BUSINESSOWNERS INSURANCE

WORKERS COMPENSATION

FLOOD INSURANCE

CYBER LIABILITY

Your customers deserve the peace of mind that comes with customized coverages and optional enhancements from The Concord Group. From quotes to claims, we’ve built insurance with small business owners in mind.

25 Increased flooding elevates business insurance

Knowledge and prevention are paramount

Statements of fact and opinion in PIA Magazine are the responsibility of the authors alone and do not imply an opinion on the part of the officers or the members of the Professional Insurance Agents. Participation in PIA events, activities, and/or publications is available on a nondiscriminatory basis and does not reflect PIA endorsement of the products and/or services.

President and CEO Jeff Parmenter, CPCU, ARM; Executive Director Kelly K. Norris, CAE; Communications Director Katherine Morra; Editor-In-Chief Jaye Czupryna; Advertising Sales Representative Kordelia Hutans; Senior Magazine Designer Sue Jacobsen; Communications Department contributors: Athena Cancio, David Cayole, Patricia Corlett, Darel Cramer, Anne Dolfi, Kordelia Hutans and Lily Scoville.

Postmaster: Send address changes to: Professional Insurance Agents Magazine, 25 Chamberlain St., Glenmont, NY 12077-0997.

“Professional Insurance Agents” (USPS 913-400) is published monthly by PIA Management Services Inc., except for a combined July/August issue. Professional Insurance Agents, 25 Chamberlain St., P.O. Box 997, Glenmont, NY 12077-0997; (518) 434-3111 or toll-free (800) 424-4244; email pia@pia. org; World Wide Web address: pia.org. Periodical postage paid at Glenmont, N.Y., and additional mailing offices.

©2023 Professional Insurance Agents. All rights reserved. No material within this publication may be reproduced—in whole or in part—without the express written consent of the publisher.

BRIEF

Weather definitions,

and why they matter

Dictionaries have their own definitions of weather-related terms that are used every day in the insurance industry:

INFlood:

An overflowing of a large amount of water beyond its normal confines, especially over what is normally dry land.

90% of natural disasters involve flooding. U.S. wetlands save more than $30 billion in annual flood damage repair costs.

Hurricane:

A storm with a violent wind—can be called a tropical cyclone in the Caribbean.

Frequently, the right side of a hurricane is the most dangerous in terms of storm surge, winds and tornadoes.

Rain water:

Water that has fallen as or been obtained from rain.

Each year, 75% of weatherrelated vehicle crashes occur on wet pavement and 47% happen during rainfall.

Storm surge:

An abnormal rise in sea level along a coast caused by the onshore winds of a severe cyclone.

When storm surge coincides with normal high tide, storm tides can reach up to 20 feet or more Much of the U.S.’s Atlantic and Gulf Coast coastlines lie less than 10 feet above sea level.

Stormtide:

A high tide that is significantly higher than normal due to onshore winds reinforcing tidal action.

Storm tide can cause water levels to rise and flood large areas very quickly and poses a major risk for drowning.

Windstorm:

A storm with very strong wind but little or no rain or snow. A derecho is a widespread and usually fast-moving straight-line windstorm.

Derechos are warm-weather occurrences—70% of them occur between May and August.

… if only

… if only

it were that easy …

it were that easy …

Definitions for weatherrelated events differ from insurance policy to insurance policy. For example, in New York state the insurance department has approved over 100 definitions of a windstorm.

This could leave your clients without coverage for certain weather events when their next-door neighbors are covered for the same type of loss. Therefore, it’s important to have frank conversations with your clients about what their insurance policies will cover before they need to make a claim.

Remind them that it takes 30 days for a flood policy to become activated, so if they call your agency as a storm is heading their way, they might not be covered.

ISO assists the private flood market

Dan Corbin, CPCU, CIC, LUTC, director of research, PIA NortheastThere is a demand for a private flood market to either supplant or supplement coverage now accessible in the National Flood Insurance Program. The formation of analytic tools and reinsurance capital in recent years has made insuring this peril—once thought to be uninsurable—feasible for private insurers.

The federal program is incapable of meeting the needs of commercial businesses having exposures much greater than the limits and coverages provided by the Standard Flood Insurance Policy forms.

In response to this market evolution, the Insurance Services Office Inc. introduced a Commercial Flood Insurance Program. In states that exempt flood insurance from filing requirements, the program will not require review by the regulator.

Policy form

The Commercial Flood Policy (FC 00 01 04 18) form is designed in similar fashion to the commercial property form, but covering the single peril of “flood,” as defined in the insert.

The ISO policy covers every event the SFIP covers, including a flood-caused backup of sewers and drains, but without the two-acre/two-or-more property restriction. Unlike the 100-foot extension in the commercial property form, personal property must be located in the building or structure.

Ordinance or law. Ordinance or law coverage is a built-in option that can designate separate limits for the increased costs to comply with an ordinance or law, the required demolition of undamaged parts of the building, and the costs to rebuild undamaged parts of the building.

Time element. Time element coverage is a built-in option that can provide a single limit for business income, extra expense, extended business income, and increased period of restoration due to ordinance or law using provisions similar to the commercial property forms.

Ingress and egress coverage, something in high demand after previous catastrophes, also is included in the time element limit of insurance.

It covers denial of access to the described premises due to the impediment of a flood or by civil authority following a flood (certain conditions apply).

Limits. The ISO policy includes a provision to combine the property limits and time element limits into a single limit on the declarations. In addition, an annual aggregate limit for more than one occurrence can be triggered on the declarations.

Like the commercial property form, coinsurance only applies if a percentage is shown, making it optional. Special sub-limits apply to furs, jewelry, artwork, stamps, dyes, and molds, which can be increased.

Further, damage by pollutants has a sub-limit of $10,000 at each described premises that can be increased, but debris removal is included in the property limit. Flatdollar deductibles apply by building or by location.

Valuation. Damaged property is valued at actual cash value. However, like the commercial property form, replacement cost is an option activated by entry on the declarations for covered property excluding the property of others, or as an option, to include it. Antiques are only covered for their functional value.

Waiting period. Instead of the NFIP 30-day waiting period before the policy takes effect, the ISO form has an exclusion for a flood that begins within 72 hours after the inception date of the policy (unless coverage existed during the 72 hours prior to policy inception).

Priority. The ISO policy can be written as excess over coverage provided by a SFIP, or an option can be made for the ISO policy to respond as primary in the absence of an eligible SFIP.

Endorsements

FC 03 01 Combined Deductible for Property and Time Element Flood Loss. This endorsement provides a flat-dollar deductible applicable to the combination of property and time element losses, eliminating the 72-hour waiting period in the “period of restoration” definition.

FC 12 01 Limitation of Coverage on Property in a Basement or Below Lowest Elevated Floor. The ISO form does not exclude property in a basement. This endorsement enables the insurer to place a sub-limit on covered property located in a basement or below the lowest elevated floor.

FC 14 10 Additional Covered Property. It can be used to add selected items of “property not covered” in the ISO form as covered property.

(continued on page 6.)

NEWS TO USE (continued from page 5.)

