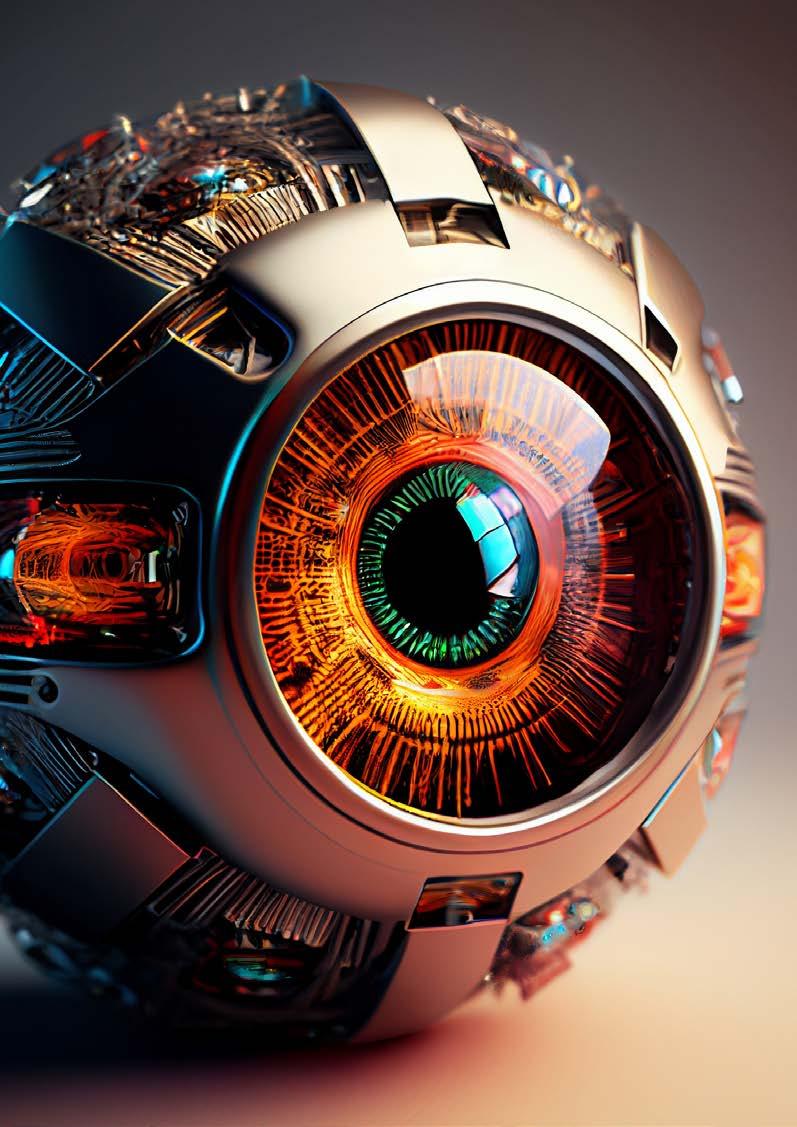

AN EYE ON YOU AS A PAYMENT

Looking into whether the future of payments is biometrics or implants

Cost of living crisis Fraud strategies

Have we run out of ideas? Using technology to stay ahead

Looking into whether the future of payments is biometrics or implants

Cost of living crisis Fraud strategies

Have we run out of ideas? Using technology to stay ahead

Welcome to the first edition of Payments Review, your source of analysis and insight on payments trends. This quarterly digital magazine, exclusively for members, brings together a range of views and voices from across the industry.

Key themes in this edition are the focus on the coming year, the economic uncertainty, dealing with the cost of living crisis, the debate over future payment methods, how to tackle financial crime and the potential of numerous initiatives to catapult the payments sector into a realm of better collaboration and coordination.

However, this is no ordinary magazine. You do not have to read it. You could watch or listen to it instead. Across many of our features, you can tap into expert voices through the videos and podcasts we have shared. For example, listen to Mastercard’s Darren Deal consult his crystal ball on what the next five years in payments has in store, or watch representative of FIS, Mastercard, Visa, and others come together to discuss why they see a bright future for virtual payments.

I hope you enjoy this first edition of Payments Review. If you wish to contribute or share your ideas, please do not hesitate to contact us.

Payments Review and The Payments Association does not necessarily agree with, nor guarantee the accuracy of statements made by contributors or accept any responsibility for any statements, which are expressed in the publications. The content and materials featured or linked to in Payments Review are for your information and education only and are not intended to address personal requirements and nor does it constitute as financial advice or recommendation.

All rights reserved. Payments Review (and any part thereof) may not be reproduced, transmitted, or stored in print, electronic form, or in any other format without the prior written permission of The Payments Association. The Payments Association, its directors and employees have no contractual liability to any reader in respect of goods or services provided by a third-party supplier.

Ben Agnew CEO

Tony Craddock

Founder & director general

Anjana Haines

Head of content

Jyoti Rambhai Editor

Contact details:

4

How the payments sector can help mitigate economic uncertainty in 2023 7

Have we run out of ideas to help customers manage the cost of living? 11

Cost of living crisis: Can the payments industry help? 13

Striving for gender parity: More action, support and change is needed 15

Open banking innovation is raising customer usage 18 Interview: Achieving payments nirvana with Kate Fitzgerald 20 Using technology to stay ahead and manage payment fraud 25 Are prepaid products the stepping stone to the evolving economy? 28

ISO 20022: Beyond compliance 33

Biometrics or electronic implants? How will you be paying in 10 years’ time 38

Data sharing with ASPSPs will support A2ART2 implementation, says industry 42

Listen to what experts say about the latest trends in payments 44

Banks call for all industries to be accountable for APP fraud 47 How proactive policy pays off 49

Gavin Alexander Content marketer

Julia Hearn

Head of marketing

Tom Brewin

Head of projects

Riccardo Tordera Head of policy

Tom McCormick

Head of sales

Sophie Bossier

Head of membership engagement

Maria Stavrou

Head of events operations

The Payments Association, Runway East, 20 St. Thomas Street, London SE1 9RS Tel: 020 7378 9890

Email: Jyoti.rambhai@thepaymentsassociation.org

Project Inclusion sets the bar on sustainability, digital currencies and cross-border payments 52

Regulators needs to look again at how GDPR functions 56

Project Regulator tackles members’ regulatory concerns 59

The Payment Association’s cracking community Christmas in the city

The events of 2022 have been entirely unpredictable. The combination of three prime ministers, global financial instability and a looming recession has left many businesses with an uncertain future heading into 2023.

With the Bank of England raising the interest rate to 3.5% in December to curb rising inflation – the largest increase in over 30 years – the UK is now facing its highest rates since the global financial crisis of 2008. This means the cost of doing business will increase further as budgets squeeze and expenses rocket.

As a result, many could be forced to scale back operations as they are discouraged from taking out loans to finance investments. Furthermore, with consumers spending less, demand for goods and services will also decrease.

In 2023, this complex economic environment means businesses will need to implement a sustainable model for growth to survive. At the heart of this will be the fintech and payments industry, who can help businesses to consolidate processes to maximise

efficiency and reduce costs, as well as ensuring they can seamlessly navigate regulatory demands.

Here’s my top three predictions on how businesses could rely upon the payments sector to mitigate economic uncertainty in 2023.

Spencer Hanlan explores how the speed and efficiency of payments, particularly cross-border, could drive innovation to offset inflation. He sets out his top three predictions of 2023.

Inflation is the silent killer of businesses and personal wealth. That is why, in this period of economic volatility, businesses will be forced to take a step back and consider how they combat fluctuating costs, while streamlining operations and responding to customer demand for reliability and speed of delivery.

