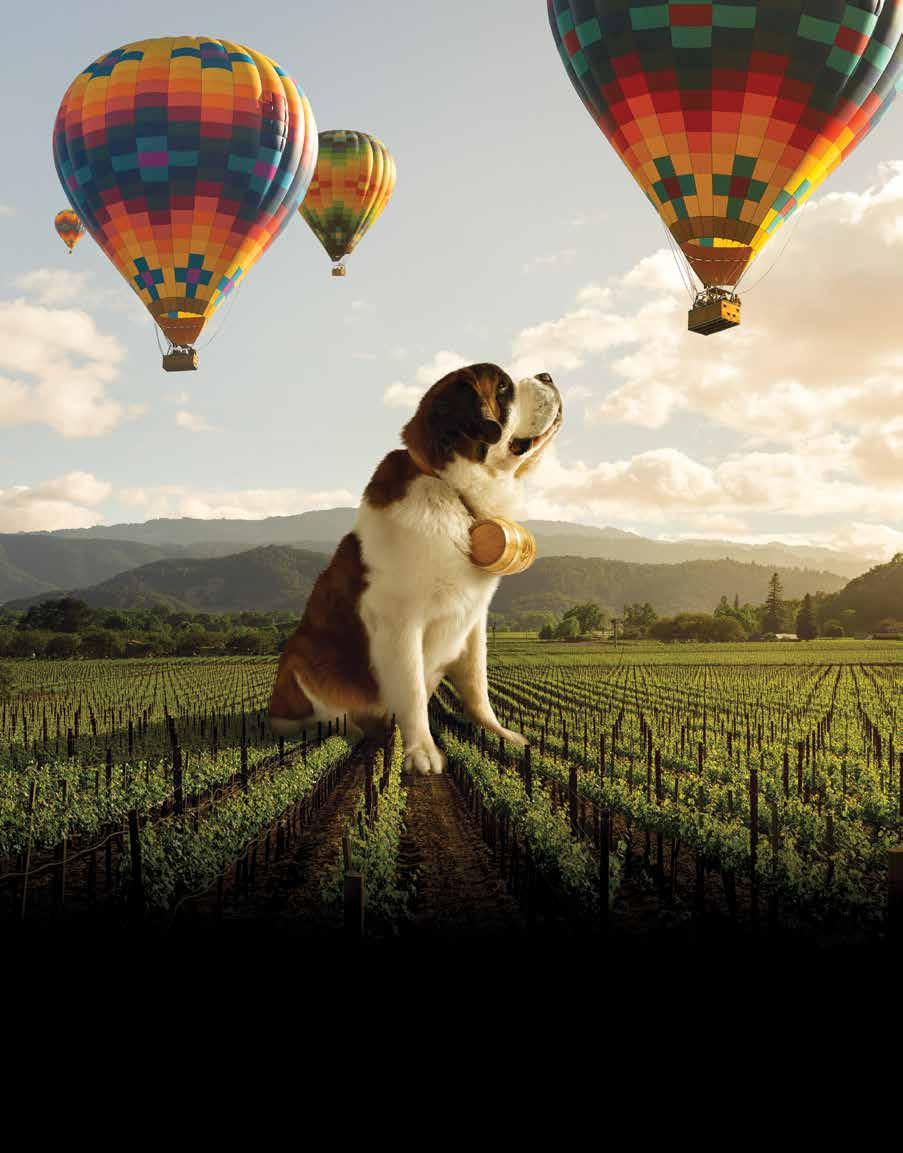

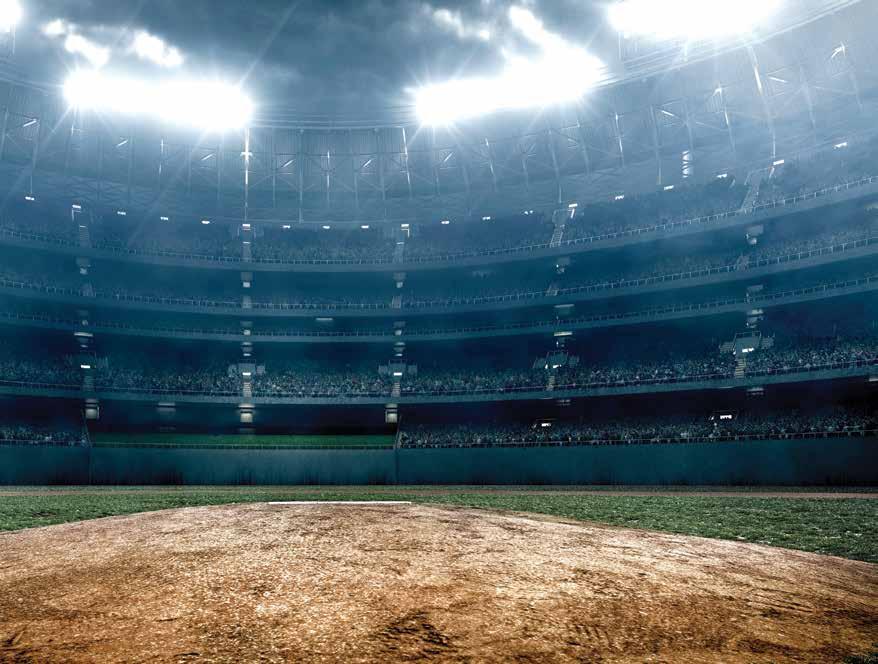

PERSONAL & COMMERCIAL INSURANCE that protects what matters most for generations

to come.

Your customers deserve peace of mind with customized coverages from The Concord Group. With a wide range of optional enhancements, we offer policies that will meet their needs.

Find out more at ConcordGroupInsurance.com

Statements of fact and opinion in PIA Magazine are the responsibility of the authors alone and do not imply an opinion on the part of the officers or the members of the Professional Insurance Agents. Participation in PIA events, activities, and/or publications is available on a nondiscriminatory basis and does not reflect PIA endorsement of the products and/or services.

President and CEO Jeff Parmenter, CPCU, ARM; Executive Director Kelly K. Norris, CAE; Communications Director Katherine Morra; Editor-In-Chief Jaye Czupryna; Advertising Sales Representative Kordelia Hutans; Senior Magazine Designer Sue Jacobsen; Communications Department contributors: Athena Cancio, David Cayole, Patricia Corlett, Darel Cramer, Anne Dolfi, Scott Finnegan, Kordelia Hutans and Lily Scoville.

Postmaster: Send address changes to: Professional Insurance Agents Magazine, 25 Chamberlain St., Glenmont, NY 12077-0997.

“Professional Insurance Agents” (USPS 913-400) is published monthly by PIA Management Services Inc., except for a combined July/August issue. Professional Insurance Agents, 25 Chamberlain St., P.O. Box 997, Glenmont, NY 12077-0997; (518) 434-3111 or toll-free (800) 424-4244; email pia@pia. org; World Wide Web address: pia.org. Periodical postage paid at Glenmont, N.Y., and additional mailing offices.

©2023 Professional Insurance Agents. All rights reserved. No material within this publication may be reproduced—in whole or in part—without the express written consent of the publisher.

IN BRIEF

The Generations

The up-and-coming generation (Gen Z), who are they?

By 2025, Generation Z will account for 27% of the workforce. They are the first generation that can’t remember life before the internet (analog cameras, CD players or paper maps).

Affecting milestones: the 2008 global financial crisis, the COVID pandemic and the war in Ukraine. Generation Z is also known as: Post-Millennials, iGeneration, Plurals, Gen Zers.

Generational differences

Gen Z could change jobs up to 10 times between the ages of 18 and 34. They are less likely to work up the career ladder at one organization (compared to previous generations). Almost 50% of Gen Z workers value work-life balance, remote working and flexible leave.

As employees, studies show Gen Z prefers

Face-to-face communication

• Written communication may be difficult to decode.

Generation Alpha

Born 2010-Now

(Ages 0-13 years)

Generation Z

Born 1997-2009

(Ages 14-26)

Millennials

Born 1981-96

(Ages 27-42)

Generation X

Born 1965-80

(Ages 43-58)

Boomers

Born 1946-64

(Ages 59-77)

Silent

Born 1928-45

(Ages 78-95)

Individual work

• They can showcase their abilities.