FC 14 20 Additional Property Not Covered. This endorsement can be used to add the following items to “property not covered” in the ISO form:

• property located in a basement or below the lowest elevated floor;

• improvements, alterations, or repairs made by other than the insured;

• glass that is not part of a building or structure;

• metals in ingots, pigs, billets, or scraps;

• property of others;

• stock;

• tenants’ improvements and betterments; and

• any type of property for which more specific property damage coverage is available.

FC 15 01 Business Income and Extra Expense from Dependent Properties. This endorsement can be used to extend business income and extra expense coverage when the suspension of the insured’s operations is caused by flood damage to property at the premises of a dependent contributing, recipient, manufacturing, or leader location.

Miscellaneous other endorsements:

• FC 02 01 Cancellation Changes–Nonpayment of Premium

• FC 09 52 Cap on Losses from Certified Acts of Terrorism

• FC 12 02

Conforming Clause and FC 12 04 Conforming Clause (Residential Condominium Association)

• FC 12 03 Aggregate Limitation for Remainder of Current Annual Policy Period

• FC 17 01

• FC 17 03

Condominium Association Changes

Condominium Commercial Unit-Owners Changes

• IL 09 85

Disclosure Pursuant to Terrorism Risk Insurance Act

ISO also created a Personal Flood Program that serves as a standard for the private personal flood insurance market. PIA members can access an itemized explanation of the changes by accessing QS90964 in the PIA QuickSource library (www.pia.org).

The ISO Commercial Flood Policy–definition of flood

B. Covered Cause of Loss–Flood

1. Flood means a general and temporary condition of partial or complete inundation of normally dry land areas due to any of the following:

a. The overflow of inland or tidal waters from a natural or man-made body of water, including:

(1) Waves, such as tidal wave and tsunami;

(2) Storm surge; and

(3) Spray from any such overflow; all whether driven by wind or not;

b. The unusual or rapid accumulation or runoff of surface waters from any source, including release of water from a dam, levee, seawall or similar boundary or containment system; or

c. Mudslides or mudflows which are caused by flooding as defined in B.1.a. or B.1.b. above. For the purpose of this Covered Cause of Loss, a mudslide or mudflow involves a river of liquid and flowing mud on the surface of normally dry land areas as when earth is carried by a current of water and deposited along the path of the current.

2. This Covered Cause of Loss includes damage to Covered Property caused by or resulting from:

a. Water or waterborne material that backs up or overflows or is otherwise discharged from a sewer, drain, sump, sump pump or related equipment, provided such discharge results from flooding as defined in B.1. above;

b. Water under the ground surface pressing on or flowing or seeping through Covered Property, provided such pressure, flow or seepage results from flooding as defined in B.1.a. or B.1.b. above; or

c. Collapse or sinking of land along the shore of a body of water as the result of erosion or undermining caused by waves or currents of water which exceed the cyclical levels and cause flooding as defined in B.1.a. above. However, coverage under this Policy does not include the cost of restoring or remediating the land.

3. All flooding in a continuous or protracted event will constitute a single occurrence of Flood.

Corbin is PIA Northeast’s director of research.

Back to the future of flood

“Roads? Where we’re going, we don’t need roads.” As any self-respecting child of the ’80s knows, those words were uttered by Dr. Emmett “Doc” Brown at the end of the film classic Back to the Future. In the context of the movie, Doc Brown says they won’t need roads as he, Marty McFly and Jennifer Parker will be traveling to the future (all the way to the year 2015!) where cars can fly.

As we sit here post-2015, we don’t yet have flying cars—much to the relief of some insurance underwriters. What we do have is extreme flooding. As I write this article, there is extreme flooding occurring across New York state and New England. Roadways have been washed away or submerged— causing some people to use boats to travel. Doc Brown may have been right after all. Of course, when the topic of flooding comes up in the insurance world, one naturally thinks of the National Flood Insurance Program. What

does the future hold for the program?

Much like Marty McFly, we cannot visit the future until we visit and learn from the past.

A history of problems

Prior to the NFIP, flood insurance was provided by the private market. However, after severe flooding in the mid-west during the early 20th century, private insurance compa-

nies decided to leave the flood marketplace in search of more profitable lines of business.

Unfortunately, water took no notice of the lack of flood insurance and flooding still occurred around the country. Without insurance, people who were hit by the disaster were forced to self-insure or rely on government assistance. During that time, Congress passed numerous disaster assistance packages funded by U.S. taxpayers to aid those who sustained damage due to flooding.

As you might imagine, passing disaster assistance bill after disaster assistance bill can be exhausting. Not to mention it raises issues of equity. Was it proper for those living in high-risk flood zones to transfer that risk to taxpayers across the country? In response, Congress established the NFIP in 1968.

The NFIP was designed to reintroduce insurance into the flood marketplace. Of course, the NFIP has been plagued by problems almost since its inception. Historically, the policies written through the NFIP have been underpurchased. Congress has taken various steps to address this issue—must notably requiring the purchase of flood insurance on any property that has a mortgage. Still flood insurance remains an underpurchased product. Currently, only about five million homes have flood insurance through the NFIP. In addition, in a study by the University of Pennsylvania’s Wharton School of Business, only 30% of properties in high-risk flood zones have insurance.1

The second major issue with the NFIP is, until recently, a lack of reinsurance. All NFIP claims are paid using policy premiums. If losses exceed premiums, the NFIP is forced to borrow money from the U.S. Treasury. For much of the history of the NFIP this was not a big issue. Generally, the NFIP took in more premiums dollars than it paid out in losses and operated in the black. That changed in 2005—which was the year of one of the worst hurricane seasons in history. The United States was hit by three devasting storms: Hurricanes Rita, Wilma and most devasting of all, Katrina. Losses related to those storms plunged the NFIP into the red and the program has yet to recover.

Following the extreme losses from the aforementioned storms, the NFIP had to borrow money from the U.S. Treasury. Losses in 2005 were followed by another extreme storm, Superstorm Sandy in 2012, that caused devastation and losses up and down the East Coast. This necessitated another round of borrowing, putting the NFIP further in the red and dangerously close to exceeding its borrowing limit. In response, the NFIP borrowing limit was extended to $30 billion dollars. In addition, $16 billion of the NFIP’s debt was forgiven.

The third major issue with the NFIP has been the presence of subsidized premium rates for many policyholders—especially those living in the most high-risk flood areas. Subsidized rates have been a feature of the program since its creation, but it was not a feature that was supposed to survive this long.

Subsidized rates were conceived to attract individuals and communities to the program. The thought was that eventually the rates would be phased out as properties in high-risk areas were either destroyed or updated to include flood mitigation protections. That has not happened thanks in large part to frequently flooded properties being rebuilt instead of razed.

As we enter the present, the NFIP is saddled by growing debt, a small number of policyholders, and artificially low rates. During the lifespan of the NFIP,

the Federal Emergency Management Agency has collected roughly $50 billion in flood insurance premiums. However, during that same time, the program has paid out close to $100 billion in flooding insurance claims.2 A system in which the program is paying out twice as much in claims as it collected in premium, is not a recipe for financial success.

Premium present

As the calendar turned to 2020, to close the gap between premiums collected and claims paid, the NFIP began to take on a new look. FEMA announced that for the first time since the 1970s, the NFIP would change the way that premiums were calculated. The goal of the new rating methodology—dubbed Risk Rating 2.0—is to charge actuarially sound premiums based on the true flood risk of property.

