7 minute read

CITY WATCH City’s taxable property value rises 12% City to update comprehensive plan

The city of Palm Coast’s taxable property value has increased 12.49% since 2022.

This is the second year in a row that the city has seen a two-digit rise in taxable value. The taxable value in July 2022 was a 19.52% from July 2021, marking the first time since 2006 that the taxable value has risen so steeply.

Advertisement

In all, the city’s preliminary taxable property value is $8.6 billion, up from $7.6 billion in 2022.

City health insurance cost to rise 20%

The cost of city employee health insurance is projected to go up by 20% for the 20232024 fiscal year.

The city has insurance from Brown & Brown Insurance.

The projected increase is largely due to increased medical costs and a spike in claims, said Danielle Boyle, senior vice president of Brown & Brown.

The cost of medication and medical visits have increased 15-25% and 8-11%, respectively, according to data from Brown & Brown. Boyle said most of the projected increase stems from an increase in the number of claims for diagnoses like cancer.

During COVID-19, she said, there was a reduction in screenings, and people are now returning to regular screenings and noticing problems.

Boyle said Palm Coast’s insurance plan has a stop-loss policy of $175,000 per person per year, If an individual exceeds that, the insurance carrier is responsible for the claims. The city also has an aggregate stop-loss of 125% for its whole policy.

The city will receive the final taxable value from the county’s property appraiser on July 1 and will present that information to City Council on July 11, Palm Coast Financial Services Director Helena Alves said at a June 13 City Council workshop. That presentation will also include proposed minimum and maximum millage rates for the City Council to consider for the 2024 fiscal year budget.

The city must adopt a maximum millage rate by July 18. After that point, the council can set the millage lower than that maximum rate, but not higher, Alves said.

The taxable property value is the total assessed value minus exemptions, and determines the maximum and minimum millage rate that the City Council can levy on residents.

The City Council will adopt a millage rate based on the final certified value and the proposed budgets that city staff members present in council workshops in July and August.

The city’s current millage rate of 4.61 mills, or $4.61 per $1,000 in taxable value, was adopted in September 2021 for the 2022 fiscal year.

If the council keeps the same 4.61 rate for the 2024 fiscal year, the city will receive approximately $38 million in ad valorem tax revenue, a $4.2 million increase from the previous year. That 4.61 millage rate earned the city $33.8 million in ad valorem tax revenue for the 2023 fiscal year and $28.3 million in the 2022 fiscal year.

One of the City Council’s new priorities, approved by the council at its May 2 meeting, is for the city’s millage rate to be “revenue neutral for taxpayers,” bringing in as much money as needed for the budget, but not more.

CITY LOOKS TO ADD FOUR-WAY INTERSECTION ON MATANZAS WOODS PARKWAY

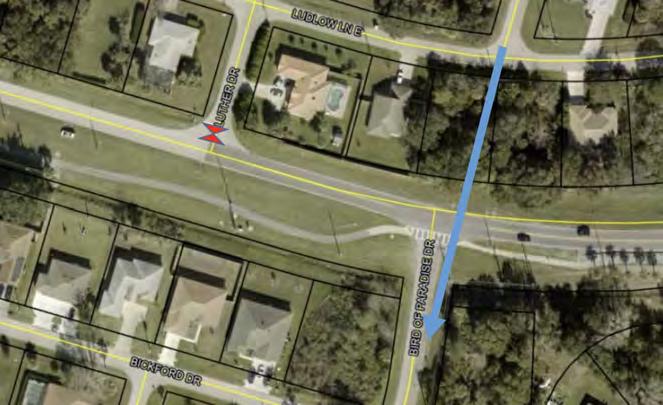

Palm Coast may buy four lots off Matanzas Woods Parkway as part of a project to realign the road and add an intersection with Bird of Paradise Drive and Luther Drive.

Bird of Paradise Drive ends at Matanzas Woods Parkway in a T-intersection.

City staff proposed that the city make that a four-way intersection with Matanzas Woods, Paradise Drive and Luther Drive to reduce traffic problems, Palm Coast Land Management Administrator Virginia Smith said.

Luther Drive would be shifted to connect to Bird of Paradise Drive, Smith said, and the current location would be closed.

The city would need to purchase the four lots and one easement to make the change, Smith said. Each lot would cost $60,000-$80,000, Director of Stormwater and Engineering Carl Cote said, and the cost could rise if the city delays the purchase.

Cote said that the purchases would be funded with impact fee money.

