13 minute read

How to create an adaptive

How to Create an Adaptive Culture

By Kevin Green, former CEO of the Recruitment & Employment Confederation and HR Director of Royal Mail.

Why do 87% of people say that they are not engaged at work?* We know that when people are engaged in their work they are happier, more productive and don’t change jobs. All leaders want their organisation to be a great place to work because they know it has an impact on the business’s performance. We know culture matters, but few organisations know how to review, modify or change their organisational culture.

If we look at organisations with winning cultures, it’s not the football tables, free fruit and away days that people value, it’s how they are treated every day. Does your business define, communicate but most importantly live its values? One of the tests I use with leadership teams is to ask them to name 10 examples in the last three months when their values have been used to help with a business decision. Have they been used to make a hiring decision, or to decide who gets a promotion or pay rise?

Adapt or Die

As markets get disrupted by new competitors and new technology, businesses need to be able to adapt to their changing environment. Often it’s the ability to pivot at pace which is the precursor of business success. This is why creating an adaptive culture is so important today.

The science of developing an adaptive culture shows it’s not a quick or easy process. A culture describes how an organisation behaves every day, how it gets things done, the DNA of the business.

Adaptive organisations will have some common traits: they will be innovative, they will constantly be experimenting to explore different ways in which they can provide customer value, they will always be looking for better ways to do things. This quest for continuous improvement will be a core, repeatable behaviour. Adaptive organisations also have strong leaders who define the purpose of the organisation, as well as the goals. In my experience, most organisations are over-managed and under-led. Leaders empower and motivate, managers control and direct.

Shifting culture

There are some key building blocks in moving towards an adaptive culture. The science shows that organisations with clarity of purpose, that live their values every day and allow people direct control over their work are more responsive and agile. This agility enables them to adapt to customers’ changing expectations and so out-perform their competitors on every financial metric.

Leaders focus on culture

Those leaders that consistently deliver great results, regardless of how the world around their business changes, will understand how to develop, enhance and then reinforce a culture that gets the most from their people.

The great value in purpose and defined values is that they are guides, they allow the people within the organisation to have the freedom to make decisions and on occasions, correct their course. But importantly they also encourage people to be as self-directed as possible - adaptive cultures create trust. You don’t need layers of managers and bureaucracy if you provide leadership guidelines (purpose and values) and allow teams to make their own decisions.

An ongoing challenge

A culture isn’t static, it evolves over time but it can be destroyed quickly. Leaders must protect the business purpose and values, the very essence of the culture and thus avoid it being degraded. Leaders love to claim their organisation is nimble – in fact this means an organisation with decentralised decision-making. No business with a top down culture can be nimble or adaptive - it’s that simple. The adaptive and nimble have a clear purpose, a set of unique values and then get out of the way of their people as they respond to customers wants and needs.

*Gallup, State of the Global Workplace, 2017

Kevin Green has written a new book entitled Competitive People Strategy: how to attract, develop and retain the staff you need for business success, published by Kogan Page

national news Colossal Increase Trouble for Virgin

The UK’s budget deficit is set to see “an absolutely colossal increase to a level not seen in peacetime”, the director of the Institute for Fiscal Studies has said.

The economic impact of coronavirus was likely to push the deficit to as high as £260bn, Paul Johnson told the BBC. He was speaking after latest figures showed that the deficit hit £48.7bn in the 2019-20 financial year. But Mr Johnson said those figures were “the numbers before the storm”.

The deficit last year - the gap between the government’s income and its expenditure - was £9.3bn higher than in the 2018-19 financial year and equivalent to 2.2% of GDP. The Office for National Statistics, which released those figures, said they did not capture the big spending announced by the government to cope with the virus. “The coronavirus pandemic is expected to have a significant impact on the UK public sector finances,” it added.

I always wanted to be somebody, but now l realise l should have been more specific. V irgin Australia has confirmed it has entered voluntary administration - making it Australia’s first big corporate casualty of the coronavirus pandemic. The country’s second-largest carrier cut almost all flights last month following wide-spread travel bans. It was already struggling with a long-term A$5bn (£2.55bn; $3.17bn) debt. The airline is now seeking new buyers and investors, after failing to get a loan from Australia’s government. Meanwhile, Sir Richard Branson - whose Virgin group is a part-owner of Virgin Australia - has offered his Caribbean island as collateral to help get a UK government bailout of Virgin Atlantic. Necker Island is likely worth only £10m, so a way to go there then. Virgin Atlantic has announced it is to cut more than 3,000 jobs in the UK and end its operation at Gatwick airport. The shock announcement comes after rival British Airways said it could not rule out closing its Gatwick operation. Pilots' union Balpa described it as "devastating". The airline currently employs a total of about 10,000 people. Virgin Atlantic, which is in the process of applying for emergency loans from the government, said that jobs will be lost across the board. "We have weathered many storms since our first flight 36 years ago but none has been as devastating as Covid-19 and the associated loss of life and livelihood for so many," said Virgin Atlantic chief executive Shai Weiss.

