands is not secure enough.” A SWF which by definition is a Government-owned investment fund of money generated by the Government, can boost our security in this increasingly uncertain global climate. Kinisha is Head of Monitoring and Evaluation at the RDA and maintains a laser-focus on results, and previously she was Head of the Macro Fiscal Unit in the Ministry of Finance.

THE BVI IN THE NEW WORLD ORDER (p.73)

Neil Smith is a no stranger to Business BVI and is uniquely qualified as a former Financial Secretary to speak to the BVI place in the New World Order. “Our progress did not come without effort, nor did it come by chance. We earned it. We had to overcome innumerable challenges and obstacles along the way.” — Dr. Robert Mathavious. Neil states that “In no other facet of BVI society is this such a potent truism - than in the financial services and tourism sectors. They are sectors that have built on and further expanded by the efforts of only a few pioneers. Today, we are challenged to further define and clarify the role that our BVI should play in the global landscape. To do so, however, it is important that we first understand the role that it currently plays.” Neil is currently Director, Programme Strategy Department at the RDA.

13.

Nearly 10 years since the inception of The McKinsey Report, Ayana Glasgow, a frequent Business BVI contributor askVision Accomplished? She writes that “Today, some will say that the BVI’s success in international financial services was more luck than vision. The sustainability of that success, however, would prove naysayers wrong. It logically follows that in 2014, the BVI Government embarked on a collaborative exercise, facilitated by the global consulting firm McKinsey. With contributions from local and international thought leaders, on the financial services industry - Building on a thriving and sustainable Financial Services Sector in the British Virgin Islands - was published.” The McKinsey Report articulated the BVI’s financial services strategic vision. Ayana is Executive Director/Resident Manager ALEMAN, CORDERO, GALINDO & LEE.

THE BVI A BUDDING ‘GLOBAL SOFT POWER IN SPORTS (p.52)

The BVI is known by its many admirers in the global marketplace, as a territory that is capable of punching above it weight in financial services and tourism. It is quietly adding sports as a third space of prowess. We asked Dean Greenaway in this, his first time at bat in Business BVI, to drill down on how he sees this potential further cementing brand BVI. In his article, Dean reminds us of the national joy we felt during the Tokyo games, where he said that “All told, by the Tokyo Olympics, BVI athletes had won seven medals in six different competitions, and had reached World Championships and Olympic Games finals, with McMaster earning 4th place finishes in both events.” Dean is himself a former Olympian having competed in the 1984 Summer Games.

14.

FUND ADMINISTRATORS AND WHERE TO FIND THEM: THE BRITISH VIRGIN ISLANDS (p.44)

We welcome Cecilia Matthews with her inaugural article looking at Funds and Fund Administrators and their role. As of 30 June 2022, the BVI Financial Services Commission (“FSC”) statistical bulletin published quarterly, stated that there are over 1,800 registered funds in the jurisdiction. They range from open-ended funds such as Professional, Private, Public, and Incubator and Approved funds to closed-ended funds such as the recently promulgated Private Investment Funds, most commonly known as PIFs. Cecilia is a funds aficionado as a Director of ATU Fund Administrators (BVI) Limited and is a Certified Public Accountant. She spent eight years in the Cayman Islands working with two large Fund Administration service providers overseeing many complex fund structures and providing first class solutions.

Ocean Villa

Oil Nut Bay’s newest neighbourhood, The Ocean Villa is unlike anything else on property. With 8 lots right on the water’s edge, 2 have already sold and the remainder will not last long. Positioned right at the ocean’s edge with zero setback, Oil Nut Bay’s Ocean Villa Neighbourhood is entirely unique to the Caribbean. Boasting ocean frontage of 110 to 160 feet, each home site is able to accommodate a home where every living space and bedroom enjoy uninterrupted sea views. While two of the total eight homesites are already spoken for, of the six remaining, three are on offer as blank slates upon which to create the ultimate dream home. Oil Nut Bay will shortly break ground on the second three creating three-bedroomed developerdesigned model homes. The Ocean Villas offer truly incomparable door to shore living!

Oil Nut Bay has unveiled a brand-new heliport certified for international arrivals – the first and only in the region. This service is available exclusively for the use of owners and guests of Oil Nut Bay. Direct flights are now available from St. Thomas and San Juan, offering a luxurious and smooth arrival experience with breathtaking views. In addition, guests can utilize the heliport to travel to St. Bart’s, St. Maarten, Anguilla and other nearby islands, allowing for easier travel access within the Caribbean.

The heliport has ICE immigration clearance on-site and the staff are fully trained and certified in all aspects of helicopter travel. As the resort is only accessible by boat or helicopter, this new service saves valuable transit time for guests and provides an arrival experience that is truly second-to-none.

In addition to the helipad, Oil Nut Bay is introducing several exciting enhancements for 2023, including a reimagined Beach Club with an updated restaurant space featuring revamped lounge areas, a new menu concept and a private dining area. The Pavilion will be transformed into a guest arrival lounge experience with an updated bar for cocktails and light bites. Additional new offerings for 2023 include a more comprehensive butler and chef service, an on-call rum butler, a curated cigar menu and sushi-making classes.

Industry analysts worldwide are saying that tourism is rebounding in a very big way. At Caribbean Hotel and Tourism Association’s MarketPlace, held in San Juan Puerto Rico in the Fall, discussions were held as regional tourism leaders weighed in on the outlook for the Caribbean against the backdrop of the pandemic, global warming and the world economy. The Caribbean has the distinction of leading the global tourism rebound. Jamaica boasted about their record of the highest arrivals ever in the history of the island’s tourism. The United States Virgin Islands (USVI) revelled in highest growth rate in the reason surpassing many previous records.

What does all this mean for British Virgin Islands tourism? It means that we have the potential to again take our rightful place as a leader on the Caribbean tourism ladder. Tourism in the BVI suffered a drastic downturn, fuelled in large part by the hurricanes of 2017 and the pandemic, but this was compounded by revised policy regulations of the yachting sector and unforeseen negative posture by a government that relegated tourism to the back burner. Listening to tourism ministers from several other destinations, a common theme was that the industry suffered from a lack of respect, as well as an understanding from other branches of government as well as residents as to the industry’s importance in driving regional economies. The pain of that has been felt by other countries, but none as severely as The BVI, which has no other supporting industry apart from Financial Services, which continues to see its own troubling times and a challenging long-term forecast.

