The Insight Perth Office Market Overview

RWC WA | April 2024

Introduction

The Perth CBD and West Perth market have continued to be hampered by limited tenant demand keeping vacancies elevated in 2023. The Property Council of Australia has amended their boundaries of the CBD market in their recent release of data resulting in volatility in results which has seen Australia high levels of negative net absorption. Despite these results, Perth CBD enjoyed some vacancy compression highlighting leasing activity and improved vibrancy, ahead of other east coast office markets. West Perth continues to be one of the top performing non-CBD markets behind Queensland regions which have not been as impacted by the work from home issues seen mostly in Sydney and Melbourne office markets.

Vacancies, however, do remain high across these markets, for Perth CBD the continued construction of assets is putting further pressure on the existing market. While the quality of new assets in the Perth markets are of an international standard, the impact they have on occupancy, rents and incentives will add to the recovery time for the office market. This is highlighted by the limited sales activity recorded across the last 12 months, dominated by the private sector and sub $10million assets, highlights the current investment appetite and the increased yields.

Unlike most office markets across the country, Perth has not felt the same impact of hybrid working conditions as other locations. This has put the leasing market in good stead for this year, already recording some improvements in face rents across all quality grades.

Infographics

Perth CBD Office Market

Change in office boundaries have had significant impact on stock levels causing volatility in absorption levels

Future supply completions (12 months)

Refurbishment 26,051m2

New Stock 45,681m2

Investment Yield

Average incentives range between 40% to 50%

Over 86% of all for lease listings are for office stock in the sub-1,000m² size range

Source: Property Council of Australia, Ray White Commercial

Australian CBD Office markets

Total vacancy by city

Source: Property Council of Australia

The Australian office markets continue to grapple with occupancy issues stemming from the continued work from home phenomenon which has impacted most office markets. Sydney and Melbourne have been the worst affected with a slow return to work resulting in businesses reconsidering their space requirements or putting off decision making resulting in a prolonged period of negative take up and elevated vacancies. Encouragingly however across the country, the move to quality has been clear, with high incentives on offer, opportunity to upgrade space into premium and A grade stock has seen an improvement to these indicators for prime grade stock however at the detriment of B grade in particular.

Perth CBD despite some change in boundaries causing elevated withdrawals and negative net absorption, has reduced its vacancy to 14.9% and remains one of the better performing CBD markets. Non-CBD’s have had mixed results given the flight to quality seeing tenants be lured into CBD’s due to improved affordability, however markets such as Brisbane Fringe and West Perth continue to show encouraging results.

Perth CBD Office

Vacancy by quality grade (%)

Source: Property Council of Australia

Encouraging results this period for the Perth CBD market with vacancies down across most quality grades. A revision of boundaries across the CBD has resulted in a reduction of stock levels of over 100,000m2, notably across secondary asset classes keeping vacancies stable or down. The addition of space in the premium class has resulted in some increase in vacancies, however this remains the lowest vacancy across Perth at 7.8%, A grade has improved stability, reducing vacancies to 16.1%. For the secondary markets, changes in the stock volume have assisted B and C grade occupancy levels, vacancies sit at 19.8% and 13.2%, respectively. While the smaller D grade market has seen an uptick to 8.7%.

The overarching “flight to quality” sentiment will remain at play for the Perth CBD market for the medium term. Despite some increase in face rents, incentives have kept effective rents competitive, luring tenancies into better quality accommodation. While WA has not had the same work from home pressures as the east coast, the improved amenity of these assets continues to attract staff into the office and aids in new employment, given the tight job market. Furthermore, the impact of ESG policy for many businesses cannot go unnoticed, with pressure by some tenants to occupy premises with improved NABERS or green star ratings to meet their corporate objectives.

Australian CBD Office markets

Net Absorption & Total Vacancy (%)

Source: Property Council of Australia

Given the revision of the Perth CBD monitored area provided by the Property Council of Australia, the change in occupied stock has had been impacted by the reduction in total stock levels. Six monthly absorption has recorded -55,081m2 yet 115,188m2 of stock has left the pool, collectively resulting in a reduction in vacancy currently at 14.9%, the lowest rate recorded since 2015, with sub-lease vacancy recorded at just 0.5%.

Despite these absorption results, overall demand to occupy space has seen some improvement, many tenants are seeking out higher quality offerings while incentives remain high however affordability concerns also have seen secondary assets perform well, a trend not seen in many parts of the country. For Perth, the outlook on occupied stock is expected to moderate over the next six months before returning back into positive territory despite the continued completion of office stock. Further reductions in total vacancies are also likely to return bringing Perth CBD back to one of the outstanding performers across the Australian office landscape.