BUSINESS WISDOM

Empty Threat

The boss of Ryanair says the airline will not resume flights if it has to keep middle seats empty to fight Covid-19, calling the idea “idiotic”. Michael O’Leary said he was hopeful 80% of flights could resume by October if travel restrictions are eased in July. But he said empty seats did not ensure safe social distancing and were financially unviable. He added that if the Irish government imposed the rule, it would have to pay for the middle seat “or we won’t fly”. Like most other big airlines, Ryanair has grounded flights

as countries around Europe have imposed travel restrictions to contain the pandemic.

national news

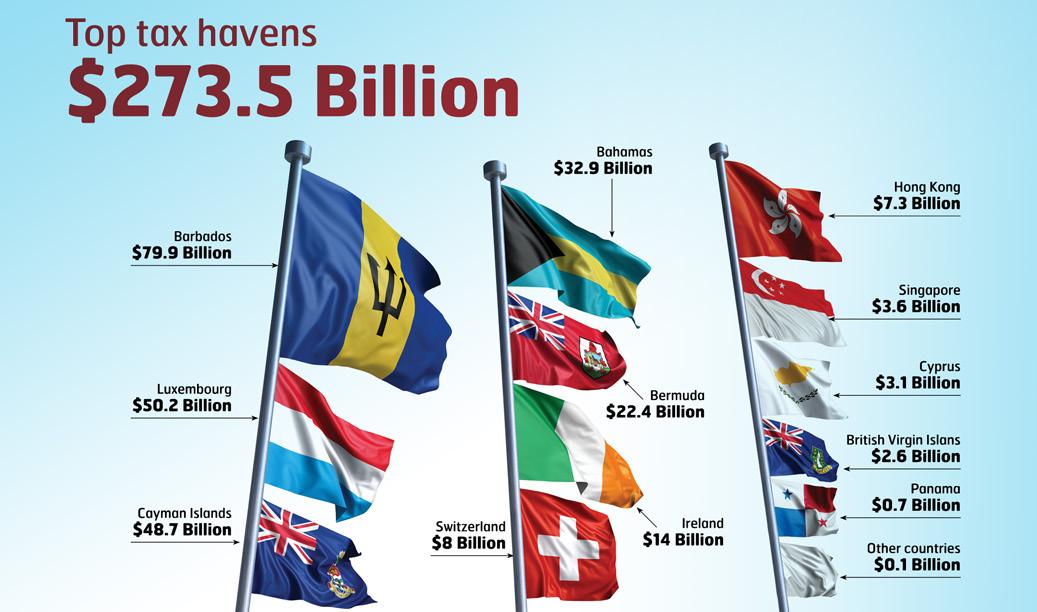

Denmark has told companies that they will not be eligible for bailout funds to help them through the coronavirus pandemic if they are registered in tax havens, prompting calls for other countries, including the UK, to attach similar strings to their own financial support packages. Tax Havens

The Danish government also said companies that access government support must not use profits to buy back shares or pay dividends to shareholders in 2020 or 2021. Earlier in April, Poland said its bailout funds would only be available to companies that pay tax in the country.

The moves have reignited debate over tax avoidance and come as Sir Richard Branson faced criticism after asking the UK government to bail out Virgin Atlantic with a £500m loan.

Electric Power Station

Work has started on an electric vehicle charging forecourt that will be able to charge 24 cars at once. It is being built on a 2.5 acre site at Great Notley, near Braintree, Essex, by sustainable energy company

Gridserve. The company hopes the roadside forecourt, which will use solar power, will “solve the challenge” of where to charge electric vehicles. Chief executive Toddington Harper said it was “updating the petrol station model for a net-zero carbon future”. It is set to open in the summer and is due to be the first of more than 100 similar sites around the country.

Bloodbath

The UK pub sector could be hit by a “bloodbath” if they are not given breaks in rent payments, an industry expert has claimed. Chief executive of UKHospitality, Kate Nicholls, called for government intervention “as a matter of urgency”. She told the Treasury Select Committee some landlords were facing legal action over not being able to pay their rent. She also said a third of the sector would be “put at risk” if lockdown measures lasted until Christmas. Cabinet Office Minister Michael Gove confirmed at the weekend that pubs would be among the last businesses to re-open when measures are reduced. A spokesman for the Department for Business said they urged owners of pubs “to act in a responsible way, exercising judgement and discretion with their tenants”. The government introduced a lease forfeiture moratorium for three months as part of its response to the coronavirus to stop people being kicked out of business premises if they miss rent payments. But Ms Nicholl said it was not taking effect “across a large swathe of the hospitality industry”.

