IRONMAKING SOLUTIONS FOR A SUSTAINABLE FUTURE www.steeltimesint.com January/February 2023 - Vol.47 No1

The rise and fall of Redcar’s blast furnace. Local production of strategic goods. The afterburn from Donald Trump’s Section 232 tariffs. A long-read article from Responsible Steel.

HISTORY DECARBONIZATION NORTH AMERICA DECARBONIZATION

TIMES INTERNATIONAL –January/February 2023 –Vol.47 No1 DIRECT REDUCED IRON – THE FUTURE OF GREEN STEELMAKING? Since 1866

STEEL

EDITORIAL

Editor

Matthew Moggridge

Tel: +44 (0) 1737 855151 matthewmoggridge@quartzltd.com

Editorial assistant Catherine Hill Tel:+44 (0) 1737855021

Consultant Editor

Dr. Tim Smith PhD, CEng, MIM

Production Editor

Annie Baker

Advertisement Production

Martin Lawrence

SALES

International Sales Manager

Paul Rossage paulrossage@quartzltd.com Tel: +44 (0) 1737 855116

Sales Director

Ken Clark kenclark@quartzltd.com Tel: +44 (0) 1737 855117

Managing Director

Tony Crinion tonycrinion@quartzltd.com Tel: +44 (0) 1737 855164

Chief Executive Officer

Steve Diprose

SUBSCRIPTION

Jack Homewood

Tel +44 (0) 1737 855028 Fax +44 (0) 1737 855034

Email subscriptions@quartzltd.com

Steel Times International is published eight times a year and is available on subscription. Annual subscription: UK £215.00 Other countries: £284.00 2 years subscription: UK £387.00 Other countries: £510.00 3 years subscription: UK £431.00 Other countries: £595.00 Single copy (inc postage): £47.00 Email: steel@quartzltd.com

Published by:

Business Media Ltd, Quartz House, 20 Clarendon Road, Redhill, Surrey, RH1 1QX,

www.steeltimesint.com

Gwent

©Quartz Business Media

ISSN0143-7798

IRONMAKING SOLUTIONS FUTURE goods. Trump’s Section 232 tariffs. Responsible Steel. STEEL TIMES INTERNATIONAL January/February 2023 Vol.47 No1 DIRECT REDUCED IRON – THE FUTURE OF GREEN STEELMAKING? Sinc 1866 CONTENTS – JANUARY FEBRUARY 1 2 Leader

4 News

The

10

Details

13 USA

Locking

17 Latin

20 India update From imports to exports. 23 Decarbonization The gold standard? Direct Reduced Iron 34 Local production of strategic goods. 40 Moving from natural gas to hydrogen. 46 Perspectives Q&A: WKE With CEO Ian Jones. 48 History The rise and fall of Redcar. 23

Quartz

England. Tel: +44 (0)1737 855000 Fax: +44 (0)1737 855034 www.steeltimesint.com Steel Times International (USPS No: 020-958) is published monthly except Feb, May, July, Dec by Quartz Business Media Ltd and distributed in the US by DSW, 75 Aberdeen Road, Emigsville, PA 17318-0437. Periodicals postage paid at Emigsville, PA. POSTMASTER send address changes to Steel Times International c/o PO Box 437, Emigsville, PA 17318-0437. Printed in England by: Pensord, Tram Road, Pontlanfraith, Blackwood,

NP12 2YA, UK

Ltd 2023

Cover courtesy of Midrex FlexTM: Moving from natural gas to hydrogen in decarbonizing ironmaking

By Matthew Moggridge.

round-up

latest global steel news.

FUTURE STEEL FORUM 2023

of the seventh Future Steel Forum , 21-22 September in Vienna.

update

horns with WTO.

America update Brazil and decarbonization.

The 7th Future Steel Forum, Vienna 21-22 September...

At this time of year I’m always wondering how long – or on what date – I’m allowed to stop wishing people a Happy New Year. It’s 19 January 2023 as I sit here writing this leader, alone in the office after dark, and I guess now is as good a time as any. But before I slam a ban on myself I might as well take this opportunity to wish all readers of Steel Times International, even the Chinese, who celebrate Chinese New Year on 22 January, a Happy New Year.

Right, that’s it, no more, not until next year at any rate.

One big thing I need to discuss is the Future Steel Forum 2023. If you turn to pages 10 and 11 of this issue you will find the first in-magazine promotion of our SEVENTH Future Steel Forum. It’s hard to believe that we’re on to our seventh successful conference, but we are and this year’s event takes place in Vienna, 21-22 September.

email address is under that image of yours truly on the left hand side of this page (and yes, I know, I need to upgrade it). I want speakers willing to make a 20-minute presentation on the relationship between digital manufacturing and decarbonization. This year’s conference will focus attention on the two big D words: digitalization and decarbonization. Can one aid the other? Let’s find out how. Not every paper will focus on this topic – there are other areas that need to be discussed too, like that of Industry 5.0. Is there such a thing? If you know the answer, drop me a line and let’s work up a presentation on the subject. I’m also looking for dicussion panelists (for the digitalization/decarbonization debate) as well as session chairs for the entire twoday event.

Matthew Moggridge Editor matthewmoggridge@quartzltd.com

Vienna is an amazing city and worth a visit. If you have a professional interest in digital manufacturing or decarbonization, please attend and/or present a paper. On the latter, the programme is currently under development and I’m looking for participants, so please get in touch (my

From a speaker perspective – or perhaps that should be ‘from a programme perspective’ – it is important that we have steelmakers speaking, mainly because this is a steel event, but we also need production technology companies, consultants and academics in the field so please get in touch and let’s make the seventh Forum the one to remember.

2 www.steeltimesint.com January/February 2023 LEADER

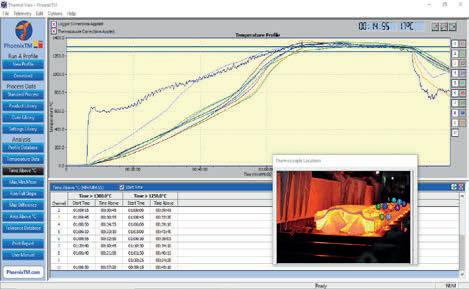

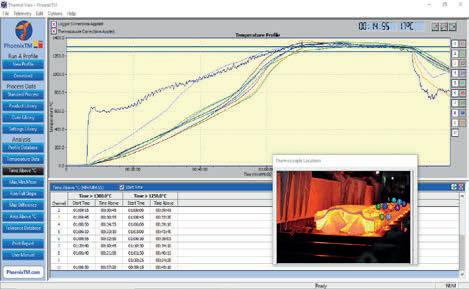

Temperature Profiling Solutions In the Steel Reheat Industry Comprehensive • Passes through furnace with Slab • Get an accurate Slab temperature profile • Measurement at up to 20 points • Live 2 way radio communications Safe • Safe system installation without production delays • Reliable protection of data logger up to 1300°C Easy • Optimise your process accurately • Validate your furnace mathematical model. PhoenixTM GmbH Germany info@phoenixtm.de PhoenixTM Ltd UK sales@phoenixtm.com PhoenixTM LLC USA info@phoenixtm.com Benefits • Optimise furnace programs • Save energy and increase production • Obtain optimal drop out temperatures • Minimise scale build up • Prevent hot roller wear & tear Where experience counts ! www.phoenixtm.com

Our innovations aiming at decarbonizing the steel industry: CO2-free steel production process Siderwin, Furnace Electrification, Carbon Capture, Heat Recovery, Jet Vapor Deposition (JVD), E-Qual® Electrical Steel Processing Technologies Technologies for cleaner and smarter steel making Innovation is part of our Group’s DNA. For over 200 years John Cockerill Industry has demonstrated its ability to think differently and its capacity of seeing things from another angle. Still today, we are combining talent and technology, history and modernity, engineering and services. Virtues that help us to accompany our steelmaking clients in their digital transformation journey and their transition to responsible, zero carbon steel making. TrainLab™ Virtual reality & immersive e-training platform for considerably improved learning retention. Follow us on johncockerill.com/industry Eagle Eye Coating® A unique and intelligent zinc coating technology. JOHN COCKERILL INDUSTRY METALS Reheating Furnaces Pickling Acid Regeneration Cold Rolling Strip Processing Automation

The Scottish Liberal Democrat party has criticised Scottish trade minister Ivan McKee after obtaining new documents about the sale of Liberty Steel’s Dalzell mills in 2016. The party claimed the documents showed ‘a cavalcade of Scottish government deception’.

Scottish National Party ministers agreed to buy the plants from Tata Steel subsidiary Longs Steel UK for £1 then ‘immediately’ sell them for £1 to metal tycoon Sanjeev Gupta’s Liberty Steel in a so-called ‘backto-back agreement’, but the plant in Motherwell, North Lanarkshire, has been under pressure as Gupta’s company, GFG Alliance, is investigated for alleged fraud.

Source: The Herald, 5 December 2022

Liberty Steel suspended production at the last operating blast furnace at its Galati plant in Romania during December to carry out a $3.92m maintenance programme. Furnace five, which last year produced 2.3Mt, will be offline until early 2023. "The timing of the programme, with steel demand across Europe impacted by macro-economic issues, will allow Galati to make the improvements to its production processes without impacting customer delivery,"

Liberty said.

Source: Argus Media, 6 December 2022

Kazakhstan’s infrastructure and industry minister, Kairbek Uskenbayev, has threatened to ban global steel giant ArcelorMittal from operating in the country after a fatal accident at a factory belonging to the Luxembourgbased company. Uskenbayev said ‘tough decisions’ were being made against the company, after a worker was killed in a factory in the Kazakh town of Termitau, and added that the government had created several commissions to study the company's safety measures.

Source: Barron’s, 8 December 2022

APOLOGY:

German steelmaker StahlHolding-Saar has announced that it has decided to invest €3.5 billion with its subsidiaries Dillinger and Saarstahl to ‘transform the industry’ in the Saarland, Germany, by enabling the production of green steel. A new production line with an electric arc furnace is planned to be built at its Völklingen site, and an electric arc furnace and direct reduced iron plant will be built at its Dillinger plant site.

