Flexible schedules, not flexible rules (legally speaking) Welcome back,sort of PAGE 20 November 2022 • New Jersey IN THIS ISSUE 9 Red flags, agency agreements 27 Advice for contractor clients 31 Agency websites and E&O

CP The Premins Company The Premins Company 132 32nd St., Ste. 408 | Brooklyn, NY 11232 • (718) 375-8300 (800)599-3279 • info@premins.com • www.premins.com 117742 1021 ✔ Credit cards for a flat $8.75 fee ✔ Debit cards for a flat $3.85 fee ✔ Free e-check ✔ Free check by fax ✔ Free auto bill pay ✔ Cash payments at CVS, Walmart and most 7-Eleven stores ✔ 24-hour online account access/management ✔ If you finance NYAIP apps, it’s time to go paperless with Premins Insurance Premium Financing with Unparalleled Payment Options Providing exceptional personalized service to the premium finance industry since 1965. OF INSURANCE PREMIUM FINANCING • OVER •

out the construction booms Advice for your contractor clients

Statements of fact and opinion in PIA Magazine are the responsibility of the authors alone and do not imply an opinion on the part of the officers or the members of the Professional Insurance Agents. Participation in PIA events, activities, and/or publications is available on a nondiscriminatory basis and does not reflect PIA endorsement of the products and/or services.

President and CEO Jeff Parmenter, CPCU, ARM; Executive Director Kelly K. Norris, CAE; Communications Director Katherine Morra; Editor-In-Chief Jaye Czupryna; Advertising Sales Executive Calley Rupp; Senior Magazine Designer Sue Jacobsen; Communications Department contributors: Crystal Brinkman, Athena Cancio, David Cayole, Patricia Corlett, Darel Cramer, Anne Dolfi and Lily Scoville.

Postmaster: Send address changes to: Professional Insurance Agents Magazine, 25 Chamberlain St., Glenmont, NY 12077-0997.

“Professional Insurance Agents” (USPS 913-400) is published monthly by PIA Management Services Inc., except for a combined July/August issue. Professional Insurance Agents, 25 Chamberlain St., P.O. Box 997, Glenmont, NY 12077-0997; (518) 434-3111 or toll-free (800) 424-4244; email pia@pia. org; World Wide Web address: pia.org. Periodical postage paid at Glenmont, N.Y., and additional mailing offices.

©2022 Professional Insurance Agents. All rights reserved. No material within this publication may be reproduced—in whole or in part—without the express written consent of the publisher.

Vol. 66, No. 10 November 2022 November 2022 • New Jersey COVER STORY

DEPARTMENTS 4 In brief 9 Legal 15 Sales 31 E&O 33 Ask PIA 37 Officers and directors directory 38 Readers’ service and advertising index

COVER DESIGN David Cayole

20 Welcome back, sort of Flexible schedules, not flexible rules (legally speaking) FEATURE 27 Dragging

IN B RI EF

LEGAL ROUND-UP

Triple-I: Investors fund lawsuits without disclosing their role

An Insurance Information Institute report finds that investors with no stake in a lawsuit beyond wanting to profit from its outcome are contributing to the growth of insurer legal costs and settlement payouts.

“Third-party litigation funding has devastatingly become a multi-billion-dollar global industry, turning lawsuits into investments at the expense of societal good,” said Sean Kevelighan, CEO, Triple-I. “It is unconscionable that plaintiffs

are able to further exploit the legal system by proactively seeking unassociated third parties to finance their lawsuits.”

Triple-I’s report notes a Swiss Re analysis found more than half of the $17 billion in thirdparty litigation funding monies allocated worldwide in 2020 were spent in the United States. Hedge funds and family offices (private wealth management advisory firms) are financing lawsuits brought by either individuals or businesses and

Liability coverage in

EPLI

Do your clients understand the difference between the two liability coverages available in professional liability coverage?

They may know that liability coverage will protect them against legal defense expenses, and damages awarded to the plaintiff, but what happens if those limits are exhausted?

Make sure they know about their coverage options:

1

Defense inside the limits of liability. With this coverage, attorney’s fees, court costs, investigation and filing legal papers are deducted from the policy limit first. This will limit the overall limit of dollars available to pay for any awarded monetary damages.

2

Legal defense outside the limits. With this coverage, there are separate limits for defense expenses, and for damages.

many have profited by doing so. Millions of people are unaware of this industry: Nearly two of five (39%) Americans surveyed as part of a national poll say they’d never heard of the term “litigation funding,” according to the Insurance Research Council.

Why this is a problem:

It extends a lawsuit’s duration and increases insurer legal and settlement costs. And, thirdparty litigators take most of the settlement money. Usually leaving the claimant with less than half of the settlement.

TERMINOLOGY:

Social inflation

How insurers’ claims costs can rise above general economic inflation, and it also includes the shifts in societal preferences over who is best placed to absorb risk. It drives higher insurer claim payouts and loss ratios.

Generally, the insurance lines most affected by social inflation:

Commercial auto Product liability Professional liability Directors and officers liability

4

The public’s thoughts on litigation trends

Most Americans believe attorney advertising increases the number of liability claims and lawsuits, and more than half of Americans link these ads to higher insurance costs.

Generally, consumers expect insurers to settle auto insurance claims fairly and quickly, but about one in four (24%) say they would hire an attorney before even contacting an insurer about an auto insurance claim.

Significant generational differences exist on these topics, with younger respondents being far more likely than older respondents to favorably view attorney involvement and litigation.

Statistic:

The litigation fund industry expanded globally at a rapid rate of 16% in 2021 (Swiss Re)

Common lawsuits for agents involve:

Do …

lawsuits in your agency Best practices

Disclose any material information regarding insurance coverage that the insured requested.

Obtain all coverages requested by the insured.

Represent the nature, extent or scope of coverage being offered or sold accurately.

Be careful when you represent yourself as an expert on a specific insurance coverage. Be careful about establishing a “special duty” to your insureds.

Don’t …

Guess. If you don’t know the answer to an insured’s question, find out.

Forget to get sign-offs on any coverage an insured declines.

Assume information, ask an insured for clarification.

Forget to have your insured sign-off on any changes to an application.

Forget to document every conversation with your insured via phone, email or text

Insufficient coverage Incorrect explanation of coverage Errors in administration Overlooked risk exposures Policy changes Inadequate communication to avoid

5

The meaning of ‘everything’

Robert M. Sullivan, partner, Sullivan & Klein LLP

Whenever we take on the defense of an agency in an errors-and-omissions matter, in our initial interview with the client, we ask for everything in the agency’s files that relates to the subject matter of the lawsuit.

For the agent, often this is interpreted as what the agent can retrieve and what is believed to be necessary to estab lish the agency’s position. For defense counsel, this means a diligent search of the agency’s files to comply with the federal or state discovery rules and to determine the exis tence of evidence, which may either inculpate or excul pate the agency.

The information is everywhere

When a claim is made against the agency, the first focus of the agency’s investigation is upon the good old reliable paper or hard-copy files of the agency. Copies of binders, certificates of insurance, correspondence and proposals may be placed in a hard-copy file. Often, in the initial review of the agency’s defense, reliance is placed upon the history of the account as demonstrated by a paper file. However, often the hard-copy agency file does not contain all the documents pertinent to the account. Typically, the agency’s file server will contain informa tion in the agency management system, which may be pertinent to the claim. The task of taking inventory of the electronic data is compounded by the fact that computer files contain additional documents and data, or different versions of documents and data, may be deposited on the hard drives of the desktop computers—or laptops or smartphones—of employees who work on the file.

Copies of emails will be found in the same disparate hardware locations belonging to every author, recipient (including those who were copied and blind copied) of the email. Further compounding the task of maintaining inventory of the electronic data is the fact that electronic files—even if deleted—continue to exist on the hard drive of a computer until they are overwritten. Deleting a file simply changes the data file to a not used status, permit ting the computer to write over the deleted data. The file may be recovered after it has been deleted—if it has not been overwritten. In general, all such data, including, when relevant, data resulting from deleted files, is discov erable under discovery statutes and court rules.

What do I keep, and how do I keep it?

One of the most common problems encountered in connection with discovery proceedings in litigation is

the issue of document destruction as part of the ongoing business operations of the firm.

Although easier to store, data—like paper documents— has a shelf life as well. How and why a company main tains or destroys electronic data can avert a claim in litiga tion of improper spoliation of evidence.

