REAL WEALTH THROUGH REAL ESTATE

Each of Pyramine Investment Inc. (together with, as the context may require, its direct or indirect subsidiaries including the Limited Partnership, the “Fund” or the “Issuer”), the limited partnership through which it will indirectly make investments (the “Limited Partnership”), the general partner of the Limited Partnership (the “General Partner”), and subsidiary partnerships of the Limited Partnership, and certain of their respective trustees, directors, officers and equity holders (collectively, the “Interested Parties”) are or will be persons who are not at arm’s length with the asset manager of the Limited Partnership, Pyramine Investment Inc.. (the “Agent”), and may be paid for the performance of certain services under various agreements.

Additionally, none of these parties are or will be limited or affected in their ability to carry on other business ventures for their own account, or for the account of others, and are currently, and may in the future be, engaged in the development of, investment in, or management of, businesses that may compete with the business of the Fund and its affiliates.

In addition, one or more of the Interested Parties, may be a principal, director and/or officer of the investment vehicles in which the Limited Partnership invests, and the Agent may be engaged by such investment vehicles to raise funds in one or more offerings.

Certain individuals who are related to Hany Adam, one of the trustees of the Fund and a director of the General Partner, own a significant interest in each of the Agent and Pyramine Investments.

Hany Adam, a principal, director and officer of the Pyramine Investment Inc. , will be a trustee of the Fund and a director and officer of the General Partner and certain other subsidiaries of the Limited Partnership.

The Agent will receive fees under the Agency Agreement and Pyramine Investment Inc., as the sole holder of the Class C Units of the Limited Partnership, will indirectly receive a portion of the Limited Partnership Proceeds distributed by the Limited Partnership. In addition, an affiliate of the Agent and Pyramine Investment Inc., will act as asset manager of the Limited Partnership.

This presentation will be incorporated by reference into the Fund’s offering memorandum to be delivered to investors in connection with the Offering (as amended or amended and restated, from time to time, the “Offering Memorandum”). The Offering Memorandum will contain important information in respect of the Offering and the Offered Securities, including various risk factors that may affect an investor’s decision to invest in the Offered Securities. The purchasers of the Offered Securities that have received this presentation may be, upon acceptance by the Issuer of the purchase price for such Offered Securities, granted certain rights of action and rescission. The Offering Memorandum will describe in greater detail the statutory rights of action that may be available to purchasers of the Offered Securities. This presentation should be read in conjunction with and is qualified in its entirety by the disclosure in, the Offering Memorandum.

R E S A L E R E S A L E R E S T R I C T I O N S R E S T R I C T I O N S

This presentation relates to the offering of the Offered Securities (the “Offering”) only in certain Provinces of Canada (the “Qualifying Jurisdictions”) and to those persons where and to whom they may be lawfully offered for sale, and only by the persons permitted to sell these Offered Securities. This presentation is not, and under no circumstances is to be construed as, a prospectus or an advertisement or a public offering of the securities described herein in any province or territory of Canada, including Ontario.

No securities regulatory authority in Canada, the United States of America or any other jurisdiction has reviewed or in any way passed upon this presentation or the merits of the Offered Securities and any representation to the contrary is an offence. The Issuer is not a reporting issuer or the equivalent thereof under the securities legislation of any jurisdiction. The Offered Securities will not be listed on any stock exchange and there is no primary or secondary market for such Offered Securities, nor is it anticipated that such market will develop. The Offered Securities have not been, and will not be, registered under the United States Securities Act of 1933, as amended, or any state securities laws and may not be offered or sold in the United States or to U.S. persons.

Any offer or sale of the Offered Securities will only be made on a private placement basis, under an exemption from the requirement that the Issuer prepare and file a prospectus with the relevant Canadian Securities regulatory authorities in the Qualifying Jurisdictions. The offers and sales of the Offered Securities will be made through the Agent, which is registered as an exempt market dealer under applicable securities laws.

The Offered Securities will not be sold until subscribers have executed and delivered subscription agreements approved and accepted by the General Partner, on behalf of the Fund, and the Agent. The Fund and the Agent reserve the right to reject all or part of any offer to purchase the Offered Securities for any reason, or allocate to any prospective purchaser less than all of the Offered Securities for which such purchaser has subscribed.