The British Virgin Islands like many other Caribbean destinations is severely challenged by human capacity to support the tourism industry. There is a chronic labour shortage, hampered by the

inability of the local Labour Department to process work permits for expatriate workers in an expeditious and timely manner, where it doesn’t negatively affect the operation of businesses. We realize as well, that tourism workers are some of the lowest paid as punctuated by statements of the Tourism Minister of Jamaica, Edmund Bartlett, a foremost and respected tourism leader in the Caribbean and the wider tourism world. We, like many others are seeing a brain drain and the inability to engender the younger generation to seek careers in hospitality. There are very few British Virgin Islanders in executive level positions in an industry which employs one in five persons.

Climate change and the resounding effects of global warming, as well as the ever-present threat during hurricane season, is yet another challenge that faces the territory. We are in the “hurricane belt” where we are seeing the increasing severity of storms. An already non replenished Treasury that is still funding the rebuild from damage realized more than 5 years ago. Coupled with the pandemic and the additional strain placed on an already challenged Health Care system, funding and financing for government infrastructure projects to support tourism looks bleak. The road ahead will be tough without some imaginative and experienced leadership at the tiller.

The British Virgin Islands Government wants to see increased visitor arrival numbers to the destination but in 2016 when BVI’s tourism was at its most historic levels, with over 1 million visitors per year, the infrastructure was hard pressed to support and cope with those numbers. The strain on beaches, parks, museums, transportation

were evident. The hurricanes and the pandemic reduced these numbers considerably. Based on the numbers YTD for 2022 we are projecting to still be at about 50% of 2016 levels with an infrastructure that can barely support what we have now, much less any significant sustained increase. Capacity studies as well as those that backed up the need for enhanced, ports, roads and policies to support tourism growth have been many, but the commitment and financing to support this are currently not on the horizon.

There is the recognition that access to the destination should not be at the whims of other gateways outside of the BVI, but the quest to build a larger air terminal on the main island, as well as a longer runway continue to be on the table, but the reality is that any such completion is years away. How do we support access when our seaports as well are challenged. There are designs on the table for seaport enhancements, but no meaningful and large-scale development can be seen. Leadership and imagination are needed to move these to reality.

Tourism must be managed in a far more holistic manner to ensure that the islands receive their full benefit. Investors have taken a very cautious approach to opportunities in The BVI. Many have been timid or even scared away for the time it takes to have a project green-lit and others have expressed frustration in the governmental process even when permission is granted. Many potential investors have settled for other opportunities in the Caribbean where the climate and posture have been more

While we posture and are unsure due to the lack of a National Strategic Plan for Tourism and a meaningful action-oriented approach by Government, our competitors have targeted our visitors determined to reduce our market share. Our competitive setneighbours such as Anguilla, St. Lucia and Antigua never outpaced us in overnight arrivals, they have now exceeded our numbers and are fighting for market share unabashedly. This is unheard of. Destinations such as Dominica and St. Vincent and the Grenadines now boast of direct air access and have innovative global marketing and public relations campaigns that rivalled anything BVI had in the marketplace before. BVI once had the enviable position of the “Sailing Capital of the World” and we are now seeing destinations such as St. Vincent and The Grenadines as well as St. Lucia and even the United States Virgin Islands encroaching on what was once ours for the keeping. Remedial and swift action are required to counter these threats. We must not assume that our competitors will rollover and play dead.

Notwithstanding the challenges mentioned, The British Virgin Islands still holds the cache of one of the premier luxury destinations in the Caribbean. We still possess strong fundamentals in the luxury space. Travel and Leisure released a well placed and timely article at the end of 2022 entitled “How Virgin Gorda is Making a Comeback”. Virgin Gorda was also named as one of the top destinations to visit in 2023 by Forbes Magazine, the only Caribbean Island to earn that distinction, proving that tourism in the BVI is quite resilient and can still benefit from a very high repeat clientele who are anxious to revisit “Nature’s Little Secrets”. The accolades continue enhanced by the reopening of many of the iconic luxury sector’s Grande dame properties such as Rosewood Little Dix Bay, (rosewoodhotels.com) who gained the distinction of being named as one of the leading properties in the Caribbean by Condé Nast and Travel & Leisure. They now feature full butler service and have their own gardens and host trendsetting organic dinners. Most recently Virgin Gorda was named to Forbes’ List of Places to Visit in 2023 – as stated earlier, the only Caribbean Island to have this distinction. Notwithstanding the pandemic, many businesses have sought to reinvent and reinvest in themselves, and we see a fairly bright rebound from the pandemic. Saba Rock (sabarockbvi.com) and Bitter End (beyc.com)are now open and re-welcoming yachtsmen and other guests with new

services as well as scintillating and delectable new menus. The overwater bungalows at Bitter End are reminiscent of sleeping on the decks of an antique sailing vessel, complete with the lull of the waves.

Many new luxe villas are now welcoming guests namely Xela and Edge of Paradise – four bedroom villas at Oil Nut Bay, (oilnutbay.com) along with three new marina villas. Rounding out their other big news is that their Heliport received approval for international flights and their newly redesigned Beach Club is welcoming new guests. Other new developments include The Village Estate at Moskito Island, Segura and La Vida at Virgin Gorda Villa Rentals (vgvirgingordavillarentals.com). New to Jost Van Dyke is The Hideout Villas (thehideoutbvi.com) which feature one and two bedroom units right on the beach with their own private plunge pools.

An unofficial count puts the British Virgin Islands at more than 400 villas and the new hot vacation destination for the traveler who is looking for all the amenities of a luxury hotel, but with a bent on privacy and aloneness. This includes new ownership at St. Bernard’s Hill House on Tortola (stbernardshillhouse.com). Long Bay Hotel at the West End

reentered the villa market with fabulous hillside villas (longbay.com).

