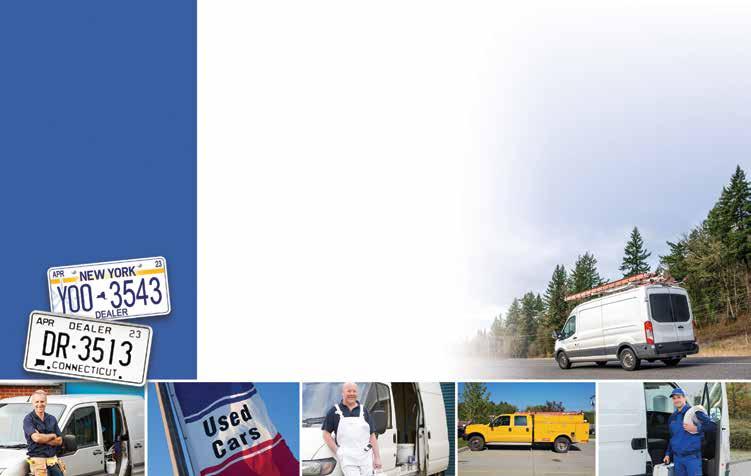

Protecting

cargo with insurance from

Protecting

cargo with insurance from

18 It all starts with you

Create powerful, enduring customer connections

25 Customer satisfaction

An even more elusive goal in dynamic economic times

29 Connecticut Convention had something for everyone

Mock cyberattacks, CE and networking

Statements of fact and opinion in PIA Magazine are the responsibility of the authors alone and do not imply an opinion on the part of the officers or the members of the Professional Insurance Agents. Participation in PIA events, activities, and/or publications is available on a nondiscriminatory basis and does not reflect PIA endorsement of the products and/or services.

President and CEO Jeff Parmenter, CPCU, ARM; Executive Director Kelly K. Norris, CAE; Communications Director Katherine Morra; Editor-In-Chief Jaye Czupryna; Advertising Sales Representative Kordelia Hutans; Senior Magazine Designer Sue Jacobsen; Communications Department contributors: Athena Cancio, David Cayole, Patricia Corlett, Darel Cramer, Anne Dolfi, Kordelia Hutans and Lily Scoville.

Postmaster: Send address changes to: Professional Insurance Agents Magazine, 25 Chamberlain St., Glenmont, NY 12077-0997.

“Professional Insurance Agents” (USPS 913-400) is published monthly by PIA Management Services Inc., except for a combined July/August issue. Professional Insurance Agents, 25 Chamberlain St., P.O. Box 997, Glenmont, NY 12077-0997; (518) 434-3111 or toll-free (800) 424-4244; email pia@pia. org; World Wide Web address: pia.org. Periodical postage paid at Glenmont, N.Y., and additional mailing offices.

©2023 Professional Insurance Agents. All rights reserved. No material within this publication may be reproduced—in whole or in part—without the express written consent of the publisher.

What customer experience (CX) is …

The impression your customers have of your brand throughout all aspects of their working with you.

What customer experience is not …

It is not just marketing. Marketing may get people interested in your agency, but their experience will determine if they remain clients.

1 COMPREHENSIVE MARKETING. COMPREHENSIVE MARKETING. Market your clients’ journey after they purchase their insurance policies, not the purchase itself.

Key strategies to consider:

Thank your clients

Provide tracking

Organize your customer support

Respond to customer reviews

Remarket

Optimize your post-purchase marketing

2 CUSTOMER PERSONA DEVELOPMENT. CUSTOMER PERSONA DEVELOPMENT. Understand who your clients are, what they need, and how you can help them.

Key points to consider:

report that their customer persona development has been in place for three years or more.

Content preferences

Mobile behaviors

Purchase decision factors

Drivers of satisfaction (and dissatisfaction)

3 END-TO-END JOURNEY MAPPING. END-TO-END JOURNEY MAPPING. Visualize the process you need to accomplish a goal. Remember this changes over time.

Key factors to consider:

Think of your specific users

Think of your scenarios

Think of your goals

journey … make it a smooth one journey … make it a smooth one

When it comes to developing your customer experience, you need to be proactive. Waiting for potential clients to find you won’t get the job done. You need to be proactive with your current clients, too.

Once you’ve sold an insurance policy to a client, you need to sell him or her on your value. If clients understand your value, they will be less likely to make future insurance-buying decisions on price, which will make them less likely to leave your agency for another one at renewal time.

A great place to start sowing the seeds of value is with cross selling.

Customer satisfaction directly impacts customer loyalty.

Make sure your clients are happy with the products and services you provide.

Customer satisfaction can predict future performance.

Happy clients are more likely to continue their relationship with you in the future.

Customer satisfaction can lead to referrals.

Happy clients are likely to share their experiences with family and friends.

1

Revenue. Every agency employee has the power to generate opportunity. If you can sell more to your current clients, you can best protect them and help your agency grow.

2

Renewal. The policies that tend to take the biggest rate increases are monoline policies. Reduce those inbound calls with upset clients by educating them about their options to combine and save.

3

Better quality customers. When you have a cross-sold account, that client understands your value! The more clients who believe in value over price for insurance are clients worth keeping.

4

Ethics. It’s the right thing to do. When you see something not covered or underinsured, you must let people know so they can make informed decisions. They rely on us.

5

Because they need it. Often, clients buy the other policy from someone else. Why not you? If they can combine and simplify their lives, isn’t that reason enough to offer the option?

6

Self-esteem. Isn’t winning your clients’ other lines of business fun? Getting to “yes” means you have more self-esteem. You also hear more congratulations from agency leadership.

7

Keep the competition away. Who wants to be in battle with another agent? When you have all your clients’ policies, you can best advise them and keep that competition far away.

(You are not “too busy.”)

One of the most common challenges that insurance professionals face when working with policyholders is the issue of communication barriers. While agents need to be available to their customers and responsive to their needs, they may struggle to keep up with requests—particularly when managing a large client base. In addition, customers may prefer to communicate via different channels (e.g., phone, email or chat), making it difficult for agents to manage all communication effectively. This can result in missed opportunities or misunderstandings, which can harm the client-agent relationship.

Along with the struggle of overcoming communication barriers, agents must depend on claims professionals to utilize the most efficient tools available. When digital solutions are disregarded, many agents are impacted by claim departments’ failure to keep up, which ultimately hurts the customer experience. Often, this is a result of the fact that carriers are having to juggle multiple independent programs to handle claims. It’s well-known that these programs do not communicate with each other without the cumbersome task of duplication or manipulation to do so. Regardless of the tools these firms add to their offerings, they still are limited. Offering a highquality customer experience means claims adjusters are calling on a suite of solutions that work seamlessly together to provide stress-free management, real-time analytics, and tech-advanced features (e.g., virtual photo scoping). And above all, we need to move toward a cohesive experience that does not start and stop at the beginning of the process but rather one that carries through to the end. When agents and claims professionals move toward their own individual goals, the gap between the two parties grows wider, ultimately leaving customers frustrated in the middle. For instance, when customers find they must pay their premiums in one portal, and then source an entirely new platform to submit a claim, a breeding ground for negative customer experiences is a result. Opportunities are missed, and policyholders begin shopping for new insurance options.

