THE PAST, PRESENT AND FUTURE OF INSURANCE PRODUCTS THE CYBER ROAD December 2022 • New York 9 Consider mid-career professionals 15 A culture of well-being 27 New hires have new expectations IN THIS ISSUE 9 Consider mid-career professionals 15 A culture of well-being 25 New hires have new expectations IN THIS ISSUE 9 Evolving cyber exposures 27 Social capital 31 Staff training IN THIS ISSUE PAGE 20

In a Competitive World, Service Matters! Lovell Safety Management continues its track record of providing affordable workers’ compensation insurance coverage for the following industries: • Building Metal Trades • Cleaners • Construction • Electrical Manufacturers • Hospitals • Launderers and Cleaners • Municipalities • Painters and Decorators • Paper Products Manufacturers • Retail Lumber • Roofers and Sheet Metal Workers • Truckers, Movers, and Warehouse people Lovell Safety Management Co., LLC 110 William Street, New York, NY 10038-3935 212-709-8600 | 1-800-5-LOVELL | www.lovellsafety.com Discounts up to 35% Call us for a Quote Today at 800-556-8355 Get a Quick Estimate by Visiting our Website at www.LovellSafety.com Win and Retain More Business with a Lovell Safety Group Over $1.15 Billion in Dividends Issued to Date

Statements of fact and opinion in PIA Magazine are the responsibility of the authors alone and do not imply an opinion on the part of the officers or the members of the Professional Insurance Agents. Participation in PIA events, activities, and/or publications is available on a nondiscriminatory basis and does not reflect PIA endorsement of the products and/or services.

President and CEO Jeff Parmenter, CPCU, ARM; Executive Director Kelly K. Norris, CAE; Communications Director Katherine Morra; Editor-In-Chief Jaye Czupryna; Advertising Sales Executive Calley Rupp; Senior Magazine Designer Sue Jacobsen; Communications Department contributors: Crystal Brinkman, Athena Cancio, David Cayole, Patricia Corlett, Darel Cramer, Anne Dolfi, Lily Scoville and Marcel Walls.

Postmaster: Send address changes to: Professional Insurance Agents Magazine, 25 Chamberlain St., Glenmont, NY 12077-0997.

“Professional Insurance Agents” (USPS 913-400) is published monthly by PIA Management Services Inc., except for a combined July/August issue. Professional Insurance Agents, 25 Chamberlain St., P.O. Box 997, Glenmont, NY 12077-0997; (518) 434-3111 or toll-free (800) 424-4244; email pia@pia. org; World Wide Web address: pia.org. Periodical postage paid at Glenmont, N.Y., and additional mailing offices.

©2022 Professional Insurance Agents. All rights reserved. No material within this publication may be reproduced—in whole or in part—without the express written consent of the publisher.

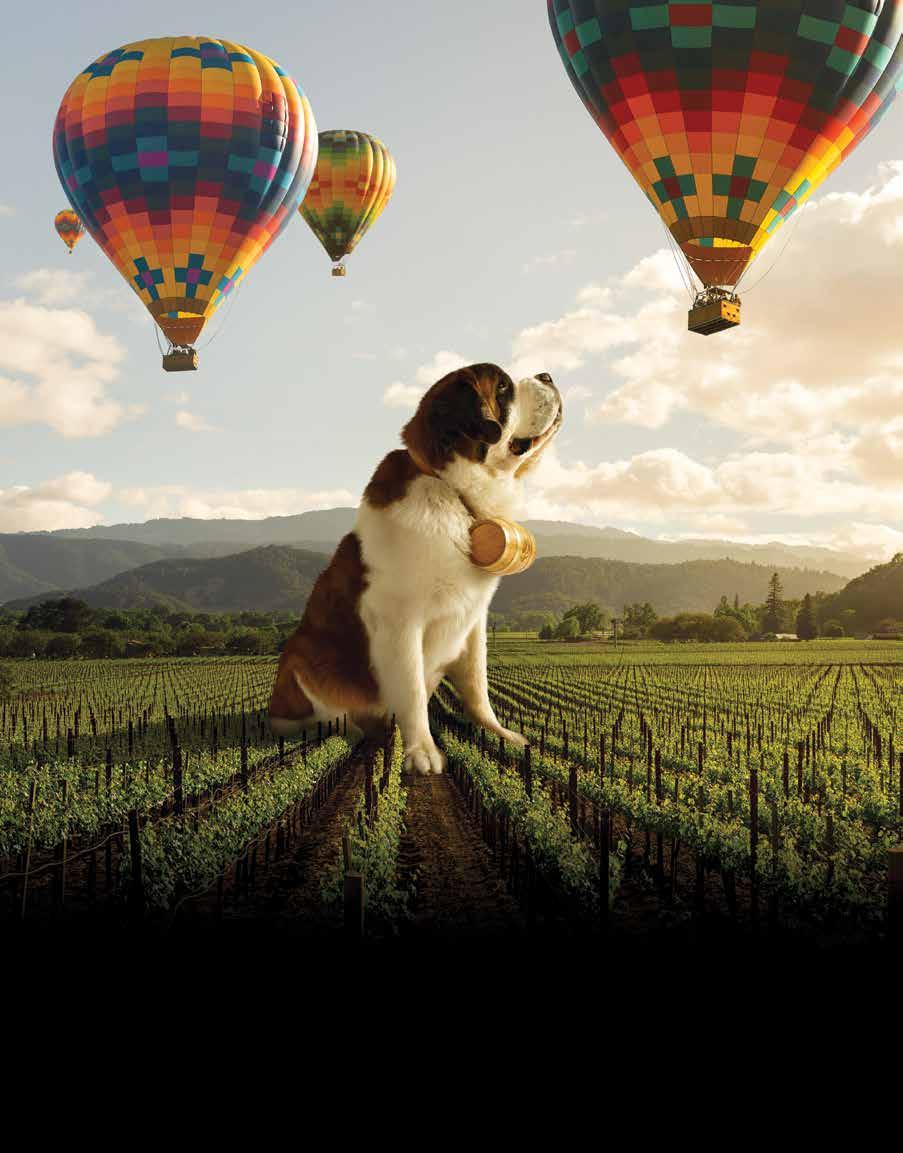

COVER DESIGN Anne Dolfi Vol. 66, No. 11 December 2022 December 2022 • New York COVER STORY

DEPARTMENTS 4 In brief 9 Tech 15 Sales 31 E&O 35 Ask PIA 41 Officers and directors directory 42 Readers’ service and advertising index

20 The cyber road The past, present, future of insurance products FEATURE 27 Social capital Unlock the power of relationship building

What is INSURTECH?

The innovative use of technology in insurance. It is a subset of FinTech (financial technology). InsurTech can be used for:

Underwriting: Information from IoT devices, aggregated public records, and behavior patterns can all contribute to the data to develop digital underwriting solutions

Claims management: InsurTech tools can help insurance agents connect information between different financial systems easily, which can help speed up the claims process

New business: Consumers are online all the time, InsurTech options help you reach prospective clients online, which can help you compete with direct writers

Distribution and marketing: Data can help you personalize your marketing messages to specific clients in specific areas

landscape:

1. Partnerships between insurers and InsurTechs. Gone are the days when insurance companies viewed InsurTech companies as direct competition. Now the two work together to deliver state-of-the-art insurance products to the market with speed.

2. Enhanced customer experience. InsurTech platforms offer data-driven insights that allow insurance producers offer better customer service and experiences to insureds.

3. More data allows insurance producers to understand clients better. This will lead to new insurance products, more personalized pricing, and more real-time delivery of services.

4. Enhanced cybersecurity and compliance. As the number of cyberattacks continues to rise, partnering with InsurTech companies can offer insurance producers the opportunity to protect their data and detect exposures across all lines of business. Additionally, these partnerships can help insurers stay updated on the most recent compliance regulations.

5. Transition from on-premise to cloud-based technology. As insurance producers move to more cloud-based technology solutions, they will become more flexible to launch new products and services, which will continue to enhance their customers’ experiences.

The effect of COVID on the InsurTech industry

According to Deloitte: “The pandemic has prompted many insurers to accentuate their digital transformation efforts and seek InsurTechs that can help accelerate virtual interactions in sales and claims, as well as reduce expenses.”

