7 minute read

Identity Verification

Jacob Sever, Co-founder & Chief Strategy Officer at Sumsub.com chats with Peter White

ne of the increasingly dire issues facing O the casino industry are anti-moneylaundering (AML) measures or the lack thereof. Corporations as mighty as Crown Resorts and Las Vegas Sands have gotten in trouble for the lack of proper AML infrastructure. These need to be part of an end-to-end solution and Sumsub is offering that and Know Your Customer (KYC) technology–and not a moment too soon.

When was the company founded and what was the inspiration behind starting the organisation?

I started the company with my brothers – Andrey and Peter – back in 2015, when the interest and the demand for our technology was only beginning to emerge.

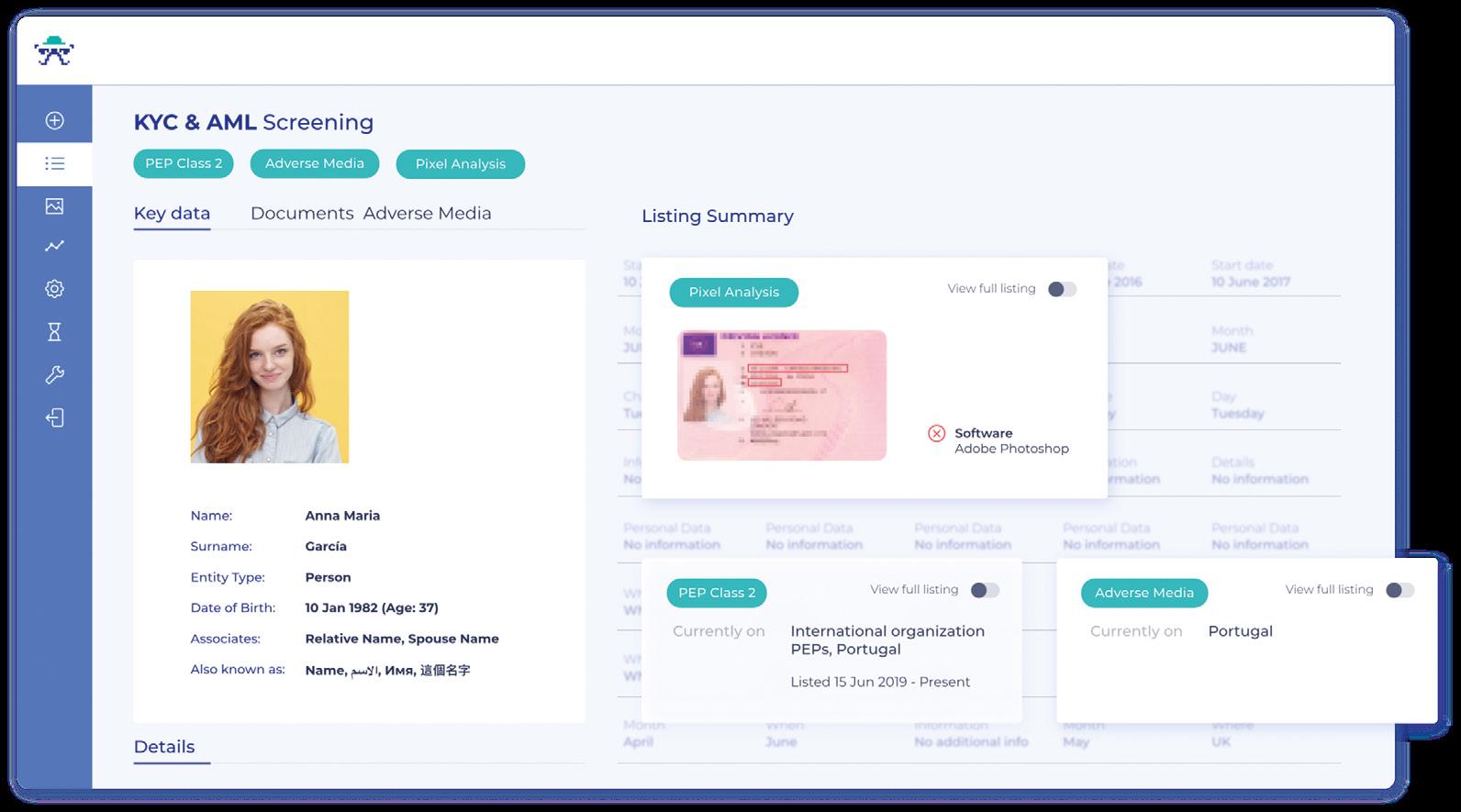

What brought us to the subject of identity verification was in fact our previous project. Before founding our own company, we were developing software that could recognize alterations made by graphic editors. It turned out to be a sensational weapon against insurance fraud—we could help companies to expose fraudulent insurance claims by detecting traces of photoshop within documents and photos, which were often submitted by car owners who were faking car damage in order to cash in on insurance.

