Incorporating NQ magazine June 2024 PQ AWARDS 2024: ALL THE ACTION pqjobs.co EXAMACCATIPS INSIDE

Tuesday 25 June Royal College of Physicians, London

•Mastering change management: a step-by-step guide for accountancy practices

Shane Lukas, AVN Inspiring Accountants

•Is AI going too fast? What to be mindful of when using this tech trend

Tushir Patel, Capium

•Companies House reform

Henry Vaile, Companies House

•The inner game of self-mastery - exploring mindset, habits, and resilience

Kim Searle, Emotional Mastery Ltd

•Rehumanising your accountancy firm with digital branding

Mike Roberts, Making Digital Real Ltd

BOOK NOW at IFA.ORG.UK/CONFERENCE24 PRICES Member £135 Non-member £160 7.5 CPD HOURS

IFA

2024 @INSTITUTEFA INSTITUTE OF FINANCIAL ACCOUNTANTS INSTITUTEOFFINANCIALACCOUNTANTS INSTITUTEFA

Conference

IN THIS ISSUE

Well, what a night it was! The 21st PQ magazine awards have become the BAFTAs of the accountancy education industry, of that there is no doubt. But they have also become the most chilled accountancy awards around! We have never had so many people dancing so soon on the night. That may be due to the wonderful Jean-Paul Noel-Cephise, the singing accountant.

Check out who walked off with our coveted trophies on YouTube – go to https://tinyurl.com/5n7kd82p

I would like to say well done to all the winners, but my biggest cheer goes to Paul Sizer (pictured below), who won the Lifetime Achievement award. He really has changed hundreds of lives in Wales.

We have all the photos inside, too.

It is great to see our YouTube video of Lord Sikka and the Post Office scandal has also hit 12,000 views. If you haven’t seen it then you can see what he has to say at https://tinyurl.com/mw7apm46

We have lots of news for you, too. There are CIMA, ICAEW and ACCA exam pass rates to ponder, and even a burlesque dancing AAT. We also ask the question: Is exams marked by AI coming to accountancy exams?

And we haven’t forgotten our tips for the ACCA exams either. Graham Hambly, Editor and Publisher, PQ magazine

4 ICAS record

Scottish institute sees highest number of annual admissions in 170-year history

5 ICAEW upgrades app New and improved MyICAEW app launched for studentss

6 Management debate

AAA pass rate soars – to the giddy heights of 38%!

12 Tech news

Software giant launches Sage for Accountants and Sage for Small Business

Features, etc

14 Have your say

Audit is not for everyone – but some accountants love it; and the Post Office scandal continues to shock. Plus our social media round-up

17 PQ Awards 2024

The industry’s top awards night went with a bang – and our photographer Phil Gammon captured all the action. So who walked off with the trophies?

20 ACCA AFM exam

Sunil Bhandari has some top advice on how to get a pass in the Advanced Financial Management exam

23 The business world

36 Non-profit organisations

CIPFA and Humentum are leading efforts on the firstever international non-profit accounting guidance

37 Careers

The rise of AI in the boardroom; our Agony Aunt dispenses more words of wisdom; and our Book Club review

38 Fun

The lighter side of life – and accountancy

The columnists

Lisa Nelson How ‘blurting’ can help you revise better 4

Robert Bruce Chairman’s sangfroid is a lesson for us all 6

Prem Sikka Ofwat must get its sums right 8

Anna Kate Phelan How e-assessment enables ‘real world’ exams 10

Eddie Herbert Demand for carbon data on the rise 12

8 AI and exam marking AI will mark exams and provide feedback in the future, top tutor believes

9 CIMA case study results

All three levels’ pass rates down on previous case study sitting

No proof that diverse management improves performance, academics claim

10 ACCA exam pass rates

Paul Merison looks at how you can use the lessons learned from the Wirecard scandal

24 CIMA spotlight

A bit of self-analysis can go a long way in helping you achieve your goals

25 AAT spotlight

Karen Groves explains how to approach a re-sit exam to ensure success

26 ACCA SBL exam

In part one of a new series, top tutor Chris Cain explains what the examiner is looking for when it comes to assessing the severity and probability of risk events

27 Sustainability

The ACCA shares its five-point plan for making the world a better place

28 CIPFA spotlight

New research from the institute finds councils are not operating on a level playing field

29 ACCA exam tips

What do the experts think will be tested in the next set of exams?

News

To subscribe for FREE go to www.pqmagazine.com

June 2024

A note from the Editor contents p17 p29 PQ Time to outsource your payroll A fully comprehensive professional payroll service offered for a very low monthly fee. My services will free valuable time to enable you to concentrate on other matters. Call Emma now for full details on 020 8803 6834/07889 885646 or email her at emmaarif@absaccounts-payroll.co.uk

LISA NELSON

Are you blurting?

‘Blurting’ is an increasingly popular revision method (featuring heavily on social media). It involves quickly jotting down everything you remember about a topic without referring to your notes or textbooks. This ‘brain dump’ exercise helps consolidate memory by forcing recall, which strengthens neural connections associated with the information being revised.

The process starts by you choosing a topic and setting a timer, typically for a few minutes. Without any aids, you write down all relevant points, concepts and details that come to mind. Once the timer stops, you compare your ‘blurted’ content with your study materials to identify gaps in knowledge, reinforcing learning through active recall and self-assessment.

Blurting is particularly useful for exams where you need to retrieve information without prompts.

However, blurting does have limitations, especially for exams requiring the application of knowledge to new scenarios, typical of most accountancy exams. Since blurting focuses on memory recall, it won’t fully prepare you for tasks demanding critical thinking, problem-solving or the application of concepts to complex problems. Therefore, while blurting might form part of your revision strategy it isn’t a passport to exam success.

The best approaches to revision will also include the completion of practice questions and mock assessments, with sufficient time spent on critically evaluating your answers against a mark scheme or sample answer to identify gaps in your ability to apply what you know.

Kaplan

In brief

CASSL elects new chair

PwC’s Aydin Bolton has been elected chair of the Chartered Accountant Student Society of London (CASSL), which represents some 6,000 ICAEW students. He takes over the baton from Sunny Yang.

CASSL’s accounts were also passed at the recent AGM (its 141st), showing the society made a net surplus for the year of £24,406, with net assets on the balance sheet standing at

A record year for Scottish NQs

The Institute of Chartered Accountants of Scotland (ICAS) is celebrating a record year, with the highest number of annual admissions in the institute’s 170year history.

Nearly 850 chartered accountants joined the profession at its annual Admission Ceremony in mid-April.

Gail Boag, Executive Director of Learning at ICAS, said: “This year we have 843 newly qualified CAs and it is fantastic to see record numbers join the profession. The increase in admissions reaffirms the strength of the ICAS CA qualification and its appeal to a new generation of jobseekers and employers alike.

“The CA qualification takes those who achieve it beyond the numbers of accountancy and serves as a

passport to the highest levels of business and finance. Testament to that is the fact that ICAS members hold senior positions in 83% of FTSE companies.

“Not only are we seeing record admissions, but we’re also seeing an increasing number of people enter the profession from a wider

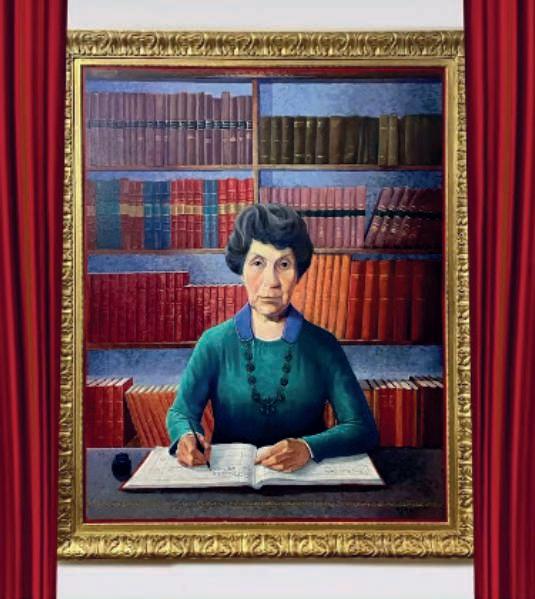

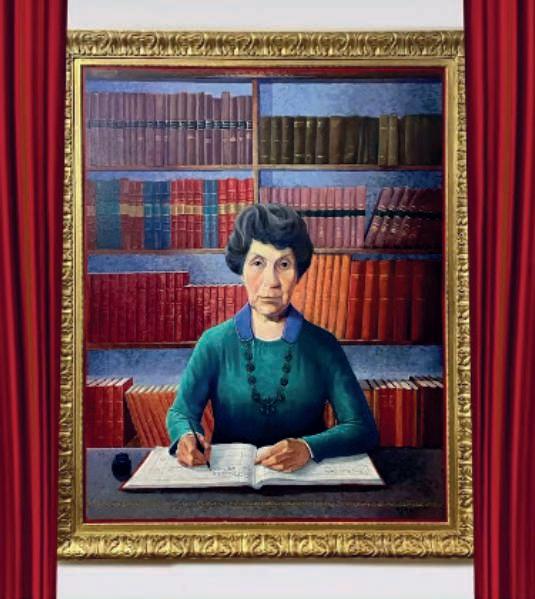

Celebrating the first female CA

It was recently the anniversary of Mary Harris Smith becoming the first female chartered accountant in the world (May 1920). To honour her ICAEW commissioned a painting by Toby Wiggins and her portrait now hangs proudly in Chartered Accountants’ Hall. About time is all we can say!

However, Harris Smith was initially denied membership because she was a woman. In 1885, ICAEW President Charles Fitch Kemp said he would be so embarrassed by the

You can’t use AI for your exams!

The Big 4 accountancy firms have been asked to explain what measures they are taking to prevent professionals using ChatGPT and other AI tools to cheat on auditing exams, according to Adam Mawardi of the Daily Telegraph.

The Financial Reporting Council has reportedly contacted the

£234,996, up 11% year-on-year.

• CASSL recent won Student Body of the Year at the 2024 PQ magazine awards, for the second year in a row. Check out all the winners on page 17

Tuition fee inquiry welcomed

The UK’ s Education Select Committee has launched a new inquiry into international student tuition fees. This will be welcomed by universities and businesses alike, who both reap huge benefits

firms and the professional bodies themselves about what they are doing to ensure the integrity of their exams.

