Industry challenges may lead to growth opportunities

PAGE 16

The Picture Big

January 2023 • New Hampshire IN THIS ISSUE 9 Cost of data breaches 13 Cross-selling strategies 23 Merger counseling

Happiness is homemade.

Give your customers a recipe for success with The Concord Group’s Home and Auto coverages.

Your policyholders deserve peace of mind with customized coverages from The Concord Group. With a wide range of optional enhancements, we offer policies to meet their needs and protect what matters most.

Find out more at ConcordGroupInsurance.com

16

23

More to a merger than an agreement

Consider corporate culture

Statements of fact and opinion in PIA Magazine are the responsibility of the authors alone and do not imply an opinion on the part of the officers or the members of the Professional Insurance Agents. Participation in PIA events, activities, and/or publications is available on a nondiscriminatory basis and does not reflect PIA endorsement of the products and/or services.

President and CEO Jeff Parmenter, CPCU, ARM; Executive Director Kelly K. Norris, CAE; Communications Director Katherine Morra; Editor-In-Chief Jaye Czupryna; Advertising Sales Executive Calley Rupp; Senior Magazine Designer Sue Jacobsen; Communications Department contributors: Athena Cancio, David Cayole, Patricia Corlett, Darel Cramer, Anne Dolfi and Lily Scoville. Postmaster: Send address changes to: Professional Insurance Agents Magazine, 25 Chamberlain St., Glenmont, NY 12077-0997.

“Professional Insurance Agents” (USPS 913-400) is published monthly by PIA Management Services Inc., except for a combined July/August issue. Professional Insurance Agents, 25 Chamberlain St., P.O. Box 997, Glenmont, NY 12077-0997; (518) 434-3111 or toll-free (800) 424-4244; email pia@pia. org; World Wide Web address: pia.org. Periodical postage paid at Glenmont, N.Y., and additional mailing offices.

©2023 Professional Insurance Agents. All rights reserved. No material within this publication may be reproduced—in whole or in part—without the express written consent of the publisher.

COVER DESIGN David Cayole Vol. 67, No. 1 January 2023 January 2023 • New Hampshire

STORY

COVER

The big picture Industry challenges may lead to growth opportunities

FEATURE

DEPARTMENTS 4 In brief 9 Legal 13 Sales 29 E&O 31 Ask PIA 34 Readers’ service and advertising index 35 Officers and directors directory

Technology trend:

Infrastructure shifts to value realization

Insurance carriers are seeing the benefits of InsurTech especially for underwriting, claims and online distribution. However, there also are customer-facing functions, which will help with the shift to value realization. As carriers adapt more cloud-based options this will help the insurance industry become more customercentric. Focusing on micro-improvements to utilize cloud applications specific to the industry and their business could be a great next step in InsurTech evolution in 2023 and beyond.

Business trend:

Climate-related weather events are expected to cost businesses

$1.3 trillion by 2026.

76% of consumers say they will stop buying from companies that treat the environment, employees, or the community in which they operate poorly.

Benefits of diversity in the workplace

Increased:

Perspectives

Creativity

Improved:

Employee engagement

Hiring results

Better:

Decision making Company reputation

Lower:

Employee turnover

Value realization: When customers understand the value they achieve from using a product or service.

Micro-improvements: Small improvements over time can make a major imprint on the health and vitality of a business.

Embrace environmental, social, and governance

What do people mean when they say environmental, social, and governance objectives? This refers to integrated frameworks in an organization’s business strategy. These frameworks create value by expanding the organization’s objectives. These objectives include: the identification, assessment and management of sustainability-related risks and opportunities for all the organization’s stakeholders (including but not limited to customers, suppliers and employees) and the environment.

How this will affect the insurance industry.

As people become more aware of environmental and society impacts, insurance companies will be judged less by their annual sustainability reports and more by the initiatives that are designed to limit their company’s impact on climate change, other environmental risks, and their impact on society.

Diversity, equity and inclusion efforts

Diversity initiatives have been growing in the insurance industry. However, there is a large gap in diversity in the industry—specifically at the executive level. Those in the insurance industry will benefit from establishing initiatives that diversify their workforce and their client base. In the new year, look to increase access to products and services in underserved communities and market segments; develop protocols to allow for a wider range of voices to be heard by leadership; and create an inclusive organizational culture.

According to S&P Global Market Intelligence: In 2020, non-white employees (including Black, Asian and other racial minorities), totaled 21.4% of the workforce at U.S. insurance companies—up from 19.8% in 2018, and 15.3% in 2010.

IN BRIEF

DEFINITIONS

4 PROFESSIONAL INSURANCE

AGENTS MAGAZINE

PIA Northeast Executive Director Kelly Norris, CAE

How would you describe PIA Northeast’s workplace culture?

PIA is a customer-service driven organization in which every employee works together to achieve our goal—to provide the best possible experience for the members we are privileged to serve.

I always tell new employees that we are corporate, but not cut-throat. We all help each other produce the best possible products and services in the industry.

As the executive director of PIA Northeast, what’s a normal day for you look like?

When you manage five organizations across the Northeast region, no two days are the same. Each board is different in every single way!

The constants in my daily routine at PIA Northeast include, communicating with the leadership of each state and our dedicated staff members who support their initiatives. We have events and projects happening all the time, and it takes our whole team to make them successful. Whether it is legislative and regulatory matters, education, events or our publications—we all work together to make them happen.

You joined PIA in 2012, how has the association changed since then?

Wow, so much has changed—especially since the pandemic. We have really adapted and thrived in a hybrid-work environment, which was never an option prior to 2020.

From a global perspective, I think we are more focused and guided by the four pillars of our value proposition— Information, Education, Legislation and Preservation.

We also have a stronger relationship with our national affiliate, which offers a lot of value to our members.

What’s your favorite thing about working for PIA?

Without a doubt the people. We have the greatest staff members who make coming to work each day a pleasure. Plus, our volunteers are passionate and engaging and help us succeed on every level. I feel very lucky to be

surrounded by such talented and dedicated people who inspire me every day.

What projects are PIA Northeast working on now? How will they benefit PIA members?

We are working on some exciting new initiatives, including: an immersive and fully digital new member on-boarding program, which will improve and modernize the initiation for new members of PIA and make it easy to access all the benefits of PIA membership.

We also are working on a new cyber security product that will walk our member agents through a cyber attack scenario, and it will give them a playbook to follow should a cyberattack happen to them.

Why is it important for PIA members to take an active role in their association? How can they get involved in PIA?

That’s a great question because it is so important to get involved! Without exception all the volunteers who I have worked with at PIA have acknowledged that they get so much more out of their membership by participating.

It is so gratifying to work with your peers to solve problems that you are experiencing in your business. With the assistance of our amazing staff, there is no limit to what we can accomplish! To get involved in the association, call me at (800) 424-4244!

Final thoughts?

I have been in the association-management business for more than 30 years and I am consistently amazed by the loyalty and dedication of the volunteers who comprise our boards. They truly believe in the mission and vision of PIA and work tirelessly to keep us current, timeless and relevant. It’s a valuable and effective partnership.

Thank you for your commitment to our association. I hope everyone had a wonderful and safe holiday season. Welcome to 2023, where PIA Northeast will continue to offer the benefits and services that will help professional independent agents thrive in this year and beyond.

Kelly Norris, CAE Executive Director

5 PIA.ORG FIVE MINUTES WITH …

PIA Northeast

What PIA membership means and how it helps you

PIA’s mission is to recognize, meet, and advance the diverse needs of its membership in Connecticut, New Hampshire, New Jersey, New York and Vermont, and influence the industry by providing the very best education, information, advocacy, and protection possible.

PIA’s vision is to be an innovative industry leader that will use its vast knowledge, resources, and expertise to advance the independent agency system. Here is an overview of your association and how it serves your agency.

The four pillars

To help PIA achieve its mission, it established its four pillars to provide the foundation for its goals:

Pillar No. 1: Information. PIA Northeast is the authoritative source of information relevant to the insurance industry and its members. It is a trusted source in providing factual and relevant information to members, policymakers, and stakeholders in the insurance industry. The Industry Resource Center provides information for member agents whenever they need it, eliminating hours of research by agents and brokers.

Carrier rating change notifications. PIA members can receive alerts on rating and outlook changes to represented carriers. To take advantage of this PIA member benefit, contact the PIA Industry Resource Center. Compliance. It’s difficult to keep up with all the changes in the industry. PIA provides notifications, tools, and training for agents to comply with the regulations and requirements of doing business.

Publications. Award-winning magazines, newsletters, and resources help members stay on top of industry trends. For the latest information, visit www.blog.pia.org.

State-specific information. PIA tracks business and compliance issues in individual states, so agents can access the most relevant information for where they operate.

