SERVING THE RAILWAY INDUSTRY SINCE 1856

Empress Excursion Marks a Milestone

SERVING THE RAILWAY INDUSTRY SINCE 1856

Empress Excursion Marks a Milestone

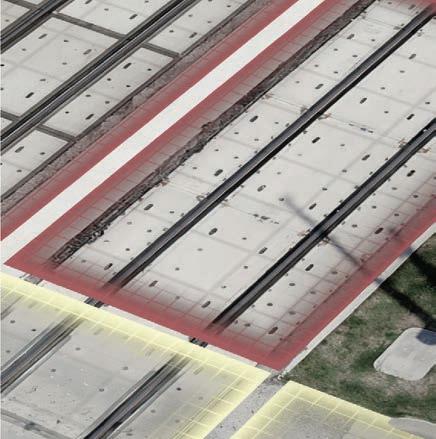

The photo below of Canadian Pacific Kansas City Manager Operating Practices, Steam Heritage Operations

Jonathan J. Morris in the engineer’s chair in CP 4-6-4 H-1b 2816, the fabled and famous Empress, could have been taken in the 1930s. Morris is checking a traditional railroad time-keeping device, a pocket watch, to ensure an on-time departure. But look closely below the array of beautiful, polished brass gauges and you’ll see a 21stcentury digital PTC display.

Yes, folks, PTC—in a steam locomotive built decades before anyone thought of combining the words “positive,” “train” and “control” to define a now-ubiquitous communications and signaling technology. It’s installed as a self-contained system on 2816—the world’s first-such application on a steam locomotive. The onboard equipment

is located in a specially designed cabinet on the lower left hand side of the tender, just behind the cab. As such, 2816 can operate solo in PTC territory. A rather elegant solution, eh? (as they say in Canada).

During more than three decades at Railway Age, I’ve enjoyed numerous cab rides on all types of equipment, diesel and electric, in North America and Europe. So far, the one I experienced (with my wife by my side) aboard 2816 on the former Kansas City Southern Pittsburg Subdivision between Amsterdam and Pittsburg, Mo., during the Kansas City-Shreveport segment of CPKC’s Calgary to Mexico City Final Spike Anniversary Steam Tour (p. 12), tops them all. And yes, we both got to blow the steam whistle (insert huge smile). It’s one of those life experiences that stays with you.

Many thanks to all the CPKC and Royal Canadian Pacific people who hosted Railway Age on the tour, which CEO Keith Creel shared first with us in September 2021 when Canadian Pacific and KCS signed the papers to create (with STB approval pending) North America’s first and only single-line transnational railroad. “We of course do not want to get out in front of the STB, but if all goes as anticipated, 2816 will be on the head end, in full steam,” he told me. It was worth the wait!

The STB approved the historic transaction 4-1 (the lone dissent coming from the agency’s current chair, but no matter). Keith Creel and Pat Ottensmeyer drove the ceremonial final spike in Kansas City on April 14, 2023.

Many years from now, God willing, I’ll be able to look back and say I and Railway Age were there. (Insert hopeful smile.)

WILLIAM C. VANTUONO Editor-in-Chief

WILLIAM C. VANTUONO Editor-in-Chief

Railway Age, descended from the American Rail-Road Journal (1832) and the Western Railroad Gazette (1856) and published under its present name since 1876, is indexed by the Business Periodicals Index and the Engineering Index Service.

Name registered in U.S. Patent Office and Trade Mark Office in Canada. Now indexed in ABI/Inform.

Change of address should reach us six weeks in advance of next issue date. Send both old and new addresses with address label to Subscription Department, Railway Age, PO Box 239, Lincolnshire IL 60069-0239 USA, or call (US, Canada and International) 847-559-7372, Fax +1 (847) 291-4816, e-mail railwayage@omeda.com. Post Office will not forward copies unless you provide extra postage.

POSTMASTER: Send changes of address to: Railway Age, PO Box 239, Lincolnshire, IL 60069-0239, USA.

Photocopy rights: Where necessary, permission is granted by the copyright owner for the libraries and others registered with the Copyright Clearance Center (CCC) to photocopy articles herein for the flat fee of $2.00 per copy of each article. Payment should be sent directly to CCC.

keeping or return of such material.

Member of:

SUBSCRIPTIONS: 847-559-7372

EDITORIAL AND EXECUTIVE OFFICES

Simmons-Boardman Publishing Corp. 1809 Capitol Avenue Omaha, NE 68102 (212) 620-7200 www.railwayage.com

ARTHUR J. McGINNIS, Jr. President and Chairman

JONATHAN CHALON Publisher jchalon@sbpub.com

WILLIAM C. VANTUONO Editor-in-Chief wvantuono@sbpub.com

MARYBETH LUCZAK Executive Editor mluczak@sbpub.com

CAROLINA WORRELL Senior Editor cworrell@sbpub.com

DAVID C. LESTER

Engineering Editor/Railway Track & Structures Editor-in-Chief dlester@sbpub.com

JENNIFER McLAWHORN

Managing Editor, RT&S jmclawhorn@sbpub.com

HEATHER ERVIN

Ports and Intermodal Editor/Marine Log Editor-in-Chief hervin@sbpub.com

Contributing Editors

David Peter Alan, Jim Blaze, Nick Blenkey, Sonia Bot, Bob Cantwell, Alfred E. Fazio, Gary Fry, Michael Iden, Don Itzkoff, Bruce Kelly, Ron Lindsey, Joanna Marsh, David Nahass, Jason Seidl, Ron Sucik, David Thomas, John Thompson, Frank N. Wilner, Tony Zenga

Art Director: Nicole D’antona Graphic Designer: Hillary Coleman

Corporate Production Director: Mary Conyers

Production Director: Eduardo Castaner

Marketing Director: Erica Hayes

Conference Director: Michelle Zolkos

Circulation Director: Joann Binz

INTERNATIONAL OFFICES

46 Killigrew Street, Falmouth, Cornwall TR11 3PP, United Kingdom 011-44-1326-313945

International Editors

Kevin Smith

ks@railjournal.com

David Burroughs dburroughs@railjournal.com

Robert Preston rp@railjournal.com

Simon Artymiuk sa@railjournal.com

Mark Simmons msimmons@railjournal.com

CUSTOMER SERVICE: RAILWAYAGE@OMEDA.COM , OR CALL 847-559-7372

Reprints: PARS International Corp. 253 West 35th Street 7th Floor New York, NY 10001 212-221-9595; fax 212-221-9195 curt.ciesinski@parsintl.com

As a “one-stop-shop,” Progress Rail offers comprehensive equipment leasing and nancing solutions to meet our customers’ speci c transportation requirements

All of our leased freight cars and locomotives undergo thorough inspections to ensure they are ready for service.

Our leasing experts specialize in eet optimization strategies ranging from small to large multi-state, multi-site operations.

Understanding customer needs and offering tailored options is what we do best. We

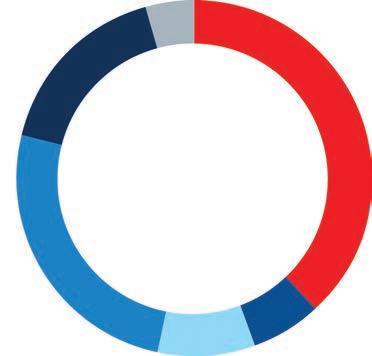

“Total originated U.S. carloads in April 2024 were 848,882, down 6.5% (58,751 carloads) from April 2023,” the Association of American Railroads reported last month. “The weekly average in April 2024 was 212,221 carloads per week, the second lowest for April in our records that go back to 1988. (April 2020, when the pandemic was just starting, was lower.) Year-to-date total carloads through April were 3.62 million, down 4.8% (180,839 carloads) from last year. Total carloads fell year-over-year each of the first four months of 2024. It’s a broken record at this point, but blame coal. In April 2024, coal averaged 46,303 carloads per week, down 28.0% from April 2023—the fourth straight double-digit percentage decline. In our records, only May 2020 had fewer coal carloads. In April 2024, coal accounted for 21.8% of non-intermodal U.S. rail volume, coal’s smallest share for any month in our records. Year-to-date coal carloads in 2024 through April were 926,967, down 17.3% (193,724 carloads) from the same time last year and the lowest January-toApril total in our records. Why is coal down so much? As one railroad explained in a Q1 2024 earnings call in late April, ‘Warmer temperatures overall led to record low natural gas prices and caused significant declines in demand.’ Coal carloads are down for reasons that have little to do with the state of the economy, so excluding them provides a better idea of current economic conditions.”

