Own Your Risk Management Potential

James K. RubleGraduate Seminars

Taught by the nation’s top instructors and open to all dues-paid designees, these CE-approved seminars explore advanced topics and apply real-life scenarios.

LIVE ONLINE AND IN-PERSON HYBRID SEMINARS:

May 15-16 Webinar

Aug. 21-22

Nov. 6-7

HYBRID—Webinar/Turning Stone Casino, Verona, NY

HYBRID—Webinar/Hard Rock Hotel Casino, Atlantic City, NJ

REGISTER ONLINE https://bit.ly/3VfDBOW

COVER STORY

20 E&S offers coverage options for the current market A chat with the president of PIWA

27 Simple businesses may not be simple to insure Agents should look to E&S for even their Main Street businesses

Statements of fact and opinion in PIA Magazine are the responsibility of the authors alone and do not imply an opinion on the part of the officers or the members of the Professional Insurance Agents. Participation in PIA events, activities, and/or publications is available on a nondiscriminatory basis and does not reflect PIA endorsement of the products and/or services.

President and CEO Jeff Parmenter, CPCU, ARM; Executive Director Kelly K. Norris, CAE; Communications Director Katherine Morra; Editor-In-Chief Jaye Czupryna; Senior Magazine Designer Sue Jacobsen; Communications Department contributors: Athena Cancio, David Cayole, Jeana Coleman, Patricia Corlett, Darel Cramer, Matthew McDonough and Damon Whimple.

Postmaster: Send address changes to: Professional Insurance Agents Magazine, 25 Chamberlain St., Glenmont, NY 12077-0997.

“Professional Insurance Agents” (USPS 913-400) is published monthly by PIA Management Services Inc., except for a combined July/August issue. Professional Insurance Agents, 25 Chamberlain St., P.O. Box 997, Glenmont, NY 12077-0997; (518) 434-3111 or toll-free (800) 424-4244; email pia@ pia.org; World Wide Web address: pia.org. Periodical postage paid at Glenmont, N.Y., and additional mailing offices.

©2024 Professional Insurance Agents. All rights reserved. No material within this publication may be reproduced—in whole or in part—without the express written consent of the publisher.

AS THE HARD MARKET CONTINUES, THE VALUE OF E&S TAKES OFF

WHAT’S DRIVING THE E&S BOOM?

Since admitted carriers need to have their insurance rates and policies approved by their state insurance departments, they have difficulty changing their rates to reflect and cover high-risk areas, which causes a lot of agents with clients in areas prone to natural catastrophes or areas near coastlines to have to look to the nonadmitted market for coverage.

Starting in 2023, reinsurance firms drove up their renewal prices , substantially. According to Hannover Re, at the time reinsurance accounted for 8% of the insurance marketplace. This seems to indicate that there will be an ever-increasing cost in commercial-lines insurance prices—which will cause more agents to look to the nonadmitted market to find insurance policies for their clients.

Underwriters always have been concerned with building valuations . They need accurate values to establish limits, buy reinsurance, and price policies. In recent years, there has been an uptick in factors that have historically affected building valuations: high inflation, labor shortages, supply-chain disruptions and rising construction costs.

THE HARD MARKET AND CLIENT MISREPRESENTATIONS

As it gets more difficult to find insurance coverage for your insureds in the admitted market, you may need to shop their insurance policies to the nonadmitted market ... but what happens if—to keep their premium costs as low as possible—your clients misrepresent information on the insurance application form?

This falls under the umbrella of misrepresentations to insurance carriers, and these falsehoods could leave you liable for insurance fraud should you not report them.

In the U.S., insurance fraud continues to be a massive issue. According to The Coalition Against Insurance Fraud, fraud costs businesses and consumers roughly $308.6 billion per year. The FBI estimates that for nonhealth insurance, the total cost of insurance fraud is estimated to be more than $40 billion per year, which costs the average U.S. family between $400 and $700 per year in the form of increased premiums.

In the context of the insurance industry and insurance transactions, misrepresentations are considered any statement that is false or misleading. If such a misrepresentation is material, then it can even lead to a voided insurance contract.

HAVE MORE THAN DOUBLED SINCE 2018

That is because these types of material misrepresentations could have influenced the insurer’s decision to accept the risk and on what terms.

Generally, insurance agents should be aware of the following duties associated with their role:

• a duty of accurate representation

• a duty to notify

• ethical and legal obligations of the profession

• regulatory compliance.

THERE’S AN INSURANCE POLICY FOR THAT

If a policyholder is concerned about multiple births, Lloyds of London offers multiple birth insurance, which covers the financial impact of having more than one child at a time.

Do your insureds’ employees participate in lottery pools at work? Lottery insurance can protect businesses from the financial impact if their employees decide to quit abruptly after winning the lottery.

For those insureds who like to play fantasy sports, fantasy sports insurance offers financial protection if a player on a person’s fantasy team is injured. The policy usually covers the cost of the league entry fee and possibly additional compensation.

Placing business with wholesalers: A how-to guide for first-timers

A hard market will turn risk takers into risk avoiders. Underwriting appetite will diminish and regular markets will vanish for undesirable or marginal risks. You know what to expect if you have endured these conditions before. But if you have not experienced a hard market, you could profit from a little preparation.

Start with the wholesale broker you previously placed business with. Talk to the principal and find out what insurers are accessible and what risks can be accommodated. It is possible you will need to develop a relationship with more than one wholesale broker to match the type of risks you typically write and to get some market depth. Try to avoid an overlap in services between brokers so you can establish a solid relationship with a few good brokers.

Letters of agreement. Typically, there will be letters of agreement that articulate the services and obligations expected of each party. Generally, you will represent your client in this type of market transaction, and the wholesale broker will represent the insurer. This will impact your legal duties and primary responsibility.

You also will want to know:

• if you have authority to issue certificates of insurance;

• what is needed to bind coverage;

• that the wholesale broker is licensed properly;

• a certificate of insurance issued by the wholesale broker’s E&O insurer;

• if payment made to the wholesale broker is deemed payment to the insurer;

• that you will be clearly advised if coverage offered is not consistent with coverage requested;

• the expected response time for quoting the risk and/ or receiving an indication of the wholesale broker’s interest in the risk;

• the proper procedures for reporting claims; and

• the criteria for a complete application submission.

