PARTICIPATING ADVERTISERS

By now you’ve surely seen those ubiquitous television commercials that feature everyone from Jimmie “JJ” Walker to Jets football hero Joe Namath to Captain Kirk, himself, William Shatner, hawking various Medicare coverage plans.

It can all be a little overwhelming if not downright confusing and, according to some experts, even misleading.

For newcomers to Medicare, the prime questions most likely involve when, how and, most dauntingly, where to begin what could be a rather intimidating process.

But, according to Jack Lippmann, president of Elder Care Services, Inc., a Rego Park-based business, in actuality, “Medicare is one of the friendliest programs the government has.” He advises anyone in need of information to call Medicare, “and they will be happy to assist you.”

And now with the fall open enrollment period (the time for signing up, reviewing benefits, making changes or switching plans) once again upon us — it runs Oct. 15 through Dec. 7 — there is some good news in the form of reduced costs for some beneficiaries.

But first, a little background. Medicare is the federal health insurance program for people 65 or older and for certain younger people with disabilities. Most people are first eligible to sign up three months before turning 65.

MedicareResources.org cautions that if you don’t sign up for Medicare when first eligible, you may be subject to a late enrollment penalty.

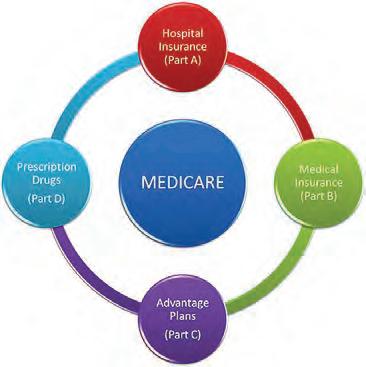

There are two main ways to get covered: the original Medicare (also known as Parts A and B) or a Medicare Advantage Plan (referred to as Part C).

According to Medicare.gov, Part A is hospital insurance, which helps cover inpatient care in hospitals, skilled nursing facility care, hospice care and home healthcare. The site indicates that most people don’t pay a monthly premium. If you don’t qualify for premiumfree coverage, you might be able to buy it with monthly payments. There is also a deductible for each benefit period as well as co-insurance that increases depending on the length of the hospital stay.

Part B is medical insurance, which helps cover services from doctors and other healthcare providers, outpatient care, home healthcare, durable medical equipment and many preventive services. Most individuals pay a monthly premium; the amount can vary depending on income. There is an annual deductible and co-insurance.

Medicare.gov points out that if you join original Medicare, you may use any doctor or hospital that takes Medicare — anywhere in the United States.

Some people who select original Medicare opt for additional coverage such as Medicare Supplemental Insurance, or Medigap, extra insurance you may buy from a private company to fill in the gaps in Parts A and B. Costs vary based on which policy you buy and other factors.

You may also choose to purchase Part D by joining a Medicare drug plan in addition to original Medicare, which helps cover the cost of prescription drugs. Premiums vary based on the plan you join. Most plans charge a deductible before the coverage kicks in. Costs also vary depending on the medicines you take and whether they are included in the plan’s covered drugs, as well on the pharmacy you choose.

Part C, known as a Medicare Advantage Plan, is a Medicare-approved plan from a private company that provides equal coverage to original Medicare Parts A and B and may provide some additional benefits. In most cases, your doctors must be in the plan’s network. This option may mean lower out-of-pocket costs than original Medicare; costs vary by plan, as do deductibles, coinsurance and copayments.

Lippmann suggests that “Medicare is superior insurance. The downfall is the need for supplemental insurance,” adding to the cost of coverage.

If a person can afford Medicare, Lippmann asks, “Why have Medicare Advantage?” But, he adds, “If they don’t have a large income and can’t afford supplemental insurance, Medicare Advantage is a blessing.”

Now, about those new, lower rates.

According to CMS.gov, “On Sept. 27, the

Centers for Medicare & Medicaid Services released the 2023 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.”