Railroad employment, Class I linehaul carriers, APRIL 2024 (% change from APRIL 2023)

7,997 (–1.99%)

(–1.14%) Transportation (other than train &

Source: Rail

NORTH AMERICAN RAILROADS

TOTAL North American CARLOADS, APRIL 2024 VS. APRIL 2023

1,295,7071,354,175 APRIL 2024 APRIL 2023

Copyright © 2024 All rights reserved.

TOTAL U.S. Carloads and intermodal units, 2015-2024 (in millions, year-to-date through APRIL 2024, SIX-WEEK MOVING AVERAGE)

parts -when you need them.

Need freight car parts in days, not weeks? You need Comet. Our dedication to service & Midwest location allow us to get you your parts -- when you actually need them.

Our seven-acre yard features over 500 SKUs of new & reconditioned parts.

GET A CATALOG

SURFACE TRANSPORTATION BOARD (STB) MEMBER PATRICK J. FUCHS, A REPUBLICAN, WAS SENATECONFIRMED BY VOICE VOTE MAY 14 TO A SECOND FIVE-YEAR TERM, WHILE DEMOCRAT JENNIFER ESPOSITO HOMENDY WAS SIMILARLY CONFIRMED BOTH TO A SECOND TERM ON THE NATIONAL TRANSPORTATION SAFETY BOARD (NTSB) AND AS ITS CHAIRPERSON. Neither faced vocalized political opposition and both had industry and labor support— Fuchs in the rail sector and Homendy among all modes.

Fuchs was first nominated to the fivemember STB by President Trump in 2018 and Senate-confirmed in January 2019 to one of two new seats created by the 2015 STB Reauthorization Act that Fuchs helped write while a Senate Commerce Committee senior staffer. Fuchs’ latest Senate confirmation follows a January President Biden nomination. STB members are limited to two terms. Upon first taking the oath of office at age 30 in 2019, Fuchs was the second youngest rail regulator since the 1887 creation of STB predecessor Interstate Commerce Commission (ICC).

Homendy, 52, twice a Trump nominee, was first Senate-confirmed to the NTSB in 2018 to fill an unexpired seat, and Senateconfirmed in 2019 to a second full five-year term. In 2021, she was Senate-confirmed as NTSB chairperson—a three-year position— following a Biden nomination. Biden renominated Homendy to both posts earlier this year. The NTSB statute does not provide for term limits. And unlike the STB statute

that allows for a maximum 12-month holdover when the second term expires, NTSB members may remain in place indefinitely— including as chairperson—pending Senate confirmation of a successor.

In nominating Fuchs to his second term, Biden said he had “advanced transportation policies that address unreasonable practices and inadequate service, adjudicated railroad transactions that generated new capital investment and routing options, and streamlined inefficient processes that unduly burden the public.”

Other legislation Fuchs helped draft included the rail and hazardous materials titles of the Fixing America’s Surface Transportation (FAST) Act—the first rail passenger service reauthorization in almost a decade that instituted reforms improving Amtrak’s permitting and performance, encouraged private-sector competition on routes, and created the Consolidated Rail Infrastructure and Safety Improvements (CRISI) program, a major source of short line railroad capital improvement funding.

Shippers, in letters of support, described Fuchs as “calm,” “solid,” “transparent” and “seriously thoughtful.”

Fuchs earned from the University of Wisconsin a double-major undergraduate degree in economics and political science, and a master’s degree in public policy analysis and management, with an emphasis on transportation policy, economics and statistics. As a graduate student, he participated in an international academic program with the National University of Singapore, focusing on international policy and economics.

Prior to joining the Senate Commerce

Committee’s Republican staff in January 2015, Fuchs was a policy analyst with the White House Office of Management and Budget, a State Department Presidential Management Fellow serving in The Hague, Netherlands, and a research assistant at the National Center for Freight and Infrastructure Research and Education.

Homendy is a career civil servant with a reputation for transparency, steadfast adherence to just-the-facts conclusions and being strong willed. During high school, she worked in Georgia Republican Newt Gingrich’s House office; while pursuing a degree in humanities at Penn State, she worked for Sen. Arlen Specter (R-Pa., who later became a Democrat); and following college, worked briefly for Rep. Lamar Smith (R-Tex.). Postcollege, Homendy gained government affairs experience with the National Federation of Independent Business and American Iron and Steel Institute, which led to positions with the AFL-CIO Transportation Trades Department and the Teamsters Union.

In 2004, she became Democratic staff director for the House Rail Subcommittee, where she helped draft two significant railroad bills: The 2008 Rail Safety Improvement Act mandated implementation of PTC, limited train crew hours of service and tightened training standards, and the 2009 Passenger Rail Investment and Improvement Act instructed the STB to establish metrics and standards for Amtrak passenger trains hosted on freight railroads.

While the NTSB now is fully staffed at five members, the May 10 retirement of STB’s Oberman leaves the five-member STB evenly divided politically. Democrat Robert E. Primus, 56, whose second term expires in December 2027, was named by Biden as Oberman’s successor as chairperson. Unlike the NTSB, the STB statute does not require Senate confirmation of a Presidentially selected chairperson.

Five Democratic names are on a White House short list to succeed Oberman, but the likelihood of a Democratic nominee gaining Senate confirmation this year is problematic. Senate Republicans, who can block a floor vote on a nominee, will want to keep the Oberman Democratic seat vacant for nomination of a Republican by Donald Trump, should he be elected in November.

– Frank N. Wilner

Thermon Velocity’s progressive technology, experienced design team and use of high quality components ensure the durability and high performance of our solutions. With Canadian and American manufacturing capabilities, Thermon VelocityTM can provide heating solutions optimally tailored to your application.

Our heaters are designed to customer specifications with the optimal enclosure material, elements, fan, connection type and thermal protection to ensure safe and efficient operation. Traditional fan forced styles include cab heater, defroster/defogger, vestibule, lavatory, baseboard, portal and underseat heaters.

The patented Calvane™ utilizes an aluminum sheath with integrally extruded fins for an extended heat transfer surface. Nickel chromium resistance wire or ribbon and high grade magnesium oxide insulation combine to provide maximum life expectancy. The Calvane™ provides a faster heat up and cool down period while being lighter than any competitive heaters.

Our extensive offering of advanced elements is perfectly suited for overhead duct heaters in transit applications. Elements are designed to customer specifications and optimized for maximum reliability and performance. The elements are mounted in a rigid metal frame and braced to withstand high shock and vibration while maintaining accessibility for ease of maintenance.

Thermon Velocity’s threshold and door pocket heaters are waterproof and durable to withstand the wet, rugged conditions of passenger entryways. Each Calbar™ element has a flat, contoured surface to maximize heat transfer and is immersion tested for 24 hours to ensure integrity.

Brightline has designated Siemens Mobility preferred bidder to supply 10 seven-car “American Pioneer 220” (AP 220) electric trainsets for the 218-mile, $12 billion Brightline West high-speed rail system connecting Las Vegas and Southern California, expected to open for service in 2028. Selection of Siemens is subject to the conclusion of definitive agreements. IAM-represented workers are expected to build the new trainsets. The contract includes 30 years of rolling stock maintenance to be performed at Brightline West’s Vehicle Maintenance Facility in Sloan, Nev., where crews will perform routine daily maintenance, as well as long-term overhauls and repairs. “This will generate high-paying jobs performing train maintenance activities on a permanent basis,” Brightline noted. The AP 220 is described as “an evolution of the proven Siemens Velaro HSR trainset platform currently operating in Europe.” Capable of speeds up to 220 mph on a dedicated right-of-way, the equipment “represents a new generation of innovative high-speed technology, featuring the latest in passenger experience, cutting-edge digital technology and a revolutionary propulsion system, built specifically for the U.S. market,” Brightline said. “The AP 220 will introduce state-of-the-art technology through an American supply chain spurring the U.S. to establish a new industry rivaling countries that have had HSR for decades and will be the first true high-speed trainsets to be built in America.” Siemens plans to establish a new facility to build the AP 220.

SWISS FEDERAL RAILWAYS (SBB) has signed a $349.7 million contract option with STADLER for supply of 33 four-car singledeck Flirt Evo EMUs, which will deployed from 2030 on cross-border services between northwestern Switzerland and the Alsace region of northeast France. The latest batch of Flirt Evo EMUs for SBB will take traction current at 15kV 16.7Hz ac in Switzerland and at 25kV 50Hz ac in France, and be equipped with safety systems for both countries. Up to three EMUs will be able to operate in multiple in France, and up to four in Switzerland. Each four-car train will have 146 seats, as well as space for bicycles, wheelchairs and large items of luggage. SBB says that two new cross-border lines will be added to the Basle S-Bahn network in December 2030, including Line S2 from Olten to Basle and Mulhouse in France.

