3 minute read

Building back better

For what has been a tumultuous past few years for the construction industry, many businesses and organisations in the sector have had to react in agile and decisive ways to survive. As the industry continues to recover, Payapps is focused in supporting construction businesses to create resilient business models bolstered by innovation and technology.

Payapps Chief Revenue Officer Brett Stephenson is no stranger to business resilience, with a background across the automotive and import and export sectors in sales, account management, logistics, finance and general management roles.

Joining Payapps in November 2021, he now manages the company’s current and future partners, sales, customer success, account management and support functions.

As the economy moves into a new phase, Stephenson says now is the time for construction businesses to seek and seize new opportunities. “The pandemic has been a huge instigator in bringing about the need for more resilient business models in the construction industry,” he says. “But we must remember there will always be new challenges that arise – such as enduring current labour shortages, inflation, environmental issues, and political forces – and it’s more important than ever to ensure that your company can adapt quickly to disruptions.”

He says “building back better” revolves around construction businesses creating a more resilient business model focusing on improved financial management, effective collaboration between builders and subcontractors and workforce productivity.

Financial resilience

Over the past couple of years, construction business insolvencies have increased sharply, and COVID-19 exposed the construction sector’s fragility of supply chains, workforce management and internal processes. The pandemic highlighted issues around risk-shifting tactics employed by general contractors to pass on risk to other parties like subcontractors.

Labour and material costs continue to rise, resulting in bid costs and payment shortfalls. Builders likely adopt a ‘pay when paid’ clause in their contracts or delay payments until they have received their payment from a third party – impacting subcontractors’ cash flow resilience. The smallest party involved in a project is generally the one holding most of the risk, and as the industry continues to work on thin margins and limited cash flow, it doesn’t take much to send a business under.

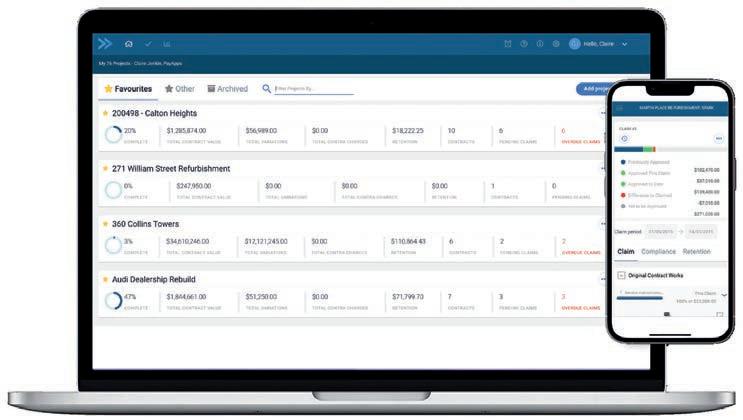

Payapps construction technology creates greater financial resilience by automating the payment claim process to provide accurate and up-to-date information on status, approvals, and values. “Being able to have that accurate data available as fast as possible certainly helps with resiliency, because if something does happen, the business can breathe easy knowing it has an efficient payment process,” says Stephenson.

“Payapps seamlessly integrates with most leading accounting and financial software like Xero, MYOB, and QuickBooks so that the business has a single source of truth and data.”

Though not the only solution to these industry concerns, Stephenson says technology plays an important role in futureproofing construction businesses, enhancing business value today and building strategic resilience for tomorrow.

“If we look at the opportunities technology unlocks in building resilience, one major benefit is business continuity,” explains Stephenson. “By improving the flow of information through connected technology and data, businesses are better positioned to manage unforeseen events or crises.”

“Strengthening your business plan to encompass strategic resilience is vital to driving an effective response to everchanging industry developments.”

For instance, Payapps provides complete visibility of project finances and liabilities through real-time data to ensure construction businesses can make informed decisions quickly and effectively. When you automate the payment claim process with Payapps, you have accurate and up-to-date documentation stored centrally in the cloud, and you know the status of all payment claims, approvals, and liabilities, including recoverable and nonrecoverable value, instantly. Instant access to real-time business information allows businesses to plan for unanticipated events.

Technology also presents a huge opportunity to improve competitiveness. Stephenson says technology can deliver actionable insights with immediate data information to unlock new business opportunities and improve customer outcomes by reducing costs and boosting efficiency.

“Payapps creates more efficient and timesaving payment processes with standardised and consistent claims every time,” says Stephenson. “It reduces the administration of progress claims by up to 50 per cent, giving businesses more time and dollars to focus on the project at hand and pursue new business opportunities.”

Building resilient collaboration

What’s more, technology aids in protecting business reputation, further increasing business competitiveness. Construction technology can ensure projects are delivered on time and within budget, eliminate data errors that cause project delays or mistakes, and provide transparency across the board. In an industry like construction, where everyone seems to know everyone else, upholding a strong reputation is vital.

“Contractors want to work with subcontractors that have a good reputation and vice versa,” says Stephenson. “Word travels quickly if you’re not doing a good job.”

“If you have access to real-time, immediate data, you can run your business and complete projects faster and more efficiently, in turn making the customer happy.”

With shortages of subcontractors risking project delays, builders are challenged to maintain a positive reputation with subcontractors to ensure continued partnership, while subcontractors are looking for more transparency and collaboration in construction projects.

Payapps technology creates greater business resilience when collaborating with partners by building trust with all parties. Having standardised information in one place means everyone, including subcontractors, works from the same numbers, even when reconciling contract variations and retention. Subcontractors and suppliers can see builders reviewing and approving payment claims promptly, reducing the risk of work stoppages and missed delivery deadlines.

One of Payapps’ customers, Mainbrace Constructions, saw a 50 per cent reduction in the time it takes them to assess and approve subcontractor progress claims after adopting Payapps.

Head of