From there, we grew to offer our solution to a variety of industries. At some point in time, we were even helping to solve police investigations while analyzing satellite images for graphic alterations—it has been a fun journey, to say the least.

While we were satisfied with our results, we still dreamed of exponential expansion. Perhaps the first step taken to where we are now, was the project with our good friends at Cryptopay, for whom we developed our first compliance and anti-fraud solution, which was based on our earlier technology.

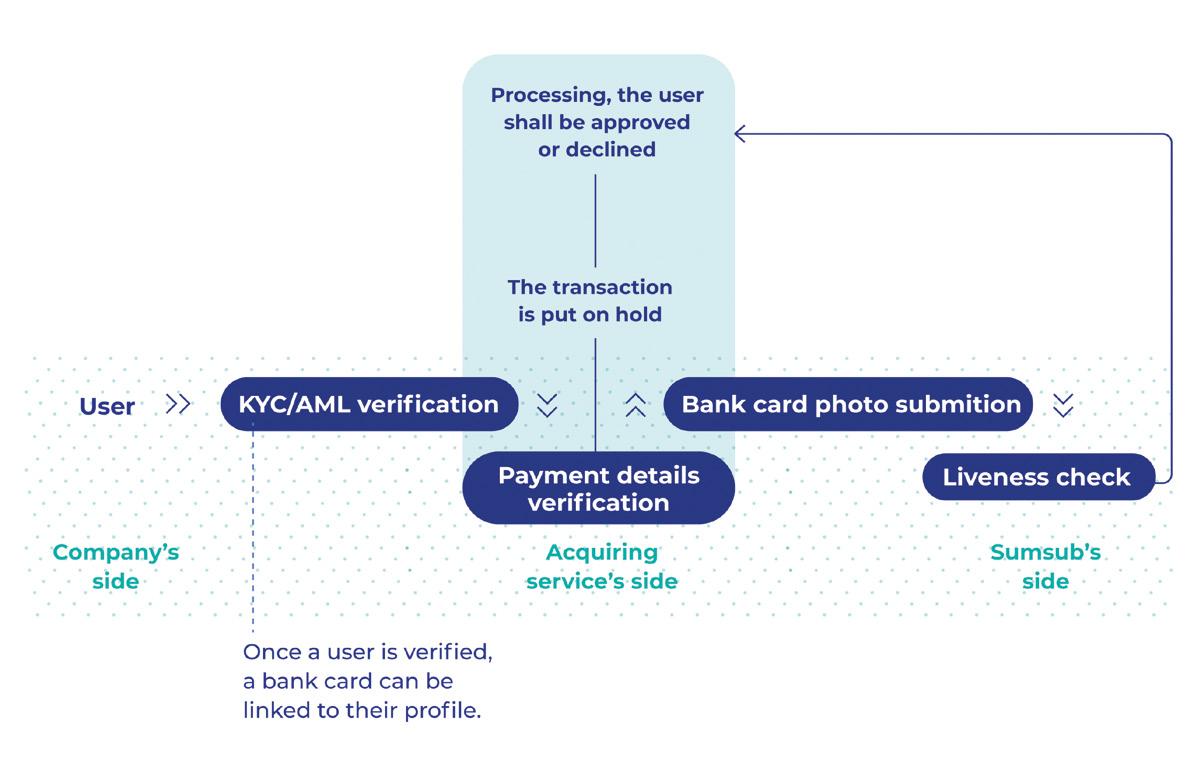

We put together everything that a company would need in such a case—our technology for the detection of graphic alterations, face matching, AML data, and tens of new features. The resulting product ended up selling like hotcakes. We were convinced that the demand was there. Rightly so too, as it definitely was, and is now greater than before.

What are the most common difficulties and challenges organisations experience and how has Sumsub helped them?

The main struggle is usually related to the absence of a unified solution for the compliance and anti-fraud challenges that businesses are thrown into from day one of their launch. They are either forced to develop their own custom technology that takes years to complete, or they end up using a few segmented solutions. Let’s say, one for EDD, another for AML, in addition to seperate ones for identification, crypto monitoring, legal support, lifecycle management, etc. One more solution, if it can be called as such, is to engage in manual processing throughout the company, which is highly unprofessional, time consuming and simply impossible to maintain in the case of larger businesses.

Because of this, companies end up spending their time and resources struggling to coordinate a handful of different solutions, while either missing instances of fraud or hurting conversion. We, on the other hand, solve these problems entirely by providing a flexible and customizable solution for any check that they might need, all under a single roof.