How to engage Gen Z

Build a diverse and inclusive work culture

• Limit the amount of switching between different work apps

• Re-examine your organization’s values

• 80% look for companies whose values align with their own

The year each generation is born:

2010 → The iPad was introduced

1997 → The Lion King debuted on Broadway

1981 → Post-It Notes launched

1965 → U.S. states in the Northeast/Canada got hit by blackouts (lasting up to 13.5 hours)

19 46 → Tupperware is introduced to U.S. consumers

CTYIP President Ryan Kelly

Tell us how you got started in the insurance industry.

I was introduced to the insurance industry when I was still in college. I had the opportunity to intern at Northwestern Mutual, during which I focused on the life-insurance sector of the industry.

After the internship, I spoke with a family friend—Jim Benson, president of Merit Insurance—he introduced me to the world of property/casualty insurance, and he ended up offering me a job at his firm after I graduated.

As YIP president, what are your priorities for the association?

The CTYIP officers and board of directors are capable insurance professionals who are driven to help this association succeed, and previous leaders have helped to lay the groundwork for success. My No. 1 priority is to drive membership. In any organization, membership waxes and wanes. However, since I took over as CTYIP president in 2022, I believe our membership has grown about 30% in just one year, and we are anticipating similar growth this year.

What was an unexpected benefit when you joined the association?

Some people might think that because we are all insurance professionals, we are all in competition with each other. However, this isn’t the case. I have enjoyed all the friends and connections I have made within the industry since I joined the association. I have made so many great friends throughout CTYIP, and we often connect during business hours—to help each other out in our business— and after work hours—for fun.

What professional goals are you still trying to accomplish?

I would like to continue to grow as an insurance professional, and to be the best producer I can be. While

working in sales I feel like there is always something more you can do to strengthen your relationship with a prospect or client—whether that’s sending an extra email, making another cold call, or going to another networking event, etc.

There also are plenty of opportunities to highlight the value of working with a dedicated insurance professional.

Who mentored you when you became involved in the industry? What was the best advice this person gave you?

I am fortunate to have several mentors during my career. However, my first mentor was the person who introduced me to the insurance industry: Jim Benson. It is hard to narrow down all the advice he offered me as I started my career, but his pushing me to get involved with PIACT and the CTYIP is definitely up there!

What advice would you give to someone just starting out in the insurance industry?

I would tell people that they made a great decision in choosing this industry. Then, I would encourage them to find a mentor. Having someone to learn from, and ask questions was always a huge advantage for me.

I also would mention that with hard work and good communication skills they can go far in this career path.

Do you have a piece of trivia you'd like to share?

I played football in college, and I am looking forward to my wedding this September!

Final thoughts?

If you are not yet involved in CTYIP, I encourage you to reach out to us, and go check out an event or board meeting—you always are welcome.

Congratulations on your upcoming nuptials!

Five ways to attract and keep top insurance agency talent

Building a strong team is a crucial part of running a successful independent insurance agency. This is especially true in times of economic uncertainty. Having the right people in place can help your agency continue to win when things get tough. With recent shifts in the U.S. market, it’s a good time for insurance agency leaders to rethink strategies for employee recruitment and retention.

In a recent study, more than half of the surveyed agency principals said finding and recruiting talent is one of the biggest challenges they face in managing their agency.1 The survey also asked insurance agency employees about the top things they look for in a job. The answers reveal some key ways agents can attract and retain talent.

No. 1: Focus on stability

Employees across industries want to feel that their job provides stability. With job-seekers facing a tough market in 2023, the stability of the insurance industry could help agencies attract candidates from outside the industry.

Insurance has a lower unemployment rate than other industries and a lower rate of job hopping, which suggests higher job satisfaction. Data from the Bureau of Labor Statistics shows that employees in this industry tend to stay in their roles longer than workers in other industries.2

No. 2: Offer parental leave

One in four agency employees (and more than one in two millennial employees) is a parent to young children.3 So perhaps it’s not surprising that agency employees listed parental leave as one of the top things they want in a job. Robust family leave policies can help agency owners retain employees and support their career growth through different stages of their lives. The recent Agent for the Future report on the state of women in insurance agencies found that parental leave and options for flexibility can be especially important in retaining women, who make up nearly 60% of agency employees.4

No. 3: Create paths for career growth

The insurance industry offers opportunities for growth in a variety of career paths. Offering continuing education and career development opportunities can help agency owners increase employee engagement and satisfaction.

It also can help them attract the next generation of talent. More than half of the millennial and Gen Z agency employees surveyed said they aspire to be a leader in their agency, and 62% listed “inspiring leadership to provide mentorship and career guidance” as the top characteristic

they want in a job.5 Investing in mentorship programs, networking opportunities and ongoing training can help agency owners create a pipeline of qualified leaders by empowering employees to reach their full potential.

No. 4: Provide flexibility

Most agency staff members are satisfied with the flexibility their agency allows. However, agency employees would prefer to work remotely more than they do currently. About half of agency employees reported that they are back in the office full-time, but 62% said they would prefer to work from home at least one day a week.6 Agency front-line staff members are more likely than leaders to say they are more productive, happier and have a better work-life balance when they work from home. Offering options for flexibility may help agency owners increase employee satisfaction and attract job candidates.

No. 5: Invest in your community

Insurance agency talent is drawn to companies that are highly involved in their communities. This is good news for independent insurance agencies.

Advertising things like community involvement, parental leave and career development opportunities in job postings could help independent insurance agents attract candidates from inside and outside the industry who share their agency’s values. And, investing in benefits that make employees feel secure and supported will help agencies attract top-tier talent and create resilient teams that are dedicated to seeing the agency succeed.

Canales is SVP and field executive of the Northeast region for Liberty Mutual Business Lines and Safeco Insurance. He is responsible for Safeco’s personal lines and Liberty Mutual’s business lines growth and profitability within the region.

1 Liberty Mutual and Safeco Insurance surveyed more than 1,100 independent insurance agency leaders and team members for its 2023 Agency Growth Study (bit.ly/45Lczp3).

2 Business Insurance, 2022 (bit.ly/43KBJSM)

3 Liberty Mutual and Safeco Insurance, 2023 Agency Growth Study (bit.ly/45Lczp3)

4 Liberty Mutual and Safeco Insurance, 2023 (www.agentforthefuture.com/women2023)

5 Liberty Mutual and Safeco Insurance, 2023 Agency Growth Study (bit.ly/45Lczp3)

6 Ibid.

THEOPHILUS ALEXANDER

Government & industry affairs specialist, PIA Northeast

Gen Z: Myths vs. facts

Generation Z—colloquially known as Gen Z—is the demographic of young adults born between 1997 and 2009, the generation after millennials. This generation is known as digital natives because these techsavvy young adults were raised on the internet and social media, and either do not know or cannot remember what life was like having a Motorola Razor, T-Mobile Sidekick, or any variation of the infamous BlackBerry.

In case you could not tell from the iconic group of phones that I listed, I was born in the spring of 1996—the tail-end of the millennial generation and I should escape the Gen Z label narrowly. However, I have been referred to as a Gen Zer, which makes the micro hairs on my scalp (I’m bald) perk up because I proudly derive from the AOL Instant Messenger and YouTube-MP3 converter era. I distinctly remember afternoons after school, connecting one end of the

ethernet cable to the router and the other end to the laptop, logging on to AIM, and scouring YouTube looking for the newest music to pirate onto my iPod Touch.

There have been many articles written about Gen Z—what they are like, what motivates them, and how to best integrate them into the workforce. However, it is important to dispel fiction from fact. Here are the top three myths about the generation with the last remaining letter in the

Latin alphabet, and some possible truths that can help you adapt to having another generation in your agency.

Myth No. 1: Gen Z is lazy and entitled

Just like their millaennial predecessors who previously wore the entitled label, Gen Zers are nothing like their parents and grandparents when they were young adults. They have re-evaluated their priorities and they are demanding more from their employers and careers. Gen Z is seeking work that aligns with their values and provides opportunities for growth and development.