The site indicates that for 2022, the standard monthly premium for Part B coverage was $170.10. That cost will be lowered in 2023 to $164.90 per month, a monthly savings of $5.20. Similarly, the annual deductible for all Medicare Part B beneficiaries was $233. That amount will be reduced to $226 in 2023, or a savings of $7.

In a recent speech, President Biden alluded to the Department of Health & Human Services’ announcement that the premium for Part B will decrease.

“For the first time in more than a decade, it’s going to go down,” Biden said.

There is more good news.

The recently passed Inflation Reduction Act caps monthly insulin costs for Medicare beneficiaries. It limits insulin co-pays to $35 per month for Medicare Part D beneficiaries starting in 2023. Seniors covered by Medicare also have a $2,000 annual out-of-pocket cap on Part D prescription drugs starting in 2025. Medicare will also be able to negotiate the costs of certain prescription drugs.

CNBC quotes Dr. Robert Gabbay, chief scientific and medical officer at the American Diabetes Association, as saying that for patients aged 65 and up who rely on insulin, the Inflation Reduction Act is a “game changer.”

Stewart M. Small, an independent insurance broker who specializes in life and health insurance, recommends the use of the fall open enrollment period “to review your current plans and options.” He points out that “there are special enrollment periods that may allow you to change off-cycle.” He strongly suggests that you “contact a Medicare specialist who is referred

to you for advice.”

During open enrollment, people who are eligible for Medicare should review their 2023 coverage options, comparing original Medicare and Medicare Advantage plans, as well as options for prescription drug plans.

According to Medicareresources.org, “If you’re enrolled in a Medicare Advantage plan and you’re not happy with it, you can switch plans during Medicare’s Open Enrollment.” The site offers four primary reasons you may want to change Medicare Advantage plans: Your preferred providers are no longer in the network; your prescription drugs have been moved to a more expensive tier; there are cheaper coverage alternatives; and richer benefits may be available elsewhere.

Which brings us back to those television commercials, which have been the source of much confusion and a barrage of complaints.

First, it should be noted, as made clear by Small, that the commercials are neither public service announcements nor endorsed by the government.

Rather, according to the very small print at the bottom of your television screen, they are paid endorsements, meaning that the celebrity spokespersons are compensated for their participation.

And, according to John Demko on the site twincityunderwriters.com, “Ads tend to purposefully use vague, misleading, or incomplete information. The ads often use strategies such as promising huge savings or discounts. Most of us don’t qualify for those discounts at

Denko advises to “focus on the information you receive from your insurance company.”

A life insurance company site further addresses the commercials’ urging for viewers to call the telephone number on the screen. “It’s done over the phone,” the site says. “There is no guarantee that you will get this insurance. You may be talking to a pro or talking to a brand-new person. There’s no continuity or quality of service.”

And a site known as Medicare university says, “The commercials are true, sort of. They only tell you part of the story. The specific benefits of each plan are different.” It adds that while the commercials suggest there are no premiums for some Medicare Advantage plans, that does not mean they are free, as implied. If you feel overwhelmed by all the hype, the site advises, “Don’t be afraid to reach out for help.”

Small agrees. “Makes sense to reach out to an independent broker to guide you because this is confusing,” he said. “Why wouldn’t everybody talk to someone?”

If you need to speak with someone, visit Medicare.gov or call 1 (800) MEDICARE (6334227). You may also schedule a consultation with Small by emailing mygroupbenefits@ gmail.com or with Lippmann by going online to eldercareservicesny.com.

In October 2020 a new look-back period was passed forcing applicants to surrender two and one-half (2.5) years of financial statements. However, due to the pandemic Medicaid was unable to enforce this new regulation and kept extending the starting date.

The last extension was from October 1, 2022 to January 1, 2023; however, the earliest date that the state will seek implementation is March 31, 2024.