Also, digital tools can be a powerful asset for claims professionals in creating smoother processes between insurance agents and clients. However, it’s important to acknowledge that they can pose certain challenges. Common issues include difficulty integrating new tools with existing systems; a lack of training or understanding of how to use tools effectively; and potential

cyber security risks. In addition, insurance agents may face communication barriers with customers who are not familiar with using certain digital channels that adjusters have presented to them—leading to potential misunderstandings or missed opportunities. However, when both agents and claims professionals are aligned on tapping into digital tools, the customer can receive support and a consistent flow from beginning to end.

As mentioned, digital tools can play a critical role in helping insurance agents overcome communication barriers and time-management issues. Ultimately, these tech tools allow for an aggressive move toward virtual inspections and adjusting, which helps claims professionals provide timely information to your valued clients and—when the agent side is on the same page with utilizing digital tools—a seamless, positive client experience is created. It’s a win-win. While virtual inspections were once just a big idea, now they are a reality that is leveraged by those who are leading the way in stress-free insurance customer-service experiences.

Also, AI and machine learning are digital tools that adjusters are beginning to tap into—and although some may feel hesitant and worry that it will reduce the workforce—many understand that it will increase efficiency for both adjusters and agents, allowing more time to focus on tasks that must be handled with the human touch. AI has enhanced chatbots that are able to provide more robust responses to common questions, reducing client wait times, as well as agent workloads. This can save time and increase convenience for both parties. By using these digital tools, agents can streamline their workflows, improve productivity, and ultimately provide a better overall experience when partnering with claims professionals who also are committed to tapping into technology to better the client experience.

Connolly has held sales and corporate development positions at several Fortune 500 companies, executing multi-milliondollar acquisitions in addition to driving large incremental sales revenues. At Brush Claims, he works with the firm’s carrier strategic partners while building and establishing new key client relationships. He also oversees the sales, marketing, customer service, and client relationship management teams.

This article is adapted from “Improving customer experience amid the digital age,” which can be read in its entirety on PIA Northeast News & Media (blog.pia.org).

You are probably familiar with the turn of phrase Don’t shoot the messenger. It means not to blame the person delivering a message for the content of that message. Often, I think that all insurance agencies should have that sign up in their lobby or on their website, as a notice to customers. The independent insurance agent is the best—and often only—connection policyholders have to the world of insurance. So, when something happens to their policies, they are apt to blame any bad news on the messenger: their insurance agent.

With premiums and nonrenewals currently on the rise across almost all lines of insurance nationwide, how is an agent supposed to deal with delivering the bad news? All an agent can really do is help to explain the facts behind why policyholders are experiencing what they are experiencing. While the answer to that question is complex, as an agent you don’t have to tell the complete

story, only the most relevant to the policyholder.

Let’s start with the most obvious, at least for the policyholder, and that’s with inflation. That is a concept we are all painfully familiar with at this point. Inflation is the rate at which prices for goods and services increase. As I wrote in the March 2023 issue of PIA Magazine, inflation in America reached 20-year highs in

2022. Which means the cost of many goods and services were similarly high. Policyholders may ask how inflation impacts their insurance premiums when they still are purchasing the same level of coverage. Ignoring the fact that the risk may be underinsured now—a topic for another article—inflation means that the cost of replacing the risk, be it a vehicle, house or business is now more than it would have been during the previous policy terms.

A policyholder might say, “Okay, I understand why inflation might increase premiums for policies that cover property, but what if I have a liability-

only policy?” Good question. That brings us to the next talking point: increasing interest rates.

The Federal Reserve is the central banking system of the United States, and in a grand sense oversees making sure the country’s economy continues to have sustainable growth. When the economy gets funny—like when inflation increases sharply—the Fed will use the main tool in its toolbelt to address it: adjusting interest rates. The Fed has been increasing rates steadily for the last year. Where there was 0% interest rate for much of the pandemic, interest rates currently sit around 5%.

How do interest rates impact premiums and risks that an insurance company will write? Here it’s time to acknowledge a hard truth: insurance companies are businesses and businesses exist to make money. It’s OK to admit that. America is a capitalist society; generally, profitability is encouraged. So, how do insurance companies make a profit?

EverGuard, is a superior Restaurant, Bar & Tavern market with 40+ years’ experience. Our continued longevity offering an uninterrupted market assures you will receive the best product underwritten by an AM Best “A” rated carrier without program interruptions.

EverGuard’s respected reputation in the RBT market speaks to our stability and reliability to provide industry-leading response time and customer service to our partner agencies.

•

Insurance companies make money differently depending on the state of interest rates and the economy. When interest rates are low, profitability comes from investments.1 Money is inexpensive to borrow, which makes the return on investing that money higher. Insurance companies will write more policies to take in more premium dollars, which they can turn around and invest. Even it if means paying out more in claims than a company takes in in premium.

However, the script flips when interest rates increase. When the cost of borrowing money increases, the return-on-investment decreases. Insurance companies are no longer looking to make money on investments. Instead, they are looking to make money on the risks they

insure. To be profitable, an insurance company will be more sensitive to the cost of claims exceeding the premium received. Insurance companies address this in several ways, including increasing premiums or decreasing exposures by either lowering limits or canceling risks outright.

The last talking point is perhaps the one that is most unfamiliar to policyholders. Heck, it is unfamiliar to many insurance agents! That is the concept of reinsurance. While reinsurance is likely a foreign concept to policyholders, at least at a high level, is a relatively easy concept to understand. It mirrors the policyholder’s own insurance experience. Reinsurance is nothing more than insurance for insurance companies.

Insurance, at its base level, is a contract to transfer risk. In typical insurance settings, a policyholder agrees to pay a premium to an insurance company to transfer the risk of paying for a future loss to said company. Reinsurance is the same concept. An insurance company purchases reinsurance to transfer some of the risk of the future loss to another party.

Just like inflation and high interest rates have caused premiums for regular insurance to increase, so to have they made premiums for reinsurance increase. There are now fewer reinsurance dollars to go around to insurance companies. In turn, insurance companies will limit their exposure by being more selective in the risks they write, as well as how much they are charging for those exposures.

I am not naïve enough to think that talking about reinsurance and economic policy will quell the angriest policyholder. However, being able to understand—and more importantly explain—the reasons why a policyholder with no significant claims history is experiencing a 20% rate increase is critical. It allows you to not only deliver a message, but it will elevate you from merely a messenger to a trusted adviser.

Lachut is PIA Northeast’s director of government & industry affairs.

1 It’s appropriate here to mention that there is obviously a lot of nuisance to how businesses make money, which I’m ignoring for the sake of brevity and our collective sanity.