In looking at the issues of electronic discovery, and in assessing sanctions for the destruction of electronic or other evidence, courts look to the existence and the compliance with document retention policies. Of impor tance as well is the suspension of document destruction protocols when a claim is asserted against an agency.

Universally, courts hold that the application of an existing document policy can lead to sanctions if that policy is not suspended when a claim is asserted.

Strategies for dealing with e-discovery

Discovery issues relating to electronic data have been, and will continue to be, the topic of numerous legal journals and court decisions. However, by applying some strate gies regarding the use and retention of information, some of the above-noted pitfalls can be avoided by the agency.

First, the agency should establish uniform protocols for the storage of electronic data. When paper files are used, specific centralized files are designated where everything is deposited, and therefore, can be readily retrieved. So too with electronic files, protocols must be established so that there are not disparate locations where data is kept, but a central repository should be employed.

Second, the agency must establish and adhere to standard protocols for destruction of electronic data. When a claim is asserted against the agency, data destruction must be suspended, and pertinent data must be identified.

Third, when changing hardware systems or software, consideration must be given to the issue of data retrieval of archived data and preservation of data, which may be transferred from the old system.

Obviously, litigation is not the primary concern when installing information systems. However, with real orga nization and planning, dealing with the contingency of litigation can be incorporated into the process of systems development so that the agency can not only run its busi ness affairs efficiently, but also can prepare and defend itself in the event of an E&O claim easily.

PROFESSIONAL INSURANCE AGENTS MAGAZINE 6 FYI

You’l l l ike us because t here’s nobody l ike us. Workers Compensation Insurance • No volume requirements • Competitive rates • Multiple options for premium payments • Open to Shock Loss/High Mods Send in your submissions today. For more information contact a marketing rep at 844-761-8400 or email us at Sales@Omahanational.com. [ Coverage in: AZ • CA • CT • GA • IL • NE • NJ • NY • PA Smart. Different. Better. Omaha National Underwriters, LLC is an MGA licensed to do business in the state of California. License No. 078229. Coverage is provided by Preferred Professional Insurance Company and/or Palomar Specialty Insurance Company. Coverage may not be available in all states.

WE PICTURE THE WORST FOR YOU. WHOLESALE BROKERAGE | BINDING AUTHORITY | EXCLUSIVE PROGRAMS JencapGroup.com

Be alert: Red flags in agency agreements

“What’s Actually in Your Agency Agreement!” (trademark pending). As your host, I will guide you through some of the most problematic or inter esting—at least to me—clauses that have popped up in agency agreements in recent years.

Before getting into actual contract provisions, let’s talk a little about types of contracts. Just like Star Wars movies, not all contracts are equal. Some are good—the Empire Strikes Back of contracts. And some are not—the Clone Wars of contracts. Some contracts are with insurance carriers, others are with wholesalers or vendors. Be aware of whom you are contracting with as that often

LEGAL

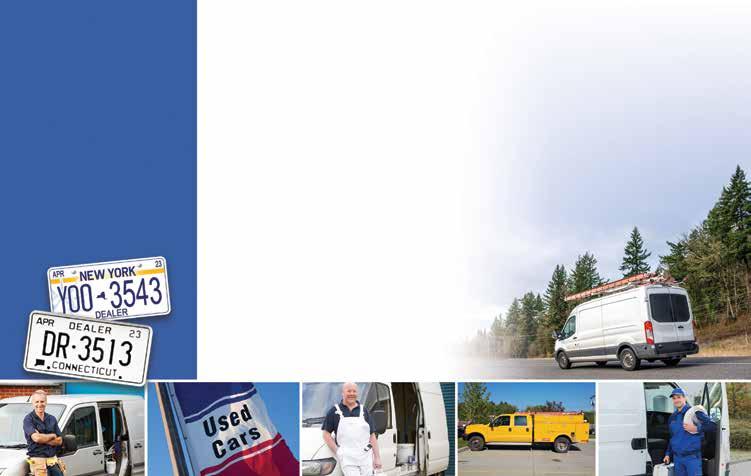

PIA.ORG 9 Steer Your Contractor and Used Car Dealer Risks to the Pros Turn to the folks that understand your clients’ businesses,

rated commercial auto and garage

resources and support you

Business Auto Liability and Physical Damage

Contractors –

Roofing, Janitorial Services and more Garage Liability — Used Car Dealers • Dealer and Transporter Plates Writing in NY, NJ, PA, & CT* • Convenient Online Quoting • 24/7/365 Claims Reporting • Flexible Payment Options Contact us today: 516-431-4441 x3507 producer@lancerinsurance.com www.lancerinsurance.com * Please contact us for a list of available products and coverages by state

deliver A- (Excellent)

liability coverages, and provide the

need to achieve profitable growth.

•

Commercial Building, Electrical, HVAC, Painting, Plumbing,

BRADFORD J. LACHUT, ESQ. Director of government & industry affairs, PIA Northeast

your

if you enjoy reading

Raise

hand

contracts. Why am I getting the sense that I am the only one with his hand up? OK, I get it. Contracts are boring. They are long and filled with terms that barely resemble English. While I can’t get you out of reading the terms of service on your new credit card, I can help you out with some other contracts: agency agree ments to be precise. That’s right! It’s time for the next installment of the wildly popular1 series:

will give you a clue as to what you can expect in the agency agreements. Carrier contracts—especially those with national carriers—often contain extensive cyber security provisions, as well as detailed clauses related to termination and indemnification. Agreements with wholesalers or vendors often will contain quirky provisions related to policy cancellations and ownership of expirations. Of course, all contracts are different, so what are some of the provisions you should be on the lookout for?

Cybersecurity

Cybersecurity was featured in the last “red flags” article (see the article Now is the winter of our discontent …, which can be found on PIA Northeast News

& Media , blog.pia.org) due to an increase in the number of agency agreements that were requiring agen cies to adopt certain cyber security protections as part of the agreement. This is closely related to an increase in state’s passing insurance-specific cyber security laws or regulations. Since that time, there has been a new development in agency agree ments related to cybersecurity. This one does not involve an agency’s cyber security practices. Instead, it addresses cyberinsurance. Many agreements now are requiring agen cies to purchase certain levels of cyberinsurance, like how agencies are required to buy certain levels of errors-and-omissions coverage.

In fact, the cyber insurance require ment often is contained in the same section at the E&O requirement and often requires the same limits— usually between $1 and $1.5 million.

If you need to purchase cyber liability insurance for your agency, PIA Northeast offers a product that can help you. For more information, log on to pia.org/quote/cyber.php. While we are talking about E&O, a new trend with E&O requirements is clauses that go beyond merely requiring an agency to procure certain coverage amounts. Often, agency agreements will contain requirements that agencies not only purchase E&O coverage in certain amounts, but they will provide the carrier or wholesaler with informa tion related to the E&O policy, including the carrier it is written with, its location, the policy number and expiration date.

Cancellation

Recently, I have seen cancellation clauses popping up in agency agree ments. These clauses do not address the cancellation of the agency agree-

PROFESSIONAL INSURANCE AGENTS MAGAZINE 10

Please refer to actual policy for details. Policies are underwritten by Great American Insurance Company, Great American Insurance Company of New York, Great American Alliance Insurance Company, and Great American Assurance Company, authorized insurers in 50 states and the DC. Products not available in all states. © 2022 Great American Insurance Company, 301 E. Fourth St., Cincinnati, OH 45202 5633-AGB (11/22) Bow, NH 877.552.2467 aimscentral.co m TM FROM THE FARM AND RANCH PROFESSIONALS AT READY TO “FALL” IN LOVE WITH FARM AND RANCH COVERAGE?

ment. Instead, they deal with the procedure for the carrier or wholesaler to cancel an insurance policy between an insured and the carrier/ wholesaler.

The language of these clauses is pretty consistent. Usually, it will state that a policy cannot be returned on a flat cancellation unless done so prior to the inception date of the policy in question. These clauses are a little perplexing as they seem to be unen forceable contract provisions. Contractual provisions cannot be enforced against someone who is not a party to the contract. And, the insured is not a party to the agency agreement. As such, these cancella tion provisions would not automati cally apply to the insurance policy of a client. A similar provision would have to appear in the insurance policy for this to apply to the insured. In those cases, the carrier or wholesaler would have to spell out the cancella tion policy more clearly—including minimum earned premium.

