LAUNCH INTO YOUR Use your resources to your best advantage Page 18 GROWTH GOALS April 2023 • New York 9 Consider mid-career professionals 15 A culture of well-being 27 New hires have new expectations IN THIS ISSUE 9 Consider mid-career professionals 15 A culture of well-being 25 New hires have new expectations IN THIS ISSUE 9 Human relations laws 25 Value of soft skills 29 Use disclaimers in proposals IN THIS ISSUE

Lovell Safety Management Co., LLC 110 William Street New York, NY 10038-3935 212-709-8600 | 1-800-5-LOVELL www.lovellsafety.com Discounts up to 35% Call us for a Quote Today at 800-556-8355 Get a Quick Estimate by Visiting our Website at www.LovellSafety.com Lovell has been the leader in workers’ compensation insurance since 1936. Learn more about our unbeatable safety group programs for: • Building Metal Trades • Cleaners • Construction • Electrical Manufacturers • Hospitals • Launderers and Cleaners • Municipalities • Painters and Decorators • Paper Products Manufacturers • Retail Lumber • Roofers and Sheet Metal Workers • Truckers, Movers, and Warehouse people We Make the Complicated Easy So You Can Focus on Winning More Business with a Lovell Safety Group Over $1.15 Billion in Dividends Issued to Date

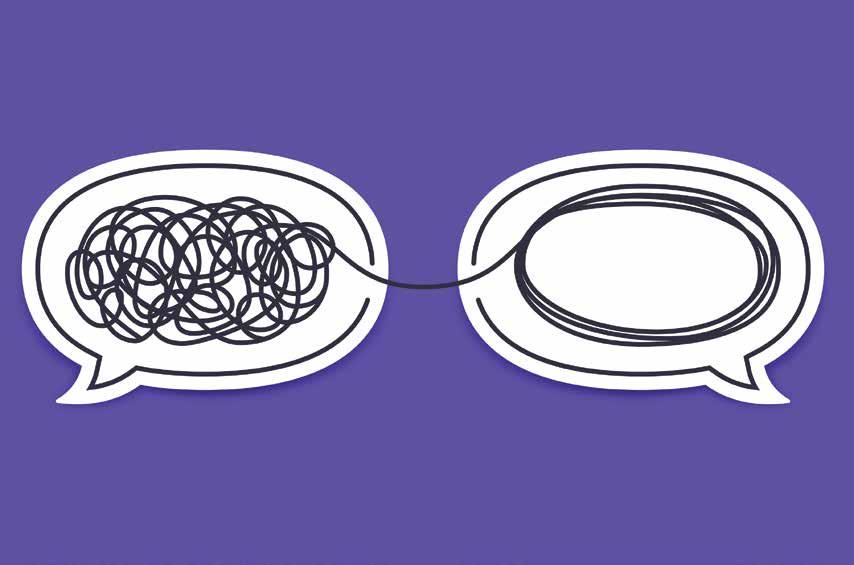

25 Soft skills

Exceptional managers communicate exceptionally

Statements of fact and opinion in PIA Magazine are the responsibility of the authors alone and do not imply an opinion on the part of the officers or the members of the Professional Insurance Agents. Participation in PIA events, activities, and/or publications is available on a nondiscriminatory basis and does not reflect PIA endorsement of the products and/or services.

President and CEO Jeff Parmenter, CPCU, ARM; Executive Director Kelly K. Norris, CAE; Communications Director Katherine Morra; Editor-In-Chief Jaye Czupryna; Advertising Sales Representative Kordelia Hutans; Senior Magazine Designer Sue Jacobsen; Communications Department contributors: Athena Cancio, David Cayole, Patricia Corlett, Darel Cramer, Anne Dolfi, Maura Rosner and Lily Scoville.

Postmaster: Send address changes to: Professional Insurance Agents Magazine, 25 Chamberlain St., Glenmont, NY 12077-0997.

“Professional Insurance Agents” (USPS 913-400) is published monthly by PIA Management Services Inc., except for a combined July/August issue. Professional Insurance Agents, 25 Chamberlain St., P.O. Box 997, Glenmont, NY 12077-0997; (518) 434-3111 or toll-free (800) 424-4244; email pia@pia. org; World Wide Web address: pia.org. Periodical postage paid at Glenmont, N.Y., and additional mailing offices.

©2023 Professional Insurance Agents. All rights reserved. No material within this publication may be reproduced—in whole or in part—without the express written consent of the publisher.

COVER DESIGN Anne Dolfi Vol. 67, No. 4 April 2023 April 2023 • New York

18 Launch into your growth goals Use your resources to your best advantage

COVER STORY

FEATURE

DEPARTMENTS 4 In brief 9 Legal 13 Sales 29 E&O 33 Ask PIA 37 Officers and directors directory 38 Readers’ service and advertising index

Trends that could impact work in 2023

One-in-four adults in the United States has a disability, and millions use assistive technologies. It’s estimated that 98% of U.S. based websites are not compliant with accessibility standards. If your agency’s website isn’t accessible, it’s not compliant with the Americans with Disabilities Act.

Brand-building activities

Businesses in recent years have pushed performance-marketing tactics. Now business people are moving back to brand-building activities.

YouTube Shorts content

Reaches clients in 60 seconds.

Key Terms

Brand Marketing Focusing on building awareness and creating an emotional connection with the customer.

Performance Marketing Focusing on generating leads and sales.

YouTube Shorts Short-form, vertical video content created using a smartphone and uploaded directly to YouTube from the YouTube app.

Fringe benefits

Employees are attracted to worthwhile benefits bundled in with their earned income and this only aids in a business’s employment retention. Most people are more interested in pursuing careers that offer employee insurance and pensions.

Non-taxed fringe benefits

According to the IRS, all earned income is taxable except for fringe benefits. Fringe benefits are the extra, or supplementary expenses—such as travel and qualified health plan benefits. These employment perks are considered nontaxable and can be excluded when filing with the IRS. However, bonuses are considered a part of an individual’s earnings, and therefore they are taxable income.

For employees to receive a full reimbursement for expenditures that are work-related (i.e., cost of travel), evidence like bills or receipts can be used as supportive documentation to further support their claim. The IRS requires that employees have verifiable proof that they had collected businessrelated expenses that can receive reimbursement.

What does an agency management system do?

The objective of an agency management system’s automated software is to use cloud-based artificial intelligence to manage an agency’s data while also using its database to generate new leads using a broadband connection. The type of software is referred to as Software as a Service. They can:

9 questions to ask when you look for a new agency management system:

1. Does the system have an easy-to-use client database?

2. Does it use digital document management, which includes all the forms and documents?

3. Does it utilize task management so you can see what’s been scheduled?

4. Does it have employee engagement features that can increase productivity?

5. Does it offer the ability to automate marketing?

6. Does it offer you a chance to measure productivity via reporting and analytics?

7. Is it easy to use?

8. Will it simplify your agency’s internal communications?

9. Does it offer commission tracking?

4 PROFESSIONAL INSURANCE AGENTS MAGAZINE

PROFESSIONAL INSURANCE AGENTS MAGAZINE 4

IN BRIEF

leads Organize books of business Create target marketing

Generate

Web accessibilities

Choosing an AMS: Single system or platform?

At its inception, the agency management system was the primary—and possibly only—software tool an insurance agent utilized to run his or her business. However, with the rise of InsurTech startups, agents now have a staggering number of technologies at their fingertips that specialize in every individual part of running an agency, from sales pipeline management, to automated marketing, to reviews and SEO.

Increasingly, professional insurance agents expect their management system to do far more than policy management; they want (and rightfully so) an all-inone technology solution for all their agency’s needs. In return, companies that create management systems have responded by working to broaden their offerings in one of two ways: either by building a more comprehensive feature set into their own software (single system approach), or by making policy data accessible for integration with other third-party software tools in an agency’s technology stack (platform approach).

It’s important for agents to understand the difference between these approaches—and how they can impact the agency—when choosing a management system.

