20 minute read

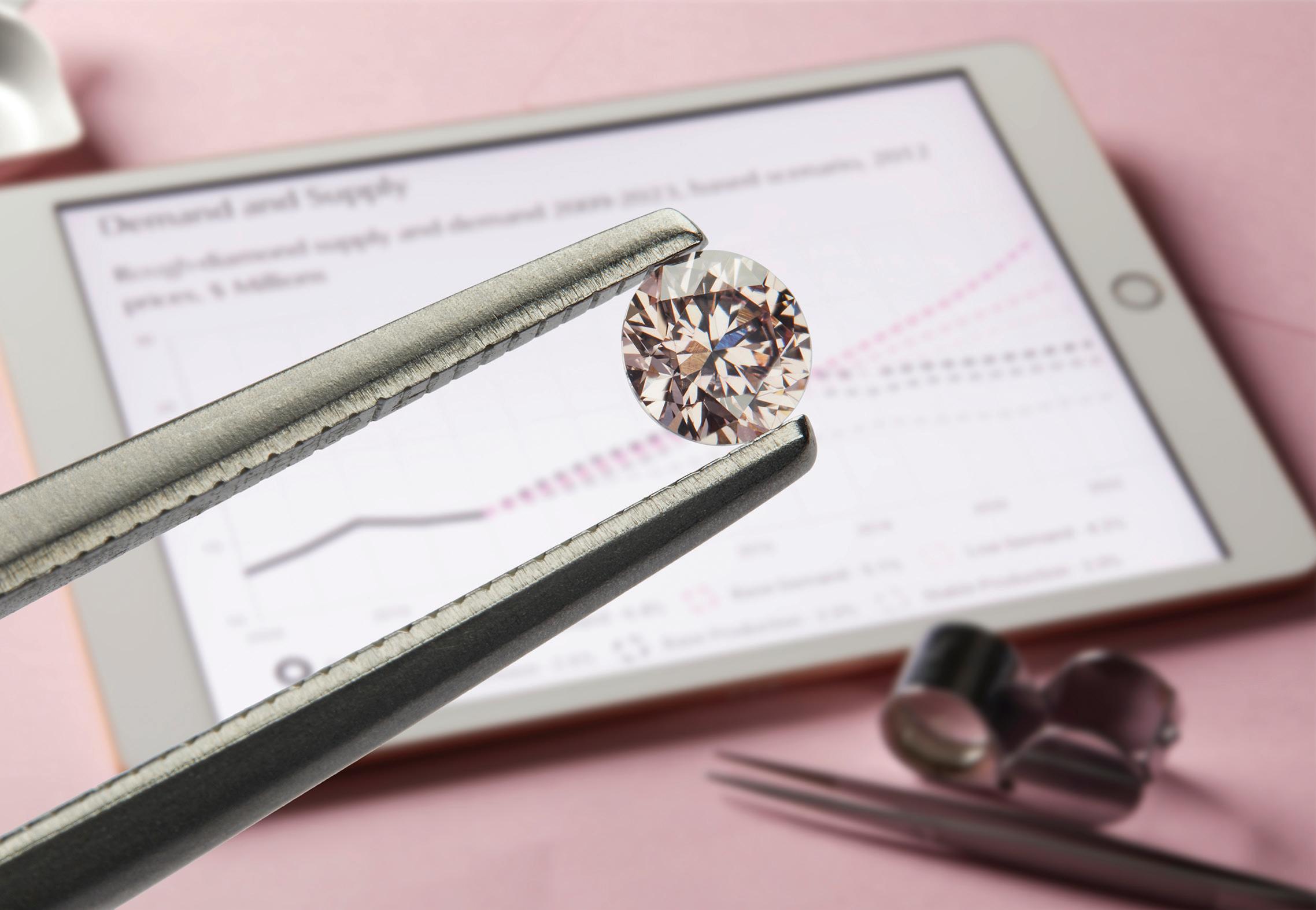

Pink diamond supply chain

IN THE PINK

Since WA’s Argyle Mine closed in 2020, the value of pink diamonds has sky rocketed. Here Anna Cisecki, Executive Director of Australian Diamond Portfolio, explains why.

Advertisement

Approximately 95 per cent of the world’s pink diamonds were produced at the Argyle Mine in Western Australia. Since its closure in 2020, the price of pink diamonds is rapidly increasing. Anna Cisecki from the Australian Pink Diamond Portfolio says the Australian mine produced the highest quality pink diamonds in the world. Investors are rapidly recognising this. Pink diamonds have displayed value increases every year without fail. Since the Argyle Mine closure, there’s less supply and greater demand.