Pillar No. 2: Education. PIA Northeast helps grow the skills and knowledge of insurance professionals through nationally recognized instructors and designations. PIA develops and delivers relevant education through multiple platforms—including on-site classes, webinars, and class series, as well as complying with all license requirements. See PIA’s education schedule, visit www.pia.org/EDU.

Nationally recognized designation programs (CIC, CISR, CPIA). PIA Northeast works with nationally

recognized instructors and industry leaders to provide sought-after designations. The programs are designed to grow the skills and knowledge-base of agents.

Pillar No. 3: Legislation. Advocacy at the state and national levels ensures PIA members’ voices are heard by lawmakers and regulators alike.

Building relationships with legislators. PIA members meet with state and federal lawmakers to build relationships and credibility. They advocate for the independent agency system and for the protection of their clients.

Compliance. PIA works with legislators and state agencies on issues of compliance and regulation—making sure members’ needs are taken into consideration.

Lobbyists and political action committees. Four state lobbyists interact daily with decision makers to advocate on behalf of members. Its non-partisan political action committees support candidates and elected officials who advance the independent agency system.

Pillar No. 4: Preservation. PIA Northeast delivers products and services specifically designed for insurance professionals to protect and grow their businesses.

E&O coverage. PIA works with quality carriers to provide excellent coverage for their business. The association has a 50-year exclusive relationship with Utica National Insurance Group. For a free quote, go to www.pia.org/quote/ errorsandomissions.php. PIA also offers unique umbrella coverage that goes over an agency’s E&O policy.

Cybersecurity. TAG Solutions’ insurance industryspecific cyber program was developed exclusively for PIA members, and it exceeds current regulatory standards. www.pia.org/quote/cyber.php.

Hartford Flood offers PIA members access to flood insurance for their commercial- and personal-lines clients.

PIA Design & Print offers a collaborative design experience tailored for small businesses, insurance agencies and associations. www.pia.org/design&print.

PIA and AVYST provide InsurTech sales and risk management solutions. avyst.com/partnerships/pianortheast.

Young Insurance Professionals. Dedicated to developing tomorrow’s leaders in Connecticut, New Jersey and New York. PIA members receive one year of complimentary YIP membership for someone in their agency.

Questions about how your PIA membership serves you? Call (800) 424-4244 or email pia@pia.org.

PROFESSIONAL INSURANCE AGENTS MAGAZINE 6 ASSOCIATION NEWS

WE PICTURE THE WORST FOR YOU. WHOLESALE BROKERAGE | BINDING AUTHORITY | EXCLUSIVE PROGRAMS JencapGroup.com

Brooks Insurance Agency is proud to support Professional Insurance Agents (PIA)

Since its founding in 1991, Brooks Insurance Agency has successfully serviced the standard markets and brokered distressed and complex lines of business. We are here to help agents find the coverage their clients need.

We represent 80+ quality carriers, including several new and exciting markets, across the country. Plus, a broad array of products and services in admitted and non-admitted markets.

MARKET STRENGTHS AND EXPERTISE

• Broad market reach

• High-touch broker specialists

• Easy, online quoting process

• Collective approach to complex insurance needs

Visit our website at www.brooks-ins.com.

Brooks Group Insurance Agency, LLC NJ License 1575143

BROOKS IS YOUR FULL-SERVICE WHOLESALER How can we help you? Call us at 732.972.0600 or email us at info@brooks-ins.com © 2023 Brooks Insurance Agency, LLC is a wholly-owned subsidiary of Venbrook Group, LLC. All rights reserved.

CLARE IRVINE, ESQ. Government affairs counsel, PIA Northeast

Understanding the true costs of data breaches

In the novel and movie, The Martian , an astronaut stranded on Mars digs up a case of plutonium to use as energy. The team had buried the plutonium far from their camp with a flag marking its location due to the risk of the plutonium leaking or the cannister developing even a small crack. When evaluating his needs for an unexpectedly long stay on Mars, astronaut Mark Watney decides he needs the heat enough to drive around with the plutonium in his vehicle.

Managing customer data in 2023 has a similar calculus. It’s necessary for businesses of all sizes to manage computerized data for their clients, but the risks can be tremendous. Industries that manage data and finances may have specific regulations and statutes that require certain protective measures to reduce the risks of a data breach.

Has your cluster lost its luster? Alpha Northeast can bring it back.

Partnering with us means that you can grow your business and continue doing what you do best.

And, we’re an affiliate of the nation’s second largest insurance agency network, ISU Insurance Agency Network—so you’ll get to work with some of the best regional and national carriers around.

When you combine forces with us:

You’ll be eligible for a 100% commission payout from noncontracted carriers and profit share from first dollar.

You’ll have greater opportunity to maximize the benefit of networking with other agencies—which means more underwriting clout and increased profit share.

You’ll have access to the top national and regional carriers.

If you choose to leave the network, you’ll face zero penalty—but we bet you’ll stay.

Insurance producers are subject to several such laws, including the Gramm-Leach-Bliley Act and state data security laws (for more information, see PIA Magazine’s December Tech article). As cumbersome and difficult as compliance may sometimes feel to agents, having clear requirements that require regular reviews and updates to data security system does put agents and producers ahead of many industries when it comes to data compliance.

PIA.ORG 9 LEGAL

www.isu-alphane.com

With Alpha Northeast, your agency will shine brighter than ever. And let’s be honest—you deserve it.

Many other businesses do not have statutory or regulatory data security requirements, including many of the businesses insured by independent agents. That does not exempt these businesses from legal exposures in the event of a data breach. By collecting and storing data from customers and third-party partners, all businesses leave themselves exposed to legal liability following a data breach. The two key areas would be tort liability and violation of a contract.

Tort law

Those in the legal profession use tort law to settle disputes that do not have a clear applicable statute or regulation to determine who is at fault. It’s the adult equivalent of siblings bringing a fight to a parent to decide the outcome, but with far more money on the line for everyone—especially the lawyers. In tort law, plaintiffs must show that the defendant had a duty toward the plaintiff before they can argue the defendant harmed the plaintiff by violating such duty. In contrast, other civil cases and all criminal charges cite a specific law the defendant allegedly violated without needing to prove the law exists.

Any customer potentially could argue that a business has a duty to take reasonable steps to protect sensitive consumer data even when no cyber security law applies. Several parties already have sued businesses for data breaches in federal courts across the country. Courts have agreed with the plaintiff’s argument that defendants could be liable for damages if a malicious third party intentionally targets the defendant’s business and obtains nonpublic information.1 It has become a developing issue facing federal courts as more data breaches lead to lawsuits.

Another important legal question in such lawsuits is whether the company acted negligently and failed to adequately protect the data it collected. For many businesses, industry best-practice rules may become evidence in these trials to show whether they sufficiently safeguarded data. For example, the Payment Card Industry Security Standards Council creates technical and operational requirements for businesses that accept card payments from major credit card companies.2 While not exactly the law, parties may point to the guidelines as evidence of industry best practices.3 Based on a 2018 study reporting that only 39% of American businesses have complied with these guidelines, many companies may be exposed to potential liability in court should a malicious third party steal their data.4

Contracts

The potential victims of a data breach may have a contract claim against a business following a data breach. Rather than allege the business had a duty to protect nonpublic data, the victims could bring up contract clauses to cite as a violation of a legally binding agreement. Businesses working with other businesses should have a contract laying out the terms of the relationship that should include a basic framework to protect sensitive data about customers and proprietary information.

The PCI Data Security Standard does not simply lay out the standards the credit card companies expect businesses to adhere to—businesses agree in their contracts with credit card companies to adhere to the standards. Many

businesses, especially smaller ones, likely contract with a third-party to handle payment processing. The third-party processing the payments would likely have the direct relationships with the major credit card companies that make it straightforward for the small business to accept multiple cards on specific terms and would likely agree to the PCI DSS with companies such as Visa, MasterCard, and American Express, directly. The third-party payment processing company should include those requirements in contracts with the client businesses to ensure their own compliance and protect the customer data. This would legally bind the small business to the PCI DSS standards by contract.

Contractual requirements could vary in their specificity. Cyber insurance contracts may require multifactor authentication and the carrier could deny coverage if the policyholder did not have this specific security measure in place. In contrast, many contracts may refer to industry standards or regulations without including the specifics. This effectively incorporates updates to the standards or regulations without requiring a new contract. A small business’s contract with a payment processor would likely bind it to adhere to the most recent PCI DSS requirements, thus requiring the small business to adapt to changes and updates without new contracts. This carries a huge risk that a business may not update its data security plans as frequently as the standards get updated, leaving a small business exposed to a data breach and contractual penalties.

Containing the risks

Businesses really have no choice but to handle and collect sensitive

PROFESSIONAL INSURANCE AGENTS MAGAZINE 10

data—despite the (sometimes) radioactive risk. Regardless of the potential legal exposures for data breaches, the only mitigation options focus on containing the risk and potential liability. Understanding and complying with contract terms is a straightforward way to reduce legal penalties for a data breach.