What does it mean to new applicants once the new regulation goes into effect? If there were

any transfers during the two and one-half (2.5) years prior to fi lling, applicants will be disqualified for a period of time depending on the amount transferred. Disqualifi cations cannot be more than two and one-half years.

Presently, applicants can transfer any amount of money one month and become fi nancially eligible for Community Medicaid the following month. This window of opportunity is slowly closing in. Potential applicants should keep in mind that the only way to avoid this issue is to apply before the rule is enforced.

Until the latest edition of the iPad or MacBook contains some kind of portal technology connecting a doctor on one end of a call to a patient on the other, telehealth service cannot be the end-all to in-person doctor appointments. It can, however, come close.

“If you need to have hands-on care, you can’t do that through telehealth,” Vice President of Telehealth Services for Northwell Health Iris Berman said. “But you know what telehealth is really good for? Having conversations, follow-up care, review of imaging, review of a wound is great, as long as a person can get a camera so the doctor could see that or a rash, so dermatology. All of the behavioral health support has been hugely successful. Neurology has done really well.”

“It is fairly widespread now and fairly easy to get a telehealth appointment within the Northwell Health system, if that’s what someone desires,” she added.

Telehealth appointments, according to Berman, can save those working from having to take time off for an appointment, and can save those incapacitated in any way from having to go through the hassle of traveling to the doctor’s office, with most of the time there spent waiting anyway.

With telehealth, or virtual consultation sessions, what can be done from the comfort of one’s home is done there.

“It’s about convenience,” she said. “But it’s not just convenience in, ‘I don’t want to go.’ It’s more convenience because people don’t want to lose time away from other activities or necessities in life.

“They’re not having to prioritize healthcare above or below another activity. There are times when you can have it all,

which wasn’t always true.”

Northwell is aiming to take advantage of the technology to make aggregating patient information easier than ever. Berman said the healthcare system is working toward putting all of a patient’s relevant care providers on one virtual call, allowing them to coordinate the best care routine in real time.

“I can have my dietician, my endocrinologist and my primary care physician coordinate, and we’re working on a scheduling system to make that happen,” she said. “That way, everyone can be on with the patient at one time, and they’re all talking to each other and coming up with a simple plan of care that’s very well-coordinated.”

Some companies have been founded on the predicated notion of the convenience of telehealth. DrHouse is a monthly subscription service offering 24/7 virtual clinical care through an app. For $19 per month, or $79 for a one-off visit, users are connected to a clinician within 15 minutes, per the company’s website.

“In-person visits are always better for treating the patient, but at the same time, there are some cons,” Co-founder and CEO Ergo Sooru said in a statement. “For example, it takes time to get to the doctor’s office, wait times in the waiting room, and exposure to germs. Telehealth visits are missing the physical touch but are much more convenient for something you know you have or prescription refills.”

Sooru says seniors have started to take advantage of the convenience.

“Seniors usually use it for prescription refills as it is easier to get them through our service,” he said. “We have also noticed that some primary care providers have started referring their patients to us for medication refills. It takes less than 30 minutes from starting a new visit to receive a prescription that our providers will send to the patient’s preferred pharmacy.”

In terms of advice for seniors interested in pursuing telehealth options, Sooru says some companies front as a provider but don’t offer, as he describes it, “healthcare.”

“These companies let you fill out the intake form and usually decide in 24 hours if they prescribe you a medication or not,” he said. “They call themselves telehealth providers, but I believe it is very far from practicing medicine. There is no effective doctor-patient communication.

“If you decide to use any telehealth provider, please check that the provider offers a video visit.”

As volunteer programs continue to be built back up post-pandemic, senior candidates are not only wanted but needed.

They offer unique skillsets and life experiences, organizers agree, and volunteering provides the opportunity not only to give back but to get a lot in return, helping to stay mentally and physically well.

“They are a wealth of knowledge,” said Merav deGuzman, director of patient and customer experience education at Long Island Jewish Forest Hills, where she oversees the volunteers at the hospital.

“They can strike up a conversation about just about anything ... And those are the types of things that we are missing in the hospital,” she said.