Smith and Cote sought the City Council’s permission at the June 13 meeting to buy two of the four lots: 266 Bird of Paradise Drive, at its $79,000 appraised value; and 6 E.

By The Numbers

$8.6 billion

Palm Coast’s preliminary taxable value as of June 1. The county property appraiser will have the certified value July 1.

12.49%

The increase in the city’s taxable value since July 2022

4.61

The city’s current millage rate

98,411 Palm Coast’s population, according to U.S. Census Bureau data from July 2022

$38 million

The amount the city will receive in property taxes in 2023 if it keeps the current millage rate of 4.61 mills

Ludlow Lane, at $56,000. The city would also need to pay $2,000 in closing costs for each property.

Smith said city staff expects to bring proposals for buying the other two lots — 264 Bird of Paradise Drive and 8 E. Ludlow Lane — before the City Council at upcoming council meetings.

The City Council hopes to soon start the city’s first full comprehensive plan update, possibly as soon as July.

The city is planning to partner with consulting firm JBrown Professional Group Inc. JBrown Director of Planning Kathie Ebaugh gave a presentation to the City Council on June 13 about the firm’s proposal for the comprehensive plan update.

Ebaugh said the firm would implement a four-phase approach over 14 months. Its primary focus, she said, will be to learn from the community about its needs and wants. The firm plans to work with city staff to hold meetings in which residents can voice their opinions.

Phase one of the plan focuses on connecting with key community partners, phase two on background data and analysis, phase three on public outreach and participation, and phase four on drafting and adopting the updated comprehensive plan.

If the council partners with JBrown, the process could start in July.

Many Palm Coast residents have said they feel that the council does not listen to them, Palm Coast Mayor David Alfin said. The comprehensive plan update is meant to let residents help shape the city’s future.

“Our community must now feel like they are being listened to,” Alfin said.

The council will vote on whether to partner with JBrown at a June 20 meeting.

It is important that the firm reaches every resident who wants to be involved, Alfin said.

“This is a transition point from the past, looking to the future,” he said. “I can’t think of anything more important.”

Public Notices

The Palm Coast Observer meets the legal requirements to publish legal notices in Flagler County, per F.S. 50.011. The Ormond Beach Observer meets the legal requirements to publish legal notices in Volusia County, per F.S.50.011.

AUDITOR INFORMATION

Circulation Verification Council 12166 Old Big Bend Road Suite 210 | Kirkwood, MO 63122 Phone: (314) 966-7711 | www.cvcaudit.com

Flagler County is the proposed location of a $10 million Florida State Guard joint training facility.