The UK accountancy watchdog told the Daily Telegraph it is working closely with these organisations over audit exams monitoring. Only recently the regulator discovered

from the inclusion of international students.

Dr Joe Marshal, CEO of the National Centre for Universities and Business (NCUB), said: “International students deliver wide-ranging benefits to the UK, and we are confident that the inquiry will find that the graduate visa has played a crucial role. We know that international students make a significant contribution – they contribute £41.9 billion to the UK economy. The financial influx from international students

socio-economic background, thanks in no small part to the work being delivered by the ICAS Foundation.”

The Foundation plays a key role in widening the pipeline of talent by supporting young people through their studies and providing individualised support until they graduate.

admission of women that he would rather retire than consider it. It was only after the Sex Disqualification (Removal) Act was passed in 1919 that she was allowed to become the first female chartered accountant.

Harris Smith set up her own accounting firm in 1887 and in women periodicals she was described as the ‘lady accountant’. Harris Smith was 75 when she was finally admitted to the ICAEW.

Women would have to wait until 1979 before they were elected onto ICAEW Council.

dozens of Big 4 employees shared answers when completing online audit exams, with students exchanging answers via WhatsApp.

Some of the Big 4 firms have now told both members and students if they are caught using AI in exams it will be considered ‘gross misconduct’ and they could lose their jobs.

significantly bolsters UK universities. They help facilitate enhanced research, innovation and educational offerings for domestic students.”

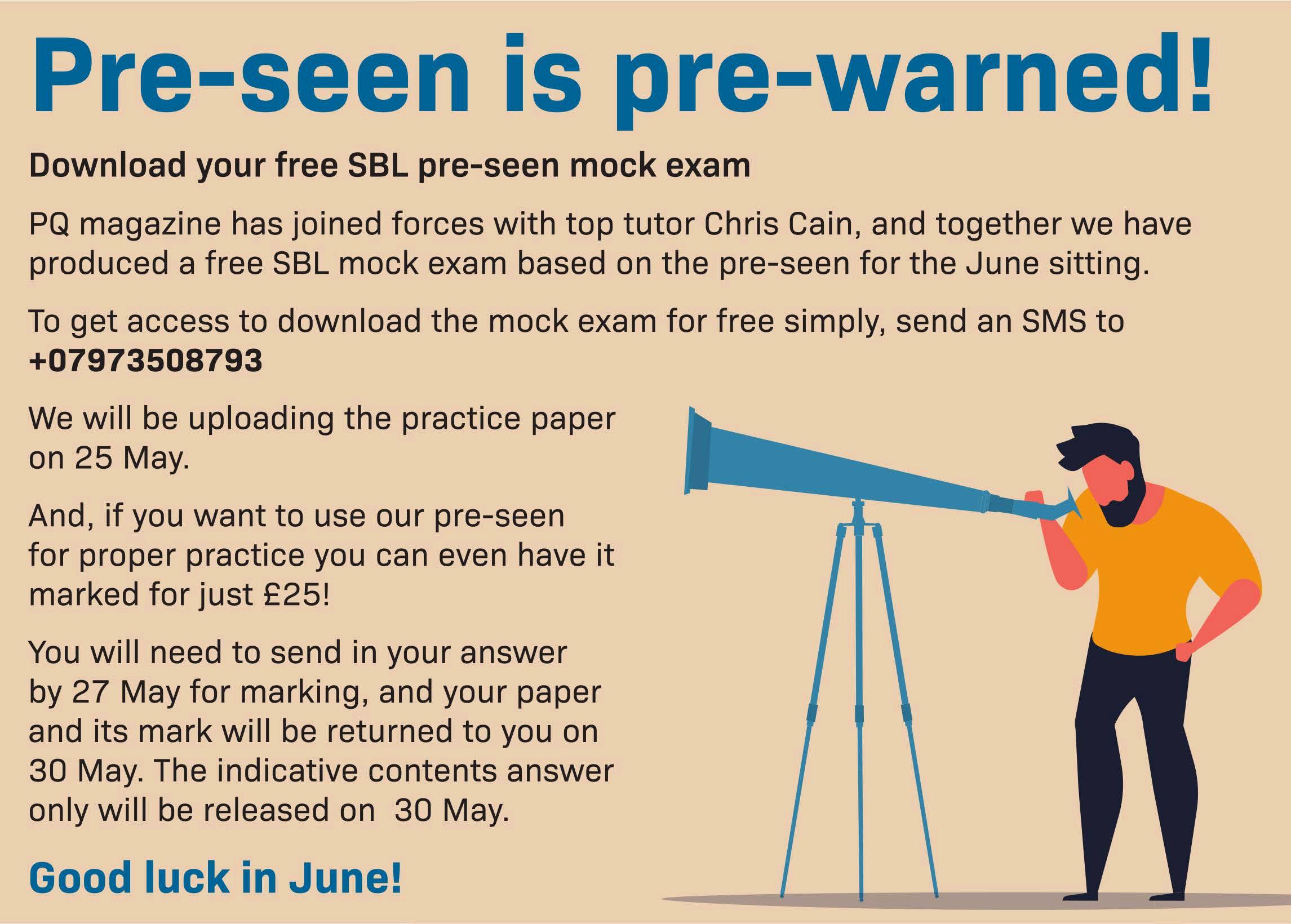

Pre-seen ACCA mock exam

PQ magazine and top tutor Chris Cain have joined forces to offer you access to a free ACCA SBL mock exam. The practice paper will be uploaded on 25 May and you can even have it marked for a small fee! For more go to page 22

PQ the PQ Magazine June 2024 4

Lisa Nelson is Director of Learning at

AAT Dance Floor Hero

Rushtons Chartered Accountants’ very own Stacey Whelan (MAAT) has made it to the Dance Hero Finals. Her story was recently picked up by the Blackpool Gazette, which ran with the headline ‘I’m a boring accountant by day and burlesque dancer by night’!

Whelan will be among

Stacey Whelan

the 12 finalists in the 2024 Dance Floor Heroes Show at the Blackpool Winter Gardens Empress Ballroom on Friday 14 June.

The event has been called ‘Strictly for real people’, and Whelan will be paired with a professional partner (Ping) for the

The winner is…

It has been called ‘the biggest night in the accountancy education industry’, and the 21st PQ magazine awards certainly lived up to its reputation.

As ICB CEO Ami Copeland said: “I cried, danced and sang along with drag queens – not a normal Monday night!”

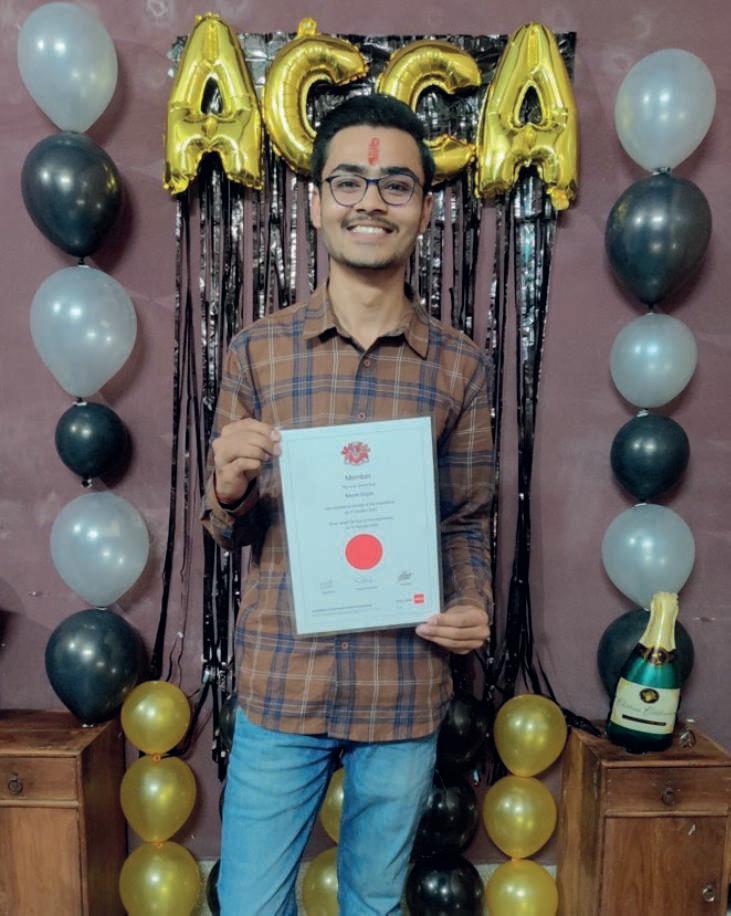

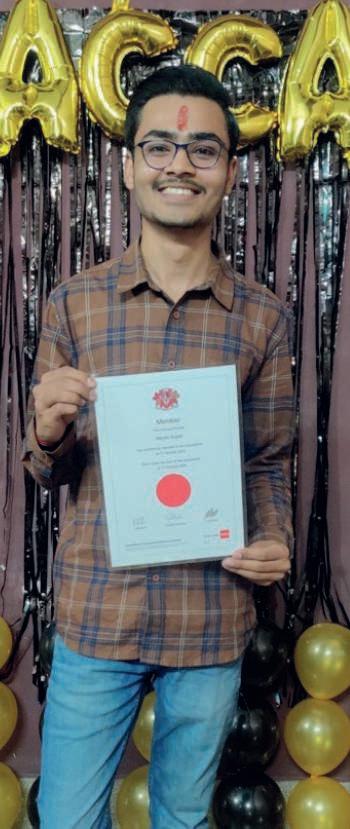

Her favourite moment of the night was meeting the PQ Graduate of the Year Tim

Mickleburgh and his gorgeous mum (pictured). She explains: “Your success story had me

competition.

All the monies raised will go to Tia’s Crown – a local charity which supports well-being and mental health through dance.

Whelan started dancing with tap and musical theatre and then went on to burlesque dancing with her pal – and it all spiralled from there.

She is running a ‘Burlesque and Bubbles’ fundraiser for the charity on Friday 31 May, with friends and fellow finalists Loie McNeill (an NHS accountant) and Linda Adams. Here is a link to her fundraiser page: https://tinyurl.com/5n7sbmp7

blubbing away. Your determination and drive are so inspiring – proving that if you get your head down and do it, success in accountancy can be yours.”

