08 Are sectoral risks undermining Pakistan’s renewable energy progress?

12 The dark side of Pakistan’s digital ‘masterplan’

17 Topline calls the top on the sharp rise in Mari Petroleum’s stock

19 Bank Makramah Limited, formerly Summit Bank, is restructuring again. What is different this time?

23 The telecom sector flourished in a tumultuous year for the economy

28 If Pakistan’s agriculture is to thrive, farmers need banks. But the banks need farmers too.

Publishing Editor: Babar Nizami - Editor Multimedia: Umar Aziz Khan - Senior Editor: Abdullah Niazi

Editorial Consultant: Ahtasam Ahmad - Business Reporters: Taimoor Hassan | Shahab Omer

Zain Naeem | Saneela Jawad | Nisma Riaz | Mariam Umar | Shahnawaz Ali | Ghulam Abbass

Ahmad Ahmadani | Aziz Buneri - Sub-Editor: Saddam Hussain - Video Producer: Talha Farooqi

Director Marketing : Mudassir Alam - Regional Heads of Marketing: Agha Anwer (Khi) Kamal Rizvi (Lhe) | Malik Israr (Isb) - Manager Subscriptions: Irfan Farooq

Pakistan’s #1 business magazine - your go-to source for business, economic and financial news. Contact us: profit@pakistantoday.com.pk

By Ahtasam Ahmad

Pakistan’s energy sector consistently dominates headlines, from contentious Independent Power Producer (IPP) contract re-negotiations to the transformative potential of the emerging solar revolution. The nation’s power landscape, marked by persistent circular debt and reliability challenges, exemplifies how energy infrastructure can fundamentally shape a country’s economic trajectory.

The critical link between economic stability and a robust power sector is well recognized by policymakers and international institutions like the International Monetary Fund (IMF), which has made power sector reforms a cornerstone of its support programs for Pakistan.

However, high-level policy discussions often overlook the complex dynamics that

shape Pakistan’s power sector challenges, reducing multifaceted issues to simplified narratives about capacity payments or transmission losses. The reality involves an intricate web of technical, financial, and governance challenges that cannot be addressed in isolation.

While this publication in its previous analyses have explored these challenges individually – focusing on specific aspects like circular debt, transmission infrastructure, or regulatory frameworks – this time we attempt to elaborate on how various risk factors in the energy sector interact, particularly their impact on the cost of capital and the viability of renewable energy projects.

The global transition to clean energy faces a stark disparity: despite record-breaking worldwide investments, emerging and developing

markets capture only a fraction of available funding, even as they harbor some of the greatest needs for clean energy expansion. Outside China, clean energy investments in emerging markets have plateaued at approximately $260 billion annually, highlighting a persistent gap between potential and reality.

This funding challenge is particularly evident in Emerging Markets and Developing Economies (EMDEs), where public sources, including development finance institutions, provide roughly half of clean energy project financing. This heavy reliance on public funding stands in sharp contrast to advanced economies, where public financing comprises just 20% of total investment.

While increased funding from all sources is crucial, many EMDEs face severe constraints in expanding public sector support. The triple impact of the COVID-19 pandemic, rising interest rates, and mounting debt sustainability concerns has significantly weakened their fiscal positions.

The infrastructure backbone of the clean energy transition – including low-emissions power generation, grid systems, and storage facilities – depends heavily on debt financing. In most emerging markets, transmission and distribution networks remain under public utility control. However, these utilities often struggle with high debt burdens and weak revenue streams, limiting their ability to secure capital for critical grid expansions needed to integrate renewable energy effectively.

The cost of capital in EMDEs presents another significant barrier, driven largely by elevated domestic interest rates that reflect persistent inflationary pressures. These high rates create a demanding investment threshold and complicate financing efforts. For projects funded in foreign currencies, particularly US dollars, borrowing costs compound further, calculated as the US base rate plus a country risk premium.

The severity of this challenge became especially apparent in 2022-2023, when long-term government bond yields – a key borrowing cost indicator – surged across many countries, with Pakistan experiencing an increase of over three percentage points.

Pakistan exemplifies the challenges faced by emerging markets in renewable energy development. Over the last three fiscal years, the country’s policy rate tripled while its credit rating dropped to a three-decade low. Although recent policy rate reductions have sparked renewed investor interest, both country-specific and sector-specific risks continue to deter investment in Pakistan’s power sector.

Renewable energy, despite being the most cost-effective electricity generation option in Pakistan, relies heavily on affordable financing to maintain competitive rates. Cost of capital constitutes more than 75% of the generation tariff for these projects. This cost of capital apart from policy rate is influenced by multiple risk factors: political uncertainty, regulatory changes, sovereign risks, currency fluctuations, off-taker reliability, and repatriation restrictions.

To quantify how these risks affect the levelized cost of energy, Renewables First, an Islamabad-based energy transition think tank, developed a risk-weighted analysis model. Their methodology assigns weightings to each risk factor based on industry and investor surveys. The model then compares existing base tariffs of established renewable projects in Pakistan against a benchmark scenario using best-in-class financing costs from markets like Germany, where debt costs 2.8% and equity investors expect an

8.3% return.

Due to these risks being consistently elevated for the past few years investors are extremely bearish on Pakistan’s renewable energy sector which is reflected in the fact that there has been no financial close recorded for utility scale renewable energy projects in the past three fiscal years.

While chaos reigns in the national grid, Karachi Electric (KE) has emerged as an unexpected bright spot in Pakistan’s renewable energy landscape. The private utility operator has recently achieved remarkable success in its renewable energy auctions, securing a record-low bid of 3.1 cents per kilowatt-hour for a 220MW hybrid project in Dhabeji, Sindh. This momentum continued with another milestone: a 3.4-cent bid for a 120MW solar project, setting another benchmark for solar technology in the country. This success stands in stark contrast to the federal government’s struggles with its ambitious 600MW solar project in Muzaffargarh. The project’s initial stumbling block was an unrealistic benchmark tariff in its Request for Proposal (RFP). At 3.4 cents per kilowatt-hour, this ceiling price set by the Private Power and Infrastructure Board (PPIB) failed to attract investors, despite using a reverse auction mechanism. The benchmark tariff, meant to guarantee price stability throughout the Power Purchase Agreement (PPA), simply didn’t align with market realities and project economics.

The challenge extends beyond tariff considerations. Pakistan’s broader risk profile significantly dampens investor confidence, with regional neighbors like India, Bangladesh, Nepal, and Sri Lanka often viewed as more attractive investment destinations. This perception is largely driven by Pakistan’s

power market complications, particularly its persistent circular debt issues and inconsistent policy environment.

To quantify this stark contrast between KE’s success and government projects, a comparative analysis of Levelized Cost of Energy (LCOE) proves illuminating. Using standard market assumptions set by the regulator - including a 120MW solar project costing approximately $59 million, financing at SOFR + 4.25%, a 14% return on equity, and a 75:25 debt-to-equity ratio - the LCOE calculation yields approximately 3.4 cents per kilowatt-hour.

However, the real insight emerges when adjusting for risk perception. Using benchmarks from the Climate Policy Initiative’s study on renewable energy investments in developing economies, we examined countries with similar credit ratings and power market challenges to Pakistan, such as Egypt, South Africa, Bangladesh, and Tunisia. Taking a conservative estimate from this peer group, applying a 30% return on equity requirement increases the tariff by over 34% to approximately 4.5 cents - and this excludes potential increases in debt risk spreads, which would push costs even higher.

And to further understand the magnitude of the crisis at hand we refer to the appeals filed by Zorlu Solar Pakistan Limited, a developer of a 100 MW solar project, with the national regulator. According to the developer, the country’s low credit rating, as indicated by S&P and Moody’s, has impacted the Project unfavourably. Leading to reluctance among lenders to provide financing. This rating significantly influences financiers decisions, impacting the cost model of the company due to factors like spread margin and country risk. Furthermore, the specific issues within the power sector, such as circular debt problems, delayed payments and renegotiations with operational projects having signed EPAs, have added to the difficulties in securing foreign financing.

The developer also referred to the results of competitive bidding for the 600 MWp solar PV project of PPIB. To substantiate its claims, it pointed out that the Federal Government earlier decided to opt for reverse competitive auction with benchmark tariff, however, that process did not find success. Later, the Federal Government decided to conduct open competitive bidding, i.e. the flexibility was given to the prospective bidders to determine tariff parameters such as equipment cost, financing cost,

equity etc.