JOHN CHAPIN President, Complete Selling

JOHN CHAPIN President, Complete Selling

Price has been coming up a lot on my recent coaching calls with sales representatives, but there was one comment that compelled me to write this article. In a story related to a sale he made, a representative said, “I told the guy, ‘Look, you just tell me where the competition is, and I’ll cut my price to match it or beat it.’”

After instructing him to never utter those words ever again for the rest of his life, he came back with, “Why not? It’s an easy sale every time. All I have to do is make sure I’m the lowest price, and I’ll get the sale every time. Besides, this guy told me he buys solely on price so that’s the only way I’ll get the sale.” In the salesperson’s defense, he’s only been in sales for three months. That said, if I had a nickel for every time sales representatives—from newbies to veterans—told me they lost a sale because of price, or they couldn’t compete because of price, or used any other similar type of price excuse for not making a sale … well, I’d have a mountain of nickels.

The first thing I asked the sales representative was why we need him if all sales simply come down to price. If prospects buy on price, I could literally show up—having never met them before—with the equipment they need, ask what price they’re willing to pay, and then sell it to them right then and there for that price. Or, they could call the business, tell the receptionist what they want and what they want to pay, and the receptionist could take care of that transaction. If that’s the case, why are we paying your salary, commission, and expenses?

Next, I asked the sales representative if the prospect eats the cheapest food, wears the cheapest clothes, drives the cheapest vehicle, and lives in the cheapest house. If he or she does, the prospect might be a pure price shopper, but my guess is he or she doesn’t. Why? Simple, in any area in which he or she doesn’t simply buy the cheapest, the prospect sees the value in paying more. So, if the prospect saw value in your product, you, and your company, he or she would be willing to pay more for these products.

Here are a couple of other factors that may make prospects appear to be price shoppers.

First, price is the one thing on a proposal that’s in English. Your prospects do not work in your industry day in and day out, they don’t understand the subtleties, and they don’t know the true differences and value in features, functions, and other variables between products, companies, and sales representatives.

Second, most of us have been conditioned to ask for a better price since we were little kids because we know salespeople are almost always willing to budge on price—at least a little. As a result—to maximize the price drop—the average prospects will tell salespeople they are strictly price shoppers and if they want the business, they’re going to have to give the maximum price cut. The reality is, people know that you do get what you pay for, and they realize that products, companies, and sales representatives are different, but when price is brought up, what does the average salesperson do? He or she immediately cuts the price (as the representative in this story did).

However, this leaves the prospects to think that maybe there is no difference other than price. I mean if there was, why wouldn’t the salesperson tell them why his or her product is more versus just cutting price? The reason is that the average salesperson is looking for quick solutions, and it takes work to learn the differences between what you offer and what the competition offers. It takes work to calculate the potential value and put that into a form that the average prospects will understand and with which will resonate with them. Finally, it takes work to find out what’s important to each individual prospect, determine whether your

product is right for a prospect, and then, if it is, articulate value in a compelling way. Most salespeople don’t want to do that hard work, it’s simply easier to cut price versus make the case for why someone should pay more for what you have.

If you have two different brands of product, there are differences between them, which equals a difference in value and price. Even if you have the same exact product but it’s being sold by two different companies, you have a difference in value between the companies and the individual sales representatives. In either of these scenarios, you’ve got to know the differences and articulate those based upon what’s important to the prospect.

That said, is price a factor? Yes. Is it the biggest factor? Study after study shows only about 7% of the population truly buy on price alone. Ninety-three percent of the time, when you have a price issue, it’s because your product costs more, and you didn’t show added value that was equal to or more than the additional investment.

So, if you do your job correctly by building value and tying it to the prospects’ needs and desires, while price will still be a factor, it will only trip you up about 7% of the time.

And by the way, you don’t want to deal with the 7% of the population who truly buys on price anyway because true low-price shoppers are a nightmare. They are never satisfied. They will call you and email you at all times of the day and night, on weekends, and during holidays, and your response will never be quick enough or good enough for them. They will show no appreciation for

you, and they have zero loyalty. Even if you’ve been dealing with them for years, as soon as someone beats you on price, they’ll be gone.

On the other hand, the people who buy value usually are the exact opposite. They are loyal and a pleasure to deal with most of the time. So, while it may be some work up front to identify and articulate your value, your life will be much more pleasant, and you’ll be a much more successful salesperson if you do that work.

Chapin is a motivational sales speaker, coach, and trainer. For his free eBook: 30 Ideas to Double Sales and monthly article, or to have him speak at your next event, go to www.completeselling.com. He has over 35 years of sales experience as a No. 1 sales rep, and he is the author of the 2010 sales book of the year: Sales Encyclopedia (Axiom Book Awards). Reach him at johnchapin@completeselling.com.

Brooks Insurance Agency is proud to support Professional Insurance Agents (PIA)

Since its founding in 1991, Brooks Insurance Agency has successfully serviced the standard markets and brokered distressed and complex lines of business. We are here to help agents find the coverage their clients need.

We represent 80+ quality carriers, including several new and exciting markets, across the country. Plus, a broad array of products and services in admitted and non-admitted markets.

MARKET STRENGTHS AND EXPERTISE

• Broad market reach

• High-touch broker specialists

• Easy, online quoting process

• Collective approach to complex insurance needs

Visit our website at www.brooks-ins.com.

Brooks Group Insurance Agency, LLC NJ License 1575143

Typically, any service provider’s emotional state influences the outcome of that service interaction. Ensuring emotionally positive points of connection are among the best predictors of customer loyalty. Have you considered your insureds’ criteria to evaluate positive service interactions with your agency? Insureds and potential clients will assess your agency’s service in five key areas. How does your organization stack up?

TAMMY KOHL and DOUG BROWNReliability. Can people depend on your agency or call centers to resolve service issues accurately and dependably? Whether the callers are insureds or people representing carriers shouldn’t matter.

Assurance. Do your producers, customer service representatives, underwriters, and leaders convey confidence and profound knowledge about your policies? How much do your insureds and industry partners trust all your agency’s service providers?

Environment/technology. This deals specifically with the comfort and ease of interacting. It spans everything from conveying an appropriate physical office appearance and employee dress within an agency’s location, to how easily and elegantly an insured can interact with your virtual presence and portal. At the human level, are employees smiling appropriately, warm, genuinely open, and using easy-to-understand language?

While talking with clients over the phone, a smile, tone of voice, and the ability to listen intently can encourage positive interactions.

When interacting using virtual technology, your smile, body language, and tone of voice still are important. Here are other essential factors to consider.

• Technology is only great when it works, so test it often.

• Do you have a professional backdrop that lessens distractions for all?

• Does your lighting and mic setup provide the best visual appearance and sound clarity? You want your virtual interaction to be as professional as if the exchange was happening face-to-face in your office.

Empathy. This vital skill demonstrates that a service provider cares. Responsiveness. This involves providing prompt, timely service and measuring the effectiveness of the agency and the individuals to help customers.

A point of connection occurs every time someone encounters anyone or anything that is related to your insurance agency.