CASSL’s Aydin Bolton said: “Such a fun evening filled with lots of entertainment and smiling faces from all across the industry… a night to remember.” He has every right to be smiling, as CASSL took home Student Body of the Year for the second year in a row. Check out all the winners on page 16

The new student app

Have you downloaded the MyICAEW app yet? Once downloaded, the new student app lets you can access your exam results and view your student profile (including your booked exams).

You can also read all the latest articles and catch up with the ones you missed.

There are also podcasts to listen to and you have access to the latest helpsheets. There also a chance to get involved in the online community too, helping you to grow your network.

To find out more go to https:// ow.ly/o7h750R2cM8. Download your Student app at Apple Store or Google Play.

PQ 5 PQ Magazine June 2024 PQ news

For more information and to receive 15% off your ICB Exemption application, call ICB HQ on 0203 405 4000 and quote ICBPQ Email us at exemptions@bookkeepers.org.uk www.bookkeepers.org.uk/PQ PQ with AAT, ACCA, ICAEW or CIMA? Why wait? Join ICB today! Fast track your career by using your existing qualifications to join the world’s largest bookkeeping organisation. As a Certified ICB Bookkeeper you’ll benefit from: Professional status and recognition Free legal and technical advice-line Local and national events Resources, webinars, templates and help sheets Accounting news, emails and updates Discounts with 100s of retailers including Sainsbury’s, Tesco, ASOS, and Curry’s And being part of a community that really cares The Institute of Certified Bookkeepers

ROBERT BRUCE

Chairman’s sang-froid a lesson for us all

I spent my afternoon at an annual general meeting the other day. It was one that I have been to before and had sworn never to go to again. In the past it has been rendered chaotic by people who are obsessed with detail or who have an ego the size of a planet. This year it ran to almost four-and-a-half hours. Why on earth had I gone along other than to vote at the appropriate points? The answer was to watch the Chairman play an absolute blinder.

I have always enjoyed AGMs, perverse as that might seem. In my early days as a journalist they were events where news and information could be prised out of the proceedings and the various executives there. I developed a technique of watching closely and spotting the hidden fault lines. But this one was different.

The Chairman, who could not have been blamed had he groaned aloud at some of issues raised, simply maintained a sunny demeanour. He greeted various bête noire of years past as old friends. He listened. He summoned up other executives to provide emollient explanations. At no time did he appear exasperated. He let the meeting run. And by the simple principle of being firm but fair, and above all friendly, he won what could have been a difficult day. It was a case study and an example to us all.

Robert Bruce is an award-winning writer on accountancy for The Times

Institute question time

Accountancy syllabuses will reflect the changes in the profession such as sustainability, technology and AI, but the fundamentals aren’t going anywhere, said ICAEW’s education chief Will Holt.

When it comes to AI, Holt said the question is what won’t AI be able to do. There will, Holt said, still be the role for accountants to ensure ethical behaviour, talk to clients, and interpret the data.

CIMA’s Stephen Flatman

Where is the evidence?

Two accounting academics say there is no evidence that diverse management teams boost profits, laying waste to four McKinsey reports which claim there was!

The new research by Professor Jeremiah Green and Professor John Hand directly disputes the

claims that diversity is a ‘business imperative’ that drives financial results.

The pair tried to reproduce the McKinsey findings, but said the firm would not let them see the data or tell them which companies they looked at. So the two academics

used the S&P 500 to look at their performance over a four-year period.

The professors concluded that McKinsey’s studies lacked robustness and should not be relied on.

They said: “In contrast to McKinsey’s results, the key finding of our study is that we observe no statistically significant difference between the likelihood of financial outperformance as measured by the industry-adjusted EBIT [earnings before interest and tax] margin of S&P 500 firms during the years 2015-2019 in the top versus bottom quartiles of S&P 500 firms ranked on McKinsey’s executive racial/ ethnic diversity metric measured in mid-2020.”

ACCA results publication dates change

ACCA has told students that both the December exam results dates for both 2024 and 2025 will be five days later than normal.

So, instead of waiting up on Sunday night for the results to be released on the Monday, students will be up on Thursday and receive their results on a Friday.

This means the December 2024 exam session results will be released on 17 January (16 January midnight), and the December 2025 results will come out on 16 January

(15 January midnight).

Interestingly, the ACCA also announced that there will be no late entry period for the March

2025 exams. Entry for the March 2025 exams will have a standard deadline of 17 January, with no late entry period.

ACCA apologised for any inconvenience and explained these changes were needed to “support operational improvements we’re making and will ensure exam integrity is maintained”.

It said: “As always, our numberone priority is for all students to receive a fair and accurate result based on their exam performance.”

Equipping accountants for sustainability

The International Federation of Accountants (IFAC) has unveiled proposals to change the International Education Standards (IES) so they embed sustainability – from analysis to reporting to assurance – across aspiring professional accountants’ training.

IFAC CEO Lee White emphasised the significance of the changes, stating: “Investors and other stakeholders need sustainability reports and

stressed that AI won’t replace your job, but someone with AI will. He also felt we are still a long way from outsourcing decision making to AI.

Audit risk and response

As part of his recently nominated ‘Exam World Meets Business World’ series, LSBF’s Paul Merison is creating three short podcasts covering the big three exam topics for the ACCA Audit and Assurance exam.

disclosures that are on a par with the high-quality, decisionuseful financial reports that accountants already deliver. To be future-fit, accountants must develop the right competencies to meet this need. The proposals provide a robust framework for the progression to develop capable accountants who produce report, and assure sustainability information.”

Key proposals include:

The podcasts will focus on an ‘answering approach’ rather than the technical understanding needed.

First up is Audit Risk and Response, at only 12 minutes or so long. Check it out at https://lnkd.in/ e3VFZnDf. The recordings will be useful for any audit student.

• Exam World Meets Business World was shortlisted for Podcast of the Year at the recent PQ magazine 2024 awards. Check out his article on the demise of Wirecard on page 23 of this issue.

• Emphasising working with experts and in multi-disciplinary teams.

• Introducing key sustainability reporting concepts, such as systems thinking, value chains and scenario analysis.

• Referencing relevant sustainability reporting and assurance standards.

• Creating new assurance competence area and learning outcomes.

Little Book of Secrets

CIMA students have been reminded that if they have case study anxiety then there is somewhere they can go. There is a new Little Book of Secrets that provides preparation support advice 48 hours leading up to your exam. Check it out at https://bit/ iy/49yPir3

The book shows you how to learn from candidates who have been there and done it, and helps you understand what the examiner is looking for.

6 PQ the PQ Magazine June 2024

In brief

PREM SIKKA

Ofwat must get its sums right

Accounting students know that financial leverage, or gearing, provides an indication of financial risks and resilience. It is usually calculated by focusing on the debt-to-equity ratio.

However, water regulator Ofwat uses debt-to-assets ratio to calculate leverage. Its estimates of leverage for major water companies are as follows: Thames Water, 78%; Northumbrian Water, 68%; United Utilities, 66%; Southern Water, 70%; and Yorkshire Water, 70%. These are well above Ofwat’s preferred ratio of 60%.

The traditional debt-to-equity ratio results in the following calculation of leverage: Thames Water, 1023%; Northumbrian Water, 1005%; United Utilities, 545%; Southern Water, 520%; and Yorkshire Water, 504%.

The Ofwat calculation understates financial risk. As any mention of leverage makes a distinction between debt and equity, Ofwat’s calculation conjures up the impression that companies have higher equity than they actually do.

The debt-to-assets ratio is problematical because water companies capitalise parts of their interest payments and repair and maintenance expenditure which they consider to be an enhancement.

The total value of capital assets forms the basis of price rises permitted by Ofwat. Companies are allowed to earn a return, which is dependent on their weighted average cost of capital (WACC). Ofwat uses the Capital Asset Pricing Model to estimate WACC. Measurement of leverage is a key input into calculation of WACC.

As water companies face uncertain futures, more questions are likely to be asked about estimates of their leverage.

Prem Sikka is Emeritus Professor of Accounting at the University of Essex

Tax briefs

Austerity not needed

The Taxing Wealth Report 2024 shows that austerity is not needed in the UK, says chartered accountant and academic Richard Murphy.

He said that instead we can have decent public services employing appropriately paid people, and we can invest in our future.

Murphy explains that making 30 relatively simple changes to existing UK taxes could raise up to £90 billion in new tax revenue.

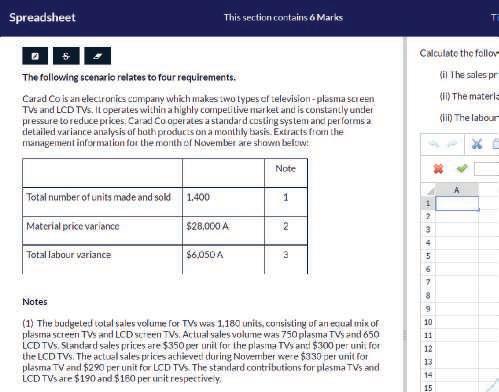

Exams marked by AI is coming

How would you feel if your professional accountancy exams were marked using AI, asked VIVA Financial Tuition’s Hugh Martin (pictured).

He said he didn’t think any tutor or lecturer jumps out of bed at the prospect of marking essay scripts, “although it is incredibly important work, it can be tedious and repetitive”.

Martin feels that AI marking exams and providing feedback is coming, especially since many professional accountancy papers consisted of typed inputs which are easy for AI to analyse. He explained services already exist for this.

The potential benefits of AI include less subjectivity, faster delivery and lower costs.

ACCA exam fees rise again

ACCA has unveiled its exam fees rises for September 2024, and many mirror the UK average rises of around 5.7%. This year’s rise follows rises of between 5% and 7% in 2023.

The association said that persistent inflation continues to drive up its costs, at a time when it is adding lots of new resources for students. Last year it launched ACCA Study Hub, and this quickly followed the ACCA Practice Platform and MyExam

Performance.

For UK students, the cost of sitting the Applied Skills papers goes up from £154 to £163.

The biggest rise comes in the SBL exam where June sitters will pay £263 and September sitters pay £278.

It may have been happening for some time, but PQ magazine has only just noticed that there is no longer a late entry fee for remote sitters. They pay the same standard fee up until the deadline date.

New insights podcast

ICAEW has launched an ICAEW Student Insights podcast, hosted by Jag Dhaliwakl.