Also, a significant portion of tariff was allowed to be pegged with USD both at COD as well as during the operational phase, to provide predictability in terms of costs and revenues for the project. In addition, a special arrangement to guarantee the timely payment to the successful bidder was provided by the Federal Government.

However, despite offering all these incentives, the Federal Government extended the timeline for the bid submission multiple times, but the process could not find the sponsor to develop the project. These results indicate that the prevailing conditions are such that sponsors and lenders are hesitant to invest in the country, despite being given the freedom to determine the cost of funds (financing cost, return on equity etc.) and other parameters by themselves.

On the contrary, KE is elevated in the eyes of investors due to the fact that it has an impeccable record of timely payments to IPPs unlike the Central Power Purchasing Agency which delays payments for months. Additional support is drawn from the fact that KE has marked its funds in Master Collection Accounts for repaying its long-term debt, ensuring timely obligations.

The government’s credibility has been further eroded by its pattern of abruptly terminating or renegotiating IPP contracts every few years. This inconsistent approach to contract management has created deep-seated uncertainty in the market.

The contrast between KE and government projects is stark, according to representatives from multilateral development banks financing Pakistan’s energy sector. While KE has earned investor confidence through streamlined processes, timely payments, and reliable contract enforcement, government initiatives continue to suffer from bureaucratic delays, payment uncertainties, and a troubling history of contract disputes.

The glaring disparity between public and private sector performance in Pakistan’s power sector calls for a fundamental rethinking of policy approaches. Government’s track record of erratic decision-making, heavy-handed interventions, and perpetual political instability has severely undermined Pakistan’s investment narrative.

Source: Renewables First

While sovereign-backed projects struggle to attract investors despite generous incentives, private entities like K-Electric successfully secure investments simply by maintaining payment discipline and financial transparency.

This divergence not only challenges the conventional wisdom of sovereign guarantees but also raises fundamental questions about governance capabilities. The government’s inability to replicate basic business practices—such as ensuring timely payments and maintaining consistent policies—suggests a deeper crisis of institutional capacity and strategic thinking.

The success of private sector initiatives demonstrates that Pakistan’s investment challenges stem not from external factors alone, but from self-inflicted wounds caused by poor governance and policy inconsistency. This reality presents a compelling case for reconsidering Pakistan’s single-buyer power generation model. By opening the market to more private players, the sector could benefit from increased operational efficiencies, improved project execution, and enhanced investor confidenceadvantages already evident in existing private sector initiatives. n

The timing of the bill and the lack of data privacy legislation in Pakistan raises questions about the government’s intentions

By Abdullah Niazi

The single stupidest decision any Pakistani can take right now is to trust the government. Especially this particular government.

And no, we are not raising a question on the competency of the incumbent cabinet and the bureaucratic leadership working underneath them. We are also not taking a moral or political stance in this assessment. What we are saying is far worse, far more insidious and dangerous than any of this. We are claiming that as responsible, well-informed, well-meaning members of the Pakistani electorate should not trust the intentions of this incumbent government.

Just look at the Digital Nation Pakistan Bill that was recently presented on the floor of the National Assembly, and which is now under deliberation by a standing committee of the lower house of parliament.

By all accounts the bill is a decent exercise in legislative writing. Shaza Fatima Khawaja, the minister of state for IT who is responsible for the bill, is an experienced parliamentarian with strong political pedigree and an academic inclination. The bill is forward looking and models itself on successful examples of centralised digital governance from around the world.

Despite all of this, the government’s intentions for what they want to do with the bill are far from clear. The disdain with which this government has treated the internet and digital life in Pakistan has no comparison. Even though the incumbent minister, at least on the surface, lacks the smugness and audacity that has come to define this government, she has been a full and happy participant in the trampling of digital rights and freedoms.

Which is why the introduction of a digital ‘masterplan’ in this bill raises more questions than it answers. But what exactly is the proposed bill? In different circumstances, could it be considered a legitimate roadmap to financial and bureaucratic inclusion for a vast chunk of this country’s people? And if implemented, what could be the downsides?

Much has been said about what the Digital Nation Pakistan Bill sets out to achieve. Perhaps nothing encapsulates the idea

behind this bill more than the concept of a Digital National Identity. Modern governance has long required efficient methods to sort, register, record, and include people into some kind of database.

Technology has evolved over time and the methods to identify people have become more sophisticated, from paper archives and files to completely digital methods. In Pakistan, for example, a massive exercise was undertaken in the early 2000s under the late Dictator Pervez Musharaf, whose regime introduced NADRA and computerised data about people’s names, dates of birth, addresses, and other basic information.

Data like this is vital in the growth of any country and economy. Having it centralised in and verifiable from one place allows for the efficient functioning of government institutions. For example, NADRA played a pivotal role in identifying and helping families that were eligible for the Benazir Income Support Programme during the Gillani administration. The infrastructure from the BISP was later used for the Ehsaas Programme in Imran Khan’s government, which became a crucial lifeline for people during the Covid-19 pandemic.

The Digital Nation Pakistan Bill proposes to build something similar to this, but much more sophisticated. Under the bill, every citizen of Pakistan would be granted a digital national identity. This would be a pin, a number, or some kind of an access marker that would be unique to every single individual, the same as a CNIC Number.

This digital identity would be used for everything. So it would have the same function as an ID card, and as such be used for things like marriage certificates, bank accounts, taxes etc, but would also be connected to everything else. Essentially, this digital identity will be centrally stored and linked to every aspect of governance you can think of. The FBR, SECP, State Bank, will all have access to this identity, and a person will be able to use their digital ID to do any kind of business.

If you want to open a store, get a loan, pay your taxes, apply for a birth certificate, or a driving licence you will simply do it through this digital ID. Individuals will be registered with NADRA, while legal entities and businesses will be registered with the SECP.

A digital identity of this sort is the basic building block of what is known as e-governance, a concept that has spread in many parts of the world where much of the everyday work

of governance is automated and done through online platforms. Pakistan currently stands at 139 in the world when it comes to e-governance.

The idea for a digital identity makes sense. This publication has in recent times repeatedly said that Pakistan has the basic building blocks to become a thriving economy. The one block in achieving this has often been government machinery, both political and bureaucratic. A digital identity system would remove a whole lot of red tape.

The bill, which once again seems to be a bespoke and well-written piece of legislation if nothing else, says that this digital identity would be connected to government entities and public sector organisations through a “data exchange layer”. In the bill’s own words, this is an interoperable digital framework that facilitates the sharing and integration of data between government entities, businesses, and individuals.

The government’s reasoning is that as of now, different departments of the government, often on a provincial and local level as well, are working separately to create platforms that digitise government. Islamabad as a city, for example, has an app that can be used to pay taxes, register property, and apply for a drivers licence. Similarly, the FBR has its own portal that can be used to file taxes and look for information. However, if you are a person living in Islamabad, you will have to sign up for these services separately.

A digital masterplan through digital identities proposes the integration of these services through a single source.

Take one use case as an example. Currently, most people file their taxes through a lawyer or accountant because that is the easiest way to go about things. Before you file your taxes, you have to gather all of your financial information including bank statements, property ownership, employment details, any cars you might own, your dependents, your maternal grandmother’s nikanamah, and any other assets you might have. All of this information is compiled and given to the FBR. If a digital identity that was fully integrated existed, all of this information regarding property, excise, dependents, etc would already be linked to your identity number.

Theoretically, all you would have to do is log in to your FBR portal, punch in your digital identity, give the website permission to access other data that is available with your ID number, and then file your taxes at the click of a button. On the other hand, it would also be much easier for the FBR to sort through this information since it would all be neatly laid out in front of them. It works both ways.

And there is more. Imagine this system is connected to other aspects of life as well. For example, if a person goes to a government or private hospital, they give their digital identity number to the hospital while registering at the front desk. Their ID is now linked to their medical history, insurance, previous reports and everything else. That makes it very convenient for doctors and patients alike. On top of this, the government will also be able to track what regions certain diseases are spreading in, and have localised data to track and combat it.

This is where things get a bit tricky. The bill has the right idea, but to implement it, they are proposing the creation of two new entities. The first will be the National Digital Commission (NDC) and the latter will be the Pakistan Digital Authority (PDA).