WHAT CAUSES THE COLOUR VARIATION IN PINK DIAMONDS?

Pink diamonds have a certain mythical allure in some ways. Unlike with other coloured diamonds, to date, we still don’t know specifically what causes their colour. Natural diamonds are formed deep within the earth when carbon is exposed to enormous heat and pressure. In the case of other coloured diamonds, if traces of another element are present, you get a coloured diamond – for example, traces of boron will result in a blue diamond, and traces of nitrogen will result in a yellow diamond. With pinks, however, there are no other trace elements; rather, it’s a twist in the lattice structure caused by an unknown fluke of nature.

WHAT ARE YOUR CONCERNS REGARDING THE ARGYLE MINE CLOSURE IN 2020?

The closure of the iconic Argyle Diamond Mine is in essence the end

of an era in the diamond world. It’s a geological masterpiece, a one-off that won’t be repeated ever again. Most of us in the industry feel pretty special to have been involved in its story, as it were. That said, even though the mine has closed, its story will not just live on, but thrive in the years to come, just like the names of history’s most famous artists – demand for their work lives on long after they themselves are gone.

HAS THE CLOSURE OF THE MINE BENEFITED YOU IN ANY WAY?

Given that the Argyle Mine represented 95 per cent of the global supply of new pink diamonds each year, its closure has profound implications for investors. They were rare to begin with, but that scarcity has gone to a whole new level now, with the production of pink diamonds essentially coming to a complete halt going forward. So with no new supply coming and growing demand, prices are being driven up significantly and we foresee a pretty strong bull run on pink diamonds for the decade to come, which will of course mean that we expect trade to continue booming.

IT’S BEEN SOME TIME SINCE THE CLOSURE, CAN YOU EXPLAIN HOW THIS HAS HAD AN IMPACT ON THE PINK DIAMOND TRADE?

In terms of the closure of the mine last year, we’re definitely seeing a sense of ‘fear of missing out’, as it were. Demand was already strong leading up to the closure, but since the announcement that the mine had ceased operating, we’ve seen an almost 50 per cent increase in demand, and this is being seen across the industry. With no new pink diamonds coming onto the market in the near future, people are becoming very motivated to buy now before the chance to own one of these unique assets is gone forever. With growing demand and finite supply, the price of pink diamonds has risen very strongly and has outperformed almost all other asset classes, including shares, property and managed funds. We’ve seen an average 30 per cent growth overall across all categories of investment pinks, with the top categories of pink diamonds seeing more than 40 per cent price growth since the Argyle Mine ceased production.

PRETTY IN PINK: NO ONE KNOWS WHAT CAUSES SOME DIAMONDS TO BE PINK. LEFT: ANNA CISECKI COUNTS HERSELF LUCKY TO BE INVOLVED IN THE ARGYLE MINE STORY.

CAN YOU PREDICT WHEN OTHER MINES MIGHT RUN OUT OF SUPPLY AS WELL?

While occasional pink diamonds can be found in other mines (in Brazil, Russia and India, for example), there is no other steady supply of pinks in the entire world. The Argyle Mine was unmatched in the sheer quantity and quality of the pink diamonds it produced over the years. So even though other diamond mines might be maintaining or even increasing production, they aren’t producing pink diamonds – especially of the quality Argyle is known for – in any great volume at all. As such, the implications for investment are significant. Market fundamentals dictate that when the supply of a product in high demand is cut, prices are very likely to increase.

AS AN INDUSTRY PROFESSIONAL, WHAT IS YOUR OPINION ON CHOOSING TO INVEST IN PINK DIAMONDS?

In terms of the future outlook, pink diamonds are incredibly well positioned to thrive, and not just because of the closure of the Argyle Mine. Pink diamonds have a number of characteristics that investors find greatly appealing, particularly considering the volatile economic situation we find ourselves in now. Some of these reasons are specific to the diamonds themselves as mentioned, including their rarity and physical beauty, which make them very attractive. They are also very stable, in that they don’t demonstrate the volatility we’ve seen in equity markets, commodities or even with gold and other precious metals. So when financial markets wobble, as they invariably do, pink diamonds can typically be relied upon to maintain their value. They are also truly limited in supply, which gives them inflationprotecting qualities, and the proven history of strong long-term returns make them attractive as investments in their own right too. It’s worth remembering that even when Argyle was in production, pink diamonds were growing by more than 10 per

FEELING FLUSH:

THE VALUE OF PINK DIAMONDS HAS GROWN 30 PER CENT IN THE PAST FINANCIAL YEAR.

cent per year. And now, with 95 per cent of the world’s annual mine production gone, and with demand continuing to rise, it is almost certain that prices will continue to rise as well, and that the next decade is likely to be incredibly rewarding for investors who put some of their money in this unique asset class.