InsurTechs offer insurers allinclusive products versus singlepoint solutions that need to be integrated by the end-user.

4 PROFESSIONAL INSURANCE AGENTS MAGAZINE

How InsurTech is shaping the U.S. insurance

4

IN BRIEF

Can technology ‘fix’ the cyber insurance market?

Ralph Labarta, chief technology officer, Engage PEO

The demand for cyber insurance coverage has grown steadily as business owners better understand cyberrisk and the potential for financial losses and liability. Demand growth is projected to continue—even as cyber insurance premiums increase dramatically.

Key factors disrupting the cyber insurance market:

• Greater number of cyber crime incidents

• Higher costs to respond/resolve exposure events

• Higher premiums as carriers try to improve loss ratios

• Smaller supply due to tighter underwriting, lower limits, and exclusionary language

Technology

offers a solution

In response to the challenges, technology solutions are playing a critical role in improving risk selection and underwriting, evaluating exposure, and supporting loss control efforts. Of particular importance to brokers and clients are cyber risk assessment tools that identify cyber vulnerabilities that materially affect threat exposures.

For example, BitSight—a cyber risk assessment tool— assesses the security hygiene of a business’s publicly available technology access points. It determines a security rating and compares the score to peers in the industry, as well as to other relevant data points. The tool can further be leveraged to assess supply-chain partners and derive a relative assessment of a business’s portfolio risk. Using BitSight’s proprietary data, the scoring is then mapped into a predictive assessment of the business’s cyberrisk. Like knowing one’s own credit score, the data is useful in evaluating insurance quotes and negotiating rates.

What this means for insurance producers

These same tools are being adopted by underwriters as they seek to better inform underwriting and risk-based premium decisions. Brokers and insurers are using BitSight, CyberCube, SecurityScorecard or similar tools—and proprietary software and data—to assess an insured’s security practices and cyberrisk. The tools provide a current and historical score that describe the insured’s cyberhygiene and they are used to support approval, premium, limits, and renewal decisions. As technology tools further develop, and underwriters and insurers further integrate their usage, greater focus will turn to standardizing ratings and their meanings.

At this stage, insurers are looking to gain a competitive advantage as they address profitability concerns and the

long-term viability of the cyber insurance market. Technology-based underwriting efforts along with increased premiums are expected to improve financial results in the near-term, but only the stabilization of healthy returns will guarantee an expanding and adequate supply of aggregate cyber insurance availability.

Not surprisingly, ratings service providers seek to leverage technologies to enhance their commercial insurance/ financial service products.

The advances in using technology and data to augment targeted underwriting questionnaires will improve the assessment of underlying cyberrisk and improve the performance of an insurer’s cyberportfolio. Technology and product innovation will further an insurer’s ability to optimally measure risk and provide adequately priced products with appropriate limits. To some extent, cyber insurance coverage will be difficult to find for businesses with sub-par cyber risk scores; however, a resurgence in market supply should be expected for those at quantifiable lower risk.

Availability of proprietary loss data

A further point of technology and cyber insurance maturity will be driven by the availability of loss data across insurers, which today is not uniformly shared. Proprietary loss data presents a competitive advantage to insurers and underwriters as they hone assessment models and technologies to improve their cyberportfolio’s performance.

As the overall health of this market improves, and improved profitability follows, incremental improvement in the accuracy of cyber risk assessment tools will continue to be critical as stable profits will again expand insurers’ tolerance for higher risk. The maturity of data models and standardization of loss data aggregation will further the health and stabilization of the cyber insurance market to the benefit of insurers, brokers, and their clients.

Looking ahead

The challenge of providing an adequate supply of cyber insurance coverage is largely due to the immaturity of the available underwriting processes and tools. Innovation in technology and data modeling will result in improved financial results for insurers and create a resurgence in supply appropriately targeted and priced to the understood cyber risk. Long-term profit stability will broaden coverage, but only to the extent improved underwriting can sustain financial performance.

5

NEWS TO USE

PIA.ORG

InsurTech: Why it is important to the insurance industry

Richard Phillips, channel manager, Cyberstone

InsurTech plays an important part in changing how insurance coverage is applied and paid for in different ways. Some of these ways are highlighted in this article. InsurTech enhances the customer experience. By leveraging technology, customers are more engaged in selecting their coverage, understanding their needs, and getting personalized service. Instead of having to travel to a branch or speak to a representative, the future of InsurTech is moving toward self-serve, online dealings in which customers have their choice of engagement channel. Insurance agents can use this technology to help their customers handle the basic, easy-to-answer questions, so that they can focus on having detailed conversations with their customers about their insurance coverage questions.

InsurTech promotes efficiency. Prospective and current policyholders often research and explore options using the internet and apps. Without having to wait for business hours or an available representative, many InsurTech companies empower users to access the information they need quickly without being bogged down in processes. Again, this allows agents the opportunity concentrate on building their businesses, rather than getting caught up in the minutia of the day.

InsurTech emphasizes individuality. Due to the innovative nature of information gathering and data processing, many new tools are available to better understand each individual’s true needs. This not only improves pricing, but it delivers more reliable, consistent coverage based on historical data.

InsurTech improves flexibility. Modern InsurTech offerings are more likely to have flexible, customized, short-term or transferrable plans. Instead of needing to lock into long-term arrangements, InsurTech is more likely to give individuals specific coverage for a specific need over a specific duration.

InsurTech reduces operating costs. Traditional insurance companies relied on brick-and-mortar locations that necessitated manual labor. Now, InsurTech companies can operate remotely with staff engaging with customers around the world. The operating model of the online company is similar skimmer with less overhead. In today’s environment of hybrid-work models, this can prove to be an invaluable tool.

InsurTech may decrease fraud. By leveraging data, analytics, trend analysis, and machine learning, InsurTech companies may be able to detect fraudulent activities if inconsistencies in data arises. In addition, big data also may be able to discover potential loopholes that insurers can seek to close to avoid exploitation.

Innovations driving InsurTech change

There continues to be a growing, evolving range of technology used in InsurTech that changes the way insurance is being performed. Here are the some of the most notable technologies being leveraged.

Automation. InsurTech change relies on efficiency. This means that when clients fill out a document online, that record is stored in a data warehouse automatically or it is used to compile a policy ready for signature automatically. Automation tools are utilized to avoid manual human intervention when technological tools can carry out a process on its own.

Big data. Big data refers to the collection of massive amounts of information. This includes a broad range of data, the fast collection of real-time data, and a variety of data sets. Big data collection techniques allow insurers to gather a broader set of data used to analyze the risk profile of a customer to better understand their characteristics and habits. In addition, this information can be gathered for millions of customers and fed into predictive models discussed earlier.

Drones. InsurTech relies on innovative hardware technologies as well. Drones can be used to assess properties, evaluate property damage when it might have been unsafe for humans to traverse, or audit a site for a claim. Drones are becoming increasingly reliant on high-definition photo and video quality, allowing for assessors to rely on photographs and stored images from flights.

Internet of Things. Though a digital concept, IoT relies on the interaction between physical goods and software. For example, auto insurers now offer devices that gauge vehicle speed, handling, and driving habits that can be used to reward positive driving habits or penalize negative driving habits. While this level of information has never been available before, insurance companies now can base premiums on the smallest of details.

PROFESSIONAL INSURANCE AGENTS MAGAZINE

6 FYI

WE PICTURE THE WORST FOR YOU. WHOLESALE BROKERAGE | BINDING AUTHORITY | EXCLUSIVE PROGRAMS JencapGroup.com

The Purple Cow Experience

There’s something much bigger than software going on at HawkSoft...

Transform your agency with an insurtech partner who provides a remarkable experience through its commitment to transparency, stability, collaborative innovation, and community. Learn more at hawksoft.com/purplecow

Agency Management System

BRADFORD J. LACHUT, ESQ. Director of government & industry affairs, PIA Northeast

Watch out for those (cyber) exposures

My favorite movie, Anchorman: The Legend of Ron Burgundy begins with the line: “Bob Dylan once wrote, The times, they are a-changin’. Ron Burgundy had never heard that song.” That line is meant to clue the viewer in on the idea that Ron Burgundy will experience a lot of change during the movie and that he will not be ready for it.