Platform approach: Growth by connection

At its core, a platform is a piece of software that can connect to (i.e., transmit data to and from) other external systems, creating an available ecosystem of resources that is customizable for the users depending on the size and needs of their businesses. A platform’s value lies not only in its own internal features, but in the usefulness of its connections to outside tools.

Usually, these connections are achieved through application programming interfaces between the main system (in this case, the agency management system) and the partner systems (other agency software tools). For example, with a platform approach, an agency management system functions as a data hub that can connect to an array of vetted API partners chosen by the agency to help them with tasks like marketing, advanced business intelligence, review management, and more.

What are the reasons for a professional insurance agent to choose a software platform rather than a single system when considering management systems?

Three major benefits of platforms are specialization, flexibility, and data autonomy.

No. 1: Specialization. Management systems are built to be the best at policy management—not necessarily the best at email marketing or payment processing or other tasks that also are important to an agency.

While a single system must spread its resources across a huge set of diverse features at the risk of becoming a jack of all trades, but master of none, a platform sticks with what it does best and partners with others who are experts in their own spaces. That way, the user gets a best-in-class experience with every single tool—rather than stellar policy management features but mediocre marketing features, for example.

When considering single systems, agents should think about whether the system truly has the depth and breadth of features needed in each area, and whether it’s worth the additional cost they may incur.

On the other side of the coin, when looking at platforms, agencies will need to consider which product integrations are offered, whether they meet the agency’s needs, and what the associated costs are.

No. 2: Customization. A platform approach also gives agents the freedom to add as few or many features to their management system as they choose. While a single system might bundle features (including some your agency might not need) with all-in-one or tiered pricing, a platform allows you to pick-and-choose the integrations that are most important for your individual agency. This makes it easy to scale your business. Rather than being constrained by the features or limits of a single system, you can add or remove integrated tools as your business grows or your needs evolve.

Additionally, platforms offer choice. A single system isn’t going to waste resources creating multiple in-house tools that perform the same function, but a platform can offer multiple integration options for each type of tool easily. Don’t like the way emails look in one marketing automation solution? Simply choose a different one. Platforms allow you to tailor your technology to fit your agency, not the other way around.

Most platforms also offer the advantage of vetting their integration partners. There is a dizzying array of technology options out there, and agents who are looking for a software tool on their own might find they have no idea where to start.

(continued on page 6.)

5 PIA.ORG NEWS TO USE

While some platforms may tout open integration with any tool or partner, this also could be a red flag that integrations are not tested with every partner or that partners are not asked to sign agreements regarding conduct with customer data—both of which can end up hurting the independent insurance agency.

Instead, look for platforms that put their seal of approval on a diverse but qualified group of integration partners. This means the platform is doing the work of culling through the available options and choosing the ones that provide the best experience with its management system—and it can be trusted to take the best care of its customers.

This gives agents the best of both worlds, allowing them to choose between multiple systems, while providing the assurance that the tool they choose will work seamlessly with the management system.

No. 3: Data autonomy. A single system silos your data in one place, which means it might not play well with others. Agency owners should be free to change management systems for their businesses if necessary, but some systems make it difficult for agency owners to make the switch by making it costly and time-consuming to extract their data from the system.

Even then, the data might not be provided in a format that can be easily migrated to another system. Client data is one of your agency’s most valuable assets, but if it’s imprisoned within one system, you’re effectively ceding ownership to the system that houses it.

On the other hand, because platforms are built with data transfer between systems in mind, it’s easy to access your data when and where your agency needs it. You can disable one integration easily and enable a different one without migrating data, because it’s still in your management system. Even if your agency wants to change management systems, you can continue to use the other third-party applications you like—and find another platform that integrates with them. Because platforms are accustomed to making data available to outside parties, it will likely be easier to get your data out of the management system in a usable format too.

Many systems claim that agencies retain ownership of their data, but true ownership requires the autonomy to

freely, easily, and affordably move your data into and out of systems according to your agency’s needs. The best choice for independent agents

Insurance agents don’t have the time or resources to manage a host of disparate software tools that aren’t fed by current client data or don’t work well with each other. As the source of truth for policy data, it’s the management system’s responsibility to either provide the tools agencies need within their system or partner with others that do. Agents who select management system platforms enjoy the benefits of specialized technology, the freedom to customize and scale their technology stack, and the ability to use their data in whatever way they choose.

Since 1995, HawkSoft has been a leader in management systems for independent insurance agencies that want effective workflows and a delightful experience for staff and policyholders. HawkSoft offers the following promise to insurance agents: your investment in HawkSoft will pay for itself in the first year. Learn more about HawkSoft’s unique father-and-son story (www.hawksoft.com/about/story). To learn more about our agency management system, request a demo at www.hawksoft.com/demo. Email sales@hawksoft. com or call (866) 884-4680, Option 4.

PROFESSIONAL INSURANCE AGENTS MAGAZINE 6

NEWS TO USE (continued

Because platforms are built with data transfer between systems in mind, it’s easy to access your data when and where your agency needs it. You can disable one integration easily and enable a different one without migrating data, because it’s still in your management system.

from page 5.)

Proudly serving quick service restaurants Workers Compensation Insurance • No volume requirements • Competitive rates • Multiple options for premium payments • Open to Shock Loss/High Mods Send in your submissions today. For more information contact a marketing rep at 844-761-8400 or email us at Sales@Omahanational.com. [ Coverage in: AZ • CA • CT • GA • IL • NC • NE • NJ • NY • PA • SC Smart. Different. Better. Omaha National Underwriters, LLC is an MGA licensed to do business in the state of California. License No. 078229. “A” (Excellent) rated coverage through Omaha National Insurance Company, Preferred Professional Insurance Company, and/or Palomar Specialty Insurance Company.

WE PICTURE THE WORST FOR YOU. WHOLESALE BROKERAGE | BINDING AUTHORITY | EXCLUSIVE PROGRAMS JencapGroup.com

BRADFORD J. LACHUT, ESQ. Director of government & industry affairs, PIA Northeast

Human relations law and the insurance industry

Answer: This popular quiz show, created by Merv Griffin, averages 25 million viewers per week, and it is my favorite show. “What is Jeopardy!?”

Yep! I love Jeopardy!. My love of the show dates to when I was eight and watched the show with my grandparents. One night, I remember the category was Potpourri —a term I did not know as a kid and I’m only slightly more familiar with now. There was a question about farm animals, and I correctly guessed that the answer was “What are sheep?”

That was the first time I remember getting a question right in Jeopardy!, and I have been hooked ever since. In honor of my love of the trivia game show and the first category I correctly guessed an answer in, let’s do our own version of Jeopardy!. This one isn’t going to deal with sheep. Instead, let’s look at some

recent trends in human relations law that certainly will impact employers big and small.

Cannabis

Answer: This plant, which was declared a Schedule I controlled substance in 1970 by the federal government, has seen a growth in popularity in the past 10 years as almost 20 states have legalized it for recreational use.

Steer Your Contractor and Used Car Dealer Risks to the Pros Turn to the folks that understand your clients’ businesses, deliver A- (Excellent) rated commercial auto and garage liability coverages, and provide the resources and support you need to achieve profitable growth. Business Auto Liability and Physical Damage • Contractors – Commercial Building, Electrical, HVAC, Painting, Plumbing, Roofing, Janitorial Services and more Garage Liability — Used Car Dealers • Dealer and Transporter Plates Writing in NY, NJ, PA, CT & OH* • Convenient Online Quoting • 24/7/365 Claims Reporting • Flexible Payment Options Contact us today: 516-431-4441 x3507 producer@lancerinsurance.com www.lancerinsurance.com * Please contact us for a list of available products and coverages by state PIA.ORG 9

LEGAL

What is cannabis? That’s right! A little more than a decade ago, Colorado become the first state in the country to legalize recreational cannabis for adult use. In the 10 years since, cannabis legalization has gone from a late-night talk show punchline to a reality in almost 20 states. This number should only increase as cannabis continues to be destigmatized, and states continue to look for avenues to generate tax revenue.