E&S market

When placing business in the E&S market, be aware of: Licensing. To legally transact insurance with an unauthorized insurer, there must be involved a producer licensed with E&S authority, unless the policyholder negotiates directly with the insurer without the assistance of a producer. Consequently, either you or the wholesale

broker must have an E&S license in the insured’s home state, which has a specific definition. Do not assume the wholesale broker is licensed in your state, get verification. White list. Generally, state regulators keep a list of insurers that have met the qualifying financial standards established for unauthorized insurers. You must verify that the wholesale broker is placing a policy with an insurer on this list.

Export list. Generally, states require insurance for risks placed with unauthorized insurers to be unavailable in the authorized market. A list of risks that are deemed to be hard to place with an authorized insurer is maintained by state regulators. Check to see if your client’s risk is on this list. If not, you need evidence of declinations from authorized insurers to show a client’s risk is unavailable.

Disclosure. Insurance placed with E&S insurers generally is not eligible for consumer protection with state guaranty funds if the insurer becomes insolvent—except in New Jersey. You will need to provide some kind of disclosure advising your client of the absence of this protection.

Tax collection. You will be required to collect the E&S tax (as well as stamping fees or other fees that are applicable) and pass them on to the E&S broker, who must make appropriate filings with the home state. The home state of the insured has sole regulatory authority over the collection and allocation of E&S premium taxes. Federal law prohibits any state other than the home state of the insured from requiring any premium tax payment for E&S insurance.

Policy forms. Generally, rates and forms in the E&S market are not filed with the state regulator. Consequently, you may see policies issued with forms and endorsements that deviate from the standard forms. Changing a few words in a form can impact the coverage provided—examine these policies carefully.

Policy termination. Unlike the authorized insurers, E&S insurers are not subject to cancellation and nonrenewal laws in some states. Consequently, the terms for canceling and nonrenewing the policy must be found in the policy itself.

Renewals. Generally, policies do not renew in the E&S market. Keep track of all expirations and follow up with a new application submission (if required).

This article is adapted from QS90689, which can be found in the PIA QuickSource library (pia.org).

BRADFORD J. LACHUT, ESQ. Director of government & industry affairs, PIA Northeast

BRADFORD J. LACHUT, ESQ. Director of government & industry affairs, PIA Northeast

There and back again: An E&S journey

In the 2023 E&S edition of PIA Magazine, I wrote about the perils and pitfalls that insurance producers face when placing business in the nonadmitted—or excess & surplus lines—marketplace through the lens of Lord of the Rings. [EDITOR’S NOTE: You can access that issue, and other back issues of PIA Magazine on PIA Northeast News & Media (blog. pia.org) in the Media Gallery.] Whether it was that article, a naive attempt to get my kids into reading the same stuff I’m into, or my internal-nerd clock going off, shortly thereafter I decided to re-read The Hobbit . Looking back on the book, I’m struck by how the journey of Bilbo Baggins resembles that of insurance producers searching for the proper coverage for their clients.

SIMON

When The Hobbit begins, our titular hobbit, Bilbo Baggins, is resting comfortably in his home within the bucolic Shire. Like any good hobbit, Bilbo is planning his next meal when he is interrupted suddenly by a wizard and a company of dwarves. Before he knows it, Bilbo is off on an adventure that will have him face trolls, goblins, giant spiders and a dragon.

AGENCY MOVES ITS NATIONAL HEADQUARTERS

Most insurance producers sell and provide service to clients within the comfortable confines of the admitted market, with insurance companies, with which they enjoy equally comfortable relationships (and hopefully legally binding contracts). However over time, markets restrict and carrier appetites change, and insurance producers may have to look outside the usual roster of company partners.

Then, the producer will turn to the nonadmitted marketplace. This market caters to risks that are not insurable in the standard or admitted insurance market due to their uniqueness, high-risk level, or other complexities that admitted insurers are unwilling or unable to underwrite. However, before embarking on a great adventure, producers must be equipped properly.

EverGuard, a long-term partner for your RBT business.

• Exceptional service is an EverGuard priority

• Uncompromised program loyalty

• Great coverages at competitive pricing with available A&B, Enhancement Endorsement & more

• No limit on alcohol sales

• Package Policy: Property, GL & Liquor Liability

• Entertainment considered

• Experienced & Professional Staff

EverGuard, is a superior Restaurant, Bar & Tavern market with 40+ years’ experience. Your RBT clients can depend upon EverGuard for their protection.

Our continued longevity offering an uninterrupted market assures you will receive the best product underwritten by an AM Best “A” rated carrier without program interruptions. EverGuard’s respected reputation in the RBT market speaks to our stability and reliability to provide industry leading response time and customer service to our partner agencies.

EverGuard Insurance Services

1900 W. Nickerson St., Seattle, WA 98119

Visit EverGuardins.com for a listing of the states the program is available

EverGuard does not offer or solicit the program in the states of Connecticut, New Hampshire, or Vermont

License to sell

The first step on our journey to the E&S marketplace is licensing. To access the E&S marketplace, retail producers must have the right licensure. Generally, state insurance law prohibits an insurance agent from placing/obtaining coverage in the E&S marketplace. Retail producers—sometimes referred to as producing brokers—must hold either a resident or nonresident broker license in the state in which the risk is located when placing/ obtaining insurance in the nonadmitted marketplace.

That is not the end of the license journey. As Bilbo was joined in his journey by a cadre of dwarves (and the occasional grey wizard), retail brokers are joined in their journey by the excess-lines broker.

com

Just as a troll may confuse a hobbit with a dwarf, it is not uncommon to mix up a retail broker with an excessline broker. After all, both types of licenses are necessary in an E&S transaction. For those who need a refresher: A retail broker interacts with insurance buyers directly, and he or she works to find them the coverage they need, whereas an excess-lines broker has a specific license to place insurance with a nonadmitted insurance carrier. This type of broker works with the retail broker to find the needed coverage. Since the nonadmitted marketplace is, by definition, less regulated than the admitted marketplace, most states require specialization from the broker accessing the marketplace. That specialization comes in the form of the excess-lines broker license. Just as a retail insurance broker specializes in placing property/casualty risk in the admitted market, an excess-lines broker will have specialized knowl-

edge of the nonadmitted market. That specialized knowledge is gained not only through original licensure, but through continuing-education requirements—not to mention the experience of doing. Given the similarities between a retail- and excesslines broker license, it’s probably no surprise that most states make obtaining a retail broker’s license a prerequisite to gaining an excesslines broker’s license.