Source: Steel Orbis, 6 December 2022

Swiss microtechnology company Panatère, a watch component manufacturer and steel recycling business based in Saignelégier, has announced that it will soon inaugurate its industrial solar furnace. According to the company, the pilot model will be able to melt green steel to produce components for the watchmaking, medical and aeronautical sectors. “Our material will be 100% recycled and melted using renewable energy,” stated Liselotte Thuring, project manager. Instead of sourcing recycled metal bars from China, Panatère plans to produce and use its own steel.

Source: Energy Industry Review, 7 December 2022

The World Trade Organization has found that tariffs on steel and aluminium imports that were imposed by the US under former president Donald Trump violate global trade rules. Trump had claimed national security concerns when he announced the new border taxes in 2018, sparking a wave of trade fights around the world. The

WTO rebuffed that argument, saying the duties did not come ‘at a time of war or other emergency’. The US said it stood by the tariffs, with assistant US trade representative Adam Hodge commenting that ‘the US strongly rejects the ruling and has no intention of removing the measures’.

Source: BBC, 9 December

In an article on Green Steelmaking in the November/December 2022 edition of Steel Times International, written by Myra Pinkham, Tim Landrum’s job title was printed incorrectly. We said that Tim was Accenture’s North American Lead when in fact he is really North America Metals Lead at Accenture. We apologise to Tim for this error.

4 NEWS ROUND-UP

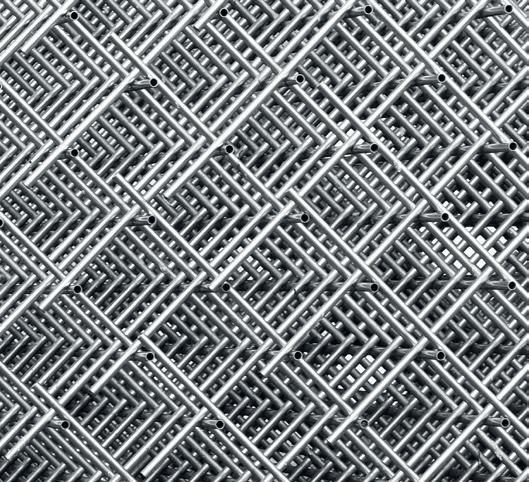

Total Construction Supplies, a UK-based manufacturer of prefabricated reinforcement steel has invested £4m into a 220,000 sq ft facility in the Midlands, with 57 jobs created so far. The company, which was founded in 1998 by Craig Gibbons and Matthew Hague, has opened a site fitted with cutting and bending machinery, welding equipment and overhead gantry cranes. Hague said: "There's a lot of talk about the UK heading for recession, but we're not seeing this, especially with the products we supply being so important for completing infrastructure projects all over the UK’’.

Source: Insider, 12 December 2022

Russian steelmaker Severstal’s Cherepovets iron and steel plant has launched two new VR simulators in employee training. The VR system is designed for training operators of metal coating and cutting machines, simulating the process of replacing paint and varnishing, as well as metal packaging. According to Severstal, the VR space is completely consistent with the real workshop situation, which can greatly enhance the accuracy of employee operations and training efficiency.

Source: Yieh Corp Steel News, 12 December 2022

ArcelorMittal Nippon Steel India has signed a memorandum of understanding with the National Skill Development Corporation to provide digital skill training to more than 1,600 young people across India. “The initiative aims to motivate young people

Ukrainian MPs have demanded that Vladimir Lisin, the head of Russian steel giant NLMK, must be sanctioned for supplying one of Vladimir Putin’s largest tank factories. Lisin is Russia’s richest man according to Forbes magazine. He was placed on Australia’s sanctions list in April, but unlike other prominent Russian tycoons, such as Roman Abramovich and Mikhail Fridman, has so far avoided designation by the EU, US and Britain.

Source: Stuff, 13 December 2022

ArcelorMittal Poland has announced that current European market conditions mean it won't be able to restart one of its idled blast furnaces before early 2023. The Luxembourg-based steelmaker idled its number 3 blast furnace at its Dabrowa Gornicza plant in early October, citing weakened European demand for steel, slowing economic activity, high energy costs and high foreign steel imports.

Source: MarketWatch, 13 December 2022

from four states – Odisha, Chhattisgarh, Gujarat, and Maharashtra – and equip them with vocational skills that will support their ability to secure and undertake employment in roles such as IT helpdesk attendants, and data entry operators," the company said in a public statement.

Source: Mint, 16 December 2022

Tata Steel has signed a memorandum of understanding with Hockey India to become an official partner of the FIH Odisha Hockey Men's World Cup 2023. Speaking on the news, Chanakya Chaudhary, vice president, corporate services, Tata Steel, said: “As a committed and long-term patron of sports in India, Tata Steel takes pride in being associated with the Hockey Men’s World Cup once again. The state of Odisha has come to be recognised as a hub of the national sport, and Tata Steel is honoured to be part of the journey. We wish the tournament all the very best and hope it will encourage more youngsters to take up this sport in the future.”

Source: Tata Steel, 14 December 2022

Tata Steel has said that its plants in Wales will pause operations for hours at a time to reduce its load on the energy grid during periods of peak demand. In an arrangement called 'load management', Tata Steel says it responds to prices, with electricity changing hourly, and turns down or turns off some energy-intensive

production lines such as rolling mills and coating lines, during peak periods.

Source: Business Live, 16 December 2022

NEWS ROUND-UP 5

South Korean steelmaker

POSCO has resumed operations at a key steel plant after a three-month-long suspension due to a typhoon. POSCO restarted the no. 2 hotrolled steel production plant in Pohang, bringing the number of running plants to 13 out of 18 following the natural disaster, the company said in a statement. The no. 2 hotrolled steel plant processes 5Mt, or 33%, of 14.8Mt of steel products churned out at POSCO's integrated steel mill.

Source: Yonhap News Agency, 18 December 2022

Turkish special steel producer Yukselen Celik expects to increase its production capacity to 200kt/yr thanks to its investment in the Dilovası service centre, as reported by Steel Orbis. The construction of the service centre will be completed in the first half of 2023 and its commissioning is planned no later than the end of the year. Investments will amount to $7-8 million, the company said in a public statement. In 2020-2021, the company increased its capacity for the production of special value-added steel from 25kt/yr to 100kt/yr following growth in export markets.

Source: GMK Center, 16 December 2022

Tata Steel has carried out the demolition of two obsolete coke plant facilities at its Jamshedpur Works under controlled conditions. The steelmaker is replacing the existing coke ovens with ‘the latest technology and higher energy efficiency’. Sanjiv Paul, vice president, safety, health and sustainability, Tata Steel, said: "We have completed an important step of safe and controlled implosions of obsolete coke plant facilities. This is a testimony to our commitment to operational efficiency, safety, resource optimisation and sustainable growth strategy."

Source: Market Screener, 18 December 2022

Nissan Motor Co and Kobe Steel have announced that Nissan plans to use ‘Kobenable steel’ for Nissan models from January 2023 onward. With this, Nissan becomes the latest global carmaker to confirm future use of low-carbon steel. Ford, Mercedes-Benz and BMW are among the other carmakers who have already collaborated with Kobe Steel. Kobenable steel, commercialised by Kobe Steel, is claimed to significantly reduce CO2 emissions in the blast furnace process. This will be the first time Kobenable Steel will be used in massproduced vehicles.

Source: Autocar Professionals, 19 December 2022

India steelmaker Rungta Mines Limited has commissioned a wire rod mill at Chaliyama steel plant in Jharkhand. The commissioning of the wire rod mill will help Rungta Mines to ‘expand the portfolio of products and serve customers with a wide array of solutions’, the company stated. The wire rods will be available on a pan-India basis. According to the company, the sale of wire rods will be made available not only for wire rod traders but also for end users.

Source: The Avenue Mail, 19 December 2022

Australian iron ore company, Fortescue, has signed a memorandum of understanding with Austria’s only crude steel producer, voestalpine, Mitsubishi Corp and Primetals Technologies, aimed at designing and engineering an industrial-scale prototype plant with a new process for net-zero-emission ironmaking. The partners also plan to investigate the implementation and operation of the plant, which will be located in Linz, Austria.

Source: Renew Economy, 20 December 2022

Indian union minister of steel, Jyotiraditya Scindia, has stated that the Indian government is considering mandating the use of ‘green steel’ in government projects. Scindia said that emissions from the steel industry have been brought down by 15% between 2005 and 2022, with the country targeting an additional 10% reduction in emissions by 2030. Energy consumption per tonne of steel produced has also come down as well as emission intensity in terms of CO2, he added. Source: The Indian Express, 20 December 2022

6 NEWS ROUND-UP

Indian steel magnate Lakshmi Mittal was photographed with Tesla and Twitter owner Elon Musk at the FIFA World Cup 2022 final in Qatar. Also seen in the viral photograph was Jared Kushner, son-inlaw of former US President Donald Trump. Elon Musk and Lakshmi Mittal, the UKbased executive chairman of ArcelorMittal, were among a large number of high-profile spectators spotted at the footy final, which was watched by billions across the world.

Source: Money Control, 20 December 2022

Nippon Steel Corp. offered to pay as much as 136.6 billion yen ($1 billion) to take Nippon Steel Trading private. Nippon Steel, which currently owns 34.5% of Nippon Steel Trading, will eventually own 80% of the company with Mitsui & Co. holding 20% if the deal succeeds and the company is delisted, according to a publicly released statement.

Source: Bloomberg, 21 December 2022

Ukraine’s Ferrexpo, one of the world’s biggest producers of iron ore pellets, has announced that improvements in its power supplies has allowed it to reopen one of its production lines. Russian targeting of Ukraine’s energy grid with missile strikes has caused widespread disruption, and transport logistics have also been complicated by the war. The London-listed company is one of the biggest employers in central Ukraine, with around 10,000 employees. Alongside use of stockpiles, the restoration of production means Ferrexpo will be able to meet the requirements of existing customer contracts. At full capacity, it has four pellet production lines.

Source: yahoo!finance, 21 December 2022

The UK's Trade Remedies Authority (TRA) has proposed that a countervailing measure on imports of stainless-steel bars and rods from India be revoked. Countervailing measures are put in place to offset imports being sold at unfair prices due to government subsidies in their country of origin. The TRA set out in its Statements of Essential Facts that revoking the measure would be unlikely to cause injury to the UK industry.