For those who have not seen the movie, that is certainly the case. Ron’s ignorance of issues surrounding equality between the sexes, as well as his inability to finish a burrito ends with the loss of his job and his standing in the greater San Diego region. Of course, if Ron was more aware of and prepared for the change that was coming, he could have avoided a lot of his missteps, as well as a massive Battle Royale fight against other area news anchors. The same is true for insurance producers (minus the Battle Royale), when it comes to reassessing your clients’ cyber risk profile. (Didn’t see that coming, did you?)

It is likely that your clients’ cyber exposures have changed a great deal over the past few years, largely because society has changed a great deal during this time. This can be seen in the way both privacy and operational cyberexposures have continued to evolve.

Privacy exposures

Privacy exposures are related to laws, regulations and contracts that

Plumbing,

PIA.ORG 9 Steer Your Contractor and Used Car Dealer Risks to the Pros

Business

and

Damage

Turn to the folks that understand your clients’ businesses, deliver A- (Excellent) rated commercial auto and garage liability coverages, and provide the resources and support you need to achieve profitable growth.

Auto Liability

Physical

Services

Garage

—

Dealer

Transporter Plates Writing in NY, NJ, PA, & CT*

Convenient Online Quoting

Claims Reporting

Flexible Payment Options Contact us today: 516-431-4441 x3507 producer@lancerinsurance.com www.lancerinsurance.com * Please contact us for a list of available products and coverages by state

• Contractors – Commercial Building, Electrical, HVAC, Painting,

Roofing, Janitorial

and more

Liability

Used Car Dealers •

and

•

• 24/7/365

•

TECH

protect the privacy rights of consumer or client information. The exposures are not created by, nor are they unique to, your clients. Instead, they are created by a third party—usually a state or federal government—and they apply to thousands of businesses. There has been an evolution in how the law handles the privacy of information or data.

For many years, there was no single data-protection law or regulation in the country. Instead, data privacy laws were industry-specific measures. Laws like Gramm-Leach-Bliley Act and the Health Insurance Portability and Accountability Act, which regulate the financial services industry and health care industry respectively, are more focused on who is holding information than the types of information being held. For example, GLBA requires a bank that holds a consumer’s identifying information to follow certain procedures to protect that information, and in the event of a breach, outlines how a bank needs to respond to both the government and consumers. However, a gas station that retains similar information would have no such requirement under GLBA because it is not a financial services institution. As you can see, it is the industry that matters and not the information.

The evolving data privacy laws

However, the future of data privacy laws seems poised to change. This means a change for your clients as well. New state laws like New York’s Stop Hacks and Improve Electronic Data Security Act and California’s Consumer Privacy Act are not sector-specific laws. Instead, these laws are data specific. They apply

Hiring made easy

to any business that holds specific data—no matter the industry. These laws also contain expansive definitions of private information. For example, the New York SHIELD Act includes usernames or emails with passwords in the list of private information that must be protected.

This means that any business, no matter the industry, that retains clients’ email addresses and passwords has to comply with the SHIELD Act. How does this impact your clients? Data security laws are no longer the exclusive concern of financial institutions and health care facilities. Any business that retains even the bare minimum of consumer data will likely be subject to data security laws. Being familiar with the laws and regulations that your clients may be subject to, not only allows you to better serve your clients’ insurance needs, but it will give you a leg up on the competition.

Contractual exposures

Not to be ignored within privacy exposures, are those exposures created by business contracts. Unlike the exposure created by laws or regulations, contractual exposures are specific between the parties of a contract. In this exposure, Party A requires Party B to take certain steps to protect confidential information shared between the two parties. These exposures have evolved a lot in just the past five years. Take agency agreements, for example. Five years ago, it was rare for an agency agreement to contain any mention of cyber security protections. Now, agency agreements almost always contain multiple paragraphs detailing the exact steps that a party must take to protect confidential information. Insurance producers need to

PROFESSIONAL INSURANCE AGENTS MAGAZINE 10

To access, visit “Tools and Resources” at pia.org

Let PIA help with your staffing needs! We’ve created the Agency Staffing Assistance Program—an online member service that helps you find and keep good employees. 116225 919

be aware of their clients’ contractual responsibilities, and how they might impact their cyber liability policies.

Operational exposures

Not all exposures are external—some come from inside an organization. Those exposures, usually referred to as operational, are created by a business or client. Unlike privacy exposures, operational exposures are almost always unique to a given business. However, that does not make them any less sudden or invisible. A business’s operational risk profile can change overnight.

Let’s say you have a client who operates a small accounting firm. There are five employees, each of whom has access to client financial information.

In 2019, those five employees were working in the office. The only way to access client information was to log in to the office network through a desktop computer that was linked directly to the agency server.

Let’s fast forward to 2022, when those same five employees are working from home. They are using personal devices to connect to the agency server and access client information. Same agency, same employees, same information—very different risk profile. That change may be obvious, but operational exposures can be invisible—as least to the insurance agent. A switch from a PC to a Mac or an update to a new operating system can change a business’s operational exposure dramatically. Do you think a business owner would think to call his or her agent to inform the agent of those changes? Probably not. It is vital that the agent ask the questions the client doesn’t know he or she should be answering to better assess a cyber risk profile.

Before you fall …

In Anchorman, Ron Burgundy recognizes the need to accept and embrace change—but only after he falls into a bear pit.

Ideally, insurance producers can help their clients embrace change and avoid falling into a proverbial (or real) bear pit by keeping them informed of changes to cyberexposures and making sure they have the appropriate coverage in place. Stay classy.

Lachut is PIA Northeast’s director of government & industry affairs.

PIA.ORG 11

Please refer to actual policy for details. Policies are underwritten by Great American Insurance Company, Great American Insurance Company of New York, Great American Alliance Insurance Company, and Great American Assurance Company, authorized insurers in 50 states and the DC. Products not available in all states. © 2022 Great American Insurance Company, 301 E. Fourth St., Cincinnati, OH 45202 5633-AGB (12/22) Bow, NH 877.552.2467 aimscentral.co m TM FROM THE FARM AND RANCH PROFESSIONALS AT “FOALING” AROUND WITH THE WRONG COVERAGE? NOT FURLONG!

(PIA)

Since its founding in 1991, Brooks Insurance Agency has successfully serviced the standard markets and brokered distressed and complex lines of business. We are here to help agents find the coverage their clients need.

We represent 80+ quality carriers, including several new and exciting markets, across the country. Plus, a broad array of products and services in admitted and non-admitted markets.

MARKET STRENGTHS AND EXPERTISE

• Broad market reach

• High-touch broker specialists

• Easy, online quoting process

• Collective approach to complex insurance needs

BROOKS IS HERE FOR YOU.

How can we help you? Call us at 732.972.0600 or email us at info@brooks-ins.com

Brooks Insurance Agency | A Venbrook Company • 70 Bridge Plaza Drive, Manalapan, NJ 07726 • 732.972.0600 • www.brooks-ins.com Brooks Group Insurance Agency, LLC | NJ License 1575143

© 2022 Brooks Insurance Agency, LLC is a wholly-owned subsidiary of Venbrook Group, LLC. All Rights Reserved.

Brooks is proud to support Professional Insurance Agents

You can grow. We can help.

Alpha Northeast—an agency network and affiliate of the nation’s second largest network, ISU Insurance Agency Network—partners with insurance agencies to help them grow their businesses.

When you combine forces with us:

100% commission payout from non-contracted carriers & profit share eligible from first dollar

You’ll have access to the top national and regional carriers

You’ll have greater opportunity to maximize the benefit of networking with other agencies—which means more underwriting clout and increased profit share

If you choose to leave the network, you’ll face zero penalty—but we bet you’ll stay

With Alpha Northeast, you’ll get to rub elbows with the best of the best—because you’re one of them.

