5 minute read

Analysis with Regina Meani

— ANALYSIS —

WITH REGINA MEANI

THERE IS NO question that 2021 was a challenging year, but it did provide some opportunities within our mining community. Reflecting on past columns from 2021, we would like to highlight some stocks and commodities to keep in our sights and to build on for 2022.

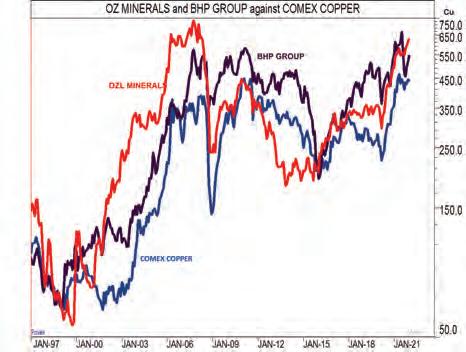

Our copper report from the August 2021 issue underlined that the metal had long been perceived as the bellwether for individual countries and for the wider global economy.

In the July/August period and further into 2021 we suggested that the price was experiencing a similar style corrective phase to 2004-2005.

As we enter 2022 the price has been preparing for another test of its previous limits in the $US4.50-$US4.70/pound area, with a push through triggering a more substantial rise for the metal. In the same article, we analysed OZ

Building on 2021

Minerals trading at $21.60 and BHP when it was at $49.48.

OZ Minerals (ASX: OZL) is Australia’s third largest copper producer operating globally, with headquarters in South Australia. The share price for OZL closely mimics copper’s performance and in the July/August period it too was experiencing a corrective phase.

In December, OZL’s share price showed the potential to test its $30-40 peak zone from 2007-2008.

Momentum is becoming squeezed and suggests that while the price may approach and push into $30 and beyond, a sustainable breakthrough may be delayed by price volatility.

Looking at BHP (ASX: BHP), Australia’s largest copper producer, we find that in the months since our copper analysis in August, the company’s share price had suffered somewhat.

Iron ore prices declined during the period and the oil price sold off in November. As we move into 2022, we find that both commodities have turned and rallied throughout December with BHP in tandem.

In mid-August 2021, BHP’s price broke down from its early-2021 highs when the price fell below $45, triggering a deeper corrective phase.

From late September into midNovember, the stock experienced multiple turning points above $35 before a push in December boosted the price above $40.

In a similar fashion to OZL, BHP’s price is heading into its $45-55 barrier zone and may need to pause and consolidate its position before a maintainable rise through the area can be supported.

Once clear of the barrier zone, longerterm objectives will come into play towards $65 and potentially $85.

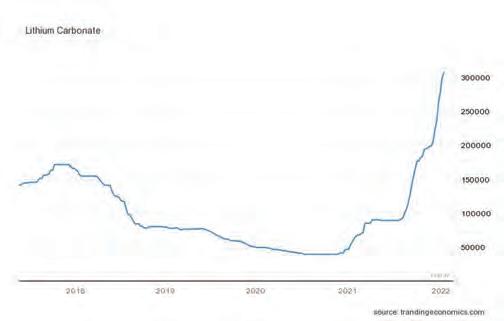

At the time of our lithium report in the October 2021 issue, the commodity was trading at about 92,500 yuan ($20,330) per tonne. In January 2022, the price breached 300,000 yuan per tonne, more than doubling in a few short months.

Lithium hydroxide is increasingly used in batteries for electrical vehicles and mobile phones and is used in breathing gas purification systems. Lithium hydroxide is produced from a chemical reaction between lithium carbonate and calcium hydroxide.

The largest lithium producers are Australia, Chile, Argentina and China, while the biggest lithium importers are China, Japan, South Korea and the United States.

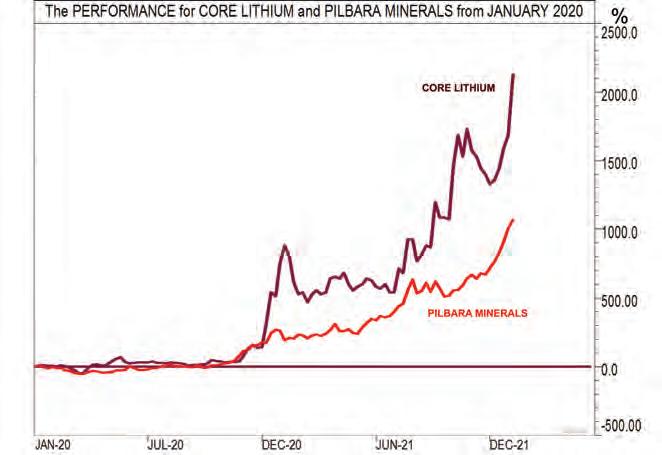

In that article we presented three Australian lithium miners and since then they have all experienced significant gains.

When we looked at Core Lithium (ASX: CXO) in September, it was trading at $0.33. From there, the price raced towards resistance in the $0.50-0.60 area before being rebuffed in October and November, with the price pulling back to around $0.50 in December.

In early January the price made another attempt to forge through resistance, stalling briefly to consolidate before producing a surge above $0.70 towards the next objective around $1.00 where another pause action maybe required ahead of objectives in the $1.00-2.00 range.

The short-term risk would be a drop through the $0.65 support, but this will rise along with the lithium price, so a trailing stop loss is in order.

With the world’s largest independent hard-rock lithium operation, Pilbara Minerals’ (ASX: PLS) share price was $2.09 in September before it reached towards resistance around $2.50 to be deflected back to support just above $1.80.

The price bounced and then forged through the resistance to meet its $3 objective in late December 2021. When an objective is reached it is always advantageous to take part or full profits depending on the indications at the time.

The price showed the potential to move beyond the $3 objective and rallied higher, but the near-term momentum then became stretched and a pause/pullback was due as the price swept towards the $4 objective.

Current support levels are located at $3.50 and then in the $2.90-3.10 range. Beyond this, the stock maintains the potential to push through $4 and towards $6 and possibly higher.

Another lithium stock of interest is Lithium Power International (ASX: LPI). The company is a lithium “pureplay” with a 51 per cent interest in the highest quality pre-production lithium brine project in South America, the Maricunga project located in northern Chile’s “lithium triangle”.

In mid-January, the price tested resistance around the company’s previous peak of $0.67 reached in 2017. The price has been moving along a strong upward path, interspersed with periods of consolidation.

As the price pushes through its previous peak a pause action may fall as it reaches towards $0.75. Further out, the stock has the potential towards $0.90-1.00 and possibly $1.50. Support at the time of writing lies in the previous peak zone in the $0.60-0.67 range.

It must also be noted that on January 12, LPI announced the demerger of its Western Australia hard rock lithium assets, enabling the company to focus its resources on developing Maricunga.

Through its wholly owned subsidiary, Lithium Power WA Holdings (DemergeCo), LPI has several prospective tenements in WA, with three tenements immediately along strike from the Greenbushes mine and three tenements in the Pilbara region of WA.

LPI recognise that its WA assets deserve a dedicated team to help advance the tenements towards production. The company will conduct a capital reduction and in-specie distribution to LPI shareholders as the WA assets are spun out to DemergeCo. DemergeCo will then apply for admission on the ASX.