20 minute read

REgUlAToRy APPRovAl oF BioSiMilARS in CAnADA

the evolution and creation of innovative technologies, medications, and transformation of patient care continue to push forward at an astonishing pace. With the advancement of medicine over the years, we have seen how biologic drugs and treatments have transformed patient care.

Biologics are therapies derived from living cells, as opposed to traditional drug products which are mainly comprised of synthesized chemicals. Today, physicians use biologics in effectively treating common disorders such as diabetes, multiple sclerosis, various forms of cancer and several other diseases. Despite their effectiveness, biologics have two key drawbacks to their use, and that is their high cost, coupled with limited accessibility through provincial and territorial formularies for most patients. With the aging Canadian population, increased life span, prolonged need for continued health care and the need for more complex and expensive treatments, the increased health care costs are inevitable.

Advertisement

Although Health Canada provides approval of new medications at a federal level, the reimbursement by public insurers is governed at the provincial level. This additional level of approval adds further complexity to the use of potential life saving, yet costly therapies. Hence, geographical location of a patient across our nation can have a huge bearing on availability and access to treatments. The large cost associated with biologics is due to the intricacies related to the development of biologics. As many widely used biologic therapies are reaching patent expiry – resulting in loss of exclusivity, along with the constant need for cost saving alternatives – development of biosimilars is on a rapid rise.

A biosimilar must show high similarity to a biologic drug that has already been authorized for sale (known as the reference biologic drug (RBD)) by Health Canada. Biosimilars are approved based on a thorough comparison to a reference drug and may only enter the Canadian market after the expiry of the reference drug patents for each indication being sought and resolution of data protection issues.1,2

The slow growth of the biosimilar market in Canada is due to several issues, such as lack of clear and transparent regulatory requirements, patient preferences, reluctance of physicians and health care providers and pharmacists to readily prescribe and substitute biosimilars. The difficulties being faced in developing a naming convention specific to biosimilars and the slow uptake by the provincial governments and insurers further adds to the complexity of this market. The European Union (EU) presently dominate the market with numerous biologics in use, owing to the favourable government regulations in this region. Meanwhile, in Canada and the United States (US), Health Canada and the Food and Drug Administration (FDA) respectively have been less flexible in the approval of biosimilars.

In Canada, biosimilars are regulated as new drugs under the Food and Drugs Act and the Food and Drug Regulations. Health Canada’s

Today, physicians use biologics in effecTively TreaTing common disorders such as diabeTes, mulTiple sclerosis, various forms of cancer and several oTher diseases. despiTe Their effecTiveness, biologics have Two key drawbacks To Their use, and ThaT is Their high cosT, coupled wiTh limiTed accessibiliTy Through provincial and TerriTorial formularies for mosT paTienTs.

Biologics and Genetic Therapies Directorate (BGTD) regulates biosimilars in collaboration with the Regulatory Operations and Regions Branch (RORB) and the Marketed Health Products Directorate (MHPD). It is important to note that biosimilars are not generic biologics and many characteristics associated with the authorization process and marketed use for generic pharmaceutical drugs do not apply. In fact, biosimilars must submit a new drug submission (NDS) as biologic drugs. Authorization for marketing of a biosimilar is not a declaration of pharmaceutical equivalence, bioequivalence or clinical equivalence to the reference biologic drug. This last point may explain the hesitation in uptake of biosimilars by some patients and health care providers. In my opinion, biosimilars play a key role in the future of medicine and further education on their role for all parties involved from agencies and governmental bodies to patients and health care providers is needed.

Today, the evaluation of each biosimilar is determined case by case, tailored to each product. Although the regulatory pathway for both biologics and biosimilars is the same and an NDS must be prepared, the difference lies in the specific data required for each submission. The focus of an NDS for a biosimilar is having adequate and well designed invitro (analytical characterization) and in-vivo (non-clinical) studies, with several detailed pharmacokinetic (PK) and pharmacodynamic (PD) studies. For a biosimilar submission, the need for clinical studies is often limited and 1-3 small clinical trials compromise the data showing the safety, efficacy and immunogenicity of a given product. The purpose of the clinical studies in such submissions is to show comparative safety and efficacy of the biosimilar to the reference drug, with no clinically meaningful differences between the two biologics. Since a biosimilar is very similar in structure and function to a reference biologic drug with well-established safety and efficacy in many cases, clinical studies do not need to be repeated for each indication.