The legalization of a previous illegal drug can create issues for employers. Many employers likely have policies against the use of drugs, but how should employers handle the legal use of cannabis by employees? Some states have answered this question for employers. For example, New York state—which legalized recreational cannabis in 2020—does not allow employers to prohibit the use of cannabis outside of the workplace and workhours. However, employers are free to prohibit cannabis usage during workhours and while employees are at worksites.

This can raise practical issues for employers. If employers can prohibit the use of cannabis, how do they enforce this prohibition? Unlike with a substance like alcohol, where we have a verified method of testing current levels of inebriation, testing for recent cannabis use may be more difficult. While cannabis can be detected through drug tests, it’s difficult to demonstrate whether the cannabis in someone’s system was ingested hours ago while on worktime or days or weeks ago on a weekend. This lack of reliability means that employers should be wary of taking any adverse action against an employee for a positive drug test alone. Doing so could put an employer at risk of a retaliation lawsuit alleging the employee is being punished for engaging in a legally protected activity.

Noncompetes

Answer: A recent regulation by the U.S. Federal Trade Commission would ban the use of these employment agreements.

What are noncompete agreements? You got it! In early 2023, the FTC released a proposed regulation that would ban the use of noncompetition or noncompete clauses. A noncompete clause is a type of restrictive covenant that restricts the ability of individuals to work in a certain sector, geographic area and/or for a certain amount of time.

In recent years, these types of agreements have come under increasing scrutiny from both courts and state Legislatures. Where once courts permitted noncompete agreements of two years. Now, they are refusing to enforce agreements longer than six months in duration.

This reexamination of noncompetes has come as the FTC has said that 30 million people—or roughly 18% of U.S. workers—are subject to noncompetition clauses. If the FTC regulation does go into effect, what does that mean for employers? Well, that depends on the usage of noncompetes. While the FTC regulation bans the use of noncompetition clauses, it does not ban the use of less restrictive restrictive covenants, like nonsolicitation or nondisclosure clauses.

Typically, those sorts of agreements protect a business by restricting an employee, or ex-employee, from contacting clients or disclosing client lists, instead of restricting the employees’ ability to work. Those employers that

utilize those lesser agreements will be unaffected by the new regulation. Those that do use noncompetition clauses should replace them with another restrictive covenant that does not inhibit the ability of the employee to work elsewhere.

All employers are encouraged to review the employment contracts they utilize to ensure that they do not violate the proposed regulation. One additional note, the regulation does allow one type of noncompete clause: Noncompete clauses still would be permitted for the sale of business or ownership interests. In those situations, a noncompletion clause could be utilized for the person selling a business or ownership interest.

Salary transparency

Answer: In 2022, New York state became the latest state to pass this sort of law designed to combat wage discrimination by requiring disclosure of salary ranges in job postings.

What is a wage transparency law? Correct again! New York state joined a growing list of states and municipalities (including: Connecticut and New Jersey) that have passed laws requiring employers to disclose a salary range for open positions. The specifics of the laws often vary, but the purpose is the same: to increase wage transparency to close the wage gap between different classifications of individual like those of different gender or race.

While these laws were passed for a noble reason, they often can create confusion among employers. This confusion is due to three issues involving the where, who, and what of wage transparency.

PROFESSIONAL INSURANCE AGENTS MAGAZINE 10

Where. Several cities, counties and towns have passed wage transparency laws. This means some businesses in the same state may have to follow different rules. For example, take New York state. Prior to the passage of a statewide law, New York City, the city of Ithaca and Westchester County all had wage transparency laws. A business posting a job in each of those locations (hypothetically) would have to follow three different laws. This leads right into the second issue of who.

Who. While wage transparency laws all have the same goal: Closing the wage gap, they often are worded differently to apply to different jobs. For example, Rhode Island takes a more reactive approach. The law in that state requires all employers to provide salary range to job applicants upon request or before discussing compensation or extending a job offer. Meanwhile, Colorado is more proactive. It requires employers to include a salary range, as well as a list of benefits, for all job ads.

Several states and municipalities in the Northeast including Connecticut, Maryland, New Jersey, New York and Rhode Island have passed some form of wage transparency law. For those in areas that do have these laws make sure you are complying with them.

For those that are not subject to wage transparency laws, it is probably wise to start considering including salary ranges on job postings. There are several reasons for this. First, this is a trend that is only growing. Even if you are not in an area now where wage disclosure is required, chances are you will be soon. Second, even if your state or city never passes a wage transparency law, the private market may force your hand anyway.

Since wage transparency laws are popping up in many different states and many different levels of government, many companies—especially those with multiple locations—are including salary ranges to ensure compliance proactively. As more and more employers include salary ranges, whether because obligated by law or voluntarily, those that do not may find their job postings getting less attention.

Our category for Final Jeopardy! is Excess & Surplus Lines. Determine your wager and for more information see next month’s column. (Exit to the Jeopardy! theme song: Think!.)

Lachut is PIA Northeast’s director of government & industry affairs.

…

to do? Well,

What. The laws don’t just differ in what jobs they apply to, but also which employers. Let’s go back to New York state. New York City’s wage transparency law applies to all employers with four or more workers with at least one of those workers who is located in New York City. The city of Ithaca’s law applies to employers with four or more workers in Ithaca. While Westchester County’s law applies to any employer posting a job that will or can be performed in Westchester. You have three municipalities all within 200 miles of one another, all with slightly different laws regarding transparency. What are businesses

the first step

is to stay

informed. Check to see if your state, county or city/town have passed similar laws.

PIA.ORG 11 Learn more: www.pia.org/AAC 117078 721

Advocacy Coalition helps elect state legislators who advance issues important to the insurance industry.

DURING ELECTION SEASON

Agents

Lake Placid autumn © Getty Images

Brooks Insurance Agency is proud to support Professional Insurance Agents (PIA)

Since its founding in 1991, Brooks Insurance Agency has successfully serviced the standard markets and brokered distressed and complex lines of business. We are here to help agents find the coverage their clients need.

We represent 80+ quality carriers, including several new and exciting markets, across the country. Plus, a broad array of products and services in admitted and non-admitted markets.

MARKET STRENGTHS AND EXPERTISE

• Broad market reach

• High-touch broker specialists

• Easy, online quoting process

• Collective approach to complex insurance needs

Visit our website at www.brooks-ins.com.

Brooks Group Insurance Agency, LLC NJ License 1575143

BROOKS IS YOUR FULL-SERVICE WHOLESALER How can we help you? Call us at 732.972.0600 or email us at info@brooks-ins.com © 2023 Brooks Insurance Agency, LLC is a wholly-owned subsidiary of Venbrook Group, LLC. All rights reserved.

DAVE KAHLE President, Kahle Way Sales Systems

Post-COVID: Proactive leadership, adjustments

We are confronting the next wave of change as our businesses and our jobs lurch back to something resembling pre-COVID normal. The question in the back of every executive’s mind is this: “How do we handle the post-COVID changes?”

Specifically, we’ll have to accommodate thanks to issues, such as employees who have enjoyed the flexibility of working from home, and customers who may be apprehensive about working with salespeople face-to-face. While there will be as many adjustments as there are people, before we start reacting to what everyone else wants to do, it may be appropriate to spend a little bit of time conceptualizing what we want to have happen. Let me weave a couple of thoughts together here.

Change = opportunity

One of the things I have learned in my more than 30 years of business consulting is this: Every change is an opportunity to create a more positive, larger change. We just must think that way to make it happen. Here’s an example. Often, I have been involved in refining a sales force’s compensation plan. Every time we refine a sales force compensation plan, it brings with it an opportunity to restructure the way sales territories are defined, or maybe the way tasks are split between outside and inside sales, or some larger and more impactful issue. So, the smaller change—sales compensation—opens the door to a larger, more systematic change.

That smaller change works sort of like a pry-bar when you are removing molding. Once you’ve used it to open a small gap in the structure, that gap can be lengthened to encompass the whole piece. So, a smaller change in the structure of an organization often opens the specter of a larger, more strategic and impactful change. It’s easier to make a big change in the middle of the implementation of a smaller change.

