18 Big reward, little effort

Six digital marketing strategies to win more business

18 Big reward, little effort

Six digital marketing strategies to win more business

Understand this AI tool to understand how it can benefit your agency

Statements of fact and opinion in PIA Magazine are the responsibility of the authors alone and do not imply an opinion on the part of the officers or the members of the Professional Insurance Agents. Participation in PIA events, activities, and/or publications is available on a nondiscriminatory basis and does not reflect PIA endorsement of the products and/or services.

President and CEO Jeff Parmenter, CPCU, ARM; Executive Director Kelly K. Norris, CAE; Communications Director Katherine Morra; Editor-In-Chief Jaye Czupryna; Magazine Advertising Sales Representative Adam Wolfe; Magazine Layout Designer Nate Voellm; Communications Department contributors: Athena Cancio, David Cayole, Jeana Coleman, Patricia Corlett, Darel Cramer, Matthew McDonough and Damon Whimple.

Postmaster: Send address changes to: Professional Insurance Agents Magazine, 25 Chamberlain St., Glenmont, NY 12077-4835.

“Professional Insurance Agents” (USPS 913-400) is published monthly by PIA Management Services Inc., except for a combined July/August issue. Professional Insurance Agents, 25 Chamberlain St., P.O. Box 997, Glenmont, NY 12077-4835; (518) 434-3111 or toll-free (800) 424-4244; email pia@ pia.org; www.pia.org. Periodical postage paid at Glenmont, N.Y., and additional mailing offices.

©2024 Professional Insurance Agents. All rights reserved. No material within this publication may be reproduced—in whole or in part—without the express written consent of the publisher.

If you haven’t used sensory branding strategies in the past, consider adopting some in your future marketing endeavors to enhance customer engagement and loyalty. You can utilize sensory branding within your agency to form a lasting connection with your customers.

As a brand, you might think you can only go so far when it comes to engaging your audience’s senses.

From a marketing perspective, visuals can help you shine and connect with your audience. With that in mind, colors matter more than you might think. By tapping into color psychology, you can create marketing materials that evoke certain emotions and ideas. Depending on your brand and the message you’re trying to convey, you can use different colors to your advantage.

Not only can you use colors to impact the feelings of your audience, but you can use real-world visuals and audio. Video marketing has seen a huge rise in popularity over the last few years. Now, short-form videos are becoming more popular thanks to platforms like TikTok and Instagram—especially with younger generations. Videos give your brand a chance to develop your voice and put a real face behind your agency. It improves accessibility and increases engagement, so don’t be afraid to pull back the curtain on your brand, make more videos, and foster closer, more comfortable relationships with your audience.

By appealing to the senses of your audience, you’re likely to make them feel more seen, heard and valued by your brand. That can go a long way in fostering loyalty, helping you to build success for years to come.

Sensory branding = Appealing to the senses of your customers to attract more people within your target audience. It also helps your existing customers to feel a deeper connection to your brand.

Red = Energy, war, danger, power, determination, passion, desire and love

Popular shades: Magenta, Burgundy and Maroon

Orange = Enthusiasm, fascination, happiness, creativity, determination, attraction, success, encouragement and stimulation

Yellow = Joy, happiness, intellect and energy

Popular shades: Amber and Beige

Green = Growth, harmony, freshness and fertility

Popular shade: Chartreuse

Blue = Peaceful, flexible and imaginative

Popular shades: Teal and Turquoise

Pink = Tenderness, vulnerability and youth

Popular shade: Salmon

Purple = Power, nobility, luxury and ambition

Popular shades: Indigo, Violet, Lavender and Mauve

White = Light, goodness, innocence and purity

Brown = Dependability, reliability and resilience

Black = Power, elegance, formality, and mystery

The ability to scale is crucial for any business—large or small. Digital ventures give you the opportunity to expand your agency beyond geographical constraints. Catering to those potential customers means you must be prepared to grow globally and exponentially. The dynamic nature of the internet also necessitates change. Online trends and tech

While e-commerce businesses do the bulk of marketing and sales online, there are opportunities online and offline that can expand your visibility and reach. A temporary physical presence at trade shows or events can help you stand out from other organizations. By seamlessly integrating your digital presence with tangible, memorable experiences, you can leave a lasting impression on people who may not have seen your brand otherwise.

Start by creating an eye-catching and cohesive brand representation that extends from your online platforms to your physical presence at events.

• Utilize visually striking signage, interactive displays, and branded merchandise to leave attendees with something to remember you by.

inevitably advance over the years, and the longevity and efficiency of your agency depend on how well you can adapt.

The ability to expand operations seamlessly to accommodate growing user demands and increased workloads ensures that your agency can adapt to evolving market conditions. Scalability enhances your capacity to handle larger volumes

• Engage with your audience through personalized demonstrations, exclusive promotions, or interactive activities that showcase the unique value of your online offerings.

• Post on social media and encourage event attendees to share their experiences online using a dedicated event hashtag, fostering both realtime engagement and postevent visibility to attendees’ extended networks.

Even if your online business page is stellar and your product offerings are outstanding, you still can flounder if you aren’t showing up for your customers. Improving customer service online is a crucial

of traffic, transactions, and data and contributes to improved performance, reliability and customer satisfaction. By investing in scalable infrastructure and technologies, you can maintain a competitive edge, respond to market fluctuations, and capitalize on emerging opportunities, thereby fostering sustainable growth and resilience in an ever-changing online marketplace.

ingredient for scaling up.

Exceptional customer service not only fosters loyalty, but it also generates positive word-of-mouth referrals—paving the way for organic acquisition.

By ...

• prioritizing responsiveness,

• addressing customer inquiries promptly, and

• offering personalized support via artificial intelligence and multiple communication channels,

.... you can show up when and where your customers need you. Satisfied customers are more likely to become repeat buyers and advocates of your brand— contributing to increased customer retention and the ability

Merilee Kern, MBA, founder, The Luxe List

Digital marketing offers unparalleled opportunities for businesses to connect, engage and convert customers in ways that were not possible with traditional marketing methods. Its dynamic nature and ability to adapt to evolving trends make it an essential component of a successful modern business strategy. Here are six costly, yet avoidable digital marketing mistakes:

No. 1: Failing to funnel. If a business does not concentrate on the entire marketing funnel and only worries about things like driving traffic to the website, email marketing content or sales conversions, then the funnel will not be optimized and not be as efficient as it could be. Or, worse, it could fail all together and not generate any revenue while having squandered both fiscal and human resources. This happens more often than you might think. We all know that revenue generation solves most problems, but many business owners erroneously believe that all they need to do is generate leads and, if fruitful on that front, everything else in the sales process will fall in line. For a funnel to work, every facet of it needs to be optimized to maximize conversions and improve the efficiency of your sales process.

Some key considerations to keep in mind when optimizing your sales funnel include things like: ensuring that your value proposition is clear and compelling right from the beginning. Visitors should understand how your product or service can solve their problems or fulfill their needs immediately.

No. 2: Monetizing leads poorly. At first this could seem odd. Promoting other ancillary products or services to your leads or established customers? But, even the largest companies do this—and with good reason. Amazon, Best Buy and Walmart all monetize their traffic and boost revenue by leveraging other products or services from other companies. Every consumer has multiple needs, and this is a great way to capitalize on that captured attention. There are many ways to be strategic so you can promote other related and synergistic products or services that make contextual sense.