If your particular E&S journey takes you outside of your home state (or Shire), be aware that it will likely present new licensing challenges. Thankfully, most states offer licensing reciprocity, granting excess-lines licenses to those brokers who hold E&S licenses in their home state. However, there is a Misty Mountain-sized exemption to this reciprocity. Many states do not extend reciprocal status to those brokers licensed in Florida and vice versa. So, those individuals doing business in the Sunshine State may encounter additional licensing requirements.

Due diligence

Wielding the appropriate licensure (like Sting itself—the sword, not the singer), brokers now can take the next, and perhaps most critical, step in the E&S journey. Brokers must face a foe only slightly less intimidating than the dragon Smaug: regulatory due diligence.

Many states require the excess broker, or more likely, the retail broker to seek coverage in the admitted market first. Only after going through a diligent effort to place a risk in the admitted marketplace can a broker turn to the nonadmitted market. Typically, this diligent effort is demonstrated through obtaining a

certain amount of coverage declinations from admitted carriers, but not any carrier will do.

Something to believe in

To truly demonstrate that a diligent effort has been made, a broker must show that he or she attempted to place coverage with an admitted carrier that the broker had reason to believe would write the risk at issue.

This reason-to-believe standard is used to evaluate the justification for rejections. A retail producer is required to demonstrate that there is a rational basis for believing that the authorized insurers that have declined the risk specialize

electronically General pia@pia.org

Conference conferences@pia.org

Design + Print design.print@pia.org

Education education@pia.org

Government & Industry Affairs govaffairs@pia.org

Industry Resource Center resourcecenter@pia.org

Member Services memberservices@pia.org

Publications publications@pia.org

Young Insurance Professionals yip@pia.org

in providing the specific type or category of coverage in question. For those having second thoughts on embarking on this journey after reading those words, know that there is a lot of grey area in the reason-to-believe standard. Brokers are not required to scour every possible admitted carrier in search of coverage. Generally, they will have satisfied this requirement if they have sought coverage from a carrier that has either written the type of insurance sought to be insured, or that the broker had reason to believe has written the type of insurance sought. For example, if an agent attempted to place a commercial auto risk (the type of insurance sought) with a carrier whom he or she knew wrote commercial auto, the agent would satisfy the requirement. However, if the agent tried to place the commercial auto risk with a carrier that he or she knew wrote exclusive professional liability, it is unlikely the requirement would be met.

That is true even if the broker may not believe that a carrier would write the particular risk in question. For example, let’s say a broker is attempting to place coverage for a second home along the coast. The broker would likely satisfy the reason-to-believe standard if he or she attempts to place the policy with a carrier whom the broker knew would write homeowners policies—even if the carrier had no track record of writing homes along the coast or of writing

While there is no bright-line rule to ensure compliance with the reason-tobelieve standard—generally speaking, brokers will have complied with the standard if they seek coverage from admitted carriers that have accepted the risk of the coverage or class before, or if they have advertised that they would

Don’t forget a handkerchief!

As our journey through the complex—and often mystical—world of E&S insurance comes to a close, it’s clear that the path of an insurance producer— much like Bilbo Baggins’ adventure—is filled with unexpected twists, formidable challenges and invaluable lessons.

Bilbo returned to the Shire with more experience and wisdom. And, insurance producers who learn to navigate the E&S marketplace can find that they also emerge more knowledgeable of and adaptable to this sector of the

So, to all insurance producers embarking on their own E&S quests, remember: The road ahead may be uncertain, but there are rewards for those willing to

Lachut is PIA Northeast’s director of government & industry affairs.

How to stand out from other agents regarding sales

In sales you must stand out from other agents and salespeople—not just the ones in your industry, but all the salespeople who are calling on your customers and prospects—as they also are competing for their time, attention and money. Here are several ways to be unique in sales.

Exceed customer expectations

Go above and beyond; under promise and over deliver. Do more than is expected of you. You exceed customer expectations by delivering more, better, and/or faster. Deliver earlier than expected, as long as it fits with the customer’s schedule. If a customer says he or she needs something in five weeks, the person making the promise should deliver it in four weeks or sooner. If possible, include a little something extra that the customer wasn’t expecting. Focus on always delivering a little more—if not in product than in service. If you make a habit of going above and beyond and delivering more than is expected, you will have happy customers.

Focus on your unique selling proposition

Your agency and your product have advantages that your competition does not. What are those advantages and unique benefits? For one, you are the one thing your competition doesn’t have. With a simple decision to do so, you can be more focused on and more committed to your customers and prospects than anyone else. Sell the unique value that you, your agency and your product have to offer.

Do the things that other salespeople don’t

Send personal, hand-written thank you notes, follow-up promptly, and do what you say you’ll do, when you say you’ll do it. Send holiday gifts—just be mindful of your state’s rebating laws—ask better questions, and know the industry and how it affects your customers and prospects better than the competition does. Be a true business partner with customers and prospects.

Stay in touch and build solid relationships

Obviously, the better your relationships with your customers, the better customers they will be. Work hard to get customers’ and prospect’s information, and use that information to build strong relationships. Show a sincere interest in what your customers and prospects are interested in. Reach out to

customers via mail, email, phone and in-person visits. Focus on building solid personal relationships with all your contacts. Email me and I’ll send out the 28 items you want to know about each customer.

Dare to be different

Be unique in your approach. Here are some quick examples:

• One salesman I know has a unique way to get to tough-toreach prospects. He buys small plastic skeletons at a Halloween Store and puts them in envelopes with his business card and a note attached. The note reads, “This is me waiting for you to call.”