As the distribution of the Offered Securities in the Qualifying Jurisdictions is being made on a private placement basis, any resale of these securities must be made in accordance with applicable securities laws. Those securities laws may require resales to be made in accordance with an exemption from the prospectus requirement, and either through a registered securities dealer or pursuant to an exemption from the dealer registration requirement. Purchasers are advised to seek their own independent legal advice prior to any resale of the Offered Securities.

The Units will be subject to resale restrictions, including a restriction on trading the Units. Until the restriction on trading expires, if ever, a Unitholder will not be able to trade the Units unless it complies with very limited exemptions from the prospectus requirements under applicable securities legislation.

As the Fund has no intention of becoming a reporting issuer in any province or territory of Canada, these restrictions on trading in the Units will not expire. In addition, the Declaration of Trust provides that Units are transferable subject to the approval of the Trustees. Consequently, Unitholders may not be able to sell their Units in a timely manner, if at all, or pledge their Units as collateral for a loan.

ATTRACTIVE ASSET CLASS WITH COMPELLING SUPPLY/DEMAND CHARACTERISTICS

BENEFITS OF AN INDUSTRY-LEADING VERTICALLY-INTEGRATED PLATFORM WITH STRONG ALIGNMENT OF INTERESTS

EXPERIENCED MANAGEMENT TEAM & A STRONG INDEPENDENT BOARD OF TRUSTEES

CONSERVATIVE FINANCIAL METRICS SUPPORT GROWTH AND DISTRIBUTIONS

million 2.5

THE POPULATION OF ONTARIO ISPROJECTEDTOGROWBY RESIDENTS OVER THE NEXT TEN YEARS GIVING INVESTORS AN OPPORTUNITY TO CAPITALIZE ON THE NEED TO BUILD MORE HOUSING.

THE PYRAMINE INVESTMENT INC., FUND IS BEING FORMED TO PROVIDE INVESTORS WITH EXPOSURE TO RESIDENTIAL REAL ESTATE DEVELOPMENT PROJECTS THAT CAPITALIZE ON DEVELOPERS’ ABILITY TO GENERATE STRONG RETURNS.

THE FUND IS RAISING A POOL OF CAPITAL TO INVEST IN WHAT IS EXPECTED TO BE A DIVERSIFIED PORTFOLIO OF RESIDENTIAL REAL ESTATE DEVELOPMENTS ACROSS ONTARIO.

PYRAMINE INVESTMENT INC., AND YOUMERIT HOLDINGS HOME INVESTMENT GROUP., HAVE PARTNERED TO CREATE VEHICLES TO MAKE OWNING A RESIDENTIAL REAL ESTATE EASY ACROSS THE GREATER TORONTO AREA (GTA) & SOUTHERN ONTARIO.

THE PARTNERSHIP IS ROOTED IN A COMMITMENT TO HELPING BUYERS TO FIND THEIR DREAM HOMES, WHILE PROVIDING STRONG RETURNS FOR INVESTORS.

PYRAMINE INVESTMENT INC.

Canada has been steadily increasing its annual immigration targets over time from 260,000 in 2015 to a planned 421,000 by 2023.

The MFT’s six target markets grew at a faster rate than the country as a whole, accounting for 56% of all population growth in 2020

Population growth remained strong in 2020 despite slowdown in immigration resulting from COVID-19 related border closures.

The Federal Government has increased its immigration target of bringing in over 1 million new Canadians over the next 3 years to compensate from the slowdown resulting from COVID-19.

Immigration targets for new Canadians have been set at 401,000 for 2021, 411,000 for 2022 and 421,000 for 2023

