18 minute read

Ann Hunt

by PaulGC

Chasing returns

ANN HUNT

Advertisement

Founder and CEO of Chasing returns

Diamond hands are a hot topic at the moment. They refer to highly risky positions that are either massively in the money or out of the money. They sound exciting – because let’s face it – they are exciting. Unfortunately, they often lead to traders blowing up their accounts and brokers losing clients.

At Chasing Returns we think of diamond hands as outlier trades.

For the maths geeks, let me explain what an outlier is. In statistics, an outlier is a data point that differs significantly from other observations.

How different I hear you ask? If your range is from -$50 to $50, then the Interquartile range is $100. You then multiply this by 1.5, to get $150.

A negative outlier trade for this trader is then anything that falls outside of Q1-$150-basically a losing trade that loses more than -$200.

Similarly a positive outlier trade is anything that is larger than Q3+$150 = $200.

We have been focused on helping traders avoid bad outlier trades, and here’s why. It turns out practically everyone trades outliers. Over 99% of traders in our study had outlier trades.

Imagine you take your entire trade history and organise it based on the P&L. You remove the worst 25% and the best 25% to give you the range of the P&L of your middle 50% of trades. This is called the Inter quartile range. These outliers have a disproportionate impact on profitability: overall only 25% of our traders were profitable but without ANY outliers that number would be 45%.

This was a pretty staggering finding when we first identified it. If we could help traders avoid outliers, their probability of success would almost double.

Of course, we really only want to curb the negative outliers- those outliers that cost the trader money. So, this is what we are focussed on.

We are helping our traders reduce their number of negative outliers, while leaving the number of positive outliers the same. The improvement is seen in clients using both our GamePlan and our PlayMaker products together.

So far, the results have been positive. We have achieved a reduction in outliers of approximately 1%. Our next goal is to reduce it by 3%, while continuing to help traders close positive outliers. We know that the average losing trader only has to eliminate 2.7% of their worst trades to get to break even.

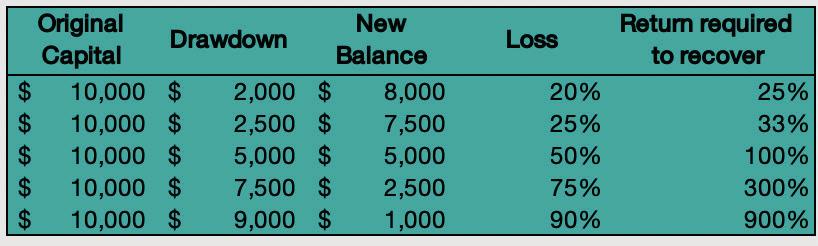

Every reduction in bad outliers will help with drawdowns. The impact of any outlier on trading capital can be significant, and recovering from a large loss is tricky due to the asymmetrical nature of losses. A loss of 25% of your capital means you then have to make profits of 33% to get back your money. A loss of 50% means you then have to double your remaining capital. Once you’ve lost over half your trading capital, the likelihood of being able to make the money back gets more and more difficult.

For anyone still not convinced, who thinks their large winners could be compensating for their large losers – think again. This is only true for 1 in three traders, but if you are a losing trader, the odds drop to 1 in 4.

Our brains are not designed for the extreme stress of diamond hands. We will be much more tempted to close the winning ones, while letting the losing one’s continue to grow. This is rooted in behavioural science-human beings are loss averse, so our brains are hardwired to avoid a loss, even if it’s irrational, e.g. not cutting your losses and closing a losing trade, but letting it run, hoping it will eventually become a winner. We have seen many a successful trader lose a substantial chunk of their profits doing exactly this.

The only way to be successful is to measure and understand how your outliers are affecting your trading outcomes.

Remember you are more likely to remember your good trades, so don’t rely on memory – track your performance.

Boring – I know. If your trading is not boring, you are doing it wrong – yes I’m a closet killjoy! So enjoy it when you get a big winner, but don’t look for a pattern or try to base your trading on it. Long term success comes from building up good habits and discipline in the middle 75% of your trades, and minimising the worst 25%.