Source: Outlook, 22 December 2022

Baowu Steel, the world's largest steelmaker, has been issued approval by Chinese authorities for its takeover of Sinosteel Group, a stateowned mining enterprise. The absorption, announced by China's state-owned Assets Supervision and Administration Commission, represents the latest in a series of purchases by Baowu Steel.

Source: Nikkei Asia, 22 December 2022

A stainless-steel sculpture representing a willow tree is to be installed in Sheffield, UK, as a permanent memorial to the Covid pandemic. Artist George King's design was chosen out of 14 entries after Sheffield City Council asked for submissions. The city centre sculpture would be a ‘meaningful, long-lasting and creative’ tribute to those who died, as well as to key workers, the council said. The memorial is due to be installed in spring next year.

Source: BBC, 22 December 2022

The Netherlands public prosecution department has said Tata Steel IJmuiden should be fined €100,000 for five different infringements of environmental rules between 2018 and 2021. In two cases, the company discharged ‘graphite dust’ into the atmosphere, which led in one instance to black snow falling

in the surrounding area. In one case, the company dumped waste into the water supply and in two others, experiments with cooling coal waste with water broke environmental guidelines, the public prosecutor said.

Source: Dutch News, 22 December 2022

www.steeltimesint.com January/February 2023 NEWS

ROUND-UP

7

Hoa Phat Group, a major Vietnamese steel manufacturer, has inked a contract to export 10kt of wire rod steel to Europe – the firstever order of Vietnamese steel bound for the continent – and plans to export the products to Cambodia. The contract is expected to unlock a ‘new, potentially lucrative market’ for Vietnamese steel products. According to a representative of Hoa Phat Hung Yen Steel Co. Ltd., a subsidiary of Hoa Phat Group, the low-carbon wire rod batch is expected to be delivered to the European buyer in February 2023.

Source: Khmer Times, 26 December 2022

CSN Mineração, the second largest exporter of iron ore in Brazil, has signed a contract for the purchase and sale of iron ore with Swiss trading company Glencore. According to the document filed with the Securities and Exchange Commission, the project foresees an export prepayment of up to a maximum value of $500 million. With the investment, the company looks to increase its own production and the purchase of iron ore from third parties from 34Mt in 2022 to 68Mt in 2027.

Source: Mining.com, 27 December 2022

International gas and technology supplier Air Liquide has recently inaugurated a four-kilometrelong pipeline that connects the Duisburg steel mill run by Thyssenkrupp Steel Europe with the French company’s hydrogen network in the Ruhr district of North Rhine-Westphalia, Western Germany. "The pipeline will enable climate-friendly hydrogen to be delivered to us from 2024 onward. We will need it for research and simulation purposes and then, most importantly, to power our first direct reduction plant," said Bernhard Osburg, CEO of Thyssenkrupp Steel.

Source: Renewables Now, 28 December 2022

Two motorists escaped serious injuries near Connecticut, USA, after colliding with a steel guardrail that impaled their car on 26 December – Boxing Day. Footage posted by the local fire rescue service showed the guardrail stuck between the passenger seats of the car following the single-vehicle accident, and debris strewn across the interstate. “Miraculously the occupants suffered only minor injuries and were transported to a local hospital with fire department paramedics,” a public statement read.

Source: yahoo!news, 28 December 2022

Kezad Group, a subsidiary of AD Ports Group, which operates industrial cities and free zones in Abu Dhabi, has signed a preliminary agreement with Dana Steel for the establishment of a new steel plant in Abu Dhabi

as the region focuses on boosting its manufacturing sector. As part of the agreement, Dana Steel will develop a 50,000-squaremetre hot and cold rolling steel complex that will help the company to increase its

manufacturing capacity in the GCC and replace imported raw materials with a new ‘made in UAE’ supply, AD Ports announced.

Source: The National News, 30 December 2022

The UK Ministry of Defence has announced the delivery of over 1,000 metal detector systems and 100 bomb defusing kits to Ukraine. The detector systems have been donated to enhance the capabilities of the Ukrainian forces to de-arm unexploded ordnance and ensure the safety of civilian homes and different infrastructures across the country. UK defence secretary Ben Wallace said: “Russia’s use of landmines and targeting of civilian infrastructure underline the shocking cruelty of Putin’s invasion. This latest package of UK support will help Ukraine safely clear land and buildings as it reclaims its rightful territory.”

Source: Army Technology, 2 January 2022

www.steeltimesint.com January/February 2023 8 NEWS ROUND-UP

ORANGE IS THE NEW GREEN. REDEFINING SUSTAINABLE METALS PRODUCTION

As the metals industry transforms in pursuit of green steel, the future of sustainability demands pioneers and leaders with vision, courage, and a willingness to push the boundaries of innovation and eco-friendly metals production. Primetals Technologies is redefining sustainable metals production.

We’re making orange the new green.

LEARN MORE

AT METEC 2023 primetals.com

FUTURE STEEL FORUM

VIENNA, AUSTRIA

DIGITALIZATION AND

The Future Steel Forum, now in its SEVENTH successful year, is heading for Vienna in September to examine the important relationship between digital manufacturing and the decarbonization of the steelmaking process. Come and listen to experts from the two most important areas of global steelmaking at present. This is a must-attend conference for anybody with an interest in the fast-developing world of Industry 4.0 technologies and those responsible for sustainable steel manufacturing.

SEPTEMBER

2023

2023

www.FutureSteelForum.com @Future_Steel Join our Future

Steel Forum Group

DECARBONIZATION

HAVE SOMETHING TO SAY AND WANT TO CONTRIBUTE?

We are now accepting abstracts for The Future Steel Forum. If you'd like to be a part of this event as a speaker, please contact Matthew Moggridge now on matthewmoggridge@quartzltd.com

SPONSOR OR EXHIBIT

To discuss any sponsorship opportunities or exhibition enquires, please contact Paul Rossage now on paulrossage@quartzltd.com

Sponsored by O cial Media Partner

To be the first to hear when registration opens for the Future Steel Forum event in Vienna, please scan this QR code

Organised by

Since 1866

BUSINESS MEDIA LTD

Locking horns with the WTO

THE ruling by the World Trade Organisation (WTO) that the tariffs imposed in 2018 by former US president Donald Trump against imports of foreign steel and aluminium violated global trade rules, did not seem to bother the administration of President Joe Biden, which had, by and large, continued with Trump’s tariffs. However, the Biden administration imposed tariff-free quotas, instead of tariffs, for certain countries with which it has special ties.

The tariffs of 25% and 10% on foreign steel and aluminium respectively had angered America’s allies, including the European Union and Japan, particularly because Trump had invoked a scarcelyused provision of US trade law, declaring imported steel and aluminium as a threat to US national security under Section 232 of the Trade Expansion Act of 1962.

China, the world’s largest steel-producing nation whose steel exports to the US were affected, had, along with other countries, challenged the tariffs at the WTO.

The WTO maintained, in its ruling, that it was ‘not persuaded’ that the US had faced ‘an emergency in international relations’ to justify the tariffs. The WTO rejected the USA’s argument of imposing the tariffs for national security reasons, saying the duties did not come ‘at a time of war or other emergency’.

But, the WTO’s ruling is unlikely to be of any impact at this point. Indeed, if the US does appeal against the WTO ruling, the matter will not be moved ahead,

considering that the WTO’s Appellate Body has not functioned for three years since the US blocked the appointment of new judges in the body.

Also, the Biden administration has gained confidence after reaching agreements with its main trading partners – the European Union, Japan and the UK – to practically drop the tariffs and substitute them with import quotas, exempting them from the levies. The trading partners, in return, dropped their retaliatory tariffs against the US.

The Biden administration has in fact taken a jibe at the WTO. “The United States strongly rejects the flawed interpretation and conclusions,’’ said Adam Hodge, spokesman for the Office of the US Trade Representative. “The United States has held the clear and unequivocal position, for over 70 years, that issues of national security cannot be reviewed in WTO dispute settlement,’’ Hodge continued, adding that the WTO had no authority ‘to second guess the national security decisions of member countries’.

However, Hodge emphasized that the Biden administration was committed to preserving US national interest by ensuring the long-term viability of the US steel and aluminium industries, adding that the reports ‘only reinforce the need to fundamentally reform the WTO dispute settlement system’.

Experts believe that the Biden administration is trying to strike a balance

between the US trading partners who were unhappy with Trump’s ‘America first’ trade policies, and retaining tariffs that are popular among many US steel and aluminium producers and their workers.

The WTO ruling against the tariffs, however, did not surprise some steelconsuming industries. There had been criticism from some quarters that the tariffs were protectionist and even though the US decision to impose tariffs for national security reasons was a sovereign one, the WTO did not agree with the logic behind the US decision.

Apparently, seeing its argument vindicated by the WTO ruling, China reacted in a statement saying that it hoped that the US would respect the ruling and correct its policies while Switzerland, which along with Norway had contested the tariffs, said that the WTO report only confirmed that countries enjoyed broad discretion to protect security interests –‘provided they meet certain minimum requirements’. Norway had contended that it had contested the US tariffs at the WTO ‘to prevent protectionism … so that the rules-based, multi-lateral trading system is not undermined’.

The US trade representative’s office sent a proposal to the EU outlining a new plan to shape the global steel and aluminium market, with the goal of promoting trade in metals that are produced in ways that minimize carbon emissions and impose tariffs on metals that are deemed to cause

13 www.steeltimesint.com January/February 2023

* US correspondent, New York

USA UPDATE

The World Trade Organisation’s recent ruling claims that tariffs imposed by the USA in 2018 ‘violate’ global trade rules, which the US government has firmly rejected, despite previous criticism from its trading partners. By Manik Mehta*

too much pollution. Details of enforcing such a plan were not publicized at the time of writing this update.

Reacting to the WTO ruling on US tariffs, which were widely supported by US steel producers, the American Iron and Steel Institute (AISI) president and CEO Kevin Dempsey, rejected the WTO dispute panel’s ruling, saying that it had ‘once again gone beyond its mandate’.

Dempsey said: “The tariffs and quotas on steel were instituted by the President following a determination by the Secretary of Commerce that high levels of steel imports and continuing global excess capacity in steel threatened to impair US national security as defined in section 232 of the Trade Expansion Act of 1962. The WTO has no authority to second guess the US government on matters of our national security. This decision highlights once again why significant and systemic reform of the WTO dispute settlement system is essential to ensure that all WTO members’ rights are fully protected.”

