26 minute read

Rebuild Karachi Asif Saad

OPINION

Asif Saad

Advertisement

Rebuild Karachi “Karachi is the capital of the Pakistani province of Sindh. It is the largest city in Pakistan and the twelfth largest city in the world…the city is Pakistan’s premier industrial and finanThe city’s decline may have much to do cial center, with an estimated GDP of $114 billion as of 2014 it is Pakistan’s most cosmopolitan city, linguistically, ethnically with a lack of political ownership, but the and religiously diverse, as well as one of Pakistan’s most secular situation cannot be allowed to continue. and socially liberal cities…Karachi collects more than a third of Pakistan’s tax revenues and generates approximately 20% of PaThe way out is for the business community kistan’s GDP. Approximately 30% of Pakistan’s industrial output to step up with a common agenda is from Karachi while Karachi ports handle 95% of its foreign trade. Almost 90% of multinationals operating in Pakistan are headquartered in Karachi. Karachi is considered to be Pakistan’s fashion capital and has hosted the Pakistan Fashion Week since Cities have a big role to play in national and global economies. According to a Mckinsey report on urbanization, “The world is in the throes of a sweeping population shift from the country side to the cities and for the first time in history more than 50% of human population is living in towns and cities…un2009” An important point is that most businesses thrive in large cities which have these elements because of which companies prefer to locate themselves there. This in turn provides more economic activity and this pattern thus becomes a virtuous cycle of its own. derpinning this transformation are the economies of scale that make concentrated urban centers more efficient”. Why the deterioration?

This scale helps cities provide better human interaction So why, despite Karachi’s disproportionate contribution to through transport and communication, health services, water and Pakistan’s economy, has the city been deteriorating in terms sanitation and most importantly attracting talent and skilled labor of basic services, infrastructure and much more critical together with managerial capability. New York, London, Istanbul, harmony between diverse social, religious and ethnic communiTokyo, Seoul, Shanghai – they are all equipped with these basic attri- ties? The Wikipedia entry actually goes on to discuss the violence butes and are therefore vibrant places to live. in the 80’s which started during the Afghan war and covers the

In my quest to learn where Karachi stands relative to the world, clean-up operation which was carried out only a few years back. I came upon Wikipedia’s description of Karachi, some of which I We do not need to look up the fact that Karachi lacks reproduce here; political ownership, the kind of leadership which smoothens the differences and makes diversity an advantage for the city. The current struggles between federal, provincial and local governAsif Saad ments intertwined with the Pakistani establishment’s influence over everything is only a continuation of the same pattern over the last 3-4 decades. And there is no end in sight to the quagmire. is a strategy consultant who What is more surprising is the lack of ownership shown by the business community in Kahas previously worked at rachi. Pakistan’s biggest local businesses are either based in Karachi or have a large presence here. various C-level positions for The Memons, the Chiniotis, the Dehli walas are just some of the big business communities whose national and multinational home base is Karachi. The multinationals with their head offices have diverse interests - from corporations chemicals and pharmaceuticals to automotive and consumer goods – representing dozens of countries. The financial markets with the stock exchange, bank head-quarters and the most important financial sector regulator – the State Bank of Pakistan, are all based in Karachi. Collectively, these local and international organizations run some of the biggest businesses, employ the most people and have the biggest influence on economic and financial policy making in Pakistan at a broader level.

Even industrial associations such as FPCCI, KCCI, OICCI, PBC, ABC and many more are all based in Karachi and have a large pool of influential individuals within their ranks.

With all this business and financial power behind it what are we to make of Karachi’s continual deterioration? The only logical conclusion one can draw is that those based here have no interest beyond their own selves. As long as their own businesses continue to operate and prosper, they are least bothered with the conditions of the roads, public utilities and general infrastructure of the city.

A simple drive through some of Karachi’s “posh” localities proves the point. You will see these localities with palatial homes worth millions of dollars whose road fronts would be full of potholes, with overflowing and open gutters and mountains of trash heaped on open plots next door.

A way forward

If there is a way out for Karachi, it is for the business community of the city to come together on a common agenda to stop the deterioration and work to improve the quality of life for its citizens. Instead of blaming the government at all levels, it is time to take ownership and engage in collective action with the specific goals like improving mass transport, water and sanitation, public utilities, environment and air pollution, quality and conditions of labor, health services and many other aspects of life.

