2 minute read

Stati sti cal data from Mintec

Vegetable oil reference prices Lipsa February 2021 report/Reuters

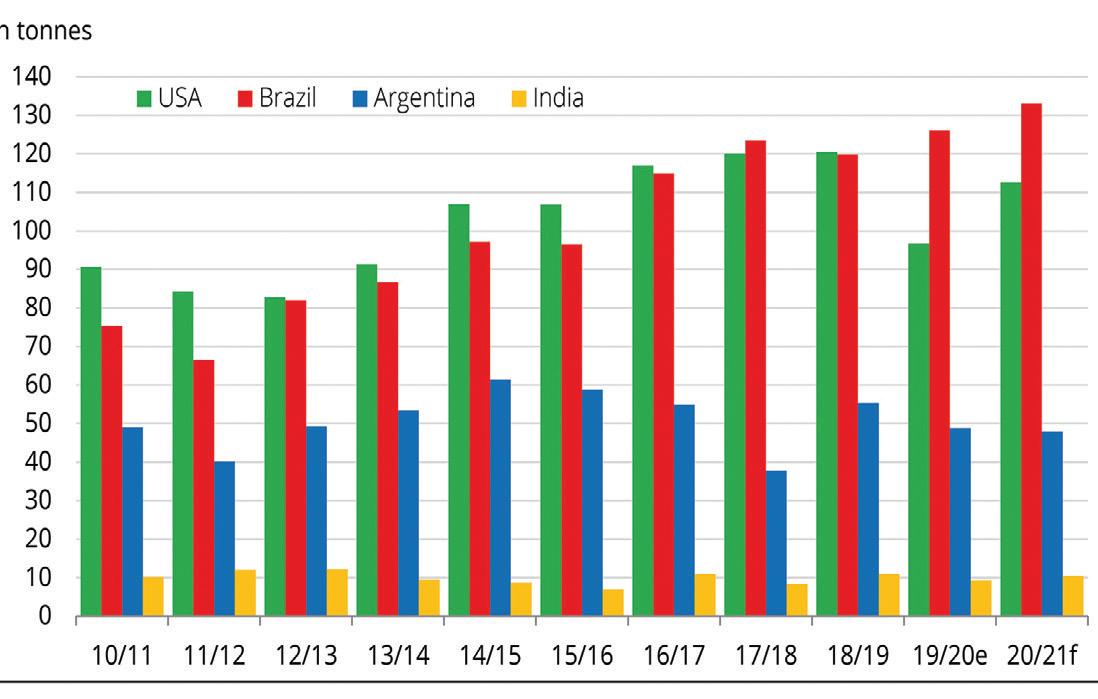

Soyabean crops in top producing countries (million tonnes) UFOP, USDA, AMI

Palm oil production – Indonesia, Malaysia, world (tonnes) Lipsa February 2021 market report

Prices of selected oils (US$/tonne) Mintec

Sep 20 Oct 20 Nov 20 Dec 20 Jan 21 Feb 21 Soyabean 872.4 869.1 946.9 1,001.7 1,053.2 1,075.1 Crude palm 740.7 752.9 855.6 918.4 915.9 974.0 Palm olein 723.1 723.2 811.8 873.6 875.1 911.6

Coconut 1,037.5 1,105.8 1,396.2 1,491.5 1,458.2 1,435.0 Rapeseed 924.3 913.4 988.0 1,040.0 1,092.5 1,131.5 Sunflower 977.3 985.6 1,117.7 1,185.1 1,298.5 1,385.9 Palm kernel 818.8 830.7 1,104.9 1,246.5 1,345.2 1,335.7 Average 871.0 883.0 1,032.0 1,108.0 1,148.0 1,178.0 Index 206.0 209.0 244.0 263.0 272.0 279.0

STATISTICAL NEWS

Vegetable oil reference prices

Strong price rises in vegetable oils continued in February, driven by slower palm oil production recovery in Asia, a delayed soyabean harvest in Brazil, very dry weather in Argentina and tight sunflower oil availability in the Black Sea region, according to Lipsa’s February market report.

Sunflower oil prices are at their highest level for nine years, due to a significant 5M tonnes sunflowerseed production loss (equivalent to 2M tonnes of oil) mainly in Ukraine and Russia, which represent more than 60% of global sunflowerseed production.

Palm oil production

A recovery in palm oil production is expected in late Q2/ early Q3 2021, mostly led by Indonesia, according to Lipsa’s February market report. China’s demand is expected to be better in Q1 than Q2 and slightly better for all of 2021. India has increased its oil stocks and CPO has lost competitiveness against other oils with the country’s new tariffs, although its imports are expected to grow in 2021 against the record low level in 2020. Europe is expected to import less CPO during 2021, Lipsa says.

Soyabean production in top producing countries

Brazil is set to harvest a record 133M tonnes of soyabeans in the current crop year, an increase of around 7M tonnes against last year, according to a US Department of Agriculture (USDA) report.

Drought-related planting delays at the end of 2020 have caused delays in harvesting but are unlikely to lead to reductions in yields, the report says.

Brazil has consolidated its number one soya position ahead of the USA based on a 1.7M ha expansion in planted area. The US soya harvest was completed at the beginning of November 2020, amounting to around 113M tonnes, a rise of 16M tonnes year-on-year. Third largest soyabean producer Argentina is expected to have a lower harvest for a second year running – at 48M tonnes – due to poor weather conditions, as well as lower yields, UFOP quoted the USDA report as saying.

Brazil, the USA and Argentina produce more than 80% of the world’s soyabeans.

Lipidos Santiaga (Lipsa), Spain, produces vegetable oils and fats for food, animal feed, technical and biofuel applications

The Union for the Promotion of Oil and Protein Plants represents companies and associations involved in the production, processing and marketing of oil and protein plants in Germany

Mintec provides independent insight and data to help companies make informed commercial decisions. Tel: +44 (0)1628 851313 E-mail: sales@mintecglobal.com