People want leaders

Another lesson from my experience consulting with over 500 businesses is this: Most people want confident leaders, and confident leaders point the way to a different and better situation in the future. And, typically, it is the leader’s job to describe that situation and point others to it. In other words, leaders create the vision of a better future, and lead people to it. Leaders don’t react, they proact.

When I pull these two thoughts together, and apply them to the postCOVID adjustments, I come out with this: Now is the time to define the structure and culture you want proactively, and to help your people adjust to the new reality. Rather than reacting to every employee’s, every customer’s, and every vendor’s wishes, first create the structure you want, and nudge people toward it. For example, you may say that in the post-COVID world, you want everyone to work in the office, together, at least two days a week. When some of those employees who have been working at home indicate they want to continue working from home, you describe your structure, explain your rationale, and have them adjust to it.

Or you may want your field salespeople to spend a day or two a week making remote sales calls via video technology. So, set up the system, put in place the tools to measure that, and let your salespeople know your new expectations. Change the structure to meet your view of what the world will demand.

What you will have done is this: You will have used this small change to create a bigger, more impactful change. You will have described the world as you want it and nudged your people into it. Instead of reacting to every individual’s whims, you will

SALES

PIA.ORG 13

Market Leading RBT Program For:

EverGuard, The Best Long-Term Partner For Your RBT Business.

EverGuard, is a superior Restaurant, Bar & Tavern market with 40+ years’ experience. Our continued longevity offering an uninterrupted market assures you will receive the best product underwritten by an AM Best “A” rated carrier without program interruptions.

EverGuard’s respected reputation in the RBT market speaks to our stability and reliability to provide industry-leading response time and customer service to our partner agencies.

• Exceptional service is an EverGuard priority

• Uncompromised program loyalty

• Great coverages at competitive pricing with available A&B, Enhancement Endorsement & more

• No limit on alcohol sales

• Package Policy: Property, GL & Liquor Liability

• Entertainment considered

• Experienced & Professional Staff

EverGuard Insurance Services

1900 W. Nickerson St., Seattle, WA 98119 EverGuard does not offer or solicit the program in the states of New Hampshire, Connecticut or Vermont.

PIA’s specialists answer:

• Legal

Michael Maher EverGuard Insurance Services

VP, Business Development Michael@everguardins.com 206.957.6576 everguardins.com

• Industry

• Coverage

• Legislative

• Regulatory … and other questions fast!

3,462 Ask PIA questions answered last year

have defined the future, and then led them to embrace that.

Leaders lead—and now is the time to do so. Take some time to conceptualize the structure, the routines, and the habits that you want to incorporate into your business, describe them specifically and develop the rationale for them, and then, prod your people into them. As people emerge from the COVID fog, be ready with a proactive structure and culture for them to engage.

When Rahm Emanuel served as President Barack Obama’s chief of staff, he was famously quoted as saying: “Never let a crisis go to waste.” While his content was politics, the principle applies in many circumstances. One of which is business management.

Use this opportunity to build the structure that will serve you well in the post-COVID world. Be proactive, not reactive.

Kahle is one of the world’s leading sales authorities. He’s written 12 books, presented in 47 states and 11 countries, and he has helped enrich tens of thousands of salespeople and transform hundreds of sales organizations. Sign up for his free weekly Ezine (www. thesalesresourcecenter.com/dkezinesubscribe). His book, How to Sell Anything to Anyone Anytime , has been recognized by three international entities as “one of the five best English language business books.” Check out his latest book, The Good Book on Business

“Information, Education, Legislation! PIA—a great way to do business.”

—Nicholas Fanelli, CPCU, CIC, CLU Newberry Insurance Group

PROFESSIONAL INSURANCE AGENTS MAGAZINE 14

Bars, Taverns, Brewpubs, Comedy Clubs, Diners, Restaurants, Live Music Venues, Tasting Rooms … 116990 820 Log on to pia.org/IRC/askpia.

CP The Premins Company The Premins Company 132 32nd St., Ste. 408 | Brooklyn, NY 11232 • (718) 375-8300 (800)599-3279 • info@premins.com • www.premins.com 117742 1021 ✔ Credit cards for a flat $8.75 fee ✔ Debit cards for a flat $3.85 fee ✔ Free e-check ✔ Free check by fax ✔ Free auto bill pay ✔ Cash payments at CVS, Walmart and most 7-Eleven stores ✔ 24-hour online account access/management ✔ If you finance NYAIP apps, it’s time to go paperless with Premins Insurance Premium Financing with Unparalleled Payment Options Providing exceptional personalized service to the premium finance industry since 1965. OF INSURANCE PREMIUM FINANCING • OVER •

x Get your quote today! (800) 424-4244 | memberservices@pia.org Employee Benefits for Insurance Agencies Let the PIA Members’ Choice group benefits program take care of your agency. Medical Dental/vision LTD with Reliance Standard Term life with Reliance Standard PIA’s curated programs for member agencies and brokerages feature carrier selection, flexible coverage, top-notch customer service, and claims assistance when you need it.

What is ANE’s Greatest Resource? Our Members! Gain intellectual capital from the highest caliber agents Increase your agency’s contingent and incentive revenue Simple contract model and minimal membership fees Business resources are hand-selected by our members Outperforming the industry Find Out What the ANE Advantage is Today 800.700.9643 information@ane-agents.com www.ane-agents.com

Use your resources to your best advantage

PROFESSIONAL INSURANCE AGENTS MAGAZINE 18

LAUNCH INTO YOUR

GROWTH GOALS

VIJAY RENGARAJAN Senior product manager, EZLynx

While the global economy is riding through the uncertain times of 2023, the future of insurance continues to look promising for the industry. Despite the pandemic, reports have shown that the insurance industry continues to grow. The fact that our industry experienced record growth and profitability during turbulent times proves once again the resiliency of the independent agency model. However, how do professional independent agents take advantage of this trend and ensure that 2023 is a year of growth for their organizations?

PIA.ORG 19

The question is answered in one word: Goals. You set them every year. But how do you know if they’re realistic? And, how do you know if you’re measuring them accurately? Or are you measuring them at all throughout the year? Technology can help. Implementing performance-goals technology into your agency management system can help you focus on:

• setting target key areas for growth;

• tailoring specific agency goals;

• building individual agents up for success; and

• using data to win more new business.

Performance-goals technology can help you increase productivity and provide data to help you define your agency’s success and meet your 2023 business goals.

Setting target key areas for growth

Before you set your goals, it’s crucial to first consider the different business targets you might want to achieve and what kind of tools you can use to get there. Understanding whether your goals relate to general business, operations, or sales will help you keep your priorities on track and help you plan accordingly. Investing in technology can simplify the process and hyper-focus on the target areas of your business—from back-office accounting to frontoffice sales—saving you immense amounts of time and money. By investing in performance-goals technology, you can set targets in your agency management system in three key areas of your insurance business:

• Policies in force: Ability to measure your agency’s business growth or track retention.

• Annualized premiums: Ability to measure your agency’s premium growth across carriers, producers, and more.

• Written premiums: Ability to measure or track your sales growth over any period of time. Setting targets in those three key areas can assist with the overall growth of your agency and can further provide the flexibility to develop your goals as absolute increases, percentage increases, or by target number. Have a plan to increase your agency’s policies in force by 10% this month? Need a producer to increase the written premium for a specific carrier by 15% this quarter? Or want

PROFESSIONAL INSURANCE AGENTS MAGAZINE 20

Please refer to actual policy for details. Policies are underwritten by Great American Insurance Company, Great American Insurance Company of New York, Great American Alliance Insurance Company, and Great American Assurance Company, authorized insurers in 50 states and the DC. Products not available in all states. © 2023 Great American Insurance Company, 301 E. Fourth St., Cincinnati, OH 45202 5637-AGB (04/23) Bow, NH 877.552.2467 aimscentral.co m TM FROM THE FARM AND RANCH PROFESSIONALS AT HOP ON OVER

SOME EAR-RESISTIBLE COVERAGE OPTIONS!