Dempsey further argued: “The Section 232 programme on steel has worked to reduce the repeated surges in imports that threatened the health of the American steel industry. It also has incentivized new capital spending by US steelmakers, with investments of more than $22 billion in new, expanded or restarted production since March 2018. Unfortunately, the global steel overcapacity crisis continues to plague steelmakers worldwide, with excess capacity estimated to exceed 562Mt in 2022, more than six times total steel production in the United States.”

Dempsey said that many countries continued to increase their steel capacity. For example, cross-border investments into Southeast Asia, including many incentivized through China’s Belt and Road Initiative, will add over 90Mt of new, export-oriented

steelmaking capacity in that region alone over the next few years. “Given these facts, we believe the Section 232 measures on steel remain critically important for US national security. AISI strongly urges the Biden administration to maintain the Section 232 programme in steel and disregard this erroneous decision.”

An issue which is raising the American consciousness is climate change and the need to reduce pollutants in the environment to improve the quality of life.

The Biden administration recently proposed that the EU establish an international consortium dedicated to promoting trade in metals produced with less carbon emissions while imposing tariffs on steel and aluminium supplied by China and other polluting countries.

The proposal, drafted in a document prepared by the Office of the US Trade Representative, provides an unprecedented model of trade co-operation which the US sees as a focal point of its approach to trade policy. The concept of such a consortium, which the Americans see as a Global Arrangement on Sustainable Steel and Aluminium (GASSA), would have

the weight of the huge American and European markets aimed at strengthening domestic industries, reducing stress on the environment and minimizing climate change impact. Tariffs would be used by the participating countries against metals whose production causes environmental harm. Experts say that the tariffs would be imposed against metals exported by China and other countries which are not in the group, while those in the group would have favourable trade terms for metals –particularly steel and aluminium.

Indeed, to become part of the arrangement, countries would have to ensure that their steel and aluminium industries comply with certain emission standards. Governments wanting to join would also have to commit to not engaging in over-production of steel and aluminium which have pushed down global metal prices and limiting activity by state-owned enterprises through which subsidies are passed. The US and European Union have been negotiating a climate-specific deal for the steel and aluminium industries since 2021.

Meanwhile, Nucor Corp has made an equity investment in a start-up company developing a process that can produce iron from low-grade ores and renewable electricity. Without giving details about the investment, Nucor said that the process being developed by the Colorado-based Electra had the ‘potential to be a gamechanger’. Indeed, Nucor chairman/CEO Leon Topalian said that ‘we are excited to partner with Electra and its revolutionary process to produce emission-free iron’.

The transformative technology ‘… could change the steel industry as we know it’, he claimed. �

www.steeltimesint.com January/February 2023 USA UPDATE 14

LINEAR POSITION SOLUTIONS FOR STEEL APPLICATIONS ABSOLUTE POSITION SENSORS WITH INDEPENDENT DETACHED ELECTRONICS Highest performance with Industry 4.0 and 85 ºC (185 ºF) Higher temperatures up to +105 °C (+221 °F) temposonics.com | info.us@temposonics.com | 800 633 7609 MTS Systems Corporation, Sensors Division • 3001 Sheldon Drive Cary, NC www.mtssensors.com/industrial Temposonics® Magnetostrictive Linear Position Sensors SOLUTIONS FOR HIGH TEMPERATURE APPLICATIONS Absolute Position Sensors with Independent Detached Electronics Accurate Measurement | Varied Operating Temperatures up to +105 °C (+221 °F) Contact applications support at 1-800-633-7609 / sensorsinfo@mts.com Model RD4 Model GBS Model ET V

Brazil and decarbonization

Wieland Gurlit, senior partner at McKinsey’s office in São Paulo, delivered an interesting presentation entitled: ‘Brazil: a potential leader in the decarbonisation of the iron and steel industry’ at ABM Week, a conference organised by the Brazilian Metallurgical Association (ABM) that was held in June 2022. This article is a recapitulation of the aforementioned presentation. By Germano Mendes de Paula*

GURLIT’S approach was divided into three parts:

a) Why is decarbonisation of the steel industry important?

b) Which are the fundamental decarbonisation alternatives?

c) How can Brazil become a leader in decarbonising the steel industry?

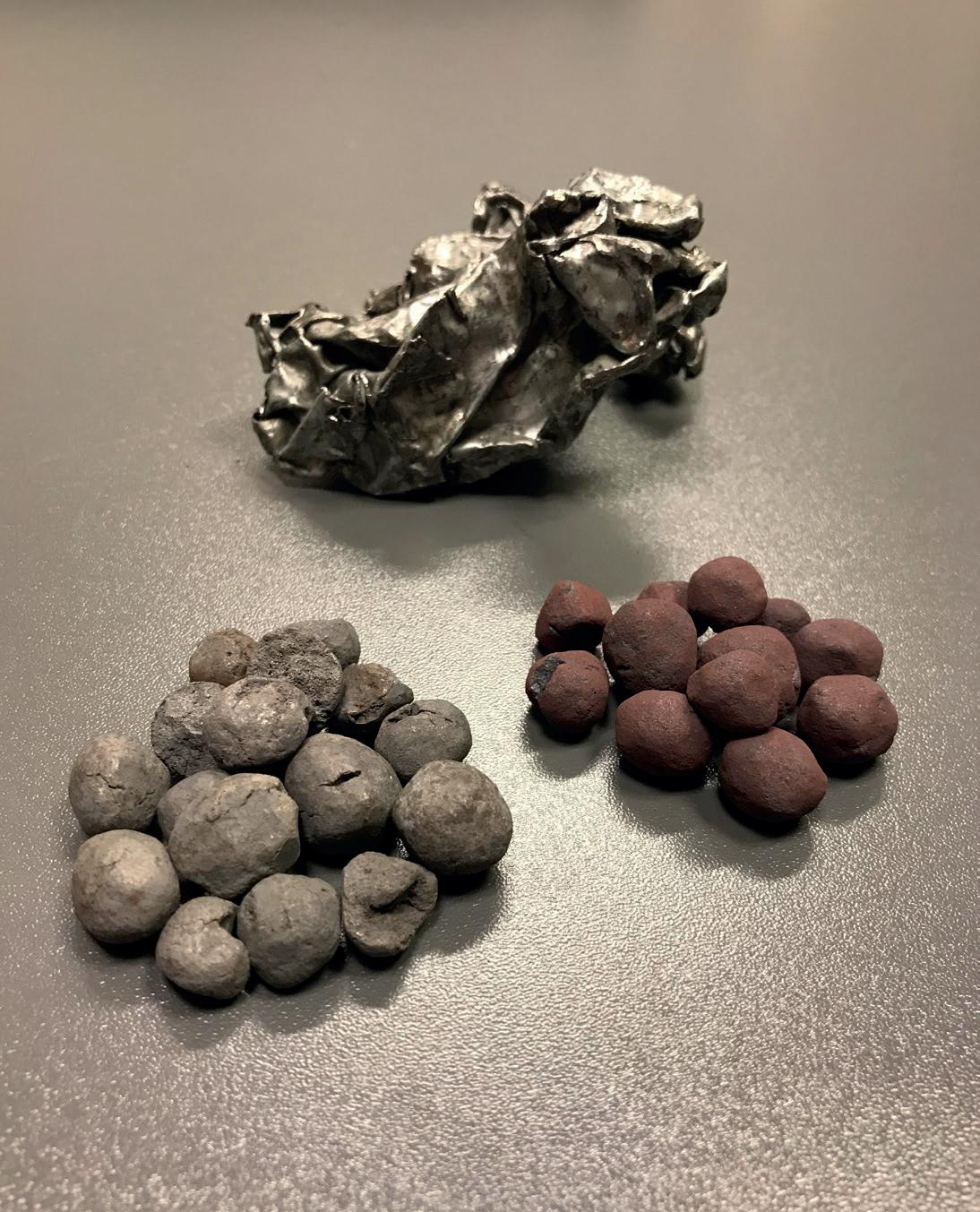

Regarding the last question, he paid attention to two issues – biocarbon and green pig iron; green H2 to green HBI –which are also the focus of this article.