We witnessed the Great Resignation in 2021—when approximately 47.4 million people voluntarily resigned from their jobs,1 three million people retired early,2 and approximately 16.1 million people experienced unemployment at some point during that year.3 While this exodus was attributed to the global COVID-19 pandemic, data suggests that this dramatic workforce change began before it.

Fact: Gen Zers are looking for flexibility and connections. Conditions like societal disagreements over mandates and restrictions, flexible work arrangements, and entrepreneurial opportunities also contributed to the mass departure of employees. As such, employers who neglect to adapt to the changing needs and values of Gen Z may find themselves struggling to attract and retain top talent in the years ahead. It is crucial for employers to listen to the needs of this generation and create a work environment that fosters growth, purpose and fulfillment. Agency owners should work to create mentorship programs that provide young employees with opportunities to enhance their professional development. Not only do these programs provide young employees with direction and feedback, but they strengthen office culture and promote camaraderie between older and younger employees.

Myth No. 2: Gen Z are job hoppers

At the height of the pandemic, many seasoned employees enjoyed the once-in-a-lifetime opportunity to work from home. However, for Gen Z and some millennials, the COVID-19 lockdown and the introduction to remote life disrupted the fabric of our daily lives and shifted the ways in which we learned, worked and interacted with one another.

Hiring made easy

Gen Zers became advocates for remote work, so much so that this generation has no reservations about quiet quitting—doing the minimum job requirements and putting in no more time, effort, or enthusiasm than necessary—or resigning from a job without giving the traditional two-week notice if working conditions are not up to their standards. Fact: Gen Zers want balance and boundaries. In addition to flexible work, Gen Z prioritizes many benefits that previous generations overlooked or were previously excluded from including supporting physical and mental health; promoting diversity, equity, and inclusion initiatives and accountability; and maintaining a healthy work-life balance. This generation sets boundaries, and if those boundaries are breached, this generation of young adults will not hesitate to leave and find gainful employment elsewhere.

Myth No. 3: Work needs to be fun

As a millennial and young professional, I can attest that being in certain workplaces can feel like an extension of college. When you and your colleagues are all around the same age, blurring the personal and professional lines at work can

be difficult. That, at times can be advantageous as it contributes to stronger trust between teammates, improves communication, and strengthens employee engagement and retention if employees can feel connected through friendship. Fact: Gen Zers want to be challenged. While it may be misconstrued as fun, young employees simply want to be challenged, engaged, taken seriously by their colleagues and know that their work holds value and substance. Employers can take several steps in their workplaces to challenge employees and maximize their engagement.

First, employers can create a workplace of transparency and open communication by encouraging employees to express their feedback, ideas and opinions, which enables employees to feel heard and valued.

Second, employers can offer their employees flexible work arrangements, including working remotely or allowing employees to adjust their work schedules to help accommodate employees’ personal needs.

Third, employers could offer professional learning and development trainings, such as conferences and webinars to boost employee engagement. Lastly, officially recognizing and rewarding achievements also can go a long way in cementing gratitude for your employees.

Conclusion

Ignore the myths of Gen Z. Instead, focus on what those individuals in this generation are truly looking for in a workplace. This can lead to a better understanding of this demographic, which can result in improved recruitment and retention, productivity, innovation and customer satisfaction. Alexander is PIA Northeast’s government & industry affairs specialist.

1 CNN, 2022 (cnn.it/430RPYo)

2 Bloomberg, 2021 (bloom.bg/3BFBPzk)

3 U.S. Department of Labor, 2022 (bit.ly/435zpFG)

Alpha Northeast—an agency network and affiliate of the nation’s second largest network, ISU Insurance Agency Network—partners with insurance agencies to help them grow their businesses.

When you combine forces with us:

commission payout from non-contracted carriers & profit share eligible from first dollar

You’ll have access to the top national and regional carriers

You’ll have greater opportunity to maximize the benefit of networking with other agencies— which means more underwriting clout and increased profit share

If you choose to leave the network, you’ll face zero penalty—but we bet you’ll stay

A fully automated surety bond MGA to fit your needs.

Driven by proprietary technology, Propeller Bonds is changing the way insurance agents market bonds across various platforms using their unique agency URL .

Propeller Bonds is an insurtech MGA/MGU equipped with an instant issue surety bond platform housing 7,000 Contract, Commercial, and Fidelity surety bonds.

Agency URLs do not require a login and can be shared across social media, email, and wed-based platforms for quick and easy access.

VANESSA MATSIS-Mc CREADY

VANESSA MATSIS-Mc CREADY

Associate general counsel and vice president of HR services, Engage PEO

Stay competitive with modern benefits

In the AppleTV+ show Severance, employees are split—their personal selves literally are left at the door when they swipe in for work. As they get to their desks, employees transition into their work selves, leaving the burdens of their personal lives at the door. In real life, successful employers address their employees as whole people. Every generation in the workplace has its different stresses and it is naïve to think they do not spill into the workplace.

Employers who want to have an engaging workplace, attract and retain top talent, and reduce workforce burnout must evolve with the needs and wants of their workforce. Gone are the days when an employer can focus only on reducing workplace stress to address burnout. Looking at the employee as a whole person is much more successful in creating a loyal, engaged workforce and reducing burnout in the workplace.

Agency owners need to offer a full suite of benefits catered to a multigenerational workforce that fits with their budget. Benefit costs can range from minimal to higher costs for the employer, but it is vital to keep in mind that the cost of recruiting, hiring, and training a new employee is significantly higher than retaining an employee—not to mention the institutional knowledge that is lost and potential loss of clients when an employee leaves. Recent studies have shown that these uncertain economic times have led to two trends:

First, a study by Care.com found almost half of U.S. employers were considering reducing their employee benefits. This is a slippery slope likely resulting in employee departures that ultimately increase costs.

Second, employee burnout is having a major impact in the workplace. Research by Eagle Hill Consulting found that almost half of U.S. workers say they are burned out. Why? It is not just work. While workload and feeling understaffed are on the list, they reported that work-life balance was one of the top causes. Every generation makes a major impact on the workforce, and today’s younger generations are no exception. Millennials and Gen Zers are demanding better work-life balance and holding employers accountable making what were once options, expectations. This is evident not only in benefit offerings but also with significant employment legislation changes. So, how can employers calibrate their benefit offerings to address the needs of the current workforce, reduce burnout and attract/retain top talent?

Financial fitness

Economic uncertainty, inflation, and stark cost of living increases around the country, combined with student loan debt, mortgage debt, rising taxes and the like are putting significant pressure on employees. Employers can offer financial fitness benefits like:

• Student loan debt repayment, in which the employer matches or contributes to the repayment, is a gold standard benefit.

• Tuition reimbursement and 529 College Savings Plans help the multigenerational workforce achieve their personal and familial goals.

• Retirement savings plans and 401(k)s are an expectation of today’s workforce, and sometimes required by law. Employer contributions to retirement plans show employer commitment to the workforce.

[EDITOR’S

NOTE:

If you don’t offer your employees a 401(k) plan, or you are looking for a better plan, consider the PIA 401(k) Plan. For more information, visit www.tagcobrand.com/pia.]

• Profit sharing and stock-option plans not only help employees buy-in, but they help them build long-term wealth.

• Financial wellness coaching is increasingly popular, as are hosting lunchand-learns regarding personal finance and discounted access to financial planning services.

• Financial assistance with other work-life programs (discussed later in this article), discounts or reimbursement for tax preparation services and cell phone or internet expenses (sometimes legally mandated) are peppering the field of financial benefits.

Health and wellness

Many U.S. employers are required by law to offer medical insurance to their employees. Many states have other required programs like workers’ compensation, short-term disability and paid family leave, which are funded through payroll taxes. Recent legislation has increased the footprint of these programs, reducing requirements for coverage, and increasing the number of eligible employees. Even though many state mandated leave programs are funded through payroll taxes, employers often incur hidden costs for temporary employees and for overtime to cover for the employee on leave.