Let the industrial bodies mentioned above form a “Rebuild Karachi” platform and let prominent and influential businessmen lead the initiative. Let them come on the media and instead of commenting upon macro-economic policies about which they know little, let them speak about the ground realities of Karachi and present solutions which they can initiate and progress.

No government would discourage financial and managerial participation by citizens who are the biggest stakeholders in this city. If the Karachi business community was to do this, it will not be unique. It will only be joining businesses around the world who support local and state governments to build city infrastructure and contribute in creating a good quality life for their communities. We do not have to look far, even within Pakistan, Sialkot chamber of commerce and the export industry based in Sialkot are known to have played a significant role in financing and managing infrastructure development projects for Sialkot city.

Naturally, the primary responsibility for developing Karachi will always be with the provincial and local administrations. But the situation in the city, with fragmented power sharing and unclear administrative lines split between many entities, what’s required is a strong and a leading role from the business community.

Take for example the issue of the 2017 population census which both the MQM and the PPP are protesting against (for different political compulsions) and for good reason. It is counter intuitive that despite massive rural to urban population shift which has impacted Sindh more than any other province in the last 4 decades, the ratio of population between provinces has not changed from the 80’s. If this is amongst the reasons being given for the census numbers to be inaccurate, it is a significant issue which needs to be addressed. Such errors cannot be ignored since the wrong math works against the affected populations in a drastic way and for a long time. Pakistan is supposed to have a population census every ten years but we have not been fulfilling this constitutional requirement and the 2017 version occurred after a gap of nearly 20 years!

Could this be where the business community starts taking ownership? One hopes this would be the beginning of the process. What about the shifting of the PIA head office? In some bizarre way, the management of the national airline is making us believe that they can fix the problems of the airline by shifting its head office to Islamabad. It’s a bit like solving the country’s problems by shifting the capital to Islamabad. We solved everything with that – didn’t we?!

Nations which don’t learn from history can never progress and I am afraid we are consistently following that path. Will the business community raise their voice for the PIA situation? It is not just jobs which are at stake. Airlines need to be located at business hubs from where there is maximum passenger traffic. It’s like Emirates moving its head office to Sharjah or British Air moving to Leeds. Does that make any sense?

I urge the business community of Karachi to come forward and stop the rot. They must think and act wisely by taking ownership of the city. The downward slide impacts businesses and unless there is collective responsibility, adverse economic circumstances will unfold even more so than before. n

Ansari Sugar Mills vs Anver Majid the saga continues

The desire of former President Asif Ali Zardari’s associate, and alleged partner in money laundering, to control his sugar mills from Karachi Central Jail continues to hamper the ability of the company to publish its financial statements

Regular readers of these short reports have likely picked up on the fact that Profit aims to cover a wide variety of listed companies, and sectors. We like to think we are building up both our, and our readers’, familiarity with a subject. And then sometimes, we deliberately cover a company again and again, because it is so ludicrous, that we can amuse ourselves just by tracking the chain of events. This case would be the latter. Poor Ansari Sugar Mills. As we pointed out in August 2020, and again in October 2020, the company has been trying to hold its annual general meeting since February 2020. But its former CEO, Anver Majid, has been fighting to make sure he remains in charge of Ansari Sugar Mills, even if Ansari Sugar Mills wants him gone. You would think this should be easy. After all, the man is in jail.

Let us recap. A Joint Investigation Team (JIT) set up by the Supreme Court accused Anver Majid in December 2018 report of money laundering for former President Asif Ali Zardari, through ‘fake accounts’. According to the JIT, most companies in Omni Group – a conglomerate that owns several companies and, among other things, controls an absurdly large proportion of Pakistan’s sugar manufacturing companies, owned by Anver Majid – acted as shell companies, and as a front group for Zardari himself.

Anver Majid was arrested in August 2018, and has been in jail or out on bail for health reasons since then. The case is still ongoing, for now. But what is well-documented on the Pakistan Stock Exchange (PSX), is that while sitting in jail in January 2020, Majid found out that the company was going to hold an AGM of its shareholders, and subsequently sued the company in February 2020.

Majid is not only the CEO, but he is also a director and holds 51.3% of shares in the company. Majid’s lawyers said the company was taking advantage of the fact that he was behind bars, and conducting an annual general

meeting without prior notice to Majid, which was a mandatory requirement.