You can send out emails or texts to databased leads to promote other such services. It doesn’t have to be someone you are speaking to directly. Many lead-generation companies generate a lead for a specific product or service, and they promote other services right away via multiple monetization strategies.

No. 3: Ignoring target audience segmentation. Failing to identify and segment your target audience properly can lead to wasted resources and ineffective marketing campaigns. Understanding your audience’s demographics, preferences and behaviors helps you tailor your marketing messages and strategies to resonate with them. Investing time in thorough audience research and creating buyer personas can help you avoid this mistake.

No. 4: Neglecting mobile optimization. With the increasing use of mobile devices for online browsing and shopping, neglecting mobile optimization can be a mistake. If your website and marketing materials are not mobile-friendly, you risk losing potential customers who have a poor user experience. Ensure that your website is responsive and that your emails, ads and content are accessible easily and readable on mobile devices.

No. 5: Not tracking and analyzing data. Failing to track and analyze your digital marketing efforts can result in wasted resources and missed opportunities for improvement. Without data-driven insights, you won’t know which strategies are effective, where your audience is coming from, or how they engage with your content. Set up proper analytics tools, track key performance indicators, and regularly review the data to make informed decisions and optimize your campaigns.

No. 6: Staffing stumbles. All too often businesses hire the wrong employee for digital marketing, which is a highly specialized sector. When it comes to the trade, most people know just a few marketing strategies. They might be good at Facebook ads, SEO, Google, YouTube or email marketing, but those who are hiring mistakenly think that is all they need to know to make a digital marketing endeavor work. Such thinking is a huge mistake, as all facets of the digital marketing-driven sales funnel needs to work together for any digital marketing campaign to work—and certainly to maximize possible outcomes.

Surprisingly, many marketing agencies also fall into this category of only concentrating on a handful of marketing strategies, convincing business owners that it’s sufficient to achieve goals. Generating and maximizing digital marketing revenue demands a holistic and comprehensive approach from properly trained tacticians.

This article is adapted from “Costly, yet avoidable digital marketing mistakes,” which can be read in its entirety on PIA Northeast News & Media (blog.pia.org).

DANIELLE CASWELL, ESQ. Associate counsel, PIA Northeast

Let’s face it, insurance and creativity are not normally two words spoken in the same sentence. That is, until you introduce marketing and branding into the discussion. Actions, such as designing your agency logo, creating slogans or taking out an ad in the newspaper, help create a distinct identity in the marketplace and leave a lasting impression with customers by fostering trust, credibility and loyalty.

After putting in the hard work to create a brand identity and to develop goodwill associated with your business, it would be an awful shame if somebody came along and copied what you did to develop their own business without your permission, right? That is why there are mechanisms to help protect your ideas—otherwise known as intellectual property—and to protect others when you might be infringing on IP that does not belong to you.

While this part of your business operations can be fun, there are a host of considerations that must be made when creating marketing and branding

material for yourself or your insurance agency to protect your own IP, and to ensure you are not infringing the IP rights of others.

Developing an insurance agency name, logo and any other branding elements are some of the first steps of business creation. They will be included in any marketing materials pushed out to the public. Luckily, under federal law, a form of IP called a trademark is available to help protect this form of branding.

Trademarks can be any word, phrase, symbol, design or combination of these that identifies both goods and/or services in the marketplace.1 A trademark is how customers distinguish you from your competitors.2 It identifies the source of your goods or services; provides legal protection for your brand; and helps you guard against counterfeiting and fraud.3 If your independent insurance agency offers distinctive services, you can consider registering service marks to protect the branding of them.4

Registering a trademark is a relatively straightforward process. However, for complex cases or to ensure proper handling, many businesses seek assistance from trademark attorneys or legal professionals. It requires conducting a trademark search to make sure your mark is unique and not already in use; application to the United States Patent and Trademark Office; and examination, publication, registration and subsequent maintenance of your mark.

Trademark ownership also requires active monitoring and enforcement of your trademark rights to help prevent others from using similar marks that could confuse consumers or dilute your brand.5 Failure to do so can lead to claims that you have abandoned your trademark or that the mark has become generic and thus not protectable. Trademarks also need to be periodically renewed.6

Trademark ownership is a fundamental aspect of business strategy, marketing and brand management. It provides essential legal protections, supports brand development and recognition, and contributes to the long-term success and profitability of a business.

Another form of intellectual property that protects original works of authorship as soon as they are fixed in a tangible form of expression is called a copyright.7 Under the law, there are many different types of works that are protected by copyright, including, but not limited to, paintings, photographs, illustrations, musical compositions, sound recordings, computer programs, books, poems, blog posts, movies and even insurance policies!8 Copyright protects expression, but not ideas, procedures, methods, systems, processes, concepts, principles or discoveries.9 Anyone can be a copyright owner—once an original work is created and fixed (i.e., by taking a photograph or writing a blog post), you become the author and owner.10 Companies and other organizations also can be copyright owners.11 The law even allows for ownership through “works made for hire” by employees who created works within the scope of employment, works created by independent contractors or certain types of commissioned works.12 You also can obtain ownership of a copyright by contract through certain transfers like assignments or wills/bequests.13

As part of an insurance agency’s marketing efforts, the creation of promotional content is likely. Advertisements, brochures and websites created by insurance agencies often are protected by copyright law, therefore the agency owns the rights to these specific works, and it can be afforded protection from unauthorized use.

Additionally, policy documents and proprietary software are eligible for copyright protection. While concepts and terms of policy documents themselves are not protected by copyright, the specific language and presentation of a written policy may be. And, if an insurance agency develops custom software

for managing policies or claims, that software can be protected by copyright law.

If an agency decides to use content that is created externally (e.g., images, videos or articles), it is essential to make sure all the proper licenses and permissions—including the right to use any third-party IP such as software, music or artwork— have been secured for use. If you are conducting any collaborations with influencers, or when using socialmedia platforms, you should clarify and document all rights to any content created and shared. If for any reason there is sponsored content in your marketing, make sure all advertising regulations and disclosure requirements have been adhered to. Creating original content, or acquiring these appropriate rights, helps to avoid potential copyright infringement claims.

Obtaining federal copyright protection is relatively straightforward. A completed application must be submitted to the United States Copyright Office with the requisite copies of your work (dependent on the category of the work being submitted), and a fee.14

Web domain names. In terms of marketing efforts, having a strong online presence is crucial. Handin-hand with developing your business’s branding and protecting it by trademark, it is essential to secure domain names that align with your brand. Owning a domain name that matches your agency’s name helps protect your brand, and it prevents

competitors or malicious actors from using a similar domain that could confuse customers or tarnish your reputation.

When choosing a domain name for your agency, avoid using names that might infringe on existing trademarks or cause confusion with established brands. Cybersquatting is a crime. Registering or using a domain name to profit from a trademark, corporate name or personal name of an individual is illegal and trademark owners can sue you in federal court under the Anticybersquatting Consumer Protection Act.15 You also should monitor and protect your own online content against such unauthorized use or replication. There are many digital rights-management tools available to help your business.