JONATHAN SIMMONS

MANAGING EDITOR

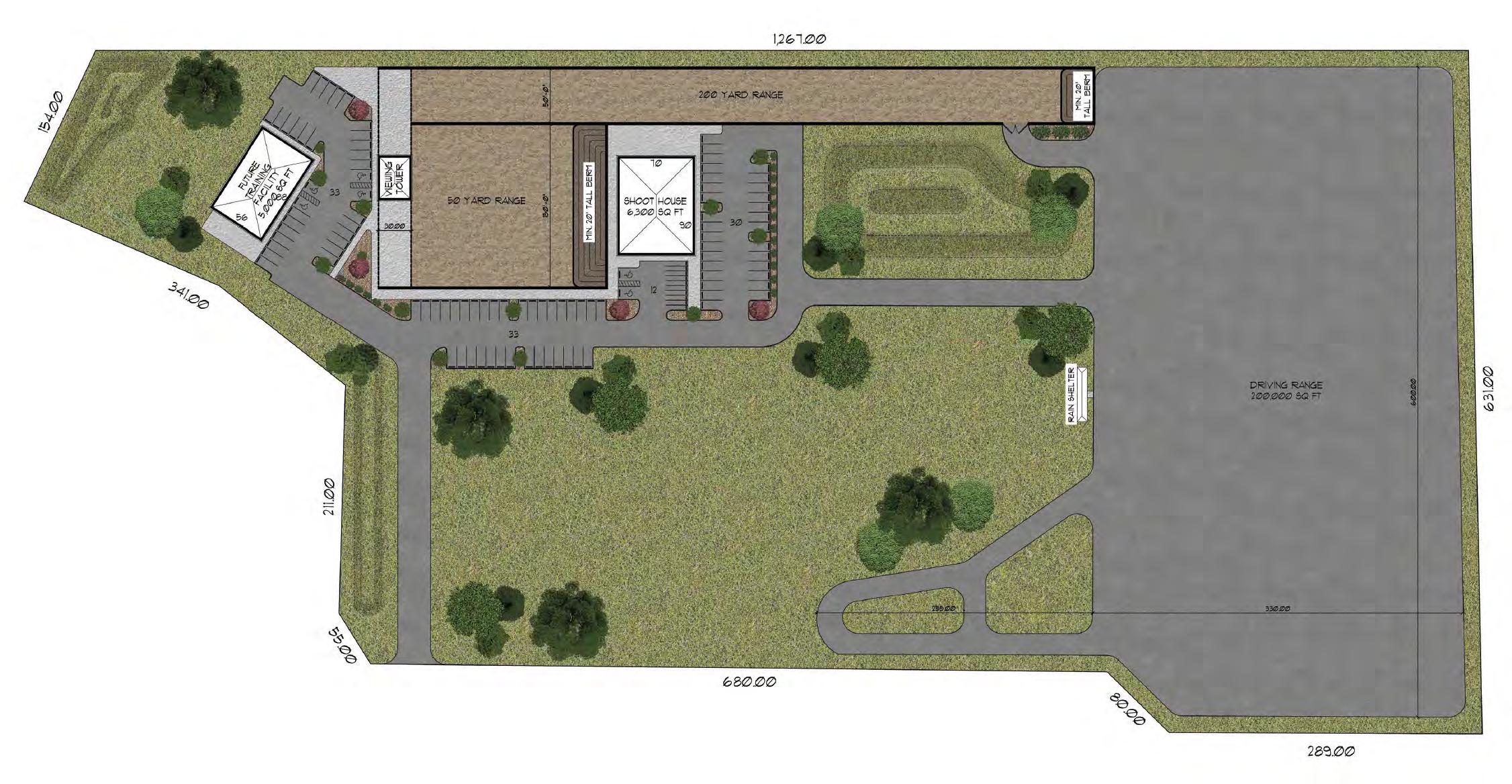

A forested plot of county government-owned land in Bunnell near the Flagler County jail may become the site of a $10 million regional training facility for the Florida State Guard and local fire and law enforcement agencies. The proposed training facility would be the main center of operations for the Florida State Guard’s leadership and key staff members.

“I see it as a phenomenal win — as an economic engine to our community,” Sheriff Rick Staly told the Observer . “If you look around the country, no one is building military bases anymore in this country, right? So, this is the equivalent of a military base coming into Flagler County, even though it’s not military.”

In the meantime, while the facility is being built, Staly expects that the guard will take over some space in and near the county’s Jail Administration Building.

Staly cautiously referred to the proposed facility as a headquarters for the State Guard, while noting that plans could change in future years.

“The director and his key staff will be here at Flagler,” Staly said. “That was the discussion — it would be the Florida State Guard headquarters. But I don’t know exactly what the director has planned for 10 years from now.”

County commissioners who spoke to the Observer said they had discussed the proposal with Staly or the county administration.

“The fact that Flagler County would be the home of this new program is very exciting, and most welcome on my part,” Commissioner Donald O’Brien said. “I think it would be great for us to be able to be the headquarters for that program, and I think it would give us more visibility as a county, certainly, and create additional jobs. And I just think, overall, it would be a net positive for us.”

Commission Chairman Greg Hansen called the proposal “a good deal for the citizens of Flagler County.”

“We get a great training facility ... and at no cost to the taxpayers,” he said. “You can even tag it as an economic development effort, because it’ll bring more people here. I hope we get it. That would be a great deal if we got it.”

Bunnell City Manager Alvin Jackson Jr. said he hasn’t yet received detailed information about the facility but has been made aware of the proposal.

“We would more than accommodate and help with that,” he said.

Commissioners did not yet have a proposed timeline for construction.

“All I know is that they’re really excited about doing it — the guard is,” Hansen said. “If it gets approved, I think they’ll move right away.”

A site plan for the facility, by local architecture firm Joseph Pozzuoli Architect, shows a 5,000-square-foot training building, 200,000-square-foot driving range for Emergency Vehicle Operations Course training, 50-yard and 200-yard gun ranges with a viewing tower, and a 6,300-square-foot shoot house for tactical training.

“I thought it was brilliant by Speaker Renner to combine forces, if you will, with the Florida State Guard — not only because it’s an economic engine to our county, but also it’s one appropriation that handles multiple public safety entities with the same dollars.”

RICK STALY, sheriff