The hospital is busier than ever, she added, as people catch up on healthcare they neglected during the pandemic, so help from volunteers, especially seniors, is needed more than ever as she tries to grow engagement to prepandemic numbers.

Seniors, deGuzman said, have the ability to make people feel warm, welcome and cared for. At LIJ Forest Hills, they might help by greeting or escorting patients, bringing them water, hospitality or magazines, or navigating the TV or connecting to the Wi-Fi.

“Patient-centered care is the norm now. It’s not about what we do or don’t do, it’s about how we make you feel ... it’s very small acts of kindness that go such a long way in patient experience.”

DeGuzman interviews candidates to match them with a role that will leave them feeling fulfilled and also comfortable and safe, especially considering Covid and health concerns.

Keeping busy, she said, helps seniors be fulfilled and avoid depression, anxiety and deterioration of independence.

And it’s a commitment, too, she said, as volunteers go through an orientation process, get medically cleared and are asked to commit six hours a week and 100 hours in total to volunteering. For more information, they can call her at (718) 830-5400.

“I would love to find seniors who sing, who play an instrument ... volunteers who speak other languages,” DeGuzman said.

She continued, “Having someone that you can sit with and speak with in your native language makes you feel better or less anxious about being in a country that you may not be a 100 percent comfortable in.”

The Community Service Society of New York, a nonprofit established in 1843, also is working build back its cohort of volunteers.

Prior to the pandemic, there were around 2,300 older adults volunteering throughout the five boroughs with the Retired and Senior Volunteer Program, which falls under the umbrella of AmeriCorps and has since been replicated nationally. The program partnered with a network of 250 organizations, but during the pandemic the number of volunteers fell to under 700, said Alina Molina, vice president of program services at CSS and a resident of Jackson Heights.

In Queens, there were 175 active volunteers last year, ranging in age from 55 to 99, working both remotely and in person.

“This is our major focus now, to get back to that, for two reasons: because of the invaluable services that volunteers are providing to organizations and also because it’s really great for older adults to be engaged and to not only feel that they’re making a contribution, but actually making a contribution,” said Molina.

Opportunities through RSVP are both internal and external.

In-house, volunteers 55 years and older can be thoroughly trained in and work with Advocacy, Counseling and Entitlement Services, which provides information and advocacy assistance to seniors and low-income New Yorkers on benefit programs including Medicaid, SNAP, SSI, Medicare, cash assistance and more; Financial Coaching Corps, where volunteers serve as financial coaches to support low-income families and individuals; MentorUP, which offers mentoring with a focus on academic supports and vocational training to youth in the juvenile justice system and young people not in school and out of work; and MentorChip, which mentors kids ages 6 to 16 whose parents are incarcerated.

Or, RSVP will pair seniors with external organizations. Programs may be located at NYC Health + Hospitals/Elmhurst, John F. Kennedy Airport and more.

“The volunteer opportunities are as diverse as the city,” said Deirdre Ryan, program direc-

tor for RSVP.

“We want folks to consider, ‘do you want to use the skills that you have existing from your lifetime of experience or do you want to try something new?” she said.

The ACES program, for example, requires 40 hours of benefits training.

It’s a personal choice, too, she added, and not a one-size-fits all approach.

“When I began volunteering, it was just something to fill my days, but over time, it became something that fills my heart — there is no price to be placed on that level of fulfillment,” Judith Purcell, a Queens Village resident and RSVP volunteer at Ronald McDonald House of Long Island, shared with RSVP in a testimonial.

Seniors RSVP volunteer fair will take place on Thursday, Nov. 17, from 10 to 11 a.m.

Register in advance at bit.ly/3rM3WYE.

AARP New York also provides seniors the opportunity to utilize their existing talents or learn new skills.

“The membership is what brings you in, but the camaraderie and the learning together as a group, working alongside volunteers is what makes you stay,” said Kemba Tamar, associate state director for volunteer resources and engagement.