The aim of the podcast is to broaden a student’s knowledge to help them become a betterrounded professional, as it covers the topics they need to know to get ahead in the workplace. Its relevant for all accountancy students.

The first episode – called ‘Artificial intelligence: accountant’s friend or foe?’ – can be found at https://ow.ly/xvV050RcUiQ

In this first episode, Dhaliwal

Some of the changes include charging VAT on the supply of financial services, charging an investment income surcharge of 15% on income earned from interest, dividends, rents and other sources, and investing £1 billion in HMRC.

Download the report at https://tinyurl.com/scyn7y

Some 295,250 tax returns already in!

Almost 300,000 self assessment customers filed their tax return in

discovers how emerging technologies are influencing the

the first week of the new tax year –that’s almost 10 months ahead of the deadline.

HMRC has revealed almost 70,000 people filed their return on the opening day this year (6 April), and it is obviously encouraging more people to do it early and not leave it until January.

Last year more than 246,000 people submitted their assessment between 6 April and 12 April 2023.

People may need to complete a tax return for the 2023 to 2024 tax year and pay any tax owed if:

However, the worry is that the depersonalisation of the process will annoy the exam-taker – you, the PQ.

Philip Meagher, co-founder and CEO at learnsignal, said: “This raises a much bigger question. If AI can correct a question on Interest Rate Swaps, then AI can perform Interest Rate Swaps, in which case the accountant needs to adapt to stay relevant.

“The real question should be whether what we are assessing is still relevant in an age of AI.”

The late fee for those wanting to sit at an exam hall has risen to a whopping £448 for the Strategic papers.

work of accountants.

The episode covers:

• The current and anticipated applications of new technologies in accountancy.

•The evolving roles and responsibilities of accountants as a result.

• The need to apply professional scepticism to new technologies.

• How accountants can continue building their skills and knowledge around technology.

Dhaliwal gets the inside track across these topics from two sector experts: Daniel Clark, business trainer and writer, and Fay Bordbar, Global Digital Skills Lead at Mazars.

• They are a self-employed individual with an income over £1,000.

• They have received any untaxed income over £2,500.

• They are renting out one or more properties.

• They claim Child Benefit and they or their partner have an income above £50,000.

• They are a partner in a partnership.

• Their taxable income earned from savings and investments is more than the £10,000.

8 PQ the PQ Magazine June 2024 news

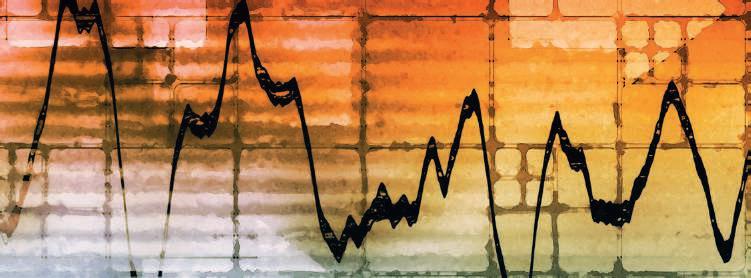

CIMA case study pass rates are down

CIMA’s February case study results are in, and they aren’t a great comparison to previous pass rates.

All three level pass rates are down on the previous case study sitting in November last year – between five and nine percentage points.

For the Strategic level gone it seems are the days of the 71% pass rate achieved in November 2022. This time around the pass rate was 54%, and only the August 2023 pass rate of 48% has been lower in the

past two years of sittings.

The same is true for the Management case study pass rate. At 60%, this is a drop of five percentage points on the November 2023 pass rate.

Finally, the Operation case study pass rate of 59% is the first time a cohort of students hasn’t managed a pass rate in the 60% range since November 2021.

CIMA CGMA Case Study pass rates

March ACA exam results

In all, 4,112 ICAEW students sat exams in March 2024. Most students (2,425) opted to sit just one paper, and the pass rate for these PQs was 71.9%. That means 682 students (28%) will be sitting that paper again.

The pass rate for students sitting two and passing two papers was higher, but only marginally,

at 72.2%. Another 16.9% of sitters passed at least one out of the two.

The 80% pass rate for those sitting FAR UK GAAP should also not be taken out of context – just five students sat this paper in March, meaning four passed and one failed!

For the first time the results also showed the pass rates for Europe

versus the rest of the world. This is a move that has to be praised, and PQ magazine would like to see other bodies follow suite.

ICAEW March 2023 Professional Level paper pass rates: Audit & Assurance 76.4%; Business Planning Taxation 70.6%; Business Strategy & Technology 86.7%; Financial Accounting and Reporting (IFRS) 73.4%; Financial Accounting & Reporting (UK GAAP) 80%; Financial Management 80.2%; Tax Compliance 77.4%

Marco Amitrano to head PwC UK

From 1 July 2024, PwC UK and Middle East will have a new senior partner in the form of Marco Amitrano.

The current managing partner and head of clients and markets will succeed Kevin Ellis and ‘reign’ for four years.

Before training to become an ICAEW, Amitrano studied for a master’s degree in electrical and electronic engineering at the University of Newcastle, and is a graduate of Columbia Business School, New York.

Born in Italy and raised in Luton and Dunstable, Amitrano is also a keen runner.

He was the only man on the ballot, either of the other two candidates would have become the first-ever woman to be in charge of PwC UK. There has, however, been a suggestion that Middle Eastern partners prevented the appointment of a woman as the firm’s new boss.

The firm Civica carried out the election process for PwC, but does not provide a breakdown of the results. The firm is insisting the election was carried out in a fair and transparent way.

PQ 9 PQ Magazine June 2024 PQ news

Feb Nov Aug May Feb 20242023202320232023 Operational 59%68%69%64%68% Management 65%58%67%72%60% Strategic 54%59%48%62%56%

ANNA KATE PHELAN

Were you jumping for joy?

The changing world of exams

I usually give my general musings on the latest in education and technology in this column. But in my day job I’m very proud to lead a fantastic team in the development of the e-assessment platform Rogo.

Last month, Anna Howard, esteemed Head of Qualifications and Membership at CIPFA, kindly came to our offices in Shoreditch for a chat about all things Rogo in our doeswhat-it-says-on-the-tin webinar, Rogo Live! (check it out on LinkedIn and the Rogo website if you fancy).

CIPFA (PQ Accountancy Body of the Year in 2023) are a highly regulated body and as such we have worked together to ensure the highest standards for candidates, employers and the sector at large.

Howard highlighted that e-assessment enabled real-world examples to be utilised in exams. For instance, no accountant working in the modern world is being asked to put together a statement of financial position or income statement without the use of a spreadsheet. Additionally, she highlighted that the use of different question types such as dragand-drop and checkbox matrix allow bodies to assess candidates in deeper ways than previously.

On that note, the e-Assessment Association will be putting on a free online conference, ‘Beyond Multiple Choice’, on 29 and 30 October. Join us in talks about how the assessment industry is changing and the ways in which AI may change testing as we know it.

Something went very right with the ACCA AAA exam this March, as the pass rate jumped to 38%. We haven’t seen a pass rate like this since June 2015, when it was 40%. The worry will be that we get a repeat of what happened in the next exam in 2015 – the September pass rate slumped to 29%!

Sitters are still struggling with APM, with two out of three sitters failing in March. The pass rate was 33%, and it seems permanently stuck at this rate, despite all the resources ACCA puts into to helping

students.

AA had the distinction of having the lowest pass rate of the Applied Skills paper, with a pass rate of 44%, this time around.

The PM pass rate jumped from

AI and degree devaluation

Universities need to embrace artificial intelligence instead of seeing it merely as a tool to aid or catch cheats and devalue degrees, says Danny Bielik, president of the Digital Education Council.

Plagiarism is a persistent challenge and AI rapidly increases the volume, ease and access of

this old scourge, says the Council in a new report. It said: “AI tools enable very high-quality academic misconduct, while AI detection tools lack sufficient accuracy and reliability. Rather than investing in AI detection tools that become obsolete almost as quickly as they are implemented, we recommend universities build a

42% last time out (December 2023) to 45% in March. That is the highest PM pass rate since June 2010.

At 53% the TX pass rate was exactly the same as the March 2023 pass rate. The same is true of the 52% FR pass rate.

Meanwhile, the FM pass rate stayed nice and high at 48% (it is all relative).

ACCA March 2024 exam pass rates: TX 53%; FR 52%; PM 45%; FM 48%; AA 44%; SBL 52%; SBR 49%; AAA 38%; AFM 46%; APM 33%; ATX 49%

resilient educational value chain.”

However, the Council found that university leaders are more worried about degree devaluation, particularly where the prestige of a degree relies on its exclusivity. As one top-tier university put it: “We give a small number of students a badge and that badge has enormous value because we’re highly selective.” AI has the potential to disrupt this over the medium term by enabling the delivery of high-quality, personalised education at scale and at a very low cost.

IASB simplifies FR for subsidiaries

The International Accounting Standards Board (IASB) has issued a new IFRS Accounting Standard for subsidiaries.

‘IFRS 19 Subsidiaries without Public Accountability: Disclosures’ permits eligible subsidiaries to use IFRS Accounting Standards with reduced disclosures.

IFRS 19 will resolve current challenges by:

• Enabling subsidiaries to keep only

one set of accounting records – to meet the needs of both their parent company and the users of their financial statements.

• Reducing disclosure requirements – IFRS 19 permits reduced disclosures better suited to the needs of the users of their financial statements.

Andreas Barckow, IASB Chair

(pictured), said: “IFRS 19 reduces costs in the financial reporting ecosystem, especially for companies, while meeting users’ information needs. It simplifies the reporting for subsidiaries by permitting the global financial reporting language to be applied throughout the group.”

FRC hands out multi-millionpound fines to PwC and EY

The Financial Reporting Council’s Executive Counsel has issued fines to PwC, EY and Oliver Clive & Co (OCC) over failures in the audits of London Capital & Finance plc (LCF).

PwC has agreed to pay £4.9m and EY £4.4m for their failures of the audit of the minibond firm. Both also received a severe reprimand. PwC audit engagement partner Jessica Miller was given a £105,000 fine. EY’s Neil Parker was fined £47,250. Meanwhile, OCC received a financial sanction of £42,000 along with a severe

reprimand.

In all, £9.5m in fines were dished out.

