14 minute read

BUSINESS NEWS

national news BUSINESS WISDOM

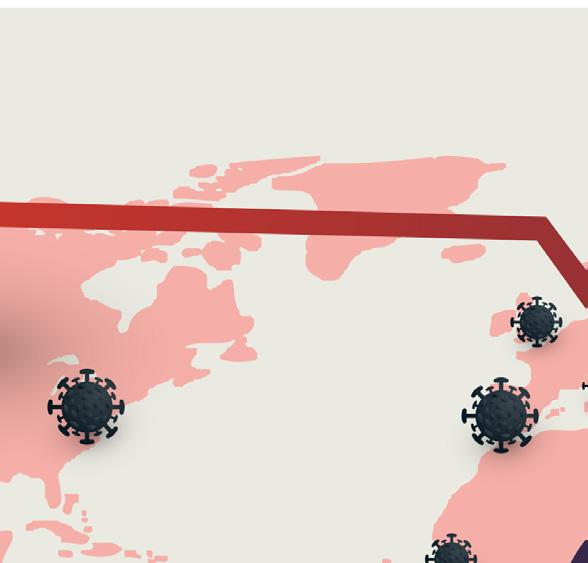

Success is not final; failure is not fatal. It is the courage to continue that counts. D emand for hotel bookings has stabilised somewhat after falling off a cliff in April, the boss of Marriott said recently, as the group reported worse than expected first quarter results. Arne Sorenson said that occupancy at Marriott hotels was rising in China, the region hit earliest by the pandemic, and had stabilised elsewhere recently. Marriott is one of the world’s largest hotels groups, with 7,400 properties in 134 countries, and is a bellwether for the travel industry. To shore up its crumbling finances, the company raised $1.6 billion from a bond sale last month and $920 million by renegotiating branded credit card deals with JP Margan and American Express. The company has $12.2 billion debt and $1.8 billion cash at the end of March. Hotel Slump SME Debt Pile

SMEs will be left with as much as £105 billion of unsustainable debt within ten months due to the pandemic, according to a first estimate of the scale of the problem from a City group set up at the request of the Bank of England. The Recapitalisation Group, a panel of 45 bankers, fund managers, accountants and other business leaders under the auspices of the City UK, said there would need to be massive equity investment and forbearance on the debt to ease the strain on the companies.

Gatwick Airport is going ahead with the plans to convert an emergency runway/taxiway to a functioning second runway, despite the collapse in air travel. It is anticipated to open in 2023 and will likely only handle short haul takeoffs. CEO Stewart Wingate said: ‘We’ve set ourselves a challenge of a public consultation in 2021 and then going into the planning process with a view to getting planning permission during the course of 2023’. No Stopping Gatwick

Sir Adrian Montague, chairman of the group, said the impact of the excessive debt would be serious, profound and far-reaching, in a letter to Andrew Bailey, governor of the BOE. He said: ‘Faced with falling revenues and additional debt, business will require full-scale recapitalisation to alleviate the hit to employment and to sustain the investment required to put the economy back on its feet’.

Sir Adrian, the chairman of insurance group, Aviva, said SME’s employed around 16 million people, which is about half the working population and turned over £2 trillion.

national news T esla reported its first ever first quarter profit - and its third straight quarter profit - of $16 million this month. The electric car maker said that its revenue in the first three months had risen to $5.99 billion from $4.54 billion in the same period last year, despite the lockdown. Its shares were up 9% at $872.53 in after-hours trading, valuing the group at about $148 billion. TESLA into Gear Dragonfly Imitator

Barclays has revealed its exposure to business borrowers in sectors of the economy hit hardest by the virus, saying that it has loaned more than double the banks entire market value. The details were published alongside first-quarter results, which showed the bank setting aside £2.12 billion for loans it expects to go sour and reporting a 38% slide in pre-tax profits to £913 million. The banks loans to industries poleaxed by the crisis include £10 billion of exposure to the hospitality sector, £2 billion to aviation and £16 billion to the oil and gas sector hit by the plunge is crude oil prices. It has a further £10 billion of loans to high street retailers. The banks market value is £19 billion against a loan book value of £663 billion. Barclays Exposed

BUSINESS WISDOM I think everybody should get rich and famous and do everything they ever dreamed of doing so they can see that it's not the answer.