These points could include, but are not limited to, the mental effort and time needed to:

• schedule an appointment with a producer,

• find a parking space or enter a well-lit, safe parking lot,

• locate the best entrance to your building or your office suite,

• log onto the web portal or app,

• wait for an answer or response,

• deal with any negative attitudes or disappointing news from the staff, etc.

As you see, the list of points of connection goes on and on.

Every person decides whether the experience is positive or negative at each connection point. Each interaction will influence the overall impression of that customer’s experience. Of course, some connections may impact customers more substantially than others. A rude receptionist could be a more critical

point of connection for an individual customer than not receiving a typical follow-up call.

A great exercise is to identify all the points of connection throughout your service cycle. An even better practice is to identify each one, then decide what the needed standardof-service should be to exceed your customers’ expectations. Exceeding clients’ expectations can create a loyal customer base for your agency.

Connecting with the insured or client depends, first and foremost, on every individual service provider. It starts with emotional self-awareness. Each service provider must set the tone. Use your smile, sincere eyes, and warm and open body language to establish the right atmosphere for a great experience. The energy and passion in your voice also can make a positive difference. Research shows that people feel service providers need to realize how much their tone of voice impacts the experience. Make sure you are sending the appropriate nonverbal messages. Behaviors and body language that express the things your customers’ value include:

• smiling genuinely (recognizing that a smile is heard, as well as seen),

• using and pronouncing their name correctly,

• taking a genuine interest,

• listening carefully,

• keeping promises and commitments,

• saying thank you, and

• putting their needs ahead of your own.

Examples of nonvaluing behaviors include:

• exhibiting an intimidating stare (whether intended or not),

• ignoring them (seemingly),

• demonstrating indifference,

• sighing in disagreement,

• rolling your eyes when they ask a question,

• fidgeting,

• breaking promises,

• avoiding commitments, and

• focusing on your agenda versus theirs.

The same techniques apply in organizations that typically deal with customers via the phone. A smile will be evident in your voice and your tone. By taking an interest through careful listening and choosing the questions you ask, you create opportunities to connect personally.

On the flip side, your insureds or clients also will be able to hear distractions in a phone call, and they will pick up on the cues if you are not paying attention, trying to multitask—or worse, only feigning interest. Whether you communicate with a customer in person, virtually, or via the phone, your customer can detect all your nonvaluing behaviors. Reading a person’s body language can tell a lot about his or her feelings. Walking briskly and erectly usually means they are confident. What is being communicated when people are talking to you, but their hands are on their hips? Typically, this means that they are in a state of readiness or aggression, creating the illusion that they are ready to spring on you. In these cases, you must move swiftly to lighten the situation or try to reframe the subject. If natural to you, interjecting humor can have an excellent relaxing effect.

Another critical key to reading nonverbal communication is interpreting what the hands and lips tell us. Reading hands and lips gives us more information about that person than any other nonverbal cue. Hands are said to be our most expressive body parts.

Do you look at customers’ hand gestures as a distraction, or do you read what those hands tell you? What are they saying if those hands are fidgeting, pointing, and waving frantically? Fidgeting would mean nervousness, pointing might be arrogance or impatience, and frantically waving could be anger or excitement.

Lips give more subtle cues about inner feelings and moods compared to the hands. How about the customers whose lips are tense? Typically, that means they are concerned about something or anxious about their interaction with you. When people are biting their lips, you should focus on removing the tension and bringing the conversation to a more comfortable level for them. Connecting with the customer can be enhanced by maintaining eye contact. Eye contact arouses strong emotions and connections to that person. Frequently looking away from the customer may indicate a lack of interest on your part or that you have just told the customer something untrue. Customers may be feeling shy or embarrassed whenever they look away from you. Maintaining eye contact reflects your sincere effort to help. If your customer maintains eye contact, it is typically a sign that he or she is accepting and beginning to trust you. Note that different cultures and ethnicities process eye contact differently, so if you work with a diverse client base, seek to understand the cultural uniqueness related to eye contact.

The two most straightforward emotions to read are anger and happiness. Anger is telegraphed by a tensing of the jaw, glaring, palms facing down, or angry noises that may sound like a growl or a grunt. Anger may have nothing to do with you. It may be from a bad day, an unrelated argument, or a delay waiting for someone to help them. Your reaction to them should be an open body position, a smile, and an attitude that communicates, “I am going to do my best to make this a positive experience for you.” While a happy customer is the easiest to deal with, always focus on the customer no matter what emotions he or she brings to the interaction.

Excellent producers, CSRs, underwriters, and leaders are in tune with the people they deal with through awareness, empathy, and emotional intelligence. They are proficient at handling conflicts and they can maintain positive attitudes while working. However, a continual barrage of negative customer interactions can be a reality within the role of a service provider, and they can cause what is commonly called emotional labor.

Arlie Hochschild, author of The Managed Heart: Commercialization of Human Feeling, defines emotional labor as displaying emotions that differ from those the service provider is feeling currently. Based on this definition, people in customer-facing jobs who must act differently than they are feeling can experience high doses of emotional labor, which can cause stress, fatigue, and diminished impulse control (i.e., short tempers).

General pia@pia.org

Conference conferences@pia.org

Design + Print design.print@pia.org

Education education@pia.org

Government & Industry Affairs govaffairs@pia.org

Industry Resource Center resourcecenter@pia.org

Member Services memberservices@pia.org

Publications publications@pia.org

Young Insurance Professionals yip@pia.org

Many emotions will fuel clients’ and insureds’ interactions. Producers, CSRs, and underwriters may deal with a higher stress level, no matter what policies they provide and discuss. Stress is a physical reaction when struggling with any harmful or threatening situation. Due to the direct connection between any service provider’s role and stressful situations, understanding, managing, and reducing stress becomes an important skill to master.

People under stress tend to be more on edge and may erupt quickly and violently, increasing their conflicts with people. Extreme stress saps everyone’s energy because our bodies are functioning in emergency mode. Reducing stress can have many health benefits and make life more enjoyable and rewarding.

Stress management is your ability to deal effectively with adverse events and stressful situations without falling apart. Build or increase your stress tolerance by staying calm. Embracing a positive outlook on new experiences and change is beneficial. People who excel at stress management tend to face crises and problems head-on with a positive attitude rather than surrendering to feelings of helplessness, hopelessness, and self-doubt.

Understand where the stress comes from or what events activate the stressful feelings. Then ask, “What can I do to reduce or eliminate stress?”

CSRs may be dealing with some stress at any time but deciding to manage and reduce that stress whenever possible is crucial. Help yourself become happier, healthier, and more productive.

Effective impulse control is your ability to resist or delay an unconscious reaction, impulse, drive, or temptation to act. The lack of impulse control is closely associated with poor stress management. It is usually identified by impatience, anger, or both—making people uptight and anxious. Controlling your impulses means deepening your use of emotional intelligence, which entails building your capacity for accepting aggressive impulses, remaining composed, and controlling aggression, hostility, and irresponsible behavior.