So, a stay order was issued by the court, which prohibited Ansari Sugar Mills from holding the meeting. That stay order has been in place since February 2020. It also explains why the last annual report publicly available is from 2017, and the last financial report is from June 30, 2018.

In the latest notice issued to the PSX on December 31, Ansari Sugar Mills pointed out that the annual general meeting cannot be held until the next date of hearing, which will be on January 7, 2021. Not that that means anything: the last date of hearing was on October 25, 2020, and just about nothing has changed since then.

Even Ansari Sugar Mills’ own tone over the months has shifted from anxious to, at this point, resigned, explaining in the notice: “the said stay order is continued from time to time, and still in the field.” The company cannot submit any new accounts because of the court stay order, and asked the PSX to ‘view the peculiar circumstances of the company’.

Peculiar indeed. Anver Majid is not willing to cede control of the company he owns – legitimately or otherwise – even from his jail cell. It is a gloomy start to the new year for Ansari Sugar Mills.

To recap: in 2015, the Federal Investigation Agency (FIA) started an investigation of four suspicious accounts in Summit Bank, which went on until 2018. The Supreme Court took suo motu notice, and ordered a joint investigation team (JIT) to investigate, which went through roughly 11,500 bank accounts. In the final JIT report issued in December 2018, the JIT implicated President Asif Ali Zardari, and also Anver Majid.

According to the report, Anver Majid and his family took bribes and managed Zaradr’s money laundering. In exchange, the Omni Group – a conglomerate that owns several companies and, among other things, controls an absurdly large proportion of Pakistan’s sugar manufacturing companies, owned by Anver Majid – benefitted, and jumping from six companies in 2007, to 83 companies by 2018, with most of the expansion coinciding with Zardari’s presidency (2008-2013).

According to the JIT, most of these companies acted as shell companies, and as a front group for Zardari himself. According to documents compiled by the JIT, between 2007 and 2018, Zardari and his family members declared a taxable income of Rs1.64 billion, while declaring personal assets valued at Rs7.74 billion.

Meanwhile, some of the money from the fake accounts was used for Anver Majid’s family. The JIT said that Rs11.12 million were paid to renovate Anver Majid’s home. Similarly, some money was used to renovate clothing boutique ‘Menahil and Mehreen’ in the upscale Clifton neighbourhood of Karachi, owned by Anver Majid’s daughter-in-law.

And just in case you thought the JIT had not noticed Ansari Sugar Mills: it did. In its report it said that Ansari Sugar Mills has 18 complaints pending against it in the Sindh Abadgar Board, a semi-autonomous body meant to protect the interests of farmers in Sindh, with allegations that it had not paid up to Rs11.2 million to sugarcane farmers. (Notice the pattern? About Rs11.2 million missing from the payments to farmers and almost the same amount spent on renovating his home?)

Furthermore, the JIT accused the mill of having unexplained income reflecting money laundering to the tune of Rs1,072 million. n

Isuzu’s Pakistani partner is definitely not bringing in Chinese SUVs to Pakistan

Ghandhara Industries denies story that has been circulating on social media about its supposed plans to partner with a Chinese automaker

It started with just one article in article innocently ended with “Tell us what a not particularly well-known you think of this upcoming addition of publication. Chery Tiggo 8 in Pakistan?”

INCPak, is short for the Well, we can tell you what GhandIndependent News Coverage Pa- hara Industries thought of this upcoming kistan, a news aggregator of sorts addition: that it was complete nonsense. that started in 2012. A cursory According to a notice issued to the Pakistan look at its homepage indicates a Stock Exchange on December 31, the comlot of news about Pakistani celebrities and pany had to explain itself to the PSX (which a significant amount of technology related had enquired about the news on December news. It also has a dedicated section for 28). Ghandhara Industries has not, in fact, automobiles. entered into any negotiations or contract

And on December 27, the website written or otherwise with any company to published the article: “Ghandhara Indus- introduce Chery Tiggo 8. tries plans to introduce Chery Tiggo 8 in “The media reports, including the Pakistan.” The article went on to say that news item in INCPAK are baseless and the Ghandhara Industries Ltd was to enter have no legal standing,” the company stated into an agreement with the China-based emphatically. Chery Automobiles to distribute and manu- One can see why the company had facture its sports utility vehicles (SUVs) in to issue a statement: in the few days since Pakistan. the article, the news had spilled over into

