5 minute read

Housing disparities persist for minorities

AG James releases report on homeownership discrimination

by Naeisha Rose Associate Editor

A report released by the office of state Attorney General Tish James Oct. 24 says the racial disparities between people of color, mostly Black and Latino New Yorkers, and their white counterparts is widening in terms of homeownership, and costing the minority groups $200 million over the course of their mortgage loans.

There were 16,000 fewer applicants of color applying for home mortgage loans statewide from 2020 to 2021 despite the government requiring lenders to offer the lowest interest rates in years during the Covid-19 pandemic. That resulted in a loss of $44 million in estimated annualized savings across the state, according to the OAG report.

The average 30-year fixed-mortgage rate was 2.65 percent in 2021. In 2019, rates were nearly double that and they have nearly tripled in 2023, according to data from Business Insider.

Blacks and Latinos, and in some cases Asian Americans, who did apply for home mortgages were more likely to be denied and the few that were approved received higher prices for their loan products and more costs associated with fees even when underwriting factors such as credit scores, debt-to-income ratio, loan-to-value ratio and application year, the OAG report continued. That was true across the board in every region of the state.

White applicants who had the same background as their Black and Latino counterparts were more than twice likely to own a home in comparison, they had better refinancing options and they paid less in fees and home insurance, the report added.

“Owning a home is an essential part of achieving the American dream and building wealth to pass on to future generations,” said James in a statement. “Unfortunately, unequal access to affordable credit is still pervasive across our state, reinforcing the legacy of segregation, leading to a disparity in homeownership, and fueling the racial wealth gap.”

Data in the report stated that Black and Latino borrowers were charged $4,200 more in interest rate payments over the course of their loans and an additional $900 in other costs and fees compared to white and Asian borrowers from 2018 to 2021, costing them $200 million more in interest and other costs and fees with loan terms of 10, 15, 20, 25 or 30 years.

Applicants of color also have a 21 percent greater probability of having their loan refinancing applications denied compared to white applicants.

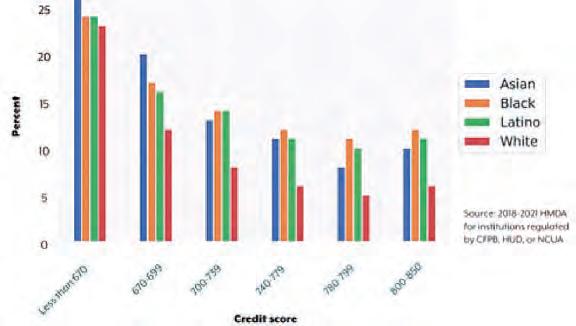

Asian Americans with a 670 credit score were denied at a higher rate — more than 25 percent — for home-purchase loans, followed by Blacks and Latinos — approximately 24 percent — than their white counterparts, about 23 percent.

Asian Americans with credit scores of 670 to 699 had their applications denied at a rate of 20 percent, followed by Black and Latinos, at more than 15 percent, and their white counterparts were denied a little over 10 percent of the time.

Blacks, Latinos and Asians were denied more than 5 to over 10 percent of the time compared to their white counterparts with credit scores ranging from 700 to 779, whereas their white counterparts were denied a little over 5 percent if not less.

Blacks, Latinos and Asians were denied at a rate of 10 percent or more when they had a credit score of 800 to 850, whereas their white counterparts were denied at a rate a little over 5 percent.

“The Attorney General’s thorough analysis unequivocally shows the racial disparities in homeownership and home financing throughout New York State,” said Assemblyman Clyde Vanel (D-Queens Village), who represents a predominantly Black District 33. “Homeownership represents a cornerstone of the American dream, yet this report paints a disheartening picture where individuals of color are denied this dream. We must focus our efforts to rectify this imbalance and pave the way for a just and inclusive future for every New Yorker.”

City Council Speaker Adrienne Adams (D-Jamaica) shared the same sentiments.

