privateinvest.com.au Supplementary Loan Information Memorandum OCTOBER 2023 PrivateInvest Select Mortgage Trust No 4 Whitlam, ACT | Residential Development Sites First Mortgage Facility Target Return – 10.00%, post fees and expenses. For personal use only by wholesale and professional Investors.

Table of Contents Directory 3 Important Notice and Disclaimer 4 1. Executive Summary 6 2. Summary of the Investment 9 3. Loan Purpose and Details 11 4. Key Stakeholders 16 5. Secured Property 21 6. Project Feasibilities 26 7. Risk 30 8. ACT Overview 33 9. Loan Assessment and Management 36 10. Loan Fees and Costs 38 11. Taxation 40 12. Investment Risks 43 13. About PrivateInvest 46 14. Applying for an Investment 54 15. Glossary 56 PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 2

PrivateInvest Pty Limited

ACN 626 703 026

Authorised Representative Number 001284225

Perth Office 561 Stirling Highway Cottesloe, Western Australia, 6011

Sydney Office 2 Short Street, Double Bay, New South Wales 2028

Postal PO Box 477, Cottesloe, Perth Western Australia 6911

Phone 1300 2 INVEST (1300 2 468 378)

Email corporate@privateinvest.com.au

Web www.privateinvest.com.au

Trustee

PrivateInvest Capital Securities Limited

ACN 611 892 249

Australian Financial Services Licence No 491287

Perth Office 561 Stirling Highway Cottesloe, Western Australia, 6011

Sydney Office 2 Short Street, Double Bay, New South Wales 2028

Postal PO Box 477, Cottesloe, Perth Western Australia 6911

Phone 1300 2 INVEST (1300 2 468 378)

Email corporate@privateinvest.com.au

Investment Manager

PrivateInvest Credit Pty Limited

ACN 625 468 215

Perth Office 561 Stirling Highway Cottesloe, Western Australia, 6011

Sydney Office 2 Short Street, Double Bay, New South Wales 2028

Postal PO Box 477, Cottesloe, Perth Western Australia 6911

Phone 1300 2 INVEST (1300 2 468 378) 1300 4 FUNDING (1300 4 386 346)

Registry Services

Automic Group Pty Ltd

Office Level 5, 126 Phillip Street

Sydney NSW 2000

Phone 1300 288 664

Email funds@automicgroup.com.au

Corporate Trusts Management Legal Advisors

McMahon Clarke

Office Level 7/ 100 Creek Street, Brisbane QLD 4000

Phone + 61 7 3239 2900

Accounting and Taxation Accountants

Pitcher Partners

Office Level 11/ 12-14 The Esplanade, Perth WA 6000

Phone (08) 9322 2022

Directory

3 PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum

Important Notice and Disclaimer

This Supplementary "Loan Information Memorandum" is dated 3 October 2023 (“the Issue Date”) and is issued by PrivateInvest Capital Securities Limited ACN 611 892 249 (“the Trustee”, “us” or “we”), being the trustee of PrivateInvest Select Mortgage Trust No 4 ABN 96 724 567 466 (“Trust”). This Loan Information Memorandum sets out information about the Trust upon which the recipient of this Loan Information Memorandum (“the Recipient”, “you”) may base a decision as to whether it should investigate a possible investment in the Trust.

The Trustee has appointed PrivateInvest Credit Pty Limited ACN 625 468 215 (“the Investment and Facility Manager”) to act as the investment and facility manager of the Trust.

This Trust is a “wholesale trust” and is not a registered managed investment scheme under the Corporations Act. This Loan Information Memorandum is supplied personally to the Recipient on the following conditions, which are expressly accepted and agreed to by the Recipient, in part consideration of the supply of this Loan Information Memorandum, as evidenced by the Recipient’s retention of this Loan Information Memorandum. If these conditions are not acceptable, then this Loan Information Memorandum is to be returned to the Trustee immediately.

1. No offer to subscribe for an interest in the Trust is made pursuant to this Loan Information Memorandum where the offer would need a regulated disclosure document under Division 2 of Part 7 9 of the Corporations Act. This Loan Information Memorandum is neither a prospectus nor a product disclosure statement regulated under the Corporations Act, nor is it required to be. A copy is not required to be, and has not been, lodged with the Australian Securities and Investments Commission (“ASIC”).

2. This Loan Information Memorandum has been prepared only for the issue to, and use by, prospective Investors who qualify as “Eligible Investors”. An Investor qualifies as an Eligible Investor if they are a “wholesale client” (as defined in section 761G of the Corporations Act) or a person who satisfies the Trustee that they are not a “retail client” within the meaning of the Corporations Act and who otherwise satisfies the Trustee’s investment criteria.

3. This information does not constitute and should not be construed as an offer, invitation, proposal, or recommendation to apply for Units by persons who are not Eligible Investors. Applications or any requests for information from persons who are not Eligible Investors will not be accepted.

4. This Loan Information Memorandum does not purport to contain all the information that may be required to evaluate an investment in the Trust (or would be required if it were a disclosure document regulated under

the Corporations Act). The Recipient and respective advisers should conduct their own independent review, investigation, and analysis of the Trust and of the information contained, or referred to, in this document, before making a decision to invest in the Trust.

5. None of the Trustee, Investment and Facility Manager, nor the tax or legal advisors named in the Directory, nor their directors, officers, employees, agents, advisers or representatives (referred to collectively as “the Beneficiaries”) makes any representation or warranty, express or implied, as to the accuracy, reliability or completeness of the information contained in this Loan Information Memorandum or previously or subsequently provided to the Recipient by any of the Beneficiaries. This includes, without limitation, any historical financial information, forward looking statements, estimates and projections and any other financial information derived therefrom. Nothing contained in this Loan Information Memorandum is, or shall be, relied upon by the Recipient or any other person, as a promise or representation, whether as to the past or the future.

6. None of the advisors (“Advisors”) named in this Loan Information Memorandum has made any statement that is included in this Loan Information Memorandum or any statement on which this Loan Information Memorandum is based. Each of the Advisors:

a. Has not authorised or caused the issue of this Loan Information Memorandum, and makes no representation or warranty, express or implied, as to the fairness, accuracy or completeness of the information contained in this Loan Information Memorandum; and

b. To the maximum extent permitted by law, expressly disclaims and takes no responsibility for any statements in or omissions from this Loan Information Memorandum.

7. Except insofar as liability under any law cannot be excluded, the Beneficiaries shall have no responsibility arising in respect of the information contained in this Loan Information Memorandum or in any other way for errors or omissions (including responsibility to any persons by reason of negligence). The Beneficiaries do not warrant nor represent the accuracy, completeness or currency of, or accept any responsibility for errors or omissions in, any information contained in or omitted from this Loan Information Memorandum (whether oral or written), and disclaim and exclude all liability (to the maximum extent permitted by law) for all losses

4 PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum

and claims arising anywhere out of, or in connection with, any information contained in or omitted from this Loan Information Memorandum (whether oral or written), including by reason of reliance by any person on such information. None of the Beneficiaries take responsibility for any information, statement or representation contained in this Loan Information Memorandum nor any omission from it.

8. Except in certain circumstances (including fraud, negligence or default by the Trustee), the Trustee enters into transactions for the Trust in its capacity as trustee of the Trust only, not in its own capacity, and its liability in relation to those transactions is limited to the relevant assets of the Trust.

9. This Loan Information Memorandum has been prepared as at the Issue Date, and its delivery at any time after the Issue Date does not imply that the information contained in it is accurate, timely or complete at any time subsequent to the Issue Date. The Trustee may in its absolute discretion, but without being under any obligation to do so, update or supplement this Loan Information Memorandum. Any further information will be provided subject to these terms and conditions.

10. The Trustee has not authorised any person to give any information or to make any representation or provide information in connection with the Trust nor any offer that is not contained in this Loan Information Memorandum. Any such information or representation not contained in this document must not be relied upon as having been authorised by or on behalf of the Trustee.

11. The Trustee reserves the right to evaluate any applications for investment in the Trust and is entitled to await receipt of cleared Trusts before deciding to reject any or all applications submitted. The Trustee is not obliged to give reasons for rejecting any application made. The Beneficiaries shall not be liable to compensate the Recipient or any applicant for Units (“Applicant”), for any costs or expenses incurred in reviewing investigating or analysing any information in relation to the Trust, in making an application or otherwise.

12. The Trustee reserves the right to charge an Applicant a dishonour fee (not exceeding the dishonour fee charged to the Trustee) in the event that a cheque on an application is void.