The Chery Tiggo 8, is a seven-seater multiple niche websites that cater to auto mid-sized crossover SUV, first introduced enthusiasts. But the letter only seemed to in 2010, and is popular in China. According cause more confusion. That is because there to the article, the SUV would compete with were now other media reports that it was in other existing SUVs in the country, like the fact Ghandhara Nissan that was introducHyundai Tucson and KIA Sportage. After ing the SUVs, not Ghandhara Industries. providing details of the car’s features, the But wait, are those the same com-

panies? Why are there two companies called Ghandhara anyway? Is one a subsidiary of the other? Is Ghandhara Nissan even bringing these SUVs to begin with?

Let us try and parse who is who.

First, forget about Ghandhara for just a moment. Start with, instead, the Bibojee Group. The conglomerate was started by family patriarch Habibullah Khan Khattak. Born in 1913 in Wana, South Waziristan, he had spent his entire life grooming for the top position of the Pakistan Army, the Commander-in-Chief (this position is now known as the Chief of the Army Staff or COAS).

And yet in 1958, when Ayub Khan made himself Field Marshal and President of Pakistan in the country’s first coup, he picked Muhammad Musa Khan for the top position. Khattak, following the long standing tradition of the armed forces in Pakistan of resigning when a junior officer is promoted to the top job, was in effect forcibly retired at the age of 46.

So much for the military career. But while Musa Khan went on to lead the Pakistan Army in the 1965 war with India, Khattak set his sights on becoming an industrialist. Known as ‘Bibo’ to his friends and family, he literally named his conglomerate the Bibojee Group, which includes three cotton spinning mills (two were measured last year), a woolen mill, an insurance company, and a construction company.

But the crown jewel of the group are the two automobile companies. While Khattak may have picked a folksy nickname for the conglomerate, he picked a grand name for the auto companies: Ghandhara, after the ancient kingdom in the Peshawar Valley mentioned in the Sanskrit epics Mahabharata and Ramayana.

The older of the two Ghandhara companies is Ghandhara Industries, which in 1963 took over the operations of General Motors Overseas Distribution Company (which had started in 1953). Initially, it focused on Bedford trucks, and Vauxhall cars. In 1972, the company was nationalised, renamed National Motors, and also started manufacturing Toyota cars.

In 1984, National Motors added Isuzu vehicles to its portfolio of products, which was just as well, since the Toyota manufacturing line had been re-privatised and handed over to the House of Habib’s joint venture with the Toyota Motor Company. In 1992, Khattak re-acquired his company, just two years before his death and changed its name back to Ghandhara Industries.

The other company is called Ghandhara Nissan Ltd, and that was incorporated in 1981. It was started as a reaction to the fact that Khattak’s old company had been nationalised – not knowing he would buy it back in the 1990s. Ghandhara Nissan was converted into a public limited company in May 1992.

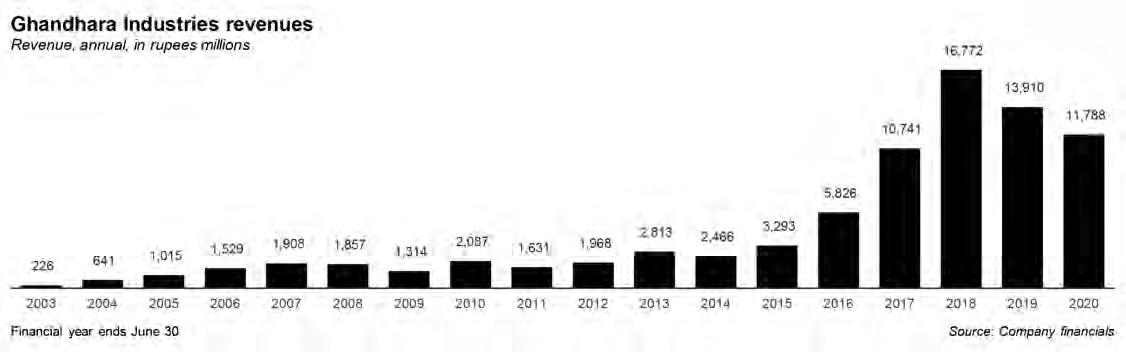

Now, both companies are part of Bibojee Group. The group has a 58% share in Ghandhara Nissan, and a 39% share in Ghandhara Industries. Ghandhara Nissan also has a 19% share in Ghandhara Industries. The key difference is that Ghandhara Industries makes and sells Isuzu trucks, buses and pick ups, while Ghandhara Nissan manufactures JAC Trucks, and imports and sells Nissan, Dongfeng and Renault vehicles.