ALSTOM last month landed an approximately C$123 million contract from British Columbia’s TRANSLINK for an additional six five-car Mark V trainsets, which will run on the SkyTrain automated rapid transit system in Vancouver. The contract was booked in the 2023/24 fiscal year. Alstom is currently supplying 41 Mark V trainsets (205 cars) to TransLink. Ordered in 2020 from Bombardier, which Alstom acquired in 2021, they will replace the original Mark I sets, slated for retirement in 2027. TransLink received the first Mark V set in December 2023; it will enter service in late 2024, following site qualification and commissioning. The other sets under the original order will be gradually added to the fleet and enter service by 2028. These sets are longer than TransLink’s current equipment and able to carry up to 25% more riders, in anticipation of the Broadway Subway and Surrey Langley SkyTrain extensions. They were purchased as part of the SkyTrain Fleet Expansion Program, which is funded under the 10-Year Vision for Metro Vancouver transportation. All the trainsets are being designed, manufactured, and tested in Canada at Alstom’s facilities in Kingston, Ontario, and in La Pocatière and Saint-Bruno-de-Montarville, Quebec.

Korean rolling stock manufacturer WOOJIN INDUSTRIAL SYSTEMS was awarded a $210 million contract by LOS ANGELES COUNTY METROPOLITAN TRANSPORTATION AUTHORITY (LACMTA) to upgrade 74 rapid transit cars built in 1999 by AnsaldoBreda of Italy. Work, due to be completed within 56 months, includes installation of new traction control, monitoring and auxiliary power supply systems, passenger information screens, and HVAC systems. Woojin says that the contract will include renovating the traction control and other onboard systems of 14 rapid transit cars that “were left incomplete by a manufacturer based outside the U.S.” LACMTA selected Woojin as preferred bidder in February. Woojin submitted its initial bid in December 2022 and the tender evaluation process included LACMTA inspection of Woojin’s U.S. manufacturing plant in July 2023. Woojin submitted its final proposal in November 2023. Woojin has a plant located at Santa Fe Springs in Los Angeles County that opened in 2011 to serve the U.S. transit market. It will build a new plant to fulfill the LACMTA contract and comply with the Buy America Act.

C.

Railway Age

David C. Lester

Railway Track & Structures

Kevin Smith International Railway Journal

Railway Age, Railway Track & Structures and International Railway Journal have teamed to offer our Rail Group On Air podcast series. The podcasts, available on Apple Music, Google Play and SoundCloud, tackle the latest issues and important projects in the rail industry. Listen to the railway leaders who make the news.

William

Vantuono

William

Vantuono

One would think California’s housing cost crisis, soaring energy prices, hundreds of companies relocating and a population exodus would induce greater regard for bene ts and costs when formulating public policy. Not so the California Air Resources Board (CARB) that seeks to impose on railroads a regulatory burden whose CARB-estimated costs could exceed $13 billion, adversely impact productivity and market growth, and fail to deliver advertised bene ts.

CARB is asking the federal Environmental Protection Agency (EPA) for authority to function as a de facto nationwide railroad regulator. It seeks a mandatory scrapping— beginning in six years—of in-state operated locomotives more than 23 years old and their replacement with zero-emissions propulsion such as hydrogen fuel cells or batteries.

Yet neither is available commercially for broad deployment. Prematurely locking railroads into unproven technology will retard incremental innovation and discourage experimentation with alternative fuels, as locomotives are long-lived assets.

Worse, while the CARB rule pretends to govern only locomotives operating in California, it ignores that rail operations are interstate—that locomotives are interchanged among railroads and traverse wide geographic areas. is is why the U.S. Surface Transportation Board (STB) holds exclusive congressional authority to prevent a patchwork of inconsistent state regulations from impeding the ow of rolling stock, locomotives and goods across state lines

Where there is “apparent con ict” among laws—such as between the Environmental Protection Act and Interstate Commerce Act—the 9th Circuit Court of Appeals held that e orts must be made to harmonize them. But as CARB seeks to usurp STB authority in a way that would impede interstate commerce, harmonization is unlikely. Railroads are asking a federal court to shut the door on CARB.

While CARB’s desire to improve air quality is admirable, it is aspirational, but the cost to railroads of a mandate to embrace unproven technology is real,

immediate, extraordinarily high and not in the public interest.

Beyond the premature sending to scrap yards of thousands of economically ecient in-service locomotives, the CARB rule would impose on railroads, in the interim, a costly duty to record idling time and fuel usage, plus calculate, as if railroads are scienti c institutions, the harm to California residents from fossil fuel emissions of yet-unscraped locomotives.

e CARB rule also assesses a tax on all non-zero emissions locomotives operated in California during the transition period. ose state-collected dollars will later be directed by CARB toward purchase of CARB-preferred locomotives, giving the agency partial authority over railroad capital spending decisions. BNSF and Union Paci c estimate their combined tax at $1.4 billion annually.

Should the EPA grant CARB the authority sought, other states could write con icting rules, creating the very inconsistent patchwork of commerce-impeding state regulation the Interstate Commerce Act is intended to prevent.

Signi cantly, the CARB rule could put short lines—most operating on thin margins and lacking market power to raise rates—out of business. California’s Sierra Northern Railway CEO Kennan H. Beard III says all 36 of his locomotives must be scrapped under the CARB rule, that battery power is currently impractical, and prototype hydrogen fuel cell power, while showing “a promising future,” is una ordable at $7 million.

Larger railroads would lose incentive to grow market share as they cannot shi to their mostly price-sensitive freight the CARB-induced higher costs, lest freight migrate to less safe and environmentally more damaging trucks, whose carbon dioxide emissions, says EPA, are 10 times those of locomotives.

While CARB says it will mandate zero emissions for big trucks, that technology also is problematic, with the cost una ordable for most eets and owner-operators. Forecast operating costs also are high, given limited mileage per charge, charging-time

CARB’s inflexible rule is arbitrary, capricious, counter-productive and an interstate commerceimpeding tax.”

delays, and battery weight that accelerates tire wear and reduces payload. Other concerns are electricity grid capacity and highway charging station availability.

“Zero-emissions locomotives will easily exceed $5 million per unit, making CARB’s authoritarian locomotive policies economically infeasible,” says railroad equipment nance expert, Railroad Financial Corp. President and Railway Age Financial Editor David Nahass.

For a rail industry whose carbon footprint already is lowest among modes, and which is voluntarily spending to reduce it further through creative and competitive innovation, CARB’s in exible rule is arbitrary, capricious, counter-productive and an interstate commerce-impeding tax.

Wilner’s new book, Railroads & Economic Regulation, is available from SimmonsBoardman Books at www.railwayeducationalbureau.com, 800-228-9670.

FRANK N. WILNER

FRANK N. WILNER

October 17 & 18, 2024

Hilton Baltimore Inner Harbor

Baltimore, MD

Railway Age | Parsons Next-Gen Train Control is an essential gathering for communications, signaling, and IT professionals — whether your focus is transit, main line passenger, or freight. Sessions will offer in-depth technical information on current CBTC and PTC projects. We’re also expanding our exploration of the fast-growing artificial intelligence-based technologies utilized to enhance efficiency and safety. Between sessions, develop vital business relationships during networking breaks.

REGISTER BY 6/26 TO SAVE!

Sponsorships: Contact Jonathan Chalon, 212.620.7224, jchalon@sbpub.com

Learn More: www.railwayage.com/nextgen

As this is written just before the Memorial Day weekend, Canadian Paci c Kansas City’s Final Spike Anniversary Steam Tour is within a few days of crossing the U.S.-Mexico border at Laredo, Tex., on an historic three-nation round-trip journey that began in Calgary on April 24 to mark the one-year anniversary of

CPKC’s o cial merger. e train, led by the Empress, H-1b Hudson-type 4-6-4 2816, built by Montreal Locomotive Works in December 1930, has delighted thousands who gathered trackside to see it go by and participate in special events along the way. Two EMD FP9A locomotives, 1401 and 4107, are included in the consist as protection power, and to assist the very heavy train on grades, if needed.