13. The information in this Loan Information Memorandum is provided personally to the Recipient as a matter of interest only. It does not amount to a recommendation either expressly or by implication with respect to any investment in the Trust. This Loan Information Memorandum does not constitute tax or investment advice and does not consider any personal objectives, circumstances, or financial needs of any Investor. Potential Applicants should obtain their own financial advice when considering an investment in the Trust.

14. The content of this Loan Information Memorandum is:

a. Has not authorised or caused the issue of this Loan Information Memorandum, and makes no representation or warranty, express or implied, as to the fairness, accuracy or completeness of the information contained in this Loan Information Memorandum; and

b. Not to be disclosed by a Recipient to any other person or entity, whether an associate or related body corporate of the Recipient, other than an employee or professional adviser to the Recipient and then only for the sole purpose of the Recipient considering and taking advice as to whether it will apply for Units; and

c. Not to be reproduced, either in whole or in any part or parts, without the Trustee’s prior written consent and, if such written consent is given, only for the purposes referred to above.

15. The Offer of Units contained in this Loan Information Memorandum is available to Eligible Investors receiving the Loan Information Memorandum in Australia. This Loan Information Memorandum does not constitute an offer in any place outside of Australia where, or to any person to whom, it would be unlawful to make such an offer. The distribution of the Loan Information Memorandum in jurisdictions outside Australia may be restricted by law and persons who come into possession of the Loan Information Memorandum should seek advice on and observe any such restrictions. Any failure to comply with such restrictions may constitute a violation of applicable securities law.

16. Certain capitalised words and expressions used in this Loan Information Memorandum are defined in the Glossary. All references to dollar amount in this Loan Information Memorandum are to Australian Dollars (“AUD”) and are exclusive of GST, unless otherwise stated.

17. The Trustee is not authorised under the Banking Act 1959 (Cth) and is not supervised by the Australian Prudential Regulation Authority, nor are the investments offered by the Trustee covered by the deposit or protection provision in Section 13A of the Banking Act.

18. All images contained in this Loan Information Memorandum reflect architect impressions via computer generated images (“CGIs”). Unless otherwise stated, no reliance should be made on the accuracy of these images.

5 PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum

Executive Summary

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum

6

Executive Summary

PrivateInvest Capital Securities Limited is pleased to offer wholesale and professional investors the opportunity to invest in a first mortgage land loan secured by two residential development sites located in Whitlam, ACT.

This Supplementary "Loan Information Memorandum" is dated 3 October 2023 (“the Issue Date”) and is issued by PrivateInvest Capital Securities Limited (“PrivateInvest”) ACN 611 892 249 and relates to an investment offer of Units in PrivateInvest Capital Select Mortgage Trust No 4 (“Units”). This Loan Information Memorandum outlines in more detail the Key Investment Summary that potential investors should read in full.

■ The purpose of the Loan is to facilitate the purchase of two residential development sites in a new land release suburb of Canberra (Whitlam) that is experiencing significant development activity.

■ The Sponsor is Jin Wang (Sponsor) of Keggins (Developer), an experienced Canberra developer (keggins.com).

■ The Developer purchased Block 1, Section 81, Whitlam ACT 2611 (Property A) and Block 1, Section 92, Whitlam ACT 2611 (Property B) (the Properties) at auction in November 2022 for $8,300,000 (incl. GST) and $7,950,000 (incl. GST) respectively.

■ Egan National Valuers (Valuer) has provided a Valuation Report for the Properties, dated 11 June 2023, providing a Market Value ‘As Is’ of $8,400,000 (excl. GST) and $7,980,000 (excl. GST) respectively.

■ The Loan will have a separate facility limit on each site at a Loan to Value Ratio (LVR) of 65 0%. The total Facility Limit will be $10,647,000 comprised of $5,460,000 on Property A and $5,187,500 on Property B. Both properties are owned by the same borrowing entity and the facility will have a term of 12 months (minimum six months).

■ PrivateInvest will also be providing a $1,638,000 second mortgage loan to the Borrower to assist with the property settlements, taking the overall LVR to 75%. This loan will be subordinated to the Loan described in this Loan Information Memorandum.

■ The target return for the investment is 10% per annum, post fees and expenses.

■ Land in Canberra is sold with a Crown Lease that specifies an allowable development yield. Property A allows for not less than 37 and not more than 48 dwellings (including five affordable dwellings) while Property B allows for not less than 28 and not more than 43 dwellings (including five affordable dwellings).

■ The Developer will submit a Development Application to build 28 townhouses and 20 onebedroom apartments on Property A and 18 townhouses and 24 one-bedroom apartments on Property B (Projects). It is forecast that Development Approval (DA) will be provided six months after lodgement.

■ The Developer intends to begin marketing the Projects around October 2023 to achieve pre-sales.

■ The primary method of repayment for both sites is via a refinance into construction loans through a non-bank lender. The Developer has a relationship with several non-bank lenders and PrivateInvest

1

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 7

may also consider funding the construction for these Projects. It is forecasted that construction will commence around Q2 2024

■ The Borrower will contribute about $5,500,000 in cash equity at settlement.

■ An Equifax search of the Borrower and Guarantor has been completed with nothing adverse to note.

■ PrivateInvest has undertaken due diligence on the Proposed Development since May 2023 and has since reached credit approval on 10 July 2023.

■ The minimum subscription is $100,000 and an Application Form can be provided on request.

■ The Closing Date for the Offer is 15 September 2023, and the Trustee holds the right to close the Offer earlier as it is expected to be over subscribed.

We welcome your interest, and potential investment in subscribing for Units in the PrivateInvest Select Mortgage Trust No 4

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 8

Summary of the Investment

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum

9

2 Summary of the Investment

Lender

PrivateInvest Capital Securities Limited ACN 611 892 249 as trustee for PrivateInvest Select Mortgage Trust No 4 ABN 96 724 567 466

Borrower Keggins 99 Pty Ltd ACN 661 107 008 in its personal capacity (Borrower).

Guarantors ■ Keggins 99 Pty Ltd ACN 661 107 008 (Corporate Guarantor) and ■ Jin Wang (Individual Guarantor).

Investment Purpose

To facilitate the purchase of two residential development sites.

Investment Amount $10,700,000 inclusive of fees.

Target Return

Targeted income is 10% per annum and after the net of fees, costs and expenses.

This is not a forecast or guaranteed return.

Investment Term 12 months, minimum term of six months.

Minimum Investment Amount

Distributions

The minimum subscription is $100,000, although the Trustee may accept lesser amounts in its absolute discretion.

The Interest Rate to the Borrower is to be serviced monthly in arrears, with three months’ interest to be withheld from the Principal Advance. This means Investor distributions will be paid monthly in arrears.

Withdrawals

An investment in PrivateInvest Select Mortgage Trust No 4 Units is an illiquid investment. Investors will not be able to withdraw their investment in PrivateInvest Select Mortgage Trust No 4 Units until the Loan has been fully repaid.

Issue of Units

PrivateInvest Select Mortgage Trust No 4 Units will be issued to Investors after satisfactory Application by the Investor and approved by the Trustee.

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 10

Loan Purpose and Details

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum

11

Loan Purpose and Details

Sources and Uses of Funds

The Loan provides cross-collateralised security over two properties (Property A and Property B). Both Property A and Property B are considered to provide similar value, development potential, and liquidity (saleability).

In addition, PrivateInvest will also be raising $1,638,000 to provide a second mortgage for the Borrower noting the purpose of this debt is to assist with the Purpose of this Loan. The second mortgage debt will be second ranking to this Loan.

The Facility Limit is comprised of the following Components and Sub- Limits:

Interest Rate

An Interest Rate of 12 00% per annum applies to all amounts outstanding under the Facility (including, without limitation, all drawings, capitalised interest, fees, costs, and expenses).

Interest is calculated from the date of the first Utilisation under the Facility and is serviced monthly in arrears (three months of interest will be pre-paid).

Default Interest Rate Interest rate plus 6 00% per annum.

Loan to Value Ratio (LVR) 65.00%.

LVR Covenant of 65.00%.