Advertising requirements. While not necessarily falling under the scope of federal IP rights, it is essential that when marketing a business, any claims or representations made in advertising are accurate and not misleading. Truth in advertising is regulated heavily on the federal level by the Federal Trade Commission—when it finds a case of fraud perpetrated against consumers, the FTC files actions in federal court for immediate and permanent orders to end scams, prevent fraudulent actors from further perpetrating scams, freezing assets and obtaining compensation for victims.16 In addition, many state insurance departments have strict rules regarding what insurance agents can and cannot say in advertisements. For example, in many states it is against the law to name an insurance company in an advertisement without also including the business address of that insurance company.

Misleading advertising can lead to legal disputes and can damage your reputation severely.

Despite learning about the ways you can protect your IP, and how you can take action to prevent the infringement of others’ IP rights, you still may want to take extra precautions to protect your agency.

Consider IP insurance, which is designed to protect businesses from financial losses associated with IP disputes and infringement. IP insurance can cover the legal costs associated with IP infringement defense and enforcement, IP asset protection, copyright/trademark infringement and contractual obligations—including attorney fees, court costs and settlements or judgments.

Be as creative as you can be in your marketing efforts for your insurance business. Develop your branding, send out your brochures and daily email blasts, create that jingle that will be permanently locked in the brains of locals for generations to come. However, be creative while also being mindful of your rights in the content you are creating, as well as the rights of others.

Complying with these IP laws and taking the time to develop robust IP protection helps secure your marketing investments; helps preserve your brand’s uniqueness and goodwill in the marketplace; and helps minimize legal risks—all of which are crucial for effective and sustainable marketing in the competitive insurance industry. Caswell is PIA Northeast’s associate counsel.

1 U.S. Patent and Trademark Office (tinyurl.com/y4a8fv89)

2 Ibid.

3 Ibid.

4 Ibid.

5 U.S. Patent and Trademark Office (tinyurl.com/2s424dzs)

6 Ibid.

7 Copyright.gov (tinyurl.com/2tmnjhac)

8 Ibid.

9 Ibid.

10 Ibid.

11 Ibid.

12 Ibid.

13 Ibid.

14 Copyright.gov (tinyurl.com/5dspcv7a)

15 American Bar Association, 2016 (tinyurl.com/55mt7yfr)

16 Federal Trade Commission (tinyurl.com/2sej9nk7)

Brooks Insurance Agency is proud to support Professional Insurance Agents (PIA)

Since its founding in 1991, Brooks Insurance Agency has successfully serviced the standard markets and brokered distressed and complex lines of business. We are here to help agents find the coverage their clients need.

We represent 80+ quality carriers, including several new and exciting markets, across the country. Plus, a broad array of products and services in admitted and non-admitted markets.

MARKET STRENGTHS AND EXPERTISE

• Broad market reach

• High-touch broker specialists

• Easy, online quoting process

• Collective approach to complex insurance needs

Visit our website at www.brooks-ins.com.

Brooks Group Insurance Agency, LLC NJ License 1575143

BROOKS IS YOUR FULL-SERVICE WHOLESALER

How can we help you? Call us at 732.972.0600 or email us at info@brooks-ins.com

DENISE STEFAN President, Engage Insurance

Open enrollment is rapidly approaching, and your role is pivotal to guide your employees through this critical period. By equipping yourself with the right information and strategies, you can navigate open enrollment smoothly and effectively.

Since the start of the pandemic, employee benefits are much more important to attracting and retaining quality employees. Data from Indeed.com indicates that businesses in lower-paying sectors, and those that don’t offer remotework opportunities, consider benefits an important recruiting tool in this tight labor market.1

Competitive, attractive employee benefit plans are vital, considering that employee turnover is expected to increase in the coming months. The Bureau of Labor Statistics reported a significant number of job openings in June 2024, reflecting a tight labor market. This often leads to increased turnover as employees find more opportunities to switch jobs for better compensation or work conditions.2

The Society of Human Resources Management’s 2024 Talent Trends Report highlights that many employees are contemplating job changes, driven by desires for higher salaries and better career advancement opportunities. The report notes that 51% of employees are considering looking for new jobs, while 60% of employees expect a promotion—with half of them ready to leave if they don’t receive it.3

To ensure a seamless open enrollment process, take the following steps:

Conduct a benefits audit. Review the current benefits package to identify areas for improvement or cost reduction. Compare the plan to industry standards, competitors and companies of a similar size. A Professional Employer Organization can help with this.

Analyze employee satisfaction. Conduct employee surveys to understand benefit preferences and identify potential gaps. Not all employees want the same benefits. You may find your benefits don’t fit with your current workforce. This is a huge, missed opportunity to increase employee retention and attract new employees.

Review budgetary constraints. Determine the overall budget allocated for employee benefits and prioritize accordingly. Your premiums may have risen to such an extent that your resources for growth are constrained. When you

receive your renewal paperwork, you may find surprises that drain your agency’s budget.

Explore broad plan options. Research various health insurance plans including HMOs, PPOs, HSAs and HDHPs. Consider alternative benefit such as wellness programs, flexible spending accounts and dependent care accounts. The purchasing power of PEOs can reveal untapped opportunities.

Understanding employee priorities is essential to crafting a competitive benefits package. Currently, the following benefits are particularly sought after:

Comprehensive health coverage. Flexible plan options, including HMOs, PPOs and HSAs, are still in high demand. Consider offering tiered plans to accommodate varying employee needs and budgets.

Mental health support. Access to mental health services, Employee Assistance Programs and flexible work arrangements to accommodate mental health needs are a must in the upcoming year.

Financial wellness. Retirement savings plans with some level of employer matching contributions, student loan repayment assistance

and financial planning resources are popular benefit offerings for different employee demographics.

Paid time off. Generous paid time off policies, including vacation, sick leave and personal days are essential for attracting and retaining top talent.

Work-life balance. Flexible work arrangements, remote-work options, and family-friendly benefits, such as pet insurance, child care and elder care support, employee discounts and paid bereavement leave demonstrate the employer’s commitment to their people.

Balancing employee satisfaction with budgetary constraints is a challenge for many businesses. Consider these strategies:

Leverage data analytics. Use data to identify cost-saving opportunities and optimize plan designs. For example, analyze health care claims data to identify areas where costs are high, and develop strategies to reduce them. This can help you get benefit plans that better meet your employees’ needs, improve your workforce’s health and control costs.

Shop around for carriers. Compare rates and plan options from multiple insurance carriers to secure the most competitive pricing. Some benefit plan administrators, such as PEOs, offer rate locks for 13, 14 or even 15 months. When you deliver value in the form of predictability and cost containment, you reinforce your reputation.

Educate employees. Provide clear and concise communication about benefit options and costs, as well as enrollment procedures, to encourage informed decision-making and reduce administrative burdens.

Promote wellness programs. Encourage employee participation in wellness initiatives to improve overall health, reduce health care costs and boost productivity.

Consider tiered benefit plans. Offer different levels of coverage based on employee income, tenure or family size to manage costs while providing choices to your workforce.

By reviewing the resources and information, you can create a benefits package that attracts and retains top talent while managing costs.

Remember, early planning, effective communication and a deep understanding of employee needs are essential for a successful open enrollment.

In her role as president, Stefan leads strategic planning efforts for Engage Insurance LLC and directs the company in fulfilling its mission of providing stable, cost-effective insurance solutions to Engage clients. She is an accomplished insurance industry executive with more than 20 years of leadership experience, including unique PEO carrier expertise. Prior to joining Engage, Stefan served as the PEO market head for Aetna’s national accounts division where she was responsible for the sales, finance, regulatory and account service aspects of Aetna’s PEO business segment.