GC:OPINION IS CAPITALISM DEAD?

Like everyone else, during the lockdownI have completed every level on Netflix, including man’s great nemesis the rom-com. Having started to develop a penchant for late night YouTube rabbit holes, I thought it was best to give my eyes something new to stare at before I began to believe in a compelling argument for the flat earth theory.

I found myself watching the back catalogue of the documentary maker Adam Curtis, who made such works as Century of the Self and Hypernormalisation.The premise of hypernormalisation argues that financiers, governments and technological utopians have since the 1970s given up on trying to solve complex ‘real world solutions’. They have built a simpler ‘fake world’ run by corporations and kept stable by politicians. From this description it sounds heavy going, but the beauty of Curtis’ work is that it is very accessible.

The phrase Hypernormalisation comes from anthropologist Alexei Yurchak, who in his book Everything Was Forever, Until It Was No More: The Last Soviet Generation (2006), where he introduces the word, describing the paradoxes of living in the late stages of the Soviet Union. He argues that the people could see the system was failing, however they could not imagine an alternative to the status quo they were living in.

Both politicians and citizens alike were resigned to maintaining the premise of everything being fine, and.over time the delusion became a self fulfilling prophecy with the fakeness of the world they discussed with each other becoming the real world. An effect which Yurchak termed ‘hypernormalisation’.

Yurchak goes deeper with his story by highlighting that people living in that era knew that those in power did not want to acknowledge that society was collapsing, moreover the people managing the state owned utilities were corrupt, greedy and stealing from them.

They had constructed a whole system based upon a false reality. The population accepted it as a normal functioning society as there was no benchmark to measure it against. Curtis sums it up by arguing that you knew you were living in an odd situation, but your brain cannot rationalise why.

After reflecting on the documentary I could see how you could apply both Yurchaks and Curtis’ description to the world we are living in now. Our current situation we are told that everything is fine, we just gave Capitalism a well earned rest for a year.

Moreover, as individuals we are not equipped to mentally deal with complex solutions required for times like this. We want immediate simplistic answers to one of the most complex medical

situations that has occurred in the last one hundred years. What perhaps struck me the most was the story of where people could see the Soviet system collapsing around their ears, but they just kept up the pretense that everything was OK.Is this what is happening to us now. Is this the end of the western Capitalist model, just we don’t know it?

You can see remarkable similarities in the example given by Yurchuk, where to all intents and purposes we have suspended Capitalism when we began the huge global government interventions as a way to stymy the effects..

I think one thing that this crisis has shown us is that we have the comparable psychological conditions of the populace compared to the last days of the Soviet Union. For example in the UK we have massive corruption within institutions that we deem as ‘trustworthy’. Evidence of this is UK health secretary Matt Hancock handing out contracts totaling many millions of pounds to his former pub landlord,who had no experience in running a medical supplies company, Despite the law courts saying that he had not acted correctly, it is just shrugged off as the norm with no opposition coming from the media or other elected representatives.

The Fakeness of reality that Yurchuk outlines could be argued is two fold. We have retreated into our phones to live in a safe world where our own personal algorithm insulates us from a collapsing system. Moreover, it is hard to mentally compute that you are living in transitional times. The society that you grew up in might just become a relic of the history books

There is one huge irony in all of this. If this were to be the debt induced end of days for capitalism, we were told in the1980’s we could break the Soviet Union by outspending them. Perhaps it has led to our own downfall in creating unsustainable national debts, with the very real potential of countries collapsing under the weight of their obligations.

Further to this, with AI looking to radically alter the way the employment market will operate, how can a state sustain a massive increase in unemployment from both Covid and AI. AI will make a huge amount of jobs no longer relevant, and what’s more striking is that they are jobs from the ‘skilled’ middle classes which look to be swallowed up. This group is the most active in voting and political participation, and will look for their leaders to offer a solution to perhaps a question that cannot be answered using our current paradigm.

Moreover, we appear to have a financial system that underpins our entire way of life that is nothing more than a sham. Banks that collapse and are propped up by the government, along with stock markets which are booming and have no real reflection of the world we live in.