With all these elements in mind, you can better provide services for your insureds, clients, and fellow employees. As an added bonus, it also may strengthen your relationships with your family members and friends.

Kohl is a partner in Trusted Advisors Network, which supports 225 independent consultants and coaches. Reach her at (484) 507-9641. For more information, visit www.trustedadvisorsnetworkllc.com. Brown is chairman/CEO of Paradigm Associates LLC. Paradigm Associates can add value to your business through strategic, executive, and sales development processes, whether you are on the insurance industry’s agency or carrier side. Visit Paradigm Associates on the web, www.paradigmassociates.us, or call (908) 276-4547.

Strong customer satisfaction is the holy grail for any service organization. Success in new sales is irrelevant if customers are leaving out the back door as quickly as they come in the front. Additionally, strong customer satisfaction promotes growth in the form of cross-sales and customer referrals and references. This especially is true among insurance agencies and agents, where competition is fierce and customer loyalty is not what it used to be.

Creating strong customer satisfaction is a difficult objective in the best of times—but when economic times are challenging, it becomes an even more elusive goal. However, it is in these times that service organizations should double down on their efforts in this regard.

Regardless of politics or root cause, no one can deny that the current economic environment is one of the more challenging ones any organization has experienced in recent times. Coming off the unique challenges of COVID closures, rampant inflation—both in insurance prod-

ucts and employee wages—has created a dynamic seldom seen. Baby boomers retiring from the workforce following COVID created a tight labor market, which in part gave rise to the Great Resignation, when employee retention in all businesses was at a low. The Federal Reserve is doing all it can to tamp down inflation, but this is causing its own set of issues, including rising interest rates and the related banking crises. The unemployment rate is slowly ticking up, which is the Fed’s stated goal, but this puts additional strain on businesses. No one knows whether the country is headed for a hard landing or some lesser effect, but some impact is inevitable.

With this dynamic environment, it is natural for service businesses to become focused internally, doing everything they can to hunker down and conserve capital. Customer service and the related customer satisfaction levels become a potential short-term sacrifice to accomplish these goals. This is a mistake.

It is crucial to remember that other agencies are living through the same circumstances. Competitors will do everything they can to win business, including compete more aggressively on price. Customers also are looking to

control costs and, if service levels are dropping at their current partners, they will be less hesitant to make changes to save money. The cycle can feed on itself creating a potential downward spiral for those not ready for it. It is in these times that the best of businesses will renew their focus on customer service and satisfaction. These are the businesses that will emerge from this cycle in the strongest positions.

Prioritizing the things that will keep customer satisfaction at the highest levels in this economic environment is more easily said than done. There is no perfect recipe for accomplishing this—each agency and its situation is unique. However, there are three key focus-areas that should be the mainstay of any strategy: employee retention and satisfaction; knowing your customers’ evolving needs; and understanding your competitors’ offerings and tactics. Prioritize employee retention. One of the top sources of customer dissatisfaction is employee turnover at the service provider. Often customers are not loyal to the business itself—rather, they are loyal to the employees with whom they work. When an employee is replaced, customers have an immediate concern about what this will mean to their service levels going forward. Customers have little patience for having to re-educate a new employee on their needs.

The Great Resignation put an even greater strain on this dynamic. Retaining employees has become a real challenge for organizations, especially in the

current new normal, in which working-from-home or hybrid work environments have become commonplace. Establishing a true company culture with employees working in a decentralized manner is difficult, if not impossible.

That said, generally, employees do not seek change for change itself. It is essential to ensure that the basics of employee satisfaction are in place at any service organization, some of which include the following:

• Are pay-scales competitive? Have they kept up with the rampant wage inflation of recent months?

• Are benefits competitive? Sometimes, these are just as important as base pay to employees.

• Is there a robust human resource function present at the organization (whether built internally or outsourced)? Issues arise, and HR professionals are essential in their resolution.

• Are managers trained on being managers? Nothing drives employee dissatisfaction like poor managerial practices.

• Are there rewards for quality performance, or is the only reward for employees being great at what they do is that they receive more work?

• Is there a structured rewards program for quality results, at the company and individual levels?

• Are there strong, open lines of communication throughout the organization?

Keeping employee turnover low is not enough though. It has become obvious that happy employees provide better customer service. Therefore, even if an organization’s employee turnover rate is at

an acceptable level, focusing on employee satisfaction will promote a higher level of service and thus stronger customer satisfaction.

Understand evolving customer wants. All organizations evolve. Leaders at customer-based companies change. As these changes occur, a customer’s needs may evolve as well. For example, historically it may have been crucial for a benefits program to be inexpensive, but this factor may become secondary if a business is having hiring challenges. Understanding customer needs as they evolve is paramount. It simply isn’t practical to anticipate every customer’s needs all the time. Therefore, agencies should periodically present alternative products and services. Sometimes customers will not even know that their needs have changed, until they are presented with options. When the service provider becomes a true consultant to the customer, customer satisfaction often is at the highest level.

Understand competitor tactics. Traditionally, customer satisfaction was measured almost exclusively by internal means—is the customer happy with the services that the service organization is providing? In today’s highly competitive landscape, especially in the world of insurance agencies, this is no longer enough. It also is crucial to identify competitors and to understand the products and services they are presenting to customers.

Even truly satisfied customers will listen to competitors periodically. If these competitors are presenting solutions that are not offered by the incumbent, this will create questions of competency or thoroughness. There is perhaps no quicker way to lose a customer.

Understanding competitor tactics is not always an easy task. Market research only goes so far, and discussions with customers about what your competitors are doing is not always a practical course. Often, the best solution is to be educated on all potential solutions that a customer may want in any field, and to ensure that the incumbent organization is able to offer most of them, or at least be able to talk about the advantages and disadvantages of each.

Focusing on customer satisfaction in these difficult times will not resonate to all. Some professionals may question whether it really requires prioritization—after all, some will fall back on their belief that things have been good enough for such a long time. At minimum, it is essential to understand where the organization stands in its quest for goodenough customer satisfaction. The gold standard in this regard is a Net Promoter Score.

NPS was first developed by Bain & Co. in the early 2000s as an efficient and effective way to measure customer loyalty. Often, the survey is comprised of a single question to determine the level of promoters of an organization versus the level of detractors: “On a scale of 1 to 10, how likely are you to recommend [X Organization] to a friend or colleague.” Scores of 9 and 10 are promoters; scores of 1 through 6 are detractors. To determine the score, the percentage of detractors is subtracted from the percentage of promoters. Often, the survey probes other areas to help service companies understand where they should focus their improvement effort.

The primary objection to conducting an NPS survey of customers is customers hate to be bothered . This concern often is over-estimated. In fact, customers frequently see efforts to understand their satisfaction level translating to a service organization that cares. When the survey is limited in scope, it is seldom seen as too much of an inconvenience.