Perth CBD Office

Vacancies by size range, no. listings

Source: Ray White Commercial

Ray White Commercial continues to undertake a study to understand the volume and type of vacant office listings across the Perth CBD. This period we have recorded 549 unique vacancies which is down from last year; this represents 283,461m2 of stock, while this is ahead of the Property Council numbers (256,400m2) this includes smaller assets which may otherwise not be included in the vacancy count. Smaller holdings, sub 250m2, which were on the decline over the past two years have seen a slight increase to 37.0%, however remain below the rate of close to 50% recorded several years ago. The majority of stock remains in the 250-1,000m2 size range which has been consistent over the last year, however we have seen an increase in the 1,000-1,999m2 size range as churn and movement across the CBD has occurred from existing tenants.

Perth CBD Office

Net Face Rents ($/m2)

Source: Ray White Commercial

The Perth CBD office market has bucked the trend of many office markets across the country, showing some increases to face rents across both prime and secondary asset types. While net face rents have increased across many Australian office markets thanks to the increases in construction costs resulting in a new levels of economic rent, the Perth CBD has seen a combination of this impact, fixed increases in existing leases and improved enquiry keeping face rents elevated.

Average prime net face rents have grown over the past year to $649/m2 within the broad range of $500-$750/m2, this up 5.36% over 12 months. Despite tenants being lured into prime assets with high incentives on offer, secondary rents also saw an uptick of 7.86% over the year to average $549/m2. Incentives are reasonably uniform across the market, offering 50% by way of rental abatement, however the requirement for fitted out space is also taken into consideration. Landlords who offer assets with great amenity and flexibility of terms have also been most successful in securing tenancies in this market.

Perth CBD & West Perth Office Transactions

Source: Real Capital Analytics, Ray White Commercial

The Perth CBD office market recorded a number of landmark deals in 2022 with assets such as Allendale Square, London House and BankWest Tower changing hands bringing volume levels close to $700million. Similarly in West Perth, the deal at 60 Ord Street for $60million did much to growth transaction activity during a time of some uncertainty with rising interest rates and difficult office market conditions nationally. In 2023 these impacts were more pronounced with limited sales turnover across all office markets. For Perth CBD, sales have been dominated by smaller strata transactions and a handful of smaller, secondary freehold assets including Westend on Murray which sold in September for $33.23million to local private investor group, Properties & Pathways. Volumes however did reach $325million due to the half share sale of the under construction Nine The Esplanade, reported at $240million (50% share) to Cbus Property highlighting the confidence of the Perth CBD office market.

Across West Perth sales activity have been subdued in 2023, only $41million in transactions have been recorded the majority selling in the sub $5million price range to the private investor sector. It has been a slow start to 2024 with no sales recorded across these regions during the first quarter, however as interest rates are anticipated to reduce and more opportunistic buyers enter the market, we could see an increase in activity during the latter part of the year.

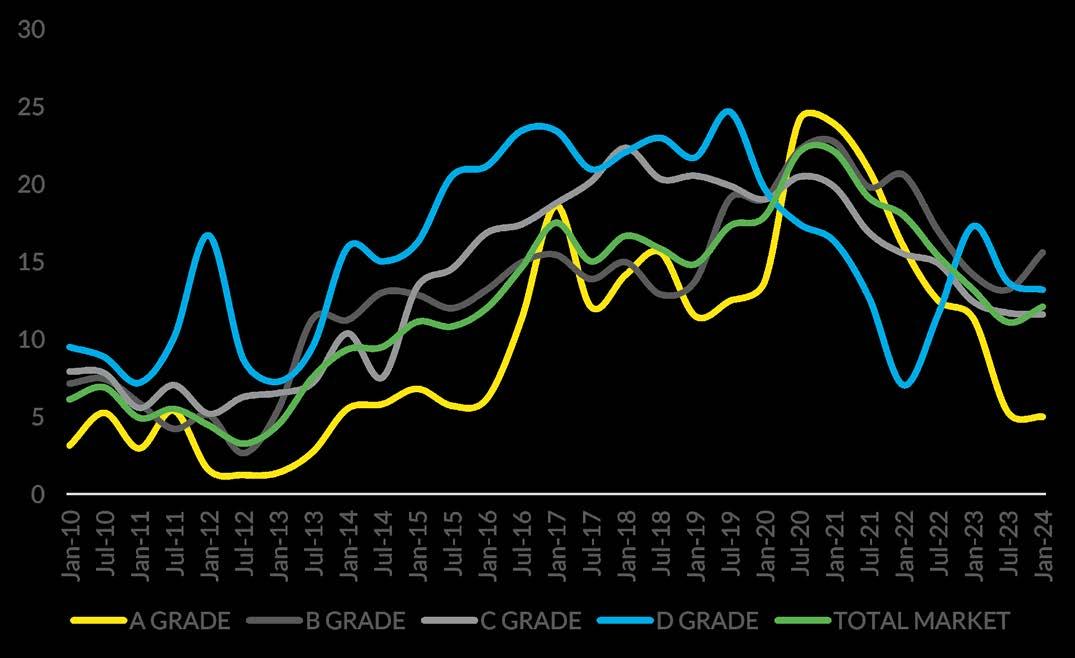

Perth CBD & West Perth Investment Yields

By quality grade

Source: Ray White Commercial

The low interest rate environment during the pandemic saw a distinct drop in acceptable yield levels for all commercial asset classes, with office no exception despite some questionable market fundamentals. These rates swiftly have been rising during 2022 and 2023 inline with the reduction in demand for office assets, the greatest revision in rates coming from the Perth CBD prime market, with limited institutional and REIT activity across the country, causing yields rates to grow, averaging 7.57% however still within a very broad range. Activity across the secondary market, however, has kept the growth in yields more subdued, currently averaging 8.17%.

