7 minute read

Sage Outdoor Advisory seeks to

SAGE OUTDOOR ADVISORY SEEKS TO ‘PAVE THE ROAD TO INVESTMENT’ FOR LAUNCHING GLAMPING BUSINESSES

Applications are now open for the first 10-20 glamping businesses to pilot the second phase of Sage’s participatory shared database. Read to the end for a full explanation.

Sage announced at the Glamping Show in October that they are nearing completion on the industry’s first quantitative glamping report. This report gathers public glamping data like average daily rate (ADR) by unit type, rates for different amenities and growth of the industry. The goal of this first data report is to help launching and expanding glamping businesses make financial projections.

If you have tried to raise money to launch your glamping business, then you probably know all too well that it can be a rocky fundraising road. Glamping business projections typically include nightly rates of $200, $300 or even $500 a night. Traditional lenders new to this industry often balk at these figures, and understandably so. If you’re new to glamping, it can be hard to believe that guests are willing to spend $200 to $500 per night to sleep in a tent or tiny home cabin, but as we all have seen, that is exactly what is happening.

Sage is led by an MAI and certified general appraiser which means they have the extensive training and credentials that allow them to interact directly with banks and investors as an independent third party. Simply put, they bridge the financing relationship between glamping businesses and money by assessing and validating business proposals.

“We work with banks and investors on a daily basis so we know what they look for,” said Shari Heilala, MAI, certified appraiser and President of Sage, “They want to see evidence that this type of business is succeeding in the market. Otherwise put, investors want to see hard data like growth, average daily rates and occupancy figures that show that customers are willing to pay for this type of experience currently in the market. The hotel and short term rental industries are inundated with this type of information that investors use to make capital decisions, but glamping is a different story. The market is so new and contains so much variety that no one has gone through the effort to invest in tracking this type of data in such a niche market.”

On the other hand, Sage Outdoor Advisory specializes entirely in this segment. “It’s all we do. We have completed well over a hundred and fifty appraisals and feasibility studies for projects in the outdoor hospitality space. Our clients often ask us, ‘what is the best unit type to use for our location? Should we invest in private bathrooms in our units? Or how much can we expect to make in our first, second, and third year?’ We answer these questions for all our clients, but we thought, let’s track the supporting data across the entire industry and make these insights available for anyone launching a business in the glamping space.”

In January, Sage hired Connor Schwab, as the Head of Outdoor Hospitality to spearhead the project. They brought on a U.S. based research team and are partnering with industry leaders to make the project a reality.

At the Glamping Show in October, Sage released some early figures in the 2022 North American Glamping Report that they co-published with Terramor/KOA. Sage plans to release a full owner-operator focused report

Shari Heilala Connor Schwab

in early 2023. If you would like to receive a copy of this report when it is released, email admin@sageoutdooradvisory.com.