Partner with us today. You deserve it.

www.isu-alphane.com

Group members are not another policyholder! At Hamond, our staff averages over 40 years of workers’ compensation experience! Group 534: Almost all construction classes eligible Group 533: Woodworkers, lumberyard, and building material dealers Group 501: Plumbing, heating, cooling, and steamfitting contractors Maximum up-front discount for qualified members 50% of the service fee paid to brokers for the first three policy terms!* Unbroken string of dividends since group’s inception! ❐ Knowing your client’s business and exposure ❐ Assisting with payroll audits ❐ Attendance at audits upon request ❐ Assisting employers with claim filing ❐ Working with the carrier to assure proper claim handling ❐ Hearing and testimony support including pre‑hearing interviews with witnesses ❐ Assisting with underwriting and billing issues ❐ Assisting with OSHA issues and training ❐ Safety audits and risk management ❐ Development of safety programs, both corporate and site-specific ❐ Development of COVID 19 workplace compliance programs Hamond Safety Management included service checklist Excellence Direct quote requests to: (800) 285-2258 • Fax: (516) 488-2167 quote@hamondgroup.com • hamondgroup.com Underwritten by New York Insurance Fund *Service fee on subsequent renewals and on our returning members at our usual 20%. ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔

JOHN CHAPIN President, Complete Selling

Sales is a numbers game

A lot of sales gurus try to refute the fact that sales is still a numbers game. They say things like, “It’s not about the numbers, it’s about the relationships.” Well, they’re partially right—it is about the relationships. However, to get the number of relationships you need, you must be out talking to a lot of people.

It’s simple, the more people you talk to, the more business you will do. Granted, you must have quality behind the numbers, but assuming you’re talking to the right people the right way, it’s all about the numbers. That said, there also is a second way that sales is a numbers game: You can use numbers to guide and predict success. Here are six ways to do that.

No. 1: Set results and activity goals. Start by setting an annual sales goal. How much do you want to sell, or how much money do you want to make? Once you know this number, you can back into the other numbers. So, based upon your annual goal, calculate your monthly and weekly sales goals. From there, calculate your daily activity. So, if your annual income goal is $200,000 and your average sale pays you $5,000, then you need 40 sales for the year. Then, you can divide those by 12 and 50 (I assume you’ll want to take some vacation time) to get monthly and weekly goals, respectively.

Ultimately, think about it this way: How many proposals does it take to get a sale? How many appointments to get a proposal? How many people do you have to talk to get an appointment? And, how many calls do you have to make to talk to someone? That will give you your daily activity goals, which you can block time for each day.

If you’re not sure of the numbers you need in each area, talk to your managers and other salespeople—or take an educated guess. Just start somewhere.

No. 2: Track your numbers. Have a sheet of paper or use an Excel spreadsheet—just have something to track your calls, the number of people spoken to, and your meetings, proposals, sales, and size of sale.

No. 3: Keep track of what happens on each call. If you made 10 cold calls, your tracking could look something like this: two people weren’t there, two weren’t available, two weren’t qualified, two weren’t interested, and you got two leads.

No. 4: Get some reasons behind the numbers. Continuing with the information you gathered in No. 3, get additional details: When will the two people be available? Why didn’t you get in to see the two prospects? Why

didn’t the two qualify for what you were offering? Why weren’t the two interested? Why were the two leads interested?

No. 5: Analyze the information. From the information gathered in the previous steps, you will start to recognize patterns and areas of the sales process that need work. For example, are you making your cold calls at the right time of day? Are you effectively handling the gatekeeper? Are you calling a qualified list? Are you building sufficient interest? What are you doing right on the leads you do get?

What about your presentations or sales calls? What happened on each call? Did you close the sale? Did you lose the sale because the person got cold feet or didn’t qualify for financing? Did you get an objection you couldn’t overcome?

What does that information tell you? Did you not build enough rapport? Enough urgency? Was the person not really an interested lead? Did you fail to qualify the prospect properly? What are you doing right and what do you need to work on?

Save these numbers in a logbook so you can come back to them later to review and look for trends. This will give you some ideas as to what you need to improve to make more sales. Also, take the results to your manager and the top salespeople in

SALES

PIA.ORG 15

DIGITAL

your agency, get their feedback, and then work on your weak areas.

No. 6: Adjust the numbers if neces sary. If you find you are not reaching your sales goals, adjust your numbers accordingly. Continue to tweak the numbers until you’re where you want to be.

Finally, just make sure your sales plan includes massive call activity. Again, at the end of the day it’s all going to come down to calling on lots of the right people. Hopefully, you’re able to figure out your numbers and come up with a plan—but when it doubt, just go knock on doors and ring lots of phones.

While you can’t always control what happens on your calls, the one element you have complete control over is your activity: the number of people you call on and reach out to daily.

Chapin is a motivational sales speaker, coach, and trainer. For his free eBook: 30 Ideas to Double Sales monthly article, or to have him speak at your next event, go to www.comple teselling.com. He has over 35 years of sales experience as a No. 1 sales rep, and he is the author of the 2010 sales book of the year: (Axiom Book Awards). Reach him at johnchapin@completeselling.com.

PROFESSIONAL INSURANCE AGENTS MAGAZINE 16

Contact Calley Rupp: crupp@pia.org (800) 424‑4244, ext. 338

PIA.org Where insurance professionals go for information, education, legislation updates and products and services to help with preservation.

10‑15,000 visits each month.

Full or half sized ads available. PIA digital news

Distributed as a member-exclusive benefit.

The primary source for PIA members’ industry news. • Drive traffic to your website. Reach the insurance industry’s property/casualty segment

with PIA Northeast PRINT PIA Magazine

Distributed 11 times each year, each issue focuses on a topic specific to the insurance industry.

Single and multi state options.

10 different ad sizes available.

•

•

•

•

Advertise

•

•

•

You’l l l ike us because t here’s nobody l ike us. Workers Compensation Insurance • No volume requirements • Competitive rates • Multiple options for premium payments • Open to Shock Loss/High Mods Send in your submissions today. For more information contact a marketing rep at 844-761-8400 or email us at Sales@Omahanational.com. [ Coverage in: AZ • CA • CT • GA • IL • NE • NJ • NY • PA Smart. Different. Better. Omaha National Underwriters, LLC is an MGA licensed to do business in the state of California. License No. 078229. Coverage is provided by Preferred Professional Insurance Company and/or Palomar Specialty Insurance Company. Coverage may not be available in all states.

These are the Workers’ Comp Markets You’re Looking for! 2270-D-2022 Market Access Only With Your PIA Membership (800) 424-4244, ext. 318 | memberservices@pia.org | https://bit.ly/3Rpe5oc Provided in partnership with Agency Resources Scan to Get Started Hundreds of class codes A low-minimum premium Quick turnaround Simplified submission process Trusted carriers Competitive commissions Exclusive Features for PIA Members Painting Plumbing Restaurants Retail And, more … Auto Body Cabinet/Floor Installation Electrical Grocery/Deli/Supermarkets Landscapers Masonry Program Appetite Guide

NATIONAL SCOPE

SIAA is dedicated to the creation, growth, retention, and evolution of the local independent agency. How does that translate for SIAA’s member agencies? They…

• Have access to 5 ways to get paid

• Own their books of business • Collectively write over $11 billion in total premium • Receive insights and favorable pricing on digital tools needed to evolve • Are independent, but never alone

To learn how SIAA’s commitment to its member agencies’ success can increase your agency income and value, contact us today. info@siaa.com | siaa.com

Success Data & Information Relationships/People Digital/Technology Opportunity/Distribution Evolving

LOCAL SUPPORT

JAMES J. VENEZIA, CPCU, CCIS President, Animal Genius Sage LLC

INSURANCE

PROFESSIONAL INSURANCE AGENTS MAGAZINE 20

THE PAST, PRESENT AND FUTURE OF

PRODUCTS THE CYBER ROAD

Historically, insurance products have followed the road most traveled with a few detours. By tradition, insurance product development has been a slow methodical process. However, this changed with the introduction of cyber insurance; this insurance emerged and accelerated through the market after a bumpy start. It continues to evolve at a pace close to the discovery of vulnerabilities—at least in the context of insurance products.

PIA.ORG 21

Underwriting insurance coverage and provisioning loss control services have improved with knowledge, technology and education. Generally, the latter (loss control services) creates friction for policyholders as integration of such services remains an arm’s-length interaction, and it is often viewed with suspicion and ill will. The ill will may appear to be an unfair statement, until it is viewed from the perspective of the insured, who anticipates recommendations and premium increases, which are perceived to be costly, yet add no value to the bottom line of the organization.