For most of its history, NFIP premiums have been set by using community-based flood maps. These maps show a community’s flood zone, the boundaries, and the base-flood elevation. Premiums for property were determined by which flood zone a property is in regardless of the individual characteristics of a property.

Risk Rating 2.0 turned that system on its head. Under Risk Rating 2.0, rates now are determined using each property’s individual flood risk, using structure-specific data. This new methodology has been given the tag line “equity in action” as it is designed to close the premium gap and put property owners on a path to paying premiums based on their true flooding risk.

Several early attempts to move toward actuarial sound rating through legislation proved too politically controversial to succeed. One

needs to look no further than the last long-term reauthorization of the NFIP for proof. In 2012, Congress passed the Biggert-Waters Flood Insurance Reform Act. That reauthorization required the NFIP to update flood maps, improve building-code enforcement, and move toward charging premiums that were actuarially sound.

The reforms codified in BiggertWaters proved controversial. Many policyholders underwent sticker shock when faced with the proposed premium increases. This caused a backlash and lead to Congress removing many of the reforms of Biggert-Waters, including actuarially sound rates, two years later with the passage of the MenendezGrimm Homeowner Insurance Affordability Act.

Future

As we look to 2024 and beyond, what is in store for the NFIP? Well, many hope what’s in store is a longterm reauthorization of the NFIP. The last long-term reauthorization was the Biggert-Waters Act. That law extended the program for a period of five years to 2017. Since 2017, the NFIP program has been reauthorized more than 24 times—with the longest extension being no longer than a year. The lack of a long-term reauthorization has prevented muchneeded reforms from being implemented. While Risk Rating 2.0 has taken aim at reforming the rate methodology. Reforms still are needed across the program to address issues like borrowing authority, community mitigation efforts and repetitive loss properties, which account for a huge number of NFIP claims. What should insurance agents be advocating for in a long-term reauthorization?

As conversations on Capitol Hill heat up for the NFIP, there is one area that insurance agents should be particularly wary of: cuts to Write-Your-Own compensation. While the NFIP is overseen by FEMA, FEMA utilizes the services of private insurance companies, referred to as WYO companies, to administer the program. These WYO companies service accounts and pay claims. For their services, WYO companies receive a percentage of the NFIP premiums. Currently, that figure is just under 30%. Several long-term reauthorization proposals would cut the WYO compensation drastically, and some proposals suggest cutting it by close to half. If these cuts were to make it into a final bill, they could do irreparable harm to the independent agent community.

The compensation WYO companies receive is not purely profit for these companies. Instead, those funds are used to offset the cost of administering the NFIP. This includes expenses a WYO would incur like paying commissions to the agents and brokers who sell the NFIP polices. If the WYO compensation rate is reduced, it almost certain that agents will see their commission cut as well. This could lead to a mass exodus of agents from the flood insurance marketplace similar to what happened in the small health insurance marketplace a few

If that were to happen, consumers across the country would find that their access to professional, expert insurance advice will be restricted. Many consumers would be forced to purchase a flood insurance policy without the expert advice of an insurance professional. This undoubtedly will lead to more uninformed choices and likely policyholders not having the proper coverage in place

Lachut is PIA Northeast’s director of Wharton, (tinyurl.com/54mdf9v8)

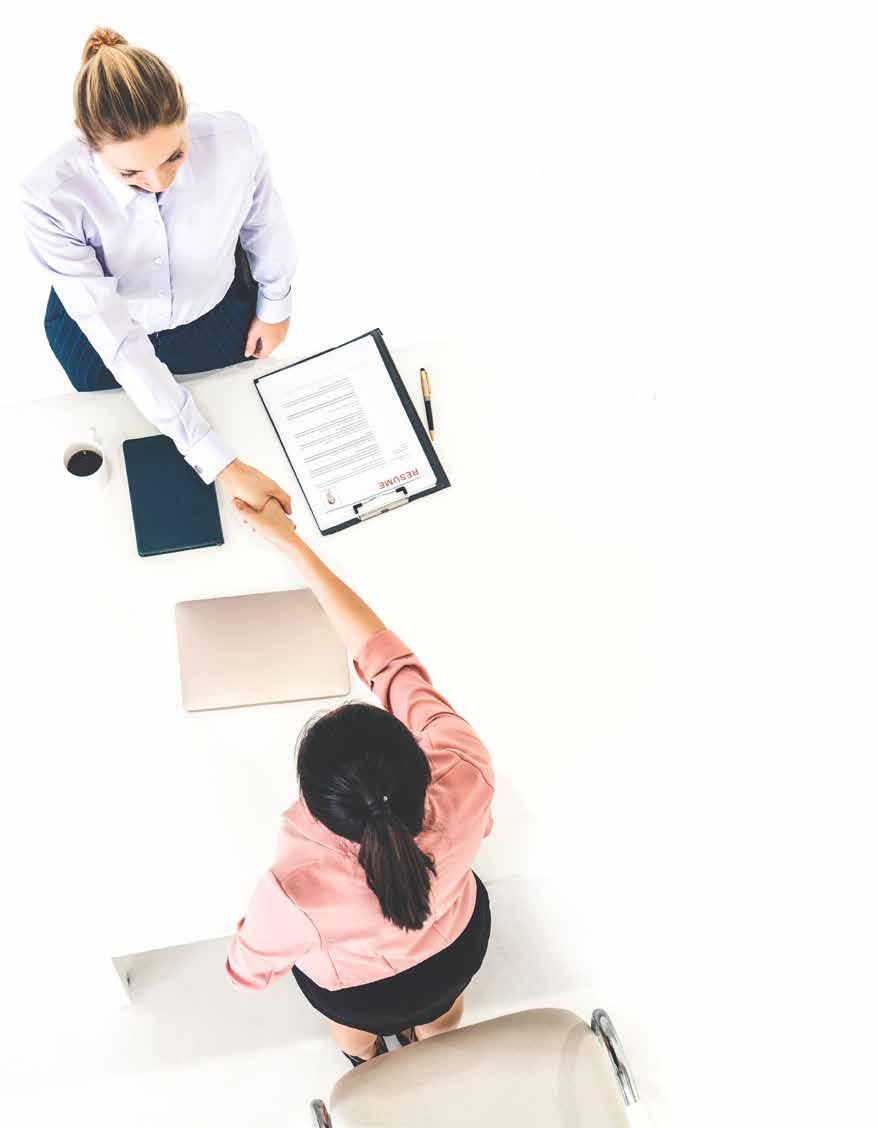

Is service part of selling?

Here is the quote that prompted this article: “I like doing deliveries. I look at that as end-to-end sales. I sell it, make sure everything goes smoothly, and then finally I deliver it and make sure they’re happy.”

On the surface, it sounds good, right? I mean that makes sense—except for one thing: the definition of a salesperson is someone who sells (period)—not someone who sells, takes care of all the paperwork, financing, preparation and delivery.

Many salespeople fill their day with service issues and other tasks that can be done by other people easily. These aspects have little or nothing to do with the actual sales process.

Sales keep everything moving

However, as the lifeblood of the organization, it is critical for salespeople to spend as much time as possible on sales tasks. Organizations survive, thrive, or die based on the level of sales revenue. If a business sells enough product, at a high enough profit margin, and doesn’t do anything illegal, it stays in business. If it doesn’t sell enough to pay the bills, it doesn’t stay in business.