Cyberinsurance also can reduce legal exposures through the contractual security requirements included in every policy.5 By establishing reasonable security measures for a company to follow, a business can get ahead of claims that it failed to protect consumer data adequately. Unlike service contracts that reference state laws or industry standards for cyber security measures, cyber insurance policies do get updated on a regular basis with requirements that adapt to the risks facing businesses. Meeting the security requirements of a cyber insurance policy helps a business significantly reduce its risk of data breach with regular mandatory updates to maintain the specified coverage.

The entire reason Mark Watney could dig up plutonium on Mars was that the crew of astronauts had brought the radioactive isotope to the red planet in the first place and took the best steps to minimize the risks that it could expose them to extraordinarily high amounts of radiation. As risky as it is for people to constantly enter private information on websites and businesses to maintain it on internal data systems, most people have decided it’s worth the potential harm from a data breach—especially if they have taken the appropriate steps to reduce the potential damage.

Irvine is PIA Northeast’s government affairs counsel.

1 McMorris v. Carlos Lopez Associates, 2021 (bit.ly/3hAxg2h)

2 American Bar Association, 2019 (bit.ly/3UPXoVc)

3 In Re Wawa Inc. Data Security Litigation, 2022 (bit.ly/3Ey3HaR)

4 Verizon, 2018 (vz.to/3OcRKdJ)

5 Remember, if you need to purchase cyber liability insurance for your agency, PIA Northeast offers a product that can help you. For more information, log on to www.pia.org/quote/cyber.php.

EverGuard, a long-term partner for your RBT business.

• Exceptional service is an EverGuard priority

• Uncompromised program loyalty

• Great coverages at competitive pricing with available A&B, Enhancement Endorsement & more

• No limit on alcohol sales

• Package Policy: Property, GL & Liquor Liability

• Entertainment considered

• Experienced & Professional Staff

EverGuard, is a superior Restaurant, Bar & Tavern market with 40+ years’ experience. Your RBT clients can depend upon EverGuard for their protection.

Our continued longevity offering an uninterrupted market assures you will receive the best product underwritten by an AM Best “A” rated carrier without program interruptions. EverGuard’s respected reputation in the RBT market speaks to our stability and reliability to provide industry leading response time and customer service to our partner agencies.

EverGuard Insurance Services

1900 W. Nickerson St., Seattle, WA 98119

EverGuard does not offer or solicit the program in the states of New Hampshire, Connecticut or Vermont.

Maher EverGuard Insurance Services VP, Business Development

PIA.ORG 11

Michael

Michael@everguardins.com 206.957.6576 everguardins.com Make 2023 The Year To Join EverGuard The Trusted Restaurant, Bar & Tavern Market Leader EverGuard Delivers Service, Stability and Experience

You’l l l ike us because t here’s nobody l ike us. Workers Compensation Insurance • No volume requirements • Competitive rates • Multiple options for premium payments • Open to Shock Loss/High Mods Send in your submissions today. For more information contact a marketing rep at 844-761-8400 or email us at Sales@Omahanational.com. [ Coverage in: AZ • CA • CT • GA • IL • NE • NJ • NY • PA Smart. Different. Better. Omaha National Underwriters, LLC is an MGA licensed to do business in the state of California. License No. 078229. Coverage is provided by Preferred Professional Insurance Company and/or Palomar Specialty Insurance Company. Coverage may not be available in all states.

Insurance renewal cross-selling strategies

You have heard the old saying from the movie Glengarry Glen Ross, that talks about the ABC’s of selling: “Always be closing.” Well, I am a firm believer in a similar concept of “Always be cross-selling.” Cross-selling is one of the most powerful tools you have as an insurance agent. Let’s explore that opportunity to cross sell.

To cross-sell insurance effectively, you need to be able to identify opportunities. One way to do this is by taking a more proactive approach. When you first start trying to cross-sell this way it can feel uncomfortable. Rest assured, you’re not the only agent who feels this way. However, with a little practice, you’ll learn to do it more naturally and effectively. The more you implement good cross-selling strategies, the easier it will get to bring up complementary and related products. Here are a few tips that can help you. That proactive approach begins with a proactive phone call to every one of your clients at least once a year. Renewal calls are like penicillin for insurance agencies in the sense that they can solve every major problem that an insurance agency has. Some of you may be asking, “What do you mean? How do renewal calls help solve agency problems?”

I’m glad you asked. More times than not you will uncover that you have bad contact information, or that the client doesn’t have enough coverage, or simply that the client’s coverage is not quite up to your agency’s standards. All these corrections not only help you update your system and sell more policies, but also become a huge value-add to your agencies. Often, this approach is called proactive retention. Instead of being reactionary to the ringing phone and upset clients, being proactive allows you to impress the client, control the situation, and cross sell more opportunities.

Look for opportunities

When you speak with a client during a renewal review call, you should look for opportunities to cross-sell. You can gather vital information, such as if your clients have policies with any other insurance agents. Even if they do, you can then get the X date, so you have that data ready to go. There are endless opportunities to cross-sell during renewals. If you keep your eyes open, you will find opportunities right underneath your nose.

You can take this time to make recommendations. Renewals represent a time when people are thinking about their insurance, and you can make recommendations, such as improving coverage up to agency standards or higher, as well as other lines of coverage you recommend. This gives you an incredible opportunity to show up and show off—by educating your prospects on why

they need your recommendations. This moves the conversation from transactional to relational. By doing this, you’ll also get the opportunity to at least quote, or plant the seed for other potential cross-sell opportunities. For example, if you were looking at a customer’s coverage and identified that he or she had home and auto coverage, but no umbrella, here is an opportunity for you to improve his or her coverage, but also get the opportunity to cross-sell. There is no shortage of ways to cross-sell when making renewal review calls. However, there is also a big opportunity for you to fall into the dangerous remarketing trap. When facing a rate increase, you might be immediately tempted to begin remarketing the policy before talking to the client. You may even hear the clients in your head asking you to remarket their coverage every time there is an increase. However, let’s stop and take a moment. Start by doing a quick review:

• Did you look at the reason for the change in rates?

• Was there something that changed in the household (e.g., driving activity, a new vehicle, a recent claim, or a protection class change)?

• Did the client have payment issues that are challenging the rate?

PIA.ORG 13 SALES

HEATH SHEARON Sales coach, Agency Performance Partners

Email> Keep these addresses handy to reach PIA electronically

General pia@pia.org

Conference conferences@pia.org

Design + Print design.print@pia.org

Education education@pia.org

Government & Industry Affairs govaffairs@pia.org

Industry Resource Center resourcecenter@pia.org

Member Services memberservices@pia.org

Publications publications@pia.org

Young Insurance Professionals yip@pia.org

• Was there an underwriting guideline update (e.g., the roof was last replaced 20-25 years ago)

• Were there weather-related issues in the area?

Take the time to investigate the reason for the increase, reach out to the customer to review the reasoning, and then act. Ask questions to get a clear picture of any changes to the risk, and then present options. If clients decline to answer these questions, that’s OK, just remind them that you were trying to help, and move on. If they answer your questions, make sure that you follow through on your promise by setting a date and time to reach back out to review the options available to them.

It’s also a good idea to remind clients that if they only have one line of business with your agency, they miss out on the most significant discount most carriers offer—the multipolicy discount. Make every renewal call special by being professional, knowledgeable, Ask open-ended questions and wait for the answer. Don’t try to answer the questions for your clients. Bring up something you might remember about them, their kids, pets, hobbies, classic car, or the last place you saw them. Customize the conversation to the type of client with whom

Make sure to refer to the existing coverage they do have and then ask where their other policies are, or if there is a note in the file that they had auto insurance with Carrier XYZ, then ask if they still have that policy. Ask when the last time the other agent reached out to review their coverage options with them. Build the relationship and be the person they want to turn to with all their insurance questions and needs. If you never ask the question, you will never know the answer. One thing is for sure, someone else will ask and get the answer. Monoline business is a race to the finish. Generally, the first person to

Cross-selling is a unique sales situation. It’s not like you have only one chance to close a deal. You’ll have several opportunities to interact with a customer, so don’t stress trying to fit everything into one conversation. That’s a surefire way to make things harder on yourself and confuse your client at the same time. Instead, be patient. By taking a proactive approach to renewals—and making proactive retention calls—you can increase the opportunity to wow your client and open the door for cross-selling opportunity.

Remember to ask questions and plant seeds along the way. The more you talk about cross-selling opportunities with your clients, the more cross-sales you’ll make. It may take a little time, but it’s well worth the effort and patience. Shearon is a second-generation insurance professional, creator of the Insurance podcast. He built a successful agency before transitioning to the carrier side. Working with hundreds of insurance agencies throughout his career as a marketing representative and consultant, Shearon has a natural ability to network and build relationships. He has parlayed that into a career in consulting with agencies all over the country in the areas of sales strategies, niche marketing, relationshipbuilding, cross-selling, customer retention, mergers and acquisitions, developing culture, and brand-building. He is a strong believer of the accountability factor in coaching and enjoys working with agencies both large and small. Reach him at Heath@Agencyperformancepartners.com.