At minimum, it is crucial for any successful service organization to know where it stands, and to determine what prioritization to place on additional efforts toward customer satisfaction, especially in these challenging times.

Times are challenging now. While pundits seldom agree on future outcomes, virtually all agree that this cycle is far from over and, at minimum, the near and mid-term future may bring even more challenging times.

Customer satisfaction will continue to be strained, as customers must navigate this landscape, even without changes at service organizations. It is the service organizations that truly focus on their customers’ satisfaction levels during this time that will ultimately emerge with the most successful paths forward.

Starkman is the founder and CEO of Engage PEO, a leading professional employment association in the country. Engage PEO is unique in its distribution model exclusively through insurance agencies and its commitment to a higher level of customer service.

PIACT held its annual Connecticut Convention at the end of March—returning to the Hartford Marriott Downtown. The event featured hundreds of agents, company representatives, exhibitors, and more industry professionals from Connecticut. Excitingly, the Connecticut Convention attracted industry professionals from out of state—insurance professionals and company representatives based out of Georgia and Illinois were in attendance. Those who attended the two-day event visited the sold-out trade show, informational seminars, and various networking events.

To see more event photos, visit the 2023 PIA Connecticut Convention online album (www.pia.org/conn).

Convention goers were invited to attend Before the Attack: A Mock Cyber Event, presented by TAG Solutions at the start of the convention. It was an interactive and favored event that highlighted trending topics like cybercrime, data breach, ransomware attacks, and major IT outages. It walked attendees step-by-step through the days following

a cyberattack. Those who attended the seminar received a comprehensive, step-by-step cyber security playbook and an agency self-assessment to take back to their agencies.

Attendees could earn up to 5 continuing-education credits if they attended both education sessions that were fresh and relevant, and offered at the convention. During Cannabis Insurance: 360 on the 420, John Fear, CISR, CPIA, seemed to strike the right chord with attendees particularly given that Connecticut’s recreational cannabis for adult-use legislation to grow cannabis will go into effect July 1, 2023. Fear offered a thorough and entertaining introduction to the insurance-issues related to national changes in marijuana possession and use laws. He and attendees examined the various risks in the cannabis supply-chain and how Connecticut’s Social Equity Council affects the establishment of those businesses. Other topics included what forms to use when applying for insurance coverage, a discussion of the supplemental applications needed, and

the potential impact in risk assessment of this ever-growing cannabis industry segment.

Fear also lead Errors & Omissions–Avoiding Coverage Gaps. He gave insights into how to approach broad topics, such as the lack of customer awareness regarding how insurance coverage protects policyholders should a claim need to be filed. Recognizing this issue—and the opportunity it presents for agents to inform their clients, only adds value to accounts through thoughtful and methodical review processes. Fear discussed how it is critical to overcome this knowledge gap. Common exposures were highlighted, as well as possible solutions that meet clients’ needs.

The Connecticut Convention offered numerous networking opportunities. During the networking luncheon, PIACT welcomed PIA National President Gerald F. Hemphill who spoke about the great things PIA is doing for its members. Additionally, CTYIP held a Welcome Reception the night before the event. On the first night of the convention, DJ Mike Nigretti, spun tunes and offered another quality networking opportunity for insurance professionals. Newly elected members of the PIACT and CTYIP officers and boards of directors were in attendance. Between the trade show and networking, to compelling education—the Connecticut Convention was an event that left attendees inspired.

The PIACT and CTYIP boards of directors held their annual business meetings on March 24, at which their 2023-24 officers and directors were elected. During the meeting, newly elected President J. Kyle Dougherty, CIC, said: “When I joined the organization as a Young Insurance Professional, I recognized the incredible level of professionalism that existed in the organization. It made me step up my game. Now these individuals are my peers, and I am so proud to serve them. They continue to inspire me to be better—and I hope I do the same for them. Whatever our members need, it’s my goal to do what I can to provide it.”

PIACT 2023-24 officers

• President: J. Kyle Dougherty, CIC

• President-elect: Nicholas Ruickoldt, CPIA

• Vice president: Kevin McKiernan, CIC, CPIA

• Treasurer: Nathan Shippee

• Secretary: Katie Bailey, ACSR, CLCS, CPIA

• Immediate past President: Bud O’Neil, CPIA

PIACT directors

The association re-elected the following individuals to serve on its board of directors for a three-year term expiring in 2026:

• Katie Bailey, CPIA, ACSR, CLCS

• Nicholas Fanelli, CIC, CPCU, CLU

• Kimberly Tompkins, CIC, AIS, AINS, PHM, CRIS, ACSR, CPIA

Newly elected for a three-year term, ending in 2026 are:

• Ryan Kelly

• Jeff Krar

• Carlos Lithgow, TRA

CTYIP 2023-24 officers

• President: Ryan Kelly

• President-elect: Justin Sloan

• Vice President: Robyn Ricciardone

• Treasurer: James Kannengeiser

• Secretary: Jacklyn Meeker

• Immediate past President: Anthony DeSalva

Elected to serve on the CTYIP board of directors are:

• Kieran Buttrick

• Jeremy Card, ARM-P, CSRM, CISR

• Christine DeFelice

• Anthony DeSalva

• Cathy Finlayson

• James Kannengeiser

• Ryan Keating

• Ryan Kelly

• Jacklyn Meeker

• Robyn Ricciardone

• Justin Sloan

• Ryan Vivenzio

Thank you to everyone who helped make Connecticut Convention a success. Plans are underway for next year’s convention. Watch your PIA publications for details.

From PIA to the sponsors, exhibitors and advertisers who helped make Connecticut Convention possible and a success, thank you!

The Andover Cos.

Arbella Insurance Group

Business Risk Partners

Central Insurance Companies

Chubb

Hippo Insurance

Jencap Group

MAPFRE Insurance

NLC Insurance Cos.

Ohio Mutual Insurance Group

Omaha National

Plymouth Rock Assurance

Progressive Insurance

Quincy Mutual Group

RT Specialty

Safeco/Liberty Mutual

Selective Insurance

SERVPRO

United Property Restoration Services

Rating agencies such as AM Best, Demotech, S&P, etc., periodically dissect the financials of nearly every insurance carrier in the marketplace. Ratings can change based on these reviews, so have a process to secure a carrier’s most up-to-date information.

All agencies should have an established minimum financial rating for the carriers with which they do business. While a minimum rating of “A-” using the AM Best rating approach is common, consider how your errors-andomissions carrier addresses insolvency in the policy form.

Not many carriers are downgraded each year. For example, an agency could have a carrier going from “A+” to “A.” While agency management may want to examine the situation more closely, there probably will not be further action needed. However, what would your agency process be if one of your carriers was downgraded from “A-” to “B”?

Identify the clients with those carriers. If the carrier is used by a wholesaler, the wholesaler should be able to provide this information to you unless it was captured in your agency management system. Give those clients a written notice. Explain the situation and advise the client that the coverage was placed with an insurance carrier that was downgraded recently.