The Foodie scene is heating up literally in many ways. PRIME (primedinevi.@gmail.com) is the new in place in the heart of Road Town overlooking main waterfront drive in both directions. PRIME features a roof top coffee and cocktail bar as well as a private dining option overlooking Road Town. Floor to ceiling windows and an open kitchen make this a spectacular addition to The Dove and many of the coffee bars around town.

The Dove, CocoMaya, Sugar Cane and many others are boasting new menus for the season. Nova at Oil Nut Bay now has brunch on both Saturday and Sunday in a spectacular setting. Blunder Bay provides the only seaside air-conditioned dining experience in the North Sound Area. Local cuisine as well as street food is a great way for guests to truly experience a “Taste of The BVI” There are many great local haunts. On Virgin Gorda Mermaids and Pirates as well as Village Café delight. Not to be missed are Mama Africa’s as well as Juliette’s kiosks along the main road and DMC White Oleander Destinations (whiteorleaderdestinations.com) host foodie tours to tempt the taste buds. As usual White Bay restaurants and Foxy’s are ‘must dos’ while in Jost Van Dyke. Anegada remains a seafood lovers haven.

I continue to look forward to the ever-evolving tourism scene in the British Virgin Islands. For sure it’s never a dull moment and that’s my Take for this edition. Enjoy.

-Sharon Flax-Brutus

In what is seen as a transformative announcement, American Airlines plans to launch direct flights to the British Virgin Islands starting in the 2023 summer season, a boost for the territory that has been actively seeking to attract service from a North American airline.

American regional affiliate Envoy Air will begin operating from Miami (MIA) to BVI’s Lettsome International Airport (EIS) from June 1, 2023. The carrier will fly the route daily with an Embraer E175 aircraft.

American said the service will be seasonal, running “through the summer,” but will also be operated during the winter season with flights set to restart in November 2023 after a brief pause.

BVI is without direct air service beyond the Caribbean so the connection to MIA, an American hub, is significant. Hon. Kye Rymer, Deputy Premier and Minister for Communications and Works, had previously said American was one of eight North American airlines with which a delegation from the territory met last October at the Routes World 2022 conference in Las Vegas.

But the American regional flights will connect the territory to the Oneworld carrier’s extensive global network via MIA, providing tourists, residents and other visitors with a means to get to BVI other than via ferries or short-hop flights from other Caribbean islands.

“This venture to have [nonstop] flights between Miami and the British Virgin Islands will make it significantly easier, faster and more affordable for persons from around the world to come to the British Virgin Islands, which is one of the must-visit tourist destinations in the world,” Rymer said in a statement announcing the new service. “Our residents will also benefit from convenient connections for business and leisure travel to dozens of destinations across American’s route network.”

American VP-Miami Juan Carlos Liscano noted the Oneworld carrier operates to 70 destinations in the Caribbean and Latin America. “This year demand has remained strong for Miami travel,” Liscano said.

Lynette Harrigan, Niche Marketing and Tourism Liaison Manager at the British Virgin Islands Tourist Board & Film Commission received the award of Member of the Most Excellent Order of the British Empire (MBE) from His Majesty King Charles III for her contributions to International Travel during the COVID-19 pandemic and to the community in the British Virgin Islands. This special recognition was given in the announcement of His Majesty King Charles III’s New Year’s Honours List and is well deserved.

Lynette, who has served the BVITB for over 20 years is highly regarded in international tourism circles and has helped to build the reputation of the British Virgin Islands as a top destination for romance, sailing, dive adventure, luxury and meetings and incentives travel. Her work has helped to diversify the tourism mix and create more business during the traditional tourism “off-season”.

In a press release by the Government of the Virgin Islands announcing the award, Lynette was said to have, “Provided exceptional service to hundreds of tourists and industry partners, even during the recent challenges. During Irma, she offered a lifeline to international partners providing crucial updates and in COVID, she assisted tourists and locals in navigating the changing and at times complex quarantine protocols and producers. She became the ‘go to’ person, working exceptionally long hours to offer around-the-clock assistance to resolve COVIDrelated travel issues.”

Commenting on the award, His Excellency Governor John Rankin, CMG, said, “Lynette is a great representative for the BVI. Over the last two decades, she has repeatedly gone above and beyond in her work for the BVI Tourist Board. She strove tirelessly throughout the pandemic to support travel, which was appreciated by both the industry and tourists. This award rightfully recognises her outstanding achievements for tourism in the BVI, particularly through COVID, as well as her contribution to the wider community.”

Director of Tourism Mr. Clive McCoy said, “Lynette is a highly valued employee of the BVITB who always answers the call in times of crisis. She provided exceptional service to both our visitors and residents travelling to and from the BVI during the COVID-19 pandemic. She continues to play a pivotal role as the Board’s Tourism Liaison to the BVI Government. Congratulations to Lynette, as she is truly deserving of this prestigious award.”

Ms. Harrigan responded, “I am grateful that His Majesty has bestowed the honour of the MBE on me, and I shall continue to serve my community with pride and humility. Though each day presents new challenges, I am driven to succeed and am truly appreciative of this recognition.”

The MBE is awarded to an individual “for an outstanding achievement or service to the community. This will have had a long-term, significant impact and stand out as an example to others”, according to the Government of the United Kingdom.

Business BVI extends our hearty congratulations to Lynette for her continuous hard work in positioning the BVI as a top tier luxury destination and for receiving this most deserving award. She earned it. A great use of an MBE.

he British Virgin Islands International Arbitration Centre (BVI IAC) in late January announced the appointment of Ms. Shan M. Greer as Chief Executive Officer. In that capacity, Ms. Greer will be responsible for the overall growth, management and operations of the institution, as well as being the head of the Secretariat of the BVI IAC. In this dual capacity, she replaces previous CEO, François Lassalle, who served from the founding of the BVI IAC and Hana Doumal, who served as Registrar from January 2021.