PROFESSIONAL INSURANCE AGENTS MAGAZINE

116889

CP The Premins Company The Premins Company 132 32nd St., Ste. 408 | Brooklyn, NY 11232 • (718) 375-8300 (800)599-3279 • info@premins.com • www.premins.com 117742 1021 ✔ Credit cards for a flat $8.75 fee ✔ Debit cards for a flat $3.85 fee ✔ Free e-check ✔ Free check by fax ✔ Free auto bill pay ✔ Cash payments at CVS, Walmart and most 7-Eleven stores ✔ 24-hour online account access/management ✔ If you finance NYAIP apps, it’s time to go paperless with Premins Insurance Premium Financing with Unparalleled Payment Options Providing exceptional personalized service to the premium finance industry since 1965. OF INSURANCE PREMIUM FINANCING • OVER •

PROFESSIONAL INSURANCE AGENTS MAGAZINE 16

SAM FRIEDMAN & MICHELLE CANAAN Deloit te Center for Financial Ser vices

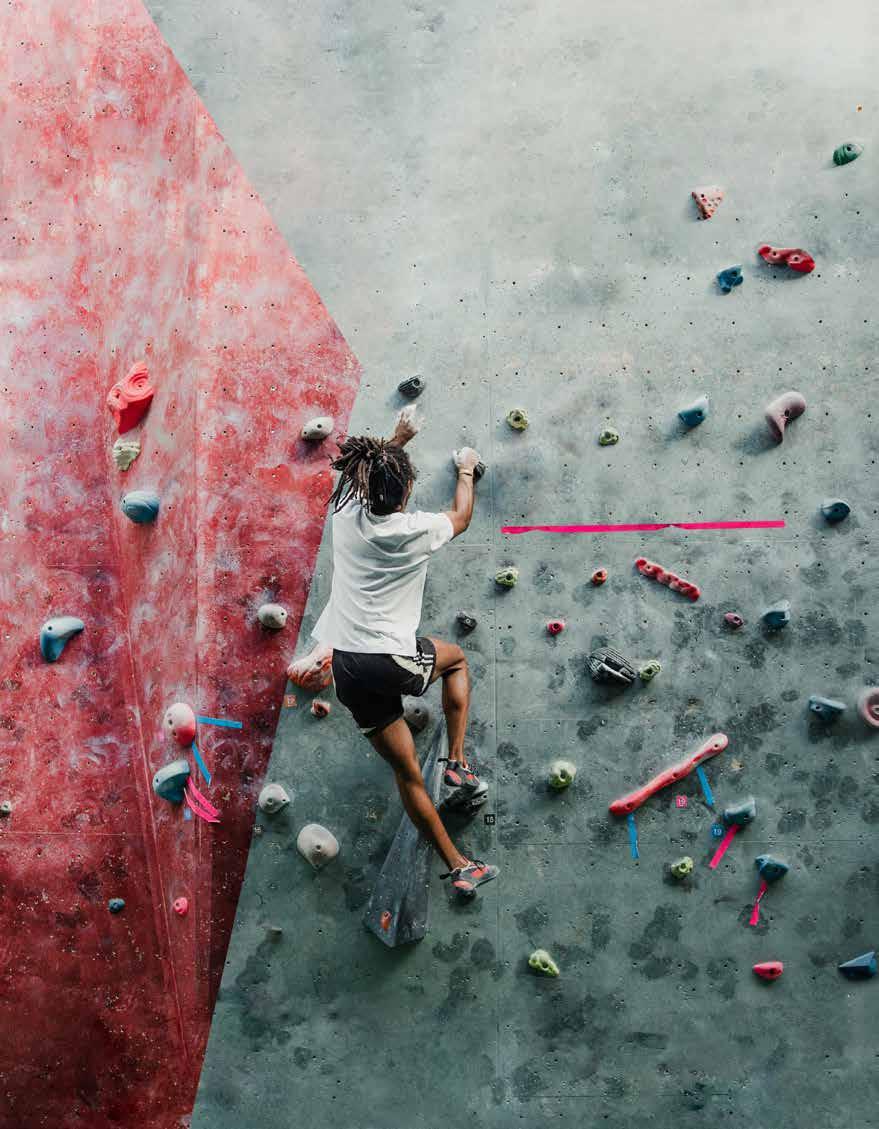

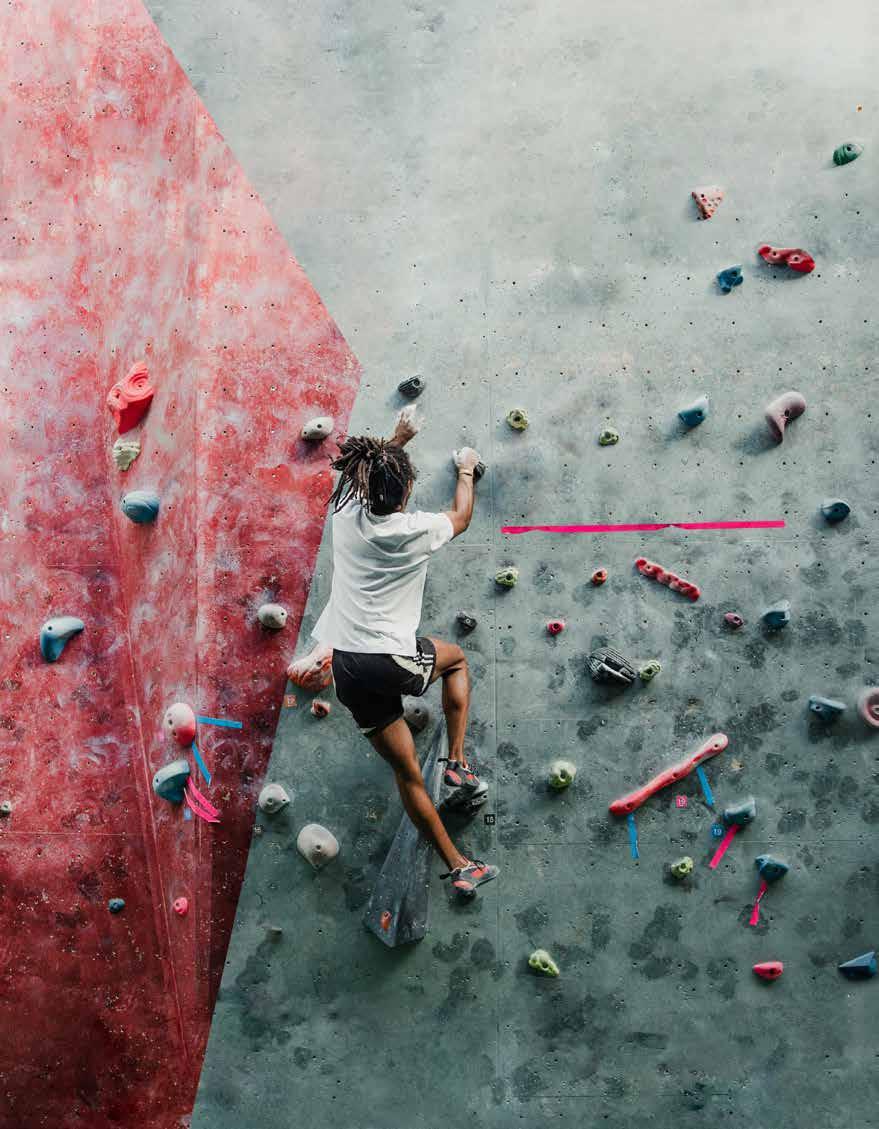

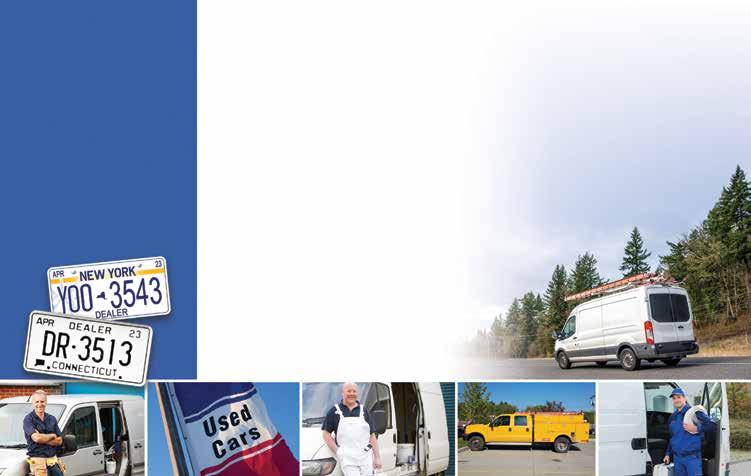

The Picture Big

Industry challenges may lead to growth opportunities

ecessity has indeed been the mother of reinvention for the insurance industry these past few years, as most carriers were remarkably adaptive and resilient in overcoming obstacles raised by the pandemic. This was likely due to all the new technology and talent put in place to upgrade systems and capabilities well before COVID-19.