• A woman who is the top salesperson at her company buys cheap baby shoes, then attaches a business card to the shoes with a note: “Just trying to get my foot in the door.”

• One woman sings to difficultto-reach prospects on their voice mail.

• A top salesperson for a pharmaceutical company dresses up for Halloween and brings candy to his prospects.

• A top computer salesperson puts helium balloon in a box with his card attached. NOTE: Make sure the ceiling isn’t too high.

• Another top salesperson sends his customers six cards a year: Thanksgiving, holiday, birthday, anniversary (the anniversary date of the day the customer started doing business with him), the start of spring, and the start of summer.

Yes, some of these ideas are a bit out there, but they absolutely work, and they definitely will set you apart from your competition. Again, just be mindful of your state’s rebating laws when you are putting your outreach plan together.

Be more committed than everyone else

Decide that you are willing to work as hard as you need to so you can help your customers and prospects be successful. In addition to working hard, commit yourself to working smart to find creative solutions for customers and prospects. Dedicate yourself to professional and personal growth and commit yourself to your success, as well as that of your customers. Be the one who comes to mind when customers think of: professionalism, work ethic and integrity. With the speed of business today and the vast amounts information and people all begging for our attention, you must differentiate yourself greatly. These tips will help you stand out and thus garner you more time, attention and business from customers and prospects.

Chapin is a motivational sales speaker, coach and trainer. For his free eBook: 30 Ideas to Double Sales and monthly article, or to have him speak at your next event, go to www.completeselling. com. Chapin has over 36 years of sales and sales management experience as a No. 1 sales representative, and he is the author of the 2010 sales book of the year: Sales Encyclopedia (Axiom Book Awards). Reach him at johnchapin@ completeselling.com.

• Brokers - No minimum premium volume requirements to place business in this program

Partner with Aon Today!

45+ years serving the travel industry

• Recognized industry partner with top national travel associations

• Custom policy specifically designed for the travel industry

Professional Liability Insurance for:

• Travel Agents and Travel Agencies

• Standard Tour Operators

• Student Tour Operators

• Adventure Tour Operators

• Receptive Tour Operators

• Destination Management Companies

• Meeting Planners (Corporate)

Policy Includes:

• Worldwide Territory

• General Liability

• Errors & Omissions

• Non-owned & Hired Auto

• Personal Injury

• Industry specific endorsements

Learn more at www.aontravpro.com/broker

E&S offers coverage options for the current market

A

chat with the president of PIWA

obert Farella, vice president of Amwins Insurance Brokerage LLC in Edison, N.J., also is the president of the Professional Insurance Wholesalers Association. Interestingly, when he was just starting out in his career, he wasn’t thinking about joining the insurance industry. He thought he was going to be an accountant—he began his professional career at EF Hutton—but he realized quickly that it wasn’t his career path.

Farella has been in the insurance industry for some 40 years—almost 37 of them in the wholesaler sector. Starting as a managing general agent writing opportunities for truckers, he learned the insurance industry from the ground up. A few years later, he entered the excess & surplus industry, where he moved around until he found his niche—specializing in casualty focusing on New York contractors. Due to several mergers and acquisitions, he spent the next 30 years with two different wholesalers, where he continued to focus on the casualty sector. Eleven years ago, he joined Amwins, and now he focuses on tough casualty accounts, such as contractors, products, and real estate.

His involvement with PIWA began 15 years ago, when a friend asked him to join the association. “It just made so much sense to get involved with the industry association that was focused on where I was building my career,” said Farella. “By being a part of PIWA, I can watch what’s happening in the industry, and I can meet all the people who are a part of it.”

As president of PIWA, he’s excited to be a part of helping the association grow and expand—especially by encouraging young insurance professionals to join, and by encouraging veteran insurance producers to mentor those who are new to the industry. “PIWA is about legislative advocacy, communication, and helping people establish new contacts,” he said. “We want young people to know that a career in insurance is exciting and fulfilling.”

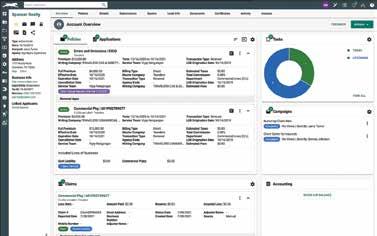

To better understand the evolution and current state of the E&S marketplace, PIA Magazine discussed with him how artificial intelligence, the hard market and other factors are playing a part in shaping the insurance industry.

How has the E&S marketplace evolved since you joined it?

It’s funny. I was just talking about the evolution of the industry the other day with my son—who joined the E&S industry a few years ago. I have a photo in my office that was taken about 30 years ago. I like to show it to people and ask them what you don’t see in it: You don’t see a computer or a cell phone—and I’m sure somewhere just out of the frame of the photo is stack of carbon paper, and a bunch of binders and files.

Over the years, the industry definitely has become more efficient. We don’t have to make copies, and stuff-and-mail manila envelopes, then wait five days to make follow-up calls on submissions to markets. We don’t have to spend all day on the phone. Even in the days of the fax machine—which was a game changer in its day—we still had to wait by the machine and make sure all the fax’s pages were sent to the recipient.

Now, we can send submissions to 10 different people in two minutes. A whole day’s operation can be handled in half an hour. This gives us more time to focus on the relationship-building side of our business. We can communicate more efficiently and provide faster answers to our brokers.

Another evolution in the industry can be seen in all the private equity that has been invested in the industry. Before we used to spend a lot of time figuring out how the industry could absorb the losses, and still provide the limits needed for our insureds. With the advent of private equity in insurance, there are MGA operations opening up all the time, providing new capacity.

What trends are you seeing in the E&S marketplace right now?

The E&S market always has been important. The insurance industry fluctuates between soft and hard markets. And, when the markets start to harden,

retail agents need to turn to the E&S markets more frequently—which is what we are seeing now, especially for contractors, tough property, real estate and auto driven accounts.

Plus, climate change has made the E&S market even more important than ever. It is becoming more difficult to write real estate, but more so when the property is by the coast, water, and areas frequently hit by tornados. Contractors in the Northeast—and specifically in New York state—continue to be difficult and tough to place.