Ms. Greer has a distinguished career in private practice in the Caribbean, Europe, and North America as arbitrator, adjudicator, dispute board member, mediator and counsel on a wide range of complex and high-value transactional and commercial disputes in the construction, infrastructure, energy, banking and finance, hotel and property development, oil and gas, telecommunications, and water sectors. Ms. Greer is well known in the Caribbean as a strong advocate for the development of arbitration practices, policies and initiatives and for her involvement in the training of legal and arbitration professionals. Prior to her recent appointment, Shan was the President of the BVIIAC Arbitration Committee.

Speaking on behalf of the Board of the BVI IAC, John Beechey CBE, said that the Board had been enthusiastic in its unanimous decision to offer the post to Ms. Greer. The Board had every confidence in her to lead the BVI IAC into its next phase of development, having negotiated the turbulence of Hurricane Irma and the pandemic.

On her assumption of her new role, Shan said: “I am excited about taking on this new challenge as CEO of the BVI IAC. Francois and Hana did an excellent job building the BVI IAC brand, and I look forward to adding value to their hard work. The BVI IAC provides world-class arbitration services from our state-of-the-art facilities, together with full administrative and recently updated arbitration procedural rules. BVI is also a signatory to the New York Convention and has adopted the UNCITRAL Model Law, which means parties choosing BVI as their seat will benefit from its quality legal framework and stable political environment. Certainly, there is a lot to be excited about in BVI.”

Ms. Greer also highlighted that, “while the BVIIAC’s facilities and rules in and of themselves weigh highly in its favour, I appreciate an institution is only as strong as its people. Rest assured, the Centre’s staff and the local arbitration and legal community are more than capable of meeting international standards.”

Under Ms. Greer’s leadership, in the next few months, the BVI IAC will launch new services and initiatives designed to meet the demands of its key markets and firmly to establish the Centre’s place as the leading arbitration institution in the Caribbean.

ATt the BVI Investment Club’s 30th Anniversary Black Tie Dinner in the Fall with attendees including the Territory’s leading business executives, leading members of Government, and visiting regional guests, CCT’s Chief Executive Officer, Averad Penn, was awarded the BVI Investment Club’s (BVIIC) Corporate Leadership Award.

The award acknowledges and celebrates exemplary leadership that has a significant and positive impact on advancing the organisation led by the recipient. Within the Club’s varied portfolio of interests, the recipient must demonstrate initiative, promotes a work environment that is respectful, collegial, and supportive, leads an effective team to achieve results, and is an excellent role model.

In accepting the award, Penn acknowledged the hard work of his entire team at CCT. “I humbly accept not as an individual but on behalf of all the managers and staff of Caribbean Cellular Telephone who make me look good every day. Leaders are only as good as their people, and I am very fortunate to have such excellent people.”

Penn also thanked the BVIIC for acting on its vision of economic empowerment for Virgin Islanders. Penn adds, “The Club’s initial investment has provided the opportunity for our young people to find a remarkable opportunity at a dynamic, agile, and competitive telecommunications company. We have proven that we have what it takes to compete with the big multinational providers, and if given a chance, we are as good, or better, than anyone.”

Penn became the CEO of CCT in 2013 and swiftly began reorganising the company. Under his leadership, CCT was led from a deficit position to profitability while navigating regulatory and technological changes and the historical impact of the Hurricanes in 2017.

Other awards given out on the celebration of the Club’s 30th anniversary year were the Secretariat Award to Ermyn Richardson; Community Awards given to Judith Charles and Nurse Bernet Scatliffe; and Entrepreneurship Awards to Kristin Fraser and Sinclair Flemming.

The BVIIC was started in 1992 by a group of Virgin Islanders and Belongers who had a vision of meaningful participation in the economic development of the Virgin Islands. The group strongly believed that through collective efforts, they could achieve far greater success than individually. Since then, the group has amassed assets valued at approximately US $100M.

Virgin Gorda Villa Rentals (VGVR), the leading management company for luxury villas on Virgin Gorda, BVI continues to expand its impressive portfolio. Known for their unique coastal and luxury villas with breathtaking views and beachfront locations, the four new villas have diversified the company’s product offering, giving travellers more top choices in terms of luxuriousness, size, style, and sheer character.

These villas have increased VGVR’s portfolio to 28 with villas ranging in size from one to six bedrooms, offer high-end amenities, that are ideal for families, couples and small groups. The villa’s locations create the perfect backdrop for small destination weddings and special celebrations. “Our villas deliver the ultimate getaway with so many amazing choices” stated Sharon Flax-Brutus, Director of Operations. Most of the villas can be booked directly, through a travel advisor or villa tour operator. Travellers and trade partners can check availability and book through the easy-to-use online reservations platform available on the website. Rates are commissionable to the trade.

Amateras is a 5,000 square-foot estate which can be rented as one’s own private resort. Perched on 1.5 acres of hilltop and set among the mighty boulders found only on Virgin Gorda. The villa offers dramatic 360-degree views of both sunrise and sunset over the Atlantic Ocean and Sir Francis Drake Channel. With three independently appointed pavilions, Amateras’ can comfortably accommodate up to eight people.

LaVida is a luxurious 5 bedroom, 7 bathroom beachfront villa in a secluded, private setting on the Virgin Gorda’s western shores. Every room faces west with ocean and beach views and breathtaking sunsets. Privacy is paramount, and guests are just mere steps from the turquoise Caribbean Sea. Villa LaVida features expansive decks surrounding a large infinity pool which offers stunning views of surrounding islands. A few steps down the artisanal stonework pathways brings guests to a virtually private beach.

Segura is a newly built ultra luxurious hillside villa located at the top of Leverick Bay. It is a different type of villa given its carefully designed features. Spectacular and unparalleled views of the North and South Sound as well as the islands of Moskito, Necker, Eustatius and Saba Rock. Five bedrooms with their own private patios facing the North Sound, a large kitchen, an expansive dining pavilion, an infinity pool, polished concrete floors, fire pit for cool nights, make this villa is a truly serene escape. Set on three levels, Segura is one with nature, from its top floor seating where one can enjoy the sun or moon rays to its interior design and muted and natural hues. A small, equipped gym on the lower level sets the perfect tone. www.vgvirgingordavillarentals.com or email vgvrbvi@gmail.com.