Biocarbon in Brazil

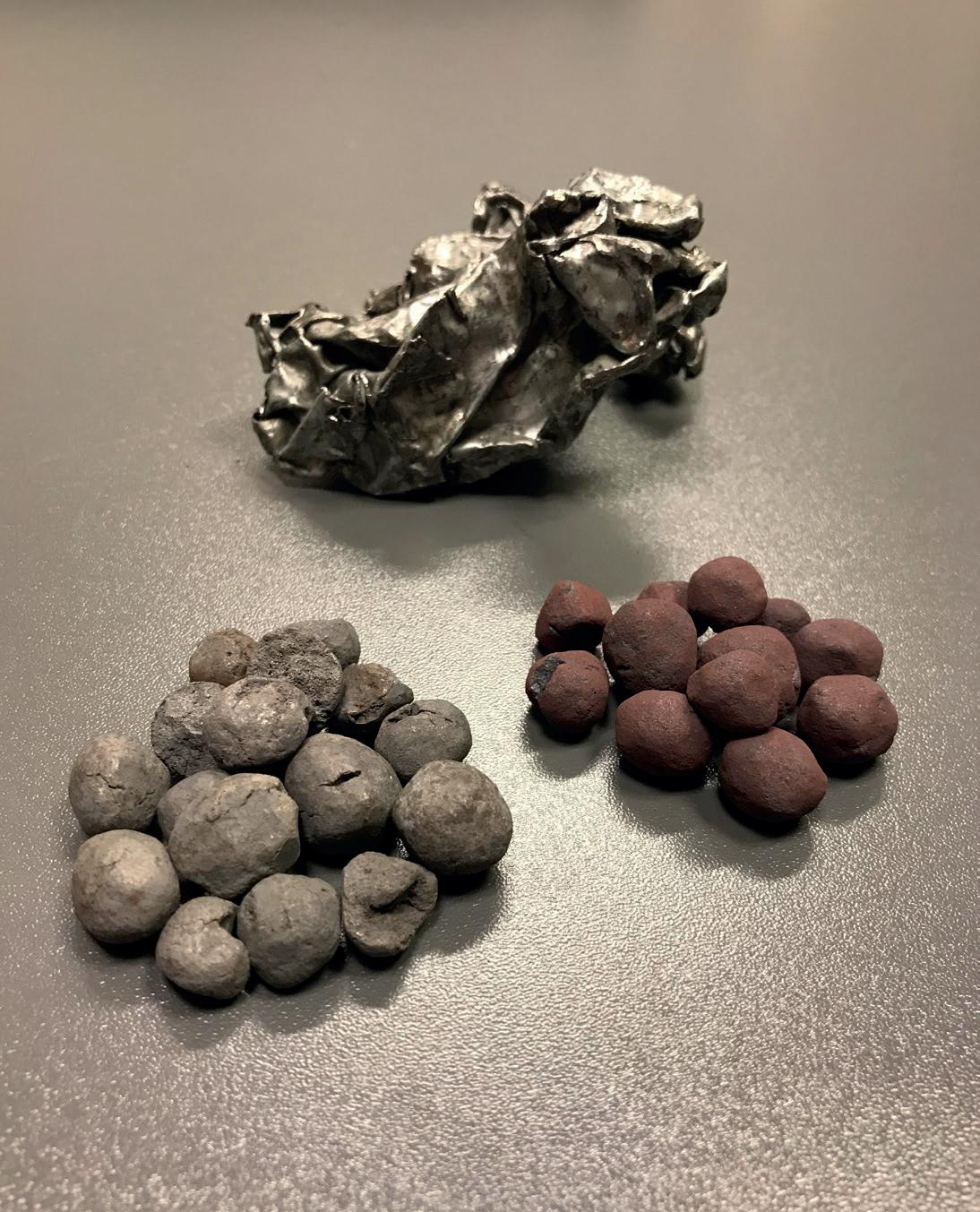

Considering specifically the Brazilian industry, McKinsey stated that biocarbon of the future will be very different from the charcoal of the guseiros (the independent pig iron producers, which rely upon charcoal blast furnaces and consumption of mini-lump iron ore). Fig 1 shows that the guseiros’ model is dependent on eucalyptus of sometimes non-traceable

and uncertified origins. In addition, this business format has four disadvantages: a) it generates significant greenhouse gas (GHG) emissions in the form of methane in the carbonisation process; b) it has low yield and no by-products; c) it consumes poor-quality charcoal; d) it does not allow for appropriating economies of scale, as the typical blast furnace varies from 50 to 150kt/yr nominal capacity.

The second option regarding biocarbon in the Brazilian steel industry, analysed by McKinsey, was called the ‘optimised charcoal blast furnace model’, which refers to charcoal integrated mills, such as Vallourec and Aperam. In this system, 100% of the eucalyptus comes from replanted and certified forests. In contrast to guseiros, it consumes high-quality charcoal and pellet. Charcoal production can generate valuable by-products and no GHG emissions, while the blast furnaces generate a comparatively higher yield. The blast furnace’s size is

around 300-500kt/yr installed capacity. The consultancy firm believes that it is a feasible solution for Brazil in the age of steel decarbonisation.

The third and final alternative concerning Brazilian steel based on biocarbon was described as the ‘scalable metallurgic biocarbon model’. Biomass feedstock will utilise replanted and certified eucalyptus, agricultural and forestry residuals. This model will employ emerging technologies such as Tecnored or Perpetual Next horizontal kilns. It might offer two advantages: a) the fabrication of valuable by-products; b) the production of charcoal fines, to be briquetted into a product with higher strength and density rather than charcoal. Such inputs can be consumed both in the Tecnored (or similar plant) ironmaking equipment and as a PCI substitute in a coke integrated mill. In Gurlit’s opinion, this third model has potential to be a global solution.

* Professor in Economics, Federal University of Uberlândia, Brazil. E-mail: germano@ufu.br

17 www.steeltimesint.com January/February 2023

LATIN AMERICA UPDATE

Fig 1

McKinsey also considers that the combination of biocarbon and carbon capture, utilisation and storage (CCUS) could lead to steel production even with a negative carbon footprint. The use of biocarbon in the sintering plant and in the blast furnace (by maximising fine injection up to 180 kt/ton and by substituting PCI) could reduce by 0.75t GHG/t crude steel, or roughly 35% of the specific generation of emissions from coke integrated mills.

As CCUS could capture 1.68t GHG/t crude steel, the outcome would reach a negative 0.43t GHG/t crude steel.

Gurlit believes that biocarbon could become an attractive complement to steel decarbonisation. He stressed that none of the emerging technologies alone will enable a global net-zero steel industry by 2050. In fact, all of them will need to be employed in combination. Nevertheless, biocarbon needs to improve its perception in the eyes of regulators and the scientific community. At least two problems should be overcome: a) the scepticism about achieving scalability with sustainability; b) the hypothesis that large scale biocarbon production would displace food production. Summing up, biocarbon is an interesting alternative for the decarbonisation of the steel industry, mainly in Brazil, but its future performance might face some relevant concerns.

Exports of H2-based HBI

A second good opportunity for the Brazilian steel industry, derived from the need to decarbonize, refers to export H2-based HBI, mainly to Europe. Gurlit said that green hydrogen will be in short supply in Europe

over the next decades. Taking Germany as an example, he estimates that demand for green H2 will amplify from 1.5Mt in 2020 to 3.4Mt in 2030 and even to 6.9Mt in 2040. Meanwhile, the respective supply will expand from zero to 1.7Mt and to 3.2Mt.

Brazil can fill the gap left by the shortage of green H2 in Europe, because the availability of competitive renewable energies puts the country among the most competitive green H2 players in the world. However, it will be quite expensive to transport H2 from Brazil to Germany. McKinsey estimates that the cost to produce green H2 in Brazil as of 2040 will be $1.20/ kg, but the ammonia costs will add $0.88/ kg and the transportation costs (including shipping and cracking) another $1.34/kg. Bearing this context in mind, the possibility to export H2-based HBI from

Brazil to Europe seems more economical. To reach such a conclusion, McKinsey assumes the following assumptions:

• Raw materials and freight: last two years’ on average;

• Electricity costs ($/MWh): Europe ($37) x Brazil ($23);

• H2 cost of production ($/kg): Europe ($2.4) x Brazil ($1.7);

• H2 transport via ammonification route from Brazil to the European Union ($/kg H2): $2.1;

• Carbon price (€ CO2eq/t): $85;

• Exchange rate ($/€): $1.2.

Fig 2 demonstrates that using the technological route consisting of H2DRI /Submerged Arc Furnace (SAF)/BOF, the landed cost to produce slabs (fully verticalised in Europe) will be equivalent to $595/t in 2030. However, by fabricating HBI in Europe, but importing H2 from Brazil, the result will be $670/t. Considering the possibility of producing H2-DRI in Brazil and exporting it to Europe, the total costs will reach $565/t. Moreover, if only the rolling activities will be performed in Europe, the costs will be $521/t. Consequently, it will be viable to export slabs and H2DRI, but not H2 properly. Similar exercises and conclusions, using the H2-DRI / EAF technological route, are shown in Fig 2

McKinsey has a positive view of the Brazilian steel value chain under the huge challenges that the global industry will face due to decarbonisation.

Biocarbon, which is a peculiarity of the country’s steel sector, and H2-DRI can be valuable assets during the future transformational changes. �

19 www.steeltimesint.com January/February 2023

Fig

LATIN AMERICA UPDATE

2

From imports to exports

Despite being the second largest crude steel producer, India has struggled to raise its exports, relying on the imports of speciality steel from other markets. With new schemes in place, the Indian government is hoping to drive self-reliance, and increase capacity. By Dilip Kumar Jha*

AFTER attaining the status of the world’s second largest crude steel producer, India is now focusing on achieving Aatmanirbhar (self-reliance) in specialty steel in the next few years. The Indian government has been making all possible efforts to attract investment in this highly remunerative sector with little success so far. But, the government is looking now to turn the tide with favourable policy support to make India a large specialty steel exporter in the years to come.

Despite having achieved 154Mt of crude steel production capacity, claiming the world’s second largest crude steel producer’s slot, (only after China which contributes nearly 57% of world output) India continues to remain highly dependent on imports of specialty steel from countries including South Korea and Japan to the

Year-wise incentive outlays (all product categories)

Financial year (April-March)

Amount (INR billion)

2024-25 7.75 2025-26 10.88 2026-27 13.94 2027-28 13.77 2028-29 12.93 2029-30 2.22 2030-31 1.73

Source: Ministry of Steel, Government of India

Product category-wise incentive outlays

Particulars

Amount (INR billion)

Coated/plated steel products 25.05

High strength/wear resistant steel 19.20

Specialty rail 2.09

Alloy steel products and steel wires 8.52

Electrical steel 8.09

Source: Ministry of Steel, Government of India

India correspondent

www.steeltimesint.com January/February 2023 INDIA UPDATE 20 *

tune of up to 4Mt, nearly two-thirds of all types of annual steel import of 6.7Mt. India currently produces nearly 18Mt of specialty steel against the annual consumption of around 22Mt. But, the trend is now set to change as the union government plans to bring down overseas dependence in specialty steel and thus foreign exchange outgoings of over $4 billion (INR 300 billion).

Production-linked incentive scheme

In an endeavour to attract capital investment, generate employment, promote technology up-gradation in the steel sector, and eventually bring down imports, the government of India introduced a production-linked incentive (PLI) scheme with a total capital outlay of INR 63.22 billion, which initially received a lukewarm response. Launched at first for five years, the PLI scheme was expanded to last another two years. Later, domestic producers were encouraged to participate in this highly remunerative specialty steel production. Five product categories were primarily covered under this scheme which includes coated/plated steel products, high strength/wear resistant steel, specialty rails, alloy steel products and steel wires, and electrical steel, as well as 19 sub-categories.

All these product categories and subcategories contribute a mere 8% of India’s existing domestic annual steel production

of 102Mt. By launching the PLI scheme in the specialty sector, the government intends to become self-sufficient in specialty steel production and move up higher on the steel value chain to be at par with advanced steelmaking countries like Japan and South Korea. Additionally, the Indian government also aims to expand exports of specialty steel to 5.5Mt by 2026-27, and consequently refuel India’s forex reserves by approximately $4.43 billion (INR 330 billion).