OhioMutualtakesprideinourcommitmentanddedicationtotheindependentagency systemandourmembers.Byfocusingoncontinuousimprovements,we’reconstantly:

Investinginnewtechnology

Improvingcustomeraccesstoinformation&services

Personalizingourproductstofitindividualneeds

Include the explanation of the rating as provided by the rating agency. For example, in the AM Best methodology, a “B” rating is defined as “Fair,” a “B+” is “Good,” etc.

Inform your client you are not able to attest to the carrier’s future status. Instead, there is the potential for the carrier to be unable to satisfy its obligation to pay claims. A goal of this written document is to educate clients to enable them to make an informed decision on whether they want to continue or discontinue coverage with the current carrier.

Ask if your clients would like you to remarket their policies. Include language advising the client that the agency is willing to remarket the account to a carrier with a higher rating. Note that there is no guarantee that the premium will be equal to or less than what the client is currently paying or that the coverage will be identical.

The clients must decide and communicate in writing what direction they want the agency to take. Some agents include choices listed on a document and they require clients to check the box that indicates their decision.

Pearsall is president of Pearsall Associates Inc., and special consultant to the Utica National E&O Program.

Utica National Insurance Group and Utica National are trade names for Utica Mutual Insurance Company, its affiliates and subsidiaries. Home Office: New Hartford, NY 13413. This information is provided solely as an insurance risk management tool. Utica Mutual Insurance Company and the other member insurance companies of the Utica National Insurance Group (“Utica National”) are not providing legal advice, or any other professional services. Utica National shall have no liability to any person or entity with respect to any loss or damages alleged to have been caused, directly or indirectly, by the use of the information provided. You are encouraged to consult an attorney or other professional for advice on these issues.

© 2023 Utica Mutual Insurance CompanyYour clients trust you to place their coverage with carriers that will honor their obligations. How can you meet this level of trust if you don’t know the financial condition of your markets? Knowing the ratings of your companies is simple.

If you want to stop worrying, sign up for PIA’s Company Rating Tracking Service, which is available exclusively to PIA members. Once you sign up for this service, you will receive an email from PIA when one of your represented carrier’s AM Best rating changes.

To participate, contact PIA’s Industry Resource Center by phone at (800) 424-4244 or by email at resourcecenter@pia.org with a listing of the carriers your agency represents. Please note: This alert is a product of PIA and is not affiliated with any service provided by AM Best.

Practical Skills

One-day Insurance Success Seminars with actionable, how-to skills that you can put to work immediately.

Stand out in the crowded insurance industry with the only sales-based insurance program of its kind—the CPIA designation.

Network With Professionals

Meet and connect with other industry professionals, including agents, producers, sales support staff, and company personnel.

Professional Development

Earn the prestigious CPIA designation—plus state-approved CE credit—demonstrating your commitment to ongoing professional development and excellence in the insurance industry. No exams required!

June 27, 2023 | 8 a.m.-4 p.m.

CPIA 3: Sustain Success

Sept. 28, 2023* | 8 a.m.-4 p.m.

CPIA 1: Position for Success

Oct. 17, 2023 | 8 a.m.-5 p.m.

CPIA 2: Implement for Success

Nov. 14, 2023 | 8 a.m.-4 p.m.

CPIA 3: Sustain Success

Dec. 12, 2023 | 8 a.m.-4 p.m.

CPIA Advanced: An E&O Loss Control Program for All Agencies

*Hybrid classroom option—Aflac, Fairfield, N.J.

Have a question? Ask PIA at resourcecenter@pia.org

Q. We ran into a problem when an insurance company asked a youthful driver to fill out a driver questionnaire. The parents objected and said they did not want their son to fill out the questionnaire unless it would remain confidential. What can we do to reassure the parents?

A. Like many states, Connecticut has enacted a law to protect the privacy of insurance information. In Section 38a-988 of the Insurance Law, you will find the limitations on the disclosure of recorded personal information. Some circumstances in which disclosure would be permitted (although numerous qualifiers and restrictions still apply) include:

• with written authorization of the individual;

• when sharing with a third party (who is likewise bound by confidentiality rules) who is performing a service for the insurance institution, agent or support organization;

• when determining eligibility to receive benefits;

• when investigating fraud;

• when sharing with an insurance regulator, law-enforcement agency or other government authority; and

• in response to a court order.

Unless for one of the reasons listed above, the law states that no insurance institution, agent or insurance support organization may disclose any personal or privileged information concerning an individual that is collected or received in connection with an insurance transaction.—Bradford

J. Lachut, Esq.Q. One of my companies sends out nonpayment cancellation notices before the premium is due, as part of its billings. This is confusing to our customers, and we end up having to explain the situation. Is this procedure allowed?

A. According to the Connecticut Insurance Department’s Bulletin PC-42-09, which was issued in 2009:

Companies may not routinely issue or include notice of nonrenewal or notice of cancellation for nonpayment coincident with the premium billing or payment notice. Notice of cancellation for nonpayment of premium

should not be issued until after nonpayment has occurred, meaning after the insurer has failed to receive payment by the due date. It is an improper practice to terminate coverage using a reason that does not exist at the time notice is given.

The bulletin also advises that:

The routine issuance of nonrenewal or cancellation notices or the use of nonspecific or nonexistent reasons for such action is improper and fails to provide the notice required by Connecticut law. This is considered an attempt to circumvent statutory notice requirements of Connecticut law. Per the bulletin, the company’s practice of sending out nonpayment cancellation notices before the premium is due, is not permitted.

—Bradford J. Lachut, Esq.Q. Suppose that more than one company under common ownership was insured under a commercial package policy. If the company that was listed as the first-named insured was to go bankrupt, could the other company refuse to pay any premiums due on the previous policy?

A. I’m afraid so. According to the Insurance Services Office Inc.’s Common Policy Conditions form (IL 00 17), the first-named insured shown in the declarations is responsible for the payment of all premiums (Under E. Premiums).

Prior to the simplification of the ISO package policies in 1986, the obligation to pay premiums was not limited to any particular named insured. The change to place premium payment responsibilities on the first-named insured was intended to overcome disputes over who the responsible party should be. Then, it is incumbent upon the producer to name the entity most likely to hold the purse first on the application.—Dan Corbin, CPCU, CIC, LUTC

Q. What is the insured’s obligation to the insurance company for premiums if the insured goes through Chapter 11 bankruptcy?

A. When an insured files bankruptcy, an automatic stay is imposed on acting against the debtor and property of the estate. The stay applies to any action or proceeding against the debtor that was or could have been commenced before the filing of the bankruptcy petition. The automatic stay prohibits any act to obtain possession of property of the estate.

Generally, courts have found that a debtor’s insurance policies are property of the estate and, therefore, the automatic stay would prevent post-petition cancellation of insurance policies based on pre-petition debt.