PIA.ORG 17

However, it also may be due to a significant change in perspective and approach from what might be possible or useful at some point down the road, to what had to be altered immediately to stay in business during the pandemic—often under the most trying of circumstances. In such an environment, any headwinds slowing transformation initiatives often became tailwinds—particularly in accelerating technology and talent transformations. Together, these adaptations should leave most carriers better able to withstand and recover quickly from difficult situations going forward.

Yet, this is hardly the time for insurers to rest on their laurels. Rising inflation, interest rates, and loss costs, along with the looming threats of recession, climate change, and geopolitical upheaval, will likely test insurer resiliency. They also will be tested by the entry of new types of competition from InsurTechs and even noninsurance entities (e.g., e-tailers and manufacturers). Instead, insurance professionals should build upon the momentum that enabled the transition to a remote workforce and virtual client engagement nearly overnight. More fundamental adjustments should be considered to maintain an ongoing culture of innovation while making customer-centricity the focal point of the industry’s standard operating model.

Growth opportunities

Cultural changes also are likely called for in how those in the insurance industry: 1. recruit, retain, and optimize talent; 2. engage with customers in customizing and distributing products and services; and 3. reconcile society’s overriding environmental, social, and governance priorities with their own traditional top- and bottom-line considerations.

There are growth opportunities as well as a variety of challenges facing insurers in an increasingly volatile economy. However, looking at the big picture, in 2023 the industry will likely have to account for a number of cross-industry agenda setting trends in human capital, technology, and sustainability—all areas that could ultimately turn out to be competitive differentiators.

Inflation

Raising revenue hasn’t been an issue for most nonlife insurers, thanks to some of the highest property/casualty rate increases posted in years—although not all product lines and individual country markets experienced the same growth levels. For example, generally, commercial lines saw more robust growth than personal lines, while homeowners premiums usually rose faster and higher than for personal auto—trends that are likely to continue into 2023 given ongoing competitive, macroeconomic and geopolitical conditions.1

In terms of expense factors, as of May 2022 average replacement costs were up 16.3%—nearly twice the consumer price index rise.2 This is in addition to the ongoing effects of social inflation, which elevate insurance claims costs because of increased litigation frequency, broader liability definitions, and legal decisions trending more in favor of plaintiffs—including higher compensatory awards from juries, particularly in the United States.3

These factors—along with the increasing impact of catastrophic weather events and cyber risk—were all likely major contributors to the $3.8 billion net underwriting loss reported by U.S. nonlife insurers in 2021, despite robust

written premium gains.4 We saw similar trends in 2022, with inflation and catastrophic events such as Hurricane Ian raising loss costs and undermining insurer profitability— the effects of which are likely to linger into 2023.

Opportunities knock for proactive players. Even in a problematic economy, there are likely to be multiple opportunities to improve top- and bottom-line results through organic growth as well as enhanced operational efficiencies. For example, the small-business insurance market appears primed for reinvention, with many buyers seeking new types of policies, greater flexibility in terms, pricing, and payment options, as well as more holistic loss control services.5 In particular, cyber insurance appears to be in greater demand—although carriers should proceed with caution as ransomware frequency was up 235% in 2021 (compared to 2019), while average ransom payments skyrocketed 370% over the same two-year period.6

In personal lines, concerns over whether the rise of autonomous vehicles might divert billions of premiums into product and professional liability coverages (since the technology and software running the car, not the driver, may be at fault in accidents) are unlikely to materialize anytime soon, given reports that selfdriving technology remains largely experimental.7 However, as more such vehicles hit the roads, auto insurers should consider designing split coverage—perhaps similar to hybrid policies already marketed to ride-share drivers in which personal auto applies when off-duty, with separate commercial coverage activating when driving for hire. The same bifurcated policies could be marketed for when autonomous

PROFESSIONAL INSURANCE AGENTS MAGAZINE 18

systems are on versus when drivers are in control.8

Beyond product innovation, insurers also should be accelerating technology transformation initiatives to upgrade operational efficiency, pricing accuracy, claims management, and customer experience—in parallel with efforts to enhance staff capabilities to exponential levels in underwriting 9 and claims.10 This should help carriers realize the full potential of all the new data, analytical tools, and enabling technologies at their disposal—from artificial intelligence to the cloud.

The new workplace offers opportunities and challenges

Forced virtualization of work during the pandemic has fueled revolutionary changes in employee expectations and upended many traditional employment models. This is not unique to the insurance business, but in conjunction with an aging workforce11 and conservative reputation,12 the challenges are exacerbated for insurers competing for skilled talent not just with peers but with other industries.

Those in the industry may struggle to fill and retain their workforce through 2023 unless there are some novel changes implemented to underlying culture that help these organizations align with evolving employee preferences for greater flexibility in where to live and work.

As evolving workforce concepts shift from theoretical to practical, arming leadership and management with the tools to prepare employees for change will potentially require shifts in culture throughout the organization. Asking people to come back in person just for the sake of being in

the office might no longer be feasible from an attraction and retention lens, so communicating the benefits of in-person collaboration, problem solving, and team building will likely be important. Moreover, reevaluating current job descriptions instead of remaining fixated on narrower industry specific qualifications could open new talent channels through broader skills-based hiring.

ESG can be a competitive differentiator

Many insurers around the world have taken significant steps to build an organizational infrastructure addressing the multitude of challenges posed by environmental, social, and governance concerns, gathered under a single and sometimes unwieldy ESG umbrella. Some have appointed chief sustainability officers or their equivalent to spearhead reporting, compliance, and mitigation initiatives.13 This task is unlikely to get easier anytime soon, with each element posing its own potentially thorny economic, legal, and reputational risks. Yet, how effectively and transparently insurers respond to increasingly vigilant stakeholders—from regulators and rating agencies to sustainability assessment firms, as well as investors and their own employees—will likely determine their ability to adhere to a “higher bottom line,”14 in which the impact of their ESG efforts on society could be as important as their traditional financial statements.

Up until now, most insurers have been focused on responding to mounting calls for more data and specific statistical commitments rather than proactively seeking opportunities to make ESG initiatives a differentiating part of their go-to-market strategy and corporate culture. Generally, they’ve also been focused on regulatory compliance and bolstering enterprise risk management, rather than innovating to differentiate and establish themselves as ESG leaders in thought and action.

Environmental. Insurers are likely to be judged not just by plans laid out in annual sustainability reports, but by how their initiatives actually: 1. limit the impact of climate change and other nascent systemic environmental risks15 while addressing carbon emissions at the source; 2. diversify their leadership and workforce; 3. enhance inclusivity of their products and services; and

4. increase transparency and accountability in their governance structures. While transitory economic and political developments may affect implementation—globally or regionally—how these four overriding goals are reflected in strategic planning, investment priorities, and budget decisions could very well determine an insurer’s reputation and competitive position in an increasingly socially conscious economy.

World leaders are coalescing around the goal of cutting carbon emissions by half within this decade to have a chance of staying below the significant tipping point of a 1.5 degree rise in global warming.16 In line with the Paris Agreement, there are calls for fossil fuels in general and coal in particular to be phased out by 2040.17

Insurers are well-positioned to be among those standing at the cusp of the transition to a low-carbon economy, given their crucial roles as both underwriters of, and institutional investors in, carbon-intensive industries.

PIA.ORG 19

To start, since more innovation is likely to facilitate the drive toward net-zero, insurers could help mitigate climate exposures through tweaking of existing policies and creation of new risk-transfer products. For example, more property carriers could cover retrofitting with sustainable building materials, while additional auto insurers might offer premium discounts to incentivize the use of electric vehicles.18 Insurers also could launch new coverages and services mitigating physical and transition risks for both emerging alternative energy industries and legacy producers transitioning to more sustainable sources.19 While U.S. insurers have worked on mitigation and adaptation efforts for quite some time to limit the impact of climate risk, they have generally trailed behind European counterparts in addressing the underlying source of greenhouse gases and associated energy transition risks. This is likely due to a lag until recently in U.S. regulatory pressure and a less conducive domestic political environment.20 However, increasing stakeholder demands on U.S. carriers now are prompting more focus on limiting the cause rather than just the effect of climate risk.

There are several steps insurers should consider that could accelerate climaterisk mitigation across the value chain, from introducing new products, services, and premium incentives, to raising awareness and adding risk-management services.