We’ve already seen the Bank of England’s efforts to support organisations by raising interest rates, but in 2023, businesses will look towards the payments industry for more help. So much so, that businesses will increasingly adopt modern payment tools to build speed and efficiency into cross-border products and services. This will then help them to manage liquidity with instant settlement, keep customers happy, unlock new revenue streams and offset inflationary pressures. By increasing the speed of cross-border products and services, businesses can ensure they pay and get paid in real-time, every time.

Fundamentally, those who can modernise their processes successfully will be better equipped to survive this uncertain time with stable and reliable finances.

Unlike ever before, businesses will be able to leverage the same payment infrastructure to receive and send money in local currencies, at low exchange rates and in real-time. In turn, this will build trust with new markets and mitigate the effects of economic uncertainty.

In 2023, businesses will become increasingly attuned to the complexity of changing global regulations. It’s here that payment providers will play a key role in removing compliance as a hurdle to international growth, customer acquisition or revenue generation.

Fundamentally, leaders want to spend their time focused on business growth, product development and customer experience. As such, managing different regulatory environments can quickly become burdensome and costly.

Many do not factor into their roadmap that each market may require a new license to move money or different compliance standards for onboarding customers and verifying identities.

Many, if not all, businesses aspire to operate globally and take advantage of talent, market appetite, and regulatory opportunities around the world. However, international expansion is often part of the long-term roadmap: a goal that follows funding, momentum objectives, or customer acquisition.

However, today’s economic challenges will see businesses accelerate these global ambitions in the relentless pursuit of growth. Opportunities to expand their customer base and drive new revenue streams become harder to ignore when combatting inflationary challenges and squeezed budgets.

As businesses adopt this global mindset, they will increasingly lean on payment providers as a reliable and flexible financial bridge into these new markets. With this support, businesses of all sizes will feel equal to larger enterprises, both in terms of resources and market opportunities.

As being compliant and adhering to regulations is of utmost importance, it can ultimately draw attention away from more strategic endeavours that lead to growth. This means that as budgets are squeezed in 2023, businesses will want to ensure time and resources are spent on what will help, not hinder, the bottom line.

The right payments partner will remove this headache, managing global regulatory compliance needs and requirements in real-time, thus making crucial resources and budgets available to be allocated to growth.

There’s no doubt that the cork is out of the bottle on innovation in the payments industry and it will play a significant part in helping businesses to mitigate economic uncertainty in 2023.

Technology continues to be a key competitive differentiator and the strategy to win must include taking advantage of payments transformation to unlock efficiency, increase the speed and reliability of payments, and demystify regulatory complexity to offset inflationary pressures and realise opportunities for growth.

1 Businesses will turn to payment speed and efficiency to combat

2 The global business mindset will speed up, not slow down, through payments innovation

By Jos Henson Gric Member of Project Inclusion and founder and CEO Flex

By Jos Henson Gric Member of Project Inclusion and founder and CEO Flex

With the number of UK adults struggling with their expenses growing rapidly, the demand for products and services to help people manage and improve their financial situation will increase. This is an opportunity for the payments sector to show how it puts its customers first.

The 2008 financial crisis showed us how households respond to financial pressures. Spending gets slashed on non-essentials and bills are juggled but, after a while, it all comes crashing down.

Increasingly desperate people ask friends and family for help, but that’s not always an option, especially if they are in the same situation.

Scared of missing payments and harming their credit score, people turn to any option they can find. Items are sold, plans cancelled and then, finally, they often look for credit to plug the financial gap.

When it comes to supporting customers through the cost of living crisis, it seems the payments sector has faded into the background and innovation has stalled. Project Inclusion intends to turn that around.

Due to previous missed payments, all too often the best, fastest and cheapest credit options are no longer available to those struggling most. Instead, they take any loan they can get no matter what the price.

Although this helps for a bit, the repayments then start to become harder to manage. Since prices are not going down and wages aren’t going up, people soon find themselves on the brink again.

This time, however, they are out of lifelines. Credit can’t save them, no matter what the APR or which dark corner of the internet the lender lives in, and this is only going to get worse.

This is the cost of living crisis. This is the crisis people are struggling with. However, it is worth remembering that, unfortunately, even before inflation hit, this was already a daily reality for over 10 million people in the UK. The combination of no savings, no insurance, and no affordable credit is a dangerous one and has left millions on the brink of a financial meltdown.

Financial pressures have dominated the daily lives of many individuals during the past decade of stagnant wages and austerity.

It turns out not having enough money to pay for basic needs is the primary cause of most people’s debt problems – not drugs, not gambling, not reckless frivolous spending or poor budgeting skills. It is just the lack of money.

It is a wide range of factors and situations that are each seemingly small, but together make up a game. Not a fun one, but a game in the casino, where the house always wins.

New products and services that will help, not just those struggling financially for the first time, but also the one in five UK adults that has been struggling for over a decade.”

So, while the cost of living crisis is, and will continue to be, an extreme hardship for millions, there is some hope that we will come out the other side with a better economy and a better society. We will have a better understanding of the real financial pressures we all face no matter what our job, education or postcode.

We can already see this happening because, unlike during the pandemic and lockdown, this time it is companies that are stepping in to help people facing new financial pressures. For example:

Supermarkets have tried to offer cheaper alternatives and information about how to cook tasty low-cost family meals;

A new generation of social media influencers offering financial advice via Instagram and TikTok have seen their audience and popularity soar exponentially; and

Martin Lewis and mainstream websites like moneysavingexpert. com and Which? have been focused almost exclusively on providing guides and tips about how to reduce energy bills and identify areas of spending that can be reduced.

Services from telecoms to utilities, as well as lenders, are also doing more to work with customers who are falling behind on their payments. It is, after all, in their best interest to identify signs of financial distress and provide

affordable solutions to customers proactively. They want to deal with it before the situation spirals out of control, resulting in them losing a customer, missed payments and, most importantly, future revenue.

Is the payments sector falling behind?

So, what about the payments sector? What are we doing?

Fintech has been a leading area of the economy for a decade now, recognised for its rapid pace of innovation and huge range of apps and services available to consumers who love the easy access, futuristic features and for making their day-today use of money better.

But this was before the cost of living crisis. Now, the sector has seemingly become shy and faded into the background. I don’t believe these great start-ups and brilliant technology minds have all suddenly run out of ideas or decided they don’t want to help their customers.

So, why haven’t they? Where are the cost of living fintech apps? I know of one, because I am the founder. I know of more, but it is only a few handfuls and most of them existed before the current financial doom and gloom.

Financial inclusion is intrinsically linked to poverty, inequality and the social welfare system.It must be addressed once and for all.”

They were founded with the goal of serving those who were left behind by banks and mainstream financial services. They intended to help people struggling financially, to provide cheaper forms of credit, easier budgeting tools or to help with debt problems.

Unfortunately, that group of consumers – already large at 10 million UK adults – is about to grow much larger. But strangely, this is what I am optimistic about because now the problems of the cost of living crisis are considered mainstream issues. As such, the demand for products and services to help people manage and improve their financial situation will increase.

Where there is demand the market will respond and innovation will surely follow with new products and services that will help, not just those struggling

financially for the first time, but also the one in five UK adults that has been struggling for over a decade.

Over the coming months, I, and the rest of Project Inclusion, will work to identify how payments innovation can help address the cost of living crisis at every level. Starting with the most important one: consumers. We will work to connect the wants and needs of consumers with the huge number of great innovators within the fintech sector.