3

COSTS TOTAL BORROWER EQUITY 2ND MORTGAGE DEBT 1ST MORTGAGE DEBT Land (at valuation) 16,380,000 4,803,769 1,511,279 10,064,952 Stamp duty 737,750 737,750 – –Establishment fee (incl GST) 270,270 – 36,036 234,234 Broker fee (incl GST) 38,288 – 9,009 29,279 Prepaid interest ( 1st 3 months) 400,211 – 81,676 318,535 Service interest (2nd 9 months) 1,209,428 1,209,428 – –Total 19,035,947 6,750,947 1,638,000 10,647,000 PrivateInvest Capital Raising First mortage debt 10,647,000 Part payment for trustee fees and set up costs 53,000 Total 10,700,000 PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 12

Description of Mortgage Security

The Borrower has granted real property mortgages over the properties described as Block 1, Section 81, Whitlam ACT 2611 and Block 1, Section 92, Whitlam ACT 2611 (being the Secured Properties) in favour of PrivateInvest Capital Securities Limited as trustee for PrivateInvest Select Mortgage Trust No 4 (Secured Party) (Mortgage).

The Mortgages takes priority over all other Security Interests over the Mortgaged Properties other than any Security Interest mandatorily preferred by law or a Security Interest which is expressly permitted to have priority over the Security under the terms of the Finance Document.

Additional Security General Security Agreement

The Grantor (in its personal and trustee capacities) will provide a General Security Agreement (GSA) in favour of the Secured Party. The GSA creates:

■ a PPSA Security Interest in the Personal Property of the Grantor, the Personal Property being:

■ all of the present and after-acquired (and other future) personal property of the Grantor (but excluding interests in personal property to which PPSA does not apply);

■ all Trust Property which is personal property (but excluding interests in personal property to which PPSA does not apply);

■ to the extent PPSA applies to it, the Trustee’s Indemnity and the Trustee’s Lien; and a charge over all the Grantor’s interest in the Other Property, that being all of the present and after-acquired (and other future) undertaking, assets, rights and interest of the Grantor, including:

■ all real and personal property, things in action, goodwill, uncalled and called but unpaid capital wherever located other than Personal Property;

■ all the Trust Property of the Trust which is not Personal Property; and

■ to the extent PPSA does not apply to it, the Trustee’s Indemnity and the Trustee’s Lien.

■ The parties intend that the GSA is to have priority over all other Security Interests given by the Grantor other than any Security Interest mandatorily preferred by law.

■ Intercreditor deed between the first and second mortgagors.

Personal Guarantees

Jing Wang (Individual Guarantor) will provide a limited guarantee and indemnity in favour of the Secured Party under the Facility Agreement.

The Individual Guarantor’s liability extends to the whole of the Secured Moneys and any other applicable recoverable costs from the Loan.

The standard Know Your Client (KYC) checks have been undertaken and an Accountants statement has been obtained stating there is no outstanding ATO liabilities by the Individual Guarantee.

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 13

Primary Loan Repayment Refinance to Construction Loan.

The Primary Loan Repayment will be via the Borrower procuring construction finance for the proposed development of townhouses and apartments for both Properties. In order to achieve this, the Developer must achieve Development Approval (DA) and a suitable level of presales for both Property A and Property B. The Developer has a number of existing relationships with other non-bank lenders that would consider providing construction finance, including various lenders on their current construction projects in Canberra. PrivateInvest may also consider providing this construction loan.

Valuation

The Borrower has entered into a contract of sale for both Property A and Property B. The contract prices were reached at auction in November 2022 and are as follows:

■ Property A: $8,300,000 (incl GST)

■ Property B: $7,950,000 (incl GST)

A Valuation Report of both Property A and Property B was completed by Egan National Valuers on 11 June 2023. An overview of the Valuation Reports is as follows:

■ Market Value ‘as is’ (Property A)

$8,400,000 (ex GST) ($175,000/dwelling) ($1,569/m2)

■ Market Value ‘as is’ (Property B)

$7,980,000 (ex GST) ($190,000/dwelling) ($1,791/m2)

The Valuation has adopted both a direct comparison and hypothetical development analysis methodology. Given there is a limited supply of development sites in Canberra that are auctioned to property developers in stages, the direct comparison method for valuing land is a preferred approach. Prospective buyers of these development sites are given a guide for the minimum and maximum number of dwellings permitted for development, meaning the residual land value to make the property development feasible is better known, hence making the auction process an efficient method for ensuring the development sites are sold at market rates. The most effective method for assessing the true value of the respective properties is the $/dwelling valuation metric.

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 14

Below is a list of comparable sales cited by the Valuer:

ADDRESS SALE PRICE SALE DATE SITE AREA ( m 2 ) DWELLINGS $/ m 2 $/ DWELLING m 2 / DWELLING AFFORDABLE HOUSING Block 5 Section 53 Holt $ 4,025,000 Jun-22 2 ,751 30 $ 1,463 $ 134,167 92 Block 1 Section 51 Lawson $ 16, 200,000 Jun-22 9, 372 150 $ 1,729 $ 108,000 62 Block 1 Section 50 Lawson $9 250 000 Jun-22 8 091 57 $ 1 143 $ 162 281 142 5 Block 1 (a) Section 64 (BN) Whitlam $ 6,644,127 Nov-20 7, 232 40 $919 $ 166,103 181 Block 1 (a) Section 61 (BS) Whitlam $ 3 600 000 Nov-20 5 736 30 $ 628 $ 120 000 191 Block 1 (a) Section 43 (BB) Whitlam $ 3 450 000 Nov-20 6 086 23 $ 567 $ 150 000 265 Block 10 (i) Section 50 (BJ) Whitlam $ 3 550 000 Nov-20 5 380 25 $ 660 $ 142 000 215 Block 8 Section 51 Taylor $ 5, 500,000 Mar-21 8,037 72 $ 684 $76, 389 112 Block 1 Section 92 Whitlam $7,950,000 Nov-22 4,455 43 $1,785 $184,884 104 5 Block 1 Section 81 Whitlam $8,300,000 Nov-22 5,355 48 $1,550 $172,917 112 5 Block 2 Section 72 Whitlam $ 10 625 000 Nov-22 7 526 52 $ 1 412 $204 327 145 Block 1 Section 72 Whitlam $ 8 850 000 Nov-22 5 810 45 $ 1 523 $ 196 667 129 Ba SCL Whitlam $ 10 100 000 Nov-22 8 224 111 $ 1 228 $ 136 486 74 10 Minimum $567 $76,389 62 Maximum $1,785 $204,327 265 Average $1,176 $150,325 140 PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 15

Key Stakeholders

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum

16

4 Key Stakeholders

Borrower

The Borrowing entity is Keggins 99 Pty Ltd ACN 661 107 008

Jin Wang (individual guarantor) is the sole Director, Shareholder, and Beneficial Owner of the Borrower.

An Equifax search of the company showed no adverse on file.

Guarantors Each of the following corporate entities:

■ Keggins 99 Pty Ltd ACN 661 107 008 (Corporate Guarantor) and Each of the following individuals:

■ Jin Wang of unit 405, 45 Honeysett View, Kingston ACT 2604 (Individual Guarantor).

The corporate entity is a special purpose vehicle that has been created for the Projects and hence has no other assets or liabilities than what is described within Sources and Uses of Funds.

Jin Wang has provided a statement of position which shows a net asset position of approximately $20m. It is expected that these assets are held in company trusts that provide little direct recourse.

Sponsor Jin Wang is the sole owner of the Developer. He is an asset-backed developer with good experience in the industry. He was schooled in Launceston before university in Hobart, moving to Canberra afterwards. His family have a background in China with both a car dealership and development. Jin also has interests in a number of complementary businesses, having a 20% stake in Kings Joinery (a Canberra based kitchen and bathroom fitter) and development walk-through rendering software business.

Jenny Chen (Jin’s partner) oversees much of the development detail/ process while also working as a Commercial Relationship Manager at St George since 2021 (previously worked in the same role at ANZ for 13 years) and holding the position as President of the Australia-China Business Council ACT division.

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 17

Developer

Keggins is a Canberra based property developer delivering high-quality projects over the past decade and is led by Jin Wang. Supporting Jin is Brett Smith (General Manager). Brett is a well-regarded property developer in the Canberra market and has extensive experience having previously worked with Hindmarsh, Art Group, and 3 Property Group. Keggins has an established relationship with NAB and other non-bank lenders including MaxCap, Qualitas, MA Financial, and Dorado.

The group is an experienced ACT developer. Their most recently completed project is ‘Sapphire’, a premium quality project on the peninsula of the Kingston Foreshore. This development accommodated a total of 76 luxury units plus ground-floor commercial and represented the last remaining waterfront block released by the ACT Government in the popular Kingston foreshore precinct. ‘Sapphire’ showcased Keggins’ ability to develop premium product.

Keggins’ Current Projects are:

■ Phillip (‘W2’), ACT (213 residential apartments).

■ 98% sold, estimated $7 5m net proceeds to Keggins;

■ Forecast practical completion: May 2024;

■ Builder: BLOC; and

■ Senior lender: Qualitas, Junior lender: MilDesi.