The NDC will be a governing body meant to provide strategic direction and to draft a Digital Masterplan. This is an apex body making bigger picture decisions. It will be chaired by the Prime Minister, and will have all four chief ministers as members. This is especially important since after the 18th amendment, most powers have been devolved to the provinces. Any sort of masterplan coordination to centralise a digital identity and integrate it with government services and entities will require concentrated coordination between the centre and the four provinces.

On top of this, the NDC will also include the Governor of the SBP, the chairman of the FBR as well as the head of the SECP. Together, this group of people will determine a framework for how digital governance should operate in Pakistan. However, the powers of this commission are very vaguely defined. It is supposed to craft all kinds of strategies related to digital elements in Pakistan. Within the bill, no specific provision has been made for the governance of the internet, but the language of the bill is vague enough that it could include all kinds of digital governance.

To implement this masterplan, the bill is also creating the PDA. This will be a body with far-reaching powers that will govern these integrated systems. It will work like any good bureaucratic body does. It will have a chairman, bureaucratic and political members,

and its job will be implementation. Part of its job will be enforcing regulations, guidelines, and standards. Essentially, if the bill becomes a law, anything that the NDC considers important for the masterplan, the PDA will have full authority to implement it. While this is not the stated mission of the bill, it could very well be used to control, censor, and monitor anything going on in the digital realm.

On top of this, the authority will also have access to every aspect of data in one location for every citizen of the country. The bill claims it will add a consent layer so that all data is shared for specific purposes, but this will essentially mean the government will have control of all this data. As a commodity, data is perhaps the most in-demand product in the world these days. Companies pay billions to mine and acquire it. This will essentially mean Pakistanis handing it over to the government, which can use it as they wish when they want. Even though it might not be legal, that rarely seems to be a problem for those in charge.

The idea here is that these digital identities can be leveraged for capital mobilisation through digitisation. However, the biggest impediment and proof against the government’s intentions is how they have treated the internet and the digital space in Pakistan before.

In a parliamentary committee session, the government claimed it was unable to “give a time frame” as to when the internet will face a reduction in disruptions, including shutdowns and throttling, said Parliamen-tary Secretary for Cabinet Secretariat Sajid Mehdi. He stated that ongoing internet disruptions were due to measures being taken by the Interior Ministry to strengthen security measures, which was why neither “the Pakistan Telecommunication Authority (PTA) nor the cabinet division” could provide a clear timeline.

This was the main concern that many members of the national assembly raised in the committee. They are very valid concerns. The government has regularly been caught in lies regarding their censorship and control of the internet. In a recent conversation, the executive of a major telco told this correspondent that the government has on certain days, whilst claiming they are not doing anything to the internet, disrupted their operations with no prior notice.

Only two weeks ago, Shaza Fatima Khawaja was denying a problem ever existed during a television talk show. When a number of tech experts pointed out the obviously slow internet, she laughed and said hers was working fine. On the 18th in the house, she admitted that there have been issues in the

past few months and the slowdown has been the result of security concerns.

Members of the National Assembly raised concerns about the impact of the state of internet disruption, causing billions in rupees in terms of business losses, academic activities being impacted, as well the inability to open images, video or voice-based messages in WhatsApp. While there were a few familiar faces that said there was a need for security, and condemned “the use of digital space for terrorism and harassment”, questions were asked as to what is taking so long regarding the national “firewall”, and, in regards to proposed legislation such as the Digital Nation Pakistan Bill, “[what] digital Pakistan are we talking about when there is no internet facility?”

This is the crux of the matter. It comes down to trust. Trusting this government with any bill—let alone one that holds the keys to controlling the digital future of Pakistan—is not just a risky decision; it’s a catastrophic one. The Digital Nation Pakistan Bill may appear, on the surface, as a well-crafted piece of legislation, but the government’s track record, particularly when it comes to digital rights, speaks volumes about its true intentions.

This is the same government that has repeatedly weaponized the internet, stifling free speech, blocking access to information, and imposing arbitrary restrictions on digital platforms. How can we trust the same players who have shown nothing but disdain for online freedoms to suddenly act in the best interest of a digital society? The same government that has trampled on the freedoms of Pakistan’s digital citizens cannot be trusted to create an environment where technology serves the public good.

Even if this bill holds the promise of a more inclusive future, the risk is too great under this administration. The introduction of this bill, while seemingly progressive in its scope, is riddled with ambiguities and potential for abuse. The government’s attempt to centralize and control digital infrastructure under the guise of creating a “Digital Nation” has the distinct odor of authoritarianism. Even if the bill’s language is forward-looking, the execution, under this administration, will most likely follow the same path of misused power, inefficiency, and surveillance that has marked their approach to nearly every other issue.

It is clear that every technological step forward is also a step closer to greater control and surveillance. The people of Pakistan deserve better—better leadership, better intentions, and above all, better protection of their freedoms. This government has shown time and again that its intentions are anything but benevolent. For the sake of our digital future, we cannot afford to let it continue down this path. n

The 27th Convocation of the Institute of Business Management (IoBM) was more than just an academic milestone; it was a celebration of perseverance, dedication, and triumph. The event paid heartfelt tribute to the persistent support of parents and faculty whose guidance and encouragement played a vital role in shaping the graduates’ journey towards a bright and promising future.

“Today marks the beginning of an exciting new chapter in your lives,” declared the Keynote Speaker, Yasmin Fasih, as she inspired the graduates during the 27th Convocation of the Institute of Business Management. Yasmin, currently serving as the Regional Human Resource Manager for Operations Execution in the Asia-Pacific region at Maersk, Singapore, is an alumna of IoBM’s inaugural batch of 1997.

A vibrant sense of excitement and limitless ambition illuminated the faces of the 1,591 graduates as they received their degrees during the 27th Convocation on Saturday, December 14, 2024.

Aspiring entrepreneurs and future leaders celebrated this significant milestone with enthusiasm, sharing the joyous moment with their proud parents.

Among the graduating class, 24 students were awarded gold medals, while 44 received merit certificates. Degrees were conferred across a diverse range of programs, including BBA, BS, MBA, MS, MPhil, and PhD.

The event was honored by the presence of distinguished guests, including Governor Sindh Kamran Khan Tessori as the Chief Guest; Dr. Gohar Ejaz, former caretaker Federal Minister of Commerce, Industry, and Production, as the Guest of Honor; and former caretaker Prime Minister of Pakistan, Anwaar-ul-Haq Kakar.

Governor Sindh Kamran Tessori, in his address,

encouraged the graduates to reflect on the day their parents accompanied them on their first day of school and how their steadfast support has guided them to this significant milestone. He praised the leadership of IoBM’s late Founder President, Shahjehan Syed Karim, for establishing this institute of higher learning. The Governor, highlighting the invaluable contributions of IoBM’s late Founder President, Shahjehan Syed Karim, to the field of education, announced his intention to recommend to the President of Pakistan that he be posthumously honored with the prestigious Hilal-e-Imtiaz.

Dr. Gohar Ejaz praised the graduates, acknowledging their success as a testament to their parents’ sacrifices and emphasizing the privilege of their accomplishment. He outlined Pakistan’s abundant opportunities and shared an economic overview, emphasizing the significant role graduates play in driving progress. “Pakistan has immense potential for growth, and what we need most today is you!” he concluded.

While presenting the Institute’s progress report, IoBM President Talib Karim underscored IoBM’s dedication to achieving AACSB accreditation, expanding global partnerships for alumni, and integrating advanced technology into the curriculum. He also highlighted the efforts of IoBM’s Center for Islamic Business and Finance, which is actively aligning its initiatives with the broader developmental goals set by the government.

In his Welcome Address, IoBM Chancellor Bashir Janmohammad encouraged the graduates to dream big and develop entrepreneurial skills to add value to their lives and careers. He also acknowledged the untiring support of parents in helping students achieve their dreams.

Anwaar-ul-Haq Kakar expressed his excitement about being among the youth, stating, “I feel energized when I am surrounded by young minds brimming with vigor. A formal education helps channel this energy toward meaningful objectives.” He encouraged the graduates to actively contribute to building an egalitarian society, describing it as the Pakistani dream we must strive to achieve.

Yasmin Fasih commended the graduates for their hard work and perseverance, reflecting on her own journey at IoBM. “Remain deliberate and purposeful in your approach, embrace lifelong learning, and don’t hesitate to take chances in life,” she encouraged.