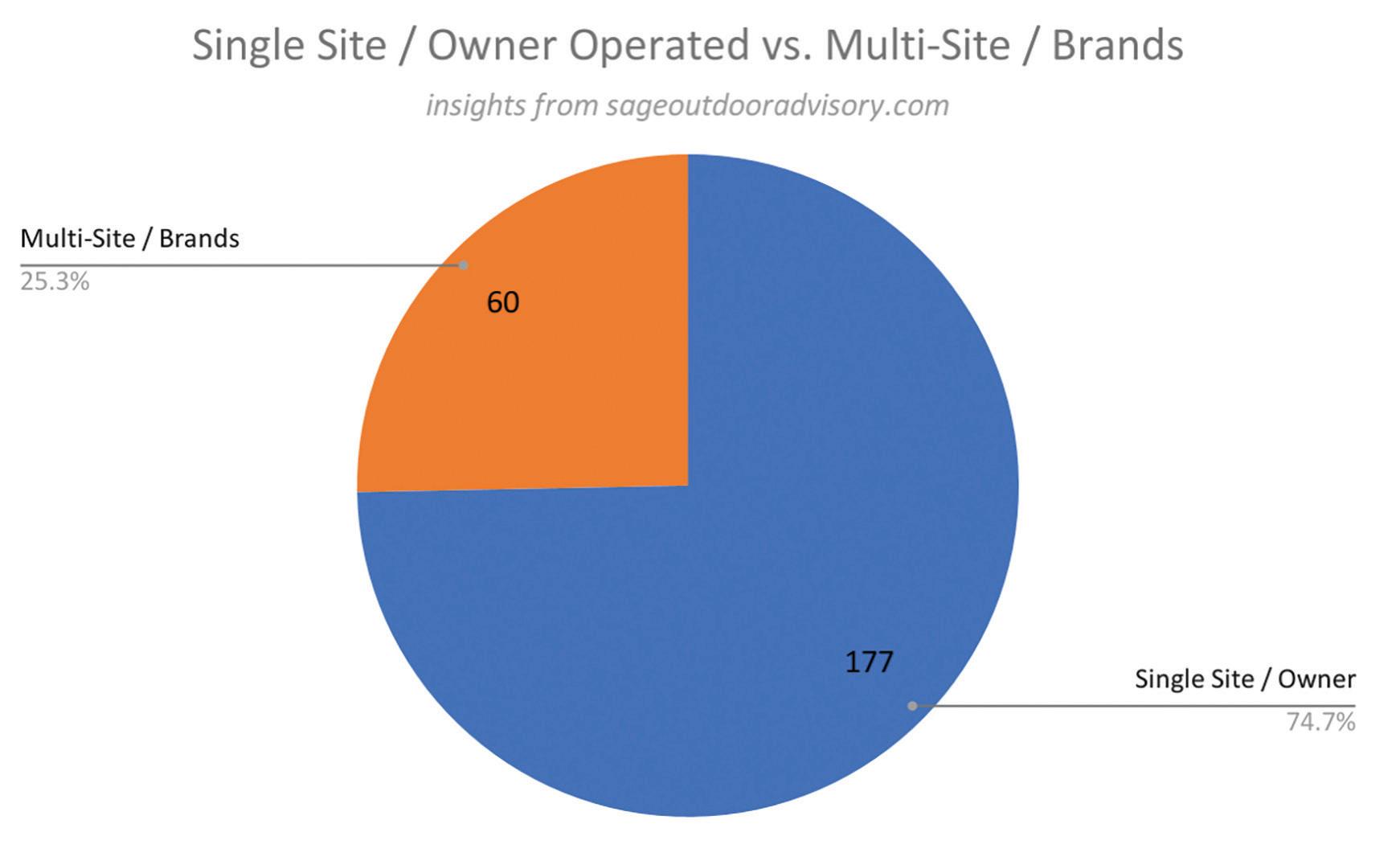

The database currently includes about 230 glamping sites which totals about 4,700 glamping units in the industry. You can see what businesses were researched in the the Sage Glamping Map on their website. While Sage is currently focused on glamping businesses, they have teamed up with AirDNA who is curating glamping short term vacation rental data that is listed on sites like AirBNB and VRBO which will be included in the future report.

Sage has agreed to pre-release some of their glamping business emerging insights with the Glamping Business Americas audience. These insights can be seen in the following tables.

The Compound Annual Growth Rate (CAGR) was 13% from 2001-2021 and 16% from 2011-2021

*Figures only include glamping businesses where guests can book directly; this does not include glamping units only listed on 3rd party sites like AirBNB, VRBO, or HipCamp *2022 incomplete numbers not included to preserve trendline

*Hard wall units include modern cabins, cabins (log), Airstreams, vintage trailers, and treehouses *Soft wall units include safari tents, bell tents, tipis, domes, yurts, and covered wagons *Regions were broken up by states with most similar weather patterns which greatly effects glamping

AMENITIES IMPACT ON AVERAGE DAILY RATE (ADR)

“As you can see, we have gleaned some pretty powerful insights and trends with the data tracked so far. The data suggests that guests are willing to pay over twice as much to stay at a property offering full food and beverage service and almost twice as much to stay in a unit with a private bathroom. On the other hand, there is little correlation in increase of nightly rates for sites with water features and for unit capacity. This data makes a monumental difference when devising your business offering and site plan” per Ms. Heilala.

Sage’s database and report tracks data that is publicly available online, but there is still much more information out there that would be incredibly useful to glamping businesses that is not publicly available.

Ms. Heilala comments “The reality is that most people running a glamping business operate in isolation. They are in the trenches and have little time to assess the health of their operations. Up until this point, there have been no tools to help in determining whether their business is outperforming or underperforming in the market.”

Sage envisions operators being able to measure how they are performing in areas such as: • Occupancy and average daily rate • Expense ratios and operating costs like payroll, insurance, legal, utilities and maintenance • Cost to make improvements like add a bathroom or amenities • Time from the property purchase to opening

To tackle this issue Sage will be rolling out a second phase of their database. This will be a participation based library of shared information. Sage will give owners and operators the opportunity to submit their business information on an anonymous basis in order to see how they compare to other glamping businesses (also on an anonymous basis). The pilot program is expected to launch early next year, and Sage will be accepting the first 10-20 businesses to apply on their website.

“One of the most unique characteristics of the glamping industry is everyone’s willingness to collaborate. People tend not to see each other as competition, but as friends and allies who can help each other out and share insights.” Ms. Heilala said, “I think the American Glamping Association and the Glamping Show have played key roles in fostering this general comradery.”

She continues, “We all seem to be unified in our goal to provide more guests with an incredible hospitality experience in nature, and Sage is in a unique position to contribute something relatively monumental to the industry as a whole.”

The mission at Sage Outdoor Advisory is to foster more environmental stewardship by providing the mass population more meaningful opportunities to experience and connect with nature. By helping more people launch glamping businesses successfully, it furthers this mission and elevates the whole industry.

Sage is offering current glamping owners the opportunity to submit their business metrics anonymously in exchange for an owner’s version of the report and early access. To be included you can sign up here or email admin@sageoutdooradvisory.com.