Mental health coverage is in high demand, especially among members of the younger generations who are more likely to openly discuss their concerns and what they need to address mental health. Covering telehealth visits and mental health benefits goes a long way to supporting employees. Employee mental health is supported when the employer provides access to time off and creates an inclusive and diverse workplace. These also create a safe, engaging, and productive workplace.

Employee Assistance Programs are a great tool to stave off burnout, and often have a variety of experts to help with various concerns.

Employers who go further than these required offerings see better traction with their employees and a better return on investment. Supplemental health insurance options are popular and help an employer speak to a range of generations. Enhanced short-term disability, vision, dental (including orthodontics), hospitalization coverage and cancer disability insurance are attractive to employees at different seasons of their lives for different reasons.

Offering access to benefits experts, who can consult with employees to help them choose the best mix of benefits for their needs is another great way to help employees.

Wellness programs not only help improve the health and lifestyle of the workforce, but they also can have a multifaceted impact on the employer’s bottom line by increasing productivity, reducing unplanned absenteeism, and decreasing health care insurance cost.

While some companies may choose to add a meditation room, yoga studio, napping pod, or gyms to the office, and others may choose to lease space for these offerings, employers can choose a lower investment option also. Offering gym or health class reimbursements, meditation apps, insurance coverage, discounts or on-site access to chiropractors, acupuncturists, and masseuses can yield similar benefits.

Chef-catered lunches calibrated for different lifestyles or access to a nutritionist are excellent wellness benefits. Employees who avail themselves of these bene-

fits often report more productivity and enthusiasm for work, and they also reduce the costs of an employer’s medical health coverage costs due to a healthier workforce.

Work and family

Work and family benefits are an important component of reducing burnout and increasing retention. Paid family leave is an expectation for today’s workforce. Historically, it was limited to maternity leave. Now it is legally mandated in several states—including Connecticut, New Jersey and New York. Even when it is an employer-driven benefit, it applies to care for many family members, often including siblings’ and grandparents’ or grandchildren’s serious health conditions, or bonding with a child. As a result, many employers go further than the laws and offer paid parental leave and/or paid family leave to care for other family members.

Paid sick time off is impacted by legislation and employee need. Historically, employees might have a small number of sick days, particularly managers or exempt employees. Such time off was less accessible to nonexempt, part-time, and hourly employees. However, due to employers’ desire to retain talent, have a healthy workplace, and when applicable, comply with the law, many employers now ofer paid sick time off for preventative care or illness for the employee, and to care for an affected family member. Paid time off and floating holidays, especially vacation time—while not generally legally mandated—is one of the top benefits a prospective employee looks for when interviewing with a business. An agency that does not offer paid time off will have a difficult time recruiting and

retaining its workforce. Employers are offering unlimited time off. Floating holidays help employees choose the holidays that are important to them while helping the employer meet business needs.

Sabbaticals (both paid and unpaid) are having a comeback. Employees take a chunk of time off, (up to three months) to reset, pursue hobbies or travel, and return refreshed.

Volunteer days—whether agency organized or at the individual level—are a popular perk.

Workplace perks can have a big impact on both financial fitness, and work and family. To woo employees to campus, assistance or discounts for chores (e.g., dry cleaning, laundry, grocery shopping and even home cleaning services) are becoming more desired. Access to concierge-type services (e.g., travel specialists who can plan and book your next trip, or entertainment concierges that can get coveted event tickets) may pay for themselves by giving employees more time to focus on work, leisure activities and health. The latter two have been found to directly impact productivity and creativity in the workplace. Locating the office in a desirable area with access to a vibrant community can help get employees back to the office.

The pressures of caregiving are real for members of all generations. Many employers offer a Dependent Care FSA that allows employees to allocate pre-tax dollars. Businesses can offer discounts or partial reimbursements for child care, elder care, adult care, and even pet care. Backup child or elder care, or allowing an employee flexible work hours is impactful.

Access to Medicare experts and estate planning services can help employees and caregivers plan for

the future. EAPs and curated services help individuals find assisted living or nursing homes, and can reduce a large stressor.

Employers should view the vast world of benefit options as an important part of today’s employer-employee relationship. These benefits are not out of reach for any sized employer, and many of the benefits can be achieved at various levels of investment. A great broker or professional employer organization can increase access to these benefits for small- and mid-sized businesses around the country.

Matsis-McCready is associate general counsel and vice president of HR services for Engage PEO.

We have the solutions YOU NEED

1,724 member inquiries

28 contracts reviewed

3,814 tool kit hits

4,955 QuickSource requests

1,673 Ask PIA hits

1,216 MarketBase™ requests

PIA membership brings with it a wealth of benefits for the professional, independent insurance agent or broker— but the personal assistance of PIA’s Industry Resource Center alone is worth the investment.

“I am so proud of being a PIA member!”

—Robert Charles Robert Charles Brokerage Inc.

A DIFFERENT VIEW

Adapt your agency now to attract and retain new employees

s the baby boomers retire, the insurance industry is undergoing a generational seismic shift, creating a demand for millennials and Gen Zers to fill 400,000 vacant positions.1 These younger workers will make up 60%—40% millennials, 20% Gen Zers—of the workforce in 2025,2 bringing their passion, dynamism, and extensive experience with technology to the industry, which is poised for change. They understand that the world is rapidly changing and want to be part of the transformation.

One of the defining characteristics of this new generation of professionals is their focus on and knowledge of technology. They are the first generation to have grown up in a world where technology is ubiquitous. They understand its power and currently use it to streamline processes, reduce costs, and improve the customer experience. They know that technology is not a threat, but rather an opportunity.

Another core characteristic of these younger workers is their commitment to social responsibility. They understand that the insurance industry has a critical role to play in society, and they are committed to using their skills and expertise to make a positive impact on the world. These workers are not just focused on profits; they are focused on people.

The next generation of independent insurance professionals is more diverse than any previous generation. They come from a wide range of backgrounds and cultures and bring fresh perspectives to the industry. They are not afraid to challenge the status quo and are not bound by tradition. They are forging a new path for the industry, one that is more inclusive, diverse and global. In essence, they are the perfect change agents, who are poised to transform the industry. They see beyond the industry’s limits into its promising, exciting, and unlimited future. The insurance business, which started a hundred years ago as a few niche markets, has now evolved into a global industry that is racing to address the new risks that arise as the world’s climate, politics, health care, technology and AI rapidly evolve.

As someone who has researched and worked in this industry, I am certain that a compelling future for insurance agencies depends on the next generation of professionals. They want to challenge themselves, push boundaries, and find creative, and novel ways to grow, expand, and move the industry forward. The question is whether the industry is truly ready to warmly welcome them.

Most agency owners do not know how to make insurance an attractive career option for millennials and Gen Zers. Since most businesses covet these employees, insurance agents have fierce competition for them from more progressive industries. Can the agency system reinvent itself to offer a compelling and bright future to win some of these innovative, growth-oriented, and eager-to-change-the-world employees?

Significant mismatches

Let’s begin with the stark realities. To attract and retain the best talent, the industry needs to address several significant mismatches between its traditionally perceived values in its employees and culture, and what the new generations need from an employer.

First, the insurance industry has a reputation of being stuck on the status quo and resistant to change.

Second, agency owners need to hire talented employees with potent innovative ideas and not just look for employees who will maintain the status quo. Now the industry needs high-quality employees who are skilled, smart, technologically savvy, and eager to make a difference.

Third, the industry needs to develop its employees and its technology. Traditionally, it has lagged behind most other industries and has offered less attractive careers to the new generations.

Fourth, the insurance industry is perceived as having a culture that is rigid, transactional, and top-down, which stifles innovation.

And, last is its personnel. The employees may need to update their dated, rigid, and inaccurate mindsets. Some employees need to exude more pride in their careers and truly know the value of the services, products, and advice they provide. I have seen talented and smart people who, when asked what they do for a living, mumble the words insurance agent under their breath, and then change the subject. I am not sure of the origin of this insecurity, but it must be eradicated to develop a new mindset about insurance, so younger people will see it as a compelling and impressive career option.

To address these serious mismatches, the industry needs to reinvent itself to offer a promising and exciting future to attract and retain topnotch employees.