No sales risk, less than 12 months to completion, and a reputable thirdparty builder, which built Keggins’ Sapphire development in Kingston.

■ Forrest, ACT (developing nine luxury townhouses, priced $3 35m to $3 8m).

■ $12m in pre-sales of a $32.5m GRV;

■ Forecast practical completion: July 2024;

■ Builder: Keggins; and

■ Senior lender: MA Financial.

Sales risk is diminished given it is about 35% pre-sold. Not a complex build, however, it will be Keggin’s largest construction contract by value and yield.

■ Lawson, ACT (site acquisition, development of c. 50 townhouses).

■ Settlement of this site is expected in Q 1 or Q2 2024

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 18

Keggins Construction Projects

The majority of Keggins’ construction projects have been single family homes, however, they also are currently completing two larger industrial projects ($11m ex GST contract value) located in Hume, ACT and the aforementioned Forrest, ACT, boutique townhouse development. Both projects are forecast to be completed in 2024

Keggins’ Other Business Interests

■ Siberian Tiger Constructions – builder entity on smaller residential projects; third party contracts only.

■ Eaglestone (https://www.eaglestonegroup.com.au/ ) – 50% owner of the Eaglestone’s business in Canberra; providing brokerage services for residential home loans. The revenue stream is primarily revenue from commission from settled home loans.

■ Kemstone (https://www.kemstone.com.au/ ) – furniture and cabinetry business owned and operated by Jin Wang. All equity invested is cash from Jin with no debt.

Organisational Structure

Keggins has a team which includes a dedicated Development Manager, Marketing and Sales Manager, Accounting Manager, and Construction Manager.

The organisational structure of Keggins is as follows:

Keggins’ group cash flow forecast (2023/24) has been provided to PrivateInvest and shows:

■ Approximately $1m in cash at settlement; and

■ Approximately $8m in cash forecast at June 2024;

Net cash flow is primarily driven by their builders’ margins and their other business interests mentioned.

Jin Wang

Brett Smith General Manager Steph Davies Marketing & Sales Manager B1 S50 Lawson Site Manager Forrest Project Foreman Forrest Project Contract Admin B1 S50 Lawson Foreman B1 S50 Lawson Contract Admin S81 & S92 Whitlam Foreman S81 & S92 Whitlam Contract Admin Shawn Cui Construction Manager S81 & 92 Whitlam Site Manager Tim Pan Development Manager 11 State Circle, Forrest Patrick Caitcheon Site Manager PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 19

Managing Director

Marketing

The Developer has an ‘in-house’ Marketing and Sales Manager, Steph Davies. Steph has been with Keggins since November 2020 and previously worked as Sales and Marketing Executive at Crafted Developments (20142020) which is a boutique property development and investment company that focuses on high end residential and commercial developments. This included ‘The Capitol Residences’, consisting of 206 apartments which commanded the fastest selling launch in Canberra for over 10 years, settling in May 2020

The Developer intends to release the Projects to market, prior to the DA, in October 2023. They will begin creating their marketing material after settlement and lodgement of the Development Application.

Valuer

The Valuers for the Property are Carolyn Mowbray (State Director ACT) and Ben Driller (Managing Director) of Egan National Valuers.

Architect

Cox Architecture, a multidisciplinary practice with studios in Sydney, Melbourne, Canberra, Brisbane, Perth, Adelaide, and Auckland, have created the draft plans for the Projects. Cox Architecture have comparable multi-dwelling experience on projects in Canberra including Tempus Turner Townhouses, Alexander & Albermarle, Edgeworth Apartments, and The Gallery Apartments.

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 20

Secured Property

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum

21

5 Secured Property

Security Properties

Whitlam

The properties located Block 1, Section 81, Whitlam ACT 2611 and Block 1, Section 92, Whitlam ACT 2611

