2 minute read

ADMIN COMPLEXITIES 'CONTINUE TO RAMP UP'

by Prime Group

continued from page 3

“Non-GP specialists saw profits of almost 49% of turnover and for GPs this was 36%,” Scott added.

While profits are increasing, so too are expenses, which could be leading more medical entities to consolidate. The report found the total number of doctors in a solo private practice has fallen by 0.5% between 2013 and 2020, while the number in group private practices has increased by 28.9%

Further, the proportion of non-GP specialists working in group private practice has increased three times faster (12%) compared to GPs (4%) in the seven years to 2020 – equivalent to an average increase of 4% per year.

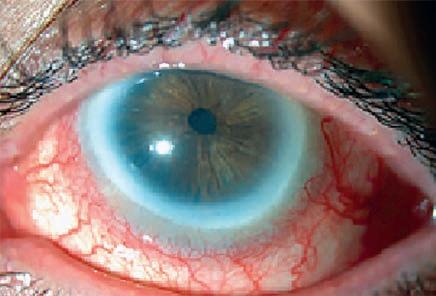

When it comes to the proportion of all doctors who are in private group medical practice, ophthalmologists rank among the highest, well over 70%.

Mr James Thiedeman, CEO of Australia’s largest private ophthalmology network the Vision Eye Institute, told Insight many doctors are choosing to join group practices once they complete their training, to allow them to focus on clinical care and “outsource” the extensive administrative burdens.

“If you ask any doctor if they prefer to spend time on patient care or paperwork, you can be pretty confident what the answer will be,” he said.

“Doctors understandably want to ‘doctor’, not administer. That said, the reality is administrative demands on clinical staff continue to grow; as complexities around funding arrangements, accreditation and regulation, people and culture and stakeholder relationship management continue to ramp up.”

Through scale, Thiedeman said large providers can also pass on the benefits of lower operating costs and access to in-house dedicated professional experts in areas like people and culture, marketing, quality and risk, and cyber security.

“It’s not surprising more and more medical specialists are increasingly choosing to align themselves with larger group practices,” he said.

“The latest data from ANZ-Melbourne Institute show ophthalmology is only second behind general practice with approximately 70% of all ophthalmologists in private practice choosing to delivering care from a group practice. My prediction is this will grow further and the scale of group practices with continue to increase.”

Operational Challenges

In the report, Scott points to many pressures facing the health sector, including sharp falls in healthcare utilisation during the COVID pandemic, the freeze on Medicare indexation between 2014-18, increasing competition among doctors and a drop in private health insurance membership between 2015-20 due to out-of-pocket costs rising faster than wages.

“How the private medical sector is responding to these pressures is a key issue because the structure and operation of the market can influence overall health expenditures, access and quality of care, out-of-pocket costs and employment in the sector,” Scott said.

Looking to the future, the report stated the long-term trend toward further consolidation of non-GP specialist private practices could continue as the number of doctors keeps increasing.

“There is also uncertainty around whether increasing inflation could lead to higher business costs through higher interest rates and upward pressure on the wages of employees. A tight fiscal environment could limit the growth in Medicare revenue and further increase Medicare and tax compliance pressures,” the report concluded.

The private medical sector could also flexibly respond to future challenges through reducing costs and improving efficiency.

“Being able to manage medical businesses more efficiently through new technology and improvements in management and organisation (such as efficient business structures) is becoming more important as cost pressures continue," the report said.

Consolidation and cost cutting can improve the efficiency of medical businesses but also has potential implications for patients in terms of access to care, choice and out-of-pocket costs which need to be monitored."