Neither company has announced to the PSX that it is bringing in the Chery Tiggo 8. However, it is Ghandhara Industries that has categorically denied the fact. The jury is still out on Ghandhara Nissan: reports persist that it will introduce new SUVS. Ghandhara Nissan is tight-lipped so far, but it did send a cryptic notice to the PSX on December 24 saying only this: that they were in discussions with stakeholders on some new business prospects, and that formal arrangements had not been decided yet. That could mean, well, anything. But clearly something is being planned at Ghandhara Nissan.

Just not at Ghandhara Industries (and don’t you forget it). n

Azgard 9 Distressed to sell its manufacturing plant for Rs825 million

The transaction is part of a distressed fire sale arranged at the behest of the company’s major creditors after the company defaulted on its loan obligations

In business, as in life, it sometimes pays number nine in Ancient Greek mythology repre- located at Ruhi Nala, Lahore, was being sold to be a little superstitious. Clearly, the sented fulfillment of creation. by the creditors of the company as a security management of Azgard 9 thought so, And that is how, Azgard 9, decided to enforcement action. The price of the entire unit, and when naming their denim com- officially form its company on the ninth day including plant and equipment? A hefty Rs825 pany, decided to draw on all the luck of February in 2004, by nine members, so that million. The sale agreement was executed on from different world cultures. As they it could ‘sow the seeds for an auspicious and December 9. explained in one of their annual reports, the term rewarding future’. The creditors were able to do this because Azgard is a reference to one of the nine worlds Fast forward some 16 years later, and one of a Lahore High Court order from July 2018, in Norse mythology, protected from the powers can imagine Azgard’s management wondering where a Creditors’ Scheme of Arrangement was that be by the Norse god Heimdall. Meanwhile, where their luck went. In a notice issued to the sanctioned. Still, the company remained hopeful, the number nine is taken from China, where it Pakistan Stock Exchange (PSX) on December despite losing a whole denim unit. “The sale of represents ‘change’ and ‘transformation’. The 30, the company said that its garment unit said FPS unit will not affect the business of the

company, as the company has arranged sufficient production facilities to cater to business requirements,” it said, without specifying what those requirements were.

How did it come to this? Let us look back at the history of the company.

Azgard Nine Ltd was incorporated in Pakistan in January 1993 as a public limited company. Initially, it went by the name ‘Indigo Denim Mills Ltd', and commenced business in January 1994. Just one month later, the name was changed to ‘Legler-Nafees Denim Mills Ltd’, and remained that way for a full decade, before settling on ‘Azgard 9’ in 2004.

The company is a composite spinning, weaving, dyeing and stitching unit, engaged in the manufacturing and selling of yarn, denim and denim products. It is registered in Lahore, and has been run by one man - Ahmed H. Sheikh - since the very beginning. Ahmed is the fourth generation of the Sheikh family, who have their origins in Shamkot, Punjab, where they first began their business in 1886. However, formal industrialized yarn manufacturing was started by the family in 1972, while spinning and denim weaning was started in 1995. Ready-made denim garments were started in 1997.

Asgard 9 has three units: Unit I is located in Kasur district, Unit-II is in Muzaffargarh and Unit-III is in by Ruhi Nala, Lahore. Today, Unit I is operational, but Unit II and III are non-operational. According to the company, they are being are held for sale under the ongoing Creditor's Scheme of Arrangement for rescheduling, re-profiling and settlement of the company’s outstanding liabilities towards its creditors. It is this third unit that is being sold for Rs825 million.