LCF went into administration just under a year after the 2017 audit report had been signed off (in February 2018). It was in that period that a significant proportion of the unpaid bonds were issued. While it is not asserted that any of the auditors would necessarily have detected the underlying issues with the company if the breaches had not occurred, all failed to provide the reasonable assurance that the financial statements taken as a whole were free from material misstatement, whether caused by fraud or error, which is the objective of any statutory audit.

The sanctions imposed take account of a

number of factors including the seriousness of the breaches and the financial strength of the auditor, as indicated by the turnover of the firm.

Jamie Symington, Deputy Executive Counsel, said in relation to all three audits: “In each of these three audits the auditors failed to identify and assess the risks of material misstatement through understanding LCF’s business. These breaches are made considerably more serious by the fact that all of the auditors knew they were auditing an expanding business which was engaged in selling unregulated financial products to retail investors, and that potential investors might place reliance on the clean audit opinions.”

10 PQ the PQ Magazine June 2024 news

Anna Kate Phelan is Head of Product at Eintech

ACCA ALP Genesis Origo

WŝĐŬ�,d&d ĨŽƌ���d�

�e h�ve � ��n�e o� live cou��e� �o� ��d�>ĞǀĞů�ϯ��nd >ĞǀĞů�ϰ�unde� YϮϬϮϮ, �o co��le�en� ou� on�de��nd o��ion� �� ��� �� �nd ��� ,d&d live� ��e��eco�ded ��ll��u� video� �h�� le�d in�o �cheduled live online in�e��c�ive ����e�cl���e� ��i�h e��e�� �u�o���� �ll de�i�ned �o �u��o�� �ou� ����e�in� o� �no�led�e –�cco���nied �i�h co��u�e� ���ed �e��� �nd �oc� e���� �o� �o�e in�o����ion vi�i� ����h�������ne��hi��co�u��cou��e������

dŚŝŶŬ����� �ƚŚŝŶŬ�,d&d

�e h�ve � �ull �ui�e o� ������ƉƉůŝĞĚ�^ŬŝůůƐ��nd ^ƚƌĂƚĞŐŝĐ�WƌŽĨĞƐƐŝŽŶĂů�cou��e�.

▪ �e��e��hi� o� ou� vi���n� KŶůŝŶĞ�>ĞĂƌŶŝŶŐ��ŽŵŵƵŶŝƚLJ �nd �cce�� �o � dedic��ed �u�o�

▪ ���� ����ne��hi� ��uden� no�e� �nd ���� �u�ho�i�ed ��ud� �e��� e��� �i� �nd �oc�e� no�e�

▪ �ull ��ll��u�� �o�ic �� �o�ic �eco�din�� �u��o��ed �� �i�e���led ‘live online’ dƵŝƚŝŽŶ ����e�cl��� �e��ion� –�eco�ded� do�nlo�d��le �nd �l����le on �ll device�

▪ Scheduled ‘live online’ ZĞǀŝƐŝŽŶ ����e�cl��� �e��ion� – �eco�ded� do�nlo�d��le �nd �l����le on �ll device�

▪ ���� co��u�e� ���ed �e��� �nd �oc� e����� ����ed� �i�h �n��e�� �nd video de��ie�� �o� �o�e in�o����ion vi�i� ����h�������ne��hi��co�u��cou��e���cc��

^ƚƵĚLJ��/D� �ĐŚŽŽƐĞ�,d&d

S�ud�in� ����� �u� ,d&d live� ,d&d on�de��nd �nd ,d&d �l�� �e�ou�ce� ��e �ll he�e �o hel� �ou ��e���e �o�� �nd ����� �ou� e����

,d&d live� �oin ou� e��e�� �u�o�� live online �o� in�e��c�ive ����e�cl���e�� de�i�ned �o �u��o�� �ou� ���lic��ion o� ��ll��u� �no�led�e�

,d&d on�de��nd� d�ive �ou� le��nin�� �i�h �ull �le�i�le �e�ou�ce� �h�� �ou con��ol

,d&d �l��� �o��e�� o� �o�ic �eco�din� �nd ��o�icienc� e�������le ���c�ice ���e���en�� �o� �o�e in�o����ion vi�i�� ����h�������ne��hi��co�u��cou��e��ci��

^ ^ƚƚƵĚLJ ǁ ǁŝƚƚŚ , ,dd&d d WĂƌƚƚŶĞƌƌƐŚŝƉ ǁ ǁŚLJ ǁŽƵůĚ LJŽƵ ŐŽ ĂŶLJǁŚĞƌĞ ĞůƐĞ tŚLJ ǁŽƵůĚ LJŽƵ ŐŽ ĂŶLJǁŚĞƌĞ ĞůƐĞ &Žƌ ƌ ŵŽƌƌĞ ŝŶĨĨŽƌŵŵĂƚŝŽŶ ĞŵŵĂŝů ŝŶĨĨŽΛŚƚĨƚƉĂƌƌƚŶĞƌƐŚŝƉ ĐŽ ƵŬ Ŭ ǁǁǁ ŚƚĨƚƉĂƌƚŶĞƌƐŚŝƉ ĐŽ ƵŬ KŶůŝŶĞ��ŽůůĞŐĞ�ŽĨ� ƚŚĞ�zĞĂƌ�ϮϬϭϳ WĞƌƐŽŶĂůŝƚLJ�ŽĨ� ƚŚĞ�zĞĂƌϮϬϭဒ WƌŝǀĂƚĞ�^ĞĐƚŽƌ��ŽůůĞŐĞ� ŽĨ�ƚŚĞ�zĞĂƌ�ϮϬϮϬ

EDDIE HERBERT Demand for carbon data on the rise

Sustainable investing is now mainstream, with investors evaluating companies not just on financial performance but also on environmental, social and governance (ESG) factors that can impact long-term profitability and risk. This shift has businesses scrambling to bolster their ESG credentials and reporting.

Of all ESG metrics, corporate carbon footprint data is under the most intense scrutiny from sustainable investors. As climate change’s economic threats become increasingly apparent, investors want to know which companies are meaningfully reducing greenhouse gas emissions and which are ill-prepared for a low-carbon future.

This has driven an increase in demand for reliable carbon footprints across all scopes of emissions. Investors need this data to construct ESG scores, comparison reports and climate risk analytics to inform capital allocation decisions. For accountants, guiding clients to measure and report their carbon footprint is key not just for environmental reasons, but also to maintain corporate valuations and appeal to investors.

Investment managers recognise that companies without a handle on their carbon accounting face higher regulatory, physical and transition risks that can reduce shareholder value.

As sustainable investing momentum accelerates, accurate carbon accounting is quickly becoming a necessity for corporations to attract capital, meet stakeholder demands for transparency and demonstrate preparedness for the net zero economy. Those who fail to prioritise credible emissions reporting and reductions may find themselves shut out of certain investment portfolios entirely.

Edward Herbert, Sales & Business Development Manager, Net Zero Now

IRIS updates

IRIS has unveiled a series of product updates for IRIS Elements, its cloud accountancy platform. IRIS has over 24,000 accountancy customers, of which some 6,000 are now using Elements to run their practice.

The new updates mean customers will be able to produce accounts for LLPs and leverage interconnected data through APIs. As part of the tax updates customers will now be able to communicate as an agent directly with HMRC and

Sage launches Sage for Accountants

Sage has launched two new suites in the UK and Canada which it hopes will transform how small businesses and accountancy practices operate and grow.

Sage for Accountants and Sage for Small Business brings together Sage’s accounting, HR and business management tools into two solutions.

There are three membership plans available – Essentials, Standard and Premium – all of which can be scaled to match users’ needs.

As part of the launch UK customers will be the first to get their hands on Sage Copilot, a new, generative AI powered

productivity assistant. Integrated within Sage for Small Business and Sage for Accountants, Sage Copilot is designed to transform operations by automating routine

administrative tasks and offering real-time business insights.

At a launch event at the Shard in London, Sage CEO Steve Hare (pictured) said he felt the industry is at a game-changing moment. He said Sage Copilot was going to have a profound impact on the profession. However, he stressed there are still questions around trust, and he does not want to play that down.

Hare said that Sage Copilot has to be accurate – 100% accurate – and that is why it has been restricted. So, when it goes out on the internet it doesn’t search everywhere; it will, for example, go to official government sites for tax tables.

AI teething issues still there

There are still some teething issues with the successful industrywide rollout of artificial intelligence, according to new research from Dext.

In its latest report, ‘AI and The Future of Accounting’, Dext says this is due to a lack of confidence and clarity to understand whether AI is a threat or an opportunity.

The report said the debate about whether AI is here to take our jobs is going to rumble on for some time. However, it said a

more pertinent concern is around AI’s use of data.

The authors of the report also

Drones – a power for good!

One announcement in the Spring Budget that might have gone under the radar was the Government’s investment in drones for the emergency services.

However, PwC stressed an equal focus should be given to integrating drone data with existing systems.

PwC’s head of drones (yes, there

avert compliance penalties with better visibility of deadlines.

From this summer a new Time and Expenses capacity will be added.

Mindscape platform launched

Deloitte and ParalympicsGB have launched a new digital experience ahead of Paris 2024. The Mindscape platform allows users to get into the mind of a real Paralympian. You can choose your avatar and complete tasks, all while learning about the

really is one), Craig Roberts, said: “It is encouraging to see that the government is investing in drones for incident response in the emergency services. The unique perspective offered by drones can assist decision making at critical incidents, increase the speed of deployment, reduce costs and enhance data

challenges around accessibility and the lived experience of disabled people.

Deloitte’s Mark Lillie said: “Technology can have a huge impact on the way people engage with sport, whether spectating or playing.”

NCSC has new boss

The National Cyber Security Centre (NCSC) has announced Richard Horne as its new CEO. Horne, who will join the NCSC in the autumn, will also become a board

said: “Excel was met with resistance when it was first introduced. And it has been a similar story for cloud accounting in more recent years.”

Interestingly, it is suggested that the more junior members of accountancy firms have more time on their hands. And the type of work they do (the more mundane) means they are often best placed to spot efficiency savings. For the full report go to https://tinyurl.com/2h7adyre

collection and quality.

“However, it is important to note that these benefits will not be fully realised simply by buying drones, training pilots and putting governance in place. To unleash the power of drones, the government should give equal focus to ensuring that drone captured data is effectively processed, centrally stored and fully integrated.”

member of GCHQ.