Encouraging response

After repeated extensions in deadline, the government finally received an encouraging response from existing and potential new steel producers. A total of 79 applications from 35 small and large steel-making companies were received with a total investment commitment of INR 460 billion to set up 28Mt of additional specialty steel production by 2030. However, out of the 79 applications, only 67 applications from 30 companies were selected, with a total committed capital outlay of INR 425 billion to set up 26Mt of new greenfield and brownfield production. Selected companies have committed 70,000 new job opportunities.

Bimlendra Jha, managing director, Jindal Steel and Power Ltd (JSPL), said that his company has committed an investment of INR 79.30 billion to manufacture eight

types of high-end alloy steel in India. JSPL is one of the qualifiers of the PLI scheme and now aims to increase the output of value-added steel using new age technologies in the Indian steel sector. JSPL along with its subsidiary Jindal Steel Odisha has submitted the highest number of entries to manufacture specialty steel products such as HR coil, sheets and plates, and API graded products used in sectors like oil and gas. Further, the company also plans to manufacture high tensile sheets under the PLI scheme which are used in structural grade fabrication and the automobile industry. JSPL has also identified auto-grade steel AHSS and cold rolled and coated products for use in the auto sector, as well as tin mill products for use in the tin and food processing industry. For application in white goods, and auto and roofing segments, JSPL group plans to manufacture coated/plated products of metallic/non-metallic alloys, colour coated, and aluminium (Al)- zinc (Zn) coated (galvalume) grades.

Similarly, Tata Steel has submitted bids to manufacture seven types of specialty steel products, while JSW Steel applied for six categories. The official documents submitted to the government reveal that ArcelorMittal Nippon Steel India has also submitted four entries, while the Indian government-owned Steel Authority of India Ltd (SAIL) submitted the least number of applications for just two specialty steel categories.

Conclusion

Specialty steel is a value-added variety wherein normal finished steel is worked upon by way of coating, plating, and heat treatment to convert into high value-added steel for use in various strategic sectors such as defence, space, power, and automobiles, among others. The price of specialty steel is increased in proportion to the additional

efforts made to produce such high-end products. With this, India is on course to become a net exporter of specialty steel in the next four to five years.

21 www.steeltimesint.com INDIA UPDATE

January/February 2023

Proven solutions for carbon capture

Ready to invest in carbon capture? Munters has the expertise and equipment to support your project. We have decades of experience in Mass Transfer and Mist Elimination – Clean technologies that are essential to any successful carbon capture project, no matter the industry. You can count on Munters proven solutions to support your carbon capture project.

Clean technologies by Munters

Learn more at www.munters.com/cleantechnologies

The gold standard?

The ResponsibleSteel Standard does not say no to new blast furnaces or ban the use of coal. The aim is not to tell companies how to make their steel, but rather to set a standard to reduce the impacts of their production processes – and that requires that all certified steel must have lower than average emissions for given inputs and production systems… and then to improve on that.

IN the small town of Lulea in northern Sweden, they are reinventing how we make one of the most common materials in the modern world. The process of manufacturing steel being pioneered there may rescue the metal alloy from its growing reputation as an environmental pariah, responsible for approaching a 10th of the annual emissions of gases causing climate change. For the pilot plant on the shores of the Baltic Sea does away with the coal-guzzling blast furnace, one of the foremost technologies of the industrial age, and replaces it with a system that employs hydrogen, made using water and wind power.

Hydrogen Breakthrough Ironmaking

Technology (HYBRIT) is a collaboration between the Swedish government and the country’s biggest steel, iron-mining, power, and car-manufacturing companies. It currently produces one tonne of steel per hour, some of which has gone into Volvo vehicles rolling off the production line during 2022. But by 2026, a commercialscale plant should be turning out more than a million tonnes of ‘green steel’ a year. And by 2050, its backers believe the technology could be making most of the world’s primary steel and cutting the industry’s carbon dioxide (CO2) emissions by more than 90%.

But HYBRIT, like other technologies now being developed to decarbonize steel

making, is currently costly. It adds about $300 to the price of a car. So, are there enough makers and consumers of steel products willing to pay this green premium? Or are governments willing to subsidize it or regulate to require it? If there are, then how can manufacturers effectively brand and certify their green-steel products – and give the financiers who must bankroll the trillion-dollar industrial transition confidence they will get returns on their investment?

Setting the standard

At ResponsibleSteel, we believe we have the answer. Set up seven years ago by steel makers and civil-society activists as an independent body, we have devised an

DECARBONIZATION 23 www.steeltimesint.com January/February 2023

international climate, environmental, social and governance standard for steel that we believe can drive the market, while making it transparent, honest and verifiable.

Steel making is the largest materials industry in the global economy. Nothing else matches steel’s combination of strength, durability and low cost, for building bridges and skyscrapers, pipelines and railway tracks, ships and automobiles, stadiums and wind turbines, consumer goods and the machines that make them. Developed countries typically have around 10 tonnes of steel in use for every man, woman and child. Around two billion tonnes more is manufactured worldwide every year.

Steel builds big. The 163-storey Burj Tower in Dubai contains 31kt of the stuff; the Beijing ‘bird’s nest’ Olympic Stadium 42kt; and the Sydney Harbour Bridge weighs in at 53kt. Yet such statistics are dwarfed by the steel content of the world’s motor vehicles. More than a billion tonnes

of steel is driving around the world’s roads every day.

But there is a downside. The production of steel is a prodigious source of the CO2 emissions warming the atmosphere. It is responsible for around 3.7 billion tonnes annually, according to the International Energy Agency (IEA). This is due primarily to its reliance on coal, the dirtiest fossil fuel, as both a fuel and a feedstock.

How steel is made

Chemically, iron ore comprises various oxides of iron. So to make steel, it has first to be stripped of its oxygen atoms. This is done by mixing the ore with coke in a

Not all steel comes from blast furnaces. Increasingly, the world is recycling scrapped steel. This does not require carbon to remove the oxygen. It can be done by melting scrap in electric-arc furnaces. Rather than coal, these furnaces require lots of electricity. So the overall carbon footprint of the process depends on how that electricity is generated in the power station. Generally, that fuel is still coal or natural gas, resulting in worldwide average emissions for electricarc furnace production of 0.6 tonnes of CO2 per tonne of output. But emissions can be much less if the electricity comes from low-carbon sources, such as wind turbines, solar panels, hydroelectric dams or nuclear

blast furnace. Coke is made from a very hard form of coal known as metallurgical (as opposed to thermal) coal. When this is burned, it creates the high temperatures needed to melt the iron ore and release its oxygen, which is captured by the carbon in the coal. The resulting ‘pig iron’ falls out to the bottom of the furnace, from where it is further refined to make steel. But the other output of the process is carbon dioxide. The production of a typical tonne of steel made in a blast furnace typically emits around 2.3 tonnes of CO2

reactors.

While some 85% of the world’s steel scrap does get recycled, this cannot meet rising global demand for steel, which has doubled in the past two decades. More than two-thirds of demand is met with primary steel from blast furnaces, making steel responsible for some 11% of global CO2 emissions and 8% of all greenhouse gas emissions. With blast furnaces making up more than three-quarters of new steel-making capacity currently under construction (India’s production is set to more than double by 2030, for example), the industry’s outsized contribution to climate change seems set to rise further –especially as other industries decarbonize.

This cannot go on. The IEA says that if the international community is to meet its pledges to limit warming to near 1.5 degrees C, the steel industry needs to reduce its CO2 emissions by more than 90% by 2050. Time is short, warns SteelZero, a Climate Group initiative run in partnership with ResponsibleSteel with a focus on scaling demand for net-zero steel

DECARBONIZATION 24 www.steeltimesint.com

by mobilising quantified and timebound public commitments from private sector steel buyers, under which steel purchasers promise to achieve 100% net-zero steel sourcing by 2050. It says that to be on track will require ‘substantial emissions reductions within this decade.’

Rising quantities of scrap

There is good news for the long term. The carbon intensity of steel production should fall as rising quantities of scrap become available to make new products. But the long lifetime of many steel products, especially in construction, means that in most countries supply will continue to lag many decades behind demand, says ResponsibleSteel co-founder Matthew Wenban-Smith, who led on the greenhouse gas requirements of the new ResponsibleSteel International Standard V2.0.

“To achieve net-zero steel, we will have to use steel efficiently, and maximize the recovery and recycling of scrap. But that is not enough,” he says. Even on optimistic assessments, there won’t be enough scrap to be the key to decarbonizing steel making for at least half a century, even if every electric-arc furnace runs on renewable energy. So the industry urgently needs other solutions. “We need to produce net-zero steel from iron ore – and at scale.”

Enter ResponsibleSteel. Our organization was set up in 2015 by veterans of past green business certification systems such as the Forest Stewardship Council (FSC), to stimulate this process. Co-founder Francis Sullivan, today calls ResponsibleSteel ‘a coalition of the willing.’ We had initial funding from ArcelorMittal, the world’s second-largest steel producer, and Australia’s BlueScope Steel, and today our

membership is responsible for around 13% of the global industry.

Under ResponsibleSteel’s membership rules, steel makers must submit at least one production site for certification to an entry-level standard, which also means committing their business to working towards near-zero emissions, explains Thuong Bui, standard and assurance director at ResponsibleSteel. By late 2022, 53 sites had been certified across five continents, collectively producing over 100Mt of steel per year. A further 15 site audits are in the pipeline, Bui explains.

The universal standard? ResponsibleSteel has enthusiastic NGO members, too. “We think it is going to be the universal standard,” says Reecha Upadhyay of Climate Catalyst, which campaigns on green steel. “We tell

for making greener steel is not ready yet, so it intends to reline an existing blast furnace at its giant ResponsibleSteel-certified Port Kembla plant, to come into operation between 2026 and 2030.

The company says this does not undermine its environmental credentials. It has committed to reducing the carbon intensity of its steel making operations by 12% between 2018 and 2030, and the relining will help achieve that. It is also expanding scrap recycling at its operation in the United States and partnering with Shell and Rio Tinto to develop greener steel making technologies, which it says it will adopt swiftly as they become commercially available and as markets open up for green steel.

The stakes are high. Blast furnaces last many decades and generally need their interior brickwork replaced every 15 to 20

governments and others considering devising their own standards: don’t spend years reinventing this. The work is done. Look no further.” But it is early days for delivery, she says. “None of the certified sites yet have clear financed pathways and action plans to achieve near-zero.”