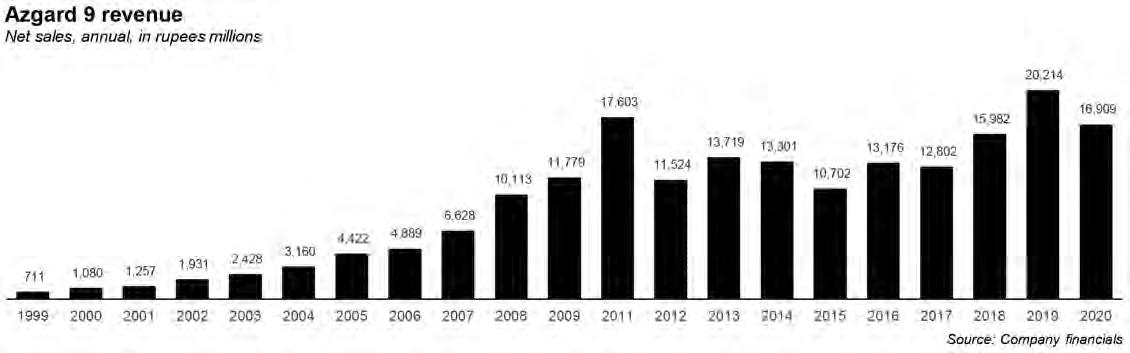

If one looks at the company’s sales over the years, the picture looks somewhat promising. The company grew steadily between 1999 and 2007, before crossing the Rs10,000 million mark in 2008. It has stayed above this mark for the last 12 years. Starting in 2015, the company’s sales went from Rs13,000 million in 2016, to Rs15,982 million in 2018, and finally, its highest sales in 2019, at Rs20,214 million.

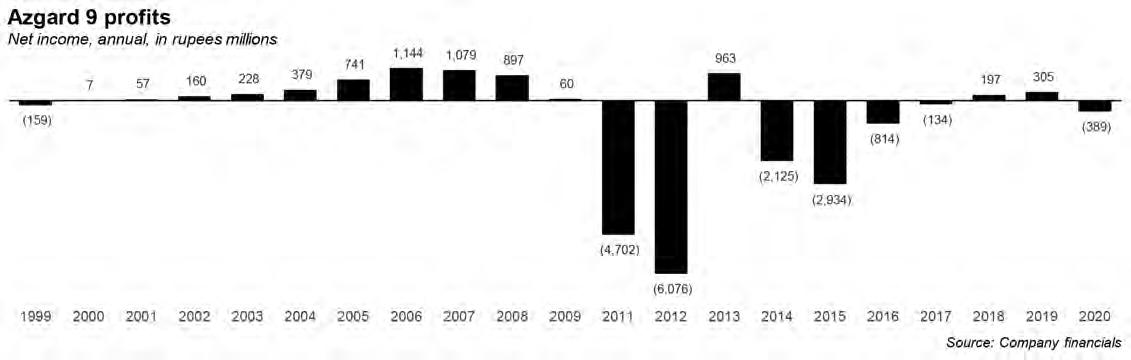

But when one looks at the company’s profit and loss statements over the same period, a very different picture emerges. Between 2000 and 2004, the company had anemic profit growth, though up till 2008 it had profit hovering around the Rs900 million mark. But in 2010, and 2011, the company had absurd losses: Rs4,702 million in 2011, andRs6,076 million in 2012. Despite a brief respite in 2013, ot had severe losses again of around Rs2,500 million in 2014 and 2015. It never really recovered from this setback, having made a small profit of Rs385 million in 2019, and a loss of Rs389 million in 2020. Objectively, the company’s multiple annual reports show the same trend: that despite the general high sales, the cost of sales are almost equal, if not higher than sales, every year.

The company had to be restructured in 2012, and the company was unable to meet debt obligation because of a liquidity crunch. Another financial restructuring was then started in 2014. Yet by 2020, the current liabilities of the company exceeded current assets by Rs 8,794 million, with financial liabilities including Rs15,406 million relating to overdue principal and interest. Meanwhile, accumulated losses stood at Rs11,752 million.

On July 31, 2019, the Lahore High Court approved the scheme, by which the principal and interest of the debt would be paid off by selling some of the company’s assets. This was meant to happen by June30, 2020, but was delayed because of Covid-19.

It is a long game: as the company noted in its latest annual report, once these non-core assets are sold then the settlement of debt obligations will start, after which the company’s debt level will [hopefully] become sustainable. n

Two and a half years after applying, PTCL’s licence has still not been renewed

The country’s second-largest telecommunications company – and the biggest one owned by the government – is facing significant delays from its own regulator

Ah, PTCL. The company has pany Ltd, seems so ingrained in society, as existed in some form since part of the social fabric as other random 1949, two years after the Pakistani things that have been around for existence of the country. decades: PIA, the army, chai – you get the This explains why Pakistan picture. Telecommunication Com- That is why it is easy to forget that

like many other companies in Pakistan, PTCL is operating off the goodwill of the regulator. In this case, that would be the Pakistan Telecommunication Authority (PTA), which issues licenses.