Social. Generally, there is strength in numbers, so some industry associations and individual carriers are forming groups to address the social challenges and increased focus on societal issues within ESG.

Still, while many insurers are taking steps to diversify their workforce, large gaps remain in the industry as a whole—particularly at the executive level. Racially and ethnically diverse professionals comprise approximately 24% of the industry’s entry-level workforce, but only 8% of senior and executive management. And while there are more women (approximately 57%) in entrylevel ranks, just 12% of them are racially and ethnically diverse women. Only 18% of the total senior and executive management positions are filled by women, and only 3% of executives reporting to CEOs are racially and ethnically diverse women.21 Insurers should be considering several internal options to bolster diversity, equity and inclusion efforts and results.

Governance. While external ESG ratings firms provide some externally vetted transparency about insurer actions and progress, as reporting responsibilities keep growing, the sheer volume of data requests and behavioral examinations could overwhelm relatively small insurer sustainability teams and keep them from taking on more strategic roles. Therefore, insurers should consider empowering chief sustainability officers with more resources—both in terms of direct reports and ESG liaisons spread throughout the organization—while including sustainability benchmarks in leadership performance evaluations considered when determining compensation and promotions to establish greater accountability.22

Part of the problem is that the lack of standardization among requests from ESG reporting agencies has been cited by insurers as often leading to duplication of effort and a waste of limited resources.23 Insurers should be stepping up efforts to establish more consistency in such assessments, collaborating with other industries to bring about a common reporting language and conver-

gence in international sustainability standards. Internally, insurers should be integrating new technology tools that automate ESG data collection and improve reporting efficiency.

Looking ahead

There will likely be plenty of difficult situations in the year and decade ahead—hopefully not as overarching as a global pandemic, but challenging, nevertheless. Yet that shouldn’t prompt insurers to be overly cautious or react defensively. Instead, they should seek to maintain the entrepreneurial, can-do mindset often displayed during the COVID-19 outbreak, which helped them nimbly transform fundamental aspects of their operations for a more digital and virtual economy.

If insurers were able to adapt and innovate so quickly and effectively under such crisis conditions, what might be preventing them from doing so on an ongoing basis? Rather than falling back on pre-pandemic operating procedures and business models, those in the insurance industry should keep experimenting with new ways of providing coverage and services to customers. They should remain on offense by positioning to thrive over the long term in a rapidly evolving, more socially aware market.

One path could be to strive to engage more proactively and collaboratively with those in underserved communities as customers and employees, managers, and senior leadership. Another could be balancing the need to keep legacy energy risks covered in a global economy still heavily dependent on fossil fuels, even while facilitating and accelerating the transition to more sustainable sources.

Internally, many insurers already have invested to enhance legacy oper-

PROFESSIONAL INSURANCE AGENTS MAGAZINE 20

ations with a host of new technologies and data sources, while boosting the capabilities of their people to take full advantage of these upgrades. The shift from laying this new foundation to fulfilling its potential is likely to remain a major challenge in the coming years, deserving of ongoing attention and investment. However, to fully transform into the insurer of the future, carriers also should strive to keep evolving their foundational culture—from a focus on risk reduction to one marked by risk-taking innovation and broader, bolder reinvention.

As evolution in society, technology, and the global economy continues to speed up, those in the insurance industry who can keep pace and maintain a commitment to transformative change will likely be among those best positioned to excel against those who are slower to adapt, as well as new forms of competition already here, and yet to emerge.

Friedman is the insurance research leader and Canaan is the insurance research manager at the Deloitte Center for Financial Services. Reach him at samfriedman@deloitte.com. This article has been adapted from Deloitte’s “2023 insurance outlook: Global insurance industry at a crossroads to shaping long-term success,” published with permission from Deloitte Development LLC, which holds the copyright. The full report can be found at bit.ly/3EaVurL.

1 Sigma, 2022, “World insurance: inflation risks front and centre,” Swiss Re

2 Insurance Information Institute and Milliman, 2022, “Expect loss pressures to continue in the P&C industry due

to inflation, supply chain, and riskier driver behavior, new Triple-I/Milliman report shows,” press release

3 Insurance Information Institute, 2022, “Social inflation: Hard to measure, important to understand”

4 Verisk and APCIA, “Property and casualty insurers experience underwriting loss in 2021, but remain strong”

5 Deloitte Insights, 2022, “How to reinvent the small-business insurance market for a digital economy”

6 Howden, 2022, “Ukraine war and cyber resilience combine to temper global ransomware activity”

7 Neal E. Boudette, Cade Metz, and Jack Ewing, 2022, “Driver-assist systems linked to hundreds of crashes,” The New York Times, 2022

8 NU Property Casualty 360, 2022, “Exploring split usage-based insurance for autonomous vehicles”

9 Deloitte Insights, 2021 “The rise of the exponential underwriter”

10 Deloitte Insights, 2021 “Preserving the human touch in insurance claims transformations”

11 Economics Daily, 2021 “Number of people 75 and older in the labor force is expected to grow 96.5 percent by 2030,” US Bureau of Labor Statistics

12 Brown & Joseph, 2018, “Attracting millennials to the insurance industry: A complete guide”

13 Deloitte Insights, 2021, “Building a more sustainable insurance industry”

14 Deloitte, 2021, “A higher bottom line: The future of financial services”

15 Impact Alpha, 2021, “Biodiversity is the new climate change”

16 Intergovernmental Panel on Climate Change, 2019, “Summary for policymakers of the IPCC special report on global warming”

17 Climate Analytics, 2019, “Global and regional coal phase-out requirements of the Paris Agreement: Insights from the IPCC Special Report on 1.5º C”

18 Cambridge, UK: Cambridge Institute for Sustainability Leadership, 2021, “Climate product innovation within the insurance sector”

19 Ibid.

20 Carrier Management, 2021, “ESG in insurance underwriting: European insurers lead the way”

21 Carlton Fields, 2022, “Insurance industry leads on DEI initiatives”

22 Sherwood, Sullivan, and Friedman, “Building a more sustainable insurance industry”

23 Ibid.

PIA.ORG 21

APPLY TO BE AN AGENT: WWW.GUARD.COM/APPLY/ Thanks for placing your trust in us. Celebrating 40 Years

PAMELA S. HARPER Founding partner and CEO, Business Advancement Inc.

More to a merger than an agreement

Consider corporate culture

Much like a marriage, there’s more to a successful merger than simply having a few things in common and saying, “I do.” Before a deal is finalized, government regulators scrutinize every aspect of the arrangement. Lawyers and accountants for both sides wouldn’t think of going through with a merger without full financial due diligence between the two organizations. Yet, too often, executives overlook one or more steps of determining cultural compatibility.

As the competition for talent continues and workplace strategies and culture are evolving, cultural due diligence between prospective partners is going to become a key differentiator between the deals that produce a significant return on investment and those that fail to meet expectations.

Corporate culture

Corporate culture is more important to a merger or acquisition than you might think—and not just in terms of touchy-feely people issues. Numerous studies indicate at least 70% of merger deals fail to achieve their intended purpose. In those same studies, business culture

clashes are named as one of the most common reasons for this failure.

Take the case of two small professional-service firms that merged and then unmerged after one month.

Company A always completes a detailed check on prospective clients to ensure that representation will not conflict with relationships to existing clients. Company A’s services are billed by the hour. On the other hand, Company B, has a much less formal relationship with its clients, and it bills on a percentage basis. Despite tremendous market synergy between these two companies, this dream deal turned into a nightmare when the leaders realized they couldn’t reach agreement on these and other critical issues.

Lesson: After the breakup, executives of both companies concluded they should have paid more attention to the corporate culture differences in working out their original deal.

As the example illustrates, differences in corporate cultures—or the formal and informal values, beliefs and practices that are part of an organization—absolutely do exist. While it is tempting to believe cultural issues and differences will go away with a change of leadership,

PIA.ORG 23

research shows that strongly established cultures can persist despite changes in key management.

Even when there are potential cultural clashes, it doesn’t necessarily mean the merger should be halted. This is the point in the process during which you must answer one simple question: Do you want to take charge of the issues or let them take charge of you and the success of your merger?

Merger counseling

Minimizing clashes that arise during mergers starts with a strategic thinking and planning process that includes cultural due diligence—weighing the suitability of a cultural merger before the deal is finalized and using the information to plan a rapid and smooth integration.

Step No. 1: What is your business culture? To gain a clear understanding of your own organization’s business culture, use the Compatibility Checklist (found later in this article) to conduct cultural due diligence before finding a merger or acquisition target. This knowledge will help you develop the criteria for evaluating potential matches.

Make sure to look at both the formal and informal business cultures. Formal culture involves everything that’s aspirational and official. This includes the company’s mission and value statement, policies, operating procedures, performance review system, and organization chart. Informal culture involves what really happens within a company—the actual values, beliefs and practices that play out in everyday behavior and performance.