1 Hiring Lab, 2024 (tinyurl.com/36hawuc9)

2 Bureau of Labor Statistics, 2024 (www.bls.gov/news.release/jolts.toc.htm)

3 SHRM, 2024 (tinyurl.com/k94jt9zb)

Cabinet/Floor

Electrical

Grocery/Deli/Supermarkets

Landscapers

Masonry

Trusted

Competitive

MICHAEL STREIT President, EZLynx

oday’s typical insurance customers are online. And, they aren’t online only sometimes. According to Global Web Index, internet users spend an average of six-and-a-half hours online every day. This average is only expected to grow. This is an important factor to consider as agents evolve their marketing strategies to become more digital. While many traditional methods, like in-person events and referrals, are still extremely effective—many others, like cold calling and direct mail, may not yield the same results as they once did.

As an agent, maybe you’re considering your digital marketing strategy. In that case, it could be time to ask, “Where are my customers?” While we already have established that they are online, we must next evaluate where on the great World Wide Web they are so we can meet them there.

Let’s look at the foundation to your digital marketing strategy—your website. Before implementing any other tactic, you should first focus on the place where all digital channels will point. This is critical because 93% of all shopping journeys now start online. This is up from 81% in 2020, according to research from Incisiv, in collaboration with Blue Yonder and Microsoft.1

Your website is one of the first representations of your agency that customers see, which means that having an attractive, intuitive and highly functional site is crucial. In fact, half of consumers say that their impression of a business is dependent on the design of its website, according to a report from Top Designs.2 Your site should have a branded layout that represents your agency’s aesthetic and that is easy to navigate with obvious buttons and clear messaging, delivering a simple experience that reassures potential customers of your agency’s competence.

According to Statista, survey respondents said that mobile phones were the preferred device for internet access, with around 95% of global users using them.3 This staggering statistic validates why agents must have a mobile-optimized website. While some providers allow you to make a mobile-enabled website, make sure that you are using a platform that is accessible on any device—not just cellphones—and that it loads quickly.

However, your website is not just an online advertisement for your agency. It also must enable your potential customers to become actual clients. After deciding that they want to work with your agency, prospects need an easy next step in their buying journey. Seamlessly integrating consumer quoting into your website allows your prospects to generate real-time comparative quotes for themselves. Not only will your potential customers love the quick selfservice, but your staff members also will love the no-touch lead capture to begin the sales process.

Another website feature—and digital marketing strategy—that agents should consider is a blog. Blogs give businesses a direct channel to connect and educate customers and prospects. As complex as insurance can be, a blog can help clarify confusing jargon and legislation—elevating your role from an agent to a trusted adviser.

Blogs are more than just educational forums though. Organizations that blog get 55% more website visitors than those that don’t.4 And even better, businesses with blogs produce an average of 67% more leads monthly than those that don’t blog.5

While we know this tactic works, as many of us use blogs to research products and services in our own personal lives, the main concern is time. Who has time to write blogs when there are prospects to sell to and clients to provide service? Your website, and your content, can be developed and hosted by a

trusted technology partner. Delegate this tactic to your tech provider so you can get custom, fresh content that draws prospects in, and then you can focus on giving advice and winning business. [EDITOR’S NOTE: For relevant content for your clients, you can access PIA Northeast News & Media at www.blog.pia.org, just be sure to link back to the PIA news site.]

When it comes to winning business, there are few strategies as effective as online reviews. In fact, one report indicates that 93% of consumers have made buying decisions based on online reviews.6 Online reviews, or testimonial sites like Google Reviews, are essentially online watering holes—places where consumers can give and listen to real opinions about products and services. With all your well-serviced, happy customers, why not ask them to sing your praises? You don’t even need to ask them directly.

Satisfied customers can be prompted automatically to leave five-star ratings on Google Reviews or other referral sites. When a new customer is added to your management system, or when policies are renewed—these are perfect times to set this automated prompt. All you must do is set the trigger and watch the reviews come in, driving more online evidence of your agency’s quality and reputation.

Want to take your review site strategy even further? Have a plan to respond to reviews regularly to show your clients you care and appreciate their input. This can be a critical growth driver according to research: Businesses that respond to at least 25%

of their reviews make 35% more in earnings than businesses that are unresponsive to reviews.7

There are times when insurance agents can’t afford to be unresponsive. However, that doesn’t mean that you or your staff members should be available around the clock. An online customer portal lets customers access your services from their phones, tablets, laptops or PCs—at anytime. This is important to a business because 90% of customers prioritize having an “immediate” response when it comes to a customer service question.8

Your customer portal should be branded to your agency, using your business’s color scheme and logo for a cohesive branding experience between your website and portal. And, because 73% of customers say that valuing their time is the most important thing a company can do to provide them with good online service,9 offer them as many selfservice options as possible. Offer capabilities like policy view and change requests, claims information and image upload, auto ID card access and download and certificate generation. These are quick tasks that make your clients feel more in control of their service while taking the more menial, time-consuming work out of your staff members’ daily workloads.

Texting also can be a great way to make information and documents more accessible to your clients without the extra effort. And, with 91% of consumers saying they are

interested in receiving texts from businesses according to a recent report,10 this form of digital communication demands consideration for a lot more than just providing services.

Tightly integrated to your agency management system, texting can help you stay in the front of your client’s minds with automated birthday wishes, policy updates and renewal notifications. Clients can even communicate with your agency, with all messages instantly stored in their account to prevent errorsand-omissions claims.

The latest technology can even quote by text. Clients can initiate their own selling process by sending a text such as “cover my car” to the number associated with your management system. Then, automated replies walk clients

Market Leading Restaurant, Bar & Tavern Program With Superior Best-in-Class Service and Coverages

Specializing in Bars, Taverns, Sports Bars, Bars with Entertainment & Brewpubs

• Exceptional service is an EverGuard priority

• Uncompromised program loyalty

• Available A&B, Enhancement Endorsement & more

• No limit on alcohol sales

• Package Policy: Property, GL & Liquor Liability

• Entertainment considered

• Experienced & Professional Staff

EverGuard is a superior Restaurant, Bar & Tavern marketwith 40+ years’ experience. Your RBT clients can depend upon EverGuard for their protection.

Our continued longevity offering an uninterrupted market assures you will receive the best product underwritten by an A.M. Best “A” rated carrier without program interruptions. EverGuard’s respected reputation in the RBT market speaks to our stability and reliability to provide industry leading response time and customer service to our partner agencies.

through the process to gather necessary information and completes the interaction by providing results from the three lowest-priced carriers. Everything is stored in the agency management system for you to follow up with the client. With 67% of consumers saying they prefer self-service over speaking to a company representative,11 you can bet you’ll see a boost in your bottom line by providing quote-by-text to clients.

Lastly, but certainly not least, email marketing should be a central part of your marketing efforts as this form of digital communication is 40 times more effective than social media for customer acquisition according to McKinsey.12 And, in a consumer report by Constant Contact, 60% of respondents say that marketing emails have influenced their purchases.13

Email marketing spans across many different types—including mass customer emails like newsletters, event invitations and promotions, or targeted messages for important dates like birthdays and renewals. These targeted emails are critical because personalized emails achieve an impressive open rate of 29% and even more impressive click-through rate of 41%.14

But that doesn’t mean your staff members need to stop what they’re doing and begin writing personalized emails. Automation within your agency management system can send tailored messages based on specified triggers for events like renewals and birthdays. Filled with data already within your system, you can set it and forget it, and keep your customers engaged.