Sales keep everything else alive and moving. Yes, the other parts are important—but with no sales or low sales—the business dies. As a result, your salespeople need to be free to sell as much as possible. This means having adequate support people for deliveries, billing questions, and other nonsalesrelated tasks.

The right person doing the right job

Think of salespeople as airline pilots. They get the plane off the ground, land the plane, and handle any in-flight emergencies. They aren’t in the back of the plane serving drinks or food to passengers; they don’t perform maintenance on the plane, put fuel in it, etc. Takeoff, landing, and in-flight emergencies— that’s it. Imagine a pilot saying he or she wants to serve the drinks and food, fill the plane with fuel, and fix any mechanical issues while the plane is sitting in the hangar. You’d think that person was crazy, right? And, you wouldn’t want to fly in that plane. Pilots don’t get paid for that, it’s not their expertise. Plus, they would not necessarily be good at those other items—they definitely aren’t as good as the people who actually do those things.

Sales all the time

In the perfect world, a salesperson would be prospecting, presenting, and closing 100% of the time to maximize revenue for the organization. Those are the activities that lead to the salesperson’s goal: sales.

In the real world, things look a little different. Here, salespeople will have other activities they need to do (e.g., paperwork, putting out fires with current customers, and doing some relationship building with current customers). There may be times when they must do something for a customer that they normally wouldn’t but, no one else is available. However, this should be a rare exception.

So, in the real world, the goal is prospecting, presenting, and closing 80% of the time during prime calling hours. Prime calling hours are the hours that prospects are available. Twenty percent of that time may be used for emergencies, service items, and other things that need immediate attention. Any activities they do (e.g., paperwork and other nontime sensitive tasks) should be done off prime hours.

Salespeople are supposed to be busy in meetings with prospects during the day doing sales calls, and not taking calls regarding administra-

tive and other mundane items. The advantage of having support people doing nonsales-related tasks (e.g., handling billing issues) is that they can get to those items quicker, and they are better at getting them done. As a result, customers get better, quicker service when they deal with someone who is specially assigned to handle that responsibility. Some salespeople say that a customer will only deal with them—regardless of the issue. Trust me when I say that the customer does not care who handles the issue—the customer only cares that it gets done as quickly and as painlessly as possible.

A time for service

Is service a part of sales? Yes. Is it as much a part of sales as most salespeople make it? No. The reality is, the representative quoted in the first paragraph of this article might deliver equipment under three circumstances: 1. this is the first delivery to a brand new customer who is a potential large customer—one that can impact your business significantly; 2. this is a delivery to a large customer, like the one just described, that you haven’t seen in a while; or 3. there is no one else available to deliver the equipment. Hopefully, the third case is rare.

However, remember the definition of a salesperson: A salesperson produces sales—he or she does not do deliveries, answer billing questions or tell a customer where to send a check—he or she makes sales and produces revenue for the agency. That’s it.

Again, the only reason the amount of service ever comes into play in the sales discussion is that most of the mediocre and poor salespeople prefer to do service work because it’s easier than drumming up new business. Preforming service work is easier than talking to strangers and facing rejection.

Chapin is a motivational sales speaker, coach, and trainer. For his free eBook: 30 Ideas to Double Sales and monthly article, or to have him speak at your next event, go to www.completeselling.com. He has over 35 years of sales experience as a No. 1 sales rep, and he is the author of the 2010 sales book of the year: Sales Encyclopedia (Axiom Book Awards). Reach him at johnchapin@completeselling.com.

Brooks Insurance Agency is proud to support Professional Insurance Agents (PIA)

Since its founding in 1991, Brooks Insurance Agency has successfully serviced the standard markets and brokered distressed and complex lines of business. We are here to help agents find the coverage their clients need.

We represent 80+ quality carriers, including several new and exciting markets, across the country. Plus, a broad array of products and services in admitted and non-admitted markets.

MARKET STRENGTHS AND EXPERTISE

• Broad market reach

• High-touch broker specialists

• Easy, online quoting process

• Collective approach to complex insurance needs

Visit our website at www.brooks-ins.com.

Brooks Group Insurance Agency, LLC NJ License 1575143

CLEAR UP MISCONCEPTIONS

BE THE ADVISER WHO HELPS CLIENTS PREPARE

Flooding is the No. 1 natural peril in the U.S., and this threat is becoming even more intense and more frequent. Yet the percentage of property owners without flood insurance protection is staggeringly high—estimates for homeowners range from 85% to 95%.1 With the increasing threat of more catastrophes, this number is alarming. The good news in all of this? You are an essential part of the solution. In our expanding artificial intelligence world, your one-to-one relationships provide sound insurance guidance and are key to helping turn the tide of Americans protected with flood insurance.

MELISSA LEUCK

MELISSA LEUCK

Why are so many without flood insurance? Here are some common misconceptions:

1. A homeowners or commercial business policy covers flood damages.

2. If the clients’ property—whether homes or businesses—are not mapped into a lender-required Special Flood Hazard Area, they do not need flood insurance.

3. If a client’s home floods, he or she will be able to repair damages from Disaster Assistance funds.

4. The client’s area doesn’t flood.

5. The only flood insurance option is the National Flood Insurance Program, and that it doesn’t provide adequate coverage.

This is where you come in as the trusted adviser. You are uniquely positioned to clarify misconceptions while placing your client’s best interests at the center of your flood insurance discussion. Time is of the essence as weather events in the U.S. are becoming more intense, threatening security on all fronts from personal and business finances to mental and physical health.

Why?

Here are three excellent reasons why it’s necessary to advise your client on flood insurance protection. It:

1. protects you

2. protects your client

3. protects your community No. 1: Protect yourself

Top errors-and-omissions lawsuits include failure to offer proper and adequate coverage and failure to identify exposures. This includes flood insurance protection. Even if flood insurance is not required by the lender, it’s a best practice to include flood insurance with new business and renewals because weather and Mother Nature are unpredictable … you never know what catastrophes will come your way with these two. Anywhere it rains or snows, it can flood. So, cover your bases and include flood insurance protection in every presentation to clients.

If your clients choose not to purchase flood insurance, or they choose not to purchase flood insurance in any of the scenarios below, make sure they sign a Rejection of Coverage form that includes the property address, and states that the specific client:

• rejects flood insurance for both the building and contents

• rejects contents coverage

• rejects building coverage

• rejects coverage amounts for replacement cost value

• reject condominium unit owners coverage

• reject excess flood coverage

For an example of an agent waiver form that is specific to the NFIP, visit: agents.floodsmart.gov.2

In the case of a flood event where your client is not covered by flood insurance, you will have a signed document that shows you offered flood insurance protection, but it was declined. This helps to prevent allegations that the client was not aware flood insurance coverage was an option and the agent did not advise him or her appropriately. Reputational risk is another critical piece in protecting yourself. Establishing trust that you’re looking out for your client’s best interests and offering all-encompassing protections sets you apart from other agents. When your insured’s property floods, he or she will have the protection needed to recover as quickly as possible, and you will be the knowledgeable agent who appropriately advised the client on flood insurance. This is a much better position than the agent who didn’t offer flood insurance protection where you could be blamed, tarnishing your reputation.