To the housing associations who have seen 60% of people on Universal Credit fall into arrears and at risk of losing their home;

To the staffing agencies, catering companies and high street businesses where people are working hard but still find it hard to make ends meet; and

To the government agencies and frontline workers that support some of the most vulnerable in society.

all charities, housing associations and agencies to participate in change

This is our open call to:

The small charities that help people in our communities who are struggling to make ends meet;

We want you. We want to hear how payments services can help people stretch their money further, make sense of their complex monthly budget. Innovation is alive and well in the payments sector and there are solutions that can help people in this difficult time.

Where they don’t exist, new products can and will be created that can help consumers, as well as give landlords, businesses and government the ability to offer better solutions through innovative partnerships.

Our hope is to take these real world, tangible solutions to the government and deal with the entrenched problems of financial inclusion that have persisted for 20 years. Financial inclusion is intrinsically linked to poverty, inequality and the social welfare system. It must be addressed once and for all.

As a member of The Payments Association, you can join Project Inclusion as a contributor. Contact Tom Brewin for more details.

In June 2022, PayPoint joined Pay.UK to help the government make cost of living support payments. By joining the Confirmation of Payee name-checking service, there is now a greater choice in payment methods so that people who most need financial support can receive payments through different platforms.

Helping the cost of living crisis comes in a variety of ways, from providing payment solutions with flexible terms to offering payment methods that reflect customer wishes for greater control, security, and flexibility.

Research by payments platform Paysafe shows that 44% of global consumers have changed their payment habits since the cost of living has risen. Payment solution providers and merchants need to meet these evolving needs.

The cost of living crisis can give merchants the opportunity to reinvent their customers’ shopping experience.

Chirag Patel, CEO of Paysafe’s digital wallets division, says “[Merchants] should focus on offering a range of payment methods that reflect consumers’ wishes for greater control and flexibility.”

However, cost is still an issue. Merchants pay around 2% to 8% of every sale to debit and credit card,

e-wallet and buy now, pay later (BNPL) facilitators. During a cost of living crisis, much of this is often picked up by customers.

Through open banking, innovations from payment providers like Volume have started making the checkout process more seamless, enabling merchants to reduce associated fees and pass on savings. Volume’s website states that it believes accepting payments should eventually be free.

Super Payments offers free online payments to businesses forever and instant cashback for shoppers to reduce costs. It only makes money “if businesses increase sales and if shoppers save money” says the company’s CEO and founder Samir Desai, who describes payment fees on digital purchases as a “tax on the internet”.

Every customer has their own reasons for choosing to pay the way they do, so offering alternative payment methods (APMs) from bank transfers to Apple Pay, Google Pay and PayPal, can help customers during the cost of living crisis.

However, adding APMs to the checkout experience can be a time consuming process. That’s why a platform that incorporates multiple payment systems can be beneficial. Companies such as Pomelo Pay offer integration through their banking app.

The payments industry is in a unique position to develop solutions that can help retailers and customers with the cost of living crisis.

However, the costs in providing APMs for some merchants, specifically small businesses, is a worry. The payments sector can help here by ensuring their payments solutions can work seamlessly with other finance management tools.

Peter Lord, co-founder and CEO of financial API provider Codat, explains that growth is no longer the top priority for many small businesses.

“While you might expect challenging conditions to lead to businesses unplugging their tech stack, our findings showed this was not the case,” explains Lord.

“They were more likely to become more reliant on financial software and look for time savings and tools that integrate with one another, rather than removing software to save costs.

“While fintech providers can’t do much to impact the rising costs themselves, they can play their part to

help SMEs by building value-added features that give them better clarity around their financial position and remove the burden of time consuming financial admin,” Lord adds.

While bank cards and digital wallets are popular payment methods, cash is seeing a resurgence.

Some of the most vulnerable groups in society rely on cash payments but Paysafe findings show that 59% of respondents to its Lost in Transaction research think it is the most reliable form of payment, and 70% would be worried if they couldn’t access it anymore.

Ross Borkett, head of banking at The Post Office, says the ability to budget daily with cash is helping customers in these difficult times.

“Postmasters are already seeing cash withdrawals increase as consumers face the cost of living crisis, with some customers finding it easier to budget in cash, and we expect this trend to continue into the difficult winter period ahead.

“Legislation to protect access to cash has been announced by the government and we’d encourage the banking industry to continue to support free access to cash for as long as it’s needed,” adds Borkett. This need for cash payments has to be acknowledged by merchants through the range of payment methods they make available to customers.

Through various payment methods and technology solutions, the payments sector can support merchants and customers during this cost of living crisis.

Research by payments platform Paysafe shows that 44% of global consumers have changed their payment habits since the cost of living has risen.”

Although the EWPN is committed to increasing diversity and inclusion in all areas of payments and fintech, its primary focus has always been gender parity. As such, we keep a close eye on changes happening across the industry, and the wider world, which may impact women working in the male-dominated world of payments.

In 2019, we published a report into diversity within the payments industry and looking back makes for interesting reading. It is encouraging to see that things have changed – almost imperceptibly – which is partly due to the impact of COVID-19 rather than an inspiring shift in mentality. Nevertheless, it has changed and continues to do so.

When we put together that inaugural report, the #MeToo movement and gender pay gap were regularly

hitting the headlines. Those topics have shifted down the news agenda, but they sparked changes that rumble on. Across all industries there seem to be multiple organisations publishing reports into gender parity, women in leadership roles, how to encourage women into the relevant industry and so on. The conversation is happening and that is hugely positive.

Throughout the 2010s, the number of women-founded and co-founded fintechs grew steadily. By 2019 the total share of fintech start-ups with women as founders or co-founders reached 12.2%, compared to 10.9% a decade earlier. The International Monetary Fund recently confirmed that the share of businesses with female founders has remained around 10-15% for the past two decades, with firms launched in the past 10 years the most likely to have been founded by women. Tides are shifting, albeit slowly.

Miranda McLean from the European Women in Payments Network (EWPN) examines how the culture has changed for women in the payments industry, but argues why more needs to be done in what is still a traditionally male-dominated sector.

According to PwC’s latest global CEO survey, 38% of financial services (FS) industry leaders say gender representation rates form part of the company’s longterm corporate strategy; and 11% include it within their annual bonus or long-term incentive plan. While this shows gender diversity is being taken seriously by a significant number of companies, it also reveals that many more are lagging behind.

According to the PwC trust index, the most highly trusted companies are 1.4 times more likely to have gender diversity targets in their chief executive compensation plans. Further demonstrating the value of diversity at work, Forbes recently found that diverse teams delivered 60% better results and made better business decisions 87% of the time.

An article published by Funds Europe in October 2022 reported on a detailed study of more than 100 professional females in the finance industry, of which 50% had experienced barriers to progression linked to life events that often impact women more than men. This included: starting a family, caring for family members, a requirement for flexible working to meet family commitments, and menopause. The study highlighted that many of these events are unavoidable, but the financial industry does little to support these women, often leading to their career progression stalling.

A Deloitte study also highlighted that organisations should do more to support women during their specific life events to reduce the impact on their careers and increase the number reaching leadership positions. Deloitte suggests addressing persistent challenges such as childcare requirements, ensuring leaders offer mentorship and allyship programmes to women at all levels, and evaluating successionplanning and promotion practices to ensure roles are filled from a diverse talent pool.

While awareness of and discomfort with the gender disparity issue are growing, what to do about it remains a stumbling block.

Businesses need to ensure their cultures and policies are appealing to and supportive of women in

all stages of life, and that development opportunities are in place for all employees — whether full time, part time, or just about to go on/return from maternity leave, for example.

Many (but of course not all) life-changing moments are unique to women — be it fertility treatment, miscarriages, menopause and even rape — and women need specific support to survive and thrive during and beyond these experiences. The theme of the first in-person EWPN conference since the Covid pandemic was human-centred design, which includes the vital work of designing workplaces and policies that support women through life’s traumas and challenges.