Limitations on placing business

Producers should be on the lookout for any clause in the agency agree ment that limits their ability to place clients with carriers other than the one with which the agency has the specific agreement.

A clause that had made its way into some big carrier agency agree ments is one that severely restricts an agency’s ability to place insurance business with a carrier outside of the one noted in the agency agreement. Under these clauses, agencies are given authority to sell, solicit, and service business for a carrier. However, the agencies are limited from placing business outside of the carrier and its affiliates.

These clauses require agencies to place all business with the carrier. Only busi ness that is not acceptable to the carrier—and that is not eligible for placement through its affiliates—may be placed with an outside the carrier. Often, agency staff members are required to demonstrate that they tried to place a risk with the carrier before they can place the risk elsewhere.

Choice of law

Choice-of-law clauses in agency agreements are not new. However, they are almost always buried at the end of an agreement, and therefore, are easy to miss.

What is a choice-of-law clause? I’m glad you asked. Choice-of-law clauses— sometime referred to a governing-law clauses—impact agency agreements in two main ways. First and foremost, they identify which state’s laws will apply to the contract in question. This is significant as often the state law that governs the contract is not the same state law that governs the agency. Usually, it is the state in which the carrier or wholesaler is located. In the event of a dispute, the state listed in the agreement—and not the agency’s home state— will be outlining the rules to follow.

The other part of these clauses is a requirement that—in the event of a dispute—not only will the state’s law identified in the contract dictate the rules by which a decision will be determined, but that any court action will be brought in the state identified in the contract.

In a practical sense, this means that agencies located in the Northeast could have their agency agreement dictated by the state law of Nebraska or Idaho. Further, in the event of a dispute, the agency would need to retain counsel familiar with Nebraska or Idaho state law, not to mention travel to that state to appear in court.

Don’t panic, PIA can help

That wasn’t so bad was it? Hopefully, this article gave you a small sampling of what to lookout for in your agency agreements. Of course, I realize this article does not do anything to make contracts easier to read or make those legal words any more legible.

Fortunately, PIA is here for you. If you are a member, PIA Northeast’s team of attorneys is on stand-by to review your agency agreements, so you don’t have to do it yourself.

Lachut is PIA Northeast’s director of government & industry affairs.

1 Nope.

PIA.ORG 11

Get Your Quote Call (800) 424-4244, ext. 408 | Web www.pia.org Why PIA Is the Best Choice for E&O • Our professional liability and cyberliability programs are designed for your agency’s needs and risk exposures • Critical coverage options—especially important when many agents are working remotely • Top-rated, stable E&O carriers • Experience & expertise from our team We’ll Navigate Your E&O Coverage You Focus on Business PIA is here to help you navigate through uncertain times, so let’s make sure you have great errors-and-omissions coverage at a competitive price.

(PIA)

Since its founding in 1991, Brooks Insurance Agency has successfully serviced the standard markets and brokered distressed and complex lines of business. We are here to help agents find the coverage their clients need.

We represent 80+ quality carriers, including several new and exciting markets, across the country. Plus, a broad array of products and services in admitted and non-admitted markets.

MARKET STRENGTHS AND EXPERTISE

• Broad market reach

• High-touch broker specialists

• Easy, online quoting process

• Collective approach to complex insurance needs

BROOKS IS HERE FOR YOU.

How can we help you? Call us at 732.972.0600 or email us at info@brooks-ins.com

Brooks Insurance Agency | A Venbrook Company • 70 Bridge Plaza Drive, Manalapan, NJ 07726 • 732.972.0600 • www.brooks-ins.com Brooks Group Insurance Agency, LLC | NJ License 1575143

© 2022 Brooks Insurance Agency, LLC is a wholly-owned subsidiary of Venbrook Group, LLC. All Rights Reserved.

Brooks is proud to support Professional Insurance Agents

What is ANE’s Greatest Resource? Our Members! Gain intellectual capital from the highest caliber agents Increase your agency’s contingent and incentive revenue Simple contract model and minimal membership fees Business resources are hand-selected by our members Outperforming the industry Find Out What the ANE Advantage is Today 800.700.9643 information@ane-agents.com www.ane-agents.com

JOHN CHAPIN President, Complete Selling

Five reasons why your sales numbers aren’t good

I belong to a workout group called Battle Ready. Basically, it’s everything you want to know about working out, weight management, etc. We have a couple of group calls every week, and a recent one: “Why Your Results Suck,” tied nicely into sales.

The first five reasons for bad results in workouts, weight goals, and overall health, were also the same reasons that most sales results are bad.

No. 1: A lack activity. I’ve said it many times, the No. 1 reason salespeople fail is that they don’t make enough calls, to talk to enough people, to get enough qualified leads, to make enough sales. You must know your annual, monthly, and weekly goals along with the daily activity that it takes to reach those goals. Then, you must get that daily activity done, no matter what.

To hit your goals, you need to know how many calls, follow-up calls, emails, etc., you need to make/send each day. Know those numbers and follow the Rule of More—which means you make more calls than you need to hit your goals. The bottom line is: You must perform the necessary amount of the right activities during the day to hit your sales goals.

No. 2: A lack of accountability. There are three levels of accountability: self, manager and others. Others include friends, family members, coaches, and anyone else who can hold you accountable.

You must be able to hold yourself accountable. You are the only person who’s with you 24/7. You know whether you’re cutting corners or not getting the work done. The most successful salespeople can push themselves harder than anyone else. That said, you also need people besides you who can give you the unvarnished truth, who can objectively see things that you can’t see, and who know more than you in one or more areas so they can guide, educate, and help you. The bottom line: You and others need to hold you accountable to getting the work done.

No. 3: Distractions. Distractions can run the gambit including social media, television, calls from friends during work hours, computer games, even chasing a fly around the office for 10 minutes. Distractions are anything that pull you away from doing your most important sales activities. Make a list of the things that distract you during the day and set rules around them. It’s fine to take occasional breaks and do non-work or fun things—just make sure you don’t take too many breaks and make sure that a few minutes don’t turn into an hour.

A more subtle distraction can be looking for the magic bullet, the shortcut, or the easier way, versus doing what works. An example is substituting an email for a phone call or in-person visit, especially on the initial call to a prospect. Another example is hanging out on social media all day versus picking up the phone or calling in-person. Don’t get distracted by the easier, morecomfortable way. It’s one thing to work smart, it’s another to avoid the fear and discomfort of calling people on the phone or meeting in-person. No. 4: Vices. Vices are like distrac tions, but they are habitual and more pervasive. Usually, they start out as distractions and then over time build into vices. The first time someone smokes a cigarette or drinks alcohol it’s rare that they are instantly hooked. Rather it’s after they continue to smoke or drink that they may develop a habit. These can lead to being out too late and drinking too much on a work night, or drinking too much at company or customer events or parties.

Smoking a cigarette or chewing tobacco to relax might be fine occa sionally, but over time these tend to increase in frequency and lead to dependency. Other vices such as overeating, and binge-watching TV also will negatively affect your

PIA.ORG 15

SALES

energy, health, effectiveness and even your confidence.

No. 5: Excuses. Excuses such as: “our prices are too high,” “there’s too much competition,” “my territory isn’t good,” “that won’t work here or in our industry,” are usually just that—excuses.

Whatever excuse you have, there’s someone who has had it worse and overcame it. In fact, with roughly 7.3 billion people on the planet, the odds are there are a lot of people who have had it worse than you and have overcome their obstacles. It’s simple, if you see roadblocks and excuses, those will be your reality. If you see reasons and solutions, those will be your reality.

You see what you believe, and you find what you look for. Whatever excuses you have, you want to ques tion and eliminate them. If you believe your prices are too high, there’s too much competition, or it’s a bad market, those will show up as objections and negatively impact your selling. There may be some truth to these beliefs, but you can’t let them completely derail your sales efforts. There always are pluses and minuses in every company and with every product, territory, or anything else in life. You need to be able to build on the positives and strengths, and you need to find a way to mini mize or eliminate the negatives or weaknesses.

Chapin is a motivational sales speaker, coach, and trainer. For his free eBook: 30 Ideas to Double Sales and monthly article, or to have him speak at your next event, go to www.comple teselling.com. He has over 34 years of sales experience as a No. 1 sales rep, and he is the author of the 2010 sales book of the year: Sales Encyclopedia (Axiom Book Awards). Reach him at johnchapin@completeselling.com.