Paradise Lane, which was completed in early 2022 is located on the beachfront community of Nail Bay Estate. This centrally air-conditioned 2-bedroom 2.5 bath villa is situated within a lush tropical garden bordering the ultra-exclusive private Nail Bay Golf Course. Elegantly appointed it has an over 1,000 sq. ft. roof top deck, as well as all the latest technological conveniences. The beach is only a short pathway from the villa and guests also have complimentary access to all the facilities of Nail Bay Sports Club.

INTERVIEW: KENNETH BAKER

For two decades before that, the agency was led by Dr. Robert Mathavious, an industry giant who was lauded on his recent retirement - see Business BVI winter 2021/22 - for helping build the economic pillar that today brings in more than half of government’s revenue.

Last fall, Mr. Baker sat down with Business BVI Managing Editor & Chief Content Officer Russell Harrigan at the FSC offices and during a nearly two-hour interview, he fielded questions on topics including his leadership philosophy, the pending public company register, economic tensions emanating from China, Taiwan, Ukraine, inflation and his strategy to help guide the industry through an uncertain future

Business BVI: It’s been nearly two years since you assumed responsibility for the managing director position here at the Financial Services Commission. What has been your biggest challenge so far, and your most satisfying accomplishment.

Kenneth Baker: It has been a turbulent two years. I assumed the role at a difficult time at the height of the pandemic. It was difficult in terms of keeping the commission going in the environment of having to work remotely. This is something that the Commission has done, but usually at a very senior level — with technology you can work remotely. But to get the whole organisation on board was a challenge. The priority was with respect to approvals for licences and for senior officers and things like that: to make sure that those go through in a timely manner and that the service standards [are met]. From a financial perspective, we didn’t know what the fallout would be. But clearly there was an impact on the economy. The tourism sector was completely shut down. Fortunately, our systems remained resilient, even in the environment of working remotely and we were able to meet our financial targets in terms of the revenue that we had projected. So I think the biggest reward is that we were able to keep the commission going with minimal impact on its operations.

BB: So you see that as not only a challenge, but also an accomplishment?

KB: Yes. And it’s really as a result of the collaborative work of the senior management team. We’d meet on a weekly basis; we’d discuss what the challenges were, how we’d go about them. From a legislative perspective, the passage of the Financial Services (Exceptional-Circumstances) Act, 2020 helped tremendously. We had a similar piece of legislation shortly after the hurricanes of 2017, but it had a finite life period. So we put in another piece of legislation, which will operate indefinitely. That was passed in April of 2020, and we continued it up until December of last year, when we felt that things had settled down sufficiently, that we didn’t need these extraordinary powers to make sure the commission operates effectively.

BB: That would have been, I suppose, a lesson out of ’17. The legislation is going to continue — not continue in operation, but it’s there should something happen?

KB: It is there, yes. I suspect what I would want to do is implement it much in the same way that the [United States] would activate

[the Federal Emergency Management Agency] when a storm’s approaching: to declare a disaster, which frees up resources. If it’s a hurricane, then I would be wanting them to implement the legislation prior, and not wait until the aftermath.

BB: At the global level, we’ve entered what is undoubtedly a sustained period of significant turmoil and uncertainty. Some are billing it the end of globalisation, we have the war in Ukraine and the related sanctions against Russia. The growing schism between the US and China, rising inflation, not seen since perhaps the early ’80s and supply chain disruption. There’s an economic slowdown coming at the global level, which is difficult as it is less than two years after the last, which was pandemic-induced. There’s a steep escalation in terms of the cost of energy and climate change challenges. Against this backdrop, how do you see the outlook for financial services in the next 18 months to two years?

KB: We do foresee a slowdown in economic activity internationally, regionally and locally. Internationally — because that’s where we get our business from — we expect to see a slowdown in incorporations. And that has a direct impact on revenue. But the FSC board has just approved an amendment to the fee schedule to increase licence fees: about a 20 percent increase in incorporation fees. So whilst we anticipate that there will be a decrease in the rate of incorporation, we are projecting that revenue should come in on par or even a little bit higher than normal. Certain people will say, “Why increase fees when things are tough?” But what we looked at is the wider popularity of the [product] and the strength of the brand. The brand is perceived as being relatively cheap versus its value. We think we need to get closer to realising the brand’s value. If you have a quality product, then the fees should reflect that.

BB: When would that increase take effect?

KB: Those increases will come into effect from January of 2023. So we are hoping that they’ll be approved by Cabinet and published during the course of this month - September. The industry requests three, four months of notice.

BB: As you said, a global slowdown is a given. China, which is a major driver of our incorporation business, seems to have hit a bad patch economically. COVID, for them — while they started off initially robust and ahead of everyone, they seem to have been the laggards left, in terms of still having complete shut down

of large cities. As a result, the economy has certainly taken a hit, and they seem to be a lot more internally driven. How do you see that? Are they going to be driving most of that slowdown that you anticipate?

KB: Yes, you’re right. China benefited significantly from the pandemic, because they supply everything to the rest of the world. But then coming out of that, what we saw is that other factors then started impacting the Chinese economy, including in the real estate property market. The major property developers are significantly leveraged with outstanding debts in the hundreds of billions of dollars — and the collapse of one or two of those companies — which then can impact the banking sector. Historically, the Chinese banking sector has always been propped up by the Chinese government, and the central bank would always step in when it needed to provide liquidity and additional capital injection. What we find is that if the Chinese economy sneezes, then we feel the direct impact of that: Our temperature starts to increase, because that economic activity is what drives the need for business companies.

BB: Do you have a philosophy or a set of guiding principles that you are using to navigate what is clearly a difficult global environment?