In today’s market, where rates are high and alternatives are everywhere, demonstrating and promoting your agency’s value to your clients and prospects is critical. Incorporating digital marketing into your overall marketing plan will help you meet your clients and prospects where they are—online.

While the advice in this article is quite extensive, my advice would be to begin with your foundation and build. Your agency website is where it all begins, then incorporate these strategies one-by-one. In no time, your agency will be gaining all the benefits from these strategies with little to no effort, all because of digital connectivity. It will be as if your technology is your most productive employee.

Streit is president of EZLynx. With nearly a decade of experience in private-equity operations, and an MBA from Harvard Business School, Streit has become well-versed in the mechanics of deals and integrations, offering invaluable insights and contributions to the insurance industry.

1 Incisiv, 2023 (tinyurl.com/r6ac7spy)

2 Clutch, 2021 (tinyurl.com/425yew7d)

3 Thrive Agency, 2024 (tinyurl.com/ysnc875h)

4 HubSpot, 2024 (tinyurl.com/ajsrpe8u)

5 Demand Metric (tinyurl.com/y2u4htjh)

6 Podium, 2017 (tinyurl.com/bp4zt8a8)

7 Exploding Topics, 2023 (tinyurl.com/4sb525b7)

8 HubSpot, 2023 (tinyurl.com/37m3n2nw)

9 Forrester, 2016 (tinyurl.com/333hvf54)

10 Attentive, 2023 (tinyurl.com/4zxat4tp)

11 Nuance Enterprise, 2023 (tinyurl.com/5fkz7nzu)

12 McKinsey & Co., 2014 (tinyurl.com/3wnj8ntn)

13 Constant Contact, 2023 (tinyurl.com/4e4eh5e5)

14 Experian Marketing Services, 2014 (tinyurl.com/34cz29kx)

ChatGPT (Generative Pretrained Transformer) has ushered in an era of immense possibilities, offering unique advantages to humanity. With its capacity for natural language processing, this sophisticated technology is not merely a tool for generating human-like text, but it is a valuable ally in various domains. This specific artificial intelligence’s ability to understand and respond to user inquiries paves the way for efficient customer service handling, reducing operational costs and increasing customer satisfaction.

Furthermore, its application in writing code and content generation ensures a continual supply of diverse and captivating content, enriching the digital landscape. Thus, AI chatbots stand as a testament to the potential of artificial intelligence in enhancing human endeavors and facilitating progress.

ChatGPT is more than a revolutionary AI language model; it’s a powerful ally in pursuing progress and excellence. With its refined elegance, intellectual depth and timeless grace, ChatGPT’s writing style has captivated numerous readers and continues to enrich the digital

landscape. Its applications span various industries, each showcasing the potential of artificial intelligence to enhance human endeavors.

As the demand for high-quality, engaging content continues to rise in today’s digital age, AI systems remain at the forefront of innovation and excellence. Its sophisticated writing style captures readers’ attention and inspires and stimulates their minds, leaving a lasting impact. With the chatbot ChatUp, the possibilities for growth and success are endless, making it an essential tool in any modern professional’s arsenal.

In the efflorescence of the digital era, the need for sophisticated, high-quality content creation has ascended to a paramount position. This is where the brilliance of an AI language model like ChatGPT shines—it is not merely a convenience, but it is a necessity in our tech-driven world.

An AI language model is a computer program designed to understand, generate, and respond to human language in a way that’s like how humans do.

It uses advanced algorithms and vast amounts of data to learn patterns, context and meaning from text. These

models are trained on various text sources, such as books, articles and internet content, to become proficient in understanding and producing human-like language.

An AI language model aims to assist humans in language-related tasks, like generating coherent sentences, providing relevant information, translating languages and even simulating conversations. It can be used in various applications (i.e., writing assistance, customer service chatbots, language translation). AI language models have been a significant advancement in artificial intelligence and have found widespread use in various industries.

Here are a few ways ChatGPT is making a significant impact in business development:

Raising the bar for digital conversation. ChatGPT is a trailblazer in digital communication. Its proficiency in comprehending and responding to human input is unparalleled. Employing AI’s most cutting-edge capabilities offers an efficient user experience and is imbued with a distinctly human touch. Simply put, it redefines the standards for digital conversation.

A catalyst for business success. ChatGPT is transforming how organizations connect with their audiences in the business domain. It enables the creation of compelling, personalized content at scale, offering a competitive edge in the digital marketing landscape. From enhancing customer service to powering social-media engagement, ChatGPT is a vital ingredient in the recipe for business success in the contemporary market.

Reinventing creative expression. For content creators and writers, ChatGPT is an indispensable ally. It empowers them to express their ideas eloquently and with finesse; it amplifies their creative potential. Its ability to generate text that is not only contextually accurate, but that is also rich in quality, sets a new benchmark for digital creativity.

The future of learning and development. Beyond business and creativity, ChatGPT is a potent tool in education and personal development. It facilitates immersive, interactive learning experiences, opening doors to knowledge for learners worldwide. Its ability to adapt to individual learning styles revolutionizes how we acquire and assimilate information.

A guardian of time and efficiency. In an era in which time is of the essence, ChatGPT stands as a beacon of efficiency. It automates many tasks, freeing up precious time for individuals and businesses. This seamless blend of productivity and accuracy makes it a cornerstone in the technology ecosystem.

Below is a comprehensive step-by-step guide that will fully empower you to leverage ChatGPT’s immense potential. By following these instructions meticulously, you will discover how to harness the true capabilities of this remarkable tool.

No. 1: Make an account. To begin your journey with ChatGPT, the first step is to create a personalized Google or Microsoft account on the Chat platform. Doing so will give you exclusive access to various features and services meticulously designed to elevate your experience.

No. 2: Understand the interface. Upon accessing ChatGPT, you are greeted by an interface that is as sleek as it is intuitive. This is when you will input your prompts and view the AI’s responses. One of the first things you’ll notice is the text box. This is your canvas, where you convey your instructions to the AI. No. 3: Craft prompts. The power of ChatGPT lies in its understanding of language and context. This understanding is harnessed through the prompts you provide. Prompts can be as simple as a single word or as complex as a paragraph. It’s important to be clear and concise in your prompts to ensure the AI understands your instructions and produces the desired output.

No. 4: Set parameters. One of the essential features of ChatGPT is the ability to manipulate its behavior through parameters. Key parameters include “temperature” and “max tokens.” The temperature parameter controls randomness. A higher value (closer to 1) results in more random outputs, while a lower value

as:

• Audience Research

• Identifying Niche Audiences

• Content Creation

• Writing Product Descriptions

• Personalizing Customer Experience

• Chatbots for Customer Support

• Creating Customer Surveys

• SEO Optimization

• Data Analysis

It enables the creation of compelling, personalized content at scale, offering a competitive edge in the digital marketing landscape.

(closer to 0) produces more deterministic responses. Tokens are ChatGPT’s units of text. For example, the sentence, Hello, how are you today? has six tokens (“Hello” “,” “how” “are” “you” “today” “?”). At the time of this writing, ChatGPT API costs $0.002 per 1,000 tokens.