PROFESSIONAL INSURANCE AGENTS MAGAZINE 16

When you give to NJPIAPAC your donation dollars go to candidates who support our industry! 116315 220 Donate today: pia.org/donateNJPAC Make Your Donation Go Further There is strength in numbers. Join the growing list of New Jersey insurance agents who support NJPIAPAC. A donation of any amount can have a substantial impact in Trenton.

Alpha Northeast can bring it back.

Partnering with us means that you can grow your business and continue doing what you do best.

And, we’re an affiliate of the nation’s second largest insurance agency network, ISU Insurance Agency Network—so you’ll get to work with some of the best regional and national carriers around.

You’ll be eligible for a 100% commission payout from noncontracted carriers and profit share from first dollar.

You’ll have access to the top national and regional carriers.

You’ll have greater opportunity to maximize the benefit of networking with other agencies—which means more underwriting clout and increased profit share.

If you choose to leave the network, you’ll face zero penalty—but we bet you’ll stay.

With Alpha Northeast, your agency will shine brighter than ever. And let’s be honest—you deserve it. www.isu-alphane.com

Has your cluster lost its luster?

When you combine forces with us:

These are the Workers’ Comp Markets You’re Looking for! 2270-D-2022 Market Access Only With Your PIA Membership (800) 424-4244, ext. 318 | memberservices@pia.org | https://bit.ly/3Rpe5oc Provided in partnership with Agency Resources Scan to Get Started Hundreds of class codes A low-minimum premium Quick turnaround Simplified submission process Trusted carriers Competitive commissions Exclusive Features for PIA Members Painting Plumbing Restaurants Retail And, more … Auto Body Cabinet/Floor Installation Electrical Grocery/Deli/Supermarkets Landscapers Masonry Program Appetite Guide

“Stone-age technology is the best.”

SAID NO AGENT EVER.

There’s a better way to quote small business online with UFG Insurance.

UFG’s new Pro-Quote online experience was built by agents for agents, getting you from zero to bind in mere minutes for most businessowners policies.

But don’t take our word for it. Experience the fast Pro-Quote platform — and its efficient, continually improving perks — for yourself.

Think UFG for your next small business need.

ufginsurance.com/online

© 2022 United Fire & Casualty Company. All rights reserved.

Simple solutions for complex times

PROFESSIONAL INSURANCE AGENTS MAGAZINE 20

BR ADFORD J. L ACHUT, ESQ. Direc tor of government & industr y af fairs, PIA Nor theast

Welcome

back,sort of

Flexible

schedules, not flexible rules (legally speaking)

ell, that was weird. The COVID-19 pandemic certainly has changed the way we work. While employees are returning to the office after two years of remote working, not everything is returning to normal. Many employers are adopting hybrid-working schedules, which allow employees to split their work schedule between the office and their home.

PIA.ORG 21

While hybrid working can be attractive to employers and employees, it also can present some challenges—especially when dealing with human resources issues. Let’s address some of the HR areas that employers need to be aware of when implementing remote/hybrid schedules in their offices.

Putting in the overtime

Hybrid working gives employees the flexibility to not only work outside of the physical office, but potentially outside of the traditional office schedule as well. Employees can now work at 10 o’clock at night just as easy as they can at 10 a.m. However, what happens when an employee works too much? I know you are thinking that is a good problem to have, but it can lead to wage-andhour violations for an employer—especially related to overtime pay.

Let’s go over the basics of overtime. Under the Fair Labor Standards Act, employers are required to pay employees overtime for all time the employer required, suffered, or permitted the employee to be worked over 40 hours in a work week.

There is a lot of nuance to the rule related to salary level and job duties that I won’t get into now because that would take an entire article in of itself and, in fact, it has (see the article The FLSA: Attack of the overtime, which can be found on PIA Northeast News & Media , blog.pia.org).

Instead, we are going to concentrate on the phrase, “required, suffered, or permitted to be worked” and how that relates to hybrid working. In the before-times (i.e., before COVID), an employer could easily track and limit an employee’s hours. Employees were in the office during the office hours and gone when the office was closed. If an employer wanted to limit an employee’s hours, the organization would just prevent employees from being on-prem ises—either by telling them not to come in or by sending them home early. With hybrid working, there is nothing to prevent an employee from working away from the office—in fact that is the whole point. The problem arises when employees work without an employer’s knowledge or permission.

A familiar comment I hear from friends and colleagues who have transitioned to a hybrid schedule, is that they often feel like they always are working because there is nothing to signal a natural beginning, middle or end of the day. This can lead to overworking. However, how do employers prevent employees from working overtime absent denying them access to connect to the office remotely?

A simple solution may be to adopt an overtime policy, and make sure all your employees know about it. The policy could be that all employees are prohibited from working overtime unless they get prior approval from a supervisor. This is a sound practice, and every employer should adopt some type of overtime policy. Unfortunately, while it is a fantastic idea, it won’t help employers. This is when the “suffered or permitted” language comes into play.

Under federal labor regulations, work not requested, but suffered or permitted is work time. It is the responsibility of the employer to exercise control over employees to ensure that work, which the employer does not wish employees to perform, is not being performed. The creation of a policy prohibiting unau thorized overtime is not enough.

Federal regulations (literally) state: “The mere promulgation of a rule against such work [overtime] is not enough. Management has the power to enforce the rule and must make every effort to do so.”1

What does this mean practically? It means that if employers really want to ensure that employees do not work overtime, they should disable their employees’ ability to work remotely.

A policy against unauthorized over time is still a good idea because— while it won’t prevent overtime—it does provide the employer with the ability to take corrective action to ensure that it does not continue to happen. Speaking of corrective action, one strategy an employer should never use when faced with unauthorized overtime is to simply not to pay the overtime. This is a terrible idea, and it is a good way to be on the receiving end of a wage-and-hour lawsuit. Even if an employee works overtime—in viola tion of company policy—he or she still must be compensated for the work he or she performed.

Discrimination is a bad idea

Just as federal law requires employers to pay overtime wages, it also protects workers from discrimina tion in the workplace. Discrimina tion or harassment based on certain protected characteristics is against the law. Characteristics such as age, race, sex, disability, and marital status are a few of those protected characteristics.

How is discrimination relevant to hybrid working? Workplace discrim ination doesn’t stop just because the workplace looks different. Discrimi nation can come in many forms.

PROFESSIONAL INSURANCE AGENTS MAGAZINE 22

Workplace sexual harassment—a form of sex discrimination—typically may be thought of as a rude or inappropriate comment spoken or overheard by a co-worker in the office. In the remote world, those kinds of comments still can be made using Zoom or Slack, or whichever communication tools you use in your agency.

In a sense, technology makes harassment easier because remotework tools offer a bubble in which co-workers can connect with each other outside of the office. This makes it possible for comments to be made privately to one individual without the risk of being seen or heard by other team members. All employers are encouraged to adopt a sexual harassment preven tion policy, which includes a way in which employees can report harass ment confidentially. This is not only encouraged, but required in Connecticut and New York state, where most employers are required to have a policy and conduct annual sexual harassment prevention training. Ideally, employees should be able to report harassment elec tronically, so that remote employees can avail themselves of the protec tion easily.

Of course, sexual harassment is not the only type of discrimination that can take place. Some discrimination can take on less obvious forms. Let’s use a hypothetical:

Castle Insurance Agency does not have a set hybrid policy, but instead goes by custom, which is to allow employees to work remotely twice a week. Employees can work a third day remotely upon request. One employee, Frank, who happens to be 60 years old, requests a third remote day and he is denied.

Meanwhile Karen, who is 30 years old, requests a third remote day and it is granted.

You see the issue, right? Frank and Karen made the same request, but they received different results. On its face, the only difference between Frank and Karen is their age. This employer is flirting with an age-discrimination lawsuit.

Employers also should be aware that many states protect employees from being discriminated against based on their martial status. That may seem like an odd thing to bring up, but marital-status discrimination is an easy trap that can snare employers. Let’s use the same example above to illustrate: Frank asks for a third remote day and he is denied. While Karen’s request is granted. This time the difference is that Frank is single and Karen is married with two kids. The employer granted Karen’s request because it knew that working from home makes things easier for Karen when picking up the kids at school.

That is very kind of the employer to make things easier for Karen, but in the process, it discriminated against Frank because he is single.

Employers also should be aware of special protections for those with disabilities and how those relate to remote work. By law, employers are required to provide reasonable accommodations to employees with disabilities, so they can perform their jobs. Allowing an employee to work remote, even permanently, could be considered a reasonable accommoda tion—depending the disability.