“For people who are looking for something meaningful, something genuine that they can connect with, that has a real tangible, fun atmosphere, AARP volunteer opportunities give you just that. While it’s not like going

back to work, it’s definitely about whatever you’re passionate about, whatever you feel most compelling.”

Seniors can become advocacy volunteers, as AARP is a nonpartisan advocate for social change on issues that matter to people 50 and older.

“Not only do we train people how to advocate to their legislators, but then they also see the fruits of their labor,” said Erin Mitchell, director of engagement.

Voter engagement is a current focus and there are also speaker opportunities such as where volunteers can visit senior centers and educate people about not falling victim to fraud.

As for Queens, volunteer opportunities could come through everything from paper shredding events to big community happenings like the annual Dragon Boat Festival in Flushing where AARP will have a table.

AARP is also hosting a virtual event to learn about volunteering with the organization on Monday, Nov. 21, from 11 am to noon. For more information, email aarpnyvolunteer@ aarp.org to visit AARP.org/iwant2volunteer.

The city Department of the Aging launched a new volunteer portal over the summer, agingvolunteers.cityofnewyork.us, to help streamline the process for residents looking to give back. Those interested can also call (212) 244-6469.

Older adult volunteers can partake in the agency’s health promotion program, where they can help organize presentations and fitness programs at senior centers; the Health Insurance Information, Counseling and Assistance Program; or the Foster Grandparent Program, which places them in community settings like schools, community based-organizations and hospitals where they can provide tutoring and emotional support.

The latter requires 15 hours per week, a background check, and participants receive a small stipend for their efforts.

“The Department for the Aging has many volunteer opportunities for older adults that put their skills and knowledge to good use, which helps them to be personally fulfilled, being active and engaged, in their communities,” said Meka Nurse, senior director of Aging Connect at DFTA, in a statement sent to the Chronicle.

“There are a variety of volunteer opportunities from visiting a homebound older New Yorker, to tutoring young children, and helping residents navigate and understand Medicare. We encourage New Yorkers young and old to visit our volunteer portal and sign up to make a difference in the life of an older adult.”

Queens Community House also provides opportunities for older adults.

“We have several older adult program participants who are a part of the Action Group, where they get to engage with participants and other neighbors, learn more about the community and explore ways to better organize and make positive change,” said Thomas Cruz, director of communications for the nonprofit.

Volunteers can participate in cleanups and rallies and help encourage Queens residents to vote leading up to elections, and more.

“When I began volunteering, it was just something to fill my days, but over time, it became something that fills my heart.”

— Judith Purcell, RSVP volunteer

by Nilsa Henriquez

by Nilsa Henriquez

Social Security benefits are a crucial part of millions of Americans’ retirement income. If you don’t have enough Social Security credits to qualify for benefits on your own record, you may be able to receive benefits on your spouse’s record.

To qualify for spouse’s benefits, you must be one of the following:

• 62 years of age or older; or

• any age and have in your care a child younger than age 16, or who has a disability and is entitled to receive benefits on your spouse’s record.

Your full spouse’s benefit could be up to one-half the amount your spouse is entitled to receive at full retirement age. If you choose to receive your spouse’s benefits before you reach full retirement age, you will get a permanently reduced benefit.

If you wait until you reach full retirement age to receive benefits, you’ll receive your full spouse’s benefit amount, which is up to one-half the amount your spouse can receive. You’ll also get your full spouse’s benefit if you are under full retirement age, but care for a child and one of the following applies:

• the child is younger than age 16; or

• the child has a disability and is entitled to receive benefits on your spouse’s record.

If you’re eligible to receive retirement benefits on your own record, we will pay that amount first. If your benefits as a spouse are higher than your own retirement benefits, you will get a combination of benefits that equal the higher spouse benefit.

For example, Sandy qualifies for a retirement benefit of $1,000 and a spouse’s benefit of $1,250. At her full retirement age, she will receive her own $1,000 retirement benefit. We will add $250 from her spouse’s benefit, for a total of $1,250.