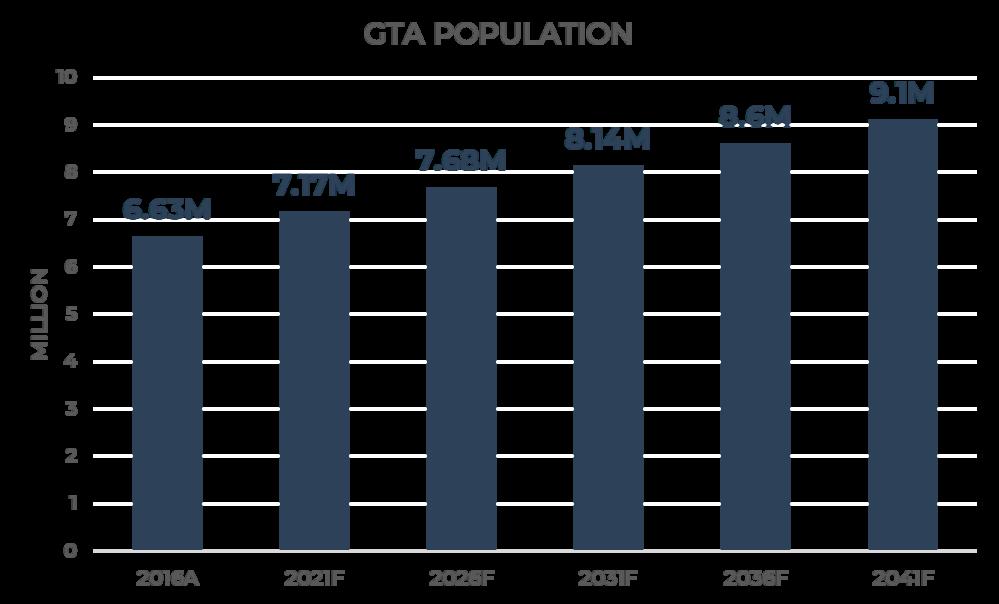

Between 1996 and 2016, the GTA population increased by ~1.9M to 6.63M and is expected to grow by another ~1.8M to 8.6M by 2031. 1As of Oct. 2020, the Government of Canada announced the 2021-2023 Immigration Levels Plan, aiming to welcome at least 401,000 new immigrants per year.

Between 1996 and 2016, the GTA population increased by ~1.9M to 6.63M and is expected to grow by another ~1.8M to 8.6M by 2031. 1As of Oct. 2020, the Government of Canada announced the 2021-2023 Immigration Levels Plan, aiming to welcome at least 401,000 new immigrants per year.

Due to COVID-19

Housing Supply Remains Inelastic to Housing Demand

Over time housing supply has shifted from low-rise towards high-rise, and in the process accommodating less people per household. Housing completions have fluctuated over the last 10 years and have not met annual demand for new housing formation.

The inventory of completed and unsold homes hit near historic lows in 2021

Most projects sell their units prior to commencing construction. Units that remain unsold following completion are considered completed and unsold new homes.

As a result, demand was well ahead of supply and more supply will be required to address the mismatch

"The pace of this mismatch will be especially important as population growth 'through immigration resumes post-pandemic

The unemployment rate is steadily recovering from the impacts of the COVID-19 pandemic and is expected to continue to rebound in 2022.

The GTA has a strong labor market, evidenced by a consistent decrease in unemployment year-over-year pre-pandemic.1 Strong job growth and opportunities drive population and housing growth.

Personal earnings growth has been in line with the average growth in 2bedroom rents, while significantly lagging the appreciation of house prices. The relative affordability of rental housing has improved further in 2020 as housing prices has accelerated strongly in the last year.

The affordability gap between rental and home ownership widened in 2020

Shorter duration leases provide inflation hedge

Diverse tenant base limits concentration risk

Defensive asset class less sensitive to economic cycles

Favourable demographic and economic trends

High barriers to entry

Availability of lower cost debt financing

Fragmented sector offers potential for consolidation

INVESTMENT PROPERTIES WERE CONCENTRATED IN THE INVESTMENT PROPERTIES WERE CONCENTRATED IN THE

RAISEAMOUNTUPTO $50M

Investment Eligibility RRSP, TFSA *

* Assumes $25M from Fund offering and $25M from a concurrent offering by the Limited Partnership.

** This slide is intended to be an illustration only and is not intended to constitute a “financial outlook” or “future oriented financial information” for purposes of applicable securities laws

The Issuer is not making any representations or predictions regarding the future housing market growth, if any, or investor IRR or profit. Market conditions may change and negative returns are also possible.

Actual results may vary significantly. See “Forward Looking Statements” and “Risk Factors” herein.

T A R G E T I N V E S T M E N T S T A R G E T I N V E S T M E N T S

TRANSACTION RANGE

$1M to $15M

PRIORITY INVESTMENT

SHARED EQUITY

DEVELOPMENT TYPE

RESIDENTIAL REAL ESTATE FOR SINGLE FAMILY DWELLINGS

PROPERTY TYPE

HIGH-RISE, MID-RISE, LOW-RISE AND REZONING

PRIMARY LOCATION

GTA & SOUTHERN ONTARIO

To become equity partners with experienced wealth management team, capitalizing on their ability to generate profits.