No. 2: Protect your client

You can help your client recover from a flooding disaster by providing basic education. Your client may not be aware that flood insurance is separate from a homeowners policy. Property owners who are not required to have flood insurance by their lender often think their property is not at risk for flooding. On average, 40% of NFIP flood insurance claims occur outside the high-risk flood areas.3 This is a significant number, and points to the unpredictable nature of flooding.

Sales tip: Visuals are powerful. When presenting a flood insurance quote, print a map showing your clients their proximity to flood threats. If just down the street is zoned as a higher-risk area and their property also is close to a source of water, such as a river or the sea, they can more

easily envision how a flood event could impact them.

And, here are some talking points that might help you get your clients thinking about the importance of flood insurance:

• Sunny-day flooding is a phenomenon that is increasing in the Northeast. This occurs when a high tide breaches land causing flooding. These extreme high tides are increasing in frequency and severity. In New York City, by the 2080s, “… large portions of certain coastal neighborhoods could flood more than every other week on average.”4

• It has been predicted that Northeastern communities will see flood threats increase dramatically from sea-level rise to storm surge. With tropical cyclones making travel further north up the Atlantic coast, in-land areas could see flooding when storms unleash all their moisture content.

• Extreme rainfall, where enormous amounts of rain fall in a very short amount of time, such as the atmospheric rivers that inundated the West Coast, creates a menacing situation for low-lying properties and places with poor drainage and storm water systems.

Financial peace-of-mind and household resilience is a valuable gift for your clients—as is the ability to quickly recover after a flood event.

No. 3: Protect your community

Last year, Hurricane Ian devastated many inland Florida homes and businesses. Unfortunately, it’s estimated only a small percentage of these structures had flood insurance. Renters were found to be the most likely to not have flood coverage.

Although contents-only coverage is available for renters, many are not aware of this policy.

Following a flood event, businesses, homeowners, and renters with flood insurance recover more quickly. Nearly $4 billion in Hurricane Ian flood claims was paid out by the NFIP and the average payment was more than $104,000.5

Property owners and renters without flood insurance are struggling to survive. Many are living in tents. Businesses that are still not up and running are unable to employ people and further contribute to the financial security of the community. It’s a stark contrast between those who had flood insurance and those who did not have flood insurance.

Citizens Property Insurance Corp., Florida’s state run, nonprofit insurance entity, is requiring flood insurance for personal residential policies. It’s in effect now for certain policies and it will continue to be phased in for remaining policies.6 How does this apply to your clients in the Northeast? It showcases the value of flood insurance as an essential part of the property/casualty package for your clients.

In California, recent flooding events and the retreat of traditional homeowners insurance carriers is leaving consumers with few options at a time when options are needed. You have the ability in your communities to help prevent lack of choice and appetite by talking with your clients and potential clients about comprehensive catastrophic risk and how to mitigate it with insurance so the risk is spread.

From misconceptions to being informed

Typically, homeowners insurance does not cover damages from flood events. Flood insurance is an essential protection that should be part of the p/c package. With flood events on the rise, a comprehensive natural catastrophe assessment for each of your clients and potential clients is a best practice. Remind your clients what is covered with each type of policy.

Federally backed lenders require flood insurance when a property is mapped in a Special Flood Hazard Area. There is a common belief that if a property is not located in a SFHA, it won’t flood. Statistically, an SFHA-mapped property means that it has a higher chance of flooding than another area not in an SFHA. However, as mentioned before in this article, an average of 40% of the NFIP’s flood insurance claims occur outside SFHAs.

Many Americans falsely believe that disaster assistance will cover their rebuilding expenses and/or provide funding for temporary housing while their property is being rebuilt. A sum of $5,000 is an average disaster assistance payment, when the average NFIP claim from Hurricane Ian was $104,000, as mentioned above. A stark contrast between the two amounts. Disaster assistance is also not a guarantee, as it is only available for presidentially declared disasters. Disaster assistance comes in two forms:

• A Small Business Administration loan—which must be paid back with interest; or

• A Federal Emergency Management Agency disaster grant, which is about $5,000 on average per household.7

As your client’s trusted flood insurance adviser, you also need to encourage individuals who do have flood insurance to apply for disaster assistance. This is not an either/or situation. Again, this showcases how having flood insurance is not a penalty, but an asset when compared to those situations when a client does not have coverage.

Inland insureds and potential insureds often are under the false pretense that they will not experience a flood event that warrants having flood insurance. Fact: 99% of U.S. counties experienced flooding.8

Flood risks come in many different forms that include drought (i.e., hardpan soil doesn’t absorb water), snowmelt, charred land from wildfire, ice jams, excessive rain, flash flooding, development (concrete isn’t a good sponge), just to name a few. It’s not just ocean-front properties or communities. With the changing climate producing more intense storms and extreme weather, the time is now to make sure your clients are protected.

Many options and opportunities

Flood insurance options are available to help you find a solution tailored to your client’s needs. Private flood insurance can complement the NFIP and, in some cases, may be a better option with coverages that better apply to your client’s needs. Excess flood sits on top of a NFIP policy and provides maximum protections—an important piece of the flood protection puzzle these days as real estate costs often exceeding the $250,000 maximum NFIP residential building limits, or $500,000 for the maximum NFIP commercial building limits.

Here is an overview to help simplify your trusted flood adviser process in five simple steps:

1. Offer flood insurance with every renters, homeowners, and business policy quote.

2. Educate your client on misconceptions.

Design+Print

3. Include private flood insurance solutions to complement the NFIP.

4. If flood insurance is declined, have your client sign a waiver.

5. Revisit annually as part of your p/c review.

Today’s climate is not only changing weather-wise, but it is also a litigious climate. Protect yourself from E&O exposure by offering flood insurance. Be the educator to help eliminate misconceptions and be the trusted flood insurance adviser your clients and community need now more than ever.

Leuck leads the client executive team at Torrent, the leading flood insurance technology and service administrator in the U.S. She is committed to industry and community education tools to expand her clients’ flood portfolios while closing the flood insurance gap. Leuck joined Torrent in 2019 and is based in Chicago, Ill.

1 NAIC, 2022 (tinyurl.com/29dfbuu2)

2 FEMA (tinyurl.com/bdejz5fk)

3 FEMA, 2020 (tinyurl.com/mr28ky3y)

4 NYC Mayor’s Office of Climate & Environmental Justice, 2022 (tinyurl. com/223u6an4)

5 FEMA, 2023 (tinyurl.com/mr43j29e)

6 Citizens Property Insurance Corp., 2023 (tinyurl.com/6ma8hcah)

7 FEMA, 2021 (tinyurl.com/3t3nakyy)

8 FEMA (tinyurl.com/2myr9mnx)

You are important to us—let us show you!

PIA Design & Print offers a one-of-a-kind relationship between you, your brand, and our diligent, creative and unique team of hardworking professionals whose top priority is building your business.

Stay on the cutting edge of HR laws and regulations

PIA HR Info Central offers:

• Points to consider when developing your agency’s personnel policy

• An administrator’s guide to assist your HR manager in job responsibilities

• Comprehensive job descriptions to tailor to your agency’s needs

• HR forms to customize

• Federal and state Labor Law information

• And more pia.org/IRC/hrinfocentral

Take our HR audit

The agency HR audit tool helps identify HR issues that may need special attention.