When Storm Ciara swept across the UK in February, Alex Caccia was strolling on Oxford's Port Meadow watching birds take to the air. He marvelled at their indifference to high winds: "While airliners were grounded by the weather the birds couldn't care less!” It was more than just a passing thought for Mr Caccia, who is the chief executive of Animal Dynamics, a technology start-up applying lessons from wildlife to drone design. Formed in 2015 to pursue the science known as biomechanics, his company already has two drones to show for an intimate study of bird and insect life. One takes inspiration from a dragonfly, and has attracted funding from the military. Its four wings make it steady in high winds that would defeat existing miniature spy drones. Known as Skeeter, the secretive project has cracked the challenge of using flapping wings to power a drone. While wings are more efficient than a propeller and allow a dragonfly to hover in the face of strong gusts, they are almost impossible for human engineers to emulate. "Making devices with flapping wings is very, very hard" says Mr Caccia. Helicopters manoeuvre by changing the pitch of rotor blades to go forward and backward or to hover. For smaller objects hovering is a major challenge. "A dragonfly is an awesome flyer" says Alex Caccia, "It's just insane how beautiful they are, nothing is left to chance in that design. It has very sophisticated flight control." The dragonfly does have 300 million years of evolution on its side. Animal Dynamics has spent four years writing software that operates the hand-launched drone like an insect and allows it to hover in gusts of more than 20 knots (23mph or 37km/h). From 22 to 27 knots is classed as a "strong breeze".

What we have learnt in Lockdown

By Fiona Shafer MD of MD HUB

• We need the Government to stop telling us “we are in this together” – we know! • None of us have ever experienced anything like this before.

• We are starting to come to terms with the shockwave that has landed.

• We are starting to demystify the government support but still a way to go.

• As MDs you suddenly find that you are responsible for not just salaries but far more emotional wellbeing for others then you could have ever imagined whilst trying to maintain productivity for the business, with your employees suddenly thrown into home working, home schooling or caring for elders and family relatives. • No pressure then on you as MDs to maintain that daily motivation.

• There is no rule book or perfect Google guide to all of this – it is where we all find ourselves at and we are all working through it hour by unknown hour. • We are overwhelmed by social media messaging from everyone (much of it brilliantly funny to keep us sane) but we can’t always get on with the everyday without looking like we don’t care.

• But we do care – more than ever before.

• We have all jumped on ZOOM or MS Teams to continue business as some sort of normal – whilst trying to figure out if our new environments are good enough.

• Should we be seen as we really are, or do we give ourselves an automated background of beach, field, star filled constellation to soften the blow of chaos or share our real world with a random background pet, partner or child behaviour? • Our elders are also now online (and now inadvertently eating into our bandwidth) and enjoying this whole new world of communication which reduces some of our angst - though we might have to remind them that they don’t have to look right into the camera to see us – it’s akin to that very embarrassing British habit of talking loudly at somebody who does not speak the same language as you – in the hope that the louder we talk they will then understand. Nose hair can also be a problem, so gentle camera adjustment advice may be required for our dads in particular.

• Random MDHUB notice: It transpires we have lots of contact lens wearers in our midst (we can’t possibly have known as we can’t see them) because we are all just beyond knackered at the moment and some spectacularly cool glasses have made an appearance .

• You wear those glasses well, guys - don’t be shy!

• Some of us need to invest in some decent window blinds (or check out what we look like to others before you join an online meeting) to stop the much needed sunlight making us look like they are NOT in a VERY dark episode of Game of Thrones when they are on line. • We are all trying to rapidly adjust to online meetings as we do in a normal one – trying not to look at our phones, tripping over gym equipment which is now on the office floor, getting up to take a call, wandering around the garden with the lap top (fun but distracting to others and the facilitator), making toast, adjusting an oil painting and answering the door for yet another Amazon delivery.

• Top MDHUB Member tip – try scheduling your meetings for either 15 or 45 minutes past the hour, to assist our increasingly congested networks. • Top Tip - PASSWORD protect ALL your ZOOM meetings as Trolling is sadly having a field day at the moment but look out for that wholly intangible and deep seated thing called Karma - we all “know” at a very deep, unspoken level when a really bad thing is readdressed and the balm it provides and Karma will no doubt work its magic back post CV19 on those who take pleasure in disrupting.