It was PTA, who in 1996, issued a license to PTCL to operate for the next 25 years, which it did happily. In a notice issued to the Pakistan Stock Exchange on the first day of the new year, PTCL explained that its license – which ran from January 1, 1996, to December 31, 2020 – had expired, and that it required a renewal of its license.

Knowing this, PTCL had initiated the process on June 29, in 2018, a full two and half years before the expiry date of the license. And like clockwork, the PTA responded a few months later, in October of that year, saying that it would renew the licence according to government policy.

And then? The PTA sat back, and did... nothing. This is what explains how two and half years later, PTCL – which is the national telecommunications provider, has the largest fibre cable network, and employs 16,000 people – suddenly finds itself unable to operate in the new year.

Just to hammer that home: the PTA is a government body. The PTCL is majority government-owned. Those 16,000 employees are government employees. You would think that someone at the PTA’s licensing division would have paid attention to the upcoming renewal.

For those readers scrambling to check if their PTCL connection is still working, PTCL has taken action to make sure it can still operate. That involved filing a literal lawsuit against PTA in the Sindh HIgh Court on December 18, two weeks before the end of the year. PTCL has requested a permanent injunction against PTA, which means that PTA cannot take any adverse action or “interfere in the business of PTCL and the provision of services on the basis of license”.

What is going on? On the surface, it seems like bureaucratic inefficiency, once again. According to the notice, PTCL and PTA and the federal government are still in talks to decide on the terms and conditions of the license.

PTCL, as mentioned before, began its life in 1949 as the Post and Telegraph Department, before morphing into the Pakistan Telephone and Telegraph Department in 1962. But in actuality, PTCL should be viewed through the prism of the 1990s: that decade was the beginnings of Pakistan’s data and telecommunications networks.

In fact, even the PTA was set up in the 1990s, as part of a range of telecommunications and internet companies and bodies introduced during the (very, very slow) digitisation process of Pakistan. Consider: the internet was introduced in Pakistan in 1993. Pakistan got its first submarine fibre optic in 2000, which was also the year it set up its first IT policy at national level.

PTC (Pakistan Telecommunication Corporation) took over the department in 1991, which was also the year the federal government announced it would partially privatise the corporation. That happened five years later, PTCL was given its original license for an agreed licence fee of Rs249 million, and also listed on the Karachi Stock Exchange.

PTA has over the years agreed to amendments in the license. In 2005, the PTA modified the license, to include a spectrum license for a fee of Rs3,647 million, which means that PTCL can provide wireless local loop (WLL) in Pakistan for 20 years. Then in 2008, PTA allowed PTCL to establish and maintain a telecommunication system in Azad Jammu and Kashmir and Gilgit-Baltistan. This was for an agreed license fee of Rs109 million. In 2015, WLL was also allowed in those territories, from Rs98 million.

But by far the most interesting thing that has happened to PTCL, is that it was partially acquired by a foreign shareholder in the mid2000s. In June 2005, the Dubai-based company Etisalat acquired a 26% share in PTCL – with management control – for $2.6 billion. And in March 2006, it was also promised some 3,384 PTCL properties.

However, only 3,248 were transferred, while 136 properties were simply not. There is some confusion over why this happened: according to one account, the properties never existed, and PTCL’s asset management wing had bungled, owning only 3,248 properties but weirdly mentioning 3,384 in the privatisation agreement finalised in 2006. According to another account, the properties were in fact partially owned, or owned by provinces, despite being occupied by the federal government.

Either way, Etisalat was not amused. The company was given five years to pay the acquisition price in installments, but citing non-compliance over the properties, Etisalat refused to pay the last $799 million chunk. In January 2020, Etisalat offered to pay $300 million, but the matter is still pending, having now been taken up by the Economic Coordination Committee (ECC) and the cabinet.

Every year, the government of Pakistan duly lists that $799 million as a source of revenue for that year, and every year, Etisalat – like Lucy with Charlie Brown and the football – refuses to pay.

Is this long-standing squabble perhaps the reason for the delay in the licence’s renewal delay?