Valedictorian Rida Asif, the proud recipient of the Shahjehan Syed Karim Gold Medal, highlighted the importance of corporate social responsibility in her address. She inspired her fellow graduates to harness their education and skills to create meaningful change and leave a lasting positive impact on society.

Topline Securities, a prominent Karachi-based investment bank and brokerage firm, has downgraded Mari Petroleum Company Ltd (Mari) from ‘HOLD’ to ‘SELL’ in its latest research report. The decision comes amid Mari’s recent stellar performance on the Pakistan Stock Exchange (PSX), which has seen the company’s stock price soar to unprecedented heights.

Sunny Kumar, an equity research analyst at Topline Securities, authored the report, expressing skepticism about the sustainability of Mari’s current valuation. Kumar argues that the recent rally in Mari’s stock price has already factored in all publicly available material information, suggesting limited upside potential for investors.

Mari has been on a remarkable upward trajectory, outpacing its peers in the oil and gas exploration sector. The company’s stock has posted a staggering return of 259% year-to-date, significantly outperforming its closest competitors. Oil & Gas Development Company (OGDC), Pakistan Petroleum Ltd (PPL), and Pakistan Oilfields Ltd (POL) have returned 108%, 86%, and 79%, respectively, during the same period.

This exceptional performance has catapulted Mari into the elite club of Pakistan’s most valuable companies. In a historic moment, Mari recently overtook OGDC to become the largest company on the PSX by market capitalization. As of the latest trading session, Mari’s market value stood at an im-

Star analyst Sunny Kumar says the market has gotten ahead of all known information, and expects the stock to have a 20% downside from current levels

pressive Rs984 billion ($3.5 billion), surpassing OGDC’s Rs963 billion ($3.4 billion).

The company’s financial results for the fiscal year 2024 further underscore its robust performance. Mari posted net income of Rs77.3 billion, reflecting a substantial 38% yearon-year increase compared to Rs56.1 billion in the fiscal year ending June 30, 2023. This record-breaking profitability was driven by a 7% year-on-year increase in hydrocarbon sales, totaling 39.01 million barrels of oil equivalent (MMBOE).

Despite Mari’s impressive track record, Kumar’s report raises red flags about the company’s current valuation. The analyst has set a December 2025 target price of Rs606 per share for Mari, implying a potential downside of 20% from current levels. This target price is based on an assessment of Mari’s 1P and 2P reserves and implies a price-to-earnings (P/E) ratio of 7.5x on projected 2026 earnings.

Kumar points out that Mari is currently trading at premium valuations compared to its peers and historical averages. The company’s fiscal year 2026 projected P/E ratio stands at 10.1x, a 47% premium to the sector average of 6.9x. Moreover, Mari is trading at a 29% premium to its 10-year historical average P/E of 7.8x.

The report also highlights that on an enterprise value to proven and probable reserves (EV/MMBOE) basis, Mari is trading at US$3.9/BOE, compared to an average of US$3.55/BOE for PPL and OGDC. This suggests that the market may be pricing in overly optimistic expectations for Mari’s future performance.

One of the key factors driving investor optimism around Mari has been its exploration success in North Waziristan. The company made a significant hydrocarbon discovery at the Shewa-1 exploratory well in June 2022, hailed as the biggest discovery in Pakistan in over a decade.

More recently, in January 2024, Mari announced another gas discovery in North Waziristan. The Shewa-2 well, drilled to a depth of 4,577 meters, yielded promising results. The Hungu formation was tested at a gas flow rate of 0.274 million standard cubic feet per day, while the Lockhart formation showed even more impressive results, with a gas flow rate of 51 million standard cubic feet per day and 391 barrels of condensate per day.

These discoveries are particularly significant given the historical context of North Waziristan. For years, the region was a hotbed of Taliban insurgency, making oil and gas exploration virtually impossible. The ability to conduct exploration activities in North Waziristan is a testament to the success of Pakistan’s long and protracted military campaign to root out militant groups from the area.

The Tehrik-e-Taliban Pakistan (TTP), led by Baitullah Mehsud, had long posed a significant threat to Pakistan’s stability. The group was held responsible for numerous attacks, including the assassination of former Prime Minister Benazir Bhutto. In response, the Pakistani military launched a major

offensive in Waziristan in June 2009, aimed at neutralizing Mehsud and his network.

The successful military operations in North Waziristan, which continued for several years, eventually created the conditions necessary for economic activities like oil and gas exploration to take place. Mari’s recent discoveries in the region are thus not just of economic significance but also symbolize the transformation of North Waziristan from a conflict zone to an area of potential economic growth.

To fully appreciate Mari’s current position, it’s essential to understand the company’s history. The story of Mari Petroleum begins with the discovery of the Mari Gas Field in 1957 by the Pakistan Stanvac Petroleum Project, a joint venture between the Government of Pakistan and Esso Eastern Incorporated U.S.A. The field came into production in 1967, marking the beginning of what would become one of Pakistan’s most important energy assets.

In 1983, a significant shift occurred when Esso Eastern sold its entire shareholding to the Fauji Foundation, the Government of Pakistan (GoP), and Oil and Gas Development Company Ltd (OGDCL). This led to the incorporation of Mari Gas Company Ltd (MGCL) in 1984, with Fauji Foundation, GoP, and OGDCL holding 40%, 40%, and 20% stakes, respectively.

The company’s evolution continued with its listing on all stock exchanges in Pakistan in 1994, following the government’s divestment of 50% of its shares. A major milestone came in 2001 when the company was granted a license for oil and gas exploration, expanding its activities beyond production.

In November 2012, recognizing its diversified operations, the company was renamed Mari Petroleum Company Ltd (MPCL). The following year, MPCL established its Services Division, comprising a 2D/3D seismic acquisition unit, a seismic data processing center, and

a fleet of onshore drilling rigs, transforming it into a fully integrated exploration and production (E&P) company.

A pivotal moment in Mari’s history came in 2014 when the Economic Coordination Committee of the Cabinet approved the dismantling of the Mari Gas Wellhead Price Agreement, replacing it with an international market-oriented crude oil pricing formula. This change allowed Mari to operate on commercial terms, unleashing its full potential in comparison with its peers.

Mari’s recent performance has been nothing short of exceptional. In fiscal year 2024, the company saw a 25% year-on-year increase in net sales, driven by higher hydrocarbon sales volume, increased wellhead prices, and the depreciation of the Pakistani Rupee. The company’s exploration expenses decreased by 19% year-on-year, partly due to the absence of dry wells.

Looking ahead, Mari has secured a five-year extension of its Mari D&P lease until November 2029, with an additional payment of 15% wellhead value. The company is also diversifying its portfolio, with its subsidiary, Mari Mining Company (Pvt) Ltd, being awarded two mineral exploration licenses in Balochistan’s Chaghi district.

In a move that signals confidence in its future prospects, Mari announced an 800% bonus issue and declared a final cash dividend of Rs134 per share for the fourth quarter of fiscal year 2024, bringing the total 2024 payout to Rs232 per share, a 58% increase from the previous year. Despite Mari’s impressive achievements, Kumar’s report suggests that the market may have gotten ahead of itself in valuing the company. The downgrade to ‘SELL’ is based on the belief that all publicly available positive

developments are already priced into the stock.

Kumar’s analysis takes into account Mari’s future earnings potential, projecting earnings per share of Rs69 and Rs80 for fiscal year 25 and 2026, respectively. These projections represent a 7-17% increase compared to fiscal 2024 earnings of Rs64 per share. The analyst assumes gas production of 860 million cubic feet per day (mmcfd) from the Mari field for FY25, increasing to 900 mmcfd for fiscal 2026. Additionally, the report factors in potential production of 70 mmcfd from the North Waziristan block starting in the third quarter of 2025.

While acknowledging the promising prospects of Mari’s North Waziristan Block, Kumar notes that the company’s valuation does not currently incorporate any reserve levels from this block. The analyst suggests that these will be updated once discoveries are made and reserve data is published.

Mari’s success comes against the backdrop of a challenging environment for Pakistan’s energy sector. The country has long grappled with energy shortages and a heavy reliance on imported fuels. The government has been actively encouraging domestic exploration and production activities, particularly in under-explored and remote areas like North Waziristan, to boost energy security and reduce the import bill.