Finally, are we losing faith in our actual money as a store of value? Whether you believe that BitCoin is a huge ponzi scheme is pretty irrelevant, as it does show that people have invested in it as a way to make a quick buck or to act as a hedge against a system that could be collapsing.

Based upon all this, We all know something is kind of strange about all this or hypernormal...so what next?

I think we can all agree that something has to

fundamentally change with our pre lockdown social contract now appearing to be out of date. Those looking for guidance from the new American President will perhaps be sadly disappointed, wIth Biden being elected promising to bring back the America of the pre Trump era. Quote clearly the old social structures are being viewed as a complete failure in benefiting the majority of people.

America desperately needs a third political party with the last four years increasing both social and political division. With Replublican and Democrat voters being regarded by each other as at the extreme fringes (whether that is true or not remains to be seen)along with the central political ground collapsing, with the largest voting group appearing to be none of the above.

Political homelessness could prove to be one of the bigger challenges in ‘normal’ times, there will be many contrasting views on the state’s relationship with the individual. The storming of Capitol Hill has appeared to have broken the seal on what the public feel is an acceptable way to voice disapproval with their political masters.

WIth even the most optimistic seeing only a recession ahead of us, how will the levers of western governments be able to solve the mass unemployment and all the related social issues this brings. Several remedies that may not solve the problem completely, but certainly go well on the way to helping some form of recovery could be universal basic income, universal healthcare and universal free education.

These all may have seemed incredibly utopian sociaist ideas in the pre pandemic world. However, could these offer a new social contract that shows that its elected officials do have its voting public’s best interest at heart.

We will need some huge 1930s FDR type program to stop repeating what happened in the 1940’s with more fringe voices moving the Overton Window and becoming politically acceptable, offering solutions that were considered outside the mainstream only a couple of years ago.

Whatever happens next is anyone’s guess. However one thing that we will need to do as a populace, is to pay attention and makeure that we have a real say in how our future relationship with the state is conducted.

FX Cubic

RICHARD BARTLETT

Head of Sales at FX Cubic

Q Congrats on your new role. What attracted you to join FX Cubic?

Thank you. I have watched FXCubic’s progress closely over for the last few years and had the pleasure to meet the CEO, Ege Kozan, and COO, Ismail Ekmen on several occasions, so I already had a good idea about how strong their technology offering was and that they had a very good team behind them. It was clear the firm has gained a huge amount of traction in the market due to innovative technology and unique functionality. All these factors, combined with the fact they are ideally positioned to become the market leader in the bridge aggregation and risk management space, are why I was so keen to join the team and play my part in their continuing success. I am truly excited about this opportunity and can honestly say, after being with the firm for only a little over a month, the response I have had from the people I have shown the system to so far, has been phenomenal. In addition, the team behind the firm are very close-knit and there is real cohesion between all the departments. Often in tech-based companies, the sales and technical teams do not mix well and this can cause internal conflicts. I am happy to report this is not the case here. This focus and willingness to all pull together is a real advantage to the company, as it will help us to continually improve and ensure our offering stays ahead of the competition.

Q What does your new role entail?

As Head of Sales, naturally, my key focus will be performing all activities related to pushing new business sales of the company’s bridge aggregation and risk management systems. This entails working with our Sales, Management and Marketing teams to come up with new strategies to maximise market penetration, new campaigns and ensuring we have the best documentation and sales processes in place etc. Aside from utilising my own network of clients and contacts, I am responsible to source new partners for the firm that we can work with closely to help accelerate our growth overall and specifically, to increase exposure in areas where we are less well known, such as Asia.

Q What do you think you can bring to the table?

After working in the FX technology space for many years I have an extensive network that I can leverage to promote the FXCubic solution effectively to many relevant parties. I also have a lot of experience in the FX technology sector and know the challenges that brokers face, so this allows me to demonstrate a deep understanding of our clients’ businesses and in turn maintain high levels of credibility, whether I am talking with a start-up or one of the largest players in the market. All brokers have slightly different ways in which they work and therefore face particular challenges, so being able to quickly identify the functionalities we have that solve these pain points is a real advantage when presenting our solution. I can also draw upon my experience to put forward ideas for enhancements to the already comprehensive technology offering. I like to think I have a good reputation in the industry too, so I am able to bring a high level of integrity to the role.