Cyber InsurTechs—an insurance product model in which a company leads with proprietary technology bundled with a cyber insurance product— changed the model and perception of loss control services. This shift in perception has changed the cyber insurance distribution model as well as the expectations of insureds.

While it is hard to say whether the effectiveness of the change can be attributed to market timing, a harmonization of well-educated technologists with proprietary technology and vision, or marketing/education, it’s likely that a combination of each of these factors, in varying degrees, has played its part.

Cyber insurance became unique

From the early to mid-2000s, cyber insurance evolved slowly—as did most insurance products. From the teen-2000s forward, the product, including its underwriting process and purchasing simplicity, gained a momentum of its own due to several factors coming together to bring awareness to cyberrisks (i.e., the fear of reputational and existential loss; and realization that cyber risk financing solutions were available). While these factors drew interest from businesses and their boards of directors, insurance companies that struggled for growth and innovation, ramped up development of the cyber insurance product line and prioritized it as a revenue stream.

As the market for cyber insurance accelerated, the competing forces of building market share, and profitably underwriting accounts, collided for traditional insurers. This was partly due to an unanticipated escalation of ransomware attacks, miscalculations of attack vectors, and immature underwriting standards in terms of requirements for cyber security protections and employee education.

It is interesting that lessons learned about cyberrisks, over the decades, were not contemplated, or forgone, in favor of other objectives. Cyberrisks are well documented in:

• The 1989 book The Cuckoo’s Egg, by Cliff Stoff; and

• The Lazarus Heist, the theft of which happened in early February 2016. It is well documented in the BBC podcast of the same name.

It appears that these lessons were far removed from the trainings of insurance professionals and the insurance underwriting community. Except for certain niches, generally, underwriting is not filled with technical specialists in specific disciplines, such as cybersecurity or software engineering. This is changing, at least with respect to cyber insurance where industry education continues to gain traction in an attempt at keep pace with threat actors.

The collision of market share and profitability was a hard impact for many insurance companies that originally anticipated loss scenarios that would track

in the manner of the 2013 Target data breach, during which personal data exfiltration—and not ransomware—would lead to cyber insurance losses. This miscalculation became especially costly as many insureds, small businesses, and large businesses, were unprepared to protect themselves against such attacks.

This lack of preparedness was financially compounded for insurers that were not underwriting to a comprehensive baseline of cyber security hygiene. In addition, the insurance marketing and sales community did not fully understand cyberrisks, which likely led to a high percentage of adverse selection; with higher-risk insureds purchasing cyber insurance coverage while moderate- to lowerrisk insureds sat on the purchasing sideline. Ultimately, the sidelines emptied onto the field as ransomware made every organization a likely target as social engineering causes every employee to be part of the attack surface.

This awakening to ransomware risk occurred while underwriting was still a relatively simple, frictionless process. Coverage grants and policy language was generous, and (of course) premiums were attractive to buyers.

As insurance companies learned hard lessons about cyberrisk, the technologist entrepreneurs were considering a model in which insurance solves the cyber risk conundrum and creates a more effective and efficient partnership between parties. This group of thought leaders recognized

Education opportunity

Create cyber education initiatives in support of stronger public education about electronic device perils and best practices.

PROFESSIONAL INSURANCE AGENTS MAGAZINE 22

a disconnect between loss control, partnership, and insurance coverage, and capitalized on an opportunity for a synergistic model.

Early on, the offerings of the cyber InsurTechs appeared suspect to many insurance professionals who relied on a traditional insurance model to underwrite, loss control and issue insurance products. A portion of the insurance community questioned the wisdom of offering protective technology services in conjunction with an insurance policy. In addition, several InsurTechs used multiple insurers to address a policyholder’s insurance needs. Important questions were raised by some insurance agents and brokers, which included the following:

• Could this create a conflict of interest if a technology platform failure led to a lag in loss control and a subsequent claim event?

• What about the quota share insurance arrangements—which were uncommon for many traditional admitted insurance lines (those lines primarily sold by the insurance agent and brokerage community)—was this the right way to structure coverage for the long run?

• Would the claims handling services be satisfactory? Early rumors caused many to envision a lone individual taking the initial call and fumbling to toggle it to a disbursed team of cyber claim professionals.

It is safe to say that these concerns quickly subsided as cyber InsurTechs proved their value to the insurance and business communities. These products became favored as a formidable partnership, which addressed a potentially grave uncertainty; this was especially true for small- and middle-market businesses. The type

of partnership created by the cyber InsurTech model was lacking in the traditional insurance product model where portals could not match actionable information inclusive of cyber security expertise that was a phone call away. The model quickly became and continues to evolve as an attractive alternative to traditional insurance.

The new age of insurance

Let us consider the growth of the cyber InsurTech model as part of the new age of insurance, in which the insurance model continues a trend toward integrating technology advances and advantages into a traditionally human-led relationship; from underwriting and claim handling, to risk scoring/benchmarking, preemptive loss/threat intelligence, and parametric claim triggers. The table below provides a sequence of events in the development of cyber InsurTechs and a sense of the evolving cyber insurance environment.

How we got to today

As the cyber insurance market continues to evolve, an important consideration for insurance professionals having the cyber insurance conversation is framing the unique aspects of, not only, different cyber insurance policies, but also unique cyber insurance underwriting, product delivery, services, and product life-cycle models. One way to think about the conversation is as follows.

Traditional insurance company perception: To understand the success of the cyber InsurTech model it is helpful to look at the traditional insurance model and insureds’ perceptions.

Traditional business insurance tends to be viewed as something you buy and set aside for that moment you hope never comes—a claim that ultimately tests your expectations of the policy. Unfortunately, cyber insurance products offered by the traditional insurance community quickly fell into this category. Typically, the model leaves risk management to the insured, the brokerage team and (maybe) an outside consulting group. Portals for information are a nice touch, although most go unexplored and unused.

In this model, a cyberpolicy is accepted or declined based upon an application, without a meeting with the insured or collaborative conversation about cyberhygiene and actions that might allow for re-underwriting the coverage. This model tends to shut the door on often loyal clients who feel abandoned in the face of significant risks.

Alternately, traditional cyber insurance may have some potential advantages.

• Historically, traditional insurers have written most cyber insurance exposures, this includes providing (real, not silent) coverage on a variety

PIA.ORG 23

ONGOING INNOVATION Evolution of attacks from hacking and data breach to social engineering and ransomware attacks Relatively long cyber insurance applications Short form applications Increasing covered losses/ declining loss ratios Market disruption and orphaned insureds Emergence of privacy and network security insurance products Development of first-party coverage lines Ongoing products enhances Relaxation of underwriting standards Market acceptance and growth Pricing models focused on growing market share Emergence and growth of InsurTechs underwriting and selling cyberinsurance InsurTechs evolve and grow Traditional insurers adjust strategies and including coverage

of policy forms, including property insurance via electronic vandalism endorsements and specific cyber insurance endorsements; directors & officers insurance specific to fiduciary duties and governance; crime insurance specific to employee dishonesty and insider cyberthreats, as well as social engineering.

• Traditional insurers have handled claims within the structural coverage areas addressed by cyber insurance, including regulatory claims and government actions on directors & officers insurance; property and business interruption claims; kidnap and extortion claims; personal injury and media liability claims; and crime claims, including employee dishonesty; as well as weather-related claims that require significant and coordinated claim handling across a large geographic area.

The above experience gives the traditional insurance platform a good deal of direct and indirect intelligence and skill as it relates to cyberrisk and related claim handling, for some insureds this is a critical value.

Cyber InsurTechs

To differentiate between the initial construction of the cyber InsurTech model and the evolution of the model, cyber InsurTechs will be described as versions, specifically, version 1.0 and 2.0, followed by a look at further evolution (version 3.0).

Cyber InsurTech version 1.0: Version 1.0 created an insurance model of collaborative partnership. From a technical perspective, the partnership allows an insured to manage cyberrisk and events from a loss identification, loss control and loss indemnification perspective aided by technology along with supportive cyber security technicians.