For employees with disabilities that impact mobility, or when special equip ment is needed to effectively operate a computer, working from home might be an ideal situation. Employers need to be aware that not only are these types of concessions required by law, but they can lead to a more productive employee.

Planning for the unexpected

Perhaps the most obvious benefit of remote working is the ability to work when the office is inaccessible. An office could be inaccessible for any number of reasons. Those of us in the Northeast know that the winter months bring the certainty of a few blizzards that could make getting to the office difficult. An illness could make the office inaccessible to a particular employee as well. As COVID-19 has taught us, sick employees should stay home and avoid coming into the office. The ability to work remotely presents the opportunity for these employees to work even when the office is inaccessible. But does an employer have to allow it? The short answer is no.

PIA.ORG 23

Employers also should be aware of special protections for those with disabilities and how those relate to remote work. By law, employers are required to provide reasonable accommodations to employees with disabilities.

Generally, it is the right of the employer to dictate where and when work is performed. The ability to work remotely is a benefit—not a right. If an employer requires an employee to be on-site—and the office is open—the employee cannot opt to work remotely without the employer’s approval.

In the case of a blizzard, this would mean an employee who is required to be in the office would have to report to the office. If the employee doesn’t do so, he or she could be charged personal time off or unpaid leave, if PTO is not available. On the flip side, if an employee is sick and he or she wishes to work remotely instead of using a sick day, the employer can require the use of a sick day.

Businesses would be wise to adopt policies for dealing with the unexpected. Create a policy for what happens in the case of a weather event or when an employee is sick. It’s important to have a policy and to follow it. Deviating from the company policy can lead to claims of discrimination like those detailed previously in this article.

What did we learn?

Toasting The Perfect Partnership For Restaurants, Bars & Taverns

It’s Time to Join EverGuard’s Trusted RBT Program

EverGuard, a long-term partner for your RBT business.

• Exceptional service is an EverGuard priority

• Uncompromised program loyalty

• Great coverages at competitive pricing with available A&B, Enhancement Endorsement & more

• No limit on alcohol sales

• Package Policy: Property, GL & Liquor Liability

• Entertainment considered

• Experienced & Professional Staff

EverGuard, is a superior Restaurant, Bar & Tavern market with 40+ years’ experience. Your RBT clients can depend upon EverGuard for their protection.

Our continued longevity offering an uninterrupted market assures you will receive the best product underwritten by an AM Best “A” rated carrier without program interruptions. EverGuard’s respected reputation in the RBT market speaks to our stability and reliability to provide industry leading response time and customer service to our partner agencies.

EverGuard Insurance Services 1900 W. Nickerson St., Seattle, WA 98119

EverGuard does not offer or solicit the program in the states of New Hampshire, Connecticut or Vermont.

Michael Maher

EverGuard

Insurance

Services

VP, Business Development Michael@everguardins.com 206.957.6576 everguardins.com

I started off this article by saying hybrid working can be beneficial to both employers and employees and spent the next 1,500 words writing about all the hidden dangers of it. This is not an attempt to scare you, rather I just want to make you aware of the pitfalls, so you can plan for them. Overtime issues, discrimina tion and dealing with the unexpected are not unique to the remote world. They have existed for as long as work has existed—now they are taking on a different form. The good news is that handling these issues often is as straight forward as adopting a policy and enforcing it uniformly. Those employers that can do this will be ahead of the game.

Lachut is PIA Northeast’s director of government & industry affairs.

1 29 Code of Federal Regulations, Section 785.13

PROFESSIONAL INSURANCE AGENTS MAGAZINE 24

In-Person or Virtual—

PIA’s CIC Seminars Give You Options

Master Innovative Strategies to Maximize Coverage and Deliver Value Collaborate with seasoned instructors and peers, in-person or online. Register today for one of PIA’s seminars, administered on behalf of The National Alliance.

November 2-3: 2022 Ruble Graduate Seminar (Hybrid)*

In-person seminar | Harrah’s Hotel & Casino in Atlantic City, N.J.

CE: N.Y.: TBA; N.J.: TBA; Conn.: TBA November 16-17:

CIC Commercial Property Seminar (Hybrid)

In-person seminar | Selective Insurance in Branchville, N.J.

CE: N.Y.: 15 BR, C3, PA, PC; N.J.: 16 GEN; Conn.: N/A

December 7-8:

2022 CIC AM: Agency Management Institute (Webinar)

CE: N.Y.: 15 BR, C1, C3, LA, LB, LSB, PA, PC Approved for the new NYS regulations for ethics and professionalism (1) and for insurance law (1); N.J.: 3 ETH, 13 GEN; Conn.: N/A

*Ruble Graduate Seminars are available as an update option for all dues-paid National Alliance designees (CICs, CRMs, CPRMs, CISRs and CSRMs). Dues-paid CISRs and CSRMs may receive up to two years’ update credit for full attendance.

Register now: scan the code www.pia.org/EDU/designations/cic

2284-D-2022

PIA’s curated programs for member agencies and brokerages feature carrier selection, flexible coverage, top-notch customer service, and claims assistance when you need it. Get your quote today! (800) 424-4244 | memberservices@pia.org Employee Benefits for Insurance Agencies Let the PIA Members’ Choice group benefits program take care of your agency. Medical Dental/vision LTD with Reliance Standard Term life with Reliance Standard

CLARE IRVINE, ESQ. Government affairs counsel, PIA Northeast

Dragging out the construction booms

Advice for your contractor clients

Building has been a big topic across the country in recent years—not just amongst those who work in construction or construction-adjacent fields. Some recent developments and trends include the following: New York City (finally) opened the Second Avenue subway, the federal government passed massive legis lation to invest in infrastructure across the country, and the NIMBY—Not In My Back Yard—movement.1

A recurring headline with many large-scale infrastructure projects is how much they cost—especially compared to other countries. For example, the Second Avenue subway line cost about $3.5 billion per mile to build, whereas similar projects in the U.S. and abroad cost about $500 million per mile.2 It cannot even be compared to the 4.3-mile extension of the Boston Green Line, which was finally put on hold in 2015 after the cost nearly tripled from its $1.12 billion estimate in 2012.3

Why so high?

Some of the costs are obvious to insurance producers and those in the broader insurance industry. Workers’

compensation, general liability, and professional liability policies for contractors involved in public or private construction projects quickly drive up the costs. These costs frequently reflect local laws—further exacerbating the costs in New York state. Union work requirements may contribute to increased costs, as does the sheer lack of experience many American states and municipalities have with large-scale projects. A city installing a light-rail line for the first time has the added costs of starting a trans port system from scratch, compared to cities that have continuously been developing their tram lines over time. Then there are the litigation costs. Americans love to file lawsuits against each other for various purposes other than employing lawyers.4 Construction projects provide many opportunities to file lawsuits against various parties for supposedly valid legal reasons. Unlike countries with administrative bodies that can evaluate projects and enforce the applicable laws, much of the enforcement for American construction regulations allows for litigation as a potential enforcement option.5 Beyond the applicable regulatory requirements, community members have loud voices when it comes to new construction and may cause

PIA.ORG

27

further delays. While parties may lose in court on the facts and laws, the delays may result in projects being put on hold due to the delays and related costs.

Obstacles to construction

Numerous laws and regulations exist to protect existing communities from potential harms—real or imagined—caused by new construction of any size. Simple consideration of storm water run-off may require compliance with federal regulations to ensure no harm to the local water. Larger-scale projects bring additional concerns, including wetlands, landfills, air quality, hazardous waste, and spill reporting. Once those in charge of the development take into consideration the impact the project will have on endangered species and possible green-building requirements, the simple planning to comply with federal regulations may take about as long as the construction of actual building.6

Federal projects have even more requirements under the National Environmental Policy Act and Environmental Impact Study requirements. Since its passage in 1970, the NEPA reports have grown into 600-page documents (plus appendices) that take an average of four-and-a-half years to complete.7 The thoroughness of these documents is necessary to attempt to minimize litiga tion. While these reports may be required by federal law, the actual enforce ment of the NEPA is through private-citizen lawsuits,8 which can quickly delay and derail a federal project simply by running down the clock.

