2 minute read

TRACK RECORD ANALYSIS

Performance Analysis

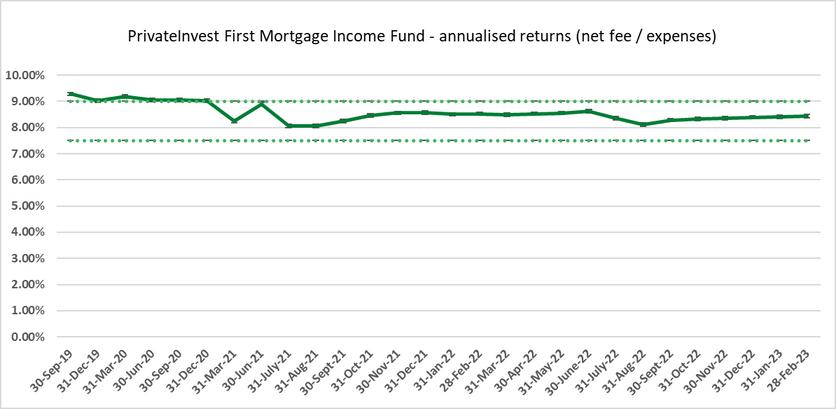

The Fund returned an annualised yield of 8.41% (1 year) and 8.71% p.a. since inception (after fees / expenses) as at February 2023 This is within the Fund’s range of targeted returns of 7.5% to 9% p.a. (The target fund return was adjusted higher to 8.25% to 9.25% p a effective from March 2023 in response to higher interest rates)

At the time of writing, 40% of loans in the Fund, are on pre-paid interest, where interest expenses are paid in advance by the Borrower, which provides income certainty for the Fund The Manager has no target for loans to be on pre-paid interest, however there is a preference for it and has started writing these into loan contracts from the 2nd half of 2022

The Fund, loan rates are increasing on new loans written (in response to higher rates, from the tightening cycle by the RBA, since May 2022) However, loan rate increases are expected to be modest, as the Manager is being prudent to ensure the right balance between loan rates, quality of Borrowers and loan risk

The Fund has had no defaults or impairment of capital since inception, however this has been during a benign credit environment

LOAN TO VALUE RATIO (LVR)

The average weighted LVR of the Fund was 60.1% (fully drawn basis), and all loans are being managed within Credit Guidelines parameters of up to 70% LVR maximum

Fees

The Fund fees and recoveries payable by the Fund are an Investment management fee of 1.95% p.a. and a Trustee fee of 0.25% p.a.

There are no entry or exit fees payable by investors in relation to the application or redemptions of units in the Fund

PrivateInvest earn separate fees directly from the Borrower which are separate to the Fund which includes a loan establishment fee of 13% of loan (which covers payment to loan brokers usually around 1%), a flat rate Discharge fee of $2,000 plus GST or alternatively if there are multiple lots, a $500 plus GST fee per Lot discharge, and a Rollover fee of 1-2% (However, not always charged. For example, circumstances outside the control of the Borrower)

PrivateInvest receive no other benefits or offer any other services (except the underwriting facility) to the Fund including building or construction, and therefore does not receive any other fees

TRANSPARENCY & REPORTING

The Manager has been transparent in its dealings with Evergreen Ratings and provided requests for information in a timely manner, with sufficient detail and explanation.

The Manager provides regularly fund reports and updates to fund unitholders each month The Manager, has engaged the following external services providers:

Pitcher

McMahon Clarke for legal services

RSM International as Trustee and Compliance auditor

Loan Book

Evergreen Ratings viewed a sample of loans in the existing loan book and found the loans met existing credit guidelines and Manager due diligence. While each loan has its inherent risks, valuations were appropriate, and the quality of the Borrower and exit strategy was sufficient While this provided a level of comfort, the Borrower would likely meet their ongoing commitments, the Fund is exposed to various risks These include the ability of the loan to refinance, property valuation declines, property project delays, planning and approval risks, and Borrower repayment risks.

The loan maturity is spread 33.3% each over < 3mths and 6-12 months, 25% over 3-6 months, and 8% of loans > 12months as at February 2023 The loan book has a short duration with mid-point around 6 months

The geographic location of the loans is spread across NSW at 71 0%, QLD at 10 8%, and WA at 18.2% as at February 2023.

The Loan book is comprised of the following loan sectors, Commercial at 20.1%, Industrial at 6 5%, Mixed Use at 15 3%, Residential subdivision at 26 0%, Residential Land at 21 4% and Service stations at 10 7% as at February 2023

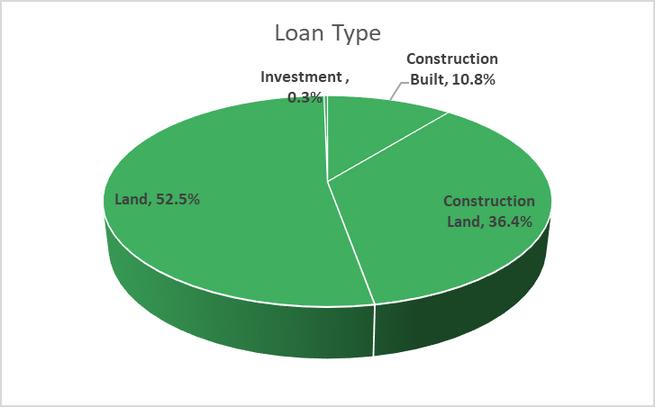

The Loan book is comprised of the following loan types across Construction Built at 10 8%, Construction Land at 34 4%, Land at 52 5% and Investment at 0 3% as at February 2023