Even auto policies are getting tougher to write in the admitted market. The increase in claims—both frequency and claims payouts—are driving up insurance premiums, especially in large cities, so policy premiums are going up. And, now that some excess companies are insisting that certain policies have $2 million in coverage, more auto policies are being written outside of standard markets.

Is COVID having any lingering effects on the industry?

I think our industry has made a good effort to get people back in the office—at least part time (two or three days a week). Insurance always has been face-to-face business, so it’s nice for me to be around my fellow co-workers to discuss new accounts, problems and opportunities.

Obviously, when COVID was at its height, we needed to adjust so that everyone was safe, but it’s easier to work out a problem or find a solution when you are sitting down in front of the person you are trying to help.

How is AI affecting the E&S marketplace?

We are just starting to lay the groundwork for AI to become a standard practice—it’s too strong for us to not bring it into the industry.

I think AI will revolutionize the insurance industry, but we haven’t figured out how it’s going to do that. If it’s going to be used to aggregate data to determine insurance quotes and coverages for classes of risks, or if it’s going to be used to help determine marketing opportunities, it might help insurance producers increase their efficiency, and help take us to the next level.

As with any new advancement, when things come, and they come quickly. Then, we must do something with it. What we need to ask ourselves is: How will AI in the insurance industry make everyone’s life better? Plus, I think it’s important to remember the human element in all this, I don’t think AI will replace the need to talk to a real person in this industry.

Now being one of the older people in the industry, who has seen a lot about how the industry has evolved and embraced new technology, I couldn’t have imagined what the industry was going to look like today compared to 40 years ago. It’s an exciting and amazing time to be in the industry.

What should producers—who are used to working with the admitted market—know about the E&S market?

When the market is hard, that’s frustrating. How do you make it through that wave? You need to develop relationships. You have to look at what’s out there, and present what you can find. There are ways to find some coverage—even if it’s not exactly what the clients are looking for. This is when you need to have a conversation, so everyone is on the same page.

You also need to be strategic about your approach, you can’t submit your application to 30 markets and send out to everyone. Rather keep your top three to five wholesalers in mind and start there.

Unlike in a soft market, in which you like to have an idea about what the right coverage is, you need to have flexibility when the market hardens. You need to rely on the relationships you developed when the market was soft to guide you through the process.

Remember that there are swings in the industry, and you must have your finger on the pulse of the marketplace. Whether it’s a soft or hard market, you need to rely on the markets you have the best relationships with and try to develop the same with the new carriers joining the market.

What is something to be aware of during a hard market?

There always are surprise markets that come out of nowhere during a hard market. There are companies that get into markets because they see opportunities, but they may not really know what they are doing. There’s a good chance that those companies won’t be around in five years. By contrast, the companies that have been in the business for 20 years are the ones that know the business and pricing needed to make sure they are around in the long run.

However, in a hard market, sometimes you need to go with the new guy. What’s important is that you keep with A-rated carriers, and you make sure that your retail agents and clients know what’s going on with the carrier. Be upfront—“We’ve never heard of the company, but it is A rated”—and let them know all the details.

Final thoughts

What most people outside the insurance industry don’t realize is how ubiquitous it is. “People have a tough time grasping the idea that without proper insurance it’s hard to do anything in life—you can’t drive a car [unless you live in New Hampshire], you can’t start a new project on your house, you can’t open a business,” said Farella. “Once you get the insurance, it’s easier to flourish in what you do.”

This is why insurance producers are vital. They are the people who are helping the insurance-buying community flourish—in the admitted market, and when needed, in the nonadmitted market.

To do this, insurance producers need to be strong communicators. “Whether it was in the days of telephones, pads of paper and pens, or in the days of cellphones and email, we need to be ready to reach out and communicate,” said Farella. “If we run into problems, we need to start a dialogue. Delivering bad news isn’t always bad. Sometimes it’s just about keeping people updated, or about finding solutions. That’s how you develop great relationships.”

And, in this industry … it’s the relationships—with clients, company partners and other insurance professionals—that help us all grow and succeed no matter the market’s cycle.

Czupryna is PIA Northeast’s publications manager and PIA Magazine’s editor-in-chief.

Grow Your Book, One Driving School at a Time

When it comes to safeguarding driving school vehicles, Lancer stands head and shoulders above the rest.

We write both private passenger and mixed fleet driving schools and offer A- “Excellent”-rated commercial auto coverages to keep your clients well protected.

• Writing in CT, NJ, NY, OH, & PA

• Agency Headquarters online quoting

• No minimum premiums

• No minimum/maximum units

Submit your driving school risks to Lancer today and watch your portfolio thrive.

516-431-4441 x 3507

producer@lancerinsurance.com www.lancerinsurance.com

Simple businesses may not be simple to insure

Agents should look to E&S for even their Main Street businesses

When most people think about excess & surplus insurance, their first thought is that its purpose is to insure big and complex risks. Today, the reality of E&S insurance is that it has become a valued solution for a wide swath of the business universe. The reason why is simple—modern business isn’t simple and needs more than generic insurance.

To understand where E&S fits today, one must first understand E&S’s history. Decades ago, E&S was a market for large, unique and complex risks. It was created as a mechanism to insure businesses that didn’t fit a mold, as opposed to businesses on Main Street. Capacity was limited, insured premiums were high, and the total market was small. It was a market of last resort—either because the risk couldn’t be insured by standard products, or because an account had risk factors that weren’t anticipated with standard insurance. Underwriters in E&S were limited, and they needed to have decades of experience. Much like there wasn’t much capital capacity, there wasn’t much underwriting talent in the space.

So, how did we get from that to where we are now? The world changed and insurance couldn’t keep up. To protect insureds, the insurance industry created a bureaucracy that limited its ability to adjust. However, this harmed the insureds’ ability to obtain the right coverage for their specific needs.

Requiring all rates and forms to be filed and approved created an unstainable situation in which business was changing at speeds faster than insurance could change. This untenable arrangement caused insureds to need new solutions and the result was a massive growth in the E&S industry.

