4 minute read

CRYPTO TRADE OPPORTUNITIES

CRYPTONAIRE LYWEEK

CRYPTO investment journal

CRYPTO TRADE OPPORTUNITIES

BITCOIN - BTC/GBP

We had mentioned in our previous analysis that we were bullish and that is how Bitcoin played out last week. The largest cryptocurrency surged above £41,795 on March 13 and hit a new all-time high at £44,238. However, the bulls could not hold on to the higher levels as the price turned down and broke below the breakout level at £41,795. This is a negative sign as it suggests traders are booking profits on rallies. The BTC/GBP pair has dipped back to the 20-day EMA, which is an important support to watch out for. If the price rebounds off this support, it will suggest traders are buying on dips. The bulls will then again try to resume the uptrend by pushing the price above the £41,795 to £44,238 overhead resistance zone.

Contrary to this assumption, if the bears sink the price below the 20-day EMA, the pair could drop to the 50-day SMA. This is an important support because the bears have not been able to break it since October 9 of last year.

Therefore, a break below it will suggest a possible change in trend. The bearish divergence on the RSI is pointing to a possible deeper correction. We will wait for the price to form a bottom before proposing a trade in it.

CRYPTONAIRE LYWEEK

CRYPTO investment journal

ETHEREUM - ETH/GBP

We were expecting Ether to reach its all-time high at £1,456.18, but the bears had other plans. They stalled the rally at £1,391.98 on March 13. The price has again dipped back to the moving averages.

The bulls will now try to defend the moving averages and if they succeed, the ETH/GBP pair may make one more attempt to rise above the all-time high. If they manage to do that, the pair could rally to £1,767.7 and then £1,968.87.

However, the flattening 20-day EMA and the RSI near the midpoint suggest the bulls are losing their grip. If the bears can sink the pair below the 50-day SMA, the decline could extend to £1,100 and then £932.54.

A strong bounce off the support levels could keep the pair range-bound for a few days. We do not find any reliable buy setups, hence we are not recommending any trade in it.

CRYPTONAIRE LYWEEK

CRYPTO investment journal

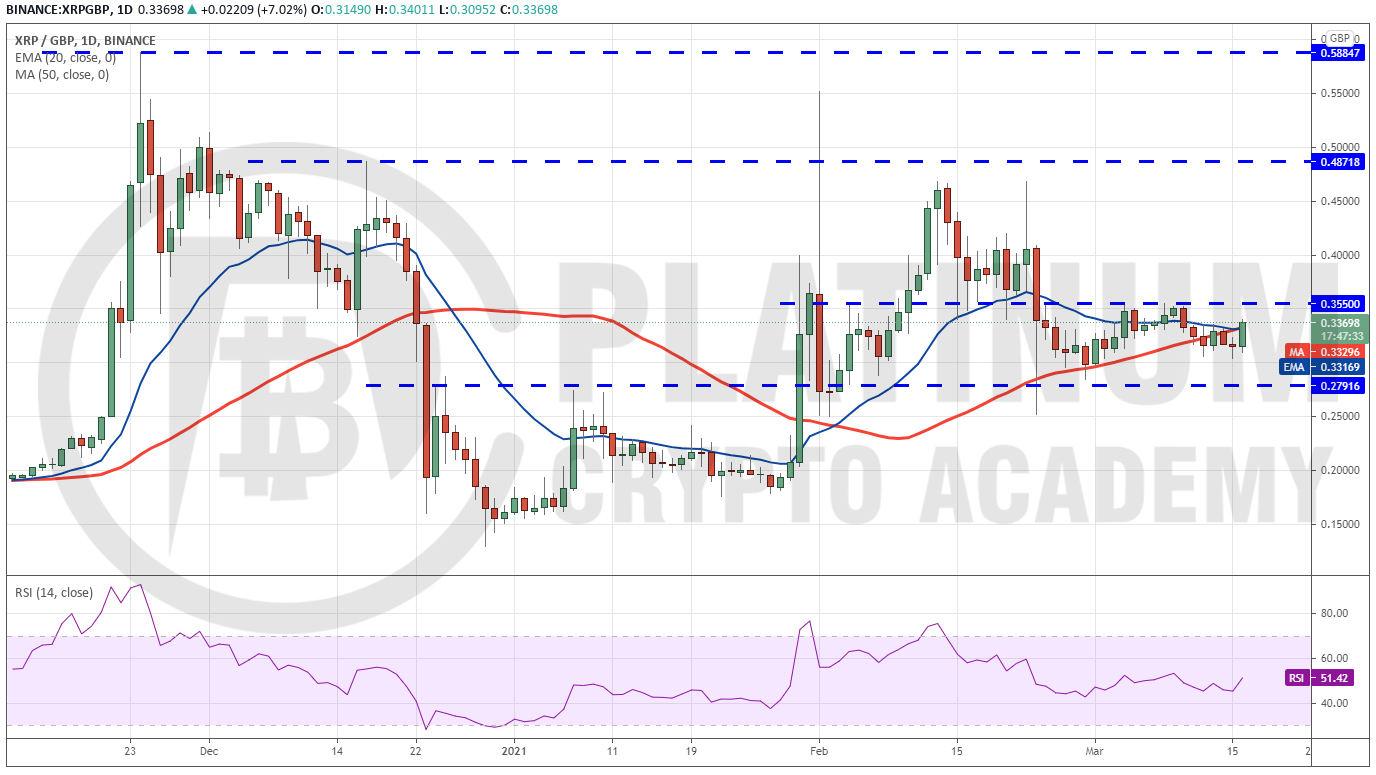

RIPPLE - XRP/GBP

XRP turned down from the overhead resistance on March 10 and slipped below the 20-day EMA. The selling continued and dragged the price below the 50-day SMA on March 12.