I was honoured to host a discussion at the conference in which the entire panel had first-hand experience of such events during their working lives. The session focused on personal challenges and lifechanging moments, what women can do when they go through such an experience and how employers can improve the support they provide to female employees in all life stages.

For International Women’s Day 2022, Banking Circle spoke to women from across the payments, banking, fintech and financial services world to gather their thoughts on how the financial services sector can play its role in achieving a world free of bias, stereotypes and discrimination. Many of the women involved in the project felt that change could happen for the financial industry, but it needs to begin in schools, and girls need to have good role models who can inspire a future generation of women into the traditionally male-dominated industry.

There is a need to go faster, not just because it is the right thing to do, which of course it is, but because businesses that do break the bias are stronger and more successful.

Open banking, the infrastructure that enables the secure sharing of financial information, continues to grow. The number of successful API calls, a metric measuring the number of operations executed on the open banking network, increased from 541.2 million in 2020 to almost 976.8 million in September 2021.

“The payments industry needs to adopt open banking payments because, ultimately, it’s going to be a massive part of the landscape,” says John Natalizia, co-founder and CEO at Snoop.

Open banking has shown us that the financial industry can welcome fresh players, tackle disruption, and bring new value to the consumer. It is sparking competition and innovation in the financial services sector to create better products and experiences for businesses and consumers.

“Open banking is not just about the initiation of a transaction on behalf of a payer,” explains Jan van Vonno, head of industry strategy at Tink.

“It is also about innovating around the transaction to create enhanced services for payers and merchants, such as financial management, confirmation of payments, and data-enriched payments.”

Businesses are using open banking to manage cash flow or make it easier to receive payments. It provides a safe payment option at a fraction of the cost of traditional methods such as invoicing and card payments.

By providing fast and easy payment experiences for users, businesses enjoy increased conversion rates and sales. With an integrated payment flow, engagement increases as users never need to leave the service. Innovations from payment providers like Volume make the checkout process seamless. This enables merchants to reduce associated fees and pass on savings to consumers.

The government’s plans to unlock the potential of open banking payments, such as through account-to-account retail transactions (A2ART), through the strategic working group overseen by the Joint Regulatory Oversight Committee (JROC) will see further progress. The Payments Association and its Project Open Banking are contributing to the strategic roadmap.

With so much progress expected on open banking, van Vonno believes that the industry should adopt open banking as it can “provide lower-cost, higher-success payments which settle instantly – a clear upgrade on what has been available to merchants so far”.

Open banking was conceived to improve financial services for customers, such as communicating with various banks to obtain information in one consolidated real-time dashboard. It is a secure way for customers to take control of their financial data and share it with organisations other than their banks.

Sharing data with authorised third parties enables customers to access services that help them make more of their money. As such, open banking solutions are safer because they require customers to authorise every payment with their bank using strong customer authentication (SCA). “[I]t is as close as you can get to a fraud-free payment method,” says Natalizia.

From smart savings apps to finding better mortgage rates or accessing credit, customers have better ways to spend, borrow, and invest. They can also benefit from reduced overdraft fees, improved customer service and the ability to build their credit scores and prove their ability to repay loans without having to rely on what banks and credit agencies know about them.

Open banking is expanding to include savings, mortgages, wealth management, and other financial services and customer account types. With increased adoption, the industry can move from open banking to open finance. More data sources, such as utility data and mobile phone data, can become available. This will deliver more personalisation and value to consumers.

As fintech continues to develop, the payments industry can benefit from:

Improved open banking products that are advantageous for businesses to offer, compared to legacy payment methods; and

Open banking payments being more widely available.

Open banking is predicted to grow nearly 680% by 2026 to 304 million users. By September 2022, the UK counted 6.57 million monthly active open banking users among the nine largest banks.”

With the variety of uses, Bottomline’s general manager and director of payments Ed Adshead-Grant says that the range of use cases vary enormously: “From better customer budgeting and financial awareness to seamless payments in real-time, affordability assessments on new customers, onboarding checks on everything from new savings accounts to property landlords who want to do background financial checks.

John Natalizia, co-founder and CEO at Snoop, agrees with Adshead-Grant. “From our perspective,

it is the ability to help consumers use their data in an intelligent way to make money [management] bespoke and personal, not one-size-fits-all and transactional. This personalisation results in more control, improved financial capability and better financial outcomes for customers,” he says.

For example, open banking has enabled PensionBee to create pension calculators and retirement forecasting tools to help customers plan. App users can also move their money between pensions. Before open banking, it was difficult for customers to locate pensions and data wasn’t easily available.

Adshead-Grant believes the winners of open banking will be those who “embrace the new change of open economies, where something that began as a compliance project in many countries can now evolve into a competitive position to win and keep new customers who want to operate in a digital world”.

Open banking is predicted to grow nearly 680% by 2026 to 304 million users. By September 2022, the UK counted 6.57 million monthly active open banking users among the nine largest banks.

Van Vonno believes this is only the starting point. “In June, Tink predicted that this number will go over 10 million by the end of 2022,” he says. “It is being driven by three unique forces: the introduction of re-confirmation of consent; the cost of living crisis demands on affordability checks; and the ongoing rise of payment initiation services and sweeping.

“We believe that these forces will extend into 2023, so we expect to find well over 15 million consumers benefiting from account information and payment initiation services around this time next year,” adds Van Vonno.

The government also supports open banking. In his first Mansion House speech as chancellor in July 2021, Rishi Sunak, now the UK Prime Minister, called for financial services to be “more open, more competitive, more technologically advanced, and more sustainable”.

As regulations, technology, and consumer awareness of their data improve, open banking will go from strength to strength. The payments sector should be embracing this change.

Kate Fitzgerald has more than two decades of payments expertise across companies including Lloyds Bank, TSB, and Nationwide Building Society. Now at the PSR, she is responsible for all of its policy development projects, ranging from fraud, APP scams, the future of open banking, competition, market reviews and the new payments architecture.

The Payments Association sat down with Fitzgerald to find out more about what’s on the policy agenda for PSR.

Kate, can you tell us about the PSR’s next focus?

Our strategy at the PSR is focused on four key areas: access and choice, protection, competition and unlocking account-to-account payments.

In essence we are the engine room of the PSR. In September we released a consultation focusing on preventing APP scams and protecting consumers. We are focused on getting the best outcomes for users.

It is important that people can trust the payments system. Consumers need to be able to make sure that their payments are safe when they make a fast payment.

How is the PSR working with wider industry and how are you balancing all the different needs?

We want to make sure that the UK payments system meets people’s needs and that they are protected. We also want to make sure there is effective competition, because that leads to better services for

everyone. We want to make sure that our payment system is efficient and commercially sustainable.

We have done a lot of work with Pay.UK on the New Payments Architecture. We ensure that we talk to a broad range of stakeholders. We make sure we talk to consumers and consumers groups. Our role is to make sure that the outcomes that we’re aiming for are addressed with the solutions we deliver.

We’ve just completed the FCA TechSprint, where we worked with various organisations to look at different ways of tackling fraud. We are also doing a lot of roundtables and bilateral meetings with banks to talk about our APP scams consultations. We are making sure that we understand the consumer voice in this.

In the CRM Code today, the cost of refunding fraud falls to the sending bank. Over 90% get paid by the sending bank. We think that the receiving bank has a big part to play, therefore we would like to dial up the incentives for the receiving bank too.”

In October, we had a day in Birmingham with Britain Thinks, where we spoke to a large group of consumers, some of whom have been a victim of fraud. We heard directly from them, about their thoughts on APP scams and what they thought of our proposals.