However, the sector faces numerous challenges, including security concerns in certain regions, regulatory uncertainties, and the global push towards renewable energy sources. Mari’s ability to navigate these challenges while delivering strong financial results has been a key factor in its market outperformance.

As the dust settles on Mari’s recent stock price rally, the market will ultimately decide whether Kumar’s cautious stance is warranted or if Mari can continue to defy expectations. Regardless of the outcome, Mari’s story remains a testament to the potential of Pakistan’s energy sector and the transformative power of effective management and strategic vision. n

The bank is expected to receive another restructuring deal, but this is nothing new for the bank that is operating under its third name now. It might not be the cure.

By Zain Naeem

Bank Makramah’s logo is doing a lot of heavy lifting. The palm tree sprouting over a desert oasis is the kind of on-the-nose symbolism you would expect from a first year BBA student giving a presentation in Marketing 101 wearing a suit he last wore to his cousin’s baraat.

The initial impression is obvious enough. They want to exude some kind of religious, Arabic, identity consistent with

their branding as an Islamic bank whose owners are based in the Gulf. But perhaps even more than that they want to use this new-life symbolism to try and shed off the baggage that comes with their previous name: Summit Bank.

It is strange enough, but the entity that is now BML is operating under its third name. The beginning of the bank dates back to the early 2000s when Arif Habib and Bangladeshi state owned Rupali bank carried out a joint venture under the name of Arif Habib Rupali Bank. Rupali bank had already

established a branch in Karachi which started operations in 1976 and this was the first time the bank was collaborating with a private sector entity.

Due to State Bank’s (SBP) regulation on equity, the bank had to be merged with Arif Habib in order to stay operational. The deal was finalized in 2004 and the bank started its operations in 2006. Subsequently, the bank was listed on the Stock Exchange in 2008. Since then, the bank was renamed to Summit Bank in 2010. The conversion to an Islamic Bank came in 2023.

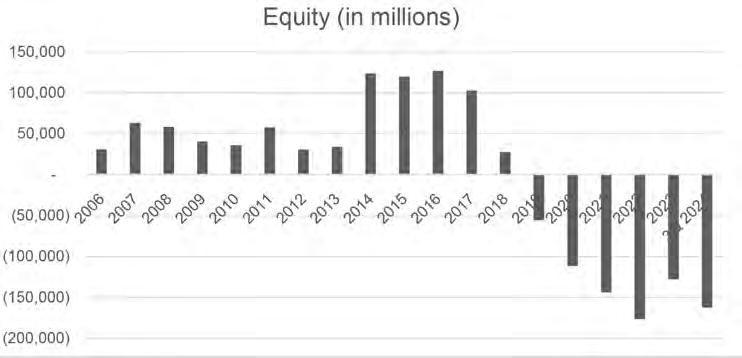

Since its inception, the bank has been plagued by losses which has seen its equity being drained away on a consistent basis. From 2008 to 2023, the bank has suffered losses every year which has meant that the bank has to rely on constant injections of new equity in order to stay afloat. In 2006, the equity of the bank was around Rs 3 billion which has become negative and stands at Rs 16 billion due to unappropriated losses of Rs 51 billion. As its losses started to pile up, the company got additional investment taking its share capital from Rs 3 billion to Rs 31 billion in 2024. Currently, the bank has assets worth Rs 267 billion and liabilities of Rs 283 billion leading to liabilities exceeding even the assets the bank owns. With such a dire situation, there is an attempt to carry out another round of restructuring.

The new deal would mean that Global Haly Development Limited will be merged with the bank and the shareholders of Global Haly will end up getting ordinary shares of Bank Makramah in return. In addition to this, the bank will also issue ordinary shares to its Term Finance Certificate Holders which will reduce the liabilities of the bank and increase its equity. Lastly, share capital of the bank will be reduced against unavailable assets leading to an overall impact of Rs 29.4 billion on the net assets of the bank. This comes in conjunction with the commitment by Abdulla Nasser Abdulla Hussain Lootah where he will deposit Rs 5 billion in the bank against share capital if the bank still needs additional capital requirements as prescribed by the SBP.

As the restructuring talks are gaining momentum, the share price of the bank has jumped from Rs 2 on 19th November to almost Rs 3 within two weeks. But the optimism has to be considered with some caution. The problem at the bank is not that it does not have backers who are willing to finance the bank through

tough times. The problem with the bank is that it is not generating enough revenues to meet its expenses. As the company fails to meet its fundamental costs, the losses start to pile up leading to loss in equity. This is the story of how the bank is not addressing its internal controls which are leading to losses in the first place. There is a need to plug this hole to save the ship from sinking.

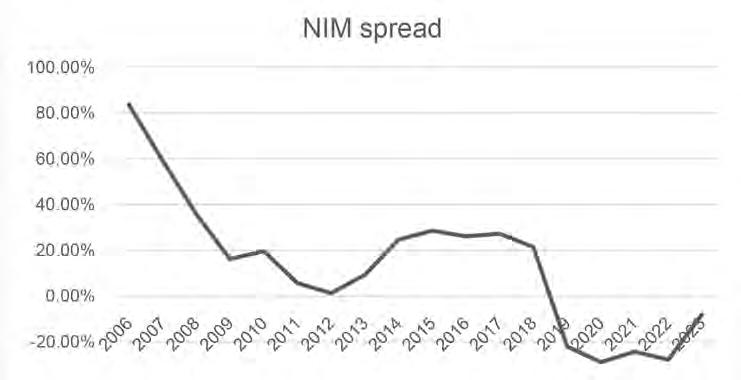

The business of a bank is to do what any manufacturing company does. Take a unit of raw material, add value to it and then sell it at a higher price. Except for a bank, the raw material is money and the deposits that it gets from the consumers. The job of the management is to yield a return from its advances and investments which is higher than the amount that is being given to the depositors. A successful bank is able to maximise the return that it earns from its advances and investments and minimizes the cost of depositors. The start to Arif Habib bank was started on the right foot. In the early years, the markup earned by the bank in 2007 was around Rs 62 crores while its expenses were Rs 25 crores leading to a net interest income of Rs 37 crores. This is the pure profit the bank earned after deducting the cost of raising the funds. Taking 2007 as a benchmark, the bank was also able to earn a gain in terms of profit it earned from selling its securities as well leading

to a profit of Rs 23 crores for the year.

This was the best the bank would see for some time. Starting from 2008, the bank started to expand in a big way. It was able to double its advances from Rs 8 billion to Rs 17 billion in a space of a year. Similarly, the bank was able to fund these advances through deposits which also grew from Rs 9.5 billion to Rs 16.6 billion. Due to an aggressive expansion strategy, the markup earned grew to Rs 2.4 billion from Rs 62 crores just a year ago while the markup expenses increased from Rs 25 crores to Rs 1.6 billion. In just a space of one year, the company saw its gross margin spread fall from 59% in 2007 to 35.8% in 2008. This points towards the fact that the spread that was being earned by the bank a year ago was greater. In 2008, the interest earned on loans decreased while profits given to depositors increased leading to this fall.

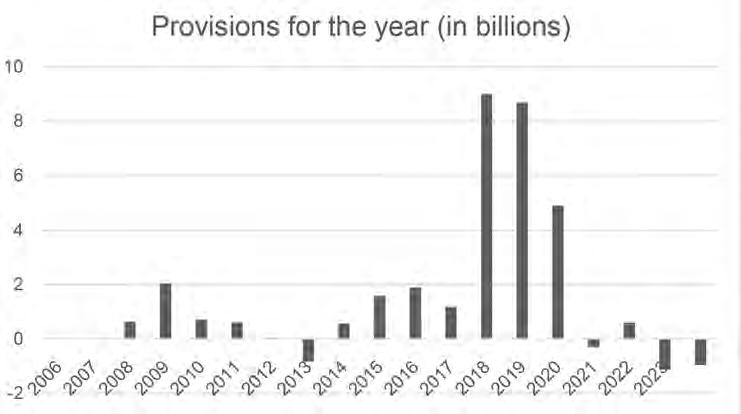

Another impact of the increase in lending was the fact that the company started to set aside provisions for loans that it expected would not be paid back. Since its inception, the bank had no such provisions but seeing an aggressive expansion strategy, the bank started to maintain a buffer against any future non performing loans. In 2008, the bank set aside Rs 62 crores for these provisions. Once other income and expenses were accounted for, the bank ended up suffering a loss of Rs 19 crores.