In a press release, the NCSC said he will lead the UK’s national technical authority for cyber security as it continues in its mission to make the UK the safest place to live and work online.

Horne joins the NCSC from PwC UK; prior to joining the Big 4 firm he was managing director of Cyber Security for Barclays PLC. He was seconded from Barclays to the Cabinet Office in 2011 to help shape and drive the Government’s first Cyber Security Strategy.

12 PQ the PQ Magazine June 2024

Tech briefs tech news

Founded by AICPA® and CIMA®, the Association of International Certified Professional Accountants® powers leaders in accounting and finance around the globe. © 2023 Association of International Certified Professional Accountants. All rights reserved. 2307-444079 Get future-ready skills the flexibly with the CGMA Finance Leadership Program (CGMA FLP). A digital-first learning and assessment platform, the CGMA FLP lets you progress at your pace, reduces formal exams and helps you qualify for new global job opportunities upon completion. Master new skills and uncover opportunities with the CGMA® Finance Leadership Program. VISIONARIES VISIONARIES BOARDROOM WANTED Find out more at aicpa-cima.com/flp.

In love with audit

I read your lead story ‘Audit at the crossroads’ (PQ magazine, May 2024) with interest, as I wanted to be an auditor after I graduated.

However, I am sure this is not the first time you have suggested no one wants to be an auditor, or highlighted the fact that auditing was not a proper career choice! Why does everyone have it in for audit?

Like many before me I trained with a firm that put almost all of its trainees in the audit department. After three years of training most, like myself, knew that audit was not where they wanted to be and moved on. However, I am still friends

with many accountants who stayed in audit and who have really enjoyed their work. In fact, they have found auditing to be a really meaningful career.

But what they do tell me is that regulation and standards just keep growing, which puts pressure on them and is making auditing more and more a tickbox process.

I think the current problems with auditing are more about accounting as a whole. New recruits are forced to work long hours by partners who did the same, so seem reluctant to change. But change it must, and technology should help here.

And there’s an easy way to address retention and attraction problems – pay audit trainees more! A well-paid auditor who can achieve a good work-life balance will be a happy auditor.

Name and email address supplied

Our star letter writer wins a fantastic ‘I love PQ’ mug!

Post Office shame

I see the Justice Secretary Alex Chalk has now confirmed that the UK government has set aside £1 billion of compensation to pay out to the victims of the Post Office scandal. They have also said they will pursue Fujitsu, who developed the Horizon software, if they are found to be at fault. But we need to keep up the pressure for this to happen. I really enjoyed your YouTube video by Lord Sikka on the role of accountants in the scandal. Like many I would support his call for a new inquiry looking specifically at their role in it all. Isn’t this a job for the Financial Reporting Council? It seems to have been very quiet through all of this.

Name and address supplied.

The Editor says: Lord Sikka’s take on the scandal now has some 12,000 views. You can check out his arguments for a new inquiry at: https://youtu.be/jkCWvJt0l6A We really like what one viewer said: “I can understand that many mistakes were made by Post Office Ltd and by Fujitsu. I can understand that the people responsible for these mistakes sought to conceal them by lies and obfuscation, so as to protect

themselves. What I will never understand is why they thought they should continue their deceitful ways when it became apparent that innocent subpostmasters were being caused immense harm by these lies and deceptions. This total lack of humanity and morals, coupled with personal greed, is heinous. I have

watched some of the Post Office Inquiry interview sessions. I am appalled that many of the people responsible for this scandal are still not telling the truth. It is obvious that many of their responses are untrue and in many cases simply ‘ridiculous’. Their sworn oath to tell the truth means nothing to most of these people.”

We recently held the PQ magazine’s 21st awards ceremony at Lio London. Of course at any awards ceremony there will be winners – but there are going to be a lot more losers! Libby Walklett didn’t win Personality of the Year (and she is a big personality), but she posted: “You could say I didn’t win last night, but I definitely felt like a winner.” She continued: “I instigated a huge ‘cuddleoff’, culminating in me literally chasing Graham Hambly round the venue when he refused to give me a cuddle after being missed off my top 15 cuddle list.” In the end she caught Sage’s Jason Haddon (pictured).

However, one winner was PQ of the Year Grazia Maria Pia Salcuni. She told LinkedIn: “Being shortlisted as PQ of the Year was already a big achievement and made me very happy about it. All the other finalists were all incredible people, so I didn’t expect anything more. At the end of the night, the last winner announced was PQ of the Year, when the name was announced I actually asked those at my table if it was me and yes, I was the one! I still have no words to describe how wonderful it was, I still don’t believe, but that’s my name on that award! A huge thanks to my family, because no matter the distance (1,320 miles, to be specific) you’re always with me. Grazie famiglia!”

Until next year!

PQ Magazine PO Box 75983, London E11 9GS | Phone: 07765 386489 | Email: graham@pqmagazine.com Website: www.pqmagazine.com | Editor/publisher: Graham Hambly graham@pqmagazine.com | Associate editor: Adam Riches | Art editor: Tim Parker

Nelson, Anna Kate Phelan, Tony Kelly, Phil Gammon, Edward Netherton, Francesca Cullaney | Subscriptions: subscriptions@pqmagazine.com | Origination services by Classified Central Media

you have any problems with delivery, or if you want to change your delivery address, please email admin@pqmagazine.com Published by PQ Publishing Ltd © PQ Publishing 2024

Contributors: Robert Bruce, Prem Sikka, Lisa

If

email graham@pqmagazine.com

Developed with accountants in mind. Visit getrogo.com for your free trial Accurate replications of questions from ACCA, AAT, CIMA, ICAEW & ICB. Discover fully-functioning spreadsheet features for your accountancy training. Discover Rogo.

Oh what a night!

So who walked away with one of our coveted PQ magazine trophies? All is revealed...

Lio London was rocking for the 21st PQ magazine awards. Jean-Paul NoelCephise, our singing accountant, was back and this time he was singing Motown! Margo and Envy were also on hand to ensure the dancing never stopped!

So, who walked off with this year’s PQ trophies? PQ of the Year was Grazia Maria Pia Salcuni, an ACCA student who works at Aspen Insurance Group. NQ of the Year went to Bethany Duffy of Grant Thornton. She was our PQ of the Year in 2020, and since then has finished both her AAT and ICAEW qualifications.

The Student Body of the Year winner was the Chartered Accountant Students' Society of London (CASSL), for the second year in a row.

The much-coveted Private Sector College of the Year award went to Kaplan, who ensure “the success of every learner is at the heart

of our business”. The Kaplan Learn Better podcast also won on the night.

Newcastle University Business School are now Public Sector College of the Year, and FME Learn Online the Online College of the Year.

Premier Training were at it again, and they landed the Study Resource of the Year for their ‘Every1counts’ series.

Accountancy Body of the Year went to the ACCA, who have introduced a student hub, a pre-seen case study and are even trying to tackle the problem with the optional pass rates through its useful tips podcast.

Personality of the Year was CIMA President Sarah Ghosh, who helped to get the dancing going with some slick moves!

The Editor’s awards on the night went to the AAT, Will Boardman and the Creative accounting project. The Lifetime Achievement award went to the wonderful Paul Sizer.

STUDENT BODY OF THE YEAR: Chartered Accountant Students’ Society of London (CASSL)

ACCOUNTANCY BODY OF THE YEAR: ACCA

PRIVATE SECTOR COLLEGE OF THE YEAR: Kaplan

PUBLIC SECTOR COLLEGE OF THE YEAR: Newcastle University Business School ONLINE COLLEGE OF THE YEAR: FME Learn Online

PRIVATE SECTOR LECTURER OF THE YEAR: Ahmed Shafi

PUBLIC SECTOR LECTURER OF THE YEAR: Lim Keong Teoh, University of Winchester STUDY RESOURCE OF THE YEAR: Premier Training

INNOVATION IN ACCOUNTANCY: Icarus accounting simulation App, UCL & Lynsie Chew

BEST USE OF SOCIAL MEDIA: Bee Motion PODCAST OF THE YEAR: Kaplan’s Learn Better Podcast

TRAINING MANAGER/MENTOR OF THE YEAR: Zeeshan Ahmed

ACCOUNTANCY TEAM OF THE YEAR: The Financial Systems Team at Christie NHS Foundation Trust

GRADUATE/APPRENTICE TRAINING PROGRAMME OF THE YEAR: Buzzacott LLP

ACCOUNTANCY PERSONALITY OF THE YEAR: Sarah Ghosh

EDITOR’S SPECIAL AWARD: Creative Accounting, a collaboration between QMUL, Coventry University & Monash University; Will Boardman’s YouTube channel; AAT advisory group initiative

ACCOUNTANCY APPRENTICE OF THE YEAR: Diana Hume

DISTANCE LEARNING STUDENT OF THE YEAR: Katie Robinson

ACCOUNTANCY GRADUATE OF THE YEAR: Tim Mickleburgh

NQ OF THE YEAR: Bethany Duffy

PQ OF THE YEAR: Grazia Maria Pia Salcuni

PQ 17 PQ Awards 2024 PQ Magazine June 2024

PQ 18 PQ Awards 2024 PQ Magazine June 2024

OF THE YEAR

STUDENT BODY

Chartered Accountant Students’ Society of London (CASSL)

Lio London was the venue for the PQ awards 2024

ACCOUNTANCY BODY OF THE YEAR ACCA PRIVATE SECTOR COLLEGE OF THE YEAR Kaplan PUBLIC SECTOR COLLEGE OF THE YEAR Newcastle University Business School ONLINE COLLEGE OF THE YEAR FME Learn Online PRIVATE SECTOR LECTURER OF THE YEAR Ahmed

PUBLIC SECTOR LECTURER OF THE YEAR

STUDY RESOURCE OF THE YEAR Premier Training INNOVATION IN ACCOUNTANCY Icarus accounting simulation App, UCL

NQ OF THE YEAR Bethany Duffy

Shafi

Lim Keong Teoh, University of Winchester

& Lynsie Chew

PQ 19 PQ Awards 2024 PQ Magazine June 2024 ACCOUNTANCY TEAM OF THE YEAR The Financial Systems Team at Christie NHS Foundation Trust BEST USE OF SOCIAL MEDIA Bee Motion GRADUATE/APPRENTICE TRAINING PROGRAMME OF THE YEAR Buzzacott LLP PODCAST OF THE YEAR Kaplan’s Learn Better Podcast ACCOUNTANCY PERSONALITY OF THE YEAR

TRAINING MANAGER/MENTOR OF THE YEAR

Sarah Ghosh

Ahmed ACCOUNTANCY APPRENTICE OF THE YEAR Diana Hume ACCOUNTANCY GRADUATE OF THE YEAR Tim Mickleburgh PQ OF THE YEAR

Zeeshan

EDITOR’S SPECIAL AWARD Creative Accounting, a collaboration between QMUL, Coventry University & Monash University EDITOR’S SPECIAL AWARD Will Boardman’s YouTube channel EDITOR’S SPECIAL AWARD AAT advisory group initiative

Grazia Maria Pia Salcuni

Meet the leading players

Lights, camera, action! Sunil Bhandari directs you as you learn the script that will get you a pass in the Advanced Financial Management exam

You probably thinking that I am about to write about a film or a play. Not quite (though after my recent trip to India, I would love to be a Bollywood actor!).

