3 minute read

World statistical data

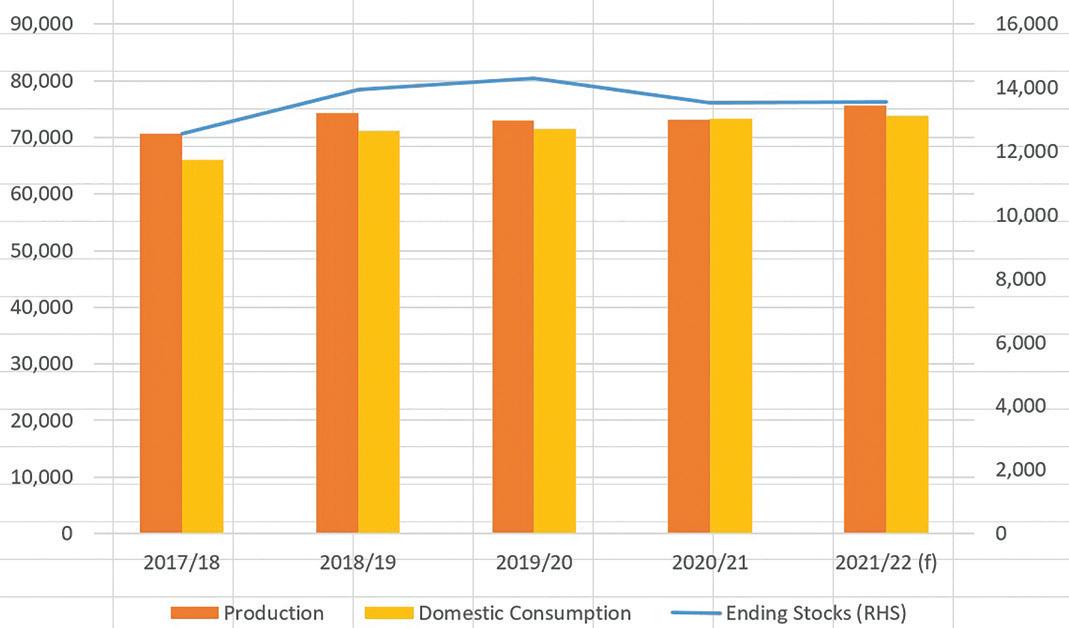

Global palm oil global supply and demand (million tonne) Mintec

Palm kernel oil prices, cif Rotterdam (€/tonne) Mintec

Coconut oil prices, cif Rotterdam (€/tonne) Mintec

Prices of selected oils (US$/tonne)

Sept 21 Oct 21 Nov 21 Dec 21 Jan 21 Feb 22 Soyabean 1,364.6 1,485.9 1,387.7 1,383.1 1,421.8 1,537.3 Crude palm 1,173.1 1,303.5 1,327.1 1,265.0 1,320.1 1,497.0 Palm olein 1,144.9 1,224.8 1,234.7 1,147.4 1,223.3 1,422.3 Coconut 1,485.2 1,857.9 1,898.6 1,781.4 1,928.3 2,145.3 Rapeseed 1,505.1 1,745.5 1,696.8 1,729.9 1,773.7 1,666.0 Sunflower 1,313.6 1,412.5 1,412.4 1,385.5 1,390.8 1,510.0 Palm kernel 1,370.5 1,797.1 1,941.0 1,743.8 2,017.5 2,262.5 Average 1,337.0 1,543.0 1,558.0 1,491.0 1,582.0 1,720.0 Index 317.0 366.0 369.0 353.0 375.0 408.0

STATISTICAL NEWS

Palm oil prices increase

The Mintec Benchmark Price (MBP) for EU palm oil increased by 34% month-on-month to a record high of €1,673 tonne on 4 March, driven by a number of factors. In January 2022, the Indonesian government implemented a regulation to curb palm oil exports to fulfil its domestic demand and stop domestic prices from rising further. As Indonesia is the major producer and exporter of palm oil, this Domestic Market Order (DMO) on exports led to supply shortages globally, driving EU palm oil prices.

Palm oil exports from Malaysia (a key exporter to the EU) have also remained limited in 2022 due to high fertiliser costs and labour issues.

More recently, prices in the vegetable oil complex have been driven by the Russia-Ukraine geopolitical conflict as both regions account for a major share of production and exports of alternative oils – sunflower oil and rapeseed oil. Shipment disruptions and other supply uncertainties stemming from this conflict have therefore put additional upward pressure on palm oil prices.

Palm kernel oil prices reach record high

The Mintec Benchmark Price (MBP) for EU palm kernel oil (PKO) reached a record high in March, climbing by 35% month-on-month and 125% year-on-year to €2,706 on 9 March. Similar to the palm oil market, PKO prices have followed an upward trend due to tight supply conditions.

In February, the Indonesian government expanded the January Domestic Market Order (DMO) on palm oil exports to include all palm oil products, further supporting prices in the PKO market.

Rising input costs and concerns over the conflict between Russia and Ukraine have also been a price driver so far in first quarter 2022.

Coconut oil prices hit all-time high

The Mintec Benchmark Price (MBP) for EU coconut oil rose by 23% month-on-month and 57% year-on-year to an all-time high of €2,123/MT on 9 March.

Despite a projected increase in global coconut oil production for the 2021/22 marketing year (up by 2% yearon-year to 3.51M tonnes), EU coconut oil prices have risen due to shortages and a decline in exports of PKO (a close alternative edible oil), in addition to a price rally in the wider vegetable oil complex.

The impact of the Russia-Ukraine conflict on sunflower oil shipments has also driven demand and, in turn, prices of EU coconut oil as an alternative edible oil.

Mintec provides independent insight and data to help companies make informed commercial decisions. Tel: +44 (0)1628 851313 E-mail: sales@mintecglobal.com Website: www.mintecglobal.com