Behind 2816, whose primary tender carries 4,600 gallons of fuel oil and 12,000 gallons of water, are two auxiliary water tenders, each holding 23,000 gallons; EMD FP9As 1401 and 1407; a tool car with a fully equipped machine shop; and 14 cars. e Empress’s 9,000-mile round trip journey between Calgary and Mexico City has never been done before in North America.

ALL PHOTOS BY THE AUTHOR

Operations Tracy Miller and Executive Vice President/ division engineers aboard inspection car CP1.

At every service stop, 2816’s crew inspects the oiling system installed on the drive wheels, a critical upgrade to the prior grease cake-based lubrication method.

State-of-the art PTC technology is integrated with vintage brass gauges in 2816’s cab. The Empress is the world’s only steam locomotive with self-contained PTC.

CPKC Senior Manager Heritage Services and Operations Adam Meeks is in charge of 2816 and her entire consist.

ALL PHOTOS BY THE AUTHOR

Operations Tracy Miller and Executive Vice President/ division engineers aboard inspection car CP1.

At every service stop, 2816’s crew inspects the oiling system installed on the drive wheels, a critical upgrade to the prior grease cake-based lubrication method.

State-of-the art PTC technology is integrated with vintage brass gauges in 2816’s cab. The Empress is the world’s only steam locomotive with self-contained PTC.

CPKC Senior Manager Heritage Services and Operations Adam Meeks is in charge of 2816 and her entire consist.

The battle for the soul of Norfolk Southern concluded with more whimpering than expected. Together, Ancora’s three board seat limited victory and its highly scripted vow to “ ght on” suggest that the wind has been let out of the pricing model for expected stock gains that were anticipated by the promised return to a hard-core PSR strategy. As reported

in Railway Age, Ancora announced its $1 billion stake in NS stock on Jan. 31. By early March, NS stock, on the heels of an Ancora suggestion that they could “drive NS’s share price up by about 65% to $420,” had risen about 10%.

Markets are funny things: A er peaking in early March, NS stock started a march back to pre-Ancora levels and dropped another roughly 3% a er the May 9 vote.

Wall Street had already backed o on the deal, as NS stock was on a slow but steady decline a er the March 12 peak. Clearly, the Street, a er seeing the opposition from the NS management team, the very well-timed and important hiring of John Orr, and the regulatory backing of Alan Shaw’s team and NS’s operating strategy, began to lose faith in the possibility of Ancora’s success in the vote. While the stock has recovered a few dollars

per share, the onus on Shaw, Orr and team to perform is square and heavy.

Boardroom theatrics are always exciting, but the end to the current chapter of the activist investor and the railroad won’t leave anyone disappointed. e Ancora soap opera is in many ways just another instance of the level of disrespect put to railroads and their management.

e battle for Norfolk Southern so pitiably lacked the aura of positivity surrounding the chase for Kansas City Southern from 2021-2023.

e timing of Ancora’s pursuit is somewhat sketchy. It follows a few weeks a er John Oliver’s attack on NS on his show Last Week Tonight. ( e Oliver show was covered in the January 2024 “Financial Edge”; the episode of the show was issued in December 2023.) It was as if Ancora saw the broadcast (such as it were), saw NS as a wounded animal and thought they could pounce.

Call it the ongoing hangover associated with the legacy of Hunter Harrison. ere are no more divisive sets of words in railroading today than Precision Scheduled Railroading, operating ratio and Hunter Harrison. Put together, they raise hair on the back of necks, cause people to get ustered and incite vindictive about how Harrison ruined railroading. at makes the NS triumph over Ancora all the more important.

Ancora’s belief that it could squeeze, knead and massage NS into a stock market

ATM does highlight what continues to be a fundamental issue plaguing North American railroading. Is rail an industry interested in volume growth or margin growth? One-third of the way through 2024, general freight loadings (except coal) are up 0.5% over the rst four months of 2023, and intermodal is up 9% over the same time frame.

Coal is another story. Coal loadings are down 17.7% YOY for the rst four months of the year. is is a demand and consumption driven change. As the pace of coal- red generating station retirements in 2024 is relatively modest, it begs the very interesting question of what the impact on coal loadings will be in 2025 when a whopping 12 gigawatts of coal- red generation is slated for retirement or decommissioning.

Even with the 2.1% increase in total (general freight, coal and intermodal) loadings, system-wide velocity has been maintained at a robust 25 mph in early 2024. While the increase in intermodal and general freight (again excluding coal) is a positive, we continue to lag far behind the bell-weather touch point of 2018’s loadings levels.

As intermodal loadings have increased, so have the dwell times of containers being moved by rail out of the ports of Los Angeles/ Long Beach with rail container dwell times 40% higher than they were at the beginning of 2024. is remains something to watch to see if a late upswing negatively impacts service levels.

What continues to be a fascinating part of the overall rail network is the leasing market and the railcar supply picture. Let’s start with a few quick facts. According to the AAR publication Rail Time Indicators, (RTI) the North American railcar eet has reduced YOY (again through the end of April) by roughly 5,000. Over the same 12 calendar months, the number of cars in storage has increased by 20,000. e stored car increases come from cars used to transport coal (with increases of roughly 30% in storage) and, more surprisingly, boxcars (also up 30%). Note also that as the gondola eet in storage has increased, the total number of gondolas in the national eet has also increased (the gondola segment includes gondola cars used to haul coal, scrap, aggregates and nished steel). So, the national eet is shrinking (albeit slightly) even as loadings are increasing. What about new cars? For the past six months, 4Q23 and 1Q24, new cars orders have totaled 10,028 while deliveries have totaled 22,081. e backlog, on the heels of the weak order numbers, has decreased over six months by 12,000, from 58,680 to 46,413. e industry is therefore moving more with less, and the order book for new assets continues to be weak. As RTI points out, there has been a generalized slowing of GDP. Additionally, manufacturing indexes show continuing slowdowns. A slowing economy and high interest rates continue to exert slight downward pressure on the economy.

e weakness in the new car market is particularly consternating. Word on the street is that there remains ample capacity for railcar deliveries in the latter part of 2024. Projections that new car production could end 2024 at some number near 45,000 units almost seem optimistic. e ongoing cocktail of challenges for new car prices of higher labor along with the higher interest rates continues to de-motivate the market to invest in new railcars. But it raises a question about the preparedness of the industry to respond if increases in demand for freight cars happen while manufacturing has slowed to levels at less than the level of replacement.

How is this impacting the lease marketplace? (For a discussion on current lease rates and the market, see the “Around the Market” section.)

Concerns about the new car market might all be apropos of nothing. If loadings growth stays within a narrow range, the need for additional new cars in the national railcar eet would be limited. e EIA forecast for natural gas pricing remains at the bargain basement level of $2.20 per MMBTU for 2024, making any tangible rebound in coal tra c unlikely (and let’s face it, the EIA is never wrong).

Furthermore, it would be unreasonable to expect an additional increase in intermodal loadings over the already present 9% upswing vs. 2023. e general consensus, whether reading publicly available information from

Bank of America or looking at the Federal Reserve’s Inventory to Sales Ratio, suggests a normalization of the inventory cycle. While there might be some additional (and traditional) holiday buildup, an additional increase in intermodal loadings of material amounts seems unlikely.

Neither does a dramatic shi in consumption based on potential decreases in interest rates by the Federal Reserve. Although core in ation continues to modulate, the Fed’s messaging has been consistently moderate and trepidatious about too many reductions too soon. Clearly, the Fed wants to ensure it does not provide any impetus that ips the apple cart and causes in ation to increase a er a long and tense period of trying to reduce it. Even the lowest CPI since April 2021 will not be enough to motivate the Fed to take quick action. Plus, in case you’re a little behind on the news cycle, there’s a Presidential election in the fall. ere is already a plan in the works to make the Fed more subservient to the Executive Branch. e Fed is going to try to seem like the most powerful person in the room while keeping schtum (quiet) about its role in the economy—just a typical solitary thinker holding up the Walls of Jericho before they crumble.

Slow and steady might be the rule for 2024. For people hoping for lower railcar prices (and lower lease rates) as a re exive response to a re-populating eet that has been modestly shrinking, this might not be

the news for which you are waiting. e good news is that if we’ve learned anything about predicting the trajectory of the economy, there are always surprises. In any case, you always have hope. Hope is an awesome strategy. Just ask Rudy Giuliani.