Early on, the model lacked some of the best-in-class insurance coverage language provided by the traditional insurance companies. This is an important consideration as the coverage tiers and limits are not indicative of coverage quality and depth. More recently, InsurTechs have improved their policy forms, and in many cases matched the quality of the traditional insurance company coverage language.

The model combines proprietary technology platforms, designed for underwriting and quoting, as well as policy issuance and real-time risk management services from identification through remediation. Frequently, insureds

Supply-chain risks

Unidentified cyber supply-chain risk will lead to potential bottlenecks for businesses. This is a particular concern for small- and middlemarket businesses that do not have the resources to audit vendors and enforce cyber insurance coverage requirements. These organizations will benefit from InsurTech innovations that offer attack-surface scans and robust supply-chain underwriting tools that include the ability to identify concerns specific to technology and nontechnology vendors, subcontractors and consultants. Facilitating this type of risk management will generate conversations and could help reduce cyber contingent/dependent business income risk and supply-chain interruptions.

receive targeted alert messages with information related to necessary corrective actions.

A unique aspect of the underwriting process is the willingness to create a real-time underwriting and prebinding partnership with an insured, offering personal loss control meetings and collaboration to address potential cyber risk concerns. This model differs from most traditional insurance experiences in which the underwriting door is shut, and the insured is left to address complicated cyber risk exposures independently.

Pre-binding meetings are handled in way to give the impression of a helping hand, as opposed to the arm’s-length relationship that has characterized the traditional insurance model of pure applicationbased cyber underwriting.

The proactive relationship building leads to strength of partnership and willing collaboration, which may be the most significant difference between the cyber InsurTech model and traditional insurance model.

Brokers who have participated in real-time underwriting and prebinding meetings come to appreciate the partnership aspects of the interaction. This refreshing experience may be the key defining attribute of the cyber InsurTech model.

Partnership aside, it is difficult to judge whether the proprietary technology of the cyber InsurTech model provides an advantage to insureds in terms of claim avoidance. However, loss data provided from at least one cyber InsurTech indicates that the loss experience has been favorable relative to the traditional insurance company model; it is important to note several factors may account for this and more time is necessary for a complete assessment.

PROFESSIONAL INSURANCE AGENTS MAGAZINE 24

While strong collaboration is a clear advantage of this model, it may be constrained by the lack of internal data and breadth of claim-handling experience brought by the traditional insurance company’s cyber insurance delivery method.

Another point of interest is the fact that a couple of InsurTechs use multiple insurance companies on a quota-share basis to provide coverage. It has been expressed that this is a hedge against aggregation risk, although there may be other reasons, including a lack of individual insurer confidence in the model or in supporting the model.

The cyber InsurTech model has pushed the envelope on commercial insurance innovation and relationship building. Version 1.0 has set a standard that agents and brokers need to understand and include in a cyber insurance marketing strategy.

Cyber InsurTech version 2.0: While maintaining the characteristics of the previous version, this one adds another element to the model, proprietary end-point software designed to mitigate losses by reducing the insured’s attack surface, limiting cyber event damages, and providing resiliency in the face of a loss through immutable back-ups.

When this model was introduced, it changed the cyber insurance paradigm. Now cyber security protection is no longer a limiting factor in attaining cyber insurance (at least to the extent an industry is within the underwriting appetite of the cyber InsurTech 2.0), as the cyber security protections are part of the cyber insurance offering.

This model allows an insured to hand off cybersecurity concerns to the InsurTech partner, attaining

Awareness initiatives

Cyber threat intelligence and awareness initiatives can be incorporated into other community alert systems to better inform the public about emerging risk and real-time vulnerabilities.

a relatively respectable level of cyber protections along with a quality cyber insurance policy.

While this model has clear advantages to organizations with non-existent or immature cyber security frameworks, organizations with more mature cyber security frameworks and technology teams (internal or external) can be resistant to add another layer of software on their computers.

This model does require a detailed understanding of the insurance policy form. Failure to set up the proprietary end-point software on a computer will result in coverage limitations at the time of a loss.

Cyber InsurTech version 3.0: What’s next? While it is difficult to predict the future, the cyber InsurTech model is likely to unleash a wave of innovation and interest in the insurance industry. An overlooked benefit of cyber insurance and the cyber InsurTech model may be the fact that it has made insurance interesting to technologists and students of the technology arts; this alone will raise the bar in insurance innovation at a rate the industry has not seen and that some may find uncomfortable.

The future is here with additional cyber insurance products based on parametric coverage triggers as well as those covering cryptocurrency emerging and developing.

Conclusion

The future of cyber insurance will be transformative as traditional insurance companies, InsurTechs, cyber security technology providers, and governments seek more favorable protective measures to address economic and existential risks posed by cyberevents.

An insurance future with a synergistic integration of individuals who have specialized skill sets will continue to increase the momentum. These individuals who choose to showcase their talents to the insurance industry will continue to evolve the model led by unique technologies, real-time partnerships, and novel collaborations. The model will develop shared intelligence and become a leading force in cyber and economic security, as well as a key factor defining resiliency in the face of otherwise catastrophic exposures.

The components of such a model already exist, the key constraint is attracting talent and crafting a sustainable educational system to address the industry’s unique needs.

Venezia has more than 37 years of experience managing risk from start up to exit. His strength is working with visionaries in all walks of life through thoughtful, collaborative dialog to provide perspective and clarity with respect to managing existing and emerging risk. Reach him by email at venezia_jj@comcast.net. For more information, visit www.linkedin.com/in/jjvenezia/.

PIA.ORG 25

Simplicity.

Insurance is complicated enough; your technology shouldn’t be. At Applied, we’re innovating to create simple, practical solutions that help you gain a competitive advantage with simplified workflows, greater efficiencies and the online experience your customers demand.

Are complex technology and inefficient workflows slowing you down?

Let Applied help you embrace simplicity and get more done.

www.appliedsystems.com/innovationdrive

JIM SULLIVAN

Social capital

Unlock the power of relationship building

Before we go any further, I think it’s important to define social capital. It is the vast network of prospects your independent insurance agency is connected to through unique traits. These comprise your agency’s social capital inventory. Traditionally, cold calls, direct-mail advertising and other marketing tactics were used to get a potential client’s notice and help build an agency’s growth. Today, the most fruitful tactics to attract potential clients utilize human connection.

Your agency possesses a great deal of social capital, but historically much of it has gone unleveraged in the pursuit of new customers. Every member of your agency has various networks that can be expanded further through social outreach, college alumni networks, former employer networks, and even customer and former customer networks. These networks can yield new connections that can be leveraged into opportunities consistently.

In an article on social capital, McKinsey & Co., explained: Social capital is the presence of networks, relationships, shared norms, and trust among individuals, teams, and

business leaders. Social capital is no longer just nice to have. It’s becoming a core lever business leaders can use to attract, retain, and bring out the best in employees, enabling [leaders] to achieve (and even exceed) [company] performance goals.

Less than half of U.S. workers are making an effort to build their networks. Only 24% are focused on getting in touch with old contacts within their professional networks. Only 28% are focused on building new relationships.1

While concerning, this research shows a clear market opportunity. Those professional insurance agents who learn to utilize social capital as part of their growth strategy will have a clear competitive advantage over their peers. Let’s explore some strategies to engage and motivate your employees to expand their social networks to create new sales opportunities for your agency.

The creation of commonality

Some InsurTech companies specialize in social-capital sales strategies. They have created tool sets and technolo-

PIA.ORG

27

Founder and president, The Endurance Group

gies to help agents better understand and utilize their social capital. These technologies can provide a framework for mapping and cataloging the social capital of an agency. Then, it employs a similar process on the people listed on the agency’s prospect list. Using complex algorithms, it finds commonalities between agency employees and prospective clients, which can be leveraged into new customer relationships. Let’s examine how this process works.

Lead generation strategy

To utilize social capital to generate new business leads you need to analyze your agency’s social capital. You need to query all your employees about some basic information—if you don’t already know the answers. Questions that can help you get started, include the following:

• Where did your employees go to school?

• Do they volunteer with any organizations? Which ones?

• Where did your employees work previously?

• Which causes/interests do they have?