Q Is there a specific market or segment you are looking to penetrate?

In short, we are looking to become the default technology provider for all FX Brokers globally. Currently we are very well known as a top-quality provider, especially in Europe and the Middle East. We are perhaps less well known in the APAC region, so we will be looking to improve our exposure in this area. As soon as the travel restrictions start to ease, we will be on the ground actively speaking with local partners and prospects, as well as attending any relevant trade shows etc. Having the chance to build relationships face to face is very important. Just having a good product is only one part of the equation to maintaining success. Building trust on a personal level and truly getting to know and understand our clients’ businesses is also key to establishing long term relationships which is always the goal. Therefore, I am really looking forward to being able to travel again to meet and entertain existing and potential clients and in turn extend the FXCubic family.

Q There are several strong solutions out there, what makes yours so different?

There are many areas that make FXCubic’s offering stand out from the crowd. Some of the key factors why so many brokers are moving to our technology are down to, superior levels of functionality and performance, intuitiveness and user friendliness of the system architecture as a whole and the very highest levels of personalised support that we offer. We have an intimate understanding of our clients’ businesses and the markets as a whole and look to develop the most relevant tools and features that assist brokers to improve profitability and efficiency and at the same time solve key challenges they are facing. Having such a pro-active and innovative approach to the technology we develop, coupled with offering unique tools, is a significant reason FXCubic is on such a huge growth trajectory. We are committed to continually advancing our technology through constant innovation and value-added functionality that is the most relevant based on current market trends and the evolving needs of our clients.

Q What about the effort factor? Is it easy for a Dealing Room to test and install?

Each FXCubic hub is a dedicated system, that is hosted on the client’s side. This means installation is super easy and they can maintain strict privacy and control over all their data, as it sits on their server that no one else can access. Due to this, setting up a test environment is very straight forward. In fact, we actively encourage our clients to fully test the system prior to making any commitment. This demonstrates our confidence in the fact that the technology works and performs as we say it does and thus inspires a lot of client confidence from the outset. We have nothing to hide, the depth, performance and scope of the technology speaks for itself.

Q How long does a demo take, as sometimes a demo by a tech provider can take forever?

The beauty of the FXCubic UI is that it has been very carefully designed with user experience at the forefront. Therefore, when presenting the system via on-line demos or face to face meetings, we are able to quickly demonstrate the key functionalities and intuitiveness of the system as whole. This is a real strength from a presenter’s point of view as it is important to really engage with the audience and maintain their focus when demonstrating the system, which is very difficult to do if you need several hours to explain everything. From our point of view, having many tools and features is useless if they cannot be easily understood, accessed and configured. This is why so much time and effort has been put into the system design by our team of expert developers to make it as user friendly as possible. A true measure of good technology, is how intuitive it is to understand and use. At FXCubic we follow this ethos when building all our technology.

Q The bridge market has become very competitive in pricing. How does your solution compare?

Even if you simply consider the raw cost and do not account for the different functionality that is on offer from each provider, we are very competitively priced. The fact is though, not all technology providers are created equally. There are varying degrees of differences between all the major players. At FXCubic we offer one of the most complete and diverse offerings. So, when you factor this into the pricing and competitiveness comparison between us and others on the market, you quickly understand that it is not just the raw cost of the service that is attractive. After considering functionality that streamlines our clients’ operations, such as, risk management features, flexible order routing capabilities, advanced control mechanisms over slippage, mark-ups, liquidity and execution etc, (to mention just a few features) all of which improve profitability, it becomes a situation where the technology pays for itself. This in our opinion is another key factor why so many clients are switching from their incumbent providers to join the FXCubic revolution!

Please feel free to contact me personally, or, any of the team, to discover how we can make a significant impact on your brokerages operational efficiency and profitability - www.fxcubic.com