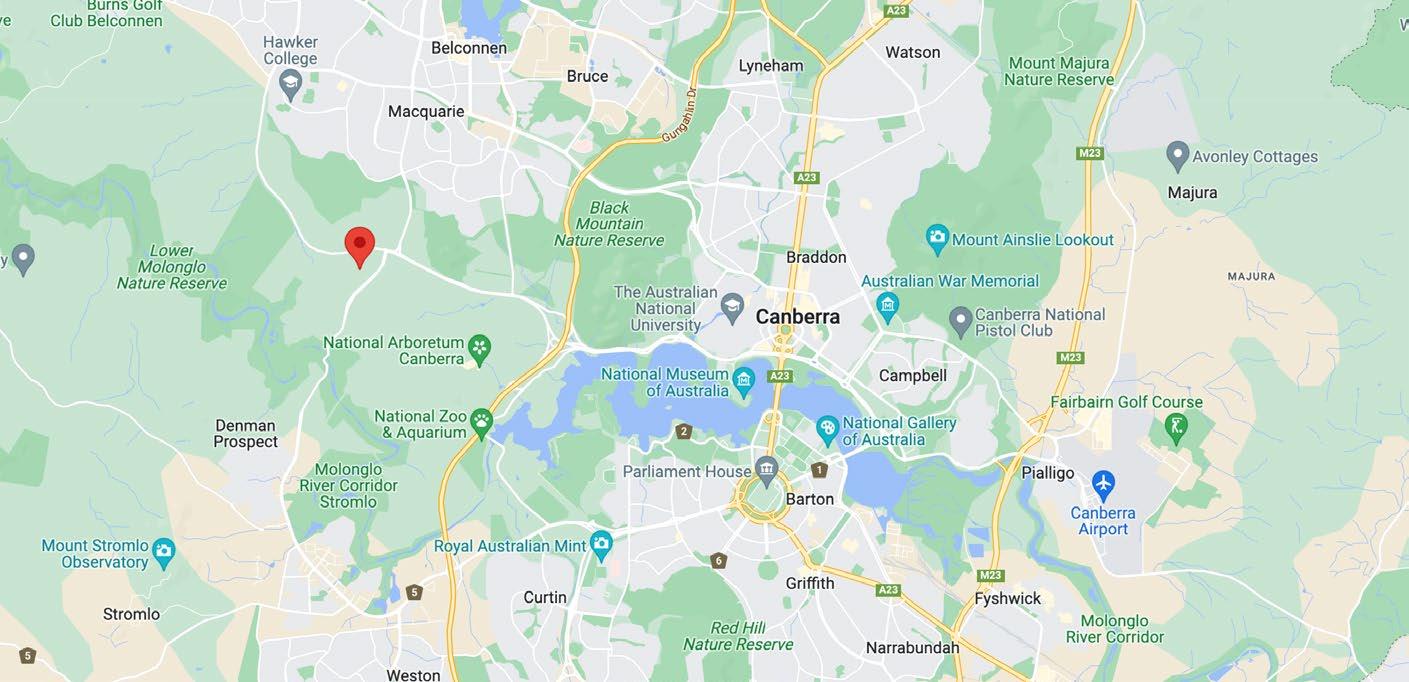

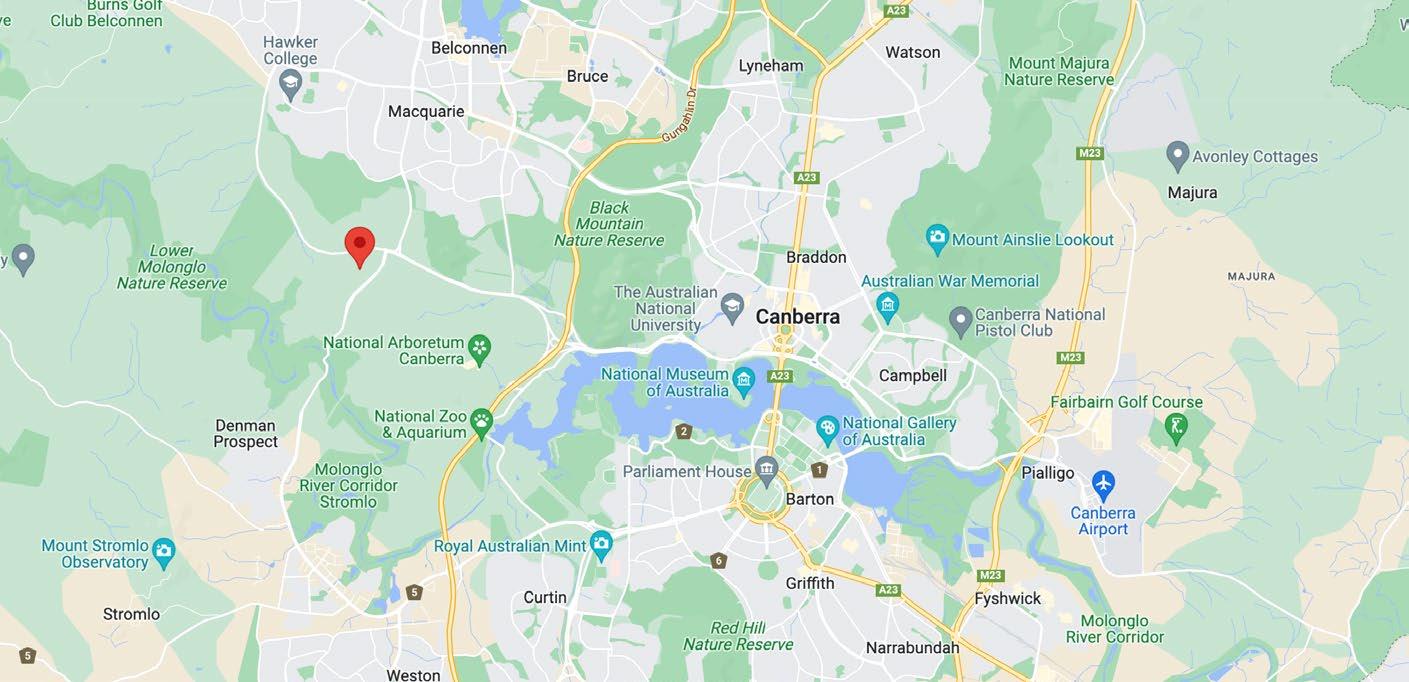

Whitlam is a new land release suburb positioned 9km west from Canberra CBD and 5km south-west from Belconnen. Land in Whitlam has been released in four stages over four years with the first residents to Whitlam having moved in this year:

■ Stage 1: early 2020

■ Stage 2: late 2020 to early 2021 (including large central neighbourhood park)

■ Stage 3: 2022 (including land for a future government school and local centre)

■ Stage 4: early 2023

Future schools will be built in Whitlam which include an early childhood education centre and primary school, open by the 2026 school year. The Evelyn Scott School, a state-of-the-art public education facility located in Denman Prospect (5km south of the Site) opened in 2021 providing preschool and primary education. Future land is being set aside for a new ACT Government college and high school within Molonglo Valley. Whitlam has been designed with playgrounds, bike paths and deciduous tree-filled streets making the suburb attractive to families of all ages and ensuring it carefully merges with the surrounding Molonglo River and nature walks. The main playground is located at the hilltop in central Whitlam and has views of the Brindabella Ranges.

Once complete, Whitlam will be home to around 5,000 people in approximately 2,100 homes. There are also several playgrounds and plenty of green spaces. Calvary Hospital is less than 5km away. Location and topography provide views of not only the Brindabella Ranges but also towards Black Mountain Tower and the National Arboretum.

Whitlam’s local government area of Molonglo Valley has experienced a 149.8% increase in population from the 2016 Census and is currently 11,435 (2021), making up just 2.5% of the total ACT population. In the five years from 2022-2027, the ACT Government has planned the release of 3,760 residential dwellings (1,618 single dwelling and 2,142 multi-unit) and a further 30,000m2 of mixed-use and commercial land and 162,000m2 of community and non-urban land. The Molonglo Valley’s planned residential land release will make up 23% of the ACT’s total new residential land during this period.

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 22

Whitlam (Right, Red Pin) with respect to the Canberra CBD (Centre)

Google Maps

Description of the Properties ‘As Is’ Property A Property A is a wedge shaped 5,354m2 land parcel situated at street level with a moderate crossfall and a westerly aspect to Keir Wilson Way.

Block 1 Section 81 Whitlam ACT 2611

Rohan Barraclough visited Property A in May 2023

Site Description

The subject site is a wedge shaped site of 5,354 square metres and situated at street level with a moderate crossfall and a westerly aspect to Keir Wilson Way with reserve to south and east boundaries.

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 23

Zoning: Property A is zoned RZ4 Medium Density Residential and RZ 3 Urban Residential Zone.

Property A is for the purpose of multi-unit housing limited to not less than 37 and not more than 48 dwellings (including five affordable dwellings), per the Crown Lease.

The objectives of this zoning are to provide: residential areas supply of low (RZ3) and medium rise (RZ4) and predominantly medium density dwellings, access to public transport services, a wide range of affordable and sustainable housing choices, a high standard of residential amenity, opportunities for home-based employment, good solar access, energy efficiency, sustainable water, and promote active living and active travel.

Development Approval: There is no current DA. The Developer’s capability is documented in the Key Stakeholders section and outlines their ability to achieve a DA.

Property B

Property B is a wedge shaped from Sculthorpe Street with a moderate to steep crossfall.

Rohan Barraclough visited Property B in May

55746 11 moderate crossfall and a westerly aspect to Keir Wilson Way with reserve to south and east boundaries.

Property B (Blue)

Image courtesy of ACTmapi

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 24

Property A (Blue)

Services: All mains water, sewerage, electricity, and telephone/NBN are available.

Zoning: Property B is zoned RZ4: Medium Density Residential.

Property B is for the purpose of multi-unit housing limited to not less than 28 and not more than 43 dwellings (including five affordable dwellings), per the Crown Lease.

The objectives of this zoning are to provide: residential areas supply of medium rise and predominantly medium density dwellings, access to public transport services, a wide range of affordable and sustainable housing choices, a high standard of residential amenity, opportunities for home-based employment, good solar access, energy efficiency, sustainable water, and promote active living and active travel.

Development Approval: There is no current DA. The Developer’s capability is documented in the Key Stakeholders section and outlines their ability to achieve a DA.

The following enquiry has been undertaken for both Properties:

Flood Status: Upon review of the ACTmapi flood tool, the Properties are not affected by flooding.

Environmental Concerns: The Valuer stated that there are no visible signs of contamination. Given the Properties are being purchased as a part of the ACT Government Land Release program, it is assumed that there are no environmental concerns.

Heritage: N/A

Bushfire: Upon reviewing the ACT Government Geospatial Data Catalogue (Bushfire Prone Areas) it is evident that the development in which the Properties are being developed now displays a pocket of non-bushfire prone area. As Whitlam continues to be developed, it is expected that this non-bushfire prone area will continue to expand.

Artist Impression

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 25

Artist Impression

Project Feasibilities

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum

26

6 Project Feasibilities

Project Timelines

The Borrower intends to submit the Development Application on settlement of the Security Properties, forecasting a 6-month approval process. They intend to begin market release prior to DA in October 2023 to achieve some pre-sales prior to commencing construction in Q2 2024, completing in around Q3 2025.

Proposed Projects Mix

The Projects conform with the planning criteria as set out in the Crown Lease for the Properties. As a result, there is limited flexibility to alter the proposed dwelling mix:

Property A (Total of 48 Dwellings)

■ 28 townhouses (11 three-bedroom and 17 two-bedroom; five include a study) and

■ 20 one-bedroom apartments (including five affordable apartments).

Property B (Total of 42 Dwellings)

■ 18 townhouses (3 three-bedroom and 15 two-bedroom) and

■ 24 one-bedroom apartments (including five affordable apartments).

The Borrower sought to include a townhouse component in the Projects, given this product has been well received in Whitlam, however, the yield requirements could not be met with a townhouse only proposal. The decision to include one-bedroom apartments solves this issue of yield and will also enable owner occupiers with limited borrowing capacity to purchase in Whitlam while also offering investors a higher yielding investment product.

The townhouses have small floorplates, so the end value of the stock is relatively low for townhouses.

The ACT Territory Plan (image below) provides a succinct view of planning design for Whitlam and how the Projects will fit into the planning scheme. Property A (Block 1, Section 81 – Red) and Property B (Block 1, Section 92 – Red) are two of three properties zoned RZ4 in Whitlam. This is to ensure that the affordable dwellings and higher density developments are in close proximity to Sections 69, 70, 71, which are designated as “Future Urban Areas”; reserved for community focused and amenity providing developments. The pink coloured sections (RZ3 Urban Residential) are areas that support low rise but slightly higher density developments (townhouses) and the yellow coloured sections (RZ1 Suburban) are areas that support low density housing (detached houses).

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 27

Projects Activation and Feasibilities

Outlined below is the indicative feasibility of the combined Projects. This is based on the June 2023 valuations from the Valuer, the Project feasibilities provided by the Developer, and additional contingency from PrivateInvest. The finance and interest costs are based on non-bank pricing (4 0% line fee, 6 0% interest rate, 2% establishment fee, and 0 5% broker fee) at a 70% LVR for 18 months, which is longer than the anticipated construction program of about 15 months. The pricing has been shown to illustrate the bankability of the Projects with less presales than bank requirements.