What measures have been taken by the PSR to combat financial crime?

Confirmation of Payee has been a really important step. We are really pleased to see banks implementing this and we imagine

that over the coming years we’ll achieve 99% coverage.

We want to ensure that the right incentives are in place for banks for stop fraud happening. We want to make sure that there is a consistent adherence to reimbursement for all banks not just the ones that are signed up to the voluntary code.

In the CRM Code today, the cost of refunding fraud falls to the sending bank. Over 90% get paid by the sending bank. We think that the receiving bank has a big part to play, therefore we would like to dial up the incentives for the receiving bank too.

We want the right incentives in place for fraud to be stopped, investigated, and reimbursed at the receiving end, which is why in our latest consultation liability for reimbursement is split between the sending and receiving bank.

What does success look like to you?

We’ll achieve success if people feel like they can trust the payments system and we don’t have a system where fraudsters are allowed to pick and defraud people. So, nirvana for me would be everybody working jointly and really hard to keep fraudsters out of the system every day.

Did you miss the financial crime podcast on scams and fighting fraudsters? Listen now here: https://thepaymentsassociation.org/ article/podcast/fighting-fraudsters-how-can-the-payments-industrystay-ahead/

A lmost two-thirds (64%) of global business leaders have found it increasingly difficult to combat fraud since the Coronavirus pandemic, according to research conducted by Stripe. This is, in part, due to the creation of thousands of new e-commerce businesses, which in turn have provided ample opportunities for fraudsters.

Tactics used to carry out payment fraud have also become more sophisticated as technology has evolved. For example, there has been a growth in automated bot attacks – the method of choice for testing stolen identity credentials.

Fraudsters have taken advantage of customers moving to remote

banking during the pandemic. According to a report by UK Finance, losses arising from internet banking fraud reached £111.8 million in 2019. In 2020, that number increased by 43% to £159.7 million in losses. As a result, companies are struggling to keep pace with the evolving online methods, volume and tools used by scammers.

With two-thirds of businesses struggling to combat fraud, The Payments Association examines how data, artificial intelligence and verification tools can be used to mitigate the risks.

Therefore, Will Megson, product lead for Stripe Radar, says the “next evolution” in fraud management should focus on “richer data to inform fraud models”. “The tools and technology to gather this information are available today, but they are often in siloed, disparate systems; businesses may have separate tools for identity verification and biometrics, for example.”

Leveraging data to consolidate information is a key step to making fraud management systems more effective. Colin Neil, UK managing director at Adyen, says: “Businesses that make use of in-built risk management systems will benefit from trend data from across the whole platform. This helps detect and mitigate fraud, as well as assisting in handling disputes and chargebacks.”

As fraudsters increasingly utilise data for their attacks, companies must do the same to combat scams. Card testing, a tool used by scammers to obtain long lists of stolen credit card data, has been a significant headache for companies.

Card testing enables fraudsters to make thousands of purchases over a very short time period to check if the cards are still active. The attacks can negatively impact businesses in a number

of ways, including higher payment processing costs, failure risks, or immobilising their websites under heavy traffic.

Research conducted by Stripe illustrates that card testing has increased significantly, with 40% more businesses exposed to such attacks today compared to before the pandemic.

It’s a constant arms race when it comes to both technology and strategy, with everyone looking to beat existing systems on their side.”

arising

internet

fraud reached £111.8 million in 2019. In 2020, that number increased by 43% to £159.7 million in losses.” Tuesday 7th February | 18:00 - 21:00 GMT The

from

bankingFactory House, London Organised by

Machine learning, a subset of artificial intelligence, has emerged as a key tool to combat fraudulent transactions. It has the advantage of processing data at rapid speed and identifying suspicious patterns.

More advanced AI used in payment fraud management can take various data points and contribute to decisions, explains Sunny Thakkar, head of global merchant fraud and exemptions products at FIS.

“Artificial machine learning is super important because with the amount of information we need to infer, a machine can make those decisions within milliseconds.

Whereas humans write rules to try and keep up with the trends, the AI can automatically start to figure out these trends.”

For example, AI machine learning can triangulate data such as email address, IP address and physical address to see if there are any red flags in a given transaction.

“It makes us a lot more vigilant in terms of finding fraud that’s more advanced and moving a lot more rapidly than we would with traditional fraud management,” adds Thakkar.

Mastercard has been using AI and behavioural technology solutions to assess data. This includes behaviour such as “how you hold your phone or how fast you type or swipe” says Ian Morris, director of communications, C&I at Mastercard. “It acts in real time to detect when devices are compromised and acts quickly to prevent fraud.”

Additional customer verification and two-factor authentication has also been one of the widely used solutions against payment fraud. Asking for customer information such as names and email addresses helps verify their legitimacy and gives a business more evidence in the case of a dispute.

Two-factor authentication adds another layer of security to a transaction, but applying it dynamically will help guard against unnecessary friction and lost revenue.

However, challenges remain in correctly identifying the cardholder. “It’s a constant arms race when it comes to both technology and strategy, with everyone looking to beat existing systems on their side,” says Gergo Varga, product

evangelist at Seon. “Fraudsters are also increasingly sharing their methods and knowledge, as well as renting out their services: Fraudas-a-Service is a reality today.”

Another fraud management tool used as part of customer verification is address verification service (AVS). However, this method can lead to a lot of legitimate transactions being blocked. Additionally, “AVS really only works in three countries, which is the UK, the US and Canada”, claims Ed Whitehead, managing director of EMEA at Signified.

“If you’re using an AVS filter, and you’re shopping for a Christmas gift to send to your brother who lives in France, suddenly that AVS filter is blocking a good order,” says Whitehead. He explains that companies should remove the reliance on rules-based data points and actually look at the transaction as a whole. Capturing large data points will allow companies to have supporting evidence to be able to assure a gateway (or an internal merchant) that this is a good transaction.

“It is all about the ability to process your data, understand that feedback loop automatically and iterate and improve the outcomes each time,” adds Whitehead.

While payment firms and banks can feel as if they are playing catch up to the tactics of fraudsters, the ability to accumulate data points and use them for effective decision making will level the playing field. Investing in verification tools, AI or machine learning might be seen as a significant upfront cost, but it could potentially save companies thousands of pounds – and more importantly, customer trust – in the future.

Delivering a programme of insights, learning and events for the payments industry.

Project ESG aims to encourage companies in the payments industry to adopt progressive strategies for how they impact the environment, our society and their governance in a sustainable way.

The Payments Association will deliver a programme of activities via Project ESG that will seek to deliver a vision for the payments industry on equality, equity, diversity and inclusion as well as sustainable financial practices.

“The world is becoming increasingly aware of the importance of embedding sustainable and community-driven practices into business; and the payments industry recognises this as an opportunity for growth. I’ve been blown away by the support our members have shown for this initiative and can’t wait to get started.”

Register your interest by emailing: jay.bennett@thepaymentsassociation.org

To learn more, visit: thepaymentsassociation.org

“We are delighted to launch Project ESG, championing progressive strategies for those in the payments industry to operate in a sustainable way.”

Charles Radclyffe, CEO, EthicsGrade

Tom Brewin, Head of Projects, The Payments Association

From a once ‘poor man’s card’ to paving the way for a new way to earn, Richard Ney examines how prepaid products are being used to underpin some of the slickest payment solutions and user experiences.

By Richard Ney CEO Lerex Technology

Iremember delivering the first French one-time usage virtual card in 2002 and, even though it provided a much-needed security improvement, the adoption of this product was quite low. Prepaid cards were seen as the ‘poor man’s’ card and mostly used as a cheaper alternative to traditional banking. Prepaid products lacked user focus and innovation, and it was extremely expensive to launch and run such a programme, making it difficult for new competition to enter the market.