FOR

to grow the annualized premium for a particular line of business by 22% this year? Having performance-goals technology can bring these goals into focus each day, so your team can stay focused on the path to success and keep your most critical growth metrics front and center for your agency. Daily monitoring of progress against these goals keeps your agents and agency accountable and driven to success.

Tailoring specific agency goals

Focusing on key growth areas is important, but every agency is unique and needs technology tailored to its specific goals and challenges. For example, agents frequently report meeting carrier production demands as one of the significant challenges they face. By incorporating a performance-goals tool into your agency management system, you can establish specific targets by carrier and monitor progress regularly. Performance-goals technology will allow you to tailor your agency’s goals by the carrier, policy type, line of business, and state, which will better position your agency for annual performance reviews and the profits that go along with them.

To dive even deeper, performancegoals tools enable you to assign tracking metrics to your agency overall. This helps avoid vague and undefinable goals, like “selling more Small Group business this year.” In contrast, a more specific goal would be “Increase my Small Group production by 20%” or “Increase my commissions by 25%.” Doing so can help gain a clearer picture of what your agency has achieved, where it is behind, where there was failure, and what is on track.

A study by Censuswide and Geckoboard looked at over 250 small- and medium-sized businesses in the U.S.,1 and not surprisingly found that setting growth targets and tracking your progress dramatically increases your chances of reaching your goals. By maintaining a simple approach to measurement that requires a few key objectives, metrics to support those objectives and defined targets give definitive insight into what’s working and what’s not, your agency will be on a path to ensure every decision is backed by data. Tailoring your agency’s specific goals can help you set your desired growth targets and track your unique goals to completion.

Building individual agents for success

Overall agency goals are essential for the big picture, but it also is important for agency success to define, track and analyze performance goals for your individual agents. In addition, measuring your staff members’ performance to watch their growth and development is essential to elevating their skills and capabilities. Incorporating performance-goals technology creates a transparent picture for your staff members on what they are doing great at, and not so great at, and gives insight for future success. It helps set realistic goals, allows you to review performance status on a regular basis, and helps agents with self-monitoring, leading to better engagement and ownership over their goals. Utilizing a performance-goals tool also allows you to open conversations for coachable moments if the data indicates that certain areas aren’t going well, or to listen to your staff members’ feedback on whether the goals are attainable. This not only provides an opportunity to see where your agency and staff can improve, but also celebrate wins and boost team morale. According to a study by Officevibe, organizations that provide regular and measurable feedback for their employees benefit from 14.9% less turnover than businesses that do not.2 Additionally, a study from Seismic found that businesses with low turnover rates ultimately bring in four times higher profits on average.3

In a time when recruiting and retaining the best talent is challenging, it’s critical to have a solid performance-goals tool incorporated into your agency management system to help establish measurable goals that can be easily tracked, increase team involvement, and move the momentum forward for your agency.

Using data to win more new business

To grow your business in 2023, you will need to focus on new sales. One of the biggest challenges for agents—when setting and measuring new sales goals— is finding good, trackable, and understandable data. That’s why it is crucial to have technology that can help you set growth targets, measure progress through accurate data in visible ways, and track targets to completion so you can bring in new business.

Using performance-goals technology, you can monitor daily progress with substantial data toward your business goals and can keep your staff members and agency accountable and motivated toward a successful future. Because you can measure the sales performance of your producers by setting goals for them solely around new policies, you have the advantage of collecting concrete

PIA.ORG 21

General pia@pia.org

Conference conferences@pia.org

Design + Print design.print@pia.org

Education education@pia.org

Government & Industry Affairs govaffairs@pia.org

Industry Resource Center resourcecenter@pia.org

Member Services memberservices@pia.org

Publications publications@pia.org

Young Insurance Professionals yip@pia.org

data in your agency management system and can better understand the best process for gaining new business.

Many agents find that it’s helpful to have technology that can set these goals weekly, monthly, or quarterly. Insurance producer sales goals should be readjusted as they grow and build a pipeline and relationships but at the very least every year—this allows you to revisit goals based on real data consistently and make the tangible changes necessary for prosperity. In fact, McKinsey found that data-driven organizations are 23 times more likely to acquire new customers, six times as likely to retain existing customers, and 19 times more likely to be profitable.4

Investing in performance-goals technology will make sure you are well on your way to transforming your operations and new business strategies and prove with data that your decision-making leads to a more efficient, performance-oriented business.

The future looks bright

Despite continuing market volatility and uncertainty, the future looks bright for the insurance industry, which showed resilience through the pandemic and in the face of inflation, losses, and reserve capital requirement headwinds. However, now is not the time for professional insurance agents to take their foot off the gas. Investing in performance-goals technology:

• can provide clear insight into your book of business and the output of your producers;

• can calculate and report progress automatically along the way; and

• can evaluate your agency’s and staff members’ overall performance easily. Additionally, by incorporating daily monitoring into your business processes, you’ll be able to plan for success without having to guess where your weak spots might be.

Technology has forever changed our industry and how insurance business gets done—adopting performance-goals technology into your agency management system gives your agency the means to plan for scalable growth, one milestone at a time. In doing so, you build more resilience and value into your agency, making 2023 the year of growth.

Rengarajan is the senior product manager at EZLynx. He is an accomplished product manager with over 15 years of experience in product ownership and IT business analysis, in the IT industry and property/casualty insurance domain.

1 Geckoboard, 2016 (bit.ly/3Ijpjby)

2 Officevibe, 2022 (bit.ly/3SrxGGG)

3 BuiltIn, 2020 (bit.ly/3IMBNtI)

4 McKinsey Global Institute, 2020 (bit.ly/3lWxCCx)

PROFESSIONAL INSURANCE AGENTS MAGAZINE Email>

electronically

Keep these addresses handy to reach PIA

116889

These are the Workers’ Comp Markets You’re Looking for! 2270-D-2022 Market Access Only With Your PIA Membership (800) 424-4244, ext. 318 | memberservices@pia.org | https://bit.ly/3Rpe5oc Provided in partnership with Agency Resources Scan to Get Started Hundreds of class codes A low-minimum premium Quick turnaround Simplified submission process Trusted carriers Competitive commissions Exclusive Features for PIA Members Painting Plumbing Restaurants Retail And, more … Auto Body Cabinet/Floor Installation Electrical Grocery/Deli/Supermarkets Landscapers Masonry Program Appetite Guide

Call (800) 424-4244, ext. 408 | Web www.pia.org Why PIA is the Best Choice for E&O • Our professional liability and cyber liability programs are designed for your agency’s needs and risk exposures • Critical coverage options—especially important when many agents are working remotely • Top-rated, stable E&O carriers • Experience & expertise from our team PIA is here to help you navigate through uncertain times, so let’s make sure you have great errors-and-omissions coverage at a competitive price. We’ll Navigate Your E&O Coverage You Focus on Business Scan to learn more and get a quote.

Leading a team to greatness is one of the top goals of any good agency manager, but it’s rarely easy. If it was, everyone would be doing it. It takes the proverbial blood, sweat, and tears to not only be the best yourself, but to lead others to be their best as well. It involves an absolute set of hard skills, soft skills, and even some innate talent.

Your awareness of your own innate talents and personality tendencies can help you develop and hone the five most important soft skills needed to be an exceptional agency manager. But first, the hard skills.

What are hard skills?

Hard skills are specific, teachable abilities. They are acquired through definitive actions like education, training, apprenticeships, experience, and practice. For example, to be a PHP developer, you need to learn how to code in PHP. That’s a specific skill for a specific job. In an agency, there are a set of concrete skills an agency leader needs to know—like knowledge of insurance products and regulations, financial analysis, risk management, sales skills, and other operational tasks.

WENDY SHEAFFER Chief product officer, The Omnia Group

And of course, we can’t forget computer skills. As our world rapidly advances, so does the insurance industry and the need to be digital in all facets of the business. You might need familiarity with certain policy management systems, customer relationship management software, and possibly some actuarial software. Hard skills are easy to quantify and can be assigned to specific roles.