It’s beginning to sound a bit like a broken record, but (again maybe with the exception of coal, as further described below) this is an historic run of rental stability at higher prices for railcar owners/lessors. is is not to say that rates are not uctuating or that in some markets they haven’t dri ed down, but by and large rates remain stable and lessors continue to hold the high hand at the no-limit poker table.

e drivers are still the same—railcar prices are higher and so are interest rates. Without a destination for the air in the balloon to release the upward pressure on pricing, rates will stay at lo y levels while car supply and demand remain relatively stable. One can imagine a scenario where, when the Fed begins to reduce interest rates, buyers rush into the market and buy cars to capture the upli in rates and terms before interest rates drop and lease rates decrease. is could create some oversupply shocks. at would be so, well, traditional. But it hasn’t happened yet.

Last year’s El Niño looks likely (50% chance by August and 69% chance by September) to

RAIL LEASES TAILORED TO YOUR NEEDS.

Your business depends on reliable transportation capacity. That’s why we match our extensive experience with one of the youngest, most diversified railcar and locomotive fleets in the industry. Turn to us for creative rail leasing solutions that can help you free up capital for your growth priorities.

Find the right vendors for your business in the Railway Age Buyer's Guide. Search for products, research vendors, connect with suppliers and make confident purchasing decisions all in one place. RailwayResource.com

convert to a La Niña weather pattern, and a heavy hurricane season seems likely. at could make for a weather-disrupted summer and fall around the rail-service-heavy Gulf of Mexico. Residents of Houston are already fretting a er May’s almost spontaneous 100 mph hit and run series of thunderstorms.

It bears remembering that a decade ago, railcar builders and buyers, over the space of two calendar years, in the incredible build years of 2014 and 2015, pumped 135,000 railcars (9% of the national eet at the time) into the market. at build pace has almost been cut in half since the “end” of COVID. History’s ner lessons o en bear repeating.

In general, lease term lengths continue on the longer side. Even at some of today’s (occasionally and slightly) lower rates, lessors are looking to lock cars up with term.

HERE’S WHAT’S HAPPENING AROUND THE MARKET:

Covered Hoppers (Grain): Rates have dropped o from some recent highs but maintain stability and strength. For jumbo

cars, look for high $500s to low $600s full service (FS), with a decrease of about $100 per car, per month for net deals. For 4,750s, expect those numbers to be in the high $300s to low $400s FS.

Covered Hoppers (Plastics): Similar story—rates are o their highs but not in a pattern of decline. For 6,200 cf cars, look for rates in the mid $600 FS. For smaller 5,800 cf cars, expect rates in the low $400s.

Covered Hoppers (DDG): ese continue to be a premium with limited availability. Look for prices in the low to mid $700s for 6,300 cf cars. Cars remain scarce.

Covered Hoppers (Cement): Some ongoing strength here despite remaining inventory and cars still being returned to investors. Renewal rates are in the high $200s FS as these cars are rather sticky. Expect a lower price for an initial lease. About 32,000 small cube hoppers were built in 2014 and 2015 and some of those have yet to cycle back into inventory.

Mill Gondolas: Scrap loadings are o YOY, but you wouldn’t know it from the

WorkSiteTrainingCourses: Locomotive:

• TestingandTroubleshooting26-Type LocomotiveAirBrakeSystems

• LocomotivePeriodicInspectionand FRARulesCompliance

• LocomotiveElectricalMaintenanceand Troubleshooting

• LocomotiveAirBrakeMaintenanceand Troubleshooting

• DistributedPowerMaintenanceand Troubleshooting

• DistributedPowerOperations,Training,and OperatingRules

FreightCar:

• FreightCarInspectionandRepair

• SingleCarAirBrakeTest

• FRAPart232BrakeSystemSafetyStandards forfreightandothernon-passengertrains

• TrainYardSafety

Track:

• TrackSafetyStandards

tightness of the market for these cars. Mill gondolas for hauling scrap are one car type continuing to be built. If you can nd them, 52-foot mill gons are pricing in the low to mid $600s FS. For cars being operated west of the Mississippi, 66-foot gons will run in the mid $700s FS. is is a rapidly aging eet. According to Railinc’s David Humphrey, almost 20,000 cars will require replacement over the next seven years a er hitting their 50-year interchange life maximum, so expect the mix of high-priced new cars and supply tension to provide support here.

Coal Cars: e additional movement of coal cars into storage (a trend likely to continue through 2024) will continue to put downward pressure on rates. Expect rates on coal gons to be in the mid $200s FS. For rapid discharge cars, expect rates in the mid $300s, also FS. Hoppers remain more di cult to nd of the two groups. Don’t expect 2025 to be an improvement. Just sayin’.

Tank Railcars: e eet has stayed roughly the same size YOY while increased loadings in chemicals (up 4% YOY) and

petroleum products (up 9% YOY) continue to pressure the market. For tank railcars being used in energy and chemical products, there is not an overabundance of tanks available in the market, and lease rates remain high. ere is excess capacity in the 30,000gallon non-coiled, non-insulated market, but that is to be expected. Lease rates for these cars are all over the map and dependent on recerti cation status. Some rates are trending down into the low $300s FS and up into the $400s. For 30,000-gallon coiled and insulated 117Js (new), look for pricing in the low $1,000s FS. For 117Rs (rebuilt) for crude oil, expect pricing in the low to high $700s FS. For 25,000-gallon tank railcars, look again for numbers in the high $800s to low $900s if it’s a 117J and in the mid 700s if it’s a 117R. For pressure tanks, look for rates in the $1,100 to $1,200 range.

Tank Railcars (Food Grade): is market has remained robust, and lease rates re ect the balance of supply and demand, with rates in the high $700s to low $800s FS. HM-216 costs continue to be a stress point for lessors

and operators. In the 2014-2015 boom, there were more than 60,000 tanks built, so expect that stress to continue.

Boxcars: As noted in the primary piece, boxcars are one of three railcar groups (and the only one not related to coal) whose number in storage has increased materially YOY. e market has recently resurged a bit and prices have risen accordingly. ere is still a continued pressure to shine a brighter light on the impending boxcar cli . Looking for 60-foot boxcars? Expect those to price in the low to high $700s FS. If you’re in the market where you need a 50-foot boxcar, prices are roughly $100 per car per month lower.

Centerbeam Flat Cars: Housing starts are relatively tepid even though some optimism exists in the market. is market was already a little so and remains so. Expect rates for these cars to be in the mid $400s to mid $500s FS.

PNW Railcars is a leader in the North American railcar leasing and management business, providing best-in-class railcar asset availability and fleet management, supported by a uniquely talented team that offers decades of combined experience. Our team is committed to serving you and dedicated to helping your business succeed.

Visit us at pnwrailcars.com or email info@pnwrailcars.com

The 2024 Guide to Equipment Leasing (pages 14 through 24) is supported by companies that provide equipment leasing and financial services and products to the rail industry. All of these firms have advertisements elsewhere in this section or have used paid profile space to present their background and capabilities.

AITX (American Industrial Transport, Inc.) is a premier provider of integrated railcar solutions, offering a wide array of services across railcar leasing, fleet management, and repair services. With a diversified portfolio of nearly 120,000 railcars and over twenty owned and operated railcar service providers including full-service tank and freight car shops, mobile services onsite partnerships and railcar storage facilities, AITX serves a crucial role in the rail transport industry. AITX offers shippers and railroads the expertise, capabilities, and services to keep their products on-track and their business moving ahead.

Tina Beckberger, Chief Commercial Officer

American Industrial Transport, LLC 300 S. Riverside Plaza, Suite 1925 Chicago, IL 60606

aitx.com

Railroad Equipment Leasing And Maintenance (RELAM) Inc. provides excellent quality MoW equipment for shortor long-term leasing. We work with you to provide customized solutions that maximize your productivity and profitability. Tell us about your upcoming projects, and we do the rest by delivering a program that works for you. From tie and rail replacement to surfacing equipment, car movers to vegetation equipment, and excavators to Wiskerchen hi-rail trucks; RELAM has the equipment you need. Facilities are located near Cleveland OH, St. Louis MO, Sacramento CA and Northern WI.

Request a proposal or more information at quotes@relaminc.com or call 800-962-2902

Our Rail division offers a full suite of leasing and financing solutions to rail shippers and carriers across North America. We’re a top lessor of highcapacity railcars and offer flexible lease terms, a diverse fleet and dedicated customer service that’s focused on building long-term relationships. Our turnkey-ready cars are available to support your increasing demand, free up capital for growth and minimize out-of-service time.