Yes, no, maybe IMBY

An increasing number of states have begun taking serious action to address problems related to affordable housing by passing laws requiring more multi family housing—including affordable housing units, built in specific regions of the state. Many of the areas being targeted have long been zoned for singlefamily homes, with local residents who oppose such projects becoming known for their stance as “Not In May Backyard.” Even those who may support increased rental units in the region still may oppose construction in their own town or community.

The scale of multifamily housing projects creates several opportunities for protests. Residents of at least one town in Connecticut raised thousands of dollars for a legal fund to oppose the construction of multifamily housing in their predominantly single-family housing town.9 Economist William Fischel refers to it as the “homevoter theory” intended to preserve the value of a home.10

People buy houses in part because of the value added by the neighborhood and go to great lengths to prevent change that may negatively impact it—from fewer trees to increased traffic to the local schools. Whether filing lawsuits against the projects or causing delays on a local level, NIMBY residents can draw out the approval process for a building project and cause further delays.

Beware of bids

Despite the high costs of construction in the United States, the primary factor in the evaluation of bids submitted by contractors is the lowest price technically acceptable. The theory is fairly straightforward; the government awards the contract to the party that submits the lowest bid while being technically capable

of performing the job. The Depart ment of Defense has explained that the lowest-price-technically-accept able method of evaluation allows for a more streamlined approach with little subjective analysis required in the process of awarding a potentially lucrative contract.11

There are many obvious shortfalls to such a system. Based on the high costs of construction and govern ment projects, it does not always result in the intended savings for state, federal, or even local govern ments. Costs may change after a bid process, putting pressure on the contractors that could result in their inability to complete a project. Such considerations carry into the insur ance industry when contractors try to cut costs by reevaluating their insurance expenses.

Many professional insurance agents face pressure from clients who seek certificates of insurance that meet the contractual requirements, but do not reflect the policy terms. It’s critical that agents only complete certificates of insurance that fully reflect the policy of insurance, no matter what the client requests.

Intentionally inaccurate and forged certificates violate state laws and may result in criminal penalties, not just a revoked insurance license. No matter what pressure contractors or subcontractors find themselves in, agents play a critical role in ensuring any certificate of insurance accu rately reflects the policy as written, and in emphasizing the need to maintain the policy after the certifi cates have been submitted.

Insuring it all

Many of these issues would not directly involve a contractor, but may quickly complicate their plans, which carries into complications

PROFESSIONAL INSURANCE AGENTS MAGAZINE 28

with their insurance. What is impor tant to keep in mind is that every construction project is different and there are limitless reasons that could cause delays.

Contractors may not have any role in lawsuits or other regulatory issues to get a project approved, but they may be impacted by the subsequent delays. Knowing the builders risk policies and available endorsements can add value to the policies provided to contractors aiming to get involved with construction of any size.

With states flush with money to spend on infrastructure, it’s impor tant to keep the potential risks and exposures related to such projects in mind when reviewing the policies of contractors.

Irvine is PIA Northeast’s government affairs counsel.

1 The opposition often uses YIMBY or “Yes In My Backyard.”

2 New York Times , 2017 (nyti.ms/3RK33Lq)

3 Vox, 2021 (bit.ly/3BCrOnf)

4 As a lawyer, I may appreciate this—depending on the purpose of the lawsuit.

5 Niskanen Center, 2021 (bit.ly/3eR8vxG)

6 The U.S. EPA has worked with the National Center for Manufacturing Sciences to put together a website with all the applicable regulations and laws the construc tion industry may need to comply with (www.cicacenter.org).

7 Niskanen Center, 2021 (bit.ly/3eR8vxG)

8 FEMA (bit.ly/3RVEpXQ)

9 New York Times, 2022 (nyti.ms/3df4XEY)

10 New York Times, 2022 (nyti.ms/3S1TirA)

11 Congressional Research Service, 2021 (bit.ly/3QFW2K8)

PIA.ORG 29

…

By phone

… (800) 424-4244 • pia@pia.org • pia.org

PIA serves members.

Online

Recipe For E&O Lawsuit

Welcome to cooking with PIA!

Today we are going to be preparing the prefect E&O lawsuit. Let’s take a look at the recipe:

• 1 policyholder who thinks they have coverage for a loss, when in fact they do not

• 4 cups celery, chopped

• 1 large gap in insurance coverage

• A dash of one insurance agency that did not provide notice to its client of the potential gap in coverage

When mixed together, this is the recipe for one hearty errors-andomissions lawsuit against your agency. Make sure you pay your agency’s E&O deductible!

How does all of this factor into selling your clients flood insurance?

The frequency of coastal flooding has doubled in the past 30 years and the national average precipitation is at historic highs. This creates a situation in which a person living in a 100-year floodplain is twice as likely to experience a flood loss over the course of a 30-year mortgage

than they are to experience a loss due to fire.

There are roughly 126 million households in the U.S. As of 2018, only 5,178,978 were insured by an insurance policy from the National Flood Insurance Program—a decrease from 5,700,235 policies about 10 years ago. So, there are at least 120 million households not covered by flood insurance. Many homeowners mistakenly believe that they have flood coverage under their homeowners policy. Of course, we know this is not true. So, what does it create? A gap in coverage. And, as we know from our recipe above, when there is a gap in a client’s insurance coverage, that is when an insurance producer gets sued.

Let’s change the recipe a bit:

• 1 policyholder who thinks they have coverage for said loss, when in fact they do not

• 1 insurance agency that sent notices to its clients about the importance of purchasing flood insurance

When mixed together this recipe creates a meaningful touchpoint for agents and their clients—which simultaneously helps the agent educate their clients, helps the agent sell more insurance policies, and provides protection for the agency in the event of an E&O lawsuit.

PIA can add a little flavor to the recipe

To help you educate your clients, PIA Design & Print has floodrelated materials and consumer content that you can personalize for your agency’s individual needs. Or, we can create a marketing piece that is unique to your agency. These materials can include sign-off options—should your clients decline flood insurance—which will offer your agency additional protections against an E&O claim. Additionally, we can print and mail these resources to your client list, which we will keep confidential.

PIA Design & Print offers a collaborative design experience tailored for insurance agencies. Give us a call today.

Insurance + Uninformed Client

Flood

=

(800) 424-4244 | design.print@pia.org | www.pia.org/design&print Advertisement

CURTIS M. PEARSALL, CPCU, CPIA President, Pearsall Associates Inc.

Is your agency’s website an E&O target?

When a potential errors-and-omissions matter is brewing and the plain tiff’s attorney is doing his or her due diligence to determine any potential liability, agents can be assured that their agencies’ websites will be re viewed and heavily scrutinized.

Its content has a significant possibility to be a key issue in determining the direction of E&O claims. In many actual E&O claims, the language on an agency’s website has impacted the degree of legal liability to which the agency has been held.

Often, agency owners contract with marketing firms to design their agencies’ websites. In most instances, the website is impressive and may play an impor tant role in attracting new business opportunities. So, what’s the problem? Many websites include language that sounds like promises and commitments, such as:

• “We will make sure you have the coverage you need.”

• “Our staff will analyze all of your risks.”

• “We will review your coverage periodically to ensure you have the protec tion you need.”

While these statements sound powerful and holistic, there are two basic issues with them.

Let’s take the first statement, “We will make sure you have the coverage you need.” How would your agency do this? Can your agency actually ensure that the client has the right protection at the time of a loss? Not really, since at the end of the day, isn’t it up to the client whether he or she wants to secure the suggested coverages? Your agency can only suggest coverages for the client to consider.

In addition, on your website, if you commit that you will review clients’ cover ages to ensure they have the right protection, do you have a process to do that? Is that process performed for all clients or only for certain clients based on the size of their premium? Imagine how it would look to find out that the commitments made on the website are not really being performed and are merely marketing fluff.

How many of the agency staff members even know what is written on your agency’s website? In many situations, it has been determined that the staff members had no actual knowledge and understanding of what the website was committing them to do. So, they were essentially going about their daily tasks without knowing that they were not doing what their website suggested they would. It is highly suggested that all agency staff members be required to review the website to be aware of the commitments they are expected to honor.

To impress the public with your agen cy’s expertise, words such as expert or specialist often appear. Once again, these words sound powerful, but are they the exact words that could be used by the plaintiff’s attorney to allege a “special rela tionship” between your agency and your client?

Special relationship is a common allegation in many E&O cases and—if it can be proved—there is a greater potential for a heightened standard of care, which may increase the level of legal liability for your agency.