YOUR WEBSITE SAYS: ‘AVERAGE 11.2 PER CENT GROWTH PER YEAR’, AND YOU’VE ALSO SAID ‘IN THE LAST 12 MONTHS, DELIVERING AN AVERAGE RETURN ON INVESTMENT OF 30 PER CENT’. COULD YOU EXPLAIN SIMPLY WHAT THIS MEANS?

Historically speaking, growth in prices is not linear – it is not the same every year, some years pink diamonds appreciate more, some years less. The average over the past 10 years has been 11.2 per cent, per year. Growth has exploded in the year since the Argyle Mine closed and we’ve seen a 30 per cent price growth in the last financial year alone.

HOW CAN BEGINNERS START TO INVEST?

One of the most beautiful things about pink diamonds is that they are still accessible to a fairly wide audience. While it’s the multimillion dollar diamonds that tend to capture most media attention, you can certainly still buy high-quality, investment grade pink diamonds from a starting point of approximately $20,000. That’s one of the reasons why they are becoming increasingly popular with retail investors, and in particular with SMSF trustees, as diamonds are an allowable investment within a self-managed super fund.

WHAT’S BEEN YOUR BIGGEST LEARNING SO FAR IN SUCH A HIGHROLLING BUSINESS?

While we do deal with high-end investors, the majority of our customers are SMSF trustees and retail investors. The key to our success has been founded on providing high quality, transparent information about pink diamonds and an end-to-end solution that makes it easy for investors to buy, store, and sell the asset.

THE VIBRANCY AND COLOUR DEPTH OF AUSTRALIAN PINK DIAMONDS IS SAID TO BE INCOMPARABLE. IS IT POSSIBLE TO TELL WHERE PINK DIAMONDS IN THE MARKET RIGHT NOW CAME FROM?

Yes – pink diamonds that were both mined and cut by the Argyle Mine will be accompanied by a Certificate of Origin and Authenticity, as well as have a laser inscription with a unique ID number physically present on the diamond itself.

WHAT DO YOU PREDICT THE VALUE OF THESE DIAMONDS TO BE IN FIVE TO 10 YEARS?

While each diamond is unique, history provides a guide of where prices will head. If pink diamonds grow by 11 per cent per annum, in line with their long-run average, then a $50k stone will be worth closer to $140k a decade from now. If they continue to grow at 30 per cent per annum like they have for the last year, that same $50k stone bought today would be worth $689k in 10 years, while 20 per cent per annum growth would see the diamond worth just over $300k. There are no guarantees of course, but given the closure of Argyle, we are confident the next decade will be at least as rewarding as the last 10 to 15 years have been.

ARE YOU AWARE OF ANY POTENTIAL LOCATIONS OF CONSIDERATION TO MINE PINK DIAMONDS IN AUSTRALIA AGAIN?

There have been no new significant deposits of viable mining opportunities to replace the pink diamonds from the Argyle Mine. Hypothetically speaking, even if a new mine were to be detected in the future, it takes on average 10 to 15 years for a mine to reach the point of commercial production.

DO YOU OWN A PINK DIAMOND YOURSELF?

I do – I am a firm believer in the importance of owning hard assets as part of a diversified portfolio. Pink diamonds form an important portion of my own SMSF.

WOMEN ON TOP

Australian women remain in the minority as leaders of the business world. Now a new book by start-up hub Fishburners wants to address that imbalance, by sharing the stories of trailblazing female founders.

Words: LJ Charleston

FIRST ROW L-R: Betty Andrews Rhoda Esquivel Sarah Cummings Claudia Galvis

SECOND ROW L-R: Lindy Chen Michelle Forster Stephanie Weiss Mellonie Francis

THIRD ROW L-R: Vanouhi Nazarian Nicole Marshall Laura Simmons Annie Slattery

It’s a truth universally acknowledged that women-led businesses are very much in the minority in Australia. Even though more women than ever are taking the leap and being their own boss, the start-up sector remains male dominated.

In October 2020 there were 355,000 registered start-ups, but only 22 per cent are run by women, pointing to a rise of only three per cent across two decades.

Australia’s biggest start-up hub Fishburners has helped more than 3,000 people start a business since 2011 – and now it wants everyone to know about the women-led businesses that are thriving.