• Top marks to one MDHUB Member who ended up buying a Gaming Headset (as that was all that was left to buy on Amazon ) to connect to “very remote working in an area of woeful connectivity” but who now looks like a grown up Air Traffic Controller. We were seriously impressed at the workgroup - in fact we were pretty awestruck as they had two very little ones running around at home, a very large workforce, some of whom are key workers for NHS construction work – so we say RESPECT to you (you know who you are and we send a lot of love for being such a great leader).

• No surprise to any of us that some of the following businesses are booming: bicycle repairs shops, coffee retailers, seed manufacturers, exercise machines, outdoor games

• Plus wine, vodka and beer sales, as we all skip into temporary (and not so temporary) self-medication to save the local Doctors and NHS from all of our additional levels of anxiety - just shows how responsible we all actually are in what is rapidly turning into the biggest ever, social experiment (maybe revolution?) of our generation.

• To come to terms with the fact that if our current Government had not been so entitled (your political persuasions to one side, we hope you will not disagree) and so hell bent on getting Brexit over the line on January 31st, they may well (but suspect not) have paid a whole lot more attention to the COVID 19 Freight train coming behind them faster than ever. It is absolutely inexcusable for business and far, far more importantly for us as human beings.

• As entrepreneurs, we are seeing you all absolutely and truly coming into your own at this time - so to work and recovery.

Business activity falls at RECORD RATE

Private sector output in the South East declined for the second month in a row during April, with the contraction the most marked since the survey began in early-1997, according to the latest NatWest PMI® data.

Driving the downturn was a further reduction in inflows of new business during April, with order book volumes falling at an unprecedented rate. Survey respondents linked drops in both activity and new business to adverse impacts stemming from the coronavirus disease 2019 (COVID-19) pandemic. Subsequently, firms reduced workforce numbers at the quickest pace on record.

The headline NatWest South East Business Activity Index – a seasonally adjusted index that measures the

combined output of the region’s manufacturing and service sectors - fell from 37.2 in March to an all-time low of 16.4 in April, to signal the most substantial reduction in the South East’s private sector output in over 23 years of data collection.

The contraction in the South East was among the softest of the 12 monitored UK regions, however, with only the North West seeing a slower fall.

At the sector level, service providers recorded a quicker reduction than manufacturers, although both saw record rates of decline.

Incoming new business across the South East’s private sector dropped for the second month running during April. Moreover, the rate of decline was the most marked since the sur

Key Findings • Headline Business Activity Index falls to all-time low • Unprecedented rate of decline in new business • Firms cut jobs at most marked rate on record

vey began in January 1997. As was the case for activity, anecdotal evidence linked the reduction to the coronavirus outbreak.

Meanwhile, private sector firms in the South East reduced staff numbers in April, as has been the case in eight of the past nine months. Firms linked latest fall to lower output requirements. Consequently, companies reported a sharp rise in spare capacity during April. The rate of backlog depletion

South East Business Activity Index sa, >50 = growth since previous month

was the most marked on record.

Input prices declined for the first time since May 2012 during April, with panellists linking the decline to lower fuel and staff costs. Moreover, the fall was the quickest for almost a decade.

Concurrently, average selling prices dropped for the second month in a row, with panellists linking the reduction to a combination of lower cost burdens and discounting in order to attract sales. The rate of decline was the most marked on record.

Firms expectations with regards to activity over the coming 12 months picked up from March’s recent low in April. However, sentiment remained historically subdued.

The NatWest South East PMI® is compiled by IHS Markit from responses to questionnaires sent to South East companies that participate in IHS Markit’s UK manufacturing and services PMI surveys. METHODOLOGY

COMMENT

Stuart Johnstone, Managing Director, London & South East, Corporate & Commercial Banking

“Private sector output in the South East declined for the second month running in April, with both activity and new business falling at the most marked rates in the survey’s 23-year history, as the economy continued to get hit by the COVID-19 pandemic. Subsequently, firms reduced staffing levels further, with the rate of job shedding the fastest on record. “That said, the downturn was not as steep as that recorded for the UK as a whole, and the South East’s headline index was below only the North West when compared to the 11 other monitored regions, indicating that the breadth of the impact of the lockdown was worse in other parts of the UK. “On a positive note, the year ahead outlook for output picked up slightly from March’s recent low, indicating some tentative signs of confidence returning to the region’s firms, with panellists linking optimism to hopes of a timely recovery from the pandemic and the prospect that lockdown measures will be eased in the near future.”

Stuart Johnstone