$' 000s REVENUE Townhouses 40,995 Apartments 15,685 Affordable Apartments 3,450 Gross realisation (incl GST) 60,130 GST 3,989 Gross realisation (ex GST) 56,141 Selling Costs 1,804 Net realisation (ex GST) 54,337 ALL FIGURES EXCL. GST TOTAL Land Valuation (June 2023) 16,380 Construction (incl Contingency) 22,243 Professional fees and other 5,573 Finance Goals 1,034 Total development costs 28,880 Total cost before senior debt interest 45,260 Non-Bank Interest Allowance 4,700 Total cost after senior debt interest 49,960 Net profit after senior debt interest 4,377 Return on cost (development margin) - pre-interest 20.1% Return on cost (development margin) - post-interest 8.8% PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 28

ACT Territory Plan (Whitlam)

The indicative Projects feasibility shows that the Projects should be bankable, however, it is likely that the Projects will require about $6m additional equity to activate construction. The source of additional equity will likely either be from family contributions, Keggins’ W2 project, the sale of the Sponsor’s principal place of residence, or from an equity partner.

If the Developer is not able to bring any further equity to the Projects, other possible exits are a construction facility that funds to an 80% (approx.) LVR or a sale of the Properties to another developer.

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 29

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum

30

Risk

Planning Risk (Low) The Developer must achieve DA to enable refinance with a construction loan. Given the proposed Development Application complies with planning requirements and Keggins is an experienced Canberra developer, the planning risk is assessed as Low.

Liquidity Risk (Low/ Medium) If the Projects cannot be activated into construction, the Properties may have to be sold as-is, with or without DA. Demand for residential development sites in Whitlam has been strong and as a result there are several developments in the area. Given the Properties are appropriately zoned, have services connected, and Whitlam’s land release program has now been closed, it is expected that there would be demand from other developers to purchase the Properties.

In the event that the Properties need to be liquidated in a short time frame, the result of any sale process would be dependent on the current demand of property developers for this type of residential development site. It is not considered that the Property is very liquid and any sale could take at least six months. Given the proposed LVR of the Loan is 65%, the liquidity risk is assessed as Low/Medium. The detachment point for the Loan is at a sale price $10.647m or $117k/dwelling; about $33k lower than the average $/dwelling in the comparable site analysis range.

Market / Sales Risk (Medium)

The majority of stock in Whitlam is two and three-bedroom townhouses, for which the market has a strong appetite; it is common for townhouse developments in Whitlam to be about 50-75% pre-sold prior to construction commencing. Whilst the Projects’ townhouses are at the smaller end of comparable townhouses, they are also cheaper, and it is anticipated that the market will have demand for these lower price point townhouses.

This Projects also includes one-bedroom apartments and affordable apartments. This stock is largely untested in the Whitlam market, however, there are some comparable sales in neighbouring Denham Prospect. The target buyers for this stock will be owner occupiers with limited borrowing capacity or investors looking for higher yielding investment properties. As borrowing capacity has reduced with higher interest rates, demand for lower cost dwellings may also increase. Overall, the market / sales risk to obtain pre-sales prior to construction refinance (exit strategy) is assessed as Medium.

7 Risk

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 31

Activation Risk (Medium)

Refinancing the land facilities with a construction facility will require the Projects to be bankable. If end values decline, or costs such as build costs or finance costs increase, the Projects may not be fundable. The Projects currently have a low development margin, however, activation risk is partially mitigated by the net asset position of the Sponsor and their ability to contribute additional cash equity if necessary. The Activation Risk of the Properties is considered medium.

Contamination Risk (Low)

There are no visible signs of contamination, the Properties have no prior use, other comparable sites in Whitlam have not had any contamination issues, and no basement is included in the proposed development, however, there is no contamination report for the Properties. The Contamination Risk of the Properties is considered low.

Serviceability Risk (Low)

Three months of interest is prepaid at settlement and thereafter the monthly interest payments on this Loan and the second mortgage is about $65k. Keggins’ group cashflow shows positive cashflow each month from their building entities and business interests and their cash position remains above $1m over the forecast 12 month period. The Serviceability Risk is considered low.

Sponsor/ Developer Risk (Low/ Medium)

Being a medium sized developer, there is risk that the Developer has another development that is placed into default or is faced with an adverse issue that affects completion.

Overall, the Developer is diversified in terms of financier and builder on their other projects. Each of the three projects are at varying stages, noting that the site in Lawson will likely settle around the time that the Developer intends to move these Projects into construction. By this time, W2 will be very near completion, releasing equity (and profit) back to the Sponsor, meanwhile Forrest will also be near completion.

Further, the Developer has other major construction projects located in Hume, ACT where they are acting solely as the builder for a combined contract sum of $11m ex GST.

Overall, the Loan is for land acquisition, has three months pre-paid interest and is serviced thereafter (noting we have reviewed the Developer’s cashflow indicating an ability to service interest). The Developer is focused on the Canberra market and has good cash flow from a diversified (albeit mostly within the property/building industry) revenue stream. The Developer is required to achieve DA and pre-sales via marketing, well within the team’s capability.

Given these prevailing factors, the Sponsor/Developer Risk is assessed as Low/Medium.

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 32

ACT Overview

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum

33

Indicative Land Release Program (ILRP)

Each year the ACT Government prepares an ILRP to accompany the ACT Budget. The ILRP sets out the Government’s intended land releases of residential, mixed use, commercial, community, and non-urban land. The ILRP plays a strategic role in catering for the ACT’s population growth, building a compact, liveable city, attracting investment in the ACT land market and strengthening the economic advantage in the ACT region.

The intention of the ILRP is to be a sustainable, competitive, and equitable program which manages the supply needs of the region.

It intends to:

■ Deliver housing diversity and affordable housing choice

■ Balance a sustainable supply of land with forecast demand to maintain an inventory of land in the planning, development, and building pipeline

■ Contribute to building a compact and efficient city and supporting sustainable growth by working towards 70% of new housing within the existing urban footprint

■ Support the development of a sustainable and resilient city in the landscape by promoting the efficient use of land and being responsive to change

■ Support a sustainable and competitive land development and construction industry to create jobs for Canberrans and attract investment into Canberra and

■ Achieve satisfactory returns to the Territory Budget.

Leasehold

The ownership of land in the ACT is similar to freehold for residential, however, properties have a 99-year leasehold title. During the term of the lease, the registered proprietor is granted the exclusive right of use and enjoyment of the land. Towards the end of the 99-year period, the ACT will grant a new residential 99-year lease and charge an administrative fee. Where a leaseholder receives permission from the Government to vary their lease to enable new or additional development, a Lease Variation Charge is applied.

8

ACT Overview

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 34

Affordable Housing

A key component of the ACT’s Affordable Housing Action Plan is the requirement for new estates and developments on sites released by the Government to include Affordable Housing. These purchasers are able to exchange contract on the greater of 1% of the purchase price or $5,000 and the scheme sets a price threshold for Affordable Housing. This Projects have an Affordable Housing requirement of ten dwellings.

The ACT Government Affordable Housing Action Plan Thresholds are indexed annually. The current thresholds are shown below and Keggins intends to meet the Affordable Housing requirement for the Properties by building five Affordable Apartments of 55m2 (Property A) and 49m2 (Property B) each at a sale price of $345,007 each.