This set off a period for the bank that never saw any profits. Even though the bank was seeing higher revenues from markup earned, the increase in markup expenses kept increasing. The spread was 35.8% of the markup earned in 2008 which shrank to 1.2% by 2012. The lowest spread margin coincided with the fact that the company saw markup interest earned of Rs 10.3 billion while its expenses were Rs 10.1 billion. The rise in the costs took place while the bank started to keep higher provisions against non performing loans. As the network of the bank kept expanding, its administrative expenses started to rise as well, leading to a loss of Rs 2.7 billion in 2012 alone.

The portfolio of the bank was expanding

where investments and advances crossed the Rs 100 billion mark in 2012 and the assets of the company had more than tripled from Rs 38 billion in 2009 to Rs 132 billion in 2012. This growth in assets was funded by deposits which increased from 31 billion in 2009 to Rs 97 billion in 2012 and borrowing carried out which went from Rs 1.8 billion to Rs 29 billion in a space of four years.

During the times the bank was facing losses, the bank was bought by Suroor Investments in 2010 which acquired 59.4% of the stake and changed the name to Summit Bank. Suroor Investments also acquired Atlas Bank and MyBank Limited bringing all of these holdings under the umbrella of Summit Bank which saw the network of the bank expand to more than 190 branches in the country.

As the bank was acquired, there was a fresh injection of equity in the bank as issued share capital was increased by carrying out a right issue. With the performance of the company in the doldrums, the issue had to be carried out at a discount which ate into some of the equity that was raised. By 2012, the share capital had increased to Rs 11 billion, however, the losses meant that the equity only totalled at around Rs 3 billion.

In terms of the investments that had been made by the company, the bank held Rs 44 billion in Treasury Bills (T-Bills) and Pakistan Investment Bonds (PIBs) which were government securities yielding a return of 10.5% on average. In comparison to this, out of the Rs 97 billion held in deposits, Rs 68 billion was held in fixed and savings accounts which yield a high return leading to a reduced spread being earned by the bank.

This was a gaping wound that needed to be highlighted as it was existing at the bank. This meant that it was paying out a higher cost to its depositors while its investments were yielding a lower rate of return. Even the funds the bank had given to higher yielding advances and loans were becoming non performing assets actually decreasing the interest earned by the bank. As the equity of a bank falls, there is an additional pressure on the bank to attract more and more depositors. Banks that have a better

standing and financial position can offer a certain amount of return on their deposits. Based on their strength, investors feel safe depositing their funds with these banks. A bank with low equity has to attract borrowers and depositors with a more attractive rate of return. This translates to higher rate to depositors, especially for fixed and term deposits, while lower borrowing rates to borrowers to lend to them.

The year 2012 was a watershed moment for the company as it saw a loss per share of Rs -2.5 even though it crossed markup earned threshold of Rs 10 billion. From 2012 to 2018, the company kept trying to battle losses showing a loss per share of Rs -3.32 in 2018. During these 6 years, the revenues and cost of the company started to fall leading to a net spread income of Rs 1.8 billion. However, after taking provisions into account, the bank actually lost Rs 7.1 billion even before other expenses were considered. With falling income from other sources and rising costs, the bank saw a loss before taxation of Rs 11 billion which decreased as it got Rs 2 billion as tax credit against their losses. From 2012 to 2018, the asset profile of the company stayed similar with the bank increasing its advances from Rs 52 billion to Rs 61 billion and decreased its investments from Rs 50 billion to Rs 19 billion.

In terms of its borrowings and deposits, the bank was also shedding some weight as it saw its borrowings go from Rs 29 billion to Rs 19 billion and its deposits decreased from Rs 97 billion to Rs 85 billion.

In order to finance the gap in their assets and liabilities, the management first issued preference shares which were converted into share capital. Share capital actually doubled from Rs 11 billion to Rs 21 billion in the six year time period, however, the losses also reached from Rs 6 billion to Rs 20 billion negating any increase in equity. By 2018, most of the investments the company had were in PIBs which were giving a low yield. In regards to advances, the company had actually given out loans of Rs 83 billion, however, its provisions stood at Rs 22 billion taking down the value of its advances to only Rs 61 billion. In terms of its deposits, the bank still held almost half the amount in savings accounts which were increasing its cost of financing.

Since 2019, it seems that things have only gotten worse for the bank. In previous years, the bank was suffering losses, however, it was at least able to cover its markup expenses with the interest income it was earning. From 2019 to 2023, the bank actually started to suffer losses caused by excessive markup expenses compared to its interest income. In 2019, the bank earned Rs 6 billion but faced expenses of Rs 7.2 billion for the year. This was before the fact that the bank took into account provisions of Rs 9 billion which led to a loss of Rs 10 billion from its interest department alone. After other expenses were accounted for, the company suffered a loss of Rs 14 billion before tax which was again tampered down by tax loss which decreased the loss to Rs 9.5 billion.

With falling equity, the company saw many of its investments and advances decreasing in 2019 as well with the size of assets going to Rs 106 billion from Rs 115 billion a year ago. The bank also started to rely on its depositors in order to fund its operations rather than borrowing from outside sources. In the past, the bank had been able to use its revaluation reserve in order to show a positive equity. After suffering another loss of Rs 10 billion, the equity for the bank became negative in 2019.

A negative equity is a dangerous sign for any company. It becomes increasingly difficult when a bank is involved. A negative equity for a bank means that even after it is able to sell all its assets and pay back its loans, it will still fall short of paying every creditor off. For a bank, a part of its creditors are depositors who have kept their hard earned money at the bank which they expect to withdraw in the future. A bank with a negative equity would mean that some of its depositors would not be able to withdraw their savings from the bank. This is why SBP requires banks to be financed to such an extent that the depositors do not see their savings being lost away in losses.

In terms of its investments, the bank was mostly invested in PIBs which were yielding a low return and two thirds of its portfolio was invested in loans given to borrowers still. In terms of the deposits, more than half the depositors had savings accounts which meant that the bank was still paying a high cost for retaining these depositors. From 2019 to 2023, the bank was able to stimulate its revenues as it saw record breaking interest income of Rs 32 billion for the year. However, the problem persisted as the bank ended up bearing interest expenses of Rs 34 billion in comparison. One positive development that has been seen is that the bank has been able to reverse some of its provisions which bode well in terms of the controls. After taking other expenses into account, the bank still suffered a loss before taxation of Rs 7.4 billion. The reason behind the bank earning a high amount of revenues was due to its investment portfolio which grew from Rs 51 billion in 2022 to Rs 180 billion in 2023. Many of these investments were funded by growth in borrowing from Rs 25 billion to Rs 130 billion and increase in depositors from Rs 122 billion to Rs 157 billion from 2022 to 2023. The net assets and equity of the bank were still negative as its losses kept increasing without any end in sight. The bank even carried out a further injection of Rs 10 billion in equity, however, the losses meant much of this increase was wiped away. The investment portfolio was primarily made up of PIBs and Ijarah as they were yielding a high rate of return for the year. The bank increased its PIB investments from Rs 14 billion to Rs 108 billion while it invested Rs 30 billion in the Ijarah market as it had converted

into an Islamic bank. In terms of the advances, the company still held Rs 34 billion as provisions against loans given out meaning it only expected Rs 19 billion to be returned from the total outlay of Rs 53 billion loaned out. Even though the bank was able to increase its deposits from Rs 122 billion to Rs 157 billion, most of the deposits were in savings accounts which overstated the cost of these deposits.

Based on the complete analysis, there are two major problems that are present at the bank which need to be addressed before any positive developments can be expected. At one end, the bank is taking deposits and borrowings at a high cost. In order to attract depositors, the bank might be giving a higher return compared to its competition but the problem is that its investments are not able to meet the costs that it is incurring. Until the bank starts to widen the spread between its revenues and expenses, the bank will keep suffering losses going forward.

Another issue plaguing the company is the fact that its credit controls are too laxed. From 2007 to 2023, the bank has made provisions of around Rs 30 billion out of its loan portfolio of Rs 53 billion. This means that the bank expects that out of every rupee loaned, the bank will lose more than half of this loan out right. This creates two issues for the bank. On one hand, its assets are losing half of their value as they are not being paid back. In addition to that, any interest income expected against this loan is also being written off which should have been an income. Both these two elements are reducing the equity of the bank over time which needs to be funded and paid out by the shareholders to keep the bank afloat.