KB: Yes. We will continue to monitor what’s happening on the international stage. That is what translates into our outlook for the economic slowdown. What we’re hoping to do, is to respond in a manner that’s appropriate for the jurisdiction. Which goes back to the point I raised earlier about increasing the cost of incorporation in a downturn. Now, some people may say that’s not the right time to do that, but if you believe in the quality of your brand, then you will have to take what we call a calculated risk in adjusting our price at that time. The management team is important: We discuss these issues, and we arrive at a consensus which we think is the best approach for the jurisdiction. In fact, the consensus view, is that we probably should have gone higher on the fees, because you recognise the strength of the brand. But my approach, is that we will do it in gradual steps. Because whilst most of the companies operate internationally, the companies also operate domestically and it therefore has implications for local businesses. Government has always been asking us to do more for the local companies. Clearly, we cannot go back to the ring-fencing regimes that we’ve had of years gone. So, government would need to find creative approaches as to how to bring relief to the

local companies, because they too will be impacted by the increase.

BB: I’m glad you touched on that. You hear it a discussed a lot in the House of Assembly in particular: As the sector has grown, there is a perception that it has done so with increased costs to the local business companies. The question I have for you — some of which you just mentioned — is, what is the FSC’s view in this regard, and what can be done about mitigating those concerns?

KB: There are two things we have been advising the HOA on. One, the House passed the Micro Business Companies Act in late 2017. For a variety of reasons, it has been suspended. We think it’s time to implement it.

BB: Who caused the suspension?

KB: The House suspended it, because there were some other factors when the Act was implemented with respect to international standards from the [Organisation for Economic Co-operation and Development] and so forth, which the Act didn’t properly address. So as not to disrupt the assessment process with a negative implication, the easier approach was to suspend the Act, get over that hurdle with the Global Forum assessment, and then come back and address those issues. Our work programme actually calls for us to revisit the whole subject: see what amendments need to be made to the Act; get those amendments done; and then bring the Act into force, with the focus being for local businesses. Because we know that economic activity is really driven by entrepreneurs: people who start up businesses. They may start it off with one or two persons — the husband and the wife or the husband and children — and then grows into bigger businesses. The micro business company is a good steppingstone for the starting off of your business, with lower incorporation fees, lower annual fees. Then when it has matured, you migrate and you transition up to the business company, which has more flexibility for bigger businesses. You are then able to afford those higher incorporation fees. Outside of that, the government has an opportunity. What we have advised, is that there are other ways to ease that burden for local companies, which is some sort of a rebate scheme. We’ve seen it in Hong Kong, where the cost of incorporating and annual fees for business companies is rebated through relief in other areas, whether it’s by a reduction in the trade licence fee or different fees that you need to pay as well.

Or it can be done through a direct rebate at the end of the year. So these steps are what we are advising government to do to bring relief to the small entrepreneurs and local businesses.

BB: Is there going to be in this review process, a chance for the airing of the concerns of the small businesses, so that when the package is orchestrated, there would have been some appreciation for their concerns? Is that your bailiwick? Or is that a governmental responsibility?

KB: That is the responsibility of government. The commission is charged with the implementation of the regime. The rebate mechanism is really not an FSC matter. The FSC’S role is to roll out and to collect the fees and so forth. What we are prepared to do, is to provide guidance and advice to the government as to how to go about developing and structuring the rebate. But the commission cannot be involved in the implementation of that. The idea of having some public discussion on it is a good idea. We’ll certainly bear that in mind.

BB: If we can go back to what’s going on globally: The sanctions against Russia, resulting from the invasion of Ukraine, have become a significant challenge for the sector locally in managing their Russian portfolio. The prevailing approach seems to be one where service providers have offloaded that business to avoid conflicts. What’s your take on this approach, and is there an offshore future for Russian business post the Ukraine challenges?

KB: It’s an interesting question. We don’t subscribe to the notion of offloading all Russian business, because that is essentially equivalent to what has been happening to the international finance centres like the BVI: If you’re offshore, the perception is that what you do is bad. In fact, that’s not the case. There’s a perception that if you’re offshore, then you’re involved in money laundering. That’s clearly not the case. The prime minister of Barbados explained it pretty well yesterday at the [US House of Representatives Committee on Financial Services]: The monies are not here in BVI; they’re not here in the international finance centres. The monies are in the major financial centres in the world. How do you launder billions of dollars in small countries? If you walk into a bank with $10 million in cash and ask to deposit it, half the population would know about that before it happens. It doesn’t happen here. That sort of money has to go through big banking systems. Now, we know from

experiences some offshore vehicles — or international-finance-centre vehicles —have been used in money-laundering cases. But at the end of the day, money laundering is getting the funds into the banking system. And the funds would not get into the banking system in the international finance centres. So going back to your question, we don’t subscribe to the offloading of all Russian business. What we do subscribe to, is conducting proper due diligence: knowing your customers and properly riskrating them. If it means that you’re from Russia, you have an elevated risk, so be it. There’s nothing wrong with having highrisk business, provided that you take the appropriate measures and you price your service accordingly.

The sanctions have now resulted in the identification of some $400 million in assets that have been frozen in the case of the BVI. Is that the extent of all assets? No, but that is what has been identified in the BVI. I suspect even more assets are in BVI companies, but elsewhere. It is for the jurisdiction where those assets are to identify those assets and to appropriately freeze them.

BB: Do you view the Ukraine-driven sanctions led by the US and the European Union as a kind of a dress rehearsal for Taiwan should China decide to cross the Taiwan Strait?

KB: Well, we’ve seen that China is taking a more proactive approach to Taiwan. They’ve been doing military exercises for years. The US is stepping up their response as well, by also having their naval presence there. So the answer to your question: That’s probably where we are heading. China’s “one country, two systems” policy that’s in Hong Kong — we’ve seen them flex their muscle there. We’ve seen them put in the national security law. We’ve seen the zero-COVID policy. I suspect to a large degree China wants to see — whether you want to call them its states or whatever — conform to the Chinese philosophy. And I suspect it’s a matter of time before they go a bit further. If that happens, you’re right.

I am not sure what the UN response would be. But I suspect the US would respond in some way. But then the US is in a bit of a difficult situation. I don’t think the response would be as quick as we saw in Russia, because the US has a significant exposure to China, in that a significant portion of US bonds are owned by China. China is a sleeping dragon: You have to be careful how you wake it up or how you disturb it.