This suggests bears are aggressively defending the higher levels. The price could now remain range-bound between £0.27916 to £0.355 for a few more days. The flat moving averages and the RSI near the midpoint also point to a possible consolidation.

However, if the bulls can drive the price above £0.355, the XRP/GBP pair is likely to pick up momentum and start its journey towards £0.48718. Therefore, we retain the buy trade proposed in the previous analysis.

This bullish view will invalidate if the pair turns down from the current levels or the overhead resistance and breaks below the £0.27916 support. Such a move could start a downtrend that may reach £0.15.

CRYPTONAIRE LYWEEK

CRYPTO investment journal

CARDANO - ADA/GBP

We had highlighted in the previous analysis that the failure to achieve a strong rebound off the 20-day EMA suggests a lack of buying support. Cardano broke below the 20-day EMA on March 12.

Although the bulls tried to push the price back above the 20-day EMA on March 13, they could not hold on to the higher levels. This shows traders are booking profits on rallies.

The 20-day EMA has flattened out and the RSI has dipped below 48, indicating that the bears are trying to make a comeback. If bears sink the price below £0.58, the pair could drop to £0.50.

A deeper correction could delay the start of the next leg of the uptrend. This bearish view will invalidate if the price turns up from the current levels and rises above £0.90. That could result in a retest of £1.07197.

CRYPTONAIRE LYWEEK

CRYPTO investment journal

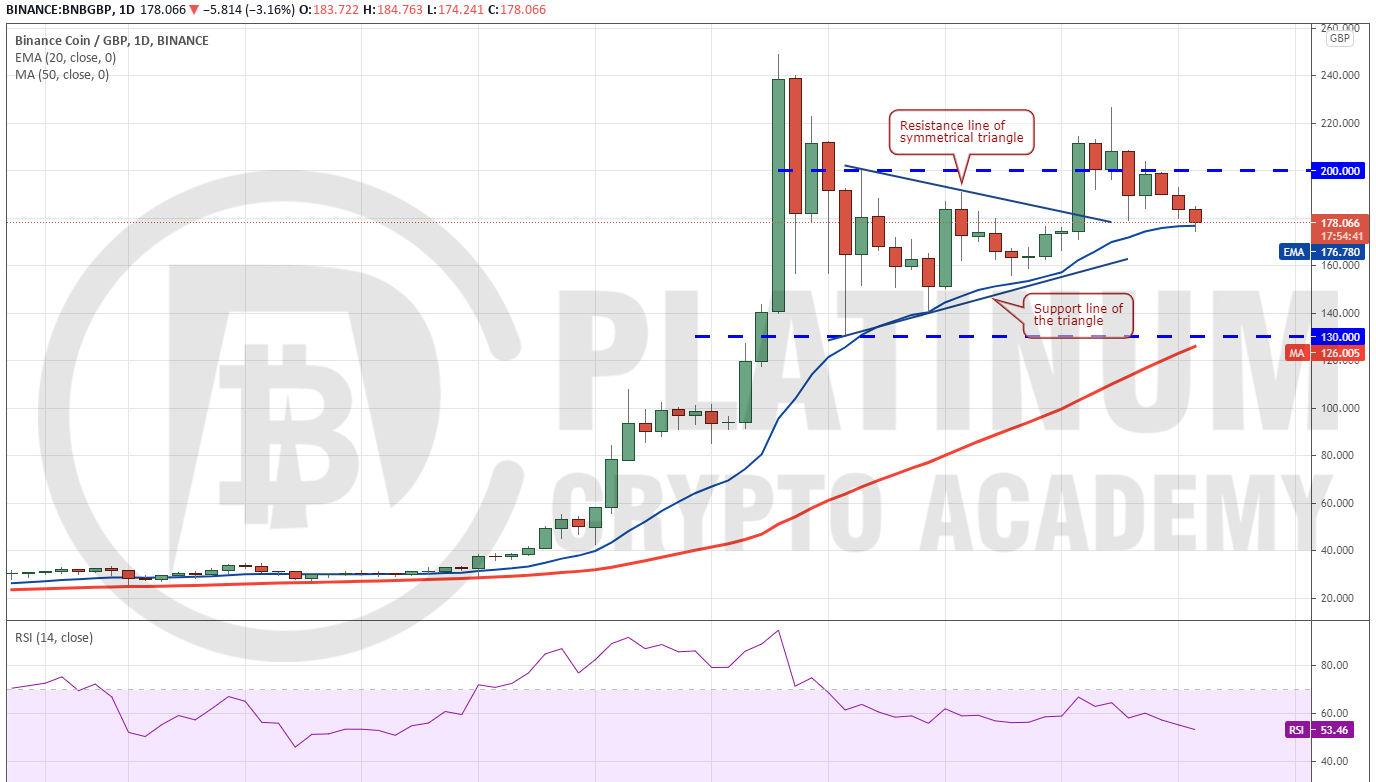

BINANCE - BNB/GBP

Binance Coin broke above the symmetrical triangle and soared above the £200 overhead resistance on March 9. The bulls attempted to resume the uptrend on March 11 but they could not sustain the higher levels, as seen from the long wick on the day’s candlestick.

This could have attracted profit-booking from short-term traders and that pulled the price back below the £200 support on March 12. The attempt by the bulls to push the price back above £200 failed on March 13.

The BNB/GBP pair continues to witness profit-booking and has now dropped to the strong support at the 20-day EMA. A strong bounce off it will signal strength, but if the bears sink the pair below it, a drop to £130 may be on the cards.

The flat 20-day EMA and the RSI near the midpoint suggest a range-bound action for the next few days. Trading can be random and volatile inside a range, hence traders could remain on the sidelines until clarity emerges.