Over the past five years, E&S has become a much larger percentage of the entire property/casualty insurance industry. In 2018, E&S accounted for approximately $30 billion, which was slightly over 5% of the p/c market. In 2022, that premium exceeded $60 billion, and it was approaching 9% market share.1 There is more complexity with E&S compared to the standard market, and yet the E&S space is outgrowing the insurance market as a whole

by leaps and bounds. Initially, one may assume that is because big, complex businesses are growing at a faster rate than traditional, Main Street businesses. However, big business isn’t growing at the pace of E&S business. So, there must be other reasons for the explosive growth of the E&S industry. Those reasons are that the business landscape has changed, the legal environment has changed, and cultural expectations have changed.

Business landscape

Businesses are more complex than ever and there is no longer a connection between size and complexity. While it used to be that a roofer had simple exposure—if the roof leaked, the business needed insurance to cover the losses sustained by the property owner—that is no longer the case, and a roofer has more needs. In 2024, one roofer also may be doing window installation, and waterproofing while another roofer may be doing painting, in addition to roofing. A policy that only covers roofing services will not provide coverage for the other services a roofing business provides—as such, a policy that covers the services of one roofer may not cover the services of another roofer.

However, the changes to the business landscape go beyond how businesses do more than they ever have before; how they conduct business has changed as well. Returning to the roofer, who is operating like a general contractor: Previously, general contractors had employees and those employees performed all the work for that contractor. Today, many general contractors use independent contractors to do work instead of their employees. Many standard policies still only cover traditional businesses that employ their workers. However, small businesses need the same specialized coverage that larger businesses need, such as catastrophic risk coverage, errors & omissions coverage, and directors & officers coverage.

Beyond having similar risks to larger businesses, one of the biggest changes in recent years is that practically every company—including more traditional businesses—is an internet company. Documents are scanned and emailed, and payments are made digitally for businesses that otherwise are traditional brick-and-mortar operations. This means traditional businesses also have cyber security exposures that they never have had before, and so, they have never had to worry about insuring … until now.

Legal environment

The plaintiff bar has become more savvy, more aggressive and more sophisticated. While the United States always has had a robust legal environment, it has become more litigious compared to past decades. The result is that getting sued isn’t just possible, it is likely. And, lawyers are incredibly good at finding an angle, which puts businesses at risk for legal theories they never expected. Much of this complex litigation strategy was constrained previously because complex litigation is costly, and so, it was expensive to sue. Litigation financing has changed how legal battles are fought, reduced financial exposure for lawyers, and incentivized attorneys to drive for larger settlements. When someone else is funding the case, lawyers don’t have to worry as much about efficiency and ensuring cases are strong; they are playing with someone else’s money.

There also are parts of the country that are notoriously biased toward plaintiffs—when the plaintiff is the little guy. These areas are known as judicial hellholes, and they span the country. Per the Judicial Hellhole 2023-24 report, some of the most notorious states/areas are: California, Georgia, Louisiana, Cook County, Ill., and New York City.

What this means is that insurance policies need to have broad coverage that anticipates more exposure. It also means that as the legal landscape changes, insurers’ costs are going up. The time it takes to file rate changes on admitted business can far outpace the speed at which carriers need new rates. When those two don’t align, standard market carriers are more likely to exit markets leaving fewer options available to insureds.

Cultural expectations

Simply put, $1 million isn’t what it used to be, and people expect juries to grant judgments that far exceed what they used to. When people don’t view $1 million as much money, that creates a bad situation for businesses trying to defend themselves.

As an illustration to show how people’s views of money has changed: As my fellow Kansas City Chiefs fans—my apologies—know, Patrick Mahomes was granted the most expensive contract in the country at $500 million over 10 years. That type of salary was unheard of as recent as a decade ago.

In the insurance industry, this phenomenon is known as social inflation, which refers to the rising costs of insurance claims due to socioeconomic, legal and behavioral trends that change over time to

drive more and bigger lawsuits. Just as we wouldn’t have expected a halfbillion-dollar quarterback contract in 2010, we wouldn’t have expected frequent verdicts over $1 million then either.

Some of the reasons behind social inflation include: the perception that the value of money has changed; public distrust of corporations; and plaintiff-friendly legal decisions. As the Mahomes’ contract illustrates along with the media’s effect on public opinion, large payout verdicts appear to be more common and juries believe that defendants—especially large corporations—can pay out much larger sums of money to plaintiffs. The public is desensitized to big numbers. Similarly, aggressive plaintiff attorneys are savvier and better able to play to jurors’ emotions to make them more likely to rule in favor of the plaintiff, regardless of the facts surrounding the case. This is compounded by the fact that the distrust the public has regarding larger businesses and corporations can lead to juries sympathizing with the plaintiffs—also regardless of the level of fault on the defendant. While public opinion has turned on large corporations it does not mean that small businesses are immune to social inflation.

Social inflation has had a serious impact on the insurance industry. There’s been a surge in nuclear verdicts or legal outcomes in which jury awards or settlements exceed $10 million. Previously, award amounts were set by judges based on precedent. Now, juries are setting the precedent that nuclear verdicts are the expected outcomes.

According to a 2022 study by the U.S. Chamber of Commerce Institute for Legal Reform, the median

nuclear verdict rose from $19.3 million in 2010 to $24.6 million in 2019. This is an increase of 27.5% and this trend shows no signs of slowing down. So, insurance agents must consider E&S products for their traditional and smallbusiness clients, lest they be caught in harmful and expensive litigation.

Conclusion

Because the E&S market is no longer just for large businesses or traditionally complex businesses, insurance agents should no longer consider E&S solutions for only their large insureds, but also for their small, more Main Street businesses.

The freedom of rate and form provides the opportunity to truly offer coverage that meets businesses’ ever-changing and dynamic needs. Through E&S, agents can become true business consultants who work hand-in-hand with business owners to match their individual needs with coverage that meets those needs.

While far from simple, E&S insurance covers complex businesses no matter if it has 10 employees or 10,000 employees.

Bublitz is the senior vice president and head of AmTrust Excess & Surplus where he is a respected leader. Before AmTrust, he served his decade-plus E&S career at several top-tier insurance companies and specialty MGUs. Before his insurance career, Bublitz spent over a decade in the consulting and auditing industry working for leading accounting and consulting firms. He holds a Bachelor of Business Administration degree from the University of Kansas, and he also holds the CPCU, ARe, and ASLI designations.