The latest measure that is being taken comes on the back of equity investment carried out by Abdulla

Nasser Abdulla Hussain Lootah

who currently owns more than 60% of the bank himself. The new restructuring is being carried out in three prongs. First of all, assets of Global Haly Development Limited will be transferred to Bank Makramah which will boost the assets of the bank as well and the equity issued will create some cushion as well. The company is also expected to issue share capital to its borrowers who will waive off the loan after they are given additional shares in the company which will decrease the liabilities. Lastly, the share capital will also be reduced against unavailable assets which will be used to eliminate the unappropriated losses that are showing in the balance sheet. The bank expects this restructuring to boost the net assets of the bank by Rs 29.5 billion which can take its equity to around Rs 13 billion into the positive region. Lootah has also promised to invest Rs 5 billion in addition to this in order to meet the requirements of the SBP.

These steps can prove to be a much needed relief for the bank, however, this is deja vu again for the bank which has seen equity injections in the past as well. The issue with the bank is not that it does not have financers with deep pockets. The problem is that there are fundamental issues present at the bank that need to be addressed before the bank can be expected to turn the corner. The bank needs to make better investment decisions in order to maximise the returns it is earning on its portfolio. In addition to that, they need better credit control to guarantee that the loans that are being made are paid back and they accrue income to the bank as well. Once these two issues are resolved, the bank can expect to get back on its feet and compete within the banking sector. Unless these glaring issues are addressed, this equity investment will also prove to be similar to the ones carried out in the past. It can only be hoped that this new deal will not prove to be beating a dead horse. n

The

telecom sector’s

2024 performance data reveals an industry on the cusp of transformation

By Hamza Aurangzeb

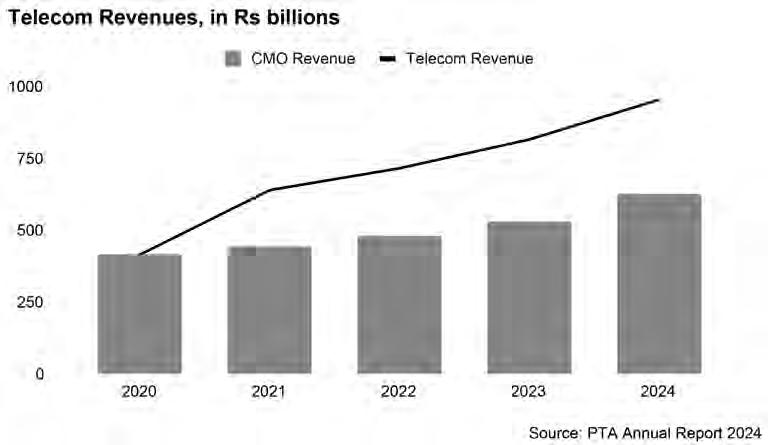

Pakistan’s telecom sector surpassed $3 billion in FY2024, marking a milestone in the industry’s growth trajectory, according to the Pakistan Telecommunication Authority (PTA)’s Annual Report 2024, released December 16. The report reveals how strategic regulatory initiatives and infrastructure development drove this achievement.

From enhanced digital connectivity to strengthened cybersecurity frameworks, the

report outlines several key developments that transformed Pakistan’s telecom landscape. Let’s examine the numbers and initiatives that shaped this remarkable performance.

Pakistan’s telecom sector is on an impressive growth trajectory, where connectivity and digital access has expanded dramatically nationwide.

Around 91% of Pakistan’s population now has access to cellular services, while 3G/4G coverage extends to over 81%. This has become possible with the help of 55,777 cell sites that are operational in the country, with 95.5% 4G-ready. Broadband subscriptions in the country have increased to an impressive 142.3 million, a staggering 91% increase in just five years. Broadband penetration in the country has climbed to 58.4% from 32.6% in 2019, reflecting Pakistan’s transition towards a

digital future through embracing internet connectivity. This has led to an increase in data consumption significantly leading to record financial achievements. If we take the example of the leading telco Jazz, as of 3Q24, its figure of 4G users has reached 49 million, an increase of 15% (YoY), which translates to a 4G penetration of 69%. Its multiplay users represent about 30% of monthly active customers, who generate an Average Revenue Per User (ARPU) 3.5x higher than that of voice-only customers.

Telecom revenues have soared to Rs955 billion ($3.4 billion) owing to an ARPU of cellular services of Rs276 in FY24, an increase of 21% (YoY). The telecom sector’s revenue has crossed the benchmark of $3 billion for the first time in three years. Furthermore, the sector attracted $765 million in investments and contributed Rs335 billion in taxes and duties to the national exchequer during FY24.

As far as data consumption is concerned, it has hit unprecedented levels, with total usage reaching 25,141 petabytes (1 PB = 1,048,576 GB) in FY24, 24.2% higher than the previous year. This spike is a result of the proliferation of mobile broadband in Pakistan. It has become a necessity for millions of people, an integral part of their daily lives. It touches every aspect of modern living including ride-hailing, food delivery, ed-tech, and digital banking. This technology empowers Pakistanis to transcend geographical and socioeconomic barriers, unlocking their true economic potential.

Pakistan’s strong international connectivity network, powered by seven submarine cables and the Pak-China Optical Fiber Cable, with an installed capacity of 16.4 Tbps ensures reliability and resilience, serving as the foundation for this growth. Moreover, four more submarine cables are under development to

meet the growing demand.

Not to forget that affordability has also played a pivotal role in the expansion of data consumption in the country. Pakistan ranks as the 6th most affordable country for mobile broadband globally, with 1 GB of data costing less than 10 cents, where the data costs have plummeted by 65.5%, from Rs77.1 per GB in FY18 to just Rs26.6 per GB in FY24.

The rampant availability of mobile broadband and soaring data consumption have certainly propelled the telecom sector towards advancement but the development of the telecom sector is also contingent upon mergers and acquisitions, which play a crucial role in market consolidation leading to its evolution.

One of the most significant developments during FY24 was the proposed 100% acquisition of Telenor Pakistan and Orion Towers by PTCL, based on an enterprise value of Rs108 billion ($388 million) on a cash-free, debt-free basis, potentially merging Telenor Pakistan and Ufone into a unified entity. PTCL acquired a financing facility of $400 million from an IFC-led consortium for this transaction.

In Pakistan’s cellular market, Jazz leads with a 46.4% market share, followed by Zong (22.1%), Telenor (19.5%), and Ufone (11.6%). However, the impending Ufone-Telenor merger will reshape the market, elevating Ufone’s subscriber base to 71.4 million, nearly rivalling Jazz. Moreover, the merged entity will command 30% of the industry’s revenues

and introduce competitive pressures in the sector.

The merger will position Ufone as the market leader in spectrum share (41%) and strengthen its portfolio across critical frequency bands. This advantage facilitates spectrum refarming, enabling a transition to high-value mobile broadband services like 5G, optimizing network efficiency, and enhancing service quality. PTCL and Ufone collectively own 14,600 towers as of 3Q24, they will inherit an additional 7,500 towers from Telenor, which will ultimately expand their portfolio to 22,100 towers and improve nationwide coverage.

Jazz dominates the mobile broadband market as well with a 48.1% market share but this Ufone-Telenor merger will consolidate the position of the unified entity with a 30.2% market share and 31% of 4G subscribers. However, when it comes to fixed broadband, PTCL already dominates the segment through its Flash Fiber initiative, with 34.1% of the market. Furthermore, PTCL, already commands 50.5% of the LDI market but is poised to grow its influence post-merger, securing 68% of wholesale IP bandwidth and 42.7% of domestic leased lines.

This acquisition of Telenor by PTCL is being assessed by PTA and CCP in two phases, where during the first phase, the immediate implications of the acquisition were reviewed, while the ongoing second phase involves a detailed examination of potential anti-competitive risks and broader market effects.

The approach of the government entities to this acquisition reflects the precedent set during the Mobilink-Warid merger of 2016, where specific conditions to safeguard competition, enhance consumer benefits, and ensure market stability were imposed. Similarly, the aim this time around as well is to ensure that this merger strengthens competition, improves service quality, and bolsters the telecom sector’s infrastructure.

