10 minute read

Legal

Insuring Hogwarts: A guide for Muggle schools

A recurring theme throughout the seven Harry Potter books and eight movies is that Hogwarts, the school for young wizards in the United Kingdom, is a very dangerous place. From the straightforward dangers that come with potions and Quidditch to the more frightening risks of Dementors, the entire Triwizard Tournament, and the ongoing threat of He-Who-Must-Not-Be-Named—Hogwarts poses a surprisingly high level of danger for 11- to 18-year-old students. Even student punishments have an element of danger, including a trip to the Forbidden Forest to investigate the crime of killing unicorns.

So, how would you insure a school with such a range of risks? While the likelihood of actual Dementors trying to take a student’s soul should not be high on the list of risks facing American students, many similar dangers do create risks and potential exposures for school districts across the country. Rather than talk about real schools, let’s use Hogwarts to examine certain considerations for insuring American schools from student injuries, angry parents, and outside risks.

Alleged discrimination

For Harry and the readers, the Sorting Hat has a starring role in the

LEGAL

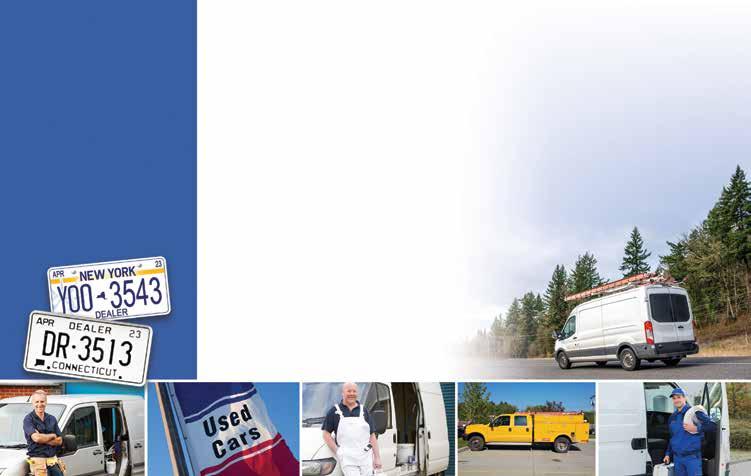

Steer Your Contractor and Used Car Dealer Risks to the Pros

Turn to the folks that understand your clients’ businesses, deliver A- (Excellent) rated commercial auto and garage liability coverages, and provide the resources and support you need to achieve profitable growth. Business Auto Liability and Physical Damage • Contractors – Commercial Building, Electrical, HVAC, Painting, Plumbing,

Roofing, Janitorial Services and more Garage Liability — Used Car Dealers • Dealer and Transporter Plates Writing in NY, NJ, PA, & CT* • Convenient Online Quoting • 24/7/365 Claims Reporting • Flexible Payment Options Contact us today: 516-431-4441 x3507

producer@lancerinsurance.com www.lancerinsurance.com

* Please contact us for a list of available products and coverages by state

introduction to Hogwarts. Harry and the other first-year students arrive at school to be sorted into houses immediately based on an expert hat’s determination of which house they would best fit. The basics come from the house system common in British schools, which sorts students for purposes of intraschool competitions and boarding when applicable. Additionally, Hogwarts houses are each associated with different traits and qualities. While Gryffindors are considered loyal, Slytherins are known as cunning and for becoming dark wizards.1 Harry knew little about Hogwarts when he stepped up for his sorting, but he already knew he did not want to end up in Slytherin. When he made this clear to the Sorting Hat, the Sorting Hat assigns him to Gryffindor. Instead of living in a dungeon, Harry gets to live in a tower with his new best friend, Ron Weasley. He goes on to play Quidditch for Gryffindor and he spend most of his next six years at school with other Gryffindors. Throughout the book series, house membership becomes a short-hand for student characteristics with deviances noticeable (e.g., Cedric Diggory being a surprising leader from Hufflepuff). The parents of Harry’s peers seemed to have no issues with the immediate stereotyping of their 11-year-olds by the Sorting Hat, but modern parents may have concerns. They may have raised their little witches or wizards with dreams of them being a brainy Ravenclaw only for the Sorting Hat to announce, “Hufflepuff!” Nonwizard parents (Muggles) may have their pride of having a wizard son erased upon learning he had been assigned to the evil house, Slytherin (and then been forced to live in a dungeon). That is only the start to the issues parents may have with Hogwarts’ attitudes toward student equality. Harry broke the rules only to end up on the Quidditch team— an opportunity no other first-year student received. Professors doled out punishments and awarded house points with such wild inconsistency that some students’ grumbles are wholly justified. In many instances, unhappy parents talk to school administrators and work things out on their own. A student may not be reassigned from Slytherin, but the headmaster may convince his parents that the assignment confirms their child’s cunning resourcefulness along with assurances the dungeons are quite comfortable. Increasingly, parents have been unable to work through their issues with the school and file