Over the past decade, things have changed dramatically. The whole financial space has evolved and become commoditised. The cost of technology has drastically reduced too, making it cheaper and easier to deliver new financial products.

With that barrier to entry lowered, the financial sphere has seen a high level of new entrants, driving innovation forward at a fast pace. Far from the five days it was sometimes taking to move money between accounts, users are now used to near realtime money movement – although it is often still a perception because actual settlement can take longer to come through.

We now live in a world where the choice of financial products is abundant and where the way we are consuming financial services is up to us. We are no longer choosing a bank at the age 16 or 18 to stick with for life, using it for all the financial services we need. Consumers choose different providers for credit, loans, income, general expenses and travel.

The growth in prepaid cards is interesting, but it is only one part of the overall payments industry. The sector is evolving at a wider economic level and the change in consumer behaviour is just the beginning.

A similar evolution and choice of providers has taken place in another area: employment.

While older generations were used to having an employer for life, progressing through the ranks until retirement, this is no longer the case. My generation (I was born in 1979) tends to change employer every three to five years; and the generation coming through now is even more ruthless and will change jobs based on an employer’s brand values. It is also more

common to be self-employed, working with multiple clients on short-term contracts at any given time –essentially the gig economy.

Employees now are adopting this mindset of how we earn money, for example, asking employers to pay them per job or task in the same way that economy workers invoice on completion of a project. This change in how we earn money could drive a change in the payments industry.

This consumption is a simple consequence of an on-demand mindset our children are growing up with. Take my three-year-old son as an example, he quickly understood that should he want something, daddy and mummy could simply buy it online and it would be delivered to him the next day.

For a movie, music or any other digital product, the wait time is more drastically reduced and having to wait a few seconds when the internet connection slows down is becoming an unacceptable nuisance.

I grew up having to wait before receiving mail orders, had to go to a specific shop for goods and services, and for the next episode in a TV series I had to make sure I tuned in on the right day at the right time. Today, we have a 24-hour delivery time, and we can stream music, videos and TV shows on demand.

Slowly, everything is becoming available whenever we want it. For a small population within the gig economy, this is also becoming true for how they work. Younger generations are ‘consuming’ jobs, picking from large pools of gigs and choosing where, when and how to work. Yet, payment options to support that are limited and not user friendly.

As the expectation of employees to be paid on demand increases, employers will have no choice but to adapt. A challenge arising from this, which is driving payment innovation, is trust. This type of arrangement doesn’t enable the trust rapport that exists between a company and a full-time employee.

Gig workers often have to deal with late payment (or not being paid at all) and chasing to be paid accurately, while businesses are wary of the job being done to their satisfaction.

Some companies are already evolving to a ‘per job’ payment, where the worker can receive their pay in near real-time once a job is completed and based on a series of criteria. However, this isn’t widely used and remains in its infancy.

To the evolving ways of working and being paid, one innovation needed in the payments sector is money streaming.

In the same way as we are streaming music or video today, tomorrow we will need to be able to stream income (or payment from a company point of view) to support the continuous growth of the on-demand model. Companies will define the criteria for the streaming to start and stop, as well as the amount being pushed, and workers will be able to get the reassurance they are getting paid fairly.

It’s not only for the gig economy

This concept isn’t new. Payment-on-demand is as old as the internet (at least) and is one of the initial drivers behind initiatives such as Bitcoin.

Twenty years ago, as the last internet bubble crashed and companies struggled to generate income, some tried to implement pay-per-view content. For example, news websites tried to charge per article, but this wasn’t how we consumed information. We didn’t want to pay for an article when we were only going

to read the first paragraph (even if it’s only a few pennies) and, in some cases, even one pence was too expensive.

The micro-payment concept was introduced to be able to pay a website for every minute a user would be viewing it, but this didn’t take off for two reasons. First, the one pence minimum denomination was often a barrier; and two, payment options were not available to support the model.

With cryptocurrencies, mostly Bitcoin, the fractional payment issue has been resolved and payment technologies are now ripe to support a streaming model. The smallest Bitcoin denomination is 0.00000001 which, as of 6 January 2021, is worth £0.00024. This is small enough to be able to charge a fraction of a penny for every second spent browsing a website.

If every piece of internet content was generating true direct revenue, this would help drive quality but would also solve the major headache some digital companies are trying to address, which is getting paid. Currently, their only choice is to provide free content, bombard us with adverts and encourage us into chunky payments once we get accustomed to their services. But this isn’t the way younger generations consume.

Digital companies, especially news organisations, are facing difficulties because it will become increasingly difficult to get paid subscriptions. We can already see the subscription model declining because it is not always in the consumer’s interest.

Users are consuming content regardless of its source and delivery platform and paying a subscription to one specific provider is not advantageous when you might be using multiple providers.

Using myself as an example, my household consumes a high quantity of TV shows. We had a subscription to Netflix, Amazon Prime, Now.TV and Disney+. I thought it was becoming a little too much and, realising we were not using Now.TV as often as the others, I cancelled it. But this isn’t in my interest, nor of Now.TV. The best

thing to do would have been to keep the subscription, but to only pay when I was using it.

This would all be possible with fractional money streaming.

By now, you might be wondering why I mentioned prepaid specifically.

One issue remaining today is speed of settlement and credit risk. The streaming model cannot work without the ability to move funds faster but, more importantly, without total assurance that the money will be received.

In this honeybee consuming approach, where the consumer loyalty is becoming sparser, it is critical for the provider to be 100% sure the user has funds available and will pay. This is obviously feasible using a lot of different mechanisms, but prepaid is inherently the perfect mechanism.

As the funds must be deposited and available before making any purchase, streaming money from or to a prepaid product removes that credit risk altogether, providing the merchant with peace of mind when delivering content.

The accessibility of prepaid products, and additional levels of features and control they provide (such as allowing the user to fine tune their spend limits on a per-provider basis if needs be) is also key to making a streaming scenario work well for all parties.

The past 20 years have seen the digitalisation of many products and the streaming revolution with music and movies. The on-demand concept is fast becoming more anchored into our daily lives and is driving rapid changes in the way we’re consuming everything. The next 10 years will see an equally disruptive change in the way money moves and is being consumed. Our children will be used to streaming money. The question is… will they be streaming fiat or digital currencies?

With cryptocurrencies, mostly Bitcoin, the fractional payment issue has been resolved and payment technologies are now ripe to support a streaming model.”

The payments world is sprinting to comply with the ISO 20022 messaging standards. Beyond the compliance lies the transformational value that could be derived by utilising the rich message format.

Tuhinabhra Mahapatra Head of next generation payments Synechron

The payments world has gone through major transformations in the past decade, especially driven by the advent of digital technologies.

However, there are several obstacles to overcome, such as the high cost of cross-border payments, lack of interoperability among payment networks, legacy applications, and technology components. Some industry developments could solve these issues and radically change how we handle payments.

We are in the midst of one such transformation –ISO 20022 messaging standards. This is finally taking shape due to the guidelines defined by the major networks for a universal standard and their commitments to implement timelines.

‘Compliance’ and ‘standards’ are two terms that don’t usually elicit excitement, but ISO 20022 is different.

This messaging standard provides a glimpse of possible future enhancements through the richness of the ISO 20022 payment messages and as the

common language for the entire payments industry.

Most banking and payments firms are looking at the implementation of ISO 20022 only through the lens of compliance. Their sole focus is to get their systems ready by the timelines set by the payments networks they are connected to.

Some organisations will follow the ‘big bang’ approach where all changes are made at once. However, some will take an interim ‘like-for-like’ approach. Either way, the larger questions remain:

What happens after the ISO 20022 implementation?