1 Fitch Ratings, S&P Global Market Intelligence, 2023 (tinyurl.com/vf8vj9ya)

Hiring made easy

Let PIA help with your staffing needs! We’ve created the Agency Staffing Assistance Program—an online member service that helps you find and keep good employees.

AMY C. WANINGER Founder & CEO, Lead at Any Level

AMY C. WANINGER Founder & CEO, Lead at Any Level

Hardening market, anything else causing you to worry?

Whenever you’re in the middle of big changes at work, you may find yourself worrying about what might happen. Whether you’re facing a reorganization, layoff, or even a process change, worry at work zaps your energy and robs you of productive time.

Worry at work destroys productivity

Not too long ago, I worked on a small team in a large company. Our executive sponsor had left the company unexpectedly. We weren’t sure we would see the same level of support from the person who would take her place. I was still new in my role and struggling to find my footing. I had just conducted an internal job search under similar circumstances in another department. Company policy prevented me from applying for another transfer so soon. I was convinced that my position would be eliminated, and that I would be caught unprepared.

My productivity plummeted while I waited … and waited. And waited some more, for an announcement about who would be taking over our department. This went on for months. My stress level heading into the holiday season was at a fever pitch. And my performance in my role was, frankly, abysmal. How could I be effective when I spent so much time playing and re-playing what-ifs in my head?

Finding time to worry at work

One day, I sat myself down for a difficult conversation. While I couldn’t control the executive search process, the hiring decision, the timeline or the attitude of the new executive, there were some things I could control. Specifically, I could control how I structured my time, how much I accomplished and my own attitude. Still, some part of me felt that if I didn’t worry about the unknowns, I couldn’t prepare myself emotionally for the horrible events I was anticipating. In other words, I wasn’t ready to completely let go of the worry. I decided to try a compromise. Rather than spending all day worrying, I set up a recurring appointment with myself each weekday, from 4:30-5 p.m. The subject of the appointment on my calendar? “Worry”

Making time for everything else

This sounds ridiculous—and it is. If you think about it, it’s no more ridiculous than worrying without a schedule. When I couldn’t get anything done at work all day because I’m worried about what might happen later, I’ve wasted a whole day.

But every time I started to worry at work, I would tell myself, “Remember our agreement? I agreed to only worry about that from 4:30-5 p.m. It’s now 8:30 a.m. What can I get done right now while I’m waiting to worry?” And I’d start working on something. Then after lunch, same thing. “Nope, can’t worry for another four hours. What can I get done while I’m waiting?”

And, do you know what happened? I got a good seven and a half hours of work done that day.

Then, when my 4:30 meeting alert popped up, I got all settled in to worry. After about two minutes, my brain said, “Well, this is stupid. I’m not going to spend 30 minutes worrying about that.” So I moved on, and managed to get another 28 minutes’ worth of work done!

We have the solutions YOU NEED

PIA membership brings with it a wealth of benefits for the professional, independent insurance agent or broker—but the personal assistance of PIA’s Industry Resource Center alone is worth the investment.

1,724 4,955 3,8141,673 1,216 28

It worked so well on Monday, that I tried it every day that week. By the end of the week, I had stopped worrying completely.

One of my co-workers called me the next Monday to commiserate: “What are we going to do if they eliminate our jobs in November?” I told him about my scheduling trick and asked him to try it. It worked for him as well!

Procrastination works too

Maybe you’re a free spirit, not tethered to Microsoft Outlook’s constant demands. There’s still a way to make this work for you.

How many people do you hear procrastinating doing exercise? How many people procrastinate going on a diet or paying their bills or talking to their financial adviser or signing up for life insurance? All these things we don’t want to do, we procrastinate.

Try to procrastinate worrying. Tell yourself, “I’ll worry about it later. I’ll worry about it someday.” Or, “I’ll worry about it on Monday, when I start my diet.”

“I am so proud of being a PIA member!”

—Robert Charles Robert Charles Brokerage Inc.

“There is no way I could get by without PIA.”

—Richard A. Mayo, CPCU Romay Insurance Services

Waninger is the founder & CEO of Lead at Any Level, where she improves employee engagement and retention for companies that promote from within. She offers assessments, advisory services, and training on essential skills for inclusive leaders. Waninger is the author of eight books. Learn more at www.LeadAtAnyLevel.com.

Have a question? Ask PIA at resourcecenter@pia.org

NPN's and NFIP policies, bond obligations and more

Personal umbrellas and trusts

Q. We have an insured who has put all his assets into a living trust. He has personal auto, homeowners and umbrella policies with us. The company has changed the named insured on the personal auto and homeowners policies to reflect the trust, but it refused to do so on the umbrella. Since the named insured is not the same, would the umbrella still provide excess coverage over these policies?

A. The Insurance Services Office Inc. has an endorsement for this scenario: the Personal Umbrella Liability Policy Trust (DL 98 08) endorsement, which amends the definition of “insured” to include a trust and trustee. However, there are two limitations on the coverage in the following provisions:

1. However, for any “occurrence” or offense, the trust is an “insured” only if coverage is provided to that trust by “underlying insurance” for such “occurrence” or offense. b. the trustee is an “insured” only:

2. However, for any “occurrence” or offense, the trustee is an “insured” only:

a. if coverage is provided to that trustee by “underlying insurance” for such “occurrence” or offense; and

b. with respect to his or her duties as a trustee.

ISO offers the following two endorsements to meet the underlying insurance requirements of its umbrella policy:

• The current Personal Auto Trust (PP 13 03) endorsement amends Paragraph C. of the definitions section: “For purposes of this policy, a private-passenger-type auto, pickup or van shall be deemed to be owned by a person if title is transferred to the trust shown in the schedule or in the declarations.”

• Also, the current Homeowners Trust (HO 06 15) endorsement names the trust (if state law permits) and each trustee (if a natural person and not a professional) to afford them Coverage A, Coverage B property insurance, and Section II liability insurance. [In order to accommodate where a trust cannot be named, use the alternative HO 06 12 endorsement.]