No. 5: Understand the output. Upon pressing “Generate,” ChatGPT will produce a text output based on your prompt and parameters. This output will appear in the same text box. It’s important to remember that the AI is contextually aware, which means the output will be related to the given prompt.

No. 6: Iterate and refine. In many cases, the first output may not perfectly meet your requirements. This is when iteration comes into play. You can influence the AI’s output by refining your prompt or adjusting the parameters. It’s a process of trial and error, of learning how to communicate effectively with the AI.

No. 7: Leverage pre-trained models. ChatGPT comes with a default model named textdavinci-002. This pre-trained model is a powerful tool that generates

high-quality text across various prompts. However, training a custom model might be beneficial for specialized tasks.

No. 8: Train custom models. To train a custom model, you’ll need a dataset representing the text type you want the model to generate. This process requires a deep understanding of machine learning, but OpenAI provides comprehensive resources.

The commercial potential of ChatGPT is extensive. Entrepreneurs and businesses can harness its robust language-processing capabilities to generate content, tackle Google’s coding test, reduce operational costs and offer enhanced services, thus opening up new revenue streams.

For instance, digital marketers might utilize their prowess in crafting compelling copy or personalized messages, driving customer engagement and increasing conversions.

ChatGPT holds remarkable potential as a lucrative medium in the burgeoning era of AI-driven solutions. Fusing artificial intelligence and natural language processing presents many opportunities to monetize its capabilities. Herein, we explore several ways to harness the power of ChatGPT for financial gain.

Content creation and marketing. One of the most straightforward applications of ChatGPT is content generation. Bloggers, writers and marketers can leverage its capabilities to craft compelling narratives. It can generate blog posts, write social-media content, create catchy headlines or devise product descriptions tailored to the target audience.

Customer support and services. The realm of customer support and services also presents an opportunity for monetization. ChatGPT can be programmed to handle routine inquiries, easing the burden on human operators and providing swift, efficient responses to customer queries. As a result, agencies can save on operational costs and enhance customer satisfaction.

Language translation and tutoring services. In the field of language translation, ChatGPT could be a game-changer. With its natural language processing capabilities, it can translate text between languages, opening up the possibility of offering translation services. Additionally, with appropriate fine-tuning, it can provide language tutoring services, helping learners grasp a new language’s nuances.

Trade and commerce. E-commerce platforms can resort to ChatGPT to help customers with their shopping experience. It can offer personalized shopping advice and product recommendations, enhancing user experience and increasing sales. Moreover, it can automate the seller-buyer negotiation process, making the procedure more streamlined.

AI consultation. Expertise in AI assistants can be monetized by offering consultation services. Agents looking to implement AI solutions could benefit from this knowledge. A consultant could offer insights into the model’s capabilities, train a custom AI language model suitable for clients’ needs, or guide ethical AI practices.

The commercialization potential of ChatGPT is boundless, limited only by the extent of one’s creativity and understanding of the technology. It is an

excellent tool to augment human capabilities, deliver superior services and generate revenue. However, remember that with great potential comes great responsibility.

While we emphasize the positive utilization of ChatGPT, we must not neglect to underscore its broader societal implications. When wielded with integrity, this remarkable technology can be an engine of prosperity, driving economic growth and individual enrichment. Striking a balance between commercialization and ethical use is not only necessary, but also imperative. [EDITOR’S NOTE: Ethical considerations could include: protecting sensitive information, monitoring for misinformation, and checking for plagiarized material.]

This technology has a big money-making potential. It can be used in many ways, like improving customer service or improving language learning tools. E-commerce platforms can harness their abilities to offer tailored shopping advice, while educators can use it to create adaptive, personalized learning experiences.

However, as we navigate the profitable avenues offered by ChatGPT, we should remain vigilant of the ethical considerations that accompany such advancements.

Yager has been helping organizations build successful roadmaps for their business goals for over 15 years. His experience spans a multitude of industries, but his effectiveness comes from understanding each organization individually and their specific challenges. He is a virtual chief information officer with TAG Solutions, an information technology managed services agency that helps organizations develop and enhance their information security programs, reduce risk and achieve compliance with state and federal information security regulations. Tag Solutions has partnered with PIA Northeast to offer association members agency-specific security plans. For more information, log on to www.pia.org/ quote/tagny.php.

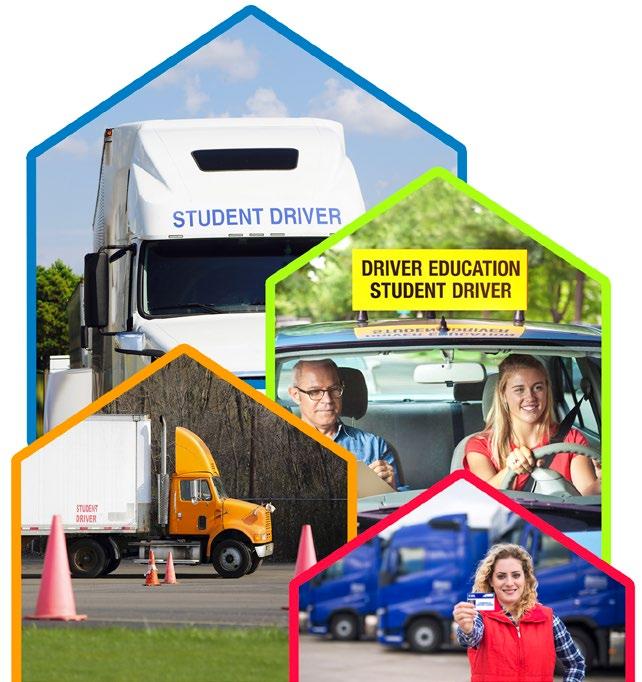

When it comes to safeguarding driving school vehicles, Lancer stands head and shoulders above the rest.

We write both private passenger and mixed fleet driving schools and offer A- “Excellent”-rated commercial auto coverages to keep your clients well protected.

• Writing in CT, NJ, NY, OH, & PA

• Agency Headquarters online quoting

• No minimum premiums

• No minimum/maximum units

Submit your driving school risks to Lancer today and watch your portfolio thrive.

516-431-4441 x 3507

producer@lancerinsurance.com www.lancerinsurance.com

•

•

• Top-rated, stable E&O carriers

• Experience & expertise from our team

Comedian Groucho Marx once said, “The secret of life is honesty and fair dealing. If you can fake that, you’ve got it made.” As interesting as it may sound, Groucho was not an insurance producer. If he had been, he may have been involved in an errors-and-omissions claim or two.

Producers and customer service representatives are tested daily on their levels of integrity and honesty in the operation of an insurance agency. How these tests are handled can lead to significant consequences. Imagine facing the following scenario:

As a producer/account executive/customer service representative, you are looking to write a specific account that, in the company’s eyes, may not be a perfect match. Perhaps the account had a loss or two (or three). Maybe it’s a property account, with a significant amount of the building vacant. Quite possibly, the account was nonrenewed by the previous carrier. The list of possibilities is endless. As you complete the application, you arrive at the questions addressing these exposures. What are you thinking? If you bend the truth, who will ever know? What could possibly happen if someone did find out?