A business model with attractive outcomes

To transform the industry’s people and culture, a new business model, which is described in McKinsey Global Institute’s February 2023 report, Performance through people: Transforming human capital into competitive advantage, may provide the guidelines for agencies to accelerate their growth and modernization. It has four components.

One: To teach agency owners how to excel at creating opportunities for their employees to continuously develop their skills.

Two: To emphasize building human capital to generate consistent earn-

ings and be more resilient while attracting and retaining talent.

Three: To prioritize developing and managing employees while delivering top-tier profitability.

Four: To focus on how management must challenge and empower their employees while fostering bottomup innovation.

A deeper dive into each component

The insurance industry has the potential to be lauded for making a positive impact in the world: It helps people when they need it the most, provides them with peace of mind, and protects them from life’s uncertainties. But to do so, it needs the skills, expertise, and passion of the next generations.

Skill development. The first component fits well with what the industry needs and what the millennials and Gen Zers want. Investing in employee skill development is essential for the industry to close the gap with other industries and offer attractive career options to younger workers. Skills learned on the job account for 46% of an employee’s lifetime earnings.3 Thus, constant skill development helps to propel employees into higher earnings brackets while providing the agency with skilled people ready to handle higher-level positions.

Therefore, agents need to shift their focus from accepting good candidates to only accepting high-quality candidates who value learning and growth. This entails agency owners being willing to make significant investments in two of the insurance industry’s weakest links: their employees and technology.

Millennials and Gen Zers are technologically savvy, so they are posi-

tioned perfectly to make remarkable contributions to accelerate the industry’s adoption of technology. They do not have the blind spots that some baby boomers had regarding the future role and limitless possibilities for technology. Building human capital. The second component of this business model is building human capital. It will result in agencies having more consistent earnings and greater resilience during a crisis. Agency owners who excel at developing and managing their people will be in the top-tier profitability consistently and they will have an employee turnover rate at least 5 points lower than their competitors.

The biggest hurdle the industry faces to be a builder of human capital is its culture. It has been inflexible, transactional, authoritative, and incorporates minimal employee development, trust, or engagement. The culture that will attract and retain today’s workforce is almost the opposite: a healthy, engaging, and vibrant culture that will inspire and energize employees.

The perception is that agencies may offer little in the way of career-pathing. Millennials and Gen Zers want a career that will train them regularly, and thus improve the odds that they will be employable three, five, and seven years from now. These younger workers have immense student debt and have delayed marrying, buying a house, and having children, in order to meet their debt payments.

Without a solid career path, they will look at other industries that offer a career as an integral part of their business. I know a few highly talented people who reluctantly left an agency and a carrier because there were few attractive opportunities for advancement.

Their human development and profitability would place these newly revamped agencies in a far stronger position than their competitors when it comes to weathering disruptions and crises. In essence, they will have turned their human capital into a potent competitive advantage. This would make an agency’s profits much less dependent on the carriers’ contingencies and more on their own employees’ skill development.

Managing top-tier profitability. The third component is to prioritize developing and managing employees to deliver top-tier profitability. This will require agencies with traditional top-down management to embrace a more participative, inclusive, and transparent management style.

These new employees value relationships, and thus need a strong, respectful, and open relationships with their managers. Since relationships are built on trust, and managers usually are promoted because of their technical skills rather than their interpersonal skills, most managers are less likely to know how to create trust. Their role needs to be redefined so they understand that they are coaches, and the agency owners must provide them with regular training so they can be very effective.

The millennials and Gen Zers want their work to have purpose and meaning, and to be socially conscious. Thus, they need to be heard, asked to contribute their ideas for new services or products and have a seat at the table when issues arise that will impact them. They are both the most innovative and creative generation ever. If given the culture they need to thrive, these employees will uncover opportunities for growth and expansion.

Challenging, empowering, innovating. The fourth component is to develop a management style that challenges and empowers employees while fostering bottom-up innovation. The leadership needs to inspire inclusivity and diversity, build trust and support, and be passionate about making its employees the absolute best in the business.

These younger employees will want a seat at the table much sooner than you think is appropriate. They will balk at taking a back seat to someone who has more experience but who lacks the key skills that are critical to a project. Allow them to participate and be impressed at their insights.

These employees have a knack for fostering connections with people, understanding how to use social media to grow a business, collaborating easily with others, and helping make the workplace a thriving community. If you are willing to empower these younger workers, they will help grow your agency in leaps and bounds.

Time is of the essence. This is a critical point for the agency owners to listen to new and diverse ideas and opinions. Forward-thinking agents will realize that to remain competitive in this fast-paced world of accelerating change, they need the new generations’ skills, ideas, and passion.

Agency owners who make the changes suggested here, will find that their agencies will be more robust, healthier, and well-positioned to tackle the upcoming challenges head-on without missing a beat. So, if you want to be ahead of your competitors, take a leap of faith and invest in your people and technology. It is a bold and wise decision that will minimize the fear of the future and replace it with an energized, clear, and confident path forward

complete with challenges, wins, and celebrations.

Thomas is the country’s leading employee and client retention expert with over 33 years of experience, mostly in the property/casualty insurance industry.

Thomas Consulting uncovers novel and innovative ways for businesses to attract and retain fiercely loyal employees and clients. Reach her at LynnThomas@thomasconsultingwins. com or (781) 899-4210.

1 A.D. Banker & Co., 2022 (bit.ly/3OnyV9P)

2 Creditors Adjustment Bureau, 2022 (bit.ly/3IqEzUU). Although some sources indicate that Gen Zers will make up 27% of the workforce by 2025 (Zurich, 2022, bit.ly/3Mk2pTs).

3 McKinsey & Co., 2022 (mck.co/3OjlgAJ)

SELECTIVE DELIVERS AN EXCEPTIONAL CUSTOMER EXPERIENCE

Consumers demand agents protect them and make it easy to do business. That’s what Selective does for our mutual customers.

Leadership is much like sailing. Members of the crew—each with unique skills and responsibilities— must work together to reach their destination safely. A successful voyage requires collaboration, communication, and accountability across the team. Strong leaders, much like strong ship captains, understand that their role is to lead with purpose, continually guiding the team toward success.

In my 30-plus years leading myself and others, I have distilled leadership into two core principles: 1. Before we can lead others, we must first lead ourselves well; and 2. Be intentional in how we nurture our own lives. We must model the behaviors we expect from our team and be the change we want to see. Once we set ourselves on the right path, we can shift our focus to pouring into those around us, helping them to become the best versions of themselves.

Leading ourselves

We are all responsible for our own professional development. No matter what position we hold, we can make it a job or make it a mission. If it’s just a job, it will show

up in the way we approach our work and be obvious to everyone around us.

Everything changes when we are on a mission in the work that we do every day, for us and for everyone with whom we work. Are you on a mission every day to serve your customers, your team, and your organization in a way that only you can?

Here are three beliefs that have supported my personal and professional growth over the course of my career. They are simple but powerful.

Expand your circle

A mentor once told me, “You are the average of the five people you spend the most time with.” It is a lesson that has stuck with me in the 20 years since I first heard it— one that has guided me throughout my career. Are you spending time with people who are pushing you to move beyond your comfort zone and to be the best version of yourself?

One of the most rewarding aspects of our industry is how willing most leaders are to share the strategies that have

The hallmarks of a great leader

The hallmarks of a great leader

Keep your people 'in the boat'

led them to success. Ask someone you respect if he or she will meet for lunch once a month to mentor you. (Your treat, of course!) Join a study group. Form a personal board of directors. The key is to find opportunities to connect with people who are at a higher level of success than you are. It may be intimidating, but that twinge of anxiety also can be energizing. The relationships you build by expanding your circle outside of your comfort zone will enrich your life in ways you never imagined.

I used this strategy while developing centers of influence to grow my business. I connected with one business leader each week—not to ask for referrals—but to learn from them. They shared their success stories and offered advice. At the end of one year, I had 52 friends and advocates in the community who did provide referrals as our relationships developed. And, I learned so much from all of them about the community and about running a business.