The sub $20million price point attractive to cash rich buyers, private families, trusts, syndicates and self-managed super funds looking to purchase and take advantage of rental growth opportunities on elevated yields. This is a similar trend for the West Perth market, historically a heavily private buyer and owner occupier market, we have seen yields grow at a lesser rate, prime currently averaging 8.25% and 9.05% for secondary assets.

The West Perth market has seen an uptick in vacancies this period to 12.1%, however this remains below the national non-CBD average of 17.9%. Compared to other non-CBD markets across the country, the West Perth office market continues to outperform with a loyal tenant pool who see the benefits of this market neighbouring the CBD.

West Perth Office Market

West Perth Vacancy

Net Face Rents

Sub-lease vacancy 0.5%

76.7% of all For Lease listings are sub 500m²

Net absorption 5,939m² | Net supply 4,402m²

“Take up levels across West Perth eclipse Perth CBD levels.”

$345/m2

$255/m2

Source: Property Council of Australia, Ray White Commercial

Average incentives range 30%

West Perth Office

Vacancy by quality grade (%)

Source: Property Council of Australia

Some volatility in vacancy rates across the West Perth market this period, however A grade stock (albeit limited) continues to yield the lowest rate at just 5.0%, reducing from 5.3% last period despite supply additions. Improvements of absorption in A grade have come at the detriment of B grade, which lost 5,274m2 of occupied stock resulting in vacancies increasing from 13.2% to 15.6%. Lower quality grades of C and D have seen limited change over this period, currently sitting at 11.6% and 13.2%, respectively. While renovation stock is in the pipeline for West Perth, it is unlikely that these will be advanced in the short to medium term allowing occupancy to further improve.

Across the total West Perth market, vacancies are 12.1% well below the 15.3% average recorded over the last 10 years. This rate has West Perth sitting fifth across the country for non-CBD markets, with markets such as Gold Coast and Sunshine Coast ahead of the precinct, however outperforming markets such as Parramatta, North Sydney and Southbank.

West Perth Office

Net Supply & Absorption (m²)

Source: Property Council of Australia

After a number of years of outstanding net absorption for the West Perth market, take up has taken a slight hit in the six months to January 2024. The six-month period has recorded losses of just 429m2 with annual results still outstanding at 5,939m2, ahead of the 10-year average of -1,359m2. For West Perth, the supply addition of refurbished stock at 1-5 Harvest Terrace (3,706sqm) and 578 Murray Street (2,063m2), growing net supply by 4,402m2. Historically West Perth has been reducing size with the total stock level currently 418,571m2 after peaking in size during 2018 at 428,864m2 The withdrawal of stock for alternative uses is likely to remain a feature of this market, with future projects in the pipeline indicative of refurbishments of existing office assets.

West Perth Office

Vacancies by size range, no. listings

Ray White Commercial continues to investigate vacant listings across the West Perth office market, while the Property Council of Australia (PCA) identified 50,753m2 of available stock, our count recorded a higher number at 85,492m2. This typically would be indicative of a large range of smaller assets which would not be included in this count together with hidden sub lease space often undisclosed.

While there continues to be a high proportion of availability in the smaller suites across West Perth, this year we have seen a greater spread across all size ranges up to 500m2. 21.90% being sub 149m2 compared to 30.0% 3 years ago, 19.52% in the 150-249m2 size range and 35.24% for 250-499m2 up from 26.81% a couple of years ago. Professional and technology tenants continue to be the major enquiry for these smaller suites including accounting, law and financial services.

Conclusion

The Perth office markets have seen difficulties for a prolonged period of time. Hampered by high vacancies which have impacted rents and incentives, new supply projects forge ahead adding new levels of quality and competition in the marketplace. For tenants, choice is high and a flight to quality continues with a focus on tenant amenity putting pressure on other parts of the market. Sales activity has been subdued similar to all regions given the broader uncertainty in office assets in a post pandemic economy which has resulted in an uplift in investment yields. Despite these results demand to purchase remains notably from the private sector looking to capitalise on changing market conditions. This year we are buoyed by the growth in tenant enquiry across both the CBD and West Perth market, which has seen some improvement in face rents which is a trend likely to continue this year, which is expected to flow through to the investment market.

Luke Pavlos

Director | Commercial Services 0408 823 823 luke.pavlos@raywhite.com

Stephen Harrison

Joint Managing Director 0421 622 777 stephen.harrison@raywhite.com

Brett Wilkins

Director of Capital Markets 0478 611 168 brett.wilkins@raywhite.com

Recent lease transactions

41 St Georges Terrace, Perth