This issue has been the central focus of more than a handful of E&O claims. In practically all these cases, the odds are stacked heavily against the agency. In most of these E&O cases, the carrier somehow did find out the truth and—when this happened—the agent caught the full brunt of the carrier’s consternation. Agency staff members interact with carriers and wholesalers on a variety of application issues. The scenario could involve when the application initially was submitted or when the carrier’s underwriter contacted the agency with additional questions.

Lying on an application to get an account written is dead wrong. It’s advisable to find another occupation if lying on applications is how you will conduct yourself. There are thousands of honest, truthful producers who present the carrier with an accurate assessment of the risk and stand by the carrier’s decision. Doing anything to the contrary gives the insurance industry a bad name. Completing an application with the customer’s input is the best practice. Ask all the questions and don’t presume to know the answer to any of them. When possible, visit the risk you are trying to insure. This enables you to speak with some

degree of credibility on any subsequent conversations. Upon the completion of the application, require the customer to review it and sign it, attesting to the accuracy of the information.

Don’t presume that you know the answers when handling carriers’ follow-up questions. Note the questions and then contact the customer to secure the answers. If the customer answers your questions over the phone or in person, document discussions in the agency file. Send a letter or email to the customer to memorialize the discussion and the responses, and include a copy of the communication in your file.

Customers often ask questions to try to understand insurance and how it works. How the producer chooses to answer these questions is extremely important. Providing the customer with incorrect information is wrong. Suppose a producer thinks, “The only way the customer will know I was wrong is if he or she has a claim. What are the chances of that?” The producer is wrong. An anonymous quote summed it up best: “I’d rather be honest than impressive.”

Make honesty the basis of your carrier relationships. The consequences can otherwise be significant. While losing one’s license is a definite possibility, the carrier/wholesaler could decide to

terminate its relationship with you. Don’t expect any carrier to be too understanding and accommodating if it finds out there has been a breach of honesty. Ensuring that all sales staff members know honesty is the only way and anything outside of that will not be tolerated should be a goal of agency management. Lying to your carriers has many significant consequences, including damaging the relationship between the agency and the carrier. In addition, if the carrier suffers a loss and believes it was misled into writing the account, it could rescind the policy, essentially leaving your agency as the insurance carrier. That is definitely a position you do not want to find yourself in.

Utica National Insurance Group and Utica National are trade names for Utica Mutual Insurance Company, its affiliates and subsidiaries. Home Office: New Hartford, NY 13413. This information and any attachments or links are provided solely as an insurance risk management tool. They are derived from information believed to be accurate. Utica Mutual Insurance Company and the other member insurance companies of the Utica National Insurance Group (“Utica National”) are not providing legal advice or any other professional services. Utica National shall have no liability to any person or entity with respect to any loss or damages alleged to have been caused, directly or indirectly, by the use of the information provided. You are encouraged to consult an attorney or other professional for advice on these issues.© 2024 Utica Mutual Insurance Company

There are thousands of honest, truthful producers who present the carrier with an accurate assessment of the risk and stand by the carrier’s decision. Doing anything to the contrary gives the insurance industry a bad name.

PROFESSIONAL LIABILITY PROGRAM

• Brokers - No minimum premium volume requirements to place business in this program

Partner with Aon Today!

45+ years serving the travel industry

• Recognized industry partner with top national travel associations

• Custom policy specifically designed for the travel industry

Professional Liability Insurance for:

• Travel Agents and Travel Agencies

• Standard Tour Operators

• Student Tour Operators

• Adventure Tour Operators

• Receptive Tour Operators

• Destination Management Companies

• Meeting Planners (Corporate)

Policy Includes:

• Worldwide Territory

• General Liability

• Errors & Omissions

• Non-owned & Hired Auto

• Personal Injury

• Industry specific endorsements

Have a question? Ask PIA at resourcecenter@pia.org

Q. Our agency uses a log for ID cards we issue on Personal Automobile Insurance Plan business. We use the same log for the Commercial Automobile Insurance Plan. Should we have separate logs for each of these?

A. While there is a requirement that you keep a transaction log for PAIP business, currently CAIP has no similar requirement. If you maintain a CAIP log voluntarily, it should be separate from your PAIP log. Otherwise, if PAIP ever wanted to inspect your log, you would have to remove the CAIP entries to be in compliance with the PAIP rules. If needed, you can download a copy of the PAIP transaction log here: tinyurl. com/ycybkyzu.—Helen K. Horn, CIC, CPIA, CISR

Q. In one of my carrier’s policies there is a provision that if my clients do any deliveries with their personal auto—and they are involved in an accident—the carrier will pay them the state minimum limits only, regardless of the limits on their policy. Is this legal?

A. Yes. It is legal. The circumstance you described is known as the step-down provision, and it is a legal practice in New Jersey. Many carriers’ policies contain the following exclusion wording:

A. We do not provide Liability Coverage for any “insured”:

5. For that “insured’s” liability arising out of the ownership or operation of a vehicle while it is being used to carry persons or property for compensation or a fee, including, but not limited to, pickup or delivery of magazines, newspapers, food, or any other products.

This Exclusion (A.5.):

a. Applies only to damages that are in excess of the minimum limits of liability required by the New Jersey Automobile Reparation Reform Act, and

b. Does not apply to a share-the-expense car pool or ride-share arrangement. [emphasis added]

It is important that your insureds be made aware of this provision in their personal auto policy.—Dan Corbin, CPCU, CIC, LUTC

Q. One of my clients received and complied with a request for a home inspection. The home inspection revealed an underground storage tank. The insurer is ordering a nonrenewal of the insurance policy because of the condition of the storage tank. However, when the policy originally was written, underground storage tanks were not part of the insurer’s underwriting guidelines. Can the insurer really nonrenew because of this?

A. Yes. The insurer is within its rights to nonrenew the policy.

To nonrenew a policy in New Jersey, proper notice of the nonrenewal must be given in order for the insurer to terminate coverage at the policy’s expiration [N.J.A.C. 11:1-20.2].

The requirements state that the nonrenewal notice:

• must be mailed or delivered by the insurer to the insured not more than 120 days nor less than 30 days prior to policy expiration;

• must contain the standard or reason for nonrenewal and specify in detail the factual basis upon which the insurer relies;

• must advise insureds that they can file a complaint with the Department of Banking and Insurance about the nonrenewal (Department of Banking and Insurance, Division of Licensing and Enforcement, P.O. Box 325, Trenton, NJ 08625); and

• must be sent by certified mail or first-class mail, with a date-stamped proof of mailing and duplicate notice retained by the insurer. [emphasis added]

The fact that the underground storage tank was not part of the insurer’s underwriting guidelines would not remove it from being a valid reason for nonrenewal. As long as the carrier has met the above requirements, then the notice and the nonrenewal will be valid.—Bradford

J. Lachut, Esq.

Q. My insured borrowed a friend’s pick-up truck so he could go to a home improvement store and get some supplies. While the insured was borrowing the truck, he got into an accident. He doesn’t want his friend to have his rates raised because of this. Will my insured’s insurance cover the damages?