Age is of no importance unless you’re a cheese

BUSINESS WISDOM

Protecting the Economy

Knill James believes that further support is needed urgently to prevent an additional 830,000 unemployed in the South East

New research that we have conducted during April shows that 830,000 people in the South East are at risk of unemployment. This is a stark and worrying number, but this is the reality of what the UK may be facing.

31% of the 1,793 SME businesses who participated in our research believe they could close permanently if the lockdown continues beyond June. Given there are 16.7 million people employed by SMEs according to the government’s own statistics released in 2019, this could result in over 830,000 in the South East being made unemployed and 5 million in total across the UK.

Kirsty Wilson said: “This is not what anyone wants. Clearly therefore one of the most important issues that the government needs to focus on is to rebuild the economy. SMEs, who account for a significant proportion of the UK’s economy and workforce, need to be a priority.”

tive hurdles of the Coronavirus Business Interruption Loan Scheme. 2. Continued support for furloughed employees, rather than a hard end to the Coronavirus Job Retention Scheme. 3. Refining the Self-Employment Income Support Scheme to ensure it is well targeted.

We are delighted to see that the government has announced a 100% government backed loan facility for SMEs to borrow up to £50,000. We will find out further details on the likely terms of these loans as well as further information on eligibility criteria over the coming days and weeks but this facility should complement the main CBILS scheme.

The ability to defer capital repayments for 12 months will be a key aspect for some business owners, giving them time to re-structure their business and the confidence to accept the loan.

But we also know this is not enough in itself. More support and more measures are needed; we know that many businesses need to see an end to the lockdown but are also worried about the impact on any ongoing social distancing measures. That’s why we will keep lobbying the government on behalf of SMEs.”

Concluding, Nick Rawson said; “In these unusual times we need to Stay Focused; Protect the Economy and Save Jobs. We are committed to doing our bit to support our clients by raising issues with the government on SMEs behalf and by collaborating with the government and others to achieve these goals.”

Nick Rawson, Partner 01273 480480 nick@knilljames.co.uk

Kirsty Wilson, Corporate Finance Director 01273 480480 kirstyw@knilljames.co.uk www.knilljames.co.uk

Together with the other member partners of the UK200Group, Knill James has written to Boris Johnson and Rishi Sunak highlighting the 3 key areas of concern for SMEs that the research has identified:

1. Access to bank funding to preserve their business; 2. Help rebuilding their business once the pandemic eases; and 3. More support for the self-employed to tide them over.

In our letter, we have called on the government to prioritise support for SMEs and in particular, we have highlighted the following measures that will help address SMEs current challenges:

1. Removing some of the administra

Keep cash flowing

COVID-19 is dire for cash flow: Maxine Reid from Quantuma on how businesses can wring as much cash generation as they can from available sources

The current impact of COVID-19 is so u n p r e c e d e n t e d and for many businesses, the speed with which it has played out has left many feeling helpless. It follows that one of the first questions that business owners will be asking is ‘how long can we survive until the worst (hopefully) passes?’ Simply, the answer depends on how much cash the business currently has in order to keep current operations as “whole” for as long as possible. In reality not many businesses, especially in the SME space, will have sufficient cash reserves to simply wait it out and fund inevitable losses unless they operate in one of the designated essential sectors and may actually experience increased demand. What we have been seeing at Quantuma is that for most businesses the immediate response to the crisis has been to look to pare back operational cost drivers by furloughing employees; reducing number of shifts etc. but also stretching supplier credit terms (perhaps predictably) even more. In many cases the above measures will not be enough and stretching creditor days past breaking point is a risky, if understandable strategy at present, for some businesses. However, business owners and directors should ensure that as well as looking at the obvious strategies they also explore less obvious avenues. Summarised below are some additional cash preservation strategies businesses should consider: • Approaching all customers (especially the larger ones) to request that all overdue sales invoices are immediately brought up to date

• Temporary suspension of the offer of credit terms (i.e. request customers put you in funds first if requiring urgent production or supply) • Approach financial stakeholders, utilities and landlords to explore payment holidays etc. • Last but not least ensure that constant attention is paid to the evolving nature of the Government’s raft of announced measures to support UK business and ensure that where your particular business qualifies for help the application process is prioritised The most important document that any business should have right now is a cashflow forecast. Whilst small and medium sized businesses may not need to provide one to some banks when applying for CBILS backed loans a business owner, regardless of business size should have one. It will not only help to show where the pinch points are and how long the business can continue without additional support but if your bank does need one, they’ll be easy to produce. Whilst banks are changing their lending criteria in line with Government guidelines they are still lending cautiously. Where banks won’t require sight of cashflow forecasts or business plans, the lenders will instead rely on their own information to assess credit and business viability. The above suggestions are clearly not exhaustive and some will only apply to certain situations but we hope that this article will help emphasise that an obsessive focus on cash generation and preservation should be a constant preoccupation for business owners during this period of uncertainty.

www.quantuma.com