LOOKING FOR COVERAGE THAT’S KIND OF A BIG WHEEL?

TM

FROM THE FARM AND RANCH PROFESSIONALS AT

Bow, NH 877.552.2467 aimscentral.com

Please refer to actual policy for details. Policies are underwritten by Great American Insurance Company, Great American Insurance Company of New York, Great American Alliance Insurance Company, and Great American Assurance Company, authorized insurers in 50 states and the DC. Products not available in all states. © 2022 Great American Insurance Company, 301 E. Fourth St., Cincinnati, OH 45202 5633-AGB (9/22)

a lawsuit. Hogwarts may be a castle, but it still needs protection from such lawsuits. A thorough general liability policy for schools should always include litigation defense costs. Schools cannot access this coverage to preemptively defend against a lawsuit, but as soon as the parents’ lawyer serves Hogwarts with the court filings—alleging the school discriminated against their darling witch by penalizing her repeatedly for no clear reason—Hogwarts can access the defense coverage. Ideally, Hogwarts would prepare for the inevitable parent lawsuit against the school, educators, and other staff by having a specialized general liability policy that specifically includes coverage for effectively everything going on at the school. Hogwarts professors—intentionally or not—may pose just as much of a risk due to a wrong comment or intentional act. The liability policy specifically should include them or be complimented by an educators’ policy that ensures coverage. A key term to watch for is whether the insurance carrier selects the defense attorney or if the carrier reimburses the school for the attorney of its choosing. While general liability policies may not always be as extensive as the name suggests, the defense litigation costs may end up saving Hogwarts enough money to consider paying house elves for their labor.

Threats from outsiders

Throughout the Harry Potter series, the school faced the ongoing threat of Lord Voldemort or He-WhoMust-Not-Be-Named. The most-evil wizard to ever live, devoted his time to trying to kill Harry because of a prophecy. During Harry’s time at Hogwarts, Voldemort went to great lengths to try and breach the security of the school. He attempted to do so through a teacher, through another student, and then just breaching the defenses of the school. The consistent threat to Hogwarts and students created a real risk that the administration (Dumbledore, but really Professor McGonagall) would need to consider insurance to cover. Whenever Hogwarts did come under attack, the school and its community did not have time to wait for someone to file a lawsuit to trigger coverage. This would quickly expose the gaps in coverage caused by exclusions in the general liability policy Hogwarts obtained to defend against angry parents

You Try Us Today Restaurants, Bars & Taverns

You’ll Stay With Us For Years

EverGuard, a long-term partner for your RBT business.

• Exceptional service is an EverGuard priority • Uncompromised program loyalty • Great coverages at competitive pricing with available

A&B, Enhancement Endorsement & more • No limit on alcohol sales • Package Policy: Property, GL & Liquor Liability • Entertainment considered • Experienced & Professional Staff EverGuard, is a superior Restaurant, Bar & Tavern market with 40+ years’ experience. Your RBT clients can depend upon EverGuard for their protection.

Our continued longevity offering an uninterrupted market assures you will receive the best product underwritten by an A.M. Best “A” rated carrier without program interruptions. EverGuard’s respected reputation in the RBT market speaks to our stability and reliability to provide industry leading response time and customer service to our partner agencies.