Increased flooding elevates business insurance

The trends in the last few years regarding the severity and frequency of natural disasters and storms is changing how businesses think of flooding. Unfortunately, due to some poor drainage situations, it has become evident that some weather events can cause more harm in areas that are typically not prone to flooding. This has shown that there is a benefit for building owners to take further measures to protect their facilities and property—going beyond the flood coverage as part of a larger business insurance plan.

Considering that extreme weather and storms are showing trends of becoming stronger and causing more property damage, now is the time for agents and brokers to work with building owners and property managers to secure their facilities and bolster their protections. Through updated building codes, advancements in technology, and meaningful infrastructure improvements, business owners can make a difference to protect their property and reduce losses.

Flooding vs. inundation

When there is an overflow of water from a body of water— like a lake or riverbed due to rainfall—this is consid-

ered a flooding event. By contrast, inundation happens when there is a large amount of water in an area that becomes submerged. This can happen if there is a large amount of rainfall in a short period of time, and there is a lack of proper drainage. Inundation also is known as pluvial flooding.

Infrastructure’s role in inundation events

When a large amount of rain falls in a short period of time, it is important to have adequate drainage. If this does not happen, areas and places that don’t typically flood can become submerged. Typically, stormwater from rain or snowmelt travels over impervious surfaces—like roadways or parking lots— and then collects and moves into different bodies of water such as rivers, lakes, bays, and oceans. However, over the decades, urban development has increased the amounts of impervious surfaces, and as a result caused the risk of flooding to increase. This is because runoff from large rainfall events overwhelms storm-water systems, which were not developed to move large amounts of water in a

Knowledge and prevention are paramount

short period of time. Urban sprawl has surpassed the original intention and capacity of the local infrastructure to contain heavy rains or a line of storms moving over the same area continually.

Another problem is that as building and housing development has increased over time, the contour of land has become altered, which has caused changes in how a property reacts to water. The continued expansion of impervious surfaces due to property development means water is less able to be absorbed into the ground, so it travels and collects and can cause flooding. As a result, inundation events are occurring more frequently.

Protect business property from flooding and inundation events

While most business owners buy flood coverage as part of a large business insurance plan, agents and brokers should advise them to take additional measures to protect their property. A flood emergency response plan is one way in which business owners can prepare for, respond to, and recover from a flood. This plan should include details about an evacuation plan with employee responsibilities, sheltering-in-place procedures, medical emergency information, emergency response teams, and public emergency services and contractor contact information.

It is also a good idea to have a Water Damage Prevention Plan, which includes routine site inspections to identify uncontrolled water-damage exposures, and basic maintenance to make sure drains are clean of debris, and it can divert to a catch basin or low point away from the building. An effective WDPP plan also incorporates technology as an invaluable component, and it includes backflow preventers on sewer connections and water-sensing technology to monitor the most vulnerable exposures. In addition, a trained team of waterdamage responders should be recruited to map and label all zonal shut-off control valves, as well as maintain an updated list of contractor’s contact numbers for emergency purposes.

Stronger building codes to withstand stronger storms

It’s not uncommon to see the destruction that a hurricane or tornado leaves behind. From torn roofs to collapsed buildings, weather catastrophes have the potential to cause a large amount of damage. However, stronger building codes are one of the best ways to make sure property can withstand catastrophes. For example, Florida implemented changes to its building codes after Hurricane Andrew, and then again in 2007 after the hurricanes of 2004 and 2005. Since then, new construction has made houses and buildings significantly more hurricane proof. Buildings constructed 30 years ago were likely built with codes that may have neglected to consider the impact of strong winds from an extreme hurricane or significant rainfall that a storm can bring— especially along the Atlantic and Gulf coasts.

One way that states can strengthen their building codes to reduce losses is by simply addressing roofs. For example, sealing the roof deck can help prevent water from entering the building if a roof tears off. It’s a small expense during

installation, but it can save tens of thousands of dollars in the long run.

Using technology as a proactive measure

Advancements in technology have led to devices and building materials that can help protect a building in severe storms. Connected devices can monitor buildings and identify problem areas with leaks. Remind your clients that after a storm passes, it is always good to check and document any initial damages. Sometimes, storm damage can lead to large property losses because of water. By installing water sensors in a building, owners and managers can get alerts of water intrusion or leaks. This is particularly important if the building or facility has had a history of water damage because these kinds of devices can capture an issue before it becomes a major loss. The difference in damage costs from being able to respond quickly to a leak, compared to not realizing something happened and letting hours go by, is significant.

Given the potential cost-savings, it also is practical for businesses to install water sensors even if the building is newer or has not had a history of claims.

Meaningful infrastructure improvements

While many existing buildings may not have been built to withstand storms or water damage, owners can make them storm-hardened.

This means improving the infrastructure to better withstand these kinds of losses. By storm-hardening a building, owners can help prevent potential damage from heavy winds and water. While it can be a nominal

upfront cost, the return on investment can be significant. For example, improving the framing inside a building can make a facility stronger and reduce the amount of potential damage during strong winds from a hurricane or tornado.

Building owners also can ensure that there is proper drainage and flood protection during construction to help reduce the loss of equipment or inventory. Suggest to your clients that they should conduct a storm-hardening assessment of their buildings to provide a starting point of what areas to address and what can be done. Some structural areas to look at include building envelope evaluation, wall types, roof types, windows, doors, exterior drainage, and landscaping. In addition, it is prudent to note the location of airhandling units, water supply, critical electrical or mechanical equipment, and whether an emergency generator has enough capacity to deliver the necessary power during an outage. Other considerations for building owners and property managers include installing stronger walls or shatter-resistant windows in their facilities, which can help prevent water from ever entering the building. In addition, they can keep the people inside the building safe during harsh weather, because if a window were to break, the glass won’t scatter all over.

A partner with experience

While it’s not easy to predict how water from a storm or natural disaster will impact businesses, it is essential for insurance agents and brokers to help business owners take proactive measures to protect their company and property. Partnering with an experienced insurance company can

be beneficial and symbiotic to the structural mitigation efforts undertaken by a business owner. Risk engineering specialists at specific companies know the unique risks and challenges that many businesses face. When it comes to flooding and inundation events, the insurer can work with agents and brokers to help business owners better understand how water may behave on their property, and help prevent issues from happening through innovative technology and specialized insurance solutions.

Agents also may want to consider offering business owners flood insurance, which is typically an optional coverage that can help protect a business against damage caused by flooding. Most people think they only need this coverage when their building is near water, but even areas considered at lower risk can be vulnerable to flooding due to many other conditions that can cause it—like poor drainage systems, rapid rainfall accumulations, seasonal snow melting or even construction run-offs.

Simmons is head of large property at The Hartford. With over 25 years of experience in the insurance industry, he specializes in underwriting, as well as recruiting, building, and coaching local teams, while offering customized programs for risks in the large-property market. Travers is property technical manager–Risk Engineering Team for The Hartford. He has more than 43 years of experience in the risk engineering field developing and delivering loss control engineering services and assessment tools for complex businesses with a focus in natural catastrophe, business impact, supply chain and fire protection engineering applications.