Although a reduced non-clinical and clinical data package is required, prior to approval, the manufacturer is required to show similarity between the biosimilar and a suitable reference biologic drug using the most advanced and current technologies. The degree of similarity at the analytical level will determine the scope and extent of the non-clinical and clinical trials. This explains how the assessment of each new biosimilar product is determined case by case. In working with Health Canada, it is best for manufacturers to request meetings with the agency as early as possible and prior to initiation of the full development program. As time to market for any product is of essence, early meetings will enable the manufacturers to determine if additional studies are needed before filing the NDS.

Health Canada provides a final determination of similarity based on the entire submission, including the entire data derived from comparative structural, functional, non-clinical and clinical studies. What is unique to Health Canada is the importance given to the reference drug’s patents. The reviewers at Health Canada do not consider the patent during their review of the application, but at the same time they will not authorize a biosimilar for market release until the issues related to the reference drug’s patents have been addressed. Hence, a biosimilar NDS that may receive notice of compliance (NOC), may still not reach the market for several years if the patent issues are not resolved. The updated Health Canada guidelines2 provide more details on requirements for a biosimilar NDS, but still several areas need to be clarified such as requirements for selection of reference product or requirements for post approval changes. The recent CARE™ publication issued on November 20173 provides an excellent tabular comparison of NDS submission requirements for a biologic vs a biosimilar, which is reproduced below.

On a positive note for Canadians, Health Canada accepts use of a reference product from another International Conference of Harmonization (ICH) country / jurisdiction for the full biosimilar program development, including analytical similarity, non-clinical and clinical studies. The European Medicines Agency (EMA)4,5 and FDA’s6 requirements are not the same, and as a result the manufacturer has to invest significant time and capital to conduct the comparative testing of multiple reference products and biosimilars. The question remains, if conducting several comparative tests of EU and US-sourced reference products is a way to produce a more concrete body of evidence regarding the similarity or if this practice is only to fulfill the battle of regulatory bodies. On the road to simplifying manufacturing of biosimilars worldwide, another hurdle that must be overcome will be to unify a set of requirements regarding the sourcing of reference products for biosimilar development programs. This in turn may help in further reducing the cost of biosimilars for patients.

To obtain an update on the currently approved biosimilars you can refer to Health Canada’s list titled Drug and Health Product Submissions Under Review (SUR) which lists all new drug submissions (including biosimilars) under review and approved.7 If a biosimilar application is approved but is on intellectual property (IP) hold, the product will not be listed as approved. By referring to the list it is evident that more applications for biosimilars are being made to Health Canada each year and the review process is certainly improving. To ensure all Canadians have full access to safe, efficacious and cost-effective medications each of us, regardless of our role in this process, can support the improvement and simplification of the review, approval and reimbursement processes for new treatments and ultimately support timely delivery of new medications to patients.

references

1. Health Canada. https://www.canada. ca/en/health-canada/services/drugshealth-products/biologics-radiopharmaceuticals-genetic-therapies/applicationssubmissions/guidance-documents/ fact-sheet-biosimilars.html. 2. Health Canada. https://www.canada. ca/en/health-canada/services/drugshealth-products/biologics-radiopharmaceuticals-genetic-therapies/applicationssubmissions/guidance-documents/ information-submission-requirementsbiosimilar-biologic-drugs-1.html. 3. S. Edwards et al. Table 1. New Drug Submission Data Requirements: Biologics

Versus Biosimilars. CARE™ Primer on Biosimilars [CARE™ Publication, Online and

Print - Version 1, page 4.]. November 2017. 4. EMA.http://www.ema.europa.eu/docs/

en_GB/document_library/Scientific_ guideline/2014/10/WC500176768.pdf 5. EMA.http://www.ema.europa.eu/docs/ en_GB/document_library/Scientific_ guideline/2015/01/WC500180219.pdf 6. FDA.https://www.fda.gov/Drugs/DevelopmentApprovalProcess/HowDrugsare-

DevelopedandApproved/ApprovalApplications/TherapeuticBiologicApplications/

Biosimilars/ucm580429.htm. 7. Health Canada. https://www.canada.ca/ en/health-canada/services/drug-healthproduct-review-approval/submissionsunder-review.html.

Mahdis Dorkalam – President CRM Pharma Consulting Inc - providing regulatory & clinical research expertise, with a focus on the needs of the Canadian market. All information provided is the sole opinion of the author and is for general informational purposes only. The author makes no warranties to the accuracy, completeness and reliability of statements for a particular purpose.