“The Attorney General’s report emphasizes how the pathway to homeownership is increasingly out of reach for Black and Latino communities due to racial discrimination and barriers to funding and access,” said Adams. “The significant exodus of Black New Yorkers over the past two decades is a consequence of that increasingly narrow path and a broader affordability and housing crisis that impacts all New Yorkers ...

“This Council is proud to have allocated over $16 million in the Fiscal Year 2024 city budget to a variety of initiatives to assist current and potential homeowners, including home loan, foreclosure prevention, and emergency repair programming. Ensuring that generations of Black and Latino New Yorkers can afford to live and stay in their communities will require solutions from all levels of government.”

City Councilwoman Nantasha Williams (D-Queens Village) concurred.

“ ... This issue hits close to home for my district, which boasts as one of the highest population of black homeowners in the country,” Williams said. “A recent census reported in The New York Times even indicated that black residents are leaving New York due to challenges related to homeownership and finances. This underscores the pressing need for intensive efforts to eradicate these disparities. We must work collectively to create a future where everyone, regardless of race or ethnicity, enjoys equal opportunities in homeownership and fair lending practices.”

The report illustrated that the compound effects of redlining, disinvestment in urban centers, urban renewal projects that destroyed neighborhoods and racial restrictive covenants have all played a factor in the lack of access people of color have to obtaining homeownership, which also resulted in a lack of trust in banks.

The American Housing Act in 1949 expanded the federal government’s role in housing, resulting in “slums” being decimated via authorized use of eminent domain, which displaced 300,000 people by 1979, according to the Massachusetts Budget & Policy Center.

Well-off minorities with good credit scores were denied mortgages, not just individually, but in neighborhoods where they were the predominant population. Government policies were approved to erect highways to separate white Americans from poor foreigners and minorities.

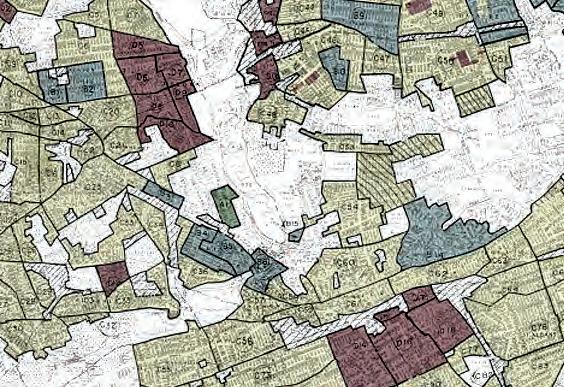

Lenders were directed to call predominantly Black neighborhoods like Long Island City, Laurelton and sections of Flushing and Corona, as well as the Hammels part of the Rockaway Peninsula, which had low-income laborers from Germany, Poland, Ireland, Great Britain, Italy, Russia, Finland, Spain and France, red zones, places too risky for investments, according to an interactive panorama created by the University of Richmond in Virginia called Mapping Inequality: Redlining in New Deal America, using data from 1934.

A section of Forest Hills was green zoned because it had only wealthy white Americans.

While the Supreme Court ruled in 1948 that racially restrictive housing, or directives by homeowner associations were unenforceable, white homeowners who sold or rented to Black, Chinese, Jewish and Japanese people from across the country would end up with voided contracts, according to a 2021 NPR report.

James believes subsidizing or providing down-payment support for first-generation homeowners; funding community development financial institutions that lend to historically excluded communities; passing public banking legislation that support entities that construct affordable housing; strengthening tools to address discriminatory practices; and supporting initiatives that ensure all New Yorkers have access to local banking services are a just a few ways to address the widening homeownership gap for people of color.

“This report makes it clear that our state must do more to provide better resources for homebuyers and strengthen housing laws to help empower more New Yorkers,” James said in a statement. “My office remains committed to fighting housing discrimination in all forms, and I look forward to working with my partners in government to address this problem.” Q

• Shutters by Hunter Douglas

- Heritance®

- Palm Beach™

• Privacy Sheers

- Luminette® with PowerGlide®

• LiteRise®

- Duette® with LiteRise®

- Parkland® Wood Blinds

- Decor® with LiteRise®