TIER DWELLING SIZE PRICE Tier 1 Dwelling with a Net Living Area of up to 80 sqm 345,000 Tier 2 Dwelling with a Net Living Area of up to 80 -105 sqm 398,326 Tier 3 Dwelling with a Net Living Area of greater than 105 sqm 453,737 PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 35

Loan Assessment and Management

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum

36

Loan Assessment and Management

Legal Documentation Fees

Loan Conditions

Precedent

Due diligence on the Loan by PrivateInvest has been completed and formal legal documentation has commenced with a target settlement date on or before, 21 September 2023

The below is a summary list, but not limited to, the Conditions Precedent to settlement with most already satisfied.

a. Originals of each Finance Document properly executed, stamped and registered, where applicable;

b. Satisfactory legal, commercial and property due diligence, including appropriate environment and Material Documents review;

c. Evidence that each Obligor has obtained all Authorisations which are required to enable that Obligor to enter into and perform its obligations under the Finance Documents to which it is expressed to be a party;

d. Evidence that each Security Interest under the GSA and each other Security (other than a Property Mortgage) has been registered under the PPSA and with each other Government Agency with which registration is required (free from all prior Security Interests and third party rights and interests and each other Security (including each Property Mortgage) has been or will be registered (free from all prior Security Interests and third party rights and interests);

e. Company constitution of the Borrower;

f. Current “As Is” and “As If Complete” market valuation of the Security Property, net of GST, for first mortgage security purposes, by an independent valuation firm and dated not more than 60 days prior to the date of the Finance Documents;

g. All documents and other evidence requested pursuant to the Lender’s AML / “know your customer” requirements;

h. Group Ownership/ Borrowing Structure diagram;

i. Discharges of all existing encumbrances in relation to the Security Property and the Obligors;

j. In respect of the Borrower, three years of certified financial statements, tax returns and ATO portal running statements;

k. Review of insurance certificates of currency and policies from insurers approved by the Lender. The Lender is to be noted as mortgagee or interested party on all relevant policies; and

l. Any other conditions precedent that the Lender requires; and

m. Final Legal Opinion from the Lender’s counsel.

9

Lawyers for Loan Documentation HWL Ebsworth Level 5, HWL Ebsworth Building, 6 National Circuit, Barton ACT 2600 PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 37

Loan Fees and Costs

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum

38

10 Loan Fees and Costs

The below fees and costs identify those paid by the Trust for the management of the Loan and those paid by the Borrower for valuing, sourcing, originating, arranging, and administering the Loan documentation.

These fees and costs are in addition to the fees, costs, and expenses disclosed in the Supplementary Loan Information Memorandum which are payable out of the assets and the Trust referable to Units (including PrivateInvest Select Mortgage Trust No 4 Units on a proportionate basis).

All fees and costs quoted exclude GST unless otherwise indicated.

Investment and Facility Management / Agent Fee

Investment and Facility Management fee will be charged in respect of each class of units, payable from the assets of the trust referable to those units.

The Investment and Facility Manager is entitled to a fee of 1 95% per annum of the total drawn Loan facility for PrivateInvest Select Mortgage Trust No 4

The fee is accrued monthly and paid one month in arrears.

Trustee Fee

The Trustee is entitled to charge a fee of 0 25% per annum of the drawn loan balance payable monthly in arrears, subject to a minimum payment of $6,000 per month, throughout the term of the Loan.

Other Trust Costs

Establishment of Unit Trust, legal costs, accounting and audit, production the Supplementary Loan Information Memorandum, promotional, capital raising and wind-up costs.

Loan Establishment Fee

2 00% of the Facility amount plus GST.

Paid by the Borrower to the Investment and Facility Manager at Financial Close.

Legal Costs, Valuation, and Stamp Duty

Paid by the Borrower.

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 39

Taxation

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum

40

For Investors, there are tax implications associated with investing and receiving income from the Trust.

The following provides a summary of the general tax considerations for Australian resident Investors. This summary is based on the income tax law as at the date of this Supplementary Loan Information Memorandum. However, income tax laws and their interpretation are subject to change and changes may have consequences for investors.

TAXATION – INVESTORS SEEK OWN ADVICE

Each Investor must take full and sole responsibility for the associated taxation implications arising from an investment in the Trust including any change in the taxation implications arising during the term of their investment. It is recommended that Investors obtain their own professional and independent taxation advice before investing in the Trust.

INCOME TAX TREATMENT OF THE TRUST

As a Unit Trust, the Trust will effectively be treated as a flow-through vehicle for income tax purposes provided that the Trust distributes all of its income to the Trust’s Investors on an annual basis. The Trustee should therefore not pay Australian income tax on the taxable income derived by the Trust. This is on the condition that the Trust will not be taxed as a company under the public trading trust provisions.

INCOME TAX TREATMENT OF INVESTORS

Provided that the Trust is treated as a flowthrough vehicle, Investors will be assessed on the taxable income derived by the Trust, based on their proportionate share of the annual income of the Trust that is distributed to them in that year. The Trust’s Investors will be required to include their share of taxable income in their tax return.

ACCRUALS TAXATION

It is possible that the Trust may derive assessable interest income on accrued interest prior to those amounts being received by the Trust or distributed to Investors. Accordingly, an Investor may be taxable on interest income of the Trust prior to receiving a distribution.

ANNUAL REPORTING

The Trustee will be required to provide distribution information (including tax components) to the ATO on an annual basis by lodging the Annual Investment Income Report. The Trustee will provide annual tax distribution statements in accordance with the ATO’s guidelines for managed investment trusts. The tax distribution statement will reconcile the cash distribution with the taxable distribution for the income year.

TAX FILE NUMBER (TFN) AND AUSTRALIAN BUSINESS NUMBER (ABN)

It is not compulsory for Investors to provide their TFN or ABN and it is not an offence if you decline to provide them. However, unless an exemption applies, if an Investor does not provide their TFN or ABN tax will be deducted from income distributions at the highest personal marginal tax rate plus the Medicare Levy (and any other levies which may be required to be withheld from distributions from time to time).

The TFN, ABN or an appropriate exemption can be provide on the application form when making an investment in the Fund. The collection of TFNs is authorised and their use is strictly regulated by taxation and privacy laws.

11

Taxation

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 41

GOODS AND SERVICES TAX (GST)

Unless stated otherwise, the fees and other costs set out in this Supplementary Loan Information Memorandum are exclusive of GST.

FOREIGN INCOME AND FOREIGN TAX CREDITS

Australian residents are required to include in their assessable income any share of any foreign income received by the Trust which forms part of the Trust’s net income. Investors will normally be entitled to a tax offset or credit in relation to any foreign taxes paid in respect of foreign sourced income received by the Trust and distributed to them.

NON-RESIDENT INVESTORS

Where an Investor is a not an Australian resident (or provides details to the Trust that indicate that they are residing outside of Australia for tax purposes), the Trustee will be required to withhold tax on distributions.

The rate of withholding tax will depend on whether the income derived by the Trust is treated as interest:

■ Where the amount is treated as interest (or in the nature of interest), the Trustee will be required to withhold 10% from the amount of the distribution. This amount will constitute a final tax. Non-resident investors may also be subject to tax in the country of their residence, but may be entitled to a credit for Australian withholding tax paid.

■ Where the amount is not treated as interest, the Trustee will be required to withhold tax at the marginal rate applicable to the Investor. This will constitute a non-final withholding tax. Non-resident investors will be required to lodge an Australian income tax return, and will receive a credit for the tax withheld.

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 42

Investment Risks

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum

43

Investment Risks

Before applying for an investment, you should consider whether the Trust, and the Loan, is suitable for you given your investment objectives. An investment in the loan through the Trust should be considered a short-term investment.

All investments involve risk and there are many factors that can impact on the performance of an investment. Many risk factors fall outside the Trustee and Investment and Facility Investment Manager’s control and cannot be completely mitigated.

In general, the risks associated with the Loan provided by the Trust relate to the risk of nonpayment of interest or recovery of capital on maturity of the Loan. These two factors are intimately linked with the success or failure of the property development project, which may be impacted by the risk factors listed below.

PROPERTY MARKET AND OTHER PROPERTY RELATED RISKS

An investment in the Trust comes with risks associated with lending against property. These include, but are not limited to:

■ A downturn in the value of the properties and in the property market in general, which can be caused or exacerbated by many factors, including for example: restrictions on the availability of credit both locally and globally;

■ A downturn in the economy (at either a local or global level, or both, such as for example: the events commonly referred to as the “global financial crisis” or the events caused by the COVID-19 pandemic);

■ Amendments to laws and/or government policy having a detrimental effect on the Trust or the property development project; and

■ The value of the properties could go down, depending on factors such as market conditions and when properties are sold and

there is always a risk that they cannot be sold for a price sufficient to repay advances made by the trust.

BORROWER RISK

There is a possibility that the Borrower may experience financial difficulties (which may or may not be related to the project or property being financed) or be placed under administration. Under these circumstances, there is a possibility that the Trust may not receive interest owed on the Loan, or full repayment of the Loan principal. The Investment and Facility Manager has significant experience in mitigating this risk by lending to credible developers with a solid and proven track record of delivery.

BORROWER FINANCING RATE RISK

There is a risk that unfavourable movements in interest rates may increase any financing expense borne by the development project. This in turn may contribute to any losses incurred, which will increase the likelihood of the Borrower being unable to meet interest expenses or repay principal on the Trust.