Then, you need to create a prospect profile for your agency. Ask yourself which types of clients you’d like to focus on for your new business. These types of questions can help you narrow down your profile:

• Is there a specific industry in which you’d like to establish a niche?

• Is there a specific geographical location?

• Are you looking for clients who have a specific annual revenue?

• Who are your target decision makers?

Once you know who you’d like to target with your new-business outreach, you need to determine your prospective clients’ social capital by answering the same questions you used to determine your agency’s social capital (i.e., school, volunteer organizations, pervious work history, and causes and interests).

After you’ve developed both social capital profiles, you need to compare them against each other:

• Did one of your agents attend the same alma mater as a lead?

• Did a person in your finance department work at the same prior company as a lead?

• Does an executive assistant volunteer at the same organization as a lead?

• Do your CEO and prospect share the same passion for a specific cause?

With all this information, you can leverage the connections through personalized outbound messaging, for example:

Hi PROSPECT NAME,

Hope all is well. I’m looking to do a bit of networking, and I noticed that you’re a fellow CONNECTION. I’d love to connect and learn more about you and swap stories about CONNECTION.

Thank you, EMPLOYEE NAME

While all this can be done on your own in your office—using hours of time and energy—remember there are InsurTech companies that have programs

that can automate the process and remove the grunt work of finding the right way to connect with prospective clients. This also can create a higher likelihood of opportunities going forward.

Results

When used correctly, social capital is one of the highest-achieving lead generation strategies available to independent agents today.

A Forbes article confirmed these numbers:

Dr. Willy Bolander, assistant professor of marketing at Florida State University and his colleague, Dr. Cinthia Satornino, assistant professor of marketing at Northeastern University, have found that as much as 33% of the variance in sales performance is attributed to an individual’s social capital.2

Comparatively, when insurance agents use cold-call outreach strategies, the acceptance rate is just 2%— according to our research. Business relationships are built on the foundation of social capital.

Lack of social capital in today’s world

However, despite its high success rate, this type of networking is not as common as it once was. In the McKinsey & Co., report mentioned earlier in this article, the company noted that social capital is in short supply. Since the onset of the COVID-19 pandemic, it found:

One of the largest consequences of the COVID-19 pandemic is the lack of social interaction and “networking practice” many people have had in recent years. It is well known in the professional services

PROFESSIONAL INSURANCE AGENTS MAGAZINE 28

space that to close a deal, the agency must develop trust with a prospect. And one of the most effective and efficient ways to develop trust is through a common connection. Unfortunately, many people today are not putting in the work to develop those connections.

The future

Insurance agents must not be afraid to adopt networking through social capital as a sales technique. Bestcase scenario, they will close a deal quickly because they bonded with a prospect who has a shared connection. Worst-case scenario, they will meet a prospect who is not interested in the services they are providing right now, but he or she may be interested in the future.

Agency leaders must tout the power of social capital to their teams and encourage them to get back out there and network.

Sullivan is the founder and president of The Endurance Group, a company that specializes in social capital sales strategies. It’s technology, Commonality, provides a framework for mapping and cataloging the social capital of an insurance agency.

1 McKinsey & Co., August, 2022 (mck.co/3yVT9z2)

2 Forbes, 2014 (bit.ly/3CRaWbO)

May the holiday season end the year on a cheerful note and make way for a fresh and bright New Year.

Happy Holidays from everyone at ELANY.

Excess Line Association of New York

120 Wall Street, 24th Floor New York, NY 10005 646.292.5500 | www.elany.org

PIA.ORG 29

CP The Premins Company The Premins Company 132 32nd St., Ste. 408 | Brooklyn, NY 11232 • (718) 375-8300 (800)599-3279 • info@premins.com • www.premins.com 117742 1021 ✔ Credit cards for a flat $8.75 fee ✔ Debit cards for a flat $3.85 fee ✔ Free e-check ✔ Free check by fax ✔ Free auto bill pay ✔ Cash payments at CVS, Walmart and most 7-Eleven stores ✔ 24-hour online account access/management ✔ If you finance NYAIP apps, it’s time to go paperless with Premins Insurance Premium Financing with Unparalleled Payment Options Providing exceptional personalized service to the premium finance industry since 1965. OF INSURANCE PREMIUM FINANCING • OVER •

CURTIS M. PEARSALL, CPCU, CPIA President, Pearsall Associates Inc.

Is staff training one of your agency’s top issues?

If your answer to the question in the headline was, “no,” then it should be. Fast forward your agency five years into the future and ask yourself: How many of your current staff members will have retired? How many positions will you need to fill?

For many agencies, this is a significant number. Every day, it seems that agency owners are struggling to find tomorrow’s staff. When you find them, how will your agency train them to handle their respective responsibilities and duties? Due to the challenges of finding staff members who have the desired insurance experience, there has been a shift in the approach. Many agency owners now are focusing on hiring individuals with the proper skill set and then teaching them insurance. This may appear to be a significant undertaking, but with a solid focus on training, agents who use this approach are having tremendous success.

In addition, let’s not presume that today’s employees have received all the training they need. In some cases, the scenario of, “Here’s your desk, these are your files, any questions?” may be more of the norm than the exception. Most employees would welcome the opportunity to receive additional training. Training covers a lot of areas including, but not limited to, technical knowledge, sales training, customer service, automation, and the proper use of the agency’s systems. While all these areas are important, let’s focus on technical proficiency.

Be careful what you say

Over the years, exposure analysis coupled with product knowledge has ranked No. 1 among the most common causes of errors-and-omissions claims. It is important to realize that agency staff members can be held liable for what they say and what they put in writing. Therefore, if they were to provide a client with incorrect information and the client were to suffer an uninsured loss due to this incorrect information, the agency could find itself facing an E&O situation. Factor in how many times clients ask your agency staff members questions on coverages, and this correlates to a significant issue for most agencies.

Ensuring that your sales staff members are knowledgeable on the products they are selling is important. Several years ago, a study revealed that cyber liability insurance was not being properly discussed with clients. The general feeling was that producers were not addressing cyber liability coverage because they didn’t fully understand it, and they were hesitant to bring up the issue

for fear of being asked questions they did not know how to answer.

Many agencies look to handle training by having staff members perform some training in addition to all their other responsibilities. Clearly, this has its drawbacks and often has resulted in a less-than-thorough outcome. The best approach is to have a dedicated person who owns the training process. This should result in a more comprehensive approach to staff training.

Evaluate technical knowledge

It would be worthwhile for agency owners to evaluate the technical knowledge of their sales staff. Some have done this using either a test or a mock sales presentation in which the staff members are asked coverage questions. This approach should determine where the producers need additional training. The training could then be done via several approaches:

• A classroom environment in which a specific type of coverage/ type of business is discussed and the exposures dissected. Use of an agency expert is one approach. Another option is look to carriers/wholesalers for this training.

• Your state agents’ association, such as PIA. Many have

PIA.ORG 31 E&O

education departments that hold training sessions on various topics.

[EDITOR’S NOTE: To see a full list of upcoming education classes offered by PIA Northeast, log on to www.pia.org/EDU/schedule.php.]

• Industry training organizations.

• Exposure Analysis software products available in the industry. Many agencies have found success through establishing divisions based on specific industries such as real estate, construction, nonprofit, etc. This type of structure results in a staff that’s totally knowledgeable on the issues of those industries, as well as the coverage needs of those clients.

Another approach is to focus on specific lines of business such as directors & officers, employment practices liability insurance, E&O, cyber, etc. These coverages are more complex. Often, they are on a claims-made basis which—when not handled properly—cause a fair amount of E&O claims.

Various prognosticators are stating that the need to educate clients is going to grow in importance. To ensure clients are educated properly requires staff members who are knowledgeable in the subject matter.

Bottom line, staff training could be the key to determining the future success of your agency. It also should greatly minimize the potential for your agency to face an E&O claim.

Lawyers Professional

Pearsall is president of Pearsall Associates Inc., and special consultant to the Utica National E&O Program.

