1 minute read

Get CONNECTED with your account...

Wherever, whenever.

Introducing... our convenient participant web site! With the online WealthCare Portal you can view your account status, submit claims and report your benefits card lost/stolen right from your computer.

Once your account is established, you can use the same user name and password to access your account via our Mobile App!

Follow the simple steps below to establish your secure user account.

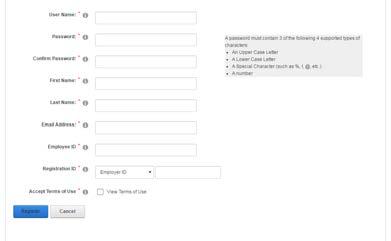

Get started by visiting https://fba.wealthcareportal.com/ and click the new user link.

You will be directed to the registration page.

Follow the prompts to create your account.

User Name

Password Name

Email Address

Employee ID (Your SSN, no spaces/dashes)

Registration ID

Employer ID (FBACOHE)

Your Benefits Card Number

Once completed, please proceed to your account.

If you are having difficulty creating your user account or you have forgotten your password to an existing account, please contact us at 800-437-3539 or flexdivision@flex-admin.com.

Smarttechnologyandpersonalized studentloanadvice,navigatingyou totheperfectsavingsplan

WhatWeOffer

Student

FinancialEducation ExpertLoanAnalysis

GradFin consults individually with borrowers to educate them on their student loans.

GradFin simplifies the complex issue of student loans with our knowledge of all repayment, PSLF programs and refinancing options in the market today.

PSLFMembership

GradFin’s Public Service Loan Forgiveness (PSLF) Membership Program is designed to help borrowers benefit from tax-free student loan forgiveness. Key components of the PSLF Membership include: personalized compliance plan, annual review, review of eligibility for the new PSLF Temporary Waiver, and a secure online portal for document storage and processing certification forms. If payments are not properly counted, GradFin will administer an appeals process with the Department of Education on the member's behalf.

GradFin experts analyze each borrower's unique loan portfolio and provide options for reducing and managing student loans.

GradFin looks at each loan individually to determine which loans are eligible for forgiveness programs, which ones need to be reviewed for refinance and best payoff strategies for the remaining loans.

Savings

Borrowers can choose from a variety of fixed and variable loan terms between 5 and 20 years. With GradFin services, borrowers have been able to save thousands of dollars over the life of their loans. GradFin borrowers save an average of $40k over the term of their loans.

GradFin uses a variety of lenders to refinance your student loans at the lowest rate.

GradFin and Pierce Group Benefits have partnered to offer eligible employees up to $100 off their monthly payments.