Step No. 2: Did you conduct cultural due diligence? This goes beyond the typical management interviews that take place in the initial stage of identifying a merger or acquisition target. For instance, using both a validated analytics tool and an assessment tool, combined with interviews, can provide a more objective and consistent picture of the culture. The best time to conduct this more-thorough information gathering is in conjunction with financial due diligence. Identifying potential issues in cultural match can be used as a point for negotiating price. It also can give you a head start in the integration process.

Step No. 3: Did you compare cultural profiles during the strategic thinking and planning phase? There always is more to the story behind the information you’ve collected. That’s why it’s important for you and your executive team to interpret the data carefully in an objective way that minimizes assumptions. This enables you to consider the aspects of the cultures that could support or hinder the success of the merger more thoroughly.

Step No. 4: Did you identify the clash areas as well as the synergies? Identifying and prioritizing possible clashes between the formal and informal business cultures of the merged companies can help you minimize them. Conversely, identifying the synergies can help you identify the positive aspects of the cultures, so they can be maximized once the deal becomes a reality. Some organizations use internal consultants because of their in-depth knowledge of the organization; others retain external consultants who have deep experience with cultural issues and are unencumbered by the internal politics of merging organizations. However, combining internal perspectives and external perspectives increases the likelihood of a successful outcome. Regard-

less of the path you choose, the earlier the process begins, the better the results.

Recognizing and addressing the potential culture conflicts and synergies—the differences and similarities between organizations—before your agency’s marriage is finalized may at first seem like one more hoop to jump through. However, it will only make a merger or acquisition go more smoothly by enabling you to plan as early as possible for how to make the most of the synergies, and overcome the many issues that can interfere with successful integration.

Compatibility checklist

When conducting cultural due diligence, it’s important to examine each of the following eight areas of the merging organizations’ cultures. They include (but are not limited) to:

No. 1: Business philosophy. What are the organizations’ philosophies and ethics regarding employees, customers, shareholders and their respective communities? Differences here may lead to clashes over strategic direction, staffing decisions, layoffs, employee benefits and compensation, philanthropy and charitable donations, financial reporting, and environmental issues.

No. 2: Critical success factors and measurements. How do the two organizations define critical success factors such as customer service or quality? Differing answers to these issues impact what is measured. A lack of synergy regarding critical success factors can lead to what I call strategic gridlock. Endless debates about how to define excellent performance and competence stall critical decisions, and the merged organiza-

PROFESSIONAL INSURANCE AGENTS MAGAZINE 24

tion’s competitive position grinds to a halt.

No. 3: Leadership and management styles. What are the characteristics of an ideal leader in each organization? How quickly are decisions usually made and communicated? Are management policies strictly enforced, or are they used more as guidelines? How do leaders foster cultures of trust, creativity and innovation? Contrasts here can mean the difference between engaged, committed employees, and disgruntled ones who feel their job is a job and nothing more.

No. 4: Organizational structure. How are the two organizations structured? Is one hierarchical while the other is flat or matrix? Are job descriptions written and followed, or do they bear little resemblance to what happens in reality? Incongru-

ence in this area can lead to confusion and clashes about roles, accountabilities and authority. [EDITOR’S NOTE: For more information on structural hierarchy, see a related article “The organizational structure of your agency” on PIA Northeast News & Media (blog.pia.org).]

No. 5: Workflow practices. How does work flow between departments in each of the two organizations? For example, does one organization rely on regular in-person meetings while the other organization relies on ad hoc virtual meetings and hand-offs? Drastic differences in the use of technology, systems and procedures can lead to unanticipated problems, along with a slip in quality and efficiency when the two organizations merge.

No. 6: Perceptions/expectations. What is the organization’s reputation on job search sites and on social media? Merging a high-trust organization into a low-trust organization can hamper productivity dramatically as conflicts escalate between individuals and groups.

No. 7: Customs/artifacts. Every organization has its own special customs and artifacts. For example, do employees work until 4:30 p.m., on the dot Monday through Friday, or are they expected to be on call at night and on weekends? Are there special celebrations around holidays? Do you award honors and/or give bonuses? Inconsistencies in these areas indicate fundamental value differences that can impact employee morale, productivity and retention negatively. No. 8: Facilities/work environment. What messages are conveyed by your work environment? Which functions and positions are performed remotely or are home-based? If one company has elaborate offices, equipment and break

PIA.ORG 25

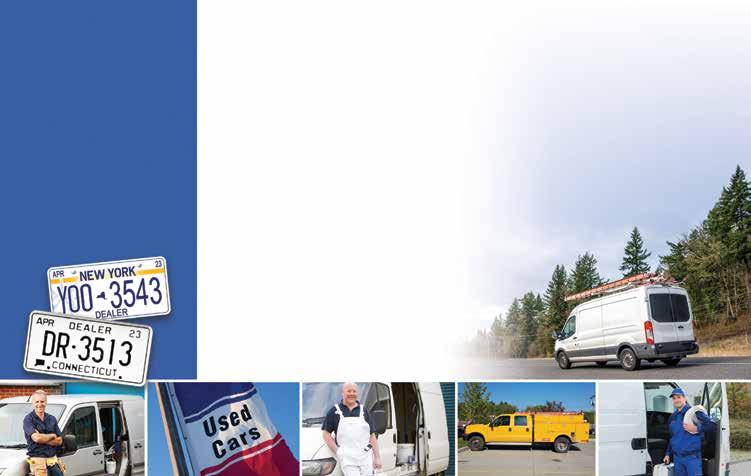

Steer Your Contractor and Used Car Dealer Risks to the Pros Turn to the folks that understand your clients’ businesses, deliver A- (Excellent) rated commercial auto and garage liability coverages, and provide the resources and support you need to achieve profitable growth. Business Auto Liability and Physical Damage • Contractors – Commercial Building, Electrical, HVAC, Painting, Plumbing, Roofing, Janitorial Services and more Garage Liability — Used Car Dealers • Dealer and Transporter Plates Writing in NY, NJ, PA, & CT* • Convenient Online Quoting • 24/7/365 Claims Reporting • Flexible Payment Options Contact us today: 516-431-4441 x3507 producer@lancerinsurance.com www.lancerinsurance.com * Please contact us for a list of available products and coverages by state

Grow your book of business— offer the protection of

rooms for employees while the other has small workstations for all but executives, it may send unintended messages of job importance and regard for employees.

The honeymoon is over

If your merger is a done deal, and you notice things—such as a significant increase in customer complaints, missed or delayed goals or the exit of key staff or clients—your organization may be experiencing a culture clash.

Other cultural clash warning signs include the following:

• product quality problems;

• overt conflicts between employees or departments;

• covert conflicts, such as passing the buck;

• low morale, often evidenced by lower attendance at work and company events; or

• unexpected financial losses, such as a drop in earnings or stock price.

Why Hartford Flood

• Competitive commissions (20% for new business; 19.5% for renewal; and 20% for rollover)

• Brand recognition, with a locally based carrier

• Multi-rater quoting system

• Online quoting, endorsements and policy issuance

• Free flood zone determinations, certified to be accurate

• Dedicated flood sales director assigned to your agency

If your organization is exhibiting these symptoms, all is not lost. Many of these issues can be successfully addressed and return on investment can be improved significantly by identifying and resolving any underlying clashes. Later still is better than never to address your cultural differences.

Harper is founding partner and CEO of Business Advancement Inc. She is an internationally known strategic growth adviser, keynote speaker, co-host of the podcast Growth Igniters® Radio, and author of the critically acclaimed book Preventing Strategic Gridlock . For more information, call (201) 612-1228 or visit www.businessadvance.com.

PROFESSIONAL INSURANCE AGENTS MAGAZINE 26

Exclusive online program access for PIA members—Personal and Commercial Flood policies

Hartford Flood

The program is available to PIA members and their policyholders in all 50 states, the District of Columbia and Puerto Rico, and offers special PIA member commissions starting with the first sale (no minimums to qualify). Get started—contact The Hartford today. CT/NY—Art Brickley | (860) 547-2190 | a.brickley@thehartford.com NJ—Cheryl A. Maginley | (860) 547-5007 | Cheryl.Maginley@thehartford.com VT/NH—Michele Battis | (704) 972-5918 | Michele.Battis@thehartford.com

PIA is here to help you navigate through uncertain times, so let’s make sure you have great errors-and-omissions coverage at a competitive price. We’ll Navigate Your E&O Coverage You Focus on Business Scan to learn more and get a quote. Call (800) 424-4244, ext. 408 | Web www.pia.org

PIA is the Best Choice for E&O • Our professional liability and cyber liability programs are designed for your agency’s needs and risk exposures • Critical coverage options—especially important when many agents are working remotely • Top-rated, stable E&O carriers • Experience & expertise from our team

Why

Everything you need to crush every goal you have.