To see this story online visit https://biotechnologyfocus.ca/regulatoryapproval-of-biosimilars-in-canada/

TaBle 1

regulatory pathway

chemistry & manufacturing (c&m) studies BioloGiCs

full package BiosiMilars

new drug submission (nds)

full package extensive comparative analytical studies between biosimilar and rbd

non-clinical study

pk/pd study

clinical efficacy full data package as per ich s6(r1)

standard pk/pd studies

required for all indications reduced and comparative to rbd

comparative pk/pd profile to rbd

in most cases, comparative to rbd for at least one indication in a representative indication and sensitive population

*clinical Trial design

*study endpoint

efficacy/safety superiority, non-inferiority or equivalence trial design

clinical outcomes or validated surrogates

establishing evidence of efficacy and safety/acceptable risk and benefit profile equivalence trial preferred over non-inferiority design. adequately sensitive to rule out clinically meaningful differences within predefined comparability margins

sensitive and clinically relevant

no meaningful difference to rbd. safety must be assessed in a sufficient number of patients treated for an acceptable period of time

immunogenicity acceptable immunogenicity profile no meaningful difference to rbd

survey results

sCope of innovation in Canada

Innovation is happening every day and broadening the horizons of science. The Canadian life sciences industry is burgeoning with new drug development, technologies, and therapies that will improve the lives and health of Canadians. As the scope of this sector changes, it is important for the industry to concrete a voice to share their input to the government, investors, and health care institutions.

two years ago, Biotechnology Focus posed an innovation survey that expressed some of the inner workings of the life sciences sector in Canada. This year’s survey has unveiled comparable results but convey a slightly contrasting snapshot than in 2016. In support of Global Biotech Week (http://globalbiotechweek.ca/ September 24th to 30th) Biotechnology Focus conducted this survey to gauge Canada’s innovation sector. It ran from July 9th to July 27th and was open to everyone in the industry, including the business sector, academics, research institutions, service providers and more. We would like to thank all 96 respondents who participated in this year’s innovation survey that helped provide an outline of the current state of the industry.

snapshot of respondents

Similar to the original survey, the first question we asked our readers was when their company/research organisation was established. Unlike in 2016 when it was dominated by companies or research organisations from 1992 or earlier, we can see that there has been an influx of newer companies or organisations coming to market from 2012 to the present. Comparatively, recent companies have been sprouting at almost double the pace jumping from 16 per cent to almost 30 per cent of the accounted response in the last two years. Bearing that in mind, we were surprised to see that the majority of the companies (42 per cent) classified themselves in the growth category with at least one stable, high-volume product design; although, those with radically new products in emerging phase (41 per cent) pulled a close second, with mature phase (18 per cent) coming out as the smaller section of the bunch and down from previous years.

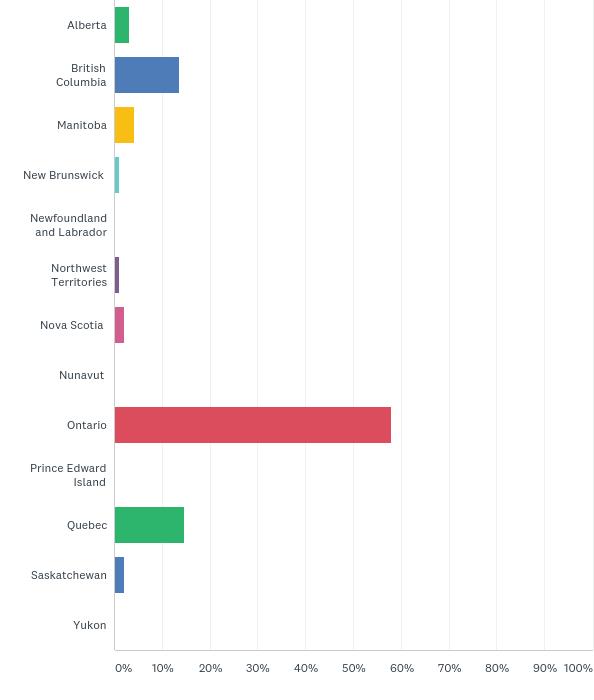

In terms of geographic regions, Ontario packed a punch with the bulk of individuals identifying they were from this region (58 per cent), while Quebec and British Columbia were neck and neck for second, but still fell way behind in contrast with close to 14 per cent representation.