Let’s explore how our full suite of services can help support your operating priorities and power your growth.

www.citrail.com

TrinityRail® provides our customers with comprehensive rail transportation products and services designed to provide value by optimizing the ownership and usage of railcars.

Available is an owned and managed fleet of approximately 141,000 railcars as well as fleet management solutions, administrative services and dedicated customer support. Access is also provided to TrinityRail’s extensive engineering and manufacturing platform, maintenance, parts, and on-site field support for operational assistance and training.

More information is available at www.trinityrail.com.

Gregg Mitchell, EVP, Chief Commercial Officer 14221 N. Dallas Parkway, Suite 1100 Dallas, TX 75254

800-631-4420

www.trinityrail.com

The Greenbrier Companies is a leading international supplier of railroad equipment and services to global freight transportation markets. Greenbrier designs, builds, and markets freight railcars in North America, Europe and Brazil through its wholly owned subsidiaries and joint ventures. We are a leading provider of railcar wheel services, parts, maintenance and retrofitting services. Greenbrier owns a lease fleet of over 12,000 railcars, manages nearly 450,000 railcars and offers fleet management, regulatory compliance and leasing services to railroads, lessors and rail shippers. Learn more about Greenbrier at www.GBRX.com. Info@GBRX.com

Thomas P. Jackson, Vice President of Marketing & General Manager One Centerpointe Drive, Suite 200 Lake Oswego, OR 97035

Tom.Jackson@GBRX.com

Union Tank Car Company is a leading designer, builder and full-service lessor of railroad tank cars and other specialized railcars. Together with its Canadian affiliate Procor, UTLX owns a fleet of approximately 120,000 railcars for lease to customers in chemical, petrochemical, energy and agricultural/food industries. UTLX manufactures tank cars in the U.S. and performs railcar maintenance services at more than 100 locations across North America. UTLX is part of Marmon Holdings, Inc., a Berkshire Hathaway company.

Union Tank Car Company

312-431-3111

leasinginquiry@utlx.com

UTLX.com

You have product to move. We have the cars to do it. PNW Railcars’ fleet is among the youngest in the industry, and continuously expanding, to handle and transport whatever you need to move dependably: agriculture, automotive, aggregates, chemicals, energy, forest products, plastics, and steel. Thanks to our ongoing investment and supply relationships, we can also accommodate any configuration requirements you may have. Give us a call and see how we can help you.

PNW Railcars, Inc.

121 SW Morrison Street Suite 1525

Portland, OR 97204

Tel.: 503-208-9295

Email: sales@pnwrailcars.com

BY WILLIAM C. VANTUONO, EDITOR-IN-CHIEF

BY WILLIAM C. VANTUONO, EDITOR-IN-CHIEF

On May 9, Genesee & Wyoming marked its 125th anniversary at the Rochester & Southern, where the global Class II and Class III railroad conglomerate got its start in 1899.

G&W unveiled two locomotives painted in the company’s heritage livery, which was established after Mort Fuller took over the company in 1977. These locomotives will operate on the Rochester & Southern and Buffalo & Pittsburgh.

In honor of the 125th anniversary, the heritage livery will be applied to locomotives this year on a few other G&W railroads.

“When you celebrate a milestone birthday, everyone asks how you lasted so long, and I think the answer to that question has three parts for G&W,” said Executive Chairman Jack Hellmann at the May 9 event. “First is the simple physics of the steel wheel on the steel rail and its ability to economically serve customers hauling heavy traffic long

In honor of the 125th anniversary, this heritage livery will be applied to locomotives this year on a few other G&W railroads.

distances. Second is the Fuller family, starting with Mort Fuller’s great-grandfather, and then leading to Mort himself, who took a huge risk in the 1970s when he purchased a controlling interest in the family railroad. Third is the people of G&W, not only those who led us to where we are today, but the team who will take us to new heights in the future.

“Remarkably, these three elements—the steel wheel, the Fuller family history, and our current team—are all represented in the G&W logo (p. 28), which was created by the graphic designer Milton Glaser, who is most famous for creating the ‘I Love NY’ logo. In the center, you will see a rail wheel and the double line representing the flange. To the left is an arrow pointing to the past, which honors the Fullers and where we came from. And to the right is an arrow pointing to the future and where we are going with the team gathered here today.”

“We’re proud of our past,” said G&W CEO Michael Miller. “We’ve grown from a single railroad to more than 100 freight railroads, established a presence at more than 30 ports to help critical goods flow across the globe, and built industrial development and transload services that are tailored to the unique needs of individual customers. We’ve become industry leaders in safety and service, receiving more than 1,000 safety awards from the [American Short Line and Regional Railroad Association] and achieving our highest-ever

customer satisfaction score last year.

“We’ve been good stewards for the communities we operate in through programs such as Operation Lifesaver and first responder trainings, and have locked hands with the rest of the industry via our memberships with ASLRRA and the Association of American Railroads.

“We’re just as excited for our future. Over the past few years, we’ve made investments in our workforce, equipment, technology platforms, infrastructure, and more to ensure that we are well-positioned to grow and adapt with the entire rail industry. Our goal is to help our current customers move more freight in an even safer, more efficient and more sustainable way, while attracting new customers with the benefits of using rail in their supply chain.

“We’ve also established and enhanced partnerships with customers, suppliers and Class I railroads. We’re actively participating in innovation through collaborations such as the RailPulse coalition to outfit the North American railcar fleet with telemetry devices and sensors. We are also working with a start-up company called Parallel Systems on building autonomous rail vehicles that can reinvigorate business on lowerdensity, more rural lines and achieve zero carbon emissions while doing so. It has never been a more exciting time to be a part of G&W.”

Nov. 5 & 6, 2024

Chicago, IL

We’re returning to Chicago with an expanded event!

Railway Age and RT&S are proud to recognize the growth in leadership roles for women in the railway industry. Our second annual Women in Rail Conference is now a two-day event, filled with instructive panels, an awards luncheon, and a local transit tour.

Join a diverse group of railroaders with a shared commitment to our industry’s future.

PROGRAM HIGHLIGHTS:

•Furthering industry inclusivity and showing allyship

•Advancing your career—from asking for a raise to developing new skills

•Understanding the latest regulatory and legislative happenings

•New tech innovations and the latest applications

•How mentorship can change your journey

•Building a safety culture

•Railway Age’s Women in Rail / RT&S’ Women in Railroad Engineering awards luncheon

•Tour of Metra’s rebuild shop and training center

Rail telematics are poised to create breakthroughs in operations and safety.

BY JOANNA MARSH, CONTRIBUTING EDITOR

BY JOANNA MARSH, CONTRIBUTING EDITOR

If you’re in the industry long enough, chances are that eventually you’ll come across a story about a wayward railcar—not necessarily an anecdote about a railcar ending up in North Dakota when it should have been in Alabama, but a story about coffee beans turning rotten because the temperature-controlled railcar wasn’t functioning properly.

While companies might label that incident as the cost of doing business, situations like this were what motivated

Daniel MacGreggor to co-found Nexxiot, a European and American tech provider. “The issue is that we still live in a physical world. My core belief or passion for Nexxiot was to address this wastefulness that’s going on,” he said. “Instead of relying on insurance payouts, companies should use technology to keep track of shipments’ location and their condition to help prevent this wastefulness.”

The idea of enabling railcar owners, railroads, shippers and other supply chain

stakeholders to keep track of where their equipment is located on the North American rail network has gained a groundswell of support in recent years, particularly as competing freight transportation methods have developed tools to provide shippers with network visibility. One solution to the overall lack of visibility in the rail network is rail telematics, or the ability for stakeholders to monitor assets via telecommunications and information technology. While the field is still relatively young, dozens of companies

One single device helps fleets improve safety, optimize maintenance planning and increase utilization through:

▶ Real-time onboard health monitoring of brakes and wheels without wireless sensors

▶ Actionable intelligence for maintenance-responsible parties through Supply Chain Visibility™ software platform

▶ GPS benefits such as dynamic ETA, geofence alerts, first- and last-mile validation and accurate mileage

have already developed sophisticated tools to address the visibility problem. Companies like Nexxiot, Amsted Digital Solutions, TrinityRail, Wabtec, Railinc® commercial products unit TransmetriQ and ZTR have begun offering their own telematics products, while partnerships like RailPulse™—the coalition established in late 2020 to “facilitate and accelerate the adoption of GPS and other telematics technology across the North American railcar network”—seek to encourage rail stakeholders to work together to promote visibility of the North American rail network. Amsted Digital Solutions has signed a multi-year agreement allowing RailPulse™ to act as a non-exclusive reseller of its IQ Series telematics technology (sidebar, p. 40).