The versatility of soft skills

Soft skills are a little different. Soft skills can be even more painful to come by because they aren’t always taught—though you can attend training sessions, webinars, or even work with a mentor to hone your soft skills. But, because they are not specifically taught for a certain role, they often are learned by way of our own failures and mistakes as much as anything else. Soft skills are not tangible the way hard skills are—they are more subjective. On the plus side, soft skills are transferrable across roles and industries—you can use them everywhere.

Unlike deftly using Excel spreadsheets or creating PowerPoint presentations, which are tangible skills, dealing with other people successfully is a soft skill. How

PIA.ORG 25

Exceptional managers communicate exceptionally Soft skills

managers treat employees, business contacts, customers—and even their own managers—involves a variety of different soft skills. Soft skills are invaluable for inspiring, leading, and motivating people. All great agency managers know how to work effectively with—and through—people.

People are the single greatest asset a business has. Your agency team members turn goals into reality. They do the work, embody the brand, and connect with your customers. So, a great manager needs to be able to connect with their team members and propel them to greatness.

The ability to work through people to get things done might start with some raw talent—talent never hurts—but it still must be honed, practiced, and perfected. Relating to people, employees in particular, can feel like a minefield. There are as many losses as wins when it comes to leading a team. Nothing makes a manager want to give up more than staffing challenges.

Important soft skills

Everyone knows those managers who rule by fear. Their team members are afraid to fail only because they do not want to provoke the manager’s fury, or endure a deliberate rudeness or insults that these leaders use to keep people from expressing opinions that do not align with theirs. These teams likely have high turnover, high disengagement, or both. A-players certainly won’t stay long. That’s why these five soft skills—listed in order of greatening importance— are essential for agency managers to be great at what they do, and lead others to be great as well.

No. 5: Conflict resolution. People disagree; it’s a constant in life. There will be times when team members experience conflict. There also will be situations in which the conflict is between a team member and the leader. Active, positive conflict resolution requires the manager to take the steps necessary for regaining common ground and resolving the conflict. It’s important for the leader to be in control of his or her temper (emotions run high in times of conflict), so the manager can appreciate the other person’s point of view, show curiosity about his or her reasoning, and demonstrate a willingness to see the situations from a different angle.

It helps if the manager has additional soft skills (yes, we are sneaking some more in here), such as a positive outlook, creative thinking, and problemsolving capabilities. Using a behavioral assessment can further develop employees toward successful conflict resolution. For example, you might have an employee with a naturally assertive approach to handling conflict who needs a little help toning down that assertiveness when dealing with more accommodating team members. On the opposite side of the equation, you could have someone who avoids or ignores conflict and needs some coaching and support for addressing those situations directly. When conflict is managed right, it can strengthen relationships and lead to innovative problem-solving.

No. 4: Motivation. A great manager knows there is more to leading a team than focusing on assignments and deadlines. Typically, there are several key performance indicators that show if a department is on track to meet a future deadline, like progress toward milestones, resource utilization, productivity, and even communication. Working toward meeting these indicators is a productive way of eventually reaching the deadline on time or early.

However, getting there requires motivation. Motivation drives or inspires action. It is the internal and external factors that influence behavior. A great manager always is looking at ways to motivate and encourage the team and individuals. Motivation doesn’t have to be complicated. Motivating team members to stay on task could be as simple as offering incentives, gamifying the process, or celebrating minor milestones.

No. 3: Coaching. Boosting a team’s productivity is possible when the manager willingly takes on the role of coach. Rather than constantly looking for faults or seeking opportunities to correct behavior, a great manager sees mistakes as learning opportunities. This manager knows what makes every team member tick through their personality assessment, observation, and daily interaction. This manager leverages strengths while working with everybody on improving any aspects that currently are weak in their performance. Being a strong coach requires a few key elements (and more soft skills). These include active listening, empowerment, adaptability, goal setting, encouragement, honest feedback, and continuous development. Nothing good happens overnight, and practice makes perfect.

No. 2: Engagement. A great manager understands that employees need to be invested in their work and work culture. Engaged employees are committed and bring high energy and enthusiasm. What could be better than that? Of course, the leader needs to keep the fires of engagement stoked. The quality of direct management and top leadership is the No. 1 factor in keeping people engaged. Great managers are approachable; they welcome input, suggestions, questions, and even

PROFESSIONAL INSURANCE AGENTS MAGAZINE 26

criticism. Engaging team members in dialogue and brainstorming sessions is an excellent way of showing that personal opinions are valued. Also, understanding an individual’s personality style will help the manager provide just the right amount of support, structure, and communication.

No. 1: Communication. Most problems in the world—in business interactions, interpersonal relationships, etc.—are caused by people’s inability to communicate effectively. It might be the lack of communication, poor communication, or even just a simple lack of understanding and a mismatch of communication styles. The ability to communicate with team members effectively is crucial for managing an insurance agency. You can’t be an effective team if everyone isn’t on the same page and working toward the same goals. Sharing information, ideas, and feedback not only keeps people on the same page, but it keeps them engaged and committed to the outcome. Communication is powerful because it improves not only the accomplishment of tasks, but also morale. You cannot have a winning team or a positive culture without communication. In fact, you’ll see it pop up as a foundational soft skill in most jobs.

How do you learn these soft skills?

Anyone who wants to can commit time and effort to learning a specific hard skill (e.g., a new computer program). However, it is a bit more complicated to learn how to communicate, engage, motivate, resolve conflict, and coach people— especially when every person on the

team is different and every manager is different. It’s a dynamic process that requires adaptability.

Of course, some people automatically have a natural talent for interpersonal interactions that allows them to succeed in most team settings. No matter what the challenges are or the makeup of the team, this person just seems to know what to say to make it work.

On the flip side, many of us have a nice share of these natural attributes, but we haven’t sharpened the necessary soft skills yet. Most leaders need to make a conscious effort to use their talents to be better at interpersonal dynamics. You might be a new manager who is not yet an expert at communicating clearly or motivating team members, but you’re confident, expressive, and willing to learn from your mistakes. It could be a matter of taking advantage of any professional and personal growth opportunities that come your way.

Developing new leaders

If you are an agency leader looking to hire a candidate in the hopes of quickly promoting him or her to a team leader role, it may take a little longer than you planned to develop the person for the position. Someone who has never empowered others, managed conflict, or engaged a team needs to learn how to do so. This person might start with understanding the process for each soft skill. It also helps new leaders to get a handle on themselves to interact more effectively with others. Self-awareness is a powerful tool.

One way to do that is through a personality assessment. Assessments are a great way to pinpoint natural tendencies. This gives you the power to easily evaluate, coach, and develop soft skills in a way that resonates with the new manager’s communication and learning style.

Understanding the traits, preferences, and motivational needs of your employees gives you the data to lead your team to greatness.

Sheaffer is chief product officer at The Omnia Group, an employee assessment firm providing the power of behavioral insight to help organizations make successful hires and develop exceptional employees. She is a subject-matter expert in using Omnia’s eight columns as a tool to make more-informed hiring and development decisions and effectively engage staff. Sheaffer works directly with clients and Omnia staff to provide a deeper understanding of how to use personality data to meet business goals. PIA members receive a complimentary behavioral assessment. For more information, visit www.OmniaGroup.com, email info@omniagroup. com, or call (800) 525-7117, and don’t forget to mention your PIA membership.

PIA.ORG 27

If you are an agency leader looking to hire a candidate in the hopes of quickly promoting him or her to a team leader role, it may take a little longer than you planned to develop the person for the position.

Our member agencies are independent, but never alone! Relationships/People

SIAA is dedicated to the creation, growth, retention, and evolution of the local independent agency.

Through relationships built with good people and helping them evolve their agencies by using technology, many of our member agencies achieve a level of success that previously seemed out of reach.

What are the benefits of membership with SIAA?

Member agencies…

•Have access to 5 ways to get paid

•Own their books of business

•Collectively write over $12.5 billion in total premium

•Receive insights and favorable pricing on digital tools needed to evolve and succeed

To learn more about how your agency can benefit from joining SIAA (things like income and value), contact us today.

info@siaa.com | siaa.com

Digital/Technology Success

CURTIS M. PEARSALL, CPCU, CPIA President, Pearsall Associates Inc.