When Was your company/research organization established? Where in canada is your company/ research organization located?

in Which sub-sectors of the industry Would your company/research organization be classified?

in Which category or categories Would your company/research organization be classified?

hoW Would you classify your company/research organization in its lifecycle?

The sizing of the companies and research organisations operating in Canada reflected comparable scoring to the 2016 innovation survey with those employing 1 to 7 employees leading the way in taking the survey with approximately 38 per cent, and an approximate 57 per cent were part of staffs equal to or under 15 employees overall. Mid-sized companies and organisations were underrepresented but have stepped up since the last survey coming from 5 per cent in 2016 to 18 per cent in 2018. However, the larger companies and organisations with over 100 people on staff had the second highest figure at 25 per cent. In this group were the global biopharma Canadian subsidiaries, contract research and manufacturing organisations, but very few Canadian biotech companies.

There are many subsectors of the life sciences industry that are covered across Canada, but the ones that stood out with the most respondents were in the fields of Health biotechnology & pharmaceuticals (63 per cent) and Medical technology & devices (32 per cent). The category that largely dominated the focus for most of the companies participating in the survey this year was research and development with 67 per cent of the respondents, while trailing a little way behind was consulting, conduct research or other service providers at approximately 34 per cent.

What biotech and life sciences businesses had to say:

One of the topics that is always on the table and thwarts this industry is access to capital. From conferences that address this issue to blogs and subjective opinions, it is posed as one of the most difficult obstacles to overcome as a start-up or mid-sized enterprise. This is reflected in the questions we asked our readers so that we could better gauge where Canadian companies lay on the frontier of biotech and the life sciences industry.

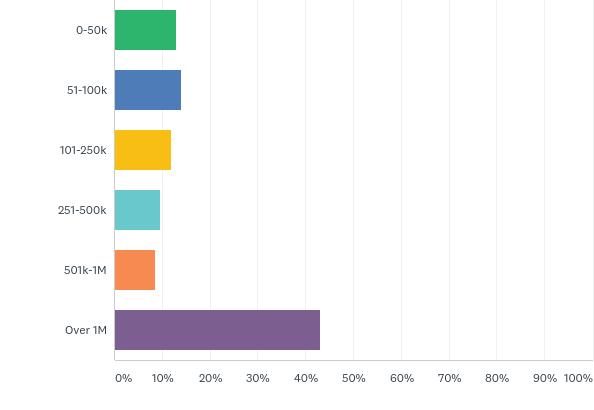

The majority of respondents fall into the under one-million-dollar category (64 per cent) when asked how much capital they acquired

in the last 12 months, hoW much did your company/research organization spend on research & development?

in 2017, What Was the average number of people employed at your company/ research organization?

in 2017. Roughly 25 per cent were within the 2-10 million range, with 5 per cent within 11-50 million and 5 per cent in the 50+ category. This response carries the idea that most companies are in the emerging phase and may be competing for the same buck. Most of the respondents (52 per cent) found funding or financing opportunities harder to come by, which further elucidates the previous point. Only 13 per cent of respondents found capital easy to come by. These results reflected both years of the survey.

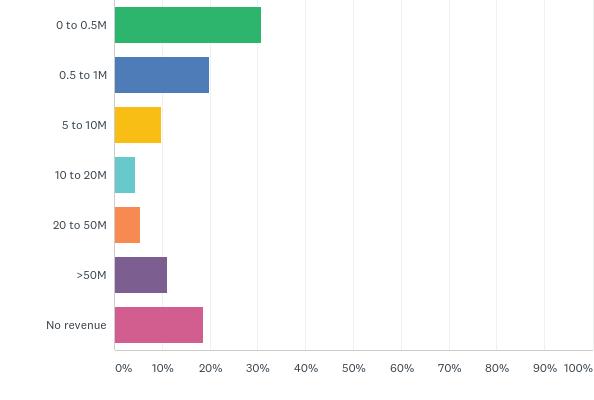

Some Canadians are feeling a bit of a financial pinch this year as interest rates continue to rise, and for several start-up companies, access to capital can feel like it’s spread a bit thin. In fact, when combining both the private and public sectors, the majority of those that answered the survey (51 per cent) made under onemillion, with the bulk of those falling on the lower part of the scale, while another 19 per cent made no revenue at all. Only 13 per cent of companies or organisations have over 5 years cash on hand, while roughly half of respondents have a year or less.