CEO Nicole O’Brien believes the newly released book Fempowered Females will inspire other women, by giving practical advice and tips about being an entrepreneur – and how your business can grow from just one great idea.

There’s clearly a hunger for such information as the book reached 'best seller' status on Amazon just two days after publication.

“Female founders have a much bigger role to play in unleashing new ideas, services and products and shaping a world that meets their needs,” Nicole says. “Fempowered tells the stories of some incredible female founders, and our hope is that it will inspire more women and girls to pursue their entrepreneurial dreams as decision makers, change makers, leaders and trailblazers.”

According to Nicole, there’s a huge need for encouragement, guidance and inspiration for womenled start-ups.

“A McKinsey Global Institute study found that advancing women’s equality could add $12 trillion to the global economy by 2025. So we’re here to get more women hired, promoted and invested in, and get more businesses started.

“It takes a lot to incorporate a start-up into a woman’s life, especially if she has a young family – but it can be done,“ Nicole continues. ”If a start-up is something you’re passionate about and you’ve got a good idea, you should go for it.” Here five of the women featured in Fempowered Founders share their words of wisdom.

BETTY ANDREWS, FOUNDER AND CEO OF HSTL&HRT

“You never know whether a business is going to be viable until you go ahead and do it. Just get started! Everyone says it but just go and do it. Don’t hire a website designer, get on WordPress or Squarespace. You don’t need a co-founder. It’s instilled in us that we need a co-founder because

it’s hard. It’s not true! You can do it on your own.

“You don’t have to be perfect to do it and you don’t have to wait. You don’t have to get an MBA, but if you want some help there’s always a way of going out and finding it. It might be hiring a business coach or asking someone to be your mentor. Go out and experiment.” hstlandhrt.com

CLAUDIA GALVIS PLATA, CEO OF PUMPFREE ENERGY

“In my corporate career, I didn’t believe in the glass ceiling until I cracked the top of my head on it. Working 100 per cent in a start-up has been harder than any corporate job but it has given me purpose because now I work with others to ensure we’re working towards something meaningful every day . My advice: check that your idea is enticing to those who would pay for it and then get the right team together to make it happen.

“For pitching, plan what to say and how to say it, then speak slowly and with all your passion. Practice, practice, practice, and make sure you know the technology you’re using; there’s no point practising with full use of your hands and a lectern and then have to handle a microphone and short cards. Dress for the audience and use clean humour. These little nuggets worked for us and we even won the Fishburners Cleantech pitch night.” pumpfree.com.au

VANOUHI NAZARIAN, CO-FOUNDER OF WAGECHECKER

“A person can spend two years sitting in their study trying to plan out what their start-up will look like, but they’ll never get anywhere. They need to be out there, selling, from day one. Even if everything isn’t perfect, be out there selling.

“For prospective founders who haven’t settled on a business idea yet, go out and talk to people in industries you care about. Spend 10 per cent of your time listening. For those who already have an idea, stop procrastinating and just do it. Stop looking for the ‘why not’ and look for the why.” wagechecker.com

MELLONIE FRANCIS, CEO OF RAREIIO

“Sometimes the journey can seem overwhelming there is so much to do. Start small, it doesn’t matter what it is, even something simple like posting to a Facebook group. Eventually it becomes easier to self-motivate.

“Women have a tremendous opportunity to enter the start-up market. From a content perspective, I’ve been very successful in my marketing journey. There’s enormous demand for women-orientated content but there aren’t enough women’s voices or enough women micro-influencers speaking out.” rareiio.com.au

NICOLE MARSHALL, FOUNDER AND CEO OF GRASSHOPPER

“Even though times are tough now around the world there are so many amazing opportunities out there. So why not take the chance to learn, grow and try out something new?

“Every time I face a fear, the next milestones become less daunting and more achievable. There’s no better time to start than now. It takes courage to create something new like a startup. You’ll never be ready to start, you’ll never be in that perfect place where everything lines up, so just start now!” playgrasshopper.io

You can buy a copy of Fempowered Founders at amzn.to/3om584k

A BLAST FROM THE

PAST

The main street of Eden has taken a step back in time with the recent unveiling of the impressively restored façade of the Hotel Australasia.

discovered the bones of the building were in remarkably good condition. The 1904/05 front façade inspired the whole project. “The first task was to rebuild the front parapet as it had been knocked off to install the new façade in 1957,” Mr Rankin said. Another major task was lifting the floorboards, taking two months to restore. Every little detail has been researched and reinstated – colours, internal timber staircase and front ironbark balustrade.