Pay attention to what is influencing you

What content are you consuming? Whether it is books, podcasts, articles, videos, TV, streaming or scrolling—is what you are spending your time on making you a better human being, family member or leader? There is nothing wrong with using any of these purely for entertainment, but be careful what you are allowing into your life. It’s influencing you whether you recognize it or not.

Prioritize your personal development

Does your calendar reflect your commitment to continual growth? Show me your calendar, and I’ll tell you what is important to you. Be sure that you have scheduled opportunities for personal and professional development. We need regular doses of energy, motivation, and inspiration in addition to specific growth opportunities.

We can’t help our team members be the best version of themselves if we don’t invest in becoming the best version of ourselves.

Leading others

Our teams are primary to our success. It is the leader’s role to support the people who are getting things done, not the other way around. One of my guiding principles in leading with purpose is that the success of team members always comes first. When the team succeeds, results will follow.

Servant leadership is a philosophy in which the leader’s main goal is to serve. Servant leaders put the needs of team members first, helping them to develop and perform as the best versions of themselves. I want to be clear: Servant leadership is not trying to make everyone happy and letting everyone do what they want. That is abdicating your leadership responsibility. Servant leadership is creating a framework that guides the team members’ actions and bolsters their success.

You can create a leadership framework and lead with purpose as well by focusing on what I call the three C’s of leadership: connection, consistency and collaboration.

Connection

Building connections deepens trust, provides a purpose, and creates a sense of community within the team. Rally to a common cause. One of the most impactful things you can do as a leader is to help team members connect to a cause greater than themselves. Create a shared vision and mission with your team, and tie them into everything that you do. Remind your team members of the great work they are doing for their clients and communities. People who believe there is meaning to their work are more engaged. Put people first. Always lead with the positive and be quick to address issues, praising in public and correcting in private. Continually fill every team member’s bucket, making 10 deposits for every withdrawal. Remember, results matter, but only as a reflection of how your people are feeling. Happy, healthy people create happy, healthy results. Lead with love. Create a culture of growing and learning together in which people are empowered to act, and are allowed to make mistakes. Expect progress, not perfection. Be present for your team physically, emotionally and spiritually. Transparency, authenticity and integrity are the hallmarks of a great leader.

Leadership tools to build connections

In addition to creating a shared vision and mission, one of the most powerful tools I have used to build connections within the team is defining the core values that guide team behavior. This may not seem ground-breaking; many organizations identify their core values. You may have a list hanging in your

office. I encourage you to take your list one step further and define what those values look like in action. Here is an example:

Our Core Values Purpose

• We are intentional about aligning our decisions, actions and goals with our values.

• We use our drive and commitment to energize, engage and inspire others.

• We are committed in heart and mind to delivering high-quality products and services.

• We move forward, innovating and improving as we go.

Growth

• We strive for improvement and pursue development.

• We will grow our business in a way that makes us proud.

• We pursue growth and learning.

• We perpetuate an atmosphere of improvement.

Excellence

• We have high expectations for ourselves and our results.

• We are unreasonably picky about whom we bring onto our team.

• We think deeply about our recommendations to be sure they make sense for each client.

• We ensure our clients are not only satisfied, but also delighted with our partnership with them.

Once defined, your core values become an exceptional tool for coaching and developing team members. They also are an excellent recruiting tool, allowing you to share your expectations and culture in a specific way with candidates. During the selection process, you also can use them to identify candidates who share the team’s values.

Consistency

It is never the big things that make the biggest difference. It is the small things done consistently over time. Creating consistency for your team members eliminates confusion and allows them to focus on what matters most.

Calm the chaos. Another valuable lesson I learned from an industry icon many years ago is that people flee unpredictable environments. Be predictable and consistent in your actions and expectations. Do you quiet chaos for your team or are you creating more of it? Stay focused on a few critical priorities. Don’t be distracted by every shiny, new object. Remember, when you have too many priorities, you really don’t have any.

Create clear expectations. Provide a framework that lets people know not only what activities and results are expected, but also what behaviors are expected. Establish guiding principles that let team members know: “This is how we do it here.” Have quarterly conversations to review performance. A team member should never be surprised by your feedback. Remember, as Brené Brown teaches us, clear is kind, and unclear is unkind.

Deliver on commitments. Your word is your bond. Keep your promises and be honest in your interactions with others. Be relentless in execution, doing what needs to be done to deliver on commitments, including jumping in and working with your team, whatever the task. Become known as a problem solver who keeps things moving forward.

Leadership tools to create consistency

Goals, action plans, and scorecards are all excellent tools for creating consistency within the team. While these tools focus on activity and results, it also is important to reinforce consistent behaviors. Guiding principles and habits for success are two tools that will help.

Guiding principles:

• We strive to be the standard by which others are judged.

• Our commitments to each other and to our agency are equally as important as our commitment to our clients.

• How we get results is as important as getting the results.

• Achieving our vision is a matter of execution, and we are committed to unmatched execution standards.

• We solve problems; we don’t share them.

• We are committed to professional communication in all situations.

• We hold ourselves personally accountable for our actions and results.

• What we are contributing is more important than what we are receiving. Habits for success:

• Weekly activity standards

• Create a referral environment

• Continue professional growth

• Execute a world-class review program

• High marketing and prospecting activity

• Strong and committed community involvement

Collaboration

Our superpower as leaders is in bringing together each person’s strengths to create a better result than any one of us could accomplish on our own.

We’re better together. Create a culture that fosters collaboration. No one on the team should feel they are going it alone. In a collaborative culture, team members are committed to helping each other. They are willing to share new ideas and offer differing opinions, knowing that their input is respected and valued. When you create connections and consistency, people want to collaborate.

Working for the greater good. Rallying around a cause that serves a greater purpose encourages collaboration, provides focus, and creates engagement. When we do this well, team members will push beyond individual goals to help other team members (as well as the organization) meet higher goals for the greater good.

This can be beneficial in creating a referral culture. Team members working for the greater good understand the importance of growing the business and are more willing to ask for referrals. At the same time, referrals get a glimpse of your engaged, collaborative culture, leaving them with the best impression of your organization and the opportunity.

Contributing at a higher level. Help your team dream bigger—individually and collectively. Do you truly believe in your team members and what they can achieve? Or are you constantly micromanaging and making decisions for them? Who are you developing? Who are you encouraging, and who are you putting courage into?

Leadership tools to foster collaboration

One area that often is overlooked when fostering collaboration is managing conflict. Even the most collaborative teams will experience conflict at some point. Help your team members work through disagreements effectively by providing a conflict resolution framework.

Issue/Conflict Resolution

Do not take the bait. Be the calm in the storm. Show empathy. Assume the best. Resist the temptation to assume negative. Get the facts. Avoid judgement and accusations.

Engage all parties. Get everyone around a table. It’s hard to hate up close.

Extend some grace. Identify what part you can take ownership of.

Create happy healthy results

Productivity, retention, and team engagement will surge as you serve your team members by developing them to contribute at higher levels, and serve yourself by continually strengthening your personal and professional capabilities.

Be intentional in your efforts to build connections, create consistency and foster collaboration. If you ask yourself every day, “How am I serving?” you will be leading with purpose— developing others to become the best versions of themselves, and in the process, growing a flourishing, profitable business.

Hubert has more than 30 years of experience helping business owners attain operational and leadership excellence. A true servant leader, she is passionate about developing others to their highest potential, and her results are evidence of the power of her serve-first philosophy. The author of Leading with Purpose: A Framework for Igniting Your Fullest Potential, Hubert is an international speaker, specializing in developing leaders, building culture, and driving results. As a principal with Korsgaden International, she helps leaders develop world-class cultures and consistent, predictable results at every level of the business. Reach her at michelle@korsgaden.com.

Create a culture that fosters collaboration. No one on the team should feel they are going it alone.

Brooks Insurance Agency is proud to support Professional Insurance Agents (PIA)

Since its founding in 1991, Brooks Insurance Agency has successfully serviced the standard markets and brokered distressed and complex lines of business. We are here to help agents find the coverage their clients need.

We represent 80+ quality carriers, including several new and exciting markets, across the country. Plus, a broad array of products and services in admitted and non-admitted markets.