What I want to emphasise in this article is that for those studying or planning to study ACCA AFM, keep in mind the topics and skills that repeat over and over again. They are very important, and this is why I call them the leading actors in ACCA AFM.

So, who are these leading actors?

Net present value (NPV)

All ACCA students (as well as those who are qualified) will be familiar with NPV. It is a major part of ACCA FM and is tested in every exam in that paper. It is only natural that this continues in AFM. However, there are wider issues to accrue for in my exam.

AFM students will still be expected to ascertain the NPV for domestic projects as they did in FM. However, AFM candidates also have to be comfortable with foreign projects (FX NPV). In addition, the adjusted present value (APV) is a version of NPV when projects are predominantly or exclusively financed using debt.

When talking about NPV within ACCA AFM

it is not only about project appraisal. It’s also about the extensive use of the spreadsheet ‘NPV function’. This replaces the need to compute the discount factors. It allows students to jump from ascertaining the project cash flows to the final NPV.

But the spreadsheet NPV function is used in different parts of ACCA AFM.

Bond valuation is regularly tested in ACCA AFM, especially as part of questions on cost of capital. The NPV function takes the future cash flows received by the bond holder and using the yield to maturity (YTM) as the discount rate produces the bond value. This again eliminates the need to use discount factors.

Finally, the NPV function is also used in business valuations. The entity value is present value of future free cash flows to the company discounted at the current weighted average cost of capital (WACC). Alternatively, the equity value is the present value the future free cash flows to equity discounted using the cost of equity (Ke). In both these cases, the NPV function comes into play here to save lots of time.

Free cash flows

Talking about free cash flows, here we have

another leading actor in AFM.

As mentioned above, there are two types of free cash flows. Free cash flows to the company (FCFCo) and free cash flows to equity (FCFe). These appear in several parts of the AFM syllabus. When talking about NPV above, the cash flows used to ascertain the NPV of a project are the future FCFCo. Also, as stated, one of the business valuation methods uses future FCFCo.

The FCFe also appears twice within ACCA AFM. Firstly, as a part of dividend policy. The FCFe is the dividend capacity value for a particular year. This is the maximum dividend that can be paid by the company.

The FCFe, along with the cost of equity, are used to find the value of the equity as part of business valuations.

Internal rate of return (IRR)

The IRR is defined as the discount rate that leads to an NPV of nil. In FM, it is part of investment appraisal as an alternative project appraisal method. The same applies in AFM.

In both FM and AFM there is a spreadsheet ‘IRR function’ that can compute the IRR for a string of future cash flows. However, in FM this can only be used for the Section C questions. Also, the old interpolation method still appears there. This is not the case in AFM, the IRR function is dominant.

The IRR function is also used within the section on bond finance. If given the bond price and the future bond cash flows, the IRR function can be used to find the yield to maturity (YTM) of the bond. This YTM can then be converted into the cost of debt by simply multiplying the YTM by (1 – tax rate).

Finally, in AFM the IRR has a variant that counteracts the weaknesses of the standard IRR. This is the modified IRR. And guess what, in AFM we have a ‘MIRR function’ to make things easier once again for the students.

Conclusion

So, for those studying ACCA AFM or planning to, you are now aware of the key players, the leading actors that appear in many parts of this film. I am not saying the other actors like risk management are not important. Far from that. But the lead actors have more words to say in the ACCA AFM film.

• Sunil Bhandari, ACCA AFM Tutor at FME Learn Online

20 PQ PQ Magazine June 2024 ACCA AFM exam

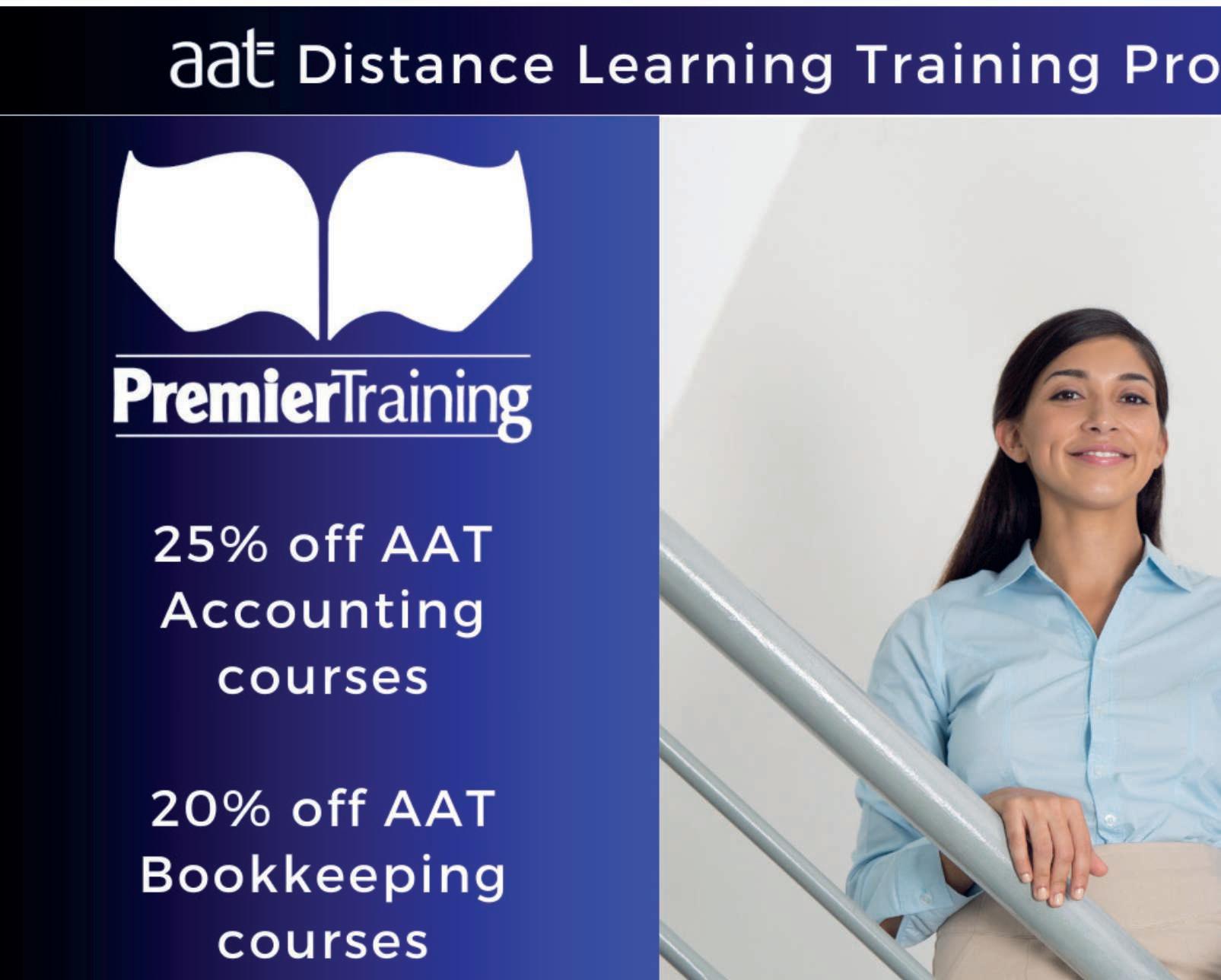

To celebrate, we are offering 25% off AAT Accounting courses and 20% off AAT Bookkeeping courses throughout May.

We offer interest-free instalment plans for all courses, as well as FREE Xero accounting software training and certication.

Please contact us on 01469 515444 or info@premiertraining.co.uk with any questions you may have.

You can also enrol online at: www.premiertraining.co.uk

Get Started Today

Start your studies the same day24 hour online access with instant access to tutor support.

Learning Resources

Award winning learning resources including printed books, eBooks & e-learning, videos and quizzes.

Assignments

Prompt marking turnaround –marked by a tutor (not a computer).

Xero Advisor Certication

Premier Training has teamed up with Xero and is pleased to offer the Xero Advisor Certication Equivalency Course FREE OF CHARGE to anyone who enrols. We are the AAT Distance Learning Training Provider of the Year! www.premiertraining.co.uk 01469 515444 Training Provider Winner Distance Learning Provider of the Year AWARDS 2024 Study Resource of the Year

Advance your career with an award-winning course or apprenticeship Flexible, inspiring and engaging. Mindful Education courses are expertly designed to bring learning to life and achieve outstanding results. Discover more mindful-education.co.uk/learners

Lessons from Wirecard’s demise

Paul Merison looks at how you can use the lessons from the business world and use them to your advantage in your exams

The COO was in fact a Russian spy who used the company to fund covert operations.

Allegedly.

If only the spy story was relevant to your exams! Unfortunately it isn’t, but obviously it is interesting so that is the bit the media highlights. That is your problem as a student, reading the business news. Everyone tells you it is a must to see the real-world application of what you are learning, but the news stories are not written for accounting students.

So let me rewrite Wirecard for students… Wirecard, a top listed German company that collapsed in 2020, admitted that $2bn of cash in bank accounts was not there. Stolen? Or perhaps it never existed? We may never know. The ex-CEO is being prosecuted and the COO… see above.