That is hardly surprising. The transformation will be expensive. Companies considering the necessary investment fear greener, more expensive products will lose out to cheaper and dirtier competitors. But on the other hand, if markets start demanding certified green steel at scale, first movers may have an advantage, as slow adopters find themselves with shrinking markets and stranded assets.

One company on the cusp of such a decision is ResponsibleSteel founder BlueScope. It says the alternative technology

years, at a cost of hundreds of millions of dollars. Under business-as-usual, half of all steel plants globally are due for this relining before 2030. The Global Energy Monitor,

DECARBONIZATION 25 www.steeltimesint.com January/February 2023

BOX ONE – GREENHOUSE GASES

GRAPH PRODUCED BY RESPONSIBLESTEEL AND STEELZERO

ResponsibleSteel’s certification system is evolving. On 14 September 2022, initial requirements for the certification of production sites were extended, following an extensive consultation. The new International Standard V2.0 sets additional tougher requirements for certifying steel, allowing steel makers that meet these to make enhanced claims to their customers.

Under the system, sites can be certified at four levels of emissions of greenhouse gases (not just CO2) of increasing strictness. To meet Level 1, the entry level for initial steel certification, producers must be better than the current average for the proportion of scrap in their feedstock. Where there is no scrap, that average is the greenhouse gas equivalent of 2.8 tonnes of CO2 per tonne of steel. It declines on a sliding scale as more scrap becomes part of the mix, to 0.35 tonnes for 100% scrap.

Level 1 is intended to be temporary. As Smith of Mighty Earth puts it: “We need to get rid of Level 1 as soon as possible. Better than average is not compliant with Paris.” Level 2 requires emissions a quarter below the current average. Levels 3 and 4 are tougher again, with Level 4 requiring emissions below 0.4 tonnes of CO2 per tonne of steel for no scrap, and below 0.05 tonnes for all scrap. The level will allow those who achieve it to claim “near-zero” emissions.

Certification requires companies to track and publish updates on their progress to reducing site emissions and on their current performance to produce certified steel. ResponsibleSteel does not currently set a timetable for companies to graduate through the levels. But Climate Catalyst says they should aim to hit Level 2 by 2030, Level 3 by 2040 and Level 4 by 2050. “It’s going to take a massive effort to get to Level 4 by 2050,” says Heaton. “But that’s what we have to aim for.”

time. If we all can be clear and consistent on that, the market can really drive change. Our aim is to work with the market to create those signals to drive that change.”

ResponsibleSteel avoids being technically prescriptive. The ResponsibleSteel Standard does not, as some NGO activists propose, say ‘no new blast furnaces’ or ‘banish coal now’. “Our position is not to tell companies how to make their steel, but to set a standard to reduce the impacts, however, they make it,” says Heaton. Initially, that requires all certified steel to have lower than average emissions for given inputs and production systems. And then to improve on that.

Critical here is the proportion of scrap used in production. This is by far the biggest determinant of emissions, but one over which a shortage of supply means many producers have little control. So ResponsibleSteel’s emission standard has a sliding scale from where no scrap goes into production and higher emissions are allowed, to 100% scrap where the required levels are much lower (See Box 1).

The purpose of this approach is partly to maximize industry buy-in and kickstart the industry towards low-carbon. But partly also because it makes no sense to set a standard that stimulates a rush for scrap when there is only a limited supply. That may help green the output of downstream companies that can afford to pay the most and corner the market in scrap, but it would penalize others, especially in developing countries with little scrap available. “It would be a beggar-myneighbour strategy,” says Heaton.

an independent think tank, reckons that the steel sector could spend $70 billion on blast furnaces in the next few years, which it estimates would lock in the future emissions of some 65 billion tonnes of CO2

Surging demand

Annie Heaton, CEO at ResponsibleSteel, expects that demand for decarbonized steel will surge with the first ResponsibleSteel

certification of steel, due in 2023, and with the growing influence of SteelZero among steel purchasers. “We believe buyers will compete to be responsible,” she says. “Our view is that the market will reward the right thing if the conditions are there. The big question for both private and public sector procurement teams has been how they can specify steel in a way that will make a difference and be credible at the same

This pragmatic, flexible approach can be a hard sell to policymakers in Europe who are attracted to promoting local recycling and adopting simple carbon-intensity targets for steel, she says. “We can seem to be apologists for dirty steel makers.” But it has widespread backing among industry analysts, including the IEA, which publishes its own sliding scale. Many environmental advocates also agree. “We need to increase scrap use as much as possible, but it has a finite supply, so you can end up with cherry-picking by the auto industry and leaving other sectors without. That doesn’t help anyone,” says Roger Smith, Japanbased project manager at Mighty Earth, a US-based environmental group and ResponsibleSteel member.

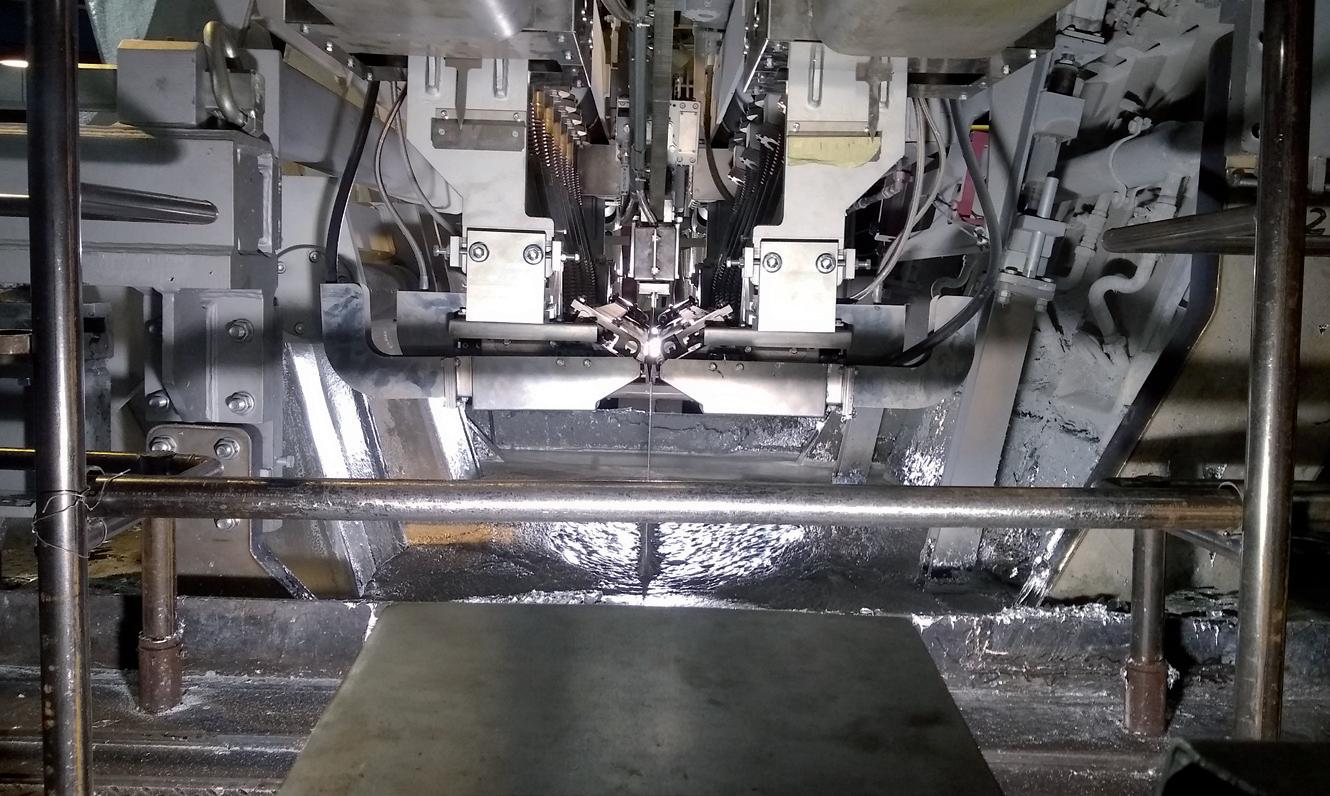

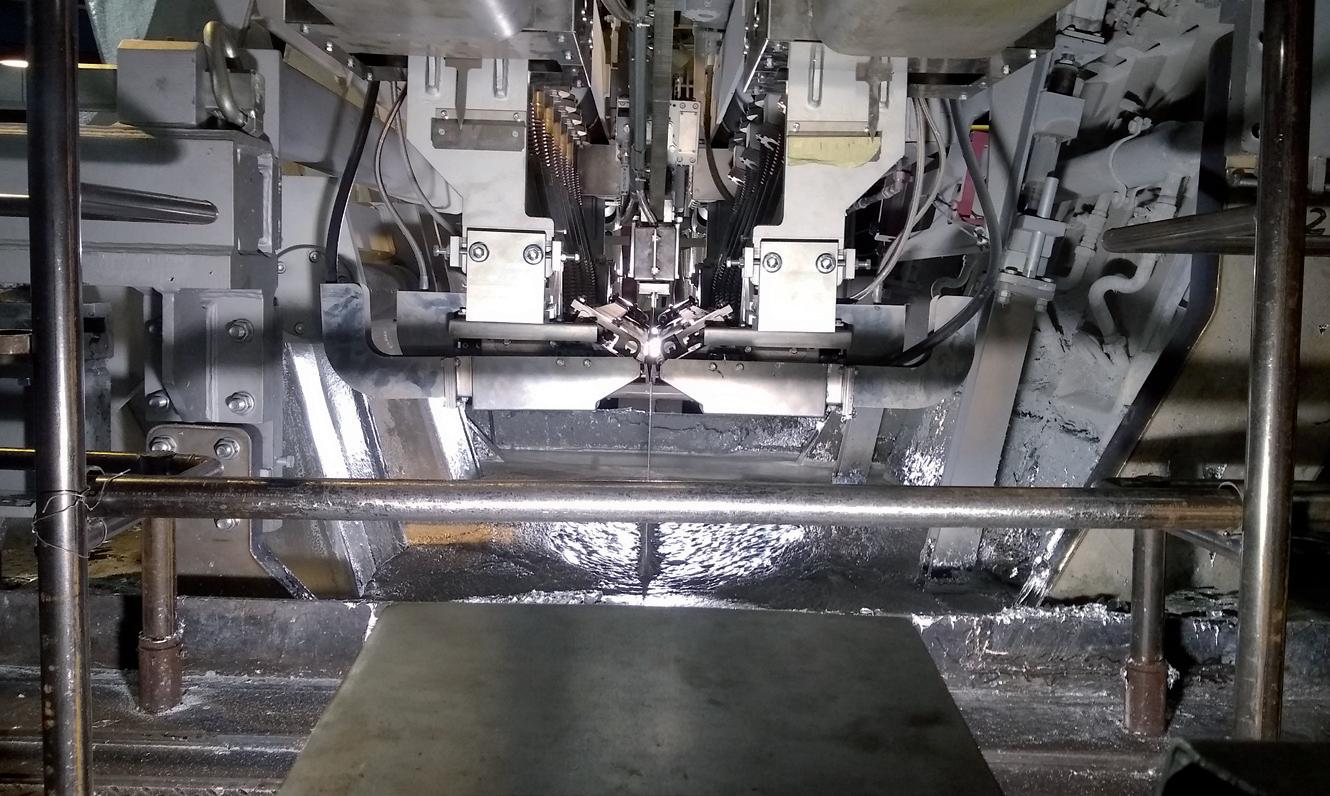

Luckily, there is an alternative to blast furnaces. It turns iron ore into pig iron