MARKET STRENGTHS AND EXPERTISE

• Broad market reach

• High-touch broker specialists

• Easy, online quoting process

• Collective approach to complex insurance needs

Visit our website at www.brooks-ins.com.

Brooks Group Insurance Agency, LLC NJ License 1575143

Protect your agency from E&O exposures

Carriers’ online applications are convenient, but they can lead to errorsand-omissions exposures for your agency. Here are some scenarios and tips that can help you protect your agency.

Scenario: Your client completes the application online and signs it digitally.

Tip: Ensure the signed application is stored in your records.

Scenario: Your client completes an application, and you enter it into the carrier’s online system.

Tip: Save a signed copy of the application for your records—regardless of whether the carrier requires it. This will help if there’s a claim alleging the information provided to the carrier was not the information the client provided to you.

Scenario: You use a checklist to obtain information instead of an application.

Tip: If you can print a copy of the application entered online, have the client review the application and sign it prior to binding coverage. Communicate to the client that he or she should review the entire application for accuracy before signing and bring any discrepancies to your attention.

State Auto®

is proud to support the PIA of Connecticut

PaceSetter® Program

For over 20 years, the premier sales training program for new agents in the industry.

Digital Experience

When you choose State Auto, you’ll find solutions to fit your customers’ business insurance needs. They’ll also have an entirely digital experience with digital signatures, electronic payments and digital delivery of policy and billing documents, supported by the personalized service offered by you, their independent agent.

Committed to the Independent Agent

We distribute our products solely through independent agents and brokers and are proud to be a Trusted Choice company partner.

Tip: If you can’t print a copy of the application entered online, have the client review the information on the checklist and sign off on its accuracy. Let the carrier know it is creating a potential E&O exposure for its agents by not providing access to the completed application.

What else you should do

Here are some additional best practices that will help you to minimize the likelihood of an E&O exposure in your agency.

Carefully document guidance you provide to help the client fill out the application and coverage discussions. Comments in your agency management system are good, but an email to the client memorializing the conversation is better—and provides protection if there’s a claim.

Get the client’s signed confirmation. Claims in which a client indicates the information he or she provided to the agent differs from what was provided to the carrier are common. You have no way to defend yourself without signed confirmation from the client. You will lose in a he said/she said scenario. Ask your client about information on the application you are unsure about before entering it into the carrier’s system. Never enter rough information to generate an estimate—it can be problematic if the application is not updated once accurate information is provided.

Lesson learned

Don’t let this happen to you: An insured procured an HO-3 policy for the claimant that was placed with a carrier. The contract was written with the following coverage limits:

• Dwelling: $155,000

• Other Structures: $15,500

• Contents: $77,500

• ALE: $31,000

The claimant’s single-family dwelling was a total fire loss. The claim against the insured arose from allegations that the insured made material misrepresentations on the carrier’s policy application regarding the claimant’s criminal history. The carrier investigated the claim and eventually rescinded the policy back to policy inception based on material misrepresentations made on the policy application. The carrier stated it would not have written the risk if it was aware of claimant’s prior criminal conduct.

The claimant noted she would pursue an E&O claim alleging that the agency answered the questions on the claimant’s policy application without any input from the claimant. The agency producer stated that he completed the application based on a phone interview with the claimant. The claimant indicated she stopped at the agent’s office, was simply advised to sign the form, and was never asked to answer or review any of the application’s questions. The dwelling loss totaled nearly $200,000.

This claim is ongoing with the creditability of the agent/claimant to be assessed.

Lesson: Be cautious in your communications if you fill out an application using information not supplied in writing by the client. Always get the completed application signed and communicate in writing to the insured that he or she should review the application for accuracy before signing. Use language such as: Please review the attached application and sign to warrant that all information is accurate. If there are any discrepancies, contact me prior to signing.

Utica National Insurance Group and Utica National are trade names for Utica Mutual Insurance Company, its affiliates and subsidiaries. Home Office: New Hartford, NY 13413. This information is provided solely as an insurance risk management tool. Utica Mutual Insurance Company and the other member insurance companies of the Utica National Insurance Group (“Utica National”) are not providing legal advice, or any other professional services. Utica National shall have no liability to any person or entity with respect to any loss or damages alleged to have been caused, directly or indirectly, by the use of the information provided. You are encouraged to consult an attorney or other professional for advice on these issues. © 2023 Utica Mutual Insurance Company

NEXT GENERATION OF AGENTS

As a member of the national Association of Professional Insurance Agents, Quincy Mutual is happy to work with and support young independent agents to help foster and grow our industry for the next generation.

YourSupercharge Insurance Sales

The Key to Boosting Practical Skills and Enhancing Sales Results

Live Webcast Schedule

Sept. 28, 2023* | 8 a.m.-4 p.m.

The Certified Professional Insurance Agent Designation Delivers:

• Practical skills

• State-approved CE credit

• A competitive edge

• Networking with professionals

• Professional development

CPIA 1: Position for Success

*In-person classroom option—Aflac, Fairfield, N.J.

Oct. 17, 2023 | 8 a.m.-5 p.m.

CPIA 2: Implement for Success

Nov. 14, 2023 | 8 a.m.-4 p.m.

CPIA 3: Sustain Success

Dec. 12, 2023 | 8 a.m.-4 p.m.

CPIA Advanced: An E&O Loss Control Program for All Agencies

PIA TECHNICAL STAFF

Have a question? Ask PIA at resourcecenter@pia.org

Cooperatives, drones, statutory disability and more

LTC partnership program training

Q. Do I need special training to sell long-term care insurance?

A. There is a training and certification requirement for Connecticut’s Partnership for Long-Term Care products. Before insurance producers can market, discuss or sell any partnership-approved long-term care insurance policies in Connecticut, they must have met the training requirements under the partnership’s certification training program. Certification training is available to life, accident and health producers who have a valid license in Connecticut. It is required for both resident and nonresident producers who wish to market partnership-approved policies. The training is a one-time requirement, and no renewal training is required.

The course has been approved for 10 continuing-education credits for Connecticut resident producers (i.e., 7 life and health, and 3 laws/regs and ethics). The completion of the course and passage of an exam will meet the partnership certification training requirements. All completions will be reported to the state of Connecticut to ensure compliance with state regulations. Be aware course completion does not guarantee CE credits, and credits must be requested upon enrollment.

More information about the partnership training and the CE credits it provides can be found at ct.gov/opm/cwp/view.asp?a=2995&q=383398.—Helen K. Horn, CIC, CPIA, CISR

Cooperative coverage

Q. Does a cooperative owner need Coverage A if he or she is just a shareholder of the building?

A. Yes. Even in Connecticut—where the cooperative owner can be held responsible only for improvements and betterments installed by the owner— there may be a substantial amount of these improvements and betterments to warrant an increase above the default limit of $5,000.

Coverage can be increased on the policy and broadened to special coverage by adding endorsement, Unit-Owners Coverage A Special Coverage (HO 17 32).—Helen K. Horn, CIC, CPIA, CISR

Recreational drone registration

Q. Recently, my client bought three drones—one for each of her sons and one for herself. Does she have to register them? If so, how does she go about doing this?

A. Yes. Drones need to be registered. As of Dec. 21, 2015, Federal Aviation Administration regulation requires anyone over the age of 13—who owns a small, unmanned aircraft between a half pound and 55 pounds—to register it with the FAA’s Unmanned Aircraft System before the owner can fly it outdoors. If the owner of the device is younger than the age of 13, then the aircraft must be registered under the name of someone who is 13 or older.

The FAA keeps the registration information in a database. An owner’s failure to register a drone could result in civil and criminal penalties up to as much as $27,000. Criminal penalties include fines of up to $250,000 and/or imprisonment for up to three years.