The information provided in these materials is intended to be general and advisory in nature. It shall not be considered legal advice. The Hartford does not warrant that the implementation of any view or recommendation contained herein will:

(i) result in the elimination of any unsafe conditions at your business locations or with respect to your busness operations; or (ii) be an appropriate legal or business practice. The Hartford assumes no responsibility for the control or correction of hazards or legal compliance with respect to your business practices, and the views and recommendations contained herein shall not constitute our undertaking, on your behalf or for the benefit of others, to determine or warrant that your business premises, locations or operations are safe or healthful, or are in compliance with any law, rule or regulation. Readers seeking to resolve specific safety, legal or business issues or concerns related to the information provided in these materials should consult their safety consultant, attorney or business advisors. All information and representations herein are as of April 2023.

The Hartford Financial Services Group, Inc., (NYSE: HIG) operates through its subsidiaries, including the underwriting company Hartford Fire insurance Company, under the brand name, The Hartford®, and is headquartered in Hartford, Conn. For additional details, please read The Hartford’s legal notice at www.thehartford.com.

Hurricanes often produce more flood vs. wind claims

Flooding from hurricanes produces large financial losses—and much of it isn’t covered by standard homeowners or commercial property policies. Following a powerful storm, insureds can find themselves without coverage or with less-than-adequate limits—even when some relief is available through government loans. To help rebuild their lives, some flood victims may turn to their agents’ errors-and-omission coverage for funding. Due to increased volatility in weather patterns, it’s more important than ever for you to inform insureds about the risk of flood and the availability of risk evaluation tools, mitigation techniques, and coverage through the federal government’s National Flood Insurance Program and/or private insurers. If you don’t, desperate insureds could take action against you.

The following are actual E&O claims examples, plus suggestions on how to avoid these situations in your agency.

Failure to place flood coverage. The insured was a long-term agency customer operating a retail shop written on a businessowners policy. The hurricane caused flood damage to the insured’s rented store, resulting in contents and inventory damage. The insurance carrier declined the claim, and the insured sued the agency for failure to offer flood coverage. The agency staff members did not document in the client’s file that flood coverage was offered/declined, resulting in a $325,000 E&O claim with an additional $145,000 of lossadjustment expenses.

Failure to procure adequate flood limits. The agency had written the insured’s building coverage, including flood, at the same limit for several years. The insured owned and operated a manufacturing operation, under a different name, which occupied the building. The manufacturing operation was not a named insured under the flood policy, nor was contents coverage provided. The storm flooded the building. Flood damage to the building was covered, but there was no coverage for the tenant’s contents, resulting in a $280,000 E&O claim with an additional $65,000 of loss-adjustment expenses.

Failure to offer excess flood coverage. The agency placed an NFIP flood policy for homeowners that were insured with a $250,000 building limit. The agent recalled verbally offering excess flood coverage, but the agent did not document the call in the file. The agency’s website proclaimed that they were “Flood Experts,” having been named “Agency of the Year” at the National Flood Conference. A hurricane destroyed the home, and the NFIP policy paid the full limits. The insured sued the agency for failure to recommend and place excess flood coverage, resulting in a $195,000 E&O claim with an addi-

tional $45,000 of loss-adjustment expenses.

Failure to adequately explain flood policy provisions. The agency wrote a large, complicated property policy for a supermarket chain encompassing numerous locations in multiple states, with flood coverage providing many unique coverage provisions. A hurricane caused flood losses at several of the insured locations. The flood claim adjustment accounted for the various provisions in the policy, with the insureds receiving far less coverage than they anticipated. The insureds sued the agency, resulting in a $2.5 million E&O claim with an additional $1.5 million of loss-adjustment expenses.

E&O risk management solutions

The examples in this article illustrate costly mistakes. To help avoid these mistakes in your agency consider the following tips:

• Offer all insureds the option to purchase flood insurance in writing.

• Use a questionnaire to ask the insureds if any changes have taken place in their business that would require additional

coverage or limits. This way, you will have a document indicating their responses.

• Review all unique coverages, policy provisions, exclusions, and limitations with the insured, and offer examples of how specific claim situations will be handled in the event of a flood loss.

• Have the insured sign an acceptance or denial of coverage form.

• Include documentation in your agency file.

• Repeat this process at each renewal.

Market Leading RBT Program For:

EverGuard, The Best Long-Term Partner For Your RBT Business.

EverGuard, is a superior Restaurant, Bar & Tavern market with 40+ years’ experience. Our continued longevity offering an uninterrupted market assures you will receive the best product underwritten by an AM Best “A” rated carrier without program interruptions.

EverGuard’s respected reputation in the RBT market speaks to our stability and reliability to provide industry-leading response time and customer service to our partner agencies.

• Exceptional service is an EverGuard priority

• Uncompromised program loyalty

• Great coverages at competitive pricing with available A&B, Enhancement Endorsement & more

• No limit on alcohol sales

• Package Policy: Property, GL & Liquor Liability

• Entertainment considered

• Experienced & Professional Staff EverGuard Insurance Services 1900 W. Nickerson St., Seattle, WA 98119 EverGuard does not offer or solicit the program in the states of New Hampshire, Connecticut or Vermont.

• Understand that by declaring your agency as an “expert” on its website or in other promotional material, you will be increasing the standard of care owed to your customers.

These examples show how flood insurance—or lack thereof—is a frequent cause of E&O claims against insurance agents. Taking time to understand the flood insurance options, offering all options to your clients, and documenting their declination or acceptance of your proposal is sound customer service and E&O loss prevention.

Utica National Insurance Group and Utica National are trade names for Utica Mutual Insurance Company, its affiliates and subsidiaries. Home Office: New Hartford, NY 13413. This information is provided solely as an insurance risk management tool. Utica Mutual Insurance Company and the other member insurance companies of the Utica National Insurance Group (“Utica National”) are not providing legal advice, or any other professional services. Utica National shall have no liability to any person or entity with respect to any loss or damages alleged to have been caused, directly or indirectly, by the use of the information provided. You are encouraged to consult an attorney or other professional for advice on these issues. © 2023 Utica Mutual Insurance Company

PIA TECHNICAL STAFF

Have a question? Ask PIA at resourcecenter@pia.org

Flood policies, earth movement, FEMA and more

Named-storm deductibles

Q. I sell policies to my clients that contain named-storm deductibles. When a news station gives a winter storm a name, what does this mean for my clients—are they at risk of being hit with a deductible they were not expecting?

A. The guidelines for when a storm becomes a named storm are as follows: Tropical cyclones with maximum sustained surface winds of 34 knots or 39 mph usually are called tropical depressions. Once the tropical cyclone reaches winds of at least 34 knots or 39 mph, they typically are called a tropical storm and they are assigned a name. If winds reach maximum sustained speeds of 64 knots or 74 mph, they are called a:

• hurricane (the North Atlantic Ocean, the Northeast Pacific Ocean east of the dateline or the South Pacific Ocean east of 160 degrees east);

• typhoon (the Northwest Pacific Ocean west of the dateline);

• severe tropical cyclone or Category 3 cyclone and above (the Southwest Pacific Ocean west of 160 degrees east or Southeast Indian Ocean east of 90 degrees east);

• very severe cyclonic storm (the North Indian Ocean); or

• tropical cyclone (the Southwest Indian Ocean).