EY, the auditors of Wirecard, received a fine and a ban from taking on new audit clients in Germany, and perhaps more importantly suffered reputational damage due to their perceived failure to check something as basic as cash at the bank. Wirecard creditors and shareholders who lost everything are suing EY for billions. Let’s learn from this:

1. Directors who cheat go to great lengths to avoid discovery

I feel slightly sorry for EY. Yes, they failed to check balances directly with the banks, but when they tried to actually visit the overseas banks themselves they were heavily controlled by Wirecard management and the bank visits seem to have been ‘staged’, with staff paid off in advance to supply false information. Once Covid hit and actual bank visits were impossible, a video call was held where allegedly a fake bank branch with actors was used.

2. Self-review threat

If auditors fail to spot a big problem in year 1, they have a big incentive not to spot it in year 2 or year 3 – as that would suggest they failed in year 1. We will never know how early EY suspected foul play, but the penalties against EY tell their own story.

3. When it seems too good to be true… Wirecard grew massively and quickly and seemed very successful. It wasn’t real. The lack of scepticism (professional marks!) shown by auditors, regulators, seasoned investors, etc., is extraordinary, and can only be put down to greed and a fear of missing out on backing what most thought to be a winner.

4. Corporate governance matters

Good governance is no guarantee of success, but weak governance often fuels disaster. Dominant executives who ignore controls and surround themselves with supporters so as to evade being challenged – it is never a good sign. That was Wirecard, with a Chairman and other NEDs who were allies of the CEO. So much

for independence.

The worrying thing is that German corporate governance regulations allowed all this to happen, as the rules were far behind that of other countries such as the UK. Germany has now tightened things up, which is nice, if a little late.

5. Auditors must not let directors influence their audit work

EY were taken to the actual bank by Wirecard management and escorted during meetings to confirm balances. Even worse, when testing control systems EY allowed Wirecard to select samples for them to test, and even allowed Wirecard to supply payment cards to allow them to act as fake customers (audit students… test data!). But this meant Wirecard could ensure those payments showed up where they wanted them to show up, making fake sales to fake customers appear real.

6. Companies with multiple ethical question marks are best avoided Wirecard did payments processing for gambling and porn sites. Many other companies did not want to touch these industries. But Wirecard also miscoded their

sales to hide the gambling and porn from regulators in countries where such sites were illegal.

To top it off, anyone who criticised Wirecard suffered online and physical intimidation or had their reputations attacked.

Red flags galore.

7. Companies who use shortcuts to avoid regulatory processes do so for a reason Wirecard got listed status by ‘reversing’ into an existing listed company. They also got banking accreditation by buying a small existing bank. One has to question why they preferred shortcuts over proper regulatory applications.

The Wirecard story has so many angles it is impossible to do it full justice in this article. Students wanting to learn from this and other real-world business stories should get hold of my ‘Exam World Meets Business World’ podcast (PQ Awards Finalist 2024), freely available from Spotify, Apple podcasts and others.

• Paul Merison is the director of Professional School at London School of Business and Finance (LSBF)

PQ 23 PQ Magazine June 2024 the business world

Forging your own path

Nasheen Wuisman explains how a bit of self-analysis can go a long way in helping you achieve your goals

Your career is your call! You dream it and will achieve it – but how will you get there? It takes years to qualify, so there will be many life changes and challenges in this time. No two candidates have an identical journey to gaining their CGMA designations. Your unique path will be paved with your own unique circumstances, strengths and weaknesses.

Self-awareness of your learning, working and home environment, and how these fit in with your personal goals, is a great starting point to make sure you use what you are good at to seize every opportunity you wish to make the most of.

Your CGMA qualification features a situational analysis tool, used for strategic planning within an organisation. Here, you can use the SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis to take control of your study journey and further your personal growth.

Let’s SWOT analyse

Get a piece of paper and write down the four headings. Under each heading, think carefully about how they relate to you and your circumstances. Here are a few possible examples:

Strengths

• I have a supportive family and/ or study buddies at work

• I rarely have to work overtime

• I get time off work for exams and/or study

• I am interested in the subject material

Weaknesses

• My typing speed in slow

• I struggle with calculations

• I get overwhelmed easily and

this leads me to procrastinate

Opportunities

• I can further my career with the many varied options the CGMA qualification will give me

• I could use online study options so that I can study while I am away from home

• I could try to set up/join a study buddy network on Facebook or WhatsApp

• I can access lots of free resources in the CGMA Study Hub

Threats

• I am starting a new project/job and don’t know how study will fit in

• If I take up exemptions from previous study, I may have knowledge gaps

• I’ve never been great at written exams, so I worry about the Case Study

What now?

Firstly, take a moment to absorb the insights from your analysis. Make sure it is complete and honest, so that you can use it successfully to

guide your studies and, so you are working in a way that is best suited to you.

Leverage your strengths. Your personal characteristics have got you this far. Consider how you can use them to maximum advantage? For instance, if you are a selfstarter then proactively draw up a study plan. Use this strength to self-motivate, and to keep moving forward. These strengths are going to help you reach your goal. Focus on your weaknesses and what you have learnt from them. This will allow you to adapt as you get further into your learning journey. Everyone has areas they struggle with and where they could improve. Gaining awareness of these weaknesses is the first step. After that, work on them, devote a bit of time to them, allow time for practice and absorption. If you are a slow typer, then use a free online tool which helps you to get that little bit faster – some weaknesses will always remain, but you are in control of trying to turn some of these around, they won’t stop you from achieving your goals, Seize opportunities that you need

for your personal improvement and growth. Look at your ‘opportunity list’ – every statement beginning with “I could…” turn into “I will…”. Developing a mindset of determination to achieve gives your CGMA studies the best possible chance of success. These are the things which will give you the edge. You don’t want to look back in a few months and think “I wish I had done those things when I had the chance”. If your circumstances allow it – take it!

Manage threats to stop them derailing your progress. Mitigating these is not realistic so don’t even try. Minimising the impact they have on your journey is the aim. Can your employer help you address any of your concerns? Should you be looking at taking up online courses to plug knowledge gaps? It is better to be prepared for these things than to simply hope everything will turn out OK. Be in control, take the action you need, reach out to us at CIMA for help –that is what we are here for.

Treat your SWOT analysis as a live document rather than a oneoff exercise. Be reflective and come back to it once a month and see what weaknesses you have addressed, what steps you have started to take to address the threats and which opportunities you have reached out to. You will find that you have developed some new strengths as well! We grow and develop all the time. Be self-aware, take control of your learning journey, revel in your progress and keep that goal in mind – always!

• Nasheen Wuisman, Senior Manager of Global Academic Progression at AICPA & CIMA, together as the Association of International Certified Professional Accountants

24 PQ PQ Magazine June 2024 CIMA spotlight

Master new skills and uncover opportunities with the CGMA® Finance Leadership Program. VISIONARIES VISIONARIES BOARDROOM WANTED

I have failed my exam – what next?

Karen Groves explains how to approach a re-sit exam to ensure success

Taking exams is never easy; life has a bad habit of getting in the way when we least need it to and throwing curveballs at us. That is on top of long working hours and children and family commitments before we start.

So you have taken an exam and failed, and wonder what to do next. Some students I have taught over the years immediately re-book their exams as quickly as possible, while for others it can throw them offtrack and make them question whether to continue.

My advice is simple: do not be defeated, pick yourself up, dust off your study books and start revising again – and have confidence that you can do this!

How do I know, I hear you ask? Well, after taking one of my ACCA exams five times (yes, I know, it was for me the worst unit ever), having a two-year ‘sulk’ after the first attempt as I hated it that much, I then had to pick myself up and start again. Believe me, the two-year gap made it worse. As my Dad recently said after I finally passed my ACCA exams and received my certificate, “there’s lots of hard work in that piece of paper but even more sheer stubbornness and a refusal to give in”. I think that pretty much sums it up. I often say to students, you must ‘want’ to achieve and pass the exams. If your heart is not in it then you will not do well. I also say to my students ‘try and

Get Started Today

Start your studies the same day - 24 hour online access with instant access to tutor support.

fail, but don’t fail to try’ (a quote by John Quincy Adams).

For this article I have based my approach on AAT exams. As a student, you will have different study resources depending on your method of study and training provider; however, you all have one thing in common in that you all have access to the AAT Lifelong Learning portal. For students studying ACCA, CIMA and ICAEW you will have comparable study resources available and should adopt a similar approach.

Over my many years of teaching, I have witnessed some students not even working through the AAT practice assessments prior to taking their exam. I view this as pretty much the same as taking a driving test with no lessons –how on earth do you know what to expect, the format and layout? You can practise as much as you like with other resources that will all be great, but until you work the AAT practice assessments you do not know what to expect in the actual exam, layout wise.

Another error students make is clicking on ‘submit’ once they have finished the AAT practice assessments. For the current Q2022 syllabus, you will then receive marks per task for the computer marked tasks, but the system will not mark the written tasks. So, you have a purely computer marked assessment and have achieved 80% overall, which is good news – but what about the remaining 20% (marks lost)? Well, unless you check your answers BEFORE you click submit, or screenshot your answers and check afterwards, you will never know.

For the written tasks that are human marked you will need to check these yourself against the model answers provided. Personally, I like to know where I have gone wrong so I can make notes and go back over revision and I’m sure you do too.

The AAT practice assessments will also ensure you are ready for the exam from a time management point of view. Each exam is timed and while working on other revision papers and questions is important, you are not timing yourself here. The practice assessments are important as they gives you a feel of what the exam will be like, as it will time you the same as in the real exam.

My other advice would be to read the Examiners’ reports carefully. Where are other students making mistakes, what are the weak areas in a unit? Go back over these to ensure you are confident.

Finally, don’t forget to use the other AAT resources, including the green light tests and e-learning.

• Karen Groves is an AAT tutor and Faculty Director – Accounting, at e-Careers

Resources Award winning learning resources including printed books, eBooks & e-learning, videos and quizzes.

PQ 25 PQ Magazine June 2024 AAT exam advice

Karen Groves picks up her Tutor of the Year award at the recent AAT Training Providers’ Awards night

Learning

www.premiertraining.co.uk

How to pass SBL (part 1)

Top tutor Chris Cain explains what the examiner is looking for when it comes to assessing the severity and probability of risk events

The ACCA publish a syllabus and study guide from SEPTEMBER 202X TO JUNE 202Y each year and gives all the potential examination Tasks including the changes and clarity made to the detailed study guide each year.