DECARBONIZATION 26 www.steeltimesint.com January/February 2023

Graph produced by ResponsibleSteel and SteelZero

without melting, by running a huge electric current through the ore, and stripping out the oxygen atoms using a gas, usually natural gas. A few plants already use this system, known as direct reduction, notably in the Middle East, where natural gas is cheap and plentiful. They typically produce half as much CO2 as coal in a blast furnace. But direct reduction can also run on hydrogen. Then, with no carbon involved, the by-product is not CO2 but H2O – water.

The hydrogen must be manufactured, however. This is best done by electrolyzing water, which also requires large quantities of energy. But if the energy for both making this ‘green hydrogen’ and running the furnace comes from low-carbon sources, then primary steel can be made with CO2 emissions as low as 0.1 tonnes per tonne of steel. This is what HYBRIT is piloting in Sweden. Vattenfall, the Swedish state electricity utility and partner in the project, calls it ‘the biggest change in steel production in over a thousand years.’

Many regard direct reduction with green hydrogen as the technical Holy Grail for near-zero production of primary steel. If it happens at scale, then it will require the creation of a huge new industry for producing green hydrogen. Alongside SSAB, a growing number of steel producers now plan to use the technology to deliver near-zero emissions by 2050, from, ArcelorMittal, Voestalpine and ThyssenKrupp in Europe to POSCO in South Korea.

Alternative fuels

Another, less technically radical way to lower emissions in primary steel production may lie in using alternative fuels in blast furnaces. For instance, coal can be replaced as a carbon fuel and feedstock by biomass.

In Brazil, steel companies already grow trees to make charcoal to burn in blast furnaces. Provided new trees replace those cut down, this could theoretically be carbon neutral. But would it in practice?

This issue has been a talking point during discussions about ResponsibleSteel’s Standard. Some environmentalists argue that timber would be better used to replace steel in construction, where the carbon remains in the wood. Others say that the claimed carbon-neutrality is a fantasy and

could collect CO2 from there and other local heavy industries, for burial in nearby former gas fields under the North Sea.

However it is done, creating low-emission ways of making primary steel is likely to remain costly, and increasingly it looks like a holding strategy until the world generates enough scrap to meet most demand through recycling in electric-arc furnaces.

Steel is already one of the most recycled of all materials. But scrap’s takeover of the industry is bound to be slow. In many developing countries that are still installing their urban infrastructure, there is as yet little scrap available. But even in developed nations its use varies greatly. In Europe, much of the abundant scrap is exported to countries where lower electricity prices make running electric-arc furnaces cheaper. The UK exports three-quarters of its scrap steel, and just 18% of its steel production is from scrap.

Green steelmaking in the USA

But in the US, which has lower electricity prices, around 70% of steel production is from scrap. (As a result, the carbon intensity of its steel industry is lower than most other countries at less than 1 tonne of CO2 per tonne of steel).

Wherever supplies are available, scrap recycling needs to be encouraged. Alongside this, we at ResponsibleSteel are also keen that our Standard ensures that electric-arc furnaces reduce the CO2 embodied in their output, by powering them with low-carbon electricity. Many still run on electricity generated in power stations that burn coal. “Just because electric-arc furnaces are lower-carbon than blast furnaces doesn’t mean they have a get-out,” says Jen Carson, head of industry at Climate Group. “Coal has to leave electric-arc furnaces, too.”

add that there is only a limited amount of land to grow trees, most of which already has other uses, such as growing food.

Coal could itself have a future if blastfurnace CO2 emissions were captured, and either used as an industrial feedstock or buried underground. Carbon-capture technology has been piloted on a small scale in the steel industry, but nobody has yet scaled it up sufficiently to deliver the kind of carbon reductions needed. Still, the British government appears keen. It envisages creating a carbon-capture hub near British Steel’s Scunthorpe plant, which

Steel companies are often big enough customers to demand green electricity from their local grids. One is US Steel, which is doubling the capacity of its recently certified Big River Steel electric-arc furnace site in Arkansas, and plans to roll out a range of branded sustainable steel products made there. It has encouraged its energy supplier to invest in new solar power capacity to meet its demands, according to senior vice president and chief strategy and sustainability officer, Richard Fruehauf.

While low-carbon steel is high on the industry’s agenda, it faces other challenges that must be addressed to meet society’s

DECARBONIZATION 27 www.steeltimesint.com January/February 2023

BOX TWO – SOURCING

Alongside greenhouse gases, the second addition to the ResponsibleSteel Standard is bringing responsibility for the sourcing of the industry’s input materials. Supply chains are complex, so this will take time and patience, says Bammert. Initial rules require companies to commit to responsible sourcing in principle. Then they must develop a full understanding of their supply chains, and assess their suppliers’ environmental, social and governance performance. Once the performance of suppliers has been assessed, companies will be required to increasingly source from suppliers that have a proven good performance, and to report publicly on their efforts.

Performance in the supply chain will, where possible, be assessed according to existing industrial certification standards, such as those of Bettercoal, the Initiative for Responsible Mining Assurance (IRMA), and for timber or charcoal replacing coal in blast furnaces, the FSC.

There are some quantifiable targets along the way. For instance, Level 1 requires producers to know where 80% of their iron and coal-based inputs come from, as well as the country of origin of 40% of scrap, and to have 100% of wood supplies from FSC-certified plantations. Level 2 will require 80% of iron and coal to come from suppliers that meet recognized performance levels, and 30% of scrap to come from audited suppliers.

By Level 4, certification will require producers to know where 98% of their ironand coal-based materials comes from, with 80% from suppliers meeting recognized standards, and to know the country of origin of 80% of scrap inputs, with 60% of that scrap from audited suppliers.

expectations of 21st century businesses. Those challenges are also reflected in ResponsibleSteel’s principles and Standard. “This non-carbon stuff is not, as some say, baggage slowing down the journey. We can’t and won’t ignore other issues,” says Heaton. “You can’t be certifying steel products that have low carbon emissions but are bad on the environment or human rights,” agrees Smith at Mighty Earth.

These issues are important in the audits carried out by independent bodies for ResponsibleSteel certification, says Sabine Bradac who has carried out these audits at LRQA, the successor to Lloyds Register. ResponsibleSteel’s audits are more thorough than many, she says, covering everything ‘from ethical governance, health and safety, human rights, collaboration with interest groups, to greenhouse gas and noise emissions, water management, biodiversity and decommissioning procedures.’ Auditors ‘interview not only employees, but also representatives of communities, NGOs, environment agencies and others,’ she says, because the companies must show they are willing to co-operate with these stakeholders.

ArcelorMittal’s European CEO Geert Van Poelvoorde observes that the process ‘has helped us improve our approach

towards our rights holders, including our local communities, our employees, and the contractors working on our sites.’

Labour and human rights

Still, there are issues to be resolved.

Setting an international industry standard for labour and human rights is complex, because even developed countries have widely differing national laws that may not meet the expectations of stakeholders in the certification process.

For instance, International Labour Organization (ILO) norms on labour rights, which are incorporated in ResponsibleSteel’s Standard, are not enshrined in United States law. This has created problems

for the member of the ResponsibleSteel board from the trade union movement, the Geneva-based international federation of trades unions, IndustriALL. Matthias Hartwich, its director for base metals, says that while the Standard is generally “strong and well-elaborated, and sometimes higher than ILO standards,” auditors aren’t always seen as fully implementing it to the letter.

This is where ResponsibleSteel’s assurance programme has the discretion to encourage progress rather than making binary assessments of pass or fail. Where one element of the Standard has not been met, the auditor can flag a ‘minor nonconformity’ for the site to improve on before the auditor’s next visit in 18 months’ time.

Establishing the credentials of process input materials from mining and elsewhere is another key requirement of certification. Overall, iron mining is estimated to be responsible for 23% of greenhouse gas emissions from the mining sector. But establishing the actual environmental footprint of these activities is not easy to achieve, says Marnie Bammert, who led the drafting of requirements on sourcing at ResponsibleSteel. “Supply chains are so complex. Some companies don’t know where much of their material comes from.”

So the current entry-level requirements ask for companies to set up procedures, collect data, increase transparency and assess and seek commitments from suppliers. At subsequent levels, they will adopt existing recognized standards – for instance on responsible mining – asking steel manufacturers to source from suppliers meeting specific performance indicators (See Box 2).

A growing issue will be ensuring good working conditions for the millions of collectors and sorters of steel scrap across the world, whose supplies the industry will use in increasing volumes. In some parts of the world, these small operators often operate in the informal economy. “Scrap is often regarded as sustainable, because it is recycling,” says Bammert. “But there can be issues around environmental and labour conditions, and few standards exist.”

The ultimate aim for most resourceintensive industries in the 21st century is likely to be the more efficient use of energy and materials. Steel will be no exception. So how can it be done? Many of the gains are likely to be downstream, among the major industrial users of steel.

DECARBONIZATION 28 www.steeltimesint.com January/February 2023