Your clients’ obligations may vary depending on the exact wording of the deductible. However, most of the named-storm deductibles we are familiar with require the storm to be a true named storm as determined by the National Weather Service—not your local news station.—Bradford J. Lachut, Esq.

Flood policy, debris removal

Q. We have insureds who—after a storm—found a lot of debris on their property—including a boat! Will their flood policy cover the debris cleanup to have these materials removed?

A. No. Under debris removal in the National Flood Insurance Policy, it states: We will pay the expense to remove non-owned debris on or in insured property and owned debris anywhere [emphasis added].

“Insured property” is the described building and/or the contents. The “described location” is land where the insured property is located. The policy will pay for debris removal when it lands on or in the insured building, but not in the yard. For example, after a flood, sand filled four to six

feet of the first floor of a house and was covered as debris removal, but none of the flotsam on the property was paid to be cleaned up. In this case, the property owner should find the boat owner and have the owner pay to tow it away since the owned debris would be covered under his or her flood policy.—Dan Corbin, CPCU, CIC, LUTC

Homeowners, earth movement

Q. After a hurricane, my client noticed that her foundation was cracking and appears to be sliding. When we submitted the claim to her Write-Your-Own flood carrier, the claim was denied. We also submitted it to her homeowners carrier that denied it. Is there any recourse for this, since it is obviously a result from the hurricane and flooding?

A. Not likely. The National Flood Insurance Program will not pay for loss to covered property caused directly by earth movement—even if the earth movement is caused by a flood, unless there is evidence of sudden erosion or undermining from a specific type of flood (see the NFIP definition of flood) causing the earth to move resulting in damage to property.

Examples of earth movement that are specifically excluded include: land subsidence, sinkholes, destabilization or movement of land that results from accumulation of water in subsurface land area, or gradual erosion. Your client may need to secure her own engineering report.

And, the ISO Homeowners Policy has an exclusion for earth movement: Earth movement means:

a. Earthquake, including land shock waves or tremors before, during or after a volcanic eruption;

b. Landslide, mudslide or mudflow;

c. Subsidence or sinkhole; or

d. Any other earth movement including earth sinking, rising or shifting. So, there would be no coverage for earth movement under the ISO Homeowners Policy either.—Dan Corbin, CPCU, CIC, LUTC

FEMA–additional living expenses

Q. One of our insureds has a homeowners policy and a flood policy and he suffered a total loss. Since the loss is considered seepage, the carrier is not allowing use of additional living expenses, since it is not a hurricane and would not be covered. It’s a catch 22. How does he get this covered?

A. You are correct; this is a sort of catch 22. Flood does not cover the extra expenses, and since it is a flood, the homeowners policy will not respond either.

I believe this is where the Federal Emergency Management Agency Disaster Recovery Program comes into play. The insured needs to submit his additional living expenses claim to his homeowners carrier. The carrier will deny it, of course.

Then, the insured will need to file a claim for FEMA Individual Disaster Assistance (with the homeowners carriers’ claim denial letter) for reimbursement—providing the area has been declared a disaster area.—Dan Corbin, CPCU, CIC, LUTC

Flood Insurance + Uninformed Client = Recipe For E&O Lawsuit

Welcome to cooking with PIA!

Today we are going to be preparing the prefect E&O lawsuit. Let’s take a look at the recipe:

• 1 policyholder who thinks they have coverage for a loss, when in fact they do not

• 4 cups celery, chopped

• 1 large gap in insurance coverage

• A dash of one insurance agency that did not provide notice to its client of the potential gap in coverage

When mixed together, this is the recipe for one hearty errors-andomissions lawsuit against your agency. Make sure you pay your agency’s E&O deductible!

How does all of this factor into selling your clients flood insurance?

The frequency of coastal flooding has doubled in the past 30 years and the national average precipitation is at historic highs. This creates a situation in which a person living in a 100-year floodplain is twice as likely to experience a flood loss over the course of a 30-year mortgage

than they are to experience a loss due to fire.

There are roughly 126 million households in the U.S. As of 2018, only 5,178,978 were insured by an insurance policy from the National Flood Insurance Program—a decrease from 5,700,235 policies about 10 years ago. So, there are at least 120 million households not covered by flood insurance. Many homeowners mistakenly believe that they have flood coverage under their homeowners policy. Of course, we know this is not true. So, what does it create? A gap in coverage. And, as we know from our recipe above, when there is a gap in a client’s insurance coverage, that is when an insurance producer gets sued.

Let’s change the recipe a bit:

• 1 policyholder who thinks they have coverage for said loss, when in fact they do not

• 1 insurance agency that sent notices to its clients about the importance of purchasing flood insurance

When mixed together this recipe creates a meaningful touchpoint for agents and their clients—which simultaneously helps the agent educate their clients, helps the agent sell more insurance policies, and provides protection for the agency in the event of an E&O lawsuit.

PIA can add a little flavor to the recipe

To help you educate your clients, PIA Design & Print has floodrelated materials and consumer content that you can personalize for your agency’s individual needs. Or, we can create a marketing piece that is unique to your agency. These materials can include sign-off options—should your clients decline flood insurance—which will offer your agency additional protections against an E&O claim. Additionally, we can print and mail these resources to your client list, which we will keep confidential.

PIA Design & Print offers a collaborative design experience tailored for insurance agencies. Give us a call today.

Advertise with PIA Northeast

• Thousands of member agencies in New York, New Jersey, Connecticut, New Hampshire and Vermont.

• Options to fit any budget.

DIGITAL

PIA.org

Where insurance professionals go for information, education, legislation updates and products and services to help with preservation.

• 10‑15,000 visits each month.

• Full- or half-sized ads available.

PIA digital news

• Distributed as a member-exclusive benefit.

• The primary source for PIA members’ industry news.

• Drive traffic to your website.

• Gives readers power to grow their business in a competitive marketplace.

• Distributed 11 times each year, each issue focuses on a topic specific to the insurance industry.

• Single- and multi-state options.

• 10 different ad sizes available.

PIANH Company Partners

DIRECTORY

PIANH 2022-2023 Board of Directors

OFFICERS

President

Keith T. Maglia Insurance Solutions Corp.

60 Westville Road Plaistow, NH 03865-2947 (603) 382-4600

kmaglia@isc-insurance.com

Vice President

Jeffrey Foy, AAI Foy Insurance-Manchester

1889 Elm St. Manchester, NH 03104-2500 (603) 641-8111

jeff.foy@foyinsurance.com

Secretary/Treasurer

Casey Hadlock Hadlock Agency Inc. 150 Old County Road Littleton, NH 03561-3628 (603) 444-5500

casey@bestinsurance.net

Immediate Past President and National Director

Lyle W. Fulkerson, Esq.

HPM Insurance

101 Ponemah Road #1 Amherst, NH 03031-2816 (603) 673-1201

lyle@hpminsurance.com

ACTIVE PAST PRESIDENTS

Lisa Nolan, CPCU Cross Insurance 1100 Elm St. Manchester, NH 03101-1500 (603) 669-3218

lnolan@crossagency.com

John Obrey Obrey Insurance Agency Inc. 1B Commons Drive, Unit 13a PO Box 1018 Londonderry, NH 03053-1018 (603) 432-3883

john@obreyinsurance.com