BB: Should China decide to invade Taiwan, given the role that China plays in our financial services sector, what do you see will be the implications for the BVI

KB: It could have significant implications for us, depending on if and how economic sanctions are applied, and how those sanctions are worded. If it’s targeted just to the leaders of China, that’s one thing. But if it goes much further than that, then, yes, it could have significant implications for the BVI. As we all know, a large portion of the business comes out of China. But then China also is a major player in the developing world, in Africa and in the Caribbean.

[Barbados] Prime Minister [Mia] Mottley spoke about that yesterday as well, because when the US cut off correspondent banking relationships, you still have to trade, you still have to buy food and import stuff. And you seek alternative arrangements. China has been there for the region. When the US pulled back its close relationship with the region, China stepped in because there was a vacuum. Between China and Taiwan, they’ve stepped in particularly with respect to the independent countries. And they have funded a lot of economic development in those countries, whether it’s airports, sporting venues, and seaports. So they have made significant investments in the region.

BB: Switching a little bit to the United Kingdom, I think it is agreed on both sides that the public registers of beneficial ownership are going to take effect in 2023. Are there plans being made by the FSC to facilitate that? And do you think that those registers will be a serious disruptor toward our Chinese and Asian business?

KB: To answer your first question, yes, the government gave a commitment some years

ago that they will transition to publicly accessible beneficial ownership registers. And then, either late last year or early this year, they assigned responsibility for that to the commission. In an amendment to the Business Companies Act that was passed late June, the legal framework for publicly accessible registers was included and passed. So the framework is there. The next step of the process would be public consultation on the implementation of the regulations to make it effective. Simultaneously, the commission is doing the technical work in the background to put the technology infrastructure in place for that. We aim to have it in place by the end of next year. We don’t see any delay in that, and we don’t see any pushing back on that timeframe. In fact, there have been discussions in the UK on why we can’t just bring it forward, because we have [the Beneficial Ownership Secure Search System, known as BOSSS]. So we are working towards meeting the obligation in the timeframe that has been given.

BB: And you clearly see the BOSSS technology as the model that will be used for that? I’m assuming it’s going to be an electronic registry?

KB: Yes, it’s going to be an electronic registry. We’re doing two things simultaneously. One, we are upgrading the VIRRGIN System. It’s 15 years old. VIRRGIN is like a Toyota Hilux — those rugged jeeps that go anywhere and are sort of indestructible. But it’s 15 years old, and you have new technology. What we want, is to get the system onto the new technology: better resiliency, better features, more ability to do data analysis. So we’re modernising the infrastructure. We are upgrading the technology. As part of that

upgrade, we will build in the ability to have publicly accessible registers.

BB: So there’s a VIRRGIN 2.0 on the horizon?

KB: Call it VIRRGIN Leap; it’s a leap forward in the technology.

BB: You are well under way to making it happen?

KB: Yes, there are going to be various steps to it. The first step really is modernising the current VIRRGIN, plus the beneficial ownership. Then there will be some other phases over the next three to five years, where we’ll be adding more things onto it.

BB: Do you see the public registry having an impact on your Asian business? They seem to have not reacted to it one way or the other. So is it a non-issue with them in terms of the continuation of their business?

KB: I suspect that there will be some individuals who will choose not to have their information publicly accessible. But because the world is shifting in that direction in any event, the international standards are moving in that direction. The fifth European [Union Anti Money-laundering] Directive has it; the [Financial Action Task Force] is advocating it. I suspect it’s only a matter of time before it becomes embedded in the FATF standards. So the world is shifting in that direction. The international finance centres, the overseas territories, are going to be sort of like the leaders in that shift, because the UK is pushing it, but the rest of the world is coming along behind us.

BB: It’s actually one of the areas where we certainly have demonstrated our leadership, even when compared to major financial centres in the world, in terms of the ability to provide this information in a very timely and quick way.

KB: It is not only that: It is the ability to react to issues. Those issues — we almost treat them like existential threats, because it’s a threat to how the jurisdiction operates. And whilst we don’t subscribe to the concept of our HOA passing legislation in one sitting — because you should create an opportunity for public hearing and public contributions — when we are under threat, we respond and put measures in place to do it. Bigger countries don’t demonstrate that nimbleness, although the US did it after 9/11, when they passed the Patriot Act in record time. Then again, the legislation was always drafted for years, and was just sitting there waiting for the right opportunity or crisis.

BB: Recently, you’ve done some amendments to the BVI Business Companies Act 2004. Come January 2023, those amendments are going to come into force. What are some of the key provisions that the amendments are going to cover, and how will it make the BVI business company more competitive?

KB: One of the simpler things, would be the abolition of the bearer share regime. We’ve had it from the [International Business Company] days. Then we started getting pressure internationally about bearer shares. So we then went and we immobilised the bearer share regime. But the empirical data shows that whilst companies had the ability to issue bearer shares, a relatively small amount of them actually did. Now the international standards are moving in directions where they’re saying bearer shares more generally should be immobilised. We’ve already gotten to that stage and we’re going further and abolishing them, because the revenue earned from them is insignificant to the risks and the perception that it imposed. We’re doing away with the regime altogether. In fact, we started a process some years ago, where we have seen that when the bearer share regime came into existence, we had at one point close to 20 authorised custodians for these bearer shares, and over time they have shrunk down to about two or three now. We saw from those that, in fact, we don’t have a big market for bearer shares. So we had asked our licensees to get rid of the ones that they have.

The second major issue is that we’re getting rid of this concept of struck-off companies. That, again, has been around since the IBC Act. Whilst the legislation tells you what cannot happen when a company is struck off, the data shows that in fact, sometimes companies are struck off and they continue to operate in contravention of what the legislation says should happen. Secondly, it was difficult to explain to international assessors how the struck-off regime worked. It was difficult to comprehend, because you’re saying the company is dead but yet it still has a bank account; it is still doing business. It became difficult to explain that. So what’s going to happen, is that the company after it’s struck off — after, I think, a six-month period — if it’s not restored, it will be dissolved. Then they would have about a year to restore it: make an application to the registrar to have the company restored and pay the outstanding fees. After that year, then you’d have to go to the court for the court to make a declaration that the company should be restored. So it will make the process of us being able to explain to assessors how the BVI regime

works simpler and more straightforward. Then the third major section in the act, is what we spoke about earlier: the legal framework for publicly accessible beneficial ownership information. Those are the three issues. It was passed by the House late in June, and it will come into effect on the January, 1st 2023.