However, premiums due after the filing are post-petition claims and are not subject to the stay. Therefore, coverage could be canceled if a post-petition claim is not paid. Usually, bankruptcy courts will want to preserve insurance for the debtor and should approve payment of an insurer’s post-petition claims.—Bradford

J. Lachut, Esq.Q. My client has an auto camper-trailer on blocks at a campsite with an attached, screened-in porch. Is the porch covered against damage or loss on his auto policy? What about liability for accidents occurring in the camper or on the porch?

A. The ISO Personal Auto Policy (Exclusion 7, under Part D) excludes trailers and facilities or equipment used with trailers, including porches. However, you can add an endorsement (PP 03 07 “Trailer/Camper Body Coverage”) to provide coverage for the trailer, which will include facilities and equipment designed to be used with the trailer automatically. Liability coverage is provided for accidents involving the ownership, maintenance or use of this trailer without endorsing the PAP with optional coverage.—Dan

Corbin, CPCU, CIC, LUTCQ. This question concerns a homeowners policy. A brother had leased a home to his sister for life. There was a fire in the house and the sister was killed. The brother does not think he was listed as an additional insured on the policy, but that he was listed on the deed to the home. The carrier is declining to pay the loss because the sister was the only insured named on

the policy. Shouldn’t the brother be able to collect?

A. Not likely. To collect under standard ISO homeowners policies, the brother must both be an insured and have an insurable interest. The brother has an insurable interest, but apparently he is not an insured. The policy was issued to the sister as an occupant of a dwelling under a life estate.

In the ISO Homeowners Policy Program Manual, see General Rules, 104 (Eligibility), A.3., which states “The owner’s interest in the building and premises liability may be covered using Additional Insured Endorsement (HO 04 41).” In the absence of this endorsement naming him as an additional insured, the insurer has no obligation to the brother.

Nevertheless, the insurer should pay the sister, or rather her estate. Generally, the estate would be obligated under contract to pass the repaired property back to the remainderman, or if not repaired, forward the claim proceeds.—Helen K. Horn, CIC, CPIA, CISR

President

J. Kyle Dougherty, CIC Dougherty Insurance Agency Inc. 2420 Main St., Ste. 5 Stratford, CT 06615-5963 (203) 377-4394 kyle@doughertyinsurance.com

President-elect

Nick Ruickoldt, CPIA

The Russell Agency LLC

317 Pequot Ave. PO Box 528 Southport, CT 06890-0528 (203) 255-2877 nruickoldt@therussellagency.com

Vice President

Kevin P. McKiernan, CIC, CPIA

Abercrombie, Burns, McKiernan & Co. Insurance Inc.

484 Post Road, Ste. A Darien, CT 06820-3651 (203) 655-7468 kmckiernan@abmck.com

Treasurer

Nathan L. Shippee Workers’ Comp Trust

47 Barnes Industrial Road S. PO Box 5042 Wallingford, CT 06492-7542 (203) 678-0110 shippee@wctrust.com

Secretary

Katie Bailey, CPIA, ACSR, CLCS

The Russell Agency LLC 317 Pequot Ave. PO Box 528 Southport, CT 06890-0528 (203) 255-2877 kbailey@therussellagency.com

Immediate Past President

Bud O’Neil, CPIA

C.V. Mason & Co. Inc. PO Box 569 Bristol, CT 06011-0569 (860) 583-4127 boneil@cvmco.com

Jonathan Black, LUTCF, CPIA, CLTC, NAMSA, NSSA

Curtis Black Insurance Associates LLC

57 North St., Ste. 119 Danbury, CT 06810-5626 (203) 792-3055 jblack245@gmail.com

Scott Burns

XS Brokers Insurance Agency Inc. 225 Asylum St. Hartford, CT 06103-1516 (617) 471-7171 sburns@xsbrokers.com

Nicholas Fanelli, CIC, CPCU, CLU Newberry Insurance Group 1760 Ellington Road South Windsor, CT 06074-2715 (860) 648-6330 papabearct38@gmail.com

Nicholas Khamarji Jr. New England Insurance PO Box 125 Easton, CT 06612 (203) 445-3594 NGK325@gmail.com

Jeffrey A. Krar Joseph Krar & Associates Inc. 1676 West St. PO Box 580 Southington, CT 06489-0580 (860) 628-3967 jkrar@jkrar.com

Carlos A. Lithgow, TRA CAL Insurance 27 5th St. Stamford, CT 06905-5013 (203) 900-3353 carlos@calics.com

Kimberly A. Tompkins, CIC, CPIA, AIS, AINS, PHM, CRIS, ACSR

Convelo Insurance Group

1385 Highway 35 PMB 170 Middletown, NJ 07748-2012 (833) 266-8356 ktompkins@conveloins.com

Patrick Walsh

Insurance Provider Group

100 Great Meadow Road, Ste. 705 Wethersfield, CT 06109-2355 (860) 764-0555 pat@insuranceprovidergroup.com

DIRECTOR AND CT-YIP REPRESENTATIVE

Ryan Kelly

AJ Gallagher Risk Management 1 Enterprise Dr., Ste 310 Shelton, CT 06484-4631 (203) 367-5328 ryan_kelly@ajg.com

ACTIVE

PAST PRESIDENTS

James R. Berliner, CPCU Berliner-Gelfand & Co. Inc. 188 Main St., Ste. A Monroe, CT 06468-1149 (203) 367-7704 jim@berlinerinsurance.com

Mark Connelly, CIC Fairfield County Bank Insurance Services 401 Main St. Ridgefield, CT 06877-4513 (203) 894-3123 mark.connelly@fcbins.com

John DiMatteo, CFP, AIF DiMatteo Insurance

79 Bridgeport Ave. Shelton, CT 06484-3254 (203) 924-5412 jdimatteo@dimatteofinancial.com

Peter Frascarelli, CPIA Ferguson & McGuire

6 North Main St. Wallingford, CT 06492-3741 (203) 269-9565 pfrascarelli@fergusonmcguire.com

Michael F. Keating

Michael J. Keating Agency Inc. 10 Arapahoe Road PO Box 270048 W. Hartford, CT 06127-0048 (860) 521-1420 mfkeating@keatinginsurance.com

Howard S. Olderman Olderman & Hallihan Agency 400 Main St. Ansonia, CT 06401-2303 (203) 734-1601 howard@oldhalins.com

Gerard Prast, CPIA XS Brokers Insurance Agency Inc. 13 Temple St., Floor 1 Quincy, MA 02169-5110 (617) 471-7171 gprast@xsbrokers.com

Shannon Rabbett, CIC Rabbett Insurance Agency 233 Addison Road PO Box 665 Windsor, CT 06095-0665 (860) 688-1303 shannon@rabbett-insurance.com

Augusto Russell, CIC Insurance Provider Group 100 Great Meadow Road, Ste. 705 Wethersfield, CT 06109-2355 (860) 764-0555

augusto@insuranceprovidergroup.com

Timothy G. Russell, CPCU The Russell Agency LLC 317 Pequot Ave. PO Box 528 Southport, CT 06890-0528 (203) 255-2877 trussell@therussellagency.com