What are the immediate benefits that the payments industry would see?

How will financial institutions unlock the true potential of ISO 20022 to their advantage?

ISO 20022 is not a new concept to the industry. In fact, a significant number of new-age, real-time payments networks have been implemented following this open standard.

As a result, we have seen transformative changes in some pockets of the industry that decided to adopt this standard. A case in point is the applications of digital payments made possible through the ‘rich’ ISO 20022 messages.

Although payments is still a fragmented world, ISO 20022 holds the promise of integrating all corners once SWIFT and other major schemes adopt the fullyfledged ISO 20022 standards.

So, what lies beyond the compliance aspect of ISO 20022? What are the transformative values that could be derived by utilising the rich message format?

Leveraging the full potential and power of ISO 20022

Until 2025, the participants of SWIFT would be in a coexistence phase where both the old and new formats can be accepted through the network.

However, it’s largely expected that the major banks and financial institutions will be early adopters, leveraging the possibilities offered by ISO 20022 and building solutions that could help them differentiate themselves from competitors. These institutions could save a significant amount of effort because of the common regulatory standards.

An efficient reconciliation process and faster settlement would be some of the key benefits these payments companies could derive through the richer data structure. This structure would make payments significantly more frictionless and have a deep impact on cross-border payments and trade finance.

Additionally, the structured remittance data and end-to-end traceability in straight-through processing would greatly help in the reconciliation process. Hence, financial institutions could save a significant amount of operational effort in reconciliation by leveraging the power of ISO 20022.

The ISO 20022 message standard could play a key role in promoting innovation by deriving enhanced value for the participants in the networks and the end users of the payment services

Digital payments overlay services hold huge potential for delivering such values, namely Request to Pay, mandate payments, transaction monitoring, fraud prevention, etc.

This messaging standard provides a glimpse of possible future enhancements through the richness of the ISO 20022 payment messages and as the common language for the entire payments industry.”

For example, invoice processing is often a complicated process given the different standards followed by the parties involved. The overlay services built using the ISO 20022 messaging standards make it possible to integrate and automate the entire payments reconciliation process.

We believe these solutions would enable organisations to significantly improve the efficiency of their accounts payable and accounts receivable systems.

Request to Pay (also known as Request for Payment, or R2P) is one of the overlay services built on top of new real-time payments, and it’s gaining prominence in most of the markets where it has been introduced. This feature provides greater flexibility, assurance and efficiency of payments to the buyer-supplier, and billers in both B2C and B2B, including in e-commerce contexts.

In the near future, we will witness many similar applications around the payments world, not only

restricted to one-time payments, but also in recurring bill payments (e.g. the Mandated Payments Service in Australia), payments in parts, or flexibility through an extension of due dates. In fact, R2P has been highlighted as one of the key features of the upcoming real-time payments services, such as NPA (Pay.UK) and FedNow.

Open banking intended to break the silos and revolutionise the banking world by enabling fintech companies (with consent from customers) to build new solutions.

A key use case is deriving customer insights, especially their spending patterns to explore opportunities for recommendations, cross-selling, etc. ISO 20022 payments are uniformly structured and machine readable which could be leveraged to build such solutions using data analytic techniques.

ISO 20022 messages could also have data elements, such as purpose code, which help to ascertain the nature of payments and the spending behaviour of customers.

The standardisation of messages and transparency of the processes enable banks and regulatory entities to develop tools for monitoring transaction fraud through payment networks. In real-time clearing and settlement systems, it’s important to identify and prevent fraud through an immediate remediation process.

Most of the non-ISO 20022 messages have issues truncating important details including names and

addresses. This increases the chances of fraud and errors while sending payments to beneficiaries. ISO 20022 standardisation addresses the limitation of data lengths. Moreover, the overlay services developed on top of ISO 20022 networks (for example, Confirmation of Payee) ensure that the payments are delivered to the intended recipients.

One of the biggest benefits offered by ISO 20022 standardisation is the interoperability of payment networks. It makes the clearing and settlement process more seamless and cost effective through the interlinked systems. It also helps to manage failure situations, thus avoiding the risks of data loss due to compatibility issues.

One of the promising use cases in discussion (and in action in a few geographies) is connecting the domestic networks or CBDCs to enable cross-border payments. ISO 20022 could play a vital role as the harmonising factor or the common language among such payment networks.

ISO 20022 will become the key enabler for innovation across the payments industry. It offers a good opportunity to overcome legacy issues.

ISO 20022 migration appears as a compliance burden right now for banks, but it will significantly transform the industry for the better. The greatest advantage would be seen by institutions quickly adopting the standards that come up with new solutions to improve their internal processes and the way they do business with external entities.

There is also a huge space for payments fintech companies to create overlay services that enrich the ISO 20022-driven payments ecosystem, and help banks in their migration journey by enhancing the feature sets of their payments hub or payment-as-aservice solutions to accept new message types.

Which domains could be impacted next? Could Securities be the new frontier for ISO 20022?

Although SWIFT supports ISO 20022 for Securities messages, it leaves the choice of implementation to network participants rather than mandating usage.

However, with the implementation of T2/T2S Consolidation, a case for Securities is likely to gain impetus. A common, universal standard could help improve the efficiency of the intertwined business processes in the Securities domain. While we have been witnessing several programmes in migrating from ISO 15022 or MT formats to ISO 20022, the same is not observed in the retail cards space where the card networks, such as Visa and Mastercard, mainly follow the ISO 8583 standards.

ISO 20022 migration isn’t expected to be all smooth sailing. We’ve noticed ISO 20022 variations in different parts of the world, especially in the real-time payment networks.

Also, there could be confusion related to the approach to follow (e.g. big bang fully-fledged or like-for-like implementation), as well as the timelines, which could be extended a few times (e.g. CBPR+ and T2 would go live in March 2023), and where all parties involved are not ready at the same time. But significant delays are not expected once the major payment schemes migrate to ISO 20022.

Over the past few years, we’ve talked to major central banks, payment solution providers, and leading global banks about their perceptions of how ISO 20022 standards are changing the payments world. We’ve noted that mindsets are decidedly shifting from strictly addressing compliance timelines to the development of innovative solutions in solving legacy problems.

There’s much more common ground now among the payments community in understanding the value this common standard could bring to the ecosystem. The industry is on the cusp of another major transformation.

The overlay services built using the ISO 20022 messaging standards make it possible to integrate and automate the entire payments reconciliation process.”

From chips embedded into consumers hands, contactless payments, biometric wearable devices, and digital currencies versus a cashless society, The Payments Association speaks to industry experts to find out the key themes likely to dominate the industry over the next decade.

By Jon MenonTechnology is set to transform the way we pay for goods and services at a blistering pace, bringing greater speed and ease to transactions. But the possibility of slicker payments for consumers may also raise questions over identity, ethics, and inclusion, according to industry observers.

Some of today’s nascent technology delivers a core use, bringing the potential to succeed in the long term and shape the direction of payments globally. On the other hand, some tools may be just be a fad and struggle to move into the mainstream. Here, several

experts break out their winners and losers over the coming 10 years.

Consumers are expected to widely adopt account-to-account payments, which directly shift money from a payer’s account to a payee’s bank account, bypassing intermediaries such as debit cards.

“Instead of things being initiated and a delay waiting for the funds to be moved, we are moving to a 24/7 instantaneous sending of money,” says Mark McMurtrie, director at Payments Consultancy Ltd.

“You send it, you receive it, you can spend it [almost right away], instead of waiting for three days for things to clear. It’s a transition from the old BACs-based system with clearing and settlement of payments to real-time or instant payments.