What are the key attributes of the Sumsub KYC & AML Compliance Software?

Sumsub is the first unified, automated compliance solution for regulated companies. We provide antifraud, KYC, KYB, crypto compliance and liveness checks, while offering a powerful dashboard that allows compliance officers to analyze statistics and manage their teams. All of that is catalyzed by constant support from our customer and legal teams.

What has been Sumsub’s reaction to these tighter requirements for gambling sites, how has the organisation assisted with operator compliance, and is there more that can be done?

We are always coming up with new features and broadening our array of products, so that we can give our clients exactly what they need, from a single source.

We are currently working on developing more types of checks, including proof of source of address and proof of source of funds checks that are especially vital for the casino industry and the gaming industry in general. Of course, we are also constantly upgrading our system’s capabilities, developing new settings in terms of check rules, branding, user paths and verification triggers. There is always more that we can do, and for that, we are very attentive to what our

clients have in mind. It isn’t uncommon for a feature to appear as the direct result of a client request. Basically, we put our minds to anything that could enhance our solution and help solve more problems.

Besides, jurisdictions are always changing; we see new regulatory laws and demands emerging with every new year, sometimes even with every new month. It’s important to constantly evolve to power up businesses with functionalities suited to these new rules.

How widespread is underage online gambling?

Underage gambling is as popular as ever. No wonder; minors have plenty of means to do so. Almost every household has a laptop, while almost every child has a smartphone. It doesn’t take much to swipe your parent’s credit card and make a bet, especially in places where online gambling is poorly regulated and there is no sophisticated identity-verification system to protect the business and the minors, both of whom are likely to face unpleasant consequences.

How easily can Sumsub’s software be integrated into websites?

Our system is extremely easy to integrate. We essentially provide a line of code that can be inserted into your app or website, and that is practically it. Of course, we also support our clients with the documentation that covers every aspect that might require clarification, as well as multiple features that make the work of the developers much easier.

How secure is your system?

We maintain bank-grade data security, which is at the core of our developmental and operational principles.

Our services and data are hosted using Amazon Web Services. All the information is encrypted and stored on our servers, which are located within European Uptime Institute-classified Tier III data centers. We encrypt, monitor and back up our data, allowing access only to authorized team members who need it for work. Twice a year, we conduct penetration tests on our app and framework with the help of third-party security experts. Besides, we provide security and awareness training to all the employees who have access to client data.

Is Sumsub available for use with operators Worldwide?

We are working with operators from all over the world and cover 220-plus countries and territories. Sumsub is doing especially well in our domestic regions, Israel and the U.K, while significant progress is being made in the U.S, Australia, New Zealand, Singapore, Hong Kong, and South Korea.

Is Sumsub fully compliant with GDPR?

Sumsub supports customer compliance with data protection laws across the globe, including GDPR.

What is your experience of the gambling sector to date?

Apart from standard KYC, the gambling sector holds a number of specific demands, such as proof of source of funds and proof of source of address verification. We have been working in the gambling industry for a while now and understand the relevant risks and challenges that operators face: identity checks, failure to verify proof of source of funds, poor client monitoring, undetected problem gambling, loose risk assessment and EDD. The casino industry is quite an attractive place for criminals and fraudsters to thrive off too.

For that, we learned how to protect the gambling sector from these problems by setting the right triggers and providing proper KYC and AML technology and guidelines.

Some of the clients we have helped along the way are Kajot-casino, Powercasino, Lottery Heroes, Pinup.ru, DrBet, Rednines Gaming, Kingswin, CopyBet, Lotto Agent, and Rivalry.

Do you think there is a role for AI technology within the identification of online customers who are at risk and need to stop, and is that an area in which you would look to expand?

Yes, of course. We provide proof of source of funds checks that help us detect problem gamblers and prevent them from losing even more money in the game, assuming that they can’t afford such losses.

Do you gamble, and if so what do you put your money into? Casinos, e-Sports, betting shops, sports betting or the lottery?

I am afraid we just have no time for that. Our business is growing and there is just too much going on to support its rapid expansion. However, I know a couple of our team members who are quite fond of betting and especially e-sports.

Investment in technology and innovation is essential to the growth of the organisation wouldn’t you agree?

Well, of course. Technology and innovation drives progress, while bringing efficiency and easiness to processes across all possible fields. Indeed, given that these are our core values, I wouldn’t dare to contradict them.

Now that the company has steady business growth, what are some of your prime objectives over the next 18 months?

I would say that, among our current primary objectives, we would like to grow the percentage of operations in certain regions and sectors; the gaming industry being the area we are looking to expand in the most.

Have you got anything else that you would like to add?

Thank you for having us.