Agency owners should review their websites at least annually to deter mine whether the agency staff members are truly doing what the websites say they are doing. This does not mean, some of the time, but rather all the time.

It is best to put yourself in the client’s position to determine whether, “the agency did what the website said it would.” But don’t stop with your website. All agency marketing material should be reviewed periodically with this same level of scrutiny.

The commitments your agency makes on your website are much more than marketing fluff. They are commitments your clients may look to hold you to in the future.

Pearsall is president of Pearsall Associates Inc., and special consultant to the Utica National E&O Program.

PIA.ORG 31 E&O

Grow your book of business— offer the protection of Hartford Flood Exclusive online access for PIA members—Personal & Commercial Flood policies • Competitive commissions for PIA members • Multi-rater quoting system • Certified & accurate flood zone determinations • Dedicated sales director assigned to your agency The program is available to PIA members and their policyholders in all 50 states, the District of Columbia and Puerto Rico, and offers special PIA member commissions starting with the first sale (no minimums to qualify). Get started—contact The Hartford today. CT/NY—Art Brickley | (860) 547-2190 | a.brickley@thehartford.com NJ—Cheryl A. Maginley | (860) 547-5007 | Cheryl.Maginley@thehartford.com VT/NH—Michele Battis | (704) 972-5918 | Michele.Battis@thehartford.com

Arson reviews, overtime exceptions and more

Dollar limitation on finder’s fee

Q. Are there any dollar limitations or restrictions as to the amount that a finder’s fee can be paid to an unlicensed individual?

A. There are no monetary limitations on paying a finder’s or referral fee to an unlicensed person.

The only restriction on the payment of a fee to an unlicensed person is that the payment may not violate the state’s anti-rebating law, and the person making the referral may not engage in any conduct that requires a producer’s license, such as discussing insurance coverages.—Helen K. Horn, CIC, CPIA, CISR

Arson investigation immunity

Q. One of our insureds is being investigated in connection with a suspected arson fire. Our office is in New York state, but the property that burned is in New Jersey. We have been asked to provide insurance information to the local law-enforcement team that is investigating the fire. Could you tell me whether we have any protection from legal action by our client if we do so?

A. New Jersey law (Article 6, Section 17:36-14, et seq.) is devoted to fire losses. An insurer or a person acting on its behalf shall not be held liable (in the absence of actual malice) for any statement made or required by the law. An insurer is required to release information to (including policy information, claims history, etc.), and cooperate with law-enforcement agencies.

New York has a similar section of law (Insurance Law Section 3432), which provides immunity with respect to information given to a law-enforcement agency in connection with a fire investigation.

It may be possible for you to arrange for the insurer to turn over the records directly. If law enforcement asks you for this information, get the request in writing.—Bradford J. Lachut, Esq.

Exemptions from DOL overtime

Q. How do I know if my employees are exempt from overtime?

A. Employees will be considered exempt from overtime under the Fair Labor Standards Act if they meet all three of the following tests:

1. The employee is paid on a salary basis not subject to reduction based on quality or quantity of work;

2. The employee’s salary must meet a minimum salary level of at least $47,476 annually;

3. The employee’s primary job duty must involve the kind of work associated with exempt executive, administrative or professional employees.

Information on the executive, administrative and professional exemptions can be found on the U.S. Department of Labor’s website at bit.ly/3wroXuu.

Note: There is an exemption for employees who are considered outside sales force, which has a different set of tests. More information on the outside-sales-force exemption can be found on the PIA Northeast website (www.pia.org) in the Ask PIA library (Ask PIA 900419).—Bradford J. Lachut, Esq.

Binding restrictions

Q. After speaking with my underwriter, I found out that the carrier is suspending my binding authority once I complete the change that I just submitted. Can it do this?

A. A carrier appoints an agent and gives him or her permission to “bind” a specific amount of insurance under the terms of the company rules and requirements.

PIA

PIA.ORG 33 ASK

PIA TECHNICAL STAFF

resourcecenter@pia.org

Have a question? Ask PIA at

Binding authority is agreed on between the company and the agent. An insur ance agent may have a variety of different binding authorities with different companies or products within the company.

When an agent submits a piece of new business or a change to a current policy, it could require additional due diligence or development on the underwrit er’s part. When this occurs, the underwriter may inform the agent that his or her authority has been suspended until the underwriter approves this risk or change.

From an errors-and-omissions standpoint, it is imperative the agent is fully aware of his or her binding authorities and when restrictions may be initi ated. This will allow the agent to inform clients properly on the status of the coverage.

Binding authorities are agreements between carriers and agents; these are not considered guidelines or something that the carrier is required to file with its state.—Bradford J. Lachut, Esq.

Tax consequences–covered theft loss

Q. What are the tax consequences of a covered theft loss?

A. People who suffer a casualty or theft loss may be able to deduct on their tax return the amount of the casualty or theft loss, reduced by any insurance recovery, salvage or other reimbursement, when they itemize tax deductions on their tax return.

For more information on how to calculate values, etc., see the IRS’s website at bit.ly/2QBQKkJ.—Bradford J. Lachut, Esq.

C.L.U.E. reports

Q. Does a company that uses the Comprehensive Loss Underwriting Exchange—a data bank maintained by LexisNexis—have to release a copy of the C.L.U.E. report to the agent of the client?

A. No. However, a client can contact LexisNexis Risk Solutions Consumer Center, PO Box 105108, Atlanta, GA 30348-5108, if the client disputes the information that the company cites in the report.

A consumer is entitled to one free C.L.U.E. report every 12 months. For more information, call (866) 897-8126 or visit the LexisNexis website at bit. ly/3PL8yb4.—Helen K. Horn, CIC, CPIA, CISR

Disclosure of customer’s records–pending lawsuit

Q. Do the Gramm-Leach-Bliley Act privacy rules that restrict the disclosure of nonpublic financial information prohibit me from sharing or disclosing a customer’s records in response to a lawsuit, regardless of whether the customer has exercised his or her opt-out rights?

A. Several court decisions have concluded that, while this specific type of inquiry was not addressed directly in the statutory language, the GLBA should not bar a proper discovery request—so long as the disclosure is made subject to an appropriate protective order. (A protective order is a process by which the court endeavors to ensure the confidentiality of material disclosed in a court proceeding.)

The opt-out provision does not apply to situations in which disclosure of the confidential information is neces sary to, “respond to judicial process or government regulatory authorities having jurisdiction over the financial institution for examination, compli ance or other purposes as authorized by law.”

Courts have concluded that the GLBA (15 USC Section 6802[e] [8]; 16 CFR 313.15) allows the use of judicial process expressly authorized by statute (i.e., a state’s civil practice rules) to permit a financial institution to disclose the customer’s nonpublic personal financial information to comply with a discovery request.—Bradford J. Lachut, Esq.

PROFESSIONAL INSURANCE AGENTS MAGAZINE 34

116990 820 Log on to pia.org/IRC/askpia. PIA’s specialists answer: 3,462 Ask PIA questions answered last year “Information, Education, Legislation! PIA—a great way to do business.” —Nicholas Fanelli, CPCU, CIC, CLU Newberry Insurance Group • Legal • Industry • Coverage • Legislative • Regulatory … and other questions fast!

Technology/automation

Features:

● Access to a featured technology consultant, including his expertise and contact information.

● Article synopses and resources, with links to in‑depth information.

● Consumer content for your website. (PIA Design & Print can personalize content for a nominal fee.)

● The latest information on the industry’s real‑time initiatives.

● Searchable database of vendors that offer technology/automation services.

resources

• Agents interview clients and prospects on site.

• Agency personnel input data directly into saved sharable forms.

• Customizes clients’ records with specific needs and helps with cross-selling.