Registration is simple—it can be done on the FAA’s Unmanned Aircraft Systems Registration webpage (faadronezone-access.faa. gov)—and it will cost $5. A registration must be renewed every three

years. The registrant must be 13 years old or older; and must be a U.S. citizen or a legal permanent resident. The registrant also needs a valid email address; a credit/debit card for payment; and a physical address and mailing address. Once the registration is completed, the registrant will receive a registration number, which can be used on all the registrant’s aircrafts—if they meet the criteria. The registration number must be displayed on the aircraft to meet the regulation’s marking requirement. For more compliance information, visit: faa.gov/uas/getting_started/register_drone.—Bradford

J. Lachut, Esq.BAP Symbol 7 newly acquired auto coverage before acquisition

Q. Our insured has an automobile policy written with Symbol 7 for comprehensive coverage in the ISO Business Auto Coverage form. If a comprehensive loss occurs to a newly acquired auto within 30 days after acquisition, but before the insured notifies us that the auto has been acquired, would this loss be covered?

A. Symbol 7 (Specifically Described Autos), unlike Symbols 1 through 6 or 19, limits coverage to: “Only those ‘autos’ described in Item Three of the Declarations for which a premium charge is shown.”

However, item 2. of Section B. Owned Autos You Acquire After The Policy Begins provides conditional coverage for newly acquired autos where Symbol 7 is designated for comprehensive coverage. To begin with, comprehensive coverage for a newly acquired auto is afforded only if the insured tells the company within 30 days that this coverage is desired. After meeting that condition, comprehensive coverage for a newly acquired auto applies only:

a. if the auto replaces a previously owned auto that had comprehensive coverage; or

b. in the case of an additional auto, if the policy already provides comprehensive coverage to all autos owned by the insured. So, coverage will depend on whether the auto is an additional auto or a replacement auto.—Dan Corbin, CPCU, CIC, LUTC

States with statutory disability

Q. We insure a business that is a one-person corporation. He will be working in North Carolina for a while. Does North Carolina have a statutory disability plan of which we should be aware?

A. No. Only six jurisdictions require statutory disability coverage: California, Hawaii, New Jersey, New York, Puerto Rico and Rhode Island. (New York is the only system that is completely separate from unemployment insurance.)

—Dan Corbin, CPCU, CIC, LUTC

Workers’ Adjustment and Retraining Notification Act

Q. In comparing employment practices liability policies, I have noted references to the federal Workers’ Adjustment and Retraining Notifica-

tion Act. Sometimes violations of this act are excluded from coverage. What are an employer’s responsibilities under the act?

A. According to the U.S. Department of Labor, the WARN Act became effective in 1989. It requires employers with 100 or more employees to provide 60 days’ notice in advance of plant closings and other mass layoffs covered by the WARN Act. Notice must be given to the workers (or their union), a state’s dislocated worker unit and the local government.

Most employers are subject to the WARN Act, but it does not apply to governmental units. Plant closings trigger notification requirements if 50 or more employees will be laid off during any 30-day period. Other mass layoffs trigger notices if: 500 or more employees lose their jobs; or 50-499 workers are affected, and they represent at least one-third of the employer’s work force.

A DOL Employer’s Guide on the WARN Act is available at doleta. gov/layoff/warn.cfm.—Dan Corbin, CPCU, CIC, LUTC

PIACT Strategic Partners

PIACT 2023-2024 Board of Directors

OFFICERS

President

J. Kyle Dougherty, CIC Dougherty Insurance Agency Inc. 2420 Main St., Ste. 5 Stratford, CT 06615-5963 (203) 377-4394 kyle@doughertyinsurance.com

President-elect

Nick Ruickoldt, CPIA

The Russell Agency LLC

317 Pequot Ave. PO Box 528 Southport, CT 06890-0528 (203) 255-2877 nruickoldt@therussellagency.com

Vice President

Kevin P. McKiernan, CIC, CPIA

Abercrombie, Burns, McKiernan & Co. Insurance Inc.

484 Post Road, Ste. A Darien, CT 06820-3651 (203) 655-7468 kmckiernan@abmck.com

Treasurer

Nathan L. Shippee Workers’ Comp Trust

47 Barnes Industrial Road S. PO Box 5042 Wallingford, CT 06492-7542 (203) 678-0110 shippee@wctrust.com

Secretary

Katie Bailey, CPIA, ACSR, CLCS

The Russell Agency LLC 317 Pequot Ave. PO Box 528 Southport, CT 06890-0528 (203) 255-2877 kbailey@therussellagency.com

Immediate Past President

Bud O’Neil, CPIA

C.V. Mason & Co. Inc. PO Box 569 Bristol, CT 06011-0569 (860) 583-4127 boneil@cvmco.com

PIA NATIONAL DIRECTOR

Jonathan Black, LUTCF, CPIA, CLTC, NAMSA, NSSA Curtis Black Insurance Associates LLC

57 North St., Ste. 119 Danbury, CT 06810-5626 (203) 792-3055 jblack245@gmail.com

DIRECTORS

Scott Burns

XS Brokers Insurance Agency Inc. 225 Asylum St. Hartford, CT 06103-1516 (617) 471-7171 sburns@xsbrokers.com

Nicholas Fanelli, CIC, CPCU, CLU Newberry Insurance Group 1760 Ellington Road South Windsor, CT 06074-2715 (860) 648-6330 papabearct38@gmail.com

Nicholas Khamarji Jr. New England Insurance PO Box 125 Easton, CT 06612 (203) 445-3594 NGK325@gmail.com

Jeffrey A. Krar Joseph Krar & Associates Inc. 1676 West St. PO Box 580 Southington, CT 06489-0580 (860) 628-3967 jkrar@jkrar.com

Carlos A. Lithgow, TRA CAL Insurance 27 5th St. Stamford, CT 06905-5013 (203) 900-3353 carlos@calics.com

Kimberly A. Tompkins, CIC, CPIA, AIS, AINS, PHM, CRIS, ACSR

Convelo Insurance Group

1385 Highway 35 PMB 170 Middletown, NJ 07748-2012 (833) 266-8356 ktompkins@conveloins.com

Patrick Walsh

Insurance Provider Group

100 Great Meadow Road, Ste. 705 Wethersfield, CT 06109-2355 (860) 764-0555 pat@insuranceprovidergroup.com

DIRECTOR AND CT-YIP REPRESENTATIVE

Ryan Kelly

AJ Gallagher Risk Management 1 Enterprise Dr., Ste 310 Shelton, CT 06484-4631 (203) 367-5328 ryan_kelly@ajg.com

ACTIVE

PAST PRESIDENTS

James R. Berliner, CPCU Berliner-Gelfand & Co. Inc. 188 Main St., Ste. A Monroe, CT 06468-1149 (203) 367-7704 jim@berlinerinsurance.com

Mark Connelly, CIC Fairfield County Bank Insurance Services

401 Main St. Ridgefield, CT 06877-4513 (203) 894-3123 mark.connelly@fcbins.com

John DiMatteo, CFP, AIF DiMatteo Group Financial Services

79 Bridgeport Ave. Shelton, CT 06484-3254 (203) 924-5412 jdimatteo@dimatteofinancial.com

Peter Frascarelli, CPIA Ferguson & McGuire

6 North Main St. Wallingford, CT 06492-3741 (203) 269-9565 pfrascarelli@fergusonmcguire.com

Michael F. Keating Michael J. Keating Agency Inc. 10 Arapahoe Road PO Box 270048 W. Hartford, CT 06127-0048 (860) 521-1420 mfkeating@keatinginsurance.com

Howard S. Olderman Olderman & Hallihan Agency 400 Main St. Ansonia, CT 06401-2303 (203) 734-1601 howard@oldhalins.com

Gerard Prast, CPIA XS Brokers Insurance Agency Inc. 13 Temple St., Floor 1 Quincy, MA 02169-5110 (617) 471-7171 gprast@xsbrokers.com

Shannon Rabbett, CIC Rabbett Insurance Agency 233 Addison Road PO Box 665 Windsor, CT 06095-0665 (860) 688-1303 shannon@rabbett-insurance.com

Augusto Russell, CIC Insurance Provider Group 100 Great Meadow Road, Ste. 705 Wethersfield, CT 06109-2355 (860) 764-0555

augusto@insuranceprovidergroup.com

Timothy G. Russell, CPCU The Russell Agency LLC 317 Pequot Ave. PO Box 528 Southport, CT 06890-0528 (203) 255-2877 trussell@therussellagency.com