✓ Direct market access with multiple carriers

✓ Full ownership of your book of business

✓ Specialized training

✓ Top vendor partners

✓ 5 ways to get paid

You decided to get into the insurance industry for a reason, and it wasn’t to just get by. You got into this business to have freedom in running your agency and significant income opportunities that help you get to an early retirement. We help make that happen.

CURTIS M. PEARSALL, CPCU, CPIA President, Pearsall Associates Inc.

CURTIS M. PEARSALL, CPCU, CPIA President, Pearsall Associates Inc.

Best practices when completing an application

In the insurance world, the application—whether in paper format or online—is one of the most important documents an agency staff member will handle. After all, it is the document that will determine acceptance, pricing, and the details of the coverage to be proposed. While this probably goes without saying, the accuracy of the information in an application is paramount. The markets an agency deals with—whether standard or nonadmitted—rely on the details of the application. When that information is not accurate, the consequences can be significant.

Key issues to consider

Be mindful of time frame. Complete applications in a time frame sufficient to enable the market to evaluate the risk. In some cases, the market may want to pre-inspect the risk, so time should be built in for that possibility. Complete the correct application. While carriers often will use an ACORD application for quoting purposes, they may have a specific application they want completed before coverage can be bound. Often, this occurs with the surplus-lines markets or on professional liability/D&O coverages.

Make the client part of the process. When possible, complete the application with the proposed client. This will enable the agency salesperson to ask the appropriate questions and to record the responses. Be sure to ask all the questions exactly as they are stated on the application.

Don’t guess at the answers. If the application is being completed in the office after a visit from the prospect, it is possible that the agency salesperson may not have asked some of the application questions. What should happen then? Secure the correct answers by having a subsequent discussion with the prospect by phone, email or in person.

Get a signature. Have the client sign the applications whenever possible— preferably all the time. This applies whether the application has a signature line or not. In the defense of an errors-and-omissions claim, a client will be held responsible and accountable for the contents of an application if he or she signed it. Therefore, don’t just ask the client to sign the application, ask him or her to review it. Then, if everything is accurate, the client should sign.

Represent the risk as it appears today

Carriers count on the idea that the application represents the risk accurately. If a loss occurs, and the carrier determines that the application had incorrect information, the carrier may have grounds to rescind the policy. There

have been situations in which the carrier—after determining that the agency salesperson intentionally misrepresented the risk—issued immediate notices of termination of the agency agreement.

Be sensitive about the completion of applications at renewal time. If the agency is remarketing the account to additional carriers, it is vital that the applications represent the risk as it appears today.

Often, applications are completed using the previous year’s information. Since the risk may have changed over the last year, this practice creates the potential for the application to not accurately represent the risk.

Utica National Insurance Group and Utica National are trade names for Utica Mutual Insurance Company, its affiliates and subsidiaries. Home Office: New Hartford, NY 13413. This information is provided solely as an insurance risk management tool. Utica Mutual Insurance Company and the other member insurance companies of the Utica National Insurance Group (“Utica National”) are not providing legal advice, or any other professional services. Utica National shall have no liability to any person or entity with respect to any loss or damages alleged to have been caused, directly or indirectly, by the use of the information provided.

You are encouraged to consult an attorney or other professional for advice on these issues. © 2023 Utica Mutual Insurance Company

PIA.ORG 29 E&O

These are the Workers’ Comp Markets You’re Looking for! 2270-D-2022 Market Access Only With Your PIA Membership (800) 424-4244, ext. 318 | memberservices@pia.org | https://bit.ly/3Rpe5oc Provided in partnership with Agency Resources Scan to Get Started Hundreds of class codes A low-minimum premium Quick turnaround Simplified submission process Trusted carriers Competitive commissions Exclusive Features for PIA Members Painting Plumbing Restaurants Retail And, more … Auto Body Cabinet/Floor Installation Electrical Grocery/Deli/Supermarkets Landscapers Masonry Program Appetite Guide

PIA TECHNICAL STAFF

Have a question? Ask PIA at resourcecenter@pia.org

Ride hailing, hold-harmless agreements and more

Ride hailing–what should I tell my clients

Q. How should I advise my clients if they are considering working with a ride-hailing service?

A. Consumers may believe they have insurance for this type of service. However, that may not be the case. Tell them that their own personal automobile insurance policy may not cover them, so they must contact their personal automobile insurance company before they start ride hailing. The typical personal automobile liability policy excludes coverage for a livery business conducted via a personal vehicle. It is a common practice for insurance carriers to include a question on their initial insurance application or renewal questionnaire, which states: “Are you currently, or have you previously, worked with any ride-hailing services?”.

So, it is best to err on the side of caution and encourage your clients to contact you to discuss their individual policy to determine what coverage, if any, would respond to these types of ride-hailing situations.

The Insurance Services Office Inc. introduced three personal auto policy endorsements in 2015 (see ISO introduces three new TNC endorsements in the PIA QuickSource library).

PIA has tracked this issue as new developments arise. For specific questions, contact PIA’s Industry Resource Center at (800) 424-4244 or resourcecenter@ pia.org.—Bradford J. Lachut, Esq.

Hold-harmless agreements–injury to an insured’s employees

Q. We have an insured who signed a contract to defend, hold harmless and indemnify a client for any liability actions—including actions brought by our insured’s employees. However, the insured did not notify the insurance company or our agency prior to signing the contract. One of our insured’s employees got hurt and collected workers’ compensation. In addition, the employee sued the client with whom our insured has the contractual hold-harmless agreement. We need to know if our insured’s policy is going to respond to the lawsuit.

A. Yes, the exposure is covered by the unendorsed ISO commercial general liability policy. The CGL exclusion for lawsuits involving bodily injury to an insured’s employee does not apply to liability assumed by the insured under an “insured contract” (the exception to exclusion e. Employer’s Liability).

An “insured contract” is defined to include “that part of any other contract or agreement pertaining to your business ... under which you assume the tort liability of another party to pay for ‘bodily injury’ or ‘property damage’ to a third person or organization.” Of course, you need to make sure the CGL policy has not been modified to remove this coverage.—Dan Corbin, CPCU, CIC, LUTC

Liability exposures on agency book

Q. I am selling my book of business to another agency and I will be working for the new agency under its name. What is my liability if a claim should arise on a policy from last year? How long will I be held liable from prior policies?

A. If you are selling a book of business, you still would have liability exposure for acts or omissions for which you are legally responsible. Therefore, if last year, you committed an act or omission on a policy, you still could be sued even though ownership of the book of business is with another agency.

It is difficult to say how long you could be held liable. It depends on the type of lawsuit that is being brought and the applicable statute of limitations.—Bradford J. Lachut, Esq.

PIA.ORG 31 ASK PIA

x x x x x Get your quote today! (800) 424-4244 | memberservices@pia.org Employee Benefits for Insurance Agencies Let the PIA Members’ Choice group benefits program take care of your agency. Medical Dental/vision LTD with Reliance Standard Term life with Reliance Standard PIA’s curated programs for member agencies and brokerages feature carrier selection, flexible coverage, top-notch customer service, and claims assistance when you need it.

PIANH Company Partners

Supporting Premier

As of publication date. For more information go to pia.org.

Sponsoring

PROFESSIONAL INSURANCE AGENTS MAGAZINE 34 DIRECTORY Readers’ service and advertising index Name Agency Address City/town State ZIP Phone Check advertisers of interest, complete form and mail to: PIANH • 25 Chamberlain St. P.O. Box 997 • Glenmont, NY 12077-0997. Or, fax (888) 225-6935.

9 Alpha Northeast

BC Applied Underwriters

22 Berkshire Hathaway/Guard Insurance Companies

8 Brooks Insurance Agency

2 Concord Group Insurance

11 Everguard

26 The Hartford

7 JENCAP

25 Lancer Insurance

12 Omaha National

34 PIA 401(k)

27 PIA E&O Insurance

14 PIA Email

32 PIA Members’ Choice Options

30 PIA NumberONE Comp Program

15 Premins Company

28 SAN Group www.tagcobrand.com/pia Learn more: New PIA Northeast Member Benefit Your 401(k) Plan Should Be A Major Reason Why People Want To Work For You Attract better employees and retain them longer by offering the security of a great 401(k) plan. With PIA Retirement Plan and TAG Resources you can offer your employees an amazing benefit without taking on the day-to-day responsibilities of looking after a 401(k) plan.

DIRECTORY

PIANH 2022-2023 Board of Directors

OFFICERS

President

Keith T. Maglia Insurance Solutions Corp.

60 Westville Road Plaistow, NH 03865-2947 (603) 382-4600

kmaglia@isc-insurance.com

Vice President

Jeffrey Foy, AAI Foy Insurance-Manchester

1889 Elm St. Manchester, NH 03104-2500 (603) 641-8111

jeff.foy@foyinsurance.com

Secretary/Treasurer