For 117 years Hotel Australasia has been an integral part of the social and physical fabric of the township of Eden; its long and colourful history holding a special place in the hearts of generations of locals. Those following the hotel’s restoration progress will be pleased to learn the doors are expected to open once again in March 2022, after its sudden closure in 2010.

Bega Valley Shire Council originally purchased the historic hotel in February 2016 as a civic space. Following strong pressure by community group Eden’s Australasia Inc, the landmark building gained Heritage listing status with a view to restoring the beautiful original front façade.

Four years later local commercial building contractor Neil Rankin bought the historic building from Bega Valley Shire Council. And with another change in ownership, developer Core Asset Development (CAD) identified the potential in the grand old lady of Eden in September 2021. CAD retained Mr Rankin and his team to finish the job. “The original colours were found around the windows and doors; everything was tiled over. It’s all been about saving and preserving the local history,” Mr Rankin said.

CAD has also bought the Eden Fishermen’s Club and plans to redevelop the site into the Sapphire of Eden, a $100 million project comprising a four-tower complex. When open the building will offer an eight-room, five-star boutique heritage hotel with restaurants, outdoor eateries and ‘Rankin’s Bar’, vodka and gin distilleries plus more.

The heritage renovation has been met with much anticipation from not just those involved in the build, but also the townspeople – many of whom have a deep and personal connection to the building’s history.

LOVE KNOWS NO BOUNDS

To Mr Rankin, Hotel Australasia is more than just another project, it’s a labour of love for him and his highly skilled team of trades. When restoration work began almost two years ago, it was Mr Rankin said, “It’s the biggest development in the town since Ben Boyd arrived in the area in 1842 with all his gold. Eden is getting a new lease on life.”

For further restoration information and updates join Eden’s Australasia Facebook page: @AustralasiaHotel

APP FOR FOR YOUR APPETITE

How a new Aussie restaurant search app is helping people with food intolerances dine out stress-free.

Words: LJ Charleston

El Salem knows how difficult it is to find places to eat that cater to her specific diet: gluten and dairy free, and low FODMAP. On most occasions, her only choice when eating out was spending ages searching menus for meals she was able to eat. She was also tired of hassling waitstaff with an endless array of questions.

“I’d just hope for the best at whatever restaurant my friends were going to. I always felt like a pain, and I hated being the person who couldn’t eat stuff all the time,” El says.

“The problem is that people with dietary requirements cannot easily find restaurants that cater for them or know what the quality of those options are for which they are often paying extra, such as for vegan cheese or gluten-free bread.” Seizing the opportunity to fill the gap in the market, El created the Eatwell app. It’s like a Tripadvisor or Google Maps for people with dietary requirements. Users can input any dietary requirement, allergy or diets they have, and the app shows them restaurants that are recommended by other users with the same needs. Then, they’re shown specific menus for what they can eat.

“My biggest success so far has been our user feedback following our launch. It was so positive with users saying it solved their problems of finding great places to eat, and they only wanted extra features like interacting with others like them on the app.

“Prior to developing our app, I did seven rounds of design getting

feedback and iterating with 80 user testing participants in our target market, which paid off,” El says. The Eatwell app helps you find the best places to eat, rated and reviewed by others with similar food issues. You can rate and review places to eat for all your dietary needs. If you have any allergies or are on a particular diet, the app has also got you covered.

It takes away any dietary-related stress by showing you a menu just for you, instead of showing the food you can’t eat.

El says the start-up journey hasn’t been easy, but it’s been an enormous help being part of the Fishburners start-up community

“My main challenge at the start was to understand how to build an app, designing it, and how to go about finding good, cost-effective engineers. I simply asked every software engineer friend I knew, as well as posting on the Fishburners Slack channel if they knew anyone who could help, which led to the two engineers we have today,” El says.

“It’s great being supported by people who’ve been in exactly the same boat, and are so helpful whenever we have questions. It’s impossible to have all the skill sets needed to successfully launch a business, and a community that’s so responsive and helpful is invaluable.”

El is now focusing on growing communities around the Eatwell app, which focuses on bringing people together through food.

“People with food intolerances usually feel like the odd one out without any decent restaurant options. We cover Sydney and are expanding to Melbourne restaurants in the coming months, and hopefully to Queensland and New Zealand,” El says.

“I’d advise other start-up founders to always focus on the user and you can’t go wrong. Instagram polls are the quickest and best way of seeking advice on specific questions. And constantly try to seek longer one-toone feedback from users and solve for their pain points.” eatwellapp.com.au