BB: A few years ago, there was much anticipation that the requirement for BVI-based substance would result in some economic growth in the territory. Was that just a mirage? Or do you think it still has possibilities?

KB: It was sold to the territory that it would provide economic stimulation: that these people who own these companies would be coming into the jurisdiction; they would need accommodation; that there would be an increase in the office accommodation market as they set things up. That increase in economic activity has not happened to the extent that was anticipated. Not that there was not an increase in activity — there was, but it was more concentrated with the trust and corporate service providers. They have been able to help their companies demonstrate economic substance, by using their own resources. So they designate their staff for the companies; they use the same office environment. You might just add in a phone line or a fax line, whatever the case may be. So they were able to demonstrate that, without incurring significant expense. What did happen, though, is that for the trust and corporate service providers who

were able to provide that service, it meant an increase in revenue for them. But because you didn’t increase your headcount [and] because we don’t have corporate taxes, there was no additional income for government. It went directly to the bottom line for the companies. The wider aspect to that, is that a significant number of those companies were exempted because of the nature of the business that they do. We were thinking that 300,000 or 400,000 companies were going to need to establish a presence. A significant number of them were exempted. If you’re just a holding company, then you don’t need to do that.

BB: Also in 2023 you have the Caribbean Financial Action Task Force assessment in the cards. How are the preparations for that going, and why is this assessment seen as critical?

KB: Yes, you’re right: The assessment is critical. The jurisdiction is a member of CFATF, and so we are obligated by membership to undergo a periodic assessment. This is a fourth round of assessment that’s being conducted, the last round being in 2008, which was the third round. During the previous round of assessment, the BVI did very well. We had one of the top assessment ratings, because it looks predominantly at whether or not you had the legislative framework in place. We did a fairly good job in developing our legislative framework, which is modelled off the international standard. When they assessed it, we were found to be largely

compliant. Since then, the FATF has revised the assessment methodology, so to speak. They have said that, not only do we want you to demonstrate that you have the legislative framework in place, but we also want you to demonstrate that you have effectively implemented that framework. You demonstrate that through, what they call eleven immediate outcomes. They take a deep dive into how effectively you have implemented it. You will demonstrate through statistics and typologies and case studies, that you have been able to identify money-laundering crimes; that you have investigated them; that you have prosecuted them; that you have convictions, because a prosecution without conviction is a futile exercise. The last part is that you have essentially taken the profit out of crime: that you have confiscated the proceeds of crime; that once a person has been sent to jail, that you have frozen and you have confiscated the assets. If you think back to when we went to university, you remember they had different types of tests. You had the multiple choice and then you had a test where you had some essays, and the essay part carries more weight. In this case, it’s broken down into two parts. The technical compliance is essentially: Do you have the legislation in place? That is probably about 25 percent of the marks. And the 75 percent — the essay part — is the effective implementation. Now, you have to have good technical compliance in order to get effective implementation. So if you fail the first part, then you cannot pass the second part. We made some amendments to the legislation just recently, so we’re pretty confident that we can get a good score on the technical compliance. The effectiveness is more of a challenge, but we think we have increased our chance of getting a good outcome there. An important point is that the assessment itself, will be led by the International Monetary Fund in conjunction with the CFATF. Then, once the report is finalised, it will go through the same CFATF process. Why the International Monetary Fund? Well, they’ve had a history of doing assessments in the international finance centre arena. They did an assessment of the BVI back in 2010 as well. So they approached and asked the Government. We discussed it with the Attorney General, who is the contact for the CFATF, and we agreed collectively as a jurisdiction to allow that to happen.

The IMF was actually here a couple of months ago and it did some training, both for the public sector and for the private sector: training as to how to go

about answering the questionnaire on the effectiveness component. It is essentially like a professor saying to you, “I want you to write an essay on a subject and these are the issues that I want you to cover in your essay. And if you follow my guidance and you do sufficient work, then you’ll likely get a passing grade.” We have set up a coordinating committee to lead that process; to engage with the other sectors.

A lot of people may think because the commission is leading it, that it’s an assessment of the commission. It’s not: It’s an assessment of the jurisdiction. So there are a lot of different players. It involves the commission, the Financial Investigation Agency, because they’re the ones responsible for receipt and analysis of Suspicious Activity Reports. They are key part of it. The police is a key part of it. The Attorney General is a key part of it, because they are responsible for international cooperation, mutual legal assistance requests. The Governor’s Office is part of it, because he is responsible for the sanctions regime. The industry is a part of it, because they’re the ones who have to implement. The DPP is part of it because that’s the office who has to prosecute these people. The customs, immigration, they’re part of it, because they need to make sure that criminals can’t get through. So it covers a lot of the public sector. That’s why we had this training to bring them in on it. The first part of the questionnaire — the technical compliance part — has been submitted. That was due at the end of August, and we’re currently working through any remaining issues. The second major submission is at the end of October, when we have to submit the effectiveness component part of it. Then the actual onsite visit will happen somewhere in March of 2023. A team of somewhere around 10 experts will be here to conduct the mutual evaluation. The window is fairly narrow in that CFATF has about two plenaries a year: one early in the year and one later in the year. So somewhere along October, November of 2023, the report should be presented at the plenary for discussion and approval. Then it goes to the FATF plenary, which is the following February, 2024. FATF would look at it to see whether or not the report is consistent with the other reports. If it is, then it is given its final approval. So about mid 2024, the report will be published to the entire community. It’s important because it will demonstrate whether or not the BVI has an effective anti-money-laundering regime in place. A lot of it is based on being able to demonstrate the true statistics to show the number of different things that you have

done and be able to articulate them clearly.

BB: Once it’s done and the assessment is made, what’s the upside of it, assuming we get a good standing? What does it say to the global financial community?