“Today, there is no real-time visibility into the status and health of more than 90% of the estimated 5.2 million railcars worldwide. Equipping these freight cars with telematics, GPS and sensor technologies enables customers to capture that hidden information and turn it into

actionable data. The result: freight visibility, increased safety of rail assets and new levels of operational efficiency,” said Wabtec. “The challenge today is that it is difficult to see across different modes. Telematics solves this problem by providing real-time railcar visibility. Through this visibility, telematics integrates the transportation network to provide more efficient execution and a seamless shipping experience.”

Rail telematics nowadays often consists of installing devices on railcars that monitor their condition. There have also been devices available for monitoring the fuel efficiency of locomotives. Some telematics offerings, like those of Amsted and Nexxiot, consist of one device that might aggregate various bits of information and send them to the cloud for shippers and other stakeholders to download and process.

The technology is for the benefit of railcar owners—the Class I railroads

and the short line operators, and the lessors and large manufacturers, with this latter group owning the lion’s share of the U.S. railcar fleet.

While rail telematics might be a buzzy concept now, the idea of using technology to monitor railcars and locomotives has been around for several decades.

In the mid- to late-2000s, the North American rail market became interested in being able to locate railcars containing hazardous materials with a higher degree of accuracy beyond updates received from the trackside network, according to Brad Myers, Chief Operating Officer for Amsted Digital Solutions, which is affiliated with Amsted Rail.

Companies also used radio frequency identification (RFID) for some assets, enabling railcars to gain access through a gate or to a port, according to MacGreggor. But the RFIDs were passive devices that had the potential to stop working. Another tool was wayside detectors that could take photos of passing trains, but those

detectors could get damaged or could miss an issue with a railcar, he noted.

But recent events revealed the attractiveness of having access to real-time data that can inform stakeholders of where their shipments are. One catalyst was the U.S. government’s mandate calling for the installation of electronic logging devices (ELDs) be installed on trucks. The ELD data opened much more rich data streams, Myers said. Another catalyst was Amazon’s approach to visibility, where customers could see how far away their packages were from their front door.

“The newer generation of people working in logistics have an expectation of such real-time updates. We need to broaden how we can provide the same or close-to-same level of location data,” Myers said.

While rail telematics is usually associated with the ability to locate railcars on a rail network using global positioning systems or other trackers, telematics offerings extend beyond keeping tabs on railcars’ whereabouts. There are products that can monitor load, door and hatch and handbrake status to ensure the integrity of the railcar and that its contents are safe and contaminant-free. There are also devices that can conduct onboard acoustic bearing detection.

These devices enable railcar owners with insight into railcar utilization and how equipment is being used or misused during events such as coupling or switching. By knowing railcars’ mileage and keeping track of when they are loaded or empty, railcar owners can also learn how to improve the turnaround times for those railcars.

“The ability to highlight outliers when they occur as to the degree of difference from say the rest of the fleet provides car owners an opportunity to target physical inspections of a railcar to ensure there are no signs of unusual or concerning damage that may affect the integrity of a railcar,” Myers said.

The benefit of receiving data on a railcar’s condition is significant for several reasons. For starters, the data can be shared with others in the supply chain. “Telematics as a whole enables field industry to collaborate

with other transportation modes by providing APIs’ seamless integration and interoperability with other systems,” said Shubham Srivastava, ZTR Senior Product Marketing Manager. “For example, data collected through telematics can be shared with other stakeholders in the supply chain such as shippers and logistics providers to optimize the multimodal transportation solutions.”

Rail safety can improve from deploying telematic tools because they enable railcar owners to shift from time-based maintenance to condition-based maintenance. For instance, an owner might have visibility into whether the railcar has seen an excessive impact or whether the handbrake has been released before it moves. Having this insight can provide

Rail telematics often consists of installing devices on railcars that monitor their condition.

assurances that the railcar is being properly maintained and safely used.

“These railcars are being passed from different people to different locations. How do we understand what happened, resolve the issue, resolve the cost and then do better so that we can avoid that in the future,” said Kurt Rohmann, ZTR Chief Commercial Officer.

In addition to safety, rail telematics can result in cost savings for the user if deployed and used e ectively. Ensuring the railcar is in good shape means the owner is getting value from the capital expenditure, according to Rohmann. A railcar owner, once aware of a problem, can buy components, allocate resources and prioritize maintenance and repair work ahead of its arrival at its next rail yard.

“There’s a lot of knowledge that should

help the rail industry be able to compete with over-the-road without that unending pressure to improve operational and cost efficiencies,” Rohmann said. “As quickly as people can learn and adopt these applications, they can then figure out how to take the data and change their operational procedures to maximize value.”

As numerous companies are each developing their own rail telematics solutions, there are also broader efforts to take an industry-wide approach to better integrate telematics into existing operations.

One prominent effort is RailPulse™, which, as General Manager David Shannon describes, is “dedicated to bringing telematics digitization into the rail industry while taking into account the structured nature of rail.”

The consortium—which includes three Class I railroads, two short line operators, three railcar lessors and manufacturers, one shipper and one institutional investor—has developed a shared platform that it expects to launch sometime this summer. The platform, which RailPulse™ created with help from a federal grant from the Consolidated Rail Infrastructure and Safety Improvements (CRISI) program, tracks railcars that have telematics installed on them as they travel through the U.S. rail network. The data collected informs owners on the location, condition and health of each railcar.

“Traditionally, telematics has been delivered in this industry on siloed levels. A customer says it would be valuable for me to put some stuff in railcars, or maybe a railroad or a leasing company might play with something on their own,” Shannon said. “But these are siloed solutions where only a small part of the industry might get some benefit. The goal of RailPulse™ is to have an industry platform where the data comes into the RailPulse™ platform, and then we can share that data out back to the company that owns the railcar but also to shippers, consignees, lessors, railroads, etc.—anybody that has the right to know.”

Shannon, who has been working

in the telematics space since it was in its infancy in the late 1990s, says RailPulse™’s goal isn’t to make money. Rather, “you join because you have a belief in the value of rail and the fact that telematics can help improve the value of rail regardless of where you sit in that ecosystem.”

Indeed, the benefit of having a consortium is that the companies involved must put their competitive requirements aside and “focus on what’s good for the industry,” Shannon said. “It is all a self-reinforcing set of drivers that ultimately go toward, how do we serve the needs the rail market better so that more companies will want to use rail or that those who already use rail will move a higher percentage of their freight on rail.”

RailPulse™ has also been working with other telematics providers to enable network visibility. Nexxiot noted recently that railcar owners using Nexxiot’s products would be able to join the RailPulse™ platform and that RailPulse™ will act as a non-exclusive reseller of Nexxiot’s hardware devices, software and services. The agreement isn’t meant to generate profit for RailPulse™ but rather to simplify the process of procuring telemetry solutions, Nexxiot said. Separately, Wabtec announced in December 2023 that it would be working with Dutch company Intermodal Telematics to develop a railcar telematics platform for railcar and tank container owners and operators.

TransmetriQ recently launched Reporting & Analytics, described as “a new comprehensive railcar fleet reporting tool that synthesizes asset location, health and repair data to provide deeper fleet insights. With customizable, interactive dashboards and configurable alerts, Reporting & Analytics makes it easier than ever for fleet managers to recognize areas of concern and optimization opportunities.”

Shippers and railcar owners can customize the data viewed in Reporting & Analytics “based on their needs, choosing to view tracing reports, health and repair insights, or both,” TransmetriQ noted. “The tool translates and synthesizes numerous data streams into dashboards the user can customize— empowering them to quickly make strategic decisions for more efficient railcar maintenance and fleet utilization.

The dashboards created by TransmetriQ’s Reporting & Analytics tool give users critical information, including:

• Fleet Health Reporting.

• Component Performance Analytics.

• Remaining Wheelset Life.

• Cycle & Dwell Times.

• Equipment Characteristics.

• Other Key Car Insights.

“These dashboards leverage direct access to trusted Railinc fleet health and movement insights,” the company said. “Designed with the input of fleet managers, Reports & Analytics provides out-of-the-box reports and fully customized reporting capabilities.”

“Gaining insight into asset repair trends has historically been difficult due to the complex nature of railcar repair data,” said TransmetriQ Product Manager Gregg Phillips. “With Reporting & Analytics automatically translating repair data into user-friendly insights, railcar managers can easily see where repair dollars are being spent, what’s driving that spending, who is performing repairs, and where they are occurring.”