“The game-changer device is going to be the smartphone, and in 10 years’ time, most payments will be initiated via the smartphone,” adds McMurtrie. “There will be fewer payments going through a Visa/Mastercard rail and more around a bank account-to-account payments rail.”

Retailers’ traditional hardware of card-reading terminals is likely to be replaced by software-point-ofsale terminals in the form of an app smartphone or a tablet used by the retailer, McMurtrie explains.

According to Peter Harmston, KPMG UK’s head of payments consulting, the cost-of-living crisis will also drive interest in real-time payments facilitated by account-to-account transactions because consumers want to know precisely how much money they have at any given moment.

“People are noticing more and more from a budgeting perspective the delay between a pending balance and the available balance,” Harmston says. He notes that the Payment Systems Regulator (PSR) is an advocate of account-to-account payments because it wants to see more competition in a market dominated by card schemes. (See interview: Achieving payments nirvana with Kate Fitzgerald)

The increased use of the socalled embedded payments – provided within app-based services such as Uber – will also speed up everyday spending, according to McMurtrie. Such apps already have the details and permission of the consumer to make transactions appear seamless, without the friction of further authorisation at the point of payment.

“What that means is that often the payment will become invisible – it will just be initiated from another service you are using,” McMurtrie says.

Industry experts believe the use of fingerprints or retina identification will become a key means of authentication in the payments industry.

“Biometrics will be the norm for identification,” says David Parker, founder of Polymath Consulting. “Now, whether we have got to the point of using fingerprints at the point of sale, or if we are using tokenised-card identification, that is a different story.”

However, the heightened security offered by biometrics won’t be enough to eradicate identity theft, which may become the biggest issue for this type of technology, he points out.

“Your identity will be your payment method. In theory, it’s more secure – it is you. But if someone fakes it, where do you go from there?

Look at all the challenges we have already from people stealing identity,” Parker adds.

Crypto crash?

Amid all the hype and investment interest in cryptocurrencies, these decentralised digital assets could be transformative in the next decade.

“Crypto will become more of a mainstream product as a way to pay – a lot of merchants are using it already,” says David Carr, chief executive officer at consultancy EU Prepaid Ltd. “Larger merchants tend to be the ones doing it. If you are spending half a million pounds on a Lamborghini, people don’t mind.”

However, while there will be growth in crypto, it won’t become the dominant means of payment, adds McMurtrie.

While “some consumer groups will want to use crypto”, concerns around regulation, crime, anonymity and tax evasion will stand in its way, he says.

“It will be a niche option. It will probably maintain interest as an investment opportunity rather than as a means of payment,” he adds.

Huge swings in the valuation of crypto assets that aren’t linked to fiat currencies, and scandals in the industry have put a cloud over the currencies. Most notably, crypto-exchange FTX filed for bankruptcy in November, owing creditors more than $3 billion. At one point, the company had been valued at $32 billion.

Polymath’s Parker is scathing about cryptos and the interest among investors in the assets. He says: “They have no use or value. Fools and their money are easily parted.”

The growth of digital currencies across private networks has seen central banks trying to ensure that the traditional monetary system isn’t bypassed. That has led to some issuing their own central bank digital currencies (CBDCs).

Critically, such CBDCs remove the risk and much of the volatility

of cryptos, retaining value over time by being linked to the country’s fiat currency. So far, 11 countries, including Jamaica and Nigeria, have started a digital currency, according to the Atlantic Council; and 114 countries, which represent 95% of global GDP, are exploring its use. China is set to expand a pilot scheme in 2023.

“I can see a big use for them in wholesale banking – you want to move money quickly and easily around the world,” says Parker, adding that for retail however, it “is trying to fit a square peg into a round hole – I’m not sure I see a need for them”.

KPMG’s Harmston sees a case for CBDCs for big business and notes that central banks would be able to gain “great insights into how the economy is doing” by tracking spending. However, he raised concerns on privacy asking if “people want their every move watched by central government”?

“This is the central government stepping into the commercialbanking space,” he explains.

Walletmor CEO Wojtek Paprota insists that implants are secure and says that the company is working on education to help widen acceptance of the technology, which he believes could increase to two million people worldwide over the next decade.”

Walletmor provides chips that can be implanted into the human hand to make contactless payments, and the company has already provided more than 1,000 such devices to customers.

Nada Kakabadse, professor of policy, governance and ethics at Henley Business School, says: “[The technology] is slowly penetrating. In 20 years, it could become the norm. The younger generation are more open to

it than the older generation because they have been born with the technology.”

But its adoption brings strong ethical concerns, warns Kakabadse. “What is worrying is, who owns the chip, who owns the information and who has access to the information,” she says.

“Should you have the technology without knowing the consequences? It’s unregulated. It’s completely open.”

However, Walletmor CEO Wojtek Paprota insists that implants are secure and says that the company is working on education to help widen acceptance of the technology, which he believes could increase to two million people worldwide over the next decade as medical services are potentially added.

“We need to look at implants in the same way we look at credit or debit cards,” he says. “It’s normal to use a debit or credit card and with implants it’s the same principle.”

The notion of an implanted device may have been around for years for pets. But people might prove a tougher market to crack.

Wearable contactless payment devices, such as wristbands and rings, may provide a bigger opportunity. The global wearable payment market is expected to grow to $80.38 billion by 2028, from about $10.35 billion in 2020, according to data company Fior Markets. But not everyone agrees that there will be a need for such devices, because people are still likely to carry a mobile phone in the coming years.

Implants are slowly penetrating. In 20 years, it could become the norm. The younger generation are more open to it than the older generation because they have been born with the technology.

“The biggest single wearable is your communication device, which will be the most important piece of equipment,” says Polymath’s Parker, who does not believe implants will be the next big thing.

“Humans don’t like to have foreign bodies stuck inside them at the best of times,” he says. “And you are still going to carry a phone, unless you are going to have an implanted GSM chip in your head as well.”

Buy Now, Pay Later (BNPL) provides short-term financing to enable consumers to pay for goods or services at a future date. It’s not a new concept, but its use in e-commerce has grown rapidly in recent years, with fintechs such as Klarna attracting younger consumers.

The market is set to surpass $1 trillion by 2030, according to statistics and analytics company Global Data. It predicts Apple, Google, Mastercard, Paypal and Visa will become leading players, forcing some fintechs out of the market.

However, as the cost of living crisis bites, regulators are taking a keener interest in the BNPL sector to ensure customers can afford higher levels of debt.

“Ultimately it is a form of payday loan, so there will be significant regulation to protect consumers of BNPL,” says KPMG’s Harmston. “It will continue in a more regulated environment.”

He adds that there may also be consolidation in the number of products available in the market over time because the proliferation of this type of finance has made choosing the most suitable line confusing for consumers.

The rapid rise in digital banking and e-commerce, exacerbated by the pandemic and fintech innovation, brings challenges for cash-dependent consumers.

Indeed, Link – the UK’s biggest ATM network - estimates that five million people would struggle to cope in a cashless society.

As such, the social and political drive to prevent financial exclusion points to a future that won’t be entirely cashless. The Financial Services and Markets Bill, expected to become law in 2023, will cement the need for banks to continue to provide access to cash as part of efforts to prevent financial exclusion. Link has said that the industry is already protecting thousands of ATMs and providing shared banking hubs.

“Cash is certainly not dead,” says Harmston. “It will continue to play an important part in our economy for the foreseeable future. It is the only kind of irrevocable instant form of anonymous payment, which doesn’t discriminate, and is therefore inclusive.”

The gamechanger device is going to be the smartphone, and in 10 years’ time, most payments will be initiated via the smartphone.”

The Payments Association’s recommendations

PSR on functional capabilities of A2ART

SHORT TERM