The strategic 3G sunset marks a critical step in Pakistan’s progression towards advanced mobile technologies like 4G and 5G. Telecom operators can redistribute spectrum and redirect resources to more efficient and high-speed technologies, significantly enhancing network performance and user experience through decommissioning third-generation networks, Spectrum refarming is an essential component of the 3G sunset, where the bandwidth will be reallocated from 3G to 4G

and 5G, providing two to three times more spectral efficiency. This enables networks to handle higher data volumes, deliver faster speeds, and improve reliability. Simultaneously, the discontinuation of obsolete 3G-only devices will establish a more streamlined and futuristic telecom infrastructure. Additionally, operators will benefit from cost efficiencies as maintaining multiple network generations is expensive. This transition will not only reduce operational costs for mobile network operators but also free up capital for investments in cutting-edge technologies.

PTA has devised a four-phase SOP for this tactical transition from 3G to 4G, where the first and second phases will focus on trial runs in remote areas to address technical and logistical challenges, the third phase will focus on low-revenue regions to expand 4G adoption, while the fourth phase will deal with completely decommissioning the 3G technology in favor of 4G technology. This gradual yet strategic approach would minimize disruptions for end-users, while ensuring the recently available 3G spectrum is efficiently utilized for wider 4G rollout, supporting faster internet speeds and improved service quality.

Jazz (Pakistan Mobile Communications Limited) leads this transition, which has already phased out over 30% of its 3G network, complying with PTA’s guidelines and the timelines stated in the SOPs. Jazz’s efforts align with the government’s Digital Pakistan vision and the growing data demands of consumers.

The 3G sunset is essential for Pakistan’s digital transformation, ensuring that the country remains on track to embrace a future powered by high-speed, next-generation mobile networks like 4G and 5G

The rollout of 5G technology holds tremendous promise for Pakistan, offering opportunities to enhance connectivity, boost economic growth,

and transform key sectors such as agriculture, healthcare, education, and manufacturing. The 5G technology with its three fundamental elements, enhanced Mobile Broadband, Ultra-Reliable Low-Latency Communications, and massive Machine-Type Communications could unlock a new era of technological innovation and development across the country.

Globally, 5G networks are already reshaping industries. More than 70 countries have launched 5G, and over 1.9 billion 5G subscriptions are expected to be active by 2024. Over half of all global mobile subscriptions are predicted to be 5G by 2027, enabling widespread adoption of advanced technologies such as the Internet of Things (IoT), smart cities, and autonomous vehicles. Pakistan, with its large population and rapidly growing digital economy, stands to benefit significantly from the adoption of 5G.

5G could be a catalyst for change in multiple sectors in Pakistan. In agriculture, it could enable precision farming through IoT sensors, drones, and real-time data analysis, helping farmers increase yields and improve sustainability. In healthcare, 5G’s low latency and high bandwidth could facilitate telemedicine, allowing patients in remote areas to receive high-quality care. The education sector could leverage 5G to enhance online learning experiences, making education more accessible, especially in rural areas. Additionally, 5G could revolutionize manufacturing by enabling smart factories, automation, and real-time supply chain management, boosting productivity and driving industrial growth.

Despite the humongous potential of 5G, there are several challenges that must be addressed. The deployment of 5G technology requires colossal investment in extending infrastructure and modernizing the existing telecom networks in the country. Regulatory frameworks need to be updated to accommodate 5G while ensuring cybersecurity, which will be crucial for protection against potential threats. Furthermore, there are concerns

regarding the equitable distribution of 5G technology across urban and rural areas in order to ensure an inclusive and sustainable advancement across all regions.

To sum it up, while challenges persist, the promise of 5G in Pakistan is undeniable. If these obstacles can be overcome, 5G could drive transformative growth in various sectors, fostering a more digitally connected and economically prosperous future for the country.

The augmentation of the telecom infrastructure in Pakistan is indispensable for a seamless rollout of 5G, the Optical Fibre Network (OFC) serves as an integral part of the telecom infrastructure. Hence, the government is in the midst of developing a National Fiberization Plan for expanding the country’s optical fiber footprint and accelerating Fiberto-the-Site (FTTS) penetration.

The demand for OFC is set to surge with 5G deployment on the horizon, as OFC plays a pivotal role in linking base stations and edge nodes to provide the bandwidth and low latency required for next-generation networks.

The World Bank is collaborating with the Ministry of Information Technology and Telecommunications (MoITT) and the Pakistan Telecommunication Authority (PTA) to conduct a feasibility study for the National Fiberization Plan funded through the Digital Economy Enhancement Project, where the implementation will involve cooperation between public and private stakeholders, with MoITT spearheading the initiative.

This plan seeks to create a conducive environment for private sector investments in OFC networks, focusing on deploying long-haul and metro networks and FTTS infrastructure. This strategic initiative will not only ensure the timely and cost-effective expansion of the optical fiber network but lay the foundation for robust telecom infrastructure, enabling Pakistan to harness the transformative potential of 5G fully.

GSource: PTA Annual Report 2024

ender inclusion in information and communication technologies (ICTs) is essential for equitable socio-economic development, particularly in countries like Pakistan. Women face significant barriers rooted in societal norms and limited access to resources,

restricting their participation in digital spaces and deepening existing disparities. Since digital transformation is reshaping economies, excluding women from this shift not only limits their potential contributions to economic growth and social progress but also exacerbates the gender gap. It is a strategic priority to bridge this divide, as women comprise nearly half of Pakistan’s population.

National frameworks such as the National Gender Policy Framework 2022, Vision 2025, and the Digital Policy 2018 emphasize inclusivity by introducing gender-sensitive regulations, expanding access to digital platforms, and fostering skill development programs. However, despite these measures, gender disparities in digital access and use remain significant.

Women in Pakistan lag behind men in mobile ownership, internet usage, and financial inclusion. For instance, while the gender gap in awareness of mobile internet has decreased from 30% in 2018 to 2% in 2024, the gap in mobile ownership and mobile internet usage is alarmingly high at 38% each. Similarly, while female participation in branchless banking has grown from 18.9 million in 202021 to 35.7 million in 2023-24, it still trails male participation by a mile. Moreover, the gender gap is conspicuous on social media platforms as well, only 24% and 28% of the users are females on Facebook and YouTube, respectively.

So what are the key challenges? The challenges include limited digital literacy, high device and broadband costs, and patriarchal norms. Furthermore, practices such as relying on male family members’ CNICs for mobile services result in underreported female subscriptions, further skewing statistics. These barriers not only limit women’s digital engagement but also perpetuate inequalities, underscoring the need for targeted interventions.

Hence, the PTA along with MoITT launched the Digital Gender Inclusion Strategy at the 2024 Digital Nation Summit to address these challenges. This comprehensive approach focuses on six areas: improving data and research, accessibility, affordability, digital skills, inclusion, and safety and security. Gender-responsive policies have been introduced to tackle affordability and remove barriers, while skill development programs have been conceived to equip women with

digital competencies for sectors like e-commerce and education.

It is also important to mention that public-private partnerships have been instrumental in driving progress, with mobile operators, tech companies, and development organizations collaborating to increase mobile subscriptions and financial account ownership among women. The inaugural Steering Committee meeting, led by the Minister of State for IT and Telecom emphasized reducing the digital gender gap within three years. Integrating women into the digital ecosystem is not just about achieving equity but also unlocking innovation, resilience, and sustainable development. Pakistan can bridge the gender divide and achieve a more inclusive digital transformation by addressing hindrances and fostering collaboration.

The telecom industry in Pakistan is undergoing a significant transformation driven by rapid digitalization across both consumer and business sectors. This digital shift offers numerous opportunities for telecom companies to diversify their revenue streams beyond traditional connectivity. The telecom industry is embracing advanced digital technologies and providing an extensive suite of digital services by opti-

mizing their service quality and coverage. The industry’s contemporary approach focuses on moving towards a tech-driven future through innovative regulatory measures and strategic initiatives.

The key initiatives include the development of an Over-the-Top (OTT) regulatory model to accommodate the convergence of telecom, broadcasting, and digital platforms. This model aims to streamline the regulatory landscape while promoting innovation and fair competition. Additionally, a spectrum-sharing framework is being propagated to optimize the utilization of limited spectrum resources, ensuring efficient management of this crucial resource as demand for connectivity grows with the rise of technologies such as 5G, IoT, and autonomous vehicles.