EverGuard Insurance Services 1900 W. Nickerson St., Seattle, WA 98119

EverGuard does not offer or solicit the program in the states of New Hampshire, Connecticut or Vermont.

2212-D-2022

Michael Maher EverGuard Insurance Services

VP, Business Development Michael@everguardins.com 206.957.6576 everguardins.com

filing lawsuits. To adequately protect the school, students, staff, and magical creatures in the event of an attack, Hogwarts would be advised to look at the UK wizarding community’s version of active-shooter insurance. Generally, active-shooter policies are triggered as soon as a person commits a targeted attack on the property of the insured. If Hogwarts obtained such coverage by the seventh book’s Battle of Hogwarts, then coverage would have been triggered when the Death Eaters—Lord Voldemort’s followers— breached the defenses that had kept them from the Hogwarts grounds. They would not necessarily need to break through the only door to the school/castle for coverage to take effect. The Battle of Hogwarts led to extensive damage to Hogwarts. While magic could help with some of the repairs, active-shooter policies also should include coverage for the nonphysical costs to address the extensive harm caused by an attack on a school. A thorough policy to provide Hogwarts and the wizarding community with the resources they need should include coverage for crisis management, counseling services, and funeral expenses. Hogwarts also should be wary of terrorism exclusions altogether. No policy may cover all the risks posed to Hogwarts from outside attacks. For example, an activeshooter policy most likely would not have applied when the Triwizard Tournament, which ended with Harry and proud Hufflepuff Cedric Diggory being transported off school grounds. Yet, one of the most valuable aspects of an active-shooter policy is a security review that would help the school bolster its defenses. For schools looking to best protect themselves, the value of an activeshooter policy may come from the services available to do its best to minimize the risk of student harm. Hogwarts may only have one entry into the main building, but the risk assessment would likely have alerted the school that the Triwizard Tournament may have been an inadvisable idea for many reasons, such as bringing dragons onto the campus.

Design+Print

(800) 424-4244 | design.print@pia.org | pia.org/design&print

Advertise with PIA Northeast

Reach the insurance industry’s P/C segment

Thousands of member agencies in NY, NJ, CT, NH, and VT PRINt

PIA Magazine Single, multi-state options available.

DIgItAl

PIA.org 10-15,000 visits each month. PIA digital news Distributed as a member-exclusive benefit.

116465 1119 Contact Cally Rupp: crupp@pia.org (800) 424-4244, ext. 231

Conclusion

No amount of effort by Hogwarts’s administrators or their insurer can fully protect students from danger— after all, Hogwarts students learn how to disarm each other and play a sport that involves flying around on broomsticks and avoiding Bludgers. Like any school, Hogwarts still would need to continually reassess its insurance coverages to ensure the best defenses against litigious parents and outside threats. Irvine is PIA Northeast’s government affairs counsel.

1 While not all Slytherins become dark wizards, no dark wizards have come from Gryffindor, Hufflepuff or Ravenclaw.

Brooks is proud to support Professional Insurance Agents (PIA)

Since its founding in 1991, Brooks Insurance Agency has successfully serviced the standard markets and brokered distressed and complex lines of business. We are here to help agents find the coverage their clients need.

We represent 80+ quality carriers, including several new and exciting markets, across the country. Plus, a broad array of products and services in admitted and non-admitted markets.

MARKET STRENGTHS AND EXPERTISE

• Broad market reach • High-touch broker specialists • Easy, online quoting process • Collective approach to complex insurance needs

BROOKS IS HERE FOR YOU.

How can we help you? Call us at 732.972.0600 or email us at info@brooks-ins.com.

We’ll Navigate Your E&O Coverage

You Focus on Business

PIA is here to help you navigate through uncertain times, so let’s make sure you have

great errors-and-omissions coverage at a competitive price.

Why PIA Is the Best Choice for E&O

• Our professional liability and cyberliability programs are designed for your agency’s needs and risk exposures