Boost your agency’s defense with disclaimers

Your agency proposal is an admissible document. This means at the time of an errors-and-omissions claim, both attorneys—the one defending your agency and the one suing your agency—have a right to review it, to evaluate whether the agency proposal helps or hurts their position.

Disclaimers in your proposal can help provide an element of protection that could be material enough to help determine the outcome of a claim—and are not limited strictly to property/casualty proposals. Here are seven examples:

No. 1: Information contained in this proposal is intended to provide you with a brief overview of the coverages provided for reference purposes only. It is not intended to provide you with all policy exclusions, limitations, and conditions. The precise coverage afforded is subject to the terms, conditions, and exclusions of the policies issued.

This type of disclaimer is designed to alert the client that the proposal is not a substitute for the policy when determining coverage issues.

No. 2: Specimen forms are available upon request.

While it is preferable to include the specimen forms, many can be lengthy. This disclaimer advises clients that the actual forms that will be part of the policy will be provided if they wish to see them. This takes on heightened importance on coverages, such as cyber, employment practices liability, direc-

Design+Print

tors & officers, and E&O, where there is no real standardization of the forms. In addition, coverages written through the excess-and-surplus marketplace typically are customized to only provide the coverage the carrier desires.

No. 3: Higher liability limits may be available. Please let us know if you would like a quote for increased limits. When your agency is quoting limits, the client should know that the limits noted on the proposal are not the only limits available.

No. 4: In evaluating your exposures to loss, we have depended upon information provided by you. If there are other areas that need to be evaluated prior to binding coverages, please bring them to our attention.

This disclaimer notes that it is the client’s responsibility to notify the agency of other issues of concern. What’s more, the client is responsible for providing the agency with accurate information. For example, what if the client fails to advise you that he or she allows employees to use their personal vehicles for business purposes, or that the client has just bought a dog or put an addition on the house?

No. 5: Exclusions and Limitations include, but are not confined to, the following: (list some key exclusions).

PIA.ORG 29

E&O

(800) 424-4244 | design.print@pia.org | pia.org/design&print

PIA Design & Print offers a one-of-a-kind relationship between you, your brand, and our diligent, creative and unique team of hardworking professionals whose top priority is building your business.

You are important to us—let us show you!

Virtually every insurance policy has exclusions, and many have limitations. Listing them could prompt discussion on what coverage is necessary to address those exclusions. This creates a sales opportunity, as the disclaimer notifies the client that not everything is covered.

No. 6: The rates quoted for these benefits may be subject to change based on final enrollment and/or final underwriting requirements. This is a common disclaimer used in benefit proposals and is designed to place responsibility on the client to notify the agency if there have been any changes to the census data provided previously.

No. 7: This policy is written by a surplus-lines insurer and is not subject to the filing or approval requirements of the (specific insurance department). Such a policy may contain conditions, limitations, exclusions, and different terms than a policy issued by an insurer granted a Certificate of Authority by the (specific insurance department). The insurer has been approved as an eligible surplus-lines insurer, but the policy is not covered by the (specific state) Insurance Guaranty Fund. This could be a key disclaimer if the E&S lines carrier becomes insolvent.

Bottom line

Many agents are sensitive to the length of their insurance proposals. While lengthy proposals are an issue, including the necessary disclaimers in your proposals can make the difference in whose favor a judgment goes if an E&O claim occurs.

Pearsall is president of Pearsall Associates Inc., and special consultant to the Utica National E&O Program.

Utica National Insurance Group and Utica National are trade names for Utica Mutual Insurance Company, its affiliates and subsidiaries. Home Office: New Hartford, NY 13413. This information is provided solely as an insurance risk management tool. Utica Mutual Insurance Company and the other member insurance companies of the Utica National Insurance Group (“Utica National”) are not providing legal advice, or any other professional services. Utica National shall have no liability to any person or entity with respect to any loss or damages alleged to have been caused, directly or indirectly, by the use of the information provided. You are encouraged to consult an attorney or other professional for advice on these issues. © 2023 Utica Mutual Insurance Company

PROFESSIONAL INSURANCE AGENTS MAGAZINE 30

Lawyers

(800) 4 40-9932 www.4lawyersinsurance.com

Professional Liability Coverage

insurance

If you have law firms as clients, you know they have unique insurance requirements that can’t be covered by a standard general liability policy. We can help you help them. Parsons & Associates has programs designed to help you cover your clients’ unique

needs.

Group 534: Almost all construction classes eligible

Group 533: Woodworkers, lumberyard, and building material dealers

Group 501: Plumbing, heating, cooling, and steamfitting contractors

Maximum up-front discount for qualified members

50% of the service fee paid to brokers for the first three policy terms!*

Unbroken string of dividends since group’s inception!

Group members are not another policyholder! At Hamond, our staff averages over 40 years of workers’ compensation experience! Knowing your client’s business and exposure Assisting with payroll audits Attendance at audits upon request Assisting employers with claim filing Working with the carrier to assure proper claim handling Hearing and testimony support including pre‑hearing interviews with witnesses Assisting with underwriting and billing issues Assisting with OSHA issues and training Safety audits and risk management Development of safety programs, both corporate

site-specific Development of COVID 19 workplace

programs Hamond Safety Management included service checklist Excellence Direct quote requests to: (800) 285-2258 • Fax: (516) 488-2167 info@hamondgroup.com • hamondgroup.com

and

compliance

Underwritten by New York Insurance Fund *Service fee on subsequent renewals and on our returning members at our usual 20%.

Real Dividends! $317 Million Paid

“Friedlander’s willingness to help and vast knowledge of Workers’ Compensation is second to none. They go above and beyond to help our clients which makes my agency shine. Thank you Friedlander Group for not only making our agency happy…but our clients too!”

Walter A. Sierra President

W. A. Sierra Insurance Agency

5 Fairlawn Drive, Suite 302 Washingtonville, Ny 10992

Restaurants

Hotels

Oil

Social Services

Residential Care

Safety Group #551*

Restaurant Group of NY, Workers’ Comp. Safety Group #556*

average dividend since inception in 1993

Hotel Group of NY, Workers’ Comp. Safety Group #578*

25%*

30%*

Oil Dealer Group of NY, Workers’ Comp. Safety Group #582*

2020-21 35%**

2019-20 35%*

2018-19 30%*

20% Average dividend since inception in 2010

Social and Health Services Group of NY, Workers’ Comp. Safety Group #585*

2020-21 35%**

2019-20 25%*

2018-19 20%*

19% average dividend since inception in 2011

Residential Care Group of NY, Workers’ Comp. Safety Group #586*

2021-22 35%**

2020-21 30%**

2019-20 25%*

16% average dividend since inception in 2012

2023 Bonus 50% of fees for first two policy periods Wholesale 4310 Greeting Card Dealer 7390 Beer/Ale Dealer 7999 Hardware Store 8018 Wholesale Store/NOC 8021 Meat, Fish Dealer-Wholesale 8032 Dry Goods, Clothing, Shoe 8047 Drug Store 8048 Fruit & Vegetables 8111 Plumbers Supplies Dealer-Wholesale Restaurant 9061 Clubs 9071 Full Service Restaurants 9072 Fast Food Restaurants– Including Drivers 9074 Bars & Taverns Social and Health Services 8854 Home Health Care – Prof. Employees 9051 Home Health Care – Non Prof. Employees 8857 Counseling – Social Work – Traveling Oil and Gas Dealer 5193 Oil Burner Installation 8350 Fuel Oil & Gas Dealer 8353 Gas Dealers, LPG & Drivers Retail 2003 Bakeries 7998 Hardware Store 8001 Florist Store 8006 Food/Fruit/Deli/Grocery 8008 Clothing/Shoe/Dry Goods 8013 Jewelry Store 8016 Quick Printing 8017 Retail (Not Classified) 8031 Meat/Fish/Poultry Store 8033 Supermarkets 8039 Department Store 8043 Retail (including Food) 8044 Furniture Store 8046 Auto Accessories 8072 Book/Music Store 8105 Leather Store 8382 Self serve gas w/conv. store Residential Care Facilities 8864 Developmental Organizations 8865 Residential Care Facility 9063 Senior Citizen Centers Hotel/Motel 9052 Hotels NOC 9058 Restaurants in Hotels *Underwritten by the State Insurance Fund Ask about low DBL rates exclusive to safety group members, underwritten by ShelterPoint Life Insurance Company, Great Neck NY Call Cosmo Preiato at (800)394-7004 ext. 203 Fax: (914)694-6004 e-mail: cosmop@friedlandergroup.com 2500 Westchester Avenue, Suite 400A Purchase, New York 10577 www.friedlandergroup.com Safety and Workers’ Compensation Strategies To Unleash Productivity and Profits Featuring insightful interviews with experts, including Paul O’Neill, the 72nd Secretary of the U.S. Treasury by Adam Friedlander, now on Amazon https://safetyandworkerscomp.com/ Up to 45% savings upfront with up to 35% advance discounts and NYS Assessment deferrals until dividends for first two periods.