• Offers agents errors and omissions protections as content isn’t transferred across multiple forms manually.

eForms Wizard signup or upgrade: avyst.com/partnerships/pianortheast

Log on to www.pia.org/IRC/tech

117091 920

eForms Wizard Bronze Level included

TECHNOLOGY INFO CENTRAL

NEW DESIGN WITH FULL COLOR EXPERT INFORMATION FOR INSUREDS PRINT AND EMAIL WITH CUSTOM OPTIONS CONTACT US: NEWSLETTERS@PIA.ORG 117194 1020

OFFICERS

President

Thomas Wilkens

McGowan Risk Specialists 234 Industrial Way W., Bldg. B, Ste 201 Eatontown, NJ 07724-4244 (732) 450-9730 twilkens@mcgowanrisk.com

President-elect

Connie Mahoney

Mark Anthony Associates 615 Sherwood Parkway PO Box 1068 Mountainside, NJ 07092-0068 (908) 654-9500 cmahoney@maainsurance.com

Vice President

Andrew Harris Jr., CIC, AAI

Liberty Insurance Associates Inc. 525 State Route 33 Millstone Township, NJ 08535-8103 (732) 792-7000 andrewharris@lianet.com

Vice President

Roger C. Butler, CIC Barclay Group 202 Broad St. Riverton, NJ 08077-1303 (856) 829-1594 rbutler@barclayinsurance.com

Treasurer

Beth Frederickson, CPIA Voluntary Risk Managers dba bethellenfrederickson LLC 19 Davenport Road Montville, NJ 07045-9184 (973) 652-8272 beth_frederickson@us.aflac.com

Secretary

Aaron Levine, CIC LG Insurance Agency PO Box 3202 Long Branch, NJ 07740-3202 (877) 288-7169 aaron@lginsuranceinc.com

Immediate Past President

Michael DeStasio Jr., TRIP AssuredPartners of NJ 20 Commerce Dr., Ste. 303 Cranford, NJ 07016-5868 (732) 574-8000 mike.destasio@assuredpartners.com

PIA NATIONAL DIRECTOR

Paul Monacelli, CIC, CPIA Veterans Insurance Agency Inc. 18 Knights Bridge Dr. Randolph, NJ 07869-4633 (973) 805-3555 paul@adpmanagementsvc.com

DIRECTORS

Lydia Bashwiner, Esq., CWCP, NJWCP

Otterstedt Insurance Agency Inc. 540 Sylvan Ave. Englewood Cliffs, NJ 07632-3022 (201) 227-1800 lbashwiner@otterstedt.com

Michael Beckerman, CPCU Beckerman & Company 430 Lake Ave. Colonia, NJ 07067-1131 (732) 499-9200 mbeckerman@beckermanco.com

Yossi Bolanos

Yossi United Insurance Agency LLC 1010 Clifton Ave., Ste. 208 Clifton, NJ 07013-3528 (973) 773-9200 ybolanos@yossiunitedinsurance.com

Alyssa Delaney

Agency Network Exchange LLC 3759 US Highway 1, Ste. 200 Monmouth Junction, NJ 08852-2430 (732) 960-2035 adelaney@ane-agents.com

Maria N. Escalona, CPIA Jimcor Agencies Inc. 60 Craig Road Montvale, NJ 07645-1709 (201) 573-8200 mescalona@jimcor.com

Lisa Hamm, CIC Clyde Paul Agency 803 Springfield Ave., Ste. 2 Summit, NJ 07901-5110 (201) 991-7598 lhamm@clydepaul.com

William J. McMahon III, CIC, CWCA McMahon Agency Inc. PO Box 239 Ocean City, NJ 08226-0239 (609) 399-0060 billm@mcmahonagency.com

Christopher J. Powell Hardenbergh Insurance Group 8000 Sagemore Dr., Ste. 8101 PO Box 8000 Marlton, NJ 08053-8099 (856) 890-7106 cpowell@hig.net

Dan Tague N2G Worldwide 111 Town Square Place Jersey City, NJ 07310-1755 (732) 556-7649 daniel.tague@N2G.com

Logan True, CRIS The True Agency LLC 4 Valley View Dr. Mendham, NJ 07945-3109 (908) 295-3277 logan@trueagencyllc.com

Casey Yarger, CIC, CRM Robert Petri & Daughter 258 Ryders Lane PO Box 820 Milltown, NJ 08850-0820 (732) 545-4540 cyarger@petriinsurance.com

ACTIVE PAST PRESIDENTS

Anthony F. Bavaro, CIC, CRM Liberty Insurance Assocs. Inc. 525 State Route 33 Millstone Township, NJ 08535-8103 (732) 792-7000 abavaro@lianet.com Louis Beckerman, CIC, CPCU Beckerman & Company 430 Lake Ave. Colonia, NJ 07067-1131 (732) 499-9200 lbeckerman@beckermanco.com

Bruce Blum, CPIA Blum & Walsh Group Inc. c/o TE Freuler Agency Inc. 270 Davidson Ave., Ste. 101 Somerset, NJ 08873-4158 (732) 246-1330 bblum@tefreuler.com

Rip Bush, CPIA Keer & Heyer Inc. 1001 Richmond Ave. Point Pleasant Beach, NJ 08742-3047 (732) 892-7700 rip@keerandheyer.com

Charles J. Caruso, CIC, CPIA Herbert L. Jamison & Co. LLC 20 Commerce Drive Cranford, NJ 07016-3612 (973) 669-2311 ccaruso@jamisongroup.com

Donna M. Cunningham, CPIA ADP Partners Insurance Agency Inc. 4 Sutton Place Florham Park, NJ 07932-2143 (973) 845-8700 donna@adppartnersinsurance.com

Andrew C. Harris, CIC, CPCU, ARM, CRM, AIS

Liberty Insurance Assocs. Inc. 525 State Route 33 Millstone Township, NJ 08535-8103 (732) 792-7000 aharris@lianet.com

Donald F. LaPenna Jr. AssuredPartners of NJ 20 Commerce Dr., Bsmt. 2 Cranford, NJ 07016-5868 (732) 574-8000 donald.lapenna@assuredpartners.com

John A. Latimer, Esq. Barclay Group 202 Broad St. Riverton, NJ 08077-1303 (856) 829-1594 jalatimer@barclayinsurance.com

Steven C. Radespiel Insurance Center of No. Jersey 33 Crestwood Pl. PO Box 399 Hillsdale, NJ 07642-0399 (201) 525-1100 sradespiel@icnj.com

Gary C. Rygiel, CIC, CPCU, ARM, CRM, AIS

Liberty Insurance Associates Inc. 525 State Route 33 Millstone Township, NJ 08535-8103 (732) 792-7000 grygiel@lianet.com

Keith A. Savino, CPIA Broadfield Group 68 Main St. Warwick, NY 10990-1329 (201) 512-4242 keiths@broadfieldinsurance.com

Stephen P. Tague, CPIA SFN Services Inc.

T/A American Insurance Services Agency 22 Robert St. Rockaway, NJ 07866-2725 (973) 479-9493 bairdkiltsteve@optonline.net William R. Vowteras Fraser Brothers Group LLC 811 Amboy Ave. PO Box 2128 Edison, NJ 08818-2128 (732) 738-7400 bill@fraserbrothers.com

PIA.ORG 37

DIRECTORY PIANJ 2022-2023

Board of Directors

PROFESSIONAL INSURANCE AGENTS MAGAZINE 38 DIRECTORY Readers’ service and advertising index Name Agency Address City/town State ZIP Phone Check advertisers of interest, complete form and mail to: PIANJ • 25 Chamberlain St. P.O. Box 997 • Glenmont, NY 12077-0997. Or, fax (888) 225-6935.

14 Agency Network Exchange

10 Agricultural Insurance Management Services

17 Alpha Northeast

BC Applied Underwriters

39 Berkshire Hathaway/Guard Insurance Companies

13 Brooks Insurance Agency

24 Everguard

25 PIA Education

26 PIA Members’ Choice Options

29 PIA Member Services

36 PIA Newsletters

18 PIA NumberONE Comp Program

35 PIA Tech Info Central

2 The Premins Company

19 United Fire Group Insurance

32 The Hartford

9 Lancer Insurance

8 JENCAP

16 NJPIAPAC

7 Omaha National

38 PIA ASAP

34 PIA Ask PIA

30 PIA Design & Print

12 PIA E&O Insurance To access, visit “Tools and Resources” at pia.org Hiring made easy Let PIA help with your staffing needs! We’ve created the Agency Staffing Assistance Program—an online member service that helps you find and keep good employees. 116225 919

We distinguish our Workers’ Compensation coverage by providing value-added services before, during, and after a claim.

Upfront loss control measures

Responsive claims handling Facilitation of quality medical care (when an accident does occur) We’ve been successfully protecting our policyholders and their employees since 1983. Browse all of our products at www.guard.com.

AmGUARD • EastGUARD • NorGUARD • WestGUARD

Our Workers’ Compensation policy is available nationwide except in monopolistic states: ND, OH, WA, and WY.

APPLY TO BE AN AGENT: WWW.GUARD.COM/APPLY/

Workers’ Compensation