A. This claim should be submitted to the friend’s insurer; and if his limits are insufficient to pay the damages, it also should be submitted to your client’s insurer. Even though your insured does not want this loss to impact the friend’s policy premium, the policy insuring the vehicle’s owner is considered the primary insurer for a covered accident. See the following section of the ISO personal auto policy:

Other insurance

If there is other applicable liability insurance we will pay only our share of the loss. Our share is the proportion that our limit of liability bears to the total of all applicable limits. However, any insurance we provide for a vehicle you do not own, including any vehicle while used as a temporary substitute for “your covered auto,” shall be excess over any other collectible insurance. [emphasis added]

Your insured’s insurance will pay on an excess basis, which means the owner’s limits first must be exhausted by claim payments.—Dan Corbin, CPCU, CIC, LUTC

President

Andrew Harris Jr., CIC, AAI, CISR

Liberty Insurance Associates Inc. 525 State Route 33 Millstone Township, NJ 08535-8103 (732) 792-7000 andrewharris@lianet.com

President-elect

Roger C. Butler, CIC Barclay Group 202 Broad St. Riverton, NJ 08077-1303 (856) 829-1594 rbutler@barclayinsurance.com

Vice President

Beth Frederickson, CPIA Voluntary Risk Managers dba bethellenfrederickson LLC 271 Route 46 West Fairfield, NJ 07004-2440 (973) 652-8272 bethfrederickson@aflac.com

Vice President

Aaron Levine, CIC

LG Insurance Agency PO Box 3202 Long Branch, NJ 07740-3202 (877) 288-7169 aaron@lginsuranceinc.com

Treasurer Lisa Hamm, CIC Clyde Paul Agency 47 Maple St., Ste. 301 Summit, NJ 07901-2571 (201) 991-7598 lhamm@clydepaul.com

Secretary Michael Beckerman, CPCU Beckerman & Company/ Acrisure of New Jersey 430 Lake Ave. Colonia, NJ 07067-1131 (732) 499-9200 mbeckerman@beckermanco.com

Immediate Past President

Connie Mahoney

Mark Anthony Associates 615 Sherwood Parkway PO Box 1068 Mountainside, NJ 07092-0068 (908) 654-9500 cmahoney@maainsurance.com

PIA NATIONAL DIRECTOR

Paul Monacelli, CIC, CPIA Veterans Insurance Agency Inc. 18 Knights Bridge Dr. Randolph, NJ 07869-4633 (973) 805-3555 paul@adpmanagementsvc.com

Lydia Bashwiner, Esq., CWCP, NJWCP

Otterstedt Insurance Agency Inc. 540 Sylvan Ave. Englewood Cliffs, NJ 07632-3022 (201) 227-1800 lbashwiner@otterstedt.com

Yossi Bolanos

Yossi United Insurance Agency LLC 1010 Clifton Ave., Ste. 208 Clifton, NJ 07013-3528 (973) 773-9200 ybolanos@yossiunitedinsurance.com

Kenneth Bull, CIC, AU Iroquois Mid-Atlantic Group Inc. PO Box 806 Olean, NY 14760-0806 (716) 373-5511 kenbull@iroquoisgroup.com

Walter Conroy

Liberty Insurance Associates Inc. 525 State Route 33 Millstone Township, NJ 08535-8103 (732) 792-7000 wconroy@lianet.com

Alyssa Delaney 155 Munro Ave. Hazlet, NJ 07734

Maria N. Escalona, CPIA Jimcor Agencies Inc. 60 Craig Road Montvale, NJ 07645-1709 (201) 573-8200 mescalona@jimcor.com

Becky Mateus, CIC, CPIA, ANFI, CFM

World Insurance Associates, LLC 100 Wood Ave. S., Floor 4 Iselin, NJ 08830-2716 (732) 380-0900 beckymateus@worldinsurance.com

William J. McMahon III, CIC, CWCA

McMahon Agency Inc. PO Box 239 Ocean City, NJ 08226-0239 (609) 399-0060 billm@mcmahonagency.com

Christopher J. Powell Hardenbergh Insurance Group 8000 Sagemore Dr., Ste. 8101 PO Box 8000 Marlton, NJ 08053-8099 (856) 890-7106 cpowell@hig.net

Logan True, CRIS The True Agency LLC 4 Valley View Dr. Mendham, NJ 07945-3109 (908) 295-3277 logan@trueagencyllc.com

Casey Yarger, CIC, CRM

Robert Petri & Daughter 258 Ryders Lane PO Box 820 Milltown, NJ 08850-0820 (732) 545-4540 cyarger@petriinsurance.com

PAST PRESIDENTS

Anthony F. Bavaro, CIC, CRM Liberty Insurance Assocs. Inc. 525 State Route 33 Millstone Township, NJ 08535-8103 (732) 792-7000 abavaro@lianet.com

Louis Beckerman, CIC, CPCU Beckerman & Company/Acrisure of NJ 430 Lake Ave. Colonia, NJ 07067-1131 (732) 499-9200 lbeckerman@beckermanco.com

Bruce Blum, CPIA, TRA Blum & Walsh Group Inc. c/o TE Freuler Agency Inc. 270 Davidson Ave., Ste. 101 Somerset, NJ 08873-4158 (732) 246-1330 bblum@tefreuler.com

Rip Bush, CPIA Keer & Heyer Inc. 1001 Richmond Ave. Point Pleasant Beach, NJ 08742-3047 (732) 892-7700 rip@keerandheyer.com

Charles J. Caruso, CIC, CPIA AssuredPartners Jamison 20 Commerce Drive Cranford, NJ 07016-3612 (973) 669-2311 charles.caruso@assuredpartners.com

Donna M. Cunningham, CPIA ADP Partners Insurance Agency Inc. 4 Sutton Place Florham Park, NJ 07932-2143 (973) 845-8700 donna@adppartnersinsurance.com

Michael DeStasio Jr., TRIP AssuredPartners of NJ 20 Commerce Dr., Ste. 303 Cranford, NJ 07016-5868 (732) 574-8000 mike.destasio@assuredpartners.com

Donald F. LaPenna Jr. AssuredPartners of NJ 20 Commerce Dr., Bsmt. 2 Cranford, NJ 07016-5868 (732) 574-8000 donald.lapenna@assuredpartners.com

John A. Latimer, Esq. Barclay Group 202 Broad St. Riverton, NJ 08077-1303 (856) 829-1594 jalatimer@barclayinsurance.com

Steven C. Radespiel Insurance Center of No. Jersey 33 Crestwood Pl. PO Box 399 Hillsdale, NJ 07642-0399 (201) 525-1100 sradespiel@icnj.com

Keith A. Savino, CPIA Broadfield Group 68 Main St. Warwick, NY 10990-1329 (201) 512-4242 keiths@broadfieldinsurance.com

Stephen P. Tague, CPIA 22 Robert St. Rockaway, NJ 07866-2725 (973) 479-9493 bairdkiltsteve@gmail.com

William R. Vowteras Fraser Brothers Group LLC 811 Amboy Ave. PO Box 2128 Edison, NJ 08818-2128 (732) 738-7400 bill@fraserbrothers.com

•

•

•

Whether you’re looking to enhance your skills in customer service or master the intricacies of life & health insurance, these programs are designed to set you apart.

CIC

Certified Insurance

Gain recognition for your experience and competence with this elite designation

CISR

Certified Insurance Service Representative

Become a trusted adviser by providing outstanding customer service

CPIA

Certified Professional Insurance Agent

Showcase your professionalism and dedication to continued growth in the industry

Instructor: Robin Federici CISR PA Webinar | Two day–morning sessions

Instructor: Mishell Magnusson

CIC Life & Health Webinar

CPIA 3: Webinar

Instructor: Steve Tague