paid to

Brokers Online Video: www.friedlandergroup.com Retailers Retail Group of NY, Workers’ Comp. Safety Group #544* 2021-22 40%** 2020-21 40%** 2019-20 40%* 36% average dividend since inception in 1992 Wholesalers Wholesale Group of NY, Workers’ Comp.

2020-21

2019-20

2018-19 27.5%** 31%

dividend

Fees

560

35%**

27.5%**

average

since inception in 1993

2018-19

36%

2020-21 40%** 2019-20 35%*

35%*

2019-20

2018-19

20%

2020-21 35%**

average dividend since inception in 2006

Dealers

*5% applied to increase the renewal advance discount. **10% applied to increase the renewal advance discount.

The Workers’ Compensation Leader

Have a question? Ask PIA at resourcecenter@pia.org

File disposal, ERISA pre-emptions and more

Who can be a sublicensee?

Q. Our agency is a corporation licensed for property/casualty. We want to obtain a life insurance license for the corporation so it can accept shared commissions from another agent. One of our employees is licensed for life, but none of the corporate officers or directors hold a life license currently. Can we make the employee the sublicensee for purposes of obtaining the life license for the corporation?

A. No. Employees are not eligible to be sublicensees. Only qualified officers, directors or (in the case of LLCs) members or nonmember managers (depending on the organizational form of the business) can be a sublicensee.

—Bradford J. Lachut, Esq.

Public adjusters and brokers

Q. What are the rules governing referral fees paid by public adjusters? Are they required to pay brokers for referring clients to them?

A. Public adjusters are regulated by Regulation 10 (Part 25). This regulation [Section 25.3(b)] prohibits public adjusters from paying anything to any person or firm for referring business to them unless the person or firm is:

1. licensed as a public adjuster;

2. licensed as a broker and was the broker of record in placing the insurance policy against which the claim is being made; or

3. licensed as a broker and was designated to act for the insured in writing before the loss occurred.

This regulation does not require public adjusters to pay a broker anything for referrals; rather, it allows them to pay the broker-of-record or another broker if the broker was authorized, in writing, to act on the insured’s behalf before the loss occurred.

—Bradford J. Lachut, Esq.

Florida nonresident–receiving commissions

Q. We have a producer in our office who is licensed in Florida as a nonresident. One of this producer’s clients is asking our agency to write a residential property in Florida. Our agency does not hold a Florida nonresident license. If we wanted to write the business and get a commission, would the agency need to have a Florida nonresident license?

A. Whether your agency would need a nonresident license in Florida would depend on if you plan on transacting insurance in the state of Florida or merely splitting commissions with the Florida-licensed producer.

Under Florida law, an insurance agency that is licensed and located in another state is required to be licensed as an agency in Florida, if it plans on transacting insurance in that state. Pursuant to Section 624.10, Florida Statutes, transacting with respect to insurance includes any of the following:

1. solicitation or inducement;

2. preliminary negotiations;

3. effectuation of a contract of insurance; or

4. transaction of matters subsequent to effectuation of a contract of insurance and arising out of it.

Therefore, if your agency plans to do any of the above (which basically includes any type of sale or providing service to a policy) for the potential client in question, a nonresident license would be required.

However, you will notice that receiving a commission is not included in the definition of transacting insurance found above. Florida permits a licensed agent to share commissions with an unlicensed agent/agency. As such, if you

PIA.ORG 33 ASK PIA

PIA TECHNICAL STAFF

were to have the Florida-licensed producer in your office write and service the business on his own, he could split the commissions with your agency without the need for your agency to obtain a Florida nonresident license.

Please note that if you were to go this route, then your agency could not be involved in providing service to the account without first becoming licensed in that state.

—Bradford J. Lachut, Esq.

Disposal of client files

Q. What would be the best way to dispose of client files when they contain private information (e.g., Social Security numbers or federal ID numbers)? Is recycling at the local center acceptable or is it best to shred the documents?

A. The Federal Trade Commission issued federal rules that require any person who maintains or otherwise possesses consumer information for a business purpose to dispose of such information properly by taking reasonable measures to protect against unauthorized access to or use of the information in connection with its disposal (see FACTA Disposal Rule and Gramm-Leach-Bliley Safeguards Rule 29 Fed Reg. 68690).

Examples of proper disposal would include burning, pulverizing or shredding of papers so that information cannot be read or reconstructed. Another method of disposal would be to contract with another party engaged in the business of record destruction. If this method is chosen, you would have to take appropriate measures or due diligence to make sure the disposal company is competent and disposes of information in accordance with the rule.

The FTC has outlined additional information, which can be found on its website (bit.ly/3xjJlxx and bit.ly/3jMXBff).

Additionally, if you do business in New Jersey or New York state, these states have state-specific document destruction laws, see N.J.S.A. 17:23A-4 and 11 NYCRR 420, respectively.

Additionally, New York state’s cyber security regulation requires that all covered entities establish a data-retention policy to ensure they are not holding onto personal information longer than needed. Learn more on the issue by accessing Establishing your data-retention policy—how to comply with NYCRR 500.13: limitations on data retention in the PIA QuickSource library.

—Bradford J. Lachut, Esq.

ERISA pre-emption

Q. We are trying to help a client with a health claim. The family is insured under a self-insured health trust based in Pennsylvania—even though they reside in New York state. Do New York state’s minimum benefit standards apply?

A. They do not. Self-insured health plans are exempt from state Insurance Law under the Employee Retirement Income Security Act pre-emption. The only factors that could determine minimum benefits for an ERISA plan would be any relevant prior case law in federal courts for the district in which the plan is based and the 2010 Patient Protection and Affordable Care Act.

—Helen K. Horn, CIC, CPIA, CISR

Audit premium for ‘inadequate’ subcontractor limits

Q. We wrote a commercial general liability policy for a contractor with a $500,000 liability limit. He engaged a subcontractor with only $300,000 in liability coverage. According to the insurance company, the subcontractor’s limits must match our CGL limits or, upon audit, it will charge for the subcontractor as if he had no insurance of his own. Is this right?

A. Yes, the company can do this. Check the general liability classification table in the ISO manual, which shows the various classifications for contractors. In the notes for contractor classes that contemplate the use of subcontractors, it clarifies that “determination of adequacy of (subcontractors’) insurance shall be made in accordance with criteria established by the company prior to policy inception.” Apparently, the company considers a subcontractor’s coverage to be inadequate if the limits do not match the insured contractor’s limits.

The notes also establish that, if the subcontractor’s coverage is deemed inadequate, the company may charge an audit premium according to the relevant specific classification for the subcontractor’s operation, rather than using one of the “subcontracted work” classifications.—Dan Corbin, CPCU, CIC, LUTC

PROFESSIONAL INSURANCE AGENTS MAGAZINE 34

PIA’s Annual Conference at the Hard Rock Hotel in Atlantic City. Amp up your insurance knowledge, connections, and business.