The Fund will invest in Equity Share Program of new and resale residential real estate mainly in GTA & Southern Ontario.

The Fund, through the Limited Partnership, will structure investments to prioritize return of capital and priority hurdles for the Fund.

The Fund intends to maximize returns while mitigating downside risk for investors by diversifying across a portfolio of projects.

Investments are expected to be diversified by property type including high-rise, mid-rise, lowrise and rezoning opportunities with a variety of developers.

The Fund may invest as debt or equity targeting project IRRs of 14.0% or higher.

Investors in the Limited Partnership (including the Fund) will receive cash distributions from the Limited Partnership on a pro rata basis (reflecting the net capital contributions of each partner), based on the number and class of Units of the Limited Partnership held. Distributions and payments will generally be made in accordance with the “waterfall” below.

12%

First, 100% to the investors until investors have received full return of capital

Second, The investors Receive 70% of the profit until they have achieved an annual preferred return of 12% while PYRAMINE received 30% of the profit

The remaining balance will be distributed 50% for the investors and 50% for Pyramine

Pyramine Investment Inc. intends to use the MFT as its exclusive income & Wealth Building residential vehicle over time for our investors.

Access to Wealth generating residential under-value deals Family estate-planning purposes

Pyramine Investment Inc. and its affiliates retain interest in the MFT ensuring its interests are aligned with Unitholders

Investing in the Offered Securities involves substantial risks. These risks include, but are not limited to, the following:

No marketability and transferability

Dependence of key personnel

Risks of investment in the business and real estate development

Financing risks

Project estimates and sensitivity analysis

Regulatory and economic developments affecting the Canadian housing market

Zoning risk

Claims under Subscription Agreement

Fluctuations in Capitalization Rates

Risk of change in investment return

Access to capital

Nature of units

Limited liability

Dilution

Structural subordination of the units

Voting rights

Capital Investment

Lack of Redemption Right

Potential for conflicts of interest

Tax related risks

Net worth of general partner

Environmental risks

Lack of separate counsel

The Limited Partnership will be relying on third party developers to develop any property in which the Fund invests

EXPERIENCED MANAGEMENT TEAM EXPERIENCED MANAGEMENT TEAM & & A STRONG INDEPENDENT BOARD OF TRUSTEES A STRONG INDEPENDENT BOARD OF TRUSTEES

Recognized by several organizations for his work in the dental space

15 years in sales selling health products to the medical industry which built an ideal foundation for his work as an investor

Active real estate investor with a several units in his real estate portfolio in Middle East, Egypt, Saudi Arabia, Dubai and Canada.

Responsible for overall strategic direction of the MFT, including investment, growth and capital structure

Founder &CEO of Hany Adam Homes Investment Group, Founder & CEO of Youmerit Holdings Investment Group

Over 25 years experience in real estate acquisition, investment and development;

CHIEF FINANCIAL OFFICERProfessional Accountant from CPA Ontario, Canada and also a Certified Public Accountant from Montana State, United States of America, with over 30 years of post-qualification professional experience.

Has wide ranging experience in handling audits and multi-disciplined consulting assignments that include business plans, business modeling, due diligence, business analysis, cost control techniques, project financing, accounting & financing structuring.

Looking past the pandemic, the MFT’s focus on high-quality shared equity housing in desirable urban areas is expected to outperform in the longterm.

BY & STRATEGY FOR LONG-TERM SUCCESS BY

Capitalizing on organic growth

Strong fundamentals that have driven long-term growth are still present (e.g. immigration, housing affordability).

Creating value from properties repositioning

Exploring acquisition opportunities

Strong recovery in core urban markets expected in second half of 2021 as pandemic impact subsides and the benefits of urban living are reestablished.

Capitalizing on the relationship with the Affiliates

THE MFT HAS THE RIGHT ASSETS THE MFT HAS THE RIGHT ASSETS & STRATEGY FOR LONG-TERM SUCCESS

We appreciate your time spent reading our booklet. If there are any specific details or additional information you would like to see included, or if you have any questions, please don't hesitate to let us know. Your feedback will help us improve and enhance future versions of this guide.