Want to apply for either your or your spouse’s benefits? Are you at least 61 years and nine months old? If you answered yes to both, visit ssa.gov/benefits/retirement to get started today.

Are you divorced from a marriage that lasted at least 10 years? You may be able to get benefits on your former spouse’s record. You can find out more by visiting ssa.gov/planners/retire/divspouse.html for more information.

P

Nilsa Henriquez is a Social Security Public Affairs Specialist located in Queens.

On October 1, 2020, a 30-month “look back” penalty period was implemented for people applying for Community Medicaid which provides health care aides in the home. This means that Medicaid will “look back” at fi nancial transactions made during the 30-month period prior to the date of application and impose a penalty for any gifts or unexplained transfers made during that period.

To qualify for Community Medicaid in 2022, an individual may only have $16,800.00 in total assets and income up to $934.00 per month. In addition, the individual will also be entitled to a $20.00 monthly personal needs allowance for a total of $954.00. The home equity limit is $955,000.00. When calculating your resources, Medicaid does not include the value of your IRAs and 401Ks. However, Medicaid will be entitled to the Required Minimum Distribution from your IRA (which will count towards your income). If the person’s income is above the Medicaid limit, they may still be able to qualify for Medicaid with proper planning.

Due to the pandemic, THE 30-MONTH “LOOK BACK” PENALTY PERIOD HAS BEEN PUSHED BACK SEVERAL TIMES AND WILL NOT BE IMPLEMENTED UNTIL MARCH 31, 2024.

NYS 2023 Budget Increases in Medicaid Income and Asset Limits for Age 65+/Disabled/Blind

The 2023 NYS budget increases the limits for income and assets for individuals age 65+, disabled and blind to qualify for Medicaid. Effective January 1, 2023, an individual 65+, disabled or blind may have monthly income of approximately $1,563.00 and total assets in sum of approximately $28,134.00. This means that more people will be able to qualify for Medicaid without having to spend down their income or assets.

To create a plan tailored to your needs, consult with an elder law attorney.

Club in Forest Park

with Nechama

Programs

Debbie

More

Denis

Moshe

Medicaid is a joint federal and state funded program, run by the state and local counties, providing medical insurance, home-care services (assisting with all activities of daily living) and nursing home medical assistance to the poor, elderly or disabled.

However, individuals requiring home-care services or nursing home medical assistance, in addition

also will need to have a medical need for these services.

Medicaid is for anyone who meets the income and resources restrictions.

• Doctors • Hospitals • Prescriptions • Nursing Homes (room & board)

• Home-care Services, such as home attendants, home health aides and nurses

MLTC stands for Managed Long-Term Care. One example: When an applicant has been approved for Medicaid home-care services, the applicant has to choose one MLTC from several approved Medicaid plans. Upon joining an MLTC a coordinator will be assigned and this coordinator will be the point person between the applicant/recipient and the MLTC.

Due to Covid-19 once again the new rule regarding transfer of assets for Community Medicaid has been extended from October 1, 2022 to January 1, 2023; however, the earliest date that the state will seek implementation is March 31, 2024.

Once the new regulation is in place, applicants wishing to apply for community Medicaid and receive homecare services paid for by Medicaid will need to submit two and one-half years of bank statements. If there were any transfers during that period, other than spouse to spouse, the applicant will be disqualified for a period of time. Presently, applicants can transfer any amount of money one month and become financially eligible for Community Medicaid the following month. This window of opportunity is closing in fast. There is no time to procrastinate. The only way to avoid this issue is to apply before the new rule is enforced.

Elder Care Services, Inc., offers Free consultations.

97-37 63rd Road,

Park, NY

For more information please contact Jack

at 718-575-5700

Exercise with Darryl

with Pat Yoga with Nechama

with Moshe

with Rivky

with Debbie

and More with Darryl

with Denis

Moshe