Similarly, shippers who manage their own fleets “can use the cycle and dwell analytics to identify problem areas and drive performance improvements such as shorter facility turn times,” said TransmetriQ Product Manager Danny Dever.

“Through our voice of the customer program, we worked closely with railcar fleet managers and learned they were seeking better ways to analyze operations to keep equipment moving in revenue service and to control repair costs,” noted Railinc Vice President of Product Management and Strategy Mika Majapuro. “The tool they created does that, and it can be readily toggled between fleetwide and specific equipment or lane analyses. With reports built for rail-specific scenarios, it’s easier than ever for fleet managers to recognize areas of concern and adjust accordingly.”

As railcar owners grow accustomed to the benefits of deploying telematics solutions, they should expect even more sophisticated capabilities on the horizon, in part brought about by advances in telematics hardware. Research teams within these companies and others are working to use artificial intelligence and machine learning to further enhance capabilities and drive innovation. Creating digital twins and utilizing edge computing and IoT (Internet of Things) could also bring about a future where operations pivot to predictive maintenance.

“Picture a railcar right now. It’s got nothing on it. No power, no sensors, no information whatsoever. Now picture a car [loaded with number of sensors],”

Rohmann said. “The locomotives are moving that way, and we’re just getting to a world where railcars [are also]. So as you picture more and more data coming off them, each data point can be further analyzed with algorithms that understand different concerns, risks, behaviors and operational efficiency improvements.”

It’s also the goal of rail telematics companies to integrate the various telematics systems within a train so that not only are different systems and products working with each other on a railcar, but also that different systems are working in tandem on the railcars and on the locomotive.

On interoperability between telematics products functioning on locomotives and railcars, Srivastava said, “While these two are in isolation right now, going forward we see them combined so that you can make intelligent decisions all the time. The telematics systems we speak of could

ultimately be designed to seamlessly integrate with onboard control systems and the signaling network, back-end management platforms and other control systems to enable real-time

One goal of rail telematics companies is integrating the various systems within a train.

data exchange and coordination across the entire network.”

“Collaboration with railroads and locomotive OEMs would be required

PHILADELPHIA 800.969.6200

DENVER 800.713.2677

DANELLA.COM/RENTALS

Over four decades of renting yellow iron equipment for railroad and transit industries. R ENTA L SY STEM S,INC.

to evolve an in-train network, and this would require various operating rule changes that would require a broad, unanimous approach. There are technologies that can certainly advance intra-train opportunities,” said Amsted’s Myers. “As an industry, if we can begin the migration and continue to validate the advances in digitalization using onboard telematics, it will only aid in how much further and faster we can go as an industry.”

Even individual stakeholders within the supply chain might find benefits from working on shared data, as needs differ between supply chain managers, shippers and purchasers. “The exciting thing is we’re getting to the point now where we are digitally equipping railcars, which is at the very, very early stages of figuring out how we can further improve our safety, operational efficiency or environmental impact of all of these assets,” Rohmann said.

confidence” to shippers and regulators, especially at a time when the rail industry has received negative press over concerns about safe operations, according to MacGreggor. “There’s a huge

pressure to address and show demonstrable actions,” he said. “And the way to do that is with hard facts and working with data empirically to address problems and reduce the industry’s risk

Digital Solutions has signed a multi-year agreement allowing RailPulse™—the coalition established in late 2020 to “facilitate and accelerate the adoption of GPS and other telematics technology across the North American railcar network”—to act as a non-exclusive reseller of its IQ Series™ telematics technology.

The RailPulse coalition comprises founding members Norfolk Southern (NS), GATX Corporation, Genesee & Wyoming Inc., TrinityRail, and Watco, which cumulatively own nearly 20% of the North American railcar fleet; plus The Greenbrier Companies, Union Pacific (UP) and Railroad Development Corporation (RDC). CPKC is the latest member, joining in February, and agribusiness company Bunge signed on as the first railcar-owning shipper in January.

“RailPulse seeks to drive productivity, value and growth in the freight rail industry through a vendor-neutral and open-architecture railcar telematics infrastructure,” the coalition reported May 20. That infrastructure or platform is said to emphasize “data standardization, cloud storage, and delivering actionable insights to enhance service levels, visibility, safety, and efficiency.” According to the coalition, “[c]onstituents will be able

to leverage RailPulse’s standard service level agreement with vendors such as Amsted Digital Solutions and access device performance data and installation recommendations for various car types. Amsted Digital Solutions is also working with RailPulse to expand its software application.”

Amsted Digital Solutions describes the IQ Series™ gateway as “a maintenance-free, low-power telematics device built to perform in the harshest operating environments,” and its “powerful built-in capabilities … paired with advanced machine learning technology virtually eliminate the need for specialized external sensors.”

When mounted on the body of almost any railcar, Amsted Digital Solutions said its IQ Series gateway provides:

• “Dynamic ETA calculations and geofence entry and exit alerts for first- and last-mile validation.

• “Accurate Load Status in Motion (LSiM) for precise loaded and empty mileage calculations

• “Impact detection.”

When mounted on one or both trucks of a railcar configured with Bogie IQ® technology, Amsted Digital Solutions said the IQ Series™ gateway “provides real-time onboard health monitoring in

profile. We’re living in a data-hungry age where the more visibility we have and the more interesting things we can discover, the more we can adjust and improve.”

addition to all of the data available from the body-mounted gateway,” including “stationary loading/unloading detection (firmware release targeted for thirdquarter 2024 via over-the-air upgrade); monitoring of wheel health; real-time monitoring of brake slide events; and impact differential detection, a feature that identifies which end of a railcar took the initial impact during a coupling event.”

According to Amsted Digital Solutions, as new features become available, “existing installed gateways can be updated through simple, over-the-air firmware upgrades,” eliminating the need for physical replacements.

“We’re excited to offer Amsted Digital Solutions’ robust telematics platform to RailPulse and its customers,” said RailPulse General Manager David Shannon, who added that the coalition is “excited about [the Amsted] approach to sensorfree technology through the Bogie IQ® solution. We anticipate substantial benefits to our users while contributing to freight rail as a whole.”

“We’re proud to partner with RailPulse as we work together to improve the competitive position of rail freight transportation,” said Brad Myers, COO and EVP of Amsted Digital Solutions, which is said to work closely with railcar systems and components supplier Amsted Rail to deliver the Bogie IQ® technology. “Our innovative approaches to telematics align seamlessly with RailPulse’s vision for an interconnected, data-driven future for freight rail.”

RailPulse also serves as a non-exclusive reseller of Nexxiot’s telemetry solutions.

Additionally, Amsted Digital Solutions SAS in 2023 landed a multi-year contract with Greenbrier Europe to supply its IQ Series™ technology to improve shipment visibility and railcar maintenance.

– Marybeth Luczak

Rail transportation has recently achieved a groundbreaking milestone with Stadler’s hydrogen-powered FLIRT H2 train. On March 22, 2024, the Zero-Emission Multiple Unit (ZEMU) secured a prestigious Guinness World Record by completing the longest distance ever traveled by a hydrogen

fuel cell (HFC)-powered electric multiple unit train without refueling. This event took place at the high-speed test track at the Transportation Technology Center (TTC) achieving an impressive distance of 1,742.025 miles (2,803.518 kilometers), which is approximately the same distance from St. Louis, Mo., to the ZEMU’s final delivery location at San Bernardino County Transit

Authority (SBCTA) in California. The FLIRT H2’s journey not only showcases the remarkable capabilities of hydrogen-powered trains but also highlights the critical role of the TTC in fostering innovation and advancing rail technology. Additionally, this new world record aligns with the 50th anniversary of the first world record achieved at the TTC. On Aug. 14, 1974,

the speed record of a rail vehicle was broken achieving 255.4 mph (411.0 kph) by the Linear Induction Motor Research Vehicle (LIMRV), a wheeled rail vehicle operating on standard track and outfitted with a gas turbine.

Stadler strategically utilized the world record opportunity to showcase the start of the new era of railway transportation with hydrogen fuel. Before, during and after the test, Stadler kept a close coordination with the Guinness World Record officials to ensure that all requirements were met. The test was monitored closely through various means including accurately measuring the length of the lap and final stopping location, keeping timestamps of each lap, counting laps, GPS trace of the train travel, and recording witness statements of personnel involved. As an extra precaution, the hydrogen fueling station at the TTC was physically closed off to prevent any doubt that the test was conducted without refueling.