Utica National Insurance Group and Utica National are trade names for Utica Mutual Insurance Company, its affiliates and subsidiaries. Home Office: New Hartford, NY 13413. This information is provided solely as an insurance risk management tool. Utica Mutual Insurance Company and the other member insurance companies of the Utica National Insurance Group (“Utica National”) are not providing legal advice, or any other professional services. Utica National shall have no liability to any person or entity with respect to any loss or damages alleged to have been caused, directly or indirectly, by the use of the information provided. You are encouraged to consult an attorney or other professional for advice on these issues. © 2022 Utica Mutual Insurance Company

PROFESSIONAL INSURANCE AGENTS MAGAZINE 32

Liability Coverage (800) 4 40-9932 www.4lawyersinsurance.com If you have law firms as clients, you know they have unique insurance requirements that can’t be covered by a standard general liability policy. We can help you help them. Parsons & Associates has programs designed to help you cover your clients’ unique insurance needs.

We’ll Navigate Your E&O Coverage You Focus on Business Get Your Quote Call (800) 424-4244, ext. 408 | Web www.pia.org Why PIA Is the Best Choice for E&O • Our professional liability and cyberliability programs are designed for your agency’s needs and risk exposures • Critical coverage options—especially important when many agents are working remotely • Top-rated, stable E&O carriers • Experience & expertise from our team PIA is here to help you navigate through uncertain times, so let’s make sure you have great errors-and-omissions coverage at a competitive price.

PIA’s curated programs for member agencies and brokerages feature carrier selection, flexible coverage, top-notch customer service, and claims assistance when you need it. Get your quote today! (800) 424-4244 | memberservices@pia.org Employee Benefits for Insurance Agencies Medical Dental/vision LTD with Reliance Standard Term life with Reliance Standard Let the PIA Members’ Choice group benefits program take care of your agency.

Have a question? Ask PIA at resourcecenter@pia.org

Credit reports, scanned documents and more

Cyber security regulation–no AMS

Q. Am I required to comply with the cyber security regulation if my agency does not have an agency management system? The policies I write for carriers are done on the internet, and all the information is uploaded to the carrier’s database. There are no Social Security numbers or driver’s license numbers stored on my computer.

A. Yes. Agents/agencies fall within the definition of “covered entity” and are required to comply with the regulation, although to a lesser extent. There is one exemption that you may qualify for. It is as follows: A covered entity that does not directly or indirectly operate, maintain, utilize or control any information systems, and that does not, and is not required to, directly or indirectly control, own, access, generate, receive or possess nonpublic information shall be exempt from the requirements of Sections 500.02, 500.03, 500.04, 500.05, 500.06, 500.07, 500.08, 500.10, 500.12, 500.14, 500.15 and 500.16 of this part.

Notice this does not exclude you from all the requirements of the regulation. You still would be required to comply with:

• Section 500.09–Risk Assessment

• Section 500.11–Third Party Service Provider Security Policy

• Section 500.13–Limitations on Data Retention

• Section 500.17–Notices to Superintendent

However, there is a new regulation proposal that PIA has commented on, so there may be changes to these rules in the future.

For more information on how to comply with the cyber security regulation, including the limited exemption, see Everything you need to know about the New York State Department of Financial Services’ cyber security requirements for financial services companies–23 NYCRR 500 in the PIA QuickSource library.—Bradford J. Lachut, Esq.

Bank must accept binder

Q. We received a request from a bank to cancel a homeowners policy. Our insured is refinancing a mortgage, and the bank states our insured must have a one-year, pre-paid policy to set up an escrow account for the new mortgage. Must we act on the bank’s instructions?

A. No. You should act only on your insured’s instructions. However, let your insured know that the bank must accept, as evidence of insurance, a binder plus a receipt showing that an annual or an installment premium has been paid.

PIA

Legislation prohibiting lenders from refusing to accept a binder at closing was passed with PIANY’s support to protect insureds against the unreasonable insurance requirements imposed by lenders. Many lenders seem unaware of its provisions, and you can help your insured by obtaining a copy of Section 6-j of the Banking Law from PIANY and providing it to bank officials. (Also, let your insureds know of any short-rate penalty they might incur by canceling the policy midterm.).

—Bradford J. Lachut, Esq.

MVRs and sponsoring company

Q. To pull a motor vehicle record for a client, I contacted LexisNexis Risk Solutions Inc. The company told me that I needed to have a “sponsoring company” before it would allow me to go forward. Can you shed some light on this?

A. LexisNexis Risk Solutions Inc.’s internal rules require an agency to

PIA.ORG 35

TECHNICAL STAFF

ASK

PIA

have a sponsoring company. The following statement is shown on the LexisNexis service application:

A minimum of one sponsor is required. You may reference up to six total sponsors to assist us with the proper setup of your account. If you have an Agency I.D. code, please enter it in the field below. If you are unsure or do not have one, please enter “None.” Click the “Add Sponsor” button if you need to enter more sponsor names. It is your responsibility to contact any and all sponsoring companies and request that they submit the appropriate authorization on your behalf. Failure to do so will delay the account setup process.

If you have questions about access to MVRs, you may call the MVR service line at (800) 456-6432.—Bradford J. Lachut, Esq.

Credit report updates

Q. An insurer uses a policyholder’s credit information in rating personal auto or homeowners insurance. In the absence of a request by the policyholder, how often must the insurer update the credit information?

A. An insurer is not required to rerun the reports on its own initiative after the policy has been issued. However, if it does, the results of that report can only be used to reduce the premium. Also, policyholders can request re-rating using current data if they have corrected information in their consumer report; or, prior to a renewal, if the insurer uses credit in determining renewal premium. With that being said, insureds may request to have their reports run as often as they like, but an insurer only has to honor that request once every 36 months.—Bradford J. Lachut, Esq.

Scanned documents

Q. Are scanned documents admissible in court?

A. New York, New Jersey, Connecticut and Vermont have adopted either the language of the Uniform Photographic Copies of Business and Public Records Act* or the Uniform Rules of Evidence Act, so long as the scanned document is done in the ordinary course of business and there is evidence that there is no way that the document can be altered, tampered with or degraded, it would be admissible as evidence. [*VT Title 12, Chapter 63, Section 1701; CT ST 52-180; N.J.S.A. 2A: 82-38; 2A: 82-40; and NY CPLR 4539(b)]. However, scanned documents are no longer admissible in court in New Hampshire, according to NH Chapter 520 (repealed 1994).

For more information, see Computer-generated records and their use in the defense of E&O claims in the PIA QuickSource library (www.pia.org). —Bradford J. Lachut, Esq.

Separation of insureds/duty to cooperate

Q. Our insured is involved in a third-party claim situation under a commercial general liability policy. The claim is based on the actions of a former employee. The adjuster can’t get in touch with this individual,

who has made it clear that he will not cooperate. Does this lack of cooperation jeopardize our client’s coverage?

A. No, it shouldn’t. Although any insured who expects the insurer to perform its obligations under the policy must cooperate with the insurer’s post-loss investigation. Nevertheless, the Separation of Insureds provision grants protection to other insureds under the policy who are not violating their duties following a loss.

The Separation of Insureds provision stipulates that each insured under the policy (whether named insured, additional insured or defined insured), will be treated as though the policy was issued to them individually. This means that if one insured is denied protection—in this situation, the employee (defined insured) for not cooperating with the insurer’s investigation—the employer (named insured) retains all rights under the policy if the employer is personally compliant with post-loss duties.

If interviewing the former employee has an impact on the question of the employer’s liability for the employee’s actions, then the burden lies with the company to obtain a statement and seek cooperation; but the employer is covered regardless of that outcome.—Dan Corbin, CPCU, CIC, LUTC

PROFESSIONAL INSURANCE AGENTS MAGAZINE 36

Retailers

Retail Group of NY, Workers’ Comp. Safety Group #544*

2021-22 40%** 2020-21 40%** 2019-20 40%*

36% average dividend since inception in 1992

Real Dividends!

$317 Million Paid

Walter A. Sierra President

W. A. Sierra Insurance Agency

5 Fairlawn Drive, Suite 302 Washingtonville, Ny 10992

Wholesalers

Wholesale Group of NY, Workers’ Comp. Safety Group #551* 2020-21 35%** 2019-20 27.5%** 2018-19 27.5%**

31% average dividend since inception in 1993

Restaurants

Restaurant Group of NY, Workers’ Comp. Safety Group #556*