Because umbrella forms vary, you should review the nonstandard forms thoroughly to ensure that they fit the criteria you are looking for.—Dan Corbin, CPCU, CIC, LUTC

Agent and agency NPNs on NFIP policies

Q. An insurance colleague told me that my National Producer Number will be required to write or renew the National Flood Insurance Program flood insurance policies. Is that true?

A. Yes. Effective Jan. 1, 2024, both an agent and an agency’s National Producer Number must be included on all new and renewing NFIP policies.—Theo Alexander

Health insurance premium rebates

Q. We received a rebate from our health insurance company because it did not meet the 80/20 rule under the federal Patient Protection and Affordable Care Act. As the employer, what can I do with the money?

A. The guidance on this issue comes from a federal rule through the PPACA, not a state rule. Basically, you need to return the money to your employees or use the money to enhance benefits for employees.

According to the healthcare.gov website: If your insurance company doesn’t meet its 80/20 targets for the year, you’ll get back some of the premium that you paid.

PIA

You may see the rebate in several ways:

1. a rebate check in the mail;

2. a lump-sum deposit into the same account that was used to pay the premium, if you paid by credit card or debit card;

3. a direct reduction in your future premium; or

4. the employer may use one of the above rebate methods, or apply the rebate in a way that benefits employees.

The first three options are straight forward—employees get their money back directly or as a reduction in future premium—but the last one is a little more vague.

The U.S. Department of Labor further explains how such rebates must be utilized by an employer “that benefits employees.” The short answer is that you “may utilize the rebate for other permissible plan purposes, including applying the rebate toward future participant premium payments or toward benefit enhancements.” You can direct the insurer “to apply the rebate toward future participant premium payments or toward benefit enhancements … .”—Theo

AlexanderObligations for bonds

Q. One of my clients has asked to have a meeting about his bond requirements. He is not a contractor. What kind of bonds could he need and what do I need to know?

A. There are virtually an endless number of types of bonds that could be needed. In essence, a bond is a surety, which is another way of saying a type of guarantee in which one party (a guarantor) agrees to meet the failed obligation assumed by, or expected of, an obligor or principal, to yet a third party—the obligee.

The obligation may take any number of forms, so you will need to know for what purpose your client needs a guarantee.

For a more complete explanation, refer to A primer on surety (QS90057 ), which can be found in the PIA QuickSource library.—Dan Corbin, CPCU, CIC, LUTC

Subrogation against tenant’s policy

Q. If a tenant of the owner’s residence causes water damage to the house, can the owner’s insurer subrogate against the tenant for the damages?

A. Yes, unless the lease agreement waives this right.

The Insurance Services Office Inc.’s HO-3 form states under F. Subrogation that the company may require from the insured an assignment of rights of recovery to the extent of any payments it makes under the policy, unless the insured has waived in writing, before the loss, all rights of recovery against the responsible party. Also, this policy provision requires the insured to cooperate in the pursuit of the subrogation claim.—Dan Corbin, CPCU, CIC, LUTC

PIA MEMBER‑EXCLUSIVE BENEFITS

HELPING AGENTS GET APPOINTMENTS TO CONNECT WITH COMPANIES, MGAS AND GAS

Let us help you build lasting relationships with companies, managing general agents and general agents. The Appointment Access Program will connect you with quality MGAs and GAs looking to appoint in your area, while the AgencyCompany Appointment Program can connect you with carriers.

Struggling with finding a specialty market? With PIA MarketBase™ , you don’t have to search blindly—or worse—turn away this business. We can connect you with nearly 100 firms offering more than 2,100 specialty risk categories.

Contact the PIA Industry Resource Center (800) 424-4244 • resourcecenter@pia.org Or Live Chat with us at: www.pia.org

PIANH Company Partners

PIANH 2023-2024 Board of Directors

OFFICERS

President Keith T. Maglia

Insurance Solutions Corp.

60 Westville Road

Plaistow, NH 03865-2947 (603) 382-4600

kmaglia@isc-insurance.com

Vice President

Jeffrey Foy, AAI

Foy Insurance-Manchester 1889 Elm St. Manchester, NH 03104-2500 (603) 641-8111

jeff.foy@foyinsurance.com

Secretary/Treasurer

Casey Hadlock

Hadlock Agency Inc. 150 Old County Road Littleton, NH 03561-3628 (603) 444-5500

casey@bestinsurance.net

Immediate Past President and National Director

Lyle W. Fulkerson, Esq.

HPM Insurance

101 Ponemah Road #1 Amherst, NH 03031-2816 (603) 673-1201

lyle@hpminsurance.com

ACTIVE

PAST PRESIDENTS

Lisa Nolan, CPCU Cross Insurance

1100 Elm St. Manchester, NH 03101-1500 (603) 669-3218 lnolan@crossagency.com

John Obrey

Obrey Insurance Agency Inc. 1B Commons Drive, Unit 13a PO Box 1018 Londonderry, NH 03053-1018 (603) 432-3883

john@obreyinsurance.com

DIRECTORS

Nick Aube

Producer Systems

1 New Hampshire Ave., Suite 125 Portsmouth, NH 03801-2907 (603) 729-3559 nick@producer.systems

Anthony Inverso

North American Insurance Alliance 234 Lafayette Road Hampton, NH 03842-4105 (207) 831-4837 anthony.inverso@naia-consulting.com

Alex Kapiloff, CPCU, CLU, CIC, AAI Kapiloff Insurance Agency, Inc. 417 Winchester St. Keene, NH 03431-3914 (603) 352-2224 akapiloff@kapiloff.com

Erik Liguori

Brown & Brown of New Hampshire, Inc. 309 Daniel Webster Hwy. Merrimack, NH 03054-4116 (603) 424-9901 erik.liguori@bbrown.com

Paul Riley

Safety Insurance

20 Custom House St., Ste 400 Boston, MA 02110-3516 (617) 951-0600 paulriley@safetyinsurance.com

Lori Sherman

Central Insurance Cos.

200 5th Ave. Waltman, MA 02451-8789 (781) 879-9002 lsherman@central-insurance.com