TAX AND STAMP DUTY RISK

Changes to tax law and policy (including for example, any changes in relation to how income of the Trust is taxed, or in relation to the deductibility of expenses, or changes to stamp duty law) might adversely impact either the Trust, or the Borrower and project to which the Trust lends. Investors should obtain independent tax advice in respect of an investment in the Trust, however, it is not possible to predict future changes to tax law or policy.

INSURANCE RISK

Various factors might influence the cost of maintaining insurance over the property or development project, or the extent of cover available. Increased insurance costs, or limits

12

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 44

on cover, can have a negative impact on the performance of a development project, which, in turn, may negatively impact on the ability of the Borrower to repay the Loan principal.

ENFORCEMENT RISK

Where the Investment and Facility Manager takes enforcement action in respect of any default by the Borrower, the costs incurred by the Investment and Facility Manager in doing so could be substantial.

The Investment and Facility Manager may use its own resources to pay for those enforcement costs (such as the costs of appointing a receiver, legal fees in enforcing against the Borrower, agent’s commissions for sale of any secured property etc.). It may also produce a third party to underwrite the enforcement expenses. The Investment and Facility or third party will have the right to recover these costs from the proceeds received from the enforcement action before any payments are made to the applicable Investors. This will most likely lead to a reduction in distributions paid to the Investors and, depending on whether the enforcement costs can ultimately be repaid out of the proceeds from the sale of any secured property, may result in the Investors suffering a loss.

It is also possible that the trustee will undertake a further capital raising to raise the capital required to pay for the expenses associated with enforcement. There is therefore a risk that Investors may be requested to contribute further capital to Trust enforcement costs. It is highly likely that any such future capital raising will be undertaken at a price less than the original issue price for the relevant Units and may therefore dilute the proportional holdings in the Units of those Investors that decide not to contribute further capital.

DOCUMENTATION RISK

A deficiency in the legal documentation relating to the Loan could, in certain circumstances, adversely affect the return on that Loan. This may make it difficult for the Trust to enforce any security it holds (e.g. first mortgage) in

respect of the arrangement and may also affect the ability to recover any penalties imposed against the Borrower. To mitigate against this risk, the Investment and facility Manager will employ experienced lawyers who specialise in the area of banking and finance law for property transactions.

WITHDRAWAL OF INVESTMENT

An investment in the PrivateInvest Select Mortgage Trust No 4 is an illiquid investment. Investors will not be able to withdraw their investment in the PrivateInvest Select Mortgage Trust No 4 until the Loan has been fully and finally repaid. You should only consider an investment in the PrivateInvest Select Mortgage Trust No 4 if you are not likely to require access to your investment in the short term.

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 45

About PrivateInvest

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum

46

PrivateInvest specialist investment finance team has decades of property experience in structuring first and second mortgage debt and preferential equity at leading investment firms and institutions. The company is exceptionally placed to identify, assess, and work with qualified borrowers seeking finance for a range of development, construction, and other property projects across Australia. Borrowers have direct access to decision makers and support networks at all stages of their property projects – this sets PrivateInvest apart from larger banks and financial institutions.

The Trustee Board of Directors, technical management team and Investment Review Committee are well placed to identify the right loan opportunities and assess the credit risk profiles – providing oversight of the risk management frameworks and execution strategies.

Through the experience of the team, its focus on transparency, oversight, collaboration, and governance, PrivateInvest has established an investment fund management company that is big enough and small enough to deliver property investment and finance producing quality investment returns and be a property capital partner to the property sector.

BIG ENOUGH. SMALL ENOUGH

PrivateInvest is an Investment Fund Manager + Private Capital Partner to the Australian commercial property sector. Unlike traditional banks, we only finance projects in the property industry and with a broader range of structured property finance. We combine the best of large and small-sized financial service providers to offer investors and borrowers an investment offering similar to larger institutional financial houses, but small enough that we can keep an active eagle eye over all of our property transactions.

INVESTMENT FUND MANAGER + CAPITAL PARTNER TO THE PROPERTY SECTOR

At PrivateInvest we offer wholesale and sophisticated investors the choice of four income Funds’ which provide investors a range of income returns, income distribution frequency and liquidity. Our investors have received above industry average risk adjusted returns across all Funds, with no loss of capital or impairment in our history. We have established repeat business with our borrowers which are offered a range of structured finance solutions to meet the requirements of their project financing needs.

NATIONAL FOOTPRINT AND DIVERSIFICATION

We are big enough to have an Australian national portfolio of investment and finance providing investors and borrowers diversification by asset type, class, market location and entry timing but small enough that we have a very “hands on” approach to the business. PrivateInvest lends against property residual stock, development and construction, and site finance.

12

About PrivateInvest

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 47

TIME IS MONEY

We are big enough to have the PrivateInvest Wholesale Funding Line which benefits our investors by lowering the risk that our Funds have excess cash reserves which dilute investment returns, while the PrivateInvest Wholesale Funding Line allows borrowers the confidence to sign finance offers that are not subject to capital raising. We are still small enough that borrowers can talk direct to the credit decision makers which improves approval times.

HIGHLY EXPERIENCED TEAM

We know property. Our specialist finance team has decades of property experience in structuring equity and debt for property transactions at leading investment firms and institutions. The combined experience extends across banking, direct development, construction, valuation and credit analysis. We are exceptionally placed to identify, assess, and work with qualified borrowers seeking finance for a range of development property projects across Australia.

GOVERNANCE AND REPORTING

Our Trustee Board has Independent Directors overseeing our highly skilled management team with additional oversight from our Investment Review Committee. PrivateInvest’s flexible risk assessment model is bolstered by our robust internal and external controls that oversee all aspects of the business including external independence, risk analysis and mitigation, regulatory compliance and backed up by institutional grade investor reporting.

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 48

The PrivateInvest Group Key Persons

Mark Roberts

EXECUTIVE CHAIRMAN, FOUNDING MANAGING DIRECTOR

Mark brings over 30 years’ property experience to PrivateInvest and its clients in both the public and private sectors.

His real estate experience includes corporate and property finance, funds management, asset management, investment management, and large-scale commercial property development.

Mark founded PrivateInvest over a decade ago, taking a measured approach to its evolution as it grew. Four years ago, Mark identified the opportunity to move into the non-bank lending sector, one of Australia’s fastest growing asset sectors which PrivateInvest has now become a genuine alternative finance solution to underserviced lenders in the commercial property market. Since that time, PrivateInvest has grown providing a range of tailored financial solutions to qualified borrowers in the real estate sector and supporting a range of significant projects and developments across Australia.

Mark has directed and executed a number of significant transactions in the finance, property and securities industries including listing an ASX entity as a major shareholder and as Managing Director. This entity became Australia’s largest in its sector, managing 5,600 rental retirement units and providing asset, facilities, tenancy, and funds management services to institutional, wholesale and retail owners.

The Roberts family private investment entity has also undertaken direct developments in the industrial, commercial, retail, hospitality and healthcare sectors.

Mark is based in Perth, Western Australia.

Leon Boyatzis

DIRECTOR, HEAD OF FUNDS MANAGEMENT, TRUSTEE BOARD MEMBER

Leon has over 25 years’ experience in property funds management.

Leon’s background combines accounting, finance, funds management and property valuation. He has held senior property industry funds management roles for listed, unlisted, retail and wholesale funds ranging from private family offices to large multinational organisations, including Multiplex and Brookfield.

With highly valuable expertise in investment, property valuation, and finance, Leon has built a reputation for driving fund performance and exceeding benchmark investor return hurdles.

This has been achieved through, for example, the development of detailed feasibility and investment models to support valuation analysis, accounting analysis including property cashflow, and fund models to drive strategic decision making and internal valuations.

Leon has been the responsible manager for a number of responsible entities holding Australian Financial Services Licences with investment in property developments on behalf of retail and wholesale clients.

Leon is a Chartered Accountant, and a Certified Practicing Valuer with the Australian Property Institute. He holds a Bachelor of Business (majoring in Accounting and Business Law).

Leon is based in Perth, Western Australia.

PrivateInvest Select Mortgage Trust No 4 (Keggins) Supplementary Loan Information Memorandum 49

Naomi Roberts

DIRECTOR – LEGAL - INVESTOR RELATIONS, TRUSTEE BOARD MEMBER

Naomi has over 20 years’ experience in the property and funds management industries, with significant expertise in compliance, corporate governance and legal functions. Her real estate experience spans across working in the family private business which involved direct development of commercial, industrial, retail and residential projects.

Naomi was previously involved in an ASX-listed national affordable rental retirement management company which became Australia’s largest in its sector, providing asset, facilities, tenancy and funds management services to institutional, wholesale and retail owners.