5 minute read

Victoria turns the sands of time

The Victorian mineral sands industry holds the potential to satisfy a growing market on a global stage. How will the state make the most of this opportunity?

Victoria may be historically known as a gold mining state, but it is the mineral sands sector that could shape its future.

Australia’s mineral sands endowment includes an estimated 274 million tonnes (Mt) of ilmenite, 79Mt of zircon and 35Mt of rutile.

Of these resources, Victoria holds 23 per cent of the country’s ilmenite, 42 per cent of its zircon and 55 per cent of its rutile – ranking second, first and first, respectively, among Australian states.

Once processed, the minerals are widely used in products such as paint, paper, plastics, ceramics and welding materials, plus a range of clean energy technologies.

Reasons both environmental and economic are what motivate companies like Iluka Resources and Astron Corporation to develop their respective resources in western Victoria.

Iluka owns the WIM100 zircon and rare earth minerals deposit in the Wimmera region, 300 kilometres west of Melbourne, and has operated in the state for almost 20 years.

The company also owns several similar WIM-style tenements nearby – known for their fine grain characteristics – but industry has been stalled by the difficulty in processing such resources.

As the zircon within some of western Victoria’s mineral sands deposits contains impurities – including the 200Mt WIM100 deposit – companies like Iluka are faced with a significant technological challenge.

Iluka chief financial officer and head of development Adele Stratton says the ability to process the minerals is key to the project’s feasibility.

“Without purification, the zircon is ineligible for the ceramics market. Ceramics account for approximately 50 per cent of the global zircon market and a zircon project that is ineligible for this market is not viable unless an economic means of purification is confirmed,” Stratton says.

“Iluka has invested considerably in developing such a solution over a number of years and continues to make pleasing progress.”

Nearby, Donald Mineral Sands (DMS) was created as a subsidiary of Astron, which has owned the Donald mineral sands project since 2004.

Just 90 kilometres northeast of WIM100, the Donald project has its own 5.4Mt of zircon, 9.2Mt of ilmenite, 8Mt of titanium products rutile and leucoxene, and 491,000 tonnes of rare earth elements.

DMS managing director Tiger Brown says the company has so far been happy with its efforts to develop a processing solution.

“Through the advancement of spiral technologies, commercial recovery questions have been addressed,” Brown says.

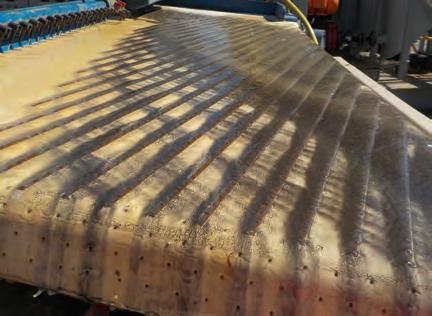

“Using specially adapted spirals for the fine-grained material, Astron has conducted pilot test work to concentrate the ore to a heavy mineral concentrate and then undertake mineral separation to final products with high recovery levels.”

Not only can these resources be a cause for the state’s economic growth, but their end-use could be vital for the wider environment and society.

Brown says DMS would be proud to see its resources put towards the production of a range of green technologies, which in turn could facilitate the ongoing development of the 40-year mine resource.

“These elements have many different

applications but are particularly important in their role in renewable and green energy transformation,” Brown says.

“Whether it may be for windmills or electric vehicle motors, rare earths are a critical element.

“The Donald project, given its significant rare earth element component, can be expected to play a valuable role in assisting Australia achieve its critical mineral objectives.”

The growing demand for these products is just one reason miners and regulators alike forecast a positive outlook for the Victorian mineral sands industry.

Iluka already has proven prowess in minerals processing, with operations in Western Australia, South Australia and Sierra Leone in West Africa.

Stratton says the company will use this experience to take advantage of opportunities which arise over the coming years.

“Concerns around future industry supply are increasing as the supply outlook for quality mineral sands declines,” Stratton says.

“We are seeing the high grade and quality of Iluka’s products being more and more sought after; and we are well positioned to address supply over the near and longer terms by deploying our operations, technical resources, product suite and development pipeline.”

The Victorian Government’s Head of Resources John Krbaleski says the development of the state’s mineral sands projects could one day feed into a circular economy for these green technologies.

“With several solar and wind projects being evaluated in northwest Victoria, there may be opportunities for future heavy mineral sand operations to be powered by renewable energy that enables the responsible production of the metals required,” Krbaleski says.

However, with various miners in the same development boat where processing solutions pose one of the biggest hurdles, significant opportunity arises for collaboration within the region.

Krbaleski expects industry to work together towards a shared goal in this way, saying there is a collection of projects that enable an opportunity for shared processing facilities to arise.

“Given that we have a world-class METS (mining, equipment, technology and services) sector, I’m confident we have the people to deliver that innovation and bring down processing costs,” Krbaleski says.

Overall, the economist by trade is buoyed by recent growth shown in the Victorian mineral sands industry.

He believes the state is taking a strong mining history and turning it into an even stronger future.

“I’m seeing a gold rush transition into a mineral sands rush. It’s looking really promising and what I’ve seen is several projects on both the west and the east of the state progressing at a significant pace,” Krbaleski says.

“These projects have been around since the 80s and 90s, but some things have really changed lately which could see them progress through the approvals process into operation.”

Another potential hitch for the Victorian mineral sands sector, however, is the regulation surrounding new mining proposals in the state.

MCA Victoria executive director James Sorahan says the removal of duplicate hurdles and a more efficient administrative process will allow for a more prosperous mineral sands industry.

“Victoria ranks poorly on perceptions of public policy on mining investment according to the Fraser Institute’s Annual Survey of Mining Companies, with Victoria ranking behind every state other than Tasmania,” Sorahan says.

Sorahan says government action will be key to improving this process, for the benefit of the mining companies, as well as the state’s economy and communities.

“The development of the pipeline of mineral sands projects would involve hundreds of millions of dollars in direct regional investment and create hundreds of direct operating jobs, while supporting indirect jobs and other businesses in Victoria,” he concludes.

Astron has completed mineral sands concentrating and processing test work.