The revenue made is in sharp contrast to how much companies and organisations are spending on research & development, with 43 per cent climbing over the million-dollar mark while the other remaining 57 per cent were more or less under half a million. Considering the duration it takes companies to bring a drug to market (10-15 years and approximately $1.5 billion to commercialise a biotechnology product), it is pivotal for companies to raise capital and retain revenue.

There are several ways to raise capital for a company or organisation. This year the federal Liberals made significant commitments to research and innovation spending in Budget 2018. According to Finance Minister Bill Morneau, this budget represents the “largest investment in fundamental and discovery research in Canadian history”. Overall, Budget 2018 proposed an investment of nearly $4 billion in Canada’s research system.

What level of education do your employees have?

hoW did you find funding or financing opportunities?

There is also an increased focus on supporting entrepreneurship and high potential businesses. However, as much as there has been an overall increase in the level of investment for industry innovation support programs, there has also been a reduction of the overall number of programs available. Other potential methods of acquiring funding would be angel investors and venture capital investors. Access to talent is an imperative part of growing a business, and this is where Canada does not lack. According to the results, 100 per cent of employees have graduated from a post-secondary establishment, with an impressive 60 per cent having obtained a PhD. Furthermore, sometimes roles and especially executive roles, can be difficult to fill regardless of how big the talent pool may be. For survey respondents the most challenging positions are in business development and sales (35 per cent). While others that stood out that were very similar in number were clinical and medical devel-

opment, regulatory affairs, chief executive officer, and the “other” category all roughly hovering around 14-20 per cent.

But what initiatives make a company or organisation successful? The program that overwhelmingly was rated the most crucial was the Scientific Research & Experimental Design Program (SR&ED) at 66 per cent. The Scientific Research and Experimental Development Program offers tax incentives that encourages and supports scientific research and experimental development. The program lets you deduct your SR&ED costs from your income for tax purposes. Also, the program gives you an investment tax credit that you can use to reduce your income tax.

The Industrial Research Assistance Program (IRAP) rated second

Which of the folloWing initiatives have you used that you Would consider most crucial to your success?

with all the investments the liberal government has promised in the upcoming years ahead, it does appear as if the scope of innovation in canada is changing. The funding is on the way for researchers and provides an opportunity to conduct clinical trials, further drug development and bring new medicines and technologies to commercialisation to this knowledge-based economy.

hoW many months of cash do you have available? hoW much capital/funding did you raise in 2017?

Which of the folloWing executive positions are the most challenging for your company/research organization to fill?

highest at 44 per cent that is a vital component of the National Research Council (NRC) and a cornerstone in Canada’s innovation system. Private equity took third place at 33 per cent as most crucial initiatives for companies’ success.

Looking again at Budget 2018, the Government of Canada proposes to invest $925 million over 5 years with an ongoing amount of $235 million per year to Tri-councils such as the Natural Sciences and Engineering Research Council (NSERC), Canadian Institutes of Health Research (CIHR), and the Social Sciences and Humanities Research Council (SSHRC). The government is also proposing a new tri-council fund and is heavily investing into the Canada Foundation for Innovation and big data funding.

So how does Canada stack up in comparison to other jurisdictions? Despite all the recently announced investments, respondents say that Canada is mostly average. Only a mere 4 per cent consider Canada excellent in that regard, which is on par with the response to that same question only two years ago. The hope is that all that will change as the funding takes possibilities to new heights.

Conclusion

With all the investments the Liberal government has promised in the upcoming years ahead, it does appear as if the scope of innovation in Canada is changing. The funding is on the way for researchers and provides an opportunity to conduct clinical trials, further drug development and bring new medicines and technologies to commercialisation to this knowledge-based economy. Comparing the results from both years of the innovation survey, there is momentum to invest in health and life sciences research

one of the topics that is always on the table and thwarts this industry is access to capital. from conferences that address this issue to blogs and subjective opinions, it is posed as one of the most difficult obstacles to overcome as a start-up or mid-sized enterprise.

What is your reported revenue (product, sales and services) for your fiscal year ending in 2017?

hoW does canadian science/business policy compare With other jurisdictions?

from the government, increasing interest from entrepreneurs and investors, and an amplified awareness from the public that make striving for a cure to diseases, cancer, and other conditions that ail us a potentially attainable goal. One thing to be sure of is that Canada’s support for science will position Canada as a global